QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Scott's Liquid Gold, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

SCOTT'S LIQUID GOLD-INC.

4880 Havana Street

Denver, Colorado 80239

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

To Be Held May 4, 2005

TO OUR SHAREHOLDERS:

The Annual Meeting of Shareholders of Scott's Liquid Gold-Inc., a Colorado corporation (the "Company"), will be held at 9:00 a.m., Mountain Time, on Wednesday, May 4, 2005 at the Company's offices, 4880 Havana Street, Denver, Colorado for the purpose of considering and acting upon the following:

- (1)

- The election of seven directors;

- (2)

- Approval of the Scott's Liquid Gold-Inc. 2005 Stock Incentive Plan;

- (3)

- Such other matters as may properly come before the meeting or any adjournment thereof.

Only shareholders of record at the close of business on March 15, 2005 are entitled to notice of and to vote at the meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | ||

Dennis P. Passantino Corporate Secretary |

Denver, Colorado

April 6, 2005

THE FORM OF PROXY IS ENCLOSED. TO ASSURE THAT YOUR SHARES WILL BE VOTED AT THE MEETING, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED, POSTAGE PREPAID, ADDRESSED ENVELOPE. NO ADDITIONAL POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE GIVING OF A PROXY WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

SCOTT'S LIQUID GOLD-INC.

4880 Havana Street

Denver, Colorado 80239

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 4, 2005

The enclosed Proxy is solicited by and on behalf of the Board of Directors of Scott's Liquid Gold-Inc., a Colorado corporation (the "Company"), for use at the Company's Annual Meeting of Shareholders to be held at 9:00 a.m., Mountain Time, on Wednesday, May 4, 2005 at the Company's offices, 4880 Havana Street, Denver, Colorado, or any adjournment thereof. This Proxy Statement and the accompanying form of Proxy are first being mailed or given to the shareholders of the Company on or about April 6, 2005.

Any shareholder signing and mailing the enclosed Proxy may revoke it at any time before it is voted by giving written notice of the revocation to the Company's Corporate Secretary, by voting in person at the meeting or by filing at the meeting a later executed proxy.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

All voting rights are vested exclusively in the holders of the Company's $0.10 par value common stock. Each share of the Company's common stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. Holders of a majority of shares entitled to vote at the meeting, when present in person or by proxy, constitute a quorum. On March 15, 2005, the record date for shareholders entitled to vote at the meeting, the Company had 10,471,000 shares of its $0.10 par value common stock issued and outstanding.

When a quorum is present, in the election of directors, those seven nominees having the highest number of votes cast in favor of their election will be elected to the Company's Board of Directors. Consequently, any shares not voted (whether by abstention, broker non-vote or otherwise) have no impact in the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger number of votes. Approval of the 2005 Stock Incentive Plan requires that the votes cast in favor of the Plan exceed the votes cast in opposition. With respect to any other matter which may properly come before the meeting, unless a greater number of votes is required by law, the matter is approved by the shareholders if the votes cast in favor of the matter exceed the votes cast in opposition. Any shares not voted (whether by abstention, broker non-vote or otherwise) have no impact on the vote for approval of the 2005 Stock Incentive Plan or for these other matters, if any, so long as a quorum is present.

The following persons are the only persons known to the Company who on March 15, 2005, owned beneficially more than 5% of the Company's common stock, its only class of outstanding voting securities:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||

|---|---|---|---|---|---|

| Mark E. Goldstein 4880 Havana Street Denver, Colorado 80239 | 2,681,965 | (1)(2) | 25.3 | % | |

| Scott's Liquid Gold-Inc. Employee Stock Ownership Plan 4880 Havana Street Denver, Colorado 80239 | 1,146,508 | (3) | 10.9 | % | |

| Atchison Investments Limited and Gregory Butcher 235 Main Street Gibraltar(4) | 1,044,126 | 10.0 | % |

- (1)

- Includes 2,126,473 shares held by the Goldstein Family Partnership, Ltd., a limited partnership of which the general partner is the Goldstein Family Corporation and whose limited partners include Mark E. Goldstein, his children, a sister, and certain other relatives. Mr. Goldstein is the sole director and sole executive officer of the Goldstein Family Corporation, and he owns 80% of the outstanding stock of the Goldstein Family Corporation in his individual name and owns as a trustee 20% of the outstanding stock of the Goldstein Family Corporation. Mr. Goldstein has the sole voting and disposition powers with respect to these shares of the Company owned by the Goldstein Family Partnership, Ltd. Also includes 120,500 shares underlying stock options granted by the Company and exercisable within 60 days, and 76,002 shares held by Mr. Goldstein's minor children. Includes 42,600 shares held jointly by Mr. Goldstein and his wife, and does not include 25,890 shares of the Company's common stock owned by Mr. Goldstein's spouse, as to which Mr. Goldstein disclaims any beneficial ownership.

- (2)

- Does not include 111,280 shares held by the Company's Employee Stock Ownership Plan attributable to Mr. Goldstein's vested interest in the Plan as of December 31, 2004.

- (3)

- The five-person committee administering the Employee Stock Ownership Plan directs the voting of shares held under such Plan. The Company's four executive officers are members of this five-person committee.

- (4)

- Atchison Investments Limited is an investment company of which the managing director and sole owner is Gregory Butcher. This information is based upon a Schedule 13D filed by that entity with the Securities and Exchange Commission and additional stock ownership information provided by Mr. Butcher. Includes 50,000 shares issued to a trust over which Mr. Butcher has voting power, and 994,126 shares over which Mr. Butcher is believed to have beneficial ownership. See "Certain Transactions" for additional information concerning Mr. Butcher.

SECURITY OWNERSHIP OF MANAGEMENT

The following table shows as of March 15, 2005, the shares of the Company's common stock beneficially owned by each director and executive officer of the Company and the shares beneficially owned by all of the directors and executive officers as a group:

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||

|---|---|---|---|---|---|

| Mark E. Goldstein | 2,681,965 | (2)(3)(4) | 25.3 | % | |

| Jeffrey R. Hinkle | 250,878 | (3)(4)(5) | 2.4 | % | |

| Jeffry B. Johnson | 127,000 | (3)(4)(6) | 1.2 | % | |

| Dennis P. Passantino | 120,000 | (3)(4) | 1.1 | % | |

| Carl A. Bellini | 111,300 | (3) | 1.1 | % | |

| Dennis H. Field | 173,500 | (3) | 1.6 | % | |

| Gerald J. Laber | 30,000 | (3) | .3 | % | |

| All Directors and executive officers as a Group (seven persons) | 3,494,643 | (3)(4) | 31.1 | % |

- (1)

- Beneficial owners listed have sole voting and disposition power with respect to the shares shown unless otherwise indicated.

- (2)

- For information regarding Mr. Goldstein's beneficial ownership of shares, see footnote 1 under the table in "Voting Securities and Principal Shareholders."

- (3)

- For each named person, includes the following number of shares underlying stock options granted by the Company: 120,500 for Mr. Goldstein; 129,000 for Mr. Hinkle; 100,000 for Mr. Johnson; 100,000 for Mr. Passantino; 105,000 for Mr. Bellini; 170,000 for Mr. Field, and 30,000 for Mr. Laber.

- (4)

- Does not include shares owned by the Company's Employee Stock Ownership Plan under which, at December 31, 2004, Mark E. Goldstein had a vested interest in 111,280 shares, Jeffrey R. Hinkle had a vested interest in 70,894 shares, Jeffry B. Johnson had a vested interest in 67,720 shares, and Dennis P. Passantino had a vested interest in 54,537 shares.

- (5)

- Of Mr. Hinkle's shares, 121,878 shares are held in a revocable trust of which Mr. Hinkle and his wife are co-trustees.

- (6)

- Of Mr. Johnson's shares, 22,000 are held jointly by Mr. Johnson and his wife.

There has been no change in control of the Company since the beginning of the last fiscal year, and there are no arrangements known to the Company, including any pledge of securities of the Company, the operation of which may at a subsequent date result in a change in control of the Company.

ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

Nominees

The Company's Board of Directors consists currently of seven directors. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy for the election of the seven nominees for director named below. If, at the time of the Meeting, any of these nominees shall have become unavailable for any reason to serve as a director, the persons entitled to vote the proxy will vote for such substitute nominee or nominees, if any, as they determine in their discretion. If elected, the nominees for director will hold office until the next annual meeting of shareholders or until their successors are elected and qualified. The nominees for director, each of whom has consented to serve if elected, are as follows:

| Name of Nominee and Position in the Company | Age | Director Since | Principal Occupation for Last Five Years | |||

|---|---|---|---|---|---|---|

| Mark E. Goldstein (Chairman of the Board, President and Chief Executive Officer) | 49 | 1983 | Chairman of the Board of the Company since February 22, 2000, President and Chief Executive Officer of the Company since August, 1990. From 1982 to 1990, Vice President—Marketing of Company. Employed by the Company since 1978. | |||

| Jeffrey R. Hinkle (Vice President—Marketing and Sales) | 51 | 2000 | Vice President—Marketing and Sales of the Company since February 2000. Vice President of Marketing and Sales for the Company's subsidiaries from November 1992 to 2000. Employed by the Company since 1981. | |||

| Jeffry B. Johnson (Treasurer and Chief Financial Officer) | 59 | 2000 | Treasurer and Chief Financial Officer of the Company since November 2000. From 1981 to 2000, Controller of Company. Employed by the Company since 1976. | |||

| Dennis P. Passantino (Vice President—Operations and Corporate Secretary) | 49 | 2002 | Vice President—Operations and Corporate Secretary since November 2002. From 1991 to 2002, Operations Manager. Employed by the Company since 1981. | |||

| Carl A. Bellini | 71 | 2000 | Management Consultant since 1997. From 1987 to 1997, Executive Vice President and Chief Operating Officer of Revco D.S., Inc. (a large drug store chain). | |||

| Dennis H. Field | 72 | 1991 | Management Consultant since 1990. From 1984 to 1990, Executive Vice President/General Manager, Faberge USA, Inc. (mass market health and beauty aids). | |||

| Gerald J. Laber, CPA | 61 | 2004 | Director since January, 2004. Investor and community volunteer since 2000. From 1980 to 2000 partner with Arthur Andersen L.L.P.; director with Applied Films Corporation, Centennial Specialty Foods, Healthetech Corporation, Qualmark Corporation, and Spectralink Corporation. |

All of the foregoing persons are currently directors of the Company. Their positions on standing committees of the Board of Directors are shown below under "Directors' Meetings and Committees".

The Company's only executive officers are those who are described in the foregoing table. The officers of the Company are elected annually at the first meeting of the Company's Board of Directors held after each annual meeting of shareholders and serve at the pleasure of the Board of Directors.

There are no family relationships among the executive officers or directors of the Company. There are no arrangements or understandings pursuant to which any of these persons were elected as an executive officer or director.

Directors' Meetings and Committees

During the year ended December 31, 2004, the Company had six directors meetings plus nine actions by unanimous written consent. The Company's Board of Directors has both a Compensation Committee and an Audit Committee. The Company does not have a nominating committee.

The primary responsibilities of the Compensation Committee include development of an executive compensation philosophy for the Company; origination of all executive compensation proposals; review of the appropriate mix of variable versus fixed compensation; and review of all transactions between the Company and any executive officer or director, whether or not involving compensation. The Committee consists currently of three outside directors of the Company and, in addition, the President of the Company. Current members of the Compensation Committee are Dennis H. Field (Chairperson), Carl A. Bellini, Gerald J. Laber, and Mark E. Goldstein (with Mr. Goldstein having no vote). The Compensation Committee met one time during 2004.

The Audit Committee has as its primary responsibilities the appointment of the independent auditor for the Company, the pre-approval of all audit and non-audit services, and assistance to the board of directors in monitoring the integrity of the financial statements of the Company, the independent auditor's qualifications, independence and performance and the Company's compliance with legal requirements. The Audit Committee operates under a written charter adopted by the board of directors, a copy of which is attached asExhibit A to this Proxy statement. The current members of the Audit Committee are Gerald J. Laber (Chairperson), Carl A. Bellini and Dennis H. Field. Each member of the Audit Committee is an independent director as defined in the current Nasdaq rules. Mr. Laber has the professional experience deemed necessary to qualify as an audit committee financial expert under rules of the Securities and Exchange Commission. The Audit Committee met five times during 2004.

Nomination Process

The Board of Directors of the Company does not have a nominating committee. The full Board of Directors performs the functions of a nominating committee. The Board of Directors believes that it does not need a separate nominating committee because the full Board is relatively small, has the time to perform the functions of selecting Board nominees and in the past has acted unanimously in regard to nominees.

In considering an incumbent director whose term of office is to expire, the Board of Directors reviews the director's overall service during the person's term, the number of meetings attended, level of participation and quality of performance. In the case of new directors, the directors on the Board of Directors are asked for suggestions as to potential candidates, discuss any candidates suggested by a shareholder of the Company and apply the criteria stated below. The Company may engage a professional search firm to locate nominees for the position of director of the Company. However, to date the Board of Directors has not engaged professional search firms for this purpose. A selection of a nominee by the Board of Directors requires a majority vote of the Company's directors. The Board of Directors consists of seven members of which three directors are independent as defined in current Nasdaq rules.

The board seeks candidates for nomination to the position of director who have excellent decision-making ability, business experience, particularly those relevant to consumer products, personal integrity and a high reputation and who meet such other criteria as may be set forth in a writing adopted by a majority vote of the Board of Directors.

Pursuant to a policy adopted by the Board of Directors, the directors will take into consideration a director nominee submitted to the Company by a shareholder; provided that the shareholder submits the director nominee and reasonable supporting material concerning the nominee by the due date for a shareholder proposal to be included in the Company's proxy statement for the applicable annual meeting as set forth in rules of the Securities and Exchange Commission then in effect. See "Shareholder Proposals" below.

Director Attendance at Company Annual Meetings

The Company does not have a policy regarding attendance by members of the Board of Directors at the Company's annual meeting of shareholders. The Company has always encouraged its directors to attend its annual meeting. In 2004, all directors attended the Company's annual meeting of shareholders.

Stockholder Communications With The Board

Historically, the Company has not had a formal process for stockholder communications with the Board of Directors. The Company has made an effort to insure that views expressed by a shareholder are presented to the Board of Directors.

Code of Business Conduct and Ethics

The Company has a Code of Business Conduct and Ethics that reflects long-standing positions of the Company and contains additional provisions. The Code applies to all employees, including executive officers, and to directors. The Code concerns, among other things, compliance with applicable law, the avoidance of conflicts of interest, no trading by such a person if the person is aware of information that may be considered material, a prohibition on taking corporate opportunities, competing fairly and honestly, diversity as an asset, the Company's efforts to provide a safe and healthful work environment, recordkeeping, confidentiality, proper use of Company assets and payments to government personnel. The Code sets forth steps which may be followed if there is a situation where it is difficult to know right from wrong. A copy of the Code of Business Conduct and Ethics may be obtained upon request to: Secretary, Scott's Liquid Gold—Inc., 4880 Havana Street, Denver, Colorado 80239.

Compensation Committee Interlocks and Insider Participation

Mr. Dennis Field serves on both the Compensation Committee and the Audit Committee. From 1978 to 1982, Mr. Field was President and Chief Operating Officer of Aquafilter Corporation, a wholly owned subsidiary of the Company which manufactured cigarette filters. After leaving Aquafilter Corporation, Mr. Field had virtually no contact with the Company from the date of his resignation to 1991 when he was asked to join the Company's Board. Prior to 1991, he was Executive Vice President/General Manager, U.S. Division, of Faberge. Mr. Field has a distinguished career with significant consumer product companies.

During 2004, none of the Company's executive officers served on the board or compensation committee of another entity which had one of its executive officers serve as a director of the Company or a member of the Company's Compensation Committee.

Executive Compensation

Summary Compensation Table

The following Summary Compensation Table shows the annual and other compensation of the chief executive officer and all other executive officers of the Company at December 31, 2004, for services in all capacities provided to the Company and its subsidiaries for the past three years.

| | | Annual Compensation | Long Term Compensation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary $ | Bonus $(1) | Other Annual Compensation ($) | Securities Underlying Options (#) | All Other Compensation ($)(2) | |||||||||

| Mark E. Goldstein Chairman of the Board, President and Chief Executive Officer | 2004 2003 2002 | $ $ $ | 400,000 390,300 350,000 | — — — | $ $ $ | 36,032 33,711 32,519 | 70,500 — | $ $ $ | 2,692 4,184 1,172 | ||||||

| Jeffrey R. Hinkle Vice President—Marketing and Sales | 2004 2003 2002 | $ $ $ | 225,000 220,100 200,000 | — — — | $ $ $ | 12,069 10,663 10,066 | 79,000 — | $ $ $ | 2,692 4,184 1,172 | ||||||

| Jeffry B. Johnson Treasurer and Chief Financial Officer | 2004 2003 2002 | $ $ $ | 190,000 190,000 190,000 | — — — | $ $ $ | 17,311 10,933 7,872 | 50,000 — | $ $ $ | 2,525 4,043 1,134 | ||||||

| Dennis P. Passantino(3) Vice President—Operations and Corporate Secretary | 2004 2003 2002 | $ $ $ | 183,750 183,750 183,750 | — — — | $ $ $ | 15,720 13,606 3,280 | 85,000 10,000 | $ $ $ | 2,490 4,089 1,122 | ||||||

Note: There were no restricted stock awards or long term incentive payouts during the last three fiscal years.

- (1)

- The Company has adopted a bonus plan for its executive officers for the year 2005. The plan provides that an amount will be distributed to the Company's executive officers equal to 10% of the annual before tax profit exceeding $1 million, excluding items that are infrequent, unusual, or extraordinary. Such amount, if any, for 2005 will be divided among the Company's executive officers as follows: President, 31%, Vice President-Marketing and Sales, 25%, Treasurer, 22%, and Vice President—Operations, 22%. In no event is a bonus paid unless pre-tax profits, excluding the above-mentioned items, exceed $1,000,000 for the fiscal year, nor is any bonus paid on the first $1,000,000 of pre-tax earnings, excluding the above-mentioned items. The Company had substantially the same plan in 2004, 2003, and 2002.

- (2)

- All Other Compensation for each of the executive officers consists of Company contributions under an Employee Stock Ownership Plan and Trust Agreement ("ESOP") which provides that the Company may contribute annually to the ESOP cash or common stock in an amount not to exceed 25% of all participants' total compensation (the maximum amount currently deductible under tax laws). The Board of Directors determines whether any contributions will be made for the year. Benefits are allocated to all eligible employees according to a formula based on compensation, except that any income earned on assets of the Trust is allocated to ESOP participants based upon the value that each participant's account bears to the total value of Trust assets.

- (3)

- Mr. Passantino became an executive officer of the Company in November, 2002.

The dollar amount of Other Annual Compensation changes from year to year because of fluctuations in the costs of benefits and their timing. Other Annual Compensation in the table above for 2002 through 2004 is comprised of the following:

| | Mark E. Goldstein | Jeffrey R. Hinkle | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2002 | 2003 | 2004 | ||||||||||||

| Automobile purchase(1) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||

| Income taxes on automobile purchase(1) | — | — | — | — | ||||||||||||||

| Other automobile expenses | 2,848 | 1,886 | 2,669 | 1,130 | 402 | 1,881 | ||||||||||||

| Memberships | 15,121 | 14,015 | 17,946 | — | — | — | ||||||||||||

| Life insurance | 2,412 | 2,412 | 2,412 | 1,344 | 1,344 | 1,478 | ||||||||||||

| Income taxes on life insurance | 2,131 | 1,839 | 1,839 | 1,026 | 944 | 1,035 | ||||||||||||

| Medical plan(2) | 3,075 | 5,362 | 3,851 | 1,406 | 2,812 | 2,688 | ||||||||||||

| Disability plan(3) | 4,672 | 4,672 | 4,672 | 5,160 | 5,161 | 4,987 | ||||||||||||

| Other | 2,260 | 3,525 | 2,643 | — | — | — | ||||||||||||

| Total other compensation | $ | 32,519 | $ | 33,711 | $ | 36,032 | $ | 10,066 | $ | 10,663 | $ | 12,069 | ||||||

Jeffry B. Johnson | Dennis P. Passantino | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2002 | 2003 | 2004 | ||||||||||||

| Automobile purchase(1) | $ | — | $ | — | $ | — | $ | 900 | $ | 6,158 | $ | 7,349 | ||||||

| Income taxes on automobile purchase(1) | — | — | — | 686 | 4,319 | 5,155 | ||||||||||||

| Other automobile expenses | 843 | 907 | 1,428 | — | 1,170 | 576 | ||||||||||||

| Memberships | — | — | — | — | — | — | ||||||||||||

| Life insurance | 2,427 | 2,427 | 3,241 | 887 | 646 | 1,016 | ||||||||||||

| Income taxes on life insurance | 1,850 | 1,657 | 2,272 | 676 | 621 | 713 | ||||||||||||

| Medical plan(2) | 1,950 | 5,140 | 9,441 | 131 | 692 | 911 | ||||||||||||

| Disability plan(3) | 802 | 802 | 929 | — | — | — | ||||||||||||

| Other | — | — | — | — | — | — | ||||||||||||

| Total other compensation | $ | 7,872 | $ | 10,933 | $ | 17,311 | $ | 3,280 | $ | 13,606 | $ | 15,720 | ||||||

- (1)

- Every three to five years, the Company provides funds needed, plus an amount to pay resulting income taxes, to each executive officer for the purchase of an automobile. In the case of Mr. Passantino, the amount shown for 2003 and 2004 represents the lease value, and income tax on that value, for his use in 2003 and 2004 of a vehicle leased by the Company.

- (2)

- In addition to group life, health, hospitalization and medical reimbursement plans which generally are available to all employees, the Company has adopted a plan which provides for additional medical coverage of not more than $50,000 per year to each of the Company's executive officers. The plan further provides that, for a period of five years following an executive officer's voluntary retirement, or involuntary retirement in the event of a change in control of the Company, the Company will, at no cost to the executive or his or her surviving dependents, cover the executive and/or such dependents under the Company Health Plan and shall also provide, at no cost to the executive, for the payment of additional medical coverage of up to $50,000 a year.

- (3)

- The Company maintains a Key Executive Disability Plan. The purpose of this Plan is to provide the executive with his or her regular salary during periods of long-term disability in excess of 90 days to age 70, or to date of death, whichever first occurs. The benefits available under this Plan will cease upon termination of employment as an executive officer of the Company other than during a period of disability. The Plan is partially funded by disability insurance maintained by the Company under which the Company is the beneficiary. The table sets forth the premiums paid by the Company for this disability insurance.

Option Grants in Last Fiscal Year

No options were granted to executive officers during 2004.

�� Outstanding Options

No options were exercised by any of the Company's executive officers during 2004. The following table summarizes information with respect to the value of each person's unexercised stock options at December 31, 2004.

| | Number of Securities Underlying Unexercised Options at Year End | In-the-Money Value of Unexercisable Options at Year End(1) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Name | |||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

| Mark E. Goldstein | 120,500 | 0 | $ | 0 | 0 | ||||

| Jeffrey R. Hinkle | 129,000 | 0 | $ | 0 | 0 | ||||

| Jeffry B. Johnson | 100,000 | 0 | $ | 5,880 | 0 | ||||

| Dennis P. Passantino | 100,000 | 0 | $ | 12,780 | 0 | ||||

- (1)

- The in-the-money value of unexercised options is equal to the excess of the per share market price of the Company's stock at December 31, 2004 of $0.60/share over the per share exercise price multiplied by the number of unexercised option.

Background

The Compensation Committee of the Board of Directors, in February, 2004 at the time of establishing the compensation payable in 2004 to the Company's executive officers, was comprised of two outside directors (Mr. Bellini and Mr. Field) and the Company's President (who serves as a non-voting member of the Committee). The responsibilities of the Compensation Committee include the origination of all executive compensation proposals.

In making decisions regarding executive compensation, the Compensation Committee considers a number of factors. The Compensation Committee has also determined that an outside consultant on compensation matters should be used once every three years.

Organization Philosophy

The Committee believes that the Company's organization and the specific responsibilities of its executive officers are an essential part of analyzing compensation levels. The first important point concerning the management of the Company is that each executive subscribes to a team concept of executive management, and operates in accordance with this concept. Although each of the executive officers has specific areas of responsibility and each is able to and often does make independent decisions, the executive officers operate as a collaborative team, and very few, if any, significant decisions are made without input from the group as a whole.

Second, each executive officer is responsible for a number of distinct areas and tasks. Each performs many tasks traditionally associated with "middle management" in other companies in addition to their respective duties of top level or executive management. As a result, the Company has very little "middle management" and operates as a fairly lean organization.

Mark E. Goldstein became President and Chief Executive Officer of the Company in 1990 and Chairman of the Board in February, 2000. Mark E. Goldstein has the responsibilities associated with these positions at a public company. He is also actively involved in the sales and marketing efforts of the Company and its development of new products. For example, Mark Goldstein is the primary contact with the Company's largest account, Wal-Mart Stores, Inc.; and he, together with Jeffrey R. Hinkle, directs the Company's advertising and promotional efforts. Mr. Goldstein also directs the Company's research and development and quality control activities. Each other executive officer reports to Mr. Goldstein as do certain key employees. He ultimately is responsible for the day-to-day operations of the Company, although he relies on the Company's other executive officers for advice and counsel.

Jeffrey R. Hinkle has been employed by the Company for 23 years. He joined the Company as a regional sales manager in 1981, held various sales positions at the Company's subsidiaries, including Vice President—Marketing of subsidiaries, and became Vice President—Marketing of the Company in February, 2000. His current title is Vice President—Marketing and Sales. Mr. Hinkle manages the Company's sales force, is responsible for marketing and works together with Mr. Goldstein in regard to the Company's advertising and promotional efforts. Together with Mr. Goldstein, Mr. Hinkle is a primary contact with the Company's largest accounts. Mr. Hinkle also is the primary contact with brokers utilized by the Company.

Jeffry B. Johnson was elected as the Company's Treasurer and Chief Financial Officer in November, 2000. Mr. Johnson has served the Company for 28 years. He joined the Company as internal auditor in 1976, was promoted to Controller in 1981, and to Chief Accounting Officer on October 1, 2000. Mr. Johnson performs all of the functions of Treasurer and Chief Financial Officer, including negotiations and maintenance of relationships with creditors. He also supervises back office functions relating to accounting, personnel, benefits and, together with Mr. Goldstein, data processing and computer operations.

Dennis P. Passantino was elected as an executive officer in November, 2002. He is the Vice President-Operations and Corporate Secretary. Mr. Passantino has served the Company for 23 years. He joined the Company as Materials Manager in 1981, was promoted to Operations Manager in 1991. Mr. Passantino has a direct responsibility for operations of the Company's plant and facilities.

Factors and Policies

In determining executive compensation in 2004, the Committee considered the management organization as described above and the following factors, among others:

- (a)

- Services performed and time devoted to the Company by the executive;

- (b)

- Amounts paid to executives in comparable companies;

- (c)

- The size and complexities of the business;

- (d)

- Successes achieved by the executive;

- (e)

- The executive's abilities;

- (f)

- The executive tenure;

- (g)

- Corporate financial results;

- (h)

- Prevailing economic conditions;

- (i)

- Compensation paid to other employees of the corporation; and

- (j)

- The amount previously paid to the executive.

The Company and the Compensation Committee have viewed the base salary as an important part of the compensation for the Company's executive officers as well as other employees. The Company's 2004 executive bonus plan provided for a bonus pool based on 10% of pre-tax profits (excluding items that are infrequent, unusual or extraordinary) for a year in excess of $1 million. Any bonus amount payable under the plan would have been divided among the executive officers. The Company had substantially the same plan in prior years and has implemented substantially the same plan for the year 2005.

The Company provides certain other benefits and perquisites to the executive officers. The Committee believes that the types of benefits offered to Company executives and the value of these benefits are similar to benefit packages provided by other companies. A number of the benefits are provided by the Company not only to the executive officers but also to other Company employees. The Company believes that these benefits are appropriate for their positions, to compensate them consistent with market levels and to facilitate performance of their jobs in a more efficient and effective manner.

Application of Factors

Utilizing these factors and policies, the Compensation Committee in February, 2004 determined that: Mr. Goldstein's base salary would remain the same in 2004, as in 2003, at $400,000; Mr. Hinkle's base salary would remain the same in 2004, as in 2003, at $225,000; that Mr. Johnson's base salary would remain the same in 2004, as in 2003, at $190,000; that Mr. Passantino's base salary would remain the same in 2004, as in 2003, at $183,750; that the 2004 key executive incentive bonus plan for executive officers be adopted; and that the components of other compensation provided to the Company's executive officers will also remain the same in 2004 as in 2003. Pursuant to authority granted by the Board, these determinations were final for the Company.

In considering the factors and policies, the Compensation Committee reviewed various matters, including:

- •

- The Company continued to expand the retail distribution of Montagne Jeunesse products.

- •

- The Company has endeavored to reposition Scott's Liquid Gold for wood, including reestablishment of distribution with certain retailers.

- •

- The Company has further developed the approach of using direct response television advertising.

- •

- The Company has repositioned Touch of Scent as well as changed the formula and packaging of Touch of Scent.

- •

- The Company continues to work on relationships for the manufacture or sale of products of others, such as private label manufacturing.

- •

- The Company is working on the development of possible new products.

- •

- The Company's four executive officers have done the work which in part of 2002 and in prior years was done by five executive officers.

- •

- The Company experienced a relatively small loss for the year 2003. As of February 2004, it is uncertain whether the Company would achieve, according to its projections, a net profit or a net loss in 2004.

- •

- The Hay Group was most recently engaged in 2004 and issued a compensation report in February, 2004. This report compared each element of the Company's base salary, total cash and total direct compensation for executive officers to the Hay Group's all-company executive compensation survey and to a peer group of fourteen companies in consumer products and specialty chemical industries. The peer group had median revenues of $30.3 million as of the most recent fiscal year end available to the Hay Group. The report concluded that:

- •

- Mr. Goldstein's base salary was raised in 2003; Mr. Hinkle's base salary was raised in 2003; Mr. Johnson's base salary was last changed when he became an executive officer in October, 2000; and Mr. Passantino's base salary has remained unchanged since prior to the time of his becoming an executive officer in November, 2002.

- •

- The Company has generally paid well its employees as part of its philosophy that good employees who are paid well and stay with the Company can contribute significantly to the successes of the Company's business. The Committee has previously reviewed the compensation of other key employees below the level of executive officer.

- •

- The base salaries, as determined by the Committee, and any bonus in 2004 were expected to be tax deductible, without being subject to a limitation on the deductibility or certain compensation in excess of $1 million under the Internal Revenue Code.

- •

- The existing form of bonus plan emphasizes performance and successes achieved by the executives, and this form of bonus plan as well as other components of compensation has been in effect for a number of years.

The aggregate total direct compensation levels (consisting of base salary, annual incentive and present value of long-term incentives) of the Company's four executives fall between the 25th and 50th percentile levels of the peer group and approximate the 25th percentile level of the general industry market, in the aggregate.

For the chief executive officer of the Company, actual total direct compensation levels are below the median of the markets by approximately 20% to 25%.

Aggregate total cash compensation levels (consisting of base salary and annual incentive) of the Company's four executive officers are within +/-5% of the median of each of the peer group and general industry group.

In the aggregate, base salary levels of the Company's four executive officers approximate the 75th percentile level of the peer group market and exceed the 75th percentile level of the general industry market.

As noted in the report, no annual incentives were paid in 2003, and therefore the actual total cash compensation equals base salary in the case of the Company.

Since 1992, the Compensation Committee has engaged a consultant on compensation matters every three years. The Hay Group was most recently engaged in 2004 and issued a report in February, 2004 as indicated above.

In conclusion, the Compensation Committee believes that the levels of compensation for the Company's executive officers have been fair and appropriate.

COMPENSATION COMMITTEE

(February 2004)

Carl A. Bellini

Dennis H. Field

Mark E. Goldstein

February 22, 2005

Stock Performance Graph

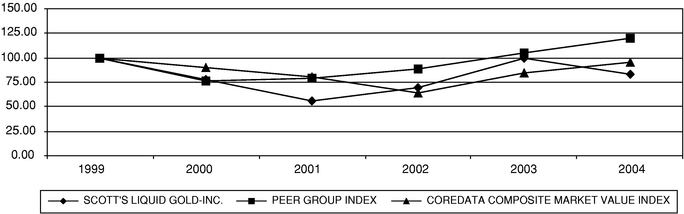

There follows a graph, constructed for the Company, comparing the cumulative total shareholder return of Scott's Liquid Gold-Inc. common stock to the CoreData Composite Market Value Index (see below), and to a selected peer group.

Fiscal year ended December 31

Assumes $100 invested on January 1, 2000

in the Company, the Peer Group,

The CoreData Composite Market Value Index

and assumes the reinvestment of any dividends

Note: The foregoing graph was prepared for the Company by CoreData Financial Information. The peer group selected by the Company consists of companies which use the standard industrial classification of specialty cleaning and sanitation and which are publicly held, and other publicly held companies which are partially or entirely engaged in the cosmetics business. The Company believes that, within its industry classes, the assembly of a peer group is difficult because the Company competes with other companies that are significantly larger than Scott's Liquid Gold-Inc., including two major companies which are not publicly traded.

The following companies comprise the peer group: Avon Products, Inc., CCA Industries, Inc., Chattem, Inc., Clorox Co., Del Laboratories, Inc., and Procter & Gamble Co. The CoreData Composite Stock Index, a published index, is a broad based common stock index, taking into account the market value of all of the companies on the New York, American and NASDAQ issues followed by CoreData, Inc. totaling over 10,000 issues. The index is fully adjusted for stock splits and stock dividends.

Compensation of Directors

Four directors are full-time executive officers of the Company and receive no additional compensation for service as a director. Carl A. Bellini, Dennis H. Field, and Gerald J. Laber are non-employee directors. The Company pays $2,500 per month to each non-employee director for his services as director.

On January 15, 1993, the Company's Board of Directors adopted the Company's 1993 Stock Option Plan for Outside Directors, which was approved by the Company's shareholders on May 5, 1993. The 1993 Plan provides for the granting of options to directors who are not employees of the Company. The purpose of the 1993 Plan is to further the growth and development of the Company by providing an incentive to outside directors of the Company, by increasing their involvement in the business and affairs of the Company, by helping the Company to attract and retain well qualified directors and/or by rewarding directors for their past dedication to the Company. The 1993 Plan became effective on January 15, 1993 and expired January 15, 2003.

A maximum of 400,000 shares of the Company's common stock were available for issuance upon the exercise of options granted under the 1993 Plan. The number of shares subject to outstanding options, and the exercise price per share of such options are subject to adjustment on account of stock dividends, stock splits, mergers, consolidations, recapitalizations, combinations or exchanges of stock, or other similar circumstances.

The 1993 Plan is administered by the Board of Directors or a committee appointed by and serving at the pleasure of the Board of Directors, consisting of no fewer than two directors. The 1993 Plan is currently administered by the Board of Directors. At March 15, 2005, options to purchase 130,000 shares of the Company's common stock were outstanding under the Plan. Except for the exercise of options for 100,000 shares by a director, who resigned from the Board during 1999, no options had been exercised at or prior to March 31, 2003.

The non-employee directors are also eligible to receive grants of options under the 1998 Stock Option Plan. Other eligible persons under the 1998 Plan are all full-time employees of the Company, and the Plan has been used primarily to provide options to full-time employees. Options granted to non-employee directors under the 1998 Plan consist of: Four options for a total of 120,000 shares granted to non-employee directors in December, 2000 (of which one option for 25,000 shares has expired); one option for a total of 50,000 shares to a non-employee director in February 2002; and one option for a total of 45,000 shares to a non-employee director in November, 2003. A maximum of 1,100,000 shares of common stock are available for issuance upon the exercise of options granted under the 1998 Plan. Options may be granted under the 1998 Plan through November 8, 2008. The option price for non-qualified stock options granted under the 1998 Plan, which are the only type available to non-employee directors, must not be less than 85% of the fair market value as of the date of grant of the shares subject to the option. In other respects, the 1998 Plan is similar to the terms of the 1993 Stock Option Plan described above.

On February 26, 2004, Mr. Laber received an option for 30,000 shares under the 1998 Plan with an exercise price of $0.76 per share, which was the fair value on the date of grant, and an expiration date of February 25, 2009; this option is fully vested.

The non-employee directors are also eligible to receive stock awards under the 2005 Stock Incentive Plan. This Plan is described below. No stock awards to non-employee directors have been made under the 2005 Plan as of March 15, 2005.

The following table summarizes information with respect to the value of each non-employee director's unexercised stock options at December 31, 2004:

| | Year End Option Values | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Unexercised Options at Year End | In-the-Money Value of Unexercised Options at Year End(1) | |||||||

| Name | |||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

| Carl A. Bellini | 105,000 | 0 | $ | 1,500 | 0 | ||||

| Dennis H. Field | 170,000 | 0 | $ | 3,000 | 0 | ||||

| Gerald J. Laber | 30,000 | 0 | $ | — | 0 | ||||

- (1)

- The in-the-money value of unexercised options is equal to the excess of the per share market price of the Company's stock at December 31, 2004 over the per share exercise price multiplied by the number of unexercised options.

APPROVAL OF 2005 STOCK INCENTIVE PLAN

In March, 2005, the Company's Board of Directors adopted the Scott's Liquid Gold-Inc. 2005 Stock Incentive Plan (the "Plan"), subject to approval and ratification by shareholders. The purpose of the Plan is to further the growth and development of the Company by affording an opportunity for stock ownership to employees, directors and consultants of the Company and its subsidiaries, to attract new employees and consultants, to retain existing employees and consultants and to encourage growth of the Company through incentives that are consistent with the Company's goals. A copy of the Plan appears asExhibit B to this Proxy Statement. Significant features of the Plan are summarized below, but this summary is qualified in its entirety by reference to the full text of the Plan.

The Plan provides that the Plan administrator may issue stock awards consisting of incentive and non-qualified stock options, stock appreciation rights, restricted stock and restricted stock units. The Plan administrator may grant one or more of these types of awards. The Board will administer the Plan unless the Board delegates the administration of the Plan to a committee, which will be appointed by and serve at the pleasure of the Board. The Plan administrator determines and designates from time to time (a) those eligible persons to whom awards are granted, (b) the size, form, terms (including vesting, if any) and conditions of awards under the Plan and (c) rules with respect to the administration of the Plan. The Plan administrator may at any time cancel an award, whether vested or unvested, if the participant engages in conduct that the Plan administrator determines to be detrimental to best interest of the Company, including failure to comply with policies or procedures of the Company.

Shares Subject to Plan; Limitations

The aggregate number of shares of Common Stock that may be issued under awards granted pursuant to the Plan may not exceed 600,000 shares. If there is a stock dividend, subdivision, reclassification, recapitalization, merger, consolidation, stock split, combination or exchange of stock, or other event described under the terms of the Plan, the administrator will make appropriate adjustments to the total number of shares available under the Plan and to outstanding awards. If an outstanding award expires or ceases to be exercisable, the shares that were subject to the award will continue to be available under the Plan.

During any single calendar year, no participant will be eligible to be granted awards exceeding 10% of the limit on shares under the Plan. From March, 2005 to the date on which the Plan terminates, no participant will be eligible to be granted awards exceeding 20% of the limit on shares.

Term of Plan

If approved by the stockholders, the Plan will be effective as of March 31, 2005. The Plan will terminate on March 31, 2015, unless terminated earlier by the Board. Termination of the Plan will not affect grants made prior to termination.

Eligibility

All full-time and part-time employees are eligible to receive any award under the Plan. Directors and consultants of the Company and its subsidiaries, who are not employees, are eligible to receive any award, other than incentive stock options, under the Plan.

Stock Options

The exercise price for an option granted under the Plan must not be less than 100% of the fair market value of the shares subject to the option at the date of grant. No option will be repriced. The term of each option may not be more than ten years from the date of grant. An option is fully vested unless otherwise provided by the Plan administrator in the option agreement. A participant may pay the exercise price and withholding taxes in cash or, upon approval of the Plan administrator, in common stock of the Company or another form of legal consideration. No incentive stock option may be granted to an employee who, at the time the incentive stock option is granted, owns stock (as determined in accordance with the Internal Revenue Code) representing more than 10% of the total combined voting power of all classes of stock of the Company or of any parent or subsidiary, unless the option price of such incentive stock option is at least 110% of the fair market value of the stock subject to the incentive stock option and the incentive stock option by its terms is not exercisable more than five years from the date it is granted.

Stock Appreciation Rights

A SAR is exercisable for the receipt of a number of shares of common stock having a fair market value equal to (1) the fair market value on the date of exercise of the number of shares as to which the SAR has been exercised over (2) the aggregate exercise price of the SAR for such number of shares. The exercise price for each SAR will be no less than the fair market value of the common stock at the time the SAR is granted. No SAR will be repriced. The term of any SAR may not exceed ten years from the date of grant. SARs will be fully vested unless otherwise determined by the Plan administrator and stated in a stock appreciation agreement.

Restricted Stock and Restricted Stock Units

Restricted stock may be granted to a participant without the payment of a purchase price. If a grant of restricted stock requires the payment of a purchase price, the purchase price of the restricted stock may not be repriced. If restricted stock has a purchase price, a participant must pay the purchase price in cash or, upon approval of the Plan administrator, in common stock or another form of legal consideration. If a participant fails to satisfy any applicable restriction (including vesting requirements) on the restricted stock, the restricted stock will be forfeited to the Company in return for no consideration or such consideration as specified in the applicable award agreement. Restricted stock constitutes issued and outstanding shares of common stock for all corporate purposes. The participant will have the right to vote the restricted stock, to receive and retain all regular cash dividends and such other distributions as the Board may, in its discretion, pay on the common stock, and to exercise all other rights, powers and privileges of a holder of common stock.

A restricted stock unit represents an obligation of the Company to deliver a specific number of shares of common stock to the participant on a specified date. Any award of restricted stock or an RSU will be fully vested or will vest in accordance with a vesting schedule provided in the agreement for that award as determined by the Plan administrator.

Valuation

For purposes of the Plan, the fair market value of common stock means the average of the closing sales prices for the common stock on its trading market for the five preceding trading days as reported in The Wall Street Journal or another publication or source for market prices selected by the Board of Directors. If there has not been trading of the common stock on a specific day, then a trading day is the next preceding day on which there was such trading. If closing sales prices are not available for the trading market, the average of the closing bid and asked prices are used. If none of these alternatives are available, the Plan administrator will determine the fair market value by applying any reasonable valuation method.

Change in Control

If the change in control event occurs, then the vesting of all awards will be accelerated in full. In anticipation of a change in control event, the Plan administrator may require that all unexercised awards be exercised upon the change in control event or within a specified number of days of the change in control. The Plan administrator may in its discretion also accelerate the vesting of any outstanding award in connection with any proposed or completed change in control event, and prior to a change in control event the Plan administrator may in its discretion terminate all unexercised awards (after acceleration of vesting) in exchange for consideration similar to that received by stockholders of common stock of the Company in the change of control event less the exercise price of the award. Alternatively, if a change in control event occurs, any surviving corporation or acquiring corporation may assume any outstanding award under the Plan or may substitute similar stock awards.

Termination of Continuous Service

Any vesting of an award ceases upon termination of a participant's service with the Company. A stock option or SAR will terminate and may not be exercised after three months after a participant's service with the Company ceases for any reason other than cause, disability or death. If a participant ceases service with the Company for cause or if the participant breaches any covenant not to compete or non-disclosure agreement, an unexercised stock option or SAR terminates immediately. If a participant ceases the service with the Company due to death or disability, an outstanding stock option or SAR will be exercisable for one year after that time but not later than the expiration date of the award. The Plan administrator may in its discretion extend the dates for termination of awards as stated in this paragraph.

If a participant terminates service with the Company for any reason, any unvested restricted stock or unvested RSUs held by the participant as of the date of termination of service will be forfeited to the Company unless otherwise provided in an applicable award agreement.

Amendment of Plan

The Board may at any time and from time to time alter, amend, suspend or terminate the Plan or any part thereof as it may deem proper, except that no such action can diminish or impair the rights under an award previously granted. However, approval of the stockholders shall be required to increase the total number of shares issuable under the Plan, to reduce the exercise price for any option, SAR or RSU or the purchase price for any restricted stock below a level required by the Plan or to modify materially requirements for eligibility under the Plan. The Plan administrator may modify, extend or renew outstanding awards except that this action must not diminish or impair the rights of a previously granted award without the consent of the participant.

Federal Income Tax Consequences

The rules governing the tax treatment of stock awards granted under the Plan depend largely on the surrounding facts and circumstances. Generally, under current federal income tax laws, a participant will recognize income, and the Company will be entitled to a deduction as follows:

Stock Options

If an employee does not dispose of the shares acquired pursuant to the exercise of an incentive stock option within one year after the transfer of the shares to the participant or within two years from the grant of the option, the employee will not realize taxable income as a result of the grant or exercise of the option (except for purposes of the alternative minimum tax upon the exercise of the option), and any gain or loss that is subsequently realized may be treated as a long term capital gain or loss, depending on the circumstances. The Company will not be able to deduct any amount for the grant of the incentive stock option or the transfer of shares upon exercise. If the employee disposes of the stock prior to one year after the transfer of the shares (or two years prior to the option grant date), the participant will realize ordinary income in an amount equal to the lesser of (a) the excess of the fair market value of the common stock acquired on the date of exercise over the exercise price or (b) the gain recognized on such disposition. Upon the exercise of a nonqualified stock option, the participant will generally realize ordinary income equal to the excess of the fair market value of the shares on the date of exercise over the exercise price. The Company will be able to deduct an amount equal to the ordinary income realized by the participant.

Restricted Stock

A participant who receives an award of restricted stock will realize ordinary income (on a per share basis) at the time any restrictions lapse equal to the difference between the fair market value of the common stock at the time such restrictions lapse and the amount (if any) paid for the stock. Alternatively, under Section 83 of the Internal Revenue Code, the participant may elect to accelerate the tax event and realize ordinary income (on a per share basis) equal to the difference between the purchase price (if any) of the common stock and the fair market value of the common stock on the date of grant upon the receipt of an award of restricted stock. When the participant recognizes ordinary income, the Company will be able to deduct an amount equal to the ordinary income recognized by the participant.

Restricted Stock Units

A participant who is granted an RSU will generally not recognize any income upon the grant of the award. The participant will generally recognize as ordinary income an amount equal to the fair market value of any shares transferred to the participant upon the vesting of such award. The Company will ordinarily be entitled to a deduction, in the amount of the ordinary income recognized by the participant, at the same time the participant recognizes such income, so long as the amount constitutes reasonable compensation.

Stock Appreciation Rights

Upon the exercise of any SAR, the value of any stock received will constitute ordinary income to the participant equal to the fair market value of the shares transferred to a participant upon the exercise. The Company will ordinarily be entitled to a deduction in the same amount and at the same time, so long as the amount constitutes reasonable compensation.

Section 409A

Section 409A, a new section added to the Code in 2004, makes significant changes to the tax treatment of certain types of deferred compensation. Failure to comply with the requirements of Section 409A results in current income of amounts deferred, along with interest and a significant tax penalty. Certain types of equity-based compensation are exempt from Section 409A. The Company intends to operate the Plan so that all grants under the Plan are exempt from Section 409A.

New Plan Benefits

As of the date of this proxy statement, no executive officer, employee, director or consultant has been granted any award under the Plan. The benefits to be received by the eligible participants pursuant to the Plan are not determinable at this time.

Other Equity Compensation Plan Information

The following table provides, as of December 31, 2004, information regarding the Company's equity compensation plans, which consists of the 1993, 1997 and 1998 Stock Option Plans. The 1993 Plan expired in January of 2003, and accordingly no shares are available for option under that Plan. The Company also has an Employee Stock Ownership Plan which invests only in common stock of the Company, but which is not included in the table below.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 1,115,500 | $ | .63 | 414,500 | |||

| Equity compensation plans not approved by security holders | -0- | -0- | -0- | ||||

| Total | 1,115,500 | $ | .63 | 414,500 | |||

The Board of Directors recommends a vote "FOR" approval and ratification of the 2005 Plan.

The Company has indemnification agreements with each of its directors and executive officers. These agreements provide for indemnification and advancement of expenses to the full extent permitted by law in connection with any proceeding in which the person is made a party because the person is a director or officer of the Company. They also state certain procedures, presumptions and terms relevant to indemnification and advancement of expenses.

The principal and controlling owner of Montagne Jeunesse, Gregory Butcher owned beneficially, to the knowledge of the Company, at March 15, 2005, approximately 10.0% of the Company's outstanding common stock. The Company has a distributorship agreement with Montagne Jeunesse, which was first established prior to Mr. Butcher's ownership of any shares in the Company and under which the Company purchases from Montagne Jeunesse, and sells in the United States, sachets of Montagne Jeunesse containing skin care and other beauty care products. During 2004, the Company's purchases of these sachets from Montagne Jeunesse were in the amount of $4,979,200. The Company's sales of Montagne Jeunesse products accounted in 2004 for a significant portion of the Company's total net revenues.

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of the outstanding shares of the Company to file with the Securities and Exchange Commission reports regarding changes in their beneficial ownership of shares in the Company. To the Company's knowledge, there was full compliance with all Section 16(a) filing requirements applicable to those persons for reports filed in 2004, except that reports for the following transactions were not timely filed: The grants of stock options on December 4, 2000 and February 19, 2002, to each of Mr. Bellini and Mr. Field; and the receipt by the Company's Employee Stock Ownership Plan of contributions of shares by the Company on June 4, 2004, and on September 2, 2004.

General

Ehrhardt, Keefe, Steiner & Hottman PC has been selected by the Audit Committee of the Board of Directors as the Company's independent auditors for the fiscal year ended December 31, 2005. Ehrhardt, Keefe, Steiner and Hottman PC has been the Company's independent auditors since June, 2003. A representative of Ehrhardt, Keefe, Steiner & Hottman PC is expected to be present at the Annual Meeting of Shareholders and to have the opportunity to make a statement if the representative so desires. Such representative also is expected to be available to respond to appropriate questions at that time.

Previous Accountants

KPMG LLP were the Company's independent auditors for the fiscal year ended December 31, 2002. On June 19, 2003, the Audit Committee of the Company's Board of Directors made the decision to change accountants. On June 20, 2003, the Company informed KPMG that the firm's appointment as principal auditors was terminated and Ehrhardt Keefe Steiner & Hottman PC ("EKS&H") was engaged as principal accountants.

KPMG's audit report on the Company's consolidated financial statements as of December 31, 2002 and for each of the years in the two-year period then ended, did not contain any adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except as follows: KPMG's audit report dated April 3, 2003 contained a separate paragraph stating that "the Company has restated the consolidated balance sheet as of December 31, 2001 and the related statements of operations, shareholders' equity and comprehensive income (loss), and cash flows for the two year period then ended, which consolidated financial statements were previously audited by other independent auditors who have ceased operations."

In connection with the audits of the two fiscal years ended December 31, 2002, and the subsequent interim period through June 20, 2003, there were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to their satisfaction would have caused them to make reference in connection with their opinion to the subject matter of the disagreement. In addition, during the above period, KPMG did not advise us that any of the reportable events as defined in Item 304(a)(1)(v) of SEC Regulation S-K existed or was applicable.

During the two most recent fiscal years ended December 31, 2001 and December 31, 2002 and the period from January 1, 2003 to the date of engaging EKS&H as stated above, the Company did not consult with EKS&H with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the consolidated financial statements, or any other matters or reportable events described in Items 304(a)(2)(i) and (ii) of SEC Regulation S-K.

The Company provided KPMG with a copy of the foregoing statements. KPMG stated that it agreed with such statements, except that KPMG said that it was not in a position to agree or disagree with statements that the changes were made by the Audit Committee, that EKS&H was engaged on June 19,2003 and that EKS&H was not consulted on any of the matters described above.

February 22, 2005

To the Board of Directors of Scott's Liquid Gold-Inc.:

We have reviewed and discussed with management the Company's audited financial statements. We have discussed with Ehrhardt, Keefe, Steiner & Hottman PC, its independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004 and filed with the Securities and Exchange Commission.

The Audit Committee is composed of the three directors named below, all of whom are independent directors as defined in Rule 4200(a)(15) of the Nasdaq Stock Market listing standards.

The Board has adopted a written charter for the Audit Committee.

Submitted by the members of the Audit Committee of the Board of Directors.

Gerald J. Laber, Chairman

Carl A. Bellini

Dennis H. Field

Disclosure of Auditor Fees

The following is a description of the fees billed to the Company by its independent auditor during each of the years ended December 31, 2004 and December 31, 2003. Ehrhardt, Keefe, Steiner & Hottman PC billed for work commencing in June, 2003, and KPMG LLP billed for work prior to June, 2003.

| | | Ehrhardt, Keefe, Steiner & Hottman PC | |||||||

|---|---|---|---|---|---|---|---|---|---|

| | KPMG LLP | ||||||||

| Audit and Non-Audit Fees | |||||||||

| 2003 | 2003 | 2004 | |||||||

| Audit fees | $ | 9,000 | $ | 32,571 | $ | 68,623 | |||

| Audit-related fees | — | 12,500 | 23,867 | ||||||

| Tax fees | 6,500 | 3,884 | 8,211 | ||||||

| All other fees | — | — | 28,250 | ||||||

| Total | $ | 15,500 | $ | 48,955 | $ | 128,951 | |||

Audit fees are for the audit of the Company's annual financial statements and the review of the Company's interim financial statements included in the Company's Quarterly Reports on Form 10-Q. Audit-related fees are for the audits of each of the three employee benefit plans. Tax fees primarily include tax compliance, tax advice and tax planning, including the review of, and assistance in the preparation of, federal and state tax returns, and tax advice and planning relating to such taxes.

Policy on Pre-Approval of Audit and Non-Audit Services

The Audit Committee's policy is to pre-approve all audit and non-audit services provided by the independent public accountants. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated limited pre-approval authority to its chairperson. The chairperson is required to report any decisions to pre-approve such services to the full Audit Committee at its next meeting.

Shareholder proposals for inclusion in the Company's proxy materials relating to the next annual meeting of shareholders must be received by the Company on or before December 7, 2005. Also, persons named in the proxy solicited by the Board of Directors of the Company for its year 2006 annual meeting of shareholders may exercise discretionary authority on any proposal presented by a shareholder of the Company at that meeting if the Company has not received notice of the proposal by February 20, 2006.

2004 ANNUAL REPORT ON FORM 10-K

Shareholders who wish to obtain, without charge, a copy of the Company's Form 10-K report for the year ended December 31, 2004 in the form filed with the Securities and Exchange Commission should address a written request to Dennis P. Passantino, Corporate Secretary, Scott's Liquid Gold-Inc., 4880 Havana Street, Denver, Colorado 80239. The Company's annual report to shareholders consists of such Form 10-K and accompanies this proxy statement.

The Company will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by mail, proxies may be solicited by officers and other regular employees of the Company by telephone, telegraph or by personal interview for which employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such persons, and the Company may reimburse such persons for reasonable out-of pocket expenses incurred by them in so doing.

As of the date of this Proxy Statement, Management was not aware that any business not described above would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons voting them.

The above Notice and Proxy Statement are sent by order of the Board of Directors.

| Dennis P. Passantino Corporate Secretary |

Denver, Colorado

April 6, 2005

EXHIBIT A

TO

PROXY STATEMENT

DATED APRIL 6, 2005

AUDIT COMMITTEE CHARTER

Purpose

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the financial statements of the Company, (2) the independent auditor's qualifications and independence, (3) the performance of the Company's independent auditors, and (4) the compliance by the Company with legal and regulatory requirements.

The Audit Committee shall prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company's annual proxy statement.

Committee Membership

The Audit Committee shall consist of no fewer than two members. The members of the Audit Committee shall meet the independence requirements of the Securities and Exchange Commission.

The members of the Audit Committee shall be appointed by the Board. Audit Committee members may be replaced by the Board.

Committee Authority and Responsibilities

The Audit Committee shall have the sole authority to appoint or replace the independent auditor, and shall pre-approve all audit engagement fees and terms and all non-audit services with the independent auditors. The Audit Committee shall consult with management but shall not delegate these responsibilities.

The Audit Committee shall meet as often as it determines, but not less frequently than quarterly. The Audit Committee may form and delegate authority to subcommittees when appropriate.

The Audit Committee shall have the authority, to the extent it deems necessary or appropriate, to retain special legal, accounting or other consultants to advise the Committee. The Company must provide appropriate funding, as determined by the Audit Committee, for payment for the services of such advisors. The Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Audit Committee shall meet with management, any internal auditors and the independent auditor in separate executive sessions at least quarterly.

The Audit Committee shall make regular reports to the Board. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval.

The Audit Committee, to the extent it deems necessary or appropriate, shall:

Financial Statement and Disclosure Matters

1. Review and discuss with management and the independent auditor the annual audited financial statements, including disclosures made in management's discussion and analysis, and recommend to the Board whether the audited financial statements should be included in the Company's Form 10-K.

2. Review and discuss with management and the independent auditor the Company's quarterly financial statements prior to the filing of its Form 10-Q, including the results of the independent auditors' reviews of the quarterly financial statements.

3. Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements, including any significant changes in the Company's selection or application of accounting principles, any major issues as to the adequacy of the Company's internal controls, the development, selection and disclosure of critical accounting estimates, and analyses of the effect of alternative assumptions, estimates or GAAP methods on the Company's financial statements.

4. Discuss with management the Company's earnings press releases, including the use of "pro forma" or "adjusted" non-GAAP information, as well as any financial information and earnings guidance provided to analysts and rating agencies.

5. Discuss with management and the independent auditor the effect of regulatory and accounting initiatives as well as any off-balance sheet structures on the Company's financial statements.