N-CSRS false 0000880195 N-1A Fidelity Aberdeen Street Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06440

Fidelity Aberdeen Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | March 31 |

|

|

Date of reporting period: | September 30, 2024 |

This report on Form N-CSR relates solely to the Registrant’s Fidelity Sustainable Target Date 2010 Fund, Fidelity Sustainable Target Date 2015 Fund, Fidelity Sustainable Target Date 2020 Fund, Fidelity Sustainable Target Date 2025 Fund, Fidelity Sustainable Target Date 2030 Fund, Fidelity Sustainable Target Date 2035 Fund, Fidelity Sustainable Target Date 2040 Fund, Fidelity Sustainable Target Date 2045 Fund, Fidelity Sustainable Target Date 2050 Fund, Fidelity Sustainable Target Date 2055 Fund, Fidelity Sustainable Target Date 2060 Fund, Fidelity Sustainable Target Date 2065 Fund, Fidelity Sustainable Target Date 2070 Fund, and Fidelity Sustainable Target Date Income Fund (the “Funds”).

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2070 Fund Fidelity Advisor® Sustainable Target Date 2070 Fund Class M : FRCYX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2070 Fund for the period June 28, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Class M A | $ 26 | 0.99% | |

AExpenses for the full reporting period would be higher.

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $571,788 | |

| Number of Holdings | 5 | |

Portfolio TurnoverA | 1% | |

A Amount not annualized

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918301.100 7667-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2070 Fund Fidelity® Sustainable Target Date 2070 Fund Class K : FRCRX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2070 Fund for the period June 28, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Class K A | $ 11 | 0.39% | |

AExpenses for the full reporting period would be higher.

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $571,788 | |

| Number of Holdings | 5 | |

Portfolio TurnoverA | 1% | |

A Amount not annualized

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918295.100 7664-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity Advisor® Sustainable Target Date 2015 Fund Class M : FSVTX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 47 | 0.92% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914950.100 7394-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2060 Fund Fidelity Advisor® Sustainable Target Date 2060 Fund Class A : FSZTX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2060 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 39 | 0.74% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $4,581,235 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915029.100 7473-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2070 Fund Fidelity Advisor® Sustainable Target Date 2070 Fund Class C : FRDCX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2070 Fund for the period June 28, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Class C A | $ 40 | 1.48% | |

AExpenses for the full reporting period would be higher.

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $571,788 | |

| Number of Holdings | 5 | |

Portfolio TurnoverA | 1% | |

A Amount not annualized

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918303.100 7668-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2055 Fund Fidelity® Sustainable Target Date 2055 Fund Class K6 : FSZRX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2055 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class K6 | $ 15 | 0.29% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,261,234 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915027.100 7471-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2045 Fund Fidelity Advisor® Sustainable Target Date 2045 Fund Class M : FSYPX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2045 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 52 | 0.99% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,918,268 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 15% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915004.100 7448-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2025 Fund Fidelity Advisor® Sustainable Target Date 2025 Fund Class A : FSWQX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2025 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 36 | 0.70% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $2,211,356 | |

| Number of Holdings | 7 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 44.4 |

| Domestic Equity Funds | 28.1 |

| International Equity Funds | 27.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 28.1 | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 25.0 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 18.2 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 10.6 | |

| Fidelity Series Sustainable Emerging Markets Fund | 9.3 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 4.9 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914966.100 7410-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2030 Fund Fidelity Advisor® Sustainable Target Date 2030 Fund Class A : FSXBX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2030 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 37 | 0.71% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $4,820,166 | |

| Number of Holdings | 7 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 37.8 |

| Domestic Equity Funds | 32.0 |

| International Equity Funds | 30.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 32.0 | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 22.2 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 20.0 | |

| Fidelity Series Sustainable Emerging Markets Fund | 10.2 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 6.5 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.3 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.8 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914975.100 7419-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2020 Fund Fidelity® Sustainable Target Date 2020 Fund Class K : FSWMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2020 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class K | $ 17 | 0.33% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,914,543 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 52.3 |

| International Equity Funds | 24.2 |

| Domestic Equity Funds | 23.3 |

| Short-Term Funds | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 32.3 | |

| Fidelity Series Sustainable U.S. Market Fund | 23.3 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 15.6 | |

| Fidelity Series Sustainable Emerging Markets Fund | 8.6 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 8.0 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 4.3 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.7 | |

| Fidelity Series Treasury Bill Index Fund | 0.2 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914963.100 7407-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date Income Fund Fidelity Advisor® Sustainable Target Date Income Fund Class M : FSUHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date Income Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 47 | 0.91% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,165,797 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 11% | |

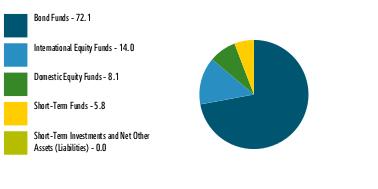

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 72.1 |

| International Equity Funds | 14.0 |

| Domestic Equity Funds | 8.1 |

| Short-Term Funds | 5.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 44.1 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 21.1 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 8.4 | |

| Fidelity Series Sustainable U.S. Market Fund | 8.1 | |

| Fidelity Series Treasury Bill Index Fund | 5.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 5.6 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.2 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 0.7 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914932.100 7376-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2045 Fund Fidelity Advisor® Sustainable Target Date 2045 Fund Class Z : FSYSX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2045 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 20 | 0.39% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,918,268 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 15% | |

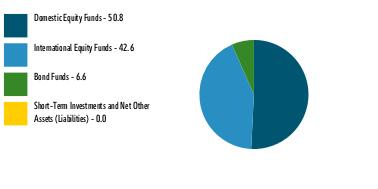

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915006.100 7450-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2020 Fund Fidelity Advisor® Sustainable Target Date 2020 Fund Class M : FSWHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2020 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 48 | 0.93% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,914,543 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 52.3 |

| International Equity Funds | 24.2 |

| Domestic Equity Funds | 23.3 |

| Short-Term Funds | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 32.3 | |

| Fidelity Series Sustainable U.S. Market Fund | 23.3 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 15.6 | |

| Fidelity Series Sustainable Emerging Markets Fund | 8.6 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 8.0 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 4.3 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 3.7 | |

| Fidelity Series Treasury Bill Index Fund | 0.2 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914959.100 7403-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2070 Fund Fidelity® Sustainable Target Date 2070 Fund : FRCQX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2070 Fund for the period June 28, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® Sustainable Target Date 2070 Fund A | $ 13 | 0.49% | |

AExpenses for the full reporting period would be higher.

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $571,788 | |

| Number of Holdings | 5 | |

Portfolio TurnoverA | 1% | |

A Amount not annualized

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918293.100 7663-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2050 Fund Fidelity Advisor® Sustainable Target Date 2050 Fund Class M : FSZAX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2050 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 52 | 0.99% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,660,101 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915013.100 7457-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2045 Fund Fidelity Advisor® Sustainable Target Date 2045 Fund Class A : FSYLX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2045 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 39 | 0.74% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,918,268 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 15% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915002.100 7446-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity® Sustainable Target Date 2015 Fund : FSVNX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable Target Date 2015 Fund | $ 22 | 0.42% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914947.100 7391-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity Advisor® Sustainable Target Date 2015 Fund Class I : FSVUX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 22 | 0.42% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914951.100 7395-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2060 Fund Fidelity Advisor® Sustainable Target Date 2060 Fund Class Z : FTDLX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2060 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 20 | 0.39% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $4,581,235 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915033.100 7477-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2065 Fund Fidelity Advisor® Sustainable Target Date 2065 Fund Class I : FTHBX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2065 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 26 | 0.49% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $3,007,785 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 9% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915041.100 7485-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2050 Fund Fidelity Advisor® Sustainable Target Date 2050 Fund Class Z : FSZCX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2050 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 20 | 0.39% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,660,101 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915015.100 7459-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity Advisor® Sustainable Target Date 2015 Fund Class Z : FSVWX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 17 | 0.32% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914952.100 7396-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2050 Fund Fidelity® Sustainable Target Date 2050 Fund : FSYWX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2050 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable Target Date 2050 Fund | $ 26 | 0.49% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,660,101 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915010.100 7454-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity® Sustainable Target Date 2015 Fund Class K : FSVZX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class K | $ 17 | 0.32% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914954.100 7398-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2015 Fund Fidelity Advisor® Sustainable Target Date 2015 Fund Class C : FSVPX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2015 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 73 | 1.42% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,141,685 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 60.7 |

| International Equity Funds | 20.4 |

| Domestic Equity Funds | 17.9 |

| Short-Term Funds | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 37.7 | |

| Fidelity Series Sustainable U.S. Market Fund | 17.9 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 12.9 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 10.9 | |

| Fidelity Series Sustainable Emerging Markets Fund | 7.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.6 | |

| Fidelity Series Treasury Bill Index Fund | 1.0 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914949.100 7393-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2055 Fund Fidelity Advisor® Sustainable Target Date 2055 Fund Class I : FSZMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2055 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 26 | 0.49% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,261,234 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915023.100 7467-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2040 Fund Fidelity Advisor® Sustainable Target Date 2040 Fund Class Z : FSYDX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2040 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 20 | 0.38% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,907,996 | |

| Number of Holdings | 7 | |

| Portfolio Turnover | 17% | |

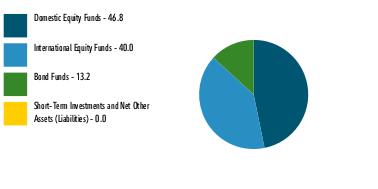

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 46.8 |

| International Equity Funds | 40.0 |

| Bond Funds | 13.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 46.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 27.0 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.7 | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 5.2 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.2 | |

| Fidelity Series International Developed Markets Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914997.100 7441-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2055 Fund Fidelity® Sustainable Target Date 2055 Fund : FSZHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2055 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable Target Date 2055 Fund | $ 26 | 0.49% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,261,234 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 8% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915019.100 7463-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2065 Fund Fidelity® Sustainable Target Date 2065 Fund : FTGPX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2065 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Sustainable Target Date 2065 Fund | $ 26 | 0.49% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $3,007,785 | |

| Number of Holdings | 5 | |

| Portfolio Turnover | 9% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915037.100 7481-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2070 Fund Fidelity Advisor® Sustainable Target Date 2070 Fund Class Z : FRDEX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2070 Fund for the period June 28, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Class Z A | $ 11 | 0.39% | |

AExpenses for the full reporting period would be higher.

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $571,788 | |

| Number of Holdings | 5 | |

Portfolio TurnoverA | 1% | |

A Amount not annualized

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 50.8 |

| International Equity Funds | 42.6 |

| Bond Funds | 6.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 50.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 28.8 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.5 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9918307.100 7670-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2040 Fund Fidelity Advisor® Sustainable Target Date 2040 Fund Class C : FSXYX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2040 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 77 | 1.48% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $5,907,996 | |

| Number of Holdings | 7 | |

| Portfolio Turnover | 17% | |

What did the Fund invest in?

(as of September 30, 2024)

| Domestic Equity Funds | 46.8 |

| International Equity Funds | 40.0 |

| Bond Funds | 13.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable U.S. Market Fund | 46.8 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 27.0 | |

| Fidelity Series Sustainable Emerging Markets Fund | 13.0 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 5.7 | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 5.2 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 1.2 | |

| Fidelity Series International Developed Markets Bond Index Fund | 1.1 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914994.100 7438-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2010 Fund Fidelity® Sustainable Target Date 2010 Fund Class K6 : FSVMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Sustainable Target Date 2010 Fund for the period April 1, 2024 to September 30, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class K6 | $ 11 | 0.21% | |

Key Fund Statistics (as of September 30, 2024)

KEY FACTS | | |

| Fund Size | $1,137,784 | |

| Number of Holdings | 9 | |

| Portfolio Turnover | 11% | |

What did the Fund invest in?

(as of September 30, 2024)

| Bond Funds | 67.1 |

| International Equity Funds | 16.7 |

| Domestic Equity Funds | 12.4 |

| Short-Term Funds | 3.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Series Sustainable Investment Grade Bond Fund | 41.3 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 16.6 | |

| Fidelity Series Sustainable U.S. Market Fund | 12.4 | |

| Fidelity Series Sustainable Non-U.S. Developed Markets Fund | 10.3 | |

| Fidelity Series Sustainable Emerging Markets Fund | 6.4 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| Fidelity Series Treasury Bill Index Fund | 3.8 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 2.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 2.4 | |

| | 100.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914946.100 7390-TSRS-1124 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF SEPTEMBER 30, 2024 | |

| | Fidelity® Sustainable Target Date 2040 Fund Fidelity® Sustainable Target Date 2040 Fund Class K6 : FSYGX |

| | | |