QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Dendrite International, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| |  |

|

DENDRITE INTERNATIONAL, INC. |

|

April 26, 2005 |

|

Dear Shareholder: |

|

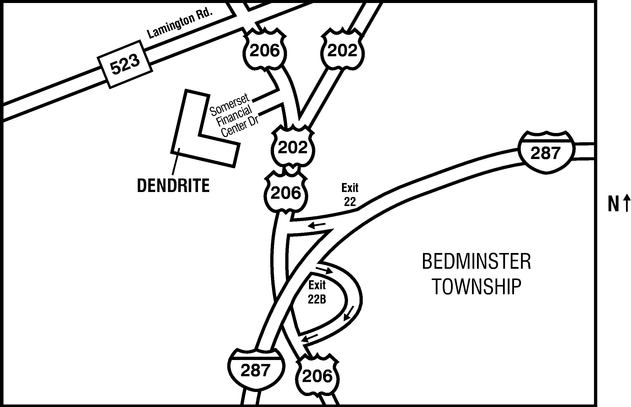

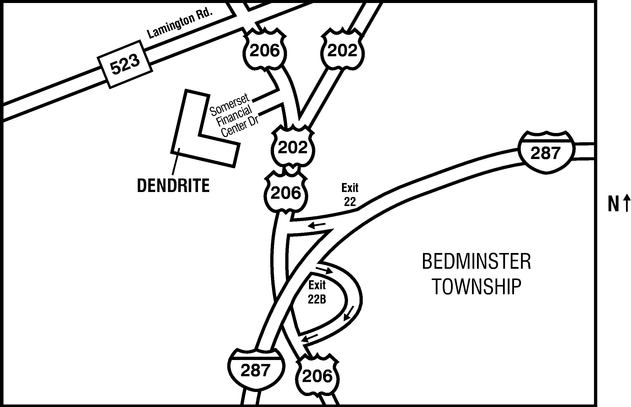

On behalf of the Board of Directors and management, I am pleased to invite you to the 2005 Annual Meeting of Shareholders of Dendrite International, Inc. The meeting will be held on Tuesday, May 17, 2005 at 9:00 a.m. at Dendrite's offices located at 1405 U.S. Highway 206, Bedminster, New Jersey 07921. |

| | |

| | Your vote at the Annual Meeting is important to Dendrite and we ask you to vote your shares by following the voting instructions in the enclosed proxy. The Notice of Annual Meeting of Shareholders, Proxy Statement and form of proxy are enclosed with this letter. |

| | |

| | The officers and directors of Dendrite appreciate your continuing support and we look forward to seeing you at the Annual Meeting. |

|

|

|

John E. Bailye

Chairman of the Board and Chief

Executive Officer |

| | Bedminster, New Jersey |

| | |

| | |

| |

| | YOUR VOTE IS IMPORTANT |

|

To assure your representation at the Annual Meeting, please vote your proxy as promptly as possible, whether or not you plan to attend the Annual Meeting. |

|

| |  | | |

|

DENDRITE INTERNATIONAL, INC.

1405 U.S. Highway 206

Bedminster, New Jersey 07921

www.dendrite.com |

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 17, 2005 |

|

To Dendrite Shareholders: |

|

The Annual Meeting of Shareholders of Dendrite International, Inc., a New Jersey corporation (the "Company"), will be held at the Company's offices located at 1405 U.S. Highway 206, Bedminster, New Jersey 07921, on Tuesday, May 17, 2005 at 9:00 a.m. local time (the "Annual Meeting") for the following purposes: |

|

1. |

|

To elect eight directors. |

|

2. |

|

To ratify the selection by the Audit Committee of Deloitte & Touche LLP as the Company's independent registered public accounting firm. |

|

3. |

|

To approve an amendment to the Company's 1997 Stock Incentive Plan to increase the number of authorized plan shares by 1,000,000 shares. |

|

Shareholders of record at the close of business on March 22, 2005 are entitled to notice of and to vote at the Annual Meeting or at any postponement or adjournment.

It is important that your shares are represented at the Annual Meeting regardless of the number of shares you may hold. If you receive more than one proxy card because your shares are registered in different names or addresses, each proxy card should be signed and returned to ensure that all of your shares are voted. The prompt return of proxies will ensure a quorum is present at the Annual Meeting. Whether or not you plan to attend the meeting, please vote your proxy promptly. |

|

|

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

|

| | | | | | Christine A. Pellizzari

Secretary |

| | Bedminster, New Jersey

April 26, 2005 |

DENDRITE INTERNATIONAL, INC.

1405 U.S. Highway 206

Bedminster, New Jersey 07921

www.dendrite.com

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 17, 2005

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Dendrite International, Inc., a New Jersey corporation ("Dendrite" or the "Company"), for use at the 2005 Annual Meeting of Shareholders to be held at 9:00 a.m. local time on Tuesday, May 17, 2005, at the Company's offices located at 1405 U.S. Highway 206, Bedminster, New Jersey 07921 and at any adjournment or postponement (the "Annual Meeting"). This Proxy Statement, Notice of Annual Meeting and proxy are being distributed to shareholders by mail or by the Internet on or about April 26, 2005.

GENERAL

Voting

The presence in person or by proxy of the holders of Common Stock representing a majority of the shares of Common Stock outstanding as of the record date constitutes a quorum for the transaction of business at the Annual Meeting. Each shareholder is entitled to one vote in person or by proxy for each share of Common Stock held as of the record date on each matter to be voted on. On March 22, 2005, the record date for the Annual Meeting, there were 42,520,636 shares of Common Stock outstanding. Abstentions and broker non-votes are included in determining whether a quorum is present. Broker non-votes occur when a broker returns a proxy but does not have authority or instructions to vote on a particular proposal.

Shares of Common Stock represented by a properly executed proxy received in time for the Annual Meeting will be voted as specified in the proxy, unless the proxy has previously been revoked. Unless contrary instructions are given in the proxy, it will be voted for the persons designated in the proxy as the Board of Directors' nominees for director, for the ratification of the independent registered public accounting firm, for the amendment of the 1997 Stock Incentive Plan, and at the discretion of the proxy holders with respect to any other matter properly submitted to shareholders at the Annual Meeting, which may include, among other things, a motion to adjourn the meeting or part of the meeting relating to one or more items to be voted on at the Annual Meeting.

If there is no quorum, a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting. If such an adjournment is proposed by the Company, the proxy holders intend to vote all shares of Common Stock for which they have voting authority in favor of the adjournment.

The Company may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. If adjournment is proposed by the Company for this reason, the execution of your proxy also authorizes the proxy holders to vote all shares for which they have such voting authority for such an adjournment, unless you otherwise indicate on your proxy.

An adjournment will have no effect on the business that may be conducted at the Annual Meeting. If the Annual Meeting is postponed or adjourned in whole or in part, your proxy will remain valid and may be voted at the postponed or adjourned meeting. You will remain able to revoke your proxy until it is voted. A separate box is included on the proxy card giving the named proxies the authority to vote on any proposed adjournment or postponement of the Annual Meeting unless you have indicated otherwise on the proxy card.

1

Under New Jersey law, if a quorum is present, the eight nominees for election to the Board of Directors who receive the greatest number of affirmative votes cast at the Annual Meeting will be elected as directors. If a quorum is present, ratification of the independent registered public accounting firm, approval of the amendment of the 1997 Stock Incentive Plan, and approval of any other matter that properly comes before the Annual Meeting requires the favorable vote of a majority of the votes cast. Only votes for or against a proposal count. Abstentions and broker non-votes will have no effect on the outcome of any matter voted on at the Annual Meeting.

Shareholders may vote using one of three alternative methods:

- (1)

- by completing and mailing the proxy card; or

- (2)

- over the telephone by following the instructions for telephone voting on the proxy card or voter instruction form; or

- (3)

- via the Internet by going to the website www.proxyvote.com and following the instructions for Internet voting on the proxy card.

If your shares are registered in the name of a bank, broker or other nominee, you still may be eligible to vote your shares over the Internet. You should contact your nominee for additional information regarding Internet voting in such case.

Proxies

Whether or not you attend the Annual Meeting, you are asked to submit your proxy, which will be voted as directed on your proxy when properly completed.

A proxy may be revoked prior to the exercise of the proxy either by delivering written notice of revocation to the Secretary of the Company or by delivering a new proxy bearing a later date. A proxy may also be revoked by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not in itself constitute revocation of a proxy.

This proxy solicitation is being made by the Board of Directors of the Company and the expense of preparing, printing and mailing this proxy statement and proxy is being paid by the Company. In addition to use of the mails, proxies may be solicited personally or by electronic mail, facsimile or telephone by regular employees and directors of the Company without additional compensation. The Company will reimburse banks, brokers and other custodians, nominees and fiduciaries for their costs in sending proxy materials to the beneficial owners of Common Stock. Dendrite has retained The Proxy Advisory Group of Strategic Stock Surveillance, LLC to assist in soliciting proxies and to provide related advice and information for a services fee and customary disbursements not expected to exceed $15,000 in the aggregate.

If a person is a participant in the Company's 401(k) savings plan and has Common Stock in a plan account, the proxy also serves as voting instructions for the plan trustee.

Annual Meeting Admission

You will need a form of personal identification to attend the Annual Meeting. If you own stock through a bank or other holder of record, you will need proof of ownership to attend the meeting. A recent brokerage statement or letter from your broker are examples of proof of ownership.

Internet Distribution of Proxy Materials

The Company will transmit the Proxy Statement and related proxy materials via the Internet to each shareholder of record that has consented to receiving such proxy materials electronically and to employees who participate in the Company's employee stock purchase plan. The Company believes that transmitting

2

the proxy materials over the Internet to shareholders saves the Company the expense of printing and mailing proxy materials.

You may also access a copy of Dendrite's annual report and proxy statement free of charge through the Investor Relations section of the Company's website, www.dendrite.com. The information contained on the website is not incorporated by reference in or otherwise considered to be part of this document.

Multiple Copies of Annual Report and Proxy Statement

We have adopted a procedure approved by the SEC called "householding" which will reduce our printing costs and postage fees. Under this procedure, shareholders of record who share the same address and do not participate in electronic delivery of proxy materials may receive only one copy of our annual report and proxy statement unless one or more of these shareholders notify us that they wish to continue receiving individual copies. Shareholders who participate in householding will continue to receive separate proxy cards.

If you are an eligible shareholder of record receiving multiple copies of our annual report and proxy statement at your household, you can request householding by contacting your broker if your shares are held in a brokerage account or by contacting the Company if you hold registered shares. If you are a shareholder of record residing at an address that participates in householding and you wish to receive separate documents in the future, you may write, call or e-mail Investor Relations, 1405 U.S. Highway 206, Bedminster, New Jersey 07921, telephone (908) 443-2000, e-mail investorrelations@dendrite.com. If you own your shares through a bank, broker or other nominee, you can request householding by contacting the nominee.

3

CORPORATE GOVERNANCE

General

Dendrite is committed to sound principles of corporate governance which promote honest, responsible and ethical business practices. The Company's corporate governance practices are actively reviewed and evaluated by the Board of Directors and the Corporate Governance and Nominating Committee. This review has included comparing the Board's current governance policies and practices with those suggested by authorities active in corporate governance as well as the practices of other public companies. Based upon this evaluation, the Board has adopted corporate governance guidelines that it believes are the most appropriate corporate governance policies and practices for the Company.

Board Independence and Composition

The Board has reviewed all relationships between each director and the Company and, based on this review, the Board has affirmatively determined that John A. Fazio, Bernard M. Goldsmith, Edward J. Kfoury, Paul A. Margolis, Terence H. Osborne and Patrick J. Zenner are each independent in accordance with all NASDAQ independence standards.

The Board determines the independence of its members through a broad consideration of all relevant facts and circumstances, including an assessment of the materiality of any relationship between the Company and a director. In making each of these independence determinations, the Board considered and broadly assessed, from the standpoint of materiality and independence, all of the information provided by each director in response to detailed inquiries concerning his independence and any direct or indirect business, family, employment, transactional or other relationship or affiliation of such director with the Company.

Lead Director

The independent members of the Board of Directors have appointed Edward J. Kfoury as Lead Director. The Lead Director's duties and authority include the following:

- •

- Presiding at all meetings of the Board of Directors at which the Chairman is not present, including executive sessions of the independent directors

- •

- Serving as a liaison between the Chairman and the independent directors

- •

- Reviewing and consulting with management on agendas for meetings of the Board of Directors and materials to be sent to the Board

- •

- Approving meeting schedules to assure that there is sufficient time for discussion of agenda items

- •

- Calling meetings of the independent directors

- •

- If requested by significant shareholders, being available for communication on issues of corporate policy, consistent with legal requirements.

Board Committees and Meetings

The Company has an Audit Committee, a Corporate Governance and Nominating Committee, and a Compensation Committee. The Board and its committees meet throughout the year on a regular schedule, hold special meetings as necessary and act by written consent as appropriate. The independent directors also hold regularly scheduled meetings at which only independent directors are present. As Lead Director, Mr. Kfoury leads these executive sessions. The charters for the Audit Committee, Corporate Governance and Nominating Committee and the Compensation Committee are available at the Investor Relations section of the Company's website, www.dendrite.com.

The Audit Committee is comprised of Messrs. Fazio, Margolis and Zenner, each of whom the Board of Directors has determined satisfies the independence and audit committee qualification standards of NASDAQ and the SEC. The Audit Committee serves as a communication point among non-Audit

4

Committee directors, internal auditors, the independent registered public accounting firm and Company management as their respective duties relate to financial accounting, financial reporting and internal controls. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to accounting policies, internal controls, financial and operating controls, standards of corporate conduct and performance, financial reporting practices and sufficiency of auditing.

The Board has determined that all Audit Committee members are financially literate and at least one member has accounting or related financial management expertise in accordance with applicable NASDAQ rules. The Board has also determined that Mr. Fazio is an audit committee financial expert within the meaning of the SEC regulations. This designation is an SEC disclosure requirement related to Mr. Fazio's experience and understanding of accounting and auditing matters and is not intended to impose any additional duty, obligation or liability on Mr. Fazio.

The Corporate Governance and Nominating Committee is comprised of Messrs. Goldsmith, Kfoury and Zenner, each of whom the Board of Directors has determined is independent within the meaning of NASDAQ independence standards. The principal responsibilities of the Corporate Governance and Nominating Committee are to assess and provide recommendations to the Board concerning corporate governance practices and to identify potential director candidates.

The Compensation Committee is comprised of Messrs. Goldsmith, Kfoury and Osborne, each of whom the Board of Directors has determined is independent within the meaning of NASDAQ independence standards. The Compensation Committee reviews and approves the compensation arrangements for the Company's senior executives and outside directors. The Compensation Committee also administers various equity incentive plans of the Company.

In 2004, the Board of Directors held 5 meetings, the Audit Committee held 12 meetings, the Corporate Governance and Nominating Committee held 3 meetings and the Compensation Committee held 4 meetings. Each director attended at least 75% of the meetings of the Board of Directors and of the Committees of which he was a member.

Director Candidates

The Corporate Governance and Nominating Committee, together with the Chairman of the Board and other Board members, from time to time as appropriate identify the need for new Board members. In identifying candidates, the Corporate Governance and Nominating Committee seeks input from the Chairman of the Board, other Board members and other sources to ensure that all points of view can be considered and the best possible candidates can be identified. The Corporate Governance and Nominating Committee may also engage an independent search firm for such purpose. Members of the Corporate Governance and Nominating Committee, the Chairman of the Board and other Board members typically interview selected candidates. The Corporate Governance and Nominating Committee will determine which candidates are to be recommended to the Board for approval.

All Dendrite directors play a critical role in guiding the Company's long-term business strategy and in overseeing the management of the Company. Board candidates are considered based on various criteria which may change over time. At a minimum, the Corporate Governance and Nominating Committee considers:

- •

- the appropriate mix of educational and professional background and business experience to make a significant contribution to the overall composition of the Board;

- •

- global business and social perspective;

- •

- if appropriate, whether the candidate would be considered an audit committee financial expert or independent;

5

- •

- demonstrated personal and professional character and reputation consistent with the image and reputation of Dendrite; willingness to apply sound and independent business judgment; and ability to work productively with the other members of the Board; and

- •

- availability for the substantial duties and responsibilities of a Dendrite director.

The Corporate Governance and Nominating Committee also considers such other factors as may be appropriate including the current composition of the Board and evaluations of prospective candidates.

Shareholders wishing to submit a director candidate for consideration by the Corporate Governance and Nominating Committee must submit the recommendation to that Committee, c/o the Secretary of the Company, 1405 U.S. Highway 206, Bedminster, New Jersey 07921, in writing, not less than 120 days nor more than 150 days prior to the annual meeting date (determined based on the same date as the preceding year's annual meeting). In order to ensure that a shareholder wishing to propose a candidate for consideration by the Corporate Governance and Nominating Committee has a significant stake in the Company, the shareholder submitting the candidate must be the beneficial owner of at least 1% of the Company's outstanding shares for at least one year. The request must be accompanied by the same information concerning the director candidate and the recommending shareholder as described in Article II, Section 7 of the Company's By-laws for shareholder nominations for director. The Corporate Governance and Nominating Committee may also request additional background or other information. Nothing above limits a shareholder's right to propose a nominee for director at an annual meeting in accordance with the procedures set forth in the Company's By-laws.

Shareholder Communications Process; Director Attendance Policy

Information regarding the Company's process for shareholders to communicate with the Board of Directors and the manner in which such communications are forwarded and the Company's policy regarding director attendance at annual meetings and the number of directors that attended last year's annual meeting is available at the Investor Relations section of the Company's website located at www.dendrite.com.

6

ITEM 1

ELECTION OF DIRECTORS

General

The Board of Directors proposes the election of eight nominees as directors of the Company. Directors are elected annually by the holders of Common Stock. Directors will hold office until the next Annual Meeting or until their successors are chosen and qualified. In the event that any of the nominees should become unavailable for election, which is not expected, the persons named in the accompanying proxy intend to vote for such other person or persons, if any, as the Board of Directors may designate as a substitute nominee.

Set forth below is a brief description of the background of each nominee for director. All nominees are current directors of the Company.

Nominee

| | Age

| | Position With The Company

|

|---|

| John E. Bailye | | 51 | | Chairman of the Board and Chief Executive Officer |

| John A. Fazio | | 61 | | Director |

| Bernard M. Goldsmith | | 61 | | Director |

| Edward J. Kfoury | | 66 | | Director |

| Paul A. Margolis | | 51 | | Director |

| John H. Martinson | | 57 | | Director |

| Terence H. Osborne | | 66 | | Director |

| Patrick J. Zenner | | 58 | | Director |

The Board of Directors recommends a vote for the above nominees.

Business Experience

John E. Bailye has served as Chief Executive Officer and a director since the Company's incorporation in 1987 and since 1991 has had the additional position of Chairman of the Board. Prior to 1987, Mr. Bailye served as a Managing Director of Foresearch Pty., Limited, a consulting company to the pharmaceutical industry in Australia. Mr. Bailye served in that capacity from the time he acquired Foresearch in 1976 until he sold the company in 1986. Mr. Bailye holds a Bachelor of Commerce in Finance, Marketing and Business from the University of New South Wales.

John A. Fazio has served as a director of the Company since 2003. Mr. Fazio served in various accounting, auditing, consulting and administrative capacities with PricewaterhouseCoopers ("PwC") from 1967 until his retirement in 2000, including Senior General Practice Partner and a National Business Leader in PwC's pharmaceutical practice, Vice Chairman, International and head of PwC's Strategic Risk Services practice. Mr. Fazio is a member of the American Institute of Certified Public Accountants and the Institute of Management Accountants. Mr. Fazio became a director of ImClone Systems Inc. in February 2003 and is a director of Heidrick & Struggles International, Inc. Mr. Fazio is a Certified Public Accountant and Certified Management Accountant and holds a Bachelor of Science in Accounting from Penn State University and Masters Degree in Accounting from Ohio State University.

Bernard M. Goldsmith has served as a director of the Company since 1996. In 1986, he founded Updata Capital, Inc., an investment banking firm focused on mergers and acquisitions in the information technology industry. Mr. Goldsmith currently serves as Managing Director of Updata. Mr. Goldsmith also founded Updata Software Company where he served as Chief Executive Officer from 1986 to 1988 and CGA Computer, Inc. where he served as Chairman and Chief Executive Officer from 1968 to 1986. He is

7

also a director of various private companies. Mr. Goldsmith holds a Bachelor of Arts in Business Administration from Rutgers University.

Edward J. Kfoury has served as a director of the Company since 1997. He has also served as the Company's Lead Director since the Board created the position in April 2003. Mr. Kfoury served as a division President and Vice President of International Business Machines Corporation ("IBM") from 1988 through 1993 and in various other positions with IBM from 1963 to 1988. Mr. Kfoury is a director of Mapics, Inc. and various privately held companies. Mr. Kfoury is also a trustee of the Maine Chapter of the Nature Conservancy, an advisory trustee of the Maine Audubon Society and President of Rangeley Lakes Heritage Trust. Mr. Kfoury holds a Bachelor of Business Administration in Marketing from the University of Notre Dame.

Paul A. Margolis has served as a director of the Company since 1993. Mr. Margolis is a general partner and director of Longworth Venture Partners, a venture capital company which invests in enterprise application software, infrastructure software and technology-enabled business services companies. Mr. Margolis founded Marcam Corporation in 1980 and was its Chairman, President and Chief Executive Officer until 1996 and a director of Marcam until 1998. He is also a director of various private companies. Mr. Margolis holds a Bachelor of Arts from Brown University and an M.B.A. from Harvard Business School.

John H. Martinson has served as a director of the Company since 1991. In 1986, he founded the Edison Venture Funds and currently serves as its managing partner. Mr. Martinson is also a director of various privately held companies. He is a former Chairman of the New Jersey Technology Council and former Chairman of the National Venture Capital Association. Mr. Martinson holds a Bachelor of Science in Aeronautics from the United States Air Force Academy, an M.S. in Astronautics from Purdue University and an M.B.A. from Southern Illinois University.

Terence H. Osborne has served as a director of the Company since 1998. He is also a director of Mapics, Inc., Witness Systems, Inc. and two privately held companies. Mr. Osborne served as a Special Advisor to General Atlantic Partners, LLC from 1997 until 2004. He served as Chairman of the Board of Prime Response Inc. from 1999 to March 2001 and Chairman of Dr. Solomon's Group PLC from 1996 to 1998. Prior to this, Mr. Osborne served initially as Vice President, Europe and subsequently as President of System Software Associates ("SSA"). Prior to joining SSA, he was employed by IBM from 1961 in various capacities including Vice President positions in the United States and Europe. Mr. Osborne holds a Bachelor of Science, with honors, in Pure and Applied Mathematics from London University.

Patrick J. Zenner has served as a director of the Company since 2001. Mr. Zenner served as the President and Chief Executive Officer of Hoffmann-La Roche, Inc., a leading research-intensive pharmaceutical company, from 1993 to 2001. Mr. Zenner served in various other capacities with Hoffmann-La Roche since 1969, including Senior Vice President of its pharmaceutical division from 1992 to 1993, Head of International Pharmaceutical Marketing from 1988 to 1992 and Vice President and General Manager of Roche Laboratories from 1982 to 1988. Mr. Zenner is also a director of Geron Corporation, Praecis Pharmaceuticals Inc., West Pharmaceutical Services, Inc., First Horizon Pharmaceutical Corporation, ArQule, Inc., CuraGen Corporation, EXACT Sciences Corporation and Xoma Corporation, a director of Creighton University and the Chairman of the Board of Trustees of Fairleigh Dickinson University. Mr. Zenner holds a Bachelor of Science in Business Administration from Creighton University and an M.B.A. from Fairleigh Dickinson University.

Director Compensation

During 2004, each non-employee director received a grant of 21,000 options and a cash retainer of $25,000. Each non-employee director also received a per meeting fee of $1,000 for in-person attendance at Board or committee meetings and $500 for telephonic meetings. The Chairpersons of the Audit Committee, Compensation Committee and the Corporate Governance and Nominating Committee each also received a grant of 5,000 options and a cash retainer of $5,000. Our Lead Director also received a grant of 10,000 options. All options granted had an exercise price equal to the fair market value of the Common Stock as of the grant date.

8

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Report of the Compensation Committee

The Compensation Committee of the Board (the "Compensation Committee") operates pursuant to a charter which gives the Compensation Committee responsibility with respect to the compensation and benefits of the Company's senior executives. The Compensation Committee's specific responsibilities include:

- •

- reviewing and approving the Company's goals and objectives relevant to the compensation of the Chief Executive Officer ("CEO");

- •

- evaluating the CEO's performance in relation to those goals and objectives and determining the CEO's compensation level;

- •

- establishing, in consultation with senior management, the Company's general compensation philosophy and overseeing the development and implementation of compensation programs;

- •

- reviewing and approving the compensation of the Company's senior executives;

- •

- reviewing the Company's compensation and employee benefits policies and practices, including incentive compensation plans and equity-based plans; and

- •

- overseeing the administration and competitiveness of such policies, practices and plans.

The Compensation Committee is authorized to engage independent compensation consultants to assist it in the performance of its functions.

The Company's 2004 fiscal year executive compensation program consisted of the following: annual base salary, other annual compensation and benefits, annual and quarterly cash bonus opportunities, performance awards and long-term compensation in the form of stock options or other stock awards. Factors used in determining compensation include competitive market considerations both within and without the industry, the contribution by the individual to the financial success of the Company or a particular area of the Company, and the long-term performance of the Company. The Compensation Committee may apply different factors or may vary the weight given to each of these factors in determining or making recommendations to the Board of Directors with respect to executive compensation in future years.

Annual Component: Base Salary, Bonus and Other Compensation

Base Salary. Each element of senior executive compensation has a different purpose and basis. Base salary and other compensation and benefits paid in 2004 were made to compensate ongoing performance throughout the year. The base salary for each executive officer and any increases to base salary were based on several factors, including individual performance, operating performance of the Company or of a particular area within the Company, and a comparison to the compensation practices of certain of the Company's competitors and other companies in its industry, generally assessing base salary of the Company's senior executives in relation to a range between the median and 75th percentile of executives in comparable positions reported by these other companies.

Bonus. Under the Company's executive bonus program, each executive officer has an incentive award target based on the achievement of specific quantitative corporate performance goals which are determined by the Compensation Committee. Each executive officer has a range of potential awards, both above and below target. The amount paid to each executive officer under the bonus program is based on achievement against the financial performance goals. Larger awards may be made if performance exceeds predetermined objectives. Smaller or no awards may be made if performance falls below such objectives.

For executive officers who primarily have corporate responsibilities, the 2004 financial performance criteria were based on earnings per share with the opportunity for quarterly and annual performance payments. For executive officers who primarily have revenue generating responsibilities, the performance objectives were 25% based on earnings per share, 50-65% based on business unit revenues and operating

9

profits, and 10-25% based on strategic revenue targets, with the opportunity for quarterly and annual payments. For the bonus component based on earnings per share, the 2004 performance criteria where met for the first and second quarters. For the bonus component based on business unit and strategic revenues, the 2004 performance criteria were met for certain executives in each quarter of 2004 depending on the target levels established.

From time to time the Company may pay to one or more of its executives annual, semi-annual and/or quarterly cash bonuses as well as performance awards in the form of option grants or share grants as an additional incentive and reward for reaching and exceeding established objectives for revenues, profitability or other performance. These bonuses or awards reflect the Compensation Committee's assessment, in consultation with the CEO (except with respect to matters pertaining to his own compensation) of that individual's achievement and the significance of that executive's contribution to the financial success of the Company or a particular area of the Company during a year.

Other Compensation. Benefits for all executive officers included, in addition to the equity programs discussed below, group term life insurance, the Company's matching portion of the executive's 401(k) plan contribution and first class, business class and charter air travel in accordance with Company policy. Certain executives are also entitled to an annual reimbursement up to $10,000 per executive for financial, estate and tax planning services.

Long-Term Component—Stock Options

The long-term component of executive compensation involves primarily the award of stock options. The number of options is established at a level intended by the Compensation Committee to be commensurate with the individual's position, responsibility and performance. Options are granted with an exercise price equal to the fair market value per share of Common Stock on the grant date. Options are granted to induce a long-term employment commitment to the Company and to demonstrate the Company's commitment to having directors and executive officers maintain a significant level of ownership interest in the Company.

Stock Ownership Requirements

In 1999, the Board of Directors adopted a Share Ownership Program which establishes stock ownership requirements for the Company's senior management and directors to encourage stock ownership by such individuals. The program was amended in 2003. Under the program, members of the Company's senior management and Board of Directors must achieve and maintain ownership of certain specified amounts of shares of the Company's stock by pre-designated milestones. Each individual subject to the program must achieve twenty-five percent (25%) of the applicable mandatory ownership level by the fourth anniversary of the later of the effective date of the program or the date of hire or promotion to the applicable position, fifty percent (50%) of the applicable mandatory ownership level within five years of such anniversary and one hundred percent (100%) of the applicable mandatory ownership level within six years of such anniversary.

Chief Executive Officer Compensation

The 2004 annual base salary for Mr. Bailye, the Chairman of the Board and Chief Executive Officer of the Company, was established pursuant to his employment agreement. The Compensation Committee may, in its discretion, determine to pay Mr. Bailye an annual or quarterly cash bonus if the Company meets or exceeds its goals. Due to the Company's performance in meeting its goals, Mr. Bailye received a quarterly cash bonus for the first and second quarter of the 2004 fiscal year. The total bonus paid to Mr. Bailye for fiscal 2004 was $192,500. Under the Company's annual option grant program, the Compensation Committee may grant Mr. Bailye options to purchase shares of Common Stock, with the options having a value up to approximately $1,200,000 determined using the Black-Scholes option pricing model. In fiscal 2004, Mr. Bailye was granted options for 200,000 shares under the annual option program. In addition, Mr. Bailye was granted 18,000 options under the 2004 stock ownership incentive program,

10

316,048 options under the Company's replacement option program and 3,018 options under the Company's Incentive Stock Bonus Program. Mr. Bailye does not participate in decisions of the Board or the Compensation Committee relating to his own compensation

Incentive Stock Bonus Program

In 1999, the Compensation Committee approved the adoption of the Incentive Stock Bonus Program whereby senior executives may elect to receive their incentive bonus (including any amounts earned but deferred in accordance with the Company's Bonus Plan) in shares of Common Stock ("Bonus Shares"). The number of such Bonus Shares equals the amount of the executive officer's bonus which the individual elects to receive in Common Stock, divided by the closing price of the Company's Common Stock on the trading date immediately prior to the payment date of the bonus. To encourage executive officers to receive their bonus in Bonus Shares, the Company grants to each executive officer who elects to receive Bonus Shares, a stock option for the same number of shares as the Bonus Shares calculated without giving effect to any Bonus Shares withheld to pay withholding taxes (the "Tandem Options"). Tandem Options vest on the first anniversary of the bonus payment date. The Tandem Options and the Bonus Shares are issued under the Company's 1997 Stock Incentive Plan.

2004 Stock Ownership Incentive Program

The Board of Directors approved a stock ownership incentive program ("SOIP") effective January 2004. Persons eligible to participate in the SOIP are those members of the Company's management and its directors who are required under the Share Ownership Program to maintain ownership of a designated number of shares of the Company's Common Stock. Participants in the SOIP received four stock options for every share of Common Stock that a participant purchased on the open market or six stock options for every share purchased by the participant by exercising and holding existing stock options previously granted to the participant, in each case, during the open window trading period in the first quarter of 2004. A maximum of 3,000 shares purchased by each participant were eligible for option grants under the program. The shares purchased under the SOIP were subject to sale restrictions that expired on December 31, 2004. All options granted under the SOIP fully vested on December 31, 2004. If any participant sold any restricted purchased shares prior to December 31, 2004, all of the options granted to such participant under the SOIP would not vest for four (4) years. No participant made such a sale.

Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code generally disallows a deduction to publicly traded companies to the extent of excess compensation over $1 million paid to the chief executive officer or to any of the four other most highly compensated executive officers in a fiscal year. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. The policy of the Compensation Committee is to establish and maintain compensation programs which recognize and reward performance which increases the value of the Company and, to the extent consistent with this policy, to seek to maintain the favorable tax treatment of such compensation. The Company also believes, however, that under some circumstances, such as to attract or retain key executives or to recognize outstanding performance, it may be in the best interests of the Company and its shareholders to compensate certain key executives in excess of deductible limits.

| | | Compensation Committee |

| | | Edward J. Kfoury (Chairperson) |

| | | Terence H. Osborne |

| | | Bernard M. Goldsmith |

11

Executive Compensation

The following table sets forth compensation information for the Company's Chief Executive Officer and the other four most highly compensated executive officers of the Company (the "Named Officers").

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term Compensation Awards

| |

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Restricted

Stock Award(s)

($)(1)

| | Number of Securities

Underlying Options

(#)

| | All Other

Compensation

($)(2)

|

|---|

John E. Bailye,

Chairman of the Board and

Chief Executive Officer | | 2004

2003

2002 | | 497,500

470,000

470,000 | | 192,500

400,000

60,000 | | —

—

— | | 537,119

301,500

100,000 | | 6,150

6,000

5,500 |

Paul L. Zaffaroni,

President and Chief

Operating Officer |

|

2004

2003

2002 |

|

450,000

450,000

450,000 |

|

106,875

325,000

48,750 |

|

—

—

— |

|

118,000

169,000

50,000 |

|

11,503

9,593

6,082 |

Kathleen E. Donovan,

Senior Vice President and

Chief Financial Officer |

|

2004

2003

2002 |

|

300,000

283,125

210,000 |

|

58,425

156,025

29,425 |

|

—

—

— |

|

118,000

210,000

15,000 |

|

6,742

9,877

5,500 |

Mark H. Cieplik,

Senior Vice President |

|

2004 |

|

300,000 |

|

203,128 |

|

86,658 |

|

93,000 |

|

6,150 |

Marc Kustoff(3),

Former Senior Vice President |

|

2004

2003

2002 |

|

325,500

325,500

325,500 |

|

76,935

231,528

90,450 |

|

—

—

— |

|

93,000

72,500

36,500 |

|

7,673

7,365

6,925 |

- (1)

- The restricted stock units vest in one-third increments on July 15, 2005, July 15, 2006 and July 15, 2007. A holder of restricted stock units is not entitled to receive any declared dividends. The number and value of restricted stock units held at December 31, 2004 were: Mr. Cieplik, 5,143 shares, $99,774.

- (2)

- For fiscal 2004, represents the Company's contribution to the 401(k) plan, as well as deferred compensation plan life insurance premium of $5,353 for Mr. Zaffaroni, $592 for Ms. Donovan and $1,523 for Mr. Kustoff.

- (3)

- Mr. Kustoff ceased employment as an executive officer in February 2005. See "Other Employment and Related Agreements" below for a description of his severance agreement under which he is entitled to a severance amount equal to one year's salary and an agreed annual bonus amount, all payable over 12 months.

12

Option Grants In Last Fiscal Year

The following table sets forth stock option grants made to the Named Officers during fiscal 2004.

The potential realizable values shown in the following table are required by the SEC and are based on arbitrarily assumed annualized rates of stock price appreciation of five percent (5%) and ten percent (10%) over the full ten-year term of the options. These stated potential realizable values are not intended to forecast possible future appreciation. No benefit from the grant of stock options can be realized by optionees unless there is an appreciation in stock price, which benefits all shareholders.

Option Grants In Last Fiscal Year

| | Number of

Securities

Underlying

Options

Granted

(#)(1)

| | Percentage

of Total

Options

Granted to

Employees

in Fiscal

Year (%)

| |

| |

| |

| |

|

|---|

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

For Option Term ($)

|

|---|

| | Exercise

or Base

Price

($/Share)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| John E. Bailye | | 200,000

3,071

18,000

429

53,999

24,133

84,580

153,507 | (2)

(3)

(4)

(5)

(5)

(5)

(5)

(5) | 7.51

0.12

0.68

0.02

2.01

0.91

3.18

5.77 | | 14.90

16.28

15.67

17.05

17.05

17.05

17.05

17.05 | | 1/27/14

2/12/14

2/17/14

2/6/13

2/6/12

10/22/07

10/22/07

10/22/07 | | 1,874,106

31,442

177,386

3,492

370,646

64,858

227,309

412,551 | | 4,749,353

79,681

449,531

8,365

863,762

136,196

477,331

866,324 |

Paul L. Zaffaroni |

|

100,000

18,000 |

(2)

(4) |

3.76

0.68 |

|

14.90

15.80 |

|

1/27/14

2/18/14 |

|

937,053

178,858 |

|

2,374,676

453,260 |

Kathleen E. Donovan |

|

100,000

18,000 |

(2)

(4) |

3.76

0.68 |

|

14.90

16.57 |

|

1/27/14

2/11/14 |

|

937,053

187,574 |

|

2,374,676

475,350 |

Mark H. Cieplik |

|

75,000

18,000 |

(2)

(4) |

2.82

0.68 |

|

14.90

15.30 |

|

1/27/14

2/20/14 |

|

702,790

173,198 |

|

1,781,007

438,917 |

Marc Kustoff |

|

75,000

18,000 |

(2)

(4) |

2.82

0.68 |

|

14.90

15.67 |

|

1/27/14

2/11/14 |

|

55,875

14,103 |

|

111,750

28,206 |

- (1)

- Option grants are eligible for the Company's replacement option program under which if the optionee tenders previously owned shares in satisfaction of the option exercise price, a replacement option for the number of shares tendered is granted for the remaining term of the underlying option, at the option exercise price equal to the fair market value of the Common Stock on the replacement option grant date. Replacement options vest one year from the grant date.

- (2)

- The options vested on December 31, 2004; however, the right to sell the underlying shares at or following exercise of the option accrues only in one-third annual increments commencing on the vesting date.

- (3)

- Options granted in connection with the Company's share bonus program. The options vested on December 31, 2004.

- (4)

- Options granted in connection with the Company's 2004 Stock Ownership Incentive Program under which the grantee received six options under the Company's 1997 Stock Incentive Plan (the "Plan") for every share, up to 3,000, the grantee purchased by exercising and holding stock options previously granted under the Plan. The options vested on December 31, 2004.

- (5)

- Represents an option under the Company's replacement option program. The options become exercisable on November 22, 2005.

13

Option Exercises and Year-End Option Holdings

The following table sets forth information regarding option exercises during fiscal 2004 and 2004 year-end option holdings for the Named Officers.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

Name

| | Shares

Acquired

on

Exercise

(#)

| | Value Realized

($)

| | Number of Securities

Underlying Unexercised

Options at

Fiscal Year End (#)

Exercisable / Unexercisable

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End ($)(1)

Exercisable / Unexercisable

|

|---|

| John E. Bailye | | 389,925 | | 1,912,566 | | 622,685/650,528 | | 1,678,538/4,659,406 |

| Paul L. Zaffaroni | | 3,000 | | 11,370 | | 420,416/213,584 | | 3,542,154/2,427,126 |

| Kathleen E. Donovan | | 51,998 | | 395,273 | | 283,293/141,459 | | 1,365,997/1,594,875 |

| Mark H. Cieplik | | 23,250 | | 199,624 | | 328,666/96,584 | | 1,078,694/1,123,809 |

| Marc Kustoff | | 46,343 | | 279,703 | | 328,761/81,896 | | 555,992/934,480 |

- (1)

- Calculated on the basis of the closing price of the Common Stock at December 31, 2004 of $19.40 per share, less the per share exercise price.

The following table provides equity compensation plan information as of the end of our 2004 fiscal year with respect to compensation plans under which the Company's equity securities are authorized for issuance.

Equity Compensation Plan Information

Plan category

| | Number of securities

to be issued upon

exercise of outstanding

options, warrants

and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

| |

|---|

| Equity compensation plans approved by security holders(1) | | 8,096,607 | (2) | $ | 14.56 | | 731,172 | (3) |

| Equity compensation plans not approved by security holders(4) | | 863,367 | | $ | 12.92 | | 535,213 | (5) |

| | |

| |

| |

| |

| Total | | 8,959,974 | | $ | 14.38 | | 1,266,385 | |

- (1)

- Represents the Company's 1992 Stock Plan, 1997 Employee Stock Purchase Plan and 1997 Stock Incentive Plan.

- (2)

- Represents 8,056,219 shares subject to outstanding options under the 1997 Stock Incentive Plan and 40,388 shares subject to outstanding options under the 1992 Stock Plan.

- (3)

- Includes 227,569 shares available for purchase under the 1997 Employee Stock Purchase Program.

- (4)

- Represents the First Amended SAI Holding, Inc. Long Term Incentive Stock Option Plan ("SAI Plan"), which was terminated on April 18, 2005 and the New Hire Option Grant Authorization Plan ("New Hire Plan").

- (5)

- Represents 0 shares available for issuance under the New Hire Plan and 535,213 shares which had been left available for issuance under the SAI Plan upon the Company's assumption of the SAI Plan with the acquisition of Software Associates International in 2002. No shares have been granted by the Company under the SAI Plan following its assumption. As of the date of this proxy statement, the SAI Plan has been terminated and no shares are available for issuance under the SAI Plan.

14

Transactions under the New Hire Plan were registered with the Securities and Exchange Commission on Form S-8. In accordance with the requirements of NASDAQ Rule 4350(i), new hires may be granted non-qualified stock options under the new hire authorization. The exercise price for options is the fair market value of the Company's Common Stock on the date of the grant. Vesting of options under the New Hire Plan is determined by the Compensation Committee. All options granted prior to 2004, and certain grants in 2004, vest twenty-five percent (25%) on the first anniversary of date of grant and the remaining seventy-five percent (75%) become exercisable pro rata over the following three year period, on a monthly basis, commencing on the first anniversary of the date of grant and ending on the fourth anniversary of the date of grant. All other option grants vested 100% on December 31, 2004, with the right to sell the underlying shares accruing in either three, or four, equal installments on each of the first three, or four, anniversaries of the date of grant. The other terms and conditions of such new hire options are generally the same as for non-qualified stock options granted under the 1997 Stock Incentive Plan. Such grants are not subject to the Employee Retirement Income Security Act of 1974, as amended.

Employment Contracts and Change In Control Agreements

Employment Agreement with John E. Bailye

The Company has an employment agreement with Mr. Bailye under which Mr. Bailye serves as Chief Executive Officer of the Company. The employment agreement provides for an annual base salary of not less than $425,000 per year, to be increased each year in accordance with the increase in the Consumer Price Index.

At least once every two years (but in no event more than once every year), the Compensation Committee will review Mr. Bailye's annual base salary in light of the performance of the Company for the purpose of evaluating an adjustment in Mr. Bailye' s annual base salary to be considered along with any Consumer Price Index increase. Mr. Bailye also is eligible to receive an annual bonus to be determined by the Compensation Committee and which is generally targeted not to exceed fifty percent (50%) of Mr. Bailye' s annual base salary for the year. Mr. Bailye is also entitled to the employee benefits generally available to other U.S. executives of the Company.

Mr. Bailye's employment agreement has a current term continuing through December 31, 2007. The term is automatically renewed for an additional year each December 31 during the term unless, prior to such December 31, either the Company or Mr. Bailye provides written notice of the intent not to renew for the following year. Upon a Change in Control, the remaining term, if less than two years at such date, is extended automatically to continue for at least two years following the Change in Control.

For purposes of Mr. Bailye's employment agreement, "Cause" is defined to include any gross misconduct or gross neglect with respect to his duties which has or is likely to have a material adverse effect upon the business of the Company, provided the good faith exercise of his business judgment in executing his duties will not constitute Cause, or a felony indictment related to his duties which has or is likely to have a material adverse effect on the business of the Company, provided that if he ultimately is not convicted of and does not plead guilty or nolo contendere to such felony, any such termination of employment is treated as a termination by the Company without Cause and he is entitled to severance.

In the event that Mr. Bailye's employment is terminated by the Company for any reason other than Cause, Disability or death, or by Mr. Bailye for Good Reason, Mr. Bailye will be entitled to receive severance equal to the sum of his annual base salary in effect as of the date of termination and his average annual bonus earned during the three completed fiscal years immediately preceding his date of termination, divided by twelve, and multiplied by the number of full and fractional months remaining in his employment term as of his date of termination.

In the event that during the employment term and within the two year period following a Change in Control, Mr. Bailye's employment is terminated by the Company for any reason other than Cause, Disability or death, or by Mr. Bailye for Good Reason, then Mr. Bailye would be entitled to receive

15

severance equal to three times the sum of his annual base salary in effect as of the date of termination and his highest annual bonus compensation earned during the three completed fiscal years immediately preceding his date of termination.

In the event that the Company provides Mr. Bailye with written notice that it is not extending the term, the Compensation Committee will determine, in its sole discretion, the amount of any severance to Mr. Bailye, which will be determined in accordance with what is usual and customary for such position in companies of comparable size operating in a similar industry as the Company.

During the term and within a period of two years following any voluntary termination by him (other than a termination for Good Reason) or any termination by the Company for Cause, Mr. Bailye is prohibited, whether directly or indirectly, in any U.S. state or foreign country where the Company or any of its affiliates is doing business at the time of termination, from (i) engaging in any venture or activity in competition with the business of the Company or its affiliates, or any business that the Company may establish that it will likely conduct within one year of his departure; (ii) soliciting for any venture or activity in competition with the business conducted by the Company or its affiliates any customers who were customers within one year of his departure or soliciting such customers to reduce their business with the Company or its affiliates, or (iii) inducing or attempting to influence any employee of the Company or its affiliates employed on the effective date of his termination or within six months prior to such termination to terminate his or her employment with the Company or its affiliates. In the event the Company terminates his employment without Cause (or elects not to extend his employment) or Mr. Bailye terminates his employment for Good Reason, the restrictive covenants described above shall apply for a period of six months following the date of termination. The above restrictive covenants generally will not apply in the event his employment is terminated for any reason during the two year period following a Change in Control, unless he agrees to have the covenants apply in exchange for certain severance and/or benefit coverage as set forth in his agreement. The agreement may not be assigned by either party other than by the Company in connection with certain business combinations.

Other Employment and Related Agreements

The Company also has employment agreements with each of the other Named Officers, other than Mr. Kustoff whose employment agreement with the Company terminated on February 25, 2005.

Mr. Zaffaroni's employment agreement provides for an annual base salary of not less than $450,000. Under his employment agreement, Mr. Zaffaroni is eligible to receive certain quarterly bonuses based on the Company's performance against its financial objectives. Beginning in 2002 and continuing each year thereafter, Mr. Zaffaroni will receive an option to purchase shares of Common Stock based on a Black-Scholes valuation of between $500,000 and $750,000. In the event of a Change in Control, if he is not retained in a similar position or if no similar position is offered to him, all outstanding options immediately vest. In the event that the Company terminates Mr. Zaffaroni's employment for any reason other than death, Cause or Disability, or if Mr. Zaffaroni terminates his employment for Good Reason within one year following a Change in Control, he is entitled to severance equal to his annual salary in effect at the time of termination.

Ms. Donovan's employment agreement provides for an annual base salary as well as eligibility for bonuses based on the Company's performance against financial objectives. In the event of a Change in Control, all outstanding options immediately vest. In the event that within one year following a Change in Control the Company terminates Ms. Donovan's employment for any reason other than death, Cause or Disability, or if Ms. Donovan terminates her employment for Good Reason, she is entitled to severance equal to her annual salary in effect at the time of termination.

Mr. Cieplik's employment agreement provides for an annual base salary as well as eligibility for bonuses based on the Company's performance against financial objectives. In the event of termination of Mr. Cieplik's employment by the Company for any reason other than death, Cause or Disability,

16

Mr. Cieplik would be entitled to receive a severance payment equal to 6 months salary and any accrued bonus.

In February, 2005, the Company entered into an agreement with Mr. Kustoff concerning his cessation of employment with the Company. Under the agreement, the Company agreed to pay to Mr. Kustoff a pre-established severance equal to one year's base salary and an agreed bonus amount ($615,500 in the aggregate), to be paid in twelve equal monthly installments, less applicable deductions. Mr. Kustoff may continue coverage under the Company's group health plan in accordance with COBRA; the Company will pay for a portion of the COBRA cost so that Mr. Kustoff's payments will remain the same as during employment, until the earlier of the end of the severance period or coverage becomes available through other employment. Outstanding stock options continue to be exercisable in accordance with the terms of the 1997 Stock Incentive Plan.

Each employment agreement and the agreement with Mr. Kustoff restricts the executive from disclosing any confidential information regarding the Company or the Company's clients, customers or suppliers, to any person without prior written consent from the Company, client, customer or supplier, as the case may be. Each such employment agreement also provides that for a period of two years following termination of employment, with or without Cause, each employee is prohibited from (i) performing services that compete with the businesses conducted by the Company or any of its affiliates or rendering services to any organization or entity which competes with the business conducted by the Company or any of its affiliates in the United States or elsewhere where the Company or any of its affiliates does business, or any business that the Company or any of its affiliates may establish that it will likely conduct within one year following the date of such employee's termination; (ii) soliciting any customers or potential customers of the Company with whom the executive had contact while employed by the Company or who was a customer of the Company at any time during one or two years immediately before the executive's termination; (iii) requesting that any of the Company's customers or suppliers discontinue doing business with the Company; (iv) knowingly taking any action that would disparage the Company or be to its disadvantage; or (v) employing or attempting to employ or assisting anyone else to employ any employee or contractor of the Company or to terminate their employment or engagement with the Company.

"Cause" is generally defined to include acts of gross misconduct, indictable offenses, any willful or intentional acts or gross negligence which injure in any material respect the reputation, business or business relationships of the Company, and material breaches of the employment agreement. "Disabled" or "Disability" is generally defined as the occurrence of any physical or mental condition which materially interferes with the performance of customary duties as an employee of the Company for a consecutive six month period. "Change in Control" is defined generally to include significant changes in the stock ownership of the Company, certain changes in the Board of Directors, certain business combinations and a sale of all or substantially all of the Company's assets. "Good Reason" is defined generally as certain changes or reductions in duties or responsibilities, certain breaches by the Company, cessation of eligibility to participate in certain employee plans, certain increased travel, or failure of the Company to obtain an agreement from a successor to assume the Company's obligations under the employment agreements.

Certain Transactions with Related Parties

During 2004, the Company chartered aircraft for Company business use from third party charter companies, including Jet Alliance. Jet Alliance is not affiliated with the Company or any executives of the Company and charters aircraft on a commercial basis on behalf of numerous individual aircraft owners. In certain instances, the aircraft provided by Jet Alliance to the Company for its chartered business travel were leased from Kookaburra Air LLC and for fiscal 2004, $266,186 was paid by Jet Alliance to Kookaburra in the form of a credit for such aircraft leased on behalf of the Company. Kookaburra is an aircraft owner whose owners are Mr. Bailye and his spouse, and Kookaburra actively charters its aircraft. The revenue from aircraft chartered by the Company is not a material portion of Kookaburra's overall business with Jet Alliance.

Mr. Bailye is a party to a registration rights agreement with the Company under which he has certain rights with respect to the registration for resale to the public of certain shares of Common Stock owned by him.

17

PERFORMANCE GRAPH

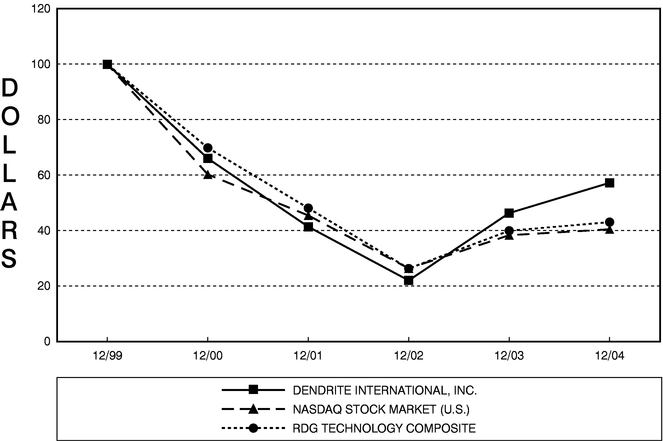

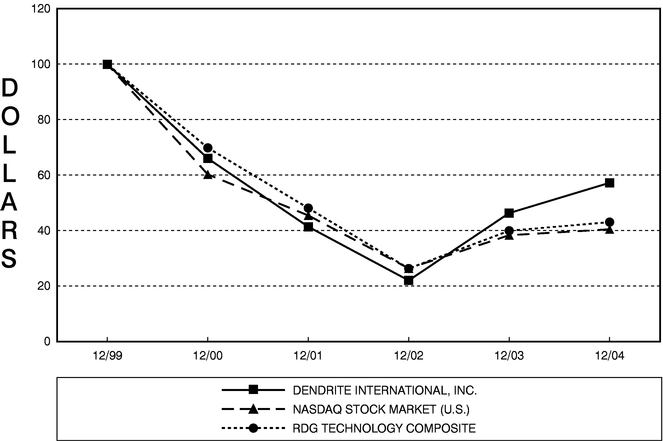

The following graph compares the percentage change in the cumulative total shareholders' return on the Company's Common Stock on a year-end basis, from December 31, 1999 to December 31, 2004, with the cumulative total return on the NASDAQ Stock Market (U.S.) Index and the RDG Technology Composite Index for the same period. In accordance with the rules of the SEC, the returns are indexed to a value of $100. The Company has never paid cash dividends on its Common Stock. Shareholders' returns over the indicated period should not be considered indicative of future shareholder returns.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG DENDRITE INTERNATIONAL, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE RDG TECHNOLOGY COMPOSITE INDEX

- *

- $100 invested on 12/31/99 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

18

Report of the Audit Committee

The primary function of the Audit Committee of the Board of Directors is to assist the Board of Directors in its oversight of the Company's system of internal control, financial reporting practices and interim reviews and audit by the independent registered public accounting firm in order to ensure the quality, integrity and objectivity of the Company's financial statements. Each member of the Audit Committee satisfies the independence and audit committee qualification standards of NASDAQ and the SEC.

For fiscal year 2004, the Audit Committee reviewed the overall audit scope, plan and results of the audit engagement. The Committee also met separately, without management, with representatives of the independent registered public accounting firm and with the Company's internal auditors. In addition, the Audit Committee reviewed and discussed the Company's annual and quarterly financial statements with management before issuance.

The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, of the American Institute of Certified Public Accountants. The Audit Committee also received and reviewed the written disclosures and confirmation from the independent registered public accounting firm required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and discussed with the independent registered public accounting firm its independence.

Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year 2004. The Audit Committee also evaluated and appointed Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal 2005.

Pursuant to Section 404 of the Sarbanes-Oxley Act, management provided as part of the Company's 2004 Annual Report on Form 10-K a report on its assessment of the effectiveness of the Company's internal control over financial reporting. Deloitte & Touche LLP, the Company's independent registered public accounting firm, rendered opinions on the effectiveness of internal control over financial reporting and on management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2004, which are also included as part of the 2004 Annual Report on Form 10-K.

During the course of 2004, management regularly discussed the internal control assessment process with the Audit Committee, including the framework used to evaluate the effectiveness of such internal control, and at regular intervals updated the Audit Committee on the status of this process and actions taken by management to respond to issues identified during this process. The Audit Committee also regularly discussed this process with Deloitte & Touche LLP.

| | | Audit Committee

John A. Fazio (Chairperson)

Paul A. Margolis

Patrick J. Zenner |

19

ITEM 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The Audit Committee has selected Deloitte & Touche LLP to be the Company's independent registered public accounting firm for the Company's 2005 fiscal year and has directed that management submit the selection of Deloitte & Touche LLP for ratification by the Company's shareholders at the 2005 Annual Meeting.

Shareholder ratification of the selection of Deloitte & Touche LLP is not required by the Company's By-laws or otherwise. However, the Board is submitting the selection of Deloitte & Touche LLP to shareholders for ratification as a matter of good corporate practice.

The Board of Directors recommends a vote for ratification of the selection of Deloitte & Touche LLP.

Principal Accountant Fees and Services

The fees billed for services rendered for fiscal 2004 by Deloitte & Touche LLP and for fiscal 2003 by Ernst & Young LLP were as follows:

| | 2004

| | 2003

|

|---|

| Audit Fees(1) | | $ | 2,609,436 | | $ | 1,100,500 |

| Audit-Related Fees(2) | | $ | 0 | | $ | 254,200 |

| Tax Fees(3) | | $ | 0 | | $ | 70,200 |

| All Other Fees(4) | | $ | 0 | | $ | 59,200 |

| | |

| |

|

| Total | | $ | 2,609,436 | | $ | 1,484,100 |

- (1)

- For 2004, represents fees for professional services provided by Deloitte & Touche LLP in connection with the integrated audit of our consolidated financial statements, the effectiveness over internal control over financial reporting and management's assessment of the Company's internal control over financial reporting, review of our quarterly financial statements, and audit services provided in connection with other statutory or regulatory filings. For 2003, represents fees for professional services provided by Ernst & Young LLP in connection with the audit of our financial statements and review of our quarterly financial statements and audit services provided in connection with other statutory or regulatory filings.

- (2)

- Consists primarily of services related to business acquisitions, employee benefit plan audits, accounting consultations and other attestation services.

- (3)

- Principally includes tax compliance fees of $29,900, and tax advice and tax planning fees of $40,300, including expatriate tax services fees of $39,600.

- (4)

- Principally include post-implementation review of information technology system configuration.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The Audit Committee has adopted a formal policy concerning the pre-approval of all services to be provided by the independent registered public accounting firm to the Company. Specific services being provided by the independent registered public accounting firm are regularly reviewed in accordance with the pre-approval policy. The Audit Committee has delegated pre-approval authority to the Audit Committee Chairman for all services with a budgeted cost of less than $50,000. The Committee receives periodic updates on services being provided by the independent registered public accounting firm,

20

including services approved by the Audit Committee Chairman, and management may present additional services for approval. All services provided by the independent registered public accounting firm for fiscal 2004 were approved in advance by the Audit Committee.

On May 11, 2004, Ernst & Young LLP ("E&Y") resigned as the Company's independent accountant. On June 28, 2004, the Company engaged Deloitte & Touche LLP to serve as the Company's independent registered public accounting firm for fiscal 2004. E&Y was initially engaged by the Company as its independent auditor effective April 4, 2002 and in that capacity rendered an opinion on the Company's consolidated financial statements for the fiscal years ended December 31, 2003 and 2002.

During the years ended December 31, 2003 and 2002 and through May 11, 2004, there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K. The Company believes that, during the years ended December 31, 2003 and 2002 and through May 11, 2004, there were no disagreements, as defined in Item 304(a)(1)(iv) of Regulation S-K, with E&Y on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of E&Y, would have caused E&Y to make reference to such disagreement in its reports. The quarterly written reports of E&Y to the Audit Committee under SAS 61 and AU Section 722 prior to E&Y's resignation are consistent with this conclusion.

In connection with its review of the Company's draft Quarterly Report on Form 10-Q for the quarter ended September 30, 2003, E&Y identified a material transaction for which during the quarter the Company had included revenue on the transfer and sale of certain irrevocable licenses in an initial stocking order to a Japanese distributor. Based on its review and analysis, E&Y determined that the revenue related to this particular transaction should be accounted for utilizing the "sell-through" method of accounting, provided the other criteria for revenue recognition under applicable accounting standards were met. After discussion and further review, the Company agreed with this position and did not include this revenue in the quarterly report or its quarterly results. This matter was reviewed with both the Company's Audit Committee and with the Company's Board of Directors in meetings on October 21, 2003 by E&Y. In connection with the Company's preparation of the Form 8-K announcing E&Y's resignation, E&Y informed the Company that, upon further review and analysis of all discussions and information through the date of its resignation, E&Y concluded that in its view in fact there had been a disagreement in connection with the matters described above. The Company has not changed its conclusion that no disagreement occurred.