The following table sets forth information regarding option exercises during fiscal 2003 and 2003 year-end option holdings for the Named Officers.

The Company has an employment agreement with Mr. Bailye under which Mr. Bailye serves as Chief Executive Officer of the Company. The employment agreement provides for an annual base salary of not less than $425,000 per year, to be increased each year in accordance with the increase in the Consumer Price Index.

At least once every two years (but in no event more than once every year), the Compensation Committee will review Mr. Bailye’s annual base salary in light of the performance of the Company for the purpose of evaluating an adjustment in Mr. Bailye’ s annual base salary to be considered along with any Consumer Price Index increase. Mr. Bailye also is eligible to receive an annual bonus to be determined by the Compensation Committee and which is generally targeted not to exceed fifty percent (50%) of Mr. Bailye’ s annual base salary for the

year. Mr. Bailye is also entitled to the employee benefits generally available to other U.S. executives of the Company.

Mr. Bailye’s employment agreement has a current term continuing through December 31, 2006. The term is automatically renewed for an additional year each December 31 during the term unless, prior to such December 31, either the Company or Mr. Bailye provides written notice of the intent not to renew for the following year. Upon a Change in Control, the remaining term, if less than two years at such date, is extended automatically to continue for at least two years following the Change in Control.

For purposes of Mr. Bailye’s employment agreement, “Cause” is defined to include any gross misconduct or gross neglect with respect to his duties which has or is likely to have a material adverse effect upon the business of the Company, provided the good faith exercise of his business judgment in executing his duties will not constitute Cause, or a felony indictment related to his duties which has or is likely to have a material adverse effect on the business of the Company, provided that if he ultimately is not convicted of and does not plead guilty or nolo contendere to such felony, any such termination of employment is treated as a termination by the Company without Cause and he is entitled to severance.

In the event that Mr. Bailye’s employment is terminated by the Company for any reason other than Cause, Disability or death, or by Mr. Bailye for Good Reason, Mr. Bailye will be entitled to receive severance equal to the sum of the annual base salary in effect as of the date of termination and his average annual bonus earned during the three completed fiscal years immediately preceding his date of termination, divided by twelve, and multiplied by the number of full and fractional years remaining in his employment term as of his date of termination.

In the event that during the employment term and within the two year period following a Change in Control, Mr. Bailye’s employment is terminated by the Company for any reason other than Cause, Disability or death, or by Mr. Bailye for Good Reason, then Mr. Bailye would be entitled to receive severance equal to three times the sum of the annual base salary in effect as of the date of termination and his highest annual bonus compensation earned during the three completed fiscal years immediately preceding his date of termination.

In the event that the Company provides Mr. Bailye with written notice that it is not extending the term, the Compensation Committee will determine, in its sole discretion, the amount of any severance to Mr. Bailye, which will be determined in accordance with what is usual and customary for such position in companies of comparable size operating in a similar industry as the Company.

During the term and within a period of two years following any voluntary termination by him (other than a termination for Good Reason) or any termination by the Company for Cause, Mr. Bailye is prohibited, whether directly or indirectly, in any U.S. state or foreign country where the Company or any of its affiliates is doing business at the time of termination, from (i) engaging in any venture or activity in competition with the business of the Company or its affiliates, or any business that the Company may establish that it will likely conduct within one year of his departure; (ii) soliciting for any venture or activity in competition with the business conducted by the Company or its affiliates any customers who were customers within one year

19

of his departure or soliciting such customers to reduce their business with the Company or its affiliates, or (iii) inducing or attempting to influence any employee of the Company or its affiliates employed on the effective date of his termination or within six months prior to such termination to terminate his or her employment with the Company or its affiliates. In the event the Company terminates his employment without Cause (or elects not to extend his employment) or Mr. Bailye terminates his employment for Good Reason, the restrictive covenants described above shall apply for a period of six months following the date of termination. The above restrictive covenants generally will not apply in the event his employment is terminated for any reason during the two year period following a Change in Control, unless he agrees to have the covenants apply in exchange for certain severance and/or benefit coverage as set forth in his agreement. The agreement may not be assigned by either party other than by the Company in connection with certain business combinations.

Other Employment and Related Agreements

The Company also has employment agreements with each of the other Named Officers.

Mr. Zaffaroni’s employment agreement provides for an annual base salary of not less than $450,000. Under his employment agreement, Mr. Zaffaroni is eligible to receive certain quarterly bonuses based on the Company’s performance against its financial objectives. Beginning in 2002 and continuing each year thereafter, Mr. Zaffaroni will receive an option to purchase shares of Common Stock based on a Black-Scholes valuation of between $500,000 and $750,000. In the event of a Change in Control, if he is not retained in a similar position or if no similar position is offered to him, all outstanding options would immediately vest. In the event that the Company terminates Mr. Zaffaroni’s employment for any reason other than death, Cause or Disability, or if Mr. Zaffaroni terminates his employment for Good Reason within one year following a Change in Control, he is entitled to severance equal to his annual salary in effect at the time of termination.

Ms. Donovan’s employment agreement provides for an annual base salary as well as eligibility for bonuses based on the Company’s performance against financial objectives. In the event of a Change in Control, all outstanding options would immediately vest. In the event that within one year following a Change in Control the Company terminates Ms. Donovan’s employment for any reason other than death, Cause or Disability, or if Ms. Donovan terminates her employment for Good Reason, she is entitled to severance equal to her annual salary in effect at the time of termination.

Ms. Pellizzari’s employment agreement provides for an annual base salary and, in the event of a Change in Control, all options immediately vest. In the event that within one year following a Change in Control the Company terminates Ms. Pellizzari’s employment for any reason other than death, Cause or Disability, or if Ms. Pellizzari terminates her employment for Good Reason, she is entitled to severance equal to her annual salary in effect at the time of termination.

Mr. Kustoff’s employment agreement provides for an annual base salary of not less than $310,000, to be reviewed annually by the Compensation Committee. Mr. Kustoff is eligible to receive certain quarterly bonuses based upon the Company’s performance against financial

20

objectives and additional bonuses based on an overachievement percentage. Upon a Change in Control, all options immediately vest. In the event that the Company terminates his employment for any reason other than death, Cause, Disability or Change in Control, Mr. Kustoff is entitled to severance equal to his annual base salary in effect as of the date of termination plus an assumed incentive payout of $290,000. If Mr. Kustoff’s employment is terminated following a Change in Control for any reason other than death, Cause, or Disability, or by Mr. Kustoff for Good Reason, he is entitled to severance equal to twenty-four months base salary plus an assumed incentive payout of $580,000.

Each employment agreement restricts the executive from disclosing any confidential information regarding the Company or the Company’s clients, customers or suppliers, to any person without prior written consent from the Company, client, customer or supplier, as the case may be. Each employment agreement also provides that for a period of two years following termination of employment, with or without Cause, each employee is prohibited from (i) performing services that compete with the businesses conducted by the Company or any of its affiliates or rendering services to any organization or entity which competes with the business conducted by the Company or any of its affiliates in the United States or elsewhere where the Company or any of its affiliates does business, or any business that the Company or any of its affiliates may establish that it will likely conduct within one year following the date of such employee’s termination; (ii) soliciting any customers or potential customers of the Company with whom the executive had contact while employed by the Company or who was a customer of the Company at any time during one or two years immediately before the executive’s termination; (iii) requesting that any of the Company’s customers or suppliers discontinue doing business with the Company; (iv) knowingly taking any action that would disparage the Company or be to its disadvantage; or (v) employing or attempting to employ or assisting anyone else to employ any employee or contractor of the Company or to terminate their employment or engagement with the Company.

“Cause” is generally defined to include acts of gross misconduct, indictable offenses, any willful or intentional acts or gross negligence which injure in any material respect the reputation, business or business relationships of the Company, and material breaches of the employment agreement. “Disabled” or “Disability” is generally defined as the occurrence of any physical or mental condition which materially interferes with the performance of customary duties as an employee of the Company for a consecutive six month period. “Change in Control” is defined generally to include significant changes in the stock ownership of the Company, certain changes in the Board of Directors, certain business combinations and a sale of all or substantially all of the Company’s assets. “Good Reason” is defined generally as certain changes or reductions in duties or responsibilities, certain breaches by the Company, cessation of eligibility to participate in certain employee plans, certain increased travel or failure to obtain an assumption agreement from a successor occurring concurrently with or within one year of a Change in Control.

Certain Transactions with Related Parties

During 2003, the Company chartered aircraft for Company business use from third party charter companies, including TAG Aviation (“TAG”) and Jet Alliance (“Jet Alliance”). TAG and Jet Alliance, which are not affiliated with the Company or any executives of the Company, charter aircraft on a commercial basis on behalf of numerous individual aircraft owners. In

21

certain instances, the aircraft provided by TAG and by Jet Alliance to the Company for its chartered business travel were leased from Kookaburra Air LLC (“Kookaburra”) and for fiscal 2003 $77,227 was paid by TAG and $416,848 by Jet Alliance to Kookaburra for such aircraft leased on behalf of the Company. Kookaburra is an aircraft owner whose owners are Mr. Bailye and his spouse, and Kookaburra actively charters its aircraft. The revenue from aircraft chartered by the Company is not a material portion of Kookaburra’s overall business with TAG and Jet Alliance.

Mr. Bailye is a party to a registration rights agreement with the Company under which he has certain rights with respect to the registration for resale to the public of certain shares of Common Stock owned by him.

In May 2002, the Company loaned Mr. Zaffaroni $500,000 in connection with his relocation. The loan was secured by real estate and marketable securities and payable in four installments through December 31, 2005. Interest was calculated on the principal balance and paid with each installment payment at a rate equal to 7.25% per annum. The Company never modified or waived any terms of the loan, consistent with the requirements of the Sarbanes-Oxley Act of 2002. Mr. Zaffaroni repaid the loan in full in October 2003.

22

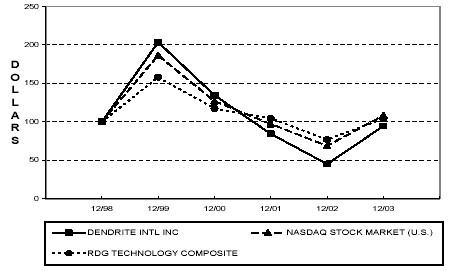

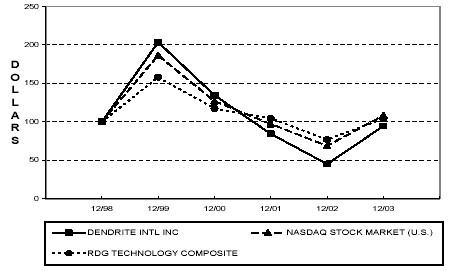

PERFORMANCE GRAPH

The following graph compares the percentage change in the cumulative total shareholders’ return on the Company’s Common Stock on a year-end basis, from December 31, 1998 to December 31, 2003, with the cumulative total return on the NASDAQ Stock Market (U.S.) Index and the RDG Technology Composite Index for the same period. In accordance with the rules of the SEC, the returns are indexed to a value of $100. The Company has never paid cash dividends on its Common Stock. Shareholders’ returns over the indicated period should not be considered indicative of future shareholder returns.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG DENDRITE INTERNATIONAL, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE RDG TECHNOLOGY COMPOSITE INDEX

* $100 invested on 12/31/98 in stock or index-

including reinvestment of dividends.

Fiscal year ending December 31.

23

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information regarding beneficial ownership of the outstanding Common Stock as of March 1, 2004 by (i) each person who is known by the Company to own beneficially more than 5% of the outstanding Common Stock, (ii) each of the directors, nominees for director and Named Officers and (iii) all current executive officers and directors as a group. Such beneficial owner has sole voting and investment power as to such shares except as otherwise indicated.

Name and Address of Beneficial Owner | | Number of Shares | | Percent of Class | |

| |

| |

| |

| | | | | | | | | |

Sterling Capital Management LLC (1) | | | 4,212,153 | | | | 9.7 | % | |

4064 Colony Road, Suite 300 | | | | | | | | | |

Charlotte, North Carolina 28211 | | | | | | | | | |

| | | | | | | | | |

Wellington Management Company, LLP (2) | | | 4,019,732 | | | | 9.2 | % | |

75 State Street | | | | | | | | | |

Boston, Massachusetts 02109 | | | | | | | | | |

| | | | | | | | | |

Brown Capital Management, Inc. (3) | | | 3,938,815 | | | | 9.0 | % | |

1201 N. Calvert Street | | | | | | | | | |

Baltimore, Maryland 21202 | | | | | | | | | |

| | | | | | | | | |

Waddell & Reed Financial, Inc. (4) | | | 3,738,054 | | | | 8.6 | % | |

6300 Lamar Avenue | | | | | | | | | |

Overland Park, Kansas 66202 | | | | | | | | | |

| | | | | | | | | |

American Express Financial Corporation (5) | | | 3,466,397 | | | | 7.8 | % | |

200 AXP Financial Center | | | | | | | | | |

Minneapolis, Minnesota 55474 | | | | | | | | | |

| | | | | | | | | |

John E. Bailye (6) | | | 3,833,092 | | | | 8.7 | % | |

c/o Dendrite International, Inc. | | | | | | | | | |

1200 Mount Kemble Avenue | | | | | | | | | |

Morristown, New Jersey 07960 | | | | | | | | | |

| | | | | | | | | |

John A. Fazio | | | 46,000 | | | | * | | |

| | | | | | | | | |

Bernard M. Goldsmith | | | 142,267 | | | | * | | |

| | | | | | | | | |

Edward J. Kfoury | | | 126,767 | | | | * | | |

| | | | | | | | | |

Paul A. Margolis | | | 135,267 | | | | * | | |

| | | | | | | | | |

John H. Martinson | | | 267,029 | | | | * | | |

| | | | | | | | | |

Terence H. Osborne | | | 114,267 | | | | * | | |

| | | | | | | | | |

Patrick J. Zenner | | | 66,790 | | | | * | | |

| | | | | | | | | |

Paul L. Zaffaroni | | | 260,837 | | | | * | | |

| | | | | | | | | |

Kathleen E. Donovan | | | 170,857 | | | | * | | |

| | | | | | | | | |

Christine A. Pellizzari | | | 61,784 | | | | * | | |

| | | | | | | | | |

Marc Kustoff | | | 236,958 | | | | * | | |

| | | | | | | | | |

| | | | | | | | | |

All executive officers and directors as a group (15 persons) (7) | | | 6,019,917 | | | | 13.0 | % | |

24

*Less than 1% of the outstanding shares of Common Stock.

(1) | Pursuant to an amended Schedule 13G filed on January 9, 2004 by Sterling Capital Management LLC, Sterling MGT, Inc., Eduardo Brea, Alexander W. McAlister, David M. Ralston, Brian R. Walton and Mark Whalen (collectively, “Sterling”), Sterling has shared voting power and shared dispositive power with respect to 4,212,153 shares. |

| |

(2) | Pursuant to a Schedule 13G filed on February 12, 2004 by Wellington Management Company, LLP (“Wellington”), Wellington has shared voting power with respect to 3,354,600 shares and shared dispositive power with respect to 4,019,732 shares. |

| |

(3) | Pursuant to an amended Schedule 13G filed on February 11, 2004 by Brown Capital Management, Inc. (“Brown”), Brown has sole voting power with respect to 2,001,255 shares and sole dispositive power with respect to 3,938,815 shares. |

| |

(4) | Pursuant to an amended Schedule 13G filed on January 30, 2004 by Waddell & Reed Financial, Inc., Waddell & Reed Investment Management Company, Waddell & Reed, Inc. and Waddell & Reed Financial Services, Inc. (collectively, “Waddell”), Waddell has sole voting and sole dispositive power with respect to 3,738,054 shares. |

| |

(5) | Pursuant to a Schedule 13G filed on February 9, 2004 by American Express Financial Corporation (“Amex”), Amex has shared voting power with respect to 378,635 shares and shared dispositive power with respect to 3,466,397 shares. |

| |

(6) | Represents 2,451,500 shares owned of record by Mr. Bailye, 561,905 shares owned of record by Carinya Holdings Company (“Carinya”), 51,000 shares owned of record by the Bailye Family Foundation (the “Foundation”), and options held by Mr. Bailye which are exercisable on or within 60 days following March 1, 2004 for 753,622 shares of Common Stock. Carinya is a general partnership the general partners of which are Mr. Bailye, Mr. Bailye’s wife, and trusts for the benefit of each of their two children. The trustees of the trusts are Mr. Bailye’s parents and Mrs. Bailye’s parents. The partnership agreement provides that the voting power with respect to shares owned by the partnership is subject to the majority vote of all partners other than Mr. Bailye. Mr. Bailye disclaims beneficial ownership of the shares owned by Carinya except to the extent of the two 10% partners’ interests owned by Mr. Bailye and his spouse. The Foundation is a trust established exclusively to provide financial support for charitable organizations which are exempt institutions under Section 501(c)(3) of the Internal Revenue Code. Mr. Bailye and his spouse constitute two of the three trustees of the Foundation. |

| |

(7) | Includes shares subject to stock options exercisable on or within 60 days following March 1, 2004, as follows: Mr. Bailye, 753,622; Mr. Fazio, 45,000; Mr. Goldsmith, 129,267; Mr. Kfoury, 103,767; Mr. Margolis, 119,267; Mr. Martinson, 171,267; Mr. Osborne, 107,267; Mr. Zenner, 60,790; Mr. Zaffaroni, 244,083; Ms. Donovan, 163,959; Ms. Pellizzari, 54,374; Mr. Kustoff, 230,207; and all directors and executive officers as a group, 2,694,392. |

25

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors to file reports regarding ownership of the Company’s Common Stock with the SEC, and to furnish the Company with copies of all such filings. Based on a review of these filings, the Company believes that all filings were timely made other than: Ms. Donovan filed three late forms each reporting a single transaction; Messrs. Fazio, Kfoury and Martinson each filed two late forms each reporting a single transaction; Mr. Bailye reported late one transaction; and Messrs. Goldsmith, Margolis, Osborne, Zaffaroni, Zenner and Ms. Pellizzari each filed one late form each reporting a single transaction.

SHAREHOLDER PROPOSALS

Shareholder proposals that are intended for inclusion in the proxy statement and related proxy materials for the Company’s 2005 Annual Meeting of Shareholders must be received by the Secretary of the Company not later than December 29, 2004 and must be in compliance with applicable SEC regulations.

Under the terms of the Company’s by-laws, shareholders who intend to submit a nomination for election as a director at an annual meeting of shareholders must be a shareholder of record on the date of providing such notice to the Secretary of the Company and on the record date for determination of shareholders entitled to vote at the annual meeting. To be eligible for consideration, a shareholder’s notice must be timely and in proper written form.

To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company not less than sixty days nor more than ninety days prior to the date of the annual meeting, provided that if the Company provides less than seventy days’ notice or announcement of the date of the annual meeting, notice by the shareholder must be received no later than the close of business on the tenth day following the day on which notice of the annual meeting date is mailed or announced, whichever occurs earlier.

To be in proper written form, a shareholder’s notice to the Secretary of the Company must set forth the items specified in the by-laws for each person whom the shareholder proposes to nominate as a director, including all information which may be required under Section 14 of the Securities Exchange Act of 1934 as well as: (a) name, age, business address and residence address; (b) principal occupation or employment; and (c) class or series and number of shares of Common Stock that are owned beneficially or by record. In addition, a shareholder’s notice must set forth the items specified in the by-laws for the shareholder giving notice, including: (a) name and address; (b) class or series and number of shares of Common Stock that are owned beneficially or of record; (c) a description of all arrangements or understandings between the shareholder and each proposed nominee or others relating to any nomination(s); and (d) a representation that the shareholder intends to appear in person or by proxy at such annual meeting to nominate the person(s) named in the notice.

26

FORM 10-K

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, IS AVAILABLE WITHOUT CHARGE UPON WRITTEN REQUEST TO INVESTOR RELATIONS, DENDRITE INTERNATIONAL, INC., 200 SOMERSET CORPORATE BOULEVARD, 8TH FLOOR, SOMERSET CORPORATE CENTER, BRIDGEWATER, NEW JERSEY 08807. THE COMPANY’S ANNUAL REPORT ON FORM 10-K IS ALSO AVAILABLE WITHOUT CHARGE THROUGH THE COMPANY’S WEBSITE, WWW.DENDRITE.COM.

OTHER MATTERS

The Board knows of no other matters which may be presented at the Annual Meeting. However, if other matters do properly come before the Annual Meeting, the Board intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

| BY THE ORDER OF THE BOARD OF DIRECTORS |

| |

|

|

| Christine A. Pellizzari |

| Secretary |

27

Appendix A

DENDRITE INTERNATIONAL, INC.

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

GENERAL

| • | The primary function of the Audit Committee is oversight. The management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements. Management is responsible for maintaining, and the internal auditing department is responsible for monitoring and evaluating, appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The external auditors are responsible for planning and carrying out a proper audit and reviews, including reviews of the Company’s quarterly financial statements prior to the filing of each quarterly report on Form 10-Q, and other procedures. |

PURPOSE OF THE AUDIT COMMITTEE

| • | The Audit Committee has been established by the Board of Directors to assist the Board in monitoring the integrity of the Company’s financial statements, its system of internal controls, the performance of the Company’s internal and external auditors, and the qualifications and independence of the external auditors. |

AUDIT COMMITTEE COMPOSITION

| • | The Audit Committee shall consist of at least three directors. The members of the Audit Committee shall be appointed by the Board of Directors. One of the members shall be appointed the Audit Committee Chairperson. Audit Committee members may be replaced by the Board of Directors. |

| | |

| • | Each member of the Audit Committee shall be “independent” as defined under applicable U.S. Securities and Exchange Commission (“SEC”) and NASDAQ rules, subject to any appropriate exceptions or exemptions from such rules as provided by the SEC or NASDAQ. |

| | |

| • | At least one member of the Audit Committee shall qualify as an “audit committee financial expert” in accordance with applicable SEC rules, and pursuant to NASDAQ rules at least one member shall have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background which results in the director’s financial sophistication in accordance with NASDAQ standards. |

| | |

| • | Each member of the Audit Committee shall be able to read and understand financial statements at the time of appointment and shall have, in accordance with NASDAQ rules, a sufficient understanding of financial reporting and internal controls, as determined by the Board of Directors, as to enable him or her to satisfy his or her duties as a member of the Audit Committee. |

A-1

AUTHORITY OF THE AUDIT COMMITTEE

| • | The Audit Committee shall have the authority to: |

| | |

| | | • | Make recommendations to the Board of Directors with respect to the Company’s internal controls and financial reporting. |

| | | | |

| | | • | Exclusively appoint, replace and establish the compensation and other engagement terms of the external auditors, which shall be funded by the Company, and oversee the performance of the external auditors. |

| | | | |

| | | • | Evaluate the performance of the external auditors. |

| | | | |

| | | • | Coordinate the resolution of any disagreements between management and the external auditors regarding financial reporting. |

| | | | |

| | | • | Pre-approve the terms of all audit and permissible non-audit services to be provided by the external auditors. |

| | | | |

| | | • | Retain legal counsel, accountants or other advisers, at the cost of the Company, to advise the Audit Committee or assist it in the conduct of any review or investigation. |

| | | | |

| | | • | Seek any information it requires from employees or other persons. |

| | | | |

| | | • | Conduct or authorize investigations into any matters within its scope of responsibility. |

| | | | |

| • | The Audit Committee may, when appropriate, delegate authority to one or more of its members or to one or more subcommittees. |

| | |

| • | The external auditors shall report directly to the Audit Committee. |

| | |

| • | The Company will fund all costs of the Audit Committee in carrying out its duties. |

ROLES AND RESPONSIBILITIES OF THE AUDIT COMMITTEE

General

| • | Annually review and reassess the adequacy of this Charter and recommend any proposed changes to the Board of Directors for approval. |

| | |

| • | Annually review the Audit Committee’s own performance. |

| | |

| • | Provide regular reports to the Board of Directors. |

Oversight of the Company’s Relationship With the External Auditors

| • | Confer with the external auditors prior to commencement of the audit to discuss the proposed scope of the audit and timely review of the Company’s quarterly filings. |

| | |

| • | Confer with the external auditors to discuss the results of the audit and quarterly reviews prior to the Company’s annual earnings being released. |

A-2

| • | Discuss with the external auditors the matters required to be discussed by Generally Accepted Auditing Standards, including the Statement on Auditing Standards No. 61, and SEC rules and regulations relating to the conduct of the audit and the quarterly reviews. |

| | |

| • | Receive on a periodic basis from the external auditors, and review, a formal written statement from the external auditors, consistent with Independence Standards Board Standard 1. |

| | |

| • | Review and discuss with the external auditors any disclosed relationships or services that may impact the objectivity and independence of the external auditors. |

| | |

| • | Take any appropriate action it determines to be necessary in response to the external auditors’ report on independence. |

| | |

| • | Review the experience and qualifications of the senior members of the external auditor team and consider regular rotation as required by applicable SEC rules or as otherwise appropriate. |

Oversight of the Company’s Internal Audit Function

| • | Review the organizational structure, qualifications and performance of the internal auditing personnel. |

| | |

| • | Review significant reports to management prepared by the internal audit personnel and management’s responses. |

| | |

| • | Review and approve the Internal Audit Plan annually. |

| | |

| • | Review and approve any changes to the Internal Audit charter. |

Financial Statement and Disclosure Matters

| • | Review and discuss with management the annual and quarterly financial statements, including Management’s Discussion and Analysis (“MD&A”), and recommend to the Board of Directors whether the audited financial statements shall be included in the Company’s Form 10-K. |

| | |

| • | Discuss with management and the external auditors any significant financial reporting issues arising in connection with the preparation of the Company’s annual financial statements, including: |

| | |

| | | • | any significant changes in the Company’s selection or application of accounting principles; |

| | | | |

| | | • | any major issues as to the adequacy of the Company’s internal controls; |

| | | | |

| | | • | critical accounting estimates and policies; |

| | | | |

| | | • | the effect of any significant alternative assumptions or estimates on the Company’s annual financial statements; and |

| | | | |

| | | • | other material communications between the external auditors and management, including any management letter. |

| | | | |

| • | Discuss with management the expected effect of any significant regulatory, accounting and financial reporting initiatives reported to the Audit Committee. |

A-3

| • | Discuss with the external auditors any difficulties encountered in the course of their audit or review work, including any restrictions on their scope of activities or on access to requested information or any significant disagreements with management. |

| | |

| • | Discuss with management the Company’s major financial risk exposures, including the Company’s risk management policies. |

| | |

| • | Prepare all reports required by applicable SEC or NASDAQ rules, including reports required to be included in the proxy statement, annual report to shareholders or other filings or submissions. |

| | |

| • | Periodically meet separately with management, with the internal auditing staff and with the external auditors, to review and discuss their respective responsibilities and performance. |

Compliance Oversight Matters

| • | Review with management the Company’s procedures for compliance with the Company’s code of business conduct and ethics. |

| | |

| • | Review with the Company’s legal counsel, legal matters that may be expected to have a material impact on the financial statements. |

| | |

| • | Review and, if appropriate, approve all material transactions between the Company and members of management, affiliated entities or other related parties. |

| | |

| • | Review policies with respect to officers’ expense accounts and perquisites including the policies on the use corporate assets. |

| | |

| • | Discuss with management and the external auditors any communications with regulators or governmental agencies brought to its attention which raise material issues regarding the Company’s financial statements or accounting policies. |

| | |

| • | Review the adequacy of the Company’s internal control structure with appropriate input from the external and internal auditors. |

Procedures For Employee and Other Third Party Complaints and Inquiries

| • | Establish and periodically review procedures for: |

| | |

| | | • | the receipt, retention and treatment of any complaints received by the Company concerning any accounting, internal controls or auditing matters; and |

| | | | |

| | | • | the confidential, anonymous submission by any Company employee of any claims or concerns regarding questionable accounting or auditing matters. |

| | |

| • | Coordinate with Company personnel responsible for receiving and processing any claim or other communication concerning the foregoing matters to ensure such matters are brought to the attention of the Chairperson of the Audit Committee. |

A-4

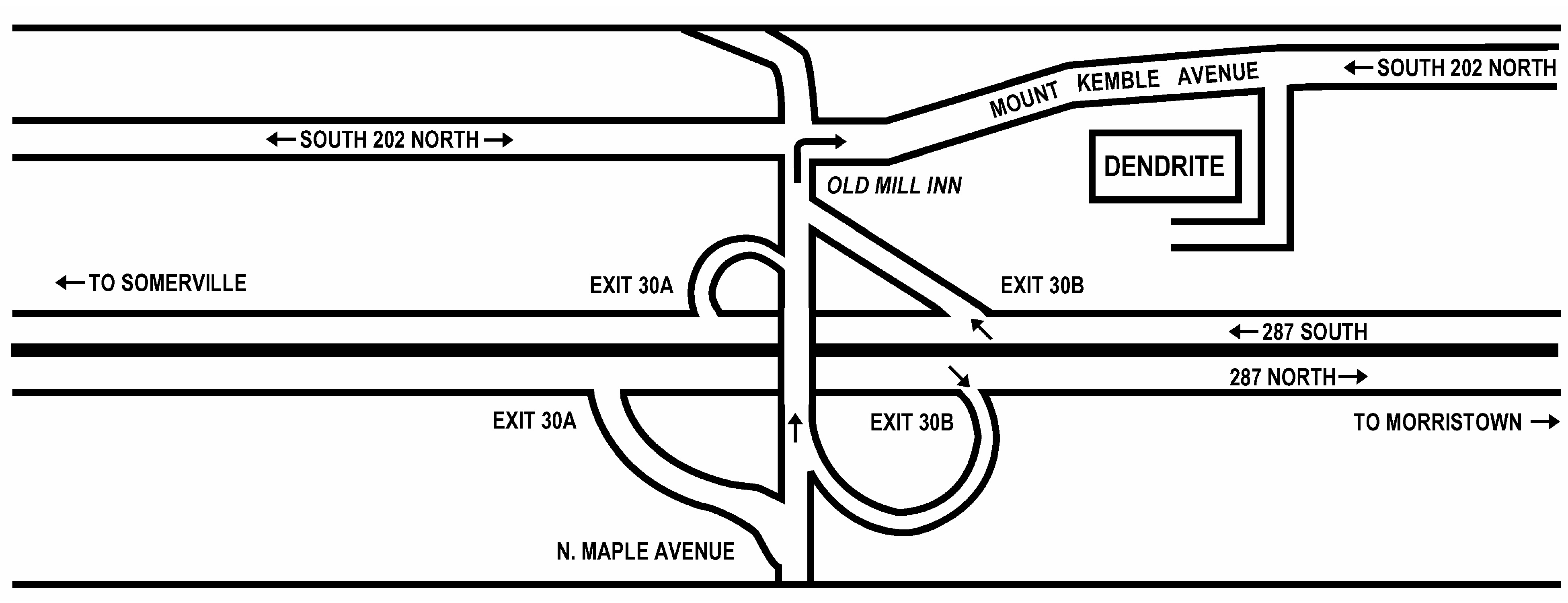

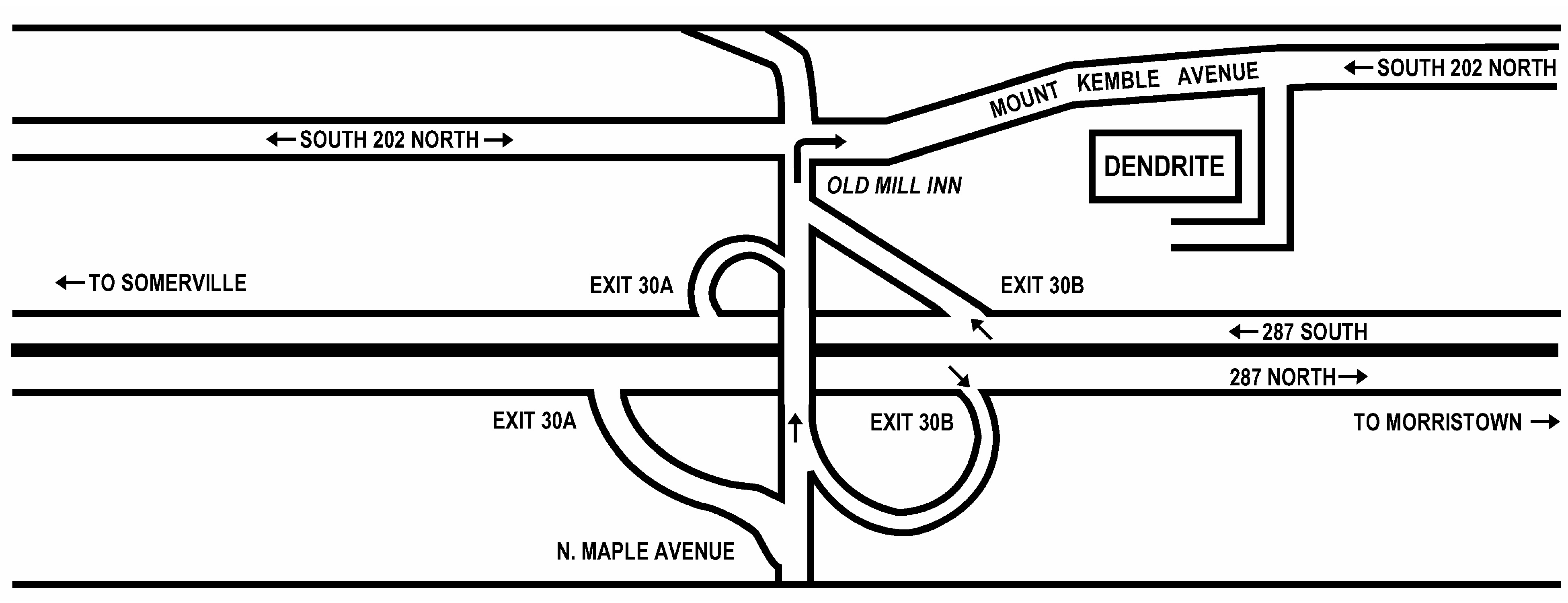

DIRECTIONS TO DENDRITE INTERNATIONAL, INC.

1200 Mount Kemble Avenue

Morristown, New Jersey 07960-6797

(973) 425-1200

From NY (Manhattan):

Take Lincoln Tunnel to NJ Turnpike SOUTH, to Route 78 WEST, to Route 24 WEST, to Route 287 SOUTH, to Exit 30B (Bernardsville/Basking Ridge), follow to traffic light (Route 202 North/Mt. Kemble Avenue). Turn RIGHT at traffic light, follow less than one mile. Dendrite is on the right.

From Newark Airport:

Take Route 1 & 9 NORTH, to Route 78 WEST, to Route 24 WEST, to Route 287 SOUTH, to Exit 30B (Bernardsville/Basking Ridge), follow to traffic light (Route 202 North/Mt. Kemble Avenue). Turn RIGHT at traffic light, follow less than one mile. Dendrite is on the right.

From Philadelphia:

Take Route 95 NORTH, to Route 206 NORTH, to Route 287 NORTH, to Exit 30B (Bernardsville/Basking Ridge), follow to traffic light (Route 202 North/Mt. Kemble Avenue). Turn RIGHT at traffic light, follow less than one mile. Dendrite is on the right.

| |

| |

DENDRITE INTERNATIONAL, INC.

PROXY CARD |

|

| |

| The undersigned hereby constitutes and appoints John E. Bailye, Kathleen E. Donovan and Christine A. Pellizzari, and each of them, proxies of the undersigned with full power of substitution, to represent and vote, as designated on the reverse side, all shares of Common Stock of Dendrite International, Inc. (the “Company”), which the undersigned could vote if personally present at the Annual Meeting of Shareholders of the Company to be held on May 17, 2004 and at any adjournment or postponement thereof. | |

| |

| The undersigned acknowledges receipt of the Company’s Annual Report to Shareholders, the Notice of the Annual Meeting of Shareholders and Proxy Statement, and revokes all former proxies. | |

| |

| THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” THE NOMINEES FOR DIRECTOR LISTED IN THE PROPOSAL ON THE REVERSE SIDE, OR FOR SUCH SUBSTITUTE NOMINEES AS MAY BE NOMINATED BY THE BOARD OF DIRECTORS IN THE EVENT ANY OF THE INITIAL NOMINEES SHOULD BECOME UNAVAILABLE. | |

|

|

| | | | |

| |

| VOTE BY INTERNET -www.proxyvote.com |

DENDRITE INTERNATIONAL, INC.

1200 MT. KEMBLE AVENUE

MORRISTOWN, NJ 07960-6797 | | Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern time the day before the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| | |

| | VOTE BY PHONE -1-800-690-6903 |

| | Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern time the day before the meeting date. Have your proxy card in hand when you call and then follow the simple instructions the Vote Voice provides you. |

| | |

| | VOTE BY MAIL |

| | Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return to Dendrite International, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| | |

|

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | DNDRT1 | KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

DENDRITE INTERNATIONAL, INC. | | |

| | | | |

| The Board of Directors recommends a vote

FOR all the nominees listed herein. | | | |

|

Vote On Directors

| | For

All | Withhold

All | For All

Except | | To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below. | |

| | | | | | | | |

| 1. | Election of Directors | | o | o | o | | | |

| | | |

| 01) John E. Bailye | | |

| 02) John A. Fazio | | |

| 03) Bernard M. Goldsmith | | |

| 04) Edward J. Kfoury | | |

| 05) Paul A. Margolis | | |

| 06) John H. Martinson | | |

| 07) Terence H. Osborne | | |

| 08) Patrick J. Zenner | | |

| | |

| | |

| (Please insert date below, sign exactly as name appears on Stock Certificate and mail in the enclosed envelope. When signing as an officer, partner, executor, administrator, trustee or guardian, please give full title. For joint accounts, each joint owner should sign.) | | |

|

|

|

| | | | | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | | | | | Signature (Joint Owners) | Date | |