ANNUAL REPORT / DECEMBER 31, 2008

Legg Mason Partners

Investors Value Fund

| | |

| Managed by | | CLEARBRIDGE ADVISORS |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Fund objective

The Fund seeks long-term growth of capital. Current income is a secondary objective.

What’s inside

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and ClearBridge Advisors, LLC (“ClearBridge”) is the Fund’s subadviser. LMPFA and ClearBridge are wholly-owned subsidiaries of Legg Mason, Inc.

Letter from the chairman

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy weakened significantly during the 12-month reporting period ended December 31, 2008. Looking back, U.S. gross domestic product (“GDP”)i contracted 0.2% in the fourth quarter of 2007. This was due to continued weakness in the housing market, an ongoing credit crunch and soaring oil and food prices. The economy then expanded 0.9% and 2.8% during the first and second quarters of 2008, respectively. Contributing to this rebound were rising exports that were buoyed by a weakening U.S. dollar. In addition, consumer spending accelerated, aided by the government’s tax rebate program. However, the dollar’s rally and the end of the rebate program, combined with other strains on the economy, caused GDP to take a step backward during the second half of 2008. According to the U.S. Department of Commerce, third quarter 2008 GDP declined 0.5% and its advance estimate for fourth quarter GDP decline was 3.8%, the latter being the worst quarterly reading since 1982.

While there were increasing signs that the U.S. was headed for a recession, the speculation ended in December 2008. At that time, the National Bureau of Economic Research (“NBER”) — which has the final say on when one begins and ends — announced that a recession had begun in December 2007. The NBER determined that a recession had already started using its definition, which is based on “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income and other indicators.”

Regardless of how one defines a recession, it felt like we were in the midst of an economic contraction for much of 2008. Consumer spending, which represents approximately two-thirds of GDP, has been disappointing. According to the International Council of Shopping Centers, retail sales rose a tepid 1% in 2008, the weakest level in at least 38 years. In terms of the job market, the U.S. Department of Labor reported that payroll employment declined in each of the 12 months of 2008. During 2008 as a whole, 2.6 million jobs were lost, the largest annual decline since World War II ended in 1945. In addition, at the end of 2008, the unemployment rate had risen to 7.2%, its highest level since January 1993.

| | |

| Legg Mason Partners Investors Value Fund | | I |

Letter from the chairman continued

Ongoing issues related to the housing and subprime mortgage markets and seizing credit markets prompted the Federal Reserve Board (“Fed”)ii to take aggressive and, in some cases, unprecedented actions. When 2008 began, the federal funds rateiii was 4.25%. This was quickly brought down to 3.00% by the end of January 2008, on the back of two Fed rate cuts. The Fed continued to lower the federal funds rate to 2.00% by the end of April 2008, but then left rates on hold for several months. This was due to growing inflationary pressures as a result of soaring oil and commodity prices, coupled with the sagging U.S. dollar. However, as inflation receded along with oil prices and the global financial crisis escalated, the Fed cut rates twice in October to 1.00%. Then, in mid-December 2008, it reduced the federal funds rate to a range of zero to 0.25%, an historic low. In conjunction with its December meeting, the Fed stated that it “will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.”

In addition to the interest rate cuts, the Fed took several actions to improve liquidity in the credit markets. In March 2008, it established a new lending program allowing certain brokerage firms, known as primary dealers, to also borrow from its discount window. Also in March, the Fed played a major role in facilitating the purchase of Bear Stearns by JPMorgan Chase. In mid-September 2008, it announced an $85 billion rescue plan for ailing AIG and pumped $70 billion into the financial system as Lehman Brothers’ bankruptcy and mounting troubles at other financial firms roiled the markets.

The U.S. Department of the Treasury has also taken an active role in attempting to stabilize the financial system, as it orchestrated the government’s takeover of mortgage giants Fannie Mae and Freddie Mac in September 2008. In addition, on October 3, 2008, the Treasury’s $700 billion Troubled Asset Relief Program (“TARP”) was approved by Congress and signed into law by President Bush. As part of TARP, the Treasury had planned to purchase bad loans and other troubled financial assets. However, in November 2008, Treasury Secretary Paulson said, “Our assessment at this time is that this is not the most effective way to use TARP funds, but we will continue to examine whether targeted forms of asset purchase can play a useful role, relative to other potential uses of TARP resources, in helping to strengthen our financial system and support lending.”

The U.S. stock market was extremely volatile and generated very poor results during the 12 months ended December 31, 2008. Stock prices declined during each of the first three months of the reporting period. This was due, in part, to the credit crunch, weakening corporate profits, rising inflation and fears of an impending recession. The market then reversed course and posted positive returns in April and May 2008. The market’s gains were largely attributed to hopes that the U.S. would skirt a recession

| | |

| II | | Legg Mason Partners Investors Value Fund |

and that corporate profits would rebound as the year progressed. However, given the escalating credit crisis and the mounting turmoil in the financial markets, stock prices moved lower during five of the last seven months of the reporting period, including S&P 500 Indexiv (the “Index”) returns of -8.91%, - -16.79% and -7.18% in September, October and November 2008, respectively. While the Index rallied approximately 20% from its low on November 20, 2008 through the end of the year, it was too little, too late. All told, the Index returned -37.00% in 2008, its third worst year ever and the biggest calendar year loss since 1937.

Looking at the U.S. stock market more closely, its descent was broad in scope, with every major index posting double-digit losses. In terms of market capitalizations, large-, mid- and small-cap stocks, as measured by the Russell 1000v, Russell Midcapvi and Russell 2000vii Indexes, returned -37.60%, -41.46% and -33.79%, respectively, during the 12-month period ended December 31, 2008. From an investment style perspective, growth and value stocks, as measured by the Russell 3000 Growthviii and Russell 3000 Valueix Indexes, returned - -38.44% and -36.25%, respectively.

A special note regarding increased market volatility

In recent months, we have experienced a series of events that have impacted the financial markets and created concerns among both novice and seasoned investors alike. In particular, we have witnessed the failure and consolidation of several storied financial institutions, periods of heightened market volatility, and aggressive actions by the U.S. federal government to steady the financial markets and restore investor confidence. While we hope that the worst is over in terms of the issues surrounding the credit and housing crises, it is likely that the fallout will continue to impact the financial markets and the U.S. economy well into 2009.

Like all asset management firms, Legg Mason has not been immune to these difficult and, in some ways, unprecedented times. However, today’s challenges have only strengthened our resolve to do everything we can to help you reach your financial goals. Now, as always, we remain committed to providing you with excellent service and a full spectrum of investment choices. And rest assured, we will continue to work hard to ensure that our investment managers make every effort to deliver strong long-term results.

We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our enhanced website, www.leggmason.com/individualinvestors. Here you can gain immediate access to many special features to help guide you through difficult times, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

| | |

| Legg Mason Partners Investors Value Fund | | III |

Letter from the chairman continued

During periods of market unrest, it is especially important to work closely with your financial advisor and remember that reaching one’s investment goals unfolds over time and through multiple market cycles. Time and again, history has shown that, over the long run, the markets have eventually recovered and grown.

Information about your fund

As you may be aware, several issues in the mutual fund industry have come under the scrutiny of federal and state regulators. Affiliates of the Fund’s manager have, in recent years, received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund is not in a position to predict the outcome of these requests and investigations.

Please read on for a more detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

January 30, 2009

| | |

| IV | | Legg Mason Partners Investors Value Fund |

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| v | The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| vi | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. |

| vii | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. |

| viii | The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| ix | The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

| | |

| Legg Mason Partners Investors Value Fund | | V |

Fund overview

Q. What is the Fund’s investment strategy?

A. The primary investment objective of the Fund is to seek long-term growth of capital. Current income is a secondary objective. The Fund invests primarily in common stocks of established U.S. companies. The Fund may also invest in other equity securities. To a lesser degree, the Fund may invest in debt securities. In selecting individual companies for investment, the portfolio managers focus on established large-capitalization companies (over $5 billion in market capitalization), seeking to identify those companies with strong franchises and favorable valuations potentially capable of producing superior returns across a range of potential scenarios. The portfolio managers employ bottom-up fundamental analysis to analyze each company in detail. In particular, we look for stocks that we believe are temporarily mispriced for reasons that may include negative investor sentiment, misunderstood fundamentals or operational challenges that the management team believes are surmountable. We continuously attempt to balance franchise value with price, focusing on new products or services, expanding demand, strong management teams, an improving industry environment or weakness in competitors.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The equity markets, as defined by the S&P 500 Indexi, declined 37%, making 2008 the worst year since 1937.

For several years, rising home prices and low interest rates supported growth in residential mortgage debt and funded elevated levels of consumer spending. These factors also masked weak underwriting standards, particularly for mortgages. As home prices started to drop, values of often highly-rated structured financial products, collateralized by residential mortgages and other forms of debt, began to show signs of distress. Deteriorating credit led to tighter underwriting standards and pressured consumer spending, which represents about 70% of the overall U.S. economy. The economic slowdown, which began in the U.S., has subsequently spread throughout the world.

The distress throughout the financial system and rapidly declining home prices led to the collapse and government-assisted sale of Bear Stearns, forced conservatorship of the nation’s two largest mortgage companies, Fannie Mae and Freddie Mac, and government seizure of the nation’s largest thrift, Washington Mutual. The government’s decision to allow Lehman Brothers, the fourth largest and oldest investment bank in the country, to fail and file for bankruptcy rippled throughout global financial markets. Concerned about the fragility of the financial system, the government was effectively forced to nationalize American International Group, the nation’s largest insurance company. Many of the nation’s largest

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 1 |

Fund overview continued

financial institutions, such as Goldman Sachs, Morgan Stanley and General Electric (GE Capital), who are dependent on capital market funding, were forced to raise capital at distressed prices. Following the collapse of Lehman Brothers, the Reserve Fund, the oldest and largest money market fund in the country, “broke the buck,” shaking the confidence of investors in all but the safest assets, such as U.S. Treasuries.

In order to restore confidence, Congress approved an unprecedented and controversial $700 billion Troubled Asset Relief Program (“TARP”) designed to provide capital relief to the financial system. Several other programs were put in place to further support credit markets. These include the Temporary Liquidity Guarantee Program, under which the Federal Deposit Insurance Corporation (“FDIC”) provides a “full faith and credit” guarantee on newly-issued senior unsecured debt, and the Commercial Paper Funding Facility, which provides a liquidity backstop for three-month unsecured and asset-backed commercial paper issuers, for both financial and non-financial institutions. In addition, President Bush signed a $17.4 billion loan rescue package to assist the ailing U.S. automakers.

Central banks across the globe continued efforts to stabilize financial markets by coordinating their efforts to lower rates and inject massive amounts of liquidity. In the U.S., the Federal Reserve Board (“Fed”)ii reduced the federal funds rateiii from 4.25% at the start of the year to a target range of 0.00-0.25% in December. A flight to safety pushed Treasury yields to record lows, with the 10-year yielding 2.25% at year end. Rates on conforming 30-year fixed mortgages dropped to 5.1% at year end after the Fed announced plans to purchase up to $500 billion of mortgage-backed securities starting in February 2009. The 30-year rate represents the lowest on record since April 1971, the year Freddie Mac started tracking the data. Slower global economic growth continued to push commodity prices down, with oil closing the year at $44.60 a barrel, down 50% from $90.11 at the end of 2007, and down 70% from the high of $146.93 reached in mid-July 2008. Easing inflationary pressures provided some relief to consumers and businesses and offered a broader set of tools to regulators to stabilize the economy.

Q. How did we respond to these changing market conditions?

A. The unprecedented disruption in the fixed-income markets, combined with a rapidly deteriorating economy, created the most precarious investment environments in decades. Government support has been critical to stabilize the economy. While we do not know the length and depth of this recession, the market is a good discounting mechanism which we believe will react positively to any sign of stabilization. In these periods of uncertainty and volatility, we have continued to seek a balance between short-term risks and longer-term opportunities as we focused on companies we believe have strong franchises capable of generating solid sustainable returns over time.

| | |

| 2 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Performance review

For the 12 months ended December 31, 2008, Class A shares of Legg Mason Partners Investors Value Fund, excluding sales charges, returned -35.52%. The Fund’s unmanaged benchmarks, the S&P 500 Index and the Russell 1000 Value Indexiv, returned -37.00% and -36.85%, respectively, over the same time frame. The Lipper Large-Cap Value Funds Category Average1 returned -37.36% for the same period.

| | | | |

| PERFORMANCE SNAPSHOT as of December 31, 2008 (excluding sales charges) (unaudited) |

| | | 6 MONTHS | | 12 MONTHS |

| Investors Value Fund — Class A Shares | | -25.72% | | -35.52% |

| S&P 500 Index | | -28.48% | | -37.00% |

| Russell 1000 Value Index | | -26.93% | | -36.85% |

| Lipper Large-Cap Value Funds Category Average1 | | -27.93% | | -37.36% |

| | | | |

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors. |

| Excluding sales charges, Class B shares returned -26.00%, Class C shares returned -25.92% and Class I shares2 returned -25.51% over the six months ended December 31, 2008. Excluding sales charges, Class B shares returned -36.05%, Class C shares returned -35.94% and Class I shares returned -35.23% over the 12 months ended December 31, 2008. All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. |

| Performance figures reflect expense reimbursements and/or fee waivers, without which the performance would have been lower. |

| TOTAL ANNUAL OPERATING EXPENSES (unaudited) |

| As of the Fund’s most current prospectus dated April 28, 2008, the gross total operating expense ratios for Class A, Class B, Class C and Class I shares were 0.86%, 1.62%, 1.57% and 0.57%, respectively. |

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended December 31, 2008, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 610 funds for the six-month period and among the 596 funds for the 12-month period in the Fund’s Lipper category, and excluding sales charges. |

| 2 | Effective August 17, 2007, all outstanding Class I shares were converted to Class O shares and Class O shares were re-designated as Class I shares. The former Class I shares were terminated. The inception date, performance history and expense waivers/reimbursements of the former Class O shares have been maintained. |

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 3 |

Fund overview continued

Q. What were the leading contributors to performance?

A. Relative to the S&P 500 Index, our overall sector allocation contributed to performance for the period. Specifically, our underweights to the Information Technology (“IT”) and Industrials sectors contributed to relative performance, as did our overweights to the Telecommunication Services (“Telecom”) and Consumer Discretionary sectors. In addition, stock selection in the Financials and Consumer staples sectors made significant contributions to relative performance.

On an individual stock basis, the leading contributors to performance included positions in McDonald’s Corp. in the Consumer Discretionary sector, Exxon Mobil Corp. in the Energy sector, Wal-Mart Stores Inc. in the Consumer Staples sector, Verizon Communications Inc. in the Telecom sector and Chubb Corp. in the Financials sector.

Q. What were the leading detractors from performance?

A. Relative to the S&P 500 Index, overall stock selection detracted from performance for the period. In particular, stock selection in the Consumer Discretionary, Energy, Telecom, Health Care, Industrials and IT sectors negatively impacted relative performance. In terms of sector allocation, the Fund’s overweight to the Financials sector and its underweights to the Health Care and Utilities sectors also detracted from relative performance.

On an individual stock basis, the leading detractors from performance for the period included our holdings in General Electric Co. in the Industrials sector, Bank of America Corp. in the Financials sector, Transocean Ltd. in the Energy sector, as well as Sprint Nextel Corp. in the Telecom sector and Liberty Media Corp. Series A Liberty Entertainment in the Consumer Discretionary sector.

Q. Were there any significant changes to the Fund during the reporting period?

A. Over the course of the fiscal year, we increased our weightings in the Consumer Staples, Energy and Telecom sectors and decreased our weightings in the Financials, Industrials, IT and Health Care sectors.

We closed a number of positions during the year, including Fund holdings in Textron Inc. in the Industrials sector, and American International Group Inc., Merrill Lynch & Co. Inc., Freddie Mac, and Wachovia Corp., all in the Financials sector (Both Merrill Lynch and Wachovia were acquired during the year). We also sold our holdings in Nokia Corp. (ADR), Texas Instruments Inc. and Comverse Technology Inc., all in the IT sector, and Liberty Media Corp., Liberty Media Corp. Series A Liberty Entertainment and Liberty Media Holding Corp. Interactive Series A, all in the Consumer Discretionary sector.

We established new Fund positions during the year in Lorillard Inc. and Unilever PLC (ADR), both in the Consumer Staples sector, Exxon Mobil Corp., Halliburton Co., El Paso Corp., and Devon Energy Corp., all in the Energy sector, as well as Verizon Communications Inc. in the Telecom

| | |

| 4 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

sector, Scripps Networks Interactive Class A Shares in the Consumer Discretionary sector and Marshall & Ilsey Corp. in the Financials sector.

Thank you for your investment in Legg Mason Partners Investors Value Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

| | |

| |

| |  |

| Robert Feitler | | Dimitry Khaykin |

| Co-Portfolio Manager | | Co-Portfolio Manager |

| ClearBridge Advisors, LLC | | ClearBridge Advisors, LLC |

January 20, 2009

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of December 31, 2008 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top 10 holdings (as a percentage of net assets) as of this date were: AT&T Inc. (4.1%), Total SA (3.8%), Wal-Mart Stores Inc. (3.6%), McDonald’s Corp. (3.3%), Wells Fargo & Co. (3.3%), Kimberly-Clark Corp. (3.1%), Philip Morris International Inc. (3.0%), JPMorgan Chase & Co. (2.8%), General Electric Co. (2.8%) and Travelers Cos. Inc. (2.8%). Please refer to pages 11 through 14 for a list and percentage breakdown of the Fund’s holdings.

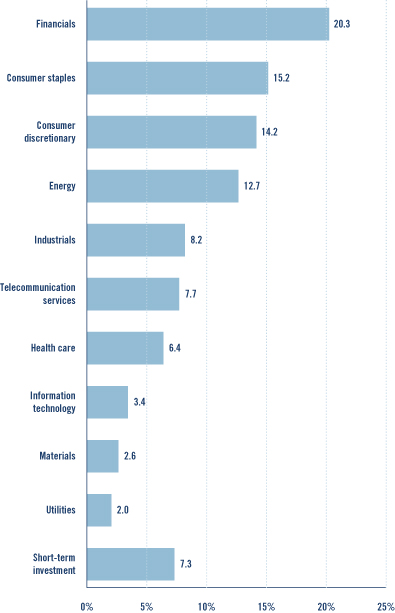

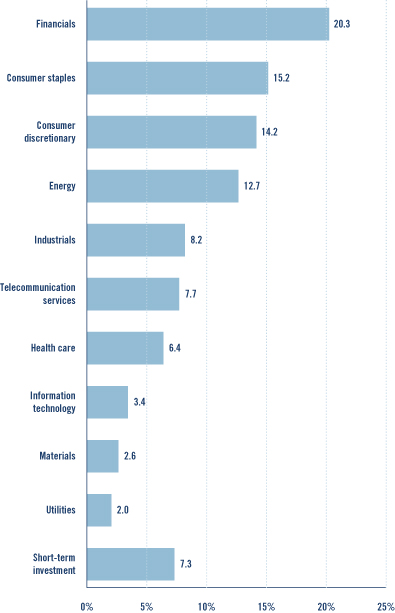

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of December 31, 2008 were: Financials (20.4%), Consumer Staples (15.2%), Consumer Discretionary (14.2%), Energy (12.7%) and Industrials (8.3%). The Fund’s portfolio composition is subject to change at any time.

RISKS: Investments in common stocks are subject to market fluctuations. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions. These risks are magnified in emerging markets. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 5 |

Fund at a glance (unaudited)

|

| INVESTMENT BREAKDOWN (%) As a percent of total investments — December 31, 2008 |

| | |

| 6 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on July 1, 2008 and held for the six months ended December 31, 2008.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| BASED ON ACTUAL TOTAL RETURN1 | | | | | |

| | | ACTUAL TOTAL

RETURN

WITHOUT

SALES

CHARGES2 | | | BEGINNING

ACCOUNT

VALUE | | ENDING

ACCOUNT

VALUE | | ANNUALIZED

EXPENSE

RATIO | | | EXPENSES

PAID DURING

THE PERIOD3 |

| Class A | | (25.72 | )% | | $ | 1,000.00 | | $ | 742.80 | | 1.06 | % | | $ | 4.64 |

| Class B | | (26.00 | ) | | | 1,000.00 | | | 740.00 | | 1.94 | | | | 8.49 |

| Class C | | (25.92 | ) | | | 1,000.00 | | | 740.80 | | 1.75 | | | | 7.66 |

| Class I | | (25.51 | ) | | | 1,000.00 | | | 744.90 | | 0.66 | | | | 2.89 |

| 1 | For the six months ended December 31, 2008. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. |

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 7 |

Fund expenses (unaudited) continued

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| BASED ON HYPOTHETICAL TOTAL RETURN1 | | | | | | | |

| | | HYPOTHETICAL

ANNUALIZED

TOTAL

RETURN | | | BEGINNING

ACCOUNT

VALUE | | ENDING

ACCOUNT

VALUE | | ANNUALIZED

EXPENSE

RATIO | | | EXPENSES

PAID DURING

THE PERIOD2 |

| Class A | | 5.00 | % | | $ | 1,000.00 | | $ | 1,019.81 | | 1.06 | % | | $ | 5.38 |

| Class B | | 5.00 | | | | 1,000.00 | | | 1,015.38 | | 1.94 | | | | 9.83 |

| Class C | | 5.00 | | | | 1,000.00 | | | 1,016.34 | | 1.75 | | | | 8.87 |

| Class I | | 5.00 | | | | 1,000.00 | | | 1,021.82 | | 0.66 | | | | 3.35 |

| 1 | For the six months ended December 31, 2008. |

| 2 | Expenses (net of fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. |

| | |

| 8 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Fund performance (unaudited)

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS1 | |

| | | WITHOUT SALES CHARGES2 | |

| | | CLASS A | | | CLASS B | | | CLASS C | | | CLASS I | |

| Twelve Months Ended 12/31/08 | | (35.52 | )% | | (36.05 | )% | | (35.94 | )% | | (35.23 | )% |

| Five Years Ended 12/31/08 | | (1.64 | ) | | (2.52 | ) | | (2.43 | ) | | (1.32 | ) |

| Ten Years Ended 12/31/08 | | 1.50 | | | 0.63 | | | 0.70 | | | 1.80 | |

| |

| | | WITH SALES CHARGES3 | |

| | | CLASS A | | | CLASS B | | | CLASS C | | | CLASS I | |

| Twelve Months Ended 12/31/08 | | (39.23 | )% | | (39.15 | )% | | (36.56 | )% | | (35.23 | )% |

| Five Years Ended 12/31/08 | | (2.79 | ) | | (2.67 | ) | | (2.43 | ) | | (1.32 | ) |

| Ten Years Ended 12/31/08 | | 0.90 | | | 0.63 | | | 0.70 | | | 1.80 | |

| | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS1 | |

| | | WITHOUT SALES CHARGES2 | |

| Class A (12/31/98 through 12/31/08) | | | | | 16.05% | | | | |

| Class B (12/31/98 through 12/31/08) | | | | | 6.45 | | | | |

| Class C (12/31/98 through 12/31/08) | | | | | 7.25 | | | | |

| Class I (12/31/98 through 12/31/08) | | | | | 19.54 | | | | |

| 1 | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable CDSC with respect to Class B and C shares. |

| 3 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.75%; Class B shares reflect the deduction of a 5.00% CDSC, which applies if shares are redeemed within one year from purchase payment and declines thereafter by 1.00% per year until no CDSC is incurred. Class C shares also reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 9 |

Historical performance (unaudited)

|

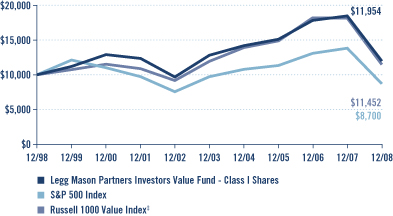

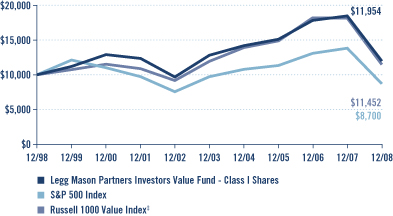

VALUE OF $10,000 INVESTED IN CLASS I SHARES OF LEGG MASON PARTNERS INVESTORS VALUE FUND

VS. S&P 500 INDEX AND RUSSELL 1000 VALUE INDEX† — December 1998 - December 2008 |

| † | Hypothetical illustration of $10,000 invested in Class I shares of Legg Mason Partners Investors Value Fund on December 31, 1998, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2008. The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Indexes are unmanaged and are not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The performance of the Fund’s other classes may be greater or less than Class I shares’ performance indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

| ‡ | Effective April 28, 2008, the Fund’s benchmarks are the S&P 500 Index and the Russell 1000 Value Index. Prior to April 28, 2008, the Fund’s sole benchmark was the S&P 500 Index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| | |

| 10 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Schedule of investments

December 31, 2008

| | | | | |

| LEGG MASON PARTNERS INVESTORS VALUE FUND | | |

| SHARES | | SECURITY | | VALUE |

| | | | | |

| COMMON STOCKS — 93.0% | | | |

| CONSUMER DISCRETIONARY — 14.2% | | | |

| | | Hotels, Restaurants & Leisure — 3.3% | | | |

| 361,500 | | McDonald’s Corp. | | $ | 22,481,685 |

| | | Media — 7.9% | | | |

| 729,200 | | DISH Network Corp.* | | | 8,086,828 |

| 1,416,680 | | News Corp., Class B Shares | | | 13,571,794 |

| 359,200 | | Scripps Networks Interactive, Class A Shares | | | 7,902,400 |

| 496,700 | | SES Global SA, FDR(a) | | | 9,561,759 |

| 1,350,800 | | Time Warner Inc. | | | 13,589,048 |

| | | Total Media | | | 52,711,829 |

| | | Multiline Retail — 1.3% | | | |

| 255,100 | | Target Corp. | | | 8,808,603 |

| | | Specialty Retail — 1.7% | | | |

| 501,000 | | Home Depot Inc. | | | 11,533,020 |

| | | TOTAL CONSUMER DISCRETIONARY | | | 95,535,137 |

| CONSUMER STAPLES — 15.2% | | | |

| | | Food & Staples Retailing — 3.5% | | | |

| 425,900 | | Wal-Mart Stores Inc. | | | 23,875,954 |

| | | Food Products — 3.0% | | | |

| 454,267 | | Kraft Foods Inc., Class A Shares | | | 12,197,069 |

| 336,000 | | Unilever PLC, ADR | | | 7,734,720 |

| | | Total Food Products | | | 19,931,789 |

| | | Household Products — 3.1% | | | |

| 394,500 | | Kimberly-Clark Corp. | | | 20,805,930 |

| | | Tobacco — 5.6% | | | |

| 539,100 | | Altria Group Inc. | | | 8,118,846 |

| 159,400 | | Lorillard Inc. | | | 8,982,190 |

| 468,500 | | Philip Morris International Inc. | | | 20,384,435 |

| | | Total Tobacco | | | 37,485,471 |

| | | TOTAL CONSUMER STAPLES | | | 102,099,144 |

| ENERGY — 12.7% | | | |

| | | Energy Equipment & Services — 2.0% | | | |

| 433,200 | | Halliburton Co. | | | 7,875,576 |

| 123,760 | | Transocean Ltd.* | | | 5,847,660 |

| | | Total Energy Equipment & Services | | | 13,723,236 |

| | | Oil, Gas & Consumable Fuels — 10.7% | | | |

| 104,980 | | Devon Energy Corp. | | | 6,898,236 |

| 883,200 | | El Paso Corp. | | | 6,915,456 |

| 194,800 | | Exxon Mobil Corp. | | | 15,550,884 |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 11 |

Schedule of investments continued

December 31, 2008

| | | | | |

| LEGG MASON PARTNERS INVESTORS VALUE FUND | | |

| SHARES | | SECURITY | | VALUE |

| | | | | |

| | | Oil, Gas & Consumable Fuels — 10.7% continued | | | |

| 210,800 | | Royal Dutch Shell PLC, ADR, Class A Shares | | $ | 11,159,752 |

| 289,892 | | Suncor Energy Inc. | | | 5,652,894 |

| 461,450 | | Total SA, ADR | | | 25,518,185 |

| | | Total Oil, Gas & Consumable Fuels | | | 71,695,407 |

| | | TOTAL ENERGY | | | 85,418,643 |

| FINANCIALS — 20.4% | | | |

| | | Capital Markets — 1.4% | | | |

| 335,919 | | Bank of New York Mellon Corp. | | | 9,516,585 |

| | | Commercial Banks — 3.8% | | | |

| 256,420 | | Marshall & Ilsley Corp. | | | 3,497,569 |

| 740,700 | | Wells Fargo & Co. | | | 21,835,836 |

| | | Total Commercial Banks | | | 25,333,405 |

| | | Consumer Finance — 2.4% | | | |

| 329,360 | | American Express Co. | | | 6,109,628 |

| 323,100 | | Capital One Financial Corp. | | | 10,303,659 |

| | | Total Consumer Finance | | | 16,413,287 |

| | | Diversified Financial Services — 4.4% | | | |

| 752,500 | | Bank of America Corp. | | | 10,595,200 |

| 602,860 | | JPMorgan Chase & Co. | | | 19,008,176 |

| | | Total Diversified Financial Services | | | 29,603,376 |

| | | Insurance — 8.4% | | | |

| 153,930 | | AFLAC Inc. | | | 7,056,151 |

| 257,600 | | Chubb Corp. | | | 13,137,600 |

| 226,060 | | Loews Corp. | | | 6,386,195 |

| 457,849 | | Marsh & McLennan Cos. Inc. | | | 11,111,995 |

| 411,180 | | Travelers Cos. Inc. | | | 18,585,336 |

| | | Total Insurance | | | 56,277,277 |

| | | TOTAL FINANCIALS | | | 137,143,930 |

| HEALTH CARE — 6.4% | | | |

| | | Health Care Providers & Services — 2.8% | | | |

| 335,530 | | UnitedHealth Group Inc. | | | 8,925,098 |

| 233,200 | | WellPoint Inc.* | | | 9,824,716 |

| | | Total Health Care Providers & Services | | | 18,749,814 |

| | | Pharmaceuticals — 3.6% | | | |

| 195,700 | | Abbott Laboratories | | | 10,444,509 |

| 280,800 | | Novartis AG, ADR | | | 13,972,608 |

| | | Total Pharmaceuticals | | | 24,417,117 |

| | | TOTAL HEALTH CARE | | | 43,166,931 |

See Notes to Financial Statements.

| | |

| 12 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

| | | | | |

| LEGG MASON PARTNERS INVESTORS VALUE FUND | | |

| SHARES | | SECURITY | | VALUE |

| | | | | |

| INDUSTRIALS — 8.3% | | | |

| | | Aerospace & Defense — 3.2% | | | |

| 155,700 | | Boeing Co. | | $ | 6,643,719 |

| 288,600 | | Raytheon Co. | | | 14,730,144 |

| | | Total Aerospace & Defense | | | 21,373,863 |

| | | Commercial Services & Supplies — 0.5% | | | |

| 105,700 | | Avery Dennison Corp. | | | 3,459,561 |

| | | Industrial Conglomerates — 4.6% | | | |

| 1,148,600 | | General Electric Co. | | | 18,607,320 |

| 222,600 | | United Technologies Corp. | | | 11,931,360 |

| | | Total Industrial Conglomerates | | | 30,538,680 |

| | | TOTAL INDUSTRIALS | | | 55,372,104 |

| INFORMATION TECHNOLOGY — 3.4% | | | |

| | | Communications Equipment — 0.2% | | | |

| 105,520 | | EchoStar Corp.* | | | 1,569,083 |

| | | Computers & Peripherals — 1.7% | | | |

| 134,900 | | International Business Machines Corp. | | | 11,353,184 |

| | | Software — 1.5% | | | |

| 499,900 | | Microsoft Corp. | | | 9,718,056 |

| | | TOTAL INFORMATION TECHNOLOGY | | | 22,640,323 |

| MATERIALS — 2.6% | | | |

| | | Chemicals — 2.6% | | | |

| 149,400 | | Air Products & Chemicals Inc. | | | 7,510,338 |

| 388,900 | | E.I. du Pont de Nemours & Co. | | | 9,839,170 |

| | | TOTAL MATERIALS | | | 17,349,508 |

| TELECOMMUNICATION SERVICES — 7.7% | | | |

| | | Diversified Telecommunication Services — 7.4% | | | |

| 974,510 | | AT&T Inc. | | | 27,773,535 |

| 271,802 | | Embarq Corp. | | | 9,774,000 |

| 349,800 | | Verizon Communications Inc. | | | 11,858,220 |

| | | Total Diversified Telecommunication Services | | | 49,405,755 |

| | | Wireless Telecommunication Services — 0.3% | | | |

| 1,319,351 | | Sprint Nextel Corp.* | | | 2,414,412 |

| | | TOTAL TELECOMMUNICATION SERVICES | | | 51,820,167 |

| UTILITIES — 2.1% | | | |

| | | Multi-Utilities — 2.1% | | | |

| 322,300 | | Sempra Energy | | | 13,739,649 |

| | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENT (Cost — $709,692,406) | | | 624,285,536 |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 13 |

Schedule of investments continued

December 31, 2008

| | | | | | | |

| LEGG MASON PARTNERS INVESTORS VALUE FUND | | | |

FACE AMOUNT | | SECURITY | | VALUE | |

| | | | | | | |

| | SHORT-TERM INVESTMENT — 7.3% | | | | |

| | | | Repurchase Agreement — 7.3% | | | | |

| $ | 49,150,000 | | Interest in $500,000,000 joint tri-party repurchase agreement dated 12/31/08 with Greenwich Capital Markets Inc., 0.060% due 1/2/09; Proceeds at maturity $49,150,164; (Fully collateralized by various U.S. government agency obligations, 2.625% to 7.125% due 7/17/09 to 11/15/30; Market value — $50,133,392) (Cost — $49,150,000) | | $ | 49,150,000 | |

| | | | TOTAL INVESTMENTS — 100.3% (Cost — $758,842,406#) | | | 673,435,536 | |

| | | | Liabilities in Excess of Other Assets — (0.3)% | | | (2,147,338 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | $ | 671,288,198 | |

| * | Non-income producing security. |

| (a) | Security is valued in good faith by or under the direction of the Board of Trustees (See Note 1). |

| # | Aggregate cost for federal income tax purposes is $760,406,480. |

| | |

| Abbreviations used in this schedule: |

| ADR | | —American Depositary Receipt |

| FDR | | —Foreign Depositary Receipt |

See Notes to Financial Statements.

| | |

| 14 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Statement of assets and liabilities

December 31, 2008

| | | | |

| ASSETS: | | | | |

| Investments, at value (Cost — $758,842,406) | | $ | 673,435,536 | |

| Foreign currency, at value (Cost — $29) | | | 27 | |

| Cash | | | 261 | |

| Dividends and interest receivable | | | 1,749,475 | |

| Receivable for Fund shares sold | | | 322,427 | |

| Prepaid expenses | | | 49,626 | |

Total Assets | | | 675,557,352 | |

| LIABILITIES: | | | | |

| Payable for Fund shares repurchased | | | 2,641,326 | |

| Investment management fee payable | | | 1,038,391 | |

| Distribution fees payable | | | 105,275 | |

| Trustees’ fees payable | | | 47,137 | |

| Accrued expenses | | | 437,025 | |

Total Liabilities | | | 4,269,154 | |

| TOTAL NET ASSETS | | $ | 671,288,198 | |

| NET ASSETS: | | | | |

| Par value (Note 6) | | $ | 508 | |

| Paid-in capital in excess of par value | | | 807,667,620 | |

| Undistributed net investment income | | | 1,404,352 | |

| Accumulated net realized loss on investments and foreign currency transactions | | | (52,377,410 | ) |

| Net unrealized depreciation on investments and foreign currencies | | | (85,406,872 | ) |

| TOTAL NET ASSETS | | $ | 671,288,198 | |

| Shares Outstanding: | | | | |

| Class A | | | 21,907,500 | |

| Class B | | | 942,314 | |

| Class C | | | 3,182,485 | |

| Class I | | | 24,803,838 | |

| Net Asset Value: | | | | |

| Class A (and redemption price) | | | $13.24 | |

| Class B* | | | $12.89 | |

| Class C* | | | $12.95 | |

| Class I (offering price and redemption price) | | | $13.22 | |

| Maximum Public Offering Price Per Share: | | | | |

| Class A (based on maximum initial sales charge of 5.75%) | | | $14.05 | |

| * | Redemption price per share is NAV of Class B and C shares reduced by a 5.00% and 1.00% CDSC, respectively, if shares are redeemed within one year from purchase payment (See Note 2). |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 15 |

Statement of operations

For the Year Ended December 31, 2008

| | | | |

| INVESTMENT INCOME: | | | | |

| Dividends | | $ | 24,696,914 | |

| Interest | | | 988,302 | |

| Less: Foreign taxes withheld | | | (532,418 | ) |

Total Investment Income | | | 25,152,798 | |

| EXPENSES: | | | | |

| Investment management fee (Note 2) | | | 5,275,472 | |

| Distribution fees (Note 4) | | | 1,956,673 | |

| Transfer agent fees (Note 4) | | | 820,788 | |

| Shareholder reports (Note 4) | | | 101,579 | |

| Registration fees | | | 76,368 | |

| Trustees’ fees | | | 62,363 | |

| Legal fees | | | 46,450 | |

| Audit and tax | | | 40,276 | |

| Insurance | | | 21,676 | |

| Custody fees | | | 10,390 | |

| Miscellaneous expenses | | | 14,884 | |

Total Expenses | | | 8,426,919 | |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 4) | | | (98,722 | ) |

Net Expenses | | | 8,328,197 | |

| NET INVESTMENT INCOME | | | 16,824,601 | |

| REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS (NOTES 1 AND 3): | | | | |

| Net Realized Loss From: | | | | |

Investment transactions | | | (50,309,885 | ) |

Foreign currency transactions | | | (1,445 | ) |

| Net Realized Loss | | | (50,311,330 | ) |

| Change in Net Unrealized Appreciation/Depreciation From: | | | | |

Investments | | | (370,547,840 | ) |

Foreign currencies | | | (4,909 | ) |

| Change in Net Unrealized Appreciation/Depreciation | | | (370,552,749 | ) |

| NET LOSS ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | | | (420,864,079 | ) |

| DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (404,039,478 | ) |

See Notes to Financial Statements.

| | |

| 16 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| FOR THE YEARS ENDED DECEMBER 31, | | 2008 | | | 2007 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 16,824,601 | | | $ | 21,390,480 | |

| Net realized gain (loss) | | | (50,311,330 | ) | | | 295,745,431 | |

| Change in net unrealized appreciation/depreciation | | | (370,552,749 | ) | | | (215,733,135 | ) |

Increase (Decrease) in Net Assets From Operations | | | (404,039,478 | ) | | | 101,402,776 | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTES 1 AND 5): | | | | | | | | |

| Net investment income | | | (15,540,032 | ) | | | (22,093,182 | ) |

| Net realized gains | | | (22,927,598 | ) | | | (57,651,155 | ) |

Decrease in Net Assets From Distributions to Shareholders | | | (38,467,630 | ) | | | (79,744,337 | ) |

| FUND SHARE TRANSACTIONS (NOTE 6): | | | | | | | | |

| Net proceeds from sale of shares | | | 36,325,889 | | | | 136,568,711 | |

| Reinvestment of distributions | | | 32,101,478 | | | | 62,500,910 | |

| Cost of shares repurchased | | | (233,718,490 | ) | | | (879,291,553 | ) |

| Net assets of shares issued in connection with merger (Note 7) | | | — | | | | 469,842,201 | |

Decrease in Net Assets From Fund Share Transactions | | | (165,291,123 | ) | | | (210,379,731 | ) |

| DECREASE IN NET ASSETS | | | (607,798,231 | ) | | | (188,721,292 | ) |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 1,279,086,429 | | | | 1,467,807,721 | |

| End of year* | | $ | 671,288,198 | | | $ | 1,279,086,429 | |

| * Includes undistributed net investment income of: | | | $1,404,352 | | | | $121,265 | |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 17 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

FOR A SHARE OF EACH CLASS OF BENEFICIAL INTEREST OUTSTANDING THROUGHOUT EACH YEAR

ENDED DECEMBER 31: | |

| CLASS A SHARES1 | | 2008 | | | 2007 | | | 20062 | | | 20052 | | | 20042 | |

NET ASSET VALUE,

BEGINNING OF YEAR | | $ | 21.34 | | | $ | 21.81 | | | $ | 20.43 | | | $ | 20.55 | | | $ | 19.07 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.29 | | | | 0.28 | | | | 0.26 | | | | 0.23 | | | | 0.29 | |

Net realized and unrealized gain (loss) | | | (7.69 | ) | | | 0.49 | | | | 3.29 | | | | 1.01 | | | | 1.70 | |

Total income (loss) from operations | | | (7.40 | ) | | | 0.77 | | | | 3.55 | | | | 1.24 | | | | 1.99 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.27 | ) | | | (0.28 | ) | | | (0.26 | ) | | | (0.23 | ) | | | (0.28 | ) |

Net realized gains | | | (0.43 | ) | | | (0.96 | ) | | | (1.91 | ) | | | (1.13 | ) | | | (0.23 | ) |

Total distributions | | | (0.70 | ) | | | (1.24 | ) | | | (2.17 | ) | | | (1.36 | ) | | | (0.51 | ) |

NET ASSET VALUE,

END OF YEAR | | $ | 13.24 | | | $ | 21.34 | | | $ | 21.81 | | | $ | 20.43 | | | $ | 20.55 | |

Total return3 | | | (35.52 | )% | | | 3.50 | % | | | 17.63 | % | | | 6.15 | % | | | 10.50 | % |

NET ASSETS,

END OF YEAR (000s) | | | $290,115 | | | | $583,441 | | | | $304,173 | | | | $314,069 | | | | $308,990 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.95 | % | | | 0.86 | % | | | 0.91 | %4 | | | 0.93 | % | | | 0.88 | % |

Net expenses | | | 0.95 | | | | 0.85 | 5 | | | 0.90 | 4,5 | | | 0.93 | | | | 0.88 | |

Net investment income | | | 1.61 | | | | 1.23 | | | | 1.21 | | | | 1.13 | | | | 1.46 | |

PORTFOLIO TURNOVER RATE | | | 23 | % | | | 14 | % | | | 25 | % | | | 53 | % | | | 36 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For a share of capital stock outstanding prior to April 16, 2007. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would both have been 0.88%. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| | |

| 18 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

| | | | | | | | | | | | | | | | | | | | |

FOR A SHARE OF EACH CLASS OF BENEFICIAL INTEREST OUTSTANDING THROUGHOUT EACH YEAR

ENDED DECEMBER 31: | |

| CLASS B SHARES1 | | 2008 | | | 2007 | | | 20062 | | | 20052 | | | 20042 | |

NET ASSET VALUE,

BEGINNING OF YEAR | | $ | 20.79 | | | $ | 21.28 | | | $ | 19.98 | | | $ | 20.13 | | | $ | 18.70 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.12 | | | | 0.10 | | | | 0.05 | | | | 0.03 | | | | 0.10 | |

Net realized and unrealized gain (loss) | | | (7.46 | ) | | | 0.47 | | | | 3.21 | | | | 1.00 | | | | 1.67 | |

Total income (loss) from operations | | | (7.34 | ) | | | 0.57 | | | | 3.26 | | | | 1.03 | | | | 1.77 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.11 | ) |

Net realized gains | | | (0.43 | ) | | | (0.96 | ) | | | (1.91 | ) | | | (1.13 | ) | | | (0.23 | ) |

Total distributions | | | (0.56 | ) | | | (1.06 | ) | | | (1.96 | ) | | | (1.18 | ) | | | (0.34 | ) |

NET ASSET VALUE,

END OF YEAR | | | $12.89 | | | | $20.79 | | | | $21.28 | | | | $19.98 | | | | $20.13 | |

Total return3 | | | (36.05 | )% | | | 2.67 | % | | | 16.49 | % | | | 5.16 | % | | | 9.46 | % |

NET ASSETS,

END OF YEAR (000s) | | | $12,146 | | | | $36,423 | | | | $31,290 | | | | $36,803 | | | | $43,386 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.81 | % | | | 1.62 | % | | | 1.84 | %4 | | | 1.89 | % | | | 1.78 | % |

Net expenses | | | 1.80 | 5,6 | | | 1.62 | 5,6 | | | 1.84 | 4,5 | | | 1.89 | | | | 1.78 | |

Net investment income | | | 0.70 | | | | 0.44 | | | | 0.26 | | | | 0.16 | | | | 0.51 | |

PORTFOLIO TURNOVER RATE | | | 23 | % | | | 14 | % | | | 25 | % | | | 53 | % | | | 36 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For a share of capital stock outstanding prior to April 16, 2007. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would both have been 1.82%. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

| 6 | As a result of a contractual expense limitation, effective March 5, 2007 until May 1, 2008, the ratio of expenses, other than brokerage, taxes and extraordinary expenses, to average net assets of Class B shares will not exceed 1.76%. |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 19 |

Financial highlights continued

| | | | | | | | | | | | | | | | | | | | |

FOR A SHARE OF EACH CLASS OF BENEFICIAL INTEREST OUTSTANDING THROUGHOUT EACH YEAR

ENDED DECEMBER 31: | |

| CLASS C SHARES1 | | 2008 | | | 2007 | | | 20062 | | | 20052 | | | 20042 | |

NET ASSET VALUE,

BEGINNING OF YEAR | | $ | 20.88 | | | $ | 21.37 | | | $ | 20.05 | | | $ | 20.20 | | | $ | 18.76 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.16 | | | | 0.11 | | | | 0.07 | | | | 0.05 | | | | 0.11 | |

Net realized and unrealized gain (loss) | | | (7.51 | ) | | | 0.48 | | | | 3.24 | | | | 0.99 | | | | 1.68 | |

Total income (loss) from operations | | | (7.35 | ) | | | 0.59 | | | | 3.31 | | | | 1.04 | | | | 1.79 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.15 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.12 | ) |

Net realized gains | | | (0.43 | ) | | | (0.96 | ) | | | (1.91 | ) | | | (1.13 | ) | | | (0.23 | ) |

Total distributions | | | (0.58 | ) | | | (1.08 | ) | | | (1.99 | ) | | | (1.19 | ) | | | (0.35 | ) |

NET ASSET VALUE,

END OF YEAR | | $ | 12.95 | | | $ | 20.88 | | | $ | 21.37 | | | $ | 20.05 | | | $ | 20.20 | |

Total return3 | | | (35.94 | )% | | | 2.71 | % | | | 16.64 | % | | | 5.20 | % | | | 9.53 | % |

NET ASSETS,

END OF YEAR (000s) | | | $41,205 | | | | $87,905 | | | | $45,553 | | | | $52,771 | | | | $67,647 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.66 | % | | | 1.57 | % | | | 1.76 | %4 | | | 1.81 | % | | | 1.75 | % |

Net expenses | | | 1.66 | 5,6 | | | 1.57 | 5,6 | | | 1.76 | 4,5 | | | 1.81 | | | | 1.75 | |

Net investment income | | | 0.89 | | | | 0.52 | | | | 0.34 | | | | 0.24 | | | | 0.56 | |

PORTFOLIO TURNOVER RATE | | | 23 | % | | | 14 | % | | | 25 | % | | | 53 | % | | | 36 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For a share of capital stock outstanding prior to April 16, 2007. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would both have been 1.74%. |

| 5 | Reflects fee waivers and/or expense reimbursements. |

| 6 | As a result of a contractual expense limitation, effective March 5, 2007 until May 1, 2008, the ratio of expenses, other than brokerage, taxes and extraordinary expenses, to average net assets of Class C shares will not exceed 1.64%. |

See Notes to Financial Statements.

| | |

| 20 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

| | | | | | | | | | | | | | | |

FOR A SHARE OF EACH CLASS OF BENEFICIAL INTEREST OUTSTANDING THROUGHOUT EACH YEAR

ENDED DECEMBER 31: | |

| CLASS I SHARES1 | | 2008 | | | 20072 | | | 20063 | | | 20053 | | | 20043 | |

NET ASSET VALUE,

BEGINNING OF YEAR | | $21.29 | | | $21.77 | | | $20.40 | | | $20.52 | | | $19.04 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | |

Net investment income | | 0.35 | | | 0.34 | | | 0.32 | | | 0.30 | | | 0.34 | |

Net realized and unrealized gain (loss) | | (7.66 | ) | | 0.48 | | | 3.29 | | | 1.01 | | | 1.71 | |

Total income (loss) from operations | | (7.31 | ) | | 0.82 | | | 3.61 | | | 1.31 | | | 2.05 | |

LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | |

Net investment income | | (0.33 | ) | | (0.34 | ) | | (0.33 | ) | | (0.30 | ) | | (0.34 | ) |

Net realized gains | | (0.43 | ) | | (0.96 | ) | | (1.91 | ) | | (1.13 | ) | | (0.23 | ) |

Total distributions | | (0.76 | ) | | (1.30 | ) | | (2.24 | ) | | (1.43 | ) | | (0.57 | ) |

NET ASSET VALUE,

END OF YEAR | | $13.22 | | | $21.29 | | | $21.77 | | | $20.40 | | | $20.52 | |

Total return4 | | (35.23 | )% | | 3.75 | % | | 17.98 | % | | 6.51 | % | | 10.83 | % |

NET ASSETS,

END OF YEAR (000s) | | $327,822 | | | $571,317 | | | $577,618 | | | $540,992 | | | $789,928 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | |

Gross expenses | | 0.61 | % | | 0.57 | % | | 0.62 | %5 | | 0.58 | % | | 0.60 | % |

Net expenses | | 0.59 | 6,7 | | 0.54 | 6,7 | | 0.62 | 5,6 | | 0.58 | | | 0.60 | |

Net investment income | | 1.98 | | | 1.52 | | | 1.49 | | | 1.47 | | | 1.72 | |

PORTFOLIO TURNOVER RATE | | 23 | % | | 14 | % | | 25 | % | | 53 | % | | 36 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | As of August 17, 2007, all Class I shares converted to Class O shares and Class O shares were redesignated as Class I shares. |

| 3 | For a share of capital stock outstanding prior to April 16, 2007. |

| 4 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 5 | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would both have been 0.60%. |

| 6 | Reflects fee waivers and/or expense reimbursements. |

| 7 | As a result of a contractual expense limitation, effective March 5, 2007 until May 1, 2008, the ratio of expenses, other than brokerage, taxes and extraordinary expenses, to average net assets of Class I shares will not exceed 0.56%. |

See Notes to Financial Statements.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 21 |

Notes to financial statements

1. Organization and significant accounting policies

The Legg Mason Partners Investors Value Fund (the “Fund”) is a separate investment series of Legg Mason Partners Equity Trust (the “Trust’). The Trust, a Maryland business trust, is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as an open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the last quoted bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these securities at fair value as determined in accordance with the procedures approved by the Fund’s Board of Trustees. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

Effective January 1, 2008, the Fund adopted Statement of Financial Accounting Standards No. 157 (“FAS 157”). FAS 157 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

| | • | | Level 1 — quoted prices in active markets for identical investments |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | |

| 22 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | |

| | | DECEMBER 31, 2008 | | QUOTED PRICES

(LEVEL 1) | | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | | SIGNIFICANT

UNOBSERVABLE

INPUTS

(LEVEL 3) |

| Investments in securities | | $ | 673,435,536 | | $ | 614,723,777 | | $ | 58,711,759 | | — |

(b) Repurchase agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practical after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(d) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 23 |

Notes to financial statements continued

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities, at the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(e) Distributions to shareholders. Distributions from net investment income for the Fund, if any, are declared and paid on a quarterly basis. Distributions of net realized gains, if any, are declared at least annually. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Class accounting. Investment income, common expenses and realized/unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that class.

(g) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that as of December 31, 2008, no provision for income tax would be required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(h) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting.

| | |

| 24 | | Legg Mason Partners Investors Value Fund 2008 Annual Report |

These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | | | | | |

| | | UNDISTRIBUTED NET

INVESTMENT INCOME | | | ACCUMULATED NET

REALIZED LOSS |

| (a) | | $ | (1,482 | ) | | $ | 1,482 |

| (a) | Reclassifications are primarily due to foreign currency transactions treated as ordinary income for tax purposes and book/tax differences in the treatment of distributions. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and ClearBridge Advisors, LLC (“ClearBridge”) is the Fund’s subadviser. LMPFA and ClearBridge are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

Under the investment management agreement, the Fund pays a base investment management fee subject to an increase or decrease depending on the extent, if any, to which the investment performance of the Fund exceeds or is exceeded by the investment record of the S&P 500 Index. The base fee is paid quarterly based on the following breakpoint schedule:

| | | |

| AVERAGE DAILY NET ASSETS | | ANNUAL RATE | |

| First $350 million | | 0.650 | % |

| Next $150 million | | 0.550 | |

| Next $250 million | | 0.525 | |

| Next $250 million | | 0.500 | |

| Over $1 billion | | 0.450 | |

At the end of each calendar quarter, for each percentage point of difference between the investment performance of the class of shares of the Fund which has the lowest performance for the period and the S&P 500 Index over the last prior 12-month period, this base fee is adjusted upward or downward by the product of (i) 1/4 of 0.01% multiplied by (ii) the average daily net assets of the Fund for the 12 month period. If the amount by which the Fund outperforms or underperforms the S&P 500 Index is not a whole percentage point, a pro rata adjustment will be made. However, there will be no performance adjustment unless the investment performance of the Fund exceeds or is exceeded by the investment record of the S&P 500 Index by at least one percentage point. The maximum quarterly adjustment is 0.025%, which would occur if the Fund’s performance exceeds or is exceeded by S&P 500 Index by ten or more percentage points. For the rolling one year periods ended March 31, 2008, June 30, 2008, September 30, 2008 and December 31, 2008 the Fund’s performance varied from that of the S&P 500 Index performance by (3.77)%, (3.41)%, (0.50)% and 0.95%, respectively. As a result, base management fees were reduced, in aggregate, by $252,432.

| | |

| Legg Mason Partners Investors Value Fund 2008 Annual Report | | 25 |

Notes to financial statements continued

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund, except for the management of cash and short-term instruments. For its services, LMPFA pays ClearBridge 70% of the net management fee it receives from the Fund.

Effective March 5, 2007 until May 1, 2008, LMPFA had contractually agreed to waive fees and/or reimburse expenses (other than brokerage, taxes and extraordinary expenses) to limit total annual operating expenses to 1.76% for Class B, 1.64% for Class C and 0.56% for Class I shares.

During the year ended December 31, 2008, the Fund was reimbursed for expenses amounting to $98,722.