UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ PreliminaryProxy Statement | | ¨ Confidential, For Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to §240.14a-12 | | |

VITESSE SEMICONDUCTOR CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

VITESSE SEMICONDUCTOR CORPORATION

741 Calle Plano

Camarillo, CA 93012

(805) 388-3700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held on January 26, 2004

Dear Vitesse Stockholder:

The ANNUAL MEETING OF STOCKHOLDERS (the “Annual Meeting”) of Vitesse Semiconductor Corporation (“Vitesse” or the “Company”), a Delaware corporation, will be held on

MONDAY, JANUARY 26, 2004 AT 10:30 A.M. AT THE

HYATT WESTLAKE PLAZA HOTEL

880 SOUTH WESTLAKE BOULEVARD

WESTLAKE VILLAGE, CALIFORNIA 91361

Only stockholders who owned stock at the close of business on December 1, 2003 can vote at this meeting or any adjournments that may take place. At the meeting we will:

| | 1. | | Elect a Board of Directors. |

| | 2. | | Approve an amendment to our 1991 Employee Stock Purchase Plan to reserve an additional 8,500,000 shares of common stock for issuance thereunder. |

| | 3. | | Approve the appointment of our independent auditors for fiscal 2004. |

| | 4. | | Attend to other business properly presented at the meeting. |

Your Board of Directors recommends that you vote in favor of the three proposals outlined in this Proxy Statement.

If your shares are held of record by a broker, bank or other nominee and you wish to vote your shares at the Annual Meeting, you must contact your broker, bank or other nominee to obtain the proper documentation and bring it with you to the Annual Meeting.

At the meeting we will also report on Vitesse’s fiscal 2003 business results and other matters of interest to stockholders.

Vitesse recently mailed a copy of its 2003 Annual Report to all stockholders. The approximate date of mailing for this notice, proxy statement and proxy card is December 18, 2003.

THE BOARD OF DIRECTORS

December 18, 2003

Camarillo, California

YOUR VOTE IS IMPORTANT

In order to assure your representation at the Annual Meeting, you are requested to complete, sign, and date the enclosed proxy as promptly as possible and return it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Please reference the information on page 1, “How do I vote?” for alternative voting methods.

VITESSE SEMICONDUCTOR CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

January 26, 2004

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Vitesse Semiconductor Corporation (“Vitesse” or the “Company”) of proxies to be voted at the Annual Meeting of Stockholders to be held on Monday, January 26, 2004, at 10:30 a.m., and at any adjournments that may take place.

The Annual Meeting will be held at the Hyatt Westlake Plaza Hotel located at 880 South Westlake Boulevard, Westlake Village, California 91361. Vitesse anticipates sending the proxy materials to stockholders on or about December 18, 2003.

The following is important information in a question-and-answer format regarding the Annual Meeting and this Proxy Statement.

| A: | | (1) The election of five nominees to serve on our Board of Directors. |

| | (2) | | The amendment of our 1991 Employee Stock Purchase Plan to reserve an additional 8,500,000 shares of common stock for issuance thereunder. |

| | (3) | | The approval of the appointment of our independent auditors for fiscal 2004. |

| | (4) | | Any other business properly presented at the meeting. |

| Q: | | How does the Board recommend I vote on the proposals? |

| A: | | The Board recommends a vote FOR each of the director nominees, FOR the amendment of the 1991 Employee Stock Purchase Plan, and FOR the appointment of KPMG LLP as the Company’s independent auditors for fiscal 2004. |

| Q: | | Who is entitled to vote? |

| A: | | Stockholders as of the close of business on December 1, 2003 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the Record Date, 215,322,283 shares of the Company’s common stock were issued and outstanding. Each stockholder is entitled to one vote for each share of common stock held on the Record Date, except to the extent that such stockholder has properly requested cumulative voting rights with respect to the election of directors. Each stockholder who has properly requested cumulative voting rights is entitled to vote, with respect to the election of directors, the number of shares held by such stockholder on the Record Date multiplied by the number of directors to be elected. |

| A: | | There are three ways you can vote: |

| | (1) | | Sign and date each proxy card you receive and return it in the prepaid envelope. |

| | (2) | | Vote through the Internet or telephone voting system more fully described on your proxy card. |

| | (3) | | Vote in person at the Annual Meeting. If your shares are held of record by a broker, bank or other nominee and you wish to vote your shares at the Annual Meeting, you must contact your broker, bank or other nominee to obtain the proper documentation and bring it with you to the Annual Meeting. |

1

| Q: | | How can I change my vote or revoke my proxy? |

| A: | | You have the right to revoke your proxy and change your vote at any time before the meeting by notifying the Company’s Secretary, or returning a later-dated proxy card, or by Internet or telephone as more fully described on your proxy card. You may also revoke your proxy and change your vote by voting in person at the meeting. |

| Q: | | What does it mean if I get more than one proxy card? |

| A: | | It means you hold shares registered in more than one account. Sign and return all proxies to ensure that all your shares are voted. |

| Q: | | Who will count the vote? |

| A: | | Representatives of EquiServe, the Company’s transfer agent, will count the votes and act as the Inspector of Election. The Company believes that the procedures to be used by the Inspector to count the votes are consistent with Delaware law concerning voting of shares and determination of a quorum. |

| A: | | A “quorum” is a majority of the outstanding shares. They may be present at the meeting or represented by proxy. There must be a quorum for the meeting to be held and action to be validly taken. If you submit a properly executed proxy card, even if you abstain from voting or if you withhold your vote with respect to any proposal, you will be considered present for purposes of a quorum and for purposes of determining voting power present. Because abstentions and withheld votes are considered present for purposes of determining voting power, abstentions and withheld votes have the effect of a vote AGAINST a proposal. If a broker indicates on a proxy that it does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), those shares will be considered present for purposes of a quorum but will not be considered present for purposes of determining voting power on that matter. |

| Q: | | Who can attend the Annual Meeting? |

| A: | | All stockholders as of the Record Date can attend. If you wish to vote your shares at the Annual Meeting and your shares are held of record by a broker, bank or other nominee, you must contact your broker, bank or other nominee to obtain the proper documentation and bring it with you to the Annual Meeting. |

| Q: | | How will voting on any other business be conducted? |

| A: | | We do not know of any business to be considered at the 2004 Annual Meeting other than the proposals described in this proxy statement. However, because the Company did not receive notice of any other proposals to be brought before the meeting by November 3, 2003 (45 days prior to the month and day of last year when proxy materials for the 2003 Annual Meeting were mailed to stockholders), if any other business is properly presented at the Annual Meeting, your signed proxy card gives authority to Louis R. Tomasetta, Vitesse’s President and Chief Executive Officer, and Eugene F. Hovanec, Vitesse’s Vice President, Finance and Chief Financial Officer, to vote on such matters at their discretion. |

| Q: | | Are there any beneficial owners of 5% or more of the Company’s Common Stock? |

| A: | | To the knowledge of the Company, there are no beneficial owners of five percent or more of the outstanding shares of Common Stock as of September 30, 2003. |

2

| Q: | | How and when may I submit proposals for the 2005 Annual Meeting? |

| A: | | To have your proposal included in the Company’s Proxy Statement for the 2005 Annual Meeting, you must submit your proposal in writing by August 20, 2004, to the Company’s Secretary, c/o Vitesse Semiconductor Corporation, 741 Calle Plano, Camarillo, California 93012. If you submit a proposal for the 2005 Annual Meeting after November 3, 2004, the proxy for the 2005 Annual Meeting may confer upon management discretionary authority to vote on your proposal. |

You should also be aware of certain other requirements you must meet to have your proposal included in the Company’s Proxy Statement for the 2005 Annual Meeting that are explained in Rule 14a-8 promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

| Q: | | Who bears the cost of this solicitation? |

| A: | | The Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. The Altman Group, Inc. was hired to assist in the distribution of proxy materials and solicitation of votes for $6,000, plus certain out-of-pocket expenses. We also reimburse brokerage houses and persons representing beneficial owners of shares for their reasonable out-of-pocket expenses in forwarding solicitation materials to such beneficial owners. Certain of the Company’s directors, officers or employees may also solicit proxies in person, by telephone, or by electronic communications but they will not receive any additional compensation for doing so. |

3

PROPOSALS YOU MAY VOTE ON

Proposal 1: Election of Directors

The Board has nominated Vincent Chan, Ph.D., James A. Cole, Alex Daly, John C. Lewis and Louis R. Tomasetta, Ph.D. for re-election to the Board this year. Detailed information on each of the Company’s nominees is provided on page 7. All directors are elected annually and serve a one-year term until the next Annual Meeting. If any director is unable to stand for re-election, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate. We expect that each nominee listed on page 7 will be able and will not decline to serve as a director.

Vote Required; Recommendation of the Board of Directors

With respect to the election of directors, stockholders have the right to cumulate votes, which means that the stockholder may cast for any candidate a number of votes greater than the number of votes which such stockholder normally is entitled to cast. The number of votes a stockholder may cast is equal to the number of shares held by such stockholder multiplied by the number of directors to be elected. Each stockholder may give all such votes to one candidate or distribute such votes among the candidates as the stockholder chooses.

In order to exercise cumulative voting rights, the candidates’ names must have been properly placed in nomination and the stockholder must give notice at the Annual Meeting of the stockholder’s intention to vote cumulatively prior to the commencement of voting. Any stockholder who has not properly requested cumulative voting shall be entitled to one vote per share.

The five candidates receiving the highest number of affirmative votes of shares entitled to vote for them will be elected to the Company’s Board of Directors. Abstentions and withheld votes will have a negative effect on the election of directors, and pursuant to Delaware law, a broker non-vote will not be treated as voting in person or by proxy on the proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED IN PROPOSAL 1.

Proposal 2: Approval of Amendment to the Company’s Employee Stock Purchase Plan

The Vitesse Semiconductor Corporation 1991 Employee Stock Purchase Plan (the “Purchase Plan”) was adopted by the Board of Directors and approved by the stockholders in August 1991 and has been amended from time to time. A total of 13,000,000 shares of common stock have been reserved for issuance under the Purchase Plan. Of these reserved shares, 1,588,874 shares remained available for future grant under the Purchase Plan as of October 31, 2003. The Board of Directors has adopted an amendment to the Purchase Plan (the “Purchase Plan Amendment”), subject to approval by the stockholders, to increase the number of shares reserved for issuance under the Purchase Plan by an additional 8,500,000 shares to an aggregate total of 21,500,000 shares. The stockholders are being asked to approve the Purchase Plan Amendment to increase the number of shares available under the Purchase Plan.

The following is a summary of the material provisions of the Purchase Plan, as amended and restated, a copy of which may be obtained from the Company or its publicly filed documents. The Purchase Plan, which qualifies under Section 423 of the Internal Revenue Code, provides for eligible employees to purchase shares of the Company’s common stock during offering periods of overlapping twenty-four months that commence on February 1 and August 1 of each year and end twenty-four months later on January 31 and July 31, respectively, before the next period commences. Each offering period will be comprised of four successive six-month purchase periods. Deductions will be made from a participating employee’s salary during each purchase period, and if the employee has not withdrawn by the last day of the purchase period, stock will be purchased for the account of the employee at the end of the purchase period at the price as set forth below.

4

Employees are eligible to participate after one month of employment if they are regularly employed by the Company for at least 20 hours per week and more than five months per calendar year. Employees who would immediately after the grant own 5% or more of the total combined voting power or value of the stock of the Company or any subsidiary are not eligible to participate. As of October 31, 2003, approximately 800 of the Company’s employees were eligible to participate in the Purchase Plan. Because participation in the Purchase Plan is voluntary, the Company cannot now determine the number of shares of common stock to be purchased by any particular individual or group of individuals.

The Purchase Plan permits eligible employees to purchase common stock through payroll deductions, which may not exceed 20% of an employee’s base compensation, including commissions, but excluding overtime and bonuses, at a price equal to 85% of the fair market value of the common stock at the beginning of the offering period or at the end of each purchase period, whichever is lower. In the event that the fair market value at the beginning of the offering period in which the participating employee is enrolled is higher than at the beginning of any immediately subsequent offering period, the participating employee shall automatically be re-enrolled for such subsequent offering period, which results in participating employees having the opportunity to buy stock at the lower values. Employees may end their participation in the Purchase Plan at any time, and participation ends automatically on termination of employment with the Company. In no event shall any employee be permitted to purchase shares of common stock under the Purchase Plan at a rate that exceeds $25,000 in fair market value (as measured at the time the option is granted) of such common stock for each calendar year. In the event of a proposed sale of all or substantially all the assets of the Company or a merger of the Company with or into another corporation, the Purchase Plan provides that each option under the Purchase Plan be assumed or an equivalent option be substituted by the successor or purchaser corporation, unless the Board decides to shorten the offering period or purchase period.

Unless terminated sooner, the Purchase Plan will terminate 20 years from its effective date. The Board has authority to amend or terminate the Purchase Plan, provided that no such action may adversely affect the rights of any participant.

Vote Required; Recommendation of the Board of Directors

Approval of the Purchase Plan Amendment requires the affirmative vote of a majority of the shares represented in person or by proxy and voting at the Annual Meeting. Abstentions and broker non-votes are not counted as affirmative votes with respect to approval of proposals such as the Purchase Plan Amendment.

The Board of Directors believes that it is in the best interests of the Company and its stockholders to be able to continue to offer its present and prospective employees the option to participate in the Purchase Plan in order to advance the interests of the Company stockholders. Absent the approval of this Proposal Two, it is expected that the Purchase Plan would terminate in January 2004 as a result of an absence of shares available for issuance under the Purchase Plan.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL 2, APPROVING THE AMENDMENT TO THE COMPANY’S EMPLOYEE STOCK PURCHASE PLAN.

Proposal 3: Approval of the Appointment of KPMG LLP as Independent Auditors

The Audit Committee has recommended, and the Board has approved, the appointment of KPMG LLP (“KPMG”) as our independent auditors for fiscal 2004 subject to your approval. KPMG has served as our independent auditors since 1989. Representatives of KPMG will attend the Annual Meeting and will be available to answer appropriate questions. They will also have the opportunity to make a statement if they desire to do so.

Audit services provided by KPMG during fiscal 2003 included an audit of the Company’s consolidated financial statements, a review of the Company’s Annual Report and certain other filings with the Securities and Exchange Commission (“SEC”). In addition, KPMG provided various other services to the Company during fiscal 2003 as described below.

5

Audit Fees

The aggregate fees billed for professional services rendered by KPMG for the audit of our annual financial statements for the year ended September 30, 2003, and the reviews of the condensed financial statements included in our quarterly reports on Forms 10-Q for the year ended September 30, 2003, were $289,620.

Financial Information Systems Design and Implementation Fees

No fees were billed by KPMG for financial information systems design and implementation during the year ended September 30, 2003.

All Other Fees

The aggregate fees billed for all other services, exclusive of the fees disclosed above relating to financial statement audit services, rendered by KPMG during the year ended September 30, 2003, were $725,835. These other services consisted of the following:

Statutory Audits and other audit-related services consisting primarily of reviews of S-8 and S-4 filings | | $ | 31,000 |

Domestic tax compliance, including preparation of returns | | $ | 383,638 |

International tax compliance, including preparation of returns | | $ | 131,851 |

Tax consulting services consisting primarily of international tax guidance, trade and customs tax guidance, state and local tax assistance, compensation and benefits tax guidance, and acquisition related guidance | | $ | 179,346 |

The Audit Committee has determined that the provision of the services described above is compatible with maintaining the independence of KPMG.

Vote Required; Recommendation of the Board of Directors

The Board of Directors has conditioned its appointment of the Company’s independent auditors upon the receipt of the affirmative vote of a majority of the shares represented, in person or by proxy, and entitled to vote at the Annual Meeting, which shares voting affirmatively also constitute at least a majority of the required quorum. In the event that the stockholders do not approve the selection of KPMG, the appointment of the independent auditors will be reconsidered by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL 3, APPROVING THE APPOINTMENT OF KPMG LLP AS INDEPENDENT AUDITORS FOR FISCAL 2004.

6

NOMINEES FOR THE BOARD OF DIRECTORS

Vincent Chan, Ph.D., Age 55, Director since 2000—Dr. Chan has served on the Massachusetts Institute of Technology’s faculty as the Joan and Irwin Jacobs Professor of Electrical Engineering and Computer Science, Aeronautics and Astronautics and as a member of the Operations Research Center since 1998. He is also the Director of MIT’s Laboratory for Information and Decision Systems. From 1995 to 1998, he was the Head of the Communications and Information Technology Division of MIT Lincoln Laboratory. Dr. Chan has over 30 years experience leading the development of advanced communication systems and networks.

James A. Cole, Age 61, Director since 1987—Mr. Cole has been a General Partner of Windward Ventures, L.P., a venture capital firm, since 1997. He was a General Partner of Spectra/New Enterprise Associates, a venture capital firm, from 1986 through 1997. He was a founder and Executive Vice President of Amplica, Inc., a GaAs microwave IC and sub-system company. Mr. Cole also serves as a director of Giga-Tronics, Inc. and a number of private companies.

Alex Daly, Age 42, Director since 1998—Mr. Daly was founder and has served as Chairman and Chief Executive Officer of Nutrophy, Inc., an online personalized nutrition company, since its inception in April 2002. From September 2001 through March 2002 he was on personal sabbatical. From May 2000 through August 2001, Mr. Daly was Chairman, President and Chief Executive Officer of Arcsight, Inc., an enterprise network security management company. From February 2000 through April 2000 he was on personal sabbatical. From January 1998 through January 2000, Mr. Daly was President and Chief Executive Officer of Cygnus Solutions, a developer of software tools. From 1995 through 1997, he served as Sr. Vice President of Marketing and then Sales at C-Cube Microsystems, a manufacturer of integrated circuits. Prior to that, Mr. Daly served at Intel Corporation, most recently as director of marketing for the mobile computing group.

John C. Lewis, Age 68, Director since 1990 (Chairman since December 2002)—Mr. Lewis served as Chairman of the Board of Directors and Chief Executive Officer of Amdahl Corporation, a manufacturer of large, general purpose computers, storage systems, software products and consulting services from August 1977 to March 2001. Before joining Amdahl in 1977, he was President of Xerox Business Systems. Mr. Lewis also serves as a director of Cypress Semiconductor Corporation and Pinnacle Systems.

Louis R. Tomasetta, Ph.D., Age 55, Director since 1987—Dr. Tomasetta, a co-founder of the Company, has been President, Chief Executive Officer and a Director since the Company’s inception in February 1987. From 1984 to 1987, he served as President of the integrated circuits division of Vitesse Electronics Corporation. Prior to that he was the director of the Advanced Technology Implementation department at Rockwell International Corporation. Dr. Tomasetta has over 30 years experience in the management and development of semiconductor businesses, products, and technologies. Dr. Tomasetta also serves as a director of a number of private companies.

7

BOARD MEETINGS AND COMMITTEES

The Company’s Board usually meets five times a year in regularly scheduled meetings, but will meet more often if necessary. The Board held eleven (11) meetings during fiscal 2003 and each director attended at least 75% of the Board meetings held during the periods in which such director served. In addition, each director attended at least 75% of the total number of meetings held by committees of the Board on which such director served.

The full Board considers all major decisions of the Company. During fiscal 2003, the Board had the following three standing committees, each of which was chaired by an outside director:

The Compensation Committee

The Compensation Committee has the following responsibilities:

| | • | | oversees the Company’s compensation and benefits policies generally; |

| | • | | evaluates senior executive performance and reviews the Company’s management succession plan; and |

| | • | | oversees and sets compensation for the Company’s senior executives. |

In December 2002, the Board adopted a new Compensation Committee Charter, which is posted on the Company’s website atwww.vitesse.com.

During fiscal 2003, the Committee consisted of Vincent Chan, James Cole and Alex Daly (Chairman of the Committee) and met four times. All members of the Compensation Committee are independent as defined by the listing standards of the National Association of Securities Dealers. No interlocking relationship existed during fiscal 2003 between the Company’s executive officers or members of the Board and the executive officers or members of the board of directors or compensation committee of any other company.

The Audit Committee

The Audit Committee assists the Board in its oversight of the following:

| | • | | the integrity of the financial statements of the Company; |

| | • | | the qualifications, independence and performance of the Company’s independent auditors; |

| | • | | the performance of the Company’s internal audit function; and |

| | • | | compliance by the Company with legal and regulatory requirements. |

In December 2003, the Board adopted a new Audit Committee Charter, which is posted on the Company’s website atwww.vitesse.com.

During fiscal 2003, the Committee consisted of James Cole, Alex Daly and John Lewis (Chairman of the Committee) and met seven times. All members of the Audit Committee are independent and financially literate as defined by the listing standards of the National Association of Securities Dealers. In addition, Mr. Lewis qualifies as a “financial expert” as defined by the rules of the Securities and Exchange Commission implementing Section 406 of the Sarbanes-Oxley Act.

8

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has the following responsibilities:

| | • | | identifies individuals qualified to become Board members, and recommends to the Board director nominees for election at the next annual or special meeting of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; |

| | • | | recommends directors for appointment to Board committees; |

| | • | | evaluates Board performance; |

| | • | | oversees and sets compensation for the Company’s directors; and |

| | • | | develops and recommends to the Board the Corporate Governance Guidelines and Code of Business Conduct and Ethics of the Company. |

In December 2002, the Board adopted a new Nominating and Corporate Governance Committee Charter and also adopted Corporate Governance Guidelines and a Code of Business Conduct and Business Ethics, each of which is posted on the Company’s website atwww.vitesse.com.

During fiscal 2003, the Committee consisted of Vincent Chan, James Cole (Chairman of the Committee) and John Lewis and met two times.Stockholders may recommend nominees to the Board by contacting the Secretary of the Company in writing at the following address: Secretary, Vitesse Semiconductor Corporation, 741 Calle Plano, Camarillo, California 93012.

DIRECTOR COMPENSATION

Non-employee directors receive $2,000 for each Board meeting attended in person and $1,000 for each meeting attended by telephone. Directors are also reimbursed for customary and usual travel expenses.

During fiscal 2003, Mr. Lewis, Chairman of the Board, was granted an option to purchase 60,000 shares of common stock and Messrs. Chan, Cole and Daly each were granted an option to purchase 40,000 shares of common stock at an exercise price of $2.18.

All non-employee directors participate in the Company’s 2001 Stock Incentive Plan (the “2001 Plan”) approved by our stockholders on January 23, 2001. Under the 2001 Plan, each year beginning in 2002, each non-employee director will receive nonstatutory options to purchase 40,000 shares (except for the Chairman, who will receive options to purchase 60,000 shares). These options are for a ten-year term and become available for purchase in installments of two percent of the total number of shares granted at the end of each month beginning January 31 after the date of grant. The exercise price of the options must be at least 100% of the fair market value of the common stock on the Nasdaq National Market on the date of grant of the option. The options may be exercised only (1) while the individual is serving as a director on the Board, (2) within six months after termination by death or disability, or (3) within three months after the individual’s term as director ends.

Employee directors receive no compensation for serving on the Board other than their employee compensation.

9

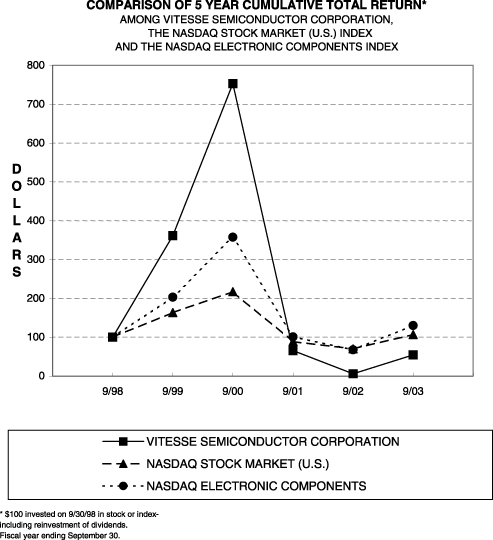

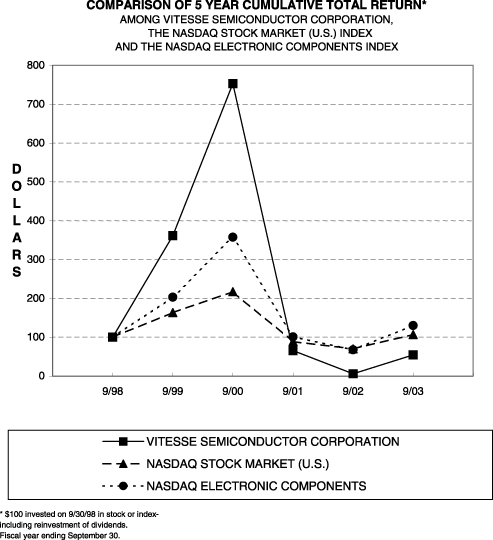

STOCK PERFORMANCE GRAPH

The following performance graph compares the cumulative total stockholder return on the Company’s common stock with the NASDAQ Stock Market-U.S. Index and the NASDAQ Electronics Components Index from market close on the last trading day in September 1998 through September 30, 2003. The graph is based on the assumption that $100 was invested in each of the Company’s common stock, the NASDAQ Stock Market-U.S. Index and the NASDAQ Electronic Components Index on September 30, 1998.

The stock price performance graph depicted below shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended. The stock price performance on the graph is not necessarily an indicator of future price performance.

10

PRINCIPAL OWNERSHIP

OF VITESSE SEMICONDUCTOR CORPORATION

COMMON STOCK

The following table sets forth certain information known to the Company with respect to beneficial ownership of common stock as of September 30, 2003 by the directors, the Named Executive Officers listed on page 12, and all directors and executive officers as a group. To the knowledge of the Company, there are no beneficial owners of five percent or more of the outstanding shares of common stock as of September 30, 2003.

Principal Stock Ownership(1)

Name of Individuals or Identity of Group

| | Shares

Beneficially

Owned

| | | Shares Exercisable

Within 60 Days of

Sept. 30, 2003

| | Total Shares

Beneficially Owned

Plus Exercisable

Within 60 Days of

Sept. 30, 2003

| | Percent

of Total

| |

Louis R. Tomasetta | | 822,079 | (2) | | 4,184,048 | | 5,006,127 | | 2.3 | % |

Eugene F. Hovanec | | 405,626 | (3) | | 1,014,253 | | 1,419,879 | | * | |

Christopher Gardner | | 127,120 | | | 967,985 | | 1,095,105 | | * | |

Ira Deyhimy | | 397,794 | | | 433,658 | | 831,452 | | * | |

James A. Cole | | 133,700 | | | 288,000 | | 421,700 | | * | |

John C. Lewis | | 115,000 | | | 191,200 | | 306,200 | | * | |

Richard Riker | | 0 | | | 303,000 | | 303,000 | | * | |

Alex Daly | | 0 | | | 184,800 | | 184,800 | | * | |

Vincent Chan | | 30,000 | | | 104,400 | | 134,400 | | * | |

All executive officers and directors as a group (10 persons) | | 2,109,470 | | | 7,980,429 | | 10,089,899 | | 4.7 | % |

| (1) | | All share information has been adjusted to reflect a 3 for 2 stock split on February 12, 1997, a 2 for 1 stock split on May 26, 1998, and a 2 for 1 stock split on October 20, 1999. |

| (2) | | Includes an aggregate of 126,000 shares held for his children, pursuant to the Transfer to Minors Act and as to which Dr. Tomasetta has voting and investment power. |

| (3) | | Includes an aggregate of 10,000 shares held for his daughter, pursuant to the Transfer to Minors Act and as to which Mr. Hovanec has voting and investment power. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors and persons who own more than 10% of a registered class of our equity securities to file certain reports regarding ownership of, and transactions in, our securities with the SEC. Such officers, directors and 10% stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of such forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and 10% stockholders were complied with during the fiscal year ended September 30, 2003.

11

COMPENSATION OF EXECUTIVE OFFICERS

The following is a summary of information regarding compensation paid to the Chief Executive Officer and the four most highly compensated executive officers other than the Chief Executive Officer who were serving as executive officers as of September 30, 2003. These five individuals are the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation

| | | Long-Term

Compensation

Awards

|

Name and Principal Position

| | Year

| | Salary

| | | Bonus(1)

| | Other Annual Compensation(2)

| | | Number of

Securities

Underlying

Options

|

LOUIS R. TOMASETTA | | 2003 | | $ | 350,000 | | | $ | 206,250 | | — | | | 1,260,000 |

President & Chief Executive Officer | | 2002 | | | 329,808 | | | | 346,913 | | — | | | 1,925,048 |

| | | 2001 | | | 316,827 | | | | 638,663 | | — | | | 1,200,000 |

| | | | | |

EUGENE F. HOVANEC | | 2003 | | | 225,000 | | | | 135,000 | | — | | | 350,000 |

Vice President, Finance & Chief Financial Officer | | 2002 2001 | | | 212,019 203,798 | | | | 227,070 439,020 | | — — | | | 533,245 300,000 |

| | | | | |

RICHARD RIKER | | 2003 | | | 200,000 | | | | — | | 44,556 | (3) | | 280,000 |

Vice President, Sales & Marketing | | 2002 | | | 200,000 | | | | — | | 139,293 | (3) | | 40,000 |

| | | 2001 | | | 57,692 | (4) | | | — | | — | | | 400,000 |

| | | | | |

CHRISTOPHER GARDNER | | 2003 | | | 200,000 | | | | 67,500 | | — | | | 225,000 |

Vice President & General Manager, | | 2002 | | | 188,461 | | | | 116,412 | | — | | | 442,885 |

Transport Division | | 2001 | | | 180,769 | | | | 229,137 | | — | | | 200,000 |

| | | | | |

IRA DEYHIMY | | 2003 | | | 175,000 | | | | 50,625 | | — | | | 98,000 |

Vice President, Strategy Development | | 2002 | | | 164,904 | | | | 81,699 | | — | | | 197,524 |

| | | 2001 | | | 157,548 | | | | 162,374 | | — | | | 50,000 |

| (1) | | Amounts paid in each year are for bonuses earned in previous years. No bonuses were earned for fiscal 2001, 2002 or 2003. Bonus amounts paid in fiscal 2001, 2002 and 2003 were earned in fiscal 2000 and prior years and are being paid according to a deferred payment schedule. |

| (2) | | Excludes certain expenses which, for any Named Executive Officer, did not exceed the lesser of $50,000 or 10% of the compensation reported in the above table, and which, for all Named Executive Officers as a group, did not exceed the lesser of $50,000 times the number of Named Executive Officers or 10% of all Named Executive Officers’ annual salaries and bonuses reported in the above table. |

| (3) | | Reimbursement for relocation expenses. |

| (4) | | Includes salary from hire date, June 2001, through 2001 fiscal year end. |

12

The following table presents additional information concerning the option awards shown in the Summary Compensation Table for fiscal year 2003. These options to purchase common stock were granted to the Named Executive Officers under the Company’s 2001 Stock Incentive Plan on October 17, 2002 and expire on October 17, 2012. All options in the table below vest in five equal semi-annual installments over a two year period, beginning on October 17, 2002.

Option Grants in Last Fiscal Year

| | | Individual Grants

| | | | |

| | | Number of

Securities

Underlying

Options

| | % of Total

Securities

Underlying

Options Granted

to Employees

in Fiscal Year

| | | Exercise

or Base

Price Per

Share

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rate of Stock

Price Appreciation for Option

Term(1)

|

Name

| | | | | | 5%

| | 10%

|

Louis R. Tomasetta | | 1,260,000 | | 9.38 | % | | $ | 0.826 | | 10/17/12 | | $ | 654,528 | | $ | 1,658,703 |

Eugene F. Hovanec | | 350,000 | | 2.61 | % | | | 0.826 | | 10/17/12 | | | 181,813 | | | 460,751 |

Richard Riker | | 280,000 | | 2.08 | % | | | 0.826 | | 10/17/12 | | | 145,451 | | | 368,601 |

Christopher Gardner | | 225,000 | | 1.68 | % | | | 0.826 | | 10/17/12 | | | 116,880 | | | 296,197 |

Ira Deyhimy | | 98,000 | | 0.73 | % | | | 0.826 | | 10/17/12 | | | 50,908 | | | 129,010 |

| (1) | | These dollar amounts are not intended to forecast future appreciation of the common stock price. Named Executive Officers will not benefit unless the common stock price increases above the stock option exercise price. Any gain to the Named Executive Officers resulting from common stock price appreciation would benefit all stockholders. |

The following table shows information for the Named Executive Officers concerning stock options exercised during fiscal 2003 and stock options unexercised at the end of fiscal year 2003.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-end Option Values

| | | Number of

Shares

Acquired

on Exercise

| | Value(1)

Realized

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Louis R. Tomasetta | | — | | $ | 0.00 | | 3,270,048 | | 3,340,000 | | $ | 2,892,836 | | $ | 4,221,504 |

Eugene F. Hovanec | | — | | | 0.00 | | 762,253 | | 895,000 | | | 804,471 | | | 1,172,640 |

Richard Riker | | — | | | 0.00 | | 247,000 | | 473,000 | | | 625,408 | | | 938,112 |

Christopher Gardner | | — | | | 0.00 | | 788,985 | | 665,000 | | | 1,008,538 | | | 753,840 |

Ira Deyhimy | | — | | | 0.00 | | 347,558 | | 295,466 | | | 404,655 | | | 328,339 |

| (1) | | Value realized is the difference between the option exercise price and the fair market value of the Company’s common stock at the date of exercise multiplied by the number of options exercised. |

13

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of September 30, 2003, with respect to the shares of the Company’s common stock that may be issued under the Company’s existing equity compensation plans. The table does not include information with respect to shares subject to outstanding options granted under the equity compensation plans assumed by the Company in connection with acquisitions of the companies which originally granted those options. Footnote (5) to the table sets forth the total number of shares of the Company’s common stock issuable upon the exercise of those assumed options as of September 30, 2003, and the weighted average exercise price of those options. No additional options may be granted under those assumed plans.

| | | A

| | | B

| | C

| |

Plan Category

| | Number of Securities

to be Issued upon

Exercise of

Outstanding Options

| | | Weighted Average

Exercise Price of

Outstanding Options

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column A)

| |

Equity Compensation Plans approved by Stockholders(1) | | 40,199,786 | (3) | | $ | 10.91 | | 3,867,692 | (4) |

Equity Compensation Plans not approved by Stockholders(2) | | 2,236,499 | | | $ | 8.92 | | 1,362,271 | |

Total(5) | | 42,436,285 | | | $ | 10.80 | | 5,229,963 | |

| (1) | | Consists of the 2001 Stock Incentive Plan, the 1991 Stock Option Plan, the 1991 Director’s Stock Option Plan, the 1989 Stock Option Plan, and the 1991 Employee Stock Purchase Plan. |

| (2) | | Consists of the 1999 International Stock Option Plan and one other immaterial plan. Options of this plan generally vest and become exercisable at the rate of 25% per year. The exercise price of all stock options must be at least equal to the fair market value of the common stock on the date of grant; if not, then deferred compensation is recorded and amortized over the vesting period. The term of options is generally 10 years. |

| (3) | | Excludes purchase rights accruing under the Company’s 1991 Employee Stock Purchase Plan. Under the Purchase Plan, each eligible employee may purchase shares of the Company’s common stock at six-month intervals at 85% of the lower of the fair market value at the beginning and end of each interval. Employees purchase such stock using accumulated payroll deductions which may not exceed 20% of their compensation, including commissions, but excluding overtime and bonuses. |

| (4) | | Includes shares available for future issuance under the 1991 Employee Stock Purchase Plan as of September 30, 2003, but excludes the additional 8,500,000 shares proposed to be added under the Purchase Plan Amendment. As of September 30, 2003, 1,588,874 shares of common stock were available for issuance under the Purchase Plan. |

| (5) | | The table does not include information for equity compensation plans assumed by the Company in connection with acquisitions of the companies which originally established those plans. As of September 30, 2003, a total of 3,513,022 shares of the Company’s common stock were issuable upon exercise of outstanding options under those assumed plans. The weighted average exercise price of those options outstanding is $9.37 per share. No additional options may be granted under those assumed plans. |

14

Summary Description of Equity Compensation Plans Not Approved by Stockholders

Vitesse International, Inc. 1999 International Stock Option Plan

The Vitesse International, Inc. 1999 International Stock Option Plan was adopted by the Board of Vitesse International, Inc., a subsidiary of the Company, in 1999 and was last amended in July 2003. The plan reserves for issuance 3,750,000 shares of the Company’s common stock pursuant to the exercise of options granted under the plan. As of December 1, 2003, there were outstanding options to purchase 2,113,326 shares under the plan. The number of shares available for future grant and previously granted but unexercised options are subject to adjustment for stock splits, stock dividends, combinations or reclassifications or other changes in the Company’s capitalization as described in the plan. Employees, including officers, and consultants of the Company and any subsidiary of the Company are eligible to participate in the plan. No options may be granted to non-employee directors. Generally, only non-U.S. employees of the Company or its subsidiaries have been granted options under the plan.

Options granted under the plan generally vest as to 25% of the shares subject to option on the first anniversary of the vesting commencement date and as to 25% annually thereafter. Terms of exercisability are determined by Vitesse International’s Board of Directors at the time of grant, but in no event may the exercisability date be delayed by more than 10 years from the date of grant. If an optionee’s status as an employee or consultant terminates for any reason (including the death or disability of the optionee), the option remains exercisable for a fixed period of time not to exceed six months but only to the extent the optionee was entitled to exercise such options on the date of termination.

When an option is exercised under the plan, Vitesse International purchases from the Company shares of the Company’s common stock for delivery to the optionee. The purchase price paid by Vitesse International is the fair market value of the shares on the date the exercise notice was received from the optionee.

In the event of a merger of the Company with or into another corporation, options granted under the plan shall be assumed or substituted by the successor company or, if the successor company does not agree to such assumption or substitution, shall become exercisable prior to the merger for a limited period of time, after which time the options shall terminate.

The Board of Directors of Vitesse International administers the plan, determines the terms of options granted under the plan in accordance with the terms of the plan, and has the power to interpret the plan. The plan expires by its terms in 2009 unless earlier terminated by the plan administrator.

Other Arrangements

The Company is a party to option agreements that were entered into during fiscal 2000 and 2001 with five employees, three of whom left the Company in fiscal 2003. Pursuant to the agreements, the Company granted the employees options to purchase an aggregate of 66,000 shares, subject to adjustment for stock splits, stock dividends, combinations or reclassifications or other changes in the Company’s capitalization. The options were granted at the fair market value of the Company’s common stock on the respective grant dates. The weighted average exercise price of the options granted under the agreements is $48.72. Options granted under the agreements vest in equal annual installments over the four-year period following the respective grant dates. If the employee is terminated for “cause” (as defined in the agreements), the relevant options remain exercisable to the extent vested for a three-month period following termination. If the employee is terminated without “cause”, the relevant options will become fully vested and exercisable during the three-month period following the date of termination. With respect to the three employees who left the Company, the exercise period on their options ended in October 2003. Under the agreements, if the optionee’s status as an employee ends due to death or disability, options granted under the agreement may be exercised within the 12-month period from the date of termination to the extent the option was exercisable on the date of termination. In the event of a merger of the Company with or into another corporation or a sale of substantially all the assets of the Company, options granted under the agreements shall be assumed or substituted by the successor company or, if the successor company does not agree to such assumption or substitution, shall become exercisable prior to the merger for a limited period of time, after which time the options shall terminate.

15

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors consists of three non-employee directors. The Committee reviews and approves salaries, bonuses and other benefits payable to the Company’s executive officers. It also administers the Company’s employee stock option and employee stock purchase plans.

Compensation Goals

The Compensation Committee establishes compensation for executive officers to align with business objectives and performance and to attract, retain and reward executive officers who contribute to the long-term success of the Company. The Company’s compensation programs, including those for executive officers, share these characteristics:

| | • | | The Company pays competitively. The Company offers a compensation program, including competitive base salaries and, where appropriate, relocation benefits, to attract and retain the best people in the industry. To ensure that pay is competitive, the Company reviews the compensation practices of other leading companies in the industry. |

| | • | | The Company pays for relative sustained performance. Executive officers are rewarded based upon corporate, departmental, and individual performance. Corporate and departmental performance are evaluated by reviewing whether strategic and business plan goals are met. Individual performance is evaluated by measuring organizational progress against set objectives. |

| | • | | The Company strives for fairness to achieve a balance in compensation paid to the executives within the Company and in comparable companies. It believes that the contributions of each member of the executive staff are vital to the success of the Company. |

| | • | | The Company believes that employees should understand the performance evaluation and compensation programs. At the beginning of the performance cycle, key quarterly and annual objectives are set for each officer. The chief executive officer gives ongoing feedback on performance to each officer. At the end of the performance cycle, the Compensation Committee evaluates the accomplishments of the key objectives in making its decisions on merit increases and stock option grants. |

Compensation Components

The Company’s compensation program, which consists of cash- and equity-based compensation, allows the Company to attract and retain highly skilled officers, provide useful products and services to customers, enhance stockholder value, motivate technological innovation, and reward executive officers and other employees. The components are:

Cash-Based Compensation:

| | • | | Salary The Committee sets base salary for officers by reviewing the compensation levels for similar positions in comparable companies in the industry. |

| | • | | Bonus Under the Company’s bonus plan, bonuses for eligible executive officers are generally paid as a percentage of their base salary and on the basis of the achievement of certain individual and corporate financial goals. The bonuses actually earned by each individual during any fiscal year are to be paid in successive years. In fiscal 2001, 2002 and 2003, no bonuses were earned under the officer’s bonus plan. |

Equity-Based Compensation:

Stock options provide additional incentives to officers to work to maximize stockholder value. The options become available for purchase over a defined period to encourage officers to continue their employment with the Company. In line with its compensation philosophy, the Company grants stock options to employees at all levels

16

of the organization based on each individual’s contribution to the Company. Options granted to executive officers during fiscal 2003 are discussed below.

Chief Executive Officer Compensation

Louis R. Tomasetta has been President and Chief Executive Officer of the Company since its incorporation in 1987. His total compensation consists of base salary, bonus and employee stock options. In determining Mr. Tomasetta’s compensation, the Committee evaluates:

| | • | | Corporate performance, principally revenue and operating profit goals |

| | • | | His individual performance |

| | • | | Compensation paid to other executive officers of the Company |

| | • | | Compensation paid to chief executive officers of comparable companies |

In light of the difficult economic environment for the Company and the telecommunication equipment industry generally, for fiscal 2003 the Compensation Committee did not increase the salary of Mr. Tomasetta or the Company’s other executive officers from the salary levels set during fiscal 2001 and no bonuses were earned by Mr. Tomasetta or other executive officers in fiscal 2001, 2002 or 2003.

For fiscal year 2003, Mr. Tomasetta’s salary was $350,000. For his performance in the prior year, he received non-statutory options to purchase 1,260,000 shares of common stock under the Company’s 2001 Stock Incentive Plan at an exercise price of $0.826. These options are for a ten-year term and become available to purchase in five semi-annual installments of 20% of the total number of shares granted beginning on October 17, 2002. Similar grants were made to other executive officers in fiscal 2003.

Mr. Tomasetta’s equity ownership in the Company includes 822,079 shares of common stock and stock options to purchase an additional 6,610,048 shares. The Compensation Committee believes the grant of options to Mr. Tomasetta is a key component of his compensation and is an important means of ensuring that the Company’s Chief Executive Officer shares significantly in the success of the Company’s business with the other stockholders.

Submitted by the Fiscal 2003 Compensation Committee of the Company’s Board of Directors:

Alex Daly

Vincent Chan

James Cole

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee assists the Board in its oversight of the integrity of the financial statements of the Company, the qualifications, independence and performance of the Company’s independent auditors, the performance of the Company’s internal audit function and compliance by the Company with legal and regulatory requirements.

The Committee has received from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee also reviewed with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee has discussed and reviewed with the independent auditors all communications required by generally accepted accounting standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

The Committee has reviewed and discussed the audited financial statements of the Company as of and for the fiscal year ended September 30, 2003, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above review and discussions with management and the independent auditors, the Committee recommended to the Board of Directors that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission. The Committee also recommended the reappointment, subject to stockholder approval, of the independent auditors, and the Board concurred in such recommendation.

Submitted by the Fiscal 2003 Audit Committee of the Company’s Board of Directors:

John Lewis

James Cole

Alex Daly

18

OTHER MATTERS

The Company knows of no other matters to be presented for consideration at the meeting. If any other matters properly come before the meeting, the persons named in the enclosed proxy card intend to vote the shares they represent as the Company may recommend.

THE BOARD OF DIRECTORS

Camarillo, California

December 18, 2003

19

AMENDED AND RESTATED

VITESSE SEMICONDUCTOR CORPORATION

1991 EMPLOYEE STOCK PURCHASE PLAN

The following constitute the provisions of the 1991 Employee Stock Purchase Plan of Vitesse Semiconductor Corporation.

1.Purpose The purpose of the Plan is to provide employees of the Company and its Designated Subsidiaries with an opportunity to purchase Common Stock of the Company through accumulated payroll deductions. It is the intention of the Company to have the Plan qualify as an “Employee Stock Purchase Plan” under Section 423 of the Internal Revenue Code of 1986, as amended. The provisions of the Plan shall, accordingly, be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

2. Definitions

(a) “Board” shall mean the Board of Directors of the Company.

(b) “Code” shall mean the Internal Revenue Code of 1986, as amended.

(c) “Common Stock” shall mean the Common Stock, $0.01 par value per share, of the Company.

(d) “Company” shall mean Vitesse Semiconductor Corporation, a Delaware corporation.

(e) “Compensation” shall mean all base straight time gross earnings including payments for shift premium and commissions and excluding overtime, incentive compensation, incentive payments, bonuses and other compensation.

(f) “Designated Subsidiaries” shall mean the Subsidiaries which have been designated by the Board from time to time in its sole discretion as eligible to participate in the Plan.

(g) “Employee” shall mean any individual who is an employee of the Company for purposes of tax withholding under the Code whose customary employment with the Company or any Designated Subsidiary is at least twenty (20) hours per week and more than five (5) months in any calendar year. For purposes of the Plan, the employment relationship shall be treated as continuing intact while the individual is on sick leave or other leave of absence approved by the Company. Where the period of leave exceeds 90 days and the individual’s right to reemployment is not guaranteed either by statute or by contract, the employment relationship will be deemed to have terminated on the 91st day of such leave.

(h) “Enrollment Date” shall mean the first day of each Offering Period.

(i) “Exercise Date” shall mean the last day of each Purchase Period within each Offering Period.

(j) “Fair Market Value” shall mean, as of any date, the value of Common Stock determined as follows:

(1) If the Common Stock is listed on any established stock exchange or a national market system, including without limitation the National Market System of the National Association of Securities Dealers, Inc. Automated Quotation (“NASDAQ”) System, the Fair Market Value of a Share of Common Stock shall be the closing sales price for such stock (or the closing bid, if no sales were reported), as quoted on such system or exchange (or the exchange with the greatest volume of trading in Common Stock on the last market Trading Day prior to the day of such determination) as reported in the Wall Street Journal or such other source as the Board deems reliable;

(2) If the Common Stock is quoted on the NASDAQ system (but not on the National Market System thereof) or is regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value of a Share of Common Stock shall be the mean between the high and low asked prices for the Common Stock on the last market Trading Day prior to the date of such determination, as reported in the Wall Street Journal or such other source as the Board deems reliable, or;

1

(3) In the absence of an established market for the Common Stock, the Fair Market Value thereof shall be determined in good faith by the Board.

(k) “Offering Period” shall mean a 24-month period with respect to which the right to purchase Common Stock may be granted under the Plan, as determined pursuant to paragraph 4(a).

(l) “Participant” means an Employee who is eligible under paragraph 3 and who elects to participate in the Plan, as provided in paragraph 5.

(m) “Plan” shall mean this Employee Stock Purchase Plan.

(n) “Purchase Period” means a six-month period during which contributions may be made toward the purchase of Stock under the Plan, as determined pursuant to paragraph 4.

(o) “Purchase Price” shall mean the price at which Participants may purchase Common Stock under the Plan, as determined pursuant to paragraph 7(b).

(p) “Reserves” shall mean the number of shares of Common Stock covered by each option under the Plan which have not yet been exercised and the number of shares of Common Stock which have been authorized for issuance under the Plan but not yet placed under option.

(q) “Subsidiary” shall mean a corporation, domestic or foreign, of which not less than 50% of the voting shares are held by the Company or a Subsidiary, whether or not such corporation now exists or is hereafter organized or acquired by the Company or a Subsidiary.

(r) “Trading Day” shall mean a day on which national stock exchanges and the National Association of Securities Dealers Automated Quotation (NASDAQ) System are open for trading.

3.Eligibility

(a) Any Employee who has been continuously employed by the Company for at least one (1) month and who shall be employed by the Company on a given Enrollment Date shall be eligible to participate in the Plan.

(b) Any provisions of the Plan to the contrary notwithstanding, no Employee shall be granted an option under the Plan (i) if, immediately after the grant, such Employee (or any other person whose stock would be attributed to such Employee pursuant to Section 424(d) of the Code) would own stock and/or hold outstanding options to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any subsidiary of the Company, or (ii) which permits his or her rights to purchase stock under all employee stock purchase plans of the Company and its subsidiaries to accrue at a rate which exceeds Twenty-Five Thousand Dollars ($25,000) worth of stock (determined at the fair market value of the shares at the time such option is granted) for each calendar year in which such option is outstanding at any time.

4.Offering and Purchase Periods

(a) While the Plan is in effect, two overlapping Offering Periods shall commence in each calendar year. The Offering Periods shall consist of the 24-month periods commencing on February 1 and August 1 of each year and terminating twenty-four months later on January 31 and July 31, respectively, before the next Offering Period commences, until the Plan terminates in accordance with paragraph 19 hereof. The Board shall have the power to change the duration and timing of Offering Periods with respect to future offerings without stockholder approval.

(b) While the Plan is in effect, two Purchase Periods shall commence in each calendar year. The Purchase Periods shall consist of the six-month periods commencing on February 1 and August 1 of each year and terminating on July 31 and January 31, respectively.

2

(c) For purposes of calculating the Purchase Price under paragraph 7(b), the applicable Offering Period shall be determined as follows:

(i) Once a Participant is enrolled in the Plan for an Offering Period, such Offering Period shall continue to apply to him or her until the earliest of (A) the end of such Offering Period, (B) the end of his or her participation in the Plan or (C) re-enrollment in a subsequent Offering Period under paragraph (ii) below.

(ii) In the event that the Fair Market Value of Stock on the last Trading Day before the commencement of the Offering Period in which the Participant is enrolled is higher than on the last Trading Day before the commencement of any subsequent Offering Period, the Participant shall automatically be re-enrolled for such subsequent Offering Period.

(iii) When a Participant reaches the end of an Offering Period but his or her participation is to continue, then such Participant shall automatically be re-enrolled for the Offering Period that commences immediately after the end of the prior Offering Period.

5.Participation

(a) An eligible Employee may become a Participant in the Plan by completing a subscription agreement authorizing payroll deductions in the form of Exhibit A to this Plan and filing it with the Company’s payroll office at least ten (10) business days prior to the applicable Enrollment Date, unless a later time for filing the subscription agreement is set by the Board for all eligible Employees with respect to a given Offering Period.

(b) Once enrolled in the Plan, a Participant shall continue to participate in the Plan until he or she ceases to be an eligible Employee, withdraws from the Plan under paragraph 10(a) or reaches the end of the Purchase Period in which his or her employee contributions were discontinued under paragraph 6(d). A Participant who withdrew from the Plan under paragraph 10(a) may again become a Participant, if he or she then is an eligible employee, by following the procedure described in paragraph 5(a) above. A Participant whose employee contributions were discontinued automatically under paragraph 6(d) shall automatically resume participation at the beginning of the earliest Purchase Period ending in the next calendar year, if he or she then is an eligible employee.

6.Payroll Deductions

(a) At the time a Participant files his or her subscription agreement, he or she shall elect to have payroll deductions made on each pay day during the Offering Period in an amount not exceeding twenty percent (20%) of the Compensation which he or she receives on each pay day during the Offering Period, and the aggregate of such payroll deductions during the Offering Period shall not exceed twenty percent (20%) of the Participant’s Compensation during said Offering Period.

(b) All payroll deductions made for a Participant shall be credited to his or her account under the Plan and will be withheld in whole percentages only. A Participant may not make any additional payments into such account.

(c) A Participant may discontinue his or her participation in the Plan as provided in paragraph 10. A Participant’s subscription agreement shall remain in effect for successive Offering Periods unless terminated as provided in paragraph 10.

(d) Notwithstanding the foregoing, to the extent necessary to comply with Section 423(b)(8) of the Code and paragraph 3(b) herein, a Participant’s payroll deductions may be decreased to 0% at such time during any Offering Period which is scheduled to end during the current calendar year (the “Current Offering Period”) that the aggregate of all payroll deductions which were previously used to purchase stock under the Plan in a prior Offering Period which ended during that calendar year plus all payroll deductions accumulated with respect to the Current Offering Period equal $21,250. Payroll deductions shall recommence at the rate provided in such Participant’s subscription agreement at the beginning of the first

3

Offering Period which is scheduled to end in the following calendar year, unless terminated by the Participant as provided in paragraph 10.

(e) At the time the option is exercised, in whole or in part, or at the time some or all of the Company’s Common Stock issued under the Plan is disposed of, the Participant must make adequate provision for the Company’s federal, state, or other tax withholding obligations, if any, which arise upon the exercise of the Option or the disposition of the Common Stock. At any time, the Company may, but will not be obligated to, withhold from the Participant’s compensation the amount necessary for the Company to meet applicable withholding obligations, including any withholding required to make available to the Company any tax deductions or benefit attributable to sale or early disposition of Common Stock by the Employee.

7.Grant of Option and Purchase Price

(a) On the Enrollment Date of each Offering Period, each eligible Employee participating in such Offering Period shall be granted an option to purchase on each Exercise Date during such Offering Period (at the applicable Purchase Price) up to a number of shares of the Company’s Common Stock determined by dividing such Employee’s payroll deductions accumulated prior to such Exercise Date and retained in the Participant’s account as of the Exercise Date by the applicable Purchase Price; provided that in no event shall an Employee be permitted to purchase during any Purchase Period more than a number of shares determined by dividing $12,500 by the fair market value of a share of the Company’s Common Stock on the Enrollment Date, and provided further that such purchase shall be subject to the limitations set forth in paragraphs 3(b) and 12 hereof. To the extent that the payroll deductions on behalf of an Employee exceed the aggregate Purchase Price, the payroll deductions credited to such Participant’s account during the Offering Period may be returned to the Employee or credited to a following Purchase Period. Exercise of the option shall occur as provided in paragraph 8, unless the Participant has withdrawn pursuant to paragraph 10, and such option shall expire on the last day of the Offering Period.

(b) The Purchase Price for each share of Stock purchased at the close of a Purchase Period shall be the lower of:

(i) 85% of the Fair Market Value of such share on the last Trading Day in such Purchase Period; or

(ii) 85% of the Fair Market Value of such share on the last Trading Day before the commencement of the applicable Offering Period (as determined under Section 4(c)).

8.Exercise of Option Unless a Participant withdraws from the Plan as provided in paragraph 10 below, his or her option for the purchase of shares will be exercised automatically on the Exercise Date, and the maximum number of full shares subject to option shall be purchased for such Participant at the applicable Purchase Price with the accumulated payroll deductions in his or her account. No fractional shares will be purchased; any payroll deductions accumulated in a Participant’s account which are not sufficient to purchase a full share shall be retained in the Participant’s account for the subsequent Offering Period, subject to earlier withdrawal by the Participant as provided in paragraph 10. Any other monies left over in a Participant’s account after the Exercise Date shall be returned to the Participant. During a Participant’s lifetime, a Participant’s option to purchase shares hereunder is exercisable only by him or her.

9.Delivery As promptly as practicable after each Exercise Date on which a purchase of shares occurs, the Company shall arrange the delivery to each Participant, as appropriate, of a certificate representing the shares purchased upon exercise of his or her option.

10.Withdrawal; Termination of Employment

(a) A Participant may withdraw all but not less than all the payroll deductions credited to his or her account and not yet used to exercise his or her option under the Plan at any time by giving written notice to the Company in the form of Exhibit B to this Plan. All of the Participant’s payroll deductions credited to his

4

or her account will be paid to such Participant promptly after receipt of notice of withdrawal and such Participant’s option for the Offering Period will be automatically terminated, and no further payroll deductions for the purchase of shares will be made during the Offering Period. If a Participant withdraws from an Offering Period, payroll deductions will not resume at the beginning of the succeeding Offering Period unless the Participant delivers to the Company a new subscription agreement.

(b) Upon a Participant’s ceasing to be an Employee for any reason or upon termination of a Participant’s employment relationship (as described in paragraph 2(h)), the payroll deductions credited to such Participant’s account during the Offering Period but not yet used to exercise the option will be returned to such Participant or, in the case of his or her death, to the person or persons entitled thereto under paragraph 14, and such Participant’s option will be automatically terminated.

(c) In the event an Employee fails to remain an Employee of the Company for at least twenty (20) hours per week during an Offering Period in which the Employee is a Participant, he or she will be deemed to have elected to withdraw from the Plan and the payroll deductions credited to his or her account will be returned to such Participant and such Participant’s option terminated.

(d) A Participant’s withdrawal from an Offering Period will not have any effect upon his or her eligibility to participate in any similar plan which may hereafter be adopted by the Company or in succeeding Offering Periods which commence after the termination of the Offering Period from which the Participant withdraws.

11.Interest No interest shall accrue on the payroll deductions of a Participant in the Plan.

12.Stock

(a) The maximum number of shares of the Company’s Common Stock which shall be made available for sale under the Plan shall be 13,000,000 shares, subject to adjustment upon changes in capitalization of the Company as provided in paragraph 18. If on a given Exercise Date the number of shares with respect to which options are to be exercised exceeds the number of shares then available under the Plan, the Company shall make a pro rata allocation of the shares remaining available for purchase in as uniform a manner as shall be practicable and as it shall determine to be equitable.

(b) The Participant will have no interest or voting right in shares covered by his option until such option has been exercised.

(c) Shares to be delivered to a Participant under the Plan will be registered in the name of the Participant or in the name of the Participant and his or her spouse.

13.Administration The Plan shall be administered by the Board of the Company or a committee of members of the Board appointed by the Board. The Board or its committee shall have full and exclusive discretionary authority to construe, interpret and apply the terms of the Plan, to determine eligibility and to adjudicate all disputed claims filed under the Plan. Every finding, decision and determination made by the Board or its committee shall, to the full extent permitted by law, be final and binding upon all parties. Members of the Board who are eligible Employees are permitted to participate in the Plan, provided that:

(a) Members of the Board who are eligible to participate in the Plan may not vote on any matter affecting the administration of the Plan or the grant of any option pursuant to the Plan.

(b) If a Committee is established to administer the Plan, no member of the Board who is eligible to participate in the Plan may be a member of the Committee.

14.Designation of Beneficiary

(a) A Participant may file a written designation of a beneficiary who is to receive any shares and cash, if any, from the Participant’s account under the Plan in the event of such Participant’s death subsequent to an Exercise Date on which the option is exercised but prior to delivery to such Participant of such shares and

5

cash. In addition, a Participant may file a written designation of a beneficiary who is to receive any cash from the Participant’s account under the Plan in the event of such Participant’s death prior to exercise of the option.