UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ PreliminaryProxy Statement | | ¨ Confidential, For Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to §240.14a-12 | | |

VITESSE SEMICONDUCTOR CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

VITESSE SEMICONDUCTOR CORPORATION

741 Calle Plano

Camarillo, CA 93012

(805) 388-3700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held on January 24, 2005

Dear Vitesse Stockholder:

The ANNUAL MEETING OF STOCKHOLDERS (the “Annual Meeting”) of Vitesse Semiconductor Corporation (“Vitesse” or the “Company”), a Delaware corporation, will be held on

MONDAY, JANUARY 24, 2005 AT 10:30 A.M. AT THE

HYATT WESTLAKE PLAZA HOTEL

880 SOUTH WESTLAKE BOULEVARD

WESTLAKE VILLAGE, CALIFORNIA 91361

Only stockholders who owned stock at the close of business on November 29, 2004 can vote at this meeting or any adjournments that may take place. At the meeting we will:

| | 1. | | Elect a Board of Directors. |

| | 2. | | Ratify of the selection of KPMG LLP as independent auditors of the Company for fiscal 2005. |

| | 3. | | Attend to other business properly presented at the meeting. |

Your Board of Directors recommends that you vote in favor of the two proposals outlined in this Proxy Statement.

If your shares are held of record by a broker, bank or other nominee and you wish to vote your shares at the Annual Meeting, you must obtain a proxy issued in your name from that record holder and bring it with you to the Annual Meeting.

��

At the meeting we will also report on Vitesse’s fiscal 2004 business results and other matters of interest to stockholders.

Vitesse is concurrently mailing a copy of its 2004 Annual Report to all stockholders. The approximate date of mailing for this notice, proxy statement and proxy card is December 17, 2004.

THE BOARD OF DIRECTORS

December 17, 2004

Camarillo, California

YOUR VOTE IS IMPORTANT

In order to assure your representation at the Annual Meeting, you are requested to complete, sign, and date the enclosed proxy card as promptly as possible and return it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Please reference the information on page 1, “How do I vote?” for alternative voting methods.

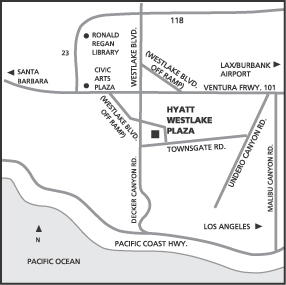

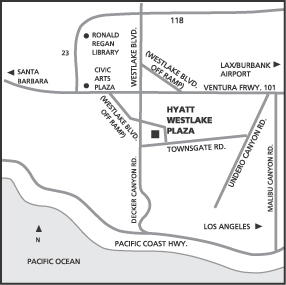

Map/Directions to Annual Stockholders Meeting

Hyatt Westlake Plaza Hotel

880 South Westlake Boulevard

Westlake Village, CA 91361

Meeting begins promptly at 10:30 a.m.

Refreshments will be available at 10 a.m.

VITESSE SEMICONDUCTOR CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

January 24, 2005

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Vitesse Semiconductor Corporation (“Vitesse” or the “Company”) of proxies to be voted at the Annual Meeting of Stockholders to be held on Monday, January 24, 2005, at 10:30 a.m., and at any adjournments that may take place.

The Annual Meeting will be held at the Hyatt Westlake Plaza Hotel located at 880 South Westlake Boulevard, Westlake Village, California 91361. Refreshments will be available at 10:00 a.m. and the business meeting will begin promptly at 10:30 a.m.

The following is important information in a question-and-answer format regarding the Annual Meeting and this Proxy Statement.

| A: | | (1) The election of five nominees to serve on our Board of Directors. |

| | (2) | | Ratification of the selection of KPMG LLP as independent auditors of the Company for fiscal 2005. |

| | (3) | | Any other business properly presented at the meeting. |

| Q: | | How does the Board recommend I vote on the proposals? |

| A: | | The Board recommends a vote FOR each of the director nominees and FOR the selection of KPMG LLP as the Company’s independent auditors for fiscal 2005. |

| Q: | | Who is entitled to vote? |

| A: | | Stockholders as of the close of business on November 29, 2004 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the Record Date, 214,678,854 shares of the Company’s common stock were issued and outstanding. Each stockholder is entitled to one vote for each share of common stock held on the Record Date. |

| A: | | There are three ways you can vote: |

| | (1) | | Sign and date each proxy card you receive and return it in the prepaid envelope. |

| | (2) | | Vote through the Internet or telephone voting system more fully described on your proxy card. |

| | (3) | | Vote in person at the Annual Meeting. If your shares are held of record by a broker, bank or other nominee and you wish to vote your shares at the Annual Meeting, you must obtain a proxy issued in your name from that record holder and bring it with you to the Annual Meeting. |

1

| Q: | | How can I change my vote or revoke my proxy? |

| A: | | You have the right to revoke your proxy and change your vote at any time before the meeting by notifying the Company’s Secretary, or returning a later-dated proxy card, or by Internet or telephone as more fully described on your proxy card. You may also revoke your proxy and change your vote by voting in person at the meeting. |

| Q: | | What does it mean if I get more than one proxy card? |

| A: | | It means you hold shares registered in more than one account. Sign and return all proxies to ensure that all your shares are voted. |

| Q: | | Who will count the vote? |

| A: | | Representatives of EquiServe, the Company’s transfer agent, will count the votes and act as the Inspector of Election. The Company believes that the procedures to be used by EquiServe to count the votes are consistent with Delaware law concerning voting of shares and determination of a quorum. |

| A: | | A “quorum” is a majority of the outstanding shares. They may be present at the meeting or represented by proxy. There must be a quorum for the meeting to be held and action to be validly taken. If you submit a properly executed proxy card, even if you abstain from voting or if you withhold your vote with respect to any proposal, you will be considered present for purposes of a quorum and for purposes of determining voting power present. Because abstentions and withheld votes are considered present for purposes of determining voting power, abstentions and withheld votes have the effect of a vote AGAINST a proposal. If a broker indicates on a proxy that it does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), those shares will be considered present for purposes of a quorum but will not be considered present for purposes of determining voting power on that matter. |

| Q: | | Who can attend the Annual Meeting? |

| A: | | All stockholders as of the Record Date can attend. If your shares are held of record by a broker, bank or other nominee and you wish to vote your shares at the Annual Meeting, you must obtain a proxy issued in your name from that record holder and bring it with you to the Annual Meeting. |

| Q: | | How will voting on any other business be conducted? |

| A: | | We do not know of any business to be considered at the 2005 Annual Meeting other than the proposals described in this Proxy Statement. However, because the Company did not receive notice of any other proposals to be brought before the meeting by November 3, 2004 (one year from the date that was 45 days prior to the month and day when proxy materials for the 2004 Annual Meeting were mailed to stockholders), if any other business is properly presented at the Annual Meeting, your signed proxy card gives authority to Louis R. Tomasetta, Vitesse’s President and Chief Executive Officer, and Eugene F. Hovanec, Vitesse’s Vice President, Finance and Chief Financial Officer, to vote on such matters at their discretion. |

| Q: | | Are there any beneficial owners of 5% or more of the Company’s common stock? |

| A: | | To our knowledge, there are no beneficial owners of five percent or more of the outstanding shares of common stock as of September 30, 2004. |

2

| Q: | | How and when may I submit proposals for the 2006 Annual Meeting? |

| A: | | The deadline for submitting proposals for inclusion in our Proxy Statement for the 2006 Annual Meeting is August 19, 2005, by which date you must submit your proposal in writing to the Company’s Secretary, c/o Vitesse Semiconductor Corporation, 741 Calle Plano, Camarillo, California 93012. |

In order for your proposal to be considered at the 2006 Annual Meeting, you must also send certain information to the Company’s Secretary no later than November 25, 2005 and no earlier than October 26, 2005. With respect to each item of business that you propose to bring before the Annual Meeting, you must submit to the Company’s Secretary (a) a brief description of the business desired to be brought before the Annual Meeting and the reasons for conducting such business at the Annual Meeting, (b) your name and address as they appear on the Company’s books, (c) the class and number of Company’s shares that you beneficially own and (d) any material interest you may have in such business. If you submit a proposal for the 2006 Annual Meeting after November 3, 2005, the proxy for the 2006 Annual Meeting may confer upon management discretionary authority to vote on your proposal.

You should also be aware of certain other requirements you must meet to have your proposal included in the Company’s Proxy Statement for the 2006 Annual Meeting that are explained in Rule 14a-8 promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

| Q: | | Who bears the cost of this solicitation? |

| A: | | The Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. The Altman Group, Inc. was hired to assist with the broker search notification and coordination of distribution of proxy materials for $3,500, plus certain out-of-pocket expenses. We also reimburse brokerage houses and persons representing beneficial owners of shares for their reasonable out-of-pocket expenses in forwarding solicitation materials to such beneficial owners. Certain of the Company’s directors, officers or employees may also solicit proxies in person, by telephone, or by electronic communications but they will not receive any additional compensation for doing so. |

3

PROPOSALS YOU MAY VOTE ON

Proposal 1: Election of Directors

The Board has nominated Vincent Chan, Ph.D., James A. Cole, Alex Daly, John C. Lewis and Louis R. Tomasetta, Ph.D. for re-election to the Board this year. Detailed information on each of the Company’s nominees is provided on page 6. All directors are elected annually and serve a one-year term until the next Annual Meeting. If any director is unable to stand for re-election, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate. We expect that each nominee listed on page 6 will be able and will not decline to serve as a director.

Vote Required: Recommendation of the Board of Directors

With respect to the election of directors, the five candidates receiving the highest number of affirmative votes shall be elected to the Company’s Board of Directors. Abstentions and withheld votes will be counted for purposes of determining the voting power present with respect to the election of directors, but will not have any effect on the outcome of the vote. Pursuant to Delaware law, a broker non-vote will not be treated as voting in person or by proxy on the proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED IN PROPOSAL 1.

Proposal 2: Ratification of the Selection of KPMG LLP as Independent Auditors

The Audit Committee has recommended, and the Board has approved, the selection of KPMG LLP (“KPMG”) as independent auditors of the Company for fiscal 2005, subject to your approval. KPMG has served as our independent auditors since 1989. Representatives of KPMG will attend the Annual Meeting and will be available to answer appropriate questions. They will also have the opportunity to make a statement if they desire to do so.

Audit services provided by KPMG during fiscal 2004 and 2003 include an audit of the Company’s consolidated financial statements, a review of the Company’s Annual Report and certain other filings with the Securities and Exchange Commission (“SEC”). In addition, KPMG provided various other services to the Company during fiscal 2004 and 2003 as described below.

4

Fees Incurred by Vitesse for KPMG LLP

The following table shows the fees paid or accrued by the Company for the audit and other services provided by KPMG for fiscal years ending September 30, 2004 and 2003, respectively.

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees(1) | | $ | 355,000 | | $ | 289,620 |

| | |

|

| |

|

|

Audit Related Fees(2) | | | 119,000 | | | 31,000 |

| | |

|

| |

|

|

Tax Fees(3) | | | | | | |

Domestic Tax | | | 70,000 | | | 383,638 |

International Tax | | | 43,000 | | | 131,851 |

Tax Consulting | | | 17,000 | | | 179,346 |

| | |

|

| |

|

|

| | | | 130,000 | | | 694,835 |

| | |

|

| |

|

|

All Other Fees(4) | | | 111,000 | | | — |

| | |

|

| |

|

|

Total | | $ | 715,000 | | $ | 1,015,455 |

| | |

|

| |

|

|

| (1) | | Audit fees billed by KPMG for audit of the Company’s annual financial statements and the review of those financial statements included in the Company’s quarterly reports on Forms 10-Q. |

| (2) | | Audit-related fees consisted primarily of reviews of statutory audits and various regulatory filings. |

| (3) | | Domestic and international tax compliance, including preparation of returns, and tax consulting services consisting primarily of international tax guidance, trade and customs tax guidance, state and local tax assistance, compensation and benefits tax guidance, and acquisition related guidance. |

| (4) | | Fees related to Debt Offering comfort letter and due diligence. |

The Audit Committee has determined that the provision of the services described above is compatible with maintaining the independence of KPMG.

Audit Committee Pre-Approval Policies and Procedures

Pursuant to its charter, the Audit Committee pre-approves all audit and permissible non-audit services provided by the Company’s independent auditors. The Audit Committee charter allows the committee to delegate its authority to pre-approve services to one or more committee members, provided that the designees present the pre-approvals to the full committee at the next committee meeting.

Vote Required: Recommendation of the Board of Directors

The Board of Directors has conditioned its selection of the Company’s independent auditors upon the receipt of the affirmative vote of a majority of the shares represented, in person or by proxy, and entitled to vote at the Annual Meeting, which shares voting affirmatively also constitute at least a majority of the required quorum. In the event that the stockholders do not ratify the selection of KPMG, the selection of the independent auditors will be reconsidered by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL 2, RATIFYING THE SELECTION OF KPMG LLP AS INDEPENDENT AUDITORS FOR FISCAL 2005.

5

NOMINEES FOR THE BOARD OF DIRECTORS

Vincent Chan, Ph.D., Age 56, Director since 2000—Dr. Chan has served on the Massachusetts Institute of Technology’s faculty as the Joan and Irwin Jacobs Professor of Electrical Engineering and Computer Science, Aeronautics and Astronautics and as a member of the Operations Research Center since 1998. He is also the Director of MIT’s Laboratory for Information and Decision Systems. From 1995 to 1998, he was the Head of the Communications and Information Technology Division of MIT Lincoln Laboratory. Dr. Chan has over 30 years experience leading the development of advanced communication systems and networks.

James A. Cole, Age 62, Director since 1987—Mr. Cole has been a General Partner of Windward Ventures, L.P., a venture capital firm, since 1997. He was a General Partner of Spectra/New Enterprise Associates, a venture capital firm, from 1986 through 1997. He was a founder and Executive Vice President of Amplica, Inc., a GaAs microwave IC and sub-system company. Mr. Cole also serves as a director of Giga-Tronics, Inc. and a number of private companies.

Alex Daly, Age 43, Director since 1998—Mr. Daly was founder and has served as Chairman and Chief Executive Officer of Nutrophy, Inc., an online personalized nutrition company, since its inception in April 2002. From September 2001 through March 2002 he was on personal sabbatical. From May 2000 through August 2001, Mr. Daly was Chairman, President and Chief Executive Officer of Arcsight, Inc., an enterprise network security management company. From February 2000 through April 2000 he was on personal sabbatical. From January 1998 through January 2000, Mr. Daly was President and Chief Executive Officer of Cygnus Solutions, a developer of software tools. From 1995 through 1997, he served as Sr. Vice President of Marketing and then Sales at C-Cube Microsystems, a manufacturer of integrated circuits. Prior to that, Mr. Daly served at Intel Corporation, most recently as director of marketing for the mobile computing group.

John C. Lewis, Age 69, Director since 1990 (Chairman since December 2002)—Mr. Lewis served as Chairman of the Board of Directors and Chief Executive Officer of Amdahl Corporation, a manufacturer of large, general purpose computers, storage systems, software products and consulting services from August 1977 to March 2001. Before joining Amdahl in 1977, he was President of Xerox Business Systems. Mr. Lewis also serves as a director of Cypress Semiconductor Corporation and Pinnacle Systems.

Louis R. Tomasetta, Ph.D., Age 56, Director since 1987—Dr. Tomasetta, a co-founder of the Company, has been President, Chief Executive Officer and a Director since the Company’s inception in February 1987. From 1984 to 1987, he served as President of the integrated circuits division of Vitesse Electronics Corporation. Prior to that he was the director of the Advanced Technology Implementation department at Rockwell International Corporation. Dr. Tomasetta has over 30 years experience in the management and development of semiconductor businesses, products, and technologies. Dr. Tomasetta also serves as a director of a number of private companies.

6

BOARD MEETINGS AND COMMITTEES

The Company’s Board usually meets five times a year in regularly scheduled meetings, but will meet more often if necessary. The Board held five (5) meetings during fiscal 2004 and each director attended at least 75% of the Board meetings held during the periods in which such director served. In addition, each director attended at least 75% of the total number of meetings held by committees of the Board on which such director served.

Communications to the Board, the non-management directors or any individual director may be sent to the Company’s Secretary, c/o Vitesse Semiconductor Corporation, 741 Calle Plano, Camarillo, California 93012.

The full Board considers all major decisions of the Company. During fiscal 2004, the Board had the following three standing committees, each of which was chaired by an outside director:

The Compensation Committee

The Compensation Committee has the following responsibilities:

| | • | | oversees the Company’s compensation and benefits policies generally; |

| | • | | evaluates senior executive performance and reviews the Company’s management succession plan; and |

| | • | | oversees and sets compensation for the Company’s senior executives. |

In December 2002, the Board adopted a new Compensation Committee Charter, which is posted on the Company’s website atwww.vitesse.com.

During fiscal 2004, the Committee consisted of Vincent Chan, James Cole and Alex Daly (Chairman of the Committee) and met five (5) times. All members of the Compensation Committee are independent as defined by the listing standards of the National Association of Securities Dealers. No interlocking relationship existed during fiscal 2004 between the Company’s executive officers or members of the Board and the executive officers or members of the board of directors or compensation committee of any other company.

The Audit Committee

The Audit Committee assists the Board in its oversight of the following:

| | • | | the integrity of the financial statements of the Company; |

| | • | | the qualifications, independence and performance of the Company’s independent auditors; |

| | • | | the performance of the Company’s internal audit function; and |

| | • | | compliance by the Company with legal and regulatory requirements. |

In December 2003, the Board adopted a new Audit Committee Charter, which is posted on the Company’s website atwww.vitesse.com and which was included as an appendix to the Company’s Proxy Statement for its 2004 Annual Meeting.

During fiscal 2004, the Committee consisted of James Cole, Alex Daly and John Lewis (Chairman of the Committee) and met seven (7) times. All members of the Audit Committee are independent and financially literate as defined by the listing standards of the National Association of Securities Dealers. In addition, Mr. Lewis qualifies as a “financial expert” as defined by the rules of the Securities and Exchange Commission implementing Section 406 of the Sarbanes-Oxley Act.

7

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has the following responsibilities:

| | • | | identifies individuals qualified to become Board members and recommends to the Board director nominees for election at the next annual or special meeting of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; |

| | • | | recommends directors for appointment to Board committees; |

| | • | | evaluates Board performance; |

| | • | | oversees and sets compensation for the Company’s directors; and |

| | • | | develops and recommends to the Board the Corporate Governance Guidelines and Code of Business Conduct and Ethics of the Company. |

In December 2002, the Board adopted a new Nominating and Corporate Governance Committee Charter and also adopted Corporate Governance Guidelines and a Code of Business Conduct and Business Ethics, each of which is posted on the Company’s website atwww.vitesse.com.

During fiscal 2004, the Committee consisted of Vincent Chan, James Cole (Chairman of the Committee) and John Lewis and met three (3) times. All members of the Nominating and Corporate Governance Committee are independent as defined by the listing standards of the National Association of Securities Dealers.

The Nominating and Corporate Governance Committee will consider director candidates recommended by any stockholder who has continuously held at least 5% of the Company’s voting securities (either directly or as part of a group) for at least one year. Stockholders may recommend director candidates to the Board by contacting the Secretary of the Company in writing at the following address: Secretary, Vitesse Semiconductor Corporation, 741 Calle Plano, Camarillo, California 93012. Such recommendations should be accompanied by (i) evidence of the stockholder’s stock ownership over the last year, (ii) a resume and contact information for the director candidate, as well as a description of the candidate’s qualifications and (iii) a statement whether the candidate has expressed interest in serving as a director. The Nominating and Corporate Governance Committee follows the same process and uses the same criteria for evaluating candidates proposed by stockholders as it does for candidates proposed by other parties. The Nominating and Corporate Governance Committee will consider such candidacy and will advise the recommending stockholder of its final decision.

The Nominating and Corporate Governance Committee uses various methods to identify director nominees. The Nominating and Corporate Governance Committee regularly assesses the appropriate size and composition of the board and the particular needs of the Board based on whether any vacancies are expected due to retirement or otherwise. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms, stockholders or other parties. All candidates are evaluated based on a review of the individual’s qualifications, skills, independence and expertise, including the criteria included in our Corporate Governance Guidelines.

DIRECTOR COMPENSATION

Non-employee directors received $2,000 for attending the fiscal first quarter meeting in October 2003. On January 26, 2004, the Nominating and Corporate Governance Committee approved a new Board of Directors Compensation Plan, effective January 1, 2004. Under the new Compensation Plan, each non-employee director receives an annual fee of $30,000, which is paid in equal quarterly installments. In addition, the Chairman of the Audit Committee receives an annual fee of $10,000, which is paid in equal quarterly installments. Directors are also reimbursed for customary travel expenses.

8

During fiscal 2004, Mr. Lewis, Chairman of the Board, was granted an option to purchase 60,000 shares of common stock and Messrs. Chan, Cole and Daly each were granted an option to purchase 40,000 shares of common stock at an exercise price of $5.85.

Each of these grants were made under the Company’s 2001 Stock Incentive Plan (the “2001 Plan”) approved by the Company’s stockholders on January 23, 2001. Under the 2001 Plan, on January 1 each year beginning in 2002, each non-employee director receives nonstatutory options to purchase 40,000 shares (except for the Chairman, who receives options to purchase 60,000 shares). These options are for a ten-year term and become available for purchase in installments of two percent of the total number of shares granted at the end of each month beginning January 31 after the date of grant. The exercise price of the options must be at least 100% of the fair market value of the common stock on the Nasdaq National Market on the date of grant of the option. The options may be exercised only (1) while the individual is serving as a director on the Board, (2) within six months after termination by death or disability, or (3) within three months after the individual’s term as director ends.

Employee directors receive no compensation for serving on the Board other than their employee compensation.

9

STOCK PERFORMANCE GRAPH

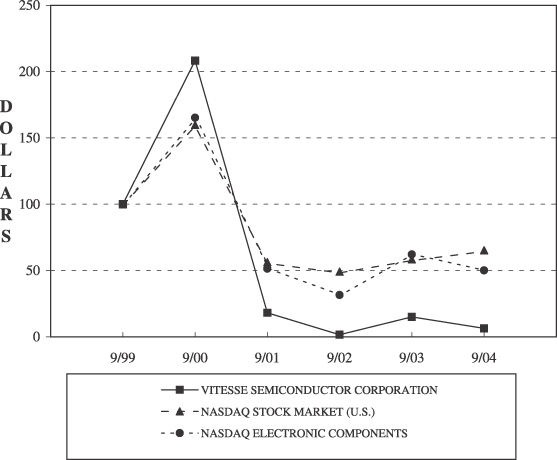

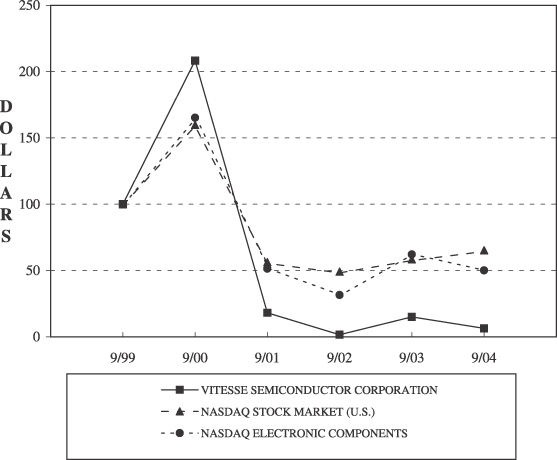

The following performance graph compares the cumulative total stockholder return on the Company’s common stock with the NASDAQ Stock Market-U.S. Index and the NASDAQ Electronics Components Index from market close on the last trading day in September 1999 through September 30, 2004. The graph is based on the assumption that $100 was invested in each of the Company’s common stock, the NASDAQ Stock Market-U.S. Index and the NASDAQ Electronic Components Index on September 30, 1999.

The stock price performance graph depicted below shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended. The stock price performance on the graph is not necessarily an indicator of future price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG VITESSE SEMICONDUCTOR CORPORATION,

THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ ELECTRONIC COMPONENTS INDEX

| | * | $100 invested on 9/30/99 in stock or index, including reinvestment of dividends. |

| | | Fiscal year ending September 30. |

10

PRINCIPAL OWNERSHIP

OF VITESSE SEMICONDUCTOR CORPORATION

COMMON STOCK

The following table sets forth certain information known to the Company with respect to beneficial ownership of common stock as of September 30, 2004 by the directors, the Named Executive Officers listed on page 12, and all directors and executive officers as a group. To the knowledge of the Company, there are no beneficial owners of five percent or more of the outstanding shares of common stock as of September 30, 2004.

Principal Stock Ownership

| | | | | | | | | | |

Name of Individuals or Identity of Group

| | Shares

Beneficially

Owned

| | | Shares Exercisable

Within 60 Days of

Sept. 30, 2004

| | Total Shares

Beneficially Owned

Plus Exercisable

Within 60 Days of

Sept. 30, 2004

| | Percent

of Total

| |

Louis R. Tomasetta | | 874,155 | (1) | | 5,839,548 | | 6,713,703 | | 3.1 | % |

Eugene F. Hovanec | | 492,702 | (2) | | 1,467,753 | | 1,960,455 | | * | |

Christopher Gardner | | 174,196 | | | 1,235,985 | | 1,410,181 | | * | |

Ira Deyhimy | | 424,470 | | | 569,774 | | 994,244 | | * | |

Yatin Mody | | 78,151 | | | 447,335 | | 525,486 | | * | |

James A. Cole | | 143,700 | | | 329,600 | | 473,300 | | * | |

John C. Lewis | | 115,000 | | | 241,600 | | 356,600 | | * | |

Richard Riker | | 0 | | | 870,000 | | 870,000 | | * | |

Alex Daly | | 0 | | | 226,400 | | 226,400 | | * | |

Vincent Chan | | 30,000 | | | 149,600 | | 179,600 | | * | |

All executive officers and directors as a group (10 persons) | | 2,332,374 | | | 11,377,595 | | 13,709,969 | | 6.4 | % |

| (1) | | Includes an aggregate of 126,000 shares held for his children, pursuant to the Transfer to Minors Act and as to which Dr. Tomasetta has voting and investment power. |

| (2) | | Includes an aggregate of 10,000 shares held for his daughter, pursuant to the Transfer to Minors Act and as to which Mr. Hovanec has voting and investment power. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors and persons who own more than 10% of a registered class of the Company’s equity securities to file certain reports regarding ownership of and transactions in such securities with the SEC. Such officers, directors and 10% stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of copies of such forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and 10% stockholders were complied with during the fiscal year ended September 30, 2004, except that Ira Deyhimy, our Vice President, Strategy Development, filed a late Form 4 on November 10, 2003 reporting a purchase of our common stock on October 27, 2003.

11

COMPENSATION OF EXECUTIVE OFFICERS

The following is a summary of information regarding compensation paid to the Chief Executive Officer and the five most highly compensated executive officers other than the Chief Executive Officer who were serving as executive officers as of September 30, 2004. The following six individuals are the “Named Executive Officers.”

Summary Compensation Table

| | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation Awards

|

Name and Principal Position

| | Year

| | Salary

| | Bonus(1)

| | Other Annual

Compensation(2)

| | | Number of Securities Underlying Options

|

LOUIS R. TOMASETTA | | 2004 | | $ | 350,000 | | | — | | — | | | 950,000 |

President & Chief Executive Officer | | 2003 | | | 350,000 | | $ | 206,250 | | — | | | 1,260,000 |

| | | 2002 | | | 329,808 | | | 346,913 | | — | | | 1,925,048 |

| | | | | |

EUGENE F. HOVANEC | | 2004 | | | 225,000 | | | — | | 34,615 | (3) | | 250,000 |

Vice President, Finance & Chief Financial Officer | | 2003

2002 | |

| 225,000

212,019 | |

| 135,000

227,070 | | —

— |

| | 350,000

533,245 |

| | | | | |

RICHARD RIKER(4) | | 2004 | | | 200,000 | | | — | | — | | | 150,000 |

Vice President, Sales & Marketing | | 2003 | | | 200,000 | | | — | | 44,556 | (5) | | 280,000 |

| | | 2002 | | | 200,000 | | | — | | 139,293 | (5) | | 40,000 |

| | | | | |

CHRISTOPHER GARDNER | | 2004 | | | 200,000 | | | — | | — | | | 100,000 |

Vice President & General Manager, Transport Division | | 2003

2002 | |

| 200,000

188,461 | |

| 67,500

116,412 | | —

— |

| | 225,000

442,885 |

| | | | | |

IRA DEYHIMY | | 2004 | | | 175,000 | | | — | | — | | | 75,000 |

Vice President, Strategy Development | | 2003 | | | 175,000 | | | 50,625 | | — | | | 98,000 |

| | | 2002 | | | 164,904 | | | 81,699 | | — | | | 197,524 |

| | | | | |

YATIN MODY | | 2004 | | | 175,348 | | | — | | — | | | 75,000 |

Vice President, Finance | | 2003 | | | 165,343 | | | 39,375 | | — | | | 119,000 |

| | | 2002 | | | 154,462 | | | 66,229 | | — | | | 178,385 |

| (1) | | Amounts paid in each year are for bonuses earned in previous years. No bonuses were earned for fiscal 2002, 2003 or 2004. Bonus amounts paid in fiscal 2002 and 2003 were earned in fiscal 2000 and prior years and were paid according to a deferred payment schedule. |

| (2) | | Excludes certain expenses which, for any Named Executive Officer, did not exceed the lesser of $50,000 or 10% of the compensation reported in the above table, and which, for all Named Executive Officers as a group, did not exceed the lesser of $50,000 times the number of Named Executive Officers or 10% of all Named Executive Officers’ annual salaries and bonuses reported in the above table. |

| (3) | | Cash payout of sabbatical, in lieu of time off. |

| (4) | | Mr. Riker’s last day of employment was October 1, 2004 |

| (5) | | Reimbursement for relocation expenses. |

12

The following table presents additional information concerning the option awards shown in the Summary Compensation Table for fiscal year 2004. These options to purchase common stock were granted to the Named Executive Officers under the Company’s 2001 Stock Incentive Plan on October 20, 2003 and expire on October 20, 2013. All options in the table below vest in equal annual installments over a four year period.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

| | | Number of

Securities

Underlying

Options

| | % of Total

Securities

Underlying

Options Granted

to Employees in Fiscal Year

| | | Exercise

or Base

Price Per

Share

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rate of Stock

Price Appreciation for Option

Term(1)

|

Name

| | | | | | 5%

| | 10%

|

Louis R. Tomasetta | | 950,000 | | 13.72 | % | | $ | 6.97 | | 10/20/2013 | | $ | 4,164,226 | | $ | 10,552,966 |

Eugene F. Hovanec | | 250,000 | | 3.61 | % | | | 6.97 | | 10/20/2013 | | | 1,095,849 | | | 2,777,096 |

Richard Riker | | 150,000 | | 2.17 | % | | | 6.97 | | 10/20/2013 | | | 657,509 | | | 1,666,258 |

Christopher Gardner | | 100,000 | | 1.44 | % | | | 6.97 | | 10/20/2013 | | | 438,340 | | | 1,110,838 |

Ira Deyhimy | | 75,000 | | 1.08 | % | | | 6.97 | | 10/20/2013 | | | 328,755 | | | 833,129 |

Yatin Mody | | 75,000 | | 1.08 | % | | | 6.97 | | 10/20/2013 | | | 328,755 | | | 833,129 |

| (1) | | These dollar amounts are not intended to forecast future appreciation of the common stock price. Named Executive Officers will not benefit unless the common stock price increases above the stock option exercise price. Any gain to the Named Executive Officers resulting from common stock price appreciation would benefit all stockholders. |

The following table shows information for the Named Executive Officers concerning stock options exercised during fiscal 2004 and stock options unexercised at the end of fiscal year 2004.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-end Option Values

| | | | | | | | | | | | | | | |

| | | Number of

Shares

Acquired

on Exercise

| | Value(1)

Realized

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year End

| | Value of Unexercised In-the-Money Options at

Fiscal Year End

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Louis R. Tomasetta | | — | | $ | 0.00 | | 4,840,048 | | 2,720,000 | | $ | 1,919,232 | | $ | 479,808 |

Eugene F. Hovanec | | — | | | 0.00 | | 1,185,253 | | 722,000 | | | 537,402 | | | 133,280 |

Richard Riker | | — | | | 0.00 | | 449,000 | | 421,000 | | | 426,496 | | | 106,624 |

Christopher Gardner | | 35,000 | | | 40,187 | | 1,051,985 | | 467,000 | | | 386,661 | | | 85,680 |

Ira Deyhimy | | — | | | 0.00 | | 480,924 | | 237,100 | | | 181,336 | | | 37,318 |

Yatin Mody | | — | | | 0.00 | | 348,285 | | 254,100 | | | 181,261 | | | 45,315 |

| (1) | | Value realized is the difference between the option exercise price and the fair market value of the Company’s common stock at the date of exercise multiplied by the number of options exercised. |

13

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of September 30, 2004, with respect to the shares of the Company’s common stock that may be issued under the Company’s existing equity compensation plans. The table does not include information with respect to shares subject to outstanding options granted under the equity compensation plans assumed by the Company in connection with acquisitions of the companies that originally granted those options. Footnote (5) to the table sets forth the total number of shares of the Company’s common stock issuable upon the exercise of those assumed options as of September 30, 2004, and the weighted average exercise price of those options. No additional options may be granted under those assumed plans.

| | | | | | | | | |

| | | A

| | | B

| | C

| |

Plan Category

| | Number of Securities

to be Issued upon

Exercise of

Outstanding Options

| | | Weighted Average

Exercise Price of

Outstanding Options

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column A)

| |

Equity Compensation Plans approved by Stockholders(1) | | 41,197,759 | (2) | | $ | 10.42 | | 12,758,492 | (3) |

Equity Compensation Plans not approved by Stockholders(4) | | 2,774,508 | | | $ | 8.02 | | 657,120 | |

Total(5) | | 43,972,267 | | | $ | 10.27 | | 13,415,612 | |

| (1) | | Consists of the 2001 Stock Incentive Plan, the 1991 Stock Option Plan, the 1991 Director’s Stock Option Plan, the 1989 Stock Option Plan, and the 1991 Employee Stock Purchase Plan. |

| (2) | | Excludes purchase rights accruing under the Company’s 1991 Employee Stock Purchase Plan. Under the Purchase Plan, each eligible employee may purchase shares of the Company’s common stock at six-month intervals at 85% of the lower of the fair market value at the beginning and end of each interval. Employees purchase such stock using accumulated payroll deductions which may not exceed 20% of their compensation, including commissions, but excluding overtime and bonuses. |

| (3) | | Includes shares available for future issuance under the 1991 Employee Stock Purchase Plan as of September 30, 2004. As of September 30, 2004, 6,180,268 shares of common stock were available for issuance under the Purchase Plan. |

| (4) | | Consists of the 1999 International Stock Option Plan and one other immaterial plan. Options of this plan generally vest and become exercisable at the rate of 25% per year. The exercise price of all stock options must be at least equal to the fair market value of the common stock on the date of grant; if not, then deferred compensation is recorded and amortized over the vesting period. The term of options is generally 10 years. |

| (5) | | The table does not include information for equity compensation plans assumed by the Company in connection with acquisitions of the companies which originally established those plans. As of September 30, 2004, a total of 2,018,262 shares of the Company’s common stock were issuable upon exercise of outstanding options under those assumed plans. The weighted average exercise price of those options outstanding is $12.76 per share. No additional options may be granted under those assumed plans. |

14

Summary Description of Equity Compensation Plans Not Approved by Stockholders

Vitesse International, Inc. 1999 International Stock Option Plan

The Vitesse International, Inc. 1999 International Stock Option Plan was adopted by the Board of Vitesse International, Inc., a subsidiary of the Company, in 1999 and was last amended in July 2003. The plan reserves for issuance 3,750,000 shares of the Company’s common stock pursuant to the exercise of options granted under the plan. As of December 1, 2004, there were outstanding options to purchase 3,096,838 shares under the plan. The number of shares available for future grant and previously granted but unexercised options are subject to adjustment for stock splits, stock dividends, combinations or reclassifications or other changes in the Company’s capitalization as described in the plan. Employees, including officers, and consultants of the Company and any subsidiary of the Company are eligible to participate in the plan. No options may be granted to non-employee directors. Generally, only non-U.S. employees of the Company or its subsidiaries have been granted options under the plan.

Options granted under the plan generally vest as to 25% of the shares subject to the option on the first anniversary of the vesting commencement date and as to 25% annually thereafter. Terms of exercisability are determined by Vitesse International’s Board of Directors at the time of grant, but in no event may the exercisability date be delayed by more than 10 years from the date of grant. If an optionee’s status as an employee or consultant terminates for any reason (including the death or disability of the optionee), the option remains exercisable for a fixed period of time not to exceed six months but only to the extent the optionee was entitled to exercise such options on the date of termination.

When an option is exercised under the plan, Vitesse International purchases from the Company shares of the Company’s common stock for delivery to the optionee. The purchase price paid by Vitesse International is the fair market value of the shares on the date the exercise notice was received from the optionee.

In the event of a merger of the Company with or into another corporation, options granted under the plan shall be assumed or substituted by the successor company or, if the successor company does not agree to such assumption or substitution, shall become exercisable prior to the merger for a limited period of time, after which time the options shall terminate.

The Board of Directors of Vitesse International administers the plan, determines the terms of options granted under the plan in accordance with the terms of the plan, and has the power to interpret the plan. The plan expires by its terms in 2009 unless earlier terminated by the plan administrator.

Other Arrangements

The Company is a party to option agreements that were entered into during fiscal 2000 and 2001 with two employees. Pursuant to the agreements, the Company granted the employees options to purchase an aggregate of 54,000 shares, subject to adjustment for stock splits, stock dividends, combinations or reclassifications or other changes in the Company’s capitalization. The options were granted at the fair market value of the Company’s common stock on the respective grant dates. The weighted average exercise price of the options granted under the agreements is $49.93. Options granted under the agreements vest in equal annual installments over the four-year period following the respective grant dates. If the employee is terminated for “cause” (as defined in the agreements), the relevant options remain exercisable to the extent vested for a three-month period following termination. If the employee is terminated without “cause”, the relevant options will become fully vested and exercisable during the three-month period following the date of termination. Under the agreements, if the optionee’s status as an employee ends due to death or disability, options granted under the agreement may be exercised within the 12-month period from the date of termination to the extent the option was exercisable on the date of termination. In the event of a merger of the Company with or into another corporation or a sale of substantially all the assets of the Company, options granted under the agreements shall be assumed or substituted by the successor company or, if the successor company does not agree to such assumption or substitution, shall become exercisable prior to the merger for a limited period of time, after which time the options shall terminate.

15

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Board of Directors consists of three independent directors. The Committee reviews and approves salaries, bonuses and other benefits payable to the Company’s executive officers. It also administers the Company’s employee stock option and employee stock purchase plans.

Compensation Goals

The Compensation Committee establishes compensation for executive officers to align with business objectives and performance and to attract, retain and reward executive officers who contribute to the long-term success of the Company. The Company’s compensation programs, including those for executive officers, share these characteristics:

| | • | | The Company pays competitively. The Company offers a compensation program, including competitive base salaries and, where appropriate, relocation benefits, to attract and retain the best people in the industry. To ensure that pay is competitive, the Company reviews the compensation practices of other leading companies in the industry. |

| | • | | The Company pays for relative sustained performance. Executive officers are rewarded based upon corporate, departmental, and individual performance. Corporate and departmental performance are evaluated by reviewing whether strategic and business plan goals are met. Individual performance is evaluated by measuring organizational progress against set objectives. |

| | • | | The Company strives for fairness to achieve a balance in compensation paid to the executives within the Company and in comparable companies. It believes that the contributions of each member of the executive staff are vital to the success of the Company. |

| | • | | The Company believes that employees should understand the performance evaluation and compensation programs. At the beginning of the performance cycle, key quarterly and annual objectives are set for each officer. The chief executive officer gives ongoing feedback on performance to each officer. At the end of the performance cycle, the Compensation Committee evaluates the accomplishments of the key objectives in making its decisions on merit increases and stock option grants. |

Compensation Components

The Company’s compensation program, which consists of cash- and equity-based compensation, allows the Company to attract and retain highly skilled officers, provide useful products and services to customers, enhance stockholder value, motivate technological innovation, and reward executive officers and other employees. The components are:

Cash-Based Compensation:

| | • | | Salary The Committee sets base salary for officers by reviewing the compensation levels for similar positions in comparable companies in the industry. |

| | • | | Bonus Under the Company’s bonus plan, bonuses for eligible executive officers are generally paid as a percentage of their base salary and on the basis of the achievement of certain individual and corporate financial goals. The bonuses actually earned by each individual during any fiscal year are to be paid in successive years. In fiscal 2002, 2003 and 2004, no bonuses were earned under the officer’s bonus plan. |

Equity-Based Compensation:

Stock options provide additional incentives to officers to work to maximize stockholder value. The options become available for purchase over a defined period to encourage officers to continue their employment with the Company. In line with its compensation philosophy, the Company grants stock options to employees at all levels

16

of the organization based on each individual’s contribution to the Company. Options granted to executive officers during fiscal 2004 are discussed below.

Chief Executive Officer Compensation

Louis R. Tomasetta has been President and Chief Executive Officer of the Company since its incorporation in 1987. His total compensation consists of base salary, bonus and employee stock options. In determining Mr. Tomasetta’s compensation, the Committee evaluates:

| | • | | Corporate performance, principally revenue and operating profit goals |

| | • | | His individual performance |

| | • | | Compensation paid to other executive officers of the Company |

| | • | | Compensation paid to chief executive officers of comparable companies |

In light of the difficult economic environment for the Company and the telecommunication equipment industry generally, for fiscal 2004 the Compensation Committee did not increase the salary of Mr. Tomasetta or the Company’s other executive officers from the salary levels set during fiscal 2003, except for an increase of approximately $10,000 in the salary of Mr. Mody, the Company’s Vice President, Finance. No bonuses were earned by Mr. Tomasetta or other executive officers in fiscal 2002, 2003 or 2004.

For fiscal year 2004, Mr. Tomasetta’s salary was $350,000. In addition, during fiscal 2004 Mr. Tomasetta received non-statutory options to purchase 950,000 shares of common stock under the Company’s 2001 Stock Incentive Plan at an exercise price of $6.97. The Compensation Committee believes the grant of options to Mr. Tomasetta is a key component of his compensation and an important means of ensuring that the Company’s Chief Executive Officer continues to share significantly in the success of the Company’s business with the other stockholders. The Compensation Committee determined that it was appropriate to grant these options in fiscal 2004 for these reasons and due to Mr. Tomasetta’s individual performance. These options are for a ten-year term and vest in four annual installments of 25% of the total number of shares granted beginning on October 20, 2004. Similar option grants were made to other executive officers in fiscal 2004. Option grants were made on similar terms to other executive officers in amounts determined by the Compensation Committee after review of individual performance and the other factors described above.

Mr. Tomasetta’s equity ownership in the Company includes 874,155 shares of common stock and stock options to purchase an additional 7,560,048 shares.

Submitted by the Fiscal 2004 Compensation Committee of the Company’s Board of Directors:

Alex Daly

Vincent Chan

James Cole

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee assists the Board in its oversight of the integrity of the financial statements of the Company, the qualifications, independence and performance of the Company’s independent auditors, the performance of the Company’s internal audit function and compliance by the Company with legal and regulatory requirements.

The Committee has received from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee also reviewed with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee has discussed and reviewed with the independent auditors all communications required by generally accepted accounting standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

The Committee has reviewed and discussed the audited financial statements of the Company as of and for the fiscal year ended September 30, 2004, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above review and discussions with management and the independent auditors, the Committee recommended to the Board of Directors that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission. The Committee also recommended the reappointment, subject to stockholder approval, of the independent auditors, and the Board concurred in such recommendation.

Submitted by the Fiscal 2004 Audit Committee of the Company’s Board of Directors:

John Lewis

James Cole

Alex Daly

18

OTHER MATTERS

The Company knows of no other matters to be presented for consideration at the meeting. If any other matters properly come before the meeting, the persons named in the enclosed proxy card intend to vote the shares they represent as the Company may recommend.

THE BOARD OF DIRECTORS

Camarillo, California

December 17, 2004

19

DETACH HERE

PROXY

VITESSE SEMICONDUCTOR CORPORATION

PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 24, 2005

The undersigned stockholder of Vitesse Semiconductor Corporation, a Delaware corporation, hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, first mailed to stockholders on or about December 17, 2004, and hereby appoints Louis R. Tomasetta and Eugene F. Hovanec, and each of them, with full power of substitution, as Proxy or Proxies, to vote all shares of the Common Stock of the undersigned at the Annual Meeting of Stockholders of Vitesse Semiconductor Corporation to be held on January 24, 2005, and at any adjournments thereof, upon the proposals set forth on this form of proxy and described in the Proxy Statement, and in their discretion with respect to such other matters as may be properly brought before the meeting or any adjournments thereof.

UNLESS A CONTRARY DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED FOR THE NOMINEES NAMED IN PROPOSAL 1 AND FOR PROPOSAL 2, AS MORE SPECIFICALLY DESCRIBED IN THE PROXY STATEMENT. IF SPECIFIC INSTRUCTIONS ARE INDICATED, THIS PROXY WILL BE VOTED IN ACCORDANCE THEREWITH.

| | | | |

SEE REVERSE SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE SIDE |

VITESSE SEMICONDUCTOR

CORPORATION

C/O EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

| | | | | | | | |

| | | | |

| | | | | | | | | |

| | | | |

| | | | | | | | | |

|

Your vote is important. Please vote immediately. |

| | | | | | | | | | | | |

| | | | | | | |

Vote-by-Internet Log on to the Internet and go to http://www.eproxyvote.com/vtss | |

| | | | OR | | | | Vote-by-Telephone Call toll-free 1-877-PRX-VOTE (1-877-779-8683) | |  |

If you vote over the Internet or by telephone, please do not mail your card.

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

| | | | | | | | | | | | |

x | | Please mark | | | | | | | | | | |

| | votes as in | | | | | | | | | | |

| | this example. | | | | | | | | | | |

MANAGEMENT RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR NAMED BELOW AND A VOTE FOR PROPOSAL 2.

| | | | | | | | | | | | |

| 1. | | To elect five directors of the Company to serve for the ensuing one year until the Company’s 2006 Annual Meeting of Stockholders and until their successors are elected. | | 2. | | To ratify the selection of KPMG LLP as the Company’s independent auditors for the fiscal year ending September 30, 2005. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

| | | | | | | | |

| Nominees: | | (01) Vincent Chan, (02) James A. Cole,

(03) Alex Daly, (04) John C. Lewis,

(05) Louis R. Tomasetta | | | | | | |

| | | | | | | | | | | | | | |

| | | FOR | | ¨ | | | | | | ¨ | | WITHHELD | | |

¨ | | | | |

| | | For all nominee(s)

except as written above | | |

Please vote, date and promptly return this proxy in the enclosed return envelope which is postage prepaid if mailed in the United States. If you vote over the Internet or by telephone, please do not mail your card.

Please sign exactly as your name appears hereon. If the stock is registered in the names of two or more persons, each should sign. Executors, administrators, trustees, guardians and attorneys-in-fact should add their titles. If the signer is a corporation, please give full corporate name and have a duly authorized officer sign stating title. If the signer is a partnership, please sign in partnership name by authorized person.

Signature: Date: Signature: Date: