Agency Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a securities lending agent. Either the Fund or the borrower may terminate the loan at any time, and the borrower, after notice, is required to return borrowed securities within a standard time period. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of February 29, 2024, the Fund had securities on loan, which were classified as common stocks in the Investment Portfolio. The value of the related collateral exceeded the value of the securities loaned at period end. As of period end, the remaining contractual maturity of the collateral agreements was overnight and continuous.

Taxes. The Fund’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

At August 31, 2023, the Fund had net tax basis capital loss carryforwards of approximately $481,416,000, including short-term losses ($274,135,000) and long-term losses ($207,281,000), which may be applied against realized net taxable capital gains indefinitely.

At February 29, 2024, the aggregate cost of investments for federal income tax purposes was $395,841,411. The net unrealized appreciation for all investments based on tax cost was $47,921,414. This consisted of aggregate gross unrealized appreciation for all investments for which there was an excess of value over tax cost of $60,702,221 and aggregate gross unrealized depreciation for all investments for which there was an excess of tax cost over value of $12,780,807.

The Fund has reviewed the tax positions for the open tax years as of August 31, 2023 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s financial

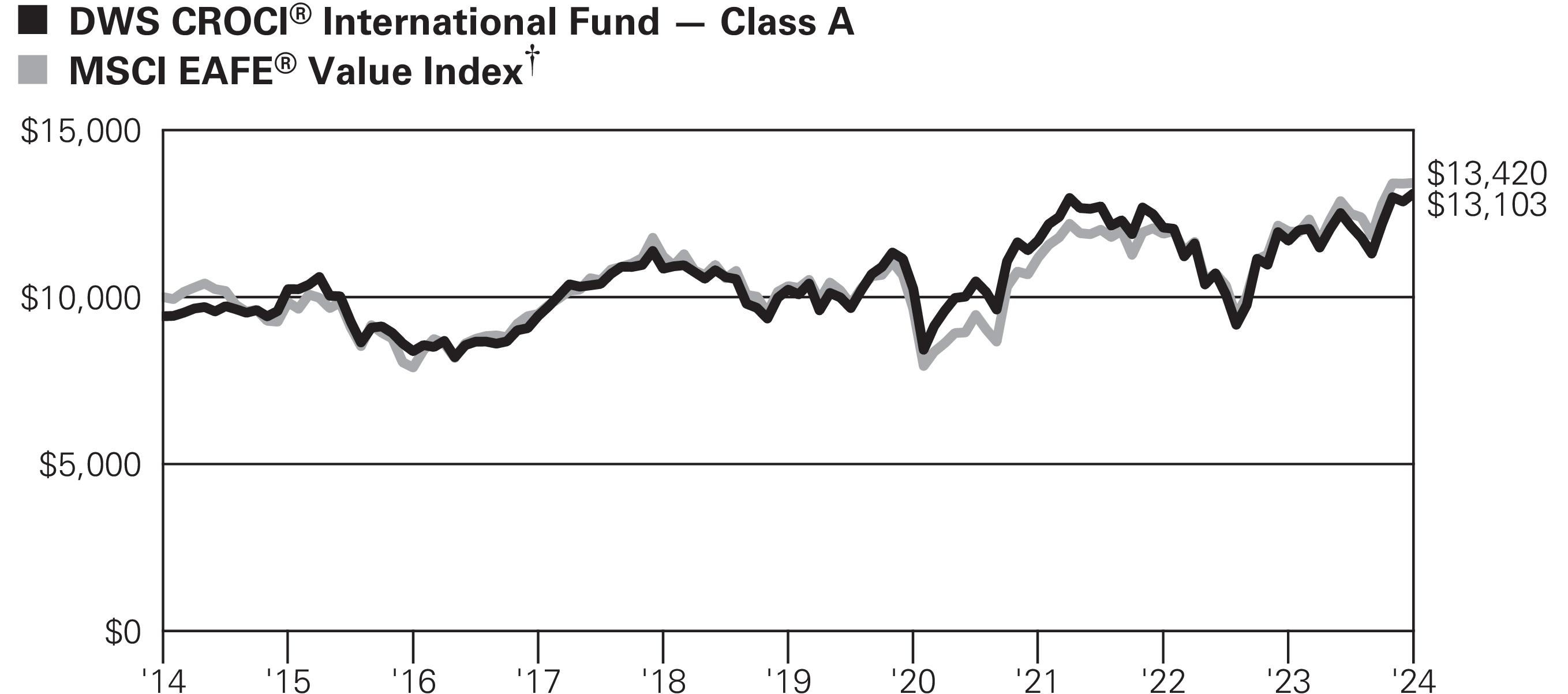

Yearly periods ended February 29

Yearly periods ended February 29