on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

Income from certain commodity-linked exchange-traded funds does not constitute “qualifying income” to the Fund. Receipt of such income could cause the Fund to be subject to tax at the Fund level. The IRS has issued a private letter ruling to the Fund stating that such income earned through its wholly owned Subsidiary constitutes qualifying income. The Fund is required to increase its taxable income by its share of the Subsidiary’s income, including net gains from commodity-linked transactions. Net investment losses of the Subsidiary cannot be deducted by the Fund in the current period nor carried forward to offset taxable income for future periods.

At October 31, 2023, the Fund had net tax basis capital loss carryforwards of $4,022,423 of long-term losses, which may be applied against realized net taxable capital gains indefinitely.

At April 30, 2024, the aggregate cost of investments for federal income tax purposes was $188,745,059. The net unrealized appreciation for all investments based on tax cost was $10,337,006. This consisted of aggregate gross unrealized appreciation for all investments for which there was an excess of value over tax cost of $20,647,853 and aggregate gross unrealized depreciation for all investments for which there was an excess of tax cost over value of $10,310,847.

The Fund has reviewed the tax positions for the open tax years as of October 31, 2023 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s consolidated financial statements. The Fund’s federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders quarterly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss, income received from passive foreign investment companies, investments in derivatives, premium amortization on debt securities, the realized tax character on distributions

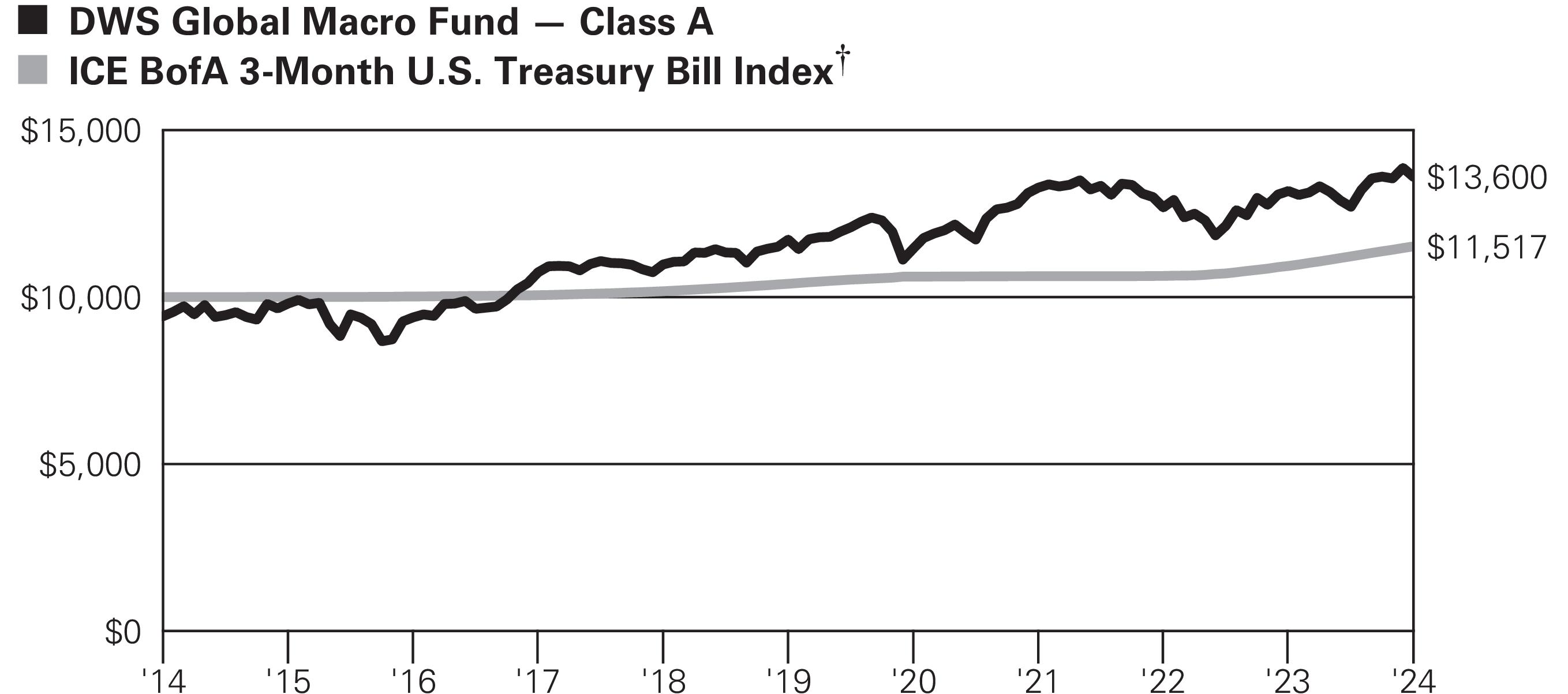

Yearly periods ended April 30

Yearly periods ended April 30