Three Months Ended September 30, 2018 Compared to Three Months Ended September 30, 2017

U.S. Business segment

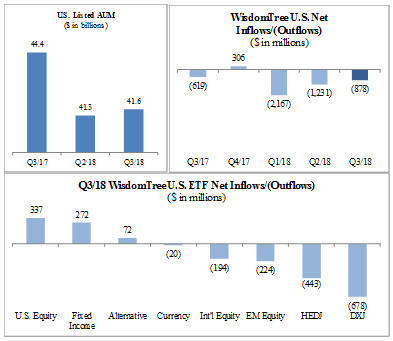

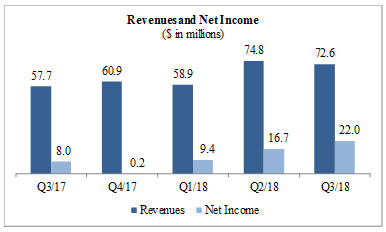

Operating revenues of the U.S. Business segment declined 8.2% from $54.9 million in the three months ended September 30, 2017 to $50.4 million in the comparable period in 2018. The decrease was due to lower average AUM and lower average U.S. listed advisory fees due to a change in product mix. Our average U.S. listed ETF advisory fee was 0.48% and 0.50% during the three months ended September 30, 2018 and September 30, 2017, respectively.

Operating expenses of the U.S. Business segment declined 8.3% from $36.8 million in the three months ended September 30, 2017 to $33.8 million in the comparable period in 2018 primarily due to lower incentive compensation and lower sales and business development. These decreases were partly offset by higher professional fees and higher third-party distribution fees. Headcount of our U.S. Business segment was 165 and 151 at September 30, 2017 and 2018, respectively.

Other income, net of the U.S. Business segment increased by 86.9%, from $0.5 million in the three months ended September 30, 2017 to $0.8 million in the comparable period in 2018, largely due to an insurance claim reimbursement recognized in the current period coupled with realized losses on our short-term investment grade bond portfolio recognized in the prior year.

International Business segment

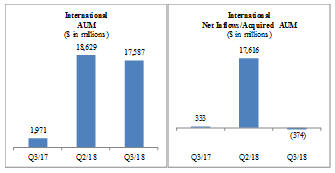

Operating revenues of the International Business segment increased $19.4 million, from $2.8 million in the three months ended September 30, 2017 to $22.2 million in the comparable period in 2018. This increase was attributable to higher average AUM primarily due to the $17.6 billion of AUM acquired in connection with the ETFS Acquisition.

Operating expenses of the International Business segment increased 202.8% from $5.6 million in the three months ended September 30, 2017 to $17.1 million in the comparable period in 2018, primarily due to the ETFS Acquisition. Fund management and administration expense and compensation expense increased due to higher average AUM and higher headcount, respectively. In addition, during the three months ended September 30, 2018 we recognized contractual gold payments expense of $2.9 million. Headcount of our International Business segment was 43 and 76 at September 30, 2017 and 2018, respectively.

Other income, net of the International Business segment was $5.0 million for the three months ended September 30, 2018, which was comprised of a gain on revaluation of deferred consideration of $7.7 million, partly offset by interest expense of $2.6 million incurred principally in connection with the Term Loan and other losses of $0.2 million.

Nine Months Ended September 30, 2018 Compared to Nine Months Ended September 30, 2017

U.S. Business segment

Operating revenues of the U.S. Business segment of $159.2 million was essentially unchanged from the nine months ended September 30, 2017, as higher average AUM was offset by lower average U.S. listed ETF advisory fees due to a change in product mix. Our average U.S. listed ETF advisory fee was 0.49% and 0.50% during the nine months ended September 30, 2018 and September 30, 2017, respectively.

Operating expenses of the U.S. Business segment increased 7.9% from $107.0 million in the nine months ended September 30, 2017 to $115.4 million in the comparable period in 2018. Included in the nine months ended September 30, 2018 were acquisition-related costs associated with the ETFS Acquisition of $8.2 million. These costs included professional advisor fees and integration costs. In addition, the increase was also attributable to higher professional fees, higher spending on sales related activities and higher third-party distribution fees expense due to a new distribution relationship announced in the fourth quarter of 2017. These increases were partly offset by lower incentive compensation.

Other income, net of the U.S. Business segment declined 78.2% from $8.9 million in the nine months ended September 30, 2017 to $2.0 million in the comparable period in 2018. This decline was principally due to the $6.9 million settlement gain which was recognized in June 2017.

International Business segment

Operating revenues of the International Business segment increased $39.6 million, from $7.5 million in the nine months ended September 30, 2017 to $47.1 million in the comparable period in 2018. This increase was attributable to higher average AUM which increased primarily due to $17.6 billion of AUM acquired in connection with the ETFS Acquisition.

Operating expenses of the International Business segment increased 151.4% from $16.4 million in the nine months ended September 30, 2017 to $41.3 million in the comparable period in 2018, primarily due to the ETFS Acquisition. Fund management and administration expense and compensation expense increased due to higher average AUM and higher headcount, respectively. In addition, during the nine months ended September 30, 2018 we recognized contractual gold payments expense of $5.6 million and acquisition-related costs of $2.2 million associated with the ETFS Acquisition.

47