UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6453

Fidelity Court Street Trust II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2007 |

Item 1. Reports to Stockholders

Fidelity®

Connecticut Municipal

Income Fund

and

Fidelity

Connecticut Municipal

Money Market Fund

Annual Report

November 30, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Fidelity Connecticut Municipal Income Fund |

Performance | <Click Here> | How the fund has done over time. |

Management's

Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Fidelity Connecticut Municipal Money Market Fund |

Investment Changes/

Performance | <Click Here> | A summary of major shifts in the fund's investments over the past six months and one year, and performance information. |

Investments | <Click Here> | A complete list of the fund's investments. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the Financial Statements |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Many stock and bond markets around the world have been unsettled of late; however, volatility can often lead to opportunity for patient investors. Financial markets are always unpredictable, but there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2007 to November 30, 2007).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

Shareholder Expense Example - continued

| Beginning

Account Value

June 1, 2007 | Ending

Account Value

November 30, 2007 | Expenses Paid

During Period*

June 1, 2007

to November 30, 2007 |

Fidelity Connecticut Municipal Income Fund | | | |

Actual | $ 1,000.00 | $ 1,031.10 | $ 2.39 |

HypotheticalA | $ 1,000.00 | $ 1,022.71 | $ 2.38 |

Fidelity Connecticut Municipal Money Market Fund | | | |

Actual | $ 1,000.00 | $ 1,016.10 | $ 2.43 |

HypotheticalA | $ 1,000.00 | $ 1,022.66 | $ 2.43 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Fidelity Connecticut Municipal Income Fund | .47% |

Fidelity Connecticut Municipal Money Market Fund | .48% |

Annual Report

Fidelity Connecticut Municipal Income Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

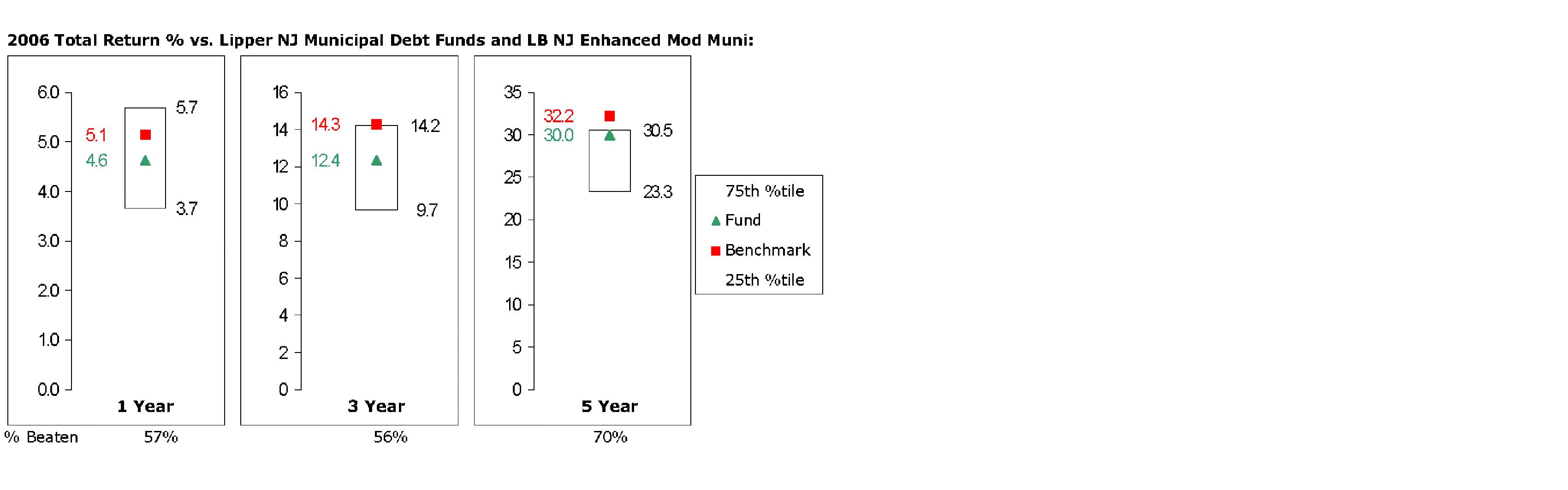

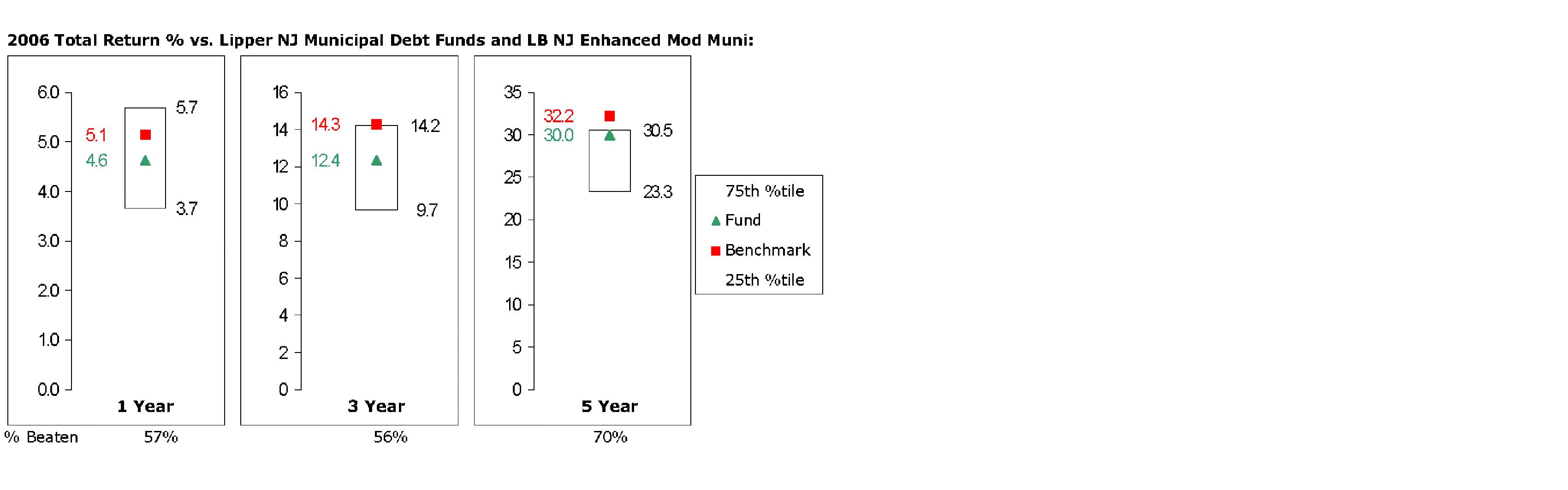

Average Annual Total Returns

Periods ended November 30, 2007 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® CT Municipal Income Fund | 3.08% | 4.11% | 4.88% |

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Connecticut Municipal Income Fund on November 30, 1997. The chart shows how the value of your investment would have changed, and also shows how the Lehman Brothers® Municipal Bond Index performed over the same period.

Annual Report

Fidelity Connecticut Municipal Income Fund

Management's Discussion of Fund Performance

Comments from Mark Sommer, Portfolio Manager of Fidelity® Connecticut Municipal Income Fund

Market volatility stemming from the subprime mortgage market crisis caused municipal bonds to post lackluster returns during the 12-month period ending November 30, 2007. While the crisis was initially centered in the taxable bond market, it spilled into the municipal market as participants pulled back the reins on risk-taking, in an overall flight-to-quality. Market liquidity suffered as broker/dealers reduced their municipal inventories and trading activity in response to increased municipal hedging costs. Both ends of the municipal credit spectrum felt the crunch. Lower-quality municipals came under pressure as high-yield funds experienced outflows for the first time in years. Insured muni bonds - considered to be among the highest quality in the fixed-income marketplace - suffered as investors questioned the financial strength and capital adequacy of muni bond insurers. Subprime mortgages again played a central role, as the market anticipated losses among insurers - to varying degrees - from their guarantees of securities backed by such mortgages. Insured muni bonds cheapened under this cloud of uncertainty. During the 12-month period, the Lehman Brothers® Municipal Bond Index - a performance measure of more than 42,000 investment-grade, fixed-rate, tax-exempt bonds - returned 2.71%. Meanwhile, the overall taxable market, as measured by the Lehman Brothers U.S. Aggregate Index, gained 6.05%.

During the past year, Fidelity Connecticut Municipal Income Fund gained 3.08%, while the Lehman Brothers Connecticut 4 Plus Year Enhanced Municipal Bond Index rose 3.32%. My focus on higher-quality bonds helped bolster returns, with most of the benefit coming in the second half of the period when investors gravitated toward higher-quality securities. Advantageous yield-curve positioning - which refers to my decision to overweight intermediate-maturity bonds and underweight longer-term bonds relative to the index - was another factor aiding the fund's returns. Although I emphasized bonds of various maturities at different points in time, I kept the fund's duration - - meaning its overall sensitivity to interest rates - in line with the index. By doing so, the impact of overall interest rate movements on the fund's relative performance was neutralized. My decision to avoid housing bonds aided the fund's performance relative to the index. Housing bonds lagged the overall Connecticut muni market on a duration-adjusted basis seemingly because of investors' growing dislike of riskier assets and the taint of the housing market slowdown. In contrast, my out-of-index stake in insured Puerto Rico bonds - which are free from state and federal taxes - proved detrimental. They came under pressure in response to worries over the territory's deteriorating credit and concerns about muni bond insurers.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Connecticut Municipal Income Fund

Investment Changes

Top Five Sectors as of November 30, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

General Obligations | 36.0 | 31.0 |

Special Tax | 16.8 | 15.0 |

Escrowed/Pre-Refunded | 12.7 | 20.2 |

Health Care | 9.0 | 7.8 |

Education | 6.7 | 6.6 |

Weighted Average Maturity as of November 30, 2007 |

| | 6 months ago |

Years | 7.0 | 6.8 |

The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision. |

Duration as of November 30, 2007 |

| | 6 months ago |

Years | 6.2 | 5.8 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

Quality Diversification (% of fund's net assets) |

As of November 30, 2007 | As of May 31, 2007 |

| AAA 79.7% | |  | AAA 75.4% | |

| AA,A 15.7% | |  | AA,A 18.8% | |

| BBB 2.3% | |  | BBB 2.3% | |

| BB and Below 0.1% | |  | BB and Below 0.1% | |

| Not Rated 0.7% | |  | Not Rated 1.8% | |

| Short-Term

Investments and

Net Other Assets 1.5% | |  | Short-Term

Investments and

Net Other Assets 1.6% | |

We have used ratings from Moody's® Investors Services, Inc. Where Moody's ratings are not available, we have used S&P® ratings. |

Annual Report

Fidelity Connecticut Municipal Income Fund

Investments November 30, 2007

Showing Percentage of Net Assets

Municipal Bonds - 98.5% |

| Principal Amount | | Value |

Connecticut - 85.1% |

Branford Gen. Oblig. 5.25% 5/15/13 (MBIA Insured) | | $ 500,000 | | $ 537,530 |

Bridgeport Gen. Oblig.: | | | | |

Series 2001 C: | | | | |

5.375% 8/15/12 (Pre-Refunded to 8/15/11 @ 100) (c) | | 3,290,000 | | 3,536,125 |

5.375% 8/15/14 (Pre-Refunded to 8/15/11 @ 100) (c) | | 1,205,000 | | 1,295,146 |

Series 2002 A, 5.375% 8/15/19 (FGIC Insured) | | 3,000,000 | | 3,209,220 |

Series 2004 A, 5.25% 8/15/16 (MBIA Insured) | | 1,320,000 | | 1,440,265 |

Series 2006 B: | | | | |

5% 12/1/14 (FSA Insured) | | 1,655,000 | | 1,808,799 |

5% 12/1/17 (FSA Insured) | | 1,830,000 | | 1,998,799 |

5% 12/1/18 (FSA Insured) | | 1,635,000 | | 1,774,139 |

Cap. City Econ. Dev. Auth. Series 2004 A, 5% 6/15/15 (FSA Insured) | | 1,705,000 | | 1,845,833 |

Connecticut Arpt. Rev. (Bradley Int'l. Arpt. Proj.) Series A: | | | | |

5.125% 10/1/31 (FGIC Insured) (b) | | 5,865,000 | | 5,956,494 |

5.25% 10/1/11 (FGIC Insured) (b) | | 4,150,000 | | 4,390,742 |

5.25% 10/1/12 (FGIC Insured) (b) | | 4,075,000 | | 4,310,535 |

Connecticut Clean Wtr. Fund Rev. 6% 10/1/12 | | 6,000,000 | | 6,527,640 |

Connecticut Dev. Auth. Poll. Cont. Rev. (United Illuminating Co. Proj.) 3%, tender 2/1/09 (a) | | 3,240,000 | | 3,202,222 |

Connecticut Dev. Auth. Wtr. Facilities Rev.: | | | | |

(Aquatron Wtr. Corp., Proj.) 4.7% 7/1/36 (XL Cap. Assurance, Inc. Insured) (b) | | 5,000,000 | | 4,700,650 |

(Bridgeport Hydraulic Proj.) 6.15% 4/1/35 (MBIA Insured) (b) | | 3,000,000 | | 3,063,870 |

Connecticut Gen. Oblig.: | | | | |

Series 2001 D: | | | | |

5.125% 11/15/15 (Pre-Refunded to 11/15/11 @ 100) (c) | | 3,215,000 | | 3,438,893 |

5.125% 11/15/18 (Pre-Refunded to 11/15/11 @ 100) (c) | | 5,995,000 | | 6,412,492 |

Series 2002 D, 5.375% 11/15/21 (Pre-Refunded to 11/15/12 @ 100) (c) | | 5,000,000 | | 5,472,050 |

Series 2002 E, 5.5% 11/15/12 (FSA Insured) | | 3,000,000 | | 3,300,210 |

Series 2003 E, 5.25% 8/15/17 (Pre-Refunded to 8/15/13 @ 100) (c) | | 3,295,000 | | 3,620,546 |

Series 2004 A, 5% 3/1/15 (MBIA Insured) | | 5,000,000 | | 5,413,900 |

Series A, 5% 12/15/15 (FSA Insured) | | 2,000,000 | | 2,206,880 |

Series B: | | | | |

5% 6/1/15 (MBIA Insured) | | 7,500,000 | | 8,143,425 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Gen. Oblig.: - continued | | | | |

Series B: | | | | |

5.25% 6/1/18 (AMBAC Insured) | | $ 3,150,000 | | $ 3,539,183 |

5.25% 6/1/19 (AMBAC Insured) | | 10,000,000 | | 11,240,500 |

5.25% 6/1/20 (AMBAC Insured) | | 16,915,000 | | 19,048,481 |

5.375% 6/15/18 (Pre-Refunded to 6/15/11 @ 100) (c) | | 5,000,000 | | 5,354,850 |

Series C, 5% 6/1/13 | | 5,000,000 | | 5,400,100 |

Series D: | | | | |

5% 11/1/15 | | 5,005,000 | | 5,497,642 |

5.375% 11/15/16 (Pre-Refunded to 11/15/12 @ 100) (c) | | 5,000,000 | | 5,472,050 |

5.375% 11/15/18 (Pre-Refunded to 11/15/12 @ 100) (c) | | 5,000,000 | | 5,472,050 |

Series E, 5% 12/15/16 | | 3,020,000 | | 3,331,151 |

Series F, 5% 12/1/21 | | 2,000,000 | | 2,145,080 |

Connecticut Gen. Oblig. Rev. (Revolving Fund Ln. Prog.) Series 2003 A, 5% 10/1/17 | | 2,000,000 | | 2,140,360 |

Connecticut Health & Edl. Facilities Auth. Rev.: | | | | |

(Danbury Hosp. Proj.) Series G, 5.625% 7/1/25 (AMBAC Insured) | | 4,695,000 | | 4,887,730 |

(Eastern Connecticut Health Network Proj.) 5.125% 7/1/30 | | 1,500,000 | | 1,467,555 |

(Hebrew Home & Hosp. Proj.) Series B: | | | | |

5.15% 8/1/28 | | 2,255,000 | | 2,300,213 |

5.2% 8/1/38 | | 4,190,000 | | 4,246,691 |

(Hosp. for Spl. Care Proj.) Series C, 5.25% 7/1/19 (Radian Asset Assurance, Inc. Insured) | | 1,170,000 | | 1,209,078 |

(Loomis Chaffee School Proj.): | | | | |

Series C, 5.5% 7/1/26 (MBIA Insured) | | 610,000 | | 613,794 |

Series E, 5% 7/1/25 | | 1,000,000 | | 1,034,200 |

(Lutheran Gen. Health Care Sys. Proj.) 7.375% 7/1/19 (Escrowed to Maturity) (c) | | 2,795,000 | | 3,366,885 |

(New Britain Gen. Hosp. Proj.) Series B, 6% 7/1/24 (AMBAC Insured) | | 1,940,000 | | 1,942,173 |

(Saint Raphael Hosp. Proj.) Series H: | | | | |

5.25% 7/1/14 (AMBAC Insured) | | 4,050,000 | | 4,447,832 |

6.5% 7/1/13 (AMBAC Insured) | | 3,125,000 | | 3,597,500 |

(Yale Univ. Proj.): | | | | |

Series W, 5.125% 7/1/27 | | 13,000,000 | | 13,232,180 |

Series X1, 5% 7/1/42 | | 14,015,000 | | 14,349,538 |

(Yale-New Haven Hosp. Proj.) Series J-1: | | | | |

5% 7/1/17 (AMBAC Insured) | | 3,095,000 | | 3,362,099 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Health & Edl. Facilities Auth. Rev.: - continued | | | | |

(Yale-New Haven Hosp. Proj.) Series J-1: | | | | |

5% 7/1/18 (AMBAC Insured) | | $ 3,020,000 | | $ 3,259,999 |

5% 7/1/19 (AMBAC Insured) | | 2,035,000 | | 2,184,450 |

5% 7/1/31 (AMBAC Insured) | | 7,000,000 | | 7,246,400 |

Connecticut Higher Ed. Supplemental Ln. Auth. Rev. (Family Ed. Ln. Prog.) Series A, 5.5% 11/15/09 (b) | | 350,000 | | 349,479 |

Connecticut Muni. Elec. Energy Coop. Pwr. Supply Sys. Rev. Series A, 5% 1/1/12 (AMBAC Insured) | | 1,520,000 | | 1,614,696 |

Connecticut Resource Recovery Auth. Resource Recovery Rev. (Fuel Co. Proj.) Series A: | | | | |

5.125% 11/15/13 (MBIA Insured) (b) | | 3,000,000 | | 3,069,930 |

5.5% 11/15/09 (MBIA Insured) (b) | | 5,500,000 | | 5,655,980 |

Connecticut Spl. Tax Oblig. Rev. (Trans. Infrastructure Proj.): | | | | |

Series A: | | | | |

5% 7/1/15 (MBIA Insured) | | 5,010,000 | | 5,471,120 |

5% 7/1/18 (AMBAC Insured) | | 2,000,000 | | 2,149,780 |

5% 7/1/23 (AMBAC Insured) | | 3,260,000 | | 3,434,051 |

5% 8/1/27 (AMBAC Insured) | | 2,000,000 | | 2,111,180 |

7.125% 6/1/10 | | 3,550,000 | | 3,738,257 |

Series B: | | | | |

5% 1/1/15 (FGIC Insured) | | 8,910,000 | | 9,620,038 |

5.25% 7/1/16 (AMBAC Insured) | | 7,645,000 | | 8,520,353 |

6.125% 9/1/12 | | 7,130,000 | | 7,738,902 |

6.5% 10/1/12 | | 7,100,000 | | 8,074,262 |

Fairfield Gen. Oblig. 5% 1/1/14 | | 1,835,000 | | 2,000,077 |

Greater New Haven Wtr. Poll. Cont. Auth. Reg'l. Wastewtr. Sys. Rev. Series A, 5% 8/15/35 (MBIA Insured) | | 1,000,000 | | 1,035,760 |

Hartford Gen. Oblig.: | | | | |

Series 2005 D: | | | | |

5% 9/1/19 (MBIA Insured) | | 1,700,000 | | 1,819,102 |

5% 9/1/22 (MBIA Insured) | | 1,700,000 | | 1,801,643 |

Series A, 5.25% 8/1/15 (FSA Insured) | | 1,335,000 | | 1,484,013 |

Naugatuck Ctfs. of Prtn. (Incineration Facilities Proj.) Series A: | | | | |

5% 6/15/14 (AMBAC Insured) (b) | | 1,335,000 | | 1,401,042 |

5% 6/15/17 (AMBAC Insured) (b) | | 775,000 | | 808,751 |

Naugatuck Gen. Oblig. 5.875% 2/15/21 (AMBAC Insured) | | 3,105,000 | | 3,455,710 |

New Britain Gen. Oblig.: | | | | |

Series B, 6% 3/1/12 (MBIA Insured) | | 2,000,000 | | 2,123,460 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Connecticut - continued |

New Britain Gen. Oblig.: - continued | | | | |

6% 2/1/12 (MBIA Insured) | | $ 5,000 | | $ 5,508 |

New Haven Air Rights Parking Facility Rev. 5.375% 12/1/11 (AMBAC Insured) | | 1,165,000 | | 1,254,204 |

New Haven Gen. Oblig.: | | | | |

Series C, 5.125% 11/1/16 (Escrowed to Maturity) (c) | | 30,000 | | 33,483 |

5% 2/1/14 (MBIA Insured) | | 2,080,000 | | 2,252,536 |

5% 2/1/15 (MBIA Insured) | | 1,705,000 | | 1,857,683 |

5% 11/1/15 (AMBAC Insured) | | 2,575,000 | | 2,826,603 |

5% 11/1/16 (AMBAC Insured) | | 6,000,000 | | 6,610,920 |

5% 2/1/20 (MBIA Insured) | | 1,925,000 | | 2,047,353 |

5% 2/1/20 (Pre-Refunded to 2/1/15 @ 100) (c) | | 505,000 | | 553,228 |

New Milford Gen. Oblig.: | | | | |

5% 1/15/15 (AMBAC Insured) | | 1,025,000 | | 1,117,640 |

5% 1/15/16 (AMBAC Insured) | | 1,025,000 | | 1,122,867 |

5% 1/15/17 (AMBAC Insured) | | 1,025,000 | | 1,126,393 |

South Central Reg'l. Wtr. Auth. Wtr. Sys. Rev.: | | | | |

18th Series B1, 5% 8/1/28 (MBIA Insured) | | 4,655,000 | | 4,830,680 |

Series A: | | | | |

5.25% 8/1/19 (MBIA Insured) | | 1,020,000 | | 1,144,879 |

5.25% 8/1/21 (MBIA Insured) | | 2,795,000 | | 3,144,012 |

Stamford Gen. Oblig.: | | | | |

5.25% 7/15/12 | | 2,810,000 | | 2,843,804 |

5.25% 7/15/14 | | 6,565,000 | | 7,180,403 |

5.25% 7/15/15 | | 3,000,000 | | 3,270,030 |

5.25% 2/1/21 (Pre-Refunded to 2/1/14 @ 100) (c) | | 1,045,000 | | 1,150,900 |

5.25% 2/1/24 (Pre-Refunded to 2/1/14 @ 100) (c) | | 1,070,000 | | 1,178,434 |

5.5% 7/15/13 | | 2,675,000 | | 2,921,127 |

5.5% 7/15/14 | | 1,250,000 | | 1,363,900 |

Stamford Hsg. Auth. Multi-family Rev. (Fairfield Apts. Proj.) 4.75%, tender 12/1/08 (a)(b) | | 6,000,000 | | 6,046,920 |

Trumbull Gen. Oblig. 5% 1/15/17 (AMBAC Insured) | | 1,100,000 | | 1,177,528 |

Univ. of Connecticut Series A, 5% 1/15/17 (MBIA Insured) | | 2,000,000 | | 2,140,960 |

Watertown Gen. Oblig. 5% 8/1/18 (MBIA Insured) | | 1,060,000 | | 1,149,263 |

West Hartford Gen. Oblig. Series A: | | | | |

5% 1/15/14 | | 1,135,000 | | 1,237,672 |

5% 1/15/15 | | 1,135,000 | | 1,236,764 |

5% 1/15/16 | | 1,135,000 | | 1,229,784 |

West Haven Gen. Oblig. 5% 7/1/15 (MBIA Insured) | | 2,480,000 | | 2,713,418 |

| | 373,242,651 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Guam - 0.3% |

Guam Ed. Fing. Foundation Series A, 5% 10/1/14 | | $ 1,000,000 | | $ 1,049,390 |

Guam Wtrwks. Auth. Wtr. and Wastewtr. Sys. Rev. 5.875% 7/1/35 | | 470,000 | | 488,885 |

| | 1,538,275 |

Puerto Rico - 12.9% |

Puerto Rico Commonwealth Gen. Oblig.: | | | | |

(Pub. Impt. Proj.): | | | | |

Series 2002 A, 5.5% 7/1/20 (MBIA Insured) | | 2,000,000 | | 2,245,640 |

Series A, 5.5% 7/1/19 (MBIA Insured) | | 2,000,000 | | 2,244,120 |

Series A, 5.5% 7/1/18 (MBIA Insured) | | 6,820,000 | | 7,657,155 |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Hwy. Rev.: | | | | |

Series 1996 Y, 5% 7/1/36 (Pre-Refunded to 7/1/16 @ 100) (c) | | 2,950,000 | | 3,263,674 |

Series 1998 AA, 5.5% 7/1/19 (MBIA Insured) | | 2,500,000 | | 2,829,725 |

Series BB, 5.25% 7/1/18 (AMBAC Insured) | | 3,000,000 | | 3,331,560 |

Series Y, 5.5% 7/1/36 (Pre-Refunded to 7/1/16 @ 100) (c) | | 1,500,000 | | 1,714,515 |

Series Z, 6.25% 7/1/15 (MBIA Insured) | | 1,000,000 | | 1,165,590 |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev.: | | | | |

Series E, 5.5% 7/1/17 (FSA Insured) | | 5,400,000 | | 6,144,660 |

Series N, 5.25% 7/1/34 | | 1,500,000 | | 1,624,395 |

Puerto Rico Commonwealth Infrastructure Fing. Auth.: | | | | |

Series 2000 A, 5.5% 10/1/40 (Escrowed to Maturity) (c) | | 4,565,000 | | 4,841,867 |

Series 2005 C, 5.5% 7/1/17 (AMBAC Insured) | | 6,010,000 | | 6,736,128 |

Puerto Rico Elec. Pwr. Auth. Pwr. Rev.: | | | | |

Series JJ, 5.25% 7/1/15 (MBIA Insured) | | 5,000,000 | | 5,466,150 |

Series QQ: | | | | |

5.25% 7/1/14 (XL Cap. Assurance, Inc. Insured) | | 1,300,000 | | 1,420,536 |

5.5% 7/1/18 (XL Cap. Assurance, Inc. Insured) | | 800,000 | | 905,560 |

Series VV, 5.25% 7/1/24 (FGIC Insured) | | 2,500,000 | | 2,738,800 |

Puerto Rico Muni. Fin. Agcy. Series 2005 C, 5.25% 8/1/17 (FSA Insured) | | 2,000,000 | | 2,237,600 |

| | 56,567,675 |

Municipal Bonds - continued |

| Principal Amount | | Value |

Virgin Islands - 0.2% |

Virgin Islands Pub. Fin. Auth. Refinery Facilities Rev. 4.7% 7/1/22 (b) | | $ 1,100,000 | | $ 1,041,018 |

TOTAL INVESTMENT PORTFOLIO - 98.5% (Cost $422,185,886) | | 432,389,619 |

NET OTHER ASSETS - 1.5% | | 6,453,008 |

NET ASSETS - 100% | $ 438,842,627 |

Swap Agreements |

| Expiration Date | | Notional Amount | | |

Interest Rate Swaps |

Receive quarterly a floating rate based on BMA Municipal Swap Index and pay quarterly a fixed rate equal to 3.847% with Citibank | Dec. 2018 | | $ 6,000,000 | | $ 191,421 |

Legend |

(a) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(b) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

(c) Security collateralized by an amount sufficient to pay interest and principal. |

Other Information |

The distribution of municipal securities by revenue source, as a percentage of total net assets, is as follows: |

General Obligations | 36.0% |

Special Tax | 16.8% |

Escrowed/Pre-Refunded | 12.7% |

Health Care | 9.0% |

Education | 6.7% |

Electric Utilities | 5.3% |

Others* (individually less than 5%) | 13.5% |

| 100.0% |

*Includes net other assets |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Connecticut Municipal Income Fund

Financial Statements

Statement of Assets and Liabilities

| November 30, 2007 |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $422,185,886) | | $ 432,389,619 |

Cash | | 40,176 |

Receivable for fund shares sold | | 156,886 |

Interest receivable | | 7,033,276 |

Swap agreements, at value | | 191,421 |

Other receivables | | 16,180 |

Total assets | | 439,827,558 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 349,746 | |

Distributions payable | 390,772 | |

Accrued management fee | 132,804 | |

Other affiliated payables | 68,954 | |

Other payables and accrued expenses | 42,655 | |

Total liabilities | | 984,931 |

| | |

Net Assets | | $ 438,842,627 |

Net Assets consist of: | | |

Paid in capital | | $ 427,217,317 |

Distributions in excess of net investment income | | (3,625) |

Accumulated undistributed net realized gain (loss) on investments | | 1,233,781 |

Net unrealized appreciation (depreciation) on investments | | 10,395,154 |

Net Assets, for 38,781,699 shares outstanding | | $ 438,842,627 |

Net Asset Value, offering price and redemption price per share ($438,842,627 ÷ 38,781,699 shares) | | $ 11.32 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended November 30, 2007 |

| | |

Investment Income | | |

Interest | | $ 18,630,904 |

| | |

Expenses | | |

Management fee | $ 1,595,207 | |

Transfer agent fees | 290,302 | |

Accounting fees and expenses | 112,465 | |

Custodian fees and expenses | 6,316 | |

Independent trustees' compensation | 1,524 | |

Registration fees | 22,851 | |

Audit | 53,701 | |

Legal | 4,970 | |

Miscellaneous | 3,711 | |

Total expenses before reductions | 2,091,047 | |

Expense reductions | (155,400) | 1,935,647 |

Net investment income | | 16,695,257 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 1,226,091 |

Change in net unrealized appreciation (depreciation) on: Investment securities | (5,190,743) | |

Swap agreements | 191,421 | |

Total change in net unrealized appreciation (depreciation) | | (4,999,322) |

Net gain (loss) | | (3,773,231) |

Net increase (decrease) in net assets resulting from operations | | $ 12,922,026 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Connecticut Municipal Income Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

November 30,

2007 | Year ended

November 30,

2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 16,695,257 | $ 16,663,488 |

Net realized gain (loss) | 1,226,091 | 3,281,822 |

Change in net unrealized appreciation (depreciation) | (4,999,322) | 1,728,089 |

Net increase (decrease) in net assets resulting

from operations | 12,922,026 | 21,673,399 |

Distributions to shareholders from net investment income | (16,680,792) | (16,651,892) |

Distributions to shareholders from net realized gain | (3,007,749) | (3,980,932) |

Total distributions | (19,688,541) | (20,632,824) |

Share transactions

Proceeds from sales of shares | 94,055,713 | 71,533,839 |

Reinvestment of distributions | 13,980,532 | 14,699,737 |

Cost of shares redeemed | (95,216,677) | (88,973,643) |

Net increase (decrease) in net assets resulting from share transactions | 12,819,568 | (2,740,067) |

Redemption fees | 4,473 | 1,298 |

Total increase (decrease) in net assets | 6,057,526 | (1,698,194) |

| | |

Net Assets | | |

Beginning of period | 432,785,101 | 434,483,295 |

End of period (including distributions in excess of net investment income of $3,625 and undistributed net investment income of $2,333, respectively) | $ 438,842,627 | $ 432,785,101 |

Other Information Shares | | |

Sold | 8,371,215 | 6,307,680 |

Issued in reinvestment of distributions | 1,241,280 | 1,295,433 |

Redeemed | (8,491,502) | (7,859,270) |

Net increase (decrease) | 1,120,993 | (256,157) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

| | | | | |

Years ended November 30, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.49 | $ 11.46 | $ 11.68 | $ 11.91 | $ 11.69 |

Income from Investment Operations | | | | | |

Net investment income B | .431 | .443 | .461 | .477 | .489 |

Net realized and unrealized gain (loss) | (.090) | .135 | (.146) | (.115) | .253 |

Total from investment operations | .341 | .578 | .315 | .362 | .742 |

Distributions from net investment income | (.431) | (.443) | (.460) | (.477) | (.487) |

Distributions from net realized gain | (.080) | (.105) | (.075) | (.115) | (.035) |

Total distributions | (.511) | (.548) | (.535) | (.592) | (.522) |

Redemption fees added to paid in capital B, D | - | - | - | - | - |

Net asset value, end of period | $ 11.32 | $ 11.49 | $ 11.46 | $ 11.68 | $ 11.91 |

Total Return A | 3.08% | 5.21% | 2.72% | 3.11% | 6.45% |

Ratios to Average Net Assets C | | | | | |

Expenses before reductions | .48% | .48% | .49% | .49% | .50% |

Expenses net of fee waivers,

if any | .48% | .48% | .49% | .49% | .50% |

Expenses net of all reductions | .44% | .42% | .47% | .48% | .49% |

Net investment income | 3.84% | 3.91% | 3.96% | 4.05% | 4.11% |

Supplemental Data | | | | | |

Net assets, end of period

(000 omitted) | $ 438,843 | $ 432,785 | $ 434,483 | $ 426,783 | $ 438,534 |

Portfolio turnover rate | 11% | 23% | 16% | 12% | 14% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

D Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Connecticut Municipal Money Market Fund

Investment Changes/Performance

Maturity Diversification |

Days | % of fund's investments 11/30/07 | % of fund's investments 5/31/07 | % of fund's investments 11/30/06 |

0 - 30 | 78.5 | 89.1 | 89.4 |

31 - 90 | 2.4 | 3.6 | 1.7 |

91 - 180 | 4.4 | 4.7 | 2.8 |

181 - 397 | 14.7 | 2.6 | 6.1 |

Weighted Average Maturity |

| 11/30/07 | 5/31/07 | 11/30/06 |

Fidelity Connecticut Municipal Money Market Fund | 47 Days | 22 Days | 29 Days |

Connecticut Tax-Free Money Market Funds Average* | 40 Days | 27 Days | 29 Days |

Asset Allocation (% of fund's net assets) |

As of November 30, 2007 | As of May 31, 2007 |

| Variable Rate

Demand Notes

(VRDNs) 72.3% | |  | Variable Rate

Demand Notes

(VRDNs) 86.9% | |

| Commercial Paper

(including CP Mode) 3.4% | |  | Commercial Paper

(including CP Mode) 3.9% | |

| Tender Bonds 3.2% | |  | Tender Bonds 2.2% | |

| Municipal Notes 15.1% | |  | Municipal Notes 4.8% | |

| Fidelity Municipal

Cash Central Fund 2.7% | |  | Fidelity Municipal

Cash Central Fund 0.0% | |

| Other Investments 0.6% | |  | Other Investments 0.5% | |

| Net Other Assets 2.7% | |  | Net Other Assets 1.7% | |

Current and Historical Seven-Day Yields |

| 12/3/07 | 9/3/07 | 5/28/07 | 2/26/07 | 11/27/06 |

Fidelity Connecticut Municipal Money Market Fund | 3.13% | 3.46% | 3.37% | 3.19% | 3.19% |

If Fidelity had not reimbursed certain fund expenses | 3.13% | 3.46% | 3.37% | 3.13% | 3.18% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it is possible to lose money by investing in the fund.

*Source: iMoneyNet, Inc.

Annual Report

Fidelity Connecticut Municipal Money Market Fund

Investments November 30, 2007

Showing Percentage of Net Assets

Municipal Securities - 97.3% |

| Principal Amount | | Value |

Connecticut - 82.2% |

Bridgeport Gen. Oblig.: | | | |

Participating VRDN: | | | |

Series ROC II R 182, 3.67% (Liquidity Facility Citibank NA) (b)(f) | $ 2,865,000 | | $ 2,865,000 |

Series ROC II R 45, 3.67% (Liquidity Facility Citibank NA) (b)(f) | 10,110,000 | | 10,110,000 |

TAN 3.65% 2/1/08 (a) | 19,300,000 | | 19,301,930 |

Connecticut Gen. Oblig. Participating VRDN Series PT 4135, 3.67% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 8,550,000 | | 8,550,000 |

Connecticut Arpt. Rev. Participating VRDN Series MSTC 01 129, 3.68% (Liquidity Facility Bear Stearns Companies, Inc.) (b)(e)(f) | 17,915,000 | | 17,915,000 |

Connecticut Dev. Auth. Health Care Rev. (Corp. for Independent Living Proj.): | | | |

Series 1990, 3.53%, LOC HSBC Bank USA, VRDN (b) | 28,600,000 | | 28,600,000 |

Series 1999, 3.53%, LOC HSBC Bank USA, VRDN (b) | 1,880,000 | | 1,880,000 |

Connecticut Dev. Auth. Poll. Cont. Rev. Bonds (New England Pwr. Co. Proj.) Series 1999: | | | |

3.55% tender 2/14/08, CP mode | 10,900,000 | | 10,900,000 |

3.65% tender 12/12/07, CP mode | 7,500,000 | | 7,500,000 |

Connecticut Gen. Oblig.: | | | |

Participating VRDN: | | | |

Series 1518, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 24,365,000 | | 24,365,000 |

Series 75, 3.64% (Liquidity Facility Goldman Sachs Group, Inc.) (b)(f) | 2,975,000 | | 2,975,000 |

Series BA 02 A, 3.63% (Liquidity Facility Bank of America NA) (b)(f) | 4,815,000 | | 4,815,000 |

Series Floaters 01 681, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 10,200,000 | | 10,200,000 |

Series LB 07 P30W, 3.73% (Liquidity Facility Lehman Brothers Hldgs., Inc.) (b)(f) | 17,665,000 | | 17,665,000 |

Series MS 00 514, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 9,695,000 | | 9,695,000 |

Series MS 01 1395, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 16,000,000 | | 16,000,000 |

Series MS 01 571, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 24,415,000 | | 24,415,000 |

Series MS 06 2139, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 5,555,000 | | 5,555,000 |

Series MS 1053, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 22,835,000 | | 22,835,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Gen. Oblig.: - continued | | | |

Participating VRDN: | | | |

Series MSTC 7008, 3.65% (Liquidity Facility Bear Stearns Companies, Inc.) (b)(f) | $ 5,000,000 | | $ 5,000,000 |

Series PA 888R, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 4,995,000 | | 4,995,000 |

Series PT 1409, 3.66% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 12,240,000 | | 12,240,000 |

Series PT 2223, 3.66% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 10,675,000 | | 10,675,000 |

Series PT 2532, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 5,265,000 | | 5,265,000 |

Series PT 2693, 3.61% (Liquidity Facility Dexia Cr. Local de France) (b)(f) | 44,160,000 | | 44,160,000 |

Series PT 4118, 3.67% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 25,260,000 | | 25,260,000 |

Series Putters 1550, 3.6% (Liquidity Facility JPMorgan Chase Bank) (b)(f) | 6,850,000 | | 6,850,000 |

Series Putters 1786, 3.6% (Liquidity Facility JPMorgan Chase & Co.) (b)(f) | 8,930,000 | | 8,930,000 |

Series Putters 2023, 3.6% (Liquidity Facility JPMorgan Chase & Co.) (b)(f) | 17,445,000 | | 17,445,000 |

Series Putters 2111, 3.6% (Liquidity Facility JPMorgan Chase Bank) (b)(f) | 23,600,000 | | 23,600,000 |

Series Putters 320, 3.6% (Liquidity Facility JPMorgan Chase & Co.) (b)(f) | 6,570,000 | | 6,570,000 |

Series ROC II R 10174, 3.64% (Liquidity Facility Citibank NA) (b)(f) | 8,810,000 | | 8,810,000 |

Series ROC II R 10192, 3.64% (Liquidity Facility Citigroup, Inc.) (b)(f) | 8,780,000 | | 8,780,000 |

Series ROC II R 10274, 3.63% (Liquidity Facility Dexia Cr. Local de France) (b)(f) | 9,230,000 | | 9,230,000 |

Series ROC II R 1064, 3.64% (Liquidity Facility Citigroup, Inc.) (b)(f) | 6,700,000 | | 6,700,000 |

Series ROC II R 3013, 3.64% (Liquidity Facility Citigroup, Inc.) (b)(f) | 5,210,000 | | 5,210,000 |

Series ROC II R 4009, 3.67% (Liquidity Facility Citigroup, Inc.) (b)(f) | 18,535,000 | | 18,535,000 |

Series ROC II R 4048, 3.67% (Liquidity Facility Citigroup, Inc.) (b)(f) | 5,150,000 | | 5,150,000 |

Series 2004 A, 3.62% (Liquidity Facility Landesbank Hessen-Thuringen), VRDN (b) | 33,970,000 | | 33,970,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

Bonds: | | | |

(Yale Univ. Proj.): | | | |

Series S-1, 3.74% tender 12/21/07, CP mode | $ 10,000,000 | | $ 10,000,000 |

Series S-2: | | | |

3.4% tender 3/11/08, CP mode | 10,690,000 | | 10,690,000 |

3.4% tender 3/12/08, CP mode | 2,700,000 | | 2,700,000 |

3.4% tender 3/12/08, CP mode | 10,380,000 | | 10,380,000 |

Series PT 905, 3.73%, tender 3/6/08 (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f)(g) | 36,280,000 | | 36,280,000 |

Participating VRDN: | | | |

Series AAB 05 59, 3.64% (Liquidity Facility Bank of America NA) (b)(f) | 18,995,000 | | 18,995,000 |

Series EGL 02 6027 Class A, 3.64% (Liquidity Facility Bayerische Landesbank (UNGTD)) (b)(f) | 19,805,000 | | 19,805,000 |

Series EGL 04 19 Class A, 3.65% (Liquidity Facility Citibank NA) (b)(f) | 14,850,000 | | 14,850,000 |

Series LB 05 K6, 3.72% (Liquidity Facility Lehman Brothers Hldgs., Inc.) (b)(f) | 9,230,000 | | 9,230,000 |

Series MS 06 1884, 3.65% (Liquidity Facility Wells Fargo & Co.) (b)(f) | 10,930,000 | | 10,930,000 |

Series MS 2097, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 9,730,000 | | 9,730,000 |

Series MS 2098, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 19,465,000 | | 19,465,000 |

(Greenwich Family YMCA Proj.) Series A, 3.61%, LOC Bank of New York, New York, VRDN (b) | 11,500,000 | | 11,500,000 |

(Hartford Hosp. Proj.) Series B, 3.57%, LOC Bank of America NA, VRDN (b) | 14,210,000 | | 14,210,000 |

(Masonicare Corp. Proj.) Series C, 3.6%, LOC Wachovia Bank NA, VRDN (b) | 19,900,000 | | 19,900,000 |

(Sacred Heart Univ. Proj.) 3.59%, LOC Bank of America NA, VRDN (b) | 8,420,000 | | 8,420,000 |

(Univ. of Bridgeport Proj.) Series B, 3.6%, LOC Bank of Nova Scotia, New York Agcy., VRDN (b) | 9,175,000 | | 9,175,000 |

(Univ. of New Haven Proj.) 3.61%, LOC Wachovia Bank NA, VRDN (b) | 7,825,000 | | 7,825,000 |

Connecticut Health & Edl. Facilities Auth. Rev. Quinnipiac Univ. Participating VRDN Series Solar 07 27, 3.78% (Liquidity Facility U.S. Bank NA, Minnesota) (b)(f)(g) | 26,305,000 | | 26,305,000 |

Connecticut Home Fin. Auth. Participating VRDN: | | | |

Series 06-K73, 3.79% (Liquidity Facility Lehman Brothers Hldgs., Inc.) (b)(e)(f) | 7,725,000 | | 7,725,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Home Fin. Auth. Participating VRDN: - continued | | | |

Series 06-P62U, 3.79% (Liquidity Facility Lehman Brothers Hldgs., Inc.) (b)(e)(f) | $ 11,000,000 | | $ 11,000,000 |

Connecticut Hsg. Fin. Auth.: | | | |

Participating VRDN: | | | |

Series LB 05 L14, 3.79% (Liquidity Facility Lehman Brothers Hldgs., Inc.) (b)(e)(f) | 9,000,000 | | 9,000,000 |

Series MT 37, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 85,000 | | 85,000 |

Series MT 374, 3.71% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(e)(f) | 925,000 | | 925,000 |

Series MT 376, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 585,000 | | 585,000 |

Series MT 63, 3.65% (Liquidity Facility Landesbank Hessen-Thuringen) (b)(e)(f) | 5,000 | | 5,000 |

Series PT 2337, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 15,000 | | 15,000 |

Series PT 3628, 3.7% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(e)(f) | 5,760,000 | | 5,760,000 |

Series ROC II R 402, 3.73% (Liquidity Facility Citibank NA) (b)(e)(f) | 3,240,000 | | 3,240,000 |

(Connecticut Gen. Hsg. Proj.) Series 2001 B4, 3.6% (AMBAC Insured), VRDN (b)(e) | 4,300,000 | | 4,300,000 |

Series 1990 C, 3.72% (Liquidity Facility Fed. Home Ln. Bank of Boston), VRDN (b)(e) | 6,855,000 | | 6,855,000 |

Series 1990 D, 3.72% (Liquidity Facility Fed. Home Ln. Bank of Boston), VRDN (b)(e) | 12,326,000 | | 12,326,000 |

Series 2001 A3, 3.6% (AMBAC Insured), VRDN (b)(e) | 12,500,000 | | 12,500,000 |

Subseries 2005 B2, 3.6% (AMBAC Insured), VRDN (b)(e) | 38,800,000 | | 38,800,000 |

Subseries 2005 D5, 3.63% (AMBAC Insured), VRDN (b)(e) | 3,850,000 | | 3,850,000 |

Subseries 2006 B2, 3.6% (AMBAC Insured), VRDN (b)(e) | 49,475,000 | | 49,475,000 |

Connecticut Hsg. Fin. Auth. Hsg. Mtg. Rev.: | | | |

(Connecticut Gen. Hsg. Proj.): | | | |

Series A-4, 3.68% (AMBAC Insured), VRDN (b)(e) | 46,440,000 | | 46,440,000 |

Series B-5, 3.6% (FSA Insured), VRDN (b)(e) | 46,780,000 | | 46,780,000 |

Series F, 3.6% (AMBAC Insured), VRDN (b)(e) | 23,750,000 | | 23,750,000 |

Connecticut Spl. Tax Oblig. Rev.: | | | |

Bonds: | | | |

(Trans. Infrastructure Proj.) Series A, 5% 8/1/08 | 7,980,000 | | 8,062,805 |

Series B, 5% 10/1/08 (FSA Insured) | 3,000,000 | | 3,038,934 |

Participating VRDN: | | | |

Series MS 01 735, 3.66% (Liquidity Facility Morgan Stanley) (b)(f) | 14,375,000 | | 14,375,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Connecticut - continued |

Connecticut Spl. Tax Oblig. Rev.: - continued | | | |

Participating VRDN: | | | |

Series PA 1039R, 3.82% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | $ 3,530,000 | | $ 3,530,000 |

Series PT 368, 3.66% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 8,700,000 | | 8,700,000 |

Series PT 4459, 3.66% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 13,660,000 | | 13,660,000 |

Series Putters 2270, 3.68% (Liquidity Facility JPMorgan Chase Bank) (b)(f) | 14,270,000 | | 14,270,000 |

Series Putters 612, 3.6% (Liquidity Facility JPMorgan Chase & Co.) (b)(f) | 5,200,000 | | 5,200,000 |

Series ROC II R 122, 3.64% (Liquidity Facility Citibank NA) (b)(f) | 12,265,000 | | 12,265,000 |

Series ROC II R 4068 3.64% (Liquidity Facility Citigroup, Inc.) (b)(f) | 4,945,000 | | 4,945,000 |

(Trans. Infrastructure Proj.): | | | |

Series 1, 3.53% (FSA Insured), VRDN (b) | 20,800,000 | | 20,800,000 |

Series 2003 1, 3.62% (AMBAC Insured), VRDN (b) | 49,735,000 | | 49,735,000 |

Series 2003 2, 3.62% (AMBAC Insured), VRDN (b) | 63,375,000 | | 63,375,000 |

East Haddam Gen. Oblig. BAN 4% 5/15/08 | 13,400,000 | | 13,421,696 |

Fairfield Gen. Oblig. BAN 4.25% 7/25/08 | 18,100,000 | | 18,165,524 |

Hamden Gen. Oblig. BAN 4.25% 7/25/08 | 12,300,000 | | 12,339,882 |

Hartford County Metropolitan District Gen. Oblig. BAN 3.75% 6/12/08 | 63,825,000 | | 63,970,738 |

Ledyard Gen. Oblig. BAN 4% 7/15/08 | 7,710,000 | | 7,722,899 |

Meriden Gen. Oblig. BAN 4.25% 8/1/08 | 22,355,000 | | 22,433,972 |

New Britain Gen. Oblig. BAN 4.25% 4/4/08 | 8,000,000 | | 8,018,712 |

New Haven Gen. Oblig.: | | | |

Series A, 3.74% 12/21/07, LOC Landesbank Hessen-Thuringen, CP | 5,000,000 | | 5,000,000 |

3.35% 2/11/08, LOC Landesbank Hessen-Thuringen, CP | 7,000,000 | | 7,000,000 |

3.36% 3/13/08, LOC Landesbank Hessen-Thuringen, CP | 2,593,000 | | 2,593,000 |

North Branford Gen. Oblig. BAN 3.75% 11/12/08 | 14,500,000 | | 14,555,829 |

Oxford Gen. Oblig. BAN 4% 8/4/08 | 18,830,000 | | 18,904,383 |

Plainville Gen. Oblig. BAN 4% 7/8/08 | 12,000,000 | | 12,039,358 |

South Central Reg'l. Wtr. Auth. Wtr. Sys. Rev.: | | | |

Participating VRDN Series EGL 06 75 Class A, 3.65% (Liquidity Facility Citibank NA) (b)(f) | 7,005,000 | | 7,005,000 |

Series 18B, 3.53% (MBIA Insured), VRDN (b) | 13,150,000 | | 13,150,000 |

Stafford Gen. Oblig. BAN 3.75% 8/15/08 | 9,075,000 | | 9,101,194 |

Stamford Gen. Oblig. BAN 4.5% 6/4/08 | 39,300,000 | | 39,449,463 |

Sterling Gen. Oblig. BAN 4% 2/1/08 | 8,265,000 | | 8,270,143 |

Thompson Gen. Oblig. BAN 4% 12/13/07 | 6,500,000 | | 6,500,931 |

Municipal Securities - continued |

| Principal Amount | | Value |

Connecticut - continued |

Town of Avon BAN 4% 10/23/08 | $ 22,322,000 | | $ 22,437,622 |

Weston Gen. Oblig. Participating VRDN Series ROC II R 6501, 3.64% (Liquidity Facility Citigroup, Inc.) (b)(f) | 1,840,000 | | 1,840,000 |

| | 1,603,200,015 |

Puerto Rico - 12.4% |

Puerto Rico Commonwealth Aqueduct & Swr. Auth. Participating VRDN Series ROC II R 10001 CE, 3.66% (Liquidity Facility Citigroup, Inc.) (b)(f) | 18,000,000 | | 18,000,000 |

Puerto Rico Commonwealth Gen. Oblig. Participating VRDN: | | | |

Series Merlots 00 EE, 3.65% (Liquidity Facility Wachovia Bank NA) (b)(f) | 9,385,000 | | 9,385,000 |

Series ROC II R 185, 3.66% (Liquidity Facility Citibank NA) (b)(f) | 4,405,000 | | 4,405,000 |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Hwy. Rev. Participating VRDN: | | | |

Series EC 1004, 3.67% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 15,700,000 | | 15,700,000 |

Series ROC II R 66, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 1,630,000 | | 1,630,000 |

Series ROC II R 815, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 8,760,000 | | 8,760,000 |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. Participating VRDN: | | | |

Series Merlots 00 FFF, 3.65% (Liquidity Facility Wachovia Bank NA) (b)(f) | 5,920,000 | | 5,920,000 |

Series Merlots 05 A20, 3.65% (Liquidity Facility Bank of New York, New York) (b)(f) | 4,080,000 | | 4,080,000 |

Series Merlots 98 B8, 3.65% (Liquidity Facility Wachovia Bank NA) (b)(f) | 5,120,000 | | 5,120,000 |

Series RobIns 14, 3.61% (Liquidity Facility Bank of New York, New York) (b)(f) | 11,975,000 | | 11,975,000 |

Series ROC II 98 1, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 2,000,000 | | 2,000,000 |

Series ROC II 99 2, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 3,500,000 | | 3,500,000 |

Series ROC II R 785 CE, 3.63% (Liquidity Facility Citigroup, Inc.) (b)(f) | 6,510,000 | | 6,510,000 |

Series ROC II R 789 CE, 3.63% (Liquidity Facility Citigroup, Inc.) (b)(f) | 4,600,000 | | 4,600,000 |

Series ROC II R 790, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 13,700,000 | | 13,700,000 |

Municipal Securities - continued |

| Principal Amount | | Value |

Puerto Rico - continued |

Puerto Rico Commonwealth Hwy. & Trans. Auth. Trans. Rev. Participating VRDN: - continued | | | |

Series ROC II R 814, 3.66% (Liquidity Facility Citibank NA) (b)(f) | $ 11,740,000 | | $ 11,740,000 |

Puerto Rico Commonwealth Infrastructure Fing. Auth. Participating VRDN: | | | |

Series EGL 00 5101 Class A, 3.62% (Liquidity Facility Banco Bilbao Vizcaya Argentaria SA) (b)(f) | 10,000,000 | | 10,000,000 |

Series Merlots 00 A15, 3.65% (Liquidity Facility Bank of New York, New York) (b)(f) | 11,865,000 | | 11,865,000 |

Puerto Rico Elec. Pwr. Auth. Pwr. Rev. Participating VRDN: | | | |

Series BBT 06, 3.64% (Liquidity Facility Branch Banking & Trust Co.) (b)(f) | 23,025,000 | | 23,025,000 |

Series MS 06 1845, 3.64% (Liquidity Facility Morgan Stanley) (b)(f) | 5,939,000 | | 5,939,000 |

Series MS 1276, 3.67% (Liquidity Facility Morgan Stanley) (b)(f) | 7,900,000 | | 7,900,000 |

Series PA 771, 3.76% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(f) | 5,015,000 | | 5,015,000 |

Series Putters 147, 3.6% (Liquidity Facility JPMorgan Chase Bank) (b)(f) | 1,100,000 | | 1,100,000 |

Series RobIns 16, 3.61% (Liquidity Facility Bank of New York, New York) (b)(f) | 4,570,000 | | 4,570,000 |

Series ROC II R 11001 CE, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 28,200,000 | | 28,200,000 |

Series ROC II R 11003 CE, 3.63% (Liquidity Facility Citibank NA) (b)(f) | 10,350,000 | | 10,350,000 |

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev. Participating VRDN Series ROC II R 11146 Z, 3.66% (Liquidity Facility Citibank NA) (b)(f) | 6,700,000 | | 6,700,000 |

| | 241,689,000 |

Municipal Securities - continued |

| Shares | | Value |

Other - 2.7% |

Fidelity Municipal Cash Central Fund, 3.66% (c)(d) | 53,657,000 | | $ 53,657,000 |

TOTAL INVESTMENT PORTFOLIO - 97.3% (Cost $1,898,546,015) | | 1,898,546,015 |

NET OTHER ASSETS - 2.7% | | 51,888,600 |

NET ASSETS - 100% | $ 1,950,434,615 |

Security Type Abbreviations |

BAN - BOND ANTICIPATION NOTE |

CP - COMMERCIAL PAPER |

TAN - TAX ANTICIPATION NOTE |

VRDN - VARIABLE RATE DEMAND NOTE |

Legend |

(a) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(c) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

(d) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(e) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

(f) Provides evidence of ownership in one or more underlying municipal bonds. |

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $62,585,000 or 3.2% of net assets. |

Additional information on each holding is as follows: |

Security | Acquisition Date | Cost |

Connecticut Health & Edl. Facilities Auth. Rev. Bonds Series PT 905, 3.73%, tender 3/6/08 (Liquidity Facility Merrill Lynch & Co., Inc.) | 3/13/07 | $ 36,280,000 |

Connecticut Health & Edl. Facilities Auth. Rev. Quinnipiac Univ. Participating VRDN Series Solar 07 27, 3.78% (Liquidity Facility U.S. Bank NA, Minnesota) | 2/8/07 - 5/3/07 | $ 26,305,000 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Municipal Cash Central Fund | $ 1,145,407 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Connecticut Municipal Money Market Fund

Financial Statements

Statement of Assets and Liabilities

| November 30, 2007 |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $1,844,889,015) | $ 1,844,889,015 | |

Fidelity Central Funds (cost $53,657,000) | 53,657,000 | |

Total Investments (cost $1,898,546,015) | | $ 1,898,546,015 |

Cash | | 39,912,347 |

Receivable for investments sold | | 1,000,303 |

Receivable for fund shares sold | | 35,260,622 |

Interest receivable | | 14,338,876 |

Distributions receivable from Fidelity Central Funds | | 24,849 |

Receivable from investment adviser for expense reductions | | 4,082 |

Other receivables | | 348,316 |

Total assets | | 1,989,435,410 |

| | |

Liabilities | | |

Payable for investments purchased | $ 19,301,930 | |

Payable for fund shares redeemed | 18,677,085 | |

Distributions payable | 43,439 | |

Accrued management fee | 581,612 | |

Other affiliated payables | 360,371 | |

Other payables and accrued expenses | 36,358 | |

Total liabilities | | 39,000,795 |

| | |

Net Assets | | $ 1,950,434,615 |

Net Assets consist of: | | |

Paid in capital | | $ 1,950,307,160 |

Undistributed net investment income | | 30,505 |

Accumulated undistributed net realized gain (loss) on investments | | 96,950 |

Net Assets, for 1,949,523,322 shares outstanding | | $ 1,950,434,615 |

Net Asset Value, offering price and redemption price per share ($1,950,434,615 ÷ 1,949,523,322 shares) | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended November 30, 2007 |

| | |

Investment Income | | |

Interest | | $ 61,628,003 |

Income from Fidelity Central Funds | | 1,145,407 |

Total income | | 62,773,410 |

| | |

Expenses | | |

Management fee | $ 6,424,942 | |

Transfer agent fees | 1,844,128 | |

Accounting fees and expenses | 175,307 | |

Custodian fees and expenses | 25,873 | |

Independent trustees' compensation | 5,913 | |

Registration fees | 8,596 | |

Audit | 44,780 | |

Legal | 11,972 | |

Miscellaneous | 9,592 | |

Total expenses before reductions | 8,551,103 | |

Expense reductions | (1,794,225) | 6,756,878 |

Net investment income | | 56,016,532 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 155,151 | |

Capital gain distributions from Fidelity Central Funds | 537 | |

Total net realized gain (loss) | | 155,688 |

Net increase in net assets resulting from operations | | $ 56,172,220 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Connecticut Municipal Money Market Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

November 30,

2007 | Year ended

November 30,

2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 56,016,532 | $ 41,544,622 |

Net realized gain (loss) | 155,688 | 51,353 |

Net increase in net assets resulting

from operations | 56,172,220 | 41,595,975 |

Distributions to shareholders from net investment income | (56,016,410) | (41,542,016) |

Share transactions at net asset value of $1.00 per share

Proceeds from sales of shares | 4,681,576,772 | 3,561,033,862 |

Reinvestment of distributions | 55,453,852 | 41,104,856 |

Cost of shares redeemed | (4,296,968,938) | (3,329,405,602) |

Net increase (decrease) in net assets and shares resulting from share transactions | 440,061,686 | 272,733,116 |

Total increase (decrease) in net assets | 440,217,496 | 272,787,075 |

| | |

Net Assets | | |

Beginning of period | 1,510,217,119 | 1,237,430,044 |

End of period (including undistributed net investment income of $30,505 and undistributed net investment income of $30,383, respectively) | $ 1,950,434,615 | $ 1,510,217,119 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

| | | | | |

Years ended November 30, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | |

Net investment income | .032 | .029 | .019 | .007 | .006 |

Net realized and unrealized gain (loss) D | - | - | - | - | - |

Total from investment operations | .032 | .029 | .019 | .007 | .006 |

Distributions from net investment income | (.032) | (.029) | (.019) | (.007) | (.006) |

Distributions from net realized gain | - | - | - D | - | - |

Total distributions | (.032) | (.029) | (.019) | (.007) | (.006) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total Return A | 3.24% | 2.97% | 1.89% | .71% | .62% |

Ratios to Average Net Assets B, C | | | | |

Expenses before reductions | .49% | .50% | .50% | .50% | .50% |

Expenses net of fee waivers, if any | .48% | .48% | .48% | .48% | .48% |

Expenses net of all reductions | .39% | .37% | .39% | .46% | .47% |

Net investment income | 3.19% | 2.94% | 1.88% | .71% | .61% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,950,435 | $ 1,510,217 | $ 1,237,430 | $ 1,065,703 | $ 1,054,577 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

D Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended November 30, 2007

1. Organization.

Fidelity Connecticut Municipal Income Fund (the Income Fund) is a fund of Fidelity Court Street Trust. Fidelity Connecticut Municipal Money Market Fund (the Money Market Fund) is a fund of Fidelity Court Street Trust II. Each trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. Fidelity Court Street Trust and Fidelity Court Street Trust II (the trusts) are organized as a Massachusetts business trust and a Delaware statutory trust, respectively. The Income Fund is a non-diversified fund. Each Fund is authorized to issue an unlimited number of shares. Each Fund may be affected by economic and political developments in the state of Connecticut.

2. Investments in Fidelity Central Funds.

The Funds may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Funds' Schedules of Investments list each of the Fidelity Central Funds as an investment of each Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Funds indirectly bear their proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete list of holdings for each Fidelity Central Fund is available upon request or at the SEC's web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Funds' Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Funds:

Security Valuation. Investments are valued and net asset value per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Wherever possible, each Fund uses independent pricing services approved by the Board of Trustees to value their investments. For the Income Fund, debt securities, including restricted securities, for which quotes are readily available, are

Annual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. The frequency of when fair value pricing is used is unpredictable. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities owned by the Money Market Fund are valued at amortized cost which approximates value.

Investment Transactions and Income. For financial reporting purposes, the Funds' investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day for the Income Fund and trades executed through the end of the current business day for the Money Market Fund. Gains and losses on securities sold are determined on the basis of identified cost. Interest income and income and capital gain distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of each trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, each Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Funds will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distribution from the Fidelity Central Funds, market discount, deferred trustees compensation and capital loss carryforwards.

The Funds purchase municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the Internal Revenue Service (IRS) will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows for each Fund:

| Cost for Federal

Income Tax

Purposes | Unrealized

Appreciation | Unrealized

Depreciation | Net Unrealized

Appreciation/

(Depreciation) |

Fidelity Connecticut Municipal Income Fund | $ 421,908,439 | $ 11,570,611 | $ (1,089,431) | $ 10,481,180 |

Fidelity Connecticut Municipal Money Market Fund | 1,898,546,015 | - | - | - |

| Undistributed

Ordinary

Income | Undistributed

Long-term

Capital Gain |

Fidelity Connecticut Municipal

Income Fund | $ 2,804 | $ 1,043,518 |

Fidelity Connecticut Municipal

Money Market Fund | 31,807 | 47,021 |

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax character of distributions paid was as follows:

November 30, 2007 | | | | |

| Tax-exempt

Income | Ordinary

Income | Long-term

Capital Gains | Total |

Fidelity Connecticut Municipal Income Fund | $ 16,680,792 | $ - | $ 3,007,749 | $ 19,688,541 |

Fidelity Connecticut Municipal Money Market Fund | 56,016,410 | - | - | 56,016,410 |

November 30, 2006 | | | | |

| Tax-exempt

Income | Ordinary

Income | Long-term

Capital Gains | Total |

Fidelity Connecticut Municipal Income Fund | $ 16,651,892 | $ - | $ 3,980,932 | $ 20,632,824 |

Fidelity Connecticut Municipal

Money Market Fund | 41,542,016 | - | - | 41,542,016 |

Short-Term Trading (Redemption) Fees. Shares held in the Income Fund less than 30 days are subject to a redemption fee equal to .50% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective on the last business day of the semiannual reporting period for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management has concluded that the adoption of FIN 48 will not result in a material impact on the Funds' net assets, results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Funds' financial statement disclosures.

Annual Report

Notes to Financial Statements - continued

4. Operating Policies.

Delayed Delivery Transactions and When-Issued Securities. Certain Funds may purchase or sell securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. During the time a delayed delivery sell is outstanding, the contract is marked-to-market daily and equivalent deliverable securities are held for the transaction. Certain Funds may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, certain Funds identify securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities. Certain Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of each applicable Fund's Schedule of Investments.

Swap Agreements. The Income Fund may invest in swaps for the purpose of managing its exposure to interest rate, credit or market risk.

Interest rate swaps are agreements to exchange cash flows periodically based on a notional principal amount, for example, the exchange of fixed rate interest payments for floating rate interest payments. The primary risk associated with interest rate swaps is that unfavorable changes in the fluctuation of interest rates could adversely impact the Fund.