| UNITED STATES | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

| FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT | ||

| INVESTMENT COMPANIES | ||

| Investment Company Act file number 811-6490 | ||

| Dreyfus Premier International Funds, Inc. | ||

| (Exact name of Registrant as specified in charter) | ||

| c/o The Dreyfus Corporation | ||

| 200 Park Avenue | ||

| New York, New York 10166 | ||

| (Address of principal executive offices) (Zip code) | ||

| Mark N. Jacobs, Esq. | ||

| 200 Park Avenue | ||

| New York, New York 10166 | ||

| (Name and address of agent for service) | ||

| Registrant's telephone number, including area code: (212) 922-6000 | ||

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/06 | |

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents | ||

| THE FUND | ||

| 2 | Letter from the Chairman | |

| 3 | Discussion of Fund Performance | |

| 6 | Fund Performance | |

| 8 | Understanding Your Fund’s Expenses | |

| 8 | Comparing Your Fund’s Expenses | |

| With Those of Other Funds | ||

| 9 | Statement of Investments | |

| 12 | Statement of Assets and Liabilities | |

| 13 | Statement of Operations | |

| 14 | Statement of Changes in Net Assets | |

| 17 | Financial Highlights | |

| 22 | Notes to Financial Statements | |

| 31 | Report of Independent Registered | |

| Public Accounting Firm | ||

| 32 | Important Tax Information | |

| 33 | Information About the Review and Approval | |

| of the Fund’s Management Agreement | ||

| 38 | Board Members Information | |

| 41 | Officers of the Fund | |

| FOR MORE INFORMATION | ||

| Back Cover | ||

| Dreyfus Premier | ||||

| Greater China Fund | The | Fund |

LETTER FROM THE CHAIRMAN

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Premier Greater China Fund, covering the 12-month period from November 1, 2005, through October 31, 2006.

Although reports of slower economic growth and declining housing prices in the United States recently have raised economic concerns among both U.S. and international investors, we believe that neither a domestic recession nor a major shortfall in global growth is likely. Stimulative monetary policies among many central banks over the last several years have left a legacy of ample financial liquidity worldwide, which should continue to support global economic growth. Indeed, most nations’ monetary policies have so far tightened only from stimulative to neutral, leaving room for further expansion.

The international equity markets seem to concur with our view that global economic conditions remain sound, as evidenced by higher stock prices over the past 12 months across most geographic regions and market capitalizations. However, investors anticipating more subdued profit growth in a slower-growth economy recently have begun to favor high-quality, multinational companies and other businesses with the ability to sustain profitability in a variety of economic environments. This pattern is consistent with previous mid-cycle slowdowns. As always, we encourage you to discuss the implications of these and other matters with your financial adviser.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s portfolio manager.

Thank you for your continued confidence and support.

| 2 |

DISCUSSION OF FUND PERFORMANCE

| Adrian Au, Portfolio Manager |

How did Dreyfus Premier Greater China Fund perform relative to its benchmark?

For the 12-month period ended October 31, 2006, the fund’s Class A, B, C, R and T shares produced total returns of 60.66%, 59.37%, 59.44%, 61.14% and 60.07%, respectively.1 In contrast, the fund’s benchmark, the Hang Seng Index,produced a total return of 32.02% for the same period.2

Strong economic growth in China and the prospect of gradual currency appreciation continued to attract foreign capital, boosting stock market returns. The fund’s strong relative performance was driven by our emphasis on financial, consumer-oriented and infrastructure-development companies.

Market conditions during the reporting period proved to be particularly favorable for Chinese companies in general and the fund’s investment strategy in particular. This level of performance is not sustainable and should not be expected to continue over the long term. Pursuing this level of return involves accepting increased risk.

What is the fund’s investment approach?

The fund, which seeks long-term capital appreciation, normally invests at least 80% of its assets in stocks of companies that (i) are principally traded in China, Hong Kong or Taiwan (Greater China), (ii) derive at least 50% of their revenues from Greater China, or (iii) have at least 50% of their assets in Greater China.To determine where the fund will invest, we analyze several factors, including economic and political trends in Greater China, the current financial condition and future prospects of individual companies and sectors in the region, and the valuation of one market or company relative to that of another.

What other factors influenced the fund’s performance?

Economic growth in China accelerated from 9.9% in 2005 to an annualized rate of 11.3% in the second quarter of 2006, benefiting the fund’s financial holdings, such as China Construction Bank and China Life Insurance.The reporting period also saw the successful privatization of major state-owned banks, including a $20 billion initial public offering of Industrial and Commercial Bank of China.The fund has established

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

positions in these newly listed financial companies with the view that China’s consumer credit market has ample potential for growth.

To avoid economic overheating, the Chinese government raised interest rates, increased bank reserve requirements and implemented measures to prevent speculation in the real estate market.These restrictions, coupled with monetary tightening by central banks in the U.S. and Japan, caused China’s stock market to decline sharply in May. Still, China’s economic growth rate moderated only slightly to a 10.4% annualized rate for the third quarter of 2006.

In light of the government’s more restrictive policies, we adopted a more cautious view regarding economically sensitive stocks, and we shifted the fund’s focus to companies serving domestic consumers as well as businesses engaged in infrastructure development.As a result, the fund benefited from gains in national department store chain Parkson Retail Group, food processor COFCO International and manufacturer Harbin Power Equipment. However, we were surprised by the swift recovery of the more cyclical sectors following the May correction, and the fund’s relatively light exposure to commodity and property-related companies — as well as underweighted positions in large-cap stocks, such as China Mobile — detracted somewhat from relative performance in the third quarter.

In other areas, the Chinese government has instituted major new initiatives in environmental control and the rural sector. More stringent rules for waste gas emissions and sewage already have been established in the Pearl and Yangtze Delta areas. Sino-Environment Technology Group, which manufactures waste gas filters, significantly benefited from these measures.

Finally, it is worth noting that several major geopolitical events occurred in Asia during the reporting period — North Korea’s testing of a nuclear weapon and the overthrow of the government in Thailand and demonstrations against Taiwanese president pressurizing him to resign — did not have a material impact on the region’s equity markets.

| What is the fund’s current strategy? |

We have continued to look for companies with accelerating earnings and reasonably valued share prices relative to their growth potential. Characteristics of such companies include high-quality management with a commitment to increasing shareholder value, strong earnings momentum with consistent free cash flow generation, sound business

| 4 |

fundamentals and long-term vision. Generally, the companies in which the fund invests have leadership potential in their respective industries.

We continue to hold shares in the financial sector as well as some oil and commodity stocks and we also continue to find a number of opportunities meeting our criteria in the domestic consumption, infrastructure and manufacturing areas, which we expect to benefit from an economic growth rate of 9% to 10% in 2007. In the domestic sector, we have identified winery, tourism and retail conglomerates, where we believe corporate restructuring may unlock shareholder value. Enhancing profitability through greater competitiveness and streamlined corporate structures is now considered a top priority in corporate China. In the infrastructure area, we have focused on railways and environmental control companies. In the manufacturing sector, we have favored such areas as aviation and telecommunications companies. We also have increased the fund’s exposure to China’s “B share” market, whose shares originally were reserved for overseas investors.We believe “B shares” are likely to appreciate as government regulations on these investments are relaxed. We also continue to investigate opportunities in the “A share” market.

| November 15, 2006 |

| Emerging markets, such as those of China and Taiwan, tend to be more volatile than the | ||

| markets of more mature economies, and generally have less diverse and less mature | ||

| economic structures and less stable political systems than those of developed countries. The | ||

| securities of companies located in emerging markets are often subject to rapid and large | ||

| changes in price. An investment in this fund should be considered only as a supplement to | ||

| a complete investment program. | ||

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into | |

| consideration the maximum initial sales charges in the case of Class A and Class T shares, or the | ||

| applicable contingent deferred sales charges imposed on redemptions in the case of Class B and | ||

| Class C shares. Had these charges been reflected, returns would have been lower. Past performance | ||

| is no guarantee of future results. Share price and investment return fluctuate such that upon | ||

| redemption, fund shares may be worth more or less than their original cost. | ||

| A significant portion of the fund’s performance was attributable to positive returns from its | ||

| initial public offering (IPO) investments. There can be no guarantee that IPOs will have or | ||

| continue to have a positive effect on the fund’s performance. IPOs tend to have a reduced | ||

| effect on performance as a fund’s asset base grows. | ||

| 2 | SOURCE: BLOOMBERG L.P. – Reflects reinvestment of net dividends and, where | |

| applicable, capital gain distributions.The Hang Seng Index is a capitalization-weighted index of | ||

| approximately 33 companies that represent 70 percent of the total market capitalization of the | ||

| Stock Exchange of Hong Kong.The components of the index are divided into 4 subindices: | ||

| Commerce, Finance, Utilities and Properties. |

The Fund 5

| FUND PERFORMANCE |

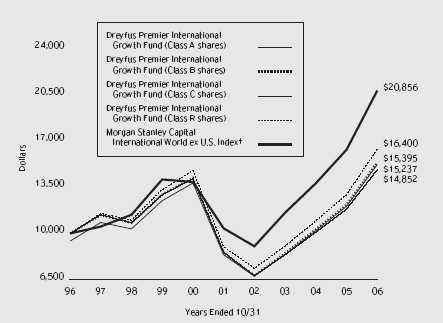

Comparison of change in value of $10,000 investment in Dreyfus Premier Greater China Fund Class A shares, Class B shares, Class C shares and Class R shares and the Hang Seng Index

† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

A significant portion of the fund’s past performance was attributable to positive returns from its initial public offering (IPO) investments.There can be no guarantee that IPOs will have or continue to have a positive effect on the fund’s performance. IPOs tend to have a reduced effect on performance as a fund’s asset base grows.

The above graph compares a $10,000 investment made in each of the Class A, Class B, Class C and Class R shares of Dreyfus Premier Greater China Fund on 5/12/98 (inception date) to a $10,000 investment made in the Hang Seng Index (the “Index”) on that date. For comparative purposes, the value of the Index on 4/30/98 is used as the beginning value on 5/12/98. All dividends and capital gain distributions are reinvested. Performance for Class T shares will vary from the performance of Class A, Class B, Class C and Class R shares shown above due to differences in charges and expenses.

The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is a capitalization-weighted index of approximately 33 companies that represent 70 percent of the total market capitalization of the Stock Exchange of Hong Kong.The components of the Index are divided into four subindices: Commerce, Finance, Utilities and Properties.The Index does not take into account charges, fees and other expenses.The Index reflects reinvestment of net dividends and where applicable, capital gain distribution. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| 6 |

| Average Annual Total Returns as of 10/31/06 | ||||||||

| Inception | From | |||||||

| Date | 1 Year | 5 Years | Inception | |||||

| Class A shares | ||||||||

| with maximum sales charge (5.75%) | 5/12/98 | 51.41% | 19.70% | 15.05% | ||||

| without sales charge | 5/12/98 | 60.66% | 21.13% | 15.86% | ||||

| Class B shares | ||||||||

| with applicable redemption charge † | 5/12/98 | 55.37% | 19.98% | 15.20% | ||||

| without redemption | 5/12/98 | 59.37% | 20.17% | 15.20% | ||||

| Class C shares | ||||||||

| with applicable redemption charge †† | 5/12/98 | 58.44% | 20.21% | 14.97% | ||||

| without redemption | 5/12/98 | 59.44% | 20.21% | 14.97% | ||||

| Class R shares | 5/12/98 | 61.14% | 21.50% | 16.20% | ||||

| Class T shares | ||||||||

| with applicable sales charge (4.5%) | 3/1/00 | 52.88% | 19.76% | 5.05% | ||||

| without sales charge | 3/1/00 | 60.07% | 20.86% | 5.78% | ||||

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class B shares assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date of purchase.

| † | The maximum contingent deferred sales charge for Class B shares is 4%. After six years Class B shares convert to | |

| Class A shares. | ||

| †† | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the | |

| date of purchase. |

The Fund 7

U N D E R S TA N D I N G YO U R F U N D ’ S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Greater China Fund from May 1, 2006 to October 31, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | ||||||||||

| assuming actual returns for the six months ended October 31, 2006 | ||||||||||

| Class A | Class B | Class C | Class R | Class T | ||||||

| Expenses paid per $1,000 † | $ 9.41 | $ 13.46 | $ 13.26 | $ 7.95 | $ 10.91 | |||||

| Ending value (after expenses) | $996.10 | $991.90 | $992.30 | $997.50 | $994.40 | |||||

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended October 31, 2006

| Class A | Class B | Class C | Class R | Class T | ||||||

| Expenses paid per $1,000 † | $ 9.50 | $ 13.59 | $ 13.39 | $ 8.03 | $ 11.02 | |||||

| Ending value (after expenses) | $1,015.78 | $1,011.70 | $1,011.90 | $1,017.24 | $1,014.27 |

- Expenses are equal to the fund’s annualized expense ratio of 1.87% for Class A, 2.68% for Class B, 2.64% for Class C, 1.58% for Class R and 2.17% for Class T; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| 8 |

| STATEMENT OF INVESTMENTS October 31, 2006 |

| Common Stocks—95.5% | Shares | Value ($) | ||||

| China—61.1% | ||||||

| Aluminum Corp. of China, Cl. H | 8,478,000 | 5,919,295 | ||||

| AviChina Industry & Technology, Cl. H | 40,814,000 | 4,040,886 | ||||

| Beauty China Holdings | 4,340,000 | 2,507,221 | ||||

| Beijing Capital Land, Cl. H | 15,000,000 | 6,480,481 | ||||

| Bengang Steel Plates, Cl. B | 20,301,925 | 9,736,947 | ||||

| China Life Insurance, Cl. H | 2,843,000 | 5,987,803 | ||||

| China Merchants Bank, Cl. H | 2,630,000 | a | 4,105,359 | |||

| China Milk Products Group | 1,934,000 | a | 1,452,455 | |||

| China Oilfield Services, Cl. H | 4,864,000 | 2,733,076 | ||||

| China Petroleum & Chemical, Cl. H | 16,300,000 | 11,275,780 | ||||

| China Shineway Pharmaceutical Group | 6,097,000 | 3,763,000 | ||||

| China Telecom, Cl. H | 27,750,000 | 10,454,598 | ||||

| ChinaSoft International | 16,470,000 | 2,795,402 | ||||

| Dalian Refrigeration | 810,000 | 371,222 | ||||

| Dongfang Electrical Machinery, Cl. H | 4,480,000 | 8,640,642 | ||||

| Golding Soft | 5,220,000 | a | 10,739 | |||

| Guangshen Railway, Cl. H | 24,178,000 | 11,378,321 | ||||

| Guangzhou Pharmaceutical, Cl. H | 5,226,000 | 3,359,821 | ||||

| Hunan Non-Ferrous Metal, Cl. H | 9,848,000 | a | 4,672,520 | |||

| Industrial and Commercial Bank of China, Cl. H | 37,600,000 | a | 16,824,564 | |||

| Lianhua Supermarket Holdings, Cl. H | 4,329,000 | 5,482,777 | ||||

| Midas Holdings | 4,576,000 | 2,922,601 | ||||

| PetroChina, Cl. H | 3,080,000 | 3,390,012 | ||||

| PICC Property & Casualty, Cl. H | 16,188,000 | a | 5,786,484 | |||

| Shandong Chenming Paper, Cl. B | 9,741,500 | 4,784,824 | ||||

| Shanghai Friendship Group, Cl. B | 9,622,206 | 7,187,788 | ||||

| Sino-Environment Technology Group | 11,092,000 | a | 9,042,198 | |||

| The9, ADR | 287,511 | a | 6,788,135 | |||

| Tom Online | 12,934,000 | a | 2,128,725 | |||

| Xinjiang Tianye Water Saving Irrigation System, Cl. H | 15,510,000 | 3,091,151 | ||||

| Yanlord Land Group | 7,050,000 | a | 6,561,718 | |||

| Yantai Changyu Pioneer Wine, Cl. B | 1,276,714 | 4,350,270 | ||||

| Zijin Mining Group, Cl. H | 4,464,000 | 2,594,414 | ||||

| ZTE, Cl. H | 1,695,600 | 6,257,229 | ||||

| 186,878,458 |

The Fund 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | Shares | Value ($) | ||||

| Hong Kong—30.7% | ||||||

| Calyon (warrants 4/17/07) | 25,150,000 | a | 2,263,668 | |||

| China Insurance International Holdings | 6,690,000 | a | 5,763,385 | |||

| China Mobile | 500,000 | 4,082,446 | ||||

| China Petroleum (warrants 1/19/07) | 18,000,000 | a | 2,013,578 | |||

| China Power International Development | 12,829,000 | 6,136,383 | ||||

| China Sciences Conservational Power | 19,450,000 | a,b | 875,315 | |||

| China Telecom (warrants 11/27/06) | 30,000,000 | a | 1,350,100 | |||

| China Telecom (warrants 5/14/07) | 30,000,000 | a | 925,783 | |||

| China Travel International Investment Hong Kong | 34,450,000 | 7,796,122 | ||||

| CITIC International Financial Holdings | 9,532,000 | 6,397,809 | ||||

| CITIC Pacific | 1,097,000 | 3,371,175 | ||||

| COFCO International | 6,771,000 | 6,033,409 | ||||

| Comba Telecom System Holdings | 7,172,000 | 2,489,894 | ||||

| Dynasty Fine Wines Group | 20,000,000 | 7,714,859 | ||||

| Hongkong Land Holdings | 687,000 | 2,583,120 | ||||

| Hua Han Bio-Pharmaceutical Holdings, Cl. H | 24,402,000 | 4,549,568 | ||||

| Industrial and Commercial Bank of China (Asia) | 3,676,000 | 6,324,240 | ||||

| Ju Teng International Holdings | 17,290,000 | a | 2,890,115 | |||

| Kerry Properties | 1,000,000 | 3,690,274 | ||||

| L.K. Technology Holdings | 20,090,000 | a | 2,686,520 | |||

| Lifestyle International Holdings | 1,629,500 | 3,159,602 | ||||

| New Heritage Holdings | 15,700,000 | 1,291,982 | ||||

| Tianjin Development Holdings | 8,714,000 | 5,848,773 | ||||

| Wasion Meters Group | 8,410,000 | 3,514,440 | ||||

| 93,752,560 | ||||||

| Taiwan—3.2% | ||||||

| Everlight Electronics | 434 | 1,145 | ||||

| Nan Ya Printed Circuit Board | 843,000 | 5,450,594 | ||||

| Shin Kong Financial Holding | 4,784,631 | 4,240,185 | ||||

| 9,691,924 |

| 10 |

| Common Stocks (continued) | Shares | Value ($) | ||||||

| United States—.5% | ||||||||

| Far East Energy | 1,327,000 a | 1,486,240 | ||||||

| Far East Energy (warrants) | 625,000 a | 0 | ||||||

| 1,486,240 | ||||||||

| Total Investments (cost $259,176,915) | 95.5% | 291,809,182 | ||||||

| Cash and Receivables (Net) | 4.5% | 13,591,215 | ||||||

| Net Assets | 100.0% | 305,400,397 | ||||||

| ADR—American Depository Receipts | ||||||||

| a | Non-income producing security. | |||||||

| b | The value of this security has been determined in good faith under the direction of the Board of Directors. | |||||||

| Portfolio Summary | (Unaudited) † | |||||||

| Value (%) | Value (%) | |||||||

| Consumer Discretionary | 15.7 | Energy | 6.5 | |||||

| Financial | 15.7 | Telecommunication Services | 6.3 | |||||

| Industrial | 13.3 | Health Care | 3.8 | |||||

| Banks | 11.0 | Other | 4.6 | |||||

| Technology | 9.5 | |||||||

| Materials | 9.1 | 95.5 | ||||||

| † | Based on net assets. | |||||||

| See notes to financial statements. | ||||||||

The Fund 11

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2006

| Cost | Value | |||||||||

| Assets ($): | ||||||||||

| Investments in securities—See Statement of Investments | 259,176,915 | 291,809,182 | ||||||||

| Cash | 2,724,732 | |||||||||

| Cash denominated in foreign currencies | 8,393,859 | 8,403,166 | ||||||||

| Receivable for investment securities sold | 5,044,967 | |||||||||

| Receivable for shares of Common Stock subscribed | 1,083,065 | |||||||||

| Dividends receivable | 225,815 | |||||||||

| Prepaid expenses | 18,005 | |||||||||

| 309,308,932 | ||||||||||

| Liabilities ($): | ||||||||||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 465,805 | |||||||||

| Payable for investment securities purchased | 2,666,865 | |||||||||

| Payable for shares of Common Stock redeemed | 483,146 | |||||||||

| Accrued expenses | 292,719 | |||||||||

| 3,908,535 | ||||||||||

| Net Assets ($) | 305,400,397 | |||||||||

| Composition of Net Assets ($): | ||||||||||

| Paid-in capital | 226,780,390 | |||||||||

| Accumulated investment (loss)—net | (602,339) | |||||||||

| Accumulated net realized gain (loss) on investments | 46,576,276 | |||||||||

| Accumulated net unrealized appreciation (depreciation) | ||||||||||

| on investments and foreign currency transactions | 32,646,070 | |||||||||

| Net Assets ($) | 305,400,397 | |||||||||

| Net Asset Value Per Share | ||||||||||

| Class A | Class B | Class C | Class R | Class T | ||||||

| Net Assets ($) | 165,363,314 | 33,402,010 | 86,666,051 | 18,751,829 | 1,217,193 | |||||

| Shares Outstanding | 5,331,279 | 1,130,958 | 2,931,775 | 596,615 | 40,209 | |||||

| Net Asset Value | ||||||||||

| Per Share ($) | 31.02 | 29.53 | 29.56 | 31.43 | 30.27 | |||||

| See notes to financial statements. | ||||||||||

| 12 |

| STATEMENT OF OPERATIONS Year Ended October 31, 2006 |

| Investment Income ($): | ||

| Cash dividends (net of $127,871 foreign taxes withheld at source) | 5,207,430 | |

| Interest | 12,734 | |

| Total Income | 5,220,164 | |

| Expenses: | ||

| Management fee—Note 3(a) | 2,840,046 | |

| Shareholder servicing costs—Note 3(c) | 873,683 | |

| Distribution fees—Note 3(b) | 702,159 | |

| Custodian fees | 365,035 | |

| Registration fees | 90,551 | |

| Professional fees | 89,848 | |

| Directors’ fees and expenses—Note 3(d) | 42,909 | |

| Prospectus and shareholders’ reports | 34,249 | |

| Miscellaneous | 19,668 | |

| Total Expenses | 5,058,148 | |

| Less—reduction in custody fees due to | ||

| earnings credits—Note 1(c) | (78,605) | |

| Net Expenses | 4,979,543 | |

| Investment Income—Net | 240,621 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments and foreign currency transactions | 48,242,447 | |

| Net realized gain (loss) on options transactions | (501,004) | |

| Net realized gain (loss) on forward currency exchange contracts | (574,987) | |

| Net Realized Gain (Loss) | 47,166,456 | |

| Net unrealized appreciation (depreciation) on investments | ||

| and foreign currency transactions | 31,508,736 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 78,675,192 | |

| Net Increase in Net Assets Resulting from Operations | 78,915,813 | |

| See notes to financial statements. |

The Fund 13

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended October 31, | ||||

| 2006 | 2005 | |||

| Operations ($): | ||||

| Investment income—net | 240,621 | 324,413 | ||

| Net realized gain (loss) on investments | 47,166,456 | (392,308) | ||

| Net unrealized appreciation | ||||

| (depreciation) on investments | 31,508,736 | (378,635) | ||

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | 78,915,813 | (446,530) | ||

| Dividends to Shareholders from ($): | ||||

| Investment income—net: | ||||

| Class A shares | (42,341) | (478,111) | ||

| Class B shares | — | (17,881) | ||

| Class C shares | — | (42,014) | ||

| Class R shares | (9,713) | (40,559) | ||

| Class T shares | — | (3,939) | ||

| Net realized gain on investments: | ||||

| Class A shares | — | (603,177) | ||

| Class B shares | — | (183,278) | ||

| Class C shares | — | (362,645) | ||

| Class R shares | — | (38,686) | ||

| Class T shares | — | (6,946) | ||

| Total Dividends | (52,054) | (1,777,236) | ||

| Capital Stock Transactions ($): | ||||

| Net proceeds from shares sold: | ||||

| Class A shares | 125,360,265 | 25,455,808 | ||

| Class B shares | 10,088,044 | 5,054,046 | ||

| Class C shares | 42,577,169 | 14,064,308 | ||

| Class R shares | 33,060,006 | 808,053 | ||

| Class T shares | 1,025,598 | 1,156,807 | ||

| 14 |

| Year Ended October 31, | ||||

| 2006 | 2005 | |||

| Capital Stock Transactions ($) (continued): | ||||

| Dividends reinvested: | ||||

| Class A shares | 33,289 | 824,935 | ||

| Class B shares | — | 152,463 | ||

| Class C shares | — | 219,860 | ||

| Class R shares | 8,607 | 68,811 | ||

| Class T shares | — | 7,761 | ||

| Cost of shares redeemed: | ||||

| Class A shares | (67,011,749) | (30,046,440) | ||

| Class B shares | (8,343,532) | (5,243,336) | ||

| Class C shares | (18,741,572) | (14,070,703) | ||

| Class R shares | (19,869,755) | (2,597,821) | ||

| Class T shares | (724,629) | (1,359,927) | ||

| Increase (Decrease) in Net Assets | ||||

| from Capital Stock Transactions | 97,461,741 | (5,505,375) | ||

| Total Increase (Decrease) in Net Assets | 176,325,500 | (7,729,141) | ||

| Net Assets ($): | ||||

| Beginning of Period | 129,074,897 | 136,804,038 | ||

| End of Period | 305,400,397 | 129,074,897 | ||

| Undistributed investment income (loss)—net | (602,339) | 51,789 | ||

The Fund 15

| STATEMENT OF CHANGES IN NET ASSETS (continued) |

| Year Ended October 31, | ||||

| 2006 | 2005 | |||

| Capital Share Transactions: | ||||

| Class A a | ||||

| Shares sold | 4,346,522 | 1,219,692 | ||

| Shares issued for dividends reinvested | 1,545 | 39,641 | ||

| Shares redeemed | (2,400,824) | (1,442,338) | ||

| Net Increase (Decrease) in Shares Outstanding | 1,947,243 | (183,005) | ||

| Class B a | ||||

| Shares sold | 369,187 | 251,559 | ||

| Shares issued for dividends reinvested | — | 7,589 | ||

| Shares redeemed | (326,226) | (261,481) | ||

| Net Increase (Decrease) in Shares Outstanding | 42,961 | (2,333) | ||

| Class C | ||||

| Shares sold | 1,529,838 | 698,048 | ||

| Shares issued for dividends reinvested | — | 10,933 | ||

| Shares redeemed | (741,776) | (703,339) | ||

| Net Increase (Decrease) in Shares Outstanding | 788,062 | 5,642 | ||

| Class R | ||||

| Shares sold | 1,120,363 | 38,181 | ||

| Shares issued for dividends reinvested | 395 | 3,272 | ||

| Shares redeemed | (686,656) | (123,086) | ||

| Net Increase (Decrease) in Shares Outstanding | 434,102 | (81,633) | ||

| Class T | ||||

| Shares sold | 35,069 | 55,136 | ||

| Shares issued for dividends reinvested | — | 380 | ||

| Shares redeemed | (27,506) | (67,284) | ||

| Net Increase (Decrease) in Shares Outstanding | 7,563 | (11,768) | ||

| a | During the period ended October 31, 2006, 34,258 Class B shares representing $894,279 were automatically | |

| converted to 32,730 Class A shares and during the period ended October 31, 2005, 15,623 Class B shares | ||

| representing $315,213 were automatically converted to 15,037 Class A shares. | ||

| See notes to financial statements. | ||

| 16 |

| FINANCIAL HIGHLIGHTS |

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Year Ended October 31, | ||||||||||||

| Class A Shares | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||

| Per Share Data ($): | ||||||||||||

| Net asset value, beginning of period | 19.32 | 19.64 | 19.18 | 12.26 | 12.32 | |||||||

| Investment Operations: | ||||||||||||

| Investment income—net a | .12 | .12 | .21 | .10 | .09 | |||||||

| Net realized and unrealized | ||||||||||||

| gain (loss) on investments | 11.59 | (.15) | .48 | 6.88 | (.11) | |||||||

| Total from Investment Operations | 11.71 | (.03) | .69 | 6.98 | (.02) | |||||||

| Distributions: | ||||||||||||

| Dividends from investment income—net | (.01) | (.13) | (.04) | (.06) | (.04) | |||||||

| Dividends from net realized | ||||||||||||

| gain on investments | — | (.16) | (.19) | — | — | |||||||

| Total Distributions | (.01) | (.29) | (.23) | (.06) | (.04) | |||||||

| Net asset value, end of period | 31.02 | 19.32 | 19.64 | 19.18 | 12.26 | |||||||

| Total Return (%) b | 60.66 | (.29) | 3.70 | 57.25 | (.19) | |||||||

| Ratios/Supplemental Data (%): | ||||||||||||

| Ratio of total expenses | ||||||||||||

| to average net assets | 1.92 | 2.05 | 2.09 | 2.82 | 3.80 | |||||||

| Ratio of net expenses | ||||||||||||

| to average net assets | 1.88 | 2.04 | 2.09 | 2.25 | 2.25 | |||||||

| Ratio of net investment income | ||||||||||||

| to average net assets | .44 | .56 | 1.02 | .68 | .61 | |||||||

| Portfolio Turnover Rate | 188.08 | 178.32 | 154.41 | 194.40 | 327.93 | |||||||

| Net Assets, end of period ($ x 1,000) | 165,363 | 65,371 | 70,072 | 33,324 | 5,165 | |||||||

| a | Based on average shares outstanding at each month end. | |||||||||||

| b | Exclusive of sales charge. | |||||||||||

| See notes to financial statements. | ||||||||||||

The Fund 17

| FINANCIAL HIGHLIGHTS (continued) |

| Year Ended October 31, | ||||||||||||

| Class B Shares | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||

| Per Share Data ($): | ||||||||||||

| Net asset value, beginning of period | 18.53 | 18.89 | 18.56 | 11.89 | 12.00 | |||||||

| Investment Operations: | ||||||||||||

| Investment income (loss)—net a | (.14) | (.05) | .08 | .00b | (.01) | |||||||

| Net realized and unrealized | ||||||||||||

| gain (loss) on investments | 11.14 | (.13) | .44 | 6.67 | (.10) | |||||||

| Total from Investment Operations | 11.00 | (.18) | .52 | 6.67 | (.11) | |||||||

| Distributions: | ||||||||||||

| Dividends from investment income—net | — | (.02) | — | — | — | |||||||

| Dividends from net realized | ||||||||||||

| gain on investments | — | (.16) | (.19) | — | — | |||||||

| Total Distributions | — | (.18) | (.19) | — | — | |||||||

| Net asset value, end of period | 29.53 | 18.53 | 18.89 | 18.56 | 11.89 | |||||||

| Total Return (%) c | 59.37 | (1.08) | 2.88 | 56.10 | (1.00) | |||||||

| Ratios/Supplemental Data (%): | ||||||||||||

| Ratio of total expenses | ||||||||||||

| to average net assets | 2.73 | 2.84 | 2.87 | 3.66 | 4.58 | |||||||

| Ratio of net expenses | ||||||||||||

| to average net assets | 2.70 | 2.83 | 2.86 | 3.00 | 3.00 | |||||||

| Ratio of net investment income | ||||||||||||

| (loss) to average net assets | (.55) | (.23) | .38 | .01 | (.08) | |||||||

| Portfolio Turnover Rate | 188.08 | 178.32 | 154.41 | 194.40 | 327.93 | |||||||

| Net Assets, end of period ($ x 1,000) | 33,402 | 20,160 | 20,601 | 6,420 | 1,565 | |||||||

| a | Based on average shares outstanding at each month end. | |||||||||||

| b | Amount represents less than $.01 per share. | |||||||||||

| c | Exclusive of sales charge. | |||||||||||

| See notes to financial statements. | ||||||||||||

| 18 |

| Year Ended October 31, | ||||||||||||

| Class C Shares | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||

| Per Share Data ($): | ||||||||||||

| Net asset value, beginning of period | 18.54 | 18.91 | 18.57 | 11.90 | 12.01 | |||||||

| Investment Operations: | ||||||||||||

| Investment income (loss)—net a | (.11) | (.04) | .07 | (.01) | (.00)b | |||||||

| Net realized and unrealized | ||||||||||||

| gain (loss) on investments | 11.13 | (.15) | .46 | 6.68 | (.11) | |||||||

| Total from Investment Operations | 11.02 | (.19) | .53 | 6.67 | (.11) | |||||||

| Distributions: | ||||||||||||

| Dividends from investment income—net | — | (.02) | (.00)b | (.00)b | — | |||||||

| Dividends from net realized | ||||||||||||

| gain on investments | — | (.16) | (.19) | — | — | |||||||

| Total Distributions | — | (.18) | (.19) | (.00)b | — | |||||||

| Net asset value, end of period | 29.56 | 18.54 | 18.91 | 18.57 | 11.90 | |||||||

| Total Return (%) c | 59.44 | (1.07) | 2.90 | 56.08 | (.92) | |||||||

| Ratios/Supplemental Data (%): | ||||||||||||

| Ratio of total expenses | ||||||||||||

| to average net assets | 2.69 | 2.82 | 2.83 | 3.42 | 4.55 | |||||||

| Ratio of net expenses | ||||||||||||

| to average net assets | 2.66 | 2.82 | 2.83 | 2.97 | 3.00 | |||||||

| Ratio of net investment income | ||||||||||||

| (loss) to average net assets | (.42) | (.21) | .33 | (.08) | (.00)d | |||||||

| Portfolio Turnover Rate | 188.08 | 178.32 | 154.41 | 194.40 | 327.93 | |||||||

| Net Assets, end of period ($ x 1,000) | 86,666 | 39,748 | 40,423 | 14,363 | 984 | |||||||

| a | Based on average shares outstanding at each month end. | |||||||||||

| b | Amount represents less than $.01 per share. | |||||||||||

| c | Exclusive of sales charge. | |||||||||||

| d | Amount represents less than .01%. | |||||||||||

| See notes to financial statements. | ||||||||||||

The Fund 19

| FINANCIAL HIGHLIGHTS (continued) |

| Year Ended October 31, | ||||||||||

| Class R Shares | 2006 | 2005 | 2004 | 2003 | 2002 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 19.56 | 19.88 | 19.38 | 12.36 | 12.41 | |||||

| Investment Operations: | ||||||||||

| Investment income—net a | .33 | .14 | .28 | .14 | .11 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | 11.60 | (.13) | .48 | 6.97 | (.08) | |||||

| Total from Investment Operations | 11.93 | .01 | .76 | 7.11 | .03 | |||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.06) | (.17) | (.07) | (.09) | (.08) | |||||

| Dividends from net realized | ||||||||||

| gain on investments | — | (.16) | (.19) | — | — | |||||

| Total Distributions | (.06) | (.33) | (.26) | (.09) | (.08) | |||||

| Net asset value, end of period | 31.43 | 19.56 | 19.88 | 19.38 | 12.36 | |||||

| Total Return (%) | 61.14 | (.04) | 3.96 | 57.93 | .10 | |||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | 1.62 | 1.77 | 1.80 | 2.56 | 3.63 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | 1.58 | 1.77 | 1.80 | 1.92 | 2.00 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 1.13 | .68 | 1.28 | 1.04 | .78 | |||||

| Portfolio Turnover Rate | 188.08 | 178.32 | 154.41 | 194.40 | 327.93 | |||||

| Net Assets, end of period ($ x 1,000) | 18,752 | 3,179 | 4,854 | 1,570 | 310 | |||||

| a Based on average shares outstanding at each month end. | ||||||||||

| See notes to financial statements. | ||||||||||

| 20 |

| Year Ended October 31, | ||||||||||||

| Class T Shares | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||

| Per Share Data ($): | ||||||||||||

| Net asset value, beginning of period | 18.91 | 19.26 | 18.83 | 12.07 | 12.15 | |||||||

| Investment Operations: | ||||||||||||

| Investment income—net a | .01 | .17 | .18 | .21 | .10 | |||||||

| Net realized and unrealized | ||||||||||||

| gain (loss) on investments | 11.35 | (.27) | .46 | 6.64 | (.13) | |||||||

| Total from Investment Operations | 11.36 | (.10) | .64 | 6.85 | (.03) | |||||||

| Distributions: | ||||||||||||

| Dividends from investment income—net | — | (.09) | (.02) | (.09) | (.05) | |||||||

| Dividends from net realized | ||||||||||||

| gain on investments | — | (.16) | (.19) | — | — | |||||||

| Total Distributions | — | (.25) | (.21) | (.09) | (.05) | |||||||

| Net asset value, end of period | 30.27 | 18.91 | 19.26 | 18.83 | 12.07 | |||||||

| Total Return (%) b | 60.07 | (.58) | 3.44 | 57.16 | (.32) | |||||||

| Ratios/Supplemental Data (%): | ||||||||||||

| Ratio of total expenses | ||||||||||||

| to average net assets | 2.28 | 2.29 | 2.43 | 3.46 | 5.80 | |||||||

| Ratio of net expenses | ||||||||||||

| to average net assets | 2.25 | 2.29 | 2.40 | 2.36 | 2.50 | |||||||

| Ratio of net investment income | ||||||||||||

| to average net assets | .02 | .81 | .85 | 1.51 | .69 | |||||||

| Portfolio Turnover Rate | 188.08 | 178.32 | 154.41 | 194.40 | 327.93 | |||||||

| Net Assets, end of period ($ x 1,000) | 1,217 | 617 | 855 | 295 | 20 | |||||||

| a | Based on average shares outstanding at each month end. | |||||||||||

| b | Exclusive of sales charge. | |||||||||||

| See notes to financial statements. | ||||||||||||

The Fund 21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Greater China Fund (the “fund”) is a separate non-diversified portfolio of Dreyfus Premier International Funds, Inc. (the “Company”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering two series, including the fund.The fund’s investment objective is long-term capital appreciation. The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment adviser. Dreyfus is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”). Hamon U.S. Investment Advisors Limited (“Hamon”) serves as the fund’s sub-investment adviser. Hamon is an affiliate of Dreyfus.

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue 200 million shares of $.001 par value Common Stock in each of the following classes of shares: Class A, Class B, Class C, Class R and Class T. Class A and Class T shares are subject to a sales charge imposed at the time of purchase. Class B shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class B share redemptions made within six years of purchase and automatically convert to Class A shares after six years.Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase and Class R shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Effective March 1, 2006, Class A shares of the fund may be purchased at net asset value (“NAV”) without payment of a sales charge:

- By qualified investors who (i) purchase Class A shares directly through the Distributor, and (ii) have, or whose spouse or minor children have,

| 22 |

- beneficially owned shares and continuously maintained an open account directly through the Distributor in a Dreyfus-managed fund, including the fund, or a Founders Asset Management LLC (“Founders”) managed fund since on or before February 28, 2006. Founders is a wholly-owned subsidiary of the Distributor.

- With the cash proceeds from an investor’s exercise of employment- related stock options, whether invested in the fund directly or indi- rectly through an exchange from a Dreyfus-managed money market fund, provided that the proceeds are processed through an entity that has entered into an agreement with the Distributor specifically relat- ing to processing stock options. Upon establishing the account in the fund or the Dreyfus-managed money market fund, the investor and the investor’s spouse and minor children become eligible to purchase Class A shares of the fund at NAV, whether or not using the proceeds of the employment-related stock options.

- By members of qualified affinity groups who purchase Class A shares directly through the Distributor, provided that the qualified affinity group has entered into an affinity agreement with the Distributor.

Effective March 1, 2006, Class A and Class T shares of the fund may be purchased at NAV without payment of a sales charge:

- For Dreyfus-sponsored IRA “Rollover Accounts” with the distrib- ution proceeds from qualified and non-qualified retirement plans or a Dreyfus-sponsored 403(b)(7) plan, provided that, in the case of a qualified or non-qualified retirement plan, the rollover is processed through an entity that has entered into an agreement with the Distributor specifically relating to processing rollovers. Upon estab- lishing the Dreyfus-sponsored IRA rollover account in the fund, the shareholder becomes eligible to make subsequent purchases of Class A or Class T shares of the fund at NAV in such account.

Effective June 1, 2006, the fund no longer offers Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares.

The Fund 23

| NOTES TO FINANCIAL STATEMENTS (continued) |

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available, are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Investments in registered investment companies are valued at their NAV.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its NAV, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair

| 24 |

valued by the Board of Directors, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Financial futures and options are valued at the last sales price. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements.The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

The Fund 25

| NOTES TO FINANCIAL STATEMENTS (continued) |

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, if any, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

On July 13, 2006, the Financial Accounting Standards Board (FASB) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax

| 26 |

returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority.Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

At October 31, 2006, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $34,231,325, undistributed capital gains $17,156,524 and unrealized appreciation $27,232,158.

The tax character of distributions paid to shareholders during the fiscal years ended October 31, 2006 and October 31, 2005, were as follows: ordinary income $52,054 and $934,087 and long-term capital gains $0 and $843,149, respectively.

During the period ended October 31, 2006, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, the fund decreased accumulated undistributed investment income-net by $842,695 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets were not affected by this reclassification.

| NOTE 2—Bank Lines of Credit: |

The fund may borrow up to $5 million for leveraging purposes under a short-term unsecured line of credit and participates with other Dreyfus-managed funds in a $100 million unsecured line of credit primarily to be utilized for temporary or emergency purposes, including the financing of redemptions. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing. During the period ended October 31, 2006, the fund did not borrow under either line of credit.

The Fund 27

| NOTES TO FINANCIAL STATEMENTS (continued) |

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to a Management Agreement (“Agreement”) with Dreyfus, the management fee is computed at the annual rate of 1.25% of the value of the fund’s average daily net assets and is payable monthly.

Pursuant to a Sub-Investment Advisory Agreement between Dreyfus and Hamon, Dreyfus pays Hamon a fee payable monthly at the annual rate of .625% of the value of the fund’s average daily net assets.

During the period ended October 31, 2006, the Distributor retained $284,533 and $4,812 from commissions earned on sales of the fund’s Class A and Class T shares, respectively, and $129,842 and $74,326 from CDSC on redemptions of the fund’s Class B and Class C shares, respectively.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class B, Class C and Class T shares pay the Distributor for distributing their shares at an annual rate of .75% of the value of the average daily net assets of Class B and Class C shares and .25% of the value of the average daily net assets of Class T shares. During the period ended October 31, 2006, Class B, Class C and Class T shares were charged $218,194, $481,465 and $2,500, respectively, pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A, Class B, Class C and Class T shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the

| 28 |

period ended October 31, 2006, Class A, Class B, Class C and Class T shares were charged $303,186, $72,731, $160,489 and $2,500, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2006, the fund was charged $141,461 pursuant to the transfer agency agreement.

During the period ended October 31, 2006, the fund was charged $4,164 for services performed by the Chief Compliance Officer.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: investment advisory fees $309,083, Rule 12b-1 distribution plan fees $73,136, shareholder services plan fees $58,023, chief compliance officer fees $1,363 and transfer agency per account fees $24,200.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward currency exchange contracts, during the period ended October 31, 2006, amounted to $492,714,866 and $399,710,875, respectively.

The fund enters into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings and to settle foreign currency transactions. When executing forward currency exchange contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward currency

The Fund 29

| NOTES TO FINANCIAL STATEMENTS (continued) |

exchange contracts, the fund would incur a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward currency exchange contracts, the fund would incur a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. The fund is also exposed to credit risk associated with counter party nonperformance on these forward currency exchange contracts which is typically limited to the unrealized gain on each open contract. At October 31, 2006, there were no forward currency exchange contracts outstanding.

At October 31, 2006, the cost of investments for federal income tax purposes was $264,590,827; accordingly, accumulated net unrealized appreciation on investments was $27,218,355, consisting of $42,648,517 gross unrealized appreciation and $15,430,162 gross unrealized depreciation.

| 30 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| Shareholders and Board of Directors Dreyfus Premier Greater China Fund |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Premier Greater China Fund (one of the funds comprising Dreyfus Premier International Funds, Inc.) as of October 31, 2006, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management.Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2006 by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Greater China Fund at October 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

| New York, New York December 11, 2006 |

The Fund 31

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund elects to provide each shareholder with their portion of the fund’s foreign taxes paid and the income sourced from foreign countries.Accordingly, the fund hereby makes the following designations regarding its fiscal year ended October 31, 2006:

—the total amount of taxes paid to foreign countries was $127,871

—the total amount of income sourced from foreign countries was $4,659,956

As required by federal tax law rules, shareholders will receive notification of their proportionate share of foreign taxes paid and foreign sourced income for the 2006 calendar year with Form 1099-DIV which will be mailed by January 31, 2007.

For the fiscal year ended October 31, 2006, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $52,054 represents the maximum amount that may be considered qualified dividend income.

| 32 |

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the Board of Directors held on May 24, 2006, the Board considered the re-approval of the Fund’s Management Agreement, pursuant to which the Manager provides the Fund with investment advisory and administrative services, and the re-approval of the Sub-Investment Advisory Agreement between the Manager and Hamon U.S. Investment Advisors Limited (the “Sub-Adviser”), pursuant to which the Sub-Adviser provides day-to-day management of the Fund’s investments subject to the Manager’s oversight.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the Fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Manager and the Sub-Adviser.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members received a presentation from representatives of the Manager regarding services provided to the Fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the Fund by Dreyfus pursuant to the Management Agreement and by the Sub-Adviser pursuant to the Sub-Investment Advisory Agreement.The presentation included a detailed summary of the services provided to Dreyfus-managed mutual funds by each business unit within the Manager. The Manager’s representatives reviewed the Fund’s distribution of accounts and the relationships the Manager has with various intermediaries and the different needs of each.The Manager’s representatives noted the diversity of distribution of the Fund, as well as other funds in the Dreyfus complex, and the Manager’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each of the Fund’s distribution channels. The Board also reviewed the number of shareholder accounts in the Fund, as well as the Fund’s asset size.

The Board members considered the research and portfolio management capabilities of the Manager and the Sub-Adviser and the Manager’s oversight of day-to-day Fund operations, including fund accounting and administration and assistance in meeting legal and regulatory require-

The Fund 33

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E F U N D ’S M A N A G E M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

ments. The Board members also considered the Manager’s extensive administrative, accounting, and compliance infrastructure, as well as the Manager’s supervisory activities over the Sub-Adviser.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board members reviewed the Fund’s performance, management fee and expense ratio over various periods, placing a significant emphasis on comparative data supplied by Lipper, Inc., an independent provider of investment company data, including contractual and actual (net of fee waivers and expense reimbursements) management fees, operating expense components and total returns. The Fund’s total returns were compared to those of a Performance Universe, consisting of all funds with the same Lipper classification, and a Performance Group, consisting of comparable funds chosen by Lipper based on guidelines previously approved by the Board. Similarly, the Fund’s contractual and actual management fee and operating expenses were compared to those of an Expense Universe, consisting of all retail funds with the same Lipper classification, and an Expense Group, which was identical to the Performance Group. As part of its review of expenses, the Board also considered other Fund expenses, such as transfer agent fees, custody fees, any 12b-1 or non-12b-1 service fees, and other non-management fees, as well as any waivers or reimbursements of Fund expenses.

In its review of performance, the Board noted that the Fund met or exceeded the median total return of the Performance Group and the Performance Universe for each period.The Board also noted that the Fund’s total return ranked first among the Performance Group for the one-year period ended March 31, 2006.

In its review of the Fund’s management fee and operating expenses, the Board examined the range of management fees and expense ratios of the funds in the Expense Group and Expense Universe, noting, among other things, that the Fund’s total expense ratio was at the median of the Expense Group, while the Fund’s contractual and actual management fees were slightly higher than the median.

| 34 |

Representatives of the Manager noted that there were no other mutual funds, or institutional or wrap fee separate accounts, that were managed by the Manager or its affiliates, with similar investment objectives, policies and strategies as the Fund. Representatives of the Manager reviewed with the Board members the fees paid to the Sub-Adviser by other accounts managed or sub-advised by the Sub-Adviser with similar investment objectives, policies and strategies as the Fund (the “Similar Accounts”). The Manager’s representatives explained the nature of the Similar Accounts and the differences in management of the Similar Accounts as compared to managing and providing services to the Fund. The Manager’s representatives also reviewed the costs associated with distribution through intermediaries.The Board analyzed the differences in fees paid to the Sub-Adviser and discussed the relationship of the advisory fees paid in light of the Manager’s and the Sub-Adviser’s performance and the services provided; it was noted that the Similar Accounts paid the Sub-Adviser management fees that were higher than the fee the Manager paid the Sub-Adviser with respect to the Fund.The Board members considered the relevance of the fee information provided for the Similar Accounts managed by the Sub-Adviser to evaluate the appropriateness and reasonableness of the Fund’s advisory fees.The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. The Manager’s representatives reviewed the dollar amount of expenses allocated and profit received by the Manager and the method used to determine such expenses and profit.The Board received and considered information prepared by an independent consulting firm regarding the Manager’s approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The Manager’s representatives stated that the methodology had also been reviewed by an independent registered public accounting firm which, like the consultant, found the methodology to be reasonable.The consulting firm also analyzed where any economies of scale might emerge

The Fund 35

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E F U N D ’S M A N A G E M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

in connection with the management of the Fund.The Board members evaluated the analysis in light of the relevant circumstances for the Fund, and the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund investors. The Board noted that it appeared that the benefits of any economies of scale also would be appropriately shared with shareholders through increased investment in fund management and administration resources. The Board members also considered potential benefits to the Manager and the Sub-Adviser from acting as investment adviser and sub-investment adviser, respectively, and noted that there were no soft dollar arrangements with respect to trading the Fund’s portfolio.

It was noted that the Board members should consider the Manager’s profitability with respect to the Fund as part of their evaluation of whether the fee under the Management Agreement bears a reasonable relationship to the mix of services provided by the Manager, including the nature, extent and quality of such services and that a discussion of economies of scale is predicated on increasing assets and that, if a fund’s assets had been decreasing, the possibility that the Manager may have realized any economies of scale would be less. Since the Manager, and not the Fund, pays the Sub-Adviser pursuant to the Sub-Investment Advisory Agreement, the Board did not consider the Sub-Adviser’s profitability to be relevant to their deliberations.The Board members also discussed the profitability percentage ranges determined by appropriate court cases to be reasonable given the services rendered to investment companies. It was noted that the profitability percentage for managing the Fund was not unreasonable given the Fund’s overall performance and generally superior service levels provided.

At the conclusion of these discussions, each of the Board members expressed the opinion that he or she had been furnished with sufficient information to make an informed business decision with respect to continuation of the Fund’s Management Agreement and

| 36 |

Sub-Investment Advisory Agreement. Based on their discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by the Manager and the Sub-Adviser are adequate and appropriate.

- The Board was satisfied with the Fund’s overall performance.

- The Board concluded that the fee paid to the Manager by the Fund was reasonable in light of comparative performance and expense and advisory fee information, costs of the services provided and profits to be realized and benefits derived or to be derived by the Manager from its relationship with the Fund.

- The Board determined that the economies of scale which may accrue to the Manager and its affiliates in connection with the management of the Fund had been adequately considered by the Manager in con- nection with the management fee rate charged to the Fund, and that, to the extent in the future it were to be determined that material economies of scale had not been shared with the Fund, the Board would seek to have those economies of scale shared with the Fund.

The Board members considered these conclusions and determinations, along with the information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that re-approval of the Fund’s Management Agreement with the Manager and Sub-Investment Advisory Agreement with the Sub-Adviser was in the best interests of the Fund and its shareholders.

The Fund 37

| BOARD MEMBERS INFORMATION (Unaudited) |

| Joseph S. DiMartino (63) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, engaging in the design, manufacture and sale of high frequency |

| systems for long-range voice and data communications, as well as providing certain |

| outdoor-related services to homes and businesses, Director |

| No. of Portfolios for which Board Member Serves: 189 |

| ——————— |

| Gordon J. Davis (65) |

| Board Member (1993) |

| Principal Occupation During Past 5 Years: |

| • Partner in the law firm of LeBoeuf, Lamb, Greene & MacRae, LLP |

| • President, Lincoln Center for the Performing Arts, Inc. (2001) |

| Other Board Memberships and Affiliations: |

| • Consolidated Edison, Inc., a utility company, Director |

| • Phoenix Companies Inc., a life insurance company, Director |

| • Board Member/Trustee for several not-for-profit groups |

| No. of Portfolios for which Board Member Serves: 24 |

| ——————— |

| David P. Feldman (66) |

| Board Member (1991) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • BBH Mutual Funds Group (11 funds), Director |

| • The Jeffrey Company, a private investment company, Director |

| • QMED, a medical device company, Director |

| No. of Portfolios for which Board Member Serves: 57 |

| 38 |

| Lynn Martin (66) |

| Board Member (1993) |

| Principal Occupation During Past 5 Years: |

| • Advisor to the international accounting firm of Deloitte & Touche, LLP and Chair to its |

| Council for the Advancement of Women from March 1993-September 2005 |

| • Advisor to Ameritech (11/05 to present) |

| Other Board Memberships and Affiliations: |

| • SBC Communications, Inc., Director |

| • AT&T Inc., Director |

| • Ryder System, Inc., a supply chain and transportation management company, Director |

| • The Proctor & Gamble Co., a consumer products company, Director |

| • Constellation Energy Group, Director |

| • Chicago Council on Foreign Relations |

| No. of Portfolios for which Board Member Serves: 9 |

| ——————— |

| Daniel Rose (77) |

| Board Member (1992) |

| Principal Occupation During Past 5 Years: |

| • Chairman and Chief Executive Officer of Rose Associates, Inc., a New York based real estate |

| development and management firm |

| Other Board Memberships and Affiliations: |

| • Baltic-American Enterprise Fund,Vice Chairman and Director |

| • Harlem Educational Activities Fund, Inc., Chairman |

| • Housing Committee of the Real Estate Board of New York, Inc., Director |