Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-12

AVERY DENNISON CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

(1) | Title of each class of securities to which transaction applies: | |||||

(2) | Aggregate number of securities to which transaction applies: | |||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

(4) | Proposed maximum aggregate value of transaction: | |||||

(5) | Total fee paid: | |||||

o | Fee paid previously with preliminary materials. | |||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

(1) | Amount Previously Paid: | |||||

(2) | Form, Schedule or Registration Statement No.: | |||||

(3) | Filing Party: | |||||

(4) | Date Filed: | |||||

Notice of 2018 Annual Meeting of Stockholders

To Our Stockholders:

We cordially invite you to attend our 2018 Annual Meeting of Stockholders at the Embassy Suites, 800 North Central Avenue, Glendale, California 91203 on Thursday, April 26, 2018, at 1:30 p.m. Pacific Time. At the meeting, we will conduct the following items of business:

| Elect the 11 directors nominated by our Board to serve a one-year term; | |||

| Approve, on an advisory basis, our executive compensation; | |||

| Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2018; and | |||

| Transact any other business properly brought before the meeting or any adjournment or postponement thereof. |

Our Board recommends that you voteFOR each of the director nominees in Item 1, andFOR Items 2 and 3. After Dean Scarborough, our Chairman, conducts these items of business at the meeting, Mitch Butier, our President and Chief Executive Officer, will discuss our 2017 performance and answer your questions.

Stockholders of record as of February 26, 2018 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof.

We will be mailing our Notice of Internet Availability of Proxy Materials, which includes instructions on how to access these materials on the Internet, on or before March 15, 2018. If you previously elected to receive a paper copy of our proxy materials, we will mail you our 2018 proxy statement; 2017 annual report, which includes a letter to stockholders from our Chairman and President/CEO; and a proxy card on or about March 16, 2018.

We want your shares to be represented and voted. You can vote as shown in the chart below.

| VOTING | ||

|---|---|---|

| | | |

On the Internet You can vote online atwww.proxyvote.com before 11:59 p.m. Eastern Time on April 25, 2018. You will need the 16-digit control number on your Notice of Internet Availability or proxy card. | ||

By Telephone In the U.S. or Canada, you can vote by calling 1.800.690.6903 before 11:59 p.m. Eastern Time on April 25, 2018. You will need the 16-digit control number on your Notice of Internet Availability or proxy card. | ||

By Mail You can vote by mail by completing, dating and signing your proxy card and returning it in the postage-paid envelope or otherwise to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. | ||

In Person Except with respect to shares held through our Employee Savings Plan, you can vote in person at the Annual Meeting. Beneficial holders must contact their broker or other nominee if they want to vote in person. | ||

On behalf of the Board of Directors, management and employees of Avery Dennison, thank you for your continued support.

| By Order of the Board of Directors | ||

Susan C. Miller Corporate Secretary | ||

March 15, 2018 |

| | | | ||

|---|---|---|---|---|

| Drive outsized growth in high value categories with higher growth and margin potential (e.g., specialty labels, graphics, industrial tapes and radio-frequency identification (RFID)) Grow profitably in our base business through tailored go-to-market strategies and disciplined execution Maintain our relentless focus on productivity through continued operational excellence and enterprise lean sigma Deploy capital effectively by balancing investments in organic growth, productivity and acquisitions, while returning cash to shareholders | Our Strategies |

| Our Values |  |

| | | | ||

|---|---|---|---|---|

| Customers We provide innovative, high quality products and solutions, with industry-leading service Employees We cultivate a diverse, engaged, safe and healthy workforce Communities We are responsible stewards of the environment and a force for good in our communities Investors We are committed to delivering superior shareholder returns over the long term | Our Stakeholders |

TABLE OF CONTENTS

| | | |

PROXY SUMMARY | i | |

| | | |

PROXY STATEMENT | 1 | |

| | | |

GOVERNANCE, SUSTAINABILITY AND SOCIAL RESPONSIBILITY | 1 | |

| | | |

OUR BOARD OF DIRECTORS | 10 | |

| | | |

Overview | 10 | |

Governance Guidelines | 12 | |

Director Independence | 13 | |

Board Leadership Structure | 14 | |

Board Committees | 15 | |

Executive Sessions | 17 | |

Risk Oversight | 17 | |

Human Capital Management | 20 | |

Director Education | 20 | |

Board and Committee Evaluations | 21 | |

Stockholder Engagement and Communications | 22 | |

| | | |

ITEM 1 — ELECTION OF DIRECTORS | 23 | |

| | | |

Selection of Director Nominees | 23 | |

Board Matrix | 25 | |

Board Refreshment and Director Succession Planning | 25 | |

Director Diversity | 27 | |

2018 Director Nominees | 27 | |

Director Compensation | 32 | |

Director Compensation Table | 34 | |

| | | |

ITEM 2 — ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | 35 | |

| | | |

COMPENSATION AND EXECUTIVE PERSONNEL COMMITTEE REPORT | 36 | |

| | | |

COMPENSATION DISCUSSION AND ANALYSIS (CD&A) | 37 | |

| | | |

Executive Summary | 37 | |

Summary of Compensation Decisions for 2017 | 48 | |

Discussion of Compensation Components and Decisions Impacting 2017 Compensation | 50 | |

Compensation-Setting Tools | 63 | |

Independent Oversight and Expertise | 64 | |

Other Considerations | 65 | |

| | | |

EXECUTIVE COMPENSATION TABLES | 67 | |

| | | |

2017 Summary Compensation Table | 67 | |

2017 Grants of Plan-Based Awards | 69 | |

2017 Outstanding Equity Awards at Fiscal Year-End | 70 | |

2017 Option Exercises and Stock Vested | 72 | |

2017 Pension Benefits | 74 | |

2017 Nonqualified Deferred Compensation | 76 | |

Payments Upon Termination as of December 30, 2017 | 78 | |

Equity Compensation Plan Information as of December 30, 2017 | 82 | |

| | | |

CEO PAY RATIO | 83 | |

| | | |

ITEM 3 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 84 | |

| | | |

AUDIT MATTERS | 85 | |

| | | |

AUDIT AND FINANCE COMMITTEE REPORT | 87 | |

| | | |

SECURITY OWNERSHIP INFORMATION | 90 | |

| | | |

Security Ownership of Management and Significant Stockholders | 90 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 91 | |

Related Person Transactions | 91 | |

| | | |

VOTING AND MEETING Q&A | 92 | |

| | | |

APPENDIX A — RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP | A-1 | |

| | | |

Avery Dennison Corporation | 2018 Proxy Statement | Table of Contents

This section summarizes information described in greater detail in other parts of this proxy statement and does not contain all the information you should consider before voting. We encourage you to read the entire proxy statement before voting.

TIME AND LOCATION OF ANNUAL MEETING

The Annual Meeting will take place at 1:30 p.m. Pacific Time on April 26, 2018 at the Embassy Suites, 800 North Central Avenue, Glendale, California 91203.

ITEMS BEING VOTED ON AT ANNUAL MEETING

You are being asked to vote on the items of business shown below at the Annual Meeting. Our Board of Directors (our "Board") recommends that you vote FOR all 11 director nominees and FOR the two other items being brought before the stockholder vote.

| ITEM | BOARD RECOMMENDATION | VOTE REQUIRED | DISCRETIONARY BROKER VOTING | PAGE REFERENCE | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Election of directors | FOR each nominee | Majority of votes cast | No | 23 | |||||

| Advisory vote to approve executive compensation | FOR | Majority of shares represented and entitled to vote | No | 35 | ||||||

| | Ratification of appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for fiscal year 2018 | FOR | Majority of shares represented and entitled to vote | Yes | 84 | |||||

We strive to create superior long-term, sustainable value for our customers, employees, and investors and improve the communities in which we operate. To realize the business aspects of this vision, we are focused on executing the following key strategies:

- •

- Driving outsized growth in high value categories with higher growth and margin potential (e.g., specialty labels, graphics, industrial tapes and radio-frequency identification (RFID));

- •

- Growing profitably in our base business through tailored go-to-market strategies and disciplined execution;

- •

- Maintaining our relentless focus on productivity through continued operational excellence and enterprise lean sigma; and

- •

- Deploying capital effectively by balancing investments in organic growth, productivity and acquisitions, while returning cash to stockholders.

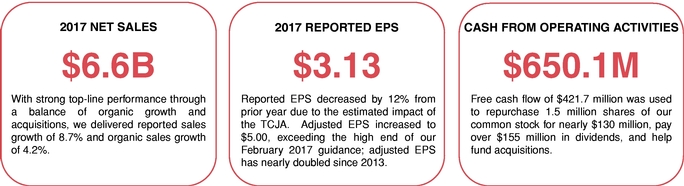

FINANCIAL PERFORMANCE HIGHLIGHTS

Strong Financial Performance and Execution of Strategic Priorities. Fiscal year 2017 marked our sixth consecutive year of strong top-line growth, margin expansion and double-digit adjusted earnings per share (EPS) growth. We exceeded our financial goals for the year, with the accomplishments shown below and on the following page.

- •

- Achieved net sales of approximately $6.6 billion, an increase of 8.7% over the prior year, through a balance of organic growth and acquisitions.

- •

- Excluding the impact of currency, sales grew by 8.2%; on an organic basis, sales grew by 4.2%, driven by growth in high value product categories and businesses serving emerging markets.

Avery Dennison Corporation | 2018 Proxy Statement | i

- •

- Although reported EPS decreased from $3.54 in 2016 to $3.13 in 2017 due to a substantial increase in our provision for income taxes to reflect the provisional estimated impact of the Tax Cuts and Jobs Act (TCJA), adjusted EPS increased from $4.02 to $5.00, significantly exceeding the high end of the $4.30-$4.50 guidance range we gave in February 2017.

- •

- With net cash provided by operating activities of $650.1 million, delivered free cash flow of $421.7 million.

- •

- On reported net income of $281.8 million, achieved return on total capital (ROTC) of 12.9%; adjusted to exclude the net impact of the TCJA, ROTC increased to 18.8%.

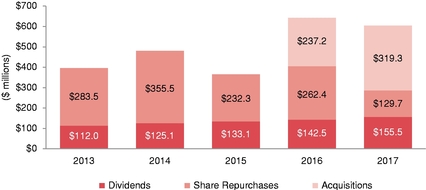

- •

- Continued our disciplined approach to capital allocation by investing $226.1 million in capital expenditures to support organic growth and $319.3 million in acquisitions and equity investments, while allocating $155.5 million to dividends and $129.7 million to share repurchases.

Organic sales growth, adjusted EPS, free cash flow, ROTC and adjusted ROTC are non-GAAP financial measures that we provide to investors to assist them in assessing our performance and operating trends and define in theCompensation Discussion and Analysis section of this proxy statement. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to, the comparable financial measures under generally accepted accounting principles in the United States of America (GAAP) and are reconciled to GAAP inAppendix A of this proxy statement.

On Track to Deliver Financial Targets. Our 2014-2018 financial goals included an organic sales growth target of 4% to 5%, reflecting confidence in the trajectory of our two largest businesses. We also targeted double-digit adjusted EPS growth. For the first time, we externally communicated a target for ROTC, which has long been a key internal financial metric for our company. We believe that the combination of our growth and ROTC targets captures our value creation objectives, which together are a proxy for economic value added (EVA), one of the performance objectives used in our long-term incentive (LTI) compensation program. As shown below, based on our results for the first four years of this five-year period, we are on track to achieve or exceed our 2018 commitments to investors.

| | | 2014-2018 TARGETS* | 2014-2017 RESULTS | ||||

|---|---|---|---|---|---|---|---|

Organic Sales Growth | 4%-5% | 4% | |||||

Adjusted EPS Growth | 12%-15%+ | 17% | |||||

ROTC | 16%+ in 2018 | 13% in 2017 Adj. = 19% in 2017 | |||||

| ON TRACK TO ACHIEVE OR EXCEED 2018 FINANCIAL TARGETS | |||||||

* | Percentages for organic sales and adjusted EPS growth reflect compound annual growth rates with 2013 as the base period. | ||||||

Avery Dennison Corporation | 2018 Proxy Statement | ii

In March 2017, we announced our 2017-2021 goals, targeting continued solid organic sales growth and double-digit growth in adjusted EPS on a compound annual basis. While we are only one year into this five-year period, we are on pace to deliver these targets, as shown below.

| | | 2017-2021 TARGETS* | 2017 RESULTS | ||||

|---|---|---|---|---|---|---|---|

Organic Sales Growth | 4+% 5+% with M&A | 4% 8% with M&A | |||||

Adjusted EPS Growth | 10+% | 24% | |||||

ROTC | 17%+ in 2021 | 13% in 2017 Adj. = 19% in 2017 | |||||

ON PACE TO DELIVER 2021 FINANCIAL TARGETS | |||||||

* | Percentages for organic sales growth and adjusted EPS growth reflect compound annual growth rates with 2016 as the base period. Target with M&A reflects completed acquisitions as of March 2017. | ||||||

Reported results for these periods are disclosed in theCompensation Discussion and Analysis section of this proxy statement.

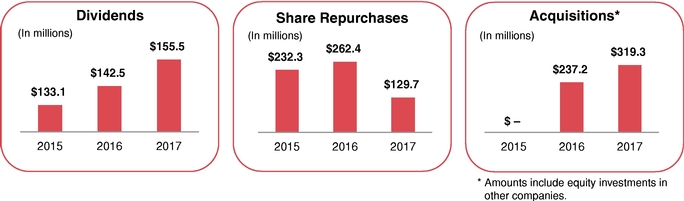

Disciplined Capital Allocation. Effectively deploying capital is one of our key strategies, and we have been consistently disciplined in our execution by investing in organic growth and productivity and acquiring targeted companies, while continuing to return cash to stockholders through dividends and share repurchases.

We have paid quarterly dividends for decades and raised our quarterly dividend rate by 125% since 2010. As shown in the graph below, over the last five years, we have allocated nearly $2 billion to dividends and share repurchases. Given our increased use of available capital for acquisitions and equity investments, we repurchased fewer shares in 2017 compared to prior years.

We have also allocated capital to investing in our businesses to support organic growth and pursuing targeted acquisitions that support our strategy of increasing our exposure to high value product categories. During 2017, we successfully completed and integrated the acquisitions of (i) Hanita Coatings Rural Cooperative Association Limited, an Israel-based pressure-sensitive manufacturer of specialty films and laminates; (ii) Yongle Tape Ltd., a China-based manufacturer of specialty tapes and related products used in a variety of industrial markets; and (iii) Finesse Medical Limited, an Ireland-based manufacturer of healthcare products used in the management of wound care and skin conditions. We also made equity investments in two other companies.

Capital Allocated to Dividends,

Share Repurchases and Acquisitions*

* Amounts for acquisitions include equity investments in other companies.

Avery Dennison Corporation | 2018 Proxy Statement | iii

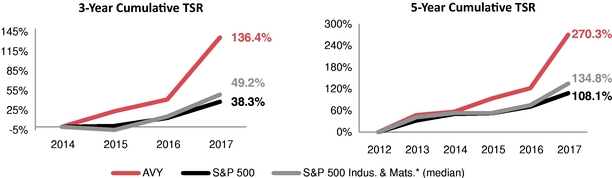

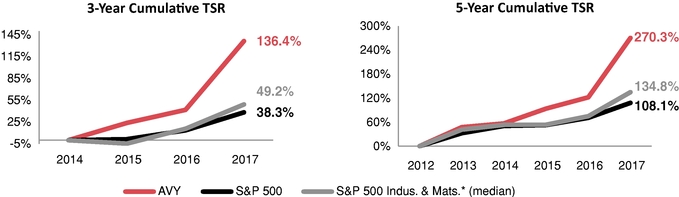

Three- and Five-Year Cumulative TSR Outperformance. As shown below, with total stockholder return (TSR) of over 66% in 2017, we delivered cumulative TSR for the 2015-2017 three-year period and the 2013-2017 five-year period that significantly outperformed the S&P 500® and the median of the S&P 500 Industrials and Materials subsets (we are a member of the Materials subset, but also share many characteristics with members of the Industrials subset; investors have informed us that they look at both subsets in evaluating our relative performance, as we do internally). TSR measures the return we have provided to our stockholders, including stock price appreciation and dividends paid (assuming reinvestment thereof).

1-, 3- and 5-YEAR TSR | ||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 3-Year TSR | 5-Year TSR | ||||||||

| | | | | | | | | | | | | | | |

AVY | 47.5% | 6.2% | 23.8% | 14.6% | 66.7% | 136.4% | 270.3% | |||||||

| | | | | | | | | | | | | | | |

S&P 500 | 32.4% | 13.7% | 1.4% | 12.0% | 21.8% | 38.3% | 108.1% | |||||||

| | | | | | | | | | | | | | | |

S&P 500 Indus. & Mats.* (median) | 41.0% | 11.7% | (4.7)% | 19.0% | 27.5% | 49.2% | 134.8% | |||||||

- *

- Based on companies in subsets as of December 31, 2017.

Avery Dennison Corporation | 2018 Proxy Statement | iv

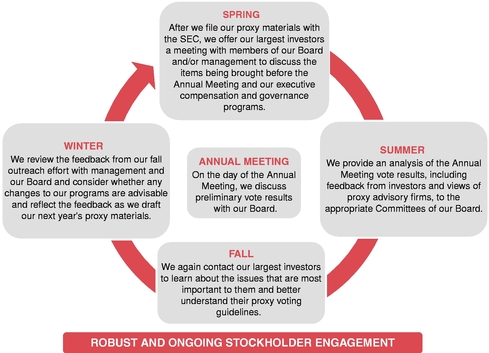

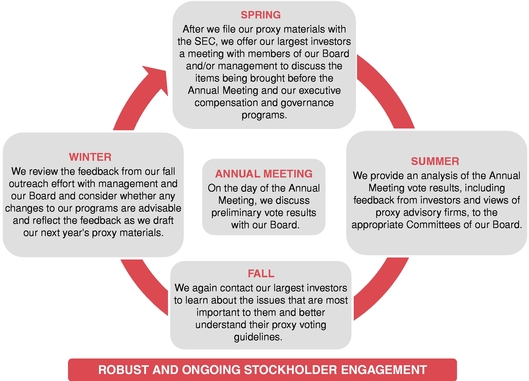

We continued our longstanding practice of ongoing engagement and open dialogue with stockholders in 2017. Our engagement program takes place throughout the year, generally as shown below.

ENGAGEMENT PROCESS

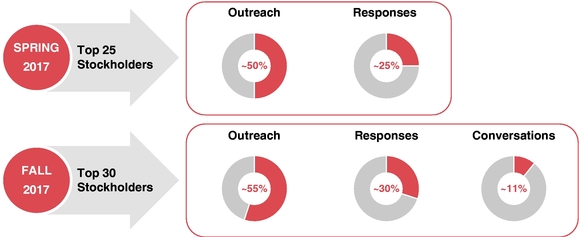

In advance of the 2017 Annual Meeting, we contacted our 25 largest institutional stockholders, representing almost 50% of our then-outstanding shares. Board members, including our Lead Independent Director, and management were made available to answer questions and address concerns regarding our executive compensation and governance programs and the items being brought to stockholder vote at the Annual Meeting. While we received responses from stockholders representing 25% of our then-outstanding shares, none of them felt that there was a need to substantively engage during that busy time.

In the fall, without the time pressures associated with proxy season, we reached out to our 30 largest institutional stockholders, representing nearly 55% of our then-outstanding shares. Proposed topics for these meetings included our business strategy and financial performance, executive compensation matters, Board composition and succession planning, and progress towards achieving our sustainability goals. We received responses from stockholders representing over 30% of our then-outstanding shares and spoke with stockholders representing approximately 11% of those shares. We substantively engaged with every stockholder who requested to do so.

Avery Dennison Corporation | 2018 Proxy Statement | v

The graphics below show the results of our 2017 engagement.

STOCKHOLDER FEEDBACK DURING 2017 ENGAGEMENT

Governance Matters

With respect to matters related to governance, we discussed several topics related to our Board's processes, including succession planning and refreshment, diversity, and evaluations. We also discussed the integration of sustainability into our business strategies, and our Board's oversight of our cybersecurity preparedness. Our stockholders expressed interest in the anticipated completion of our CEO transition and our Board's views on proxy access; both of these matters were subsequently addressed with our December 2017 announcement of Dean Scarborough's retirement as our Executive Chairman at the end of that year and our adoption of proxy access.

Executive Compensation Matters

With respect to matters related to executive compensation, our stockholders expressed support for our program generally and appreciated the more graphical disclosure in our 2017 proxy statement. In addition, we discussed our approach to human capital management, in particular our diversity and inclusion efforts, as well as the linkage between our executive incentive compensation and business strategies. We also provided additional clarification on the market-leveraged stock units (MSUs) included in our LTI program.

Our Board and management believe that ongoing stockholder engagement fosters a deeper understanding of investors' evolving expectations on compensation and governance matters. We look forward to maintaining our longstanding practice of connecting with stockholders to ensure our programs continue to align with best practices.

Avery Dennison Corporation | 2018 Proxy Statement | vi

Sustainability is one of our values and has long been part of our approach to doing business. Our aim is to improve the sustainability of our products and processes while helping to create shared value for all of our stakeholders. Key to our progress has been integrating sustainability into our underlying business strategies and engaging employees at all levels.

We report on our sustainability progress every two years. In September 2017, we issued our 2014-2016 Sustainability Report, summarizing our key achievements during the period and progress towards reaching the 2025 sustainability goals we set in 2015. We encourage you to review the report on our website atwww.averydennison.com/sustainability. Our sustainability goals are shown below and our progress is described underSustainability in theGovernance, Sustainability and Social Responsibility section of this proxy statement.

| 2025 SUSTAINABILITY GOALS | ||||

|---|---|---|---|---|

| | | | | |

| | FOCUS AREA | GOAL(S) | ||

| Greenhouse Gas Emissions | Achieve at least 3% absolute reduction year-over-year. | ||

| Paper | Source 100% certified paper, of which at least 70% will be Forest Stewardship Council®–certified. | ||

| Films | Ensure that 70% of the films we buy conform to, or enable end products to conform to, our environmental and social guiding principles. | ||

| Chemicals | Ensure that 70% of the chemicals we buy conform to, or enable end products to conform to, our environmental and social guiding principles. | ||

| Products and Solutions | Through innovation, deliver above-average growth in sales from sustainability-driven products and services. Ensure that 70% of our products and solutions conform to, or enable end products to conform to, our environmental and social guiding principles. | ||

| Waste | Be 95% landfill-free, with at least 75% of our waste reused, repurposed or recycled. Eliminate 70% of the matrix and liner waste from our value chain. | ||

| Transparency | Commit to goals publicly and be transparent in reporting our progress. | ||

| People | Continue to cultivate a diverse (40%+ female at the level of manager and above), engaged, safe (recordable injury rate of <0.25), productive and healthy workforce. Continue to invest in our employees and the communities in which we work. | ||

Avery Dennison Corporation | 2018 Proxy Statement | vii

2018 DIRECTOR NOMINEES (ITEM 1)

Our Board has overseen our strong recent performance, including the following:

- •

- Successful execution of our Board-aligned business strategies, which has driven our strong TSR performance over the most recent three- and five-year periods of over 136% and 270%, respectively, in each case substantially outperforming the S&P 500;

- •

- The closing and integration of five acquisitions and the completion of equity investments in three other companies in the last two years, demonstrating our disciplined approach to acquisitions through which we target companies that can enhance our existing capabilities and increase our exposure to high value product categories; and

- •

- Seamless execution of our Board's executive succession planning with the 2016 election of Mitch Butier as our Chief Executive Officer (CEO), after serving as Chief Operating Officer under our previous CEO, Dean Scarborough (who then became our Executive Chairman), as well as the 2017 election of Greg Lovins as our Chief Financial Officer (CFO).

APPOINTMENT OF NEW DIRECTOR

Upon the recommendation of our Governance and Social Responsibility Committee, our Board appointed Andres Lopez as an independent director on our Board, effective February 1, 2017. Mr. Lopez brings deep packaging industry expertise as President and CEO of Owens-Illinois, Inc., after having served in leadership roles of increasing responsibility at the glass container manufacturing company (as described in greater detail in his biography on page 28 of this proxy statement). Mr. Lopez was subsequently elected to our Board by our stockholders at the 2017 Annual Meeting.

RETIREMENT OF EXECUTIVE CHAIRMAN

In December 2017, Mr. Scarborough, then Executive Chairman, notified the Board that he would be retiring from our company at the end of the year. He was our employee through December 31, 2017 and continues to serve as non-executive Chairman.

DIRECTOR NOMINEES

Our director nominees have demonstrated their commitment to diligently executing their fiduciary duties on behalf of our stockholders, and we recommend that our stockholders elect each of the nominees shown in the chart below at the Annual Meeting.

| NAME | AGE | DIRECTOR SINCE | PRINCIPAL OCCUPATION | INDEPENDENT | AC | CC | GC | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bradley A. Alford | 61 | 2010 | Retired Chairman & CEO, Nestlé USA | M | M | |||||||||

| Anthony K. Anderson | 62 | 2012 | Retired Vice Chair & Managing Partner, Ernst & Young LLP | M | M | |||||||||

| Peter K. Barker | 69 | 2003 | Retired Chairman of California, JPMorgan Chase & Co. | M | | C | ||||||||

| Mitchell R. Butier | 46 | 2016 | President & CEO, Avery Dennison Corporation | |||||||||||

| Ken C. Hicks | 65 | 2007 | Retired Chairman, Foot Locker, Inc. | M | M | | ||||||||

| Andres A. Lopez | 55 | 2017 | President & CEO, Owens-Illinois, Inc. | M | ||||||||||

| David E. I. Pyott (LID) | 64 | 1999 | Retired Chairman & CEO, Allergan, Inc. | M | M | |||||||||

| Dean A. Scarborough | 62 | 2000 | Retired Executive Chairman, Avery Dennison Corporation | |||||||||||

| Patrick T. Siewert | 62 | 2005 | Managing Director & Partner, The Carlyle Group | C | | | ||||||||

| Julia A. Stewart | 62 | 2003 | Former Chairman & CEO, DineEquity, Inc. | C | M | |||||||||

| Martha N. Sullivan | 61 | 2013 | President & CEO, Sensata Technologies Holding N.V. | M | M | |

AC = Audit & Finance Committee CC = Compensation & Executive Personnel Committee GC = Governance & Social Responsibility Committee

M = Member C = Chair LID = Lead Independent Director

Avery Dennison Corporation | 2018 Proxy Statement | viii

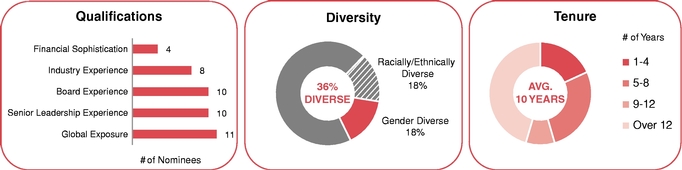

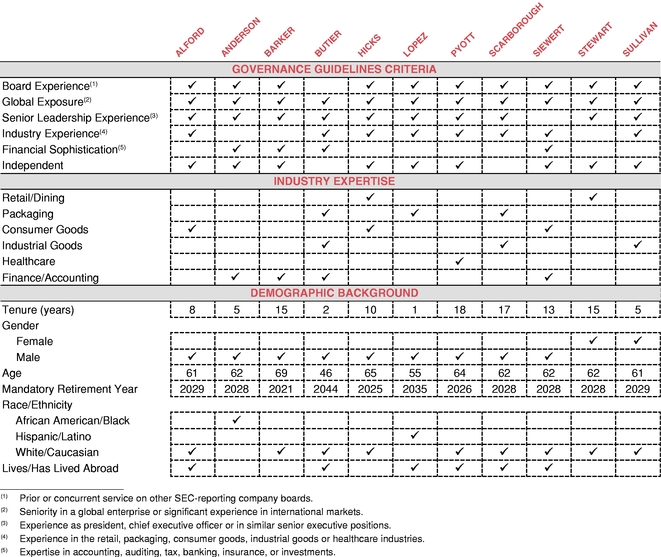

Our director nominees bring a balance of skills, qualifications and demographic backgrounds in overseeing our company, as highlighted below and shown in greater detail in the Board Matrix included inItem 1 — Election of Directors of this proxy statement.

Our governance program reflects our values and facilitates our Board's independent oversight of our company. The highlights of our program are shown below.

- ✓

- 82% Independent

- ✓

- Robust Lead Independent Director Role

- ✓

- Ongoing Director Succession Planning and Board Refreshment

- ✓

- Executive Succession Planning and Leadership Development

- ✓

- Annual Board Evaluations

- ✓

- Mandatory Director Retirement Policy

- ✓

- Governance Guidelines

- ✓

- Strong Committee Governance

- ✓

- Direct Board Access to Management and Experts

ADOPTION OF PROXY ACCESS

In December 2017, responding to feedback from our largest stockholders, our Board amended our bylaws to permit a stockholder, or a group of no more than 20 stockholders, owning at least 3% of our company's stock continuously for at least three years to submit director nominees (up to 20% of our Board) for inclusion in our proxy materials, subject to the terms and conditions described in our bylaws.

APPROVAL OF EXECUTIVE COMPENSATION (ITEM 2)

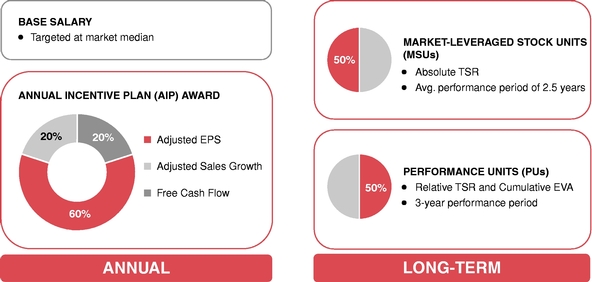

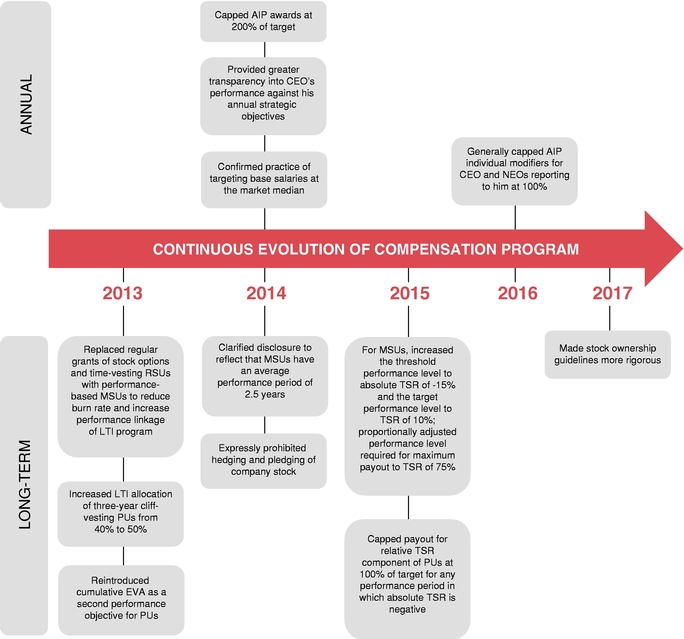

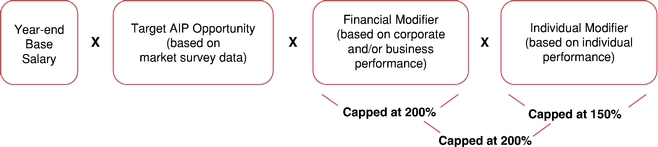

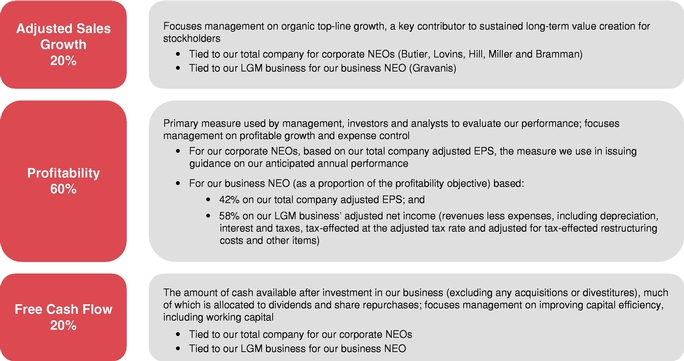

COMPENSATION DESIGN

Our Board's Compensation and Executive Personnel Committee (the "Compensation Committee") designs our executive compensation program to motivate our executives to execute our business strategies and deliver long-term stockholder value. The program delivers pay for performance, with realized compensation dependent on our company achieving annual and long-term financial performance and value creation objectives that advance the interests of our stockholders.

Avery Dennison Corporation | 2018 Proxy Statement | ix

PERFORMANCE-BASED COMPENSATION

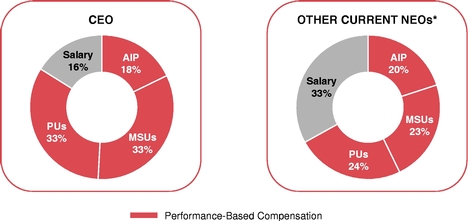

Target total direct compensation (TDC) to our executives is comprised of the following three components:

- •

- Base salary;

- •

- Performance-based cash incentive under our Annual Incentive Plan (AIP); and

- •

- Long-term incentives delivered in performance-based equity awards, consisting 50% of performance units (PUs) and 50% of MSUs.

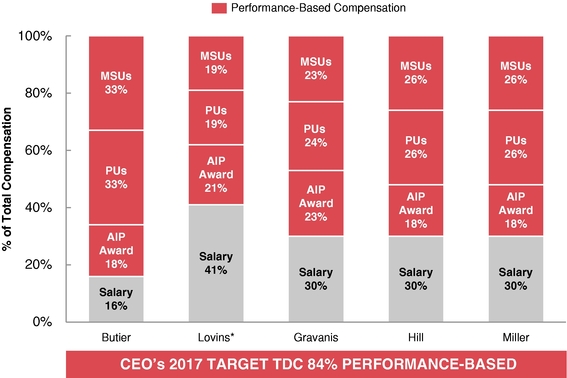

The Compensation Committee establishes the target TDC of our Named Executive Officers (NEOs) to incent economic and stockholder value creation, giving consideration to the market median, role responsibilities, individual performance, tenure, retention and succession. The majority of this compensation is performance-based, meaning that our executives may ultimately not realize some or all of these components of compensation if we fail to achieve our financial objectives. In 2017, approximately 84% and 67% of the TDC of our CEO and average of our other current NEOs, respectively, was performance-based.

2017 Target Total Direct Compensation Mix

| ||

* Mr. Lovins' 2017 AIP award was prorated based on his opportunity of 40% of base salary for the first six months of the year and his opportunity of 60% of base salary for the second six months of the year. His MSUs and PUs were awarded based on his previous LTI opportunity of 120% of base salary rather than his increased LTI opportunity of 180% of base salary. | ||

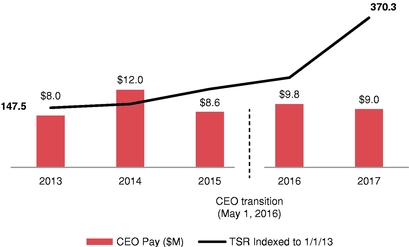

PAY-FOR-PERFORMANCE

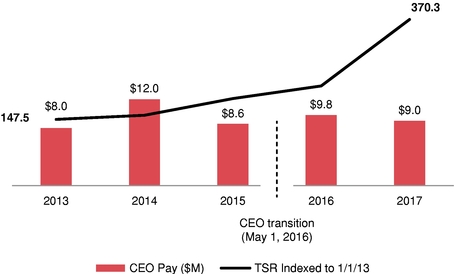

Over the past five years, our cumulative TSR has increased over 270% while the total compensation of our CEO has increased by only 13%. In the graph below, CEO pay reflects the compensation of our former CEO, Mr. Scarborough, from 2013 to 2015 and the compensation of our current CEO, Mr. Butier, for 2016 and 2017.

Five-Year CEO Pay and Cumulative TSR

Avery Dennison Corporation | 2018 Proxy Statement | x

COMPENSATION BEST PRACTICES

As summarized below and described in further detail in theCompensation Discussion and Analysis section of this proxy statement, our executive compensation program aligns with our goals and strategies and reflects best practices.

What We Do

- ✓

- Pay for performance — 84% of our CEO's 2017 target TDC was tied to company performance

- ✓

- Emphasize long-term performance — 66% of our CEO's 2017 target TDC was equity-based and tied to delivering long-term stockholder value

- ✓

- Use double-trigger change of control vesting provisions — vesting requires qualifying termination of employment within 24 months

- ✓

- Manage share usage conservatively — our three-year average burn rate at the end of fiscal year 2017 of 0.8% was at the 50th percentile of companies in the S&P 500

- ✓

- Maintain rigorous stock ownership guidelines — 6x base salary for our CEO (an increase for 2017 from the previous 5x) and 3x base salary for our other NEOs; require holding 50% of ownership level in vested shares

- ✓

- Able to clawback compensation

- ✓

- Use an independent compensation consultant retained directly by, and serving at the direction of, the Compensation Committee

- ✓

- Annually evaluate the Compensation Committee and review its charter

- ✓

- Periodically assess risks related to our compensation policies and practices

- ✓

- Following termination, obtain releases from liability from and impose restrictive covenants on our departing executives

- ✓

- Review tally sheets reflecting all compensation components for our NEOs

What We Don't Do

- ✗

- No employment contracts with our NEOs

- ✗

- No guaranteed AIP awards

- ✗

- No excise tax gross-ups on change of control severance benefits

- ✗

- No hedging or pledging of company stock by directors and officers

- ✗

- No tax gross-ups on perquisites

- ✗

- No above-market interest rates in our only deferred compensation plan currently open for deferrals

- ✗

- No re-pricing of stock options without stockholder approval

- ✗

- No payout of accrued dividends before performance conditions are met and underlying equity awards vest

- ✗

- No granting of stock options below fair market value

- ✗

- No NEOs with supplemental retirement benefits

RATIFICATION OF APPOINTMENT OF PwC (ITEM 3)

Our Board's Audit and Finance Committee has appointed PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for fiscal year 2018, and our Board is seeking stockholder ratification of the appointment. PwC is very well qualified to act as our independent registered public accounting firm and has a deep understanding of our operations and accounting practices. The Audit and Finance Committee considered the qualifications, performance, and independence of PwC, the quality of its discussions with PwC, and the fees charged by PwC for the level and quality of services provided during 2017, and determined that the reappointment of PwC is in the best interest of our company and stockholders.

Avery Dennison Corporation | 2018 Proxy Statement | xi

GOVERNANCE, SUSTAINABILITY AND SOCIAL RESPONSIBILITY |

We produce pressure-sensitive materials and a variety of tickets, tags, labels and other converted products. Some pressure-sensitive materials are sold to printers and converters that convert the materials into labels and other products through embossing, printing, stamping and die-cutting. We sell materials in converted form as tapes and reflective sheeting. We also manufacture and sell a variety of other converted products and items not involving pressure-sensitive components, such as fasteners, tickets, tags, radio-frequency identification inlays and tags, and imprinting equipment and related services, which we market to retailers, apparel manufacturers, and brand owners.

Under the oversight of our Board of Directors (our "Board"), we have designed our governance program to comply with applicable laws and regulations — including the rules of the Securities and Exchange Commission (SEC) and the listing standards of the New York Stock Exchange (NYSE) — and reflect best practices as informed by the practices of other large public companies, recommendations from our outside advisors, the voting guidelines of our stockholders and the policies of proxy advisory firms. The key features of our program and the related benefits to our stockholders are described in theGovernance Highlights section of our Proxy Summary.

We encourage you to visit the Corporate Governance section of our website atwww.averydennison.com/corporategovernance, where you can review and download the following documents:

- •

- Amended and Restated Certificate of Incorporation;

- •

- Amended and Restated Bylaws ("Bylaws");

- •

- Corporate Governance Guidelines (our "Governance Guidelines");

- •

- Charters for our Board's Audit and Finance Committee (the "Audit Committee"), Compensation and Executive Personnel Committee (the "Compensation Committee"), and Governance and Social Responsibility Committee (the "Governance Committee");

- •

- Code of Conduct;

- •

- Code of Ethics for the Chief Executive Officer (CEO) and Senior Financial Officers; and

- •

- Audit Committee Complaint Procedures for Accounting and Auditing Matters.

You can access these documents on our website using the links contained in this proxy statement, but should note that information on our website is not and should not be considered part of, nor is it incorporated by reference into, this proxy statement. You can also receive copies of these documents, without charge, by writing to our Corporate Secretary at Avery Dennison Corporation, 207 Goode Avenue, Glendale, California 91203.

Avery Dennison Corporation | 2018 Proxy Statement | 1

CODE OF ETHICS

We have adopted a Code of Ethics that requires our CEO, Chief Financial Officer (CFO) and Chief Accounting Officer (CAO) to act professionally and ethically in fulfilling their responsibilities.

- •

- Our CEO, CFO and CAO mustavoid actual or apparent conflicts of interest and disclose any material transaction or relationship that could reasonably be expected to raise a conflict of interest to the Governance Committee.

- •

- In addition, they must:

- •

- Ensure that our SEC filings are complete and accurate and contain understandable information;

- •

- Respect the confidentiality of information acquired in the course of the performance of their responsibilities;

- •

- Employ corporate assets responsibly; and

- •

- Report violations of our Code of Ethics to the Chair of either the Audit Committee or the Governance Committee.

Supporting the principles reflected in our Code of Ethics, our controllership and internal audit functions ensure that we maintain a robust internal control environment, with the leaders of these functions regularly reporting to, and periodically meeting in executive session with, the Audit Committee.

Our Code of Ethics is available on our website atwww.averydennison.com/codeofethics. Only the Audit Committee or Governance Committee can amend or waive the provisions of the Code of Ethics, and any amendments or waivers must be posted promptly on our website or timely filed with the SEC on a Current Report on Form 8-K. We last amended our Code of Ethics in April 2014.

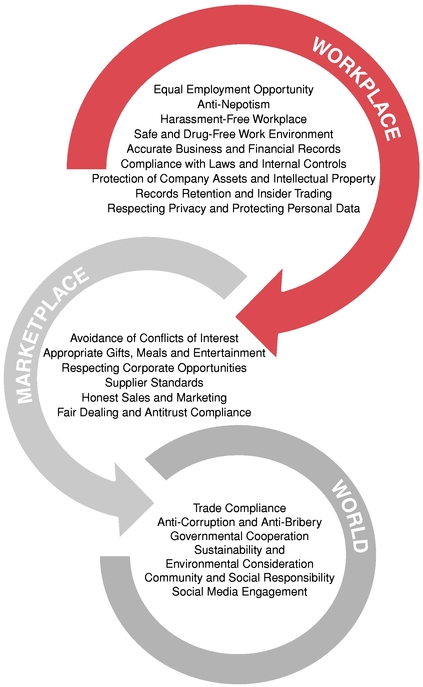

CODE OF CONDUCT

Our Code of Conduct applies to all of our directors, officers and employees. It has been translated into over 30 languages and our leaders affirm their commitment to complying with it when they first join our company and annually thereafter. We train employees on the Code of Conduct at least bi-annually, in addition to our online training program consisting of four courses per year covering specific risk areas from the Code of Conduct that designated computer-based employees are required to complete. To ensure that the policies and principles encompassed in our Code of Conduct reach all our employees globally, we also develop and launch three "Talkabout" toolkits (also in over 30 languages) each year, which managers are required to use to engage in meaningful discussion with their teams regarding topics from the Code of Conduct. These toolkits consist of presentation slides, a leader discussion guide and an introductory subtitled video, which includes messages from company leadership.

Recent Code Updates

In 2017, we refreshed our Code of Conduct, which is available on our website atwww.averydennison.com/codeofconduct, with updated leadership messages, additional guidance on certain higher risk areas, and case studies to provide additional guidance on more complex ethical situations. We introduced the updated Code of Conduct with manager and employee communications and created a pocket version for distribution to all employees.

In 2018, we are further updating our Code of Conduct to reflect our recently updated values of Integrity, Courage, External Focus, Diversity, Sustainability, Innovation, Teamwork and Excellence. In an effort to reinforce our strengths and bring focus to areas in which we have opportunities to further develop, we streamlined and consolidated our previous values and leadership principles into a single set of eight simplified, more memorable values. Moving forward, these values will help shape our culture and guide our behavior as we continue to grow. Later this year, our "Values in Action" campaign will give our employees around the world an opportunity to demonstrate how they are living these values and helping maintain our collective values-based culture.

Avery Dennison Corporation | 2018 Proxy Statement | 2

Ethics-Based Policies

The ethics-based policies and other matters discussed in our Code of Conduct are shown below. Our global supplier standards extend our commitment to many of these principles to our third party service providers, establishing our expectation that they also do business in an ethical manner.

Business Conduct GuideLine

Our Business Conduct GuideLine is a hotline available at all hours for employees or third parties to report potential violations of our Code of Conduct, anonymously if they so choose.

The GuideLine may be reached by (i) calling 888.567.4387 toll-free in the United States; 704.731.0166 collect from outside the United States; 10.800.711.0729 toll-free in North China; or 10.800.110.0672 toll-free in South China or (ii) visitingwww.integrity-helpline.com/AveryDennison.jsp (www.financial-integrity.com/AveryDennison.jsp in Europe).

Avery Dennison Corporation | 2018 Proxy Statement | 3

The hotline is operated by an independent third party and accepts reports in any language to accommodate the needs of our global workforce and customer/supplier base. All reports are investigated under the direction of our Chief Compliance Officer, in consultation with our law department and senior management and with oversight from the Governance Committee. We prohibit retaliation for good-faith reporting.

COMPLAINT PROCEDURES FOR ACCOUNTING AND AUDITING MATTERS

The Audit Committee has adopted procedures for the confidential, anonymous submission of complaints related to accounting, accounting standards, internal accounting controls and audit practices.

These procedures relate to complaints of (i) fraud or deliberate error in the preparation, evaluation, review or audit of our financial statements or other financial reports; (ii) fraud or deliberate error in the recording or maintenance of our financial records; (iii) deficiencies in, or noncompliance with, our internal accounting controls; (iv) misrepresentation or false statement to or by a senior officer or accountant regarding any matter contained in our financial records, statements, or other reports; or (v) deviation from full and fair reporting of our financial condition. Any person, including third parties, may submit a good faith complaint regarding accounting and auditing matters and employees may do so without fear of dismissal or other retaliation. The Audit Committee oversees these procedures, which are available on our website atwww.averydennison.com/auditprocedures. Investigations are conducted under the direction of our internal audit department in consultation with our Chief Compliance Officer, law department and senior management to the extent appropriate under the circumstances.

Stockholders and other interested parties interested in communicating regarding these matters may make a confidential, anonymous report by contacting the Business Conduct GuideLine as described on the previous page or writing to the Audit and Finance Committee Chair, c/o Corporate Secretary, Avery Dennison Corporation, 207 Goode Avenue, Glendale, California 91203.

STOCK OWNERSHIP GUIDELINES

2017 Changes to Guidelines

In the fourth quarter of 2016, the Compensation Committee evaluated the effectiveness and market consistency of our executive stock ownership guidelines to ensure that they effectively encourage our Named Executive Officers (NEOs) and other leaders to maintain meaningful ownership of our common stock.

At the Compensation Committee's request, Willis Towers Watson reviewed market practices for stock ownership guidelines at companies with $3 billion to $10 billion in annual revenue. Based on this data, Willis Towers Watson recommended the following changes to our guidelines to make them more stringent and better reflect market practices. Upon the advice of its independent compensation consultant, the Compensation Committee approved the changes shown below to our stock ownership guidelines for NEOs and other executives, effective January 1, 2017.

- •

- Eliminated the share guidelines, maintaining only the salary-multiple guidelines, which effectivelyincreased the minimum number of shares required to achieve compliance.

- •

- Increased our CEO's minimum ownership level from 5x to 6x his annual base salary.

- •

- Discontinued counting unexercised stock option gains and began counting only 50% of unvested value of market-leveraged stock units (MSUs) (rather than 100%) for purposes of measuring compliance.

- •

- Required holding 50% of the ownership level in vested shares.

In February 2017, upon the advice of Willis Towers Watson, the Compensation Committee also approved the following changes to our non-employee director stock ownership guidelines, effective as of the 2017 Annual Meeting: (i) eliminated the share guideline, maintaining only the dollar guideline, and (ii) discontinued counting unexercised stock option gains towards measuring compliance, counting only shares owned, deferred stock units (DSUs) and unvested restricted stock units (RSUs), consistent with our revised executive stock ownership guidelines. Non-employee directors are also required to hold 50% of their ownership level in vested shares, which includes DSUs.

Avery Dennison Corporation | 2018 Proxy Statement | 4

2017 Guidelines

Our revised stock ownership guidelines require that non-employee directors acquire and maintain a minimum equity interest in our company equal to $500,000 and our CEO and other NEOs acquire and maintain a minimum equity interest in our company equal to 6x and 3x their annual base salary, respectively.

If a director or NEO fails to achieve or make reasonable progress towards achieving his or her minimum ownership level, he or she is required to retain shares acquired, net of taxes, from the exercise of stock options or vesting of stock awards until such level is met. Executives are not allowed to transact in company stock until they certify their compliance with our ownership guidelines after giving effect to the transaction they plan to effectuate.

The following shares/units and their related values are considered in measuring compliance with our stock ownership guidelines: (i) shares beneficially owned or deemed to be beneficially owned, directly or indirectly, under federal securities laws; (ii) shares or units held in qualified and non-qualified employee benefit plans; (iii) unvested RSUs subject only to time-based vesting; and (iv) 50% of the value of unvested MSUs at the target payout level. Neither unvested PUs nor stock options are considered in measuring compliance.

The Governance Committee reviewed the stock ownership of our non-employee directors in February 2018, noting that all of them had exceeded the minimum ownership level required by the guidelines, except for Mr. Lopez who became a director in February 2017 and has five years to reach the minimum ownership level. The Committee noted that because Mr. Lopez had made reasonable progress towards meeting the applicable level, he was also in compliance. On average, the ownership level of our non-employee directors was approximately 7x the minimum ownership level, aligning their interests with those of our stockholders and incenting their focus on creating long-term stockholder value.

The Compensation Committee reviewed NEO stock ownership in October 2017 and determined that all of our Current NEOs were in compliance with our stock ownership guidelines, except for Mr. Gravanis.

| COMPLIANCE WITH STOCK OWNERSHIP GUIDELINES | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| | SHARES AS OF 2017 FYE (#) | GUIDELINE | % OF GUIDELINE | COMPLIANCE | ||||||||

NON-EMPLOYEE DIRECTORS | | | $500,000 | | | | | |||||

Bradley Alford | 32,159 | 695% | ||||||||||

Anthony Anderson | 13,021 | 281% | ||||||||||

Peter Barker | 55,635 | 1203% | ||||||||||

Ken Hicks | 36,522 | 790% | ||||||||||

Andres Lopez | 2,408 | 52% | ||||||||||

David Pyott | 63,576 | 1374% | ||||||||||

Dean Scarborough | 51,095 | 1105% | ||||||||||

Patrick Siewert | 14,226 | 308% | ||||||||||

Julia Stewart | 52,125 | 1127% | ||||||||||

Martha Sullivan | 19,635 | 425% | ||||||||||

PRESIDENT & CEO | | | 6x Base Salary | | | | | |||||

Mitchell Butier | 149,394 | $6,798,000 | 238% | |||||||||

OTHER CURRENT NEOs | | | 3x Base Salary | | | | | |||||

Gregory Lovins | 19,818 | $1,650,000 | 130% | |||||||||

Georges Gravanis | 15,943 | $1,885,785 | 91% | |||||||||

Anne Hill | 48,110 | $1,596,135 | 326% | |||||||||

Susan Miller | 22,078 | $1,643,082 | 145% | |||||||||

Avery Dennison Corporation | 2018 Proxy Statement | 5

INSIDER TRADING POLICY

Our insider trading policy prohibits our directors, officers and employees from (i) engaging in transactions in our company's stock while in the possession of material non-public information; (ii) engaging in transactions in the stock of other companies while in possession of material non-public information that they become aware of in performing their duties; and (iii) disclosing material non-public information to unauthorized persons outside our company.

Limited Trading Windows

In addition, our insider trading policy restricts trading for directors and officers (including all NEOs) during blackout periods, which generally begin two weeks before the end of each fiscal quarter and end two business days after the release of earnings for the quarter.

Prohibition on Hedging and Pledging

Our insider trading policy expressly prohibits our directors and executive officers from (i) purchasing financial instruments (such as prepaid variable forward contracts, equity swaps, collars and exchange funds) designed to hedge or offset any decrease in the market value of shares of our common stock they hold, directly or indirectly, or (ii) pledging any of their shares of common stock to secure personal loans or other obligations, including by holding such shares in a margin account.

To our knowledge, based on our review of their written representations, all of our directors and executive officers complied with our insider trading policy during 2017.

Sustainability is one of our core values and has long been part of our approach to doing business, driving us to work collaboratively across our entire value chain to address the environmental and social impacts of our products. Our aim is to improve the sustainability of our products and processes to create shared value for all of our stakeholders. In 2017, management led the execution of our sustainability strategy through our Sustainability Council, chaired by Mitch Butier, our President/CEO, and comprised of other corporate and business leaders, with Board oversight through the Governance Committee.

Avery Dennison Corporation | 2018 Proxy Statement | 6

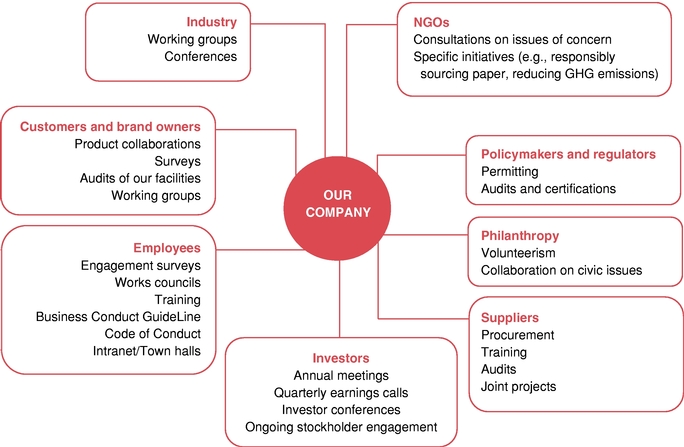

ENGAGING OUR STAKEHOLDERS

We seek to ensure that our sustainability efforts are consistent with stakeholder expectations. We regularly communicate with individuals and organizations interested in how we do business generally and our sustainability efforts in particular, and also conduct stakeholder interviews as part of our regular sustainability assessments. These activities allow us to focus on the areas in which we can have the most impact.

SUSTAINABILITY STRATEGY

The foundation of our sustainability strategy is a science-based sustainability framework developed by The Natural Step, an international NGO. The Natural Step framework serves as the basis of our environmental and social guiding principles, listed below.

- •

- Create shared value for our customers, their value chains and the communities we serve.

- •

- Do not pollute with manufactured materials.

- •

- Discover and capture lost value at every stage of the value chain.

- •

- Do not pollute with extracted materials.

- •

- Empower our people to innovate and create value.

- •

- Do not impede people's wellness, influence, competence, equity and meaning.

- •

- Do not over-harvest or over-encroach on living systems.

- •

- Embrace the collaboration that is inherent to sustainability.

ADVANCEMENTS TOWARDS 2025 SUSTAINABILITY GOALS

We report on our sustainability progress every two years. In September 2017, we issued our 2014-2016 Sustainability Report, summarizing our achievements towards reaching the 2025 sustainability goals we set in 2015. In the first two years of the 10-year goal horizon, we made significant progress, the key to which has been integrating sustainability into our underlying business strategies and engaging employees at all levels. We encourage you to review the report, which contains more information on our progress summarized on the following page, on our website atwww.averydennison.com/sustainability.

Avery Dennison Corporation | 2018 Proxy Statement | 7

| 2025 SUSTAINABILITY GOALS | ||||

|---|---|---|---|---|

| | | | | |

| FOCUS AREA | GOAL(S) | HIGHLIGHTS OF PROGRESS REPORTED IN SEPTEMBER 2017 | ||

| Greenhouse Gas Emissions  | Achieve at least 3% absolute reduction year-over-year. | Reduced our absolute CO2 emissions over 3% from 2015-2016. Reduced our energy consumption by nearly 4% during 2014-2016. | ||

Paper  | Source 100% certified paper, of which at least 70% will be Forest Stewardship Council® — certified. | Over 75% of the total volume of paper we procured in 2016 was responsibly sourced in accordance with the principles of the Forest Stewardship Council® or Programme for the Endorsement of Forest Certification. | ||

Films  | Ensure that 70% of the films we buy conform to, or enable end products to conform to, our environmental and social guiding principles. | Worked to employ renewable, bio-based film made from plants, such as the sugar-based Bonsucro®-certified filmic facestock we use in our bio-based polyethylene film product. | ||

Chemicals  | Ensure that 70% of the chemicals we buy conform to, or enable end products to conform to, our environmental and social guiding principles. | Completed the first phase of an enhanced enterprise-wide restricted substance list (RSL) program, focused on avoiding RSL chemicals in designing new products. | ||

Products and Solutions  | Through innovation, deliver above-average growth in sales from sustainability-driven products and services. Ensure that 70% of our products and solutions conform to, or enable end products to conform to, our environmental and social guiding principles. | Developed ClearIntent™, a growing portfolio of products made with materials that are responsibly sourced, reduced and recycled within our Label and Graphic Materials business. Continued to enable customers to replace conventional packaging and brand elements with more environmentally friendly alternatives through our Retail Branding and Information Solutions business. In 2016, added certified paper and fabric to the mix of factors customers can analyze as they seek a balance of cost, performance and sustainability through our Greenprint™ environmental impact-analysis tool. | ||

Waste  | Be 95% landfill-free, with at least 75% of our waste reused, repurposed or recycled. Eliminate 70% of the matrix and liner waste from our value chain. | As of the end of 2016, diverted over 90% of our solid waste from landfills with 59 landfill-free sites worldwide, and recycled nearly 60% of the diverted waste. Continued working with customers, recyclers and others to create a recycling infrastructure and network of processors to meet our customers' needs, using research to show that our label liners can be feasibly recycled by identifying capable recyclers worldwide. | ||

Transparency  | Commit to goals publicly and be transparent in reporting our progress. | Published our 2014-2016 sustainability report and continued stakeholder engagement with regular assessments. | ||

People  | Continue to cultivate a diverse (40%+ female at the level of manager and above), engaged, safe (recordable injury rate of <0.25), productive and healthy workforce. Continue to invest in our employees and the communities in which we work. | Created a more flexible work environment, developed female employees' leadership skills and raised awareness of unconscious bias across our company. While making progress with our gender diversity efforts, our female representation at the management level was 32% at the end of 2016. Continued our world class safety record, with a recordable incident rate of 0.25 in 2016, far surpassing the manufacturing industry average of 3.8 in 2015 (the then-most recently available industry average). | ||

Avery Dennison Corporation | 2018 Proxy Statement | 8

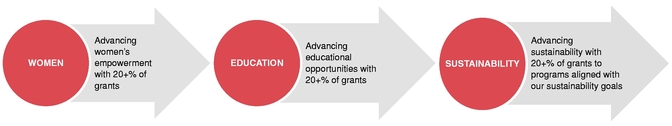

AVERY DENNISON FOUNDATION

With Board oversight from the Governance Committee, our social responsibility efforts promote our spirit of community and help strengthen the places around the world in which we do business. We make most of our community investments through the Avery Dennison Foundation (the "Foundation"), which annually invests 5% of its assets from the prior year to advance women's empowerment, education and sustainability in the communities where our employees live and work and encourages employee engagement with a spirit of invention and innovation. The Foundation invests in communities by making grants to community-based organizations, promoting employee volunteerism and engagement, and awarding scholarships.

GLOBAL GRANTMAKING

The Foundation's global grantmaking initiative is its primary means of giving. Grantmaking is also aided by our employees worldwide who help identify qualified nongovernmental organizations (NGOs). Grant decisions are guided by the following priorities:

EMPLOYEE ENGAGEMENT

As the hands and heart of our company, our employees are critical to advancing the Foundation's efforts. Because they often have the best understanding of the needs of their communities, more than 110 employee-organized Community Investment Teams coordinate volunteerism locally at our global locations. Nearly 50% of the Foundation's grants are enhanced with volunteer time from our employees.

The Foundation also engages employees through the Granting Wishes program, which allows employees in the U.S., Europe and Latin America to recommend one-time grants to local NGOs. Employees often have a connection to the organizations they nominate through volunteerism or service on the organization's board. In the seven years since the Foundation launched Granting Wishes, more than 700 of our employees have taken part, enabling grants of over $1.1 million to more than 200 organizations, including Doctors Without Borders, UNICEF, the American Red Cross and Habitat for Humanity.

SCHOLARSHIPS

The Foundation provides scholarships to the children of our employees in the U.S., China and India. Since 1977, more than 600 scholarships totaling over $2.2 million have been awarded to students entering their first year of college.

In China and India, the Foundation's InvEnt Scholarships have for more than a decade supported the next generation of innovators in science, technology, engineering and mathematics. By providing undergraduates with tuition assistance, an invention competition and professional development opportunities, the Foundation inspires the spirit of innovation in tomorrow's engineers and technology workers. As part of their application, students submit ideas for an invention they then design during their scholarship year. Scholarships are awarded to students who demonstrate outstanding innovative spirit and excellent practical competence.

Avery Dennison Corporation | 2018 Proxy Statement | 9

OUR BOARD OF DIRECTORS |

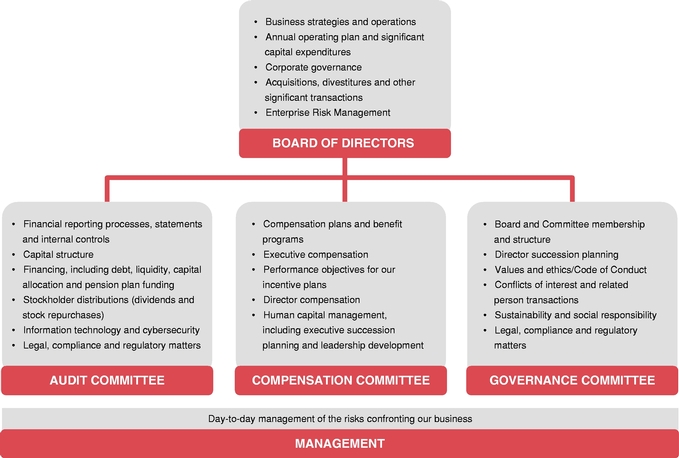

Our Board oversees, counsels and ensures management is serving the best interests of our company and stockholders, with the goal of maximizing the performance of our businesses to create long-term value.

Our Board's primary responsibilities include the following:

- •

- Establishing astrong governance program, with a Board and Committee structure that ensures independent oversight;

- •

- Overseeing ourbusinesses, strategies and risks;

- •

- Maintaining theintegrity of our financial statements;

- •

- Evaluating the performance of our senior leaders and determiningexecutive compensation;

- •

- Conductingsuccession planning for our CEO and other senior executives, including ensuring we have ahuman capital management program that is developing our future leaders; and

- •

- Approving ourannual operating plan and significant strategic and operational actions, includingsignificant capital expenditures and acquisitions.

BOARD COMPOSITION

Our Bylaws provide that our Board be comprised of between eight and 12 directors, with the exact number fixed from time to time by Board resolution. Our Board currently has fixed the number of directors at 11. The nominees for election at the Annual Meeting — and the year of their initial appointment or election, current or most recent principal occupation, independence status, and committee memberships — are shown in the chart below.

| NAME | DIRECTOR SINCE | PRINCIPAL OCCUPATION | INDEPENDENT | AC | CC | GC | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bradley A. Alford | 2010 | Retired Chairman & CEO, Nestlé USA | M | M | ||||||||

| Anthony K. Anderson | 2012 | Retired Vice Chair & Managing Partner, Ernst & Young LLP | M | M | ||||||||

| Peter K. Barker | 2003 | Retired Chairman of California, JPMorgan Chase & Co. | M | | C | |||||||

| Mitchell R. Butier | 2016 | President & CEO, Avery Dennison Corporation | ||||||||||

| Ken C. Hicks | 2007 | Retired Chairman, Foot Locker, Inc. | M | M | | |||||||

| Andres A. Lopez | 2017 | President & CEO, Owens-Illinois, Inc. | M | |||||||||

| David E. I. Pyott (LID) | 1999 | Retired Chairman & CEO, Allergan, Inc. | | M | M | |||||||

| Dean A. Scarborough | 2000 | Retired Executive Chairman, Avery Dennison Corporation | ||||||||||

| Patrick T. Siewert | 2005 | Managing Director & Partner, The Carlyle Group | C | | | |||||||

| Julia A. Stewart | 2003 | Former Chairman & CEO, DineEquity, Inc. | C | M | ||||||||

| Martha N. Sullivan | 2013 | President & CEO, Sensata Technologies Holding N.V. | M | M | |

AC = Audit & Finance Committee CC = Compensation & Executive Personnel Committee GC = Governance & Social Responsibility Committee

M = Member C = Chair LID = Lead Independent Director

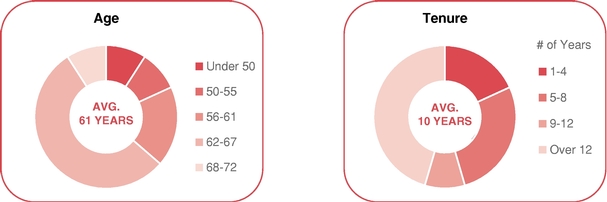

The ages of our director nominees range from 46 to 69, with an average age of 61. Their lengths of service range from one to 18 years, with an average tenure on our Board of ten years. None of our directors serves on more than two other boards of SEC-reporting companies, except for Messrs. Anderson and Pyott, who are both retired and serve on three such other boards.

Avery Dennison Corporation | 2018 Proxy Statement | 10

APPOINTMENT OF NEW INDEPENDENT DIRECTOR

During the second half of 2016, the Governance Committee oversaw our Board's search for a new independent director. The Committee engaged Korn Ferry, an executive search firm, to assist with the search. Korn Ferry identified a number of potential candidates (including Andres Lopez) who were initially evaluated by the Governance Committee and our Chairman, with input from other Board members and senior management. The Governance Committee and other members of our Board interviewed Mr. Lopez, unanimously supporting his candidacy based on his extensive packaging industry expertise and the end customer insights he could bring to our Board. Upon the recommendation of the Governance Committee, our Board appointed Mr. Lopez to our Board effective February 1, 2017, recognizing his packaging industry experience, public company board experience and global exposure. Also upon the recommendation of the Governance Committee, our Board subsequently appointed Mr. Lopez to the Audit Committee, effective immediately after the 2017 Annual Meeting, at which he was first elected to our Board by our stockholders.

RETIREMENT OF EXECUTIVE CHAIRMAN

In December 2017, Mr. Scarborough, then Executive Chairman, notified the Board that he would be retiring from our company at the end of the year. He was our employee through December 31, 2017 and continues to serve as non-executive Chairman.

BOARD MEETINGS AND ATTENDANCE

Our Board met five times and acted three times by unanimous written consent during 2017. There were 16 Committee meetings during the year. All of our directors attended the Board and Committee meetings held during 2017 of which he or she was a member. Directors are strongly encouraged to attend our annual stockholder meetings under our Governance Guidelines and all of our directors attended the 2017 Annual Meeting.

Board and Committee meeting2017 attendance = 100%

Avery Dennison Corporation | 2018 Proxy Statement | 11

Our Governance Guidelines provide the governance framework for our company and reflect the values of our Board, as highlighted below. They are reviewed at least annually and amended from time to time to reflect changes in regulatory requirements, evolving market practices, recommendations from our advisors and feedback from our stockholders. Our Governance Guidelines were most recently amended in February 2017.

Governance Guidelines Highlights

Board Composition

- ✓

- Reasonable Board size of 11 directors

- ✓

- No over-boarded directors

- ✓

- Mandatory retirement after age 72, with no term limits

Director Independence

- ✓

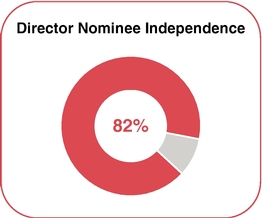

- 82% independent

- ✓

- Executive sessions of independent directors at every 2017 Board meeting

Board Leadership Structure

- ✓

- Annual review of Board leadership structure by the Governance Committee

- ✓

- Robust Lead Independent Director role and independent Committee Chairs

Board Committees

- ✓

- 100% independent

- ✓

- Act under charters delineating Committee responsibilities

- ✓

- Directors required to attend Board and Committee meetings

Board Duties

- ✓

- Directors entitled to rely on independent legal, financial or other advisors at our expense

- ✓

- Regular review of long-term strategic plans, including major risks and mitigating strategies

- ✓

- Regular succession planning for our CEO and other executive officers through the Compensation Committee

Continuous Board Improvement

- ✓

- All new directors participate in an initial orientation to familiarize themselves with our company and after joining a Committee to understand its responsibilities

- ✓

- Directors continue their education through meetings with management, visits to our facilities and attendance at accredited director education programs

- ✓

- The Governance Committee oversees an annual evaluation process to ensure our Board, Committees, Chairman and Lead Independent Director are functioning effectively

Director Qualifications

- ✓

- The Governance Committee reviews the skills and characteristics of our Board members and recommends director nominees

Avery Dennison Corporation | 2018 Proxy Statement | 12

Our Governance Guidelines require that our Board be comprised of a majority of directors who satisfy the criteria for independence under NYSE listing standards. These standards also require that our audit, compensation and nominating committees be comprised entirely of independent directors. An independent director is one who meets the independence requirements of the NYSE and who our Board affirmatively determines has no material relationship with our company, directly or indirectly as a partner, stockholder or officer of an entity with which we have a relationship.

Each year, our directors complete a questionnaire designed to solicit information that may have a bearing on the annual independence determination, including all relevant relationships they have with our company, directly or indirectly through our company's sale or purchase of products or services to or from the companies or firms by which they are employed. The Governance Committee reviews any relevant disclosures made in the questionnaires with our General Counsel/Corporate Secretary, as well as any transactions our company has with director-affiliated entities. In February 2018, the Governance Committee reviewed the relationships impacting the independence of our director nominees referenced below.

- •

- Mr. Butier. Mr. Butier serves as our President and CEO.

- •

- Mr. Scarborough. Mr. Scarborough formerly served as our Executive Chairman and was an employee of our company through December 31, 2017.

- •

- Mr. Lopez. Although there were no sales in 2016 or 2017, in 2015 we sold products to Owens-Illinois, Inc., for which Mr. Lopez serves as President and CEO. The payments we received from the company were on competitive terms, in the ordinary course of business, and less than $1 million, the lower of the two applicable thresholds set forth in the NYSE's independence standards.

After review and discussion of the relevant facts and circumstances, the Governance Committee concluded that only Messrs. Butier and Scarborough had relationships that were disqualifying under NYSE listing standards, otherwise material or impairing of director independence. Upon recommendation of the Governance Committee, our Board affirmatively determined the nine director nominees named below to be independent, representing 82% of our nominees.

| | | |

|---|---|---|

|  |

For a discussion of the potential impact of tenure on director independence, see theBoard Refreshment and Director Succession Planning section of this proxy statement.

Avery Dennison Corporation | 2018 Proxy Statement | 13

Our Board currently has a Chairman, who as a recent former employee is not independent, a separate CEO and a Lead Independent Director. Our Governance Guidelines give our Board — acting through its independent directors — the discretion to separate or combine the roles of Chairman and CEO as it deems appropriate based on the needs of our company at any given time; to facilitate this decision-making, the Governance Committee annually reviews our Board leadership structure, providing its recommendation on the appropriate structure for the following year to our independent directors. Our independent directors do not view any particular Board leadership structure as necessarily preferable, rather they make an informed annual determination taking into account, among other things, our financial position, business strategies and any feedback received from our stockholders.

Our Lead Independent Director balances our non-independent Chairman and CEO roles, exercising critical duties in the boardroom to ensure effective and independent Board decision-making. Our Governance Guidelines clearly delineate these responsibilities, which are shown below. Mr. Pyott currently serves as our Lead Independent Director.

| LEAD INDEPENDENT DIRECTOR | PRIMARY RESPONSIBILITIES | |

| Current Selectee: David Pyott Executive Sessions Led in 2017: 5 Lead Independent Director is selected annually by our independent directors. | • Preside over executive sessions of independent directors and meetings of our Board at which the non-independent Chairman is not present • Serve as liaison between the non-independent Chairman and our independent directors • Approve meeting agendas and schedules and other information sent to our Board to ensure that appropriate items are discussed, with sufficient time for discussion of all items • Call meetings of independent directors when necessary or appropriate • If requested,consult and meet with our stockholders |

In addition to these responsibilities, Mr. Pyott performed the following activities as Lead Independent Director in 2017:

- •

- Regularly consulted with each of the Chairman and CEO to help guide management's ongoing engagement with the Board on our strategic direction, including reviewing our business strategies and assessing acquisition opportunities;

- •

- Provided feedback to our Chairman and our CEO after executive sessions of independent directors;

- •

- Consulted on an ad hoc basis with other independent directors; and

- •

- Met with members of senior management other than our CEO.

Supplementing our Lead Independent Director in providing independent Board leadership are our Committee Chairs, all of whom are independent. The Governance Committee evaluated the performance of our Chairman and Lead Independent Director during the Board evaluation process conducted in the fourth quarter of 2017. Based on these evaluations, we believe our current Board leadership structure is providing effective independent oversight of our company. During our ongoing engagement with our stockholders on governance matters, none of them has expressed concerns with our current Board leadership structure, which we believe reflects support for our robust and clearly delineated Lead Independent Director role.

In February 2018, the Governance Committee evaluated our Board leadership structure and recommended to our Board that Mr. Scarborough continue serving as Chairman, noting that his mentorship during our CEO transition has continued to assist management in executing our Board-aligned strategies to drive long-term stockholder value creation and that he received positive feedback on his performance from our independent directors during the 2017 Board evaluation process. Upon the recommendation of the Governance Committee, our Board elected Mr. Scarborough (with him abstaining) to continue serving as our Chairman, effective immediately after the Annual Meeting subject to his re-election. The Governance Committee also recommended that Mr. Pyott (with him abstaining) continue serving as Lead Independent Director. Mr. Pyott has significantly contributed to our executive compensation and governance programs through his strong, independent and strategic leadership of our Board. Upon the recommendation of the Governance Committee, our independent directors selected Mr. Pyott (with him abstaining) to continue serving as our Lead Independent Director, effective immediately after the Annual Meeting subject to his re-election.

Avery Dennison Corporation | 2018 Proxy Statement | 14

Each of our Board committees has a written charter that describes its purposes, membership and meeting structure, and responsibilities. These charters, which may be found on our website atwww.averydennison.com/corporategovernance, are reviewed by the respective committee at least annually, with any recommended changes adopted upon approval by our Board. Amended charters are promptly posted on our website. The Charters for the Audit, Compensation and Governance Committees were last amended in February 2017, December 2015 and December 2016, respectively.

Each of our Board committees has the ability to form and delegate authority to subcommittees and may obtain advice and assistance from internal or external consultants, legal counsel or other advisors at our expense. In addition, each committee annually evaluates its performance. The primary responsibilities, membership and meeting information for the three committees of our Board are summarized below and on the following page.

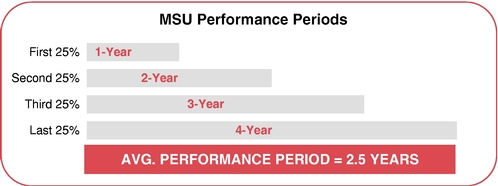

| AUDIT & FINANCE COMMITTEE | PRIMARY RESPONSIBILITIES | |