- AVY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Avery Dennison (AVY) DEF 14ADefinitive proxy

Filed: 5 Mar 21, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

AVERY DENNISON CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Section III 2021 Notice and Proxy Statement

NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

| RECORD DATE | February 22, 2021 | |

| MEETING DATE | April 22, 2021 | |

| MEETING TIME | 1:30 p.m. Pacific Time | |

| MEETING FORMAT | Online at www.virtualshareholdermeeting.com/AVY2021 | |

MEETING AGENDA

| 1 | Elect the 9 directors nominated by our Board to serve a one-year term | |

| 2 | Approve, on an advisory basis, our executive compensation | |

| 3

| Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2021 | |

| 4

| Transact any other business properly brought before the meeting or any adjournment or postponement thereof | |

Our Board recommends that you vote FOR each of our nine director nominees in Item 1 and FOR Items 2 and 3.

Stockholders of record as of February 22, 2021 are entitled to notice of, and to vote during, the meeting and any adjournment or postponement thereof. This notice and our proxy materials are being distributed or made available to stockholders on or about March 8, 2021.

We want your shares to be represented and voted. We encourage you to vote promptly as this will save us the time and expense of additional proxy solicitation. As shown on the right, you can vote online, by telephone, by mail or during the meeting.

On behalf of the Board of Directors, management and employees of Avery Dennison, thank you for your continued support. We look forward to talking with you during the Annual Meeting.

By Order of the Board of Directors,

Vikas Arora

Vice President, Associate General Counsel and

Corporate Secretary

March 5, 2021

Online

You can vote online at www.proxyvote.com by 11:59 p.m. Eastern Time on April 21, 2021. You will need the 16-digit control number on your Notice of Internet Availability or proxy card.

By Telephone

In the U.S. and Canada, you can vote by calling 1.800.690.6903 by 11:59 p.m. Eastern Time on April 21, 2021. You will need the 16-digit control number on your Notice of Internet Availability or proxy card.

By Mail

You can vote by mail by completing, dating and signing your proxy card and returning it in the postage-paid envelope or otherwise to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717.

During Meeting

Unless your shares are held through our Employee Savings Plan, you can vote during the Annual Meeting. Beneficial holders must contact their broker or other nominee to be able to vote during the meeting.

Avery Dennison Corporation | 2021 Proxy Statement | Table of Contents

|

This proxy summary contains highlights of information described in greater detail in other parts of this proxy statement and does not contain all the information you should consider before voting. We strongly encourage you to read the entire proxy statement before voting.

DISTRIBUTION OF PROXY MATERIALS

We will mail our Notice of Internet Availability of Proxy Materials, which includes instructions on how to access these materials online, on or about March 8, 2021. If you previously elected to receive a paper copy of our proxy materials, we will mail you our 2020 integrated report, which includes a letter to stockholders from our Chairman, President and Chief Executive Officer; our 2020 annual report; our notice and proxy statement for the 2021 Annual Meeting of Stockholders (the “Annual Meeting”); information regarding our businesses, financial achievements and continued progress as it relates to environmental, social and governance (ESG) matters; and a proxy card, on or about March 8, 2021.

TIME, DATE AND FORMAT OF ANNUAL MEETING

The Annual Meeting will take place at 1:30 p.m. Pacific Time on April 22, 2021. Due to continued public health concerns about in-person gatherings given the coronavirus/COVID-19 pandemic (“COVID-19”), particularly in Los Angeles County, California, the meeting will be held virtually, with attendance via the internet. To attend the virtual Annual Meeting, you will need to log in to www.virtualshareholdermeeting.com/AVY2021 using the 16-digit control number on your Notice of Internet Availability of Proxy Materials or proxy card.

The live audio webcast of the Annual Meeting will begin promptly. Online access will open at 1:15 p.m. Pacific Time to allow time for you to log in and test your device’s audio system. We encourage you to access the meeting in advance of the start time. For additional instructions on how to attend the Annual Meeting, please refer to the Voting and Meeting Q&A section of this proxy statement.

ITEMS BEING VOTED ON DURING ANNUAL MEETING

You are being asked to vote on the items of business shown below during the Annual Meeting. Our Board of Directors (our “Board”) recommends that you vote FOR each of our 9 director nominees and FOR the other two items being brought before the stockholder vote.

Item | Board Recommendation | Vote Required | Discretionary Broker Voting | Page Reference | ||||||||

| 1 | Election of directors |  | FOR each nominee | Majority of votes cast | No | 38 | ||||||

| 2 | Advisory vote to approve executive compensation |  | FOR | Majority of shares represented and entitled to vote | No | 48 | ||||||

| 3 | Ratification of appointment of PricewaterhouseCoopers LLP as independent registered public accounting firm for fiscal year 2021 |  | FOR | Majority of shares represented and entitled to vote | Yes | 91 | ||||||

VOTING PRIOR TO OR DURING ANNUAL MEETING

You may vote your shares by submitting a proxy at www.proxyvote.com in advance of the Annual Meeting or voting during the meeting at www.virtualshareholdermeeting.com/AVY2021. If you hold your shares in “street name,” you may vote during the meeting only if you properly request and receive a legal proxy in your name from the broker, bank or other nominee that holds your shares. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting as described in the Voting and Meeting Q&A section of this proxy statement.

Avery Dennison Corporation | 2021 Proxy Statement

| 1

|

ASKING QUESTIONS DURING ANNUAL MEETING

We have designed the format of the Annual Meeting to ensure that stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, using easy-to-use online tools that allow stockholders to attend and participate. After the business portion of the Annual Meeting concludes and the meeting is adjourned, our Chairman/CEO will lead a Q&A session during which we intend to answer all questions submitted on the day of or during the meeting that are pertinent to our company and the items being brought before stockholder vote. Answers to any questions not addressed during the meeting will be posted promptly after the meeting on the investors section of our website. For additional information on submitting questions during the Annual Meeting, please refer to the Voting and Meeting Q&A section of this proxy statement.

OUR COMPANY

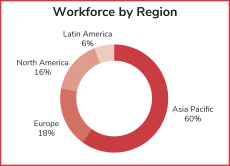

We are a global materials science company specializing in the design and manufacture of a wide variety of labeling and functional materials. Our products, which are used in nearly every major industry, include pressure-sensitive materials for label and graphic applications; tapes and other bonding solutions for industrial, medical and retail applications; tags, labels and embellishments for apparel; and radio-frequency identification (RFID) solutions serving apparel and other markets. We employ more than 32,000 employees in more than 50 countries.

STRATEGY OVERVIEW

We are committed to the continuing success of all our stakeholders. In a challenging 2020 due to the extraordinary impact of COVID-19, we focused on ensuring the health and well-being of our employees, delivering for our customers, minimizing the impact of the pandemic-driven recession for our investors, and supporting our communities, while continuing to invest in the long-term success of our company. We have refined how we present our key strategies shown below and on the following page, but our areas of strategic focus are consistent with recent years.

1

| ||||

Drive outsized growth in high-value categories

| • | We strive to increase the proportion of our portfolio in high-value products and solutions, both organically and through acquisitions; high-value categories serve markets that are growing faster than gross domestic product (GDP), represent large pools of potential profit and leverage our core capabilities, and include our specialty and durable label materials, graphics and reflective solutions, industrial tapes, intelligent labels that use RFID tags and inlays, and external embellishments |

| • | In 2020, organic sales change in high-value product categories outpaced that of our base businesses by more than one point, driven by growth in specialty labels, external embellishments and RFID; also advanced our RFID platform through our acquisition of the Transponder (RFID inlay) division of Smartrac, a manufacturer of RFID products (which we refer to as “Smartrac”) |

2

| ||||

Grow profitability in our base businesses

| • | We strive to improve profitability in our base businesses by carefully balancing volume, price and mix, reducing complexity and tailoring our go-to-market strategies |

| • | In 2020, we protected, and even grew, operating margins in our base businesses |

3

| ||||

Focus relentlessly on productivity

| • | We employ product reengineering and enterprise lean sigma to expand our operating margins, enhance our competitiveness (particularly in our base businesses) and provide a funding source for reinvestment |

| • | In 2020, we significantly expanded operating margins, showing agility in response to COVID-19 by delivering approximately $200 million of cost reduction through both structural and temporary actions |

2

| 2021 Proxy Statement | Avery Dennison Corporation

|

4

| ||||

Effectively allocate capital

| • | We balance our investments in organic growth, productivity, and acquisitions and venture investments, while continuing to return cash to stockholders through dividends and share repurchases |

| • | In 2020, leveraging our strong balance sheet, we invested nearly $220 million in capital expenditures to support organic growth; completed two acquisitions; and increased our quarterly dividend rate by 7% in October after having maintained it earlier in the year and resumed repurchase of shares in Q3 after having suspended it in March, in each case due to then-uncertain impact of COVID-19 on our businesses |

5

| ||||

Lead in an environmentally and socially responsible manner

| • | We work to deliver innovations that advance the circular economy and reduce the environmental impact of our operations; build a more diverse workforce and inclusive culture; maintain a culture of health and safety; and support our communities primarily through the Avery Dennison Foundation |

| • | In 2020, we continued to make progress toward our 2025 sustainability goals, reducing the environmental impact of our operations and investing in innovation platforms focused on recyclability/enabling circularity and waste reduction/elimination; redoubling our efforts to drive sustainable change in diversity and inclusion, including by sharpening our focus on racial/ethnic workforce diversity, particularly in the U.S.; and contributing $10 million to the Avery Dennison Foundation to significantly increase the scope and pace of its grantmaking in the communities in which we operate |

PERFORMANCE HIGHLIGHTS

COVID-19 Response

Our top priority in 2020 given the continuing public health crisis of COVID-19 was the health, safety and well-being of our employees, followed immediately by delivering for our customers. To minimize the impact of the pandemic-driven recession on our investors, we worked to mitigate the impact of COVID-19 on our supply chain, as well as ensure we maintained a strong balance sheet and financial flexibility as we confronted uncertain capital markets. We also took several actions to support our communities during this difficult time. The actions we took in response to COVID-19 are described in the chart on the following page.

Avery Dennison Corporation | 2021 Proxy Statement

| 3

|

COVID-19 RESPONSE | ||

Protecting Employee Well-Being |

✓ Early in pandemic, ensured that employees continued to receive full pay

✓ Extended salary continuation in jurisdictions with weaker social safety nets

✓ Provided supplemental payments to express gratitude to frontline workers, with ~84% of employees (all below manager level) receiving these payments

✓ Continually adapted rigorous site safety protocols based on continuously evolving health information and governmental regulations

| |

Serving Customers |

✓ Adapted quickly to manage demand in label materials and address lockdowns impacting RBIS customers

✓ Leveraged operational excellence to maximize production capacity in label materials

✓ Developed and rapidly commercialized N95 masks primarily for sale to customers

✓ Continued to successfully execute large RFID rollouts

| |

Mitigating Supply Chain Risk |

✓ Maintained strong relationships with suppliers and customers, which helped keep supply chains open for essential businesses

✓ Selectively built strategic inventory

✓ Leveraged global footprint with dual sourcing or readily available alternatives for most commodities

| |

Maintaining Strong Balance Sheet and Financial Flexibility |

✓ Drew down $500 million under revolving credit facility in Q1 to mitigate dependence on then-unavailable commercial paper markets; promptly repaid in Q2

✓ Temporarily suspended share repurchases in March; resumed repurchases in Q3

✓ Increased dividend rate by 7% in October, after having maintained it earlier in year

✓ Heightened focus on working capital management

| |

Supporting Communities |

✓ Made $10 million contribution to Avery Dennison Foundation to significantly increase scope and pace of its support of communities in which we operate

✓ Shifted resources to produce personal protective equipment and hand sanitizer to donate to local communities

✓ Donated face masks and other needed materials to local hospitals

✓ Avery Dennison Foundation made nearly $3 million in grants to bolster rapid community response; also established employee assistance fund (supplemented by employee donations) to support team members who were furloughed, laid off, suspended or terminated due to COVID-19

| |

Strong 2020 Performance

In 2020, by consistently executing our strategies, we continued to prove our resilience across business cycles, delivering a year of strong earnings per share (EPS) growth, significant operating margin expansion and record free cash flow, despite the challenging macroeconomic environment caused by COVID-19. These results reflected the extraordinary efforts undertaken by our leaders and teams globally to respond to COVID-19 and mitigate its impact on our company. Although we could not have predicted the pandemic, our performance in its face evidences our rigorous scenario planning, which has enabled us to be prepared for a wide range of macroeconomic scenarios. We advanced all our key strategies and delivered strong performance, reflecting the preparedness and agility of our team members worldwide, who came together to help us navigate one of the most challenging periods in our company’s history.

Our strong performance in fiscal year 2020 reflects the strength of our markets, our industry-leading positions, the strategic foundations we have laid, and our talented team. Our key financial achievements for the year are described below and on the following page.

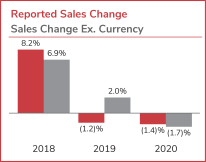

• Reported net sales of $6.97 billion, down 1.4% from prior year due to impact of COVID-19, with growth rebounding in 2H from its low in Q2, and roughly one-point benefit from extra week in 2020 fiscal year

• Excluding impact of currency, sales declined 1.7% due to impact of COVID-19; sales on organic basis declined by 3.4%. Sales declined slightly in our Label and Graphic Materials (LGM) reportable segment, where increase in

4

| 2021 Proxy Statement | Avery Dennison Corporation

|

sales in Label and Packaging Materials business, driven by increased consumption of packaged goods and growth of e-commerce, was more than offset by declines in combined Graphics and Reflective Solutions driven by sharp decline in demand in Q2 following government-mandated lockdowns. Sales declined more significantly in our Retail Branding and Information Solutions (RBIS) and Industrial and Healthcare Materials (IHM) reportable segments, markets of which were more adversely impacted by COVID-19 |

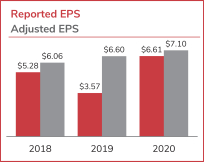

• Reported EPS substantially increased from $3.57 in 2019 to $6.61 in 2020, reflecting prior-year settlement charges resulting from U.S. pension plan termination and significant operating margin expansion in 2020

• Adjusted EPS increased 8% from $6.60 to $7.10, driven by operating margin expansion; adjusted EPS was at high end of $6.90 to $7.15 annual guidance range provided to investors in January 2020

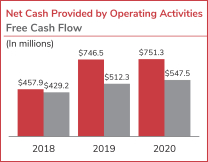

• With reported net cash provided by operating activities of $751.3 million, delivered record free cash flow of $547.5 million, exceeding 2020 goal of $500+ million

• On reported net income of $555.9 million, achieved return on total capital (ROTC) of 18.1%

Sales change excluding the impact of currency (sales change ex. currency), organic sales change, adjusted EPS, free cash flow and ROTC are supplemental, financial measures that we provide to assist investors in assessing our performance and operating trends. These measures are defined, qualified and reconciled from generally accepted accounting principles in the United States of America (GAAP) in the last section of this proxy statement. These non-GAAP financial measures are not a substitute for or superior to the comparable financial measures under GAAP.

|  |  |

Achieving Financial Targets

In March 2017, we announced five-year financial goals through 2021, including targets for compound annual organic sales growth, 2021 GAAP operating margin, compound annual adjusted EPS growth and 2021 ROTC. The combination of our growth and ROTC targets is a proxy for growth in economic value added (EVA), one of the performance objectives used in our long-term incentive (LTI) program. As shown below, based on our results for the first four years of this five-year period, we are largely on track to achieve these commitments. Our 2017-2020 compound annual organic sales growth of 2.0% was lower than our top-line target, but higher than forecasted global GDP growth (a key tenet of our top-line objective) of 1.5% over the same period.

For the 2017-2020 period, on a four-year compound annual basis (with 2016 as the base period), GAAP reported net sales and reported EPS increased by 3.5% and 16.9%, respectively, and reported net income increased by 14.7%.

|

| 2017-2021 Targets | 2017-2020 Results(1) | ||

Sales Growth(2) | 5%+ ex. currency(3)

4%+ organic | 3.8% ex. currency

2.0% organic | ||

GAAP Operating Margin | 11%+ in 2021 | 11.6% in 2020 | ||

Adjusted EPS Growth(2) | 10%+ | 15.3% | ||

ROTC | 17%+ in 2021 | 18.1% in 2020 | ||

| LARGELY ON TRACK TO ACHIEVE FINANCIAL TARGETS | ||||

| (1) | Results for non-GAAP measures are reconciled from GAAP in the last section of this proxy statement. |

| (2) | Percentages for targets reflect five-year compound annual growth rates, with 2016 as the base period. Percentages for results reflect four-year compound annual growth rates, with 2016 as the base period. |

| (3) | Target for sales growth ex. currency reflects the impact of completed acquisitions as of March 2017 of approximately one point. |

Avery Dennison Corporation | 2021 Proxy Statement

| 5

|

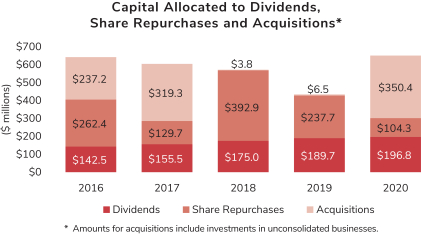

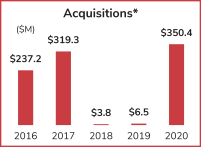

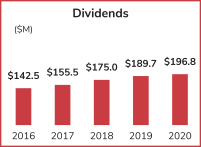

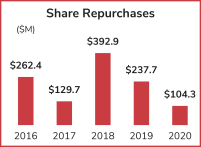

Effective Capital Allocation

We have been consistently effective in executing our approach to capital allocation, balancing our investments in organic growth, productivity, and acquisitions and venture investments with continuing to return cash to stockholders through dividends and share repurchases. In 2020, on net income of $555.9 million, we invested $218.6 million in capital expenditures to support our future growth and further productivity improvement and allocated $350.4 million to acquisitions and venture investments; we also paid $196.8 million in dividends and repurchased $104.3 million in shares of our common stock.

We have invested in our businesses to support organic growth and pursued complementary and synergistic acquisitions. Our spending on capital expenditures in 2020 was 15% lower than 2019 but consistent with our externally communicated outlook for the year, during which we accelerated our pace of investment in high-value categories, particularly RFID. We also allocated over $350 million to acquisitions. In February 2020, we completed our acquisition of Smartrac for approximately $255 million. Together with our then-existing Intelligent Labels business, this acquisition created a platform with over $500 million in annual revenues, with increased potential for long-term growth and profitability, enhanced research and development capabilities, expanded product lines and additional manufacturing capacity. In December 2020, we completed our acquisition of ACPO, Ltd., an Ohio-based manufacturer of self-wound (linerless) pressure-sensitive overlaminate products, for approximately $88 million. During 2020, we also invested in three startup companies developing innovative technological solutions that we believe have the potential to advance our businesses.

In 2020, we deployed $301.1 million to pay an annual dividend of $2.36 per share and repurchase 0.8 million shares of our common stock. We raised our quarterly dividend rate by approximately 7% in October 2020, after having maintained it earlier in the year due to the impact of COVID-19. Given the uncertain impact of COVID-19 at that time, in March 2020, we suspended our repurchase of shares and did not resume repurchases until the third quarter; as a result, in 2020, we allocated less than half the capital we deployed to share repurchases in 2019.

As shown below, over the last five years, we have allocated over $900 million to acquisitions and venture investments and nearly $2 billion to dividends and share repurchases.

6

| 2021 Proxy Statement | Avery Dennison Corporation

|

Total Stockholder Return (TSR) Outperformance

We experienced strong TSR in 2020 despite the uncertain macroeconomic environment during most of the year as a result of COVID-19, delivering TSR of over 20% and outperforming the S&P 500. However, we believe that our longer-term TSR is a more meaningful measure of our performance than our one-year TSR, which can be significantly impacted by short-term market volatility that may be unrelated to our performance (as occurred at various times during 2020). We focus on TSR because it measures value we create for our stockholders, including stock price appreciation and dividends paid (assuming reinvestment of dividends). We compare ourselves to the median of the S&P 500 Industrials and Materials subsets because we are a member of the Materials subset, and also share many characteristics with members of the Industrials subset; this practice is further informed by feedback from our investors, who have indicated that they look at both subsets in evaluating our performance relative to that of our peers.

5-Year Cumulative TSR

1-, 3- and 5-Year TSR

| AVY | S&P 500 | S&P Indus. & Mats.* | ||||

2016 | 15% | 12% | 21% | |||

2017 | 67% | 22% | 28% | |||

2018 | (20)% | (4)% | (14)% | |||

2019 | 49% | 32% | 34% | |||

2020 | 21% | 18% | 17% | |||

3-Year TSR | 43% | 49% | 32% | |||

5-Year TSR | 173% | 103% | 116% | |||

| * | Based on median of companies in both subsets as of December 31, 2020. |

STOCKHOLDER ENGAGEMENT

In addition to our extensive investor relations program through which members of management engage with our investors throughout the year, we have a longstanding practice of supplemental engagement with stockholders to discuss our strategies, performance, governance, executive compensation, sustainability and human capital management practices and solicit their feedback. This engagement program takes place throughout the year, as shown below.

Avery Dennison Corporation | 2021 Proxy Statement

| 7

|

Summary of 2020 Engagement Results

In 2020, we contacted our top 30 investors (representing 60-65% of our outstanding shares) in both the spring and the fall. Board members, in particular our Lead Independent Director, and management were made available to answer questions and address concerns. In the aggregate, we received responses from and engaged with investors representing ~35% and ~30%, respectively, of our outstanding shares. We engaged with every stockholder who requested to meet, and our Lead Independent Director led the majority of our off-season engagements. We also discussed the process, results and feedback from our 2020 engagement with the Talent and Compensation Committee (the “Compensation Committee”) and the Governance Committee of our Board.

Our 2020 engagements focused primarily on two key areas of investor interest: our response to COVID-19’s impact on our employees, customers, investors and communities, and our diversity and inclusion progress in light of the demonstrated need for greater racial and social justice in society. We also shared with our top 30 investors our first ESG Download, a report that consolidates our ESG policies and metrics, which we published in August 2020. This document spurred substantial discussion how we have incorporated ESG matters into our business strategies and progress made in meeting our ESG goals.

In addition, following the lower support director Mark Barrenechea received for his reelection at our 2020 Annual Meeting, we again solicited our stockholders’ views on his board commitments. In these discussions, we highlighted his contributions to our Board, demonstrated commitment to our company and management, industry experience and information technology expertise, skill alignment with our strategic priorities, and consistently strong attendance and engagement during his tenure.

The results of our 2020 engagement with our top 30 stockholders on governance, executive compensation, sustainability and human capital management matters are shown below.

| 2020 ENGAGEMENT RESULTS | ||||

|  |  |

Summary of 2020 Engagement Feedback

Our Board and management believe that regular stockholder engagement fosters a deeper understanding of investors’ evolving expectations on ESG matters and helps us ensure our programs continue to align with best practices.

Governance and Environmental Sustainability Matters

With respect to matters related to governance and environmental sustainability, inclusive of climate change, we discussed Board oversight of our strategies, our response to COVID-19 and progress toward our 2025 sustainability goals, including with respect to plastics recyclability and greenhouse gas emissions; our Board’s expanded stakeholder focus, as reflected in our strategies and evidenced in our ESG Download published in August 2020; and Board composition and refreshment, particularly the outside board commitments of one of our directors and the racial/ethnic and gender diversity on our Board.

Executive Compensation and Social Sustainability Matters

With respect to executive compensation and social sustainability, we discussed Board oversight of our strategies, our response to COVID-19 (including the potential for changes to executive compensation to address the impact of the pandemic, as well as measures implemented to support employees more broadly), and diversity and inclusion initiatives, particularly related to race/ethnicity in the U.S.; the potential for consideration of non-financial measures in our incentive compensation programs to address ESG topics while maintaining pay-for-performance alignment; the status of changes initially approved for 2020 CEO compensation but reversed due to COVID-19; and the Compensation Committee’s oversight of additional talent management topics such as succession planning, leadership development and pay equity.

8

| 2021 Proxy Statement | Avery Dennison Corporation

|

SUSTAINABILITY

Sustainability is one of our core values and has long been an integral part of the way we do business. Our aim is to improve the sustainability of our products and processes, build a more diverse workforce and an inclusive culture, maintain a culture of health and safety, and support our communities to create value for all our stakeholders. Key to our progress has been integrating sustainability into our business strategies and engaging employees at all levels.

In our 2020 integrated sustainability and annual report, we present highlights of our achievements against our 2025 sustainability goals and announce our more ambitious 2030 sustainability goals, which are focused on delivering innovations that advance the circular economy, reducing the environmental impact in our operations and supply chain, and making a positive social impact by enhancing the livelihood of our people and communities.

In the first five years of the 10-year horizon for our 2025 sustainability goals, we have made meaningful progress, as shown in the scorecard shown below. You can find additional information in our 2020 integrated sustainability and annual report, as well as on the sustainability section of our website.

| 2020 SUSTAINABILITY SCORECARD | ||||||

Focus Area | Goal(s) | Baseline Year | Highlights of Progress | |||

Greenhouse Gas Emissions

|

Achieve at least 3% absolute reduction year-over-year and at least 26% overall reduction by 2025 |

2015 |

Reduced absolute GHG emissions by ~19% in 12 months through Q3 2020 compared to same period in prior year, primarily due to increased purchase of renewable energy credits; GHG emissions fell ~45% compared to baseline year | |||

Paper

|

Source 100% certified paper, of which at least 70% is Forest Stewardship Council®-certified |

2015 |

Of total volume of paper procured in 2020, ~92% was certified, with ~83% of facestocks Forest Stewardship Council®-certified | |||

Films

|

Ensure that 70% of films we buy conform to, or enable end products to conform to, our environmental and social guiding principles |

N/A |

~97% of 2020 film volume conformed to LGM’s restricted substance list | |||

Chemicals

|

Ensure that 70% of chemicals we buy conform to, or enable end products to conform to, our environmental and social guiding principles |

N/A |

~96% of 2020 chemical volume conformed to LGM’s restricted substance list | |||

Products and Solutions

|

Through innovation, deliver above-average growth in sales from sustainability-driven products and services

Ensure that 70% of our products and solutions conform to, or enable end products to conform to, our environmental and social guiding principles |

2015 |

~44% and ~55% of LGM and RBIS sales, respectively, in 2020 came from sustainability-driven products that are responsibly sourced, enable recyclability, contain recycled content, or use less material without compromising performance | |||

Waste

|

Be 95% landfill-free, with at least 75% of our waste reused, repurposed or recycled

Eliminate 70% of the matrix and liner waste from our value chain |

2015 |

Diverted ~94% of solid waste from landfills and recycled ~67% of waste as of year-end 2020 | |||

People

|

Continue to cultivate diverse (40%+ female at level of manager and above), engaged, safe (recordable incident rate of <0.25), productive and healthy workforce

Continue to invest in our employees and the communities in which they live and work |

2015 |

Increased female representation at level of manager and above by ~7% from baseline year; level was 34% at year-end 2020

Continued world-class safety record, with recordable incident rate of 0.21 in 2020, far surpassing manufacturing industry average of 3.0 in 2019 (most recently available industry average) | |||

Transparency

|

Commit to goals publicly and be transparent in reporting progress |

N/A |

Enhanced transparency by providing greater ESG disclosures in 2019 integrated sustainability and annual report published in March 2020, committing to publishing progress annually; first ESG Download published in August 2020; and 2020 integrated sustainability and annual report and ESG Download, both published in March 2021 | |||

Avery Dennison Corporation | 2021 Proxy Statement

| 9

|

DIVERSITY AND INCLUSION

Diversity is one of our core values, reflecting our interest in ensuring an inclusive and respectful environment for people of all backgrounds and orientations and our recognition that we gain strength from diverse ideas and teams. The importance of diversity and inclusion (D+I) to our company is further evidenced by the diversity-related targets included in our 2025 sustainability goals. Over the past several years, we have made consistent progress in our D+I journey, as shown below. In 2020, we redoubled our efforts to drive sustainable change, recognizing the need to accelerate our collective journey toward greater racial and social justice in society. We are for the first time making publicly available our EEO-1 statistics, which we collect as required by the U.S. Equal Opportunity Commission. This information, which reflects the voluntary self-identification by our U.S. employees in 2020, can be found in our ESG Download published in March 2021.

| HIGHLIGHTS OF D&I JOURNEY | ||

2014-2015

|

• Established goal of 40%+ female at manager level and above

• Employees established Northeast Ohio Chinese employee resource group (ERG)

| |

2016

|

• Launched unconscious bias training for managers globally

• Released D+I Talkabout Toolkit

• Initiated Women.Empowered development program

• Increased flexible work arrangements

• Added inclusion index to employee engagement survey

| |

2017

|

• Employees established Elevate, Women’s ERG

• Required gender diverse hiring slate goals globally

• Joined CEO Action for Diversity & Inclusion

| |

2018

|

• Employees established Black ERG

• Added diversity as company value

• Launched Men as Allies program

• Reviewed director+ level gender pay equity, making adjustments where needed

| |

2019

|

• Employees established Veterans ERG

• Employees established UNITE, LGBTQ+ ERG

• Launched North America iBelong D+I employee engagement campaign

• Expanded gender pay equity review, making adjustments where needed

| |

2020

|

• Employees established Voz Latina ERG

• Launched D+I Town halls in North America

• Established Regional D+I Councils and certain Regional D+I Executive Councils

• Increased transparency through greater ESG reporting

• Began recruiting for enterprise-wide D+I leader

• Continued expanding gender pay equity review and began evaluating U.S. racial/ethnic pay equity, making adjustments where needed

|

10

| 2021 Proxy Statement | Avery Dennison Corporation

|

2021 DIRECTOR NOMINEES (ITEM 1)

Matrix of Director Skills, Qualifications and Demographic Backgrounds

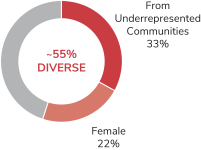

Our director nominees bring a balance of skills, qualifications and demographic backgrounds to their oversight of our company, as shown in the matrix below. In 2020, we asked each of our directors to complete a Board diversity questionnaire, with a long list of demographic characteristics for them to indicate the categories with which they self-identify; as a result, this matrix has been significantly expanded from previous years based on the characteristics we included in our questionnaire and updated to reflect our directors’ responses. The Governance Committee regularly evaluates the skills, qualifications and demographic backgrounds desirable for our Board to best advance our business strategies and serve the interests of all our stakeholders.

|

| Governance Guidelines Criteria | ||||||||||||||||||

Independent | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ✓ | |||||||||

Senior Leadership Experience(1) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| |||||||||

Industry Experience(2) | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Global Exposure(3) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Board Experience(4) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ✓ | |||||||||

Financial Expertise(5) |

| ✓ |

|

|

|

|

| ✓ | ✓ | |||||||||

| Industry Experience | ||||||||||||||||||

Retail/Dining |

|

|

| ✓ | ✓ |

|

|

|

| |||||||||

Packaging | ✓ |

|

|

|

|

|

| ✓ |

| |||||||||

Consumer Goods |

|

| ✓ |

| ✓ |

|

|

| ✓ | |||||||||

Industrial Goods/Technology |

|

|

|

|

| ✓ | ✓ | ✓ |

| |||||||||

| Demographic Background | ||||||||||||||||||

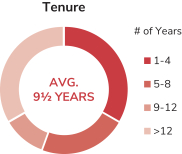

Tenure (years) | 4 | 8 | 11 | 18 | 13 | 2 | 8 | 4 | 15 | |||||||||

Gender(6) |

|

|

|

|

|

|

|

|

| |||||||||

Female |

|

|

| ✓ |

|

| ✓ |

|

| |||||||||

Male | ✓ | ✓ | ✓ |

| ✓ | ✓ |

| ✓ | ✓ | |||||||||

Non-Binary Gender |

|

|

|

|

|

|

|

|

| |||||||||

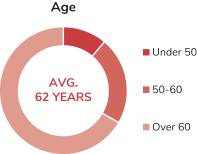

Age | 58 | 65 | 64 | 65 | 68 | 56 | 64 | 49 | 65 | |||||||||

Mandatory Retirement Year | 2035 | 2028 | 2029 | 2028 | 2025 | 2037 | 2029 | 2044 | 2028 | |||||||||

Race/Ethnicity(6) |

|

|

|

|

|

|

|

|

| |||||||||

Black or African American |

| ✓ |

|

|

|

|

|

|

| |||||||||

Hispanic or Latino | ✓ |

|

|

|

|

|

|

|

| |||||||||

White | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Asian (including South Asian) |

|

|

|

|

|

|

|

|

| |||||||||

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

| |||||||||

Native American or Alaska Native |

|

|

|

| ✓ |

|

|

|

| |||||||||

LGBTQ+(6) | ||||||||||||||||||

Veteran(6) |

|

|

|

| ✓ |

|

|

|

| |||||||||

Lives/Has Lived Abroad | ✓ |

| ✓ |

|

| ✓ |

| ✓ | ✓ | |||||||||

| (1) | Experience as president, chief executive officer or in similar senior executive positions. |

| (2) | Experience in the retail/dining, packaging, consumer goods or industrial goods/technology industries. |

| (3) | Seniority in a global enterprise or significant experience in international markets. |

| (4) | Prior or concurrent service on other U.S. public company boards. |

| (5) | Expertise in accounting, auditing, tax, banking, insurance or investments. |

| (6) | Based on each director’s self-identification in our 2020 Board diversity questionnaire. |

Avery Dennison Corporation | 2021 Proxy Statement

| 11

|

Board Performance Highlights

Our Board provides strong oversight of our management team and company, with many notable accomplishments in recent years, highlights of which are described below.

| • | Supported management in navigating challenges presented by COVID-19, ensuring we protected employee well-being, delivered for customers, mitigated supply chain risk, maintained strong balance sheet and financial flexibility, and supported communities, while continuing focus on long-term business strategies and ongoing risk mitigation |

| • | Supported consistent execution of strategic priorities, which delivered significant operating margin expansion and double-digit compound adjusted EPS growth in first four years of our 2017-2021 financial targets, as well as 2016-2020 TSR of 173%, substantially outperforming S&P 500 |

| • | Oversaw completion of seven acquisitions that advanced our capabilities and increased proportion of our portfolio consisting of high-value product categories |

| • | Oversaw executive leadership development and succession planning, with several experienced leaders promoted to senior executive positions and effectively transitioning into roles, including both our Chief Human Resources Officer and our Chief Legal Officer in 2020 |

| • | Onboarded and mentored CEO after he became Chairman in 2019 and successfully transitioned Patrick Siewert into Lead Independent Director role in 2020 following departure of David Pyott |

| • | Implemented thoughtful Board refreshment and succession planning, with 4 new directors appointed in last 8 years, 2 of whom increased racial/ethnic or gender diversity |

Board Governance Highlights

Our Board’s governance program reflects our company values and facilitates our directors’ independent oversight of our company. Highlights of our program, which we believe is generally consistent and aligned with the Investor Stewardship Group’s Corporate Governance Principles for U.S. Listed Companies, are shown below.

Stockholder Rights |

✓ Market-standard proxy access

✓ No supermajority voting requirements

✓ No poison pill

✓ No exclusive forum or fee-shifting bylaws | |

Board Governance |

✓ Annual election of directors

✓ Majority voting in director elections

✓ Single class of outstanding voting stock

✓ Current directors 90% independent; director nominees 89% independent

✓ Robust Lead Independent Director role

✓ Regular director succession planning and Board refreshment

✓ Continuous executive succession planning and leadership development

✓ Annual Board evaluations

✓ Mandatory director retirement policy

✓ Governance Guidelines

✓ Strong Committee governance

✓ Direct access to management and experts |

APPROVAL OF EXECUTIVE COMPENSATION (ITEM 2)

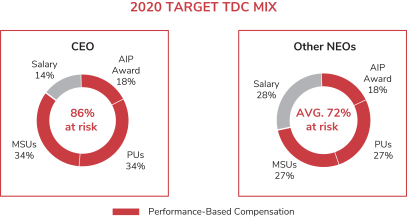

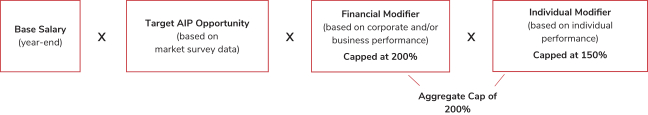

The Compensation Committee designs our executive compensation program to motivate our leaders to execute our business strategies and deliver long-term value for our investors. The program delivers pay for performance, with realized compensation dependent on our company achieving challenging annual and long-term financial performance targets and value creation objectives that advance the interests of our stockholders.

12

| 2021 Proxy Statement | Avery Dennison Corporation

|

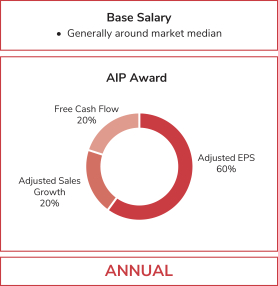

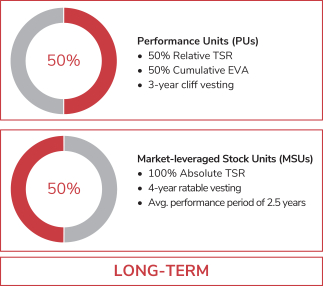

Performance-Based Compensation

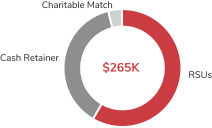

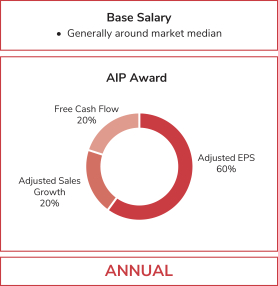

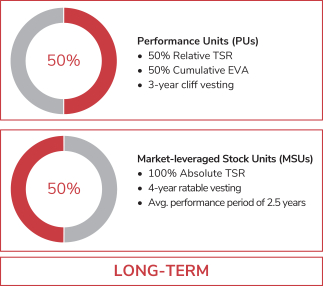

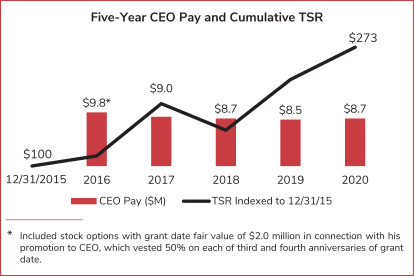

Target total direct compensation (TDC) for our corporate Named Executive Officers (NEOs) is comprised of the elements shown below.

ELEMENTS OF TARGET TDC FOR CORPORATE NEOs

|  |

The Compensation Committee establishes the target TDC of our NEOs to incent strong operational and financial performance and stockholder value creation, giving consideration to the market median, role responsibilities, individual performance, tenure, retention and succession. As shown below, the majority of this compensation is performance-based, meaning that our executives ultimately may not realize the value of the at-risk components of TDC if we fail to achieve our financial objectives.

Avery Dennison Corporation | 2021 Proxy Statement

| 13

|

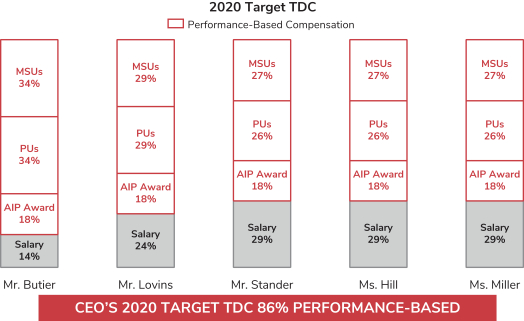

Pay for Performance

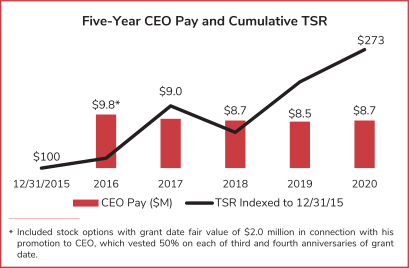

As shown in the graph below, over the past five years, our cumulative TSR has increased by 173% while the annual compensation of our CEO has remained relatively constant, except for 2016 when he received a one-time equity grant in connection with his promotion to CEO.

Changes in 2020 Executive Compensation

Changes Approved in April 2020

Given the uncertain impact of COVID-19 on market conditions, our CEO recommended to the Compensation Committee in April 2020 that the base salary increases for our executive leadership team (which includes all of our NEOs) approved by the committee in February 2020 be indefinitely postponed, and no such increases were given in 2020. In light of market conditions at the time and also at the recommendation of our CEO, the Compensation Committee determined that his 2020 target annual and long-term incentive opportunities should remain at 2019 levels. As a result, the Compensation Committee approved the reductions in CEO compensation for 2020 described below.

| • | His target AIP opportunity for 2020 would remain at previous level of 125% of base salary rather than 140% of base salary approved by Compensation Committee in February 2020 |

| • | His target LTI opportunity for 2020 would remain at previous level of 475% of base salary rather than 585% of base salary as approved by Compensation Committee in February 2020 |

| • | Both target opportunities would be based on his 2019 year-end base salary of $1,133,000 |

In connection with these reductions, our CEO forfeited 5,811 PUs and 6,662 MSUs, with an aggregate grant date fair value of approximately $1.3 million, granted to him in February 2020.

Changes Approved in February 2021

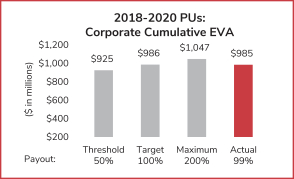

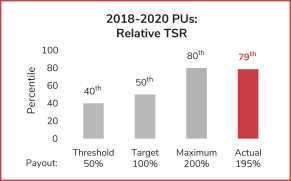

Despite the adverse impact of COVID-19, no adjustments to short- or long-term incentive compensation were made for our corporate NEOs; their 2020 AIP awards and 2018-2020 PUs paid out on the basis of unadjusted company results. Similarly, the goals for their 2020-2022 PUs granted to them in February 2020 were not adjusted to reflect the impact of COVID-19.

COVID-19 had a disproportionate impact on RBIS’ results in 2020. As a result, although the business achieved its short-term objectives while managing a challenging environment during the year, the business did not achieve any of its original goals for 2020. However, RBIS delivered substantial temporary cost savings and accelerated restructuring actions to expand its operating margins; achieved its net income plan for the second half of the year and significantly grew sales on an organic basis in the fourth quarter; successfully integrated Smartrac and exceeded its 2020 performance targets for the acquisition; and achieved a high employee engagement score, despite having taken

14

| 2021 Proxy Statement | Avery Dennison Corporation

|

aggressive actions to reduce costs. Using its allowable discretion to exclude some of this impact, the Compensation Committee approved an AIP financial modifier of 60% for the RBIS team to recognize their achievements in navigating the challenges the business faced during the year. Given our business NEO’s 25% linkage to total company adjusted EPS, his overall adjusted AIP financial modifier was 76%.

The Compensation Committee also reviewed the performance of the 2018-2020 PUs for our business NEO. Noting that RBIS had entered 2020 with performance during the first two years of the three-year performance period in excess of the maximum level of performance and using its allowable discretion to exclude some of the extremely adverse impact, the Compensation Committee determined to increase the payouts for the 2018-2020 for all RBIS participants from 84% to 126% to recognize the team’s impressive EVA performance through 2019, as well as their achievements in navigating the challenges related to COVID-19 that the business faced during 2020. In addition, the Compensation Committee reviewed the performance of the 2020-2022 PUs for our business NEO. Noting that RBIS had taken substantial actions to protect operating margins during the year and using its allowable discretion to exclude some of this impact, the Compensation Committee determined to revise RBIS’ EVA goals originally approved in February 2020 for threshold, target and maximum EVA performance. The revised goals continue to require strong growth and margin improvement compared to the 2019 baseline for the business, although on a different trajectory than originally planned given the extraordinary impact of COVID-19 on RBIS’ markets in 2020.

2021 CEO Compensation

Based on expert advice provided by its independent compensation consultant, Willis Towers Watson, and giving further consideration to the feedback from investors received in 2019 and 2020, the Compensation Committee determined to reinstate the longer-term approach it intended for our CEO’s 2020 compensation for 2021. Consistent with the Committee’s initial decision in February 2020, our CEO’s 2021 target TDC was set between the market 50th and 75th percentiles of his market peers, reflecting his strong performance throughout his five-year tenure in the role, during which our company delivered top quartile performance. The committee’s current intent is not to revisit his compensation until 2024 unless warranted by market conditions or our company results.

Reviewing 2020 market pay rates and projected 2021 market pay rates for companies with annual revenues between $6 billion and $10 billion, the Compensation Committee determined to target our CEO’s target TDC for 2021 at $9.9 million by increasing (i) his base salary by 6% to $1.2 million, noting that his base salary had not been increased in the previous three years; (ii) his target AIP opportunity from 125% of base salary to 140% of base salary; and (iii) his target LTI opportunity from 475% of base salary to 585% of base salary. The Compensation Committee recognized that our CEO had delivered strong value creation for all our stakeholders by leading the execution of our strategies during his five-year tenure in the role and successfully navigating the impact of COVID-19 in 2020. The Compensation Committee noted that over 90% of his new target TDC would consist of at-risk, performance-based compensation; our CEO’s realized compensation will depend on our company achieving strong TSR performance, delivering our 2021 financial targets and 2025 sustainability goals, and continuing to engage our employees, serve our customers, deliver for our investors, and support the communities in which we operate.

Avery Dennison Corporation | 2021 Proxy Statement

| 15

|

Executive Compensation Best Practices

As summarized below and described in further detail in the CD&A section of this proxy statement, our executive compensation program aligns with our financial goals and business strategies and reflects best practices.

Pay-for-Performance |

✓ 86% of CEO 2020 target TDC tied to company performance

✓ 68% of CEO 2020 target TDC equity-based to incent delivery of long-term stockholder value

✓ Rigorous stock ownership policy; requires CEO ownership of ~6x base salary, with 50%+ held in vested shares | |

Compensation Best Practices |

✓ Double-trigger equity vesting requires termination of employment after change of control

✓ Three-year average burn rate of 0.67% at year-end 2020 at 50th percentile of S&P 500 companies

✓ Compensation clawback in event of accounting restatement

✓ Independent compensation consultant retained and serving at direction of Compensation Committee

✓ Annual Compensation Committee evaluation and charter review

✓ Periodic formal risk assessment of compensation policies and practices

✓ Releases from liability and restrictive covenants for departing executives

✓ Review of NEO tally sheets reflecting all compensation components | |

× No NEO employment contracts

× No guaranteed AIP awards; NEO AIP awards based on company or business performance

× No excise tax gross-ups on change of control severance benefits

× No tax gross-ups on perquisites

× No above-market interest rates for deferred compensation

× No re-pricing of stock options without stockholder approval

× No payout of MSU dividend equivalents until vesting

× No grant of stock options below fair market value

× No supplemental retirement benefits |

RATIFICATION OF APPOINTMENT OF PwC (ITEM 3)

Our Board’s Audit and Finance Committee has appointed PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for fiscal year 2021 and our Board is seeking stockholder ratification of the appointment. PwC remains well-qualified to act as our independent registered public accounting firm, has a deep understanding of our operations and accounting practices, and maintains rigorous procedures to continuously ensure auditor independence. The committee considered the qualifications, performance, independence and tenure of PwC, the quality of its discussions with PwC, and the fees charged by PwC for the level and quality of services provided by the firm during 2020, and determined the reappointment of PwC to be in the best interest of our company and stockholders.

16

| 2021 Proxy Statement | Avery Dennison Corporation

|

Under the oversight of our Board of Directors (our “Board”), we have designed our governance program to comply with applicable laws and regulations – including the rules of the Securities and Exchange Commission (SEC) and the listing standards of the New York Stock Exchange (NYSE) – and to reflect best practices as informed by the practices of other large public companies, recommendations from our outside advisors, the voting guidelines of our stockholders and the policies of proxy advisory firms. The key features of our program are described in the Board Governance Highlights section of the proxy summary; together they form a governance program that we believe is generally consistent and aligned with the Investor Stewardship Group’s Corporate Governance Principles for U.S. Listed Companies.

We encourage you to visit the investors section of our website under Corporate Governance, where you can view and download current versions of the documents shown below, which are referenced in this proxy statement:

| • | Amended and Restated Certificate of Incorporation |

| • | Amended and Restated Bylaws (our “Bylaws”) |

| • | Corporate Governance Guidelines (our “Governance Guidelines”) |

| • | Charters for our Board’s Audit and Finance Committee (the “Audit Committee”), Talent and Compensation Committee (the “Compensation Committee”), and Governance Committee |

| • | Code of Conduct |

| • | Code of Ethics for the Chief Executive Officer (CEO) and Senior Financial Officers |

| • | Audit Committee Complaint Procedures for Accounting and Auditing Matters |

Information on our website is not and should not be considered part of, nor is it incorporated by reference into, this proxy statement. You can receive copies of these documents, without charge, by writing to our Corporate Secretary at Avery Dennison Corporation, 207 Goode Avenue, Glendale, California 91203.

CODE OF ETHICS

We have adopted a Code of Ethics that requires our CEO, Chief Financial Officer (CFO) and Chief Accounting Officer (CAO) to act professionally and ethically in fulfilling their responsibilities. Only the Audit Committee or the Governance Committee can amend or waive the provisions of our Code of Ethics, and any amendments or waivers must be posted promptly on our website or timely filed with the SEC on a Current Report on Form 8-K. We last amended our Code of Ethics in April 2014.

| Code of Ethics Responsibilities |

• Avoid actual or apparent conflicts of interest

• Ensure complete and accurate SEC filings

• Respect confidentiality of financial and other information

• Employ corporate assets responsibly

• Report Code of Ethics violations to Chair of Audit or Governance Committees

|

Supporting fulfillment of responsibilities, our controllership and internal audit functions ensure that we maintain a robust internal control environment, with the leaders of these functions regularly reporting to, and periodically meeting in executive session with, the Audit Committee.

CODE OF CONDUCT

Our Code of Conduct applies to all of our directors, officers and employees and reflects our values of Integrity, Courage, External Focus, Diversity, Sustainability, Innovation, Teamwork and Excellence. It includes leadership messages, detailed information regarding higher risk areas, and case studies to provide guidance on situations that raise complex ethical questions. Our Code of Conduct has been translated into over 30 languages and our leaders affirm their commitment to complying with it when they first join our company and thereafter as part of our annual compliance certification. We train employees on the Code at least biannually, in addition to our online training program generally consisting of four courses per year covering specific risk areas from the Code that computer-based employees are required to complete.

Avery Dennison Corporation | 2021 Proxy Statement

| 17

|

To ensure that the policies and principles encompassed in our Code of Conduct reach all our employees, we develop and launch three “Talkabout” toolkits (also in over 30 languages) globally each year, which managers are required to use to engage in meaningful discussion with their teams regarding topics from the Code of Conduct. These toolkits consist of presentation slides and an introductory subtitled video, which includes messages from our Chief Compliance Officer and other company leaders.

Ethics-Based Corporate Culture and Policies

Reflecting the culture of our company, the ethics-based corporate policies and other matters discussed in our Code of Conduct are shown below. Our global supplier standards extend our commitment to our third party service providers, establishing our expectation that they also do business in an ethical manner.

Business Conduct GuideLine

Our Business Conduct GuideLine (the “GuideLine”) is a whistleblower hotline available at all hours for employees or third parties to report potential violations of our Code of Conduct or applicable laws, anonymously if they so choose.

The GuideLine may be reached by (i) calling 800.461.9330 toll-free in the U.S., 720.514.4400 direct with applicable charges from any location, or toll-free outside of the U.S. using the country-specific toll-free numbers found in our Code of Conduct or (ii) visiting averydennison.com/guidelinereport (averydennison.com/guidelinereport-eu in Europe). The hotline is operated by an independent third party and accepts reports in any language to accommodate the needs of our global workforce and customer/supplier base. Reports are investigated under the direction of our Chief Compliance Officer, in consultation with our law department and senior management and with oversight from the Governance Committee. We prohibit retaliation for good-faith reporting.

18

| 2021 Proxy Statement | Avery Dennison Corporation

|

COMPLAINT PROCEDURES FOR ACCOUNTING AND AUDITING MATTERS

The Audit Committee has adopted procedures for the confidential, anonymous submission of complaints related to accounting, accounting standards, internal accounting controls and audit practices.

These procedures relate to reports of (i) fraud or deliberate error in the preparation, evaluation, review or audit of our financial statements or other financial reports; (ii) fraud or deliberate error in the recording or maintenance of our financial records; (iii) deficiencies in, or noncompliance with, our internal accounting controls; (iv) misrepresentation or false statement to or by a senior officer or accountant regarding any matter contained in our financial records, statements, or other reports; or (v) deviation from full and fair reporting of our financial condition. Any person, including third parties, may submit a good faith complaint regarding accounting and auditing matters and employees may do so without fear of retaliation. The Audit Committee oversees these procedures, with investigations conducted under the direction of our internal audit department in consultation with our Chief Compliance Officer, law department and senior management to the extent appropriate under the circumstances.

Stockholders and other interested parties interested in communicating regarding these matters may make a confidential, anonymous report by contacting the GuideLine or writing to the Audit and Finance Committee Chair, c/o Corporate Secretary, Avery Dennison Corporation, 207 Goode Avenue, Glendale, California 91203.

STOCK OWNERSHIP POLICY

Our stock ownership policy requires that non-employee directors acquire and maintain a minimum ownership interest in our company of $500,000 and our CEO and other current NEOs acquire and maintain a minimum ownership interest in our company equal to 6x and 3x his or her annual base salary, respectively; at least 50% of the applicable minimum ownership requirement must be held in vested shares.

The values of the following shares/units are considered in measuring compliance with our stock ownership policy: shares beneficially owned or deemed to be beneficially owned, directly or indirectly, under federal securities laws; for officers, shares or units held in qualified and non-qualified employee benefit plans, unvested restricted stock units (RSUs) subject to time-based vesting, and 50% of the value of unvested market-leveraged stock units (MSUs) at the target payout level; and, for non-employee directors, RSUs and deferred stock units (DSUs). Unvested performance units (PUs) and stock options are not considered in measuring compliance.

If a director or officer fails to achieve or make reasonable progress towards achieving his or her respective ownership requirement, he or she is required to retain shares acquired, net of taxes, from the exercise of stock options or vesting of stock awards until such level is met. These individuals are not allowed to transact in company stock until they certify that they will remain in compliance with our stock ownership policy after giving effect to the transaction they plan to effectuate.

The Compensation Committee and the Governance Committee reviewed the stock ownership of our non-employee directors in December 2020 and February 2021, respectively. Both Committees determined that all of our non-employee directors were in compliance with our stock ownership policy, with average ownership of 10x the minimum ownership requirement, helping ensure their interests remain aligned with those of our stockholders and further incenting their focus on long-term stockholder value creation.

Avery Dennison Corporation | 2021 Proxy Statement

| 19

|

The Compensation Committee reviewed executive stock ownership in December 2020 and determined that all of our executive officers, including all NEOs, were in compliance with our stock ownership policy.

| STOCK OWNERSHIP POLICY COMPLIANCE | ||||||||||||||

|

| Shares* as of 2020 FYE (#) | Minimum Requirement | % of Requirement | Policy Compliance | ||||||||||

Non-Employee Directors |

|

|

| $ 500,000 |

|

|

|

|

|

| ||||

Bradley Alford | 41,050 |

| 1,266% | ✓ | ||||||||||

Anthony Anderson | 16,992 |

| 524% | ✓ | ||||||||||

Peter Barker | 64,465 |

| 1,988% | ✓ | ||||||||||

Mark Barrenechea | 5,593 |

| 172% | ✓ | ||||||||||

Ken Hicks | 42,828 |

| 1,320% | ✓ | ||||||||||

Andres Lopez | 7,438 |

| 229% | ✓ | ||||||||||

Patrick Siewert | 16,485 |

| 508% | ✓ | ||||||||||

Julia Stewart | 61,570 |

| 1,899% | ✓ | ||||||||||

Martha Sullivan | 27,184 |

| 838% | ✓ | ||||||||||

Chairman, President & CEO |

|

|

| 6x Base Salary |

|

|

|

|

|

| ||||

Mitchell Butier | 240,724 | $6,798,000 | 546% | ✓ | ||||||||||

Other NEOs |

|

|

| 3x Base Salary |

|

|

|

|

|

| ||||

Gregory Lovins | 41,470 | $1,854,000 | 345% | ✓ | ||||||||||

Deon Stander | 30,339 | $1,665,387 | 281% | ✓ | ||||||||||

Anne Hill | 24,120 | $1,644,018 | 226% | ✓ | ||||||||||

Susan Miller | 14,865 | $1,743,144 | 131% | ✓ | ||||||||||

| * | Reflects shares/units considered in measuring compliance with our stock ownership policy rather than vested shares. |

INSIDER TRADING POLICY

Our insider trading policy prohibits our Board members, officers and employees from engaging in transactions in our company’s stock while in the possession of material non-public information; engaging in transactions in the stock of other companies while in possession of material non-public information that they become aware of in performing their duties; and disclosing material non-public information to unauthorized persons outside our company.

Limited Trading Windows

Our insider trading policy restricts trading by Board members, officers (including our NEOs) and director-level employees during blackout periods, which generally begin two weeks before the end of each fiscal quarter and end two business days after the release of earnings for the quarter. Additional blackout periods may be imposed, with or without notice depending on the circumstances.

Prohibitions on Hedging and Pledging

Our insider trading policy prohibits our directors, officers and employees from purchasing financial instruments (such as prepaid variable forward contracts, equity swaps, collars and exchange funds) designed to hedge or offset any decrease in the market value of shares of our common stock they hold, directly or indirectly. In addition, directors and officers are expressly prohibited from – and our non-officer employees are strongly discouraged from – pledging any of their shares of common stock to secure personal loans or other obligations, including by holding such shares in a margin account.

To our knowledge, based on our review of their written representations in our annual director and officer questionnaire, all of our Board members and executive officers complied with our insider trading policy during 2020, and none of them has hedged or pledged shares of our common stock.

20

| 2021 Proxy Statement | Avery Dennison Corporation

|

Sustainability and Diversity are two of our core values and have long been part of our approach to doing business, driving us to work within our company and across our entire value chain to address the environmental and social impacts of our products and practices. We aim to continually improve the environmental sustainability of our products and processes, build a more diverse and inclusive workforce, and provide meaningful support for our communities to create value for all our stakeholders.

With strategic guidance and direction provided by Mitch Butier, our Chairman, President and CEO, responsibility over ensuring that we continue to make meaningful progress toward achieving our 2025 sustainability goals resides with Deon Stander, Vice President and General Manager of our Retail Branding and Information Solutions business. Our enterprise-wide Sustainability Council, led by Mr. Stander and comprised of a cross-divisional and cross-functional group of leaders to drive broad accountability and continually accelerate our progress, generally meets bimonthly and updates our executive leadership team quarterly.

Board oversight over environmental sustainability and community investment is primarily conducted by the Governance Committee, which receives a report from management on each of these topics at least once a year. In addition, our full Board engages with business leaders on their sustainability initiatives during its regular review of their business strategies. In July and December 2020, our Board held strategy sessions focused on environmental sustainability and our innovation efforts to address the increasing need and demand for more sustainable products.

Board oversight over social sustainability is conducted primarily through the Compensation Committee, which regularly reviews our diversity and inclusion progress and discusses other matters related to human capital management. In December, substantially all members of our entire Board engaged with, and challenged, management in an in-depth discussion of our D+I journey, including by reviewing the initiatives being undertaken by each of Regional D+I Councils and analyzing D+I statistics for our executive leadership team and our U.S. workforce.

We seek to ensure that our sustainability efforts are consistent with the expectations of our stakeholders. We regularly communicate with individuals and organizations interested in how we do business generally and our sustainability efforts in particular, and also conduct stakeholder interviews as part of our regular materiality assessments. These assessments help set our sustainability agenda, focusing us on the areas in which we can have the most impact. In 2020, we partnered with Environmental Resources Management to refresh our materiality assessment and reprioritize the sustainability topics most significant to our stakeholders. An updated materiality map showing the importance of various ESG topics to our company and our external stakeholders described on the following page may be found in our second ESG Download published in March 2021.

Avery Dennison Corporation | 2021 Proxy Statement

| 21

|

SUSTAINABILITY STAKEHOLDERS

| 1

| ||||

Industry

Working Groups Conferences

| 2

| ||||

Customers and Brand Owners

Product Collaborations Surveys Site Audits Working Groups

| 3

| ||||

Employees

Engagement Survey Works Councils Employee Resource Groups Intranet/Town Halls

Code of Conduct Training Business Conduct GuideLine

| 4

| ||||

Investors

Annual Meetings Quarterly Earnings Calls Investor Meetings Stockholder Engagement Program

| 5

| ||||

Non-Governmental Organizations

Consultations on Issues of Concern Specific Initiatives (e.g., responsibility sourcing paper, reducing GHG emissions)

| 6

| ||||

Policymakers and Regulators

Permitting Audits Certifications

| 7

| ||||

Communities

Foundation Grantmaking Employee Volunteerism Civic Collaboration

| 8

| ||||

Suppliers

Supplier Standards Compliance Training Supplier Audits Joint Projects

PROGRESS TOWARD ACHIEVING 2025 GOALS; NEW 2030 GOALS

In our 2020 integrated sustainability and annual report, we present highlights of our progress against our 2025 sustainability goals and announce our more ambitious 2030 sustainability goals. After updating our materiality assessment to better understand the environmental and social sustainability challenges facing our company and stakeholders, we reframed our eight 2025 goals into the following three broader goals that we are aiming to achieve by 2030: deliver innovations that advance the circular economy; reduce the environmental impact in our operations and supply chain; and make a positive social impact by enhancing the livelihood of our people and communities. Within each of these goals, we have specific targets related to environmental and social sustainability. Going forward, we will report our progress against both sets of goals.

22

| 2021 Proxy Statement | Avery Dennison Corporation

|

In the first five years of the 10-year horizon for our 2025 sustainability goals, we have made meaningful progress, as shown in the scorecard in the proxy summary. You can find additional information in our 2020 integrated sustainability and annual report, our ESG Downloads available in the investors section of our website, and the sustainability section of our website.

In our ESG Downloads published at least annually, we disclose our ESG metrics using the frameworks of the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI) and CDP Worldwide. In November 2020, we joined the United Nations Global Compact and made commitments to the UN Sustainable Development Goals.

Diversity is one of our core values, reflecting our desire to ensure an inclusive and respectful environment for people of all backgrounds and orientations and our recognition that we gain strength from diverse ideas and teams. The importance of D+I to our company is further evidenced by the diversity-related targets included in our 2025 sustainability goals. D+I at our company is led by our cross-functional and cross-divisional D+I Council, chaired by our President/CEO and advised by our Chief Human Resources Officer. Highlights of our D+I journey are shown in the proxy summary and further described below.

In recent years, among other initiatives, our D+I efforts have focused on training our managers globally on unconscious bias; increasing the number of sites offering flexible work arrangements; adding an inclusion index to our annual employee engagement survey; and expanding our Women.Empowered program featuring interactive discussions among nominated female participants to facilitate and enhance their development. We joined CEO Action for Diversity & Inclusion, the largest CEO-driven business commitment to advance D+I in the workplace, externally committing ourselves to our internal value. We also began evaluating evaluated gender pay equity annually, making adjustments to compensation for both male and female employees where needed.

In 2019, we began formally encouraging and more actively supporting employee resource groups (ERGs), a few of which had already begun to form through the initiative of their individual founders. ERGs are voluntary executive-sponsored and employee-led groups comprised of individuals who join together based on common interests or demographic backgrounds such as race, ethnicity, sexual orientation and veteran status. Participation in these groups is not limited to individuals in these categories, but rather is open to all employees interested in learning about the experiences and challenges of their colleagues. Our ERGs expanded in number throughout 2019 and 2020, with increasing participation and engagement beyond the U.S. Our ERGs currently include groups centered around women, ethnic Chinese, Black employees, military veterans, Hispanic/Latinx employees, and LGBTQ+ individuals.

In 2020, we established Regional D+I Councils in North America; Latin America; Europe; Middle East and Africa; North Asia; and South Asia, which provide leadership of initiatives that more strongly resonate with employees in their respective regions. In addition, we established Regional D+I Executive Councils in certain of these regions to provide a direct avenue for the initiatives and outcomes sought by those Regional D+I Councils to be heard, aligned upon and implemented by their regional business leaders. We also began evaluating racial/ethnic pay equity in the U.S.

Having delayed the launch of the program in 2020 due to COVID-19, we plan to launch global harassment prevention training in 2021 to supplement the anti-harassment messages we continually reinforce as part of our Values and Ethics program. We are also hiring a global D+I leader for our company, as well as similarly dedicated resources in the regions in which we operate. Most important, we are increasing external transparency into our D+I journey with more robust, ongoing ESG reporting so our stakeholders may critically assess our progress and help us achieve our goals.

OTHER HUMAN CAPITAL MANAGEMENT MATTERS

Succession Planning