UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06515

Morgan Stanley Global Fixed Income Opportunities Fund

(Exact name of registrant as specified in charter)

1585 Broadway, New York, New York 10036

(Address of principal executive offices) (Zip code)

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-762-1886

Date of fiscal year end: October 31,

Date of reporting period: October 31, 2023

Item 1 - Report to Shareholders

Morgan Stanley

Global Fixed Income

Opportunities Fund

Annual Report

October 31, 2023

Morgan Stanley Global Fixed Income Opportunities Fund

Table of Contents (unaudited)

Welcome Shareholder | 3 | ||||||

Fund Report | 4 | ||||||

| Performance Summary | 10 | ||||||

| Expense Example | 12 | ||||||

| Portfolio of Investments | 14 | ||||||

| Statement of Assets and Liabilities | 38 | ||||||

| Statement of Operations | 40 | ||||||

| Statements of Changes in Net Assets | 42 | ||||||

| Notes to Financial Statements | 43 | ||||||

| Financial Highlights | 67 | ||||||

| Report of Independent Registered Public Accounting Firm | 73 | ||||||

| Investment Advisory Agreement Approval | 74 | ||||||

| Liquidity Risk Management Program | 77 | ||||||

Important Notices | 78 | ||||||

U.S. Customer Privacy Notice | 80 | ||||||

Trustees and Officers Information | 83 | ||||||

2

Welcome Shareholder,

We are pleased to provide this Annual Report, in which you will learn how your investment in Morgan Stanley Global Fixed Income Opportunities Fund (the "Fund") performed during the latest twelve-month period. It includes an overview of the market conditions and discusses some of the factors that affected performance during the reporting period. In addition, the report contains financial statements and a list of portfolio holdings.

Morgan Stanley Investment Management is a client-centric, investor-led organization. Our global presence, intellectual capital, and breadth of products and services enable us to partner with investors to meet the evolving challenges of today's financial markets. We aim to deliver superior investment service and to empower our clients to make the informed decisions that help them reach their investment goals.

As always, we thank you for selecting Morgan Stanley Investment Management and look forward to working with you in the months and years ahead.

This material must be preceded or accompanied by a prospectus for the fund being offered.

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

3

Fund Report (unaudited)

For the year ended October 31, 2023

Total Return for the 12 Months Ended October 31, 2023 | |||||||||||||||||||||||

| Class A | Class L | Class I | Class C | Class R6 | Class IR | ||||||||||||||||||

| 4.26 | % | 4.09 | % | 4.68 | % | 3.47 | % | 4.78 | % | 4.78 | % | ||||||||||||

| Bloomberg Global Aggregate (Hedged USD) Index1(i) | Global Fixed Income Opportunities Blend Index2 | Lipper Global Income Funds Index3 | |||||||||

| 1.72 | % | 1.72 | % | 3.29 | % | ||||||

The performance of Morgan Stanley Global Fixed Income Opportunities Fund's (the "Fund") six share classes varies because each has different expenses. The Fund's total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

The market rallied in November 2022 as central banks adopted a dovish tone. U.S. Treasury 10-year yields ended the month at 3.61%, down a whopping 61 basis points (bps) from their October 2022 peak.(ii) Real yields joined the party as well, with U.S. 10-year real yields down approximately 20 bps over the month of November 2022, about 50 bps down from their intra-month high.(ii) It wasn't just the U.S. bond market that rallied; it was truly a global phenomenon, with yields falling anywhere from 23 bps in Australia to 185 bps in Hungary, with the exception of Japan and some emerging markets (EM) countries.(ii) Furthermore, credit spreads narrowed and the U.S. dollar fell significantly during the month. Securitized credit sectors underperformed many other credit markets as

securitized spreads tightened less because of their generally shorter durations and spread durations. The bond rally was sparked by reduced worries about central bank over-tightening, better news on the inflation front, a market underexposed to duration and credit, and lastly, high yields, making bonds look attractive. December 2022 proved to be a fitting end to a terrible year for bonds and financial assets in general, with yields up significantly once again. Optimism based on declining inflation, weaker growth and less hawkish central banks proved to be illusory. European bonds were hit particularly hard, with French 10-year yields up over 70 bps on the month and Germany not far behind.(iii) U.S. Treasuries did reasonably well, with 10-year yields up only 27 bps.(iii) Credit markets bucked the trend a bit with U.S. investment grade and European credit markets marginally tighter on the month. U.S. high yield corporate debt was the outlier, with spreads over 20 bps wider in the month.(iii) Securitized markets also did well in spread terms, as they continued to play catch-up to the corporate credit markets.

The price action for developed market interest rates in the first quarter of 2023 was staggering and historic. Early in the quarter, strong economic data and hawkish language from the Federal Reserve (Fed) saw yields continue their

(i) "Bloomberg®" and the Bloomberg Index/Indices used are service marks of Bloomberg Finance L.P. and its affiliates, and have been licensed for use for certain purposes by Morgan Stanley Investment Management (MSIM). Bloomberg is not affiliated with MSIM, does not approve, endorse, review, or recommend any product, and does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any product.

(ii) Source: Bloomberg L.P. Data as of November 30, 2022. One basis point = 0.01%

(iii) Source: Bloomberg L.P. Data as of December 31, 2022.

4

movement upwards; however, that was reversed in March 2023 as the collapse of Silicon Valley Bank unfolded. After spiking, rate volatility slowly declined from the highs but remained elevated late in the first quarter of 2023 as the market digested news and tried to interpret the impact of the banking situation. During the first quarter of 2023, 2-, 5-, 10- and 30-year Treasury yields fell by 40, 43, 41 and 31 bps, respectively.(iv) The rally was mostly in real yields, as 10-year breakeven inflation rates rose by 2 bps for the quarter.(iv) The Bloomberg U.S. Corporate Index spread widened 8 bps during the quarter to 138 bps.(v) With the turmoil in the banking sector, the widening was concentrated in the financial sector. Toward the end of March 2023, the market took some confidence from the lack of follow-on headlines, suggesting the events were somewhat idiosyncratic. This led to a drop in equity and interest rate volatility and tighter credit spreads. Given the higher representation of financial issuers on the short end of the yield curve, there was a significant flattening in the corporate spread curve. Investment grade credit fundamentals could be summarized as "things are better in 2023 but far from good," compared to 2022. Despite support for the market from numerous sources, multiple headwinds suggested that above-average risk premiums were appropriate. Higher interest rate volatility and concern about potential FDIC (Federal Deposit Insurance Corporation) sales from failed banks pressured the agency mortgage-backed securities (MBS) market during the first quarter of 2023. Current coupon spreads widened 8 bps to 153 bps above comparable duration U.S. Treasuries.(iv) The average 30-year mortgage rate did not follow other yields lower, as it rose slightly during the quarter to 6.75%.(iv) Securitized credit sectors widened along with financial corporate bonds. Fundamental credit conditions remained stable despite recession risks. Delinquencies

across many asset classes started to increase slowly. But overall delinquencies remained low from a historical perspective. Additionally, securitization structures remained relatively robust in the post-Global Financial Crisis era, and we believed most securities could generally withstand high levels of defaults without being materially impacted.

While banking fears dominated the price action observed in the first quarter of 2023, market behavior coming into the second quarter of 2023 seemed to be range-bound between two narratives. The first was a resilient labor market and sticky core inflation due to pressures from elevated services inflation. The second was the concern around an economic fallout and a potential credit crunch driven by regional banking fears. However, both narratives stood down during May 2023 as all eyes turned to the U.S. debt ceiling. Once a deal in Congress became imminent, that uncertainty subsided and all eyes turned back to the economic data. Economic and labor market data continuously surprised to the upside, conflicting with fears of a weak economy burdened by banking woes, persistent inflation and hawkish policymakers. During the second quarter of 2023, 2-, 5-, 10- and 30-year Treasury yields rose by 87, 58, 37 and 21 bps, respectively.(vi) The upswing in rates was primarily due to the market repricing government yields to reflect a stronger economy and subsequent Fed hikes. The Bloomberg U.S. Corporate Index spread tightened 15 bps during the quarter to

(iv) Source: Bloomberg L.P. Data as of March 31, 2023.

(v) Source: Bloomberg L.P. Data as of March 31, 2023. The Bloomberg U.S. Corporate Index is a broad-based benchmark that measures the investment grade, fixed-rate, taxable, corporate bond market.

(vi) Source: Bloomberg L.P. Data as of June 30, 2023.

5

123 bps.(vi) The bulk of the tightening was due to the market repricing weakness in the financial sector lower, with financial spreads tightening 25 bps as the market abandoned fears of a potential systemic financial crisis.(vi) U.S. investment grade spreads broadly performed well due to several economic data surprises (particularly in the U.S.), such as the labor markets remaining strong and inflation starting to fall, and bondholder-friendly corporate news. Finally, general risk sentiment improved as debt ceiling contention faded, risks of a recession accompanied by a spike in defaults receded, and equity market volatility fell to pre-COVID levels. Broadly, securitized credit sectors were relatively unchanged in the second quarter of 2023, though AAA collateralized loan obligations (CLOs), asset-backed securities (ABS) and non-agency commercial mortgage-backed securities (CMBS) tightened 12 bps, 18 bps and 9 bps, respectively.(vi) Within securitized assets, fundamental credit conditions remained stable despite recession risks. Agency mortgage-backed securities yields broadly tracked the rates market, with yields rising roughly 60 bps in the second quarter of 2023.(vi)

Rising real yields and steeper curves created headwinds for risk assets in the third quarter of 2023. On a global basis, major equity and bond indexes declined as central banks maintained a hawkish stance even as inflation cooled in their respective economies. During the third quarter of 2023, 2-, 5-, 10- and 30-year Treasury yields rose by 15, 45, 73 and 84 bps, respectively.(vii) While rates increased across the Treasury curve, long yields rose significantly more than short yields, and the inversion in the curve (between 2- and 10-year maturities) narrowed by over 60 bps.(vii) The yield on 10-year Japanese government bonds also rose to its highest level

in a decade, pressured by the Bank of Japan's decision to boost its yield cap to 1%, as well as expectations of tighter policy ahead.(vii) Amid signs of economic resilience, central banks in the eurozone, Canada and Australia maintained restrictive policies to further reduce inflation, driving rates higher in those regions. Monetary authorities in emerging markets generally adopted a more hawkish stance as domestic demand remained strong. China was a notable outlier, where the government introduced policy easing measures to address deepening credit problems and weakness in the economy. Credit spreads were largely unchanged, with the Bloomberg U.S. Corporate Index spread tightening 2 bps during the third quarter of 2023.(vii) Nonetheless, defaults started to pick up, especially in the bank loan market, which has floating-rate coupons, as did concerns about companies needing to refinance maturing debt at much higher coupons at a time when growth is expected to weaken. We began to see higher quality credits offering historically attractive starting valuations, and we expect them to outperform lower quality sectors in the coming quarters as growth becomes more challenging and defaults accelerate. Our approach to securitized sectors did not change during the third quarter of 2023.

In October 2023, yields continued to rise (yield curves "bear steepened" with the long end rising faster than the short end), spreads widened, and the dollar strengthened. As war broke out in the Middle East, economic data remained resilient in the U.S. and inflation remained sticky across the globe, it was evident that rates were to remain higher for longer. The 10-year interest rate rose 36 bps in the U.S., 18 bps in Japan,

(vi) Source: Bloomberg L.P. Data as of June 30, 2023.

(vii) Source: Bloomberg L.P. Data as of September 30, 2023.

6

25 bps in New Zealand and 44 bps in Australia in the month.(viii) Yields in the emerging markets also continued their ascent as most countries fixed their sights on what was happening in the U.S. Credit spreads were mostly wider over the month for many of the same reasons (e.g., resilient U.S. economy, continuing inflation, hawkish central banks, higher rates, war in the Middle East, etc.) with high yield corporate bonds underperforming investment grade corporate bonds. Securitized credit was mixed over the month, but the trend was toward slightly wider spreads. Within currencies, the U.S. dollar continued to strengthen against most currencies.

Performance Analysis

All share classes of the Fund outperformed the Bloomberg Global Aggregate (Hedged USD) Index (the "Index"), the Global Fixed Income Opportunities Blend Index and the Lipper Global Income Funds Index for the 12 months ended October 31, 2023, assuming no deduction of applicable sales charges.

Macro decisions, along with the portfolio's positioning within spread sectors, contributed to the positive absolute performance. Rising global yields detracted the most from performance, but this was more than offset by the higher "risk-free" returns earned in the U.S., euro area, U.K., New Zealand, Australia, South Africa, Mexico and Brazil. The portfolio's currency positioning over the 12-month period marginally detracted from performance, particularly the long positions in EM currencies (Brazilian real, Peruvian sol, Polish zloty, Colombian peso, and others) earlier in 2023. Notably, these losses were mostly offset by the long Mexican peso position, which contributed to performance. Regarding the portfolio's positioning within spread sectors, exposures to

securitized credit (ABS, non-agency residential mortgage-backed securities [RMBS] and CMBS), investment grade corporate bonds, and high yield corporate bonds all contributed to absolute performance as credit spreads mostly tightened over the year.

As of the close of the period, looking forward in terms of strategy, we are wary of chasing yields lower in this environment. While markets are now pricing in rate cuts in many countries (eurozone, U.S., Canada) there is a reasonable chance that these cuts either won't happen or will happen in smaller sizes. It should be noted that the chances of rate cuts in the eurozone are higher than they are in the U.S., but bond yield differentials and yield curve shapes already reflect this. Therefore, we believe a neutral position on interest rate exposure is now warranted while we wait for new data on the extent of the U.S. and global slowdown, particularly on the inflation front. We do think selected EM bond markets look attractive. Recent U.S. economic data released in November 2023 suggest the tightening in financial conditions in the third quarter of 2023 is working to slow the economy. We think a cautious modestly long position in credit markets both in investment grade and in high yield is warranted. Shorter-maturity high yield bonds do look attractive in this environment, in our view. The outlook for inflation will be critical to determine if markets need to be worried about credit spreads. We continue to favor shorter-maturity securitized credit, such as RMBS, ABS and selected CMBS, the most. That said, the outlook has modestly deteriorated as household balance sheets come under more pressure and excess savings are run down. We are trying to take advantage of higher yields on higher quality issuers to seek our target returns, rather than venturing down the risk/rating

(viii) Source: Bloomberg L.P. Data as of October 31, 2023.

7

spectrum. Anything that would reduce the chances of further rate hikes and higher borrowing costs we expect to benefit securitized credit. The outlook for the U.S. dollar also appears to be changing, though we remain largely neutral as we have been for the last few months of the reporting period. It looks opportune to begin thinking about underweighting the dollar versus selected EM currencies once again. Lower and more stable U.S. yields combined with still high carry in many EM currencies make these currencies attractive in our view.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

PORTFOLIO COMPOSITION* as of 10/31/23 | |||||||

Corporate Bonds | 34.8 | % | |||||

Mortgages — Other | 19.6 | ||||||

Sovereign | 13.1 | ||||||

Short-Term Investments | 12.3 | ||||||

Asset-Backed Securities | 11.8 | ||||||

Commercial Mortgage-Backed Securities | 3.8 | ||||||

Agency Fixed Rate Mortgages | 2.9 | ||||||

Senior Loan Interests | 0.6 | ||||||

Supranational | 0.5 | ||||||

| Collateralized Mortgage Obligations — Agency Collateral Series | 0.4 | ||||||

Investment Company | 0.2 | ||||||

* Percentages indicated are based upon total investments (excluding Securities held as Collateral on Loaned Securities) as of October 31, 2023. Does not include open futures contracts with a value of $122,596,841 and net unrealized depreciation of $572,615. Does not include open foreign currency forward exchange contracts with net unrealized appreciation of $8,876,372.

LONG-TERM CREDIT ANALYSIS as of 10/31/23 | |||||||

AAA | 10.8 | % | |||||

AA | 0.8 | ||||||

A | 11.3 | ||||||

BBB | 27.0 | ||||||

BB | 13.0 | ||||||

B or Below | 7.8 | ||||||

Not Rated | 29.3 | ||||||

Subject to change daily. Provided for informational purposes only and should not be deemed as a recommendation to buy or sell the types of securities mentioned above. All percentages for portfolio composition are stated as a percentage of total investments and all percentages for long-term credit analysis are stated as a percentage of total long-term investments.

Security ratings disclosed with the exception for those labeled "not rated" is an aggregation of the highest security level rating amongst Standard & Poor's Ratings Group ("S&P"), Moody's Investors Services, Inc. ("Moody's") and Fitch Ratings ("Fitch"), each a Nationally Recognized Statistical Ratings Organization ("NRSRO").

Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

8

Investment Strategy

The Fund will normally invest at least 80% of its assets in a portfolio of fixed-income securities. This policy may be changed without shareholder approval; however, you would be notified upon 60 days' notice in writing of any changes. The Fund's "Adviser," Morgan Stanley Investment Management Inc. and/or "Sub-Adviser," Morgan Stanley Investment Management Limited, will allocate the Fund's investments among the following asset classes or market segments: (1) corporate securities, (2) residential and commercial mortgage-backed securities, (3) asset-backed securities, (4) emerging market securities, (5) convertible securities, (6) U.S. government securities and foreign sovereign debt, and (7) derivatives, including interest rate-related derivatives and currency derivatives. Securities may be rated either investment grade or below investment grade and denominated in any currency, hedged or un-hedged. The amount of the Fund's assets committed to any one asset class or market segment will fluctuate. However, the Fund may invest up to 65% of its net assets in any one asset class or market segment. The Adviser and Sub-Adviser have the flexibility to select any combination of at least two asset classes of the aforementioned groups depending upon market conditions and the current economic environment and, as a result, at any given time the Fund's assets may be invested in certain groups and not others.

9

Performance Summary (unaudited)

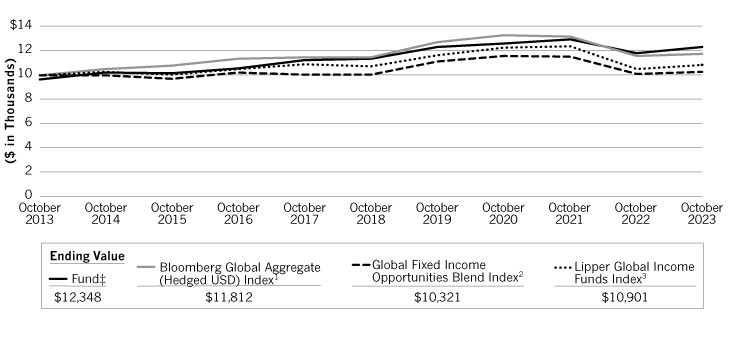

Performance of $10,000 Investment—Class A

Over 10 Years

10

Average Annual Total Returns—Period Ended October 31, 2023 (unaudited) | |||||||||||||||||||||||||||

Symbol | Class A Shares* (since 07/28/97) DINAX | Class L Shares** (since 07/28/97) DINCX | Class I Shares*** (since 07/28/97) DINDX | Class C Shares† (since 04/30/15) MSIPX | Class R6 Shares†† (since 09/13/13) MGFOX | Class IR Shares††† (since 06/15/18) MFIRX | |||||||||||||||||||||

| 1 Year | 4.26 0.825 | %4 | 4.09 — | %4 | 4.68 — | %5 | 3.47 2.495 | %4 | 4.78 — | %4 | 4.78 — | %4 | |||||||||||||||

| 5 Years | 1.624 0.945 | 1.324 — | 1.914 — | 0.874 0.875 | 1.994 — | 1.964 — | |||||||||||||||||||||

| 10 Years | 2.474 2.135 | 2.204 — | 2.764 — | — — | 2.834 — | — — | |||||||||||||||||||||

| Since Inception | 3.514 3.385 | 3.024 — | 3.794 — | 1.344 1.345 | 3.164 — | 1.884 — | |||||||||||||||||||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/im/shareholderreports or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class L, Class I, Class C, Class R6 and Class IR shares will vary due to differences in sales charges and expenses. See the Fund's current prospectus for complete details on fees and sales charges. Fund returns are calculated based on the net asset value as of the last business day of the period.

* The maximum front-end sales charge for Class A is 3.25%.

** Class L has no sales charge. Class L shares are closed to new investments.

*** Class I has no sales charge.

† The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase. Class C shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. Performance for periods greater than eight years reflects this conversion (beginning April 2023).

†† Class R6 has no sales charge.

††† Class IR has no sales charge.

(1) The Bloomberg Global Aggregate (Hedged USD) Index provides a broad-based measure of the global investment grade fixed-rate debt markets. Currency exposure is hedged to the U.S. dollar. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by the Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed-rate debt markets with returns in unhedged USD) from the Fund's inception to December 31, 2016 to the new benchmark represented by the Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Lipper Global Income Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Global Income Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund was in the Lipper Global Income Funds classification as of the date of this report. It is not possible to invest directly in an index.

(4) Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges.

(5) Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges.

‡ Ending value assuming a complete redemption on October 31, 2023.

11

Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, which may include advisory fees, administration fees, distribution and shareholder services (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 05/01/23 – 10/31/2023.

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12

Expense Example (unaudited) continued

| Beginning Account Value | Ending Account Value | Expenses Paid During Period(1) | |||||||||||||

05/01/23 | 10/31/23 | 05/01/23 – 10/31/23 | |||||||||||||

Class A | |||||||||||||||

Actual (–0.72% return) | $ | 1,000.00 | $ | 992.80 | $ | 4.32 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.87 | $ | 4.38 | |||||||||

Class L | |||||||||||||||

Actual (–0.93% return) | $ | 1,000.00 | $ | 990.70 | $ | 6.37 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.80 | $ | 6.46 | |||||||||

Class I | |||||||||||||||

Actual (–0.79% return) | $ | 1,000.00 | $ | 992.10 | $ | 3.11 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.03 | $ | 3.16 | |||||||||

Class C | |||||||||||||||

Actual (–1.31% return) | $ | 1,000.00 | $ | 986.90 | $ | 8.11 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.04 | $ | 8.24 | |||||||||

Class R6 | |||||||||||||||

Actual (–0.73% return) | $ | 1,000.00 | $ | 992.70 | $ | 2.51 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.68 | $ | 2.55 | |||||||||

Class IR | |||||||||||||||

Actual (–0.73% return) | $ | 1,000.00 | $ | 992.70 | $ | 2.51 | |||||||||

Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.68 | $ | 2.55 | |||||||||

(1) Expenses are equal to the Fund's annualized expense ratios of 0.86%, 1.27%, 0.62%, 1.62%, 0.50% and 0.50% for Class A, Class L, Class I, Class C, Class R6 and Class IR shares, respectively, multiplied by the average account value over the period and multiplied by 184/365 (to reflect the one-half year period). If the Fund had borne all of its expenses, the annualized expense ratios would have been 0.87%, 1.28%, 0.63%, 1.63%, 0.51% and 22.66% for Class A, Class L, Class I, Class C, Class R6 and Class IR shares, respectively.

13

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Corporate Bonds (35.0%) | |||||||||||||||||||

Australia (2.7%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

$ | 2,143 | Newcastle Coal Infrastructure Group Pty. Ltd. (a) | 4.40 | % | 09/29/27 | $ | 1,940,744 | ||||||||||||

1,925 | Newcastle Coal Infrastructure Group Pty. Ltd. (a) | 4.70 | 05/12/31 | 1,551,398 | |||||||||||||||

3,492,142 | |||||||||||||||||||

Energy | |||||||||||||||||||

2,098 | Santos Finance Ltd. | 4.125 | 09/14/27 | 1,911,403 | |||||||||||||||

Finance | |||||||||||||||||||

4,945 | Australia & New Zealand Banking Group Ltd. (a) | 2.57 | 11/25/35 | 3,572,675 | |||||||||||||||

EUR | 2,300 | Commonwealth Bank of Australia | 1.936 | 10/03/29 | 2,345,661 | ||||||||||||||

$ | 5,000 | Westpac Banking Corp. | 2.668 | 11/15/35 | 3,636,096 | ||||||||||||||

9,554,432 | |||||||||||||||||||

Industrials | |||||||||||||||||||

EUR | 1,000 | Aurizon Network Pty. Ltd. | 3.125 | 06/01/26 | 1,028,718 | ||||||||||||||

2,600 | Sydney Airport Finance Co. Pty. Ltd. | 4.375 | 05/03/33 | 2,700,345 | |||||||||||||||

3,729,063 | |||||||||||||||||||

Utilities | |||||||||||||||||||

1,650 | APA Infrastructure Ltd. | 2.00 | 03/22/27 | 1,604,868 | |||||||||||||||

Total Australia | 20,291,908 | ||||||||||||||||||

Brazil (0.4%) | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

$ | 2,275 | JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc. | 2.50 | 01/15/27 | 1,999,645 | ||||||||||||||

Energy | |||||||||||||||||||

1,400 | Petrobras Global Finance BV | 6.50 | 07/03/33 | 1,305,727 | |||||||||||||||

Total Brazil | 3,305,372 | ||||||||||||||||||

Burkina Faso (0.2%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

1,930 | IAMGOLD Corp. (a) | 5.75 | 10/15/28 | 1,522,278 | |||||||||||||||

Canada (1.0%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

2,260 | NOVA Chemicals Corp. (a) | 4.875 | 06/01/24 | 2,223,442 | |||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

1,420 | Air Canada (a) | 3.875 | 08/15/26 | 1,293,403 | |||||||||||||||

See Notes to Financial Statements

14

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

$ | 1,370 | Garda World Security Corp. (a) | 6.00 | % | 06/01/29 | $ | 1,045,746 | ||||||||||||

1,700 | Garda World Security Corp. (a) | 9.50 | 11/01/27 | 1,546,409 | |||||||||||||||

1,500 | Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc. (a) | 7.00 | 12/31/27 | 1,276,765 | |||||||||||||||

3,868,920 | |||||||||||||||||||

Total Canada | 7,385,765 | ||||||||||||||||||

Chile (0.1%) | |||||||||||||||||||

Communications | |||||||||||||||||||

1,000 | Liberty Latin America Ltd. | 2.00 | 07/15/24 | 951,252 | |||||||||||||||

Colombia (0.1%) | |||||||||||||||||||

Finance | |||||||||||||||||||

$ | 711 | Grupo Aval Ltd. (a) | 4.375 | 02/04/30 | 525,317 | ||||||||||||||

Denmark (0.7%) | |||||||||||||||||||

Finance | |||||||||||||||||||

EUR | 5,500 | Danske Bank AS | 1.375 | 02/12/30 | 5,509,125 | ||||||||||||||

France (4.6%) | |||||||||||||||||||

Communications | |||||||||||||||||||

4,600 | Orange SA | 5.00 | (b) | 4,850,932 | |||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

2,800 | Renault SA | 1.125 | 10/04/27 | 2,567,492 | |||||||||||||||

Energy | |||||||||||||||||||

2,280 | TotalEnergies SE | 2.00 | (b) | 1,880,968 | |||||||||||||||

Finance | |||||||||||||||||||

2,500 | AXA SA | 3.25 | 05/28/49 | 2,393,113 | |||||||||||||||

1,900 | Banque Federative du Credit Mutuel SA | 5.125 | 01/13/33 | 1,956,164 | |||||||||||||||

3,100 | BNP Paribas SA | 0.50 | 06/04/26 | 3,092,787 | |||||||||||||||

$ | 2,400 | BNP Paribas SA (a) | 2.819 | 11/19/25 | 2,309,570 | ||||||||||||||

EUR | 2,400 | BNP Paribas SA | 2.875 | 10/01/26 | 2,436,789 | ||||||||||||||

1,600 | BNP Paribas SA | 4.375 | 01/13/29 | 1,690,987 | |||||||||||||||

4,500 | BPCE SA | 2.375 | 04/26/32 | 4,099,405 | |||||||||||||||

800 | BPCE SA | 4.00 | 11/29/32 | 821,656 | |||||||||||||||

$ | 1,875 | BPCE SA (a) | 5.15 | 07/21/24 | 1,847,976 | ||||||||||||||

EUR | 3,100 | Credit Agricole Assurances SA | 4.50 | (b) | 3,220,807 | ||||||||||||||

See Notes to Financial Statements

15

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

EUR | 2,000 | Credit Agricole SA | 2.625 | % | 03/17/27 | $ | 1,990,479 | ||||||||||||

25,859,733 | |||||||||||||||||||

Total France | 35,159,125 | ||||||||||||||||||

Germany (1.7%) | |||||||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

2,300 | Volkswagen International Finance NV | 4.625 | (b) | 2,306,615 | |||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

2,780 | Bayer AG | 4.625 | 05/26/33 | 2,914,784 | |||||||||||||||

650 | Techem Verwaltungsgesellschaft 675 GmbH (a) | 2.00 | 07/15/25 | 663,229 | |||||||||||||||

600 | Techem Verwaltungsgesellschaft 675 GmbH | 2.00 | 07/15/25 | 612,212 | |||||||||||||||

4,190,225 | |||||||||||||||||||

Energy | |||||||||||||||||||

2,400 | Wintershall Dea Finance BV | 1.332 | 09/25/28 | 2,183,605 | |||||||||||||||

Finance | |||||||||||||||||||

1,900 | Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | 3.25 | 05/26/49 | 1,836,477 | |||||||||||||||

3,000 | Vonovia SE | 0.625 | 12/14/29 | 2,439,253 | |||||||||||||||

4,275,730 | |||||||||||||||||||

Total Germany | 12,956,175 | ||||||||||||||||||

India (0.3%) | |||||||||||||||||||

Industrials | |||||||||||||||||||

$ | 2,650 | Fly Leasing Ltd. (a) | 7.00 | 10/15/24 | 2,440,610 | ||||||||||||||

Ireland (0.4%) | |||||||||||||||||||

Finance | |||||||||||||||||||

1,375 | AerCap Ireland Capital DAC/AerCap Global Aviation Trust | 2.45 | 10/29/26 | 1,223,589 | |||||||||||||||

750 | AerCap Ireland Capital DAC/AerCap Global Aviation Trust | 3.65 | 07/21/27 | 673,613 | |||||||||||||||

EUR | 1,455 | Luminis Finance PLC | 4.00 | (c) | 12/06/24 | 1,485,325 | |||||||||||||

Total Ireland | 3,382,527 | ||||||||||||||||||

Italy (0.7%) | |||||||||||||||||||

Finance | |||||||||||||||||||

EUR | 3,000 | Assicurazioni Generali SpA | 5.50 | 10/27/47 | 3,164,403 | ||||||||||||||

1,040 | Intesa Sanpaolo SpA | 4.875 | 05/19/30 | 1,093,841 | |||||||||||||||

4,258,244 | |||||||||||||||||||

See Notes to Financial Statements

16

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Industrials | |||||||||||||||||||

$ | 1,300 | F-Brasile SpA/F-Brasile U.S. LLC, Series XR (a) | 7.375 | % | 08/15/26 | $ | 1,209,027 | ||||||||||||

Total Italy | 5,467,271 | ||||||||||||||||||

Luxembourg (0.3%) | |||||||||||||||||||

Finance | |||||||||||||||||||

EUR | 1,000 | Blackstone Property Partners Europe Holdings Sarl | 1.25 | 04/26/27 | 886,235 | ||||||||||||||

1,500 | Blackstone Property Partners Europe Holdings Sarl | 2.20 | 07/24/25 | 1,494,686 | |||||||||||||||

Total Luxembourg | 2,380,921 | ||||||||||||||||||

Mexico (0.4%) | |||||||||||||||||||

Energy | |||||||||||||||||||

$ | 2,000 | Petroleos Mexicanos | 10.00 | 02/07/33 | 1,769,806 | ||||||||||||||

Finance | |||||||||||||||||||

1,579 | Banco Actinver SA/Grupo GICSA SAB de CV (a) | 4.80 | 12/18/34 | 1,105,300 | |||||||||||||||

Total Mexico | 2,875,106 | ||||||||||||||||||

Netherlands (1.5%) | |||||||||||||||||||

Communications | |||||||||||||||||||

EUR | 1,600 | Prosus NV | 2.031 | 08/03/32 | 1,163,333 | ||||||||||||||

2,250 | UPC Holding BV | 3.875 | 06/15/29 | 2,003,381 | |||||||||||||||

3,166,714 | |||||||||||||||||||

Finance | |||||||||||||||||||

3,000 | ASR Nederland NV | 5.00 | (b) | 3,153,255 | |||||||||||||||

2,000 | ING Groep NV | 1.00 | 11/13/30 | 1,927,621 | |||||||||||||||

2,300 | NN Group NV | 4.50 | (b) | 2,370,670 | |||||||||||||||

7,451,546 | |||||||||||||||||||

Industrials | |||||||||||||||||||

$ | 1,000 | Trivium Packaging Finance BV (a) | 8.50 | 08/15/27 | 835,922 | ||||||||||||||

Total Netherlands | 11,454,182 | ||||||||||||||||||

Panama (0.5%) | |||||||||||||||||||

Utilities | |||||||||||||||||||

4,361 | AES Panama Generation Holdings SRL | 4.375 | 05/31/30 | 3,562,901 | |||||||||||||||

See Notes to Financial Statements

17

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Poland (0.2%) | |||||||||||||||||||

Industrials | |||||||||||||||||||

$ | 2,080 | Canpack SA/Canpack U.S. LLC (a) | 3.875 | % | 11/15/29 | $ | 1,635,546 | ||||||||||||

Portugal (0.2%) | |||||||||||||||||||

Utilities | |||||||||||||||||||

EUR | 1,800 | EDP - Energias de Portugal SA | 1.70 | 07/20/80 | 1,770,961 | ||||||||||||||

Spain (3.2%) | |||||||||||||||||||

Communications | |||||||||||||||||||

1,910 | Lorca Telecom Bondco SA | 4.00 | 09/18/27 | 1,881,492 | |||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

1,675 | Grifols SA | 2.25 | 11/15/27 | 1,552,008 | |||||||||||||||

425 | Grifols SA (a) | 2.25 | 11/15/27 | 393,793 | |||||||||||||||

1,945,801 | |||||||||||||||||||

Energy | |||||||||||||||||||

2,050 | Repsol International Finance BV | 2.50 | (b) | 1,929,909 | |||||||||||||||

Finance | |||||||||||||||||||

2,500 | Banco Santander SA | 3.125 | 01/19/27 | 2,543,866 | |||||||||||||||

$ | 5,000 | Banco Santander SA | 5.179 | 11/19/25 | 4,827,958 | ||||||||||||||

EUR | 1,700 | Banco Santander SA | 5.75 | 08/23/33 | 1,788,628 | ||||||||||||||

5,000 | CaixaBank SA | 2.25 | 04/17/30 | 5,006,793 | |||||||||||||||

14,167,245 | |||||||||||||||||||

Utilities | |||||||||||||||||||

2,000 | Iberdrola Finanzas SA | 4.875 | (b) | 2,035,462 | |||||||||||||||

1,700 | Iberdrola International BV, Series NC6 | 1.45 | (b) | 1,567,672 | |||||||||||||||

1,000 | NorteGas Energia Distribucion SA | 0.905 | 01/22/31 | 790,902 | |||||||||||||||

4,394,036 | |||||||||||||||||||

Total Spain | 24,318,483 | ||||||||||||||||||

Sweden (0.5%) | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

1,570 | Verisure Holding AB, 3.25% - 02/2027 | 3.25 | 02/15/27 | 1,505,478 | |||||||||||||||

Finance | |||||||||||||||||||

3,025 | Akelius Residential Property Financing BV | 1.125 | 01/11/29 | 2,542,648 | |||||||||||||||

Total Sweden | 4,048,126 | ||||||||||||||||||

See Notes to Financial Statements

18

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Switzerland (0.8%) | |||||||||||||||||||

Finance | |||||||||||||||||||

$ | 1,375 | UBS AG | 5.125 | % | 05/15/24 | $ | 1,357,107 | ||||||||||||

2,000 | UBS Group AG (a) | 2.593 | 09/11/25 | 1,929,125 | |||||||||||||||

EUR | 1,450 | UBS Group AG | 2.875 | 04/02/32 | 1,331,770 | ||||||||||||||

$ | 1,725 | UBS Group AG (a) | 6.537 | 08/12/33 | 1,658,454 | ||||||||||||||

Total Switzerland | 6,276,456 | ||||||||||||||||||

Turkey (0.3%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

2,670 | Eldorado Gold Corp. (a) | 6.25 | 09/01/29 | 2,292,755 | |||||||||||||||

United Kingdom (2.3%) | |||||||||||||||||||

Communications | |||||||||||||||||||

GBP | 2,350 | Virgin Media Secured Finance PLC | 4.25 | 01/15/30 | 2,316,664 | ||||||||||||||

Energy | |||||||||||||||||||

$ | 2,300 | BP Capital Markets PLC | 4.875 | (b) | 2,009,384 | ||||||||||||||

Finance | |||||||||||||||||||

EUR | 1,700 | Aviva PLC | 3.875 | 07/03/44 | 1,775,543 | ||||||||||||||

$ | 2,075 | Barclays PLC | 3.932 | 05/07/25 | 2,046,933 | ||||||||||||||

2,600 | HSBC Holdings PLC | 2.633 | 11/07/25 | 2,493,447 | |||||||||||||||

GBP | 3,200 | Lloyds Banking Group plc | 1.875 | 01/15/26 | 3,685,413 | ||||||||||||||

EUR | 900 | Lloyds Banking Group PLC | 4.947 | (b) | 890,623 | ||||||||||||||

$ | 1,725 | Standard Chartered PLC (a) | 2.678 | 06/29/32 | 1,283,284 | ||||||||||||||

12,175,243 | |||||||||||||||||||

Utilities | |||||||||||||||||||

GBP | 850 | NGG Finance PLC | 5.625 | 06/18/73 | 991,109 | ||||||||||||||

Total United Kingdom | 17,492,400 | ||||||||||||||||||

United States (11.9%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

$ | 3,500 | Celanese U.S. Holdings LLC | 6.165 | 07/15/27 | 3,417,636 | ||||||||||||||

Communications | |||||||||||||||||||

1,306 | Arches Buyer, Inc. (a) | 4.25 | 06/01/28 | 1,083,104 | |||||||||||||||

EUR | 1,220 | AT&T, Inc. | 3.95 | 04/30/31 | 1,259,899 | ||||||||||||||

$ | 2,050 | Charter Communications Operating LLC/Charter Communications Operating Capital | 2.25 | 01/15/29 | 1,660,581 | ||||||||||||||

1,200 | Clear Channel Outdoor Holdings, Inc. (a)(d) | 7.75 | 04/15/28 | 918,624 | |||||||||||||||

See Notes to Financial Statements

19

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 1,238 | Sprint Spectrum Co. LLC/Sprint Spectrum Co. II LLC/ Sprint Spectrum Co. III LLC (a) | 4.738 | % | 09/20/29 | $ | 1,223,682 | ||||||||||||

1,400 | Univision Communications, Inc. (a) | 4.50 | 05/01/29 | 1,114,405 | |||||||||||||||

7,260,295 | |||||||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

2,720 | American Airlines, Inc./AAdvantage Loyalty IP Ltd. (a) | 5.75 | 04/20/29 | 2,456,241 | |||||||||||||||

4,800 | Dick's Sporting Goods, Inc. (d) | 3.15 | 01/15/32 | 3,624,659 | |||||||||||||||

2,260 | Ferrellgas LP/Ferrellgas Finance Corp. (a) | 5.375 | 04/01/26 | 2,117,485 | |||||||||||||||

2,300 | Hyundai Capital America (a) | 1.80 | 01/10/28 | 1,914,203 | |||||||||||||||

1,485 | Macy's Retail Holdings LLC (a)(d) | 5.875 | 03/15/30 | 1,258,074 | |||||||||||||||

1,630 | Newell Brands, Inc. (e) | 5.20 | 04/01/26 | 1,540,461 | |||||||||||||||

3,000 | Nissan Motor Acceptance Co. LLC (a) | 7.05 | 09/15/28 | 2,964,298 | |||||||||||||||

1,990 | Peloton Interactive, Inc. | 0.00 | (f) | 02/15/26 | 1,477,726 | ||||||||||||||

1,000 | Premier Entertainment Sub LLC/Premier Entertainment Finance Corp. (a)(d) | 5.625 | 09/01/29 | 704,120 | |||||||||||||||

1,400 | Resorts World Las Vegas LLC/RWLV Capital, Inc. (a) | 4.625 | 04/16/29 | 1,076,670 | |||||||||||||||

1,570 | Tempur Sealy International, Inc. (a) | 3.875 | 10/15/31 | 1,177,781 | |||||||||||||||

3,000 | Warnermedia Holdings, Inc. | 4.279 | 03/15/32 | 2,488,544 | |||||||||||||||

22,800,262 | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

980 | Allied Universal Holdco LLC/Allied Universal Finance Corp. (a)(d) | 6.00 | 06/01/29 | 709,152 | |||||||||||||||

2,275 | BAT Capital Corp. | 6.421 | 08/02/33 | 2,144,865 | |||||||||||||||

1,643 | BioMarin Pharmaceutical, Inc. | 0.599 | 08/01/24 | 1,584,924 | |||||||||||||||

1,500 | Sotheby's (a) | 7.375 | 10/15/27 | 1,341,218 | |||||||||||||||

EUR | 3,150 | Upjohn Finance BV | 1.362 | 06/23/27 | 2,979,116 | ||||||||||||||

8,759,275 | |||||||||||||||||||

Energy | |||||||||||||||||||

$ | 1,625 | Energy Transfer LP | 4.95 | 06/15/28 | 1,536,663 | ||||||||||||||

1,493 | Global Partners LP/GLP Finance Corp. | 7.00 | 08/01/27 | 1,408,504 | |||||||||||||||

1,275 | Occidental Petroleum Corp. | 7.875 | 09/15/31 | 1,366,290 | |||||||||||||||

1,475 | ONEOK, Inc. | 6.10 | 11/15/32 | 1,422,138 | |||||||||||||||

1,600 | Sabine Pass Liquefaction LLC | 4.50 | 05/15/30 | 1,435,717 | |||||||||||||||

7,169,312 | |||||||||||||||||||

Finance | |||||||||||||||||||

1,375 | Acrisure LLC/Acrisure Finance, Inc. (a) | 10.125 | 08/01/26 | 1,385,000 | |||||||||||||||

1,125 | Ally Financial, Inc. | 3.875 | 05/21/24 | 1,106,359 | |||||||||||||||

See Notes to Financial Statements

20

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 2,475 | Ally Financial, Inc. | 5.125 | % | 09/30/24 | $ | 2,439,278 | ||||||||||||

2,100 | Ally Financial, Inc. | 6.992 | 06/13/29 | 2,008,005 | |||||||||||||||

EUR | 1,570 | Bank of America Corp. | 2.824 | 04/27/33 | 1,453,494 | ||||||||||||||

$ | 1,900 | Charles Schwab Corp. | 6.136 | 08/24/34 | 1,780,636 | ||||||||||||||

1,180 | Global Atlantic Fin Co. (a) | 4.70 | 10/15/51 | 823,118 | |||||||||||||||

EUR | 1,200 | Goldman Sachs Group, Inc. | 2.00 | 11/01/28 | 1,153,254 | ||||||||||||||

$ | 1,425 | Howard Hughes Corp. (a) | 4.375 | 02/01/31 | 1,086,421 | ||||||||||||||

2,060 | Jane Street Group/JSG Finance, Inc. (a)(d) | 4.50 | 11/15/29 | 1,757,745 | |||||||||||||||

1,610 | Jefferies Finance LLC/JFIN Co.-Issuer Corp. (a) | 5.00 | 08/15/28 | 1,286,730 | |||||||||||||||

EUR | 700 | JPMorgan Chase & Co. | 0.597 | 02/17/33 | 548,369 | ||||||||||||||

$ | 1,375 | Osaic Holdings, Inc. (a)(d) | 10.75 | 08/01/27 | 1,368,329 | ||||||||||||||

EUR | 1,200 | Prologis Euro Finance LLC | 1.875 | 01/05/29 | 1,118,554 | ||||||||||||||

$ | 1,975 | Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc. (a) | 3.875 | 03/01/31 | 1,529,499 | ||||||||||||||

1,350 | Synchrony Bank | 5.625 | 08/23/27 | 1,234,115 | |||||||||||||||

3,825 | Truist Financial Corp. | 5.867 | 06/08/34 | 3,481,187 | |||||||||||||||

25,560,093 | |||||||||||||||||||

Industrials | |||||||||||||||||||

1,300 | LABL, Inc. (a) | 8.25 | 11/01/29 | 967,687 | |||||||||||||||

805 | LABL, Inc. (a) | 10.50 | 07/15/27 | 697,751 | |||||||||||||||

EUR | 2,040 | Standard Industries, Inc. | 2.25 | 11/21/26 | 1,899,493 | ||||||||||||||

$ | 1,900 | Vontier Corp. | 1.80 | 04/01/26 | 1,698,410 | ||||||||||||||

5,263,341 | |||||||||||||||||||

Technology | |||||||||||||||||||

1,140 | AthenaHealth Group, Inc. (a) | 6.50 | 02/15/30 | 932,601 | |||||||||||||||

3,800 | Concentrix Corp. | 6.65 | 08/02/26 | 3,777,937 | |||||||||||||||

EUR | 1,400 | Fidelity National Information Services, Inc. | 1.50 | 05/21/27 | 1,340,403 | ||||||||||||||

$ | 1,300 | McAfee Corp. (a) | 7.375 | 02/15/30 | 1,041,132 | ||||||||||||||

7,092,073 | |||||||||||||||||||

Utilities | |||||||||||||||||||

1,675 | Southern Co. (e) | 4.475 | 08/01/24 | 1,652,970 | |||||||||||||||

2,000 | Vistra Operations Co. LLC (a) | 4.875 | 05/13/24 | 1,979,874 | |||||||||||||||

3,632,844 | |||||||||||||||||||

Total United States | 90,955,131 | ||||||||||||||||||

| Total Corporate Bonds (Cost $296,464,989) | 267,959,693 | ||||||||||||||||||

See Notes to Financial Statements

21

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Sovereign (13.1%) | |||||||||||||||||||

Brazil (4.3%) | |||||||||||||||||||

BRL | 166,000 | Brazil Notas do Tesouro Nacional, Series F | 10.00 | % | 01/01/27 - 01/01/29 | $ | 32,836,632 | ||||||||||||

Colombia (0.7%) | |||||||||||||||||||

COP | 27,996,400 | Colombian TES, Series B | 7.00 | 03/26/31 | 5,369,216 | ||||||||||||||

Dominican Republic (1.1%) | |||||||||||||||||||

$ | 1,700 | Dominican Republic International Bond (a) | 5.50 | 02/22/29 | 1,553,461 | ||||||||||||||

DOP | 135,100 | Dominican Republic International Bond (a) | 11.25 | 09/15/35 | 2,361,040 | ||||||||||||||

211,950 | Dominican Republic International Bond (a) | 13.625 | 02/03/33 | 4,250,882 | |||||||||||||||

Total Dominican Republic | 8,165,383 | ||||||||||||||||||

Greece (0.8%) | |||||||||||||||||||

EUR | 4,040 | Hellenic Republic Government Bond | 4.25 | 06/15/33 | 4,311,676 | ||||||||||||||

1,750 | Hellenic Republic Government Bond | 4.375 | 07/18/38 | 1,824,965 | |||||||||||||||

Total Greece | 6,136,641 | ||||||||||||||||||

Hungary (1.2%) | |||||||||||||||||||

HUF | 2,316,080 | Hungary Government Bond | 4.50 | 05/27/32 | 5,232,494 | ||||||||||||||

1,929,890 | Hungary Government Bond | 4.75 | 11/24/32 | 4,405,481 | |||||||||||||||

Total Hungary | 9,637,975 | ||||||||||||||||||

Indonesia (0.8%) | |||||||||||||||||||

IDR | 92,000,000 | Indonesia Treasury Bond | 7.00 | 02/15/33 | 5,747,263 | ||||||||||||||

2,000,000 | Indonesia Treasury Bond | 8.375 | 03/15/34 | 136,223 | |||||||||||||||

Total Indonesia | 5,883,486 | ||||||||||||||||||

Ivory Coast (0.3%) | |||||||||||||||||||

EUR | 2,600 | Ivory Coast Government International Bond (a) | 4.875 | 01/30/32 | 2,085,648 | ||||||||||||||

Mexico (0.3%) | |||||||||||||||||||

1,300 | Petroleos Mexicanos | 2.75 | 04/21/27 | 1,071,623 | |||||||||||||||

$ | 1,280 | Petroleos Mexicanos | 6.70 | 02/16/32 | 944,603 | ||||||||||||||

Total Mexico | 2,016,226 | ||||||||||||||||||

New Zealand (0.7%) | |||||||||||||||||||

NZD | 3,910 | New Zealand Government Bond | 4.25 | 05/15/34 | 2,036,492 | ||||||||||||||

6,470 | New Zealand Government Bond | 4.50 | 05/15/30 | 3,575,435 | |||||||||||||||

Total New Zealand | 5,611,927 | ||||||||||||||||||

See Notes to Financial Statements

22

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Nigeria (0.4%) | |||||||||||||||||||

$ | 1,300 | Africa Finance Corp. (a) | 4.375 | % | 04/17/26 | $ | 1,202,751 | ||||||||||||

2,500 | Nigeria Government International Bond | 7.375 | 09/28/33 | 1,887,400 | |||||||||||||||

Total Nigeria | 3,090,151 | ||||||||||||||||||

Peru (1.4%) | |||||||||||||||||||

PEN | 22,700 | Peru Government Bond | 5.40 | 08/12/34 | 4,936,643 | ||||||||||||||

25,400 | Peru Government Bond | 6.15 | 08/12/32 | 6,048,483 | |||||||||||||||

Total Peru | 10,985,126 | ||||||||||||||||||

Romania (0.7%) | |||||||||||||||||||

EUR | 1,750 | Romania Government International Bond (a) | 6.375 | 09/18/33 | 1,828,996 | ||||||||||||||

4,300 | Romanian Government International Bond (a) | 3.75 | 02/07/34 | 3,602,823 | |||||||||||||||

Total Romania | 5,431,819 | ||||||||||||||||||

Uruguay (0.4%) | |||||||||||||||||||

UYU | 141,100 | Uruguay Government International Bond | 9.75 | 07/20/33 | 3,518,744 | ||||||||||||||

| Total Sovereign (Cost $105,014,105) | 100,768,974 | ||||||||||||||||||

Agency Fixed Rate Mortgages (2.9%) | |||||||||||||||||||

$ | 1 | Federal Home Loan Mortgage Corporation, Gold Pool: | 6.50 | 10/01/32 | 583 | ||||||||||||||

| Federal National Mortgage Association, Conventional Pools: | |||||||||||||||||||

14 | 6.50 | 05/01/28 - 01/01/32 | 14,055 | ||||||||||||||||

2 | 7.00 | 11/01/32 | 2,315 | ||||||||||||||||

November TBA | |||||||||||||||||||

17,300 | (g) | 5.50 | 11/01/53 | 16,422,160 | |||||||||||||||

2,000 | (g) | 6.00 | 11/01/53 | 1,946,563 | |||||||||||||||

Government National Mortgage Association, | |||||||||||||||||||

3,734 | 6.00 | 08/20/53 | 3,678,000 | ||||||||||||||||

Various Pools: | |||||||||||||||||||

1 | 7.50 | 07/20/25 | 1,115 | ||||||||||||||||

4 | 8.00 | 05/15/24 - 05/15/30 | 4,534 | ||||||||||||||||

| Total Agency Fixed Rate Mortgages (Cost $22,221,904) | 22,069,325 | ||||||||||||||||||

See Notes to Financial Statements

23

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Asset-Backed Securities (11.9%) | |||||||||||||||||||

$ | 712 | ABFC Trust 1 Month Term SOFR + 1.16% | 6.489 | (c)% | 08/25/33 | $ | 693,386 | ||||||||||||

2,649 | AMSR Trust (a) | 3.867 | 01/19/39 | 2,336,506 | |||||||||||||||

500 | Apidos CLO XXXV Ltd. 3 Month Term SOFR + 6.01% (a) | 11.427 | (c) | 04/20/34 | 471,341 | ||||||||||||||

16 | Asset-Backed Securities Corp. Home Equity Loan Trust 1 Month Term SOFR + 0.49% | 3.273 | (c) | 03/25/36 | 15,542 | ||||||||||||||

1,371 | Bayview Financial Revolving Asset Trust 1 Month Term SOFR + 1.11% (a) | 6.441 | (c) | 02/28/40 | 1,188,502 | ||||||||||||||

37 | Bear Stearns Asset-Backed Securities Trust | 4.582 | (c) | 07/25/36 | 36,152 | ||||||||||||||

2,201 | Blackbird Capital Aircraft Lease Securitization Ltd. (a) | 4.213 | 12/16/41 | 2,028,657 | |||||||||||||||

378 | Business Loan Express Business Loan Trust 1 Month USD LIBOR + 0.40% (a) | 5.854 | (c) | 10/20/40 | 340,501 | ||||||||||||||

5,500 | Cascade Funding Mortgage Trust, Class M4 (a) | 4.25 | (c) | 04/25/33 | 4,193,519 | ||||||||||||||

1,024 | Cascade MH Asset Trust (a) | 4.00 | (c) | 11/25/44 | 973,871 | ||||||||||||||

500 | CBAM 2021-14 Ltd. 3 Month Term SOFR + 3.36% (a) | 8.777 | (c) | 04/20/34 | 444,062 | ||||||||||||||

555 | Chase Funding Loan Acquisition Trust | 5.50 | 08/25/34 | 504,443 | |||||||||||||||

345 | Citigroup Mortgage Loan Trust, Inc. 1 Month Term SOFR + 3.11% (a) | 8.439 | (c) | 07/25/44 | 386,597 | ||||||||||||||

Conn's Receivables Funding LLC, | |||||||||||||||||||

3,600 | (a) | 0.00 | (f) | 12/15/26 | 3,110,144 | ||||||||||||||

2,094 | (a) | 4.59 | 05/15/26 | 2,089,897 | |||||||||||||||

1,313 | (a) | 9.52 | 12/15/26 | 1,314,867 | |||||||||||||||

1,500 | Countrywide Asset-Backed Certificates Trust 1 Month Term SOFR + 1.69% | 3.789 | (c) | 03/25/35 | 1,276,871 | ||||||||||||||

1,817 | ECAF I Ltd. (Cayman Islands) (a) | 4.947 | 06/15/40 | 1,144,703 | |||||||||||||||

Finance of America HECM Buyout, | |||||||||||||||||||

4,290 | (a) | 6.00 | (c) | 08/01/32 | 2,886,298 | ||||||||||||||

5,000 | (a) | 7.87 | (c) | 02/25/32 | 4,025,027 | ||||||||||||||

4,000 | FMC GMSR Issuer Trust (a) | 7.17 | 04/25/27 | 3,431,607 | |||||||||||||||

2,504 | GAIA Aviation Ltd. (Cayman Islands) (a) | 7.00 | 12/15/44 | 1,320,816 | |||||||||||||||

GSAA Home Equity Trust, | |||||||||||||||||||

337 | 6.502 | 11/25/36 | 125,145 | ||||||||||||||||

53 | 1 Month Term SOFR + 1.99% | 7.314 | (c) | 12/25/34 | 51,622 | ||||||||||||||

EUR | 1,205 | Hestia Financing 3 Month EURIBOR + 2.50% (Luxembourg) | 6.205 | (c) | 12/31/46 | 1,186,648 | |||||||||||||

$ | 245 | JOL Air Ltd. (Cayman Islands) (a) | 4.948 | 04/15/44 | 189,021 | ||||||||||||||

See Notes to Financial Statements

24

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 500 | KKR CLO 16 Ltd. 3 Month Term SOFR + 7.37% (a) | 12.787 | (c)% | 10/20/34 | $ | 459,476 | ||||||||||||

1,376 | LoanMe Trust Prime (a) | 5.00 | 09/15/34 | 1,270,459 | |||||||||||||||

979 | METAL LLC (a) | 4.581 | 10/15/42 | 603,545 | |||||||||||||||

2,619 | MFA 2021-NPL1 LLC (a) | 2.363 | 03/25/60 | 2,525,620 | |||||||||||||||

2,285 | New Residential Mortgage LLC, Class A (a) | 5.437 | 06/25/25 | 2,190,150 | |||||||||||||||

GBP | 2,000 | Newday Funding Master Issuer PLC 3 Month GBP SONIA + 1.90% (United Kingdom) (a) | 7.098 | (c) | 03/15/29 | 2,419,466 | |||||||||||||

Newtek Small Business Loan Trust, | |||||||||||||||||||

$ | 314 | Daily U.S. Prime Rate - 0.55% (a) | 7.95 | (c) | 02/25/44 | 311,468 | |||||||||||||

876 | Daily U.S. Prime Rate + 0.10% (a) | 8.60 | (c) | 12/25/48 | 852,879 | ||||||||||||||

NRZ Excess Spread-Collateralized Notes, Class A | |||||||||||||||||||

783 | (a) | 2.981 | 03/25/26 | 703,573 | |||||||||||||||

1,860 | (a) | 3.104 | 07/25/26 | 1,675,515 | |||||||||||||||

2,828 | Oakwood Mortgage Investors, Inc. | 7.405 | (c) | 06/15/31 | 335,379 | ||||||||||||||

3,629 | Pagaya AI Technology in Housing Trust, Class E2 (a) | 3.60 | 10/25/40 | 2,713,250 | |||||||||||||||

3,000 | PMT FMSR Issuer Trust 1 Month USD LIBOR + 3.00% (a) | 8.439 | (c) | 03/25/26 | 2,954,139 | ||||||||||||||

PRET LLC, Class A1 | |||||||||||||||||||

2,879 | (a) | 1.843 | 09/25/51 | 2,593,804 | |||||||||||||||

2,998 | (a) | 8.232 | (c) | 09/25/53 | 2,991,871 | ||||||||||||||

Progress Residential 2020-SFR1 Trust, | |||||||||||||||||||

2,975 | (a) | 3.032 | 04/17/37 | 2,798,641 | |||||||||||||||

2,447 | (a) | 3.431 | 04/17/37 | 2,293,204 | |||||||||||||||

3,250 | Raptor Aircraft Finance I LLC (a) | 4.213 | 08/23/44 | 2,598,752 | |||||||||||||||

ReadyCap Lending Small Business Loan Trust, | |||||||||||||||||||

261 | Daily U.S. Prime Rate - 0.50% (a) | 8.00 | (c) | 12/27/44 | 251,031 | ||||||||||||||

2,878 | Daily U.S. Prime Rate + 0.07% (a) | 8.57 | (c) | 04/25/48 | 2,880,388 | ||||||||||||||

3,000 | Retained Vantage Data Centers Issuer LLC, Class A2A (a) | 5.00 | 09/15/48 | 2,713,410 | |||||||||||||||

2,057 | Shenton Aircraft Investment I Ltd. (Cayman Islands) (a) | 4.75 | 10/15/42 | 1,758,808 | |||||||||||||||

939 | Start II Ltd. (Bermuda) (a) | 4.089 | 03/15/44 | 848,709 | |||||||||||||||

1,397 | Start Ltd. (a) | 4.089 | 05/15/43 | 1,248,427 | |||||||||||||||

1,000 | TICP CLO VI Ltd. 3 Month Term SOFR + 6.51% (a) | 11.906 | (c) | 01/15/34 | 921,242 | ||||||||||||||

Tricon American Homes Trust, | |||||||||||||||||||

1,480 | (a) | 3.745 | 03/17/38 | 1,350,878 | |||||||||||||||

4,000 | (a) | 4.882 | 07/17/38 | 3,731,730 | |||||||||||||||

See Notes to Financial Statements

25

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 1,225 | Trimaran Cavu 2021-1 Ltd. 3 Month Term SOFR + 3.71% (Cayman Islands) (a) | 9.124 | (c)% | 04/23/32 | $ | 1,145,255 | ||||||||||||

Trinitas CLO VI Ltd., | |||||||||||||||||||

1,000 | 3 Month Term SOFR + 4.01% (a) | 9.39 | (c) | 01/25/34 | 907,118 | ||||||||||||||

1,000 | 3 Month Term SOFR + 7.08% (a) | 12.456 | (c) | 01/25/34 | 869,536 | ||||||||||||||

1,945 | VCAT LLC (a) | 1.743 | 05/25/51 | 1,801,383 | |||||||||||||||

1,000 | Vibrant CLO XII Ltd. 3 Month Term SOFR + 7.37% (a) | 12.787 | (c) | 01/20/34 | 936,121 | ||||||||||||||

1,500 | Wellfleet CLO 2022-1 Ltd. 3 Month Term SOFR + 4.14% (a) | 9.534 | (c) | 04/15/34 | 1,418,353 | ||||||||||||||

| Total Asset-Backed Securities (Cost $98,952,804) | 90,839,325 | ||||||||||||||||||

Collateralized Mortgage Obligations - Agency Collateral Series (0.4%) | |||||||||||||||||||

9,926 | Federal Home Loan Mortgage Corporation, IO | 4.334 | (c) | 11/25/55 | 2,685,391 | ||||||||||||||

Federal National Mortgage Association, | |||||||||||||||||||

IO REMIC | |||||||||||||||||||

649 | 0.00 | (c) | 10/25/39 - 03/25/44 | 26,054 | |||||||||||||||

59 | 6.44% - SOFR30A | 1.115 | (h) | 08/25/41 | 1,009 | ||||||||||||||

578 | Government National Mortgage Association, IO, 6.14% - 1 Month Term SOFR | 0.796 | (h) | 12/20/42 | 44,844 | ||||||||||||||

| Total Collateralized Mortgage Obligations - Agency Collateral Series (Cost $2,846,495) | 2,757,298 | ||||||||||||||||||

Commercial Mortgage-Backed Securities (3.8%) | |||||||||||||||||||

527 | CG-CCRE Commercial Mortgage Trust 1 Month Term SOFR + 1.97% (a) | 7.303 | (c) | 11/15/31 | 512,607 | ||||||||||||||

900 | Citigroup Commercial Mortgage Trust (a) | 3.503 | (c) | 12/10/41 | 619,422 | ||||||||||||||

Commercial Mortgage Trust | |||||||||||||||||||

1,500 | (a) | 3.40 | (c) | 08/15/57 | 1,361,719 | ||||||||||||||

300 | 4.612 | (c) | 02/10/47 | 215,131 | |||||||||||||||

139 | (a) | 4.735 | (c) | 07/15/47 | 123,206 | ||||||||||||||

IO | |||||||||||||||||||

1,500 | 0.281 | (c) | 02/10/47 | 279 | |||||||||||||||

2,272 | COOF Securitization Trust, IO (a) | 2.591 | (c) | 10/25/40 | 113,592 | ||||||||||||||

3,275 | COOF Securitization Trust II, IO (a) | 2.166 | (c) | 08/25/41 | 145,089 | ||||||||||||||

Credit Suisse Mortgage Trust, | |||||||||||||||||||

Class A | |||||||||||||||||||

2,634 | 1 Month Term SOFR + 3.57% (a) | 8.908 | (c) | 05/15/26 | 2,357,702 | ||||||||||||||

3,000 | 1 Month Term SOFR + 3.61% (a) | 8.95 | (c) | 12/15/35 | 2,998,082 | ||||||||||||||

3,000 | 1 Month Term SOFR + 3.83% (a) | 9.164 | (c) | 08/15/26 | 2,644,267 | ||||||||||||||

See Notes to Financial Statements

26

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 3,598 | 1 Month Term SOFR + 4.08% (a) | 9.419 | (c)% | 04/15/26 | $ | 3,527,690 | ||||||||||||

Federal Home Loan Mortgage Corporation, | |||||||||||||||||||

IO | |||||||||||||||||||

7,000 | 2.629 | (c) | 01/25/49 | 1,010,406 | |||||||||||||||

6,430 | 3.068 | (c) | 11/25/36 | 1,616,252 | |||||||||||||||

189 | FREMF Mortgage Trust SOFR30A + 5.36% (a) | 10.681 | (c) | 07/25/26 | 182,401 | ||||||||||||||

31,578 | GS Mortgage Securities Corp. Trust, IO (a) | 0.457 | (c) | 10/10/32 | 50,702 | ||||||||||||||

2,194 | JP Morgan Chase Commercial Mortgage Securities Trust, IO | 0.703 | (c) | 07/15/47 | 24 | ||||||||||||||

JPMBB Commercial Mortgage Securities Trust | |||||||||||||||||||

136 | (a) | 3.983 | (c) | 09/15/47 | 114,468 | ||||||||||||||

405 | (a) | 4.627 | (c) | 04/15/47 | 373,222 | ||||||||||||||

IO | |||||||||||||||||||

2,584 | 0.934 | (c) | 08/15/47 | 5,828 | |||||||||||||||

KGS-Alpha SBA COOF Trust, | |||||||||||||||||||

IO | |||||||||||||||||||

381 | (a) | 2.555 | (c) | 04/25/40 | 19,198 | ||||||||||||||

388 | (a) | 3.102 | (c) | 07/25/41 | 39,760 | ||||||||||||||

1,500 | MFT Mortgage Trust (a) | 3.283 | (c) | 08/10/40 | 1,013,699 | ||||||||||||||

1,500 | MKT 2020-525M Mortgage Trust (a) | 2.941 | (c) | 02/12/40 | 444,011 | ||||||||||||||

1,500 | Natixis Commercial Mortgage Securities Trust (a) | 4.135 | (c) | 05/15/39 | 1,164,716 | ||||||||||||||

3,000 | SG Commercial Mortgage Securities Trust (a) | 3.477 | (c) | 09/15/39 | 2,162,740 | ||||||||||||||

930 | Sutherland Commercial Mortgage Trust (a) | 2.23 | (c) | 12/25/41 | 881,028 | ||||||||||||||

EUR | 392 | Taurus 2018-1 IT SRL 3 Month EURIBOR + 2.78% (Italy) | 6.578 | (c) | 05/18/32 | 412,252 | |||||||||||||

$ | 1,341 | Velocity Commercial Capital Loan Trust (a) | 6.90 | 05/25/47 | 1,330,836 | ||||||||||||||

2,611 | VMC Finance 2021-HT1 LLC 1 Month Term SOFR + 1.76% (a) | 7.099 | (c) | 01/18/37 | 2,554,114 | ||||||||||||||

900 | Wells Fargo Commercial Mortgage Trust (a) | 4.37 | (c) | 04/15/50 | 768,899 | ||||||||||||||

395 | WFRBS Commercial Mortgage Trust (a) | 4.679 | (c) | 09/15/46 | 357,562 | ||||||||||||||

| Total Commercial Mortgage-Backed Securities (Cost $33,613,768) | 29,120,904 | ||||||||||||||||||

Mortgages - Other (19.7%) | |||||||||||||||||||

1,800 | 510 Asset Backed 2021-NPL1 Trust (a) | 2.24 | 06/25/61 | 1,687,767 | |||||||||||||||

2,565 | 510 Asset Backed 2021-NPL2 Trust (a) | 2.116 | 06/25/61 | 2,384,208 | |||||||||||||||

78 | Banc of America Alternative Loan Trust 1 Month Term SOFR + 0.76% | 6.00 | (c) | 07/25/46 | 60,474 | ||||||||||||||

See Notes to Financial Statements

27

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Banc of America Funding Trust, | |||||||||||||||||||

$ | 8 | 5.25 | % | 07/25/37 | $ | 7,813 | |||||||||||||

345 | 5.50 | 09/25/35 | 311,874 | ||||||||||||||||

46 | 6.00 | 07/25/37 | 36,668 | ||||||||||||||||

GBP | 800 | Banna RMBS DAC 3 Month GBP SONIA + 3.50% (United Kingdom) | 8.72 | (c) | 12/30/63 | 954,344 | |||||||||||||

$ | 3,382 | Bayview Commercial Asset Trust, Class A4A 1 Month Term SOFR + 1.61% (a) | 6.939 | (c) | 12/25/37 | 2,801,725 | |||||||||||||

69 | BCAP LLC Trust (a) | 3.856 | (c) | 03/26/37 | 58,860 | ||||||||||||||

44 | Bear Stearns ARM Trust | 3.732 | (c) | 05/25/47 | 34,602 | ||||||||||||||

4,000 | Boston Lending Trust (a) | 3.25 | (c) | 05/25/62 | 2,886,772 | ||||||||||||||

Brean Asset Backed Securities Trust, | |||||||||||||||||||

3,180 | (a) | 1.40 | (c) | 10/25/63 | 2,605,031 | ||||||||||||||

5,000 | (a) | 4.00 | 09/25/63 | 4,162,889 | |||||||||||||||

Cascade Funding Mortgage Trust, | |||||||||||||||||||

2,340 | (a) | 2.00 | (c) | 09/25/50 | 2,120,686 | ||||||||||||||

1,034 | (a) | 2.00 | (c) | 02/25/52 | 794,698 | ||||||||||||||

326 | (a) | 2.80 | (c) | 06/25/69 | 316,545 | ||||||||||||||

4,000 | (a) | 2.91 | (c) | 02/25/31 | 3,928,860 | ||||||||||||||

4,500 | (a) | 3.25 | (c) | 11/25/35 | 3,986,275 | ||||||||||||||

3,000 | (a) | 3.735 | (c) | 06/25/36 | 2,867,636 | ||||||||||||||

5,500 | (a) | 3.75 | (c) | 04/25/25 | 4,380,805 | ||||||||||||||

5,348 | (a) | 4.00 | (c) | 06/25/69 | 4,469,453 | ||||||||||||||

3,642 | (a) | 4.00 | (c) | 10/25/68 | 3,517,993 | ||||||||||||||

4,500 | (a) | 5.072 | (c) | 10/27/31 | 4,091,569 | ||||||||||||||

3,000 | (a) | 5.683 | (c) | 02/25/31 | 2,970,620 | ||||||||||||||

93 | Chase Mortgage Finance Trust 1 Month Term SOFR + 0.71% | 6.00 | (c) | 02/25/37 | 34,492 | ||||||||||||||

55 | ChaseFlex Trust | 6.50 | 02/25/35 | 45,826 | |||||||||||||||

CHL Mortgage Pass-Through Trust, | |||||||||||||||||||

252 | 5.438 | (c) | 09/25/34 | 221,180 | |||||||||||||||

82 | 5.50 | 05/25/34 | 78,065 | ||||||||||||||||

649 | 6.00 | 12/25/36 | 373,639 | ||||||||||||||||

2,452 | CIM Trust (a) | 2.569 | 07/25/55 | 2,392,702 | |||||||||||||||

Citigroup Mortgage Loan Trust, Inc., | |||||||||||||||||||

1,101 | (a) | 2.50 | (c) | 05/25/51 | 808,022 | ||||||||||||||

59 | 4.889 | (c) | 11/25/36 | 49,942 | |||||||||||||||

Countrywide Alternative Loan Trust, | |||||||||||||||||||

78 | 3.84 | (c) | 05/25/36 | 64,358 | |||||||||||||||

108 | 3.922 | (c) | 10/25/35 | 102,532 | |||||||||||||||

See Notes to Financial Statements

28

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 36 | 3.958 | (c)% | 08/25/35 | $ | 31,082 | |||||||||||||

17 | 5.50 | 02/25/36 | 8,889 | ||||||||||||||||

170 | 1 Month Term SOFR + 0.61% | 5.50 | (c) | 10/25/35 | 108,259 | ||||||||||||||

79 | 1 Month Term SOFR + 0.47% | 5.799 | (c) | 05/25/47 | 69,287 | ||||||||||||||

140 | 6.00 | 07/25/37 | 72,046 | ||||||||||||||||

358 | 6.00 | 04/25/36 | 170,984 | ||||||||||||||||

Countrywide Reperforming Loan REMIC Trust, | |||||||||||||||||||

REMIC | |||||||||||||||||||

114 | (a) | 6.50 | 03/25/35 | 114,523 | |||||||||||||||

105 | (a) | 7.50 | 11/25/34 | 99,954 | |||||||||||||||

6,511 | Credit Suisse First Boston Mortgage Securities Corp., Class B 1 Month Term SOFR + 2.96% (a) | 4.30 | (c) | 03/25/45 | 6,693,516 | ||||||||||||||

CSFB Mortgage-Backed Pass-Through Certificates, | |||||||||||||||||||

213 | 6.50 | 12/25/33 | 206,953 | ||||||||||||||||

254 | 7.50 | 10/25/32 | 249,070 | ||||||||||||||||

1,653 | CSMC Mortgage-Backed Trust | 6.50 | 05/25/36 | 500,542 | |||||||||||||||

EUR | 236 | Dssv Sarl 3 Month EURIBOR + 3.00% (Spain) | 6.663 | (c) | 10/15/24 | 248,216 | |||||||||||||

180 | EMF-NL Prime 3 Month EURIBOR + 0.80% (Netherlands) | 4.785 | (c) | 04/17/41 | 181,291 | ||||||||||||||

722 | Eurohome Mortgages PLC 3 Month EURIBOR + 0.21% (Germany) | 3.925 | (c) | 08/02/50 | 571,876 | ||||||||||||||

FMC GMSR Issuer Trust, Class A | |||||||||||||||||||

$ | 4,000 | (a) | 3.62 | (c) | 07/25/26 | 3,257,215 | |||||||||||||

1,600 | (a) | 4.44 | (c) | 10/25/26 | 1,211,166 | ||||||||||||||

2,000 | (a) | 4.45 | (c) | 01/25/26 | 1,720,107 | ||||||||||||||

GBP | 1,400 | Great Hall Mortgages No. 1 PLC 3 Month GBP SONIA + 3.12% (United Kingdom) | 8.339 | (c) | 06/18/38 | 1,537,566 | |||||||||||||

GSR Mortgage Loan Trust, | |||||||||||||||||||

$ | 78 | 3.62 | (c) | 03/25/37 | 42,014 | ||||||||||||||

10 | 3.971 | (c) | 05/25/35 | 7,486 | |||||||||||||||

290 | 4.019 | (c) | 12/25/34 | 260,487 | |||||||||||||||

872 | 5.50 | 03/25/35 | 713,210 | ||||||||||||||||

205 | HarborView Mortgage Loan Trust | 5.044 | (c) | 05/19/33 | 186,091 | ||||||||||||||

2,500 | Harvest Commercial Capital Loan Trust, Class M5 (a) | 5.964 | (c) | 04/25/52 | 2,113,591 | ||||||||||||||

3,992 | Headlands Residential 2021-RPL1 LLC (a) | 2.487 | (c) | 09/25/26 | 3,514,153 | ||||||||||||||

EUR | 669 | IM Pastor 4 FTA 3 Month EURIBOR + 0.14% (Spain) | 4.074 | (c) | 03/22/44 | 619,592 | |||||||||||||

See Notes to Financial Statements

29

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 17 | Impac CMB Trust 1 Month Term SOFR + 0.89% | 6.219 | (c)% | 10/25/35 | $ | 17,916 | ||||||||||||

3,014 | Imperial Fund Mortgage Trust, Class A1 (a) | 7.369 | 11/25/67 | 3,031,019 | |||||||||||||||

120 | JP Morgan Alternative Loan Trust | 6.00 | 12/25/35 | 90,149 | |||||||||||||||

3,104 | La Hipotecaria Panamanian Mortgage Trust (Panama) (a) | 4.35 | 07/13/52 | 2,852,374 | |||||||||||||||

EUR | 844 | Lansdowne Mortgage Securities No. 2 PLC 3 Month EURIBOR + 0.34% (Ireland) | 4.207 | (c) | 09/16/48 | 797,841 | |||||||||||||

Lehman Mortgage Trust, | |||||||||||||||||||

$ | 76 | 5.50 | 02/25/36 | 38,300 | |||||||||||||||

340 | 6.50 | 09/25/37 | 106,250 | ||||||||||||||||

2,200 | LHOME Mortgage Trust, Class A1, Class A1 (a) | 8.00 | (c) | 08/25/28 | 2,203,368 | ||||||||||||||

Ludgate Funding PLC, | |||||||||||||||||||

EUR | 851 | 3 Month EURIBOR + 0.85% (United Kingdom) | 4.805 | (c) | 01/01/61 | 809,899 | |||||||||||||

486 | 3 Month EURIBOR + 1.10% (United Kingdom) | 5.055 | (c) | 01/01/61 | 444,871 | ||||||||||||||

Mansard Mortgages PLC, | |||||||||||||||||||

GBP | 380 | 3 Month GBP SONIA + 1.22% (United Kingdom) | 6.439 | (c) | 10/15/48 | 402,899 | |||||||||||||

325 | 3 Month GBP SONIA + 2.12% (United Kingdom) | 7.339 | (c) | 12/15/49 | 386,910 | ||||||||||||||

727 | 3 Month GBP SONIA + 3.12% (United Kingdom) | 8.339 | (c) | 12/15/49 | 863,783 | ||||||||||||||

$ | 637 | MASTR Alternative Loan Trust | 6.00 | 05/25/33 | 576,515 | ||||||||||||||

26 | MASTR Asset Securitization Trust 1 Month Term SOFR + 6.00% | 6.00 | (c) | 06/25/36 | 15,237 | ||||||||||||||

916 | Med Trust, Class D 1 Month Term SOFR + 2.11% (a) | 7.449 | (c) | 11/15/38 | 879,719 | ||||||||||||||

1,095 | Merrill Lynch Mortgage Investors Trust, IO (a) | 0.00 | (c) | 02/25/36 | 11 | ||||||||||||||

GBP | 2,000 | Mortgage Funding PLC 3 Month GBP SONIA + 3.32% (United Kingdom) | 8.539 | (c) | 03/13/46 | 2,380,738 | |||||||||||||

$ | 87 | MortgageIT Trust 1 Month Term SOFR + 1.01% | 6.339 | (c) | 10/25/35 | 84,287 | |||||||||||||

GBP | 631 | Newgate Funding PLC 3 Month GBP LIBOR + 3.00% (United Kingdom) | 8.581 | (c) | 12/15/50 | 686,087 | |||||||||||||

| Nomura Asset Acceptance Corp. Alternative Loan Trust, | |||||||||||||||||||

$ | 2,020 | 5.755 | (c) | 06/25/36 | 527,333 | ||||||||||||||

96 | 7.931 | (c) | 06/25/36 | 93,026 | |||||||||||||||

4,488 | NYMT Loan Trust (a) | 5.944 | (c) | 10/25/60 | 4,374,286 | ||||||||||||||

3,000 | Ocwen Loan Investment Trust, Class M1 (a) | 3.00 | (c) | 06/25/36 | 2,606,172 | ||||||||||||||

1,951 | PMC PLS ESR Issuer LLC (a) | 5.114 | 02/25/27 | 1,867,930 | |||||||||||||||

See Notes to Financial Statements

30

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2023 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

PNMAC GMSR Issuer Trust, | |||||||||||||||||||

$ | 3,337 | 1 Month USD LIBOR + 2.65% (a) | 8.089 | (c)% | 08/25/25 | $ | 3,336,620 | ||||||||||||

4,000 | 1 Month USD LIBOR + 3.85% (a) | 9.289 | (c) | 02/25/25 | 4,000,169 | ||||||||||||||

Residential Accredit Loans, Inc. Trust, | |||||||||||||||||||

53 | 6.00 | 04/25/36 | 37,118 | ||||||||||||||||

31 | 6.00 | 01/25/37 | 23,430 | ||||||||||||||||

230 | RFMSI Trust | 6.00 | 07/25/36 | 187,126 | |||||||||||||||

GBP | 473 | RMAC Securities No. 1 PLC 3 Month GBP SONIA + 0.59% (United Kingdom) | 5.809 | (c) | 06/12/44 | 537,968 | |||||||||||||

RMF Buyout Issuance Trust, | |||||||||||||||||||

$ | 3,500 | (a) | 3.63 | (c) | 10/25/50 | 2,876,059 | |||||||||||||

1,200 | (a) | 3.69 | (c) | 11/25/31 | 1,026,089 | ||||||||||||||

4,000 | (a) | 4.50 | (c) | 04/25/32 | 2,718,515 | ||||||||||||||

8,385 | (a) | 6.00 | 10/25/50 | 5,450,314 | |||||||||||||||

RMF Proprietary Issuance Trust, | |||||||||||||||||||

2,520 | (a) | 3.25 | (c) | 04/26/60 | 1,829,810 | ||||||||||||||

1,000 | (a) | 4.00 | (c) | 08/25/62 | 834,551 | ||||||||||||||

Seasoned Credit Risk Transfer Trust, Class M | |||||||||||||||||||

1,148 | (a) | 3.75 | (c) | 09/25/55 | 997,407 | ||||||||||||||

3,250 | (a) | 4.25 | (c) | 08/25/59 | 2,782,307 | ||||||||||||||

2,500 | (a) | 4.25 | (c) | 05/25/60 | 2,150,252 | ||||||||||||||

1,000 | (a) | 4.50 | (c) | 02/25/59 | 847,877 | ||||||||||||||

3,100 | 4.75 | (c) | 10/25/58 | 2,835,830 | |||||||||||||||

196 | Sequoia Mortgage Trust 1 Month Term SOFR + 0.73% | 6.074 | (c) | 07/20/33 | 183,820 | ||||||||||||||

6,287 | Stanwich Mortgage Loan Co. LLC (a) | 2.735 | 10/16/26 | 5,750,909 | |||||||||||||||