UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06515

Morgan Stanley Global Fixed Income Opportunities Fund

(Exact Name of Registrant as Specified in Charter)

1585 Broadway, New York, New York 10036

(Address of Principal Executive Offices)

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and Address of Agent for Services)

(212) 762-1886

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

TABLE OF CONTENTS

0000882381morganstanley:BloombergGlobalAggregateHedgedUSDIndex21308BroadBasedIndexMember2024-03-31

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $87 | 0.82% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

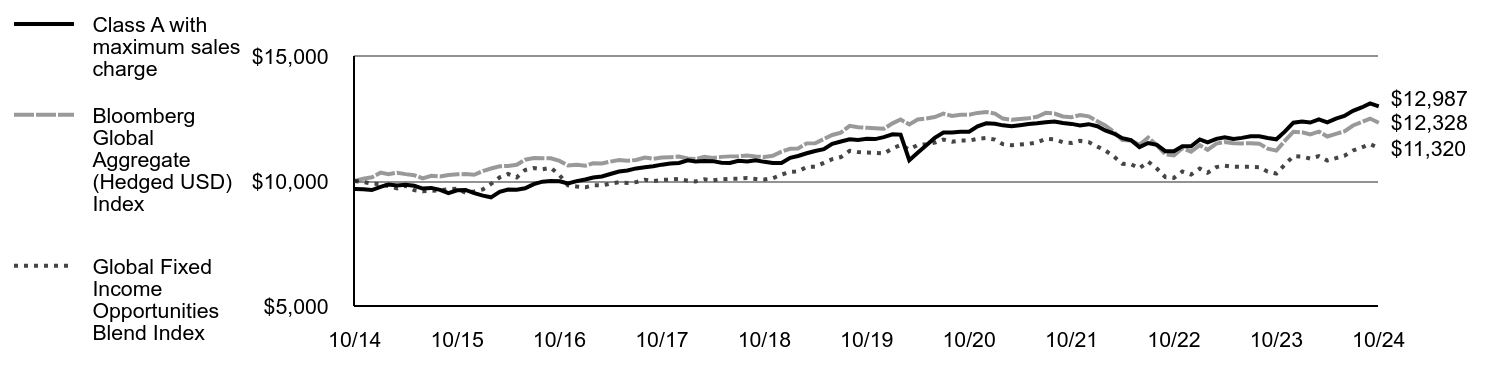

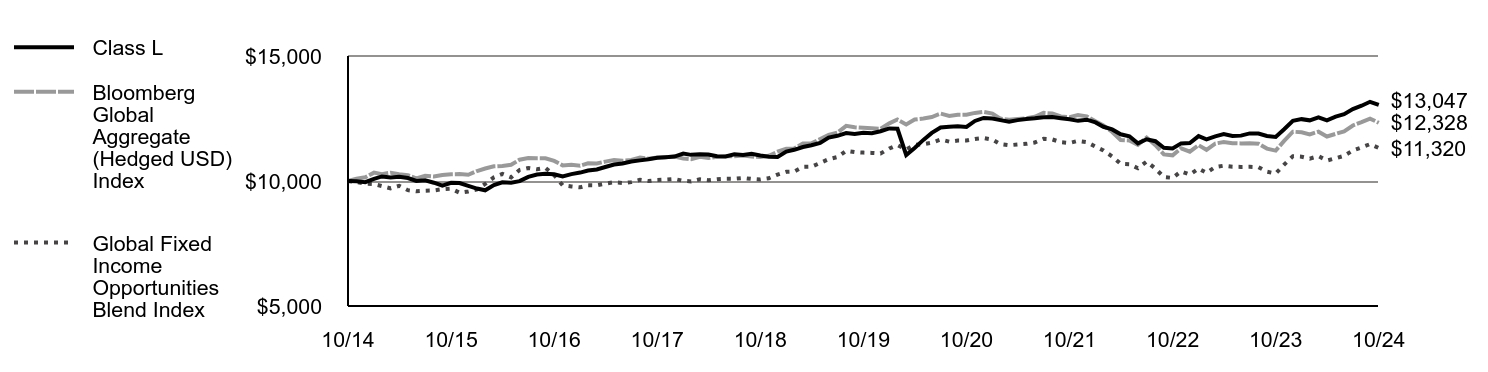

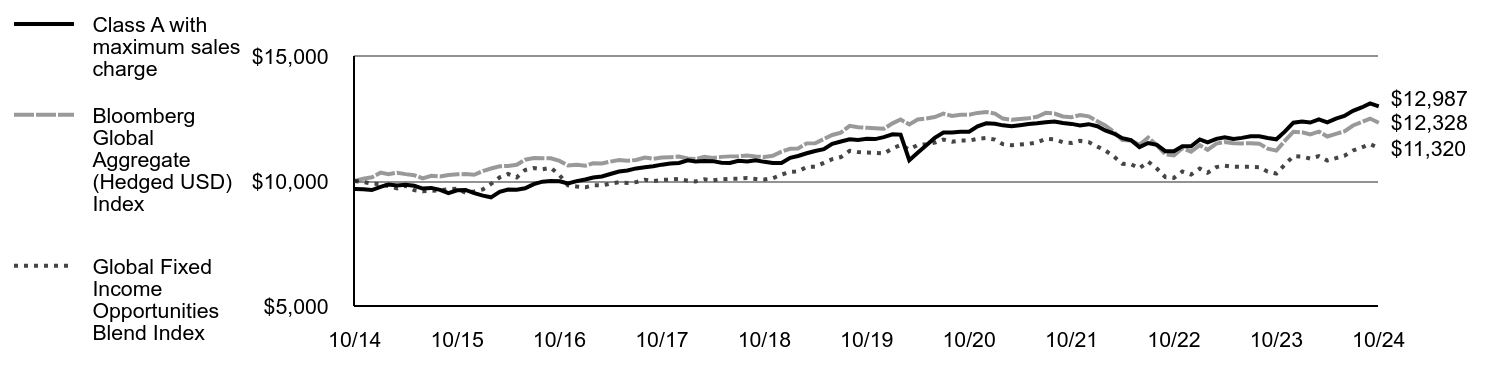

Comparison of the change in value of a $10,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index | Global Fixed Income Opportunities Blend Index |

|---|

| 10/14 | $9,681 | $10,000 | $10,000 |

| 11/14 | $9,674 | $10,094 | $9,963 |

| 12/14 | $9,639 | $10,146 | $9,895 |

| 1/15 | $9,768 | $10,335 | $9,879 |

| 2/15 | $9,863 | $10,274 | $9,799 |

| 3/15 | $9,823 | $10,333 | $9,705 |

| 4/15 | $9,849 | $10,275 | $9,808 |

| 5/15 | $9,808 | $10,233 | $9,633 |

| 6/15 | $9,697 | $10,106 | $9,590 |

| 7/15 | $9,724 | $10,206 | $9,612 |

| 8/15 | $9,648 | $10,179 | $9,623 |

| 9/15 | $9,518 | $10,239 | $9,672 |

| 10/15 | $9,630 | $10,272 | $9,693 |

| 11/15 | $9,641 | $10,277 | $9,532 |

| 12/15 | $9,515 | $10,249 | $9,583 |

| 1/16 | $9,413 | $10,399 | $9,666 |

| 2/16 | $9,347 | $10,499 | $9,881 |

| 3/16 | $9,567 | $10,586 | $10,148 |

| 4/16 | $9,661 | $10,604 | $10,283 |

| 5/16 | $9,650 | $10,648 | $10,145 |

| 6/16 | $9,710 | $10,851 | $10,441 |

| 7/16 | $9,877 | $10,916 | $10,520 |

| 8/16 | $9,974 | $10,910 | $10,469 |

| 9/16 | $9,998 | $10,909 | $10,527 |

| 10/16 | $9,988 | $10,803 | $10,234 |

| 11/16 | $9,904 | $10,625 | $9,828 |

| 12/16 | $9,996 | $10,654 | $9,783 |

| 1/17 | $10,058 | $10,615 | $9,747 |

| 2/17 | $10,137 | $10,706 | $9,830 |

| 3/17 | $10,181 | $10,701 | $9,826 |

| 4/17 | $10,280 | $10,774 | $9,893 |

| 5/17 | $10,379 | $10,837 | $9,950 |

| 6/17 | $10,422 | $10,806 | $9,922 |

| 7/17 | $10,503 | $10,842 | $9,955 |

| 8/17 | $10,548 | $10,941 | $10,046 |

| 9/17 | $10,591 | $10,890 | $9,999 |

| 10/17 | $10,654 | $10,936 | $10,042 |

| 11/17 | $10,698 | $10,953 | $10,057 |

| 12/17 | $10,723 | $10,977 | $10,080 |

| 1/18 | $10,825 | $10,899 | $10,008 |

| 2/18 | $10,776 | $10,875 | $9,985 |

| 3/18 | $10,801 | $10,965 | $10,068 |

| 4/18 | $10,794 | $10,924 | $10,030 |

| 5/18 | $10,729 | $10,965 | $10,068 |

| 6/18 | $10,721 | $10,985 | $10,087 |

| 7/18 | $10,809 | $10,988 | $10,089 |

| 8/18 | $10,782 | $11,022 | $10,120 |

| 9/18 | $10,831 | $10,980 | $10,082 |

| 10/18 | $10,766 | $10,958 | $10,062 |

| 11/18 | $10,719 | $11,012 | $10,111 |

| 12/18 | $10,718 | $11,171 | $10,257 |

| 1/19 | $10,927 | $11,289 | $10,366 |

| 2/19 | $10,999 | $11,303 | $10,378 |

| 3/19 | $11,110 | $11,505 | $10,564 |

| 4/19 | $11,201 | $11,512 | $10,571 |

| 5/19 | $11,273 | $11,678 | $10,723 |

| 6/19 | $11,486 | $11,842 | $10,873 |

| 7/19 | $11,579 | $11,935 | $10,959 |

| 8/19 | $11,671 | $12,205 | $11,207 |

| 9/19 | $11,638 | $12,149 | $11,155 |

| 10/19 | $11,687 | $12,128 | $11,136 |

| 11/19 | $11,676 | $12,114 | $11,123 |

| 12/19 | $11,754 | $12,089 | $11,100 |

| 1/20 | $11,866 | $12,307 | $11,300 |

| 2/20 | $11,856 | $12,458 | $11,439 |

| 3/20 | $10,831 | $12,264 | $11,261 |

| 4/20 | $11,129 | $12,462 | $11,443 |

| 5/20 | $11,426 | $12,498 | $11,475 |

| 6/20 | $11,724 | $12,560 | $11,533 |

| 7/20 | $11,939 | $12,697 | $11,659 |

| 8/20 | $11,944 | $12,605 | $11,574 |

| 9/20 | $11,968 | $12,651 | $11,617 |

| 10/20 | $11,971 | $12,652 | $11,617 |

| 11/20 | $12,184 | $12,724 | $11,684 |

| 12/20 | $12,306 | $12,763 | $11,720 |

| 1/21 | $12,287 | $12,695 | $11,657 |

| 2/21 | $12,226 | $12,497 | $11,475 |

| 3/21 | $12,186 | $12,448 | $11,430 |

| 4/21 | $12,231 | $12,481 | $11,460 |

| 5/21 | $12,279 | $12,509 | $11,486 |

| 6/21 | $12,306 | $12,570 | $11,542 |

| 7/21 | $12,354 | $12,726 | $11,685 |

| 8/21 | $12,382 | $12,700 | $11,662 |

| 9/21 | $12,323 | $12,580 | $11,552 |

| 10/21 | $12,284 | $12,548 | $11,521 |

| 11/21 | $12,224 | $12,637 | $11,604 |

| 12/21 | $12,273 | $12,586 | $11,556 |

| 1/22 | $12,190 | $12,388 | $11,375 |

| 2/22 | $12,022 | $12,223 | $11,224 |

| 3/22 | $11,900 | $11,960 | $10,982 |

| 4/22 | $11,711 | $11,638 | $10,687 |

| 5/22 | $11,632 | $11,622 | $10,672 |

| 6/22 | $11,355 | $11,446 | $10,510 |

| 7/22 | $11,521 | $11,738 | $10,778 |

| 8/22 | $11,446 | $11,431 | $10,496 |

| 9/22 | $11,192 | $11,064 | $10,159 |

| 10/22 | $11,190 | $11,026 | $10,124 |

| 11/22 | $11,393 | $11,307 | $10,382 |

| 12/22 | $11,386 | $11,174 | $10,260 |

| 1/23 | $11,663 | $11,431 | $10,496 |

| 2/23 | $11,542 | $11,249 | $10,329 |

| 3/23 | $11,685 | $11,498 | $10,558 |

| 4/23 | $11,752 | $11,557 | $10,612 |

| 5/23 | $11,680 | $11,512 | $10,570 |

| 6/23 | $11,725 | $11,505 | $10,564 |

| 7/23 | $11,793 | $11,509 | $10,568 |

| 8/23 | $11,791 | $11,494 | $10,554 |

| 9/23 | $11,720 | $11,296 | $10,372 |

| 10/23 | $11,667 | $11,216 | $10,299 |

| 11/23 | $11,976 | $11,602 | $10,653 |

| 12/23 | $12,334 | $11,972 | $10,993 |

| 1/24 | $12,384 | $11,949 | $10,972 |

| 2/24 | $12,339 | $11,867 | $10,896 |

| 3/24 | $12,464 | $11,974 | $10,995 |

| 4/24 | $12,346 | $11,781 | $10,818 |

| 5/24 | $12,497 | $11,885 | $10,913 |

| 6/24 | $12,600 | $11,988 | $11,008 |

| 7/24 | $12,806 | $12,220 | $11,221 |

| 8/24 | $12,942 | $12,354 | $11,344 |

| 9/24 | $13,103 | $12,497 | $11,475 |

| 10/24 | $12,987 | $12,328 | $11,320 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 11.31% | 2.13% | 2.98% |

| Class A with maximum 3.25% front end sales charge | 7.77% | 1.47% | 2.65% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 2.12% |

Global Fixed Income Opportunities Blend IndexFootnote Reference1 | 9.92% | 0.33% | 1.25% |

| Footnote | Description |

Footnote1 | The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed rate debt markets with returns in unhedged USD) from the Fund’s inception to December 31, 2016 to the new benchmark represented by Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. It is not possible to invest directly in an index. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

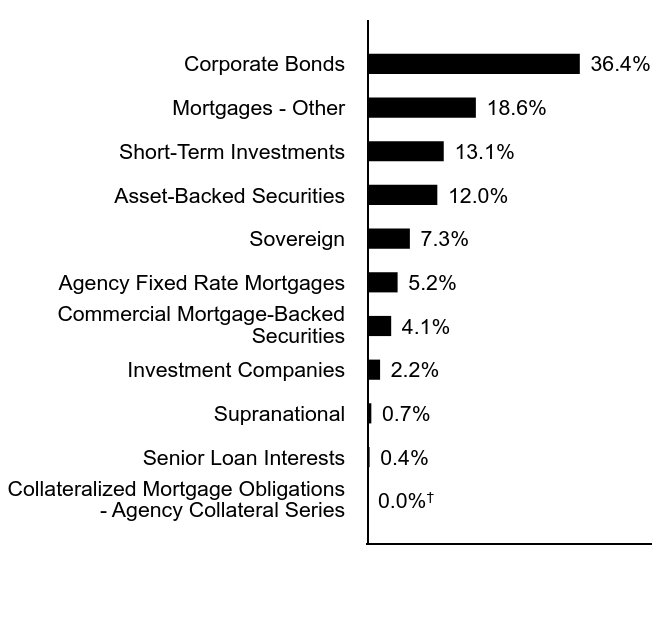

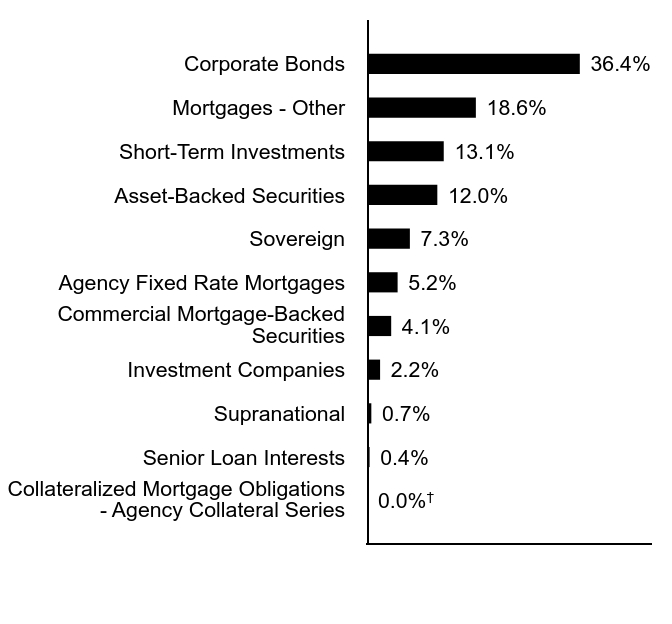

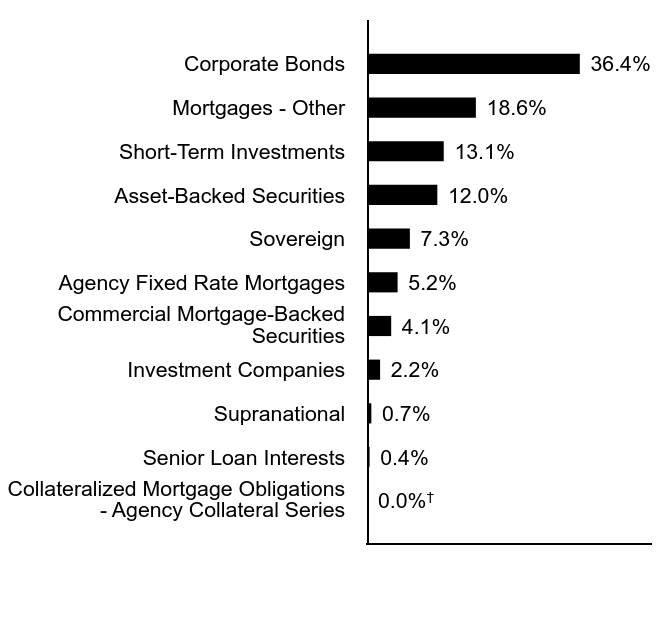

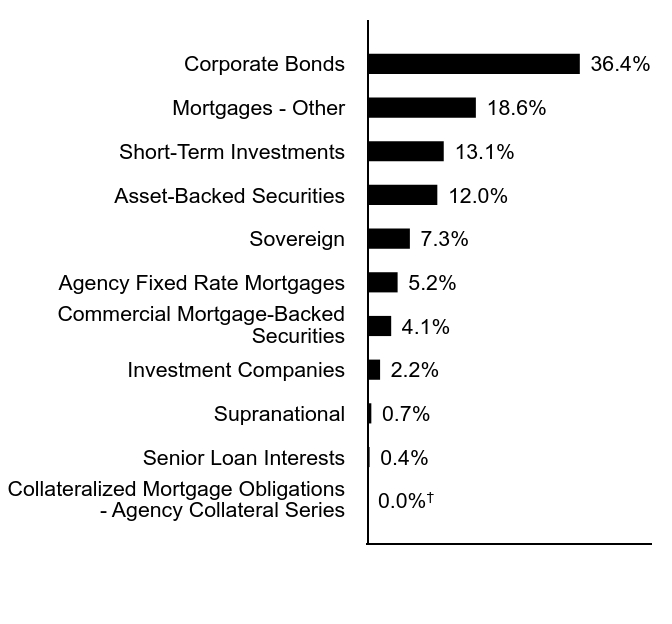

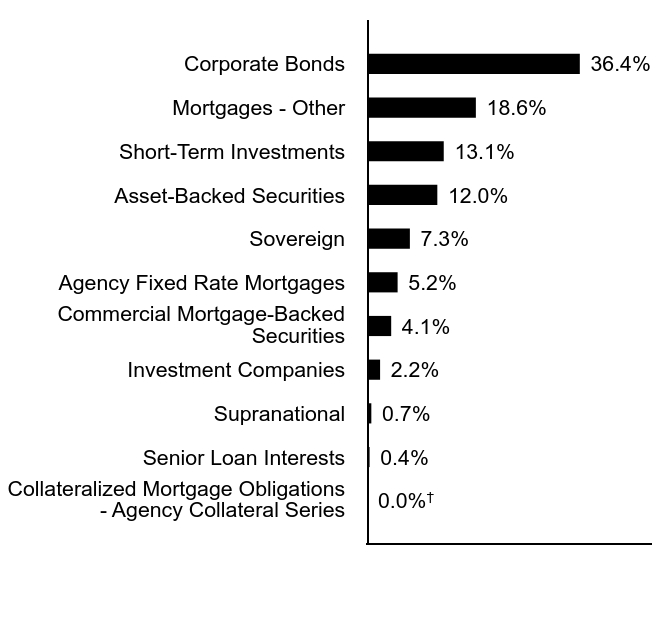

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

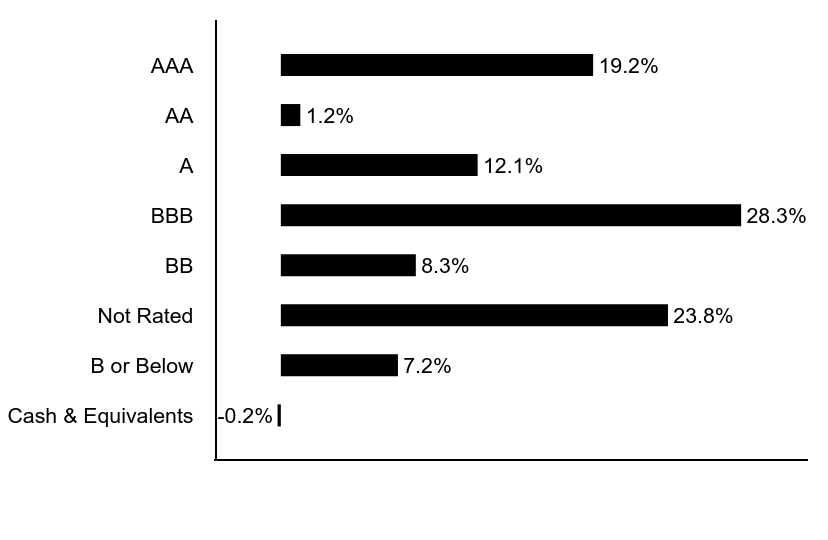

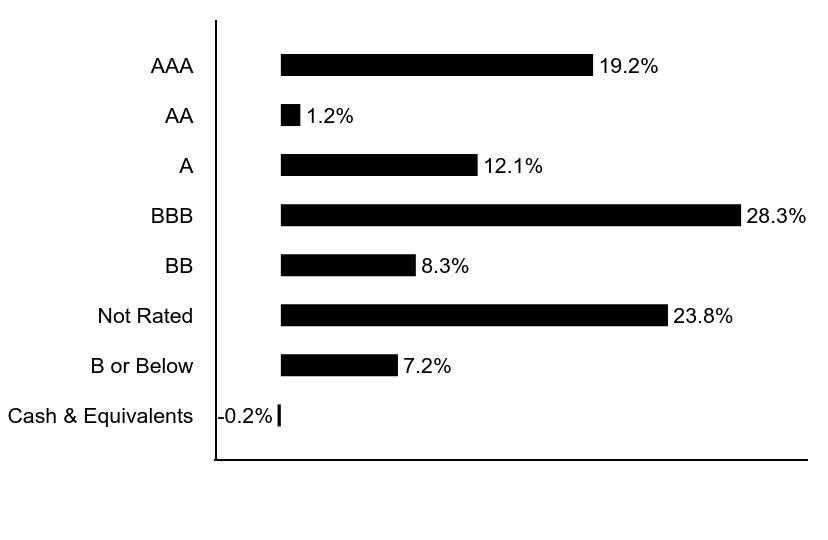

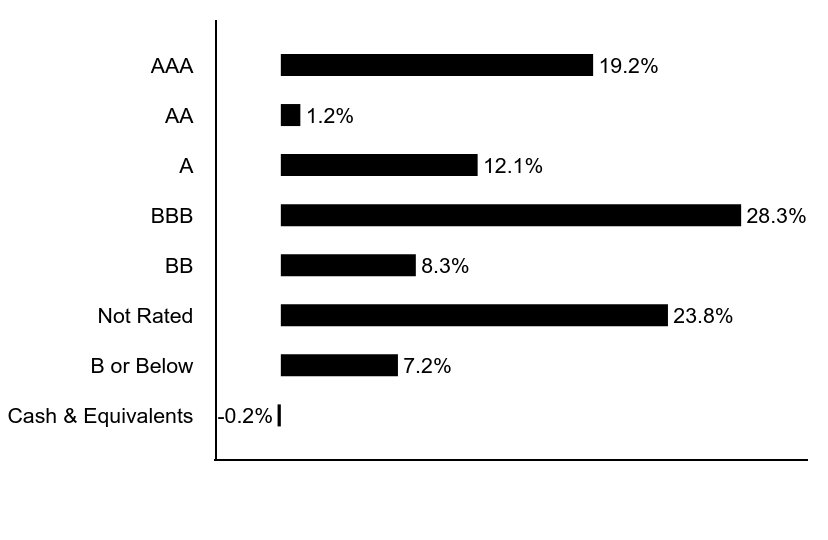

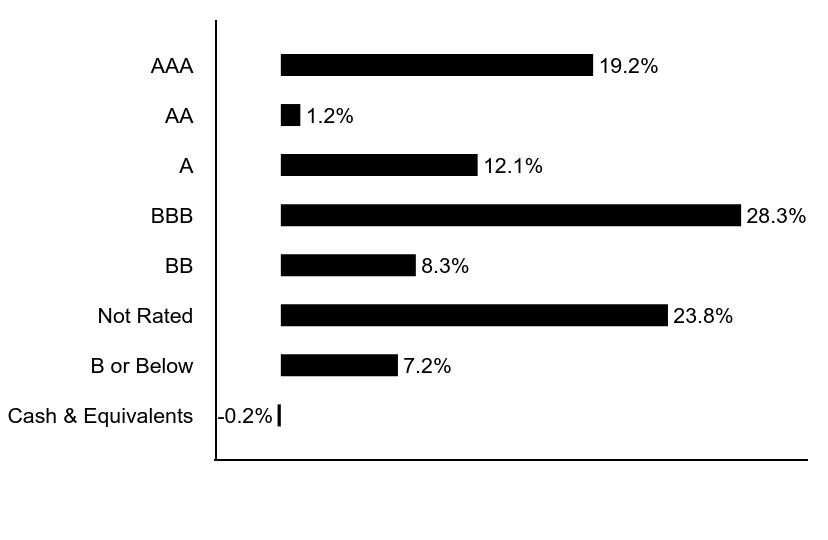

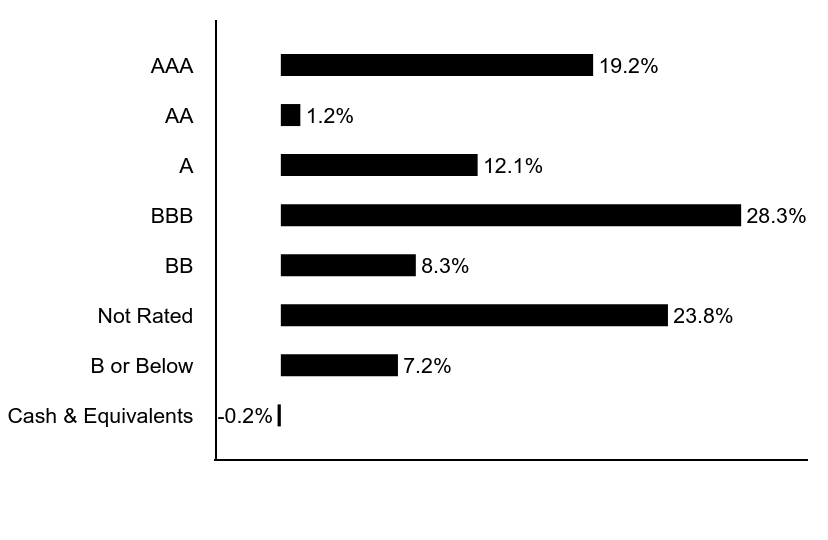

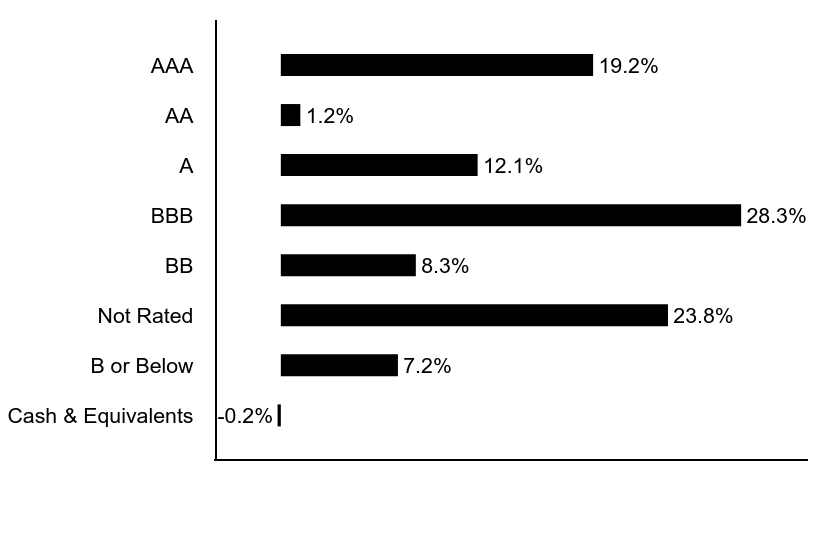

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $165 | 1.57% |

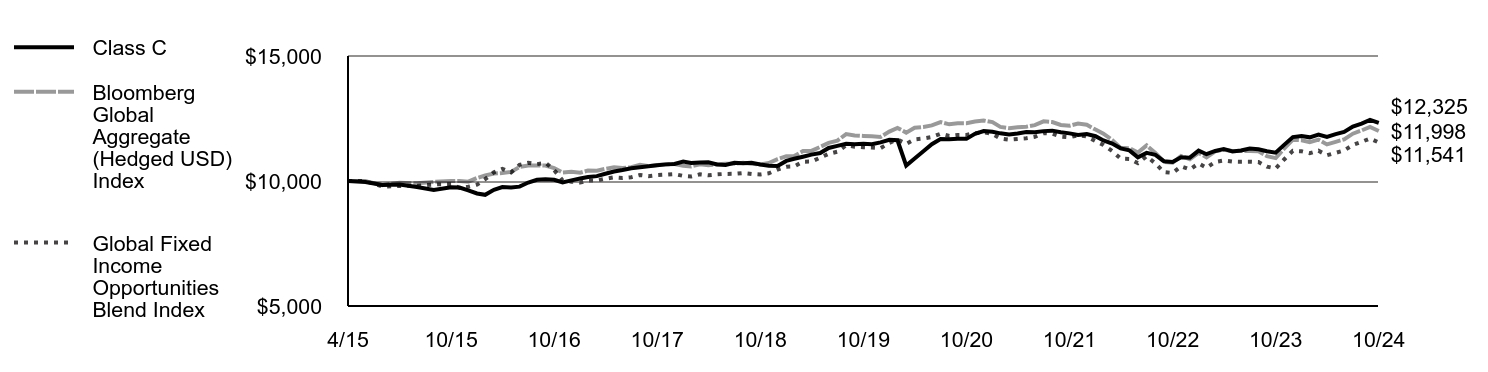

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

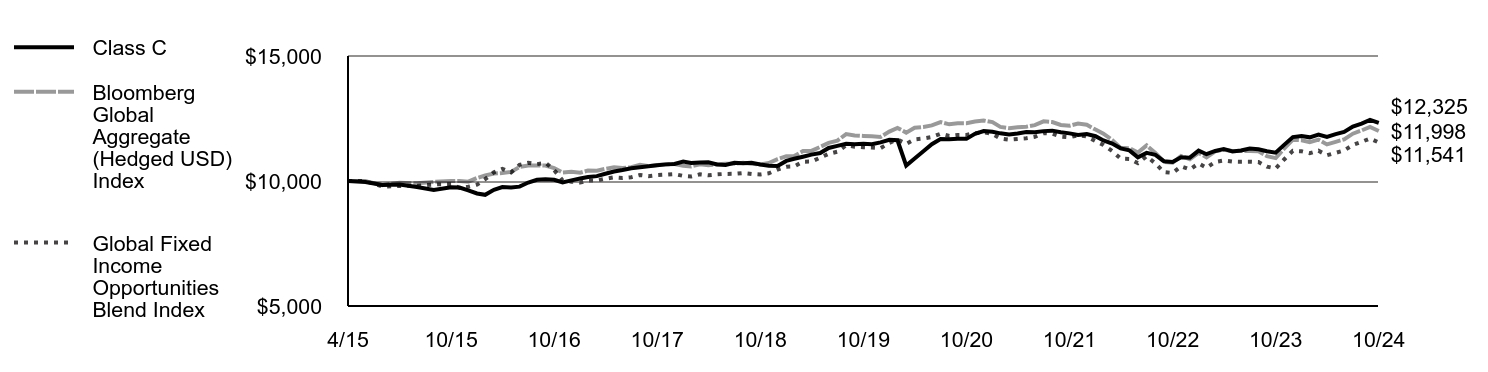

Comparison of the change in value of a $10,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index | Global Fixed Income Opportunities Blend Index |

|---|

| 4/15 | $10,000 | $10,000 | $10,000 |

| 5/15 | $9,956 | $10,000 | $10,000 |

| 6/15 | $9,839 | $9,835 | $9,778 |

| 7/15 | $9,862 | $9,933 | $9,800 |

| 8/15 | $9,762 | $9,906 | $9,812 |

| 9/15 | $9,643 | $9,965 | $9,862 |

| 10/15 | $9,752 | $9,997 | $9,882 |

| 11/15 | $9,740 | $10,002 | $9,719 |

| 12/15 | $9,626 | $9,975 | $9,770 |

| 1/16 | $9,501 | $10,121 | $9,855 |

| 2/16 | $9,447 | $10,218 | $10,074 |

| 3/16 | $9,646 | $10,302 | $10,347 |

| 4/16 | $9,755 | $10,319 | $10,484 |

| 5/16 | $9,737 | $10,363 | $10,344 |

| 6/16 | $9,774 | $10,560 | $10,646 |

| 7/16 | $9,938 | $10,623 | $10,726 |

| 8/16 | $10,047 | $10,618 | $10,674 |

| 9/16 | $10,065 | $10,617 | $10,733 |

| 10/16 | $10,048 | $10,514 | $10,435 |

| 11/16 | $9,939 | $10,340 | $10,020 |

| 12/16 | $10,026 | $10,368 | $9,974 |

| 1/17 | $10,101 | $10,331 | $9,938 |

| 2/17 | $10,157 | $10,419 | $10,023 |

| 3/17 | $10,195 | $10,414 | $10,018 |

| 4/17 | $10,289 | $10,485 | $10,086 |

| 5/17 | $10,382 | $10,546 | $10,145 |

| 6/17 | $10,438 | $10,517 | $10,117 |

| 7/17 | $10,513 | $10,551 | $10,150 |

| 8/17 | $10,552 | $10,647 | $10,242 |

| 9/17 | $10,590 | $10,598 | $10,195 |

| 10/17 | $10,627 | $10,643 | $10,238 |

| 11/17 | $10,665 | $10,659 | $10,254 |

| 12/17 | $10,684 | $10,683 | $10,277 |

| 1/18 | $10,779 | $10,607 | $10,204 |

| 2/18 | $10,724 | $10,583 | $10,181 |

| 3/18 | $10,744 | $10,671 | $10,265 |

| 4/18 | $10,749 | $10,631 | $10,227 |

| 5/18 | $10,658 | $10,671 | $10,265 |

| 6/18 | $10,644 | $10,691 | $10,284 |

| 7/18 | $10,725 | $10,694 | $10,287 |

| 8/18 | $10,710 | $10,726 | $10,319 |

| 9/18 | $10,733 | $10,685 | $10,279 |

| 10/18 | $10,662 | $10,665 | $10,259 |

| 11/18 | $10,610 | $10,717 | $10,309 |

| 12/18 | $10,602 | $10,872 | $10,458 |

| 1/19 | $10,803 | $10,987 | $10,569 |

| 2/19 | $10,888 | $11,000 | $10,582 |

| 3/19 | $10,971 | $11,197 | $10,771 |

| 4/19 | $11,055 | $11,204 | $10,778 |

| 5/19 | $11,119 | $11,365 | $10,933 |

| 6/19 | $11,322 | $11,524 | $11,086 |

| 7/19 | $11,406 | $11,615 | $11,173 |

| 8/19 | $11,490 | $11,878 | $11,427 |

| 9/19 | $11,470 | $11,823 | $11,374 |

| 10/19 | $11,491 | $11,803 | $11,354 |

| 11/19 | $11,474 | $11,789 | $11,341 |

| 12/19 | $11,544 | $11,765 | $11,317 |

| 1/20 | $11,648 | $11,977 | $11,522 |

| 2/20 | $11,631 | $12,124 | $11,663 |

| 3/20 | $10,617 | $11,935 | $11,481 |

| 4/20 | $10,903 | $12,128 | $11,667 |

| 5/20 | $11,188 | $12,163 | $11,700 |

| 6/20 | $11,473 | $12,223 | $11,758 |

| 7/20 | $11,677 | $12,357 | $11,887 |

| 8/20 | $11,675 | $12,267 | $11,801 |

| 9/20 | $11,691 | $12,312 | $11,844 |

| 10/20 | $11,686 | $12,313 | $11,845 |

| 11/20 | $11,887 | $12,383 | $11,912 |

| 12/20 | $11,998 | $12,421 | $11,949 |

| 1/21 | $11,972 | $12,355 | $11,885 |

| 2/21 | $11,906 | $12,163 | $11,700 |

| 3/21 | $11,860 | $12,115 | $11,654 |

| 4/21 | $11,897 | $12,146 | $11,684 |

| 5/21 | $11,956 | $12,173 | $11,710 |

| 6/21 | $11,955 | $12,233 | $11,768 |

| 7/21 | $11,995 | $12,385 | $11,914 |

| 8/21 | $12,014 | $12,360 | $11,890 |

| 9/21 | $11,950 | $12,243 | $11,778 |

| 10/21 | $11,905 | $12,211 | $11,747 |

| 11/21 | $11,839 | $12,298 | $11,831 |

| 12/21 | $11,879 | $12,248 | $11,783 |

| 1/22 | $11,792 | $12,056 | $11,598 |

| 2/22 | $11,622 | $11,896 | $11,443 |

| 3/22 | $11,496 | $11,639 | $11,197 |

| 4/22 | $11,306 | $11,326 | $10,896 |

| 5/22 | $11,223 | $11,311 | $10,881 |

| 6/22 | $10,948 | $11,139 | $10,716 |

| 7/22 | $11,123 | $11,423 | $10,989 |

| 8/22 | $11,043 | $11,125 | $10,702 |

| 9/22 | $10,791 | $10,768 | $10,358 |

| 10/22 | $10,760 | $10,731 | $10,323 |

| 11/22 | $10,949 | $11,004 | $10,586 |

| 12/22 | $10,935 | $10,874 | $10,461 |

| 1/23 | $11,217 | $11,125 | $10,702 |

| 2/23 | $11,072 | $10,947 | $10,531 |

| 3/23 | $11,201 | $11,190 | $10,765 |

| 4/23 | $11,282 | $11,248 | $10,820 |

| 5/23 | $11,182 | $11,203 | $10,777 |

| 6/23 | $11,218 | $11,197 | $10,771 |

| 7/23 | $11,299 | $11,200 | $10,774 |

| 8/23 | $11,266 | $11,186 | $10,761 |

| 9/23 | $11,192 | $10,993 | $10,575 |

| 10/23 | $11,134 | $10,915 | $10,500 |

| 11/23 | $11,445 | $11,291 | $10,861 |

| 12/23 | $11,757 | $11,651 | $11,208 |

| 1/24 | $11,796 | $11,629 | $11,186 |

| 2/24 | $11,746 | $11,549 | $11,110 |

| 3/24 | $11,858 | $11,653 | $11,210 |

| 4/24 | $11,761 | $11,465 | $11,029 |

| 5/24 | $11,874 | $11,567 | $11,127 |

| 6/24 | $11,965 | $11,667 | $11,223 |

| 7/24 | $12,177 | $11,893 | $11,440 |

| 8/24 | $12,298 | $12,023 | $11,566 |

| 9/24 | $12,443 | $12,162 | $11,700 |

| 10/24 | $12,325 | $11,998 | $11,541 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since 4/30/15 (Inception) |

|---|

| Class C | 10.70% | 1.41% | 2.22% |

| Class C with maximum 1% deferred sales charge | 9.70% | 1.41% | 2.22% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 1.93% |

Global Fixed Income Opportunities Blend IndexFootnote Reference1 | 9.92% | 0.33% | 1.52% |

| Footnote | Description |

Footnote1 | The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed rate debt markets with returns in unhedged USD) from the Fund’s inception to December 31, 2016 to the new benchmark represented by Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. It is not possible to invest directly in an index. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $60 | 0.57% |

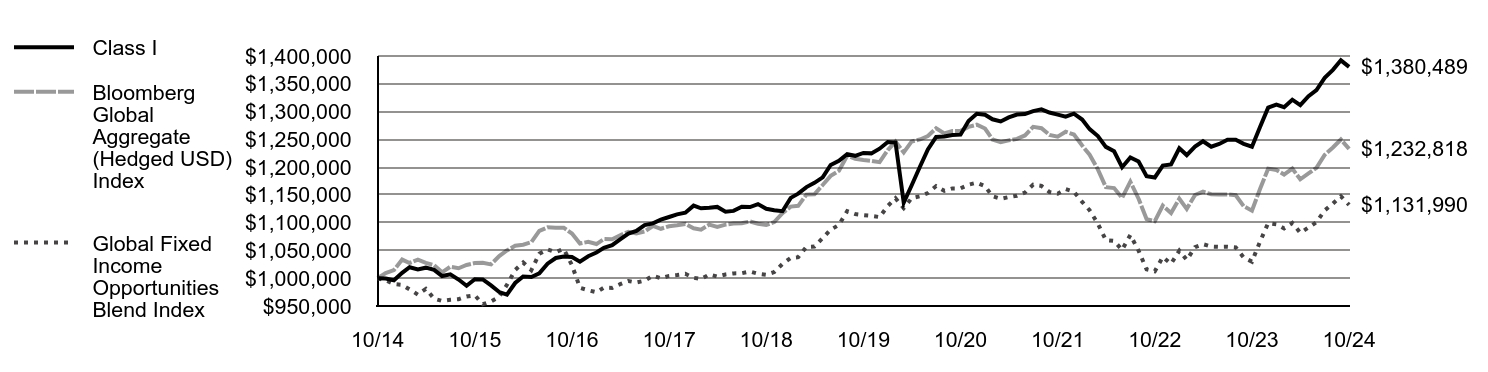

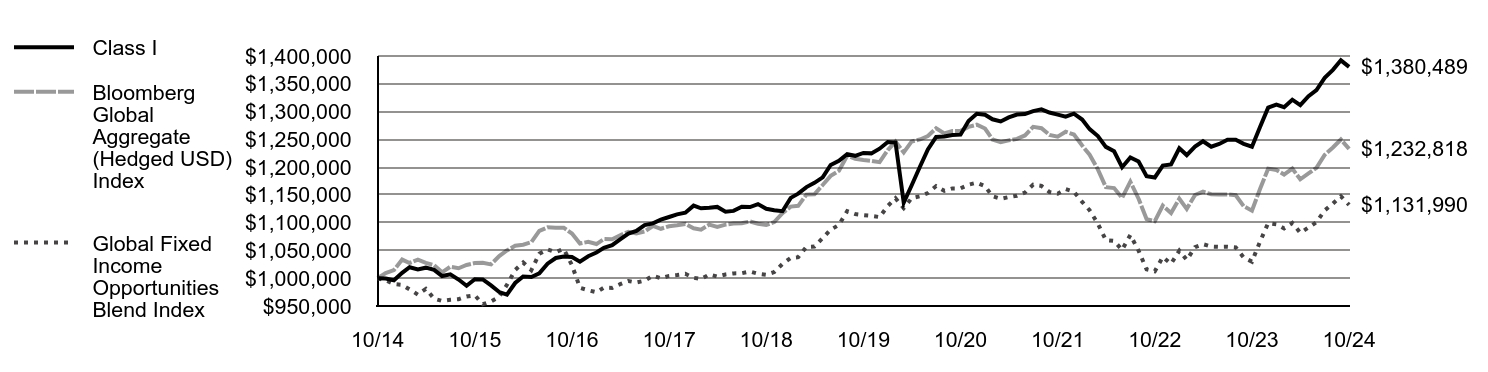

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index | Global Fixed Income Opportunities Blend Index |

|---|

| 10/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 11/14 | $999,512 | $1,009,390 | $996,349 |

| 12/14 | $996,306 | $1,014,616 | $989,489 |

| 1/15 | $1,009,790 | $1,033,538 | $987,924 |

| 2/15 | $1,019,804 | $1,027,432 | $979,924 |

| 3/15 | $1,015,944 | $1,033,319 | $970,479 |

| 4/15 | $1,018,996 | $1,027,542 | $980,800 |

| 5/15 | $1,014,978 | $1,023,282 | $963,264 |

| 6/15 | $1,003,949 | $1,010,633 | $959,045 |

| 7/15 | $1,007,030 | $1,020,643 | $961,194 |

| 8/15 | $997,665 | $1,017,884 | $962,312 |

| 9/15 | $986,401 | $1,023,921 | $967,216 |

| 10/15 | $998,307 | $1,027,242 | $969,259 |

| 11/15 | $997,879 | $1,027,715 | $953,212 |

| 12/15 | $987,021 | $1,024,934 | $958,279 |

| 1/16 | $975,095 | $1,039,927 | $966,583 |

| 2/16 | $970,428 | $1,049,923 | $988,107 |

| 3/16 | $991,417 | $1,058,566 | $1,014,808 |

| 4/16 | $1,003,215 | $1,060,364 | $1,028,306 |

| 5/16 | $1,002,278 | $1,064,846 | $1,014,512 |

| 6/16 | $1,008,672 | $1,085,116 | $1,044,137 |

| 7/16 | $1,026,168 | $1,091,599 | $1,052,008 |

| 8/16 | $1,036,378 | $1,091,043 | $1,046,898 |

| 9/16 | $1,039,067 | $1,090,913 | $1,052,662 |

| 10/16 | $1,038,227 | $1,080,335 | $1,023,446 |

| 11/16 | $1,029,844 | $1,062,492 | $982,783 |

| 12/16 | $1,039,562 | $1,065,404 | $978,268 |

| 1/17 | $1,046,271 | $1,061,523 | $974,704 |

| 2/17 | $1,054,720 | $1,070,610 | $983,048 |

| 3/17 | $1,059,464 | $1,070,116 | $982,595 |

| 4/17 | $1,069,977 | $1,077,373 | $989,258 |

| 5/17 | $1,080,447 | $1,083,662 | $995,032 |

| 6/17 | $1,085,176 | $1,080,629 | $992,247 |

| 7/17 | $1,095,737 | $1,084,181 | $995,509 |

| 8/17 | $1,098,673 | $1,094,062 | $1,004,582 |

| 9/17 | $1,105,370 | $1,089,011 | $999,944 |

| 10/17 | $1,110,196 | $1,093,604 | $1,004,162 |

| 11/17 | $1,115,013 | $1,095,298 | $1,005,717 |

| 12/17 | $1,117,936 | $1,097,747 | $1,007,965 |

| 1/18 | $1,130,685 | $1,089,910 | $1,000,770 |

| 2/18 | $1,125,880 | $1,087,453 | $998,513 |

| 3/18 | $1,126,867 | $1,096,469 | $1,006,792 |

| 4/18 | $1,128,334 | $1,092,389 | $1,003,046 |

| 5/18 | $1,119,888 | $1,096,470 | $1,006,793 |

| 6/18 | $1,121,229 | $1,098,514 | $1,008,670 |

| 7/18 | $1,128,614 | $1,098,815 | $1,008,946 |

| 8/18 | $1,128,010 | $1,102,192 | $1,012,047 |

| 9/18 | $1,133,407 | $1,097,976 | $1,008,175 |

| 10/18 | $1,125,104 | $1,095,830 | $1,006,206 |

| 11/18 | $1,122,526 | $1,101,192 | $1,011,129 |

| 12/18 | $1,120,641 | $1,117,098 | $1,025,734 |

| 1/19 | $1,144,638 | $1,128,930 | $1,036,598 |

| 2/19 | $1,152,283 | $1,130,287 | $1,037,844 |

| 3/19 | $1,164,054 | $1,150,531 | $1,056,432 |

| 4/19 | $1,171,718 | $1,151,216 | $1,057,062 |

| 5/19 | $1,181,482 | $1,167,781 | $1,072,272 |

| 6/19 | $1,203,790 | $1,184,156 | $1,087,307 |

| 7/19 | $1,211,523 | $1,193,474 | $1,095,863 |

| 8/19 | $1,223,471 | $1,220,540 | $1,120,715 |

| 9/19 | $1,220,317 | $1,214,884 | $1,115,522 |

| 10/19 | $1,225,586 | $1,212,787 | $1,113,597 |

| 11/19 | $1,224,741 | $1,211,364 | $1,112,290 |

| 12/19 | $1,233,158 | $1,208,880 | $1,110,010 |

| 1/20 | $1,245,105 | $1,230,696 | $1,130,041 |

| 2/20 | $1,244,250 | $1,245,759 | $1,143,872 |

| 3/20 | $1,136,129 | $1,226,371 | $1,126,070 |

| 4/20 | $1,167,329 | $1,246,224 | $1,144,299 |

| 5/20 | $1,200,558 | $1,249,756 | $1,147,543 |

| 6/20 | $1,231,713 | $1,255,994 | $1,153,270 |

| 7/20 | $1,254,266 | $1,269,719 | $1,165,872 |

| 8/20 | $1,255,135 | $1,260,518 | $1,157,424 |

| 9/20 | $1,257,859 | $1,265,123 | $1,161,652 |

| 10/20 | $1,258,405 | $1,265,215 | $1,161,737 |

| 11/20 | $1,283,026 | $1,272,434 | $1,168,365 |

| 12/20 | $1,296,015 | $1,276,343 | $1,171,955 |

| 1/21 | $1,294,365 | $1,269,497 | $1,165,669 |

| 2/21 | $1,286,096 | $1,249,750 | $1,147,536 |

| 3/21 | $1,282,229 | $1,244,826 | $1,143,015 |

| 4/21 | $1,289,426 | $1,248,080 | $1,146,003 |

| 5/21 | $1,294,641 | $1,250,866 | $1,148,561 |

| 6/21 | $1,295,531 | $1,256,966 | $1,154,163 |

| 7/21 | $1,300,883 | $1,272,589 | $1,168,508 |

| 8/21 | $1,304,012 | $1,270,039 | $1,166,166 |

| 9/21 | $1,298,187 | $1,258,048 | $1,155,156 |

| 10/21 | $1,294,481 | $1,254,759 | $1,152,136 |

| 11/21 | $1,290,766 | $1,263,709 | $1,160,354 |

| 12/21 | $1,296,193 | $1,258,584 | $1,155,648 |

| 1/22 | $1,285,600 | $1,238,810 | $1,137,492 |

| 2/22 | $1,268,360 | $1,222,332 | $1,122,361 |

| 3/22 | $1,255,882 | $1,195,983 | $1,098,167 |

| 4/22 | $1,236,481 | $1,163,839 | $1,068,652 |

| 5/22 | $1,228,538 | $1,162,238 | $1,067,182 |

| 6/22 | $1,199,888 | $1,144,599 | $1,050,986 |

| 7/22 | $1,217,493 | $1,173,753 | $1,077,756 |

| 8/22 | $1,209,942 | $1,143,112 | $1,049,620 |

| 9/22 | $1,183,714 | $1,106,415 | $1,015,925 |

| 10/22 | $1,181,375 | $1,102,628 | $1,012,448 |

| 11/22 | $1,202,807 | $1,130,726 | $1,038,248 |

| 12/22 | $1,204,758 | $1,117,382 | $1,025,994 |

| 1/23 | $1,233,974 | $1,143,118 | $1,049,626 |

| 2/23 | $1,221,634 | $1,124,885 | $1,032,884 |

| 3/23 | $1,236,813 | $1,149,829 | $1,055,788 |

| 4/23 | $1,246,571 | $1,155,748 | $1,061,223 |

| 5/23 | $1,236,775 | $1,151,199 | $1,057,045 |

| 6/23 | $1,241,693 | $1,150,511 | $1,056,415 |

| 7/23 | $1,249,098 | $1,150,884 | $1,056,757 |

| 8/23 | $1,249,098 | $1,149,438 | $1,055,429 |

| 9/23 | $1,241,945 | $1,129,616 | $1,037,228 |

| 10/23 | $1,236,697 | $1,121,595 | $1,029,863 |

| 11/23 | $1,271,691 | $1,160,159 | $1,065,273 |

| 12/23 | $1,306,955 | $1,197,236 | $1,099,317 |

| 1/24 | $1,312,390 | $1,194,889 | $1,097,163 |

| 2/24 | $1,307,948 | $1,186,690 | $1,089,634 |

| 3/24 | $1,321,333 | $1,197,391 | $1,099,460 |

| 4/24 | $1,311,731 | $1,178,112 | $1,081,758 |

| 5/24 | $1,327,806 | $1,188,537 | $1,091,330 |

| 6/24 | $1,338,785 | $1,198,850 | $1,100,800 |

| 7/24 | $1,360,579 | $1,222,010 | $1,122,066 |

| 8/24 | $1,375,045 | $1,235,394 | $1,134,355 |

| 9/24 | $1,392,200 | $1,249,730 | $1,147,518 |

| 10/24 | $1,380,489 | $1,232,818 | $1,131,990 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 11.63% | 2.41% | 3.28% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 2.12% |

Global Fixed Income Opportunities Blend IndexFootnote Reference1 | 9.92% | 0.33% | 1.25% |

| Footnote | Description |

Footnote1 | The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed rate debt markets with returns in unhedged USD) from the Fund’s inception to December 31, 2016 to the new benchmark represented by Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. It is not possible to invest directly in an index. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class IR | $49 | 0.46% |

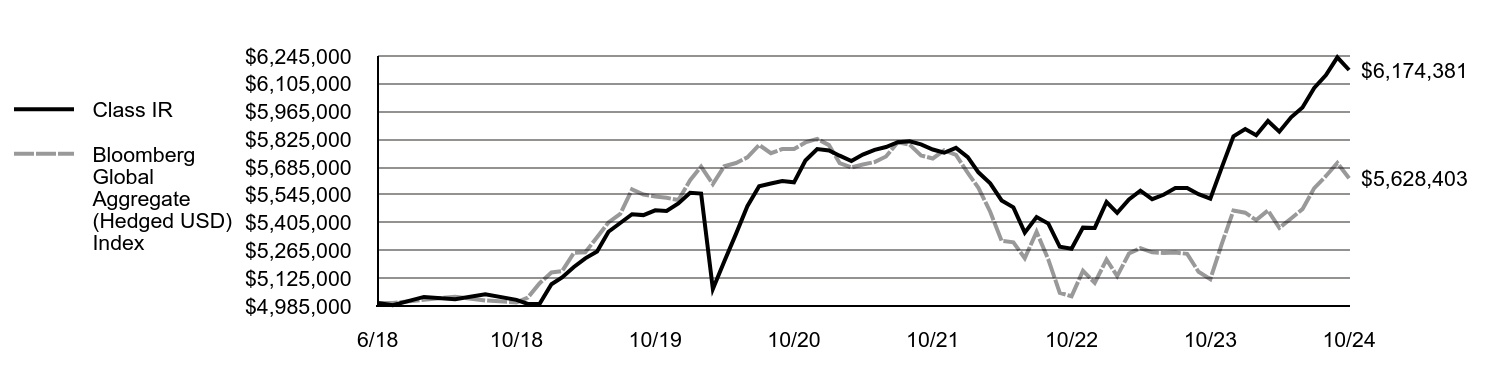

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

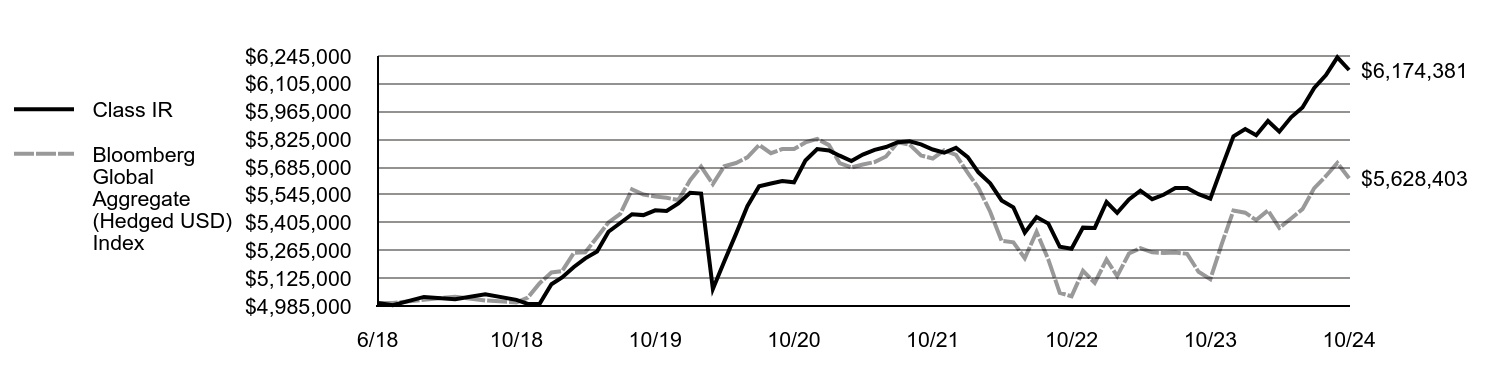

Comparison of the change in value of a $5,000,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index |

|---|

| 6/18 | $5,000,000 | $5,000,000 |

| 6/18 | $4,988,667 | $5,000,000 |

| 7/18 | $5,030,710 | $5,016,613 |

| 8/18 | $5,019,560 | $5,032,031 |

| 9/18 | $5,043,636 | $5,012,781 |

| 10/18 | $5,015,725 | $5,002,986 |

| 11/18 | $4,995,576 | $5,027,464 |

| 12/18 | $4,996,598 | $5,100,084 |

| 1/19 | $5,094,585 | $5,154,103 |

| 2/19 | $5,128,872 | $5,160,297 |

| 3/19 | $5,181,522 | $5,252,720 |

| 4/19 | $5,225,117 | $5,255,849 |

| 5/19 | $5,259,666 | $5,331,478 |

| 6/19 | $5,359,258 | $5,406,235 |

| 7/19 | $5,403,278 | $5,448,776 |

| 8/19 | $5,447,436 | $5,572,345 |

| 9/19 | $5,443,084 | $5,546,524 |

| 10/19 | $5,467,362 | $5,536,949 |

| 11/19 | $5,463,903 | $5,530,454 |

| 12/19 | $5,501,685 | $5,519,115 |

| 1/20 | $5,555,183 | $5,618,714 |

| 2/20 | $5,551,659 | $5,687,483 |

| 3/20 | $5,070,449 | $5,598,967 |

| 4/20 | $5,209,804 | $5,689,607 |

| 5/20 | $5,348,630 | $5,705,733 |

| 6/20 | $5,487,819 | $5,734,208 |

| 7/20 | $5,588,673 | $5,796,870 |

| 8/20 | $5,602,593 | $5,754,864 |

| 9/20 | $5,615,033 | $5,775,887 |

| 10/20 | $5,608,146 | $5,776,308 |

| 11/20 | $5,718,154 | $5,809,266 |

| 12/20 | $5,776,334 | $5,827,114 |

| 1/21 | $5,769,256 | $5,795,858 |

| 2/21 | $5,742,528 | $5,705,702 |

| 3/21 | $5,715,855 | $5,683,223 |

| 4/21 | $5,748,348 | $5,698,079 |

| 5/21 | $5,772,038 | $5,710,798 |

| 6/21 | $5,786,371 | $5,738,650 |

| 7/21 | $5,810,666 | $5,809,973 |

| 8/21 | $5,815,109 | $5,798,333 |

| 9/21 | $5,799,590 | $5,743,590 |

| 10/21 | $5,773,564 | $5,728,571 |

| 11/21 | $5,757,381 | $5,769,434 |

| 12/21 | $5,781,992 | $5,746,035 |

| 1/22 | $5,735,183 | $5,655,757 |

| 2/22 | $5,658,663 | $5,580,527 |

| 3/22 | $5,603,423 | $5,460,231 |

| 4/22 | $5,517,243 | $5,313,479 |

| 5/22 | $5,482,177 | $5,306,169 |

| 6/22 | $5,354,704 | $5,225,641 |

| 7/22 | $5,433,675 | $5,358,742 |

| 8/22 | $5,400,231 | $5,218,849 |

| 9/22 | $5,283,345 | $5,051,311 |

| 10/22 | $5,273,406 | $5,034,022 |

| 11/22 | $5,379,907 | $5,162,304 |

| 12/22 | $5,378,484 | $5,101,379 |

| 1/23 | $5,509,271 | $5,218,878 |

| 2/23 | $5,454,434 | $5,135,636 |

| 3/23 | $5,522,498 | $5,249,515 |

| 4/23 | $5,566,389 | $5,276,542 |

| 5/23 | $5,523,176 | $5,255,769 |

| 6/23 | $5,545,652 | $5,252,632 |

| 7/23 | $5,579,268 | $5,254,333 |

| 8/23 | $5,579,854 | $5,247,731 |

| 9/23 | $5,548,501 | $5,157,233 |

| 10/23 | $5,525,656 | $5,120,616 |

| 11/23 | $5,682,456 | $5,296,678 |

| 12/23 | $5,840,542 | $5,465,951 |

| 1/24 | $5,876,602 | $5,455,237 |

| 2/24 | $5,845,842 | $5,417,805 |

| 3/24 | $5,917,549 | $5,466,660 |

| 4/24 | $5,863,708 | $5,378,643 |

| 5/24 | $5,936,165 | $5,426,236 |

| 6/24 | $5,985,830 | $5,473,320 |

| 7/24 | $6,083,894 | $5,579,059 |

| 8/24 | $6,149,206 | $5,640,164 |

| 9/24 | $6,238,209 | $5,705,612 |

| 10/24 | $6,174,381 | $5,628,403 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since 6/15/18 (Inception) |

|---|

| Class IR | 11.74% | 2.46% | 3.36% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 1.87% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class L | $124 | 1.18% |

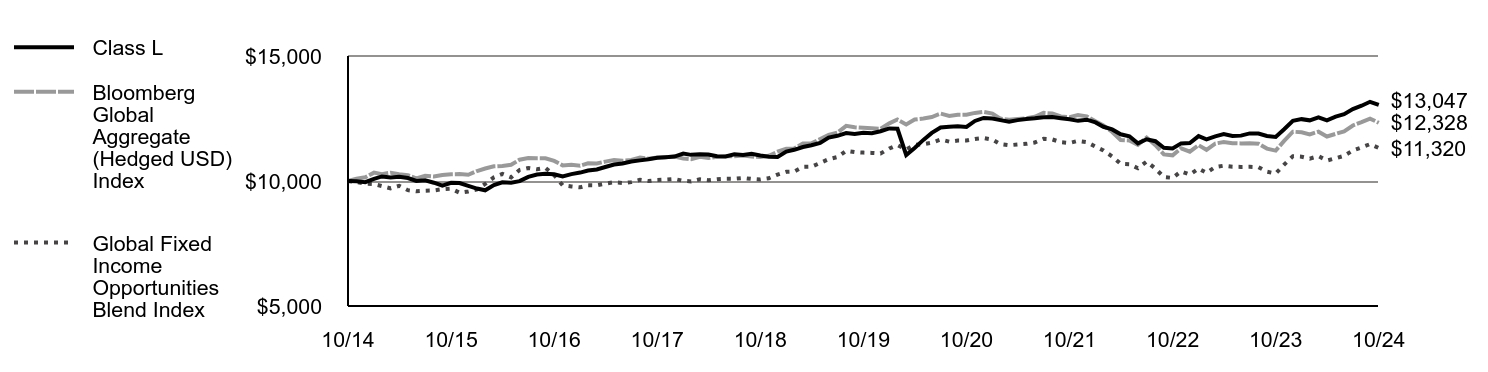

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

Comparison of the change in value of a $10,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index | Global Fixed Income Opportunities Blend Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,991 | $10,094 | $9,963 |

| 12/14 | $9,954 | $10,146 | $9,895 |

| 1/15 | $10,085 | $10,335 | $9,879 |

| 2/15 | $10,182 | $10,274 | $9,799 |

| 3/15 | $10,139 | $10,333 | $9,705 |

| 4/15 | $10,165 | $10,275 | $9,808 |

| 5/15 | $10,120 | $10,233 | $9,633 |

| 6/15 | $10,004 | $10,106 | $9,590 |

| 7/15 | $10,030 | $10,206 | $9,612 |

| 8/15 | $9,931 | $10,179 | $9,623 |

| 9/15 | $9,813 | $10,239 | $9,672 |

| 10/15 | $9,927 | $10,272 | $9,693 |

| 11/15 | $9,918 | $10,277 | $9,532 |

| 12/15 | $9,804 | $10,249 | $9,583 |

| 1/16 | $9,698 | $10,399 | $9,666 |

| 2/16 | $9,628 | $10,499 | $9,881 |

| 3/16 | $9,834 | $10,586 | $10,148 |

| 4/16 | $9,948 | $10,604 | $10,283 |

| 5/16 | $9,934 | $10,648 | $10,145 |

| 6/16 | $9,994 | $10,851 | $10,441 |

| 7/16 | $10,165 | $10,916 | $10,520 |

| 8/16 | $10,262 | $10,910 | $10,469 |

| 9/16 | $10,285 | $10,909 | $10,527 |

| 10/16 | $10,272 | $10,803 | $10,234 |

| 11/16 | $10,183 | $10,625 | $9,828 |

| 12/16 | $10,275 | $10,654 | $9,783 |

| 1/17 | $10,337 | $10,615 | $9,747 |

| 2/17 | $10,417 | $10,706 | $9,830 |

| 3/17 | $10,459 | $10,701 | $9,826 |

| 4/17 | $10,559 | $10,774 | $9,893 |

| 5/17 | $10,659 | $10,837 | $9,950 |

| 6/17 | $10,701 | $10,806 | $9,922 |

| 7/17 | $10,782 | $10,842 | $9,955 |

| 8/17 | $10,825 | $10,941 | $10,046 |

| 9/17 | $10,868 | $10,890 | $9,999 |

| 10/17 | $10,930 | $10,936 | $10,042 |

| 11/17 | $10,954 | $10,953 | $10,057 |

| 12/17 | $10,977 | $10,977 | $10,080 |

| 1/18 | $11,099 | $10,899 | $10,008 |

| 2/18 | $11,046 | $10,875 | $9,985 |

| 3/18 | $11,070 | $10,965 | $10,068 |

| 4/18 | $11,060 | $10,924 | $10,030 |

| 5/18 | $10,991 | $10,965 | $10,068 |

| 6/18 | $10,980 | $10,985 | $10,087 |

| 7/18 | $11,069 | $10,988 | $10,089 |

| 8/18 | $11,038 | $11,022 | $10,120 |

| 9/18 | $11,086 | $10,980 | $10,082 |

| 10/18 | $11,019 | $10,958 | $10,062 |

| 11/18 | $10,968 | $11,012 | $10,111 |

| 12/18 | $10,965 | $11,171 | $10,257 |

| 1/19 | $11,177 | $11,289 | $10,366 |

| 2/19 | $11,247 | $11,303 | $10,378 |

| 3/19 | $11,359 | $11,505 | $10,564 |

| 4/19 | $11,429 | $11,512 | $10,571 |

| 5/19 | $11,520 | $11,678 | $10,723 |

| 6/19 | $11,736 | $11,842 | $10,873 |

| 7/19 | $11,807 | $11,935 | $10,959 |

| 8/19 | $11,919 | $12,205 | $11,207 |

| 9/19 | $11,883 | $12,149 | $11,155 |

| 10/19 | $11,928 | $12,128 | $11,136 |

| 11/19 | $11,914 | $12,114 | $11,123 |

| 12/19 | $11,990 | $12,089 | $11,100 |

| 1/20 | $12,102 | $12,307 | $11,300 |

| 2/20 | $12,088 | $12,458 | $11,439 |

| 3/20 | $11,041 | $12,264 | $11,261 |

| 4/20 | $11,322 | $12,462 | $11,443 |

| 5/20 | $11,644 | $12,498 | $11,475 |

| 6/20 | $11,924 | $12,560 | $11,533 |

| 7/20 | $12,141 | $12,697 | $11,659 |

| 8/20 | $12,166 | $12,605 | $11,574 |

| 9/20 | $12,187 | $12,651 | $11,617 |

| 10/20 | $12,165 | $12,652 | $11,617 |

| 11/20 | $12,401 | $12,724 | $11,684 |

| 12/20 | $12,522 | $12,763 | $11,720 |

| 1/21 | $12,500 | $12,695 | $11,657 |

| 2/21 | $12,436 | $12,497 | $11,475 |

| 3/21 | $12,370 | $12,448 | $11,430 |

| 4/21 | $12,435 | $12,481 | $11,460 |

| 5/21 | $12,481 | $12,509 | $11,486 |

| 6/21 | $12,506 | $12,570 | $11,542 |

| 7/21 | $12,552 | $12,726 | $11,685 |

| 8/21 | $12,555 | $12,700 | $11,662 |

| 9/21 | $12,514 | $12,580 | $11,552 |

| 10/21 | $12,470 | $12,548 | $11,521 |

| 11/21 | $12,406 | $12,637 | $11,604 |

| 12/21 | $12,452 | $12,586 | $11,556 |

| 1/22 | $12,342 | $12,388 | $11,375 |

| 2/22 | $12,169 | $12,223 | $11,224 |

| 3/22 | $12,064 | $11,960 | $10,982 |

| 4/22 | $11,870 | $11,638 | $10,687 |

| 5/22 | $11,787 | $11,622 | $10,672 |

| 6/22 | $11,504 | $11,446 | $10,510 |

| 7/22 | $11,670 | $11,738 | $10,778 |

| 8/22 | $11,591 | $11,431 | $10,496 |

| 9/22 | $11,331 | $11,064 | $10,159 |

| 10/22 | $11,302 | $11,026 | $10,124 |

| 11/22 | $11,504 | $11,307 | $10,382 |

| 12/22 | $11,517 | $11,174 | $10,260 |

| 1/23 | $11,794 | $11,431 | $10,496 |

| 2/23 | $11,669 | $11,249 | $10,329 |

| 3/23 | $11,786 | $11,498 | $10,558 |

| 4/23 | $11,874 | $11,557 | $10,612 |

| 5/23 | $11,797 | $11,512 | $10,570 |

| 6/23 | $11,815 | $11,505 | $10,564 |

| 7/23 | $11,904 | $11,509 | $10,568 |

| 8/23 | $11,898 | $11,494 | $10,554 |

| 9/23 | $11,799 | $11,296 | $10,372 |

| 10/23 | $11,764 | $11,216 | $10,299 |

| 11/23 | $12,071 | $11,602 | $10,653 |

| 12/23 | $12,404 | $11,972 | $10,993 |

| 1/24 | $12,474 | $11,949 | $10,972 |

| 2/24 | $12,426 | $11,867 | $10,896 |

| 3/24 | $12,549 | $11,974 | $10,995 |

| 4/24 | $12,426 | $11,781 | $10,818 |

| 5/24 | $12,575 | $11,885 | $10,913 |

| 6/24 | $12,675 | $11,988 | $11,008 |

| 7/24 | $12,879 | $12,220 | $11,221 |

| 8/24 | $13,012 | $12,354 | $11,344 |

| 9/24 | $13,168 | $12,497 | $11,475 |

| 10/24 | $13,047 | $12,328 | $11,320 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class L | 10.91% | 1.81% | 2.70% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 2.12% |

Global Fixed Income Opportunities Blend IndexFootnote Reference1 | 9.92% | 0.33% | 1.25% |

| Footnote | Description |

Footnote1 | The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed rate debt markets with returns in unhedged USD) from the Fund’s inception to December 31, 2016 to the new benchmark represented by Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. It is not possible to invest directly in an index. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

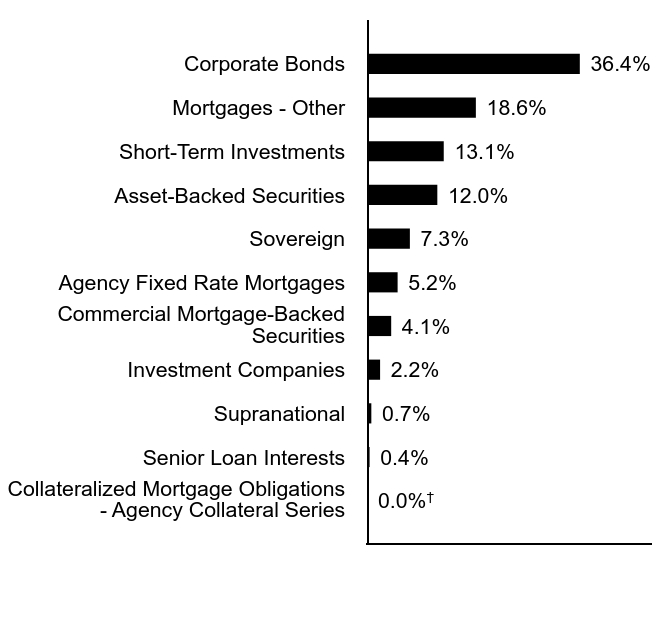

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about Morgan Stanley Global Fixed Income Opportunities Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $49 | 0.46% |

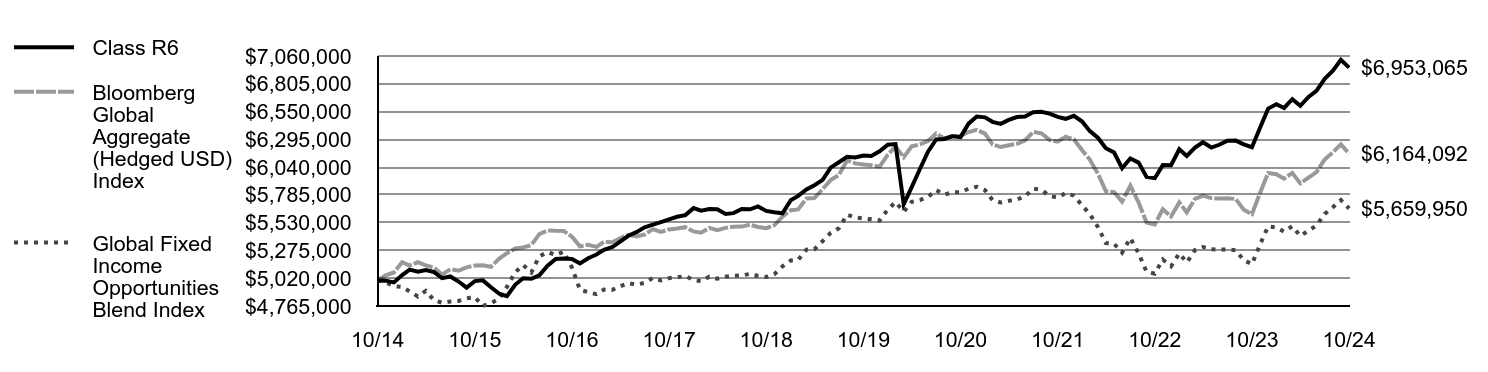

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Global Aggregate Hedged USD Index:

↑ Securitized debt exposure, particularly within non-agency residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS).

↑ Long exposure to investment grade and high yield corporate bonds as spreads tightened across the board.

↑ Long exposure to developed markets rates on the back of global government bonds rallying over the period, particularly within the U.S. and Canada. Higher “risk-free” rates continued to benefit performance.

↓ Emerging markets currency exposure, particularly long exposures to Dominican peso and Mexican peso.

↓ Short duration exposure to the U.K. for the majority of the period as yields marginally fell.

↓ Credit default swap exposure.

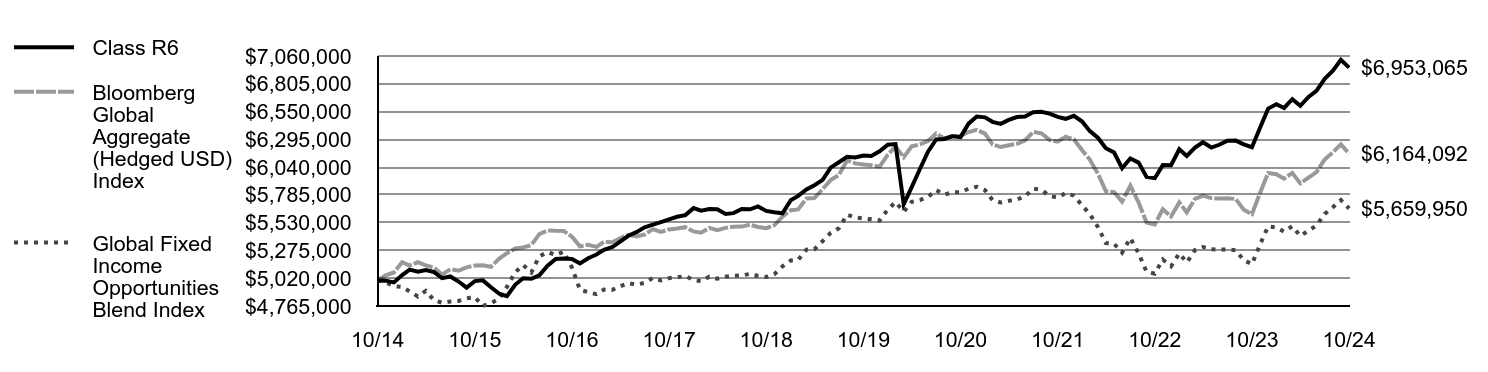

Comparison of the change in value of a $5,000,000 investment for the period indicated.

| | Bloomberg Global Aggregate (Hedged USD) Index | Global Fixed Income Opportunities Blend Index |

|---|

| 10/14 | $5,000,000 | $5,000,000 | $5,000,000 |

| 11/14 | $4,997,670 | $5,046,951 | $4,981,747 |

| 12/14 | $4,981,764 | $5,073,079 | $4,947,445 |

| 1/15 | $5,049,263 | $5,167,691 | $4,939,619 |

| 2/15 | $5,099,406 | $5,137,158 | $4,899,621 |

| 3/15 | $5,080,253 | $5,166,595 | $4,852,395 |

| 4/15 | $5,095,664 | $5,137,708 | $4,903,999 |

| 5/15 | $5,075,737 | $5,116,410 | $4,816,320 |

| 6/15 | $5,020,741 | $5,053,166 | $4,795,225 |

| 7/15 | $5,036,285 | $5,103,215 | $4,805,968 |

| 8/15 | $4,989,631 | $5,089,419 | $4,811,561 |

| 9/15 | $4,933,595 | $5,119,605 | $4,836,082 |

| 10/15 | $4,993,482 | $5,136,209 | $4,846,297 |

| 11/15 | $5,000,444 | $5,138,574 | $4,766,060 |

| 12/15 | $4,937,262 | $5,124,669 | $4,791,394 |

| 1/16 | $4,877,722 | $5,199,636 | $4,832,916 |

| 2/16 | $4,854,497 | $5,249,613 | $4,940,533 |

| 3/16 | $4,959,844 | $5,292,830 | $5,074,041 |

| 4/16 | $5,019,206 | $5,301,818 | $5,141,532 |

| 5/16 | $5,014,877 | $5,324,230 | $5,072,558 |

| 6/16 | $5,047,213 | $5,425,581 | $5,220,687 |

| 7/16 | $5,135,101 | $5,457,997 | $5,260,040 |

| 8/16 | $5,195,878 | $5,455,215 | $5,234,491 |

| 9/16 | $5,200,419 | $5,454,563 | $5,263,312 |

| 10/16 | $5,196,600 | $5,401,675 | $5,117,229 |

| 11/16 | $5,154,893 | $5,312,461 | $4,913,913 |

| 12/16 | $5,203,787 | $5,327,018 | $4,891,338 |

| 1/17 | $5,237,623 | $5,307,615 | $4,873,521 |

| 2/17 | $5,280,137 | $5,353,051 | $4,915,241 |

| 3/17 | $5,304,128 | $5,350,581 | $4,912,974 |

| 4/17 | $5,357,010 | $5,386,866 | $4,946,291 |

| 5/17 | $5,409,729 | $5,418,308 | $4,975,161 |

| 6/17 | $5,443,312 | $5,403,144 | $4,961,237 |

| 7/17 | $5,486,870 | $5,420,905 | $4,977,546 |

| 8/17 | $5,511,514 | $5,470,308 | $5,022,908 |

| 9/17 | $5,535,774 | $5,445,056 | $4,999,721 |

| 10/17 | $5,560,075 | $5,468,021 | $5,020,808 |

| 11/17 | $5,584,423 | $5,476,491 | $5,028,586 |

| 12/17 | $5,599,296 | $5,488,733 | $5,039,826 |

| 1/18 | $5,663,373 | $5,449,550 | $5,003,848 |

| 2/18 | $5,639,496 | $5,437,263 | $4,992,566 |

| 3/18 | $5,654,469 | $5,482,343 | $5,033,959 |

| 4/18 | $5,652,281 | $5,461,945 | $5,015,229 |

| 5/18 | $5,610,372 | $5,482,351 | $5,033,966 |

| 6/18 | $5,617,435 | $5,492,569 | $5,043,349 |

| 7/18 | $5,654,835 | $5,494,074 | $5,044,731 |

| 8/18 | $5,652,252 | $5,510,960 | $5,060,235 |

| 9/18 | $5,679,363 | $5,489,878 | $5,040,877 |

| 10/18 | $5,637,900 | $5,479,151 | $5,031,028 |

| 11/18 | $5,625,279 | $5,505,958 | $5,055,643 |

| 12/18 | $5,616,144 | $5,585,490 | $5,128,670 |

| 1/19 | $5,736,769 | $5,644,651 | $5,182,992 |

| 2/19 | $5,775,377 | $5,651,434 | $5,189,220 |

| 3/19 | $5,834,664 | $5,752,654 | $5,282,162 |

| 4/19 | $5,873,372 | $5,756,080 | $5,285,308 |

| 5/19 | $5,922,690 | $5,838,907 | $5,361,360 |

| 6/19 | $6,034,868 | $5,920,780 | $5,436,537 |

| 7/19 | $6,084,438 | $5,967,369 | $5,479,316 |

| 8/19 | $6,134,162 | $6,102,699 | $5,603,577 |

| 9/19 | $6,129,261 | $6,074,420 | $5,577,612 |

| 10/19 | $6,146,032 | $6,063,934 | $5,567,984 |

| 11/19 | $6,142,138 | $6,056,821 | $5,561,452 |

| 12/19 | $6,184,682 | $6,044,402 | $5,550,049 |

| 1/20 | $6,244,926 | $6,153,481 | $5,650,207 |

| 2/20 | $6,251,689 | $6,228,795 | $5,719,361 |

| 3/20 | $5,699,040 | $6,131,855 | $5,630,349 |

| 4/20 | $5,855,968 | $6,231,121 | $5,721,497 |

| 5/20 | $6,023,125 | $6,248,782 | $5,737,713 |

| 6/20 | $6,179,867 | $6,279,968 | $5,766,348 |

| 7/20 | $6,293,439 | $6,348,593 | $5,829,361 |

| 8/20 | $6,298,207 | $6,302,589 | $5,787,120 |

| 9/20 | $6,323,150 | $6,325,613 | $5,808,260 |

| 10/20 | $6,315,395 | $6,326,074 | $5,808,684 |

| 11/20 | $6,439,276 | $6,362,170 | $5,841,827 |

| 12/20 | $6,504,793 | $6,381,716 | $5,859,775 |

| 1/21 | $6,496,823 | $6,347,485 | $5,828,344 |

| 2/21 | $6,455,656 | $6,248,748 | $5,737,682 |

| 3/21 | $6,436,712 | $6,224,130 | $5,715,077 |

| 4/21 | $6,473,302 | $6,240,400 | $5,730,017 |

| 5/21 | $6,499,980 | $6,254,329 | $5,742,807 |

| 6/21 | $6,504,924 | $6,284,832 | $5,770,815 |

| 7/21 | $6,543,480 | $6,362,944 | $5,842,538 |

| 8/21 | $6,548,482 | $6,350,196 | $5,830,832 |

| 9/21 | $6,531,006 | $6,290,242 | $5,775,782 |

| 10/21 | $6,501,698 | $6,273,794 | $5,760,679 |

| 11/21 | $6,483,474 | $6,318,546 | $5,801,772 |

| 12/21 | $6,511,190 | $6,292,920 | $5,778,241 |

| 1/22 | $6,458,477 | $6,194,050 | $5,687,458 |

| 2/22 | $6,372,307 | $6,111,660 | $5,611,806 |

| 3/22 | $6,310,100 | $5,979,915 | $5,490,836 |

| 4/22 | $6,213,051 | $5,819,195 | $5,343,261 |

| 5/22 | $6,173,563 | $5,811,190 | $5,335,910 |

| 6/22 | $6,030,014 | $5,722,997 | $5,254,930 |

| 7/22 | $6,118,944 | $5,868,766 | $5,388,778 |

| 8/22 | $6,081,282 | $5,715,559 | $5,248,100 |

| 9/22 | $5,949,656 | $5,532,075 | $5,079,623 |

| 10/22 | $5,938,463 | $5,513,141 | $5,062,238 |

| 11/22 | $6,058,395 | $5,653,632 | $5,191,239 |

| 12/22 | $6,056,793 | $5,586,908 | $5,129,972 |

| 1/23 | $6,204,074 | $5,715,590 | $5,248,129 |

| 2/23 | $6,142,321 | $5,624,426 | $5,164,421 |

| 3/23 | $6,218,970 | $5,749,143 | $5,278,938 |

| 4/23 | $6,268,395 | $5,778,742 | $5,306,116 |

| 5/23 | $6,219,733 | $5,755,993 | $5,285,227 |

| 6/23 | $6,245,044 | $5,752,557 | $5,282,073 |

| 7/23 | $6,282,899 | $5,754,420 | $5,283,783 |

| 8/23 | $6,283,558 | $5,747,190 | $5,277,144 |

| 9/23 | $6,248,251 | $5,648,078 | $5,186,139 |

| 10/23 | $6,222,525 | $5,607,976 | $5,149,317 |

| 11/23 | $6,399,100 | $5,800,795 | $5,326,366 |

| 12/23 | $6,577,124 | $5,986,179 | $5,496,587 |

| 1/24 | $6,617,731 | $5,974,445 | $5,485,813 |

| 2/24 | $6,583,092 | $5,933,451 | $5,448,172 |

| 3/24 | $6,663,842 | $5,986,955 | $5,497,300 |

| 4/24 | $6,603,211 | $5,890,561 | $5,408,790 |

| 5/24 | $6,684,806 | $5,942,684 | $5,456,650 |

| 6/24 | $6,740,735 | $5,994,249 | $5,503,998 |

| 7/24 | $6,851,165 | $6,110,052 | $5,610,329 |

| 8/24 | $6,924,714 | $6,176,972 | $5,671,777 |

| 9/24 | $7,024,942 | $6,248,650 | $5,737,592 |

| 10/24 | $6,953,065 | $6,164,092 | $5,659,950 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 11.74% | 2.50% | 3.35% |

| Bloomberg Global Aggregate (Hedged USD) Index | 9.92% | 0.33% | 2.12% |

Global Fixed Income Opportunities Blend IndexFootnote Reference1 | 9.92% | 0.33% | 1.25% |

| Footnote | Description |

Footnote1 | The Global Fixed Income Opportunities Blend Index is a performance linked benchmark of the old benchmark represented by Bloomberg Global Aggregate Index (unhedged USD) (a benchmark that provides a broad-based measure of the global investment grade fixed rate debt markets with returns in unhedged USD) from the Fund’s inception to December 31, 2016 to the new benchmark represented by Bloomberg Global Aggregate (Hedged USD) Index for periods thereafter. It is not possible to invest directly in an index. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $788,752,575 |

| # of Portfolio Holdings | 408 |

| Portfolio Turnover Rate | 155% |

| Total Advisory Fees Paid | $2,482,642 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations - Agency Collateral Series | 0.0%Footnote Reference† |

| Senior Loan Interests | 0.4% |

| Supranational | 0.7% |

| Investment Companies | 2.2% |

| Commercial Mortgage-Backed Securities | 4.1% |

| Agency Fixed Rate Mortgages | 5.2% |

| Sovereign | 7.3% |

| Asset-Backed Securities | 12.0% |

| Short-Term Investments | 13.1% |

| Mortgages - Other | 18.6% |

| Corporate Bonds | 36.4% |

| Footnote | Description |

Footnote† | Amount is less than 0.05% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash & Equivalents | -0.2% |

| B or Below | 7.2% |

| Not Rated | 23.8% |

| BB | 8.3% |

| BBB | 28.3% |

| A | 12.1% |

| AA | 1.2% |

| AAA | 19.2% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

(b) Not applicable.

Item 2. Code of Ethics

The registrant has adopted a code of ethics (the "Code of Ethics") that applies to its Principal Executive Officer and Principal Financial Officer. The Registrant undertakes to provide a copy of such code of ethics to any person upon request, without charge, by calling 1 (212) 259-1155. The Registrant has not amended the code of ethics as described in Form N-CSR during the period covered by this report. The registrant has not granted any waiver, including an implicit waiver, from a provision of the code of ethics as described in Form N-CSR during the period covered by this report.

Item 3. Audit Committee Financial Expert

The registrant's Board of Trustees has determined that Jakki L. Haussler, an “independent” Trustee, is an “audit committee financial expert" serving on its audit committee. Under applicable securities laws, a person who is determined to be an audit committee financial expert will not be deemed an "expert" for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or the liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services

(a) – (d)

The following table presents the aggregate fees billed to the registrant for the registrant’s fiscal years ended October 31, 2023 and October 31, 2024 by the registrant’s principal accountant, Ernst & Young LLP, for professional services rendered for the audit of the registrant’s annual financial statements and fees billed for other services rendered by Ernst & Young LLP during those periods.

2024

| | | Registrant | | | Covered Entities(1) | |

| Audit Fees | | $ | 80,324 | | | $ | N/A | |

| Non-Audit Fees | | | | | | | | |

| Audit Related Fees | | $ | — | (2) | | $ | — | (2) |

| Tax Fees | | $ | — | (3) | | $ | — | (4) |

| All Other Fees | | $ | — | | | $ | 372,395 | (5) |

| Total Non-Audit Fees | | $ | — | | | $ | 372,395 | |

| | | | | | | | | |

| Total | | $ | 80,324 | | | $ | 372,395 | |

2023

| | | Registrant | | | Covered Entities(1) | |

| Audit Fees | | $ | 75,070 | | | $ | N/A | |

| Non-Audit Fees | | | | | | | | |

| Audit Related Fees | | $ | — | (2) | | $ | — | (2) |

| Tax Fees | | $ | — | (3) | | $ | — | (4) |

| All Other Fees | | $ | — | | | $ | 1,586,712 | (5) |

| Total Non-Audit Fees | | $ | — | | | $ | 1,586,712 | |

| | | | | | | | | |

| Total | | $ | 75,070 | | | $ | 1,586,712 | |

N/A – Not applicable, as not required by Item 4.

(1) Covered Entities include the Adviser (excluding sub-advisors) and any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Registrant.

(2) Audit-Related Fees represent assurance and related services provided that are reasonably related to the performance of the audit of the financial statements of the Covered Entities' and funds advised by the Adviser or its affiliates, specifically data verification and agreed-upon procedures related to asset securitizations and agreed-upon procedures engagements.

(3) Tax Fees represent tax compliance, tax planning and tax advice services provided in connection with the preparation and review of the Registrant’s tax returns.

(4) Tax Fees represent tax compliance, tax planning and tax advice services provided in connection with the review of Covered Entities' tax returns.

(5) The Fees included under “All Other Fees” are for services provided by Ernst & Young LLP related to surprise examinations for certain investment accounts to satisfy SEC Custody Rules and consulting services related to merger integration for sister entity to the Adviser.

(e)(1) The registrant’s audit committee has adopted policies and procedures relating to the pre-approval of services provided by the registrant’s principal accountant (the “Pre-Approval Policies”). The Pre-Approval Policies establish a framework intended to assist the audit committee in the proper discharge of its pre-approval responsibilities. As a general matter, the Pre-Approval Policies (i) specify certain types of audit, audit-related, tax, and other services determined to be pre-approved by the audit committee; and (ii) delineate specific procedures governing the mechanics of the pre-approval process, including the approval and monitoring of audit and non-audit service fees. Unless a service is specifically pre-approved under the Pre-Approval Policies, it must be separately pre-approved by the Audit Committee.

The Pre-Approval Policies and the types of audit and non-audit services pre-approved therein must be reviewed and ratified by the registrant’s audit committee at least annually. The registrant’s audit committee maintains full responsibility for the appointment, compensation, and oversight of the work of the registrant’s principal accountant.

(e)(2) No services described in paragraphs (b)-(d) above were approved by the registrant’s audit committee pursuant to the “de minimis exception” set forth in Rule 2-01 (c)(7)(i)(C) of Regulation S-X.

(f) Not applicable.

(g) See table above.

(h) The registrant’s audit committee has considered whether the provision by the registrant’s principal accountant of non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants

The registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act whose members are:

Nancy C. Everett, Eddie A. Grier and Jakki L. Haussler.

Item 6. Schedule of Investments

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

Morgan Stanley

Global Fixed Income

Opportunities Fund

Annual Financial Statements and Additional Information

October 31, 2024

Morgan Stanley Global Fixed Income Opportunities Fund

Table of Contents (unaudited)

This material must be preceded or accompanied by a prospectus for the fund being offered.

There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

2

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2024

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Corporate Bonds (37.9%) | |

| | | Australia (1.6%) | |

| | | Basic Materials | |

$ | 1,856 | | | Newcastle Coal Infrastructure Group Pty. Ltd. (a) | | | 4.40 | % | | 09/29/27 | | $ | 1,802,676 | | |

| | 1,912 | | | Newcastle Coal Infrastructure Group Pty. Ltd. (a) | | | 4.70 | | | 05/12/31 | | | 1,786,591 | | |

| | | | 3,589,267 | | |

| | | Consumer, Non-Cyclical | |

EUR | 1,405 | | | Transurban Finance Co. Pty. Ltd. | | | 4.225 | | | 04/26/33 | | | 1,591,833 | | |

| | | Finance | |

| | 2,630 | | | Australia & New Zealand Banking Group Ltd. | | | 5.101 | | | 02/03/33 | | | 2,975,306 | | |

$ | 4,000 | | | Westpac Banking Corp. | | | 2.668 | | | 11/15/35 | | | 3,419,643 | | |

| | | | 6,394,949 | | |

| | | Industrials | |

EUR | 1,200 | | | Sydney Airport Finance Co. Pty. Ltd. | | | 4.375 | | | 05/03/33 | | | 1,374,584 | | |

| | | | | Total Australia | | | | | | | 12,950,633 | | |

| | | Brazil (0.3%) | |

| | | Industrials | |

$ | 2,050 | | | MV24 Capital BV | | | 6.748 | | | 06/01/34 | | | 1,990,490 | | |

| | | Burkina Faso (0.3%) | |

| | | Basic Materials | |

| | 2,130 | | | IAMGOLD Corp. (a)(b) | | | 5.75 | | | 10/15/28 | | | 2,078,769 | | |

| | | Canada (0.4%) | |

| | | Consumer, Non-Cyclical | |

| | 1,370 | | | Garda World Security Corp. (a) | | | 6.00 | | | 06/01/29 | | | 1,285,115 | | |

| | | Utilities | |

| | 1,700 | | | Algonquin Power & Utilities Corp. (c) | | | 5.365 | | | 06/15/26 | | | 1,710,295 | | |

| | | | | Total Canada | | | | | | | 2,995,410 | | |

| | | China (0.2%) | |

| | | Communications | |

EUR | 1,600 | | | Prosus NV | | | 2.031 | | | 08/03/32 | | | 1,499,903 | | |

| | | Colombia (0.3%) | |

| | | Energy | |

$ | 2,220 | | | Ecopetrol SA | | | 8.875 | | | 01/13/33 | | | 2,282,191 | | |

See Notes to Financial Statements

3

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2024 continued

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Denmark (1.2%) | |

| | | Finance | |

EUR | 5,000 | | | Danske Bank AS | | | 1.375 | % | | 02/12/30 | | $ | 5,404,893 | | |

DKK | 26,317 | | | Realkredit Danmark AS | | | 4.00 | | | 10/01/56 | | | 3,817,092 | | |

| | | | | Total Denmark | | | | | | | 9,221,985 | | |

| | | France (4.7%) | |

| | | Communications | |

EUR | 3,500 | | | Orange SA | | | 5.00 | | | (d) | | | 3,914,676 | | |

| | | Consumer, Cyclical | |

| | 1,500 | | | RCI Banque SA | | | 5.50 | | | 10/09/34 | | | 1,664,747 | | |

| | | Consumer, Non-Cyclical | |

| | 1,700 | | | Cerba Healthcare SACA | | | 3.50 | | | 05/31/28 | | | 1,546,800 | | |

| | | Energy | |

| | 6,480 | | | TotalEnergies SE | | | 2.00 | | | (d) | | | 6,295,386 | | |

| | 1,330 | | | TotalEnergies SE | | | 3.25 | | | (d) | | | 1,288,500 | | |

| | | | 7,583,886 | | |

| | | Finance | |

| | 2,200 | | | AXA SA | | | 3.25 | | | 05/28/49 | | | 2,353,044 | | |

| | 2,000 | | | Banque Federative du Credit Mutuel SA | | | 5.125 | | | 01/13/33 | | | 2,317,767 | | |

$ | 2,200 | | | BNP Paribas SA (a) | | | 2.819 | | | 11/19/25 | | | 2,197,423 | | |

EUR | 3,600 | | | BPCE SA | | | 5.75 | | | 06/01/33 | | | 4,158,427 | | |

| | 2,000 | | | Credit Agricole SA | | | 2.625 | | | 03/17/27 | | | 2,152,371 | | |

| | 4,000 | | | Societe Generale SA | | | 1.00 | | | 11/24/30 | | | 4,225,010 | | |

| | | | 17,404,042 | | |

| | | Utilities | |

| | 2,000 | | | Electricite de France SA | | | 2.625 | | | (d) | | | 2,044,671 | | |

| | 2,400 | | | Engie SA | | | 4.75 | | | (d) | | | 2,686,594 | | |

| | 300 | | | Engie SA | | | 5.125 | | | (d) | | | 336,234 | | |

| | | | 5,067,499 | | |

| | | Total France | | | | | | | | | | | 37,181,650 | | |

| | | Germany (2.9%) | |

| | | Consumer, Cyclical | |

| | 600 | | | Volkswagen International Finance NV | | | 3.875 | | | (d) | | | 632,894 | | |

| | 2,000 | | | Volkswagen International Finance NV | | | 4.625 | | | (d) | | | 2,166,802 | | |

| | 1,700 | | | Volkswagen International Finance NV | | | 7.50 | | | (d) | | | 1,994,971 | | |

| | | | 4,794,667 | | |

See Notes to Financial Statements

4

Morgan Stanley Global Fixed Income Opportunities Fund

Portfolio of Investments ◼ October 31, 2024 continued

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Consumer, Non-Cyclical | |

EUR | 2,580 | | | Bayer AG | | | 4.625 | % | | 05/26/33 | | $ | 2,940,632 | | |

| | | Energy | |

| | 2,400 | | | Wintershall Dea Finance BV | | | 1.332 | | | 09/25/28 | | | 2,399,998 | | |

| | | Finance | |

| | 300 | | | Allianz SE | | | 2.121 | | | 07/08/50 | | | 298,786 | | |

| | 1,900 | | | Allianz SE | | | 5.824 | | | 07/25/53 | | | 2,306,446 | | |

$ | 2,375 | | | Deutsche Bank AG | | | 3.961 | | | 11/26/25 | | | 2,371,920 | | |

EUR | 1,000 | | | Deutsche Bank AG | | | 4.50 | | | 07/12/35 | | | 1,114,419 | | |

| | 1,900 | | | Muenchener Rueckversicherungs-Gesellschaft AG in

Muenchen | | | 3.25 | | | 05/26/49 | | | 2,028,025 | | |