UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

600 Steamboat Road,

Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203)299-3500

Date of fiscal year end: September 30

Date of reporting period: OCTOBER 1, 2019 – MARCH 31, 2020

(Semi-Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | SEMI-ANNUAL REPORT |

| | |

| | | AMG Funds March 31, 2020 |

| | |

|

| | |

| | | AMG Managers Brandywine Fund |

| | | Class I:BRWIX |

| | |

| | | AMG Managers Brandywine Blue Fund |

| | | Class I:BLUEX |

| | | |

| | | |

| | | |

| | | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary or, if you invest directly with the Funds, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1.800.548.4539 to inform the Funds that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Funds.

| | | | |

| amgfunds.com | | | | 033120 SAR073 |

| | |

| | | AMG Funds Semi-Annual Report — March 31, 2020(unaudited) |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | FUND PERFORMANCE | | | 4 | |

| | | |

| | | FUND SNAPSHOTS, ROSES AND THORNS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | 5 | |

| | | |

| | | AMG Managers Brandywine Fund | | | 5 | |

| | | |

| | | AMG Managers Brandywine Blue Fund | | | 9 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 13 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 14 | |

| | | |

| | | Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal period | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 15 | |

| | | |

| | | Detail of changes in assets for the past two fiscal periods | | | | |

| | | |

| | | Financial Highlights | | | 16 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 18 | |

| | | |

| | | Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| | | |

| | | FUNDS LIQUIDITY RISK MANAGEMENT PROGRAM | | | 23 | |

| | | | | | | |

|

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| | |

| | Letter to Shareholders |

DEAR FELLOW SHAREHOLDER:

The infamous achievements of major market barometers sum up the March quarter. It was the worst quarter since the waning months of the 2008 financial crisis for the S&P 500® Index. The Dow Jones Industrial Average declined more than it did in any quarter since 1987, when Black Monday left its mark on the closing quarter of that year. As far as first quarters go, it was just the worst.

Coronavirus-related fears stormed through the market, leaving virtually no shelter as investors repriced stocks in wholesale manner.

AMG Managers Brandywine Fund declined 18.95 percent in the three months through March. The Russell 3000® and Russell 3000® Growth Indexes declined 20.90 and 14.85 percent. AMG Managers Brandywine Blue Fund declined 15.13 percent in the quarter as the S&P 500®, Russell 1000® and Russell 1000® Growth Indexes declined 19.60, 20.22 and 14.10 percent.

Every economic sector in the benchmarks suffered declines, with the energy sector by far the hardest hit. A record-setting collapse in oil prices, triggered by a price war between Russia and Saudi Arabia and compounded by rapidly deteriorating economic conditions, decimated the energy sector’s outlook.

As fighting the pandemic prompted shutdowns,shelter-in-place orders and resource realignment, investors fled cyclical economic sectors. Record jobless claims further dampened expectations for companies in any way reliant on discretionary spending on the part of business or consumer customers.

Most “bright spots” were relative, meaning their declines were less pronounced than average. The consumer staples and health care sectors, where demand is generally static under most circumstances, fit that description.

While there were no exceptional sectors, there were companies that managed to navigate the mayhem thanks to characteristics that investors deemed exceptionally suited for the unusual conditions. Zoom Video Communications was one of those exceptions.

The video-first communications platform operator finished 2019 with about 10 million users of its service. As weeks wore on andstay-at-home advisories spread here and abroad, Zoom enjoyed a previously unimaginable opportunity to showcase its technology. By providing everyone from fitness instructors to corporate executives the means to meetface-to-face without occupying the same space, Zoom was able to grow its base of free and paid users to 200 million by the end of March.

For most companies, however, new restrictive measures were a curse. That was the overwhelming experience of holdings from the consumer discretionary sector, which generated some of the biggest percentage declines during the period.

Tempur Sealy International was a major detractor in both Funds. The bedding product maker came into the quarter with strong operational momentum, partly boosted by are-established relationship with Mattress Firm, a major retail outlet just over a year out of bankruptcy. During the quarter, Mattress Firm announced it would close stores, furlough employees and suspend benefits, among other moves. Tempur Sealy shares fell as it became clear that Mattress Firm and other retail channels for its products were questionable at best.

Consumer discretionary holdings represented the third largest portfolio position in both Funds. In Brandywine, they were the second biggest detractors from absolute performance and the biggest detractors from results relative to the Russell 3000® Growth Index. The third biggest return detractors in Brandywine Blue, they contributed to relative performance versus the Russell 1000® Growth Index.

Technology holdings, which comprised the biggest positions in both Funds, detracted the most from quarterly returns. They were the third and second most significant detractors from relative performance for Brandywine and Brandywine Blue, respectively. Apple was a notable detractor in both Funds. Investors grew concerned about demand trends as the company shuttered retail stores, beginning in China, which is a big market for iPhones.

Comprising the second largest position in both Funds, health care holdings were the third and second largest detractors from returns in Brandywine and Brandywine Blue. They weighed the second most on relative results for Brandywine and the most for Brandywine Blue. IQVIA Holdings, a contract research organization, detracted from performance in both Funds. Shares declined after the company warned about delays in research project timelines and disruptions in site operations among customers.

The financial sector generated a positive absolute return for Brandywine thanks primarily to eHealth, which boasts a combination of attributes that appear well-suited for the times. Health insurance security is an obvious concern amid the outbreak andface-to-face interactions, as we all know, are to be avoided. eHealth operates an online health insurance marketplace, with strong emphasis on Medicare-related plans.

For more information on holdings that influenced March-quarter results, please see Roses & Thorns on page 6 for Brandywine and page 10 for Brandywine Blue.

We’re acutely aware that the near-term environment is likely to be marked by continued volatility. We know that on each day we show up for work, whether in the office or remotely, we need to build on and challenge what we learned the day before. Based on our firm’s 46 years of experience, we also know that unique circumstances like these typically present rare opportunities to emerge better informed and, in time, whole.

In a March 31 article titled “Stocks Cheap After First-Quarter Plummet,” financial research firm Morningstar noted a swift reversal in its view of buying opportunities, writing “The market hasn’t been this heavily discounted in many years.”

Thanks for your confidence in our research-driven investment approach and the team that implements it to capitalize on the opportunities the market will present going forward. We wish you and your family good health.

Scott Gates

Chief Investment Officer

Friess Associates, LLC

2

|

About Your Fund’s Expenses(unaudited) |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution(12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first line of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

Six Months Ended March 31, 2020 | | Expense

Ratio for

the Period | | Beginning

Account

Value

10/01/19 | | Ending

Account

Value

03/31/20 | | Expenses

Paid

During

the Period* |

AMG Managers Brandywine Fund |

|

Based on Actual Fund Return |

| | | | |

Class I | | 1.11% | | $1,000 | | $881 | | $5.22 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 1.11% | | $1,000 | | $1,019 | | $5.60 |

AMG Managers Brandywine Blue Fund |

|

Based on Actual Fund Return |

| | | | |

Class I | | 1.16% | | $1,000 | | $923 | | $5.58 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class I | | 1.16% | | $1,000 | | $1,019 | | $5.86 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 366. |

3

|

Fund Performance(unaudited) Periods ended March 31, 2020 |

The table below shows the average annual total returns for the periods indicated for each Fund, as well as each Fund’s relative index for the same time periods ended March 31, 2020.

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | Six

Months* | | | One

Year | | | Five

Years | | | Ten Years | |

|

AMG Managers Brandywine Fund2, 3, 4, 5, 6, 7, 8 | |

Class I | | | (11.94 | %) | | | (12.54 | %) | | | 4.46 | % | | | 7.26 | % |

Russell 3000® Growth Index10 | | | (5.77 | %) | | | (0.44 | %) | | | 9.74 | % | | | 12.68 | % |

Russell 3000® Index11 | | | (13.70 | %) | | | (9.13 | %) | | | 5.77 | % | | | 10.15 | % |

S&P 500® Index12 | | | (12.31 | %) | | | (6.98 | %) | | | 6.73 | % | | | 10.53 | % |

|

AMG Managers Brandywine Blue Fund2, 3, 4, 5, 6, 8, 9 | |

Class I | | | (7.73 | %) | | | (2.50 | %) | | | 7.20 | % | | | 8.60 | % |

Russell 1000® Growth Index13 | | | (4.98 | %) | | | 0.91 | % | | | 10.36 | % | | | 12.97 | % |

Russell 1000® Index14 | | | (13.01 | %) | | | (8.03 | %) | | | 6.22 | % | | | 10.39 | % |

S&P 500® Index12 | | | (12.31 | %) | | | (6.98 | %) | | | 6.73 | % | | | 10.53 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Funds and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

* Not annualized.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Funds are net of expenses and based on the published NAV as of March 31, 2020. All returns are in U.S. dollars ($). |

| 2 | The Fund returns for all periods prior to October 1, 2013, reflect performance of the predecessor funds, Brandywine Fund and Brandywine Blue Fund, and were managed by Friess Associates, LLC with the same investment objective and substantially similar investment policies. |

| 3 | Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. |

| 4 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

| 5 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 6 | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. |

| 7 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| | |

| | | 8 The Fund is subject to risks associated with investments inmid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 9 A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. 10 The Russell 3000® Growth Index measures the performance of those Russell 3000® Index companies with higherprice-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 3000® Growth Index is unmanaged, is not available for investment and does not incur expenses. 11 The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment and does not incur expenses. 12 The S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the S&P 500® Index is unmanaged, is not available for investment and does not incur expenses. |

| | |

| | | 13 The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higherprice-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment and does not incur expenses. 14 The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the U.S. market. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment and does not incur expenses. |

| | | The Russell Indices are trademarks of the London Stock Exchange Group companies. The S&P 500® Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved. Not FDIC insured, nor bank guaranteed. May lose value. |

4

|

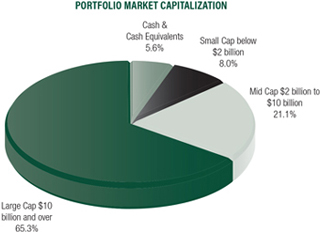

AMG Managers Brandywine Fund Fund Snapshots(unaudited) March 31, 2020 |

PORTFOLIO BREAKDOWN

| | | | | | | | |

| Industry (Top Ten) | | AMG

Managers

Brandywine

Fund1 | | | Russell

3000®

Growth

Index | |

Data Processing & Outsourced Services | | | 9.5 | % | | | 6.7 | % |

| | | |

Health Care Equipment | | | 6.8 | % | | | 3.3 | % |

| | | |

Application Software | | | 6.4 | % | | | 5.1 | % |

| | | |

Biotechnology | | | 6.4 | % | | | 4.0 | % |

| | | |

Semiconductors | | | 5.6 | % | | | 3.8 | % |

| | | |

Interactive Home Entertainment | | | 4.3 | % | | | 0.3 | % |

| | | |

Internet & Direct Marketing Retail | | | 4.2 | % | | | 6.6 | % |

| | | |

Packaged Foods & Meats | | | 3.8 | % | | | 0.4 | % |

| | | |

Pharmaceuticals | | | 3.2 | % | | | 3.8 | % |

| | | |

Technology Hardware, Storage & Peripherals | | | 3.1 | % | | | 7.8 | % |

| | | |

Other Common Stock | | | 41.1 | % | | | 58.2 | % |

| | | |

Short-Term Investments | | | 4.2 | % | | | 0.0 | % |

| | | |

Other Assets | | | 1.4 | % | | | 0.0 | % |

| 1 | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | | | | | |

| Security Name | | % of

Net Assets | | | % Change from

Book Cost | |

Amazon.com, Inc. | | | 4.2 | | | | 12.5 | |

| | | |

Tandem Diabetes Care, Inc. | | | 4.1 | | | | 29.0 | |

| | | |

NVIDIA Corp. | | | 3.4 | | | | (2.9 | ) |

| | | |

Apple, Inc. | | | 3.1 | | | | (20.0 | ) |

| | | |

Global Payments, Inc. | | | 3.1 | | | | 101.1 | |

| | | |

Visa, Inc., Class A | | | 2.9 | | | | 123.7 | |

| | | |

Electronic Arts, Inc. | | | 2.7 | | | | 2.2 | |

| | | |

Netflix, Inc. | | | 2.6 | | | | 4.1 | |

| | | |

Microsoft Corp. | | | 2.5 | | | | 0.1 | |

| | | |

The Home Depot, Inc. | | | 2.5 | | | | (12.3 | ) |

| | | | | | | | |

| | | |

Top Ten as a Group | | | 31.1 | | | | | |

| | | | | | | | |

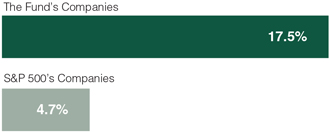

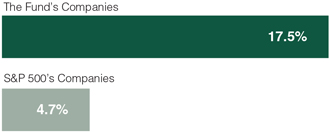

ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS

Forecasted Increase in Earnings Per Share 2020 vs 2019

Source: Consensus estimates from FactSet Research Systems Inc.

This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund. Earnings growth rates based on existing estimates on March 31. Widespread estimate reductions occurred in the time since amid deteriorating economic conditions related to theCOVID-19 crisis.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

5

|

AMG Managers Brandywine Fund Roses and Thorns(unaudited) Quarter Ending March 31, 2020 |

| | | | | | |

$ Gain

(in millions) | | % Gain | | | Biggest $ Winners Reason for Move |

| $7.0 | | | 40.1% | | | eHealth Inc. (EHTH) |

| | | | | | | The Internet-based health insurance agency earned $4.13 per share in the December quarter, exceeding the consensus estimate by 65 percent. Medicare-related applications increased 200 percent following significant investment in the company’s online enrollment platform over the past year. eHealth also issued better-than-expected 2020 guidance. Investors viewed the company’s online business model positively as social distancing measures went into effect. |

| $2.3 | | | 9.1% | | | Advanced Micro Devices Inc. (AMD) |

| | | | | | | The semiconductor maker earned $0.32 per share in the December quarter, up from $0.08 in theyear-ago period and ahead of the consensus estimate. Strength in the company’s Computing and Graphics segment drove a 50 percent increase in revenue. Leverage realized through progress in the production of AMD’s Ryzen mainstream computing and Rome server processors helped boost gross profit margins to 45 percent from 38 percent in the same quarter the year before. Guidance for 2020, which exceeded consensus expectations, forecasted accelerating revenue growth. |

| $2.0 | | | 12.0% | | | Vertex Pharmaceuticals Inc. (VRTX) |

| | | | | | | The small molecule drug developer exceeded December-quarter expectations with 31 percent earnings growth. Revenue climbed 63 percent to more than $1.4 billion. Investors applauded the early U.S. approval of the company’s breakthrough cystic fibrosis drug Trikafta, which generated $420 million in sales in the short window between the October 21 regulatory nod and the end of the quarter. Analysts expected $84 million in sales for the new drug. |

| $2.0 | | | 8.0% | | | Tandem Diabetes Care Inc. (TNDM). |

| | | | | | | The maker of insulin pumps for people with diabetes earned $0.04 per share in the December quarter, exceeding expectations for a loss. The company’s 2020 guidance was also better than expected. A pivotal trial for a competing product was suspended in March to correct a software anomaly. Meanwhile, the market share leader in the space is conducting a recall. Tandem drew positive attention as investors saw expanded opportunity for the company’s newControl-IQ in the fractured competitive landscape. |

| $2.0 | | | 11.4% | | | Domino’s Pizza Inc. (DPZ) |

| | | | | | | The company, consisting of more than 17,000 company-owned and franchised pizza stores in the U.S. and overseas, grew December-quarter earnings 19 percent, exceeding the consensus estimate. The period represented the 35th consecutive quarter of U.S. same-store sales growth and the 104th in its international business. As the world’s largest pizza chain, investors viewed the company’s delivery experience and infrastructure as assets asstay-at-home advisories increased demand for food delivery options. |

$Loss

(in millions) | | % Loss | | | Biggest $ Losers Reason for Move |

| $8.4 | | | 68.6% | | | Tempur Sealy International Inc. (TPX) |

| | | | | | | The bedding product maker grew December-quarter earnings 52 percent, exceeding the consensus estimate for the fourth consecutive quarter. Known for its higher-priced memory foam mattresses, shares fell as investors feared the company’s momentum would be disrupted by a falloff in demand. The company previously benefited from a recently renewed relationship with retailer Mattress Firm, which announced cost-cutting measures in March as the outbreak took a toll on customer traffic. |

| $7.5 | | | 47.9% | | | Taylor Morrison Home Corp. (TMHC) |

| | | | | | | The homebuilder earned $0.51 per share in the December quarter, up from $0.08 in theyear-ago period. Revenue increased 13 percent. A 42 percent increase in new sales orders was the highlight of the quarter, reflecting strength in all geographies. Shares declined on concerns about the balance sheet impact of an acquisition and potential disruption related to the pandemic. |

| $7.2 | | | 52.5% | | | Thor Industries Inc. (THO) |

| | | | | | | The recreational vehicle maker delivered mixed January-quarter results, with a modest earnings shortfall on better-than-expected revenue. Share price performance reflected emerging uncertainties related to the coronavirus outbreak, including likely spending restraint among consumers facing the possibility of a recession. Thor ultimately suspended production in late March amid concern for employees and the deteriorating backdrop. |

| $6.5 | | | 29.7% | | | Exact Sciences Corp. (EXAS) |

| | | | | | | The diagnostics company focused on the detection of colorectal cancer grew December-quarter earnings to $0.54 per share from a loss in theyear-ago period, exceeding the consensus estimate. Acquired during the quarter, Genomic Health was a significant contributor to results. Shares declined amid the widespread cancellation of routine medical visits as resources shifted to fight the coronavirus outbreak, potentially weighing on future testing volumes. |

| $6.1 | | | 20.4% | | | The Walt Disney Co. (DIS) |

| | | | | | | Although the entertainment and media company reported expectation-beating earnings and revenue for the December quarter, advisories discouraging and/or forbidding group gatherings prompted the company to shutter its global network of parks. Also, with sporting events suspended indefinitely, concerns grew about the related impact on ESPN viewership and advertising. |

All gains/losses are calculated on an average cost basis from December 31, 2019 through March 31, 2020. Companies still held at the end of the period appear in the accompanying Schedule of Portfolio Investments.

This commentary reflects the viewpoints of Friess Associates, LLC as of March 31, 2020, and is not intended as a forecast or guarantee of future results.

6

|

AMG Managers Brandywine Fund Schedule of Portfolio Investments(unaudited) March 31, 2020 |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Common Stocks - 94.4% | | | | | |

| |

| | Communication Services | | | | | |

| | |

| | | | Cable & Satellite - 1.5% | | | | | |

| | | |

| | 22,418 | | | Charter Communications, Inc., Class A* | | | $10,345,221 | | | | $9,781,197 | |

| | |

| | | | Interactive Home Entertainment - 4.3% | | | | | |

| | | |

| | 169,451 | | | Activision Blizzard, Inc. | | | 9,329,579 | | | | 10,078,946 | |

| | | |

| | 176,061 | | | Electronic Arts, Inc.* | | | 17,249,250 | | | | 17,636,030 | |

| | |

| | | | Interactive Media & Services - 2.9% | | | | | |

| | | |

| | 59,671 | | | Facebook, Inc., Class A* | | | 9,669,321 | | | | 9,953,123 | |

| | | |

| | 373,239 | | | Twitter, Inc.* | | | 12,258,691 | | | | 9,166,750 | |

| | |

| | | | Movies & Entertainment - 2.6% | | | | | |

| | | |

| | 45,945 | | | Netflix, Inc.* | | | 16,580,928 | | | | 17,252,347 | |

| | | | | | | | | | | | |

| | |

| | Total Communication Services | | | 75,432,990 | | | | 73,868,393 | |

| | |

| | | | This sector is 2.1% below your Fund’s cost. | | | | |

| | |

| | Consumer Discretionary | | | | | | | | |

| | |

| | | | General Merchandise Stores - 1.7% | | | | | |

| | | |

| | 118,827 | | | Target Corp. | | | 12,312,437 | | | | 11,047,346 | |

| | |

| | | | Home Improvement Retail - 2.5% | | | | | |

| | | |

| | 86,129 | | | The Home Depot, Inc. | | | 18,339,149 | | | | 16,081,146 | |

| | |

| | | | Internet & Direct Marketing Retail - 4.2% | | | | | |

| | | |

| | 14,023 | | | Amazon.com, Inc.* | | | 24,301,664 | | | | 27,340,923 | |

| | |

| | | | Restaurants - 1.5% | | | | | |

| | | |

| | 183,845 | | | Papa John’s International, Inc. | | | 9,868,873 | | | | 9,811,808 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Discretionary | | | 64,822,123 | | | | 64,281,223 | |

| | |

| | | | This sector is 0.8% below your Fund’s cost. | | | | |

| | |

| | Consumer Staples | | | | | | | | |

| | |

| | | | Hypermarkets & Super Centers - 1.4% | | | | | |

| | | |

| | 31,822 | | | Costco Wholesale Corp. | | | 6,932,047 | | | | 9,073,407 | |

| | |

| | | | Packaged Foods & Meats - 3.8% | | | | | |

| | | |

| | 384,147 | | | The Hain Celestial Group, Inc.*,1 | | | 9,592,285 | | | | 9,976,298 | |

| | | |

| | 29,760 | | | The Hershey Co. | | | 4,018,106 | | | | 3,943,200 | |

| | | |

| | 216,239 | | | Mondelez International, Inc., Class A | | | 12,879,947 | | | | 10,829,249 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Staples | | | 33,422,385 | | | | 33,822,154 | |

| | |

| | | | This sector is 1.2% above your Fund’s cost. | | | | |

| |

| | Financials | | | | | |

| | |

| | | | Financial Exchanges & Data - 1.7% | | | | | |

| | | |

| | 65,969 | | | CME Group, Inc. | | | 6,197,944 | | | | 11,406,700 | |

| | |

| | | | Insurance Brokers - 2.1% | | | | | |

| | | |

| | 97,615 | | | eHealth, Inc.*,1 | | | 3,530,623 | | | | 13,746,144 | |

| | | | | | | | | | | | |

| | |

| | Total Financials | | | 9,728,567 | | | | 25,152,844 | |

| | |

| | | | This sector is 158.5% above your Fund’s cost. | | | | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Health Care | | | | | |

| | |

| | | | Biotechnology - 6.4% | | | | | |

| | | |

| | 114,552 | | | ACADIA Pharmaceuticals, Inc.* | | | $4,867,104 | | | | $4,839,822 | |

| | | |

| | 183,398 | | | BioMarin Pharmaceutical, Inc.* | | | 16,507,248 | | | | 15,497,131 | |

| | | |

| | 197,719 | | | Exact Sciences Corp.*,1 | | | 16,472,923 | | | | 11,467,702 | |

| | | |

| | 41,298 | | | Vertex Pharmaceuticals, Inc.* | | | 8,672,115 | | | | 9,826,859 | |

| | |

| | | | Health Care Services - 2.5% | | | | | |

| | | |

| | 100,040 | | | Addus HomeCare Corp.* | | | 8,023,768 | | | | 6,762,704 | |

| | | |

| | 36,854 | | | Quest Diagnostics, Inc. | | | 3,248,275 | | | | 2,959,376 | |

| | | |

| | 745,472 | | | R1 RCM, Inc.* | | | 7,923,244 | | | | 6,776,341 | |

| | |

| | | | Health Care Equipment - 6.8% | | | | | |

| | | |

| | 84,687 | | | Abbott Laboratories | | | 4,869,982 | | | | 6,682,651 | |

| | | |

| | 106,556 | | | Hill-Rom Holdings, Inc. | | | 10,204,045 | | | | 10,719,534 | |

| | | |

| | 412,727 | | | Tandem Diabetes Care, Inc.* | | | 20,584,190 | | | | 26,558,982 | |

| | |

| | | | Life Sciences Tools & Services - 1.4% | | | | | |

| | | |

| | 32,617 | | | Thermo Fisher Scientific, Inc. | | | 5,572,949 | | | | 9,250,181 | |

| | |

| | | | Managed Health Care - 1.6% | | | | | |

| | | |

| | 41,983 | | | UnitedHealth Group, Inc. | | | 10,045,179 | | | | 10,469,721 | |

| | |

| | | | Pharmaceuticals - 3.2% | | | | | |

| | | |

| | 181,627 | | | Bristol-Myers Squibb Co. | | | 10,003,755 | | | | 10,123,889 | |

| | | |

| | 88,809 | | | Zoetis, Inc. | | | 12,146,650 | | | | 10,451,931 | |

| | | | | | | | | | | | |

| | |

| | Total Health Care | | | 139,141,427 | | | | 142,386,824 | |

| | |

| | | | This sector is 2.3% above your Fund’s cost. | | | | |

| |

| | Industrials | | | | | |

| | |

| | | | Aerospace & Defense - 1.6% | | | | | |

| | | |

| | 59,100 | | | L3Harris Technologies, Inc. | | | 12,403,563 | | | | 10,645,092 | |

| | |

| | | | Building Products - 2.3% | | | | | |

| | | |

| | 185,017 | | | Fortune Brands Home & Security, Inc. | | | 11,719,633 | | | | 8,001,985 | |

| | | |

| | 180,388 | | | Universal Forest Products, Inc. | | | 9,012,186 | | | | 6,708,630 | |

| | |

| | | | Research & Consulting Services - 1.4% | | | | | |

| | | |

| | 75,052 | | | FTI Consulting, Inc.* | | | 8,725,108 | | | | 8,988,978 | |

| | |

| | | | Trading Companies &

Distributors - 1.2% | | | | | |

| | | |

| | 443,722 | | | BMC Stock Holdings, Inc.* | | | 13,004,520 | | | | 7,867,191 | |

| | | | | | | | | | | | |

| | |

| | Total Industrials | | | 54,865,010 | | | | 42,211,876 | |

| | |

| | | | This sector is 23.1% below your Fund’s cost. | | | | |

| |

| | Information Technology | | | | | |

| | |

| | | | Application Software - 6.4% | | | | | |

| | | |

| | 45,070 | | | Adobe, Inc.* | | | 11,261,231 | | | | 14,343,077 | |

| | | |

| | 75,800 | | | salesforce.com, Inc.* | | | 11,837,726 | | | | 10,913,684 | |

| | | |

| | 670,983 | | | SVMK, Inc.* | | | 13,692,031 | | | | 9,064,980 | |

| | | |

| | 50,043 | | | Zoom Video Communications, Inc., Class A*,1 | | | 5,678,077 | | | | 7,312,283 | |

The accompanying notes are an integral part of these financial statements.

7

|

AMG Managers Brandywine Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Information Technology(continued) | | | | | |

| | |

| | | | Communications Equipment - 1.6% | | | | | |

| | | |

| | 140,190 | | | Lumentum Holdings, Inc.* | | | $7,086,237 | | | | $10,332,003 | |

| | |

| | | | Data Processing & Outsourced

Services - 9.5% | | | | | |

| | | |

| | 136,360 | | | Fiserv, Inc.* | | | 13,348,057 | | | | 12,952,836 | |

| | | |

| | 139,960 | | | Global Payments, Inc. | | | 10,039,962 | | | | 20,186,431 | |

| | | |

| | 39,602 | | | Mastercard, Inc., Class A | | | 6,992,037 | | | | 9,566,259 | |

| | | |

| | 119,890 | | | Visa, Inc., Class A1 | | | 8,635,439 | | | | 19,316,677 | |

| | |

| | | | Electronic Equipment &Instruments - 1.9% | | | | | |

| | | |

| | 143,783 | | | Keysight Technologies, Inc.* | | | 8,797,926 | | | | 12,031,762 | |

| | |

| | | | IT Consulting & Other

Services - 2.3% | | | | | |

| | | |

| | 161,740 | | | Booz Allen Hamilton Holding Corp. | | | 7,041,068 | | | | 11,101,834 | |

| | | |

| | 152,360 | | | Perficient, Inc.* | | | 6,684,476 | | | | 4,127,432 | |

| | |

| | | | Semiconductors - 5.6% | | | | | |

| | | |

| | 231,472 | | | Advanced Micro Devices, Inc.* | | | 6,487,312 | | | | 10,527,347 | |

| | | |

| | 82,574 | | | NVIDIA Corp. | | | 22,403,962 | | | | 21,766,506 | |

| | | |

| | 105,205 | | | Silicon Motion Technology Corp. ADR (Taiwan) | | | 4,876,502 | | | | 3,856,815 | |

| | |

| | | | Systems Software - 2.5% | | | | | |

| | | |

| | 103,233 | | | Microsoft Corp. | | | 16,262,193 | | | | 16,280,876 | |

| | |

| | | | Technology Hardware, Storage & Peripherals - 3.1% | | | | | |

| | | |

| | 80,502 | | | Apple, Inc. | | | 25,579,314 | | | | 20,470,854 | |

| | | | | | | | | | | | |

| | |

| | Total Information Technology | | | 186,703,550 | | | | 214,151,656 | |

| | |

| | | | This sector is 14.7% above your Fund’s

cost. | | | | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Materials | | | | | |

| | |

| | | | Fertilizers & Agricultural

Chemicals - 2.3% | | | | | |

| | | |

| | 142,775 | | | The ScottsMiracle-Gro Co. | | | $15,898,414 | | | | $14,620,160 | |

| | |

| | | | Gold- 0.6% | | | | | |

| | | |

| | 365,037 | | | SSR Mining, Inc.

(Canada)* | | | 5,956,852 | | | | 4,154,121 | |

| | | | | | | | | | | | |

| | |

| | Total Materials | | | 21,855,266 | | | | 18,774,281 | |

| | |

| | | | This sector is 14.1% below your Fund’s

cost. | | | | |

| | |

| | Total Common Stocks | | | 585,971,318 | | | | 614,649,251 | |

| |

| | Short-Term Investments - 4.2% | | | | | |

| |

| | Other Investment Companies - 4.2% | | | | | |

| | | |

| 9,087,045 | | | Dreyfus Government Cash Management Fund, Institutional Shares,

0.29%2 | | | 9,087,045 | | | | 9,087,045 | |

| | | |

| 9,087,045 | | | Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares,

0.39%2 | | | 9,087,045 | | | | 9,087,045 | |

| | | |

| 9,362,410 | | | JPMorgan U.S. Government Money Market Fund, IM Shares, 0.35%2 | | | 9,362,410 | | | | 9,362,410 | |

| | | |

| | | | Total Other Investment Companies | | | 27,536,500 | | | | 27,536,500 | |

| | | | | | | | | | | | |

| | |

| | Total Short-Term Investments | | | 27,536,500 | | | | 27,536,500 | |

| | |

| | Total Investments - 98.6% | | | 613,507,818 | | | | 642,185,751 | |

| | |

| | Other Assets, less Liabilities - 1.4% | | | | | | | 8,954,112 | |

| | |

| | Total Net Assets - 100.0% | | | | | | $ | 651,139,863 | |

| | | | | | | | | | | | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $47,946,933 or 7.4% of net assets, were out on loan to various borrowers and are collateralized by various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Yield shown represents the March 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of March 31, 2020:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Common Stocks† | | | $ | 614,649,251 | | | | | — | | | | | — | | | | $ | 614,649,251 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Other Investment Companies | | | | 27,536,500 | | | | | — | | | | | — | | | | | 27,536,500 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | $ | 642,185,751 | | | | | — | | | | | — | | | | $ | 642,185,751 | |

| | | | | | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the six months ended March 31, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

8

|

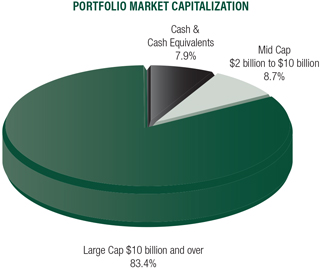

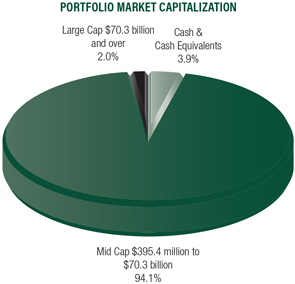

MG Managers Brandywine Blue Fund Fund Snapshots(unaudited) March 31, 2020 |

PORTFOLIO BREAKDOWN

| | | | | | | | | | |

| Industry (Top Ten) | | AMG

Managers

Brandywine

Blue Fund1 | | Russell 1000®

Growth

Index |

| | | |

Data Processing & Outsourced Services | | | | 11.4 | % | | | | 7.0 | % |

| | | |

Application Software | | | | 7.3 | % | | | | 5.1 | % |

| | | |

Biotechnology | | | | 6.7 | % | | | | 3.3 | % |

| | | |

Semiconductors | | | | 6.0 | % | | | | 3.9 | % |

| | | |

Interactive Home Entertainment | | | | 5.5 | % | | | | 0.3 | % |

| | | |

Internet & Direct Marketing Retail | | | | 4.2 | % | | | | 7.0 | % |

| | | |

Pharmaceuticals | | | | 4.1 | % | | | | 7.0 | % |

| | | |

Interactive Media & Services | | | | 4.1 | % | | | | 8.7 | % |

| | | |

Systems Software | | | | 3.6 | % | | | | 10.7 | % |

| | | |

Packaged Foods & Meats | | | | 3.1 | % | | | | 0.3 | % |

| | | |

Other Common Stock | | | | 36.1 | % | | | | 46.7 | % |

| | | |

Short-Term Investments | | | | 7.5 | % | | | | 0.0 | % |

| | | |

Other Assets | | | | 0.4 | % | | | | 0.0 | % |

| 1 | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | | | | | | | |

| Security Name | | % of

Net Assets | | % Change from

Book Cost |

| | | |

Amazon.com, Inc. | | | | 4.2 | | | | | 12.6 | |

| | | |

NVIDIA Corp. | | | | 3.8 | | | | | (1.9 | ) |

| | | |

Microsoft Corp. | | | | 3.6 | | | | | (3.7 | ) |

| | | |

Electronic Arts, Inc. | | | | 3.5 | | | | | (0.8 | ) |

| | | |

Visa, Inc., Class A | | | | 3.5 | | | | | 124.0 | |

| | | |

Global Payments, Inc. | | | | 3.5 | | | | | 100.7 | |

| | | |

Apple, Inc. | | | | 3.1 | | | | | (20.0 | ) |

| | | |

salesforce.com, Inc. | | | | 2.9 | | | | | (10.2 | ) |

| | | |

Netflix, Inc. | | | | 2.9 | | | | | 5.9 | |

| | | |

Adobe, Inc. | | | | 2.9 | | | | | 26.9 | |

| | | | | | | | | | |

Top Ten as a Group | | | | 33.9 | | | | | | |

| | | | | | | | | | |

ESTIMATED EARNINGS GROWTH RATE OF THE FUND’S INVESTMENTS

Forecasted Increase in Earnings Per Share 2020 vs 2019

Source: Consensus estimates from FactSet Research Systems Inc.

This is not a forecast of the Fund’s future performance. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund. Earnings growth rates based on existing estimates on March 31. Widespread estimate reductions occurred in the time since amid deteriorating economic conditions related to theCOVID-19 crisis.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

9

|

AMG Managers Brandywine Blue Fund Roses and Thorns(unaudited) Quarter Ending March 31, 2020 |

| | | | | | | | | | |

$ Gain

(in millions) | | | | % Gain | | | | Biggest $ Winners | | Reason for Move |

| | | | |

$0.6 | | | | 7.5% | | | | Advanced Micro Devices Inc. (AMD) |

| | | | | | | | | The semiconductor maker earned $0.32 per share in the December quarter, up from $0.08 in theyear-ago period and ahead of the consensus estimate. Strength in the company’s Computing and Graphics segment drove a 50 percent increase in revenue. Leverage realized through progress in the production of AMD’s Ryzen mainstream computing and Rome server processors helped boost gross profit margins to 45 percent from 38 percent in the same quarter the year before. Guidance for 2020, which exceeded consensus expectations, forecasted accelerating revenue growth. |

| | | | |

| $0.6 | | | | 12.0% | | | | Vertex Pharmaceuticals Inc. (VRTX) |

| | | | | | | | | The small molecule drug developer exceeded December-quarter expectations with 31 percent earnings growth. Revenue climbed 63 percent to more than $1.4 billion. Investors applauded the early U.S. approval of the company’s breakthrough cystic fibrosis drug Trikafta, which generated $420 million in sales in the short window between the October 21 regulatory nod and the end of the quarter. Analysts expected $84 million in sales for the new drug. |

| | | | |

| $0.5 | | | | 29.1% | | | | Zoom Video Communications Inc. (ZM) |

| | | | | | | | | The company, which provides a video conferencing and content sharing communications platform, earned $0.15 per share in the January quarter, up from a breakeven quarter in theyear-ago period and ahead of the consensus estimate. Revenue surged 78 percent. Enthusiasm grew regarding the potential for future results asshelter-in-place orders helped drive Zoom’s free and paid subscriber base to 200 million from 10 million in the first three months of 2020. |

| | | | |

| $0.5 | | | | 11.4% | | | | Domino’s Pizza Inc. (DPZ) |

| | | | | | | | | The company, consisting of more than 17,000 company-owned and franchised pizza stores in the U.S. and overseas, grew December-quarter earnings 19 percent, exceeding the consensus estimate. The period represented the 35th consecutive quarter of U.S. same-store sales growth and the 104th in its international business. As the world’s largest pizza chain, investors viewed the company’s delivery experience and infrastructure as assets asstay-at-home advisories increased demand for food delivery options. |

| | | | |

| $0.3 | | | | 4.0% | | | | Amazon.com Inc. (AMZN) |

| | | | | | | | | The online shopping service earned $6.47 per share in the December quarter versus a consensus estimate of $4.04. Revenue increased 21 percent to more than $87 billion as the company experienced record Prime membership growth. With extensive essential wares for sale online andfar-reaching delivery capabilities, investors viewed Amazon as a likely recipient of increased demand during the pandemic. |

| | | | | |

$ Loss

(in millions) | | | | % Loss | | | | Biggest $ Losers | | Reason for Move |

| | | | |

| $2.0 | | | | 31.3% | | | | Exact Sciences Corp. (EXAS) |

| | | | | | | | | The diagnostics company focused on the detection of colorectal cancer grew December-quarter earnings to $0.54 per share from a loss in theyear-ago period, exceeding the consensus estimate. Acquired during the quarter, Genomic Health was a significant contributor to results. Shares declined amid the widespread cancellation of routine medical visits as resources shifted to fight the coronavirus outbreak, potentially weighing on future testing volumes. |

| | | | |

| $1.8 | | | | 37.0% | | | | IQVIA Holdings Inc. (IQV) |

| | | | | | | | | The company, which provides contract research services to customers in the life sciences market, grew December-quarter earnings 16 percent, exceeding the consensus estimate. Shares declined after management advised that the coronavirus outbreak was increasingly delaying clinical trial timelines and impacting customer site operations in ways likely to constrict demand. |

| | | | |

| $1.7 | | | | 19.5% | | | | The Walt Disney Co. (DIS) |

| | | | | | | | | Although the entertainment and media company reported expectation-beating earnings and revenue for the December quarter, advisories discouraging and/or forbidding group gatherings prompted the company to shutter its global network of parks. Also, with sporting events suspended indefinitely, concerns grew about the related impact on ESPN viewership and advertising. |

| | | | |

| $1.4 | | | | 21.0% | | | | Global Payments Inc. (GPN) |

| | | | | | | | | The provider of electronic transaction processing technology solutions grew December-quarter earnings 22 percent, exceeding the consensus estimate. The company’s growth was aided by a merger with Total Systems Services, a combination expected to deliver costs synergies in 2020. Shares declined due to concerns about the company’s exposure to small and midsized businesses, which face hardships stemming from precautions taken to fight the spread of coronavirus. |

| | | | |

| $1.2 | | | | 19.8% | | | | Apple Inc. (APPL) |

| | | | | | | | | The provider of consumer electronics, software and online services grew December-quarter earnings 19 percent, exceeding the consensus estimate. Revenue climbed 9 percent on solid demand for Apple’s iPhone 11. Shares declined as the company closed retail stores in response to the pandemic, with closures starting in China, where Apple generates aboutone-fifth of its handset sales. |

All gains/losses are calculated on an average cost basis from December 31, 2019 through March 31, 2020. Companies still held at the end of the period appear in the accompanying Schedule of Portfolio Investments.

This commentary reflects the viewpoints of Friess Associates, LLC as of March 31, 2020, and is not intended as a forecast or guarantee of future results.

10

|

AMG Managers Brandywine Blue Fund Schedule of Portfolio Investments(unaudited) March 31, 2020 |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Common Stocks - 92.1% | | | | | |

| |

| | Communication Services | | | | | |

| | |

| | | | Cable & Satellite - 2.0% | | | | | |

| | | |

| | 7,450 | | | Charter Communications, Inc., Class A* | | | $3,437,947 | | | | $3,250,510 | |

| | |

| | | | Interactive Home Entertainment - 5.5% | | | | | |

| | | |

| | 51,678 | | | Activision Blizzard, Inc. | | | 2,846,961 | | | | 3,073,807 | |

| | | |

| | 55,576 | | | Electronic Arts, Inc.* | | | 5,613,969 | | | | 5,567,048 | |

| | |

| | | | Interactive Media & Services - 4.1% | | | | | |

| | | |

| | 21,000 | | | Facebook, Inc., Class A* | | | 3,402,922 | | | | 3,502,800 | |

| | | |

| | 118,282 | | | Twitter, Inc.* | | | 3,889,245 | | | | 2,905,006 | |

| | |

| | | | Movies & Entertainment - 2.9% | | | | | |

| | | |

| | 12,200 | | | Netflix, Inc.* | | | 4,326,292 | | | | 4,581,100 | |

| | | | | | | | | | | | |

| | |

| | Total Communication Services | | | 23,517,336 | | | | 22,880,271 | |

| | |

| | | | This sector is 2.7% below your Fund’s cost. | | | | |

| |

| | Consumer Discretionary | | | | | |

| | |

| | | | Footwear - 2.1% | | | | | |

| | | |

| | 38,800 | | | NIKE, Inc., Class B | | | 3,974,598 | | | | 3,210,312 | |

| | |

| | | | General Merchandise Stores - 1.9% | | | | | |

| | | |

| | 32,821 | | | Target Corp. | | | 3,437,586 | | | | 3,051,369 | |

| | |

| | | | Home Improvement Retail - 2.5% | | | | | |

| | | |

| | 20,692 | | | The Home Depot, Inc. | | | 4,562,378 | | | | 3,863,403 | |

| | |

| | | | Internet & Direct Marketing Retail - 4.2% | | | | | |

| | | |

| | 3,414 | | | Amazon.com, Inc.* | | | 5,911,773 | | | | 6,656,344 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Discretionary | | | 17,886,335 | | | | 16,781,428 | |

| | |

| | | | This sector is 6.2% below your Fund’s cost. | | | | |

| |

| | Consumer Staples | | | | | |

| | |

| | | | Hypermarkets & Super Centers - 1.8% | | | | | |

| | | |

| | 9,820 | | | Costco Wholesale Corp. | | | 2,140,276 | | | | 2,799,977 | |

| | |

| | | | Packaged Foods & Meats - 3.1% | | | | | |

| | | |

| | 11,661 | | | The Hershey Co. | | | 1,570,184 | | | | 1,545,082 | |

| | | |

| | 67,500 | | | Mondelez International, Inc., Class A | | | 4,020,455 | | | | 3,380,400 | |

| | | | | | | | | | | | |

| | |

| | Total Consumer Staples | | | 7,730,915 | | | | 7,725,459 | |

| | |

| | | | This sector is 0.1% below your Fund’s cost. | | | | |

| |

| | Financials | | | | | |

| | |

| | | | Financial Exchanges & Data - 2.1% | | | | | |

| | | |

| | 18,775 | | | CME Group, Inc. | | | 1,763,774 | | | | 3,246,385 | |

| | |

| | | | This sector is 84.1% above your Fund’s cost. | | | | |

| |

| | Health Care | | | | | |

| | |

| | | | Biotechnology - 6.7% | | | | | |

| | | |

| | 46,700 | | | BioMarin Pharmaceutical, Inc.* | | | 3,958,619 | | | | 3,946,150 | |

| | | |

| | 58,761 | | | Exact Sciences Corp.*,1 | | | 4,879,080 | | | | 3,408,138 | |

| | | |

| | 13,541 | | | Vertex Pharmaceuticals, Inc.* | | | 2,852,468 | | | | 3,222,081 | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| | |

| | | | Health Care Services - 0.5% | | | | | |

| | | |

| | 8,915 | | | Quest Diagnostics, Inc. | | | $862,429 | | | | $715,875 | |

| | |

| | | | Health Care Equipment - 1.0% | | | | | |

| | | |

| | 20,519 | | | Abbott Laboratories | | | 1,244,320 | | | | 1,619,154 | |

| | |

| | | | Life Sciences Tools & Services - 2.7% | | | | | |

| | | |

| | 15,250 | | | Thermo Fisher Scientific, Inc. | | | 3,112,829 | | | | 4,324,900 | |

| | |

| | | | Managed Health Care - 2.1% | | | | | |

| | | |

| | 13,017 | | | UnitedHealth Group, Inc. | | | 3,101,560 | | | | 3,246,180 | |

| | |

| | | | Pharmaceuticals - 4.1% | | | | | |

| | | |

| | 58,373 | | | Bristol-Myers Squibb Co. | | | 3,204,513 | | | | 3,253,711 | |

| | | |

| | 27,444 | | | Zoetis, Inc. | | | 3,756,326 | | | | 3,229,884 | |

| | | | | | | | | | | | |

| | |

| | Total Health Care | | | 26,972,144 | | | | 26,966,073 | |

| | |

| | | | This sector is less than 0.1% below your

Fund’s cost. | | | | |

| |

| | Industrials | | | | | |

| | |

| | | | Aerospace & Defense - 2.5% | | | | | |

| | | |

| | 22,400 | | | L3Harris Technologies, Inc. | | | 4,687,864 | | | | 4,034,688 | |

| | |

| | | | Building Products - 1.6% | | | | | |

| | | |

| | 56,915 | | | Fortune Brands Home & Security, Inc. | | | 3,597,731 | | | | 2,461,574 | |

| | | | | | | | | | | | |

| | |

| | Total Industrials | | | 8,285,595 | | | | 6,496,262 | |

| | |

| | | | This sector is 21.6% below your Fund’s cost. | | | | |

| |

| | Information Technology | | | | | |

| | |

| | | | Application Software - 7.3% | | | | | |

| | | |

| | 14,121 | | | Adobe, Inc.* | | | 3,541,076 | | | | 4,493,867 | |

| | | |

| | 32,050 | | | salesforce.com, Inc.* | | | 5,140,470 | | | | 4,614,559 | |

| | | |

| | 16,470 | | | Zoom Video Communications, Inc., Class A*,1 | | | 1,864,561 | | | | 2,406,596 | |

| | |

| | | | Data Processing & Outsourced

Services - 11.4% | | | | | |

| | | |

| | 41,420 | | | Fiserv, Inc.* | | | 4,111,354 | | | | 3,934,486 | |

| | | |

| | 37,520 | | | Global Payments, Inc. | | | 2,696,027 | | | | 5,411,510 | |

| | | |

| | 12,374 | | | Mastercard, Inc., Class A | | | 2,164,570 | | | | 2,989,063 | |

| | | |

| | 34,550 | | | Visa, Inc., Class A1 | | | 2,485,668 | | | | 5,566,696 | |

| | |

| | | | Electronic Equipment &

Instruments - 2.2% | | | | | |

| | | |

| | 41,640 | | | Keysight Technologies, Inc.* | | | 2,559,756 | | | | 3,484,435 | |

| | |

| | | | IT Consulting & Other Services - 2.8% | | | | | |

| | | |

| | 63,776 | | | Booz Allen Hamilton Holding Corp. | | | 3,134,855 | | | | 4,377,585 | |

| | |

| | | | Semiconductors - 6.0% | | | | | |

| | | |

| | 76,441 | | | Advanced Micro Devices, Inc.* | | | 2,166,570 | | | | 3,476,536 | |

| | | |

| | 22,948 | | | NVIDIA Corp. | | | 6,165,606 | | | | 6,049,093 | |

| | |

| | | | Systems Software - 3.6% | | | | | |

| | | |

| | 36,200 | | | Microsoft Corp. | | | 5,927,938 | | | | 5,709,102 | |

The accompanying notes are an integral part of these financial statements.

11

|

AMG Managers Brandywine Blue Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| |

| | Information Technology(continued) | | | | | |

| | |

| | | | Technology Hardware, Storage & Peripherals - 3.1% | | | | | |

| | | |

| | 19,058 | | | Apple, Inc. | | | $6,055,632 | | | | $4,846,259 | |

| | | | | | | | | | | | |

| | |

| | Total Information Technology | | | 48,014,083 | | | | 57,359,787 | |

| | |

| | | | This sector is 19.5% above your Fund’s

cost. | | | | |

| |

| | Materials | | | | | |

| | |

| | | | Fertilizers & Agricultural

Chemicals - 2.3% | | | | | |

| | | |

| | 34,781 | | | The ScottsMiracle-Gro Co. | | | 3,993,823 | | | | 3,561,574 | |

| | |

| | | | This sector is 10.8% below your Fund’s

cost. | | | | |

| | |

| | Total Common Stocks | | | 138,164,005 | | | | 145,017,239 | |

| |

| | Short-Term Investments - 7.5% | | | | | |

| |

| | Other Investment Companies - 7.5% | | | | | |

| | | |

| | 3,892,718 | | | Dreyfus Government Cash Management Fund, Institutional Shares, 0.29%2 | | | 3,892,718 | | | | 3,892,718 | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | Cost | | | Value | |

| | | |

| | 3,892,718 | | | Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.39%2 | | | $3,892,718 | | | | $3,892,718 | |

| | | |

| | 4,010,679 | | | JPMorgan U.S. Government Money Market Fund, IM Shares, 0.35%2 | | | 4,010,679 | | | | 4,010,679 | |

| | | |

| | | | Total Other Investment Companies | | | 11,796,115 | | | | 11,796,115 | |

| | | | | | | | | | | | |

| | |

| | Total Short-Term Investments | | | 11,796,115 | | | | 11,796,115 | |

| | |

| | Total Investments - 99.6% | | | 149,960,120 | | | | 156,813,354 | |

| | |

| | Other Assets, less Liabilities - 0.4% | | | | | | | 578,048 | |

| | |

| | Total Net Assets - 100.0% | | | | | | $ | 157,391,402 | |

| | | | | | | | | | | | |

| * | Non-income producing security. |

| 1 | Some of these securities, amounting to $11,267,469 or 7.2% of net assets, were out on loan to various borrowers and are collateralized by various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Yield shown represents the March 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of March 31, 2020:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks† | | | $ | 145,017,239 | | | | | — | | | | | — | | | | | $145,017,239 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

| | | | |

Other Investment Companies | | | | 11,796,115 | | | | | — | | | | | — | | | | | 11,796,115 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | $ | 156,813,354 | | | | | — | | | | | — | | | | $ | 156,813,354 | |

| | | | | | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the six months ended March 31, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

12

| | |

| | | Statement of Assets and Liabilities(unaudited) March 31, 2020 |

| | | |

| | | |

| | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | | AMG

Managers

Brandywine

Blue Fund | |

| | |

Assets: | | | | | | | | |

| | |

Investments at value1(including securities on loan valued at $47,946,933, and $11,267,469, respectively) | | | $642,185,751 | | | | $156,813,354 | |

| | |

Receivable for investments sold | | | 29,494,388 | | | | 5,510,582 | |

| | |

Dividend and interest receivables | | | 75,803 | | | | 33,426 | |

| | |

Securities lending income receivable | | | 6,918 | | | | 1,233 | |

| | |

Receivable for Fund shares sold | | | 3,361 | | | | 3,597 | |

| | |

Prepaid expenses and other assets | | | 28,026 | | | | 13,908 | |

| | |

Total assets | | | 671,794,247 | | | | 162,376,100 | |

| | |

Liabilities: | | | | | | | | |

| | |

Payable for investments purchased | | | 19,870,855 | | | | 4,774,698 | |

| | |

Payable for Fund shares repurchased | | | 56,822 | | | | 20,415 | |

| | |

Accrued expenses: | | | | | | | | |

| | |

Investment advisory and management fees | | | 509,256 | | | | 120,460 | |

| | |

Administrative fees | | | 86,805 | | | | 20,533 | |

| | |

Shareholder service fees | | | 14,467 | | | | 6,844 | |

| | |

Other | | | 116,179 | | | | 41,748 | |

| | |

Total liabilities | | | 20,654,384 | | | | 4,984,698 | |

| | | | | | | | |

| | |

Net Assets | | | $651,139,863 | | | | $157,391,402 | |

| | |

1Investments at cost | | | $613,507,818 | | | | $149,960,120 | |

| | |

Net Assets Represent: | | | | | | | | |

| | |

Paid-in capital | | | $625,471,820 | | | | $158,013,201 | |

| | |

Total distributable earnings (loss) | | | 25,668,043 | | | | (621,799 | ) |

| | |

Net Assets | | | $651,139,863 | | | | $157,391,402 | |

| | |

Class I: | | | | | | | | |

| | |

Net Assets | | | $651,139,863 | | | | $157,391,402 | |

| | |

Shares outstanding | | | 15,440,104 | | | | 3,902,454 | |

| | |

Net asset value, offering and redemption price per share | | | $42.17 | | | | $40.33 | |

The accompanying notes are an integral part of these financial statements.

13

| | |

| | | Statement of Operations(unaudited) For the six months ended March 31, 2020 |

| | | |

| | | |

| | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | | AMG

Managers

Brandywine

Blue Fund | |

| | |

Investment Income: | | | | | | | | |

| | |

Dividend income | | | $2,579,686 | | | | $757,562 | |

| | |

Interest income | | | 220,318 | | | | 76,073 | |

| | |

Securities lending income | | | 142,878 | | | | 7,828 | |

| | |

Total investment income | | | 2,942,882 | | | | 841,463 | |

| | |

Expenses: | | | | | | | | |

| | |

Investment advisory and management fees | | | 3,515,678 | | | | 821,846 | |

| | |

Administrative fees | | | 599,263 | | | | 140,087 | |

| | |

Shareholder servicing fees - Class I | | | 99,877 | | | | 46,696 | |

| | |

Transfer agent fees | | | 46,760 | | | | 6,894 | |

| | |

Professional fees | | | 41,622 | | | | 21,118 | |

| | |

Trustee fees and expenses | | | 35,477 | | | | 8,219 | |

| | |

Custodian fees | | | 33,884 | | | | 14,115 | |

| | |

Reports to shareholders | | | 29,325 | | | | 10,928 | |

| | |

Registration fees | | | 14,801 | | | | 13,033 | |

| | |

Miscellaneous | | | 12,411 | | | | 3,050 | |

| | |

Total expenses | | | 4,429,098 | | | | 1,085,986 | |

| | | | | | | | |

| | |

Net investment loss | | | (1,486,216 | ) | | | (244,523 | ) |

| | |

Net Realized and Unrealized Loss: | | | | | | | | |

| | |

Net realized gain on investments | | | 17,865,171 | | | | 12,582,808 | |

| | |

Net change in unrealized appreciation/depreciation on investments | | | (103,690,850 | ) | | | (24,624,397 | ) |

| | |

Net realized and unrealized loss | | | (85,825,679 | ) | | | (12,041,589 | ) |

| | | | | | | | |

| | |

Net decrease in net assets resulting from operations | | | $(87,311,895 | ) | | | $(12,286,112 | ) |

The accompanying notes are an integral part of these financial statements.

14

| | |

| | | Statements of Changes in Net Assets For the six months ended March 31, 2020 (unaudited) and the fiscal year ended September 30, 2019 |

| | | |

| | | |

| | | | | | | | | | | | | | | | |

| | | AMG

Managers

Brandywine Fund | | AMG

Managers

Brandywine Blue Fund |

| | | March 31, 2020 | | September 30, 2019 | | March 31, 2020 | | September 30, 2019 |

| | | | |

Decrease in Net Assets Resulting From Operations: | | | | | | | | | | | | | | | | |

| | | | |

Net investment loss | | | $(1,486,216 | ) | | | $(2,046,989 | ) | | | $(244,523 | ) | | | $(351,529 | ) |

| | | | |

Net realized gain on investments | | | 17,865,171 | | | | 60,047,241 | | | | 12,582,808 | | | | 23,261,222 | |

| | | | |

Net change in unrealized appreciation/depreciation on investments | | | (103,690,850 | ) | | | (109,350,378 | ) | | | (24,624,397 | ) | | | (24,677,744 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (87,311,895 | ) | | | (51,350,126 | ) | | | (12,286,112 | ) | | | (1,768,051 | ) |

| | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

| | | | |

Class I | | | (78,234,351 | ) | | | — | | | | (24,116,514 | ) | | | (18,414,046 | ) |

| | | | |

Capital Share Transactions:1 | | | | | | | | | | | | | | | | |

| | | | |

Net increase (decrease) from capital share transactions | | | 30,537,355 | | | | (55,802,477 | ) | | | 11,549,663 | | | | 5,426,761 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total decrease in net assets | | | (135,008,891 | ) | | | (107,152,603 | ) | | | (24,852,963 | ) | | | (14,755,336 | ) |

| | | | |

Net Assets: | | | | | | | | | | | | | | | | |

| | | | |

Beginning of period | | | 786,148,754 | | | | 893,301,357 | | | | 182,244,365 | | | | 196,999,701 | |

| | | | |

End of period | | | $651,139,863 | | | | $786,148,754 | | | | $157,391,402 | | | | $182,244,365 | |

1See Note 1(g) of the Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements.

15

| | |

| | | AMG Managers Brandywine Fund Financial Highlights For a share outstanding throughout each fiscal period |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I | | For the six

months ended

March 31, 2020

(unaudited) | | For the fiscal years ended September 30, |

| | 2019 | | 2018 | | 20171 | | 2016 | | 2015 |

| | | | | | |

Net Asset Value, Beginning of Period | | | | $52.89 | | | | | $56.01 | | | | | $44.48 | | | | | $37.42 | | | | | $34.54 | | | | | $33.25 | |

| | | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)2 | | | | (0.10 | ) | | | | (0.13 | ) | | | | (0.21 | )3 | | | | (0.17 | )3,4 | | | | (0.08 | )3,5 | | | | 0.04 | 3,6 |

| | | | | | | |

Net realized and unrealized gain (loss) on investments | | | | (5.26 | ) | | | | (2.99 | ) | | | | 11.74 | | | | | 7.23 | | | | | 2.96 | | | | | 1.25 | |

| | | | | | |

Total income (loss) from investment operations | | | | (5.36 | ) | | | | (3.12 | ) | | | | 11.53 | | | | | 7.06 | | | | | 2.88 | | | | | 1.29 | |

| | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net realized gain on investments | | | | (5.36 | ) | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | |

| | | | | | |

Net Asset Value, End of Period | | | | $42.17 | | | | | $52.89 | | | | | $56.01 | | | | | $44.48 | | | | | $37.42 | | | | | $34.54 | |

| | | | | | |

Total Return7 | | | | (11.94 | )%8 | | | | (5.57 | )% | | | | 25.92 | %3 | | | | 18.87 | %3 | | | | 8.34 | %3 | | | | 3.88 | %3 |

| | | | | | |

Ratio of net expenses to average net assets | | | | 1.11 | %9 | | | | 1.10 | % | | | | 1.10 | % | | | | 1.11 | % | | | | 1.11 | % | | | | 1.10 | % |

| | | | | | |

Ratio of gross expenses to average net assets | | | | 1.11 | %9 | | | | 1.10 | % | | | | 1.10 | %10 | | | | 1.12 | %10 | | | | 1.11 | %10 | | |

| 1.10

| %10

|

| | | | | | |

Ratio of net investment income (loss) to average net assets | | | | (0.37 | )%9 | | | | (0.26 | )% | | | | (0.43 | )%3 | | | | (0.43 | )%3 | | | | (0.24 | )%3 | | |

| 0.10

| %3

|

| | | | | | |

Portfolio turnover | | | | 100 | %8 | | | | 145 | % | | | | 138 | % | | | | 187 | % | | | | 185 | % | | | | 190 | % |

| | | | | | |

Net assets end of period (000’s) omitted | | | | $651,140 | | | | | $786,149 | | | | | $893,301 | | | | | $771,474 | | | | | $720,766 | | | | | $759,185 | |

| 1 | Effective February 27, 2017, the Fund’s Class S shares were renamed to Class I shares. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 4 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.22). |

| 5 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.10). |

| 6 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.07). |

| 7 | The total return is calculated using the published Net Asset Value as of period end. |

| 10 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments andnon-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

16

| | |

| | | AMG Managers Brandywine Blue Fund Financial Highlights For a share outstanding throughout each fiscal period |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I | | For the six

months ended

March 31, 2020

(unaudited) | | For the fiscal years ended September 30, |

| | 2019 | | 2018 | | 20171 | | 2016 | | 2015 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net Asset Value, Beginning of Period | | | | $49.78 | | | | | $56.64 | | | | | $45.69 | | | | | $36.87 | | | | | $33.95 | | | | | $33.51 | |

| | | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)2 | | | | (0.06 | ) | | | | (0.10 | ) | | | | (0.24 | ) | | | | (0.12 | )3 | | | | (0.02 | )4 | | | | 0.10 | 5 |

| | | | | | | |

Net realized and unrealized gain (loss) on investments | | | | (2.87 | ) | | | | (1.40 | ) | | | | 11.19 | | | | | 8.94 | | | | | 3.02 | | | | | 0.34 | |

| | | | | | |

Total income (loss) from investment operations | | | | (2.93 | ) | | | | (1.50 | ) | | | | 10.95 | | | | | 8.82 | | | | | 3.00 | | | | | 0.44 | |

| | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | | — | | | | | — | | | | | — | | | | | — | | | | | (0.08 | ) | | | | — | |

| | | | | | |

Net realized gain on investments | | | | (6.52 | ) | | | | (5.36 | ) | | | | — | | | | | — | | | | | — | | | | | — | |

| | | | | | |

Total distributions to shareholders | | | | (6.52 | ) | | | | (5.36 | ) | | | | — | | | | | — | | | | | (0.08 | ) | | | | — | |

| | | | | | |

Net Asset Value, End of Period | | | | $40.33 | | | | | $49.78 | | | | | $56.64 | | | | | $45.69 | | | | | $36.87 | | | | | $33.95 | |

| | | | | | |

Total Return6 | | | | (7.73 | )%7 | | | | (0.17 | )% | | | | 23.97 | % | | | | 23.92 | % | | | | 8.86 | % | | | | 1.31 | % |

| | | | | | |

Ratio of expenses to average net assets | | | | 1.16 | %8 | | | | 1.15 | % | | | | 1.16 | % | | | | 1.20 | % | | | | 1.20 | % | | | | 1.20 | % |

| | | | | | |

Ratio of net investment income (loss) to average net assets | | | | (0.26 | )%8 | | | | (0.20 | )% | | | | (0.47 | )% | | | | (0.29 | )% | | | | (0.05 | )% | | | | 0.29 | % |

| | | | | | |

Portfolio turnover | | | | 89 | %7 | | | | 135 | % | | | | 122 | % | | | | 167 | % | | | | 139 | % | | | | 156 | % |

| | | | | | |

Net assets end of period (000’s) omitted | | | | $157,391 | | | | | $182,244 | | | | | $197,000 | | | | | $172,454 | | | | | $156,953 | | | | | $169,180 | |

| 1 | Effective February 27, 2017, the Fund’s Class S shares were renamed to Class I shares. |

| 2 | Per share numbers have been calculated using average shares. |

| 3 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.18). |

| 4 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.04). |

| 5 | Includesnon-recurring dividends. Without these dividends, net investment loss per share would have been $(0.08). |

| 6 | The total return is calculated using the published Net Asset Value as of period end. |

17

| | |

| | | Notes to Financial Statements(unaudited) March 31, 2020 |

| | | |

| | | |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES