UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-06526

Boston Trust Walden Funds

(Exact name of registrant as specified in charter)

One Beacon Street

Boston, MA 02108

(Address of principal executive offices) (Zip code)

50 South La Salle Street

Chicago, IL 60603

(Name and address of agent for service)

1-800-282-8782

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a)

Annual Report

December 31, 2023

| Boston Trust Asset Management Fund | Boston Trust Walden Balanced Fund |

| Boston Trust Equity Fund | Boston Trust Walden Equity Fund |

| Boston Trust Midcap Fund | Boston Trust Walden Midcap Fund |

| Boston Trust SMID Cap Fund | Boston Trust Walden SMID Cap Fund |

| | Boston Trust Walden Small Cap Fund |

| | Boston Trust Walden International Equity Fund |

Important Update for Shareholders: New Reporting Format from July 2024

Starting July 2024, you will receive a streamlined shareholder report. This concise report will cover key fund details, including expense data, performance metrics, and other essential statistics.

Prefer the report in digital format? Easy instructions are available on the back cover of this report for opting in for e-delivery.

For those interested, more detailed information, such as the Fund’s financial statements, will be accessible online. You also can request that a free copy be sent to you in either paper or electronic format.

| Table of Contents | Annual Report |

| | December 31, 2023 |

| Boston Trust Asset Management Fund | |

| Manager Commentary | 2 |

| Investment Performance | 3 |

| Schedule of Portfolio Investments | 8 |

| Financial Statements | 10 |

| Financial Highlights | 12 |

| | |

| Boston Trust Equity Fund | |

| Manager Commentary | 2 |

| Investment Performance | 3 |

| Schedule of Portfolio Investments | 13 |

| Financial Statements | 14 |

| Financial Highlights | 16 |

| | |

| Boston Trust Midcap Fund | |

| Manager Commentary | 4 |

| Investment Performance | 5 |

| Schedule of Portfolio Investments | 17 |

| Financial Statements | 19 |

| Financial Highlights | 21 |

| | |

| Boston Trust SMID Cap Fund | |

| Manager Commentary | 6 |

| Investment Performance | 7 |

| Schedule of Portfolio Investments | 22 |

| Financial Statements | 24 |

| Financial Highlights | 26 |

| | |

| Annual ESG Report | 27 |

| | |

| Boston Trust Walden Balanced Fund | |

| Manager Commentary | 28 |

| Investment Performance | 29 |

| Schedule of Portfolio Investments | 38 |

| Financial Statements | 40 |

| Financial Highlights | 42 |

| | |

| Boston Trust Walden Equity Fund | |

| Manager Commentary | 28 |

| Investment Performance | 29 |

| Schedule of Portfolio Investments | 43 |

| Financial Statements | 44 |

| Financial Highlights | 46 |

| | |

| Boston Trust Walden Midcap Fund | |

| Manager Commentary | 30 |

| Investment Performance | 31 |

| Schedule of Portfolio Investments | 47 |

| Financial Statements | 49 |

| Financial Highlights | 51 |

| | |

| Boston Trust Walden SMID Cap Fund | |

| Manager Commentary | 32 |

| Investment Performance | 33 |

| Schedule of Portfolio Investments | 52 |

| Financial Statements | 53 |

| Financial Highlights | 55 |

| | |

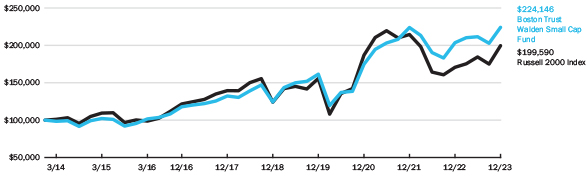

| Boston Trust Walden Small Cap Fund | |

| Manager Commentary | 34 |

| Investment Performance | 35 |

| Schedule of Portfolio Investments | 56 |

| Financial Statements | 58 |

| Financial Highlights | 60 |

| | |

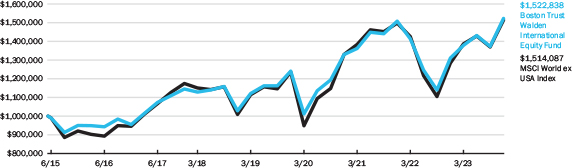

| Boston Trust Walden International Equity Fund | |

| Manager Commentary | 36 |

| Investment Performance | 37 |

| Schedule of Portfolio Investments | 61 |

| Financial Statements | 63 |

| Financial Highlights | 65 |

| | |

| Notes to the Financial Statements | 66 |

| Report of Independent Registered Public Accounting Firm | 75 |

| Supplementary Information | 76 |

| Investment Adviser Contract Approval | 83 |

| Information about Trustees and Officers | 85 |

Boston Trust Walden Inc., a subsidiary of Boston Trust Walden Company, serves as investment adviser (the “Adviser”) to the Boston Trust Walden Funds and receives a fee for its services. Boston Trust Walden Company provides certain administrative, operational, and investment support functions for the Adviser and is paid a fee for these services by the Adviser.

Shares of the Funds are not deposits of, obligations of, or guaranteed by Boston Trust Walden Company or its affiliates, nor are they federally insured by the FDIC. Investments in the Funds involve investment risks, including the possible loss of principal. Funds are distributed by Foreside Financial Services, LLC.

The foregoing information and opinions are for general information only. The Boston Trust Walden Funds and Boston Trust Walden Company do not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only, and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice. Portfolio composition is as of December 31, 2023 and is subject to change without notice.

The Boston Trust Walden Funds may invest in foreign securities, which may involve risk not typically associated with U.S. investments.

The Funds’ ESG integration and, as applicable, values based screening could cause the Funds to avoid investments that may result in the Funds underperforming similar funds without comparable ESG Policies.

Boston Trust Asset Management Fund Boston Trust Equity Fund December 31, 2023 Amy Crandall Kaser, CFP® Co-Portfolio Manager Jason T. O’Connell, CFA, CAIA, CFP® Co-Portfolio Manager Boston Trust Walden Inc. Asset Management Fund Objective The Fund seeks long-term capital growth and income through an actively managed portfolio of stocks, bonds and money market instruments. Equity Fund Objective The Fund seeks long-term growth of capital through an actively managed portfolio of stocks. Investment Concerns Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities. Foreign investing involves risks not typically associated with U.S. investments, including adverse political, social and economic developments and differing auditing and legal standards. These risks are magnified in emerging markets. Small- to mid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Intermediate-term, higher quality bonds generally offer less risk than longer-term bonds and a lower rate of return. Cash equivalents offer low risk and low return potential. | Manager Commentary (Unaudited) Management Discussion of Fund Performance Stocks closed a strikingly strong year with most of the primary indices registering gains well into the double-digits in 2023. The S&P 500 Index led the way with a more than 26% return for the calendar year. The Index’s impressive gains were driven, in large part, by just a small group of technology-oriented companies thought to have outsized growth prospects well into the future. Dubbed the Magnificent Seven by the financial media, the group consists of Alphabet (Google) Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla. At points during the year, those seven companies accounted for a near 30% weight in the S&P 500 and thoroughly dominated its performance to the extent that they were collectively responsible for 99% of the Index’s return through the month of October. Notably, the average stock in the Index had a far different experience, advancing a still healthy but comparatively mild 13.8% for the year. Gains became far more broad-based later in the year, with a larger, more diverse set of businesses taking part in the continued market rally. The bond market experienced volatility throughout the year, precipitated by the Federal Reserve’s aggressive policy maneuvers to curb inflation. However, the moves in US government bond yields largely amounted to a round trip by year-end, meaning that investors holding such bonds throughout the period earned a return approximately equal to the income. The broader bond markets, which include non-government securities, fared better as investors were compensated for taking on credit risk that began to appear less severe amidst stronger than anticipated economic data and an end to rate increases by the Federal Reserve. Boston Trust Asset Management Fund and Boston Trust Equity Fund Both delivered substantial but comparatively muted gains in 2023. For the full year, the Funds' values advanced 13.72% and 17.29%, respectively. During the year, the Boston Trust Asset Management Fund's performance was supported by its higher-than-average allocation to equities. However, while the equity holdings in both funds delivered strong absolute returns, on average, those securities trailed the S&P 500 benchmark given the team’s decision not to veer from its diversification and valuation disciplines. Similarly, the relatively conservative tack taken in the Boston Trust Asset Management Fund's fixed income segment led to a positive result but did not meet the return of the broader indices, which generally carry more credit risk and interest rate sensitivity. We begin 2024 with improved business conditions versus a year ago: inflation is down, a historic interest hiking cycle is behind us, and the labor market and consumer spending remain reasonably healthy. Furthermore, the Federal Reserve’s indications that it may be in a position to reverse course to a more accommodative interest rate policy increases our confidence that the US has sidestepped a deep or prolonged recession. With that economic backdrop and the select availability of sound businesses whose shares do not imply overly optimistic outcomes, the Boston Trust Asset Mangement Fund’s asset allocation remains tilted in favor of equities. Of course, plenty of macroeconomic and geopolitical uncertainty remains. Therefore, the Fund’s fixed income segment is designed to play the important role of providing ballast against not only the inherent volatility in stocks but also should the presently benign economic conditions deteriorate, or an exogenous event undermine investor confidence.* * Portfolio composition is subject to change. |

| Investment Performance (Unaudited) | Boston Trust Asset Management Fund |

| | Boston Trust Equity Fund |

| | December 31, 2023 |

| | For the periods ended 12/31/23 |

| | Average Annual Total Returns |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | 20 Years | Since Inception (12/1/95) | Since Inception (10/1/03) |

| Boston Trust Asset Management Fund | 13.72% | 5.69% | 9.88% | 8.17% | 9.38% | 7.60% | 8.10% | — |

| Boston Trust Equity Fund | 17.29% | 9.32% | 14.54% | 10.85% | 12.51% | 9.16% | — | 9.48% |

| S&P 500 Total Return Index | 26.29% | 10.00% | 15.69% | 12.03% | 13.97% | 9.69% | 9.64% | 10.07% |

| Bloomberg U.S. Government/Credit Bond Index | 5.72% | -3.53% | 1.41% | 1.97% | 2.77% | 3.24% | 4.30% | 3.19% |

| FTSE 3-Month U.S. Treasury Bill Index | 5.26% | 2.24% | 1.91% | 1.26% | 0.87% | 1.42% | 2.19% | 1.42% |

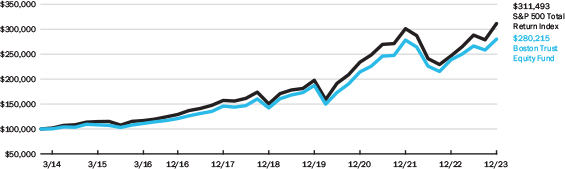

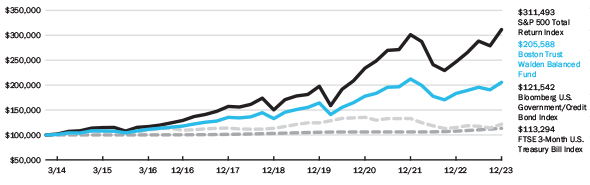

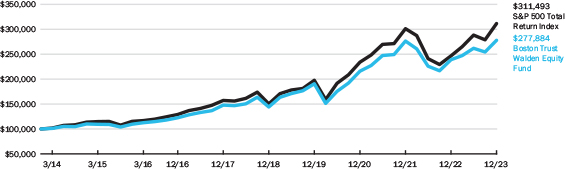

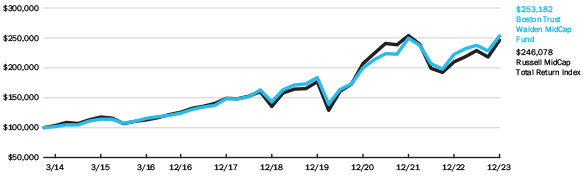

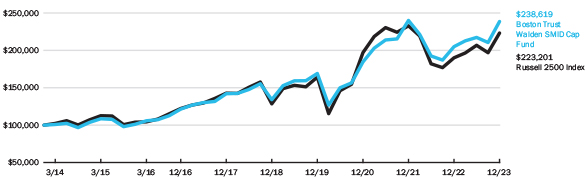

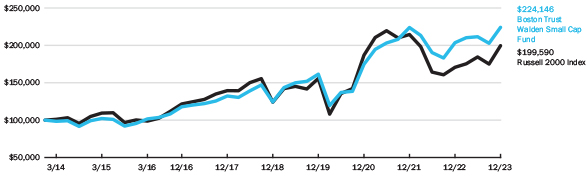

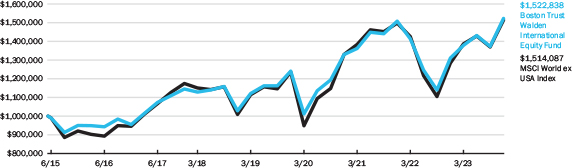

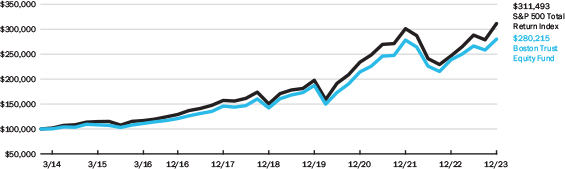

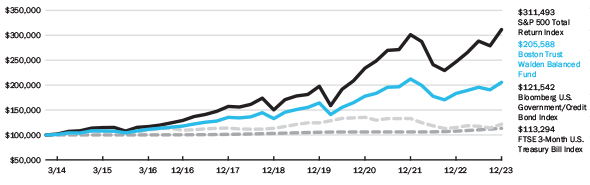

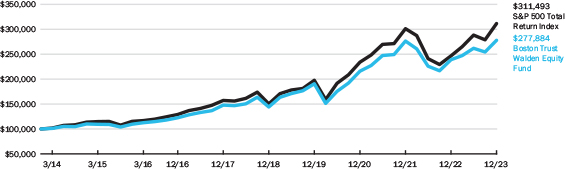

Hypothetical Growth of a $100,000 Investment

The above charts represent a 10-year hypothetical $100,000 investment in the Boston Trust Asset Management Fund and the Boston Trust Equity Fund, and includes the reinvestment of dividends and capital gains in the Funds. The returns shown on the table and the graphs do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Asset Management Fund is measured against a combination of equity and fixed income indices. The Boston Trust Equity Fund is measured against the Standard & Poor’s 500 Total Return Index (“S&P 500”), which is widely regarded as a gauge of the U.S. equities market, includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also widely viewed as a proxy for the total market. The Bloomberg U.S. Government/Credit Bond Index includes Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), government-related issues (e.g., agency, sovereign, supranational, and local authority debt), and USD Corporates. The Bloomberg U.S. Government/Credit Bond Index is a component of the Bloomberg U.S. Aggregate Bond Index. The FTSE 3-Month U.S. T-Bill Index reflects monthly return equivalents of yield averages that are not marked to the market. The index is an average of the last three-month treasury bill issues. The three-month treasury bills are the short-term debt obligations of the U.S. Government. The indexes are unmanaged and their performance does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Funds’ performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

| Boston Trust Asset Management Fund |

| |

| Fund Net Asset Value: | $58.81 |

| Gross Expense Ratio1: | 0.83% |

| | |

| Boston Trust Equity Fund | |

| | |

| Fund Net Asset Value: | $39.96 |

| Gross Expense Ratio1: | 0.86% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from each Fund’s prospectus dated May 1, 2023. Please see the Fund’s most recent prospectus for details. Additional information pertaining to each Fund’s expense ratio as of December 31, 2023 can be found in the financial highlights included in this report. |

Boston Trust Midcap Fund December 31, 2023 Stephen J. Amyouny, CFA Lead Portfolio Manager Richard Q. Williams, CFA Co-Portfolio Manager Mark Zagata, CFA Co-Portfolio Manager Boston Trust Walden Inc. Fund Objective The Fund seeks long-term capital growth through an actively managed portfolio of stocks of middle capitalization (“mid cap”) companies. Investment Concerns Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities. Mid cap funds typically carry additional risks since smaller companies generally have a higher risk of failure. | Manager Commentary (Unaudited) Management Discussion of Fund Performance The Boston Trust Midcap Fund returned 13.05% in the calendar year 2023, trailing the Russell Midcap®Index return of 17.23%. The Adviser's analysis of the year suggests the Fund’s valuation discipline (which seeks to identify the stocks of companies that are reasonably valued) detracted from performance results. Outlook The valuation of the mid cap market (as measured by the Russell Midcap®Index price-to-earnings ratio) as of the end of 2023 was approximately in line with historical averages. The Adviser believes that pockets of speculative valuation exist, however, and remain a risk. Further, index earnings may have reached a new record in 2023, and the increasingly supportive economic backdrop suggests this trajectory may continue in 2024. The Adviser believes that over the long-term, companies with stronger fundamentals generate superior returns. The Adviser believes that a well-diversified Fund comprised of reasonably valued stocks of higher quality companies will add value over full market cycles. A full market cycle includes one bear and one bull market.* * Portfolio composition is subject to change. |

| Investment Performance (Unaudited) | Boston Trust Midcap Fund |

| | December 31, 2023 |

| | For the periods ended 12/31/23 |

| | Average Annual Total Returns |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | Since Inception (9/24/07) |

| Boston Trust Midcap Fund | 13.05% | 7.91% | 11.95% | 9.79% | 13.17% | 9.40% |

| Russell MidCap®Index | 17.23% | 5.92% | 12.68% | 9.42% | 13.58% | 8.64% |

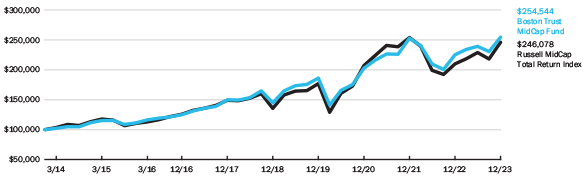

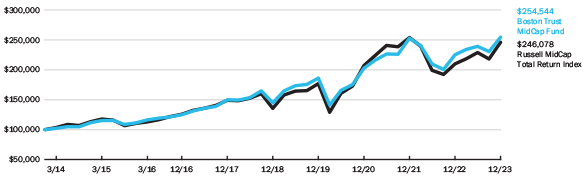

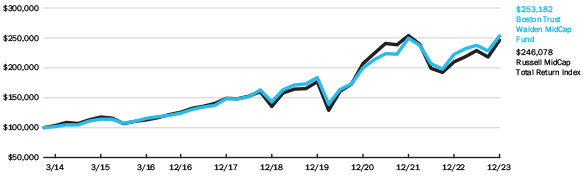

Hypothetical Growth of a $100,000 Investment

The above chart represents a 10-year hypothetical $100,000 investment in the Boston Trust Midcap Fund, and includes the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust Midcap Fund is measured against the Russell Midcap®Index, which is an unmanaged index that tracks the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap®Index is a subset of the Russell 1000®Index. It includes approximately 800 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell Midcap®Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell®is a trademark of Russell Investment Group. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

| Fund Net Asset Value: | $22.98 |

| Gross Expense Ratio1: | 1.00% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from the Fund’s prospectus dated May 1, 2023. The contractual fee limit under the Fund’s expense limitation agreement is 1.00% of the Fund’s average annual net assets, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. The investment performance may reflect fee recoupments. If such fee recoupments had not occurred, the quoted performance would have been higher. The contractual fee waivers continue through May 1, 2024 and may be renewed thereafter. Additional information pertaining to the Fund’s expense ratio as of December 31, 2023 can be found in the financial highlights included in this report. |

Boston Trust SMID Cap Fund December 31, 2023 Kenneth P. Scott, CFA Lead Portfolio Manager Richard Q. Williams, CFA Co-Portfolio Manager Leanne Moore Co-Portfolio Manager Boston Trust Walden Inc. Fund Objective The Fund seeks long-term capital growth through an actively managed portfolio of stocks of small to middle capitalization (“SMID cap”) companies. Investment Concerns Equity securities (stocks) are more volatile and carry more risk and return potential than other forms of investments, including investments in high-grade fixed income securities. SMID cap companies typically have a higher risk of failure and historically have experienced a greater degree of volatility. | Manager Commentary (Unaudited) Management Discussion of Fund Performance The Boston Trust SMID Cap Fund returned 13.14% in the calendar year 2023, trailing the Russell 2500™ Index return of 17.42%. Despite the strong absolute market return, analysis of the data suggests there was no evidence of a performance headwind due to the Fund’s investment style. Thus, the Adviser attributes the performance shortfall to unfavorable stock selection during the year, a contrast to the prior two years, when the Fund enjoyed style tailwinds and incrementally favorable performance of Fund holdings relative to the high quality opportunity set. Outlook The valuation of the small-mid cap market (as measured by the Russell 2500™ Index price-to-earnings ratio) as of the end of 2023 was approximately in line with historical averages. The Adviser believes that pockets of speculative valuation exist, however, and remain a risk. Further, index earnings may have reached a new record in 2023, and the increasingly supportive economic backdrop suggests this trajectory may continue in 2024. The Adviser believes that over the long-term, companies with stronger fundamentals generate superior returns. The Adviser believes that a well-diversified Fund comprised of reasonably valued stocks of higher quality companies will add value over full market cycles. A full market cycle includes one bear and one bull market.* * Portfolio composition is subject to change. |

| Investment Performance (Unaudited) | Boston Trust SMID Cap Fund |

| | December 31, 2023 |

| | For the periods ended 12/31/23 |

| | Average Annual Total Returns |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception (11/30/11) |

| Boston Trust SMID Cap Fund | 13.14% | 9.09% | 12.24% | 9.28% | 10.97% |

| Russell 2500™ Index | 17.42% | 4.24% | 11.67% | 8.36% | 11.20% |

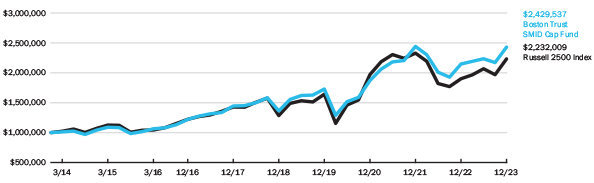

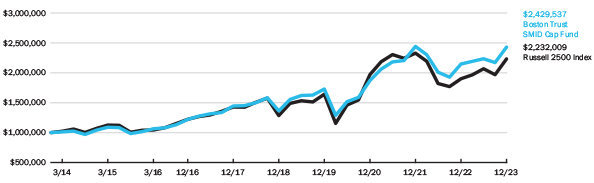

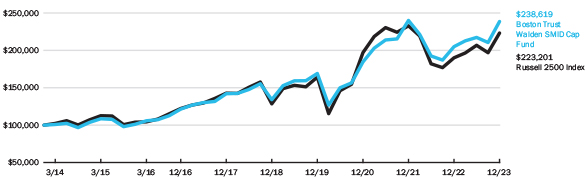

Hypothetical Growth of a $1,000,000 Investment

The above chart represents a 10-year hypothetical $1,000,000 investment in the Boston Trust SMID Cap Fund, and includes the reinvestment of dividends and capital gains in the Fund. The returns shown on the table and the graph do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Boston Trust SMID Cap Fund is measured against the Russell 2500™ Index, which is an unmanaged index that tracks the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “SMID” cap. The Russell 2500™ Index is a subset of the Russell 3000®Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell®is a trademark of Russell Investment Group. The performance of an index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

| Fund Net Asset Value: | $23.07 |

| Gross Expense Ratio1: | 0.86% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-282-8782 ext. 7050.

| 1 | The Gross Expense Ratio is from the Fund’s prospectus dated May 1, 2023. The contractual fee limit under the Fund’s expense limitation agreement is 0.75% of the Fund’s average annual net assets, subject to certain limitations as described in the Fund’s prospectus. Please see the Fund’s most recent prospectus for details. The investment performance may reflect fee reductions. If such fee reductions had not occurred, the quoted performance would have been lower. The contractual fee waivers continue through May 1, 2024 and may be renewed thereafter. Additional information pertaining to the Fund’s expense ratio as of December 31, 2023 can be found in the financial highlights included in this report. |

| | Boston Trust Asset Management Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Common Stocks (75.7%) | | | | | | |

| | | Shares | | | Fair Value ($) | |

| Communication Services (8.0%) | | | | | | |

| Alphabet, Inc., Class A (a) | | | 40,000 | | | | 5,587,600 | |

| Alphabet, Inc., Class C (a) | | | 220,000 | | | | 31,004,600 | |

| Comcast Corp., Class A | | | 200,000 | | | | 8,770,000 | |

| | | | | | | | 45,362,200 | |

| Consumer Discretionary (5.2%) | | | | | | | | |

| Lowe's Cos., Inc. | | | 25,000 | | | | 5,563,750 | |

| NIKE, Inc., Class B | | | 102,500 | | | | 11,128,425 | |

| O'Reilly Automotive, Inc. (a) | | | 4,500 | | | | 4,275,360 | |

| Ross Stores, Inc. | | | 15,000 | | | | 2,075,850 | |

| Starbucks Corp. | | | 67,000 | | | | 6,432,670 | |

| | | | | | | | 29,476,055 | |

| Consumer Staples (7.4%) | | | | | | | | |

| Church & Dwight Co., Inc. | | | 50,000 | | | | 4,728,000 | |

| Costco Wholesale Corp. | | | 30,000 | | | | 19,802,400 | |

| Diageo PLC, Sponsored ADR | | | 25,000 | | | | 3,641,500 | |

| McCormick & Co., Inc. (Non Voting) | | | 40,000 | | | | 2,736,800 | |

| PepsiCo, Inc. | | | 30,000 | | | | 5,095,200 | |

| Procter & Gamble (The) Co. | | | 25,000 | | | | 3,663,500 | |

| Sysco Corp. | | | 35,000 | | | | 2,559,550 | |

| | | | | | | | 42,226,950 | |

| Energy (3.4%) | | | | | | | | |

| Chevron Corp. | | | 20,000 | | | | 2,983,200 | |

| ConocoPhillips | | | 25,000 | | | | 2,901,750 | |

| Exxon Mobil Corp. | | | 110,000 | | | | 10,997,800 | |

| Schlumberger NV | | | 45,000 | | | | 2,341,800 | |

| | | | | | | | 19,224,550 | |

| Financials (12.3%) | | | | | | | | |

| American Express Co. | | | 30,000 | | | | 5,620,200 | |

| Berkshire Hathaway, Inc., Class B (a) | | | 22,500 | | | | 8,024,850 | |

| Chubb Ltd. | | | 20,000 | | | | 4,520,000 | |

| Cincinnati Financial Corp. | | | 60,000 | | | | 6,207,600 | |

| FactSet Research Systems, Inc. | | | 13,720 | | | | 6,545,126 | |

| JPMorgan Chase & Co. | | | 92,750 | | | | 15,776,775 | |

| Northern Trust Corp. | | | 40,000 | | | | 3,375,200 | |

| T. Rowe Price Group, Inc. | | | 45,000 | | | | 4,846,050 | |

| Visa, Inc., Class A | | | 57,500 | | | | 14,970,125 | |

| | | | | | | | 69,885,926 | |

| Health Care (9.6%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 1,000 | | | | 139,030 | |

| Becton, Dickinson and Co. | | | 35,000 | | | | 8,534,050 | |

| Edwards Lifesciences Corp. (a) | | | 95,000 | | | | 7,243,750 | |

| Johnson & Johnson | | | 56,500 | | | | 8,855,810 | |

| Merck & Co., Inc. | | | 50,000 | | | | 5,451,000 | |

| Mettler-Toledo International, Inc. (a) | | | 3,500 | | | | 4,245,360 | |

| Stryker Corp. | | | 25,000 | | | | 7,486,500 | |

| UnitedHealth Group, Inc. | | | 19,750 | | | | 10,397,782 | |

| Waters Corp. (a) | | | 7,500 | | | | 2,469,225 | |

| | | | | | | | 54,822,507 | |

| Industrials (10.1%) | | | | | | | | |

| Automatic Data Processing, Inc. | | | 65,000 | | | | 15,143,050 | |

| Donaldson Co., Inc. | | | 50,000 | | | | 3,267,500 | |

| Hubbell, Inc. | | | 23,500 | | | | 7,729,855 | |

| Illinois Tool Works, Inc. | | | 25,400 | | | | 6,653,276 | |

| Union Pacific Corp. | | | 41,000 | | | | 10,070,420 | |

| United Parcel Service, Inc., Class B | | | 54,000 | | | | 8,490,420 | |

| W.W. Grainger, Inc. | | | 7,300 | | | | 6,049,437 | |

| | | | | | | | 57,403,958 | |

| Information Technology (17.4%) | | | | | | | | |

| Accenture PLC, Class A | | | 62,000 | | | | 21,756,420 | |

| Apple, Inc. | | | 167,000 | | | | 32,152,510 | |

| Cisco Systems, Inc. | | | 65,000 | | | | 3,283,800 | |

| Microsoft Corp. | | | 98,150 | | | | 36,908,326 | |

| Oracle Corp. | | | 50,000 | | | | 5,271,500 | |

| | | | | | | | 99,372,556 | |

| Materials (1.9%) | | | | | | | | |

| Air Products and Chemicals, Inc. | | | 25,500 | | | | 6,981,900 | |

| AptarGroup, Inc. | | | 32,500 | | | | 4,017,650 | |

| | | | | | | | 10,999,550 | |

| Utilities (0.4%) | | | | | | | | |

| Eversource Energy | | | 35,500 | | | | 2,191,060 | |

| TOTAL COMMON STOCKS (Cost $102,608,421) | | | | | | | 430,965,312 | |

Corporate Bonds (4.0%)

| | | Principal

Amount ($) | | | | |

| Communication Services (0.0%)(b) | | | | | | |

| Verizon Communications, Inc., | | | | | | |

| 4.02%, 12/3/29, Callable 9/3/29 @ 100 | | | 250,000 | | | | 242,007 | |

| Consumer Discretionary (0.5%) | | | | | | | | |

| Home Depot (The), Inc., 2.70%, | | | | | | | | |

| 4/15/30 | | | 1,000,000 | | | | 911,132 | |

| Lowe's Cos., Inc., 3.10%, 5/3/27, | | | | | | | | |

| Callable 2/3/27 @ 100 | | | 750,000 | | | | 718,501 | |

| Lowe's Cos., Inc., 1.30%, 4/15/28 | | | 750,000 | | | | 659,567 | |

| McDonald's Corp., 2.62%, 9/1/29, | | | | | | | | |

| MTN, Callable 6/1/29 @ 100 | | | 500,000 | | | | 458,075 | |

| Toyota Motor Credit Corp., 3.65%, 1/8/29 | | | 350,000 | | | | 342,331 | |

| | | | | | | | 3,089,606 | |

| Consumer Staples (0.1%) | | | | | | | | |

| The Estee Lauder Cos., Inc., | | | | | | | | |

| 2.38%, 12/1/29, Callable 9/1/29 @ 100 | | | 750,000 | | | | 668,469 | |

| | | | | | | | | |

| Financials (1.5%) | | | | | | | | |

| Bank of America Corp., 4.18%, | | | | | | | | |

| 11/25/27, Callable 11/25/26 @100 | | | 500,000 | | | | 486,326 | |

| Berkshire Hathaway, Inc., 3.13%, | | | | | | | | |

| 3/15/26, Callable 12/15/25 @100 | | | 2,000,000 | | | | 1,944,395 | |

| Cincinnati Financial Corp., 6.92%, 5/15/28 | | | 500,000 | | | | 536,553 | |

| JPMorgan Chase & Co., 3.90%, | | | | | | | | |

| 7/15/25, Callable 4/15/25 @ 100 | | | 1,000,000 | | | | 984,503 | |

| JPMorgan Chase & Co., (Variable, | | | | | | | | |

| 3M CME Term SOFR + 1.38%), | | | | | | | | |

| 4.01%, 4/23/29(c) | | | 500,000 | | | | 481,510 | |

| 8 | See Notes to Financial Statements | |

| | Boston Trust Asset Management Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Corporate Bonds (continued) | | | | | | |

| | | Principal

Amount ($) | | | Fair Value ($) | |

| Financials (continued) | | | | | | |

| Visa, Inc., 3.15%, 12/14/25, Callable 9/14/25 @ 100 | | | 2,000,000 | | | | 1,951,801 | |

| Wells Fargo & Co., 3.55%, 9/29/25, MTN | | | 2,000,000 | | | | 1,954,550 | |

| | | | | | | | 8,339,638 | |

| Health Care (0.6%) | | | | | | | | |

| Becton, Dickinson & Co., 6.70%, 12/1/26 | | | 750,000 | | | | 786,985 | |

| Merck & Co., Inc., 1.70%, 6/10/27 | | | 350,000 | | | | 321,061 | |

| Pfizer, Inc., 3.60%, 9/15/28 | | | 500,000 | | | | 488,071 | |

| Stryker Corp., 1.95%, 6/15/30 | | | 1,000,000 | | | | 856,389 | |

| UnitedHealth Group, Inc., 3.37%, 4/15/27 | | | 500,000 | | | | 484,501 | |

| Zoetis, Inc., 3.90%, 8/20/28 | | | 750,000 | | | | 734,271 | |

| | | | | | | | 3,671,278 | |

| Industrials (0.8%) | | | | | | | | |

| Emerson Electric Co., 2.00%, | | | | | | | | |

| 12/21/28, Callable 10/21/28 @ 100 | | | 1,400,000 | | | | 1,253,584 | |

| Hubbell, Inc., 3.50%, 2/15/28 | | | 1,000,000 | | | | 958,879 | |

| John Deere Capital, 2.80%, 9/8/27, MTN | | | 500,000 | | | | 473,996 | |

| John Deere Capital, 3.45%, 3/7/29, MTN | | | 1,250,000 | | | | 1,199,331 | |

| Union Pacific Corp., 3.95%, 9/10/28 | | | 400,000 | | | | 397,067 | |

| | | | | | | | 4,282,857 | |

| Information Technology (0.4%) | | | | | | | | |

| Apple, Inc., 3.25%, 2/23/26, Callable 11/23/25 @ 100 | | | 2,500,000 | | | | 2,439,957 | |

| | | | | | | | | |

| Materials (0.1%) | | | | | | | | |

| Air Products and Chemicals, Inc., 1.85%, 5/15/27 | | | 400,000 | | | | 368,955 | |

| TOTAL CORPORATE BONDS (Cost $23,612,568) | | | | | | | 23,102,767 | |

| U.S. Government & U.S. Government Agency Obligations (19.3%) |

| |

| Federal Farm Credit Bank (2.3%) | | | | | | |

| 3.39%, 2/1/28 | | | 2,000,000 | | | | 1,953,616 | |

| 3.85%, 12/26/25 | | | 2,770,000 | | | | 2,745,659 | |

| 2.95%, 1/27/25 | | | 2,000,000 | | | | 1,966,736 | |

| 3.25%, 2/27/34 | | | 1,500,000 | | | | 1,364,476 | |

| 3.87%, 9/20/32 | | | 1,000,000 | | | | 970,074 | |

| 4.37%, 3/3/33 | | | 1,500,000 | | | | 1,510,534 | |

| 3.50%, 3/2/34 | | | 3,000,000 | | | | 2,791,603 | |

| | | | | | | | 13,302,698 | |

| Federal Home Loan Bank (1.3%) | | | | | | | | |

| 2.87%, 9/13/24 | | | 2,500,000 | | | | 2,464,924 | |

| 3.50%, 7/20/32 | | | 1,500,000 | | | | 1,413,584 | |

| 4.00%, 6/10/33 | | | 2,500,000 | | | | 2,439,863 | |

| 2.50%, 12/10/27 | | | 1,500,000 | | | | 1,418,027 | |

| | | | | | | | 7,736,398 | |

| U.S. Treasury Bond (4.7%) | | | | | | | | |

| 5.37%, 2/15/31 | | | 5,500,000 | | | | 6,035,820 | |

| 4.50%, 2/15/36 | | | 15,250,000 | | | | 16,307,373 | |

| 4.37%, 8/15/43 | | | 4,000,000 | | | | 4,098,125 | |

| | | | | | | | 26,441,318 | |

| U.S. Treasury Inflation Indexed Note (1.2%) | | | | | | | | |

| 0.13%, 4/15/27 | | | 4,358,760 | | | | 4,098,589 | |

| 0.63%, 7/15/32 | | | 3,176,790 | | | | 2,910,417 | |

| | | | | | | | 7,009,006 | |

| U.S. Treasury Note (9.8%) | | | | | | | | |

| 2.25%, 11/15/27 | | | 6,500,000 | | | | 6,116,348 | |

| 2.88%, 5/15/28 | | | 7,500,000 | | | | 7,198,242 | |

| 2.13%, 5/31/26 | | | 5,000,000 | | | | 4,775,391 | |

| 0.88%, 11/15/30 | | | 11,000,000 | | | | 9,051,797 | |

| 1.63%, 5/15/31 | | | 10,000,000 | | | | 8,592,578 | |

| 3.37%, 5/15/33 | | | 6,000,000 | | | | 5,770,312 | |

| 3.87%, 8/15/33 | | | 14,000,000 | | | | 14,010,937 | |

| | | | | | | | 55,515,605 | |

| TOTAL U.S. GOVERNMENT & U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $106,953,017) | | | | | | | 110,005,025 | |

Investment Companies (0.7%)

| | | Shares | | | | |

| Northern Institutional Treasury | | | | | | |

| Portfolio (Premier Class), 5.22% (d) | | | 3,870,712 | | | | 3,870,712 | |

| TOTAL INVESTMENT COMPANIES (Cost $3,870,712) | | | | | | | 3,870,712 | |

| Total Investments (Cost $237,044,718) — 99.7%(e) | | | | | | | 567,943,816 | |

| Other assets in excess of liabilities — 0.3% | | | | | | | 1,563,463 | |

| Net Assets — 100.0% | | | | | | $ | 569,507,279 | |

| (a) | Non-income producing security. |

| (b) | Represents less than 0.05%. |

| (c) | Variable or floating rate security. Security issued at a fixed coupon rate, which converts to a variable rate at a future date. Rate shown is the rate in effect as of December 31, 2023. |

| (d) | Rate disclosed is the seven day yield as of December 31, 2023. |

| (e) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| ADR | American Depositary Receipt |

| MTN | Medium Term Note |

| PLC | Public Limited Company |

| | See Notes to Financial Statements | 9 |

| Financial Statements | Boston Trust Asset Management Fund |

Statement of Assets and Liabilities

December 31, 2023

| Assets: | | | |

| Investments, at fair value(cost $237,044,718) | | $ | 567,943,816 | |

| Interest and dividends receivable | | | 2,032,940 | |

| Receivable for tax reclaims | | | 3,440 | |

| Receivable for capital shares issued | | | 1,155 | |

| Prepaid expenses | | | 20,180 | |

| Total Assets | | | 570,001,531 | |

| Liabilities: | | | | |

| Payable for capital shares redeemed | | | 23,989 | |

| Payable to Custodian | | | 41,641 | |

| Accrued expenses and other liabilities: | | | | |

| Investment adviser | | | 348,582 | |

| Administration and accounting | | | 31,015 | |

| Chief compliance officer | | | 1,852 | |

| Custodian | | | 4,391 | |

| Shareholder servicing fees | | | 11,387 | |

| Transfer agent | | | 3,983 | |

| Other | | | 27,412 | |

| Total Liabilities | | | 494,252 | |

| Net Assets | | $ | 569,507,279 | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 237,876,260 | |

| Total distributable earnings | | | 331,631,019 | |

| Net Assets | | $ | 569,507,279 | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 9,683,918 | |

| Net Asset Value, Offering Price and Redemption price per share | | $ | 58.81 | |

Statement of Operations

For the year ended December 31, 2023

| Investment Income: | | | |

| Dividends | | $ | 7,871,186 | |

| Interest | | | 5,222,569 | |

| Less: Foreign tax withholding | | | (2,580 | ) |

| Total Investment Income | | | 13,091,175 | |

| Expenses: | | | | |

| Investment adviser | | | 4,130,044 | |

| Administration and accounting | | | 180,192 | |

| Chief compliance officer | | | 24,789 | |

| Custodian | | | 81,716 | |

| Shareholder servicing | | | 138,062 | |

| Transfer agency | | | 24,468 | |

| Trustee | | | 54,051 | |

| Other | | | 115,490 | |

| Total expenses | | | 4,748,812 | |

| Net Expenses | | | 4,748,812 | |

| Net Investment Income | | | 8,342,363 | |

| Net Realized/Unrealized Gains (Losses) from | | | | |

| Investments: | | | | |

| Net realized gains from investment transactions | | | 26,487,937 | |

| Net realized gains from redemptions in-kind (a) | | | 4,356,353 | |

| Change in unrealized appreciation on investments | | | 33,974,692 | |

| Net realized/unrealized gains on investments | | | 64,818,982 | |

| Change in Net Assets Resulting from Operations | | $ | 73,161,345 | |

| (a) | | See Note 3 in the Notes to Financial Statements. |

| 10 | See Notes to Financial Statements | |

| Financial Statements | Boston Trust Asset Management Fund |

Statements of Changes in Net Assets

| | | For the year ended

December 31, 2023 | | | For the year ended

December 31, 2022 | |

| Investment Activities: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 8,342,363 | | | $ | 6,326,739 | |

| Net realized gains from investment transactions | | | 30,844,290 | | | | 6,394,661 | |

| Change in unrealized appreciation (depreciation) on investments | | | 33,974,692 | | | | (114,355,885 | ) |

| Change in Net Assets Resulting from Operations | | | 73,161,345 | | | | (101,634,485 | ) |

| Distributions To Shareholders: | | | | | | | | |

| Total Distributions | | | (35,809,356 | ) | | | (24,865,921 | ) |

| Change in Net Assets Resulting from distributions to shareholders | | | (35,809,356 | ) | | | (24,865,921 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 17,349,182 | | | | 13,998,321 | |

| Dividends reinvested | | | 17,136,793 | | | | 12,757,441 | |

| Cost of shares redeemed | | | (48,970,508 | ) | | | (51,657,993 | ) |

| Cost of in-kind shares redeemed (a) | | | (4,698,109 | ) | | | — | |

| Change in Net Assets Resulting from Capital Share Transactions | | | (19,182,642 | ) | | | (24,902,231 | ) |

| Change in Net Assets | | | 18,169,347 | | | | (151,402,637 | ) |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 551,337,932 | | | | 702,740,569 | |

| End of year | | $ | 569,507,279 | | | $ | 551,337,932 | |

| Share Transactions: | | | | | | | | |

| Issued | | | 295,997 | | | | 232,525 | |

| Reinvested | | | 297,565 | | | | 223,345 | |

| Redeemed | | | (833,092 | ) | | | (872,055 | ) |

| Redeemed in-kind (a) | | | (77,706 | ) | | | — | |

| Change in shares | | | (317,236 | ) | | | (416,185 | ) |

| (a) | See Note 3 in the Notes to Financial Statements. |

| | See Notes to Financial Statements | 11 |

| Financial Statements | Boston Trust Asset Management Fund |

Financial Highlights

Selected data for a share outstanding throughout the years indicated.

| | | For the year

ended

December

31, 2023 | | | For the year

ended

December

31, 2022 | | | For the year

ended

December

31, 2021 | | | For the year

ended

December

31, 2020 | | | For the year

ended

December

31, 2019 | |

| Net Asset Value, Beginning of Period | | $ | 55.13 | | | $ | 67.46 | | | $ | 56.29 | | | $ | 55.17 | | | $ | 44.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.89 | | | | 0.63 | | | | 0.48 | | | | 0.53 | | | | 0.48 | |

| Net realized/unrealized gains (losses) from investments | | | 6.60 | | | | (10.42 | ) | | | 11.69 | | | | 3.74 | | | | 10.93 | |

| Total from investment activities | | | 7.49 | | | | (9.79 | ) | | | 12.17 | | | | 4.27 | | | | 11.41 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.80 | ) | | | (0.65 | ) | | | (0.49 | ) | | | (0.53 | ) | | | (0.48 | ) |

| Net realized gains from investment transactions | | | (3.01 | ) | | | (1.89 | ) | | | (0.51 | ) | | | (2.62 | ) | | | (0.03 | ) |

| Total distributions | | | (3.81 | ) | | | (2.54 | ) | | | (1.00 | ) | | | (3.15 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 58.81 | | | $ | 55.13 | | | $ | 67.46 | | | $ | 56.29 | | | $ | 55.17 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 13.72 | % | | | (14.65 | )% | | | 21.65 | % | | | 7.83 | % | | | 25.81 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000's) | | $ | 569,507 | | | $ | 551,338 | | | $ | 702,741 | | | $ | 597,013 | | | $ | 623,151 | |

| Ratio of net expenses to average net assets | | | 0.82 | % | | | 0.83 | % | | | 0.81 | % | | | 0.88 | % | | | 0.90 | % |

| Ratio of net investment income to average net assets | | | 1.45 | % | | | 1.05 | % | | | 0.77 | % | | | 0.96 | % | | | 1.02 | % |

| Portfolio turnover rate | | | 24.76 | %(a) | | | 35.52 | % | | | 6.51 | % | | | 12.18 | % | | | 5.76 | % |

| (a) | Excludes impact of in-kind transactions. |

| 12 | See Notes to Financial Statements | |

| | Boston Trust Equity Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Common Stocks (99.2%) | | | | | | |

| | | Shares | | | Fair Value ($) | |

| Communication Services (9.6%) | | | | | | |

| Alphabet, Inc., Class A (a) | | | 15,000 | | | | 2,095,350 | |

| Alphabet, Inc., Class C (a) | | | 100,000 | | | | 14,093,000 | |

| Comcast Corp., Class A | | | 116,500 | | | | 5,108,525 | |

| | | | | | | | 21,296,875 | |

| Consumer Discretionary (6.9%) | | | | | | | | |

| Lowe's Cos., Inc. | | | 10,000 | | | | 2,225,500 | |

| NIKE, Inc., Class B | | | 30,000 | | | | 3,257,100 | |

| O'Reilly Automotive, Inc. (a) | | | 3,300 | | | | 3,135,264 | |

| Ross Stores, Inc. | | | 7,000 | | | | 968,730 | |

| Starbucks Corp. | | | 40,000 | | | | 3,840,400 | |

| TJX (The) Cos., Inc. | | | 21,500 | | | | 2,016,915 | |

| | | | | | | | 15,443,909 | |

| Consumer Staples (8.2%) | | | | | | | | |

| Church & Dwight Co., Inc. | | | 15,000 | | | | 1,418,400 | |

| Costco Wholesale Corp. | | | 13,750 | | | | 9,076,100 | |

| Diageo PLC, Sponsored ADR | | | 7,500 | | | | 1,092,450 | |

| McCormick & Co., Inc. (Non Voting) | | | 14,000 | | | | 957,880 | |

| PepsiCo, Inc. | | | 18,000 | | | | 3,057,120 | |

| Procter & Gamble (The) Co. | | | 9,000 | | | | 1,318,860 | |

| Sysco Corp. | | | 20,000 | | | | 1,462,600 | |

| | | | | | | | 18,383,410 | |

| Energy (4.7%) | | | | | | | | |

| Chevron Corp. | | | 13,000 | | | | 1,939,080 | |

| Exxon Mobil Corp. | | | 50,000 | | | | 4,999,000 | |

| Schlumberger NV | | | 67,500 | | | | 3,512,700 | |

| | | | | | | | 10,450,780 | |

| Financials (14.2%) | | | | | | | | |

| American Express Co. | | | 12,000 | | | | 2,248,080 | |

| Berkshire Hathaway, Inc., Class B (a) | | | 10,000 | | | | 3,566,600 | |

| Chubb Ltd. | | | 10,000 | | | | 2,260,000 | |

| Cincinnati Financial Corp. | | | 20,000 | | | | 2,069,200 | |

| FactSet Research Systems, Inc. | | | 5,500 | | | | 2,623,775 | |

| JPMorgan Chase & Co. | | | 44,250 | | | | 7,526,925 | |

| Northern Trust Corp. | | | 22,500 | | | | 1,898,550 | |

| T. Rowe Price Group, Inc. | | | 20,000 | | | | 2,153,800 | |

| Visa, Inc., Class A | | | 28,000 | | | | 7,289,800 | |

| | | | | | | | 31,636,730 | |

| Health Care (15.1%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 13,600 | | | | 1,890,808 | |

| Becton, Dickinson and Co. | | | 15,000 | | | | 3,657,450 | |

| Cooper (The) Cos., Inc. | | | 8,250 | | | | 3,122,130 | |

| Edwards Lifesciences Corp. (a) | | | 22,500 | | | | 1,715,625 | |

| Johnson & Johnson | | | 25,500 | | | | 3,996,870 | |

| Merck & Co., Inc. | | | 22,500 | | | | 2,452,950 | |

| Mettler-Toledo International, Inc. (a) | | | 1,500 | | | | 1,819,440 | |

| Stryker Corp. | | | 12,000 | | | | 3,593,520 | |

| UnitedHealth Group, Inc. | | | 12,000 | | | | 6,317,640 | |

| Waters Corp. (a) | | | 8,250 | | | | 2,716,147 | |

| Zoetis, Inc. | | | 12,000 | | | | 2,368,440 | |

| | | | | | | | 33,651,020 | |

| Industrials (13.1%) | | | | | | | | |

| Automatic Data Processing, Inc. | | | 20,000 | | | | 4,659,400 | |

| Deere & Co. | | | 4,750 | | | | 1,899,383 | |

| Donaldson Co., Inc. | | | 15,000 | | | | 980,250 | |

| Hubbell, Inc. | | | 12,500 | | | | 4,111,625 | |

| Illinois Tool Works, Inc. | | | 15,000 | | | | 3,929,100 | |

| Union Pacific Corp. | | | 22,500 | | | | 5,526,450 | |

| United Parcel Service, Inc., Class B | | | 15,000 | | | | 2,358,450 | |

| W.W. Grainger, Inc. | | | 7,000 | | | | 5,800,830 | |

| | | | | | | | 29,265,488 | |

| Information Technology (23.9%) | | | | | | | | |

| Accenture PLC, Class A | | | 25,000 | | | | 8,772,750 | |

| Analog Devices, Inc. | | | 16,500 | | | | 3,276,240 | |

| Apple, Inc. | | | 80,750 | | | | 15,546,797 | |

| Microsoft Corp. | | | 51,000 | | | | 19,178,040 | |

| Oracle Corp. | | | 40,000 | | | | 4,217,200 | |

| TE Connectivity Ltd. | | | 16,500 | | | | 2,318,250 | |

| | | | | | | | 53,309,277 | |

| Materials (2.6%) | | | | | | | | |

| Air Products and Chemicals, Inc. | | | 14,800 | | | | 4,052,240 | |

| AptarGroup, Inc. | | | 14,250 | | | | 1,761,585 | |

| | | | | | | | 5,813,825 | |

| Utilities (0.9%) | | | | | | | | |

| Eversource Energy | | | 31,700 | | | | 1,956,524 | |

| TOTAL COMMON STOCKS (Cost $69,787,257) | | | | | | | 221,207,838 | |

| | | | | | | |

| Investment Companies (0.7%) | | | | | | |

| Northern Institutional Treasury | | | | | | |

| Portfolio (Premier Class), 5.22% (b) | | | 1,437,531 | | | | 1,437,531 | |

| TOTAL INVESTMENT COMPANIES (Cost $1,437,531) | | | | | | | 1,437,531 | |

| Total Investments (Cost $71,224,788) — 99.9%(c) | | | | | | | 222,645,369 | |

| Other assets in excess of liabilities — 0.1% | | | | | | | 258,801 | |

| Net Assets — 100.0% | | | | | | $ | 222,904,170 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day yield as of December 31, 2023. |

| (c) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| | See Notes to Financial Statements | 13 |

| Financial Statements | Boston Trust Equity Fund |

Statement of Assets and Liabilities

December 31, 2023

| Assets: | | | |

| Investments, at fair value(cost $71,224,788) | | $ | 222,645,369 | |

| Cash | | | 31 | |

| Dividend receivable | | | 423,899 | |

| Receivable for tax reclaims | | | 1,720 | |

| Prepaid expenses | | | 6,347 | |

| Total Assets | | | 223,077,366 | |

| Liabilities: | | | | |

| Payable for capital shares redeemed | | | 2,038 | |

| Accrued expenses and other liabilities: | | | | |

| Investment adviser | | | 140,602 | |

| Administration and accounting | | | 14,406 | |

| Chief compliance officer | | | 685 | |

| Custodian | | | 1,852 | |

| Shareholder servicing fees | | | 1,039 | |

| Transfer agent | | | 3,738 | |

| Other | | | 8,836 | |

| Total Liabilities | | | 173,196 | |

| Net Assets | | $ | 222,904,170 | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 71,533,955 | |

| Total distributable earnings | | | 151,370,215 | |

| Net Assets | | $ | 222,904,170 | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 5,578,577 | |

| Net Asset Value, Offering Price and Redemption price per share | | $ | 39.96 | |

Statement of Operations

For the year ended December 31, 2023

| Investment Income: | | | |

| Dividends | | $ | 3,418,812 | |

| Less: Foreign tax withholding | | | (1,290 | ) |

| Total Investment Income | | | 3,417,522 | |

| Expenses: | | | | |

| Investment adviser | | | 1,543,975 | |

| Administration and accounting | | | 75,824 | |

| Chief compliance officer | | | 8,084 | |

| Custodian | | | 26,821 | |

| Shareholder servicing | | | 9,942 | |

| Transfer agency | | | 19,884 | |

| Trustee | | | 17,692 | |

| Other | | | 39,514 | |

| Total expenses | | | 1,741,736 | |

| Net Expenses | | | 1,741,736 | |

| Net Investment Income | | | 1,675,786 | |

| Net Realized/Unrealized Gains (Losses) from | | | | |

| Investments: | | | | |

| Net realized gains from investment transactions | | | 631,737 | |

| Change in unrealized appreciation on investments | | | 30,524,230 | |

| Net realized/unrealized gains on investments | | | 31,155,967 | |

| Change in Net Assets Resulting from Operations | | $ | 32,831,753 | |

| 14 | See Notes to Financial Statements | |

| Financial Statements | Boston Trust Equity Fund |

Statements of Changes in Net Assets

| | | For the year ended

December 31, 2023 | | | For the year ended

December 31, 2022 | |

| Investment Activities: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 1,675,786 | | | $ | 1,308,874 | |

| Net realized gains from investment transactions | | | 631,737 | | | | 2,008,906 | |

| Change in unrealized appreciation (depreciation) on investments | | | 30,524,230 | | | | (34,852,417 | ) |

| Change in Net Assets Resulting from Operations | | | 32,831,753 | | | | (31,534,637 | ) |

| Distributions To Shareholders: | | | | | | | | |

| Total Distributions | | | (3,434,420 | ) | | | (6,000,589 | ) |

| Change in Net Assets Resulting from distributions to shareholders | | | (3,434,420 | ) | | | (6,000,589 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 10,808,134 | | | | 12,205,790 | |

| Dividends reinvested | | | 1,341,506 | | | | 2,789,935 | |

| Cost of shares redeemed | | | (10,072,720 | ) | | | (8,896,664 | ) |

| Change in Net Assets Resulting from Capital Share Transactions | | | 2,076,920 | | | | 6,099,061 | |

| Change in Net Assets | | | 31,474,253 | | | | (31,436,165 | ) |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 191,429,917 | | | | 222,866,082 | |

| End of year | | $ | 222,904,170 | | | $ | 191,429,917 | |

| Share Transactions: | | | | | | | | |

| Issued | | | 281,535 | | | | 337,500 | |

| Reinvested | | | 34,389 | | | | 77,628 | |

| Redeemed | | | (268,351 | ) | | | (247,975 | ) |

| Change in shares | | | 47,573 | | | | 167,153 | |

| | See Notes to Financial Statements | 15 |

| Financial Statements | Boston Trust Equity Fund |

Financial Highlights

Selected data for a share outstanding throughout the years indicated.

| | | For the year

ended

December

31, 2023 | | | For the year

ended

December

31, 2022 | | | For the year

ended

December

31, 2021 | | | For the year

ended

December

31, 2020 | | | For the year

ended

December

31, 2019 | |

| Net Asset Value, Beginning of Period | | $ | 34.61 | | | $ | 41.55 | | | $ | 32.89 | | | $ | 29.55 | | | $ | 22.64 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.30 | | | | 0.24 | | | | 0.20 | | | | 0.27 | | | | 0.24 | |

| Net realized/unrealized gains (losses) from investments | | | 5.67 | | | | (6.08 | ) | | | 9.56 | | | | 4.00 | | | | 6.94 | |

| Total from investment activities | | | 5.97 | | | | (5.84 | ) | | | 9.76 | | | | 4.27 | | | | 7.18 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.26 | ) | | | (0.24 | ) | | | (0.20 | ) | | | (0.27 | ) | | | (0.24 | ) |

| Net realized gains from investment transactions | | | (0.36 | ) | | | (0.86 | ) | | | (0.90 | ) | | | (0.66 | ) | | | (0.03 | ) |

| Total distributions | | | (0.62 | ) | | | (1.10 | ) | | | (1.10 | ) | | | (0.93 | ) | | | (0.27 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 39.96 | | | $ | 34.61 | | | $ | 41.55 | | | $ | 32.89 | | | $ | 29.55 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 17.29 | % | | | (14.16 | )% | | | 29.77 | % | | | 14.53 | % | | | 31.74 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000's) | | $ | 222,904 | | | $ | 191,430 | | | $ | 222,866 | | | $ | 168,487 | | | $ | 159,651 | |

| Ratio of net expenses to average net assets | | | 0.85 | % | | | 0.86 | % | | | 0.85 | % | | | 0.90 | % | | | 0.91 | % |

| Ratio of net investment income to average net assets | | | 0.81 | % | | | 0.66 | % | | | 0.53 | % | | | 0.93 | % | | | 0.88 | % |

| Portfolio turnover rate | | | 6.19 | % | | | 10.30 | % | | | 7.33 | % | | | 9.30 | % | | | 2.61 | % |

| 16 | See Notes to Financial Statements | |

| Boston Trust Midcap Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Common Stocks (98.8%) | | | | | | |

| | | Shares | | | Fair Value ($) | |

| Communication Services (3.2%) | | | | | | |

| Cable One, Inc. | | | 2,890 | | | | 1,608,545 | |

| Electronic Arts, Inc. | | | 26,195 | | | | 3,583,738 | |

| Omnicom Group, Inc. | | | 25,445 | | | | 2,201,247 | |

| | | | | | | | 7,393,530 | |

| Consumer Discretionary (10.5%) | | | | | | | | |

| AutoZone, Inc. (a) | | | 1,375 | | | | 3,555,214 | |

| Carter's, Inc. | | | 31,980 | | | | 2,394,982 | |

| Choice Hotels International, Inc. | | | 21,485 | | | | 2,434,251 | |

| Columbia Sportswear Co. | | | 29,265 | | | | 2,327,738 | |

| Ross Stores, Inc. | | | 39,055 | | | | 5,404,821 | |

| Ulta Beauty, Inc. (a) | | | 9,005 | | | | 4,412,360 | |

| Williams-Sonoma, Inc. | | | 17,115 | | | | 3,453,465 | |

| | | | | | | | 23,982,831 | |

| Consumer Staples (6.1%) | | | | | | | | |

| BJ's Wholesale Club Holdings, Inc. (a) | | | 48,455 | | | | 3,230,010 | |

| Church & Dwight Co., Inc. | | | 23,170 | | | | 2,190,955 | |

| Dollar General Corp. | | | 17,895 | | | | 2,432,825 | |

| Hershey (The) Co. | | | 15,890 | | | | 2,962,532 | |

| Sysco Corp. | | | 42,000 | | | | 3,071,460 | |

| | | | | | | | 13,887,782 | |

| Energy (4.4%) | | | | | | | | |

| Baker Hughes Co. | | | 183,895 | | | | 6,285,531 | |

| Marathon Oil Corp. | | | 158,715 | | | | 3,834,555 | |

| | | | | | | | 10,120,086 | |

| Financials (14.5%) | | | | | | | | |

| American Financial Group, Inc. | | | 20,850 | | | | 2,478,857 | |

| Brown & Brown, Inc. | | | 45,915 | | | | 3,265,016 | |

| Cboe Global Markets, Inc. | | | 16,650 | | | | 2,973,024 | |

| East West Bancorp, Inc. | | | 35,600 | | | | 2,561,420 | |

| Everest Re Group Ltd. | | | 7,850 | | | | 2,775,603 | |

| FactSet Research Systems, Inc. | | | 10,310 | | | | 4,918,385 | |

| M&T Bank Corp. | | | 16,300 | | | | 2,234,404 | |

| Northern Trust Corp. | | | 38,425 | | | | 3,242,301 | |

| SEI Investments Co. | | | 82,310 | | | | 5,230,800 | |

| T. Rowe Price Group, Inc. | | | 31,530 | | | | 3,395,466 | |

| | | | | | | | 33,075,276 | |

| Health Care (14.4%) | | | | | | | | |

| Agilent Technologies, Inc. | | | 24,515 | | | | 3,408,320 | |

| Chemed Corp. | | | 3,830 | | | | 2,239,593 | |

| Cooper (The) Cos., Inc. | | | 12,625 | | | | 4,777,805 | |

| Laboratory Corp. of America Holdings | | | 6,820 | | | | 1,550,118 | |

| Medpace Holdings, Inc. (a) | | | 12,300 | | | | 3,770,319 | |

| Mettler-Toledo International, Inc. (a) | | | 2,980 | | | | 3,614,621 | |

| STERIS PLC | | | 14,170 | | | | 3,115,275 | |

| Teleflex, Inc. | | | 10,695 | | | | 2,666,691 | |

| Waters Corp. (a) | | | 17,140 | | | | 5,643,002 | |

| West Pharmaceutical Services, Inc. | | | 5,645 | | | | 1,987,717 | |

| | | | | | | | 32,773,461 | |

| Industrials (19.6%) | | | | | | | | |

| A O Smith Corp. | | | 36,395 | | | | 3,000,404 | |

| AMETEK, Inc. | | | 25,645 | | | | 4,228,604 | |

| Broadridge Financial Solutions, Inc. | | | 17,545 | | | | 3,609,884 | |

| Cummins, Inc. | | | 9,185 | | | | 2,200,450 | |

| Donaldson Co., Inc. | | | 57,355 | | | | 3,748,149 | |

| Expeditors International of Washington, Inc. | | | 27,990 | | | | 3,560,328 | |

| Graco, Inc. | | | 29,910 | | | | 2,594,992 | |

| Hubbell, Inc. | | | 8,745 | | | | 2,876,493 | |

| Lincoln Electric Holdings, Inc. | | | 16,485 | | | | 3,584,828 | |

| Nordson Corp. | | | 12,595 | | | | 3,327,095 | |

| Paychex, Inc. | | | 56,210 | | | | 6,695,173 | |

| Rockwell Automation, Inc. | | | 10,010 | | | | 3,107,905 | |

| W.W. Grainger, Inc. | | | 2,730 | | | | 2,262,324 | |

| | | | | | | | 44,796,629 | |

| Information Technology (10.7%) | | | | | | | | |

| Amdocs Ltd. | | | 26,190 | | | | 2,301,839 | |

| ANSYS, Inc. (a) | | | 13,485 | | | | 4,893,437 | |

| Check Point Software Technologies Ltd. (a) | | | 16,575 | | | | 2,532,494 | |

| F5, Inc. (a) | | | 14,355 | | | | 2,569,258 | |

| Fortinet, Inc. (a) | | | 50,000 | | | | 2,926,500 | |

| TE Connectivity Ltd. | | | 28,770 | | | | 4,042,185 | |

| Teradyne, Inc. | | | 22,000 | | | | 2,387,440 | |

| Zebra Technologies Corp., Class A (a) | | | 10,330 | | | | 2,823,499 | |

| | | | | | | | 24,476,652 | |

| Materials (6.4%) | | | | | | | | |

| AptarGroup, Inc. | | | 29,215 | | | | 3,611,558 | |

| Avery Dennison Corp. | | | 14,950 | | | | 3,022,292 | |

| Ball Corp. | | | 46,420 | | | | 2,670,078 | |

| Packaging Corp. of America | | | 14,970 | | | | 2,438,763 | |

| RPM International, Inc. | | | 26,365 | | | | 2,943,125 | |

| | | | | | | | 14,685,816 | |

| Real Estate (3.9%) | | | | | | | | |

| AvalonBay Communities, Inc. | | | 14,460 | | | | 2,707,201 | |

| CubeSmart | | | 47,775 | | | | 2,214,371 | |

| Jones Lang LaSalle, Inc. (a) | | | 20,470 | | | | 3,866,169 | |

| | | | | | | | 8,787,741 | |

| Utilities (5.1%) | | | | | | | | |

| Atmos Energy Corp. | | | 20,615 | | | | 2,389,278 | |

| Essential Utilities, Inc. | | | 71,300 | | | | 2,663,055 | |

| Eversource Energy | | | 73,790 | | | | 4,554,319 | |

| ONE Gas, Inc. | | | 32,390 | | | | 2,063,891 | |

| | | | | | | | 11,670,543 | |

| TOTAL COMMON STOCKS (Cost $167,569,271) | | | | | | | 225,650,347 | |

| | | | | | | | | |

| Investment Companies (0.8%) | | | | | | | | |

| Northern Institutional Treasury | | | | | | | | |

| Portfolio (Premier Class), 5.22% (b) | | | 1,857,573 | | | | 1,857,573 | |

| TOTAL INVESTMENT COMPANIES (Cost $1,857,573) | | | | | | | 1,857,573 | |

| Total Investments (Cost $169,426,844) —99.6%(c) | | | | | | | 227,507,920 | |

| Other assets in excess of liabilities — 0.4% | | | | | | | 1,013,923 | |

| Net Assets — 100.0% | | | | | | $ | 228,521,843 | |

| | See Notes to Financial Statements | 17 |

| | Boston Trust Midcap Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day yield as of December 31, 2023. |

| (c) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| PLC | Public Limited Company |

| 18 | See Notes to Financial Statements | |

| Financial Statements | Boston Trust Midcap Fund |

| Statement of Assets and Liabilities | | | |

| December 31, 2023 | | | |

| | | | |

| Assets: | | | |

| Investments, at fair value(cost $169,426,844) | | $ | 227,507,920 | |

| Cash | | | 1,341,437 | |

| Dividend receivable | | | 224,030 | |

| Receivable for capital shares issued | | | 501,021 | |

| Prepaid expenses | | | 18,778 | |

| Total Assets | | | 229,593,186 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 844,849 | |

| Payable for capital shares redeemed | | | 23,660 | |

| Accrued expenses and other liabilities: | | | | |

| Investment adviser | | | 141,977 | |

| Administration and accounting | | | 14,357 | |

| Chief compliance officer | | | 685 | |

| Custodian | | | 2,517 | |

| Shareholder servicing fees | | | 19,838 | |

| Transfer agent | | | 4,507 | |

| Other | | | 18,953 | |

| Total Liabilities | | | 1,071,343 | |

| Net Assets | | $ | 228,521,843 | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 169,865,559 | |

| Total distributable earnings | | | 58,656,284 | |

| Net Assets | | $ | 228,521,843 | |

| Shares outstanding (par value $0.01, unlimited number of shares authorized) | | | 9,945,534 | |

| Net Asset Value, Offering Price and Redemption price per share | | $ | 22.98 | |

| Statement of Operations | | | |

| For the year ended December 31, 2023 | | | |

| | | | |

| Investment Income: | | | |

| Dividends | | $ | 3,037,794 | |

| Total Investment Income | | | 3,037,794 | |

| Expenses: | | | | |

| Investment adviser | | | 1,446,915 | |

| Administration and accounting | | | 62,474 | |

| Chief compliance officer | | | 7,547 | |

| Custodian | | | 24,236 | |

| Shareholder servicing | | | 233,935 | |

| Transfer agency | | | 24,469 | |

| Trustee | | | 16,778 | |

| Other | | | 70,934 | |

| Gross expense before recoupment | | | 1,887,288 | |

| Recoupment of prior expenses reimbursed by the investment adviser | | | 42,027 | |

| Total expenses | | | 1,929,315 | |

| Net Expenses | | | 1,929,315 | |

| Net Investment Income | | | 1,108,479 | |

| Net Realized/Unrealized Gains (Losses) from Investments: | | | | |

| Net realized gains from investment transactions | | | 9,001,956 | |

| Change in unrealized appreciation on investments | | | 15,103,204 | |

| Net realized/unrealized gains on investments | | | 24,105,160 | |

| Change in Net Assets Resulting from Operations | | $ | 25,213,639 | |

| | See Notes to Financial Statements | 19 |

| Financial Statements | Boston Trust Midcap Fund |

| Statements of Changes in Net Assets | | | | | | |

| | | For the year ended

December 31, 2023 | | | For the year ended

December 31, 2022 | |

| Investment Activities: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 1,108,479 | | | $ | 710,622 | |

| Net realized gains from investment transactions | | | 9,001,956 | | | | 7,210,769 | |

| Change in unrealized appreciation (depreciation) on investments | | | 15,103,204 | | | | (27,325,299 | ) |

| Change in Net Assets Resulting from Operations | | | 25,213,639 | | | | (19,403,908 | ) |

| Distributions To Shareholders: | | | | | | | | |

| Total Distributions | | | (9,691,068 | ) | | | (7,363,133 | ) |

| Change in Net Assets Resulting from distributions to shareholders | | | (9,691,068 | ) | | | (7,363,133 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares issued | | | 79,231,729 | | | | 37,031,229 | |

| Dividends reinvested | | | 7,840,523 | | | | 5,968,235 | |

| Cost of shares redeemed | | | (36,586,492 | ) | | | (26,483,479 | ) |

| Change in Net Assets Resulting from Capital Share Transactions | | | 50,485,760 | | | | 16,515,985 | |

| Change in Net Assets | | | 66,008,331 | | | | (10,251,056 | ) |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 162,513,512 | | | | 172,764,568 | |

| End of year | | $ | 228,521,843 | | | $ | 162,513,512 | |

| Share Transactions: | | | | | | | | |

| Issued | | | 3,603,931 | | | | 1,654,281 | |

| Reinvested | | | 355,257 | | | | 271,407 | |

| Redeemed | | | (1,658,914 | ) | | | (1,203,248 | ) |

| Change in shares | | | 2,300,274 | | | | 722,440 | |

| 20 | See Notes to Financial Statements | |

| Financial Statements | Boston Trust Midcap Fund |

Financial Highlights

Selected data for a share outstanding throughout the years indicated.

| | | For the year

ended

December

31, 2023 | | | For the year

ended

December

31, 2022 | | | For the year

ended

December

31, 2021 | | | For the year

ended

December

31, 2020 | | | For the year

ended

December

31, 2019 | |

| Net Asset Value, Beginning of Period | | $ | 21.26 | | | $ | 24.96 | | | $ | 21.02 | | | $ | 19.55 | | | $ | 15.78 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.13 | | | | 0.10 | | | | 0.08 | | | | 0.12 | | | | 0.10 | |

| Net realized/unrealized gains (losses) from investments | | | 2.60 | | | | (2.80 | ) | | | 5.09 | | | | 1.60 | | | | 4.39 | |

| Total from investment activities | | | 2.73 | | | | (2.70 | ) | | | 5.17 | | | | 1.72 | | | | 4.49 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.10 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.12 | ) | | | (0.09 | ) |

| Net realized gains from investment transactions | | | (0.91 | ) | | | (0.91 | ) | | | (1.13 | ) | | | (0.13 | ) | | | (0.63 | ) |

| Total distributions | | | (1.01 | ) | | | (1.00 | ) | | | (1.23 | ) | | | (0.25 | ) | | | (0.72 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 22.98 | | | $ | 21.26 | | | $ | 24.96 | | | $ | 21.02 | | | $ | 19.55 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 13.05 | % | | | (10.94 | )% | | | 24.81 | % | | | 8.81 | % | | | 28.59 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000's) | | $ | 228,522 | | | $ | 162,514 | | | $ | 172,765 | | | $ | 139,723 | | | $ | 145,305 | |

| Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Ratio of net investment income to average net assets | | | 0.57 | % | | | 0.45 | % | | | 0.36 | % | | | 0.59 | % | | | 0.67 | % |

| Ratio of expenses (before fee reductions or recoupment of fees previously reimbursed by the investment adviser) to average net assets (a) | | | 0.98 | % | | | 1.00 | % | | | 1.00 | % | | | 1.05 | % | | | 1.04 | % |

| Portfolio turnover rate | | | 26.29 | % | | | 27.89 | % | | | 19.72 | % | | | 38.33 | % | | | 18.46 | % |

| (a) | During the periods, certain fees may have been reduced or recouped by the investment adviser. If such fee reductions/recoupments had not occurred, the ratio would have been as indicated. |

| | See Notes to Financial Statements | 21 |

| | Boston Trust SMID Cap Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Common Stocks (98.5%) | | | | | | |

| | | Shares | | | Fair Value ($) | |

| Communication Services (2.7%) | | | | | | |

| Cable One, Inc. | | | 8,890 | | | | 4,948,085 | |

| Interpublic Group of (The) Cos., Inc. | | | 320,395 | | | | 10,457,693 | |

| Omnicom Group, Inc. | | | 71,550 | | | | 6,189,790 | |

| | | | | | | | 21,595,568 | |

| Consumer Discretionary (11.0%) | | | | | | | | |

| Carter's, Inc. | | | 100,055 | | | | 7,493,119 | |

| Cavco Industries, Inc. (a) | | | 17,381 | | | | 6,024,602 | |

| Choice Hotels International, Inc. | | | 89,150 | | | | 10,100,695 | |

| Columbia Sportswear Co. | | | 118,563 | | | | 9,430,501 | |

| Service Corp. International | | | 232,039 | | | | 15,883,070 | |

| Texas Roadhouse, Inc. | | | 65,920 | | | | 8,057,402 | |

| TopBuild Corp. (a) | | | 31,725 | | | | 11,873,398 | |

| Williams-Sonoma, Inc. | | | 88,371 | | | | 17,831,500 | |

| | | | | | | | 86,694,287 | |

| Consumer Staples (3.3%) | | | | | | | | |

| BJ's Wholesale Club Holdings, Inc. (a) | | | 228,836 | | | | 15,254,208 | |

| Flowers Foods, Inc. | | | 470,535 | | | | 10,591,743 | |

| | | | | | | | 25,845,951 | |

| Energy (3.8%) | | | | | | | | |

| Cactus, Inc., Class A | | | 208,025 | | | | 9,444,335 | |

| Callon Petroleum Co. (a) | | | 212,298 | | | | 6,878,455 | |

| Core Laboratories, Inc. | | | 304,420 | | | | 5,376,057 | |

| Helmerich & Payne, Inc. | | | 230,275 | | | | 8,340,561 | |

| | | | | | | | 30,039,408 | |

| Financials (15.1%) | | | | | | | | |

| American Financial Group, Inc. | | | 98,300 | | | | 11,686,887 | |

| Cboe Global Markets, Inc. | | | 83,325 | | | | 14,878,512 | |

| Cohen & Steers, Inc. | | | 80,685 | | | | 6,110,275 | |

| Commerce Bancshares, Inc. | | | 103,578 | | | | 5,532,082 | |

| East West Bancorp, Inc. | | | 138,345 | | | | 9,953,923 | |

| FactSet Research Systems, Inc. | | | 34,795 | | | | 16,598,955 | |

| International Bancshares Corp. | | | 61,256 | | | | 3,327,426 | |

| Jack Henry & Associates, Inc. | | | 51,845 | | | | 8,471,991 | |

| Northern Trust Corp. | | | 112,025 | | | | 9,452,670 | |

| SEI Investments Co. | | | 245,440 | | | | 15,597,712 | |

| Selective Insurance Group, Inc. | | | 105,990 | | | | 10,543,885 | |

| UMB Financial Corp. | | | 85,093 | | | | 7,109,520 | |

| | | | | | | | 119,263,838 | |

| Health Care (13.2%) | | | | | | | | |

| Charles River Laboratories | | | | | | | | |

| International, Inc. (a) | | | 68,800 | | | | 16,264,320 | |

| Chemed Corp. | | | 24,210 | | | | 14,156,798 | |

| Cooper (The) Cos., Inc. | | | 47,100 | | | | 17,824,524 | |

| Medpace Holdings, Inc. (a) | | | 57,885 | | | | 17,743,489 | |

| Revvity, Inc. | | | 61,632 | | | | 6,736,994 | |

| Teleflex, Inc. | | | 53,919 | | | | 13,444,163 | |

| Waters Corp. (a) | | | 55,125 | | | | 18,148,804 | |

| | | | | | | | 104,319,092 | |

| Industrials (21.4%) | | | | | | | | |

| A O Smith Corp. | | | 140,335 | | | | 11,569,217 | |

| Allegion PLC | | | 64,700 | | | | 8,196,843 | |

| Applied Industrial Technologies, Inc. | | | 65,700 | | | | 11,345,733 | |

| Donaldson Co., Inc. | | | 214,970 | | | | 14,048,289 | |

| ExlService Holdings, Inc. (a) | | | 447,077 | | | | 13,792,325 | |

| Expeditors International of Washington, Inc. | | | 99,950 | | | | 12,713,640 | |

| Hubbell, Inc. | | | 33,030 | | | | 10,864,558 | |

| IDEX Corp. | | | 54,471 | | | | 11,826,199 | |

| Lincoln Electric Holdings, Inc. | | | 55,675 | | | | 12,107,086 | |

| Masco Corp. | | | 87,603 | | | | 5,867,649 | |

| Nordson Corp. | | | 62,379 | | | | 16,478,037 | |

| Paycom Software, Inc. | | | 61,082 | | | | 12,626,871 | |

| Robert Half International, Inc. | | | 71,443 | | | | 6,281,269 | |

| Snap-on, Inc. | | | 45,360 | | | | 13,101,782 | |

| The Toro Co. | | | 82,665 | | | | 7,935,013 | |

| | | | | | | | 168,754,511 | |

| Information Technology (13.0%) | | | | | | | | |

| Akamai Technologies, Inc. (a) | | | 89,475 | | | | 10,589,366 | |

| Amdocs Ltd. | | | 123,070 | | | | 10,816,622 | |

| Check Point Software Technologies Ltd. (a) | | | 50,300 | | | | 7,685,337 | |

| Dolby Laboratories, Inc., Class A | | | 89,810 | | | | 7,739,826 | |

| F5, Inc. (a) | | | 88,375 | | | | 15,817,357 | |

| Manhattan Associates, Inc. (a) | | | 24,553 | | | | 5,286,752 | |

| NetApp, Inc. | | | 107,860 | | | | 9,508,938 | |

| Progress Software Corp. | | | 194,375 | | | | 10,554,563 | |

| Qualys, Inc. (a) | | | 79,359 | | | | 15,576,585 | |

| Zebra Technologies Corp., Class A (a) | | | 33,795 | | | | 9,237,187 | |

| | | | | | | | 102,812,533 | |

| Materials (6.3%) | | | | | | | | |

| AptarGroup, Inc. | | | 99,290 | | | | 12,274,230 | |

| Avery Dennison Corp. | | | 51,950 | | | | 10,502,212 | |

| Packaging Corp. of America | | | 50,740 | | | | 8,266,053 | |

| RPM International, Inc. | | | 114,350 | | | | 12,764,891 | |

| Silgan Holdings, Inc. | | | 126,265 | | | | 5,713,491 | |

| | | | | | | | 49,520,877 | |

| Real Estate (6.6%) | | | | | | | | |

| Camden Property Trust | | | 50,299 | | | | 4,994,188 | |

| CubeSmart | | | 186,350 | | | | 8,637,323 | |

| Jones Lang LaSalle, Inc. (a) | | | 76,075 | | | | 14,368,285 | |

| Lamar Advertising Co., Class A | | | 87,935 | | | | 9,345,732 | |

| Physicians Realty Trust | | | 502,130 | | | | 6,683,350 | |

| STAG Industrial, Inc. | | | 215,298 | | | | 8,452,599 | |

| | | | | | | | 52,481,477 | |

| Utilities (2.1%) | | | | | | | | |

| Atmos Energy Corp. | | | 41,725 | | | | 4,835,928 | |

| IDACORP, Inc. | | | 51,845 | | | | 5,097,400 | |

| ONE Gas, Inc. | | | 101,820 | | | | 6,487,970 | |

| | | | | | | | 16,421,298 | |

| TOTAL COMMON STOCKS (Cost $665,835,725) | | | | | | | 777,748,840 | |

| 22 | See Notes to Financial Statements | |

| | Boston Trust SMID Cap Fund |

| Schedule of Portfolio Investments | December 31, 2023 |

| Investment Companies (1.5%) | | | | | | |

| | | Shares | | | Fair Value ($) | |

| Northern Institutional Treasury | | | | | | |

| Portfolio (Premier Class), 5.22% (b) | | | 11,730,244 | | | | 11,730,244 | |

| TOTAL INVESTMENT COMPANIES (Cost $11,730,244) | | | | | | | 11,730,244 | |

| Total Investments (Cost $677,565,969) — 100.0%(c) | | | | | | | 789,479,084 | |

| Other assets in excess of liabilities — 0.0% | | | | | | | 353,999 | |

| Net Assets — 100.0% | | | | | | $ | 789,833,083 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day yield as of December 31, 2023. |

| (c) | See Federal Tax Information listed in the Notes to the Financial Statements. |

| PLC | Public Limited Company |

| | See Notes to Financial Statements | 23 |

| Financial Statements | Boston Trust SMID Cap Fund |

| Statement of Assets and Liabilities | | | |

| December 31, 2023 | | | |

| | | | |

| Assets: | | | |

| Investments, at fair value(cost $677,565,969) | | $ | 789,479,084 | |

| Dividend receivable | | | 775,691 | |

| Receivable for investments sold | | | 1,230,680 | |

| Receivable for capital shares issued | | | 771,514 | |

| Prepaid expenses | | | 48,518 | |

| Total Assets | | | 792,305,487 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 516,002 | |

| Payable for capital shares redeemed | | | 206,530 | |

| Payable to Custodian | | | 1,209,495 | |

| Accrued expenses and other liabilities: | | | | |

| Investment adviser | | | 431,955 | |

| Administration and accounting | | | 36,736 | |

| Chief compliance officer | | | 2,296 | |

| Custodian | | | 7,557 | |

| Transfer agent | | | 4,004 | |

| Other | | | 57,829 | |

| Total Liabilities | | | 2,472,404 | |

| Net Assets | | $ | 789,833,083 | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 687,187,336 | |

| Total distributable earnings | | | 102,645,747 | |

| Net Assets | | $ | 789,833,083 | |