UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2012

Item 1. Report to Stockholders.

[Calvert International Equity Fund Semi-Annual Report to Shareholders]

and

[Calvert Capital Accumulation Fund Semi-Annual Report to Shareholders]

and

[Calvert International Opportunities Fund Semi-Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Dear Shareholder:

After a difficult summer of 2011, investor sentiment improved toward the end of 2011, and many investors clearly breathed a sigh of relief in early 2012. Headlines about Europe’s sovereign debt crisis had reached a fever pitch during the final months of 2011 and investors worldwide held their breath, concerned about the potential fallout on markets near and far.

However, long-term refinancing operations agreed to in December 2011 by the European Central Bank that enabled the region’s banks to borrow at very low interest rates as well as progress on a Greek bailout seemed to pull the eurozone back from the brink of collapse and reassured investors. As a result, the broad international markets of the MSCI EAFE Index improved, returning 14.73% for the reporting period.

Overall, key U.S. economic indicators such as the unemployment rate, manufacturing data, housing market fundamentals, and consumer confidence showed gradual improvement. But consumer spending remained weak, and gasoline prices topping $4.00 a gallon in some areas in March did not help. As a result, economic growth continued at a snail’s pace.

In contrast to the fourth quarter, when the Standard & Poor’s (S&P) 500 Index earned nearly all of its return during October, the S&P 500 Index had a strong and mostly steady climb in the first quarter of 2012 to end the reporting period at 25.89%. Investors became more open to risk over the reporting period as well.

Broadening the Reach of SRI

It’s worth noting that corporate responsibility is just as relevant today as it’s always been—and perhaps even more so in these times of economic uncertainty. At Calvert, we have long believed that a company’s environmental, sustainability, and governance policies correlate strongly with its risk management and financial performance. It’s clear that more and more investors, consumers, and companies are reaching the same conclusions, and that the use of shareholder advocacy to effect change is becoming an increasingly powerful tool.

However, we always welcome additional proof of this, especially from venerable sources such as Ernst & Young. In a new white paper, the management consulting firm noted that social and environmental issues accounted for 40% of shareholder proposals on proxy ballots last year, up one-third from 2010. Ernst & Young also predicts these issues will dominate proposals for the third consecutive year in 2012, thanks to a convergence of factors drawing attention to companies’ actions on sustainability and environmental issues.1 Perhaps even more important is the broadening of support. Sustainability proposals overall received favorable votes from a record 21% of shareholders in 2011, and nearly one-third of the proposals had support exceeding 30%—a critical level where corporate boards can’t help but take notice. This is on par with Calvert’s own experiences, where 38% of resolutions we filed or co-filed that resulted in a vote last year received support of more than 30%.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 4

If you’re interested in learning more about our shareholder advocacy efforts this year, visit us online at www.calvert.com/sri-resolutions.html.

Calvert’s Women’s Principles and Diversity

In March, Calvert helped mark the two-year anniversary of the United Nation’s Women’s Empowerment Principles (WEP) at the U.N. Gender Equality for Sustainable Business Event, which emphasized the business case for promoting gender equality in the workplace. More than 400 chief executives have now publicly committed to implementing the WEP, which were adapted from the Calvert’s Women’s Principles® in 2010. We’re also participating in the WEP Leadership Group, comprised of 30 leading companies, investors, and women-focused organizations seeking to encourage broader adoption of the Principles.

We filed six shareholder resolutions for the upcoming annual meeting season asking companies to add specific considerations of race and gender diversity to their desired director characteristics. Five were successfully withdrawn after management agreed. Notably, this includes American Financial Group, whose resistance last year led to a vote supported by 27% of shareholders. So, persistence does indeed pay off. The lone holdout is Urban Outfitters, where company resistance led to a vote last year that received 22% support.

Leading the Path to Sustained Sustainability in the Next Economy

In October, Calvert had the privilege of co-hosting the 2011 United Nations Environment Programme Finance Initiative (UNEP-FI) Global Roundtable in Washington, D.C. More than 500 attendees from the investment, banking, and insurance industries discussed the tipping point for linking global sustainability and market stability as the cornerstone of the “next economy.” In my opening remarks as UNEP-FI co-chair of the Global Steering Committee, I highlighted the importance of the financial community working together. This is necessary not only to restore trust in financial systems, but also to make a meaningful impact on the pressing challenges facing the world today so that a sustainable future will exist for all. This is an idea that’s been at the heart of Calvert Investments for more than 30 years. Calvert’s leadership on these topics was evident at the event, with Calvert team members speaking on panels about human rights, water, and ecosystem services.

Other Calvert News

As you may know, we launched Calvert Equity Income Fund2 last fall to offer the potential for attractive income generation and competitive total return by investing in a portfolio of large-cap, dividend-paying stocks that we believe provide compelling value. Calvert Large Cap Value Fund co-portfolio managers James McGlynn, CFA and Yvonne Bishop, CFA are managing the new Fund. Both Funds feature Calvert’s SAGE strategy, which involves Calvert actively engaging with companies held in the Funds to engender positive change.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 5

A Variety of Ways to Stay Informed

We are cautiously optimistic about the continued economic recovery, but much uncertainty and the potential for renewed volatility remains. That’s why we always feel it’s best to maintain a well-diversified mix of U.S. and international stocks, bonds, and cash appropriate for your goals and risk tolerance. And of course, we suggest you consult your financial advisor if you have questions or concerns.

We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals. And now, you can get the same information on the go with Calvert’s new iPhone® app, which is available for free from iTunes.

As always, we thank you for investing with Calvert.

Barbara J. Krumsiek

President and CEO

Calvert Investments, Inc.

May 2012

1 Ernst & Young, Leading Corporate Sustainability Issues in the 2012 Proxy Season: Is your board prepared?

2 Investment in mutual funds involves risk, including possible loss of principal invested. For more information on any Calvert fund, please contact Calvert at 800.368.2748 for a free summary prospectus and/or prospectus. An investor should consider the investment objectives, risks, charges, and expenses of an investment carefully before investing. The summary prospectus and prospectus contain this and other information. Read them carefully before you invest or send money. Calvert mutual funds are underwritten and distributed by Calvert Investment Distributors, Inc., member FINRA and subsidiary of Calvert Investments, Inc.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 6

As always, Calvert continues to work hard to ensure you have a say in the responsible management of environmental, social, and governance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Overall Shareholder Advocacy Efforts

Through March 31, 2012, Calvert had filed 23 shareholder proposals in the 2012 proxy season.

The most popular topics were board diversity, sustainability disclosure, climate change, and loan servicing. Several of these are discussed in more detail below. Through March 31, 2012, we had successfully withdrawn 14 resolutions after companies agreed to the terms.

Setting a Fair and Sustainable Table

Many food crops are already showing vulnerability to climate change. For example, higher temperatures and extreme rainfall are expected to increase disease and stress in Central and South American coffee bean crops, resulting in lower output. Last year, our shareholder resolution asked J.M. Smucker to disclose the climate-related risks for its Folgers Coffee and other coffee brands, which reflect 40% of the company’s revenue. We have re-filed the proposal this year in the hope that last year’s strong support of 30% persuades the company to reconsider its position.

We also filed a resolution with Colgate-Palmolive about palm oil sourcing. Despite some sustainability advantages to using palm oil in food, lotions, soaps, and shampoo, significant problems exist in the way palm oil trees are grown in some countries—resulting in significant greenhouse gas emissions, displacement of local and Indigenous Peoples, and destruction of endangered species. After discussions with company management, Colgate announced a goal of purchasing only certified sustainable palm oil by 2015, and we successfully withdrew the proposal.

Finally, Calvert began working with Oxfam America, farm worker unions, and consumer groups to develop a new certification system for on-farm sustainability of fruits and vegetables grown in the United States. The pilot project evaluates farm worker welfare, pesticide reduction, and product safety.

Rooting Out Supply Chain Abuses

Calvert co-authored a guide with Christian Brothers Investments and the Interfaith Center on Corporate Responsibility to help companies comply with the California Transparency in Supply Chain Act (SB 657). This ground-breaking U.S. law requires manufacturers and retailers with global gross receipts exceeding $100 million that operate in California to disclose efforts to eliminate slavery and human trafficking from their direct supply chains on their corporate website. The guide also serves as an advocacy tool for more effective management of labor and human rights risks within global supply chains.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 7

On a related note, Calvert is greatly concerned by news reports about factory conditions for some of Apple’s suppliers, especially in China. We have been working with a larger investor coalition to engage Apple’s senior management, and we believe the company has made significant strides in the last few months toward full supply chain transparency and “zero tolerance” for workplace abuses. Apple has also moved aggressively to have the Fair Labor Association conduct third-party audits of its suppliers and is posting the results of these monthly audits on its website. We will continue to monitor the situation and work with Apple to remedy its supply chain issues.

Improving Regulation of ESG Issues

Clean Air Act. Calvert coordinated an investor letter to congressional leaders urging timely implementation of new Clean Air Act rules under development at the Environmental Protection Agency (EPA). These rules would help modernize and improve the efficiency of electric utilities, reduce cross-state air pollution, lower emissions of mercury and air toxins, and create well-paid construction, engineering, and manufacturing jobs. The EPA announced the new Mercury and Air Toxics rule in December—a victory for the health of both the public and the economy.

Dodd-Frank Reform & Consumer Protection Act of 2010. We continue to participate in a complicated Securities and Exchange Commission (SEC) rule-making process for this law, particularly regarding section 1502 on “conflict minerals.” This section requires companies that use gold, tin, tantalum, and tungsten in their products to disclose whether these metals are coming from specific mines in the Democratic Republic of Congo and adjoining countries. Profits from these mines have been used to fuel the weapon supply for one of the world’s bloodiest conflicts since World War II.

An early supporter of the legislation, Calvert is working with a coalition of investors, human rights organizations, and major multinational corporations that recently met with the SEC chairman as well as several commissioners and their staff. We also presented the investor perspective at an SEC roundtable in October 2011 and have submitted a series of letters and comments about the complex and controversial issues involved. We hope to see a final rule in the coming months.

Community Investments

Many of our Funds participate in Calvert’s High Social Impact Investing program, which is administered through the Calvert Foundation. This community investment program may allocate a small percentage of Fund assets at below-market interest rates to investments that provide economic opportunity for struggling populations.1 One such investment is Pride Industries, which creates jobs for people with disabilities and is an up-and-coming leader in helping individuals overcome barriers to employment. In fiscal year 2010, the organization employed 4,100 individuals, 60% of whom were disabled.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 8

Another example is Via Verde, an innovative and award-winning affordable housing development in the South Bronx. This complex combines urgently needed low- to moderate-income housing with a new model for affordable, green, and healthy urban living in a design that improves the attractiveness of the community around it.

Special Equities

A modest but important portion of certain funds is allocated to small private companies developing products or services that address important sustainability or environmental issues. One recent investment was LearnZillion, a Washington, D.C.-based group using video technology to provide individualized learning in primary schools.2 “Best of class” video modules allow the teacher to track each student’s progress, give the right lessons at the right time, and provide timely support—all with interactive feedback. We are unsure if this approach will be the breakthrough learning improvement the schools need, but all agree innovative solutions need to be tried.

Calvert was also instrumental in getting the U.S. State Department to focus attention on the importance of “impact investing,” by way of a conference with an address by Secretary of State Hillary Clinton. We are gratified the U.S. government is manifesting the best of American values by becoming involved in supporting social entrepreneurs.

1 As of March 31, 2012, Calvert Social Investment Foundation (“Calvert Foundation” or “Foundation”) Community Investment Notes represented the following percentages of Fund net assets: Calvert Capital Accumulation Fund 0.55%, Calvert International Equity Fund 1.37%, and Calvert Small Cap Fund 0.50%. The Calvert Foundation is a 501(c)(3) nonprofit organization. The Foundation’s Community Investment Note Program is not a mutual fund and should not be confused with any Calvert Investments-sponsored investment product.

2 As of March 31, 2012, LearnZillion represented 0.02% of Calvert Balanced Portfolio. Holdings are subject to change.

As of March 31, 2012, the following companies represented the following percentages of net assets: J.M. Smucker 0.11% of Calvert Social Index Fund, Colgate-Palmolive 0.51% of Calvert Social Index Fund, and Apple 6.52% of Calvert Social Index Fund. Holdings are subject to change.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 9

Investment Performance

Calvert International Equity Fund (Class A shares at NAV) returned 16.80% for the six-month period ended March 31, 2012 compared with 14.68% for the MSCI EAFE IMI. Stock selection was the primary driver of the Fund’s relative outperformance over this reporting period.

Investment Climate

During the six-month reporting period, strong earnings from U.S. companies, continued improvements in U.S. macroeconomic data, and aggressive accommodative monetary policy worldwide helped equity markets rally hard off their lows posted last fall, albeit on low volume. For the trailing six-month period, the Russell 1000, Russell 2000, MSCI EAFE, and MSCI Emerging Markets Indices returned 26.27%, 29.83%, 14.73%, and 19.20%, respectively.

The growth investment style slightly outperformed the value style, and within the Russell 1000 Index, Financials, Information Technology, and Consumer Discretionary were the top-performing sectors. The

| CALVERT INTERNATIONAL |

| EQUITY FUND |

| MARCH 31, 2012 |

| | | |

| INVESTMENT PERFORMANCE | | | |

| (total return at NAV*) | | | |

| | 6 Months | | 12 Months | |

| | ended | | ended | |

| | 3/31/12 | | 3/31/12 | |

| Class A | 16.80 | % | -5.80 | % |

| Class B | 16.13 | % | -6.81 | % |

| Class C | 16.28 | % | -6.57 | % |

| Class I | 17.20 | % | -5.13 | % |

| Class Y | 17.02 | % | -5.39 | % |

| |

| MSCI EAFE Investable | | | | |

| Market Index (IMI) | 14.68 | % | -5.38 | % |

| | | | |

| Lipper International | | | | |

| Large-Cap Core | | | | |

| Funds Average | 16.31 | % | -5.98 | % |

| |

| TEN LARGEST | | | % of | |

| STOCK HOLDINGS | | | Net Assets | |

| Adidas AG | | | 2.4 | % |

| Check Point Software | | | | |

| Technologies Ltd. | | | 2.3 | % |

| Toyota Motor Corp. | | | 2.3 | % |

| Novartis AG | | | 2.2 | % |

| Kingfisher plc | | | 2.1 | % |

| BG Group plc | | | 2.1 | % |

| SAP AG | | | 2.1 | % |

| Canadian National Railway Co. | | 2.0 | % |

| Pearson plc | | | 2.0 | % |

| Groupe Danone | | | 1.9 | % |

| Total | | | 21.4 | % |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 10

Utilities, Telecommunications, and Consumer Staples sectors lagged as the risk-on trade returned with a vengeance.

In the United States, improving jobs data were a significant boost to equity market performance with the recent and welcome improvements in the unemployment rate and jobless claims compounding the positive effects from strong corporate earnings. The falling unemployment rate also helped drive continued improvement in consumer confidence and consumer spending, which were not as heavily impacted by rising gasoline prices as they could have been had the stock market and the job market not been improving.

The manufacturing sector continued to provide significant support to the U.S. economic recovery, with a weak U.S. dollar supporting strong exports and the national Purchasing Manager’s Index firmly in an expansionary mode. Vehicle sales and production both looked encouraging as well. However, deepening recession in Europe and the overall slowdown in the global economy will de-emphasize the contribution of exports to U.S. gross domestic product (GDP). Therefore, the continued recovery of the U.S. consumer will be important for a self-sustained U.S. economic recovery. The service sector has been showing signs of improvement recently--a sign the manufacturing-led recovery in the United States may be spreading to other sectors.

U.S. bank lending continued to improve despite regulatory pressures threatening the long-term profitability of the banking industry. An improving consumer balance sheet allowed banks to increase lending while adhering to higher lending standards. The U.S. housing market continued to bottom out and showed signs of improvement, though it is not out of the woods yet, especially with foreclosed

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| MARCH 31, 2012 |

| |

| | % of Total | |

| ECONOMIC SECTORS | Investments | |

| Consumer Discretionary | 20.9 | % |

| Consumer Staples | 10.0 | % |

| Energy | 4.9 | % |

| Financials | 20.4 | % |

| Health Care | 7.2 | % |

| Industrials | 10.6 | % |

| Information Technology | 10.5 | % |

| Limited Partnership Interest | 0.8 | % |

| Materials | 5.5 | % |

| Telecommunication Services | 5.6 | % |

| Time Deposit | 1.8 | % |

| Utilities | 1.3 | % |

| Venture Capital | 0.5 | % |

| Total | 100 | % |

inventories still high. The housing sector, while not providing much growth, is not likely to be the drag on the economy that it has been for many quarters since the bursting of the housing bubble.

Despite visible improvements in macroeconomic data, in January the U.S. Federal Reserve (Fed) announced an extension of its low interest rate policy through the end of 2014. It also adopted a formal inflation target of 2% and suggested that balance sheet expansion (QE3) is not out of the question should economic conditions deteriorate, though this is less likely in the near term. The move appeared to reflect the Fed’s heightened focus on unemployment, which has become an increasingly important part of the Fed’s dual mandate of price stability and maximum employment this election year.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 11

This aggressively accommodative monetary policy is likely to create an environment conducive to imbalances and bubbles in the economy and markets. With U.S. interest rates and the dollar at historic lows, U.S. dollar-denominated commodities like oil have been rising in price to levels where the demand destruction begins to create negative feedback on both commodity prices and economic growth globally. Interestingly, this negative feedback may be disproportionately higher for the commodity-hungry emerging market economies than for the United States itself. Therefore, it could be that the United States will end up “exporting” the recessionary pressures outside its borders to more commodity-intensive economies like China and Brazil.

Still, with global economic challenges keeping inflation in check, policymakers around the globe continued their efforts toward easing monetary policies, which should help stimulate economic growth. Unfortunately for the global economy and consumers, the rate of increase in oil prices kept pace with the stock market, exacerbated by the geopolitical tensions in the Middle East. This rising oil price trend, if not reversed, will likely put a damper on global economic growth.

In the eurozone, investors increasingly worried about the currency’s potential collapse during the fourth quarter of 2011, though there was some stability to start 2012. Yields on the sovereign debt of Spain, Greece, Italy, and France soared in November, but have gradually declined since then, signaling that the LTRO (long term refinancing operation) may have helped the eurozone sovereign bond markets by driving down short-term yields and, for the time-being, reduced investor perception of the probability of a global financial crisis.

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| MARCH 31, 2012 |

| |

| AVERAGE ANNUAL TOTAL RETURNS | |

| |

| CLASS A SHARES | (with max. load) | |

| One year | -10.26 | % |

| Five year | -8.77 | % |

| Ten year | 1.76 | % |

| |

| CLASS B SHARES | (with max. load) | |

| One year | -11.47 | % |

| Five year | -9.08 | % |

| Ten year | 1.10 | % |

| |

| CLASS C SHARES | (with max. load) | |

| One year | -7.51 | % |

| Five year | -8.67 | % |

| Ten year | 1.35 | % |

| |

| CLASS I SHARES | | |

| One year | -5.13 | % |

| Five year | -7.20 | % |

| Ten year | 3.04 | % |

| |

| CLASS Y SHARES* | | |

| One year | -5.39 | % |

| Five year | -7.60 | % |

| Ten year | 2.41 | % |

* Calvert International Equity Fund first offered Class Y Shares on October 31, 2008.

Performance prior to that date reflects the performance of Class A Shares at net asset value (NAV). Actual Class Y Share performance would have been different.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 12

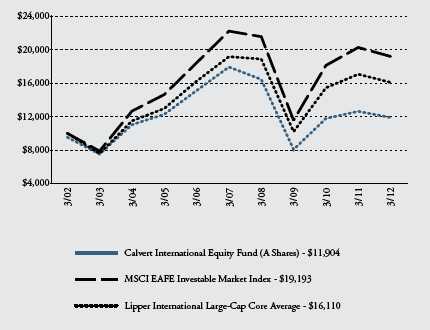

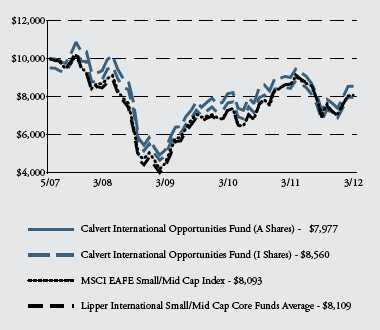

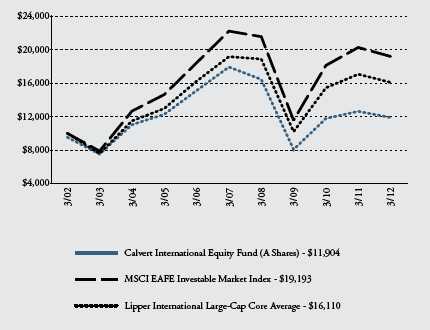

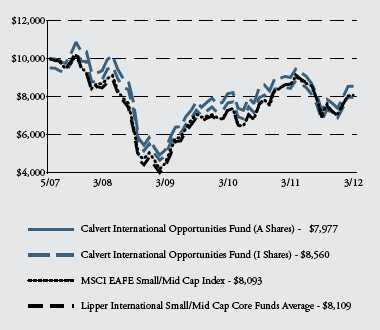

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Classes A shares and reflect the deduction of the maximum front-end sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.82%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 13

Despite the positive impact of the LTRO, Europe continued to provide a negative backdrop to investor confidence and was a drag on the global economy. Eurozone GDP contracted 0.3% in the fourth quarter of 2011, while the unemployment rate in the eurozone reached a 15-year high of 10.8%. These data confirmed our concerns about the eurozone’s economic outlook and the worsening recession in Europe, including the core economies.

A deal on the Greek bailout was reached by all involved parties with the resulting Greek bond swap reducing Greece’s debt burden by 100 billion euros. Even with the bond swap, debt in Greece is becoming an increasingly larger percentage of GDP due to the rate at which Greece’s GDP is contracting, a trend that will continue to jeopardize the country’s credit health.

A positive inflation trend allowed the Chinese government to continue to reposition its economic policy from contractionary for most of 2011 to stimulative. The Chinese economy continued to decelerate during the period as foreign direct investment, one of the major drivers of economic growth in China, declined on a year-over-year basis for four consecutive months. Increasing domestic consumption in the country will be key to offsetting this effect. China cut its economic growth target from 8% to 7.5%, signaling the country’s need to transition to a more sustainable, consumer-driven economic model.

Portfolio Strategy

Stock selection was positive across all sectors, with selection effects strongest in Financials, Industrials, and Health Care. Top contributors included Assa Abloy, Novo Nordisk, and Svenska Handelsbanken.

Country allocation was also a positive contributor, adding 1.11 percentage points to the Fund’s active return, primarily driven by the Fund’s overweight to North America. However, sector allocation detracted 1.15 percentage points for the period, primarily driven by the Fund’s 3% allocation to cash.

Market Outlook

A sharp slowdown or, more importantly, a hard landing in China, fueled by a possible bursting of a real-estate bubble there, would certainly create strong ripple effects throughout the global economy, including the United States, but this indirect impact could be less damaging than a domestic recession in the United States.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 14

If U.S. economic recovery proves robust enough to withstand the negative head-winds from Europe and China in 2012, U.S. equities may significantly outperform Treasuries given the relative valuation of the two asset classes. Highly bid up dividend-yielding securities may also underperform as investor risk aversion subsides. However, if more investors refocus on the underlying economic fundamentals in Europe, the risk aversion may return for some time during the year. In this environment, despite stronger economic data in the United States, one thing is certain--equity market volatility is likely to be here to stay for most of 2012.

May 2012

As of March 31, 2012, the following companies represented the following percentages of Fund net assets: Assa Abloy 1.25%, Novo Nordisk 1.71%, and Svenska Handelsbanken 1.18%. Holdings are subject to change.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 15

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2011 to March 31, 2012).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 16

| | BEGINNING | ENDING ACCOUNT | EXPENSES PAID |

| | ACCOUNT VALUE | VALUE | DURING PERIOD* |

| | 10/1/11 | 3/31/12 | 10/1/11 - 3/31/12 |

| CLASS A | | | |

| Actual | $1,000.00 | $1,168.00 | $9.73 |

| Hypothetical | $1,000.00 | $1,016.02 | $9.05 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS B | | | |

| Actual | $1,000.00 | $1,161.30 | $16.05 |

| Hypothetical | $1,000.00 | $1,010.15 | $14.93 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS C | | | |

| Actual | $1,000.00 | $1,162.80 | $14.49 |

| Hypothetical | $1,000.00 | $1,011.60 | $13.48 |

| (5% return per | | | |

| year before expenses) | | | |

| | | |

| CLASS I | | | |

| Actual | $1,000.00 | $1,172.00 | $5.73 |

| Hypothetical | $1,000.00 | $1,019.72 | $5.33 |

| (5% return per | | | |

| year before expenses) | | | |

| |

| CLASS Y | | | |

| Actual | $1,000.00 | $1,170.20 | $7.53 |

| Hypothetical | $1,000.00 | $1,018.06 | $7.00 |

| (5% return per | | | |

| year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.80%, 2.97%, 2.68%, 1.06%, and 1.39% for Class A, Class B, Class C, Class I, and Class Y, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 17

| | | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2012 |

| |

| EQUITY SECURITIES - 94.9% | SHARES | | VALUE |

| Australia - 1.4% | | | |

| Amcor Ltd. (ADR) | 3,181 | $ | 98,325 |

| QR National Ltd. | 310,404 | | 1,200,356 |

| Santos Ltd. | 93,793 | | 1,384,696 |

| Sims Metal Management Ltd | 74,748 | | 1,138,401 |

| Sims Metal Management Ltd. (ADR) | 36,251 | | 553,553 |

| | | | 4,375,331 |

| |

| Austria - 0.0% | | | |

| Erste Group Bank AG (ADR) | 5,237 | | 60,644 |

| Telekom Austria AG (ADR) | 271 | | 6,277 |

| Verbund AG (ADR) | 507 | | 3,052 |

| | | | 69,973 |

| |

| Belgium - 0.0% | | | |

| Ageas (ADR) | 2,056 | | 4,276 |

| Delhaize Group SA (ADR) | 2,364 | | 124,346 |

| | | | 128,622 |

| |

| Brazil - 3.3% | | | |

| BM&FBOVESPA SA | 169,393 | | 1,045,337 |

| Itau Unibanco Holding SA (ADR) | 217,700 | | 4,177,663 |

| Natura Cosmeticos SA | 188,499 | | 4,108,603 |

| Tim Participacoes SA (ADR) | 41,146 | | 1,327,370 |

| | | | 10,658,973 |

| |

| Canada - 5.3% | | | |

| Canadian National Railway Co.: | | | |

| New York Exchange | 16,907 | | 1,342,923 |

| Toronto Exchange | 82,124 | | 6,516,160 |

| Cenovus Energy, Inc. | 84,100 | | 3,022,061 |

| EnCana Corp. New York Exchange | 29,499 | | 579,655 |

| Potash Corporation of Saskatchewan, Inc. | 116,844 | | 5,338,602 |

| Suncor Energy, Inc. New York Exchange | 6,475 | | 211,732 |

| | | | 17,011,133 |

| |

| China - 0.7% | | | |

| China Merchants Bank Co. Ltd | 1,051,915 | | 2,151,452 |

| |

| Denmark - 1.8% | | | |

| Danske Bank A/S (ADR)* | 15,792 | | 132,337 |

| H Lundbeck A/S (ADR) | 3,480 | | 69,565 |

| Novo Nordisk A/S, Series B | 39,622 | | 5,484,763 |

| Novozymes A/S (ADR) | 1,844 | | 53,955 |

| | | | 5,740,620 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 18 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Finland - 0.4% | | | |

| Metso Oyj (ADR) | 420 | $ | 18,014 |

| Nokia Oyj (ADR) | 7,964 | | 43,722 |

| Outotec Oyj | 23,541 | | 1,193,791 |

| Sampo Oyj (ADR) | 6,861 | | 98,455 |

| | | | 1,353,982 |

| |

| France - 8.9% | | | |

| Air France-KLM (ADR)* | 2,564 | | 14,538 |

| Air Liquide SA | 44,647 | | 5,951,076 |

| Air Liquide SA (ADR) | 7,681 | | 205,006 |

| AXA SA (ADR) | 18,230 | | 302,071 |

| BNP Paribas SA (ADR) | 7,862 | | 185,622 |

| Cap Gemini SA (ADR) | 207 | | 4,608 |

| Carrefour SA (ADR) | 27,123 | | 128,563 |

| Cie Generale des Etablissements Michelin | 17,400 | | 1,295,370 |

| Cie Generale d’Optique Essilor International SA (ADR) | 1,395 | | 62,036 |

| Credit Agricole SA (ADR) | 33,364 | | 101,093 |

| Danone (ADR) | 27,083 | | 375,912 |

| Dassault Systemes SA | 21,321 | | 1,961,420 |

| Groupe Danone | 88,366 | | 6,162,598 |

| L’Oreal SA (ADR) | 4,044 | | 99,604 |

| Publicis Groupe | 82,000 | | 4,519,691 |

| Sanofi SA | 26,369 | | 2,047,469 |

| Sanofi SA (ADR) | 11,115 | | 430,706 |

| Schneider Electric SA | 24,631 | | 1,609,038 |

| Schneider Electric SA (ADR) | 11,305 | | 147,191 |

| Suez Environnement Co. (ADR) | 1,758 | | 13,413 |

| Valeo SA (ADR) | 5,507 | | 144,559 |

| Vallourec SA | 39,400 | | 2,495,553 |

| Veolia Environnement SA (ADR) | 21,929 | | 362,048 |

| | | | 28,619,185 |

| |

| Germany - 9.5% | | | |

| Adidas AG | 97,720 | | 7,628,043 |

| Aixtron SE (ADR) | 23,607 | | 409,109 |

| Allianz SE | 25,700 | | 3,066,109 |

| Allianz SE (ADR) | 70,176 | | 832,989 |

| Brenntag AG | 8,911 | | 1,091,040 |

| Celesio AG (ADR) | 942 | | 3,335 |

| Commerzbank AG (ADR)* | 999 | | 2,557 |

| Continental AG* | 13,853 | | 1,307,284 |

| Continental AG (ADR)* | 61 | | 5,745 |

| Deutsche Post AG (ADR) | 7,514 | | 144,644 |

| Henkel AG & Co. KGaA | 24,363 | | 1,520,385 |

| K+S AG (ADR) | 1,685 | | 44,383 |

| Kabel Deutschland Holding AG* | 49,300 | | 3,044,379 |

| Merck KGaA (ADR) | 345 | | 12,689 |

| SAP AG | 96,548 | | 6,740,931 |

| SAP AG (ADR) | 17,919 | | 1,251,105 |

| Volkswagen AG, Preferred | 17,107 | | 3,007,675 |

| Volkswagen AG (ADR), Preferred | 9,371 | | 328,360 |

| | | | 30,440,762 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 19 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Greece - 0.0% | | | |

| National Bank of Greece SA (ADR)* | 49,475 | $ | 132,098 |

| |

| Hong Kong - 3.8% | | | |

| AIA Group Ltd. | 398,000 | | 1,458,364 |

| Bank of East Asia Ltd. (ADR) | 3,753 | | 13,886 |

| China Merchants Holdings International Co. Ltd. | 924,000 | | 3,088,231 |

| City Telecom HK Ltd. (ADR) | 58,461 | | 779,870 |

| Esprit Holdings Ltd. (ADR) | 62,073 | | 247,671 |

| Hang Lung Properties Ltd. | 104,989 | | 385,380 |

| Hang Lung Properties Ltd. (ADR) | 87,965 | | 1,603,602 |

| Hang Seng Bank Ltd. (ADR) | 1,110 | | 14,709 |

| Hong Kong Exchanges and Clearing Ltd. | 209,546 | | 3,519,309 |

| Hong Kong Exchanges and Clearing Ltd. (ADR) | 3,389 | | 56,630 |

| Johnson Electric Holdings Ltd. (ADR) | 1,074 | | 6,788 |

| Li & Fung Ltd. (ADR) | 22,086 | | 100,933 |

| PCCW Ltd. (ADR) | 2,456 | | 8,915 |

| SJM Holdings Ltd. | 508,000 | | 1,031,147 |

| | | | 12,315,435 |

| |

| India - 0.3% | | | |

| Infosys Ltd. (ADR) | 16,400 | | 935,292 |

| |

| Indonesia - 0.3% | | | |

| Bank Mandiri Persero Tbk PT | 1,423,500 | | 1,066,380 |

| |

| Ireland - 0.4% | | | |

| Experian plc (ADR) | 11,240 | | 174,220 |

| Kerry Group plc | 22,393 | | 1,036,141 |

| WPP plc (ADR) | 667 | | 45,603 |

| | | | 1,255,964 |

| |

| Israel - 2.3% | | | |

| Check Point Software Technologies Ltd.* | 115,961 | | 7,402,950 |

| |

| Italy - 0.0% | | | |

| Intesa Sanpaolo SpA (ADR) | 10,926 | | 117,127 |

| |

| Japan - 13.6% | | | |

| Advantest Corp. (ADR) | 4,514 | | 72,359 |

| Aeon Co. Ltd. (ADR) | 3,305 | | 43,527 |

| Asahi Glass Co. Ltd. (ADR) | 24,499 | | 208,976 |

| Astellas Pharma, Inc | 28,300 | | 1,167,506 |

| Bank of Yokohama Ltd. | 211,000 | | 1,059,928 |

| Canon, Inc | 100,243 | | 4,755,811 |

| Canon, Inc. (ADR) | 30,411 | | 1,449,388 |

| Dai Nippon Printing Co. Ltd. (ADR) | 22,230 | | 226,079 |

| Dai-ichi Life Insurance Co. Ltd. | 855 | | 1,185,785 |

| Daiwa House Industry Co. Ltd. (ADR) | 489 | | 64,793 |

| Denso Corp. (ADR) | 6,160 | | 103,611 |

| Eisai Co. Ltd. (ADR) | 254 | | 10,119 |

| FANUC Corp | 21,261 | | 3,787,071 |

| Fujitsu Ltd. (ADR) | 11,218 | | 296,604 |

| Honda Motor Co. Ltd. (ADR) | 36,718 | | 1,411,073 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 20 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Japan - Cont’d | | | |

| KDDI Corp. | 512 | $ | 3,329,879 |

| Konami Corp. (ADR) | 2,378 | | 67,845 |

| Kubota Corp. (ADR) | 7,329 | | 354,724 |

| Lawson, Inc | 19,800 | | 1,251,690 |

| Mitsui Fudosan Co. Ltd | 75,256 | | 1,445,492 |

| Mizuho Financial Group, Inc. (ADR) | 201,536 | | 650,961 |

| MS&AD Insurance Group Holdings (ADR) | 34,938 | | 358,464 |

| Nippon Yusen KK (ADR) | 89,927 | | 562,943 |

| Nissan Motor Co. Ltd. (ADR)* | 51,937 | | 1,115,087 |

| Nitto Denko Corp. (ADR) | 7,983 | | 326,425 |

| Nomura Holdings, Inc. (ADR) | 161,596 | | 712,638 |

| NSK Ltd. (ADR) | 1,607 | | 24,925 |

| NTT DoCoMo, Inc | 882 | | 1,470,446 |

| ORIX Corp | 7,330 | | 702,627 |

| ORIX Corp. (ADR) | 7,678 | | 370,464 |

| Panasonic Corp. (ADR) | 77,651 | | 718,272 |

| Sega Sammy Holdings, Inc. (ADR) | 6,279 | | 31,646 |

| Seiko Epson Corp. (ADR) | 9,704 | | 68,025 |

| Sekisui House Ltd. | 142,000 | | 1,397,343 |

| Sharp Corp. (ADR) | 27,019 | | 199,400 |

| Sony Corp. | 52,900 | | 1,093,752 |

| Sony Corp. (ADR) | 38,955 | | 809,095 |

| Sumitomo Mitsui Trust Holdings, Inc. (ADR) | 40,720 | | 127,861 |

| Tokyo Gas Co. Ltd. | 333,118 | | 1,576,364 |

| Toyota Motor Corp. | 168,682 | | 7,306,859 |

| Toyota Motor Corp. (ADR) | 17,903 | | 1,554,338 |

| | | | 43,470,195 |

| |

| Luxembourg - 0.9% | | | |

| Nielsen Holdings NV* | 93,600 | | 2,821,104 |

| |

| Mexico - 0.3% | | | |

| FINAE, Series D, Preferred (b)(i)* | 1,962,553 | | 238,632 |

| Grupo Financiero Banorte SAB de CV | 190,500 | | 845,563 |

| | | | 1,084,195 |

| |

| Netherlands - 2.6% | | | |

| ASML Holding NV | 2,469 | | 123,796 |

| BE Semiconductor Industries NV | 4,208 | | 31,223 |

| Gemalto NV | 20,692 | | 1,365,516 |

| ING Groep NV (CVA)* | 161,212 | | 1,342,907 |

| Koninklijke Philips Electronics NV | 45,962 | | 935,327 |

| PostNL NV (ADR) | 13,469 | | 82,161 |

| TNT Express NV (ADR) | 13,119 | | 161,364 |

| Yandex NV* | 122,700 | | 3,296,949 |

| Ziggo NV* | 31,077 | | 969,273 |

| | | | 8,308,516 |

| |

| Norway - 0.9% | | | |

| DnB ASA | 101,620 | | 1,304,408 |

| Petroleum Geo-Services ASA* | 76,518 | | 1,117,046 |

| Yara International ASA (ADR) | 8,545 | | 408,366 |

| | | | 2,829,820 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 21 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Philippines - 0.6% | | | |

| Philippine Long Distance Telephone Co. (ADR) | 29,053 | $ | 1,806,806 |

| |

| Portugal - 0.1% | | | |

| Portugal Telecom SGPS SA (ADR) | 29,155 | | 157,729 |

| |

| Russia - 0.2% | | | |

| X5 Retail Group NV (GDR) (e)* | 32,700 | | 750,138 |

| |

| Singapore - 0.5% | | | |

| City Developments Ltd. (ADR) | 479 | | 4,282 |

| Oversea-Chinese Banking Corp. Ltd | 188,830 | | 1,339,614 |

| Singapore Telecommunications Ltd. (ADR) | 11,258 | | 283,364 |

| | | | 1,627,260 |

| |

| South Africa - 1.3% | | | |

| African Bank Investments Ltd. (ADR) | 169 | | 4,301 |

| Aspen Pharmacare Holdings Ltd.* | 85,776 | | 1,327,463 |

| Clicks Group Ltd.* | 379,200 | | 2,214,787 |

| MTN Group Ltd. (ADR) | 21,938 | | 388,522 |

| Nedbank Group Ltd. (ADR) | 3,939 | | 86,264 |

| Tiger Brands Ltd. (ADR) | 1,994 | | 69,391 |

| | | | 4,090,728 |

| |

| Spain - 0.3% | | | |

| Banco Bilbao Vizcaya Argentaria SA (ADR) | 43,088 | | 344,273 |

| Banco Santander SA (ADR) | 74,002 | | 567,595 |

| International Consolidated Airlines Group SA (ADR)* | 678 | | 9,607 |

| | | | 921,475 |

| |

| Sweden - 4.1% | | | |

| Assa Abloy AB, Series B | 127,400 | | 4,000,109 |

| Atlas Copco AB (ADR) | 2,340 | | 56,909 |

| Hennes & Mauritz AB, B Shares | 140,454 | | 5,080,601 |

| SKF AB (ADR) | 650 | | 15,827 |

| Svenska Cellulosa AB (ADR) | 3,578 | | 61,864 |

| Svenska Handelsbanken AB | 118,500 | | 3,776,172 |

| | | | 12,991,482 |

| |

| Switzerland - 6.1% | | | |

| Adecco SA (ADR) | 277 | | 7,235 |

| Compagnie Financiere Richemont SA | 24,371 | | 1,528,166 |

| Credit Suisse Group AG* | 68,600 | | 1,955,440 |

| Credit Suisse Group AG (ADR) | 33,797 | | 963,553 |

| Julius Baer Group Ltd.* | 53,473 | | 2,158,706 |

| Nobel Biocare Holding AG (ADR) | 495 | | 3,118 |

| Novartis AG | 125,005 | | 6,918,795 |

| Roche Holding AG (ADR) | 39,128 | | 1,707,546 |

| STMicroelectronics NV | 16,908 | | 138,477 |

| Swatch Group AG, Bearer Shares | 7,900 | | 3,636,459 |

| Zurich Financial Services AG (ADR)* | 18,785 | | 506,819 |

| | | | 19,524,314 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 22 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Taiwan - 0.4% | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. (ADR) | 75,600 | $ | 1,155,168 |

| |

| Thailand - 0.4% | | | |

| Kasikornbank PCL | 231,100 | | 1,172,355 |

| |

| United Kingdom - 22.8% | | | |

| ARM Holdings plc | 189,106 | | 1,789,646 |

| Aviva plc (ADR) | 17,740 | | 188,399 |

| Barclays plc (ADR) | 20,253 | | 306,833 |

| BG Group plc | 294,893 | | 6,826,107 |

| BG Group plc (ADR) | 42,482 | | 983,883 |

| British Land Co. plc (ADR) | 543 | | 4,127 |

| British Sky Broadcasting Group plc | 110,588 | | 1,195,074 |

| BT Group plc (ADR) | 27,414 | | 991,290 |

| Bunzl plc (ADR) | 631 | | 51,035 |

| Capita plc | 109,331 | | 1,280,239 |

| Centrica plc | 312,006 | | 1,578,118 |

| Centrica plc (ADR) | 9,287 | | 188,619 |

| GlaxoSmithKline plc | 84,866 | | 1,894,588 |

| HSBC Holdings plc: | | | |

| Hong Kong Exchange | 418,691 | | 3,685,807 |

| London Exchange | 273,331 | | 2,424,183 |

| HSBC Holdings plc (ADR) | 22,325 | | 991,007 |

| Inmarsat plc | 103,553 | | 761,980 |

| J Sainsbury plc (ADR) | 7,617 | | 150,816 |

| Johnson Matthey plc | 40,829 | | 1,539,702 |

| Johnson Matthey plc (ADR) | 141 | | 10,589 |

| Kingfisher plc | 1,393,187 | | 6,830,669 |

| Legal & General Group plc (ADR) | 608 | | 6,299 |

| Man Group plc (ADR) | 39,306 | | 83,329 |

| Old Mutual plc (ADR) | 1,023 | | 20,532 |

| Pearson plc | 335,083 | | 6,240,485 |

| Persimmon plc | 124,280 | | 1,271,515 |

| Petrofac Ltd. | 51,860 | | 1,442,520 |

| Prudential plc | 120,559 | | 1,440,625 |

| Prudential plc (ADR) | 60,796 | | 1,460,928 |

| Reckitt Benckiser Group plc | 107,917 | | 6,094,998 |

| Reckitt Benckiser Group plc (ADR) | 18,380 | | 208,061 |

| Sage Group plc (ADR) | 7,701 | | 147,397 |

| Smith & Nephew plc (ADR) | 15,944 | | 805,172 |

| SSE plc (ADR) | 18,076 | | 388,815 |

| Standard Chartered plc (s) | 223,464 | | 5,572,784 |

| Tate & Lyle plc | 100,285 | | 1,130,226 |

| Tesco plc | 866,586 | | 4,571,573 |

| Tesco plc (ADR) | 44,802 | | 716,384 |

| Unilever plc (ADR) | 44,310 | | 1,464,445 |

| United Utilities Group plc (ADR) | 4,302 | | 83,244 |

| Vodafone Group plc | 1,768,777 | | 4,869,073 |

| Vodafone Group plc (ADR) | 23,339 | | 645,790 |

| Willis Group Holdings plc | 19,500 | | 682,110 |

| | | | 73,019,016 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 23 |

| | | | |

| EQUITY SECURITIES - CONT’D | | SHARES | | VALUE |

| United States - 1.5% | | | | |

| Bristol-Myers Squibb Co. | | 25,205 | $ | 850,669 |

| H.J. Heinz Co | | 16,400 | | 878,220 |

| MeadWestvaco Corp | | 44,502 | | 1,405,818 |

| Powerspan Corp.: | | | | |

| Series A, Convertible Preferred (b)(i)* | | 45,455 | | — |

| Series B, Convertible Preferred (b)(i)* | | 20,000 | | — |

| Series C, Convertible Preferred (b)(i)* | | 239,764 | | — |

| Series D, Convertible Preferred (b)(i)* | | 45,928 | | — |

| Series D, Preferred Warrants (strike price $3.44/share, | | | | |

| expires 12/31/12) (b)(i)* | | 2,347 | | — |

| Pricesmart, Inc. | | 13,928 | | 1,014,098 |

| Sealed Air Corp | | 26,185 | | 505,632 |

| | | | | 4,654,437 |

| |

| |

| Total Equity Securities (Cost $281,623,842) | | | | 304,160,017 |

| |

| |

| VENTURE CAPITAL LIMITED | | ADJUSTED | | |

| PARTNERSHIP INTEREST - 0.9% | | BASIS | | |

| Balkan Financial Sector Equity Fund CV (b)(i)* | $ | 582,848 | | 483,361 |

| Blackstone Cleantech Venture Partners (b)(i)* | | 60,160 | | 43,369 |

| China Environment Fund 2004 (b)(i)* | | - | | 388,568 |

| Emerald Sustainability Fund I (b)(i)* | | 661,912 | | 420,612 |

| gNet Defta Development Holdings LLC (a)(b)(i)* | | 400,000 | | 323,387 |

| SEAF Central and Eastern European Growth Fund LLC (a)(b)(i)* | | 347,969 | | 634,574 |

| SEAF India International Growth Fund (b)(i)* | | 374,476 | | 384,029 |

| ShoreCap International LLC (b)(i)* | | - | | 173,392 |

| Terra Capital (b)(i)* | | 469,590 | | 1 |

| |

| Total Venture Capital Limited Partnership Interest (Cost $2,896,955) | | 2,851,293 |

| |

| | | PRINCIPAL | | |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.3% | | AMOUNT | | |

| Access Bank plc, 8.477%, 8/29/12 (b)(i) | | 125,000 | | 127,757 |

| FINAE: | | | | |

| Note I, 6.50%, 12/10/15 (b)(i) | | 250,000 | | 250,000 |

| Note II, 6.50%, 2/29/16 (b)(i) | | 500,000 | | 500,000 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 (b)(i)(w) | | 26,417 | | 6,604 |

| Windhorse International-Spring Health Water Ltd., 8.00%, 3/13/13 (b)(i) 56,000 | | 56,000 |

| |

| Total Venture Capital Debt Obligations (Cost $957,417) | | | | 940,361 |

| |

| |

| HIGH SOCIAL IMPACT INVESTMENTS - 1.4% | | | | |

| Calvert Social Investment Foundation Notes, 0.94%, 7/1/14 (b)(i)(r) | | 4,431,583 | | 4,382,703 |

| |

| Total High Social Impact Investments (Cost $4,431,583) | | | | 4,382,703 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 24 |

| | | | | |

| | | PRINCIPAL | | | |

| TIME DEPOSIT - 1.8% | | AMOUNT | | VALUE | |

| State Street Time Deposit, 0.113%, 4/2/12 | $ | 5,801,623 | $ | 5,801,623 | |

| |

| Total Time Deposit (Cost $5,801,623) | | | | 5,801,623 | |

| |

| |

| |

| TOTAL INVESTMENTS (Cost $295,711,420) - 99.3% | | | | 318,135,997 | |

| Other assets and liabilities, net - 0.7% | | | | 2,376,930 | |

| NET ASSETS - 100% | | | $ | 320,512,927 | |

| |

| |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares outstanding of common stock with | | | |

| 250,000,000 shares of $0.01 par value shares authorized: | | | | | |

| Class A: 13,990,853 shares outstanding | | | $ | 315,063,912 | |

| Class B: 358,264 shares outstanding | | | | 11,289,463 | |

| Class C: 1,460,326 shares outstanding | | | | 34,846,797 | |

| Class I: 6,826,883 shares outstanding | | | | 151,588,120 | |

| Class Y: 527,281 shares outstanding | | | | 7,722,233 | |

| Undistributed net investment income | | | | 597,734 | |

| Accumulated net realized gain (loss) on investments | | | | | |

| and foreign currency transactions | | | | (223,006,634 | ) |

| Net unrealized appreciation (depreciation) on investments, foreign currencies, | | | |

| and assets and liabilities denominated in foreign currencies | | | | 22,411,302 | |

| |

| |

| NET ASSETS | | | $ | 320,512,927 | |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A (based on net assets of $191,115,746) | | | $ | 13.66 | |

| Class B (based on net assets of $4,358,477) | | | $ | 12.17 | |

| Class C (based on net assets of $17,403,569) | | | $ | 11.92 | |

| Class I (based on net assets of $100,040,649) | | | $ | 14.65 | |

| Class Y (based on net assets of $7,594,486) | | | $ | 14.40 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 25 |

| | | |

| RESTRICTED SECURITIES | ACQUISITION DATES | | COST |

| Access Bank plc, 8.477%, 8/29/12 | 8/29/07 | $ | 125,000 |

| Balkan Financial Sector Equity Fund CV LP | 1/12/06 - 1/24/12 | | 582,848 |

| Blackstone Cleantech Venture Partners LP | 7/29/10 - 1/25/12 | | 60,160 |

| Calvert Social Investment Foundation Notes, 0.94%, 7/1/14 | 7/1/11 | | 4,431,583 |

| China Environment Fund 2004 LP | 9/15/05 - 4/1/09 | | - |

| Emerald Sustainability Fund I LP | 7/19/01 - 5/17/11 | | 661,912 |

| FINAE: | | | |

| Series D, Preferred | 2/28/11 | | 252,686 |

| Note I, 6.50%, 12/10/15 | 12/10/10 | | 250,000 |

| Note II, 6.50%, 2/29/16 | 2/24/11 | | 500,000 |

| gNet Defta Development Holdings LLC, LP | 8/30/05 | | 400,000 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 | 12/22/06 | | 26,417 |

| Powerspan Corp.: | | | |

| Series A, Convertible Preferred | 8/20/97 | | 250,000 |

| Series B, Convertible Preferred | 10/5/99 | | 200,000 |

| Series C, Convertible Preferred | 12/21/04 - 6/12/08 | | 273,331 |

| Series D, Convertible Preferred | 6/20/08 | | 157,996 |

| Series D, Preferred Warrants (strike price $3.44/share, | | | |

| expires 12/31/12) | 12/5/07 - 6/20/08 | | - |

| SEAF Central and Eastern European Growth Fund LLC, LP | 8/10/00 - 8/26/11 | | 347,969 |

| SEAF India International Growth Fund LP | 3/22/05 - 5/24/10 | | 374,476 |

| ShoreCap International LLC, LP | 8/12/04 - 12/15/08 | | - |

| Terra Capital LP | 11/23/98 - 3/14/06 | | 469,590 |

| Windhorse International-Spring Health Water Ltd., 8.00%, | | | |

| 3/13/13 | 9/13/11 | | 56,000 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 26 |

(a) Affiliated company.

(b) This security was valued by the Board of Directors. See Note A.

(e) Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(i) Restricted securities represent 2.6% of net assets of the Fund.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

(s) 105,000 shares of Standard Chartered plc have been soft segregated in order to cover outstanding commitments to certain limited partnerships investments within the Fund. There are no restrictions on the trading of this security.

(w) Mayer Laboratories, Inc. is in default for principal and interest. Past due accrued interest as of March 31, 2012 totaled $960.

* Non-income producing security.

Abbreviations:

ADR: American Depositary Receipts

CVA: Certificaten Van Aandelen

GDR: Global Depositary Receipts

LLC: Limited Liability Corporation

plc: Public Limited Company

LP: Limited Partnership

See notes to financial statements.

www.calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 27

| | | |

| STATEMENT OF OPERATIONS |

| SIX MONTHS ENDED MARCH 31, 2012 |

| |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Dividend income (net of foreign taxes withheld of $234,357) | $ | 3,037,252 | |

| Interest income | | 61,231 | |

| Total investment income | | 3,098,483 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 1,141,372 | |

| Transfer agency fees and expenses | | 347,388 | |

| Administrative fees | | 440,755 | |

| Distribution Plan expenses: | | | |

| Class A | | 227,994 | |

| Class B | | 22,435 | |

| Class C | | 84,337 | |

| Directors’ fees and expenses | | 17,597 | |

| Custodian fees | | 126,356 | |

| Registration fees | | 33,754 | |

| Reports to shareholders | | 95,339 | |

| Professional fees | | 21,831 | |

| Miscellaneous | | 37,326 | |

| Total expenses | | 2,596,484 | |

| Reimbursement from Advisor: | | | |

| Class A | | (70,673 | ) |

| Class B | | (4,334 | ) |

| Class C | | (5,872 | ) |

| Class I | | (29,049 | ) |

| Class Y | | (3,564 | ) |

| Fees paid indirectly | | (49 | ) |

| Net expenses | | 2,482,943 | |

| |

| NET INVESTMENT INCOME | | 615,540 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | (14,827,679 | ) |

| Foreign currency transactions | | (225,227 | ) |

| | | (15,052,906 | ) |

| |

| Change in unrealized appreciation (depreciation) on: | | | |

| Investments and foreign currencies | | 62,334,430 | |

| Assets and liabilities denominated in foreign currencies | | 10,885 | |

| | | 62,345,315 | |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | 47,292,409 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 47,907,949 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 28 |

| | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | SIX MONTHS

ENDED | | | YEAR

ENDED | |

| | | MARCH

31, | | | SEPTEMBER

30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2012 | | | 2011 | |

| Operations: | | | | | | |

| Net investment income | $ | 615,540 | | $ | 4,177,788 | |

| Net realized gain (loss) | | (15,052,906 | ) | | 1,597,366 | |

| Change in unrealized appreciation or (depreciation) | | 62,345,315 | | | (54,531,070 | ) |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 47,907,949 | | | (48,755,916 | ) |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (2,117,750 | ) | | (655,710 | ) |

| Class C shares | | (14,293 | ) | | — | |

| Class I shares | | (1,414,874 | ) | | (542,675 | ) |

| Class Y shares | | (79,164 | ) | | (3,993 | ) |

| Total distributions | | (3,626,081 | ) | | (1,202,378 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 13,321,679 | | | 37,038,781 | |

| Class B shares | | 11,863 | | | 95,958 | |

| Class C shares | | 572,341 | | | 1,483,373 | |

| Class I shares | | 10,205,417 | | | 31,388,444 | |

| Class Y shares | | 524,874 | | | 8,008,040 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 1,891,096 | | | 608,387 | |

| Class C shares | | 11,391 | | | — | |

| Class I shares | | 1,274,329 | | | 483,830 | |

| Class Y shares | | 35,166 | | | 419 | |

| Redemption fees: | | | | | | |

| Class A shares | | 5,475 | | | 4,506 | |

| Class C shares | | 2 | | | 249 | |

| Class I shares | | — | | | 669 | |

| Class Y shares | | 14 | | | 6 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (24,117,497 | ) | | (79,188,924 | ) |

| Class B shares | | (825,932 | ) | | (1,646,677 | ) |

| Class C shares | | (1,899,579 | ) | | (4,408,325 | ) |

| Class I shares | | (14,521,874 | ) | | (14,266,871 | ) |

| Class Y shares | | (1,435,586 | ) | | (1,831,646 | ) |

| Total capital share transactions | | (14,946,821 | ) | | (22,229,781 | ) |

| |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | 29,335,047 | | | (72,188,075 | ) |

| |

| |

| NET ASSETS | | | | | | |

| Beginning of period | | 291,177,880 | | | 363,365,955 | |

| End of period (including undistributed net investment | | | | | | |

| income of $597,734 and 3,608,275, respectively) | $ | 320,512,927 | | $ | 291,177,880 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 29 |

| | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | SIX MONTHS

ENDED | | YEAR

ENDED | |

| | MARCH

31, | | SEPTEMBER

30, | |

| CAPITAL SHARE ACTIVITY | 2012 | | 2011 | |

| Shares sold: | | | | |

| Class A shares | 1,047,408 | | 2,582,076 | |

| Class B shares | 1,037 | | 7,466 | |

| Class C shares | 51,191 | | 119,086 | |

| Class I shares | 748,443 | | 2,086,100 | |

| Class Y shares | 38,688 | | 527,710 | |

| Reinvestment of distributions: | | | | |

| Class A shares | 156,677 | | 42,634 | |

| Class C shares | 1,079 | | — | |

| Class I shares | 98,632 | | 31,789 | |

| Class Y shares | 2,767 | | 28 | |

| Shares redeemed: | | | | |

| Class A shares | (1,901,110 | ) | (5,606,048 | ) |

| Class B shares | (72,751 | ) | (130,029 | ) |

| Class C shares | (170,383 | ) | (353,754 | ) |

| Class I shares | (1,037,570 | ) | (929,886 | ) |

| Class Y shares | (108,242 | ) | (125,742 | ) |

| Total capital share activity | (1,144,134 | ) | (1,748,570 | ) |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 30 |

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: The Calvert International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Calvert World Values Fund, Inc. is comprised of three separate series. The operations of each series are accounted for separately. The Fund offers five classes of shares of capital stock - Classes A, B, C, I, and Y. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment may be waived for certain institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Directors. In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At March 31, 2012, securities valued at $8,412,989, or 2.6% of net assets were fair valued in good faith under the direction of the Board of Directors.

The Fund utilizes various methods to measure the fair value of its investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 31 |

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows.

Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters. Such securities would be categorized as Level 2 in the hierarchy in these circumstances. Utilizing this technique may result in transfers between Level 1 and Level 2. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are fair valued by the Fund’s Board of Directors and are categorized as Level 3 in the hierarchy. Venture capital direct equity securities are generally valued using the most appropriate and applicable method to measure fair value in light of each company’s situation. Methods may include market, income or cost approaches with discounts as appropriate based on assumptions of liquidation or exit risk. Examples of the market approach are subsequent rounds of financing, comparable transactions, and revenue times an industry multiple. An example of the income approach is the discounted cash flow. Examples of the cost approach are replacement cost, salvage value, or net asset percentage. Venture capital limited partnership (“LP”) securities are valued at the fair value reported by the general partner of the partnership adjusted as necessary to reflect subsequent capital calls and distributions and any other available information. In the absence of a reported LP unit value, fair value may be estimated based on the Fund’s percentage equity in the partnership and/or other balance sheet information and portfolio value for the most recently available period reported by the general partner. In some cases adjustments may be made to account for daily pricing of material public holdings within the partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 32 |

of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2012:

| | | VALUATION INPUTS | | |

| |

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | |

| Equity securities* | $303,921,385 | — | — | $303,921,385 | ** |

| Time deposit | — | $5,801,623 | — | 5,801,623 | |

| Venture capital | — | — | $8,412,989 | 8,412,989 | |

| |

| TOTAL | $303,921,385 | $5,801,623 | $8,412,989 | $318,135,997 | |

* For further breakdown of equity securities by country, please refer to the Statement of Net Assets.

** Exclusive of $238,632 venture capital equity shown in venture capital heading.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | VENTURE CAPITAL | | TOTAL | |

| Balance as of 9/30/11 | $8,898,945 | | $8,898,945 | |

| Accrued discounts/premiums | - | | - | |

| Realized gain (loss) | (7,387 | ) | (7,387 | ) |

| Change in unrealized appreciation (depreciation) | 78,198 | | 78,198 | |

| Purchases | 38,245 | | 38,245 | |

| Sales | (595,012 | ) | (595,012 | ) |

| Transfers in and/or out of Level 31 | - | | - | |

| Balance as of 3/31/12 | $8,412,989 | | $8,412,989 | |

1 The Fund’s policy is to recognize transfers into and transfers out of Level 3 as of the end of the reporting period.

For the six months ended March 31, 2012, total change in unrealized gain (loss) on Level 3 securities included in the change in net assets was $78,198. Total unrealized gain (loss) for all securities (including Level 1 and Level 2) can be found on the accompanying Statement of Operations.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 33 |

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund (within seven days for Class I shares). The redemption fee is accounted for as an addition to paid-in capital.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 34 |

The fee is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.