Exhibit 99.6

Traditional Business

Our traditional business consists of our Cott North America, Cott U.K. and All Other reporting segments. Our traditional business produces, either directly or through third-party manufacturers with whom we have co-packing arrangements, carbonated soft drinks (“CSDs”), 100% shelf stable juice and juice-based products, clear, still and sparkling flavored waters, energy drinks and shots, sports drinks, new age beverages, ready-to-drink teas, liquid enhancers, freezables, ready-to-drink alcoholic beverages, hot chocolate, coffee, malt drinks, creamers/whiteners, cereals and beverage concentrates. Cott North America’s net revenue from external customers was $1,290.9 million and represented 44.0% of our total net revenue for the twelve month period ended April 2, 2016. Cott U.K.’s net revenue was $545.4 million and represented 18.6% of our total revenue for the twelve month period ended April 2, 2016. All Other’s net revenue was $58.2 million and represented 2.0% of our total net revenue for the twelve month period ended April 2, 2016. Collectively, our traditional business’ net revenue was $1,894.5 million and represented 64.6% of our total net revenue for the twelve month period ended April 2, 2016.

Aquaterra Acquisition

On January 4, 2016, Cott acquired Aquaterra Corporation (“Aquaterra”), Canada’s oldest and largest direct-to-consumer home and office water delivery business delivering water and coffee to homes and offices (the “Aquaterra Acquisition”). The aggregate purchase price paid by the Company in the Aquaterra Acquisition was approximately C$62 million (approximately U.S. $44.5 million). We have integrated Aquaterra into our DSS reporting segment.

The Eden Acquisition

On June 7, 2016, Carbon Acquisition Co B.V., a private company with limited liability incorporated under the laws of the Netherlands and a wholly-owned subsidiary of Cott Corporation, as the purchaser, entered into the Share Purchase Agreement (the “Share Purchase Agreement”) with Hydra Luxembourg Holdings S.à.r.l., a private limited liability company incorporated in Luxembourg, the seller, and Cott Corporation, the purchaser’s guarantor, to acquire the sole issued and outstanding share in the share capital of Eden Holdings, the indirect parent company of Eden Springs Europe B.V., a leading provider of water and coffee solutions in Europe, for a purchase price of approximately €470 million, subject to customary adjustments for cash, debt, working capital and other items. Consistent with Cott’s acquisition and diversification strategy, the Eden Acquisition will allow us to further improve product and channel mix while reducing exposure to large format retailers, create a strong international HOD platform with further tuck-in and expansion opportunities, provide us with meaningful scale across Europe with access to attractive end-markets with a positive growth outlook, and expand our direct to consumer business (by combining DSS, Aquaterra and Eden we will have over 2 million direct to customer delivery points across North America, Europe and Israel). On a pro forma basis, for the twelve months ended April 2, 2016, assuming that the Eden Acquisition had occurred on January 4, 2015, we would have had net sales and Combined Acquisition Adjusted EBITDA of approximately $3.3 billion and $437.6 million, respectively.

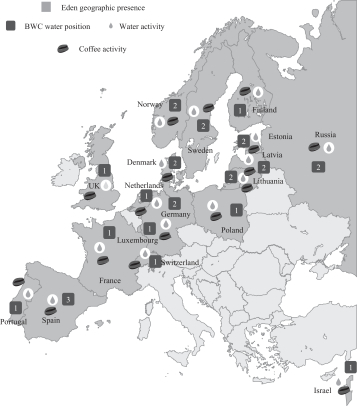

Eden is a leading provider of water and coffee solutions in Europe. Eden operates in 17 European countries, and Israel, and has a higher combined water and coffee installed client base than any of its competitors. Eden offers a variety of integrated water and coffee solutions designed to cater to the broad range of tastes and requirements of its diverse customer base. Its offerings are segmented into water and coffee solutions:

Water Solutions

| • | Eden’s stand-alone bottled water coolers (“BWC”) offering is its principal business and consists of the installation, rental and servicing of stand-alone bottled water coolers and the sale and delivery of bottled water and accessory products to its customers. According to a report by Zenith International from 2015, it is |

2

the largest BWC provider in Europe and holds the largest or second largest presence by BWC client base in 16 of the 17 European countries in which it operates, as well as in Israel. |

| • | Eden’s point of use plumbed in water coolers (“POU”) offering consists of the installation, rental and servicing of point of use plumbed in water coolers that access and filter tap water, as well as the sale of accessory products. According to a report by Zenith International from 2015, Eden holds the second largest POU position by client base across the 17 European countries that it is present in and it believes POU represents a significant opportunity for sustainable growth. |

| • | Eden’s small pack plastic (polyethylene terephthalate) bottles of water (“PET”) offering consists of the sale of branded small pack plastic bottles of water for personal use. It offers its PET products primarily in Israel to retail outlets through a third party distributor and it believes it currently holds the largest share of the Israeli PET segment. |

Coffee Solutions

| • | Eden’s office coffee solutions (“OCS”) offering consists of the installation, rental and servicing of a variety of stand-alone coffee machines and the sale and delivery of coffee (capsule, bean, ground and soluble), tea, chocolate and accessory products. It has been growing its OCS presence and is a leading OCS provider in the UK and, according to a 2012 report by GIL-CSC, in Israel. |

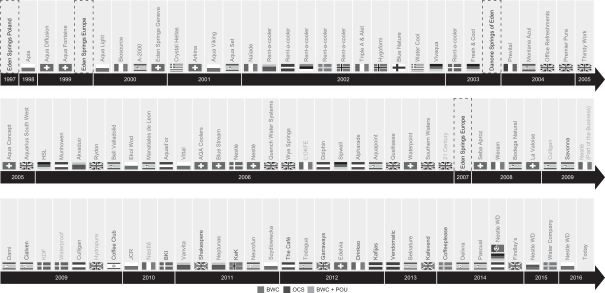

Eden’s water and coffee business models have significant operational overlap in areas such as customer service, billing and collection, sales and marketing and administration, which allows it to integrate new coffee customers onto its existing water business platforms and offer a dual water and coffee solution with increased operational efficiency. In recent years, Eden has achieved revenue growth and consolidated its position in the water and coffee space through strategic acquisitions. For the twelve months ended March 31, 2016, Eden generated revenues of €357.0 million and Adjusted EBITDA of €65.5 million.

We believe the Eden Acquisition will create substantial strategic and financial benefits, including:

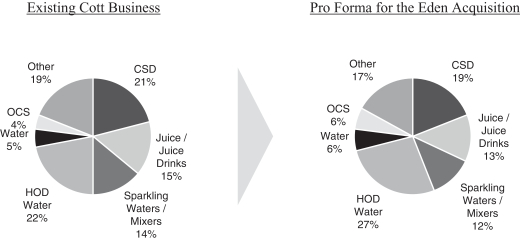

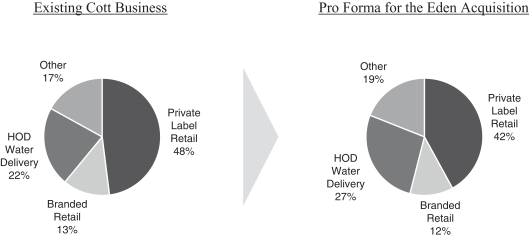

| • | Improves product and channel mix while reducing exposure to large format retailers: As detailed in the charts below, the Eden Acquisition will further improve our product mix outside of CSDs and shelf stable juices, and drive our channel mix beyond large format retailers. |

| • | Creates a strong international HOD platform with further tuck-in and expansion opportunities: Eden is a leading provider in the water solutions space and currently holds the largest or second largest share by BWC client base in 17 of the 18 countries in which it operates. Following the closing of the Eden Acquisition, we intend to proactively pursue accretive, synergistic acquisitions to continually build customer density and reduce the overall cost of servicing Eden’s existing customer base |

| • | Provides meaningful scale across Europe with access to attractive end-markets with positive growth outlook: The combined BWC and POU segment in Europe (based on the number of water coolers installed) is forecasted by Zenith International to grow at a CAGR of approximately 3.1% from 2015 through 2019, driven primarily by growth in GDP, total hours worked and a continued focus on well-being and the health benefits of water consumption. We believe that Eden’s leading presence in the BWC segment and pan-European scale strongly positions it to capture an increasing portion of growth in the water solutions space, cross-sell coffee and water solutions and continue to generate increased operational efficiencies. |

| • | Expands our direct to consumer business: The Eden Acquisition provides us access to a customer base that is broad in terms of customer size, industry and geographic region, including a diversified base of offices and homes ranging from recognized blue chip companies to individual homes and offices across 18 countries. Like DSS, Eden has a low customer concentration. For the year ended December 31, |

3

2015, its top 10 customers in aggregate accounted for less than 5% of its total revenue. The new route-to-market also creates synergy opportunities by allowing us to sell Cott products through this new channel to existing Eden customers. |

| • | Continues Cott’s acquisition and diversification strategy: Our business strategy includes evaluating mid-to-larger scale opportunities to expand our positions in the HOD water, OCS and filtration services categories, as well as other higher margin or growth-oriented categories where our platform, operating strength and synergies can be leveraged. We believe that the Eden Acquisition represents such an opportunity, and is consistent with our ongoing strategy to continue to accelerate the pace and scale of our acquisition-based diversification outside of CSDs and shelf stable juices, with a focus on other beverage categories and beverage adjacencies, as well as driving our channel mix beyond large format retailers while ensuring our transactions are value-creative. |

Product Categories and Channels

We have a diversified product portfolio across major beverage categories with an expanding presence in beverages that are on-trend with consumer demand. Since 2009, we have invested in developing new products and completed a number of acquisitions to enhance the breadth of our product focus and to continue to diversify our revenues and channel mix. Comparing Cott’s and DSS category and channel mix to that of the combined Cott, DSS and Eden Holdings business, CSDs and shelf stable juices would have been reduced from 36% to 32% of our revenues for the year ended January 2, 2016, and private label beverages sold would have been reduced from 48% to 42% of our portfolio on a historical combined basis for the year ended January 2, 2016.

The following chart sets forth Cott’s net revenues for the year ended January 2, 2016 by product category and channel mix, on a stand-alone basis and on a pro forma basis, assuming the Eden Acquisition had occurred on January 4, 2015:

Revenues by Product for the year ended January 2, 2016

4

Revenues by Channel for the year ended January 2, 2016

Competitive Strengths

The combination of our national scale and density of our routes in key markets, our industry-leading infrastructure, and our emphasis on superior customer service is intended to create significant competitive strengths. With respect to our DSS business, we continually invest in our delivery infrastructure, call center and service capabilities to maintain our established position as a leader in this segment. We believe these investments have positioned us to capitalize on a number of positive industry dynamics and new growth opportunities. First, we intend to capture new customers as we capitalize on favorable consumer trends across our addressable markets, including increased focus on health and wellness, concerns about deteriorating municipal water quality and the shift to single-cup coffee systems. Second, we believe our ability to cross-sell complementary water and coffee products and services represents a significant untapped opportunity; only around 5% of our commercial water delivery customer locations purchase our coffee products. Third, the highly fragmented market in which we operate affords us ample opportunity to make the most of our scale, systems and customer density to execute synergistic tuck-in acquisitions across all of our service areas. We believe these strengths, along with the strengths outlined below, will allow us to capitalize on growth opportunities, such as the Eden Acquisition, to drive sustainable and profitable growth.

Leading Position in Multiple Beverage Categories with Diverse Products and Services Portfolio

With the DSS Acquisition, we combined a leading provider in the direct-to-consumer beverage services industry with our traditional business, one of the world’s largest producers of beverages on behalf of retailers, brand owners and distributors. We have the largest national presence in the North American HOD bottled water industry by volume and are one of the top five presences in the U.S. OCS and filtration services industries. The HOD bottled water and OCS market segments in the U.S. exhibited strong growth, and we believe we are well-positioned to capitalize on future growth given our leading position in both market segments. In bottled water, we offer a portfolio of well-known regional brands with longstanding heritages, such as Sparkletts, Hinckley Springs, and Kentwood Springs, which have contributed to our being the largest or one of the largest HOD bottled water providers in most cities in which we operate. In OCS, we offer a complete range of products under leading brands including Keurig, Mars Alterra, Starbucks Coffee, Caribou Coffee, Peet’s Coffee & Tea and Javarama. We are one of the only direct-to-customer providers that can offer comprehensive services to residential customers and small and medium-sized businesses, as well as large regional and national corporations and retailers, universities and government agencies. Our broad direct-to-consumer network creates an advantage in marketing and customer reach, while our extensive range of products and capabilities allows us to offer

5

customers a convenient, single solution for coffee, tea and high quality drinking water. We believe our position will be further strengthened through our ongoing efforts to enhance and promote our full-service beverage offering to new and existing customers.

Our traditional business focuses on marketing or supplying retailer, licensed and company-owned brands, as well as manufacturing beverages on a contract basis for national brand customers. We also sell CSD concentrates and non-carbonated concentrates internationally. We believe that our position as a market leader, our broad portfolio offering and our existing infrastructure will enable us to continue to penetrate the contract manufacturing, private-label and value brand markets, whether by winning new customers, launching new product stock keeping units (“SKUs”) with existing customers, or supplying retailers who currentlyself-manufacture.

Eden is a leading provider in the water solutions space and currently holds the largest or second largest share by BWC client base in 17 of the 18 countries in which it operates. Eden launched its POU offering in Europe in 2008 and by 2015 had already become the second largest player by client base across the European countries in which it is present, a position Eden retains today. The combined BWC and POU segment in Europe (based on the number of water coolers installed) is forecasted by Zenith International to grow at a CAGR of approximately 3.1% from 2015 through 2019, driven primarily by growth in GDP, total hours worked and a continued focus on well-being and the health benefits of water consumption.

Extensive, Flexible Manufacturing and Distribution Capabilities

We believe we own the largest combined national production and distribution network for HOD, OCS and filtration services, serving approximately 1.5 million customers in the United States and Canada. DSS operates a national footprint of branch distribution facilities, combined production and distribution facilities and over 2,000 direct-to-consumer routes. With the Aquaterra Acquisition, we believe we have a leading position in Canada serving approximately 70,000 customers in Canada. We believe that having the largest North American HOD production and distribution network in the industry gives us the ability to reduce our purchasing, manufacturing and delivery costs relative to our competitors.

Manufacturing flexibility is one of the core competencies within our traditional business and is critical to our success, as our products will typically feature customized packaging, design and graphics for our key customers. We believe our ability to produce multiple SKUs and packages on our production lines and manage complexities through quick-line changeover processes differentiates us from our competition.

6

and filtration tuck-in acquisitions. Our acquisition strategy is consistent with our objective to continually build customer density and reduce the overall cost of servicing our existing customer base. We have a proven track record of achieving significant synergies and integrating companies onto our platform and we believe we will continue to improve our profitability and margins through acquisitions.

During the year ended January 2, 2016, we acquired nine separate HOD water businesses. These acquisitions support our previously announced objective of acquisitions where we expect to be able to capitalize on synergies with our existing business.

We have managed to pursue this acquisition strategy while reducing leverage levels from the time of the DSS acquisition by employing a combination of disciplined purchase pricing, successful integration and synergy realization, and opportunistic access to the equity capital markets.

Consistent with our acquisition strategy, we regularly pursue acquisition opportunities and we are currently participating in processes regarding several potential acquisition opportunities, including ones that would be significant to us. We cannot predict the timing of any contemplated transaction and none are currently probable.

Capture DSS, Aquaterra and Eden Synergies

We captured $10.0 million of DSS synergies in 2015. We have established a goal of delivering approximately $10.0 million of incremental synergies in each of 2016 and 2017, for a total expected delivery of $30.8 million of DSS synergies by the end of 2017, consisting of approximately $23.8 million in cost synergies and approximately $7.0 million in revenue synergies. In addition, we expect to capitalize on both the capture of synergies and the expansion of our partnerships in 2017 and beyond once we have fully integrated the Aquaterra Acquisition in 2016. With respect to the Eden Acquisition, we expect that we will capture approximately $11.0 million of synergies by the end of 2019. These synergies are comprised predominantly of procurement and administrative cost savings opportunities by leveraging our procurement expertise and optimizing our consolidated corporate and back office platform. Collectively, we believe the DSS, Aquaterra and Eden synergy opportunities will facilitate cash flow and margin improvement as we integrate these businesses and operate them as a consolidated, global water and coffee delivery platform.

Grow Contract Manufacturing and Other Beverage Categories in Our Traditional Business with a Focus on the “4Cs”

The business strategy of our traditional business is to hold volumes broadly stable through growing our sparkling water and mixer category and contract manufacturing channel to offset declines in private label CSDs and shelf stable juices, and continue to focus on our “4Cs” of customers, costs, capex and cash.

Maintain Customer Focus

Customer relationships are important for any business, but at Cott, where many of our products bear our customers’ brand names, we must maintain particularly close partnerships with our customers. We will continue to provide our customers with high quality products and services at an attractive value that will help them provide quality, value-oriented products to their consumers. We will continue to focus on our high levels of customer service, as well as innovations through the introduction of new packages, flavors and varieties of beverages. We believe our focus on our customers will enable us to leverage our existing relationships and to develop new ones in current and new markets.

Control Operating Costs

We understand that our long-term success will be closely tied to our ability to remain a low-cost supplier. Effective management of our operating costs is critical to our success. As part of our ongoing management of

10

Recent Developments

The Eden Acquisition

On June 7, 2016, Carbon Acquisition Co B.V., a wholly-owned subsidiary of Cott Corporation, entered into the Share Purchase Agreement to acquire Eden Holdings, the indirect parent company of Eden Springs Europe B.V., for a purchase price of approximately €470 million, subject to customary adjustments for cash, debt, working capital and other items. Pursuant to the Share Purchase Agreement, Carbon Acquisition Co B.V. will purchase the sole issued and outstanding share in the share capital of Eden Holdings and Eden Holdings and its subsidiaries will become wholly-owned subsidiaries of Cott Corporation.

We intend to finance a portion of the Eden Acquisition, to repay a portion of Eden’s and its subsidiaries’ outstanding indebtedness and to pay certain related fees and expenses with the proceeds from this offering. See “Use of Proceeds.”

Closing of the Eden Acquisition is subject to certain closing conditions, including obtaining regulatory approvals.

The Eden Acquisition will be consummated concurrently with the repayment of certain existing indebtedness of Eden and its subsidiaries (including €175.0 million aggregate principal amount of Floating Rate Senior Secured Notes due 2019, €125.1 million aggregate principal amount of 8.00% Senior Secured Notes due 2019 and €50.0 million under a revolving credit facility), the release of the proceeds of the notes offered hereby from escrow, the additional borrowing under our ABL Facility and the use of cash on hand, and the payment of certain related fees and expenses (these transactions, including the issuance of the notes offered hereby on the issue date, are referred to collectively as the “Transactions”).

ABL Facility Amendment

On June 7, 2016, we entered into Amendment No. 7 to our ABL Facility (the “ABL Facility Amendment”) to permit, among other things, the Eden Acquisition and the issuance of the notes hereunder and to make certain other changes thereto in connection with the Eden Acquisition. We intend to draw approximately an additional $71.0 million under our ABL Facility to finance a portion of the purchase price payable with respect to the Eden Acquisition, to repay a portion of Eden and its subsidiares’ outstanding indebtedness and to pay certain related fees and expenses. See “Description of Other Indebtedness—ABL Facility” and “Use of Proceeds.”

Escrow of the Notes

This offering is expected to be consummated on , 2016, which will be prior to the consummation of the Eden Acquisition. We expect that the Escrow Issuer will enter into the Escrow Agreement (as defined below) pursuant to which on the issue date, unless the Eden Acquisition has occurred at or prior to such time, the Escrow Issuer will deposit an amount equal to the gross proceeds of this offering, together with cash necessary to fund a special mandatory redemption of the notes on , 2016, including accrued and unpaid interest on the notes, into a segregated escrow account until the date that the escrow release conditions are satisfied. The release from escrow will be conditioned on the satisfaction of certain conditions (collectively, the “escrow release conditions”) described in the Escrow Agreement, including the consummation of the Eden Acquisition in accordance with the Share Purchase Agreement (as defined below). The gross proceeds of the notes, together with cash necessary to fund the special mandatory redemption, will be secured by a first-priority security interest in the escrow account and all deposits and investment property therein and upon satisfaction of the escrow release conditions, the net proceeds will be used as set forth under “Use of Proceeds.” If the Eden Acquisition is not consummated on or prior to the Escrow End Date, if we notify the Trustee and the Escrow Agent that the Share Purchase Agreement has been terminated in accordance with its terms or upon the occurrence of certain other events, the notes will be subject to a special mandatory redemption at a price equal to 100% of the initial issue price of the notes, plus accrued and unpaid interest from the issue date or the most recent interest payment date, as applicable, to, but not including, the date of such special mandatory redemption.

12

Summary Historical Financial and Other Data of Cott

The following tables set forth our summary historical financial and other data. You should read the following summary data in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Form 10-K and in our Quarterly Report on Form 10-Q for the quarter ended April 2, 2016, our audited consolidated financial statements and related notes, our unaudited interim consolidated financial statements and related notes, the historical consolidated financial statements of Eden and related notes, the section entitled “Summary Historical Consolidated Financial and Other Data of Eden,” and the section entitled “Unaudited Pro Forma Condensed Combined Financial Information,” in each case, included or incorporated by reference herein. See the sections entitled “Where You Can Find More Information” and “Incorporation by Reference of Certain Documents.”

No separate financial information has been provided in this offering memorandum for the Escrow Issuer because (1) the Escrow Issuer does not conduct any operations, (2) the Escrow Issuer has no material assets, (3) the Escrow Issuer will be combined with Cott Corporation by way of an amalgamation under applicable Canadian corporation law upon satisfaction of the escrow release conditions, and (4) “Cott Corporation,” the combined company formed upon the combination of the Escrow Issuer and Cott Corporation, will assume all of the Escrow Issuer’s obligations under the notes. The Indenture will restrict the Escrow Issuer from conducting any business or activities other than the issuance of the notes offered hereby and the transactions contemplated by the Escrow Agreement, and the Escrow Issuer will have no assets other than the escrowed funds and no liabilities other than the notes.

Our summary historical financial and other data for the years ended December 28, 2013, January 3, 2015 and January 2, 2016 and as of January 3, 2015 and January 2, 2016 have been derived from our audited historical consolidated financial statements included or incorporated by reference herein. The balance sheet data as of December 28, 2013 have been derived from Cott’s audited historical consolidated financial statements not included or incorporated by reference in this offering memorandum. Our summary historical financial and other data for the three months ended April 4, 2015 and April 2, 2016 and as of April 2, 2016 have been derived from our unaudited interim historical consolidated financial statements included or incorporated by reference herein. Our balance sheet data as of April 4, 2015 have been derived from our unaudited interim historical consolidated financial statements not included or incorporated by reference in this offering memorandum. Our summary historical financial and other data for the twelve months ended April 2, 2016 is derived from our unaudited historical statement of operations from our Form 10-Q for the quarter ended April 2, 2016 and the statement of operations of the nine months ended January 2, 2016. The statement of operations for the last nine months of 2015 was calculated by taking our full year 2015 statement of operations from our Form 10-K and subtracting the year-to-date statement of operations from the Form 10-Q for the quarter ended April 4, 2015. In the opinion of management, the unaudited interim consolidated financial data reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly our financial position for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

20

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Dec. 28, 2013 | Jan. 3, 2015 | Jan. 2, 2016 | Apr. 4, 2015 | Apr. 2, 2016 | Apr. 2, 2016 | |||||||||||||||||||

| (millions of U.S. dollars) | ||||||||||||||||||||||||

Income Statement Data: | ||||||||||||||||||||||||

Revenue, net | $ | 2,094.0 | $ | 2,102.8 | $ | 2,944.0 | $ | 709.8 | $ | 698.4 | $ | 2,932.6 | ||||||||||||

Cost of sales | 1,818.6 | 1,826.3 | 2,048.5 | 508.5 | 484.4 | 2,024.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross Profit | 275.4 | 276.5 | 895.5 | 201.3 | 214.0 | 908.2 | ||||||||||||||||||

Selling, general and administrative expenses | 180.3 | 213.7 | 768.6 | 188.5 | 197.0 | 777.1 | ||||||||||||||||||

Loss on disposal of property, plant and equipment | 1.8 | 1.7 | 6.9 | 1.4 | 0.9 | 6.4 | ||||||||||||||||||

Restructuring | 2.0 | 2.4 | — | — | — | — | ||||||||||||||||||

Asset impairments | — | 1.7 | — | — | — | — | ||||||||||||||||||

Acquisition and integration expenses | 3.1 | 41.3 | 20.6 | 4.7 | 1.4 | 17.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 88.2 | 15.7 | 99.4 | 6.7 | 14.7 | 107.4 | ||||||||||||||||||

Other expense (income), net | 12.8 | 21.0 | (9.5 | ) | (10.4 | ) | (2.2 | ) | (1.3 | ) | ||||||||||||||

Interest expense, net | 51.6 | 39.7 | 111.0 | 27.7 | 27.8 | 111.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income (loss) before income taxes | 23.8 | (45.0 | ) | (2.1 | ) | (10.6 | ) | (10.9 | ) | (2.4 | ) | |||||||||||||

Income tax expense (benefit) | 1.8 | (61.4 | ) | (22.7 | ) | (9.4 | ) | (9.0 | ) | (22.3 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income (loss) | 22.0 | 16.4 | 20.6 | (1.2 | ) | (1.9 | ) | 19.9 | ||||||||||||||||

Less: Net income attributable to non-controlling interests | 5.0 | 5.6 | 6.1 | 1.3 | 1.4 | 6.2 | ||||||||||||||||||

Less: Accumulated dividends on convertible preferred shares | — | 0.6 | 4.5 | 2.7 | — | 1.8 | ||||||||||||||||||

Less: Accumulated dividends on non-convertible preferred shares | — | 0.2 | 1.4 | 0.8 | — | 0.6 | ||||||||||||||||||

Less: Foreign exchange impact on redemption of preferred shares | — | — | 12.0 | — | — | 12.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income (loss) attributed to Cott Corporation | $ | 17.0 | $ | 10.0 | $ | (3.4 | ) | $ | (6.0 | ) | $ | (3.3 | ) | $ | (0.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Fiscal Year Ended | Unaudited | |||||||||||||||||||

Three Months Ended | ||||||||||||||||||||

| Dec. 28, 2013 | Jan. 3, 2015 | Jan. 2, 2016 | Apr. 4, 2015 | Apr. 2, 2016 | ||||||||||||||||

| (millions of U.S. dollars) | ||||||||||||||||||||

Cash Flow Data: | ||||||||||||||||||||

Cash flows provided by (used in) operating activities | $ | 154.9 | $ | 56.7 | $ | 254.6 | $ | (1.1 | ) | $ | (18.7 | ) | ||||||||

Cash flows used in investing activities | (71.6 | ) | (850.3 | ) | (99.7 | ) | (29.0 | ) | (73.5 | ) | ||||||||||

Cash flows provided by (used in) financing activities | (213.3 | ) | 835.7 | (160.1 | ) | (20.4 | ) | 71.2 | ||||||||||||

21

| Fiscal Year Ended | Unaudited | |||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||

| Dec. 28, 2013 | Jan. 3, 2015 | Jan. 2, 2016 | Apr. 4, 2015 | Apr. 2, 2016 | Apr. 2, 2016 | |||||||||||||||||||

| (millions of U.S. dollars) | ||||||||||||||||||||||||

Balance Sheet Data (at period end): | ||||||||||||||||||||||||

Cash and cash equivalents | $ | 47.2 | $ | 86.2 | $ | 77.1 | $ | 34.5 | $ | 55.1 | $ | 55.1 | ||||||||||||

Property, plant and equipment, net | 480.5 | 864.5 | 769.8 | 845.2 | 774.6 | 774.6 | ||||||||||||||||||

Total assets(1) | 1,410.7 | 3,073.2 | 2,887.3 | 3,010.9 | 2,927.6 | 2,927.6 | ||||||||||||||||||

Short-term borrowings | 50.8 | 229.0 | 122.0 | 221.0 | 62.8 | 62.8 | ||||||||||||||||||

Long-term debt (excludes CPLTD)(1) (2) | 397.9 | 1,541.3 | 1,525.4 | 1,529.8 | 1,524.1 | 1,524.1 | ||||||||||||||||||

Total debt(2) (3) | 452.6 | 1,774.3 | 1,650.8 | 1,754.9 | 1,590.3 | 1,590.3 | ||||||||||||||||||

Net debt(1) (4) | 405.4 | 1,688.1 | 1,573.7 | 1,720.4 | 1,535.2 | 1,535.2 | ||||||||||||||||||

Total equity | 604.4 | 548.9 | 645.9 | 512.7 | 778.9 | 778.9 | ||||||||||||||||||

Other Financial Data (unaudited): | ||||||||||||||||||||||||

EBITDA(5) | $ | 176.0 | $ | 105.4 | $ | 332.7 | $ | 74.5 | $ | 69.4 | $ | 327.6 | ||||||||||||

Adjusted EBITDA(6) | 197.9 | 180.2 | 357.0 | 73.7 | 70.9 | 354.2 | ||||||||||||||||||

Adjusted EBITDA margin (in %)(7) | 9.5 | % | 8.6 | % | 12.1 | % | 10.4 | % | 10.2 | % | 12.1 | % | ||||||||||||

Free cash flow(8) | 99.6 | 10.0 | 143.8 | (28.4 | ) | (48.2 | ) | 124.0 | ||||||||||||||||

Capital expenditures(9) | 55.3 | 46.7 | 110.8 | 27.3 | 29.5 | 113.0 | ||||||||||||||||||

Depreciation and amortization | 100.6 | 110.7 | 223.8 | 57.4 | 52.5 | 218.9 | ||||||||||||||||||

Eden Adjusted EBITDA(10) | 65.9 | 66.9 | 70.2 | 14.2 | 16.4 | 72.4 | ||||||||||||||||||

Combined Acquisition Adjusted EBITDA(11) |

| 437.6 | ||||||||||||||||||||||

Pro forma total secured indebtedness |

| 525.8 | ||||||||||||||||||||||

Pro forma total indebtedness |

| 2,165.5 | ||||||||||||||||||||||

Ratio of pro forma total net secured indebtedness to Combined Acquisition Adjusted EBITDA(12) |

| 1.1x | ||||||||||||||||||||||

Ratio of pro forma total net indebtedness to Combined Acquisition Adjusted EBITDA(12) |

| 4.8x | ||||||||||||||||||||||

| (1) | Amounts for the three months ended April 4, 2015 presented to reflect the reclassification of unamortized debt issuance costs of $22.7 million to long-term debt in accordance with GAAP. |

| (2) | “CPLTD” is the current portion of long-term debt. |

| (3) | Presented net of unamortized debt issuance costs and premiums on debt. |

| (4) | Net debt means our total debt less cash and cash equivalents. |

| (5) | EBITDA means earnings before interest expense, income taxes, depreciation, amortization and net income attributable to non-controlling interests, accumulated dividends on preferred shares and foreign exchange impact on redemption of preferred shares. Other companies may define EBITDA differently and, as a result, our measure of EBITDA may not be directly comparable to EBITDA of other companies. Other disclosures related to the use of EBITDA, as well as a reconciliation of net (loss) income attributed to Cott Corporation to EBITDA, are included in footnote (6) below. |

| (6) | Adjusted EBITDA means EBITDA adjusted for items which are not considered by management to be indicative of the underlying results. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about our financial performance. However, we have incurred the charges and expenses that constitute these adjustments in prior periods and expect to incur them in future periods. These expectations are forward- |

22

| looking statements within the meaning of the securities laws and actual results may vary due to various risks, including those identified under “Risk Factors.” Because we use these adjusted financial results in the management of our business and to understand underlying business performance, we believe this supplemental information is useful to investors for their independent evaluation and understanding of our business performance and the performance of our management. The non-GAAP financial measures described above are in addition to, and not meant to be considered superior to, or a substitute for, our financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this offering memorandum reflect our judgment of particular items, and may be different from, and therefore may not be comparable to, similarly titled measures reported by other companies. The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income (loss) with respect to Cott Corporation: |

Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||

| Dec. 28, 2013 | Jan. 3, 2015 | Jan. 2, 2016 | Apr. 4, 2015 | Apr. 2, 2016 | Apr. 2, 2016 | |||||||||||||||||||

| (millions of U.S. dollars) | ||||||||||||||||||||||||

Reconciliation: | ||||||||||||||||||||||||

Net income (loss) attributed to Cott Corporation | $ | 17.0 | $ | 10.0 | $ | (3.4 | ) | $ | (6.0 | ) | $ | (3.3 | ) | $ | (0.7 | ) | ||||||||

Interest expense, net | 51.6 | 39.7 | 111.0 | 27.7 | 27.8 | 111.1 | ||||||||||||||||||

Income tax expense (benefit) | 1.8 | (61.4 | ) | (22.7 | ) | (9.4 | ) | (9.0 | ) | (22.3 | ) | |||||||||||||

Depreciation and amortization | 100.6 | 110.7 | 223.8 | 57.4 | 52.5 | 218.9 | ||||||||||||||||||

Net income attributable to non-controlling interests(a) | 5.0 | 5.6 | 6.1 | 1.3 | 1.4 | 6.2 | ||||||||||||||||||

Accumulated dividends on preferred shares(b) | — | 0.8 | 5.9 | 3.5 | — | 2.4 | ||||||||||||||||||

Foreign exchange impact on redemption of preferred shares(c) | — | — | 12.0 | — | — | 12.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

EBITDA | 176.0 | 105.4 | 332.7 | 74.5 | 69.4 | 327.6 | ||||||||||||||||||

Restructuring and asset impairments | 2.0 | 4.1 | — | — | — | — | ||||||||||||||||||

Bond redemption and other financing costs | 12.7 | 25.2 | — | — | — | — | ||||||||||||||||||

Facility reorganization costs(d) | — | — | 3.0 | — | — | 3.0 | ||||||||||||||||||

Acquisition and integration costs(e) | 3.1 | 41.3 | 20.6 | 4.7 | 1.4 | 17.3 | ||||||||||||||||||

Purchase accounting adjustments, net(f) | 1.0 | 2.9 | 4.2 | 4.2 | 0.5 | 0.5 | ||||||||||||||||||

Unrealized commodity hedging loss (gain), net(g) | — | 1.2 | (1.2 | ) | (0.3 | ) | — | (0.9 | ) | |||||||||||||||

Unrealized foreign exchange and other gains, net | (0.7 | ) | (0.5 | ) | (10.9 | ) | (10.9 | ) | (2.6 | ) | (2.6 | ) | ||||||||||||

Loss on disposal of property, plant & equipment(h) | 2.4 | 3.2 | 6.9 | 1.5 | 0.9 | 6.3 | ||||||||||||||||||

Other adjustments(i) | 1.4 | (2.6 | ) | 1.7 | — | 1.3 | 3.0 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Adjusted EBITDA | $ | 197.9 | $ | 180.2 | $ | 357.0 | $ | 73.7 | $ | 70.9 | $ | 354.2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (a) | The portion of net income attributable to third-party ownership interests in our business. |

| (b) | Dividends attributable to convertible and non-convertible preferred shares issued during the DSS Acquisition. The Company redeemed the outstanding convertible and non-convertible preferred shares in 2015. |

23

| (c) | Non-recurring foreign exchange impact related to the difference in U.S. dollar to Canadian dollar conversation rates from date of issuance to date of redemption of convertible and non-convertible preferred shares in 2015. |

| (d) | Non-recurring costs related to the closure of facility production lines and related employee severance costs in the United Kingdom. |

| (e) | Non-recurring costs related to third-party advisory and professional fees, administrative costs, and other costs associated with our acquisition and integration activities. |

| (f) | Non-cash accounting adjustments recorded in accordance with GAAP. |

| (g) | Non-cash adjustment related to changes in the fair value of our commodity derivative instruments. |

| (h) | Non-cash adjustment recorded upon the disposal of property, plant & equipment. |

| (i) | Non-recurring costs related to Company investing and financing activities, legal settlements, legal entity reorganization and other non-recurring expenses. |

| (7) | We define Adjusted EBITDA margin as Adjusted EBITDA divided by total net revenue. |

| (8) | The following table provides a reconciliation of net cash provided by operating activities to free cash flow. |

| For the Year Ended | Unaudited | |||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||

| Dec. 28, 2013 | Jan. 3, 2015 | Jan. 2, 2016 | Apr. 4, 2015 | Apr. 2, 2016 | Apr. 2, 2016 | |||||||||||||||||||

| (millions of U.S. dollars) | ||||||||||||||||||||||||

Net cash provided by (used in) operating activities | 154.9 | 56.7 | 254.6 | (1.1 | ) | (18.7 | ) | 237.0 | ||||||||||||||||

Less: Capital expenditures | (55.3 | ) | (46.7 | ) | (110.8 | ) | (27.3 | ) | (29.5 | ) | (113.0 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Free Cash Flow | $ | 99.6 | $ | 10.0 | $ | 143.8 | $ | (28.4 | ) | $ | (48.2 | ) | $ | 124.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (9) | Includes information technology expenditures. |

| (10) | For a reconciliation of EBITDA and Adjusted EBITDA to net loss with respect to Eden, see the section entitled “Summary Historical Consolidated Financial and Other Data of Eden.” These amounts in millions of U.S. Dollars have been converted from Euro at the average conversion rate for the relevant period. |

| (11) | Combined Acquisition Adjusted EBITDA represents the sum of Cott Adjusted EBITDA and Eden Adjusted EBITDA for the periods presented plus $11 million of estimated synergies (expected to be achieved by the end of 2019) to be derived from cost savings in the areas of procurement and administration. The $11 million of synergies expected to be achieved by the end of 2019 are comprised of approximately €5 million of procurement/fleet cost savings and approximately €5 million of administrative and other costs savings. However, the expected synergies related to the Eden Acquisition are inherently uncertain, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and are beyond our control. Combined Acquisition Adjusted EBITDA does not take into account merger and integration costs that may be incurred in order to achieve the expected synergies. Although we expect to begin achieving these synergies upon closing of the Eden Acquisition, we cannot assure you that we will be able to achieve these synergies as planned or at all. See “Risks Related to the Eden Acquisition—We may not realize the expected benefits of the Eden Acquisition because of integration difficulties or other challenges.” Investors should be aware that Adjusted EBITDA for Eden may not be entirely comparable to Cott’s measures of Adjusted EBITDA. See “Presentation of Financial Information.” Combined Acquisition Adjusted EBITDA has not been prepared in accordance with the requirements of Regulation S-X or any other securities laws relating to the presentation of pro forma financial information, and is not in compliance with Article 11 of Regulation S-X. Combined Acquisition Adjusted EBITDA is presented for information purposes only and does not purport to represent what our actual financial position or results or operations would have been if the recently completed acquisitions and the Eden Acquisition had been completed as of an earlier date or that may be achieved in the future. |

24

These measures are derived on the basis of methodologies other than in accordance with GAAP. These rules govern the manner in which non-GAAP financial measures are publicly presented and prohibit in all filings with the SEC, among other things:

| • | the exclusion of charges or liabilities that require, or will require, cash settlement or would have required cash settlement, absent an ability to settle in another manner, from a non-GAAP liquidity measure other than EBITDA and Adjusted EBITDA; and |

| • | the adjustment of a non-GAAP financial measure to eliminate or smooth items identified as non-recurring, infrequent, or unusual, when the nature of the charge or gain is such that it has occurred in the past two years or is reasonably likely to recur within the next two years. |

| (12) | Pro forma total net secured indebtedness and Pro forma total net indebtedness are net of pro forma as adjusted cash and cash equivalents of $52.5 million. See “Capitalization.” |

25

Summary Historical Consolidated Financial and Other Data of Eden

The following tables set forth the summary historical consolidated financial and other data of Eden, a direct subsidiary of Eden Holdings, and its subsidiaries for the periods and as of the dates indicated. No historical consolidated financial data of Eden Holdings is included in this offering memorandum. We believe that the only material differences between Eden Holdings and Eden relate to additional cash and cash equivalents held in Eden Holdings and intercompany transactions that are either substantially eliminated on consolidation or will be settled concurrent with the closing of this transaction. No separate financial information has been provided in this offering memorandum for Eden Holdings. See“Risk Factors—The financial statements of Eden presented in this offering memorandum do not satisfy our obligations under the Exchange Act and the financials of Eden Holdings that we will file may materially differ from those presented herein.”

The summary historical consolidated financial and other data as of December 31, 2013, 2014 and 2015 and for the periods then ended have been derived from Eden’s audited historical consolidated financial statements included elsewhere in this offering memorandum. The summary historical consolidated financial and other data for the three months ended March 31, 2015 and March 31, 2016 and the balance sheet data as of March 31, 2016 have been derived from Eden’s unaudited historical consolidated financial statements included elsewhere in this offering memorandum. The balance sheet data as of March 31, 2015 have been derived from Eden’s unaudited historical consolidated financial statements not included elsewhere in this offering memorandum. The unaudited consolidated financial statements were prepared on a basis consistent with Eden’s audited consolidated financial statements. In the opinion of Eden’s management, the unaudited consolidated financial statements include all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the results for those periods. The results of operations for interim periods are not necessarily indicative of the result to be expected for the full year or any future period.

The summary historical financial and other data of Eden for the twelve months ended March 31, 2016 is derived from its unaudited historical statement of operations for the quarter ended March 31, 2016 and the statement of operations of the nine months ended December 31, 2015. The statement of operations for the last nine months of 2015 was calculated by taking Eden’s full year 2015 statement of operations and subtracting the year-to-date statement of operations for the quarter ended March 31, 2015.

The following summary historical consolidated financial and other data prepared in accordance with IFRS should be read in conjunction with the historical consolidated financial statements and the related notes of Eden included elsewhere in this offering memorandum.

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Income Statement Data | Dec. 31, 2013 (three months)(1) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | Mar. 31, 2016 | ||||||||||||||||||

| (€ in thousands) | ||||||||||||||||||||||||

Revenue | € | 61,584 | € | 283,144 | € | 355,816 | € | 82,306 | € | 83,508 | € | 357,018 | ||||||||||||

Cost of goods sold | (20,327 | ) | (99,093 | ) | (118,349 | ) | (28,173 | ) | (27,376 | ) | (117,552 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross profit | 41,257 | 184,051 | 237,467 | 54,133 | 56,132 | 239,466 | ||||||||||||||||||

Service expenses | (24,366 | ) | (106,800 | ) | (135,390 | ) | (32,194 | ) | (32,066 | ) | (135,262 | ) | ||||||||||||

Sales & marketing expenses | (5,824 | ) | (25,933 | ) | (35,909 | ) | (8,497 | ) | (8,544 | ) | (35,956 | ) | ||||||||||||

General and administration expenses | (5,368 | ) | (19,467 | ) | (26,446 | ) | (6,428 | ) | (6,483 | ) | (26,501 | ) | ||||||||||||

Amortization of customer relations and tradenames | (1,305 | ) | (8,041 | ) | (11,209 | ) | (2,608 | ) | (2,791 | ) | (11,392 | ) | ||||||||||||

Other operating expenses(2) | (11,750 | ) | (16,711 | ) | (21,940 | ) | (4,678 | ) | (3,494 | ) | (20,756 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

(Loss) Income from operations | (7,356 | ) | 7,099 | 6,573 | (272 | ) | 2,754 | 9,599 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

26

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Income Statement Data | Dec. 31, 2013 (three months)(1) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | Mar. 31, 2016 | ||||||||||||||||||

| (€ in thousands) | ||||||||||||||||||||||||

Financial income | € | 630 | € | 4,701 | € | 3,492 | € | 2,012 | € | 911 | € | 2,391 | ||||||||||||

Financial expenses | (4,635 | ) | (36,882 | ) | (40,344 | ) | (10,414 | ) | (10,676 | ) | (40,606 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net financial expenses | (4,005 | ) | (32,181 | ) | (36,852 | ) | (8,402 | ) | (9,765 | ) | (38,215 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Loss before taxes on income | (11,361 | ) | (25,082 | ) | (30,279 | ) | (8,674 | ) | (7,011 | ) | (28,616 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Taxes on income | (1,670 | ) | (2,818 | ) | (72 | ) | (499 | ) | (539 | ) | (112 | ) | ||||||||||||

Net loss | (13,031 | ) | (27,900 | ) | (30,351 | ) | (9,173 | ) | (7,550 | ) | (28,728 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (1) | Eden was established on May 16, 2013 as Rhone Capital IV LP’s indirect wholly-owned investment vehicle. On June 14, 2013, Eden signed an agreement with Eden Springs BV to acquire the entire shareholding and control of the direct wholly-owned subsidiaries of Eden Springs BV: Eden Springs Europe B.V. and the Israeli subsidiaries. On October 23, 2013, the transaction was completed and Eden became the sole shareholder of Eden Springs Europe B.V. and Israeli subsidiaries. |

| (2) | Other operating expenses consists primarily of restructuring and certain acquisition-related integration costs, establishment of a new business line such as POU in Israel, litigation and release of unused provisions and liabilities such as customer deposits received, as well as business development expenses with long-term payback periods. |

| Unaudited | ||||||||||||||||||||

| As of | As of | |||||||||||||||||||

| Balance Sheet Data (at period end): | Dec. 31, 2013 | Dec. 31, 2014 | Dec. 31, 2015 | March 31, 2015 | March 31, 2016 | |||||||||||||||

| (€ in thousands) | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||

Current assets | ||||||||||||||||||||

Cash and cash equivalents | 14,571 | 17,741 | 12,524 | 13,374 | 18,020 | |||||||||||||||

Trade receivables - net | 54,858 | 60,088 | 68,105 | 66,311 | 66,061 | |||||||||||||||

Income tax receivable | 837 | 1,165 | 2,224 | 1,232 | 2,536 | |||||||||||||||

Receivable from related parties | 440 | 93 | 115 | 167 | 137 | |||||||||||||||

Prepaid and other assets | 6,147 | 10,841 | 7,767 | 40,886 | 14,516 | |||||||||||||||

Inventories | 12,074 | 14,446 | 17,944 | 17,404 | 18,707 | |||||||||||||||

Financial asset at fair value through profit or loss | — | — | — | — | 11,580 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 88,927 | 104,374 | 108,679 | 139,374 | 131,557 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Non-current assets | ||||||||||||||||||||

Property, plant and equipment | 66,013 | 71,970 | 82,360 | 84,033 | 86,979 | |||||||||||||||

Goodwill | 103,000 | 135,789 | 164,511 | 174,748 | 171,957 | |||||||||||||||

Other intangible assets | 82,582 | 88,114 | 91,055 | 102,493 | 90,806 | |||||||||||||||

Deferred tax assets | 12,666 | 14,360 | 15,956 | 15,555 | 17,371 | |||||||||||||||

Other non-current assets | 4,399 | 2,437 | 2,332 | 2,465 | 2,913 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 268,660 | 312,670 | 356,214 | 379,294 | 370,026 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total assets | 357,587 | 417,044 | 464,893 | 518,668 | 501,583 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

27

| Unaudited | ||||||||||||||||||||

| As of | As of | |||||||||||||||||||

| Balance Sheet Data (at period end): | Dec. 31, 2013 | Dec. 31, 2014 | Dec. 31, 2015 | March 31, 2015 | March 31, 2016 | |||||||||||||||

| (€ in thousands) | ||||||||||||||||||||

LIABILITIES | ||||||||||||||||||||

Current liabilities | ||||||||||||||||||||

Borrowings | 10,495 | 55,116 | 4,767 | 1,967 | 4,253 | |||||||||||||||

Trade accounts payable | 21,921 | 33,083 | 36,805 | 32,740 | 38,724 | |||||||||||||||

Current tax liability | 6,293 | 4,921 | 4,626 | 6,158 | 4,462 | |||||||||||||||

Other current liabilities | 27,849 | 36,127 | 44,651 | 46,289 | 42,931 | |||||||||||||||

Customer deposits and prepaid income | 23,722 | 30,707 | 33,534 | 32,238 | 32,798 | |||||||||||||||

Provisions | 3,437 | 3,826 | 2,208 | 1,735 | 1,381 | |||||||||||||||

Payable to parent company | — | 75 | 75 | 75 | 75 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 93,717 | 163,855 | 126,666 | 121,202 | 124,624 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Non-current liabilities | ||||||||||||||||||||

Deferred tax liabilities | 17,142 | 18,347 | 19,178 | 21,529 | 21,268 | |||||||||||||||

Borrowings | 150,608 | 204,870 | 298,616 | 324,612 | 341,601 | |||||||||||||||

Other non-current liabilities | 1,310 | 69 | 52 | 64 | 56 | |||||||||||||||

Provisions | 1,218 | 1,128 | 1,026 | 1,032 | 986 | |||||||||||||||

Liability for employee rights | 3,902 | 5,240 | 5,250 | 5,941 | 5,225 | |||||||||||||||

Borrowings from shareholders and other related parties | 88,027 | 47,792 | 57,394 | 54,019 | 58,557 | |||||||||||||||

Derivative financial instruments | 2,123 | 5,420 | 5,201 | 5,615 | 5,638 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 264,330 | 282,866 | 386,717 | 412,812 | 433,331 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total liabilities | 358,047 | 446,721 | 513,383 | 534,014 | 557,955 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

DEFICIT | ||||||||||||||||||||

Share capital | — | — | — | — | ||||||||||||||||

Share premium | 13,430 | 13,430 | 13,430 | 13,430 | 13,430 | |||||||||||||||

Other reserves | (150 | ) | (1,038 | ) | (371 | ) | (1,222 | ) | (371 | ) | ||||||||||

Currency translation adjustment | (747 | ) | (1,222 | ) | 9,649 | 22,466 | 9,317 | |||||||||||||

Accumulated deficit | (13,035 | ) | (40,935 | ) | (71,352 | ) | (50,111 | ) | (78,924 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (502 | ) | (29,765 | ) | (48,644 | ) | (15,437 | ) | (56,548 | ) | |||||||||||

Non-controlling interests in equity | 42 | 88 | 154 | 91 | 176 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total deficit | (460 | ) | (29,677 | ) | (48,490 | ). | (15,346 | ) | (56,372 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total liabilities net of deficit | 357,587 | 417,044 | 464,893 | 518,668 | 501,583 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Dec. 31, 2013 (three months) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | March 31, 2016 | |||||||||||||||||||

| (€ in thousands) | ||||||||||||||||||||||||

Cash Flow Data: | ||||||||||||||||||||||||

Cash flows provided by operating activities | € | 110 | € | 36,078 | € | 32,474 | € | 730 | € | 6,857 | € | 38,601 | ||||||||||||

Cash flows used in investing activities | (72,142 | ) | (56,869 | ) | (62,452 | ) | (74,448 | ) | (34,793 | ) | (22,797 | ) | ||||||||||||

Cash flows provided by (used in) financing activities | 86,249 | 23,910 | 22,117 | 68,401 | 33,535 | (12,749 | ) | |||||||||||||||||

28

Summary Other Financial Data

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Dec. 31, 2013 (three months) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | Mar. 31, 2016 | |||||||||||||||||||

| (€ in thousands) | ||||||||||||||||||||||||

Revenue | € | 61,584 | € | 283,144 | € | 355,816 | € | 82,306 | € | 83,508 | € | 357,018 | ||||||||||||

Solutions | ||||||||||||||||||||||||

Water | 52,540 | 221,492 | 285,411 | 64,727 | 66,039 | 286,723 | ||||||||||||||||||

Coffee | 9,044 | 61,652 | 70,405 | 17,579 | 17,469 | 70,295 | ||||||||||||||||||

Geography | ||||||||||||||||||||||||

Europe | 41,278 | 197,323 | 261,698 | 62,041 | 61,918 | 261,575 | ||||||||||||||||||

Israel | 20,306 | 85,821 | 94,118 | 20,265 | 21,590 | 95,443 | ||||||||||||||||||

EBITDA(2) | (1,518 | ) | 33,490 | 41,240 | 7,884 | 11,339 | 44,695 | |||||||||||||||||

Adjusted EBITDA(2) | 10,232 | 50,201 | 63,180 | 12,562 | 14,833 | 65,451 | ||||||||||||||||||

Adjusted EBITDA margin (in %)(3) | 16.6 | % | 17.7 | % | 17.8 | % | 15.3 | % | 17.8 | % | 18.3 | % | ||||||||||||

Net capital expenditures | 3,494 | 16,059 | 22,700 | 5,928 | 5,283 | 22,055 | ||||||||||||||||||

Adjusted free cash flow(4) | 9,333 | 40,385 | 36,599 | 287 | 6,593 | 42,865 | ||||||||||||||||||

| (2) | EBITDA and Adjusted EBITDA are not measures of financial performance under IFRS and should not be construed as alternatives to other indicators of our operating performance, cash flows or any other measure of performance derived in accordance with IFRS. Eden defines “EBITDA” as net loss before taxes on income, net financial expenses and depreciation and amortization. Adjusted EBITDA is defined as EBITDA after applying adjustments to eliminate certain costs related to restructuring and integration of acquisitions, as well as other costs such as establishment of new business lines, business development expenses with long-term payback periods, as well as cost savings from acquisitions and the annualized impact of acquisitions. In addition, EBITDA and Adjusted EBITDA, as Eden defines them, may not be comparable to other similarly titled measures used by other companies. We present EBITDA and Adjusted EBITDA because we believe it is helpful to investors as measures of our operating performance and ability to service our debt. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS. See “Presentation of Financial Information.” The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net loss: |

| Unaudited | ||||||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||

| Dec. 31, 2013 (three months) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | Mar. 31, 2016 | |||||||||||||||||||

| (€ in thousands) | ||||||||||||||||||||||||

Net Loss | (13,031 | ) | (27,900 | ) | (30,351 | ) | (9,173 | ) | (7,550 | ) | (28,728 | ) | ||||||||||||

Taxes on income | 1,670 | 2,818 | 72 | 499 | 539 | 112 | ||||||||||||||||||

Net financial expenses | 4,005 | 32,181 | 36,852 | 8,402 | 9,765 | 38,215 | ||||||||||||||||||

Depreciation and amortization | 5,838 | 26,391 | 34,667 | 8,156 | 8,585 | 35,096 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

EBITDA | (1,518 | ) | 33,490 | 41,240 | 7,884 | 11,339 | 44,695 | |||||||||||||||||

Adjustments: | ||||||||||||||||||||||||

Other operating expenses(a) | 11,750 | 16,711 | 21,940 | 4,678 | 3,494 | 20,756 | ||||||||||||||||||

Adjusted EBITDA | 10,232 | 50,201 | 63,180 | 12,562 | 14,833 | 65,451 | ||||||||||||||||||

29

| (a) | Other operating expenses include adjustments for: |

| 1. | Acquisition, integration and restructuring costs of €10.0 million for the three months ended December 31, 2013, €8.9 million and €14.1 million for the years ended December 31, 2014 and 2015, respectively, €2.8 million and €2.2 million for the three months ended March 31, 2015 and 2016, respectively, and €13.5 million for the twelve months ended March 31, 2016. These costs include professional fees incurred to acquire companies, costs to integrate and rationalize personnel and certain corporate functions. |

| 2. | Establishment costs of €3.1 million and €4.7 million for the years ended December 31, 2014 and 2015, respectively, €0.9 million and €0.8 million for the three months ended March 31, 2015 and 2016, respectively, and €4.6 million for the twelve months ended March 31, 2016. These costs include costs incurred to hire and train sales personnel on certain growth initiatives. |

| 3. | Management fees and other expenses of €1.7 million for the three months ended December 31, 2013, €4.7 million and €3.2 million for the years ended December 31, 2014 and 2015, respectively, €1.0 million and €0.5 million for the three months ended March 31, 2015 and 2016, respectively, and €2.7 million for the twelve months ended March 31, 2016. These costs include fees paid to the owner of the business to advise management as well as other costs related to maintaining the ownership. |

| (3) | Adjusted EBITDA margin for a given period is Adjusted EBITDA for that period divided by total revenue for that period. |

| (4) | Adjusted free cash flow represents Adjusted EBITDA less net capital expenditures after changes in operating working capital. |

Summary of Certain Operational Data of Eden

| Unaudited | ||||||||||||||||||||

| Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

| Dec. 31, 2013 (three months) | Dec. 31, 2014 | Dec. 31, 2015 | Mar. 31, 2015 | Mar. 31, 2016 | ||||||||||||||||

Client base(a) at beginning of period | 654,220 | 655,733 | 763,703 | 763,703 | 898,681 | |||||||||||||||

Change in client base attributable to organic growth (net) | (13,721 | ) | 4,592 | 18,513 | (1,629 | ) | 6,485 | |||||||||||||

Change in client base attributable to acquisition (net) | 15,234 | 103,378 | 116,465 | 75,771 | 49,824 | |||||||||||||||

Client base at end of period | 655,733 | 763,703 | 898,681 | 837,845 | 954,990 | |||||||||||||||

Retention Rate(b) | 85.3 | % | 86.5 | % | 87.0 | % | 86.5 | % | 87.0 | % | ||||||||||

| (a) | Client base is the total number of BWC or POU water coolers or OCS coffee machines installed at customer premises. |

| (b) | Retention rate is defined as 1 minus (the total number of BWC, POU and OCS clients lost in a period as a percentage of the average number of total BWC, POU and OCS clients at the beginning of each month during that period). The numbers for the three month periods are annualized. |

30

In addition, these systems and services are vulnerable to interruptions or other failures resulting from, among other things, natural disasters, terrorist attacks, software, equipment or telecommunications failures, processing errors, computer viruses, hackers, other security issues or supplier defaults. Security, backup and disaster recovery measures may not be adequate or implemented properly to avoid such disruptions or failures. Any disruption or failure of these systems or services could cause substantial errors, processing inefficiencies, security breaches, inability to use the systems or process transactions, loss of customers or other business disruptions, all of which could negatively affect our business and results of operations.

If we are unable to securely maintain our customers’ confidential or credit card information, or other private data relating to our employees or our Company, we could be subject to negative publicity, costly government enforcement actions or private litigation, which could damage our business reputation and negatively affect our results of operations.

The protection of our customer, employee and Company data is critical to us. We have procedures and technology in place to safeguard our customers’ debit card, credit card and other personal information, our employees’ private data and Company records and intellectual property. However, if we experience a data security breach of any kind, we could be exposed to negative publicity, government enforcement actions, private litigation or costly response measures. In addition, our reputation within the business community and with our customers may be affected, which could result in our customers discontinuing their purchases of our products and services or their use of the debit or credit card payment option. Any loss of our ability to securely offer our customers a credit card payment option would make our products less attractive to many small organizations by negatively affecting our customer experience and significantly increasing our administrative costs related to customer payment processing. This could cause us to lose market share to our competitors and could have a negative effect on our results of operations.

We also face other risks that could adversely affect our business, results of operations or financial condition, which include:

| • | any requirement to restate financial results in the event of inappropriate application of accounting principles or otherwise; |

| • | any event that could damage our reputation; |

| • | failure to properly manage credit risk from customers; |

| • | failure of our processes to prevent and detect unethical conduct of employees; |

| • | a significant failure of internal controls over financial reporting; |

| • | failure of our prevention and control systems related to employee compliance with internal policies and regulatory requirements; and |

| • | failure of corporate governance policies and procedures. |

Our ability to use net operating losses to offset future taxable income may be subject to certain limitations, which could have a significant impact on our business.

At January 2, 2016, we had, subject to the limitation discussed below, $328.0 million and $333.9 million of net operating loss carryforwards for U.S. federal and state tax purposes, respectively, and $4.3 million for Canadian tax purposes. The U.S. loss carryforwards will expire in varying amounts through 2034 and 2035 for U.S. federal and state operating loss carryforwards, respectively, and the Canadian carryforward will expire in 2035, if not otherwise used. In general, under Section 382 and 383 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” is subject to limitations on its ability to utilize its pre-change net operating losses (“NOLs”) or tax credits to offset future taxable income. If we undergo an ownership change, our ability to utilize federal NOLs or tax credits could be limited by Section 382

45

and 383 of the Code. In addition, future changes in our stock ownership, many of which are outside of our control, could result in an ownership change under Section 382 and 383 of the Code. Our NOLs or credits may also be impaired under state tax law. Accordingly, we may not be able to utilize a material portion of our NOLs or credits.

Our ability to utilize our U.S. federal and state NOLs or credits is conditioned upon generating U.S. federal and state taxable income. If we are unable to generate U.S. federal and state taxable income to utilize our NOLs, an adjustment to reserve for these NOLs could materially impact our balance sheet.

Valuation allowances have been provided for deferred tax assets related to our state NOLs. Additionally, uncertainties exist as to the future utilization of the operating loss carryforwards. Therefore, in accordance with Financial Accounting Standards Board (“FASB”) and ASC 740-10, we have established a valuation allowance of $15.4 million at January 2, 2016.

Risks Related to Eden’s Business and Industry

For the purposes of this section “—Risks Related to Eden’s Business and Industry” only, the words “we,” “us,” “our,” “Eden,” “Eden Spring,” “Company” and words of similar import refer to Eden Holdings and its subsidiaries on a consolidated basis.

Our business operates in a highly competitive industry.

We operate in a highly competitive industry. Competitive factors with respect to our business include pricing, distribution capabilities, logistics, quality, reputation, brand recognition, technical expertise, advertising, sales activities, retention programs, product innovation, increased efficiency in production and distribution techniques and packaging. Our competitors may have greater business resources and/or financial resources and/or less debt than us. We also face competition from regional brands and local competitors in the markets that we serve.

Within our water offering, our BWC offering faces increased competition from the POU category. Because businesses with POU solutions tend to use less bottled water due to the availability of a continuous supply of filtered water, the installation of these systems poses a competitive threat to our BWC business and reduces the number of potential customers for our BWC solutions. Although we believe we are well positioned to offer our POU solutions to quitting BWC customers, we may not be able to offset a decline in revenue from our BWC customers that switch to one of our competitor’s POU offerings, which could have an adverse effect on our business, financial condition and results of operations. Further, the bottled water industry itself faces competition from other non-alcoholic beverage products, including bottled carbonated and non-carbonated soft drinks. In addition, in the event of a change in consumer preference or if the quality of tap water significantly improves, consumers in certain markets may choose to drink tap water instead of purchasing bottled water or using POU. Increased competition and pricing pressure or a significant increase in the consumption by consumers of tap water could have an adverse effect on our business, financial condition and results of operations.

Our OCS segment is also subject to intense competition and our coffee business competes with providers of both operated and non-operated coffee solutions such as manual fresh bean machines and vending machines. Further, the coffee industry itself faces competition from other non-coffee products, including other hot beverages and soft drinks. Increased competition could have an adverse effect on our business, financial condition and results of operations.

If we are not able to retain and attract customers, our financial performance will be impaired.

Our economic success is based on our ability to retain current customers and attract new customers to our products and services. If we are unable to retain and attract customers, our financial performance will be impaired, and we could fail to meet our financial obligations.

46

Our ability to compete successfully for new customers and to increase retention depends on, among other things:

| • | the actual and perceived quality and cost of our products; |

| • | our successful execution of marketing and sales strategies, including the acceptance of our value proposition; service delivery and customer care activities, including new account set up and billing; and our credit and collection policies; |

| • | our ability to anticipate and develop new product offerings and services that are attractive to existing or potential customers; |

| • | our ability to reliably deliver products and services on schedule; |

| • | our ability to meet unexpected customer shortages with quick delivery of refills; and |

| • | our ability to adequately staff our customer service teams to effectively respond to customer inquiries and effectively manage any customer dissatisfaction or similar issues. |

We believe that quality of service and reliability of delivery and technical support are key competitive factors in the water and coffee businesses and directly relate to the ability to attract customers and increase retention. If we cannot generate new customers, keep our retention at acceptable levels, and maintain a high level of customer service as we seek to expand our operations, our business, financial condition and results of operations would be adversely affected.

Changing consumer tastes or preferences or improvement in municipal tap water supplies could result in decreased demand for and sales of our products.

Our success is dependent on customer and consumer tastes and preferences. Any significant changes in these preferences or any inability on our part to anticipate or react to such changes could result in reduced demand for our products and erosion of our competitive and financial position. Our success depends on the ability to respond to customer and consumer trends and preferences and these may shift due to a variety of factors.

We believe that the growth of the bottled water industry is due, in large part, to consumer preferences for high quality products and consumer taste preferences for bottled water over tap water and other beverages. In certain markets, POU solutions are eroding BWC volumes due to economic and sustainability preferences. This trend could be expedited by significant improvements in municipal tap water, particularly in certain Eastern Europe markets like Russia where the quality of municipal tap water is currently perceived as poor. In addition, the trend could increase if supported by campaigns to increase the use of tap water over spring water for environmental, or other, reasons. For instance, on August 25, 2013, new regulations were promulgated under the Israeli Public Health Ordinance with the intention of improving the quality of tap water in Israel. Various Israeli bodies and entities, including the Governmental Authority for Water and Sewerage, the Ministry of Environmental Protection and the municipal water companies, had campaigned to improve the quality of tap water and reduce the use of bottled water in Israel.

In the OCS segment, growth is driven by consumer preferences for single-cup brewing, higher quality coffee and increased consumption away from home as well as a shift to preferences for premium coffee solutions. In addition, growth is also impacted by the demand for our physical equipment (e.g. dispensers and our coffee brewers) that we rent or sell to our customers whose tastes and preferences may be affected by the aesthetics of the equipment, ease of use, and energy efficiency standards, among other factors. These factors may not continue to benefit our business to the same extent in the future.

Any change in consumer preferences away from bottled water and filtered water or from the coffee solutions we provide could result in decreased demand for our products and services.

47

If our bottling processes or water sources were contaminated for any reason, our business could be seriously affected.