|

Exhibit 99.7

|

€450 million Senior Notes due 2024

Investor Presentation

June 14 – 17, 2016

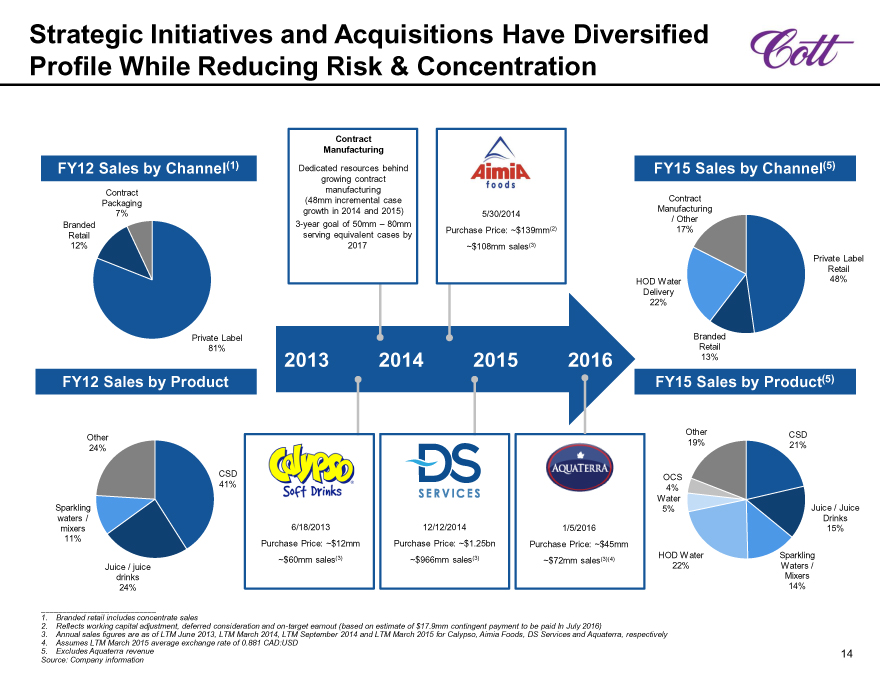

Strategic Initiatives and Acquisitions Have Diversified

Profile While Reducing Risk & Concentration

Contract

Manufacturing

FY12 Sales by Channel(1) Dedicated resources behind FY15 Sales by Channel(5)

growing contract

Contract manufacturing

Packaging (48mm incremental case Contract

7% growth in 2014 and 2015) 5/30/2014 Manufacturing

/ Other

Branded 3-year goal of 50mm – 80mm Purchase Price: ~$139mm(2) 17%

Retail serving equivalent cases by

12% 2017 ~$108mm sales(3)

Private Label

Retail

HOD Water 48%

Delivery

22%

Private Label Branded

81% Retail

2013 2014 2015 2016 13%

FY12 Sales by Product FY15 Sales by Product(5)

Other

24%

CSD

41%

Sparkling

waters /

mixers 6/18/2013

11% Purchase Price: ~$12mm

~$60mm sales(3)

Juice / juice

drinks

24%

12/12/2014

Purchase Price: ~$1.25bn

~$966mm sales(3)

1/5/2016

Purchase Price: ~$45mm

~$72mm sales(3)(4)

Other CSD

19% 21%

OCS

4%

Water

5% Juice / Juice

Drinks

15%

HOD Water Sparkling

22% Waters /

Mixers

14%

Branded retail includes concentrate sales

Reflects working capital adjustment, deferred consideration and on-target earnout (based on estimate of $17.9mm contingent payment to be paid In July 2016)

Annual sales figures are as of LTM June 2013, LTM March 2014, LTM September 2014 and LTM March 2015 for Calypso, Aimia Foods, DS Services and Aquaterra, respectively

Assumes LTM March 2015 average exchange rate of 0.881 CAD:USD

5. Excludes Aquaterra revenue 14

Source: Company information

DS Services is a Leading North American Direct-to-

Consumer Services Provider

Water Delivery Services(1) Office Coffee Services (“OCS”)

2015 Revenue(2):

$1,021mm

2015 Revenue: $724mm (71%) Filtration 2015 Revenue: $121mm (12%)

OCS 2%

12%

Retail

Retail 15% Filtration Services

Water

Delivery

Services

71%

2015 Revenue: $149mm (15%) 2015 Revenue: $27mm (2%)

1. Other revenue included in Water Delivery Services revenue

2. Excludes Aquaterra revenue 16

Source: Company information

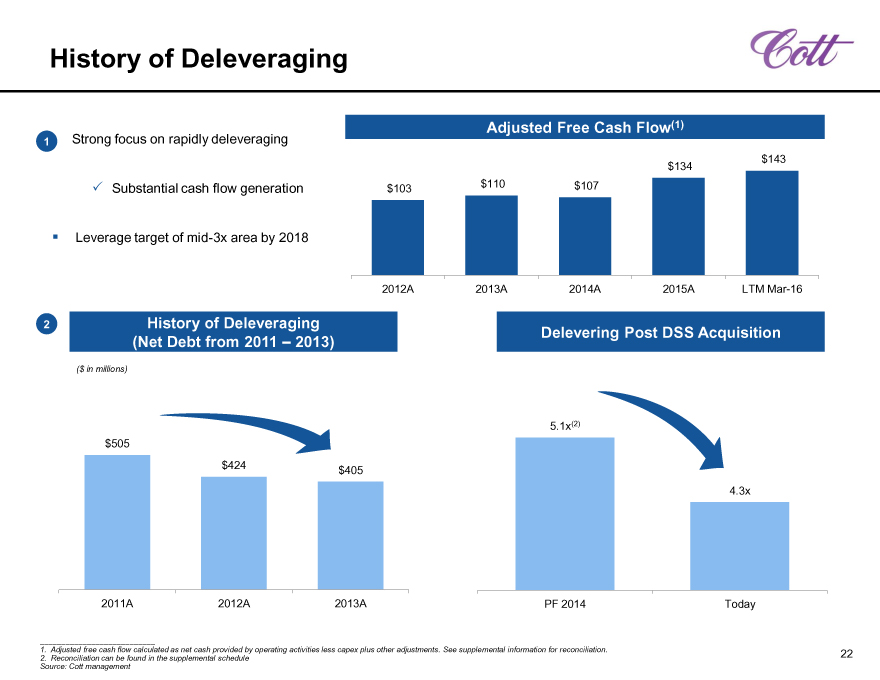

History of Deleveraging

Adjusted Free Cash Flow(1)

1 Strong focus on rapidly deleveraging

$134 $143

Substantial cash flow generation $103 $110 $107

Leverage target of mid-3x area by 2018

2012A 2013A 2014A 2015A LTM Mar-16

2 History of Deleveraging Delevering Post DSS Acquisition

(Net Debt from 2011 – 2013)

($ in millions)

5.1x(2)

$505

$424 $405

4.3x

2011A

2012A

2013A

PF 2014

Today

1. Adjusted free cash flow calculated as net cash provided by operating activities less capex plus other adjustments. See supplemental information for reconciliation. 22

2. Reconciliation can be found in the supplemental schedule

Source: Cott management

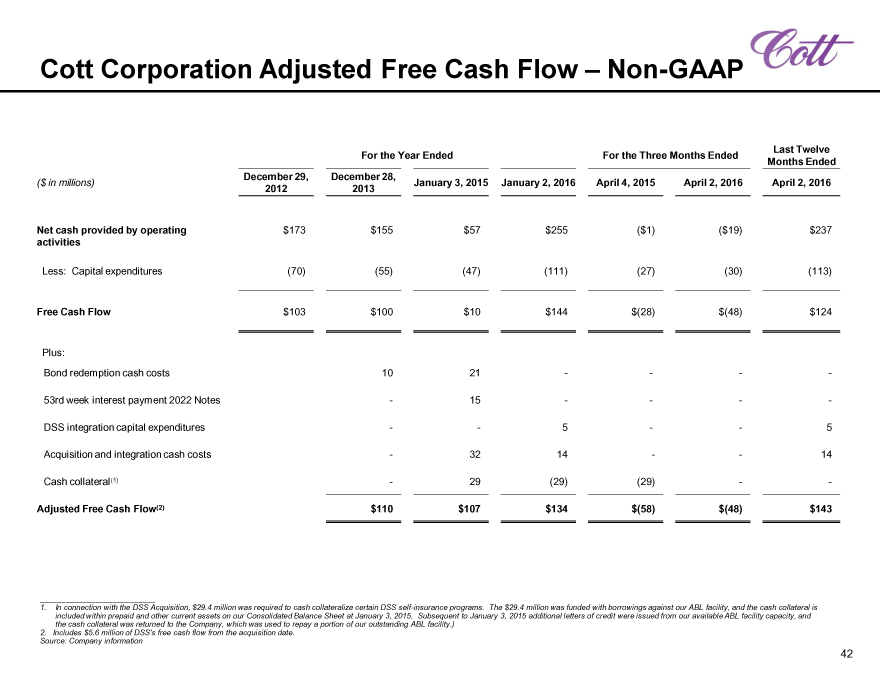

Cott Corporation Adjusted Free Cash Flow ? Non-GAAP

Last Twelve

For the Year Ended For the Three Months Ended Months Ended

December 29, December 28,

($ in millions) January 3, 2015 January 2, 2016 April 4, 2015 April 2, 2016 April 2, 2016

2012 2013

Net cash provided by operating $173 $155 $57 $255 ($1) ($19) $237

activities

Less: Capital expenditures (70) (55) (47) (111) (27) (30) (113)

Free Cash Flow $103 $100 $10 $144 $(28) $(48) $124

Plus:

Bond redemption cash costs 10 21 ——— -

53rd week interest payment 2022 Notes — 15 ——— -

DSS integration capital expenditures —— 5 —— 5

Acquisition and integration cash costs — 32 14 —— 14

Cash collateral(1) — 29 (29) (29) — -

Adjusted Free Cash Flow(2) $110 $107 $134 $(58) $(48) $143

In connection with the DSS Acquisition, $29.4 million was required to cash collateralize certain DSS self-insurance programs. The $29.4 million was funded with borrowings against our ABL facility, and the cash collateral is included within prepaid and other current assets on our Consolidated Balance Sheet at January 3, 2015. Subsequent to January 3, 2015 additional letters of credit were issued from our available ABL facility capacity, and the cash collateral was returned to the Company, which was used to repay a portion of our outstanding ABL facility.)

Includes $5.6 million of DSS’s free cash flow from the acquisition date.

Source: Company information

42

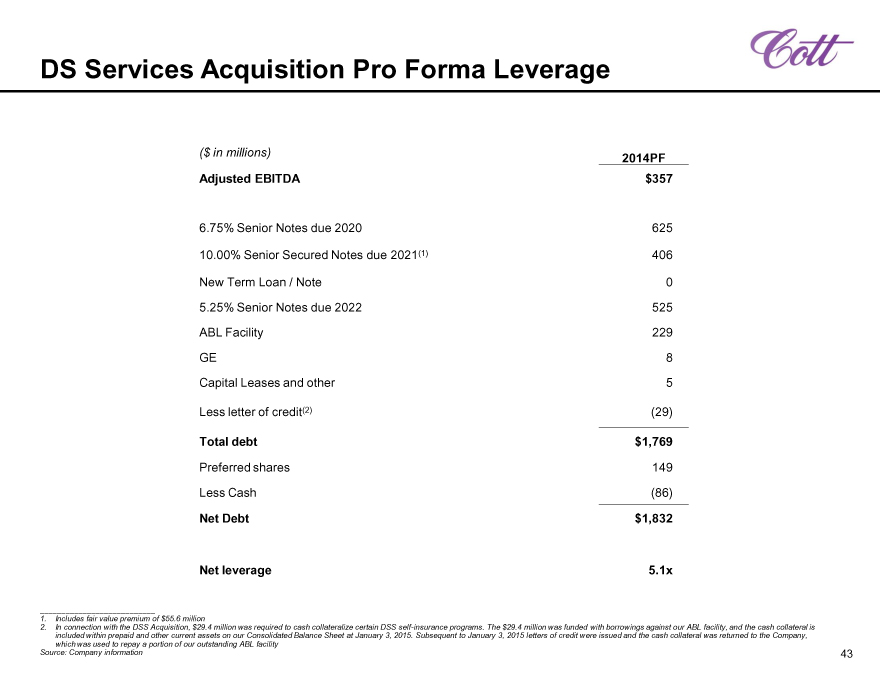

DS Services Acquisition Pro Forma Leverage

($ in millions) 2014PF

Adjusted EBITDA $357

6.75% Senior Notes due 2020 625

10.00% Senior Secured Notes due 2021(1) 406

New Term Loan / Note 0

5.25% Senior Notes due 2022 525

ABL Facility 229

GE 8

Capital Leases and other 5

Less letter of credit(2) (29)

Total debt $1,769

Preferred shares 149

Less Cash (86)

Net Debt $1,832

Net leverage 5.1x

Includes fair value premium of $55.6 million

In connection with the DSS Acquisition, $29.4 million was required to cash collateralize certain DSS self-insurance programs. The $29.4 million was funded with borrowings against our ABL facility, and the cash collateral is included within prepaid and other current assets on our Consolidated Balance Sheet at January 3, 2015. Subsequent to January 3, 2015 letters of credit were issued and the cash collateral was returned to the Company, which was used to repay a portion of our outstanding ABL facility

Source: Company information

43