FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July, 2012

Commission File Number 1-11080

THE ICA CORPORATION

(Translation of registrant's name into English)

Blvd. Manuel Avila Camacho 36

Col. Lomas de Chapultepec

Del. Miguel Hidalgo

11000 Mexico City

Mexico

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F.....x.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ..... No...x...

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

| Empresas ICA Announces UnauditedSecond Quarter 2012 Results |

Mexico City, July 27, 2012—Empresas ICA, S.A.B. de C.V. (BMV and NYSE: ICA), the largest engineering, construction, procurement and infrastructure company in Mexico, announced today its unaudited results for the second quarter of 2012.

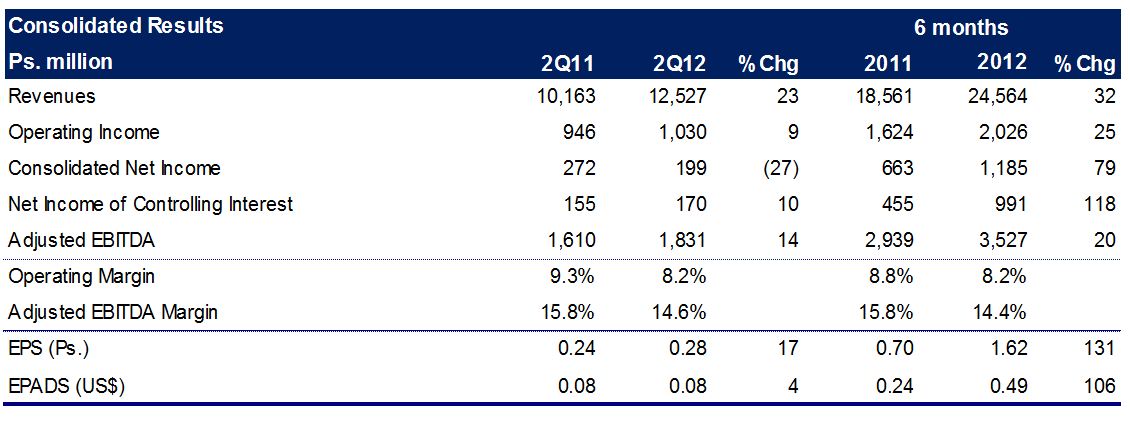

Summary for Second Quarter

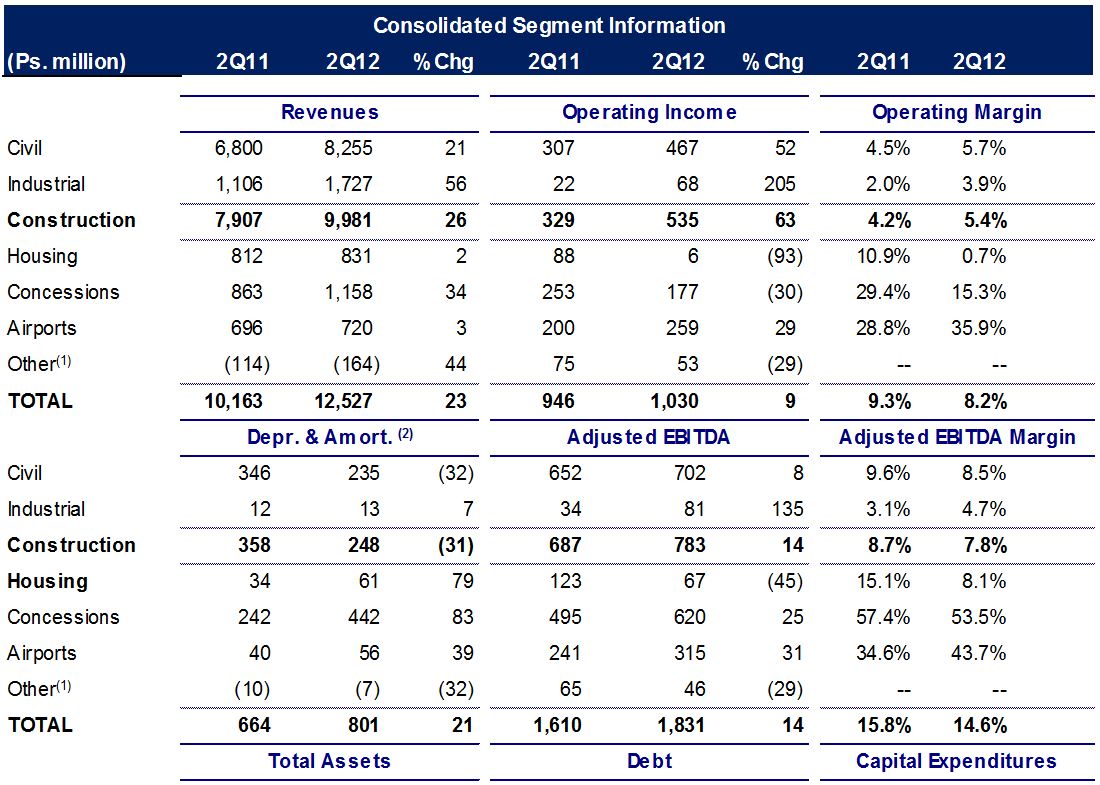

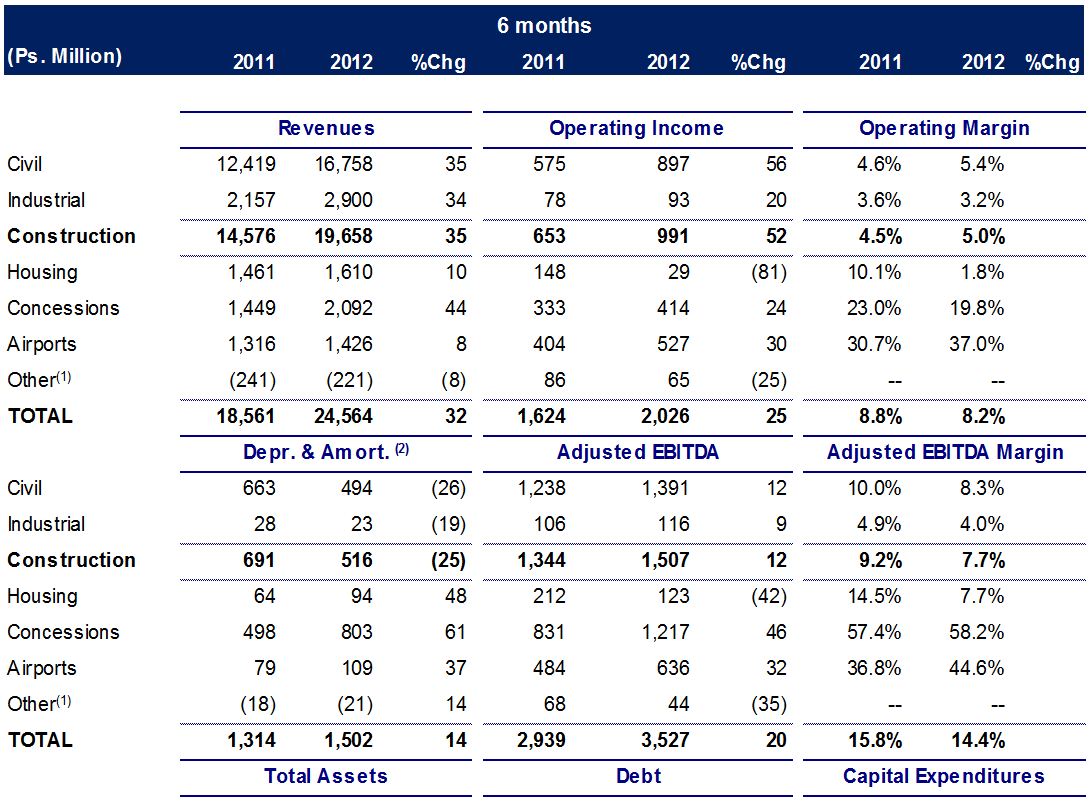

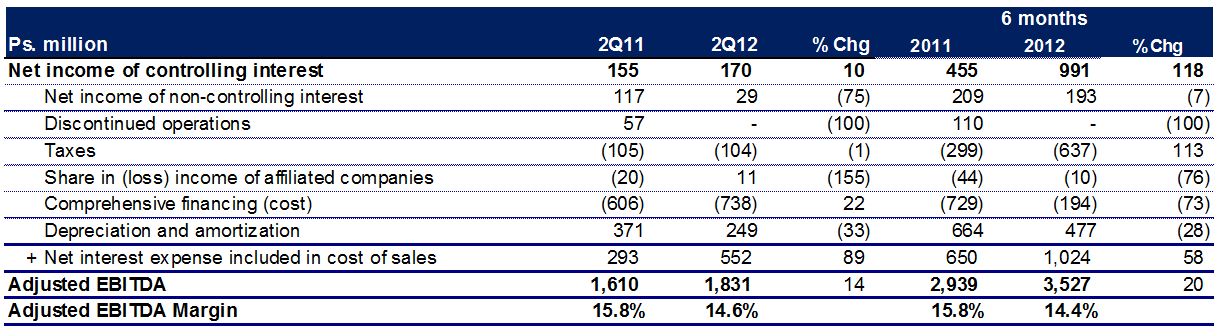

ICA delivered strong revenue and earnings in 2Q12. Consolidated revenue rose 23% in the second quarter of 2012, compared to the second quarter of 2011. All five business segments reported growth for the quarter, led by Civil Construction and Concessions. Adjusted EBITDA rose 14% to Ps. 1,831 million in 2Q12. This marks the 18th quarter in a row where ICA has delivered growth in both revenues and Adjusted EBITDA. Net income of controlling interest rose 10%. Earnings per share increased 17% to Ps. 0.28, after taking into account the repurchase and cancellation of shares in 2011.

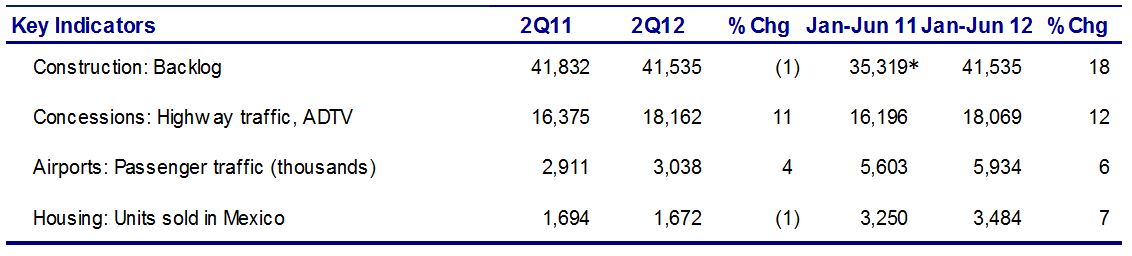

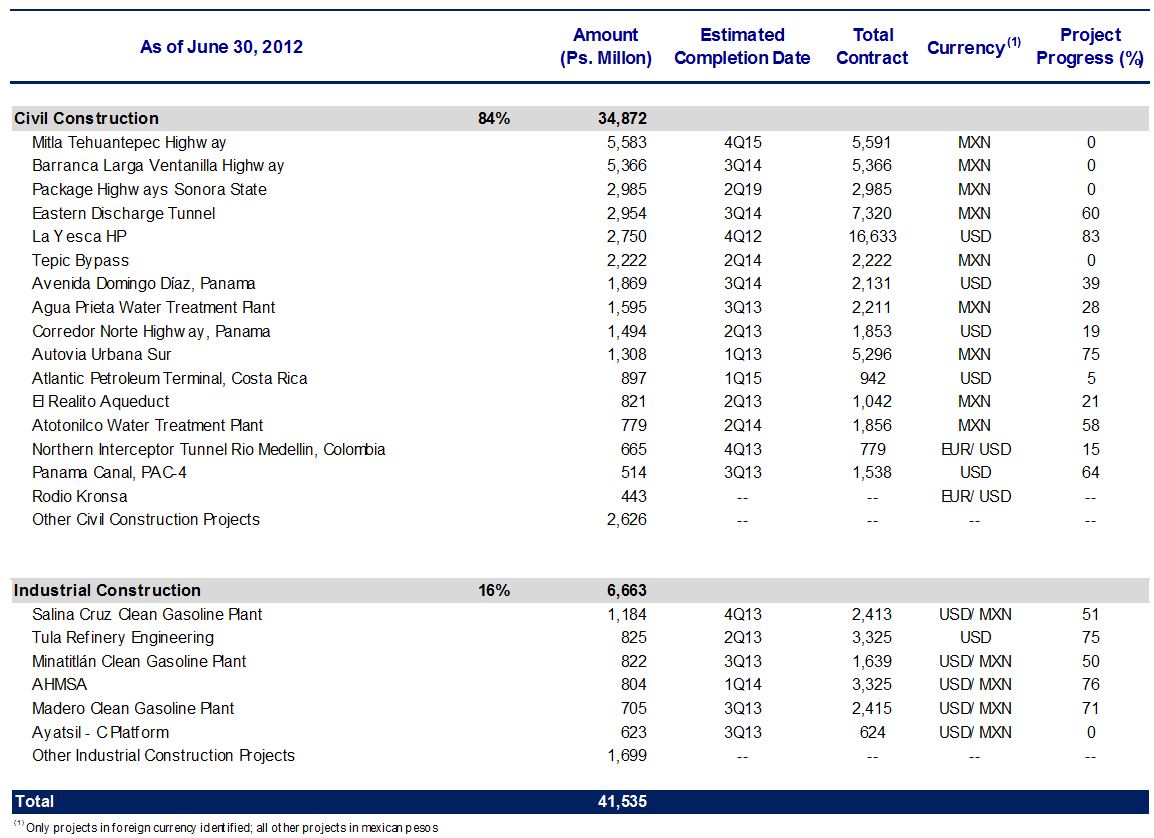

Construction backlog rose to Ps. 41,535 million. This backlog level positions the Company positively during the coming months, as a new government takes office.

ICA recorded significant operational accomplishments in the quarter, including the early delivery of the Los Cabos convention center in time to serve as the site of the G20 heads of state meeting, the start of operational testing of the Metro Line 12, the opening of another segment of the Rio de los Remedios-Ecatepec tollroad, and positive passenger traffic growth trends in the Airports division, among others.

Highlights of the second quarter include:

| · | Total revenue grew 23% in 2Q12 as compared to 2Q11. All five business segments reported growth. Progress in the execution of the principal Civil Construction projects contributed more than 70% of overall growth in revenue, followed by Industrial Construction. |

| · | Operating income increased 9% and Adjusted EBITDA increased 14% as compared to 2Q11. The principal business segments contributed to the increase. |

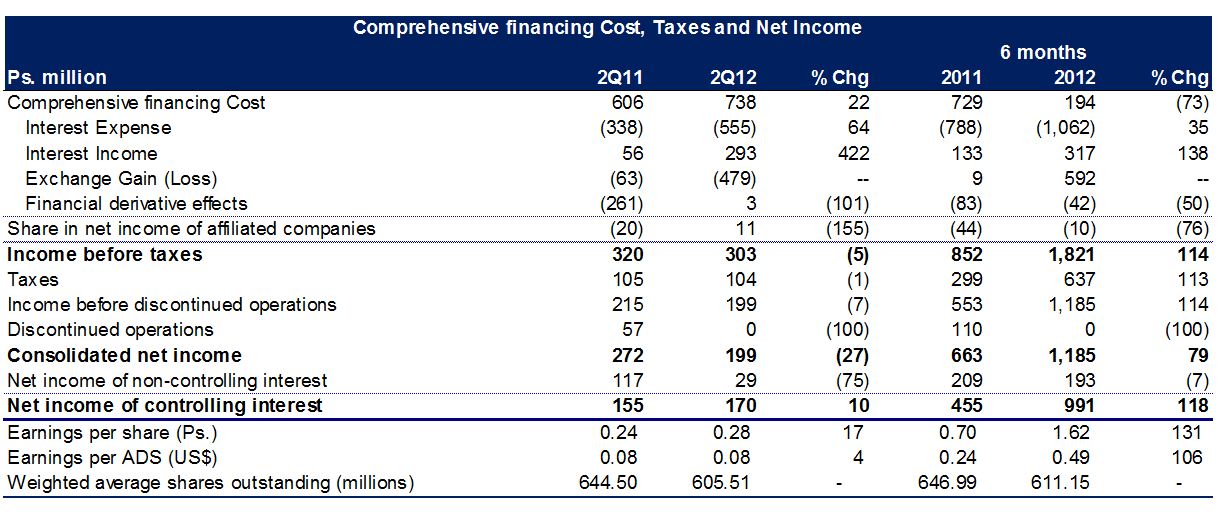

| · | Comprehensive financing cost was Ps. 738 million in 2Q12, principally as a result of an increased exchange loss from the depreciation of the peso in the quarter. |

| · | Consolidated net income was Ps. 199 million as a result of the strong growth in operating income. Net Income of Controlling Interest increased 10% to Ps. 170 million in 2Q12. Earnings per share reached Ps. 0.28 (US$ 0.08 per ADS). |

For more information contact: | |

Investor Relations: Luz Montemayor luz.montemayor@ica.com.mx Iga Wolska iga.wolska@ica.com.mx relacion.inversionistas@ica.com.mx (5255) 5272 9991 ext.3692 | | Victor Bravo, CFO victor.bravo@ica.com.mx In the United States: Daniel Wilson Zemi Communications, (1212) 689 9560 dbmwilson@zemi.com |

| | | |

* As of December 31, 2011.

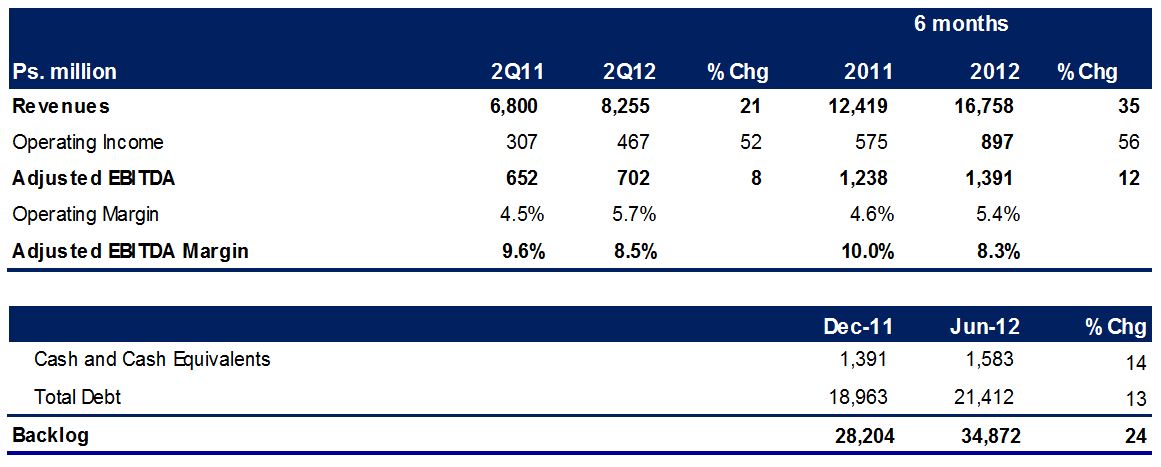

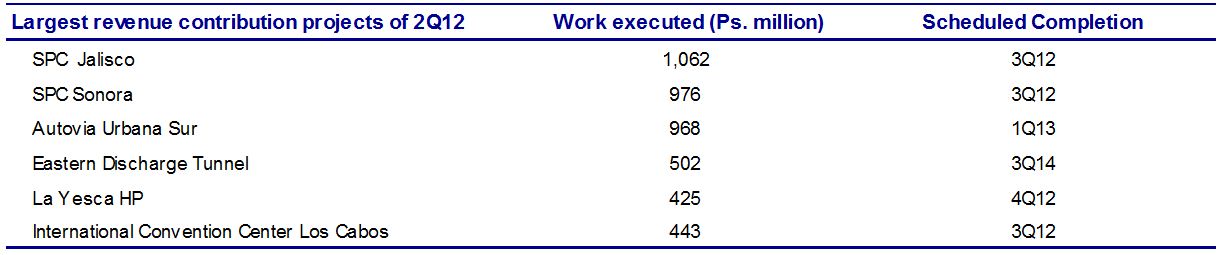

| · | Civil Construction and Industrial Construction (together representing 79% of consolidated revenue and 43% of Adjusted EBITDA in 2Q12) showed strong growth. In Civil Construction, the increase came principally as a result of the two social infrastructure projects under long-term Service Provider Contracts (SPCs), the Autovía Urbana Sur highway, and the Los Cabos International Convention Center. Industrial Construction revenue growth was led by execution of private sector projects and the clean fuels refinery upgrades. |

| · | The La Yesca hydroelectric project continues to advance in line with its completion at the end of 2012. The reservoir continues to fill, which is a critical step before starting the tests required for the delivery of La Yesca to Mexico’s Federal Electricity Commission (CFE). |

| · | On May 30, 2012, ICA announced the acquisition of a 51% controlling interest in San Martín Contratistas Generales, S.A., Peru’s leading company dedicated principally to construction in the mining sector. San Martín’s financial statements are consolidated effective June 30, 2012. |

| · | Construction backlog reached Ps. 41,535 million as of June 30, 2012, an increase of 18% as compared to December 31, 2011. Additions to backlog during the quarter totaled Ps. 15,102 million, as a result of ICA’s strong promotion efforts. The principal new Civil Construction projects were the Barranca Larga-Ventanilla highway and the multi-year contract for the modernization and maintenance of the federal highways in Sonora. Industrial Construction new contracts included the contract for the Ayatsil C offshore platform for Pemex. |

| · | Concessions (9% of revenue and 35% of Adjusted EBITDA in 2Q12) benefited from increases in financial income and construction revenues from the concessions under construction, particularly the SPC projects that are advancing at an accelerated rate and are in their final phase. Revenues from concessions in operation rose 86% in 2Q12. |

| · | ICA acquired the remaining 50% of the Rio de los Remedios-Ecatepec tollroad that is structured as a long-term public financed work, taking advantage of the opportunity to consolidate the value in our asset portfolio. ICA now owns 100% of this project. |

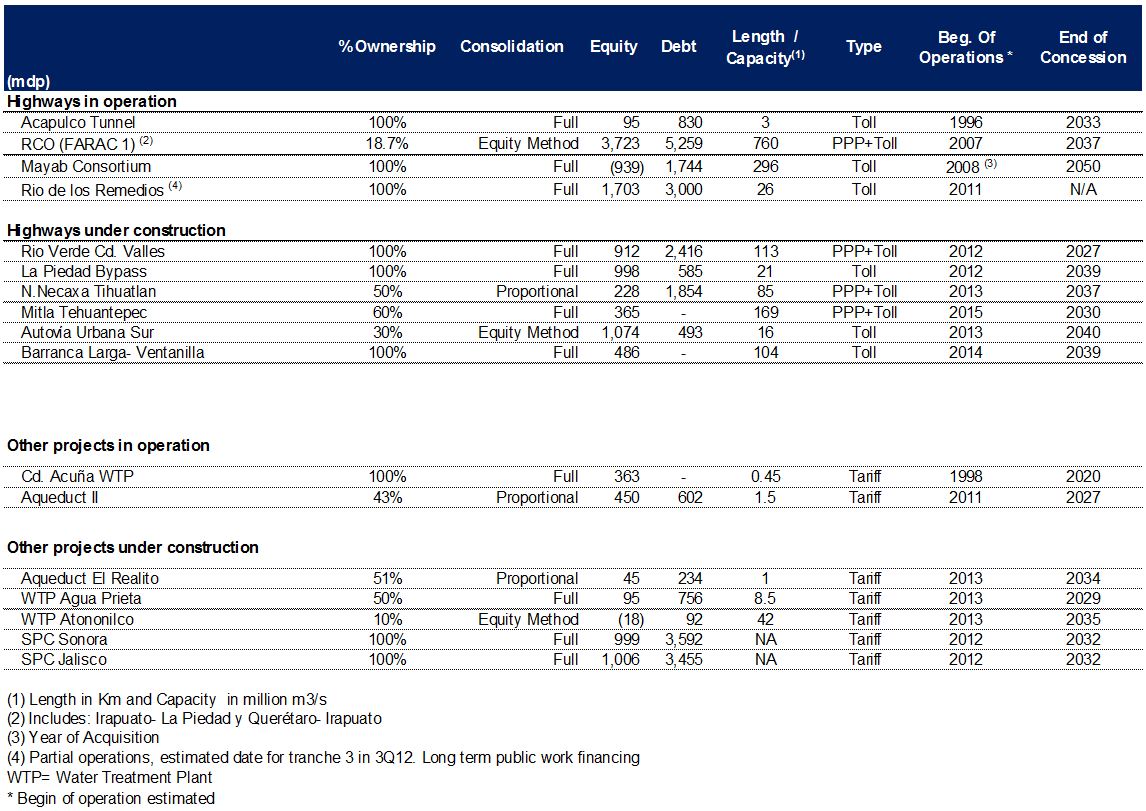

| · | As of June 30, 2012, ICA’s Concessions segment was participating in 17 projects, including ten highways, five water projects, and two SPCs. Of these, 11 are under construction, five are in full operation, and one is in partial operation. |

| · | Airports (6% of revenue and 18% of Adjusted EBITDA in 2Q12) benefited from a 4% increase in passenger traffic volume as the air transport sector continues to recover. In addition, OMA’s commercial and diversification initiatives continue to drive non-aeronautical revenue growth. |

| · | Housing development (6% of revenue and 4% of Adjusted EBITDA in 2Q12) had a 2% increase in revenues, as a result of a change in the mix of units sold in Mexico. |

| Investor Relations | www.ica.com.mx | 2/23 |

| · | Civil Construction revenues increased 21% in 2Q12 as compared to 2Q11, primarily due to work on the two SPC projects, the Autovía Urbana Sur highway, and the Los Cabos convention center, as well as an increased rate of work on the Eastern Discharge Tunnel. |

| · | The La Yesca hydroelectric project continues to advance toward its scheduled completion at the end of 2012. The rate that the reservoir continues to fill will enable the start of the tests required for the delivery of the project on schedule to the CFE. The electromechanical works are in the final stages of installation. |

| · | Operating income was Ps. 467 million, an increase of 52% compared to 2Q11, as a result of the growth in revenues and higher margins. |

| · | Adjusted EBITDA reached Ps. 702 million, an increase of 8% compared to 2Q11. |

| · | Civil Construction debt as of June 30, 2012 was Ps. 21,412 million. The La Yesca debt was Ps.13,946 million as of June 30, 2012, and represented 65% of Civil Construction debt and 24% of ICA’s total debt. As a financed public work, the debt increases as the execution of the project advances, and this is documented in certifications for completed work. Once the project is completed, these certifications are expected to be collected, and the La Yesca debt is expected to be repaid in full from payments made by the client. |

| Investor Relations | www.ica.com.mx | 3/23 |

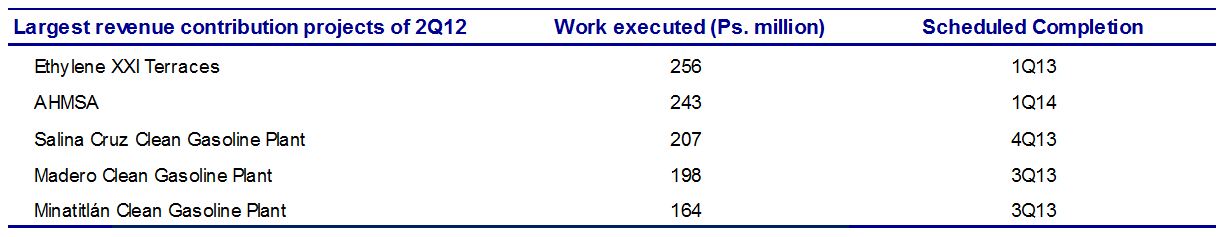

| · | Revenues increased 56% in 2Q12 compared to 2Q11 primarily due to the start of Ethylene XXI terraces project the Fénix project for AHMSA. The clean fuels projects at the Madero, Minatitlán, and Salina Cruz refineries also made an important contribution. |

| · | Adjusted EBITDA reached Ps. 81 million in 2Q12, an increase of 135% as compared to 2Q11. The Adjusted EBITDA margin was 4.7%. The increase in Adjusted EBITDA margin as compared to the same period of the prior year reflects a change in the mix of projects under construction as a result of new contracts with higher margins. |

| Investor Relations | www.ica.com.mx | 4/23 |

| · | Construction backlog was Ps. 41,535 million as of June 30, 2012, equivalent to 13 months work at the average rate for the first six months of 2012; 84% of backlog was for Civil Construction and 16% for Industrial Construction. In Industrial Construction we register our share of the backlog in proportion to our shareholding in ICA Fluor. |

| · | New contracts and additions to existing contracts totaled Ps. 15,102 million in 2Q12. |

| · | In Civil Construction, we added the Barranca Larga-Ventanilla highway and the contract for the modernization and maintenance of 797.4 km of federal highways in Sonora. In addition, contract enlargements were signed for the La Yesca hydroelectric project and the Rio de los Remedios highway. |

| · | Projects outside of Mexico represented 15% of backlog, including projects of Grupo Rodio Kronsa, our Spanish subsidiary, and construction contracts in four Latin American countries. |

| · | In Industrial Construction, we signed a contract with Pemex for the fabrication of the Ayatsil C offshore platform. ICA’s proportional share of the contract is Ps.624 million. We also increased the size of several contracts, including the Ethylene XXI project. |

| Investor Relations | www.ica.com.mx | 5/23 |

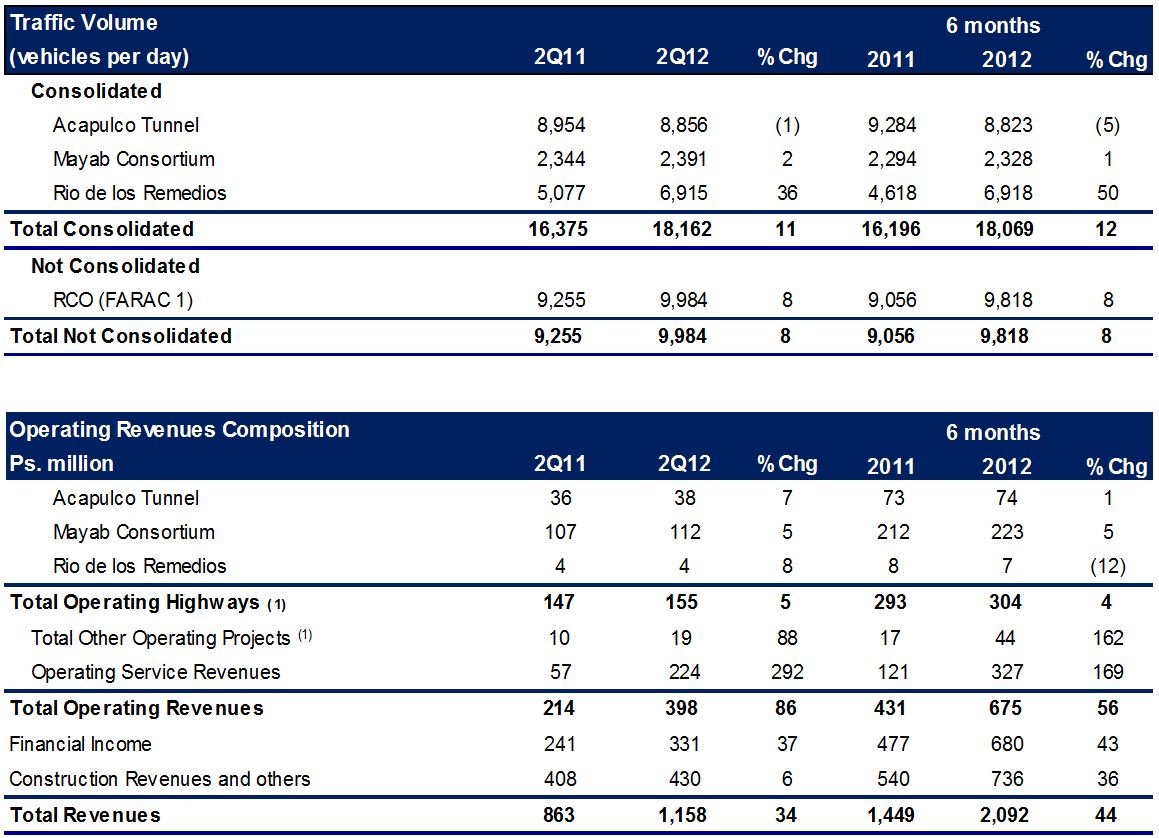

Concessions

| · | Average Daily Traffic Volumes (ADTV) on consolidated highways increased 11% in 2Q12, principally because of increased traffic on the Rio de Los Remedios-Ecatepec and Del Mayab tollroads, which offset a reduction in traffic on the Acapulco Tunnel. |

| · | Concessions revenues increased 34% to Ps. 1,158 million, with increases from both concessions under construction and those in operation. Revenue from projects in operation increased 86%. |

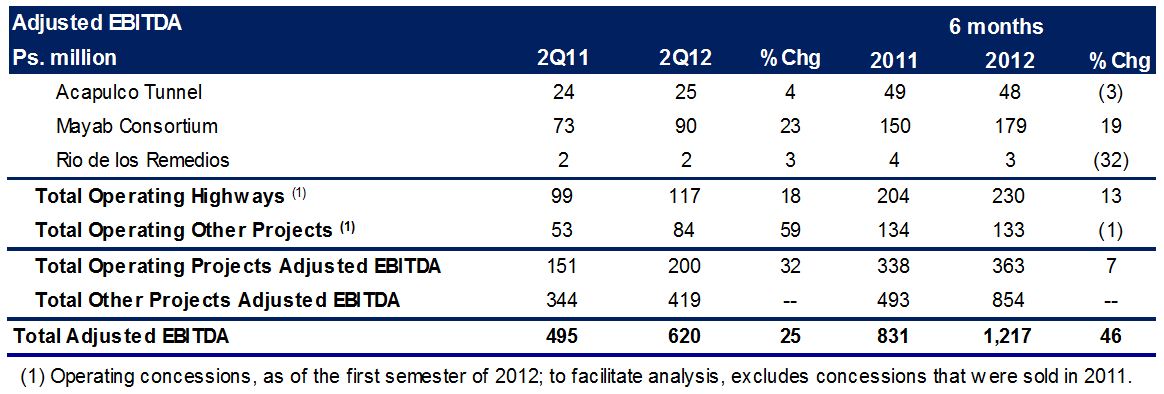

| · | Adjusted EBITDA rose 25% to Ps. 620 million. The increase was the result of financial income and construction revenue on the 11 concessions in the construction phase and the concessions in operation. The Adjusted EBITDA for operating projects rose 32%. |

| · | Concessions segment debt increased 10% as compared to December 31, 2011, as a result of drawings on financings for projects that are in the construction phase. The segment’s decrease in cash from Ps. 7,142 million on December 31, 2011 to Ps. 3,495 million on June 30, 2012 reflects the funding of the construction of the two SPC projects, using the proceeds of the bonds placed in 2011 and 2012. |

| · | During 2Q12, we acquired the remaining 50% of the Rio de los Remedios long-term public financed public works project. We also opened one additional segment of this tollroad. |

In 3Q11, ICA completed the sale of the Corredor Sur concession to the Government of Panama. As a result the Concessions segment’s2Q11 results do not include the results of the Corredor Sur, which are included in ICA’s consolidated results in the line item Discontinued Operations.

| Investor Relations | www.ica.com.mx | 6/23 |

Operating Concessions information

| Investor Relations | www.ica.com.mx | 7/23 |

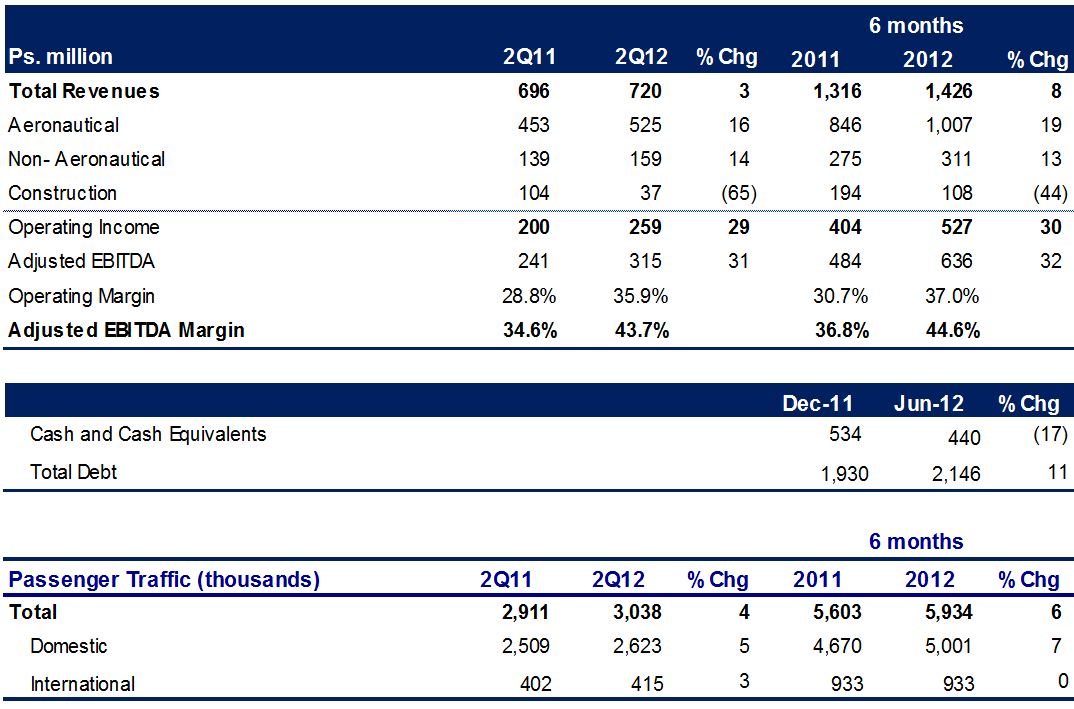

| · | Total passenger traffic increased 4% in 2Q12, reflecting the continued recovery of the air transport sector. |

| · | Total revenue increased 3% to Ps. 720 million. The sum of aeronautical and non-aeronautical revenues grew 16%. |

| · | Aeronautical revenues increased 16% as a result of the increase in traffic and increases in passenger charges and tariffs for other services in October 2011 and April 2012. Aeronautical revenue per passenger increased 11%. |

| · | Non-aeronautical revenues grew 14%, principally as the result of increased use of parking lots, an increase in rates at the NH Terminal 2 Hotel, and alternative advertising in the airports. |

| · | Non-aeronautical revenue per passenger rose 10% as a result of commercial development and diversification initiatives. |

| · | Adjusted EBITDA increased 31% to Ps. 315 million in 2Q12 from Ps. 241 million in 2Q11 principally as a result of the growth in revenues. |

| · | Airports debt was Ps. 2,146 million as of June 30, 2012. |

The Airports segment includes Grupo Aeroportuario del Centro Norte (OMA), Aeroinvest, and Servicios de Tecnología Aeroportuaria (SETA). The earnings report of OMA, which is the operating company in the Airports segment, can be found at http://ir.oma.aero. Those results differ from the ones presented here as a result of consolidation effects.

| Investor Relations | www.ica.com.mx | 8/23 |

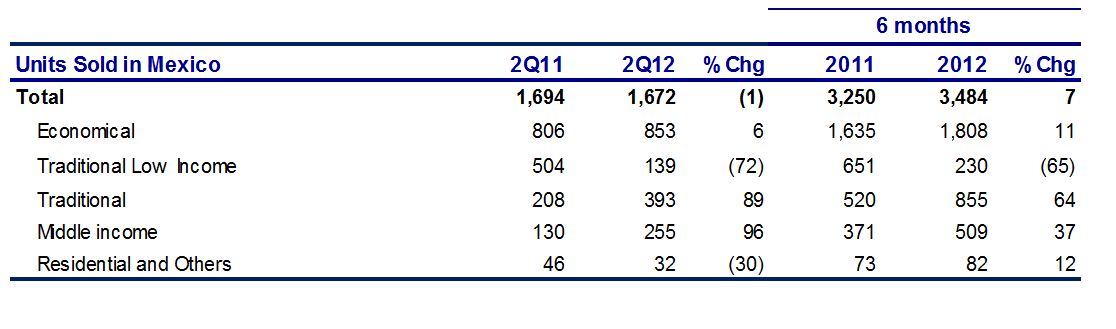

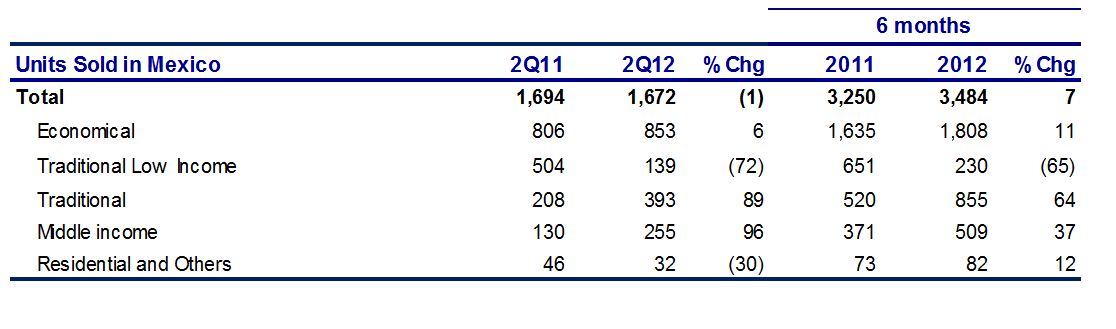

| · | Housing units sold in Mexico reached 1,672 units in 2Q12, a decrease of 1% compared to 2Q11. |

| · | Housing revenues increased 2% to Ps. 831 million in 2Q12, as a result of a higher average price on the mix of units sold. Revenues of ViveICA represent 80% of the revenues of the Housing Development segment, and our subsidiary Los Portales in Peru the balance. |

| · | Adjusted EBITDA decreased 45%, as a result of a deferral in the delivery of units sold by Los Portales in Peru which have higher margins. |

| · | At the end of 2Q12, ViveICA had 27 projects underway in 13 states in Mexico. ViveICA’s land reserve as of June 30, 2012 was 1,552 hectares, equivalent to 81,102 homes. |

| Investor Relations | www.ica.com.mx | 9/23 |

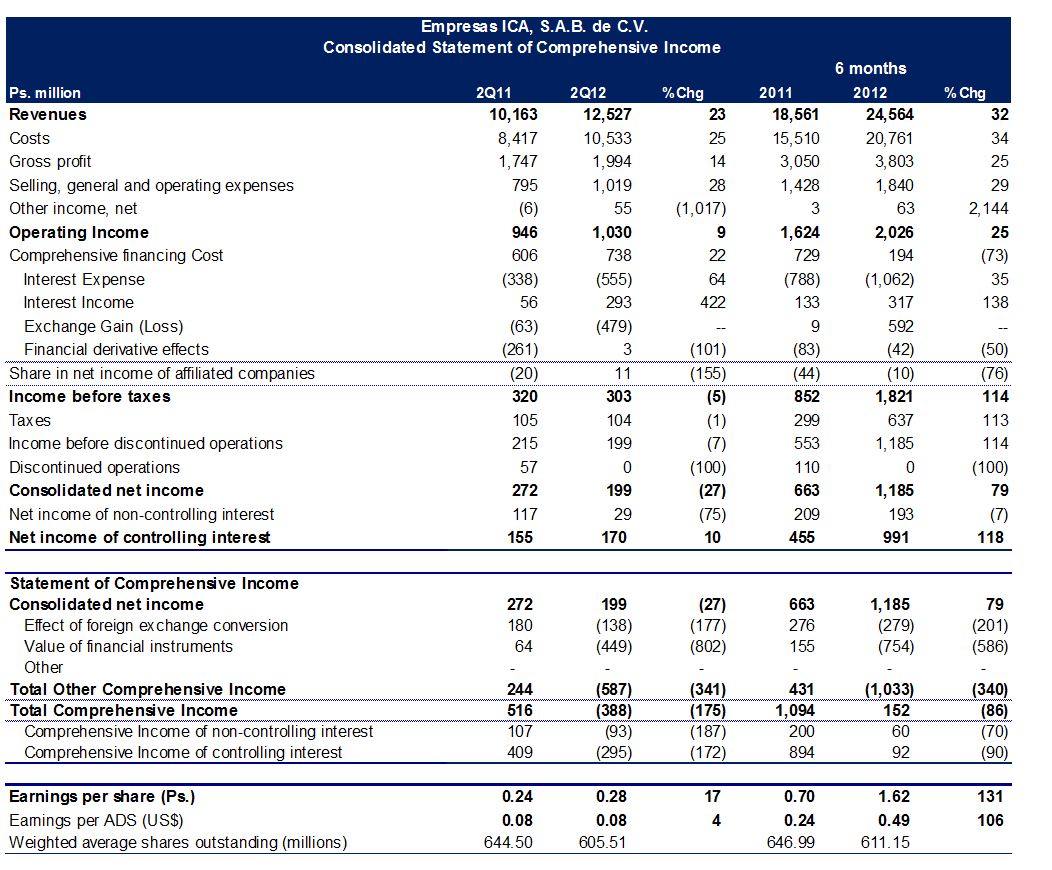

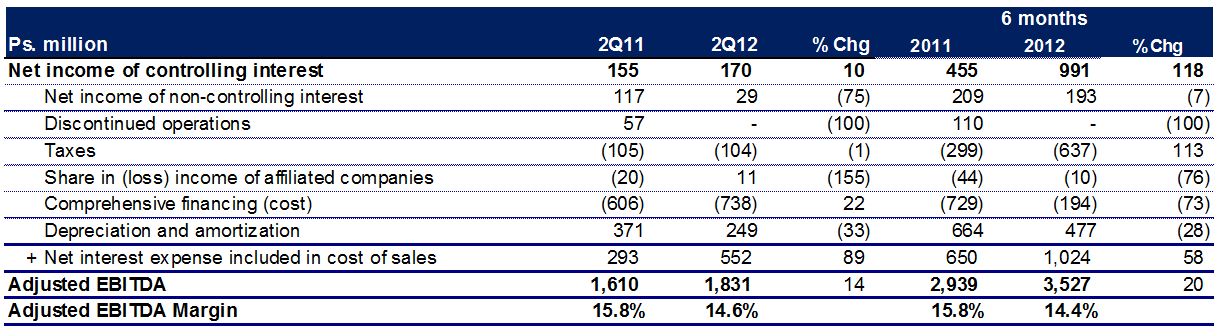

| · | Revenues increased 23% to Ps. 12,527 million in 2Q12. Civil and Industrial Construction accounted for 86% of the increase in revenues and Concessions for 12%. For the first six months of 2012, revenues increased 32%, reaching Ps. 24,564 million. |

| · | Cost of sales increased 25%, slightly above the rate of revenue growth, and was 84.1% of revenues. For the first six months of 2012, costs were 84.5% of revenues, as compared to 83.6% in the same period of 2011. Cost of sales also includes interest expense on financed projects in Civil Construction, Industrial Construction, Concessions, and Housing. |

| · | Selling, general, and administrative expenses were Ps. 1,019 million, an increase of 28%, because of higher general, promotion, and administrative expenses. These expenses were 8.1% of revenue as compared to 7.8% in 2Q11. In the first six months of 2012, these expenses increased 29%, or at a slower rate than revenues. |

| · | Operating income increased 9% to Ps. 1,030 million in 2Q12, with an operating margin of 8.2%. For the first six months of 2012, operating income increased 25% to Ps. 2,026 million. |

| · | Adjusted EBITDA was Ps. 1,831 million, an increase of 14% over 2Q11, as a result of the strong performance of Concessions, Construction, and Airports. The Adjusted EBITDA margin was 14.6%. In the first six months of 2012, Adjusted EBITDA rose 20% to Ps. 3,527 million, with an Adjusted EBITDA margin of 14.4%. Civil and Industrial Construction contributed 43% of Adjusted EBITDA in 2Q12, Concessions 35%, Airports 18%, and Housing the balance. |

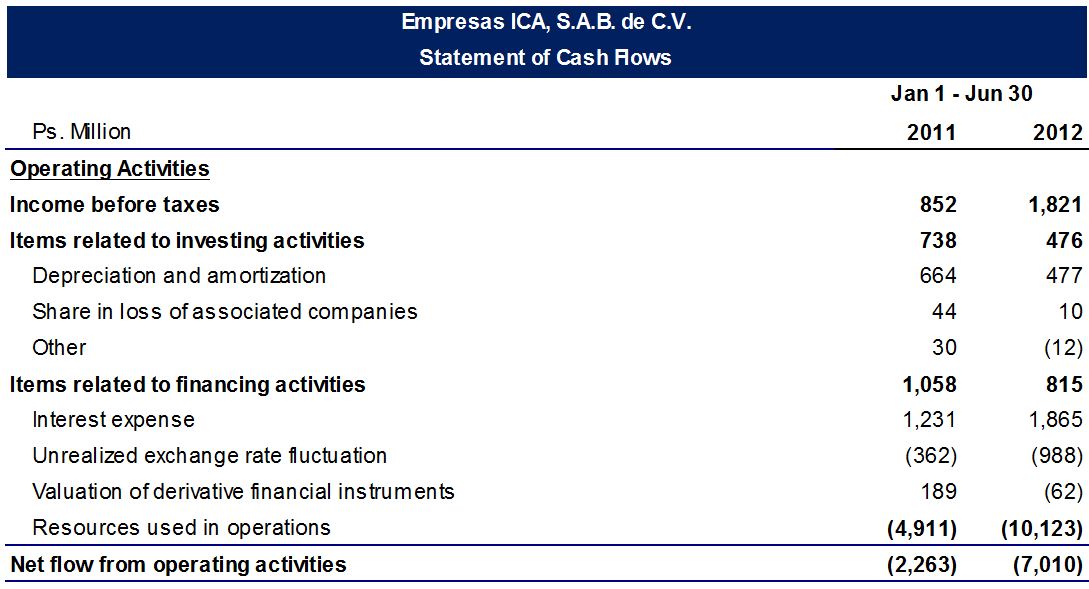

| · | Comprehensive financing cost was Ps. 738 million in 2Q12, principally the result of an increase in the exchange loss as a result of the depreciation of the peso in 2Q12. For the first six months of 2012, the comprehensive financing cost was Ps. 194 million. Exchange gains and losses do not represent cash inflows or outflows. |

| Investor Relations | www.ica.com.mx | 10/23 |

| · | Taxes were Ps. 104 million in 2Q12, with an effective tax rate of 34%. In the first six months of 2012, taxes were Ps. 637 million, with an effective rate of 35%. The effective tax rate was affected by the flat rate corporate tax (IETU) incurred by some subsidiaries and higher tax rates on some international operations. |

| · | Discontinued operations. This reflects the operation of the Corredor Sur tollroad in 2Q11. The concession was sold in 3Q11. |

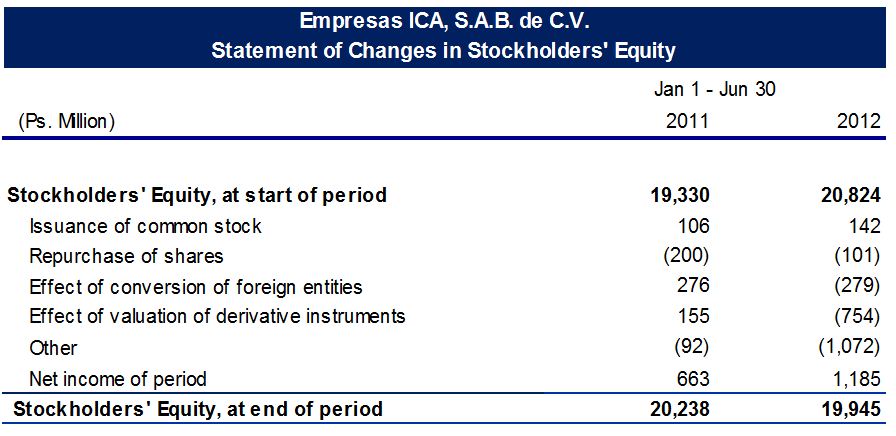

| · | Consolidated net income was Ps. 199 million in 2Q12, a decrease of 27%, principally because of the exchange loss. Consolidated net income for the first six months of 2012 was Ps. 1,185 million, an increase of 79% compared to the 2011 period, as a result of the increase in operating income. |

| · | Net income of the controlling interest was Ps. 170 million in 2Q12. Earnings per share were Ps.0.28 and Earnings per ADS were US$ 0.08. The 17% increase in earnings per share also includes the positive effect on EPS of the repurchase and cancellation of shares in 2011. Net Income of controlling interest for the first six months of 2012 was Ps. 991 million, an increase of 106%. Earnings per share for the first six months of 2012 were Ps. 1.62 (US$0.49 per ADS). |

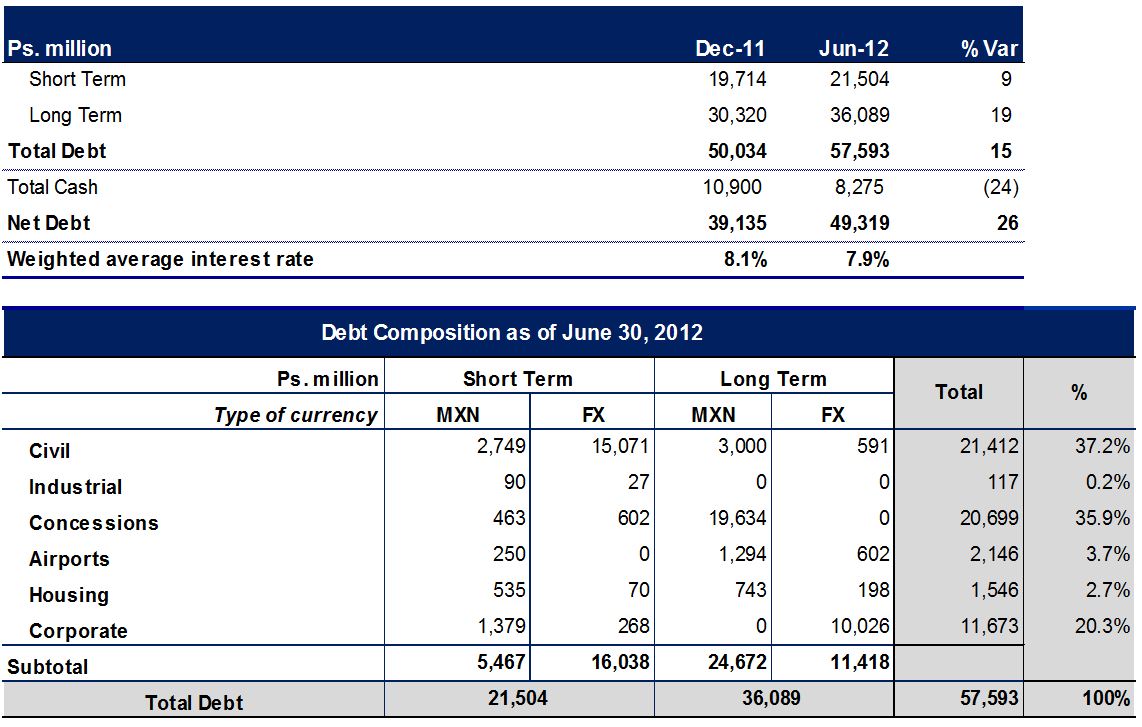

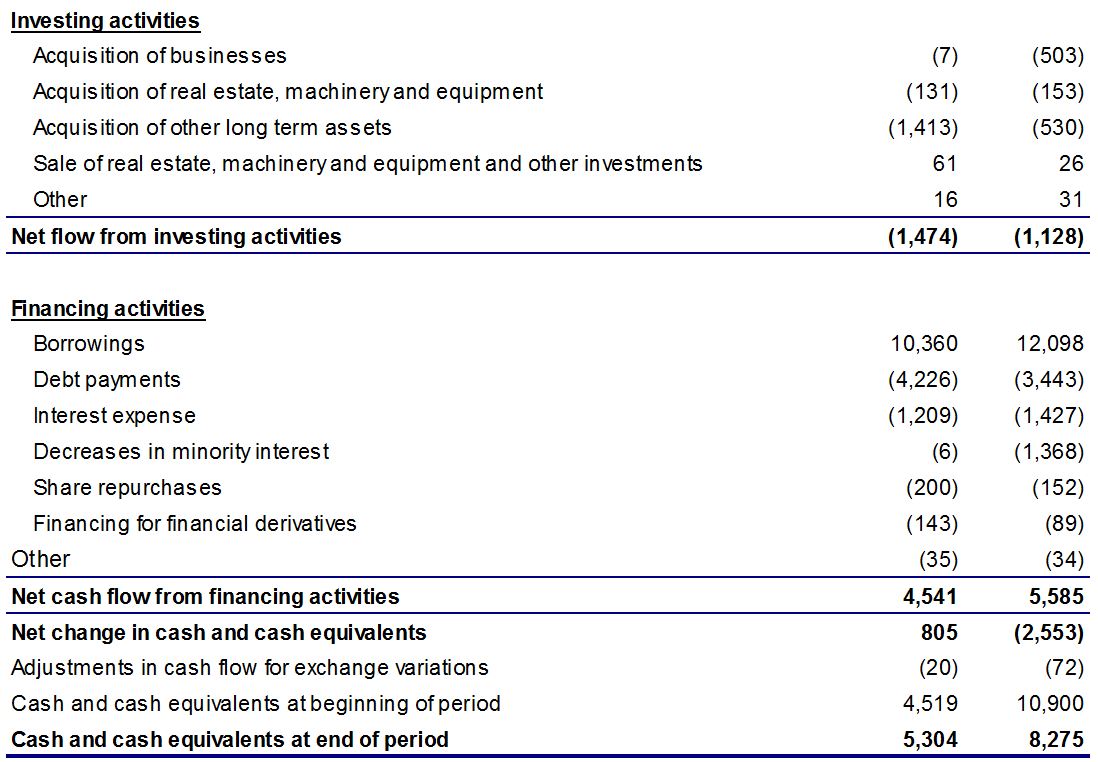

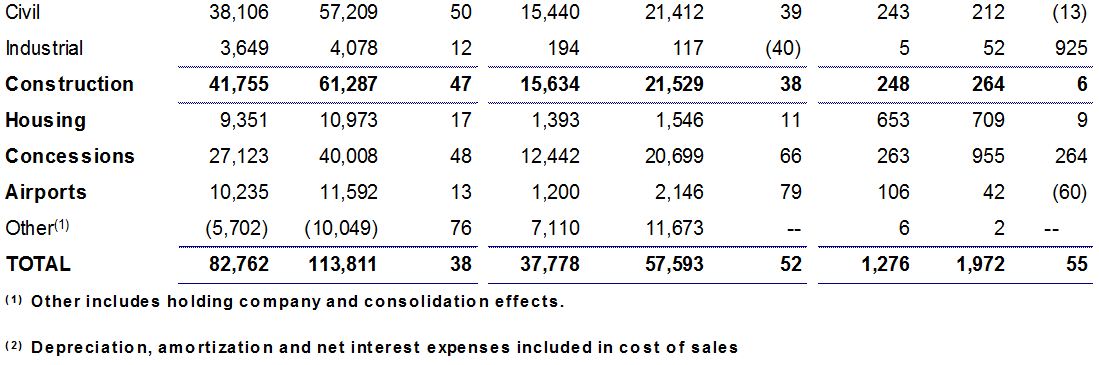

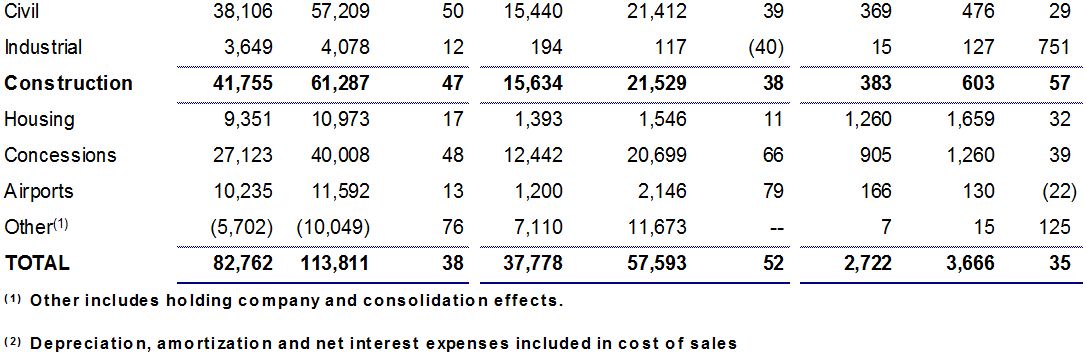

Debt

| · | Total debt as of June 30, 2012 was Ps. 57,593 million, an increase of 15%, or Ps. 7,559 million as compared to December 31, 2011. |

| · | Of total debt, 73% corresponds to Civil Construction and Concessions. |

| · | 65% of Civil Construction debt is for the La Yesca hydroelectric project, whose source of payment is the Government of Mexico, through CFE. The La Yesca debt is expected to be paid upon completion of the project, which is expected at the end of 2012. The remaining Civil Construction debt corresponds to working capital lines for projects in execution and is expected to be paid as collections are made on each project. |

| Investor Relations | www.ica.com.mx | 11/23 |

| · | Concessions debt consists of structured project finance credit facilities whose source of repayment are the cash flows to be generated by each project once it starts operation. Of the total Concessions debt, 70% corresponds to projects under construction, and 30% corresponds to the four consolidated operating concessions. |

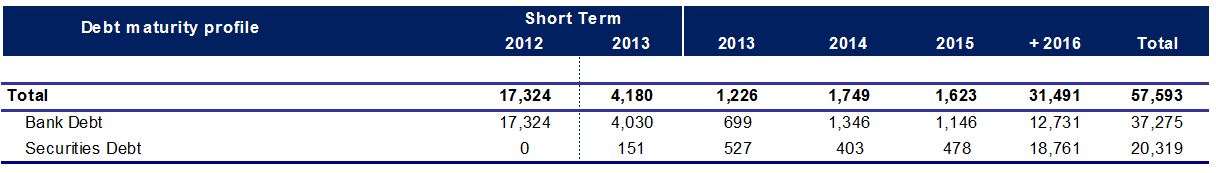

| · | Debt issued at the parent company level represents 20% of total debt. The excess cash balances of each segment and the dividends and fees paid to the parent company are the source of payment for these loans. On July 24, 2012, we placed senior notes maturing in 2017 to repay short-term debt and improve ICA’s debt maturity profile. The effects of this transaction will be reflected in 3Q12 results. (See Subsequent Event below). |

| · | Housing and Airports segments account for 6% of total debt, which is principally composed of working capital for projects in execution and, to a lesser extent, for long-term investments. |

| · | 65% of debt is bank debt and 35% is securities debt as of June 30, 2012. |

| · | 37% of debt as of June 30, 2012 was short-term. Of total short-term debt, 65% represents the debt for La Yesca (which was 24% of total debt as of June 30, 2012). La Yesca debt will continue to increase as work is executed and as the project moves toward expected completion and payment by the Government of Mexico, through CFE. |

| · | 48% of debt is denominated in foreign currency, principally U.S. dollars. This includes principally our senior notes due 2021 and the debt of the La Yesca hydroelectric project that will be paid for by the client in dollars upon on completion of the project. |

| · | ICA’s policy is to contract financing for projects in the same currency as the source of repayment. In addition, the Company uses financial derivatives to reduce exchange and interest rate risks. |

| · | ICA expects to continue to be active in the capital markets to finance projects that generate value for the Company. |

| · | Cash balances (including cash equivalents and restricted cash) as of June 30, 2012 were Ps. 8,275 million, a decrease of Ps. 2,625 million as compared to December 31, 2011, principally from funding the construction of the SPC social infrastructure projects. Net debt reached Ps. 49,319 million. |

| Investor Relations | www.ica.com.mx | 12/23 |

On July 24, 2012, ICA placed US$ 350 million of new Senior Notes due 2017 (the “Notes”). The proceeds were used to pay short term debt in order to improve the Company's debt maturity profile. The Notes have a coupon of 8.375% per year payable semi-annually, with a yield to maturity at issuance of 8.625%. The Notes were issued pursuant to exemptions from registration provided under Rule 144A and Regulation S under the U.S. Securities Act of 1933, as amended. The Notes were issued by Empresas ICA, S.A.B. de C.V. and guaranteed on a senior unsecured basis by Constructoras ICA, S.A. de C.V., Controladora de Operaciones de Infraestructura, S.A. de C.V. and Controladora de Empresas de Vivienda, S.A. de C.V., each a subsidiary of the Company.

ICA acquired 4,207,000 shares in the market between May 3 and 14, 2012, at an average price of Ps. 23.93 per share, using the share purchase reserve of up to Ps. 1,850 million approved by the Shareholders’ Meeting on April 19, 2012, and in accordance with our Policy for the Acquisition and Disposition of Own Shares. As of June 30, 2012, shares in Treasury totaled 9,817,074, equivalent to 1.62% of outstanding shares; the unused portion of the share purchase reserve was Ps. 1,749.3 million.

Conference Call Invitation

ICA’s conference call will be held on Monday, July 30, at 10:00 am Eastern Time (9:00 am Mexico City time). To participate, please dial toll-free 1-877-941-8416 from the U.S. or 1-480-629-9808 internationally. The conference ID is 4552502. The conference call will be Webcast live through streaming audio and available on ICA’s website at http://www.ica.com.mx/ir

A replay will be available until August 6, 2012 by calling toll-free 1-877-870-5176 from the U.S. or 1-858-384-5517 internationally, again using conference ID 4552502.

| Investor Relations | www.ica.com.mx | 13/23 |

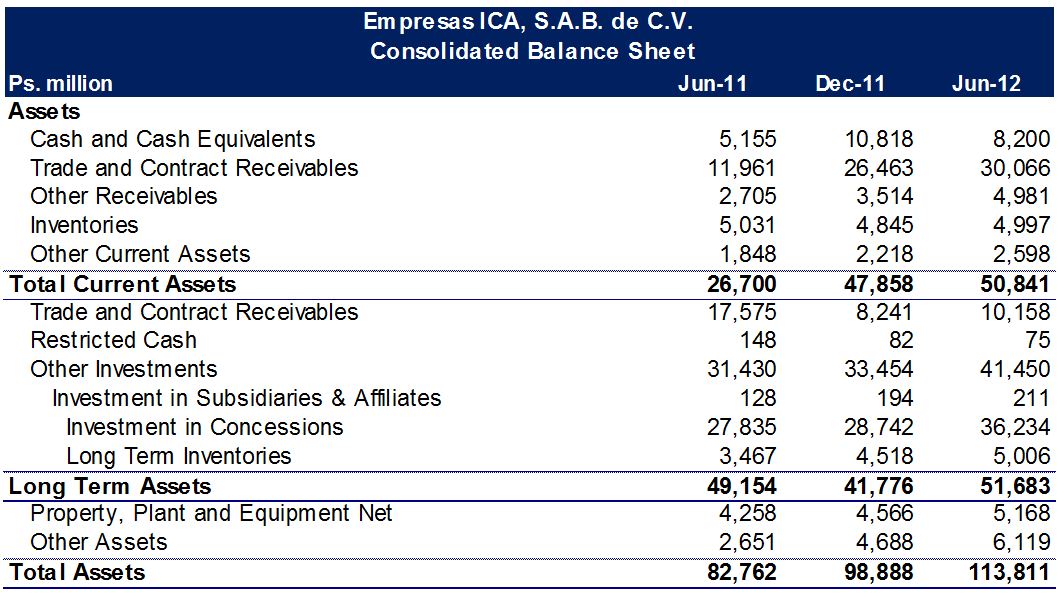

Consolidated Financial Statements

| Investor Relations | www.ica.com.mx | 14/23 |

| Investor Relations | www.ica.com.mx | 15/23 |

| Investor Relations | www.ica.com.mx | 16/23 |

| Investor Relations | www.ica.com.mx | 17/23 |

| Investor Relations | www.ica.com.mx | 18/23 |

Backlog

| Investor Relations | www.ica.com.mx | 19/23 |

Concession Portfolio

Other Concessioned Projects, Operating Information

Housing Units Sold in Mexico

| Investor Relations | www.ica.com.mx | 20/23 |

The unaudited condensed consolidated financial statements of Empresas ICA, S.A.B. de C.V. and subsidiaries (ICA) have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and presented in accordance with IAS 34 “Intermediate Financial Reporting”. These financial statements include all the adjustments, including those of a normal and recurring nature, required for an adequate presentation of the results of operations. Results for interim reporting periods may not be indicative of full year results. As a result, the reading and analysis of these interim financial statements should be done in conjunction with the financial statements for the year ended December 31, 2011, which were also prepared under IFRS.

Unaudited financials: Financial statements are unaudited statements.

Prior period comparisons: Unless stated otherwise, comparisons of operating or financial results are made with respect to the comparable prior-year period, or balances as of December 31, 2011.

Percentage changes: Are calculated based on actual amounts.

Adjusted EBITDA: Adjusted EBITDA is not a financial measure computed under IFRS and should not be considered an indicator of financial performance or free cash flow. We define Adjusted EBITDA as net income of controlling interest plus (i) net income of non-controlling interest, (ii) discontinued operations, (iii) income taxes, (iv) share in net income of affiliates, (v) net comprehensive financing cost, (vi) depreciation and amortization, and (vii) net interest expense included in cost of sales. Our management believes that Adjusted EBITDA provides a useful measure of its performance, supplemental to net income and operating income, because it excludes the effects of financing decisions, non-controlling shareholdings, and other non-operating items. The calculation of Adjusted EBITDA is also provided as a result of requests from the financial community and is widely used by investors in order to calculate ratios and to make estimates of the total value of our company in comparison to other companies. Financial ratios calculated on the base of Adjusted EBITDA are also widely used by credit providers in order to gauge the debt servicing capacity of companies and are relevant measures under one or more of our or our subsidiaries’ financing agreements.

Exchange rate: Amounts in U.S. dollars (US$) are converted at an exchange rate of Ps. 13.348 per U.S. dollar as of June 30, 2012 and Ps. 13.9322 as of December 31, 2011.

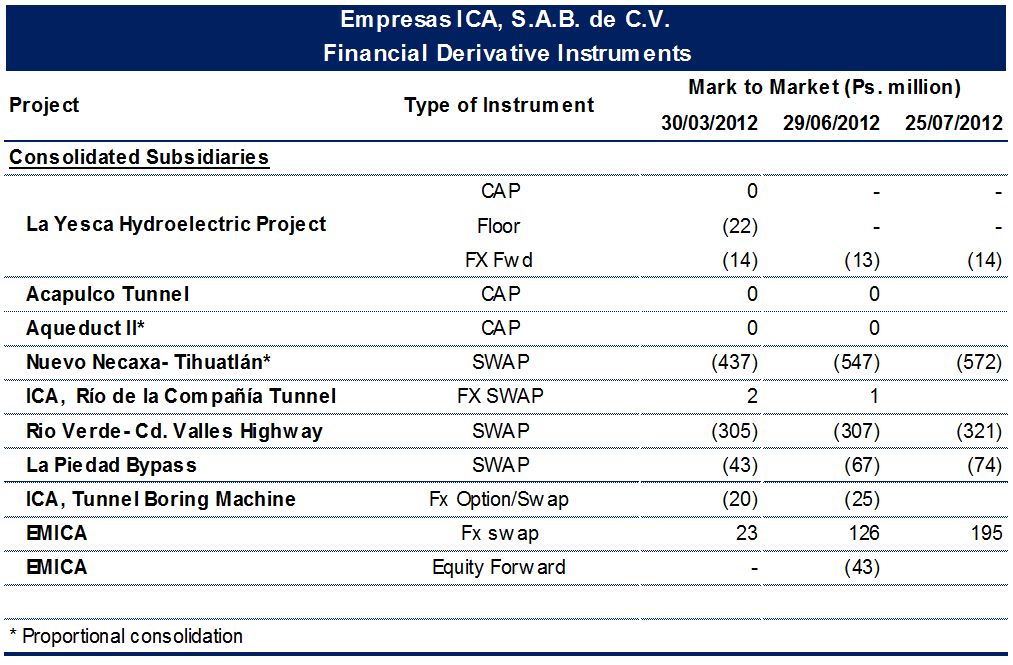

Financial Derivative Instruments: ICA enters into financial derivative contracts in the subsidiaries where projects are located solely in order to reduce the uncertainty on the returns on projects. The instruments entered into are established on a notional amount. Interest rate derivatives are used in order to fix maximum financial costs. Exchange rate derivatives are entered into in order to reduce the exchange risk on projects that incur labor and materials costs in a currency different from the currency of the financing of the project. ICA enters into its financings in the same currency as the source of repayment. ICA has a policy of not entering into derivatives for speculative purposes.

From an accounting perspective, there are two classifications for derivative instruments. “Hedging financial instruments” must meet the specific requirements established in IFRS. Other derivative financial instruments that do not meet IFRS requirements for hedge accounting treatment are designated as trading derivatives.

ICA values all derivatives at fair value. Fair value is based on market prices for derivatives traded in recognized markets; if no active market exists, fair value is based on other recognized valuation methodologies in the financial sector, validated by third party experts, and supported by sufficient, reliable, and verifiable information.

Fair value is recognized in the balance sheet as an asset or liability, in accordance with the rights or obligations derived from the contracts executed and in accordance with accounting norms. For hedging derivatives, changes in fair value are recorded temporarily in other comprehensive income within stockholders’ equity, and are subsequently reclassified to results at the same time that they are affected by the item being hedged. For trading derivatives, the fluctuation in fair value is recognized in results of the period as part of Comprehensive Financing Cost.

| Investor Relations | www.ica.com.mx | 21/23 |

In accordance with Article 63 of the Circular for Issuers, ICA entered into one-year forward contracts to acquire 20,889,000 shares of the Company, in a series of nonconsecutive transactions between May 22 and July 6, 2012, at a weighted average strike price of Ps. 24.93 per share, equivalent to Ps. 520.7 million. The forward contracts entered into in 2Q12 were for 17,684,000 shares. The total amount of shares represented 3.45% of shares outstanding.

If market conditions are favorable, the forward contracts will be exercised with a charge to the share repurchase reserve approved by the Shareholders’ Meeting, in accordance with the Policy for the Acquisition and Disposition of Own Shares approved by the Board of Directors. The value of the exercising will be calculated by multiplying at maturity the numbers of shares in each contract and strike price.

In the event of not exercising the instruments, the price for settling the contracts will be the difference between the strike price and the price of ICA’s shares in the market. As of June 30, 2012, the fair value for not exercising the contracts was the equivalent to a loss of Ps. 43 million in financial derivative effects.

Additional information regarding our exposure to financial derivative instruments required to be furnished by Mexican regulations to the National Banking and Securities Commission is attached hereto as Exhibit 99.1, which is incorporated herein by reference.

ADTV: Average Daily Traffic Volume is the number of vehicles that travel the entire length of a highway.

Concessions Revenue is composed of the following:

Operating revenue from concessions: includes tolls and fee payments from the government for the availability of PPP roads and or tariffs based on traffic volume, according to the type of concession.

Operations and maintenance: revenue from the provision of services for operating and maintaining highways for non-consolidated affiliates.

Financial income: the revenue associated with financing.

Construction: the revenue recognized by the concessionaire for costs that are not attributable to the construction company.

SPC: Services Provider Contract. Long-term contract for the provision of services to the Ministry of Public Security, which includes the construction and operation of social infrastructure.

RCO: Red de Carreteras de Occidente, S.A.P.I.B. de C.V. An unconsolidated affiliate of ICA. The company’s principal activity is to operate, maintain, conserve, and exploit the highways that make up the FARAC 1 package of tollroads, as well as to construct, operate, maintain, conserve, and exploit the Expansion Works, in accordance with the Concession Agreement with the federal Government, acting through the Ministry of Communications and Transportation.

| Investor Relations | www.ica.com.mx | 22/23 |

PPP: Public-Private Partnership is a legal mechanism that enables a private sector company to provide services to the federal, state, or municipal government clients through fixed term licenses, generally from 20 to 40 years, to finance ,construct, establish, operate, and maintain a public means of transportation or communication. The client’s payment consists of a fixed payment for the availability of the highway together with a minimum shadow tariff based on traffic volume.

This report may contain projections or other forward-looking statements related to ICA that reflect ICA’s current expectations or beliefs concerning future events. Such forward-looking statements are subject to various risks and uncertainties and may differ materially from actual results or events due to important factors such as changes in general economic, business or political or other conditions in Mexico, Latin America or elsewhere, changes in capital markets in general that may affect policies or attitudes towards lending to Mexico or Mexican companies, changes in tax and other laws affecting ICA’s businesses, increased costs, unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms and other factors set forth in ICA’s most recent filing on Form 20-F and in any filing or submission ICA has made with the SEC subsequent to its most recent filing on Form 20-F. All forward-looking statements are based on information available to ICA on the date hereof, and ICA assumes no obligation to update such statements.

Empresas ICA, S.A.B. de C.V. is Mexico's largest construction and infrastructure operations company. Founded in 1947, ICA’s principal lines of business are civil and industrial construction and engineering; infrastructure operations, including airports, toll roads, and water systems; and homebuilding. For more information visit www.ica.com.mx.

| Investor Relations | www.ica.com.mx | 23/23 |

EXHIBITS

| | |

| | |

| 99.1 | | Qualitative and Quantitative Financial Derivative Instruments Report of the Company to the National Banking and Securities Commission, dated July 27, 2012 (English translation). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 27, 2012

| Empresas ICA, S.A.B. de C.V. | |

| | /s/ ALONSO QUINTANA KAWAGE |

| | Name: Alonso Quintana Kawage |

| | Title: Chief Executive Officer |

| | | |