Exhibit 99.1

| (Translation) | File 151.112.32 |

NATIONAL BANKING AND SECURITIES COMMISSION

LIC. RAFAEL COLADO IBARRECHE

Chief Supervisor of Issuers

LIC. ANDREA FABIOLA TINOCO H.

Chief Supervisor for Compliance with Stock Market Supervision

Mexico City, July 27, 2012

RE: 151-2/76211/2009

RODRIGO A. QUINTANA KAWAGE, acting in my capacity as legal representative of Empresas ICA S.A.B. de C.V. (ICA or “the Issuer”) with an address for notifications located at Blvd. Manuel Ávila Camacho No. 36, 15th floor, Col. Lomas de Chapultepec, 11000, Mexico City, Federal District, and being duly registered before the National Banking and Securities Commission (CNBV) respectfully appear and state the following:

On January 20, 2009 I was notified of Order No. 151-2/76211/2009, File 151.112.32 which requested that ICA disclose qualitative and quantitative information regarding ICA’s exposure to financial derivative instruments, whether to increase profitability or to hedge risks, in order to provide investors information that would allow them to understand ICA’s operations with financial derivative instruments.

Based on the foregoing requirement, we state the following:

I. Qualitative and Quantitative Information

i) ICA only contracts hedging instruments in order to reduce the uncertainty on the return on its projects. It is the policy to contract financial instruments at the level of the project in order to mitigate the risks resulting from interest rates and exchange rate fluctuations. From an accounting perspective, the derivative instruments may be classified as hedging instruments or trading instruments, although in all cases the objective is to mitigate risks to which ICA is exposed in its projects. Interest rate hedges are established based on a notional value with the objective to cap maximum financial costs.

Exchange rate hedges are contracted to ensure that the project will have sufficient resources for labor costs and inputs that are incurred in currencies different from those provided by the financing of the project, which is in the same currency as the source of repayment. ICA contracts all derivatives in the subsidiaries where the projects are located.

The contracting of financial derivatives is linked to the financing of projects, as a result of which it is often the case that the counterparty is the same institution that is providing the financing or one of its affiliates (e.g., Banco Santander, Goldman Sachs, Bank of America Merrill Lynch, Banamex, ING Bank, Morgan Stanley). These derivatives are non exchange traded (OTC) derivatives.

Our internal control policies state that the contracting of credits (tied to the financing of projects) and the risks inherent in the projects require collaborative analysis by representatives from the Finance, Law, Administration, and Operations areas, prior to any approval. This analysis also includes the use of derivatives to hedge the risks of the financing. Once this analysis has been concluded and documented, the responsibility for contracting derivates belongs to the Finance area, in accordance with internal control policy.

The hedging instruments are contracted to fix the variable interest rates of the loans. The changes between the fair value of these instruments and the primary positions are compensated at an inverse correlation within a range between 80% and 125%. These instruments are classified as highly effective.

The decision to contract derivative financial instruments is linked to the amount and level of financing for the project. The levels of authorization do not expressly contemplate requiring the authorization of the Corporate Practices or Audit Committees. With respect to approval authorization levels, ICA has documented policies, of which the most important are the following:

| § | The Chief Executive Officer, the Vice President for Finance and Administration, and/or the responsible Finance officer have limits on their authorities to act, whether in terms of amounts or for unusual or non-recurring operations. |

| § | The Chief Executive Officer has the authority to establish limits on the approval authorities of other Officers in terms of amounts or kind of operation. |

| § | In the event that a higher level of authorization is required, the Board of Directors will make the approval, after considering the opinion of the Chief Executive Officer and/or the applicable Committees. |

The derivatives that are contracted do not have margin calls, in accordance with what is negotiated with each counterparty. For those projects that require collateral, the policy is that any required deposits to be made or standby letters of credit be provided at the time of contracting the derivative. This collateral will only be payable in the event of non-compliance.

In accordance with the standards of the International Swaps and Derivatives Association (ISDA), it is agreed that counterparties may act as valuation or calculation agents, in order to determine fair value and required payments.

While there is no formal risk committee, as previously stated various areas participate in the evaluation, administration, and monitoring of project risks (both financial and operational). As regards risk administration, there are documented processes that require the periodic review of risks.

ii) ICA uses the valuations of counterparties (valuation agents) and a price provider authorized by the CNBV in order to calculate the fair value of derivative positions for accounting purposes. The valuations are made using formal, documented methodologies. The calculated values are based on fair value measurements techniques recognized in the financial sector and supported by sufficient, reliable and verifiable information. The data used for the calculations comes from reliable and verifiable sources that reflect market prices.

Fair value is recognized in the balance sheet as an asset or liability, in accordance with the rights or obligations derived from the contracts executed and in accordance with accounting norms. Changes in fair value are recorded in the balance sheet. In addition to the valuations that are received, the pricing provider carries out tests of effectiveness for the derivatives that qualify as hedging instruments from an accounting perspective.

When the transactions comply with all hedging requirements, the Company designates the derivatives as hedging financial instrument at the beginning of the relationship. For fair value hedges, the fluctuation in the fair value of both the derivatives and the open risk position is recognized in results of the period in which it takes place. For cash flow hedges, the effective portions is temporarily recognized in comprehensive income within stockholder’s equity and is subsequently reclassifies to results at the same time that they are affected by the item being hedge; the ineffective portion is recognized immediately in results of the period.

As previously mentioned, occasionally derivatives contracted as hedges do not qualify for accounting treatment as hedging instruments, and are classified as trading derivatives for accounting purposes. In these cases, the fluctuation in fair value on these derivatives is recognized in the results of the period.

iii) ICA has a policy of contracting derivatives instruments at the project level and not contracting instruments that have margin call or additional credit requirements beyond those authorized by the responsible committees at the time of approval. At July 30, 2012 there has been no default on the contracts.

AUNETI

When financing for the AUNETI project was obtained, the bank charged the Company a one-time commission fee of 1.75% of the total debt amount of Ps.5,510 million. However, instead of discounting the debt by the commission fee, the Ps.96 million (Ps.48 million proportionate amount for ICA) was added to interest rate swap derivatives outstanding with the same bank, the fee will be settled through each exchange made on settlement of the interest rate swaps. Recognition of this transaction resulted in a deferred asset subject to amortization and a derivative financial instrument liability at the beginning of the debt contract.

These swaps are classified as trading instruments. Because the swaps are related to a project that is in the construction stage, the changes in the fair value derivative are capitalized in other assets as part of the cost of the project.

RCO

(Variable rate to fixed rate)

In October 2007, four swaps that change the profile of variable rate financing to a weighted average fixed rate of 8.52% on a notional amount of Ps.15,070 million were entered into. These swaps were classified, as of May 2008, as cash flow hedges. At December 31 2010 and 2009, the fair value, which represents the percentage related to ICA based on its participation in RCO, was recognized in other comprehensive income within stockholders’ equity. In February 2010, there was a reduction in the notional amount of the derivative from Ps.15,500 million to Ps.15,070 million.

RCO

(Variable rate to fixed rate plus UDIS)

Revenues from a highway project are derived from rates charged to users that are indexed to inflation. In October and December 2007, two swaps were entered into to change the profile of variable rate financing to a weighted average rate of 4.33% plus UDIS. The notional amount of both swaps is Ps.11,365 million. These derivatives were classified in 2008 as derivatives for trading purposes and the fluctuations in fair value are recognized within comprehensive financing result in the financial statements of RCO and in the Company, under the heading of equity in the (losses) profits of associated companies. As of December 31, 2010 and 2009, these financial instruments have been designated as hedging instruments and their fair value was recognized, in the percentage of equity which ICA holds of this associated company, within other comprehensive income under stockholders' equity.

On October 2, 2009, RCO’s stockholders placed long-term infrastructure development equity certificates with Mexican institutional investors, particularly Afores. The funds collected were used mainly to pre-pay part of the debt of RCO. As a result of this transaction, the notional amounts of the fixed rate swaps plus UDIs of Ps.12,975 million, were reduced to Ps.11,365 million.

LIPSA

In January 2010, an interest rate swap was contracted to set the project financing rate. With this instrument, a floating interest rate of the 28-day TIIE is received and a fixed interest rate of 8.59% is paid. As of December 31, 2010, it is considered as a hedging derivative and fair value fluctuations are presented under other comprehensive income within equity.

On February 16, 2011, the derivative was restructured to adjust to the project conditions.

On April and August 2011 two interest rate swaps was contracted in order to fulfill the project conditions

ATOTONILCO

In January 2011, an interest rate swaps was contracted to fix the credit rate of the project. The company receives a floating rate and pays a fixed rate of 8.37%. The floating rate received is TIIE 28 days.

DISTRIBUIDOR VIAL SAN JERÓNIMO-MUYUGUARDA

In May 2011, an interest rate swap was contracted to fix the credit rate of the project. The company receives a floating rate and pays a fixed rate of 7.835%. The floating rate received is TIIE 28 days.

AGUA PRIETA

In June 2011, an interest rate swap was contracted to fix the credit rate of the project. The company receives a floating rate and pays a fixed rate of 8.170%. The floating rate received is TIIE 28 days.

EL REALITO

In July 2011, an interest rate swap was contracted to fix the credit rate of the project. The company receives a floating rate and pays a fixed rate of 7.8075%. The floating rate received is TIIE 28 days

MITLA

In May 2012, an interest rate swaps were contracted to fix the credit rate of the project. The company receives a floating rate and pays a fixed rate of 7.24%. The floating rate received is TIIE 28 days

LA YESCA

(CAP and FLOOR)

To protect the project from fluctuations in the London Interbank Offered rate (“LIBOR”) (because it is a financed project), two options were entered into in October 2007 establishing a CAP on that rate of 5.5% for a notional amount of up to U.S.$852 million, paying a premium of U.S.$7.33 million. On January 10, 2008, the Company agreed with the financial agent to substitute this CAP with the combination of the purchase of a CAP option and the sale of a FLOOR option, beginning February 1, 2008. The CAP establishes a ceiling of 4.5% on the LIBOR rate and the FLOOR establishes a floor of 2.95%. In order to guarantee its potential obligations under the FLOOR option, the Company was required to establish collateral through a letter of credit of U.S. $6 million. A commission of U.S. $1 million was paid as a result of this restructuring.

In October 2008, the CAP and FLOOR were designated as cash flow hedging instruments. As of September 30 2011, the fluctuation in fair value of the FLOOR was recognized in other comprehensive income within stockholders’ equity for the amount of its intrinsic value. The intrinsic value in the case of options is determined by the difference between the exercise price and market price of the underlying security, provided that this difference is not negative.

| c) | Exchange rate instruments, FX swaps and options |

LA YESCA

(Foreign exchange FX FWD)

The La Yesca project’s financing and contract revenue are in U.S. dollars. However, most project costs are incurred in Mexican pesos. Therefore, the project must exchange the U.S. dollars received from the financing to Mexican pesos to cover its obligations in that currency; therefore, four foreign currency exchange options were entered into from May to August 2008.

The option schemes established an exchange rate of Ps.11.33 per U.S. dollar for the period from July 2008 to July 2010 for the first three options and to April 2011 for the last option. The notional amount for the foreign currency exchange option fluctuates between US194.5 and US$499.5 million dolars.

Due to changes in the La Yesca construction schedule the Company restructured the options in 2009. This coverage scheme sets an exchange rate of Ps.11.35. The renegotiation cost of the financial derivative was U.S. $33 million, which will be paid once the La Yesca project is terminated, and will accrue interest at the LIBOR rate plus 450 basis points, and is recorded within other long-term liabilities.

In July 2010, the derivative was further restructured to adjust to the project conditions. This coverage scheme maintains an exchange rate of Ps.11.35 per US dollar during the term of the instrument, with a maximum exchange rate of Ps.17.00. As part of this restructuring, U.S.$16 million was prepaid, with a remnant as of December 31, 2010 of U.S.$17 million, which is included under other long-term liabilities.

In August 2011, was restructured to fit the derivative project conditions. The new scheme provides a level of exchange rate of $ 12.00 pesos per dollar; the maximum rate was reduced to $ 16.00. The cost of this restructuring was U.S. $ 2.9 million.

Even though such options represent economic hedges, they are classified as trading. However, because the La Yesca project is in the construction stage, the fair value of the option is capitalized within other assets as part of the project cost.

ALTOS HORNOS DE MEXICO (“AHMSA”) (ICAFD PROJECT)

U.S. dollar forwards with various maturities were entered into to eliminate the exchange rate risk associated with this project.

The fair value of these hedging derivatives is recorded in stockholders’ equity under other comprehensive income.

TUNEL EMISOR ORIENTE

In 2010, exchange and interest rate swaps were entered into to mitigate the respective risks. The primary position relates to loans for the acquisition of machinery related to the project. The fair value of these hedging derivatives is recorded in stockholders’ equity under other comprehensive income. The foreign exchange rate level is $16.9 pesos per dollar.

MAYAB

In December 2011 we entered into two fx forwards to mitigate the foreign exchange risk.(USDMXN). The primary position relates to a loan related to this project. The fair value of these hedging derivatives is recorded in stockholder’s equity under other comprehensive income. The foreign exchange rate level is $16.9 pesos per dollar

AEROINVEST

In January 2012 we entered into a Cross Currency Swap transaction with limited losses to mitigate the foreign exchange risk and the interest risk. The primary position relates to a loan related to this project. The fair value of these hedging derivatives is recorded in stockholder’s equity under other comprehensive income. The agreed exchange rate is $13.66 pesos per dollar with an interest rate between 9.40% and 10.40%.

CICASA

In January 2012 we entered into a Cross Currency Swap transaction with limited losses to mitigate the foreign exchange risk and the interest risk. The primary position relates to a loan related to this project. The fair value of these hedging derivatives is recorded in stockholder’s equity under other comprehensive income. The agreed exchange rate is $13.66 pesos per dollar with an interest rate is 9.05%.

EMICA

In June 2012 we entered into a Currency Option transaction to mitigate the foreign exchange risk. The primary position relates to a contract obligation in Nuevos Soles Peruanos.

In accordance with Article 63 of the Circular for Issuers, ICA announces that it has entered into one-year forward contracts to acquire 20,889,000 shares of the Company, in a series of non consecutive transactions between May 22 and July 6, 2012, at a weighted average strike price of Ps. 24.93 per share, equivalent to Ps. 520.7 million. The forward contracts entered into in 2Q12 were for 17,684,000 shares, which represented 3.45% of shares outstanding. In accordance with the Policy for the Acquisition and Disposition of Own Shares approved by the Board of Directors, if market conditions are favorable, the forward contracts will be exercised with a charge to the share repurchase reserve approved by the Shareholders’ Meeting.

In the event of not exercising the instruments, the price for settling the contracts will be the difference between the strike price and the then price of ICA’s shares in the market. As of June 30, 2012, the fair value for not exercising the contracts was the equivalent to a loss of Ps. 43 million.

iv) Based on the interest rate and exchange rate projections recently issued by Banco de México, and assuming these rates are maintained, the Issuer does not expect to suffer any material adverse impact from its derivative positions on its results of operations for the third quarter of 2012 as a result of additional changes in the peso or changes in interest rates since June 30, 2012.

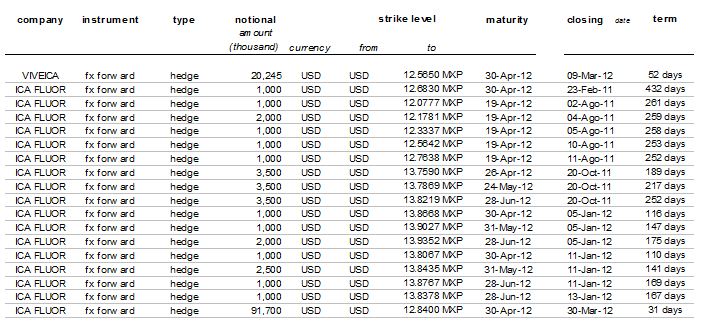

In accordance with your request for this section, we set forth below the derivatives that matured during the quarter.

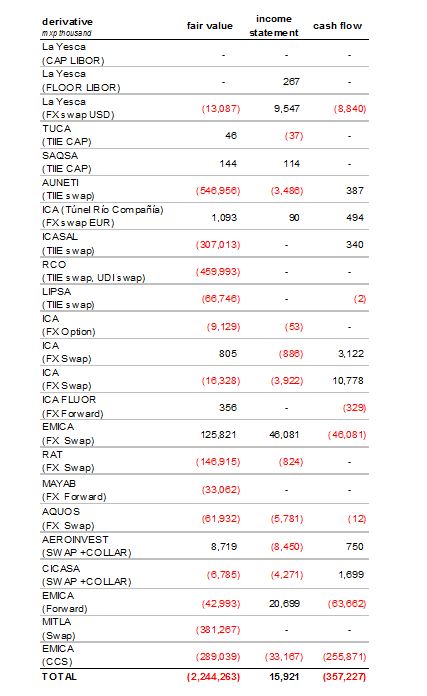

The following were the effects of derivative transactions as of June 30, 2012:

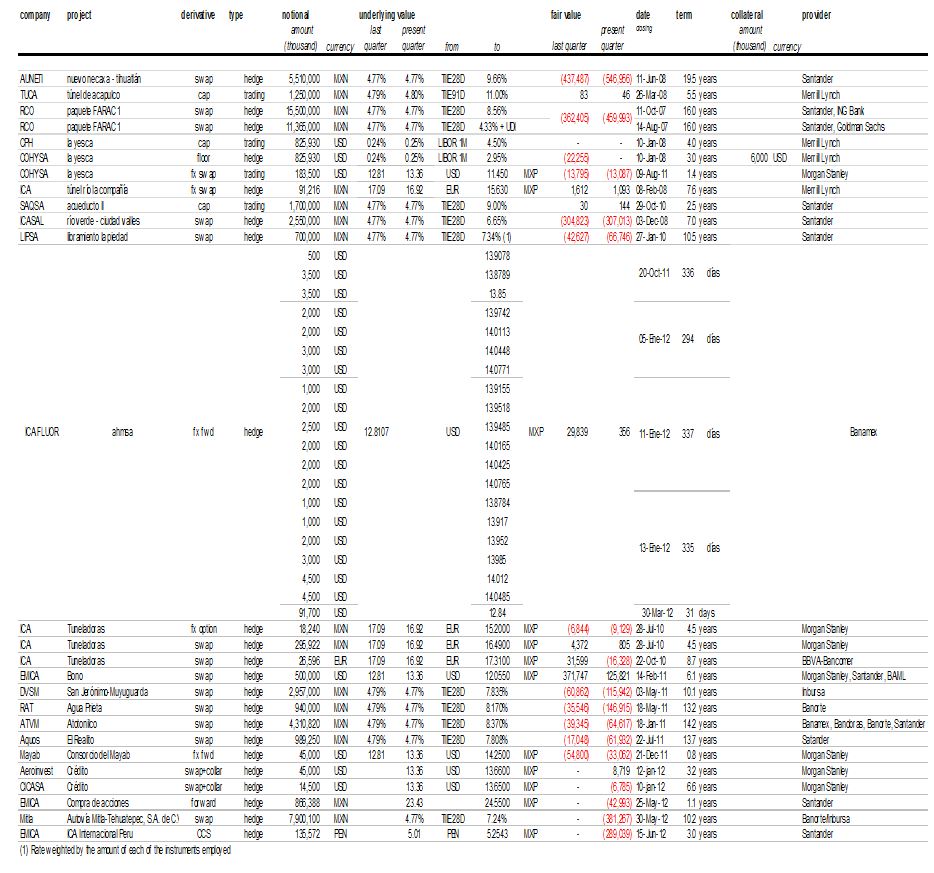

v) Table 1 presents the information requested regarding all material instruments that the Issuer currently has outstanding through project companies, including subsidiaries and affiliates.

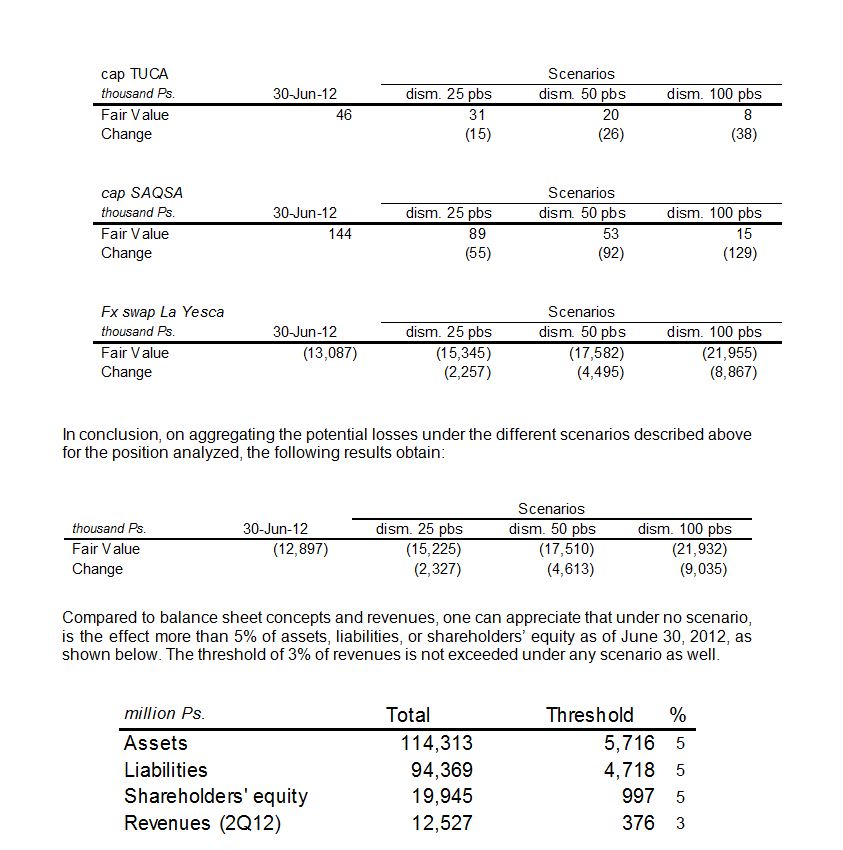

II. SENSITIVITY ANALYSIS

The derivatives instruments identified in the table above as hedging derivatives were excluded from the sensitivity analysis because they do not show any ineffectiveness.

Sensitivity analysis was developed considering three scenarios: a) 25 bp reduction in interest rates; b) 50 bp reduction in interest rates; and c) 100 bp reduction in interest rates

In virtue of the foregoing, the undersigned respectfully submits to the National Banking and Securities Commission:

FIRST. I have responded on time and in the appropriate manner, and with the authorities granted to me.

SECOND. I have delivered the information required in your Order No. 151-2/76211/2009.

Mexico City, July 27, 2012

________________________________________

Empresas ICA, S.A.B. de C.V.

By: Rodrigo A. Quintana Kawage

Position: Legal Representative