UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

KOHL’S CORPORATION |

(Name of Registrant as Specified in Its Charter) |

| |

MACELLUM BADGER FUND, LP MACELLUM BADGER FUND II, LP MACELLUM ADVISORS, LP MACELLUM ADVISORS GP, LLC JONATHAN DUSKIN LEGION PARTNERS HOLDINGS, LLC LEGION PARTNERS, L.P. I LEGION PARTNERS, L.P. II LEGION PARTNERS SPECIAL OPPORTUNITIES, L.P. XV LEGION PARTNERS, LLC LEGION PARTNERS ASSET MANAGEMENT, LLC CHRISTOPHER S. KIPER RAYMOND T. WHITE ANCORA CATALYST INSTITUTIONAL, LP ANCORA CATALYST, LP ANCORA MERLIN, LP ANCORA MERLIN INSTITUTIONAL, LP ANCORA CATALYST SPV I LP SERIES M ANCORA CATALYST SPV I LP SERIES N ANCORA CATALYST SPV I LP SERIES O ANCORA CATALYST SPV I LP SERIES P ANCORA CATALYST SPV I SPC LTD SEGREGATED PORTFOLIO G ANCORA ADVISORS, LLC ANCORA HOLDINGS, INC. ANCORA FAMILY WEALTH ADVISORS, LLC THE ANCORA GROUP INC. INVERNESS HOLDINGS, LLC ANCORA ALTERNATIVES, LLC FREDERICK DISANTO 4010 PARTNERS, LP 4010 CAPITAL, LLC 4010 GENERAL PARTNER, LLC STEVEN E. LITT MARGARET L. JENKINS JEFFREY A. KANTOR THOMAS A. KINGSBURY CYNTHIA S. MURRAY |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Macellum Badger Fund, LLC , a Delaware limited partnership, Legion Partners Holdings, LLC (“Legion Partners Holdings”), a Delaware limited liability company, Ancora Holdings, Inc., an Ohio corporation and 4010 Capital, LLC, a Delaware limited liability company, together with the other participants named herein (collectively, the “Investor Group”), have filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2021 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

Item 1: On March 26, 2021, Christopher Kiper, Managing Member of Legion Partners Holdings, gave a presentation at the University of Alabama, the slides and quotes concerning the Company from the presentation are pasted below:

“The next thing I'm going to talk about this is something that we are in a proxy fight over right now.”

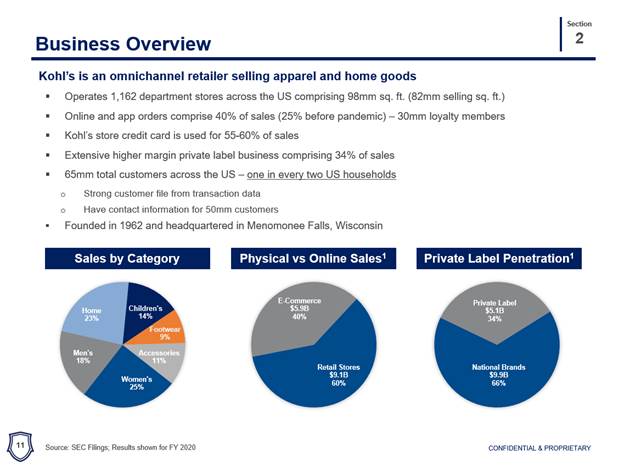

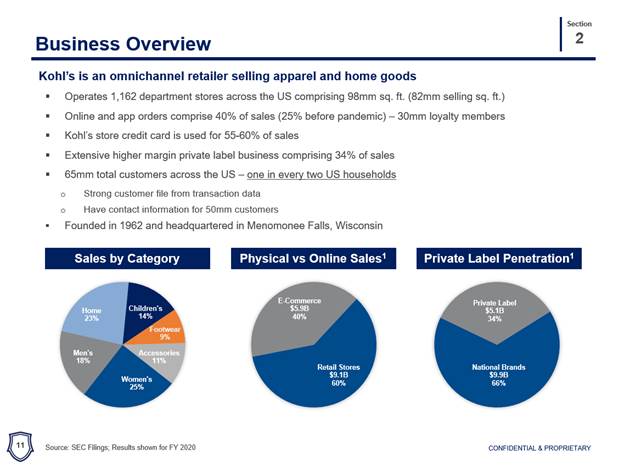

“And so, I'll just give you a little bit of background about Kohl's everyone's probably heard of it. They operate 1,100 department stores across the US, the average department store that they have runs about 80,000 square feet. Unlike Macy's, unlike JC Penney, this is a chain of stores that is in the 95% off-mall. So they have great locations, and if you went out and looked at stood in the parking lot of a Kohl's and looked around, what you'd likely see is a TJ Maxx, a Burlington, or Ross, may be Target, but really thriving, healthy competitive retailers. This is not something that is super highly attached to enclosed shopping malls. In fact, malls make up only about 5% of their store base. The next thing you'd notice about this company is that 55 to 60% of the purchases happen on their own credit card so they have an extremely loyal customer base.”

“One out of every two US households is a Kohl’s shopper. And if you look down below the categories of spending women's is the biggest category at Kohl's, it's been shrinking a little bit because they've had a really tough time managing their women's apparel category they've lost about a half a billion dollars of sales there, but there are some opportunities to fix that and it's part of what our campaign is focused on in terms of Kohl’s performance.“

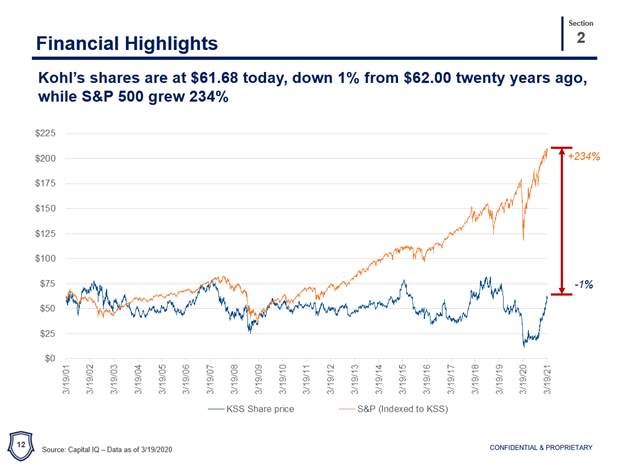

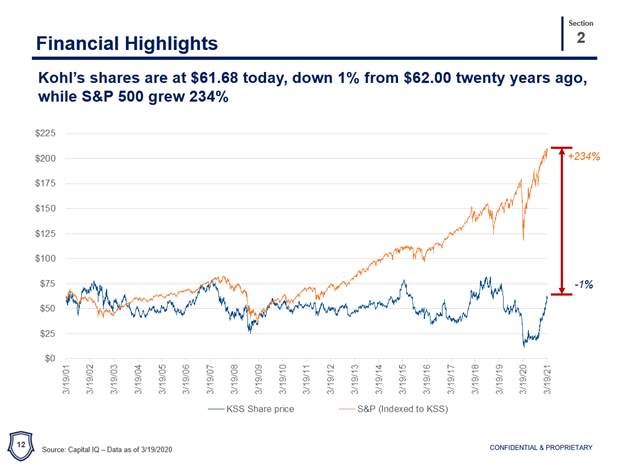

“The next chart is rather interesting. If we went back and looked at Kohl’s stock 20 years ago, and Kohl’s stock now. It hasn't gone anywhere, that the stock was actually down 1% over a 20-year time horizon, which is not very exciting for investors, especially when you look at the orange line on that chart which is the S&P 500 index so you can get a sense for how you would have done, owning the S&P versus Kohl’s, the company hasn't done well.“

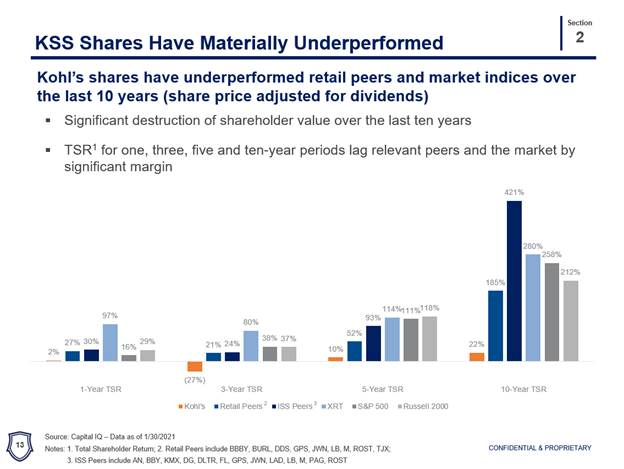

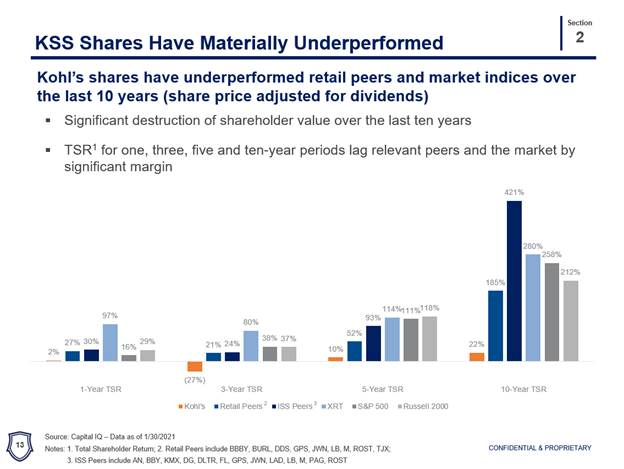

“If we look at shorter periods of returns though on this chart you can see on a one-year basis, a three-year basis a five-year basis a ten-year basis Kohl’s underperforms. Every one of its peer groups and so the way to read this chart the orange bars are Kohl’s on the first grouping the one-year TSR you can't even see their bar because it's so small. The bar that is next to theirs is the retail peers so that's how the peers did if you were to have invested in the peers. The next group is a group called ISS peers, and then the lighter blue is the XRT, that's a retail ETF. The next group is the S&P 500, and then finally the Russell 2000 so no matter what index or peer group you want to compare them to. This is a company and a board that massively underperforms – that is the one thing that they do very consistently.”

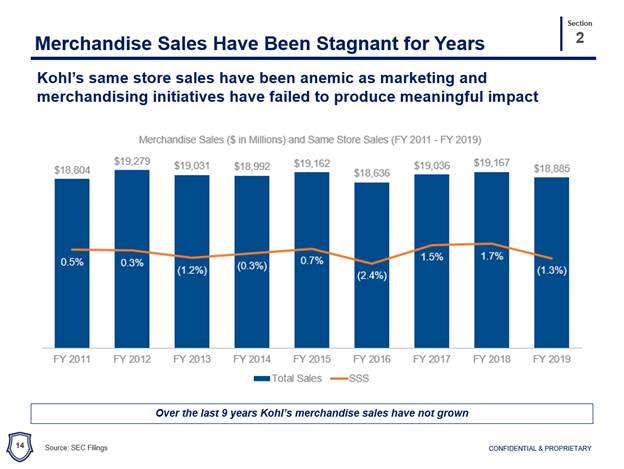

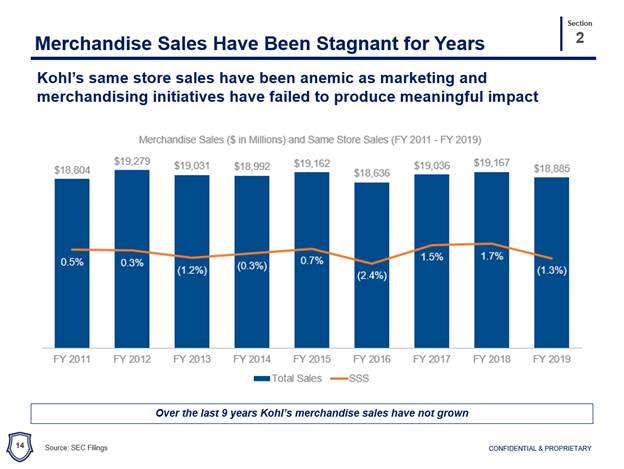

“If we look at why this is happening it is because the merchandise sales don't grow. Over the last 11 years, this is their merchandise sales went from $18.8 billion to $18.9 billion. Back in 2014, they rolled out something called the Greatness Agenda, and they said that they were going to grow the top line to $21 billion in sales where you can see the greatness agenda failed - it didn't come true. And same store sales just don't go anywhere. And the other thing I would note, a lot of retailers when you look at them over a timeframe like this, you'd see that their store base change. The Kohl’s store base is basically unchanged. So there's no growth or shrink really of stores over this period it's pretty much the same number of stores in across the entire time sequence.”

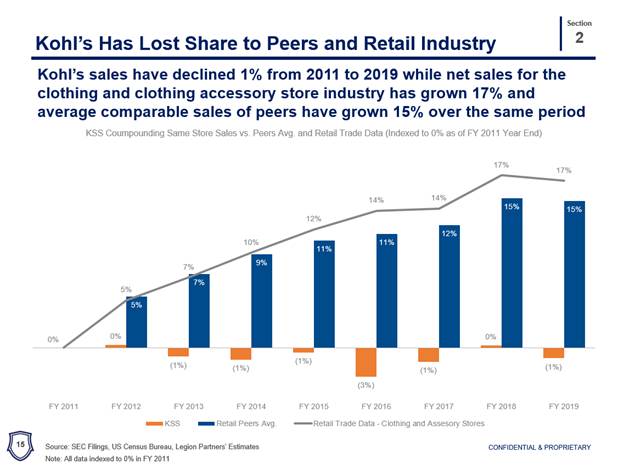

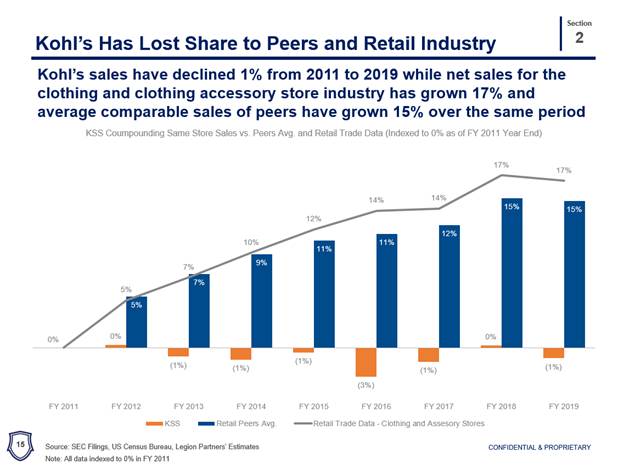

“Alright, so they don't grow, but how did the, how did the peers do and how does the industry do the blue bar, are the peers since 2011 the peers have grown 15% and Kohl's has declined 1%. And then the other thing we were able to do was to go in and pull census data on the apparel category generally and if you do that what you find the apparel category has grown at about 17%. So, they are losing share both to their peers and broadly to the apparel index as you sort of think about how those sales are going.”

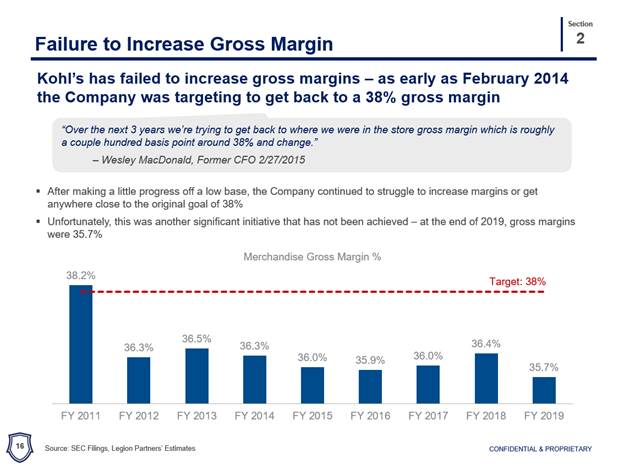

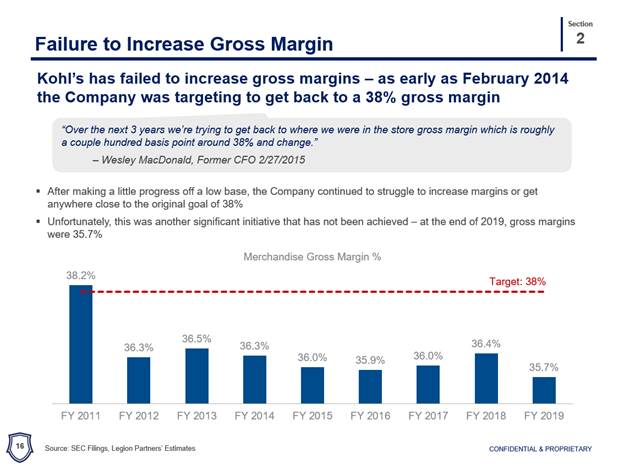

“One of the aspects of their income statement that we spent a lot of time studying is the margin structure and looking at gross margins. They promised to investors back in 2015 that they were going to fix their gross margin structure to get back to 38%. What you can see in 2011 their margins on a gross margin basis for merchandise were over 38%. They've never gotten back anywhere near that. Meanwhile, have suggested several times that they had a plan to do it but so far they haven't been able to move the needle.”

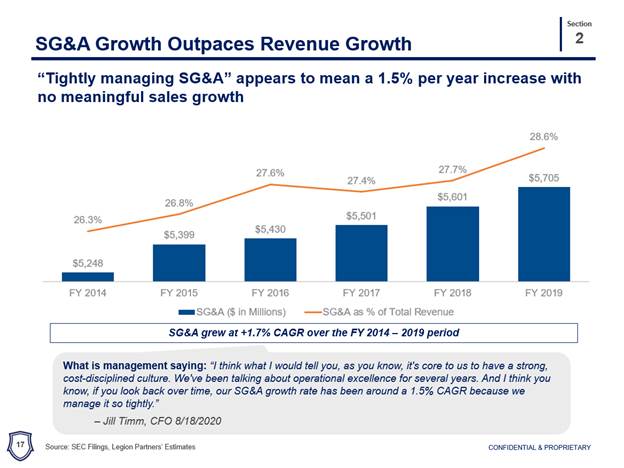

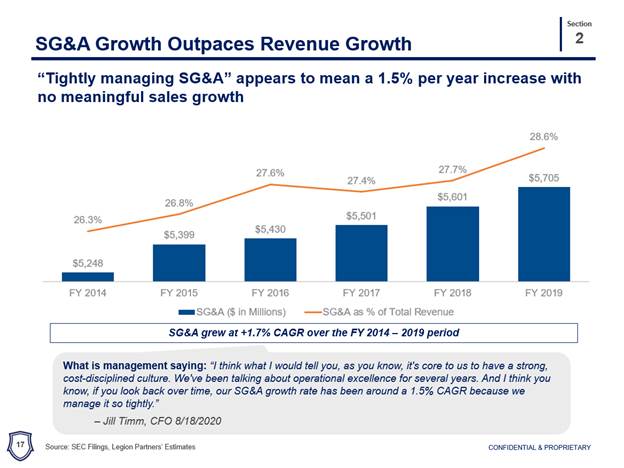

“The one thing that they have been able to do quite well is spend more on SGA. And if we look from 2014 through 2019 we can't actually do this analysis going back further because there was a change in how you do the accounting of their credit card revenue. But looking at it for the period where the numbers are all comparable. You can see that SG&A grew by about a half a billion dollars. One of the things you'll notice if you study Kohl's they talk a lot about operational excellence and tightly managing SG&A, but what that really means is SGA goes up every year, and we've already seen that the top line, unfortunately doesn't.“

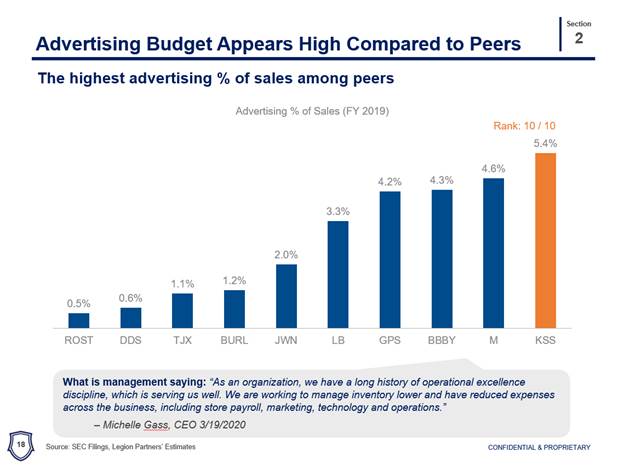

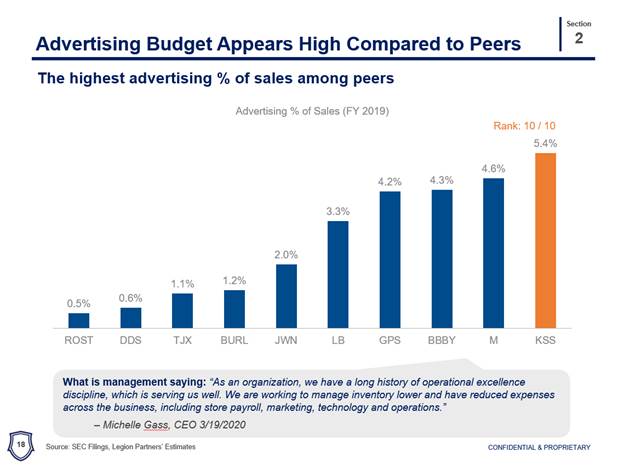

“One of the big reasons why S&GA goes up every year is because these folks have been historically addicted to print advertising and do a lot of it. And so if we look at the amount that they're spending on advertising as a percent of top line sales as compared to their peers, you'll see that the percentage is in excess of Macy's Bed Bath & Beyond, The Gap, L Brands. It's higher than everybody. Interestingly, once we started knocking on their door, they mentioned that they could reduce this expense by $200 million dollars a year to put the dollars in perspective they're spending about a billion dollars a year on advertising.”

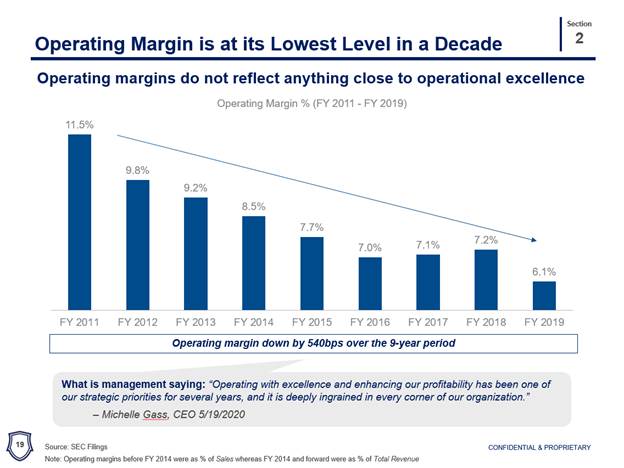

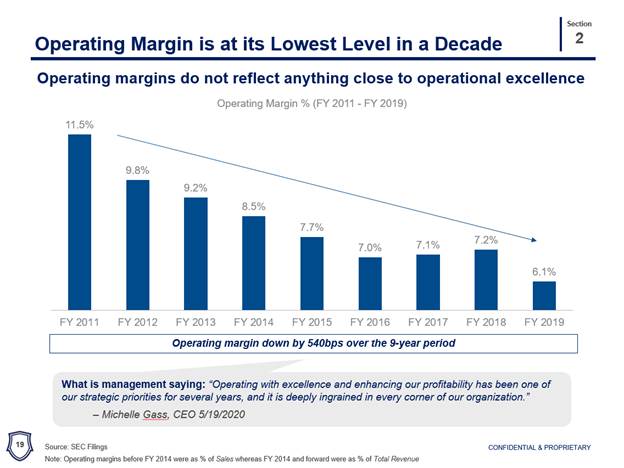

“And so what this all leads to when the top line doesn't grow the gross margins don't go up, and the SGA goes up, margins come down over time, and so margins have gone from 11.5% down to 6%. And, unfortunately, for shareholders, there's nothing changing about this trend. Management's been talking about the fact that they have a plan to fix this, but they haven't shown any evidence of it. And the last time that management had a plan, it was the Greatness Agenda, which didn't produce, what it was supposed to in terms of desired results.”

“The other thing that's really interesting back to what management's talking about now after we started knocking on their door, is that they've said, with the amount of sales that they had back in 2019 that they could have, based on what they know now, generated a 7% to 8% operating margin. Well, I think shareholders should be asking a lot of questions about why they only achieved a 6% operating margin if that was true in 2019. So they really left hundreds of millions of dollars on the table, because they're not very, very much tightly managing this business as they would suggest.”

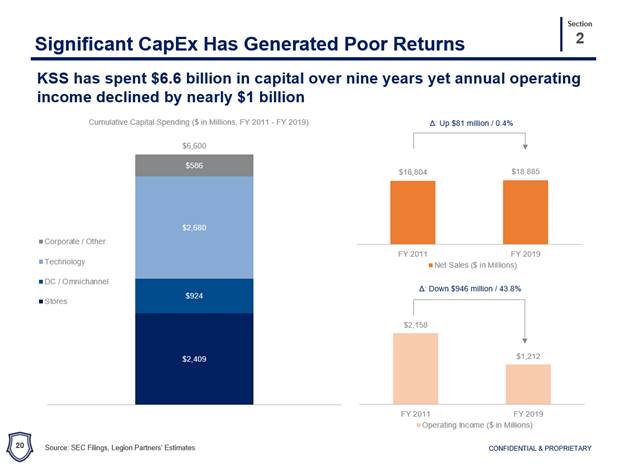

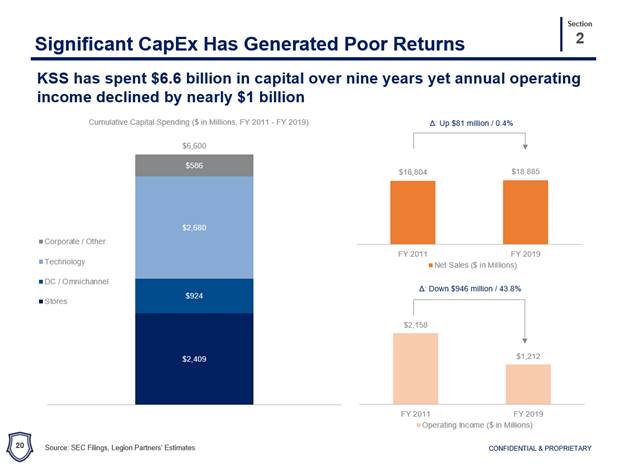

“In terms of capital spending, it's not a capital spending problem they spent over $6.6 billion in capital that's generated, less than a 1% growth in sales, and an operating income that's gone down by a billion dollars in total so annually they're earning a billion less than they were in 2011.”

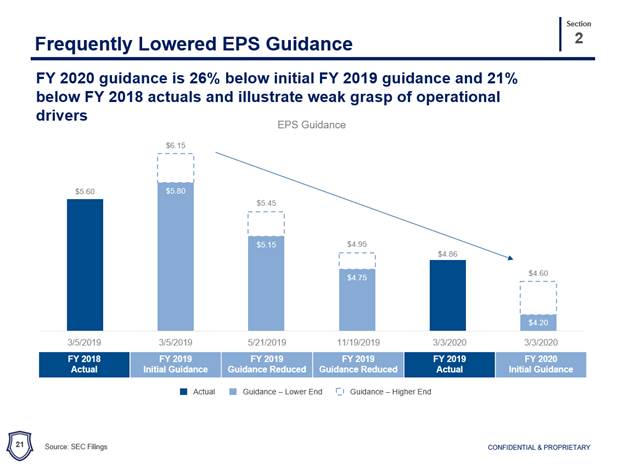

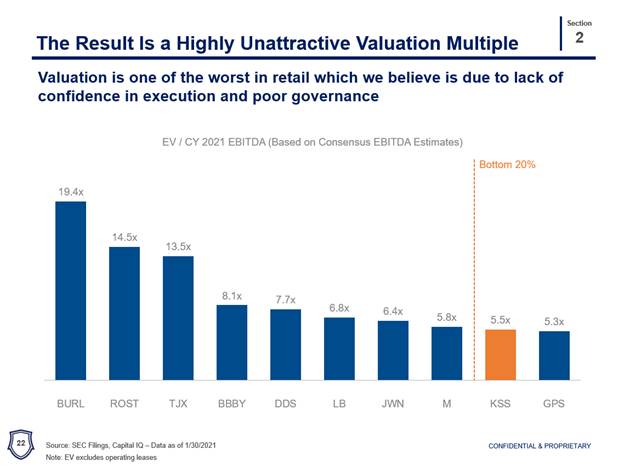

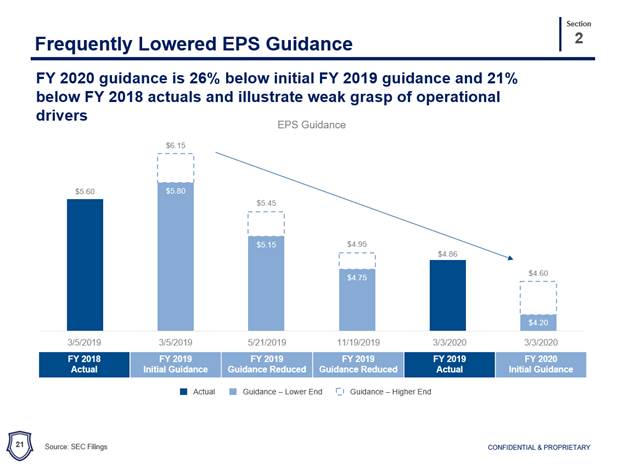

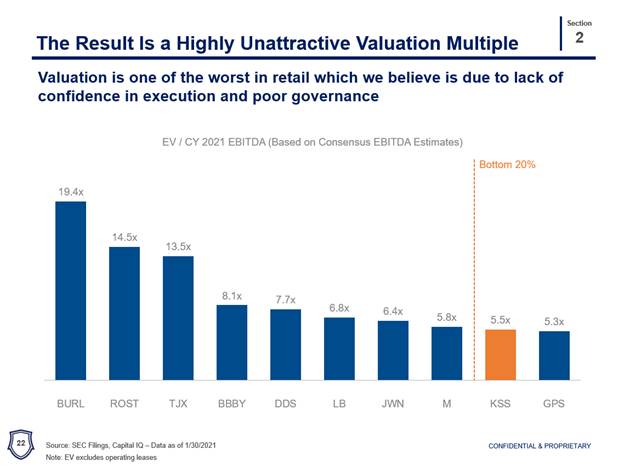

“They frequently miss guidance, this is their EPS guidance they not only set guidance guidance low, but then they reduce it. Their initial 2020 guidance, It was a stair step down and that that's a number that was pre-COVID. So they are really sort of stair stepping down their guidance and what does this all translate to its worst in class EBITDA multiple for Kohl’s, and something that we'd like to see traded a lot better multiple once we get a better board focused on really doing the things that can improve value here.”

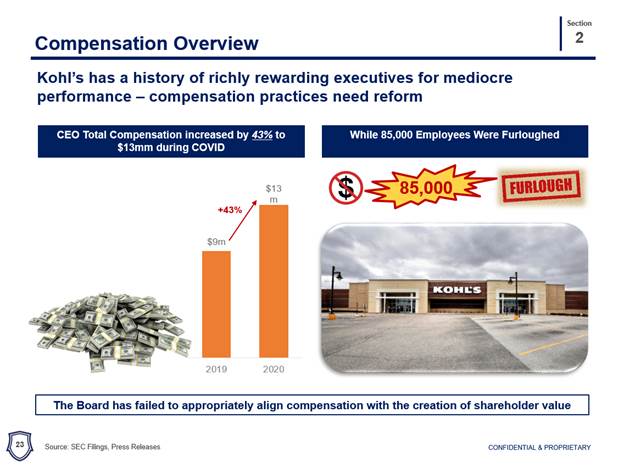

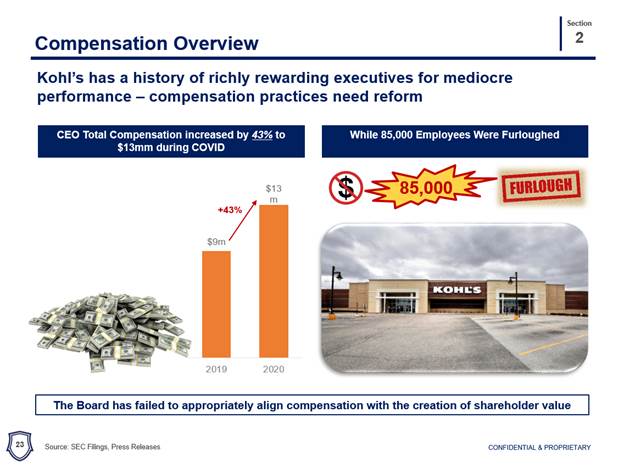

“From a compensation overview, this is what they paid the CEO in 2020 which was rather shocking. So from 2019 to 2020, there was a 43% increase in the CEOs compensation. Meanwhile they furloughed 85,000 employees, the amount that they paid the CEO in 2020 was the highest amount any executive has ever earned which was rather shocking, given the fact that COVID had gone on, and some of their employees were out of work for months.”

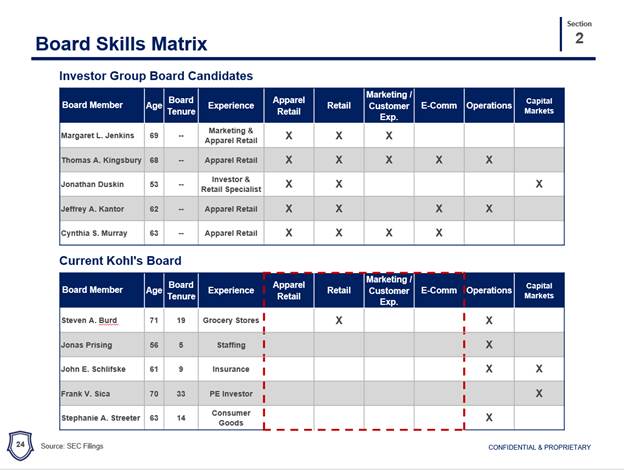

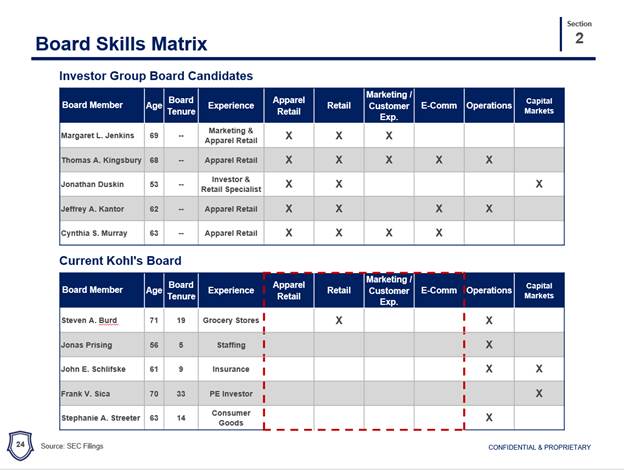

“In terms of the candidates that we've put forward for the board, all of our candidates have retail apparel expertise, none of the candidates that we're trying to knock off the board that's the bottom group on this slide, those are the current Kohl's board members that we would like to see removed. They don't really have any retail apparel expertise. The group at the top all those Tom Kingsbury, Margaret Jenkins John Duskin, Jeff Cantor, Cinny Murray, all of them with strong apparel retail expertise, and the group at the bottom you can see experience in grocery stores, staffing businesses, CEO of an insurance company, PE investor, but really no one with any apparel retail expertise which is what's needed at Kohl's.”

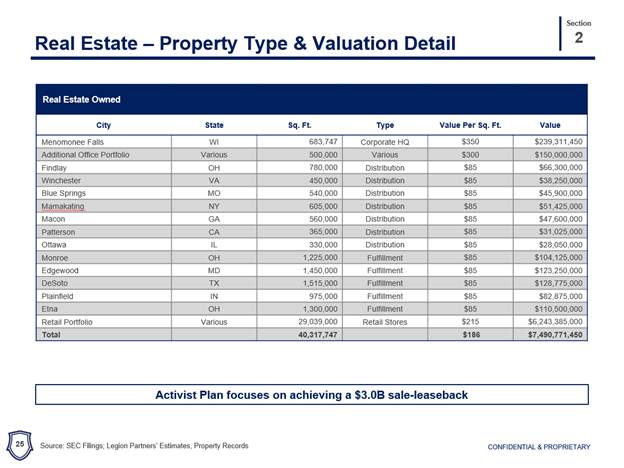

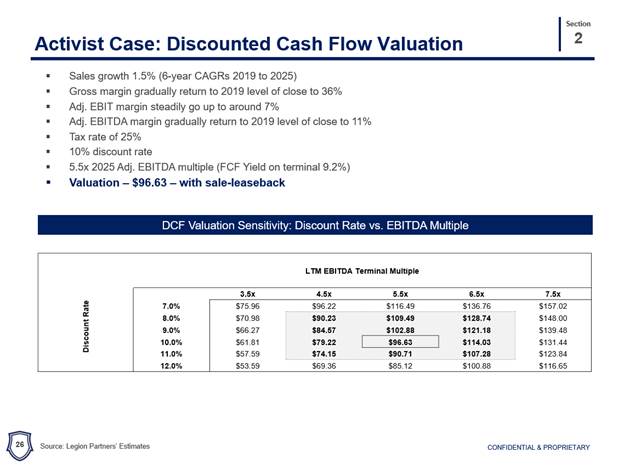

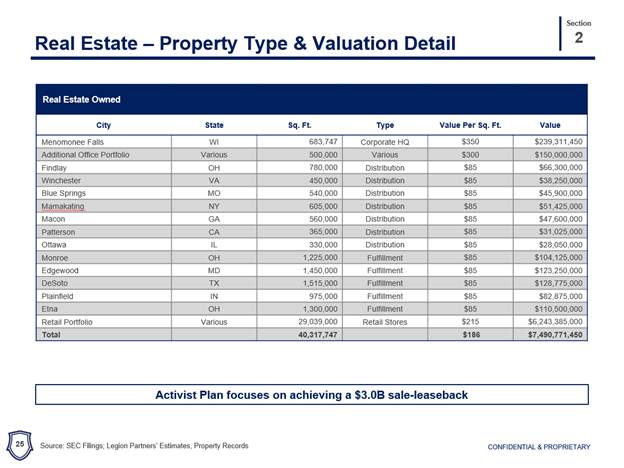

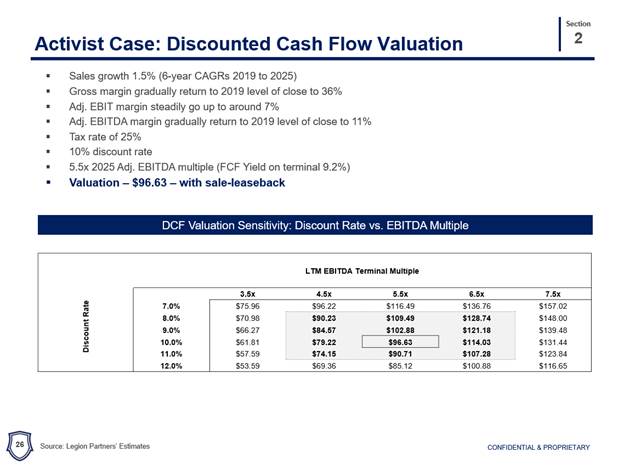

“And then, one idea that we've been talking about is a sale leaseback of real estate. They own about $7.5 billion of real estate, and we did a deep dive on this with a real estate private equity firm, and this is an area that is really a big opportunity for you when you're studying businesses to go try and find those, those underlying assets that aren't being properly valued and here they had $7.5 billion of real estate that they own. We think you can do a $3 billion sale leaseback and use a large amount of those proceeds to do a stock buyback. And if you do that, we get to $100 stock price the stock today is right around $60, so an awful lot of upside, we bought into the stock at around $20 so we're already up quite a bit, but we see a lot more upside from here.”

“For us, the most important part is to find a good retailer, where we really liked the underlying retail operation, and I think Kohl's has a really strong proposition being 95% off mall, and then in those scenarios, it's really looking at why do you own, you know the real estate at all. I think in most companies that we invest in, when we think about the ownership of real estate, we would sort of ask why, why, why would you want to own a bunch of real estate, especially when you think about it in terms of, think about the real estate almost as though it's a separate business, and in the in the case of, in the case of a Kohl's as an example, you can do, sale, lease backs at a, you know, basically, a seven cap rate which implies if you run through the math that you can do that for about 14 to 15 times EBITDA. Meanwhile, the stocks trading at 5 times EBITDA. So there's a gigantic arbitrage to be had by monetizing the real estate, and then using the proceeds to retire shares, and the same thing was true of Bed Bath & Beyond. The same thing is true at another retailer we're looking at right now. It's just uncommon to see sort of size where the real estate is, you know, $7.5 billion of value and the market cap is a little over $9 billion it's rather remarkable that there's that much value that's tied up on the balance sheet.”

“So what I would tell you is, they have the right locations which is the most important aspect of this so they're off-mall. They're very easy to transact with 95% of these are not attached to enclosed shopping malls. So that's point number one, really important. And when you go it's back to you go to the parking lot, you look around and who the folks are it is TJ Maxx, Ross, Burlington all firms that are, you know, killing it from a same store sales growth perspective. So folks that are attracting new customers.”

“The other thing I would say is if we think about it. On the flip side, the department stores are losing, you know, shoppers every day as they close stores that are going somewhere back out there into the world to find the things that they were looking for. And if we look back over the last few years there's billions of dollars of department store, shoppers, whether it's Sears closing stores or JC Penney's closing stores or Macy's now closing stores. And the same thing is true if we sort of forecast forward. There's billions more to come out of folks that are you know going out of business or shrinking the size of their businesses. And so to the extent that those people enjoyed that department store shopping experience and actually walking into a brick and mortar store calls represents a great place for them to go and so the first question is, how can we more effectively market to pick it up, that market share to get those people into the Kohl's box.”

“And so there's a number of things that Kohl's has tried to do that that so far haven't really moved the needle Amazon returns was one of the things they tried. So they brought in Amazon where you could return your package to Kohl's, and then they give you a coupon to buy something at a discount. While you're there, hoping to get more customers to come in, and then they recently because beauty was something that they were not able to execute on their own beauty is only about 2% of their total sales, they just cut a deal with Sephora where they're going to build out 850 Sephora stores, inside of Kohl's.”

“They still though haven't really answered their women's apparel problem, women's apparel, if you look at Kohl's over indexes to private label, and there's a big opportunity to do better. One of the things that they've done historically is they have three or four different private label brands that are pretty big within the women's category, and when they get a winning, you know, for example top and one of the in one of those lines. They'll then mass produce that top the same top across all the other lines in slightly potentially different colors but when you walk into the store that and you look at this, everything looks very much the same because you know they figured out that they had one winning top and then they mass produced it. So there's an opportunity to do more on the merchandising front.”

“As you see, department stores closing there's an opportunity to pick up more national brands to bring in more national brands versus private label which may have a higher appeal to customers, but really executing private label better as well. So, we think it is you think about this this long term, you want to be an omnichannel retailer that's easy to transact with people like strip centers if you drive around the strip centers, you'll still see that they're filled with cars people wanting to go there and transact. And then when you add on top of it the fact that you can drive up right in front curbside pickup, whatever you need. It's easy to do BOPUS if you'd like to do that when you go online, you see that they've got it in then pick it up out front of the store without ever going into the store, they can, they can do that they rolled that out within weeks of the pandemic starting. So I think the answer is to really be easy to transact with.”

“And then part of that gets back into fixing the mobile experience fixing both the app and the website and making it as seamless and as easy as possible. One of the things that we've noticed about Kohl's is there seems to be something that's horribly wrong within their algorithm. So if you if you go and look at Kohl's transcripts and study what they've been talking about, they would say that they have a problem that has impacted their margins, from split shipments. When I first heard split shipments, I thought, oh wow, that must mean sometimes they send somebody two packages when they ordered something. When we went in and actually did our work what we found was, what it often meant was, customers got four and five packages. And so we have an example of something that we got where we ordered three different SKUs of the exact same pair of socks. They sent one from Connecticut, they sent one from the middle of the country and they sent one from California and we're just getting like packages everyday coming with you know, random pairs of socks in it. The inefficiencies from operating your business like this are large.”

Item 2: On March 29, 2021, the Investor Group issued the following press release and letter to shareholders:

INVESTOR GROUP HIGHLIGHTS EGREGIOUS EXECUTIVE COMPENSATION AT KOHL’S

Sends Letter to Shareholders Detailing Board’s Persistent Actions to Lower the Bar and Reward Executives Despite Deteriorating Results and Stock Price Underperformance

Kohl’s CEO Total Compensation Increased by 43% in 2020 – While 85,000 Employees Were Furloughed for Several Months and Were Paid in Aggregate an Estimated 10% Less Compared to 2019

Three of the Five Directors Group Seeks to Replace Are Members of the Compensation Committee and Have Been Involved in Designing Deeply Flawed Compensation Program

Group Believes Its Highly-Qualified Nominees – Who Possess Strong Retail Industry Experience – Would Help Reverse Culture of Pay for Underperformance and Oversee Successful Turnaround of Company

Encourages All Shareholders to Vote on the White Proxy Card Today to Support Group’s Nominees and Help Kohl’s Reach Its Full Potential

NEW YORK – March 29, 2021 – Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group”) today issued a letter to shareholders in connection with its nominations of five candidates for election to the Board of Directors (the “Board”) of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”). The Investor Group is deemed to beneficially own, in the aggregate, 14,696,905 shares of the Company’s common stock, including 2,447,000 shares underlying call options currently exercisable, constituting approximately 9.3% of the Company’s outstanding common stock.

The full text of the letter is below. The letter and additional materials are also available at: https://createvalueatkohls.com/.

March 29, 2021

Dear Fellow Kohl’s Shareholder:

Macellum Advisors GP, LLC, Ancora Holdings, Inc., Legion Partners Asset Management, LLC, and 4010 Capital, LLC (collectively, the “Investor Group” or “we”) beneficially own a total 14,696,905 shares of Kohl’s Corporation, a Wisconsin corporation, (“Kohl’s” or the “Company”), including 2,447,000 shares underlying call options currently exercisable, constituting approximately 9.3% of the Company’s outstanding common stock, par value $0.01 per share (the “Common Stock”), and making us one of the Company’s largest shareholders. We are seeking your support on the WHITE proxy card to vote FOR our five highly qualified director nominees – Jonathan Duskin, Margaret L. Jenkins, Jeffrey A. Kantor, Thomas A. Kingsbury and Cynthia S. Murray – at the Company’s upcoming annual meeting of shareholders scheduled for May 12, 2021.

Kohl’s Executive Compensation Appears to Serve Executives Not Shareholders or Employees

As stewards of shareholder capital, one of a board’s most important responsibilities is to have a compensation program that sets fair and thoughtful targets to properly align pay with performance. We believe the Kohl’s Board has failed in this regard. In our view, the Board has created a compensation plan that rewards executives despite years of underperformance, by consistently setting short and long-term targets for bonuses below prior years’ results. We contend that this “heads we win, tails shareholders lose” structure is diametrically opposed to shareholder alignment and value creation.

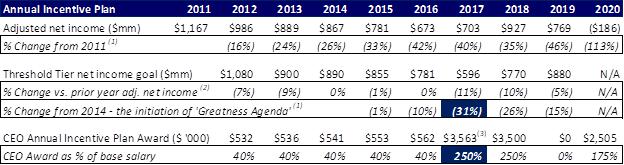

As shown below, the Board’s recently disclosed compensation decisions for 2020 – a year in which net sales declined 20% and adjusted net income was a loss of $186 million – highlight the Board’s failure to appropriately align compensation with performance:

| Ø | Total compensation for Kohl's CEO increased by 43% in 2020, resulting in $12.9 million in aggregate compensation. |

| Ø | 2020 compensation for Kohl's CEO was the highest earned by a Kohl's executive in 15 years, despite the fact that 2020 financial performance was the worst by far over that time period. |

| Ø | The CEO pay ratio was 1,098:1 in 2020 between Kohl's CEO and the median employee, increasing from 923:1 in 2019. |

This exorbitant CEO compensation stands in stark contrast to the fate of Kohl's employees, 85,000 of which were furloughed for several months and who we estimate were paid nearly 10% less in the aggregate in 2020 compared to 2019.

2020 Is Not an Outlier – Kohl’s Management Has Been Richly Rewarded For Years Despite Declining Operating Results

From 2011 to 2019, Kohl’s paid its top five executives more than $278 million in total compensation. While this sum is quite staggering on its own, what is most concerning for shareholders is that the Company underperformed its industry group by a wide margin over this period. From 2011 to 2019, Kohl’s net sales stagnated from $18.8 billion in 2011 to $18.9 billion in 2019, with compounded same store sales declining by 1%. Over the same period, the “Clothing and Clothing Accessory Store” industry, as reported by the U.S. Census Bureau in the Annual Retail Trade Survey, grew 17% in net sales. Worse still, Kohl’s operating income dropped by almost $1 billion, or 44%, from $2.2 billion in 2011 to $1.2 billion in 2019.

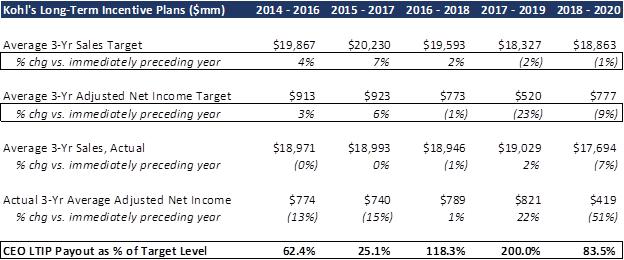

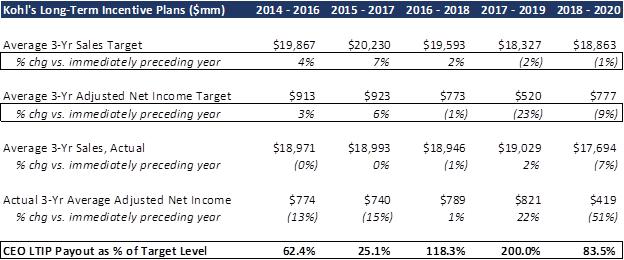

Despite this underperformance, Kohl’s CEO received a 250% bonus in both 2017 and 2018, in addition to a 118% payout under the Company’s 2016-2018 long-term incentive plan (“LTIP”), after the Company badly missed its own targets for those periods set in the Greatness Agenda just a few years earlier.

In light of this misalignment of pay with performance, shareholders deserve an answer to one simple question:

How Could the Kohl’s Board Approve Such Outrageous Executive Compensation for Deteriorating Results?

Shareholders rely on boards to design and implement executive compensation programs which provide appropriate alignment and long-term incentives to help drive sustainable value creation. The decisions boards make with regard to executive compensation offer a window into their culture, alignment, respect for shareholders’ capital, and desire to create shareholder value.

The message from Kohl’s Board to its shareholders seems loud and clear – executives will continue to be rewarded regardless of long-term operating results or share price performance. Kohl’s Board has demonstrated a troubling long-term track record of continuously lowering the bar and paying higher and higher levels of compensation for deteriorating results.

Kohl’s stated compensation philosophy contained in every annual proxy statement is as follows:

“As part of our pay for performance philosophy, our goals are intended to be difficult to achieve, and failure to achieve the goals has significant consequences.”

Yet despite this credo, Kohl’s annual and long-term incentive plans show a consistent pattern of rewarding executives with excessive compensation for meeting an ever-declining set of objectives. Kohl’s LTIP consists of rolling three-year cumulative targets for sales and net income. The three-year measurement periods overlap as a new program is set each subsequent year. Far from being “difficult to achieve,” the 2017 to 2019 LTIP set a “Target Level” for sales and net income which would pay out a 100% performance share unit award to management for achieving average annual sales of 2% less than actual sales in 2016 and average annual adjusted net income 23% below adjusted 2016 net income.

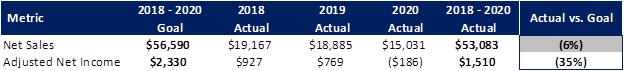

Source: SEC Filings

Note: Net Income adjusted to exclude non-recurring items. 2018 net income compares to 2017 figure after adjusting for decline in corporate tax rate

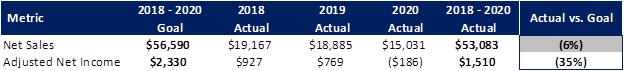

The 2018-2020 LTIP also set Target Levels below the prior year’s actual results, yet the Board still saw fit to apparently manipulate the structure of this plan to ensure a payout. The Board explains in the Company’s 2021 Proxy Statement that given the devastating impact of COVID in 2020, it became clear that management would not hit the three-year cumulative targets for this tranche.

Source: SEC Filings

Rather than allow management to “suffer” just as Kohl’s employees and communities had, the Board lowered the bar by amending the plan to a retroactive annual plan rather than a cumulative long-term plan, creating a windfall for management that would not have been payable under the original plan. Importantly, the Board made this change in January 2021, long after the economy showed signs of recovering from the COVID pandemic and when it was known to the Board that the large performance share unit award granted to the CEO in March 2020 had appreciated dramatically (to a potential value of more than $25 million). As a result of the Board’s ex post facto adjustments, Kohl’s CEO received an average LTIP payout of 98% of the target during the last five years, while from the period 2014 to 2019 (excluding COVID-impacted 2020) Kohl’s sales declined by 1% and tax-adjusted net income declined by 26%.

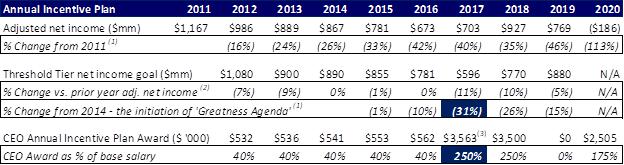

This disturbing pattern of paying for underperformance and continuously setting the bar lower is equally evident in Kohl’s Annual Incentive Plan structure. As shown in the table below, the Annual Incentive Plan approved by the Board each year has enabled the CEO to achieve multi-million dollar incentive payouts despite a persistent decline in adjusted net income. In our view, the Board’s construction of this plan demonstrates a flawed philosophy of lowering the threshold net income goal each year to a level at or below actual performance in the previous year.

Note: (1) Cumulative change % for 2018, 2019 and 2020 are calculated using a tax rate of 23.2% applied to the 2011 and 2014 adjusted net income. (2) Change % for 2018 is calculated using a tax rate of 23.2% applied to the 2017 adjusted net income. (3) Plus an additional $3.5 million award for CEO-elect Michelle Gass.

As a result, Kohl’s CEO was paid:

| · | A “Top Tier” 250% bonus in 2017 for achieving adjusted net income that was 19% below 2014, the baseline year for the “Greatness Agenda” |

| · | Another “Top Tier” 250% bonus for 2018 adjusted net income that was still 11% below 2014 after adjusting for tax differences |

The performance bar has been lowered so frequently that by 2019 the threshold to achieve a bonus had fallen 38% from 2011 actual net income (tax adjusted).

As with the LTIP, the Board amended the Annual Incentive Plan in 2020, enabling a large annual bonus for the CEO and other named executive officers. Specifically, the Board removed all objective quantitative measures, instead basing 50% of bonuses on Kohl’s sales results compared to a curated peer group, and 50% on the Board’s discretion. This enabled the CEO to receive a $2.5 million bonus in 2020 even though sales declined 20% and earnings were negative. Again, this change was made in addition to amendments to the LTIP, which separately rewarded the CEO handsomely, and under a backdrop in which Kohl’s employees appeared to be suffering an approximate 10% pay cut.

The Board proclaims to shareholders in Kohl’s proxy statements that a “failure to achieve target goals has significant consequences,” but this feels like an incredibly hollow statement in light of the Board’s actions, which speak louder than words. In addition, the assertion that “As part of our pay for performance philosophy, our goals are intended to be difficult to achieve” seems absurd in light of all the evidence to the contrary.

We believe the Board’s broken culture of rewarding management for mediocre or downright poor performance stems in part from their propensity to compare Kohl’s to the narrow, ailing department store sector rather than to a broader, more relevant group of discretionary soft-goods retailers. A deeper level of relevant retail experience on the Board would contribute to a better understanding of the true competitive environment and to the design of more appropriate incentive structures.

The Five Incumbent Directors We Are Opposing Shoulder Significant Responsibility for Kohl’s Misaligned Compensation Plans

Our campaign aims to remove the following five directors from the Kohl’s Board. Each of these directors lacks retail apparel expertise, and they have served on the Board for an average of 16 years. Importantly, three of the five (Messrs. Burd, Prising and Sica) are current members of the Compensation Committee, with Mr. Prising serving as its Chair, and have been deeply involved in designing and implementing what we believe is a flawed compensation program at Kohl’s. The five incumbent Kohl’s directors we are seeking to remove are as follows:

| Board Member | Age | Board Tenure | Experience | Apparel Retail | Retail | Marketing / Customer Exp. | E-Comm | Operations | Merchandising | Capital Markets |

| Steven A. Burd* | 71 | 19 | Grocery Stores | | X | | | X | | |

Jonas Prising* (Chair of Compensation Committee) | 56 | 5 | Staffing | | | | | X | | |

| John E. Schlifske | 61 | 9 | Insurance | | | | | X | | X |

Frank V. Sica* (Chairman of the Board) | 70 | 33 | PE Investor | | | | | | | X |

Stephanie A. Streeter (Chair of Audit Committee) | 63 | 14 | Consumer Goods | | | | | X | | |

* Member of Compensation Committee

| · | Our Nominees Have the Relevant Retail and Governance Expertise to Better Align Kohl’s Compensation Structure with Shareholders |

| · | Our five director nominees bring significant apparel retail expertise and a strong desire to improve Kohl’s compensation practices: |

| Board Candidate | Age | Board Tenure | Experience | Apparel Retail | Retail | Marketing / Customer Exp. | E-Comm | Operations | Merchandising | Capital Markets |

| Margaret L. Jenkins | 69 | -- | Marketing &

Apparel Retail | X | X | X | | | | |

| Thomas A. Kingsbury | 68 | -- | Apparel Retail | X | X | X | X | X | X | X |

| Jonathan Duskin | 53 | -- | Investor &

Retail Specialist | X | X | | X | | | X |

| Jeffrey A. Kantor | 62 | -- | Apparel Retail | X | X | X | X | X | X | |

| Cynthia S. Murray | 63 | -- | Apparel Retail | X | X | X | X | X | X | |

Revitalizing Kohl’s strategy and improving compensation practices are not a short-term focus. Our desire is to build long-term value and we have carefully selected directors who we believe are far better positioned to turnaround Kohl’s than the Company’s five stale directors with irrelevant skillsets who have overseen significant underperformance at Kohl’s.

If you have any questions or require assistance with your vote, please contact Saratoga Proxy Consulting, who is assisting us, and whose contact information appears below.

Thank you for your support,

Jonathan Duskin Macellum Advisors GP, LLC | Frederick DiSanto Ancora Holdings, Inc. | Christopher Kiper Legion Partners Asset Management, LLC | Steve Litt 4010 Capital, LLC |

About Macellum

Macellum Advisors GP, LLC, together with its affiliates (collectively, “Macellum”) have substantial experience investing in consumer and retail companies and assisting such companies in improving their long-term financial and stock price performance. Macellum’s historical investments include: Collective Brands, GIII Apparel Group, Hot Topic, Charming Shoppes and Warnaco, among other companies. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders, as we did with Perry Ellis. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change, including at The Children’s Place Inc., Christopher & Banks Corporation, Citi Trends, Inc. Bed Bath and Beyond Inc. and most recently at Big Lots, Inc.

About Ancora

Ancora Holdings, Inc. is an employee owned, Cleveland, Ohio based holding company, which wholly owns four separate and distinct SEC Registered Investment Advisers and a broker dealer. Ancora Advisors LLC specializes in customized portfolio management for individual investors, high net worth investors, investment companies (mutual funds), and institutions such as pension/profit sharing plans, corporations, charitable & “Not-for Profit” organizations, and unions. Ancora Family Wealth Advisors, LLC is a leading, regional investment and wealth advisor managing assets on behalf of families and high net-worth individuals. Ancora Alternatives LLC specializes in pooled investments (hedge funds/investment limited partnerships). Ancora Retirement Plan Advisors, Inc. specializes in providing non-discretionary investment guidance for small and midsize employer sponsored retirement plans. Inverness Securities, LLC is a FINRA registered Broker Dealer.

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

About 4010 Capital

4010 Capital is a value-oriented investment manager with substantial experience investing in the consumer discretionary sector. 4010 Capital employs comprehensive fundamental analysis to invest in companies which it believes are trading at a discount to intrinsic value and have a pathway to improving operating performance.

Contacts

Media:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com

Investor:

John Ferguson / Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com