UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| Kohl’s Corporation |

(Name of Registrant as Specified in Its Charter) |

| |

MACELLUM BADGER FUND, LP MACELLUM BADGER FUND II, LP MACELLUM ADVISORS, LP MACELLUM ADVISORS GP, LLC JONATHAN DUSKIN LEGION PARTNERS HOLDINGS, LLC LEGION PARTNERS, L.P. I LEGION PARTNERS, L.P. II LEGION PARTNERS SPECIAL OPPORTUNITIES, L.P. XV LEGION PARTNERS, LLC LEGION PARTNERS ASSET MANAGEMENT, LLC CHRISTOPHER S. KIPER RAYMOND T. WHITE ANCORA CATALYST INSTITUTIONAL, LP ANCORA CATALYST, LP ANCORA MERLIN, LP ANCORA MERLIN INSTITUTIONAL, LP ANCORA CATALYST SPV I LP SERIES M ANCORA CATALYST SPV I LP SERIES N ANCORA CATALYST SPV I LP SERIES O ANCORA CATALYST SPV I LP SERIES P ANCORA CATALYST SPV I SPC LTD SEGREGATED PORTFOLIO G ANCORA ADVISORS, LLC ANCORA HOLDINGS, INC. ANCORA FAMILY WEALTH ADVISORS, LLC THE ANCORA GROUP INC. INVERNESS HOLDINGS, LLC ANCORA ALTERNATIVES, LLC FREDERICK DISANTO 4010 PARTNERS, LP 4010 CAPITAL, LLC 4010 GENERAL PARTNER, LLC STEVEN E. LITT MARGARET L. JENKINS JEFFREY A. KANTOR THOMAS A. KINGSBURY CYNTHIA S. MURRAY |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Macellum Badger Fund, LLC , a Delaware limited partnership, Legion Partners Holdings, LLC, a Delaware limited liability company, Ancora Holdings, Inc., an Ohio corporation and 4010 Capital, LLC, a Delaware limited liability company, together with the other participants named herein (collectively, the “Investor Group”), have filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2021 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

On April 6, 2021, the Investor Group issued the following press release and letter to shareholders:

INVESTOR GROUP URGES SHAREHOLDERS TO REJECT KOHL’S MISINFORMATION CAMPAIGN

Sends Letter to Shareholders Highlighting the Reality Behind Three Myths Being Perpetuated by Kohl’s

Sees No “Momentum” at Kohl’s, But Rather Recent Performance that Continues to Lag Peers

Highlights 54% Relative Underperformance Versus Peers from Pre-Covid Levels

Believes There is Little New About Kohl’s “New” Strategic Plan – Which is Largely Recycled from Previous Ill-Fated “Greatness Agenda”

Encourages All Shareholders to Vote on the White Proxy Card Today to Elect Group’s Nominees and Help Kohl’s Reach Its Full Potential

NEW YORK – April 6, 2021 – Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group”) today issued a letter to shareholders in connection with its nominations of five candidates for election to the Board of Directors (the “Board”) of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”). The Investor Group is deemed to beneficially own, in the aggregate, 14,696,905 shares of the Company’s common stock, including 2,447,000 shares underlying call options currently exercisable, constituting approximately 9.3% of the Company’s outstanding common stock.

The letter details how several key assertions by Kohl’s are nothing more than myths unsupported by reality. The full text of the letter is available at:

https://createvalueatkohls.com/wp-content/uploads/2021/04/Letter-to-KSS-Shareholders_4-6-21.pdf.

For more information, visit www.CreateValueAtKohls.com.

About Macellum

Macellum Advisors GP, LLC, together with its affiliates (collectively, “Macellum”) have substantial experience investing in consumer and retail companies and assisting such companies in improving their long-term financial and stock price performance. Macellum’s historical investments include: Collective Brands, GIII Apparel Group, Hot Topic, Charming Shoppes and Warnaco, among other companies. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders, as we did with Perry Ellis. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change, including at The Children’s Place Inc., Christopher & Banks Corporation, Citi Trends, Inc. Bed Bath and Beyond Inc. and most recently at Big Lots, Inc.

About Ancora

Ancora Holdings, Inc. is an employee owned, Cleveland, Ohio based holding company, which wholly owns four separate and distinct SEC Registered Investment Advisers and a broker dealer. Ancora Advisors LLC specializes in customized portfolio management for individual investors, high net worth investors, investment companies (mutual funds), and institutions such as pension/profit sharing plans, corporations, charitable & “Not-for Profit” organizations, and unions. Ancora Family Wealth Advisors, LLC is a leading, regional investment and wealth advisor managing assets on behalf of families and high net-worth individuals. Ancora Alternatives LLC specializes in pooled investments (hedge funds/investment limited partnerships). Ancora Retirement Plan Advisors, Inc. specializes in providing non-discretionary investment guidance for small and midsize employer sponsored retirement plans. Inverness Securities, LLC is a FINRA registered Broker Dealer.

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

About 4010 Capital

4010 Capital is a value-oriented investment manager with substantial experience investing in the consumer discretionary sector. 4010 Capital employs comprehensive fundamental analysis to invest in companies which it believes are trading at a discount to intrinsic value and have a pathway to improving operating performance.

Contacts

Media:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com

Investor:

John Ferguson / Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com

April 6, 2021

Dear Fellow Shareholders,

Macellum Advisors GP, LLC, Ancora Holdings, Inc., Legion Partners Asset Management, LLC, and 4010 Capital, LLC (collectively, the “Investor Group” or “we”) beneficially own a total 14,696,905 shares of Kohl’s Corporation, a Wisconsin corporation, (“Kohl’s” or the “Company”), including 2,447,000 shares underlying call options currently exercisable, constituting approximately 9.3% of the Company’s outstanding common stock, par value $0.01 per share (the “Common Stock”), and making us one of the Company’s largest shareholders. We are seeking your support on the WHITE proxy card to vote FOR our five highly qualified director nominees – Jonathan Duskin, Margaret L. Jenkins, Jeffrey A. Kantor, Thomas A. Kingsbury and Cynthia S. Murray – at the Company’s upcoming annual meeting of shareholders scheduled for May 12, 2021.

KOHL’S PATTERN OF MISLEADING STATEMENTS

In an apparent effort to win shareholder support, Kohl’s management and its Board of Directors (the “Board”) have repeatedly made misleading claims about their performance and the success of their “new” strategy. These claims appear to stem from a desire to protect the seats of five long-tenured incumbent directors at any cost – or more precisely, at the cost of spending an estimated $10 million of shareholder money on proxy defense advisors and related services. In this letter, the Investor Group highlights just a few of the efforts by the Board to twist the facts.

| o | “We are building on proven momentum to drive top line growth in several key areas.” |

| o | We see NO MOMENTUM. The Investor Group sees little evidence that Kohl’s initiatives to drive top line growth are working. To the contrary, Kohl’s has performed poorly over the last two quarters as compared to its apparel and soft home peers, trailing segment leaders by a wide margin in most categories in which they compete – even as the economy has begun to reopen from the COVID pandemic. What is even more concerning is that Kohl's is significantly trailing off-mall retailers (and even many mall-based retailers) during a time when there is a clear advantage to being in off-mall locations. Net Sales performance for off-mall retailers in 2H 2020 vs. 2H 2019 is up 5% compared to Kohl’s being down 11%. |

Net Sales Performance vs. Peers (See full details on Table A below)

| Second Half 2020 vs. Second Half 2019 % Change |

| KSS excl. Home | (16%) | KSS - Home | 7% |

| Apparel/Soft Goods Peers Median | (2%) | Soft-Home Peers Median | 16% |

| KSS excl. Home vs. Peers | (14%) | KSS - Home vs. Peers | (9%) |

| Source: SEC Filings. See full list of peers below in Table A. |

| o | “New strategic plan announced in October 2020 focuses on accelerating growth and improving profitability” (emphasis added). |

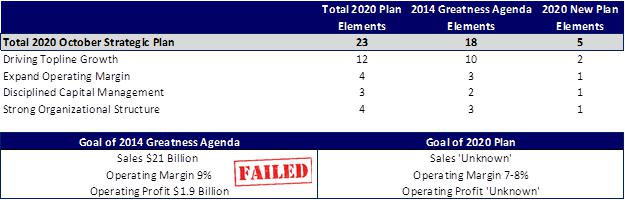

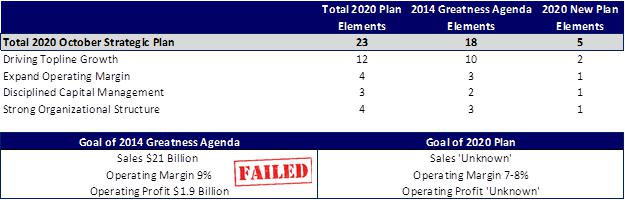

| o | 77% of the components of the “new” strategic plan are recycled from the failed “Greatness Agenda”. Four of the five directors we are seeking to replace were members of the Board that helped oversee the creation of the Greatness Agenda and Kohl’s current CEO was highlighted as a “key leader”1 and an architect of the program. |

We believe the Board’s track record demonstrates it is not capable of overseeing the development of a plan that can create sustainable long-term shareholder value. Similar to the current strategic plan, the Greatness Agenda was long on platitudes but short on details. The few targets that were disclosed included achieving $21 billion in sales and $1.9 billion in operating income by 2017. Unfortunately, the Greatness Agenda missed these targets by a wide margin (missed by 9% and 25%, respectively, by 2017), yet many of the same initiatives are being recycled today (with even lower targets) in the hope that what didn’t work then will somehow be successful now.

Side by Side Analysis of Strategic Plans (See full details on Table B below)

|

| Source: Company reports and Investor Group estimates. |

| o | “Since launching our strategy, our stock price has increased by more than 200%.” |

| o | Kohl’s stock has consistently done one thing – UNDERPERFORMED. Kohl’s stock continues to materially underperform its retail peers over any reasonable measurement period. The fact that Kohl’s stock price has increased over a very short, 154-day time frame is in large part a function of how poorly the stock performed during the initial phases of the COVID pandemic. We believe this recent performance has virtually nothing to do with the new strategic plan Kohl’s unveiled in October 2020. |

| o | Evaluating Kohl’s stock performance from a pre-pandemic level illustrates a much different narrative: |

1 Source: Kohl’s press release dated September 26, 2017; Kohl’s Q&A dated May 29, 2018.

Kohl’s Total Shareholder Return vs. Retail Peers

| | Share Price Performance (Total Shareholder Returns Including Dividends) |

| | Pre-COVID to Present (1) | For the Periods Ending 1/31/2021 |

| 1 Year | 3 Year | 5 Year | 10 Year |

| Kohl's Corporation | 22% | 7% | (23%) | 10% | 23% |

| Retail Peer Group (2) | 76% | 55% | 54% | 74% | 168% |

| Russell 2000 Index | 35% | 30% | 37% | 115% | 205% |

| S&P 500 Index | 26% | 17% | 39% | 111% | 255% |

| XRT | 97% | 107% | 95% | 131% | 331% |

| | | | |

| Kohl's Relative Performance: | | | | |

| Retail Peer Group (2) | (54%) | (48%) | (77%) | (64%) | (144%) |

| Russell 2000 Index | (13%) | (23%) | (60%) | (104%) | (181%) |

| S&P 500 Index | (4%) | (10%) | (63%) | (101%) | (231%) |

| XRT | (75%) | (101%) | (118%) | (121%) | (307%) |

Source: Company SEC Filings, Capital IQ (1) Period defined as 1/1/2020 – 3/31/2021 (2) Retail Peer Group includes AEO, ANF, BIG, BKE, BURL, CAL, CHS, DDS, DKS, EXPR, FL, GCO, GPS, HIBB, HOME, JWN, LB, LULU, M, PLCE, ROST, SCVL, TCS, TGT, TJX, URBN, WSM, ZUMZ |

| o | Kohl’s history of disappointing investors – particularly lowering initial earnings per share (EPS) expectations for 2020 to $4.40 before the start of the pandemic from almost $6.00 at the start of 2019 – caused the stock to suffer more than most during the pandemic. |

| o | Over the same period that Kohl’s is highlighting a 200% stock price increase, Nordstrom, Inc.’s stock price was up 229% and Macy’s Inc. was up 191%, further indicating that the increase in Kohl’s stock price is related to department stores rallying versus any indication that Kohl’s “new” strategy is working. |

| o | From the beginning of 2020 to Kohl’s pandemic low, Kohl’s stock price declined 76% vs 56%2 for its retail peer group. As the following chart depicts, Kohl’s October investor presentation coincided with positive vaccination news and talks of a new stimulus bill, making the very short-term period of positive performance the Board is touting extremely misleading. Kohl’s rallied with many other retailers as a pathway out of the pandemic emerged, though the Company still lagged its peers materially until the point when the Investor Group publicly announced our campaign. |

2 Period from December 31, 2019 to April 3, 2020

|

Source: Company SEC Filings, Capital IQ Peer Group includes AEO, ANF, BIG, BKE, BURL, CAL, CHS, DDS, DKS, EXPR, FL, GCO, GPS, HIBB, HOME, JWN, LB, LULU, M, PLCE, ROST, SCVL, TCS, TGT, TJX, URBN, WSM, ZUMZ |

As avid students of the retail industry, the Investor Group and their nominees see a different story – a Board lacking in credibility and willing to say anything to create a false narrative that they have a new strategic plan which is showing signs of success. As we have demonstrated above, the Board’s strategy is NOT new and does NOT appear to be gaining momentum. The Board needs a meaningful overhaul with new, independent directors that possess the necessary skill sets to address Kohl’s sustained period of underperformance rather than remain the “best of worst” in retail.

We urge all shareholders to vote for our five highly accomplished directors for real change. If you have any questions or require assistance with your vote, please contact Saratoga Proxy Consulting, who is assisting us, and whose contact information appears below.

Thank you for your support,

Jonathan Duskin Macellum Advisors GP, LLC | Frederick DiSanto Ancora Holdings, Inc. | Christopher Kiper Legion Partners Asset Management, LLC | Steve Litt 4010 Capital, LLC |

About Macellum

Macellum Advisors GP, LLC, together with its affiliates (collectively, “Macellum”) have substantial experience investing in consumer and retail companies and assisting such companies in improving their long-term financial and stock price performance. Macellum’s historical investments include: Collective Brands, GIII Apparel Group, Hot Topic, Charming Shoppes and Warnaco, among other companies. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders, as we did with Perry Ellis. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change, including at The Children’s Place Inc., Christopher & Banks Corporation, Citi Trends, Inc. Bed Bath and Beyond Inc. and most recently at Big Lots, Inc.

About Ancora

Ancora Holdings, Inc. is an employee owned, Cleveland, Ohio based holding company, which wholly owns four separate and distinct SEC Registered Investment Advisers and a broker dealer. Ancora Advisors LLC specializes in customized portfolio management for individual investors, high net worth investors, investment companies (mutual funds), and institutions such as pension/profit sharing plans, corporations, charitable & “Not-for Profit” organizations, and unions. Ancora Family Wealth Advisors, LLC is a leading, regional investment and wealth advisor managing assets on behalf of families and high net-worth individuals. Ancora Alternatives LLC specializes in pooled investments (hedge funds/investment limited partnerships). Ancora Retirement Plan Advisors, Inc. specializes in providing non-discretionary investment guidance for small and midsize employer sponsored retirement plans. Inverness Securities, LLC is a FINRA registered Broker Dealer.

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

About 4010 Capital

4010 Capital is a value-oriented investment manager with substantial experience investing in the consumer discretionary sector. 4010 Capital employs comprehensive fundamental analysis to invest in companies which it believes are trading at a discount to intrinsic value and have a pathway to improving operating performance.

Contacts

Media:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com

Investor:

John Ferguson / Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com

Table A – Net Sales Performance vs. Peers

| | % Change | | | % Change |

| Apparel/Soft Goods Peers | 2H 2020 vs. 2H 2019 | | Soft-Home Peers | 2H 2020 vs. 2H 2019 |

| LULU | 23% | | HOME | 44% |

| DKS | 21% | | TGT- Soft Home Only | 30% |

| HIBB | 20% | | WSM - Williams Sonoma Only | 24% |

| BKE | 15% | | TJX - Home Goods Only | 16% |

| Old Navy (1) | 10% | | TCS | 13% |

| TGT (2) | 10% | | BIG - Soft Home Only | 11% |

| FL (1) | 7% | | KSS - Home | 7% |

| LB | 7% | | M - Home | 0% |

| SCVL | 3% | | | |

| ZUMZ | 2% | | | |

| GPS (1) | 1% | | | |

| BURL | (1%) | | | |

| AEO | (2%) | | | |

| ROST | (3%) | | | |

| ANF (1) | (4%) | | | |

| URBN | (5%) | | | |

| TJX-MarMaxx (3) | (8%) | | | |

| CAL (4) | (10%) | | | |

| GCO (5) | (11%) | | | |

| PLCE | (13%) | | | |

| KSS ex Home (6) | (16%) | | | |

| JWN | (18%) | | | |

| DDS | (22%) | | | |

| M ex Home (7) | (24%) | | | |

| CHS | (27%) | | | |

| EXPR | (31%) | | | |

| Peer Average | (2%) | | Peer Average | 20% |

| Peer Median | (2%) | | Peer Median | 16% |

Source: SEC Filings

Note: (1) Includes United States sales only. (2) Includes "apparel and accessories" category only in order to exclude outsized growth of the home furnishings, hardlines, beauty & household, and food & beverage. (3) Includes United States sales for Marshalls and TJ Maxx only (excludes HomeGoods and international). (4) Includes Famous Footwear retail sales only (excludes Wholesale division). (5) Includes Journeys and Johnston & Murphy only (excludes Schuh international and Licensed Brands segments). (6) Excludes Home category to isolate sales of apparel and accessories. (7) Excludes Home/Other category to isolate sales of apparel and accessories.

Definition: Off-mall retailers include: TGT, Old Navy United States sales only, BURL, ROST and TJX United States sales only.

Table B – Side by Side Analysis of Strategic Plans