ASC 606, Revenue from Contracts with Customers Exhibit 99.2 May 22, 2018

In Q1 2018, Kohl’s adopted Revenue from Contracts with Customers (ASC Topic 606), as required. The new standard eliminated the transaction- and industry-specific revenue recognition guidance under prior U.S. GAAP and replaced it with a principles-based approach for revenue recognition and disclosures. Under the standard, revenue is recognized when a customer obtains control of promised goods or services in an amount that reflects the consideration the entity expects to receive in exchange for those goods or services. The new standard has an immaterial impact on our accounting for returns and rewards program such as Kohl’s Cash and our loyalty program. Revenues from our credit card operations, which were previously recorded as a reduction of SG&A expenses, are now included in “Other Revenue” which is a new line on the face of our income statement. This change in presentation had no impact on our net income. The standard was adopted on a retrospective basis. Restated quarterly and annual 2017 income statements are included in these materials. Overview

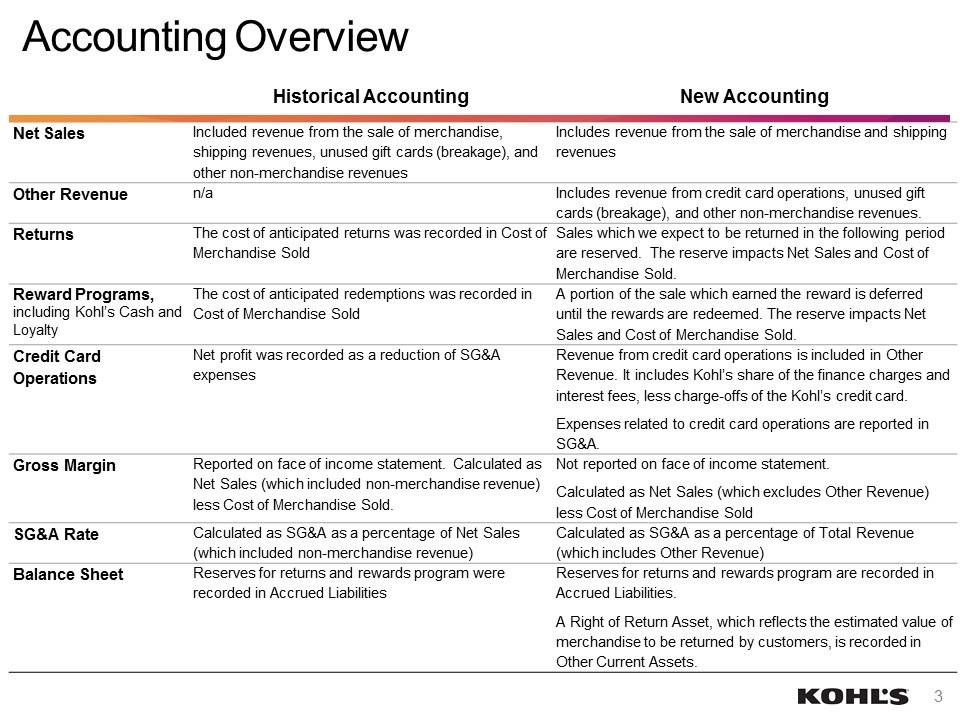

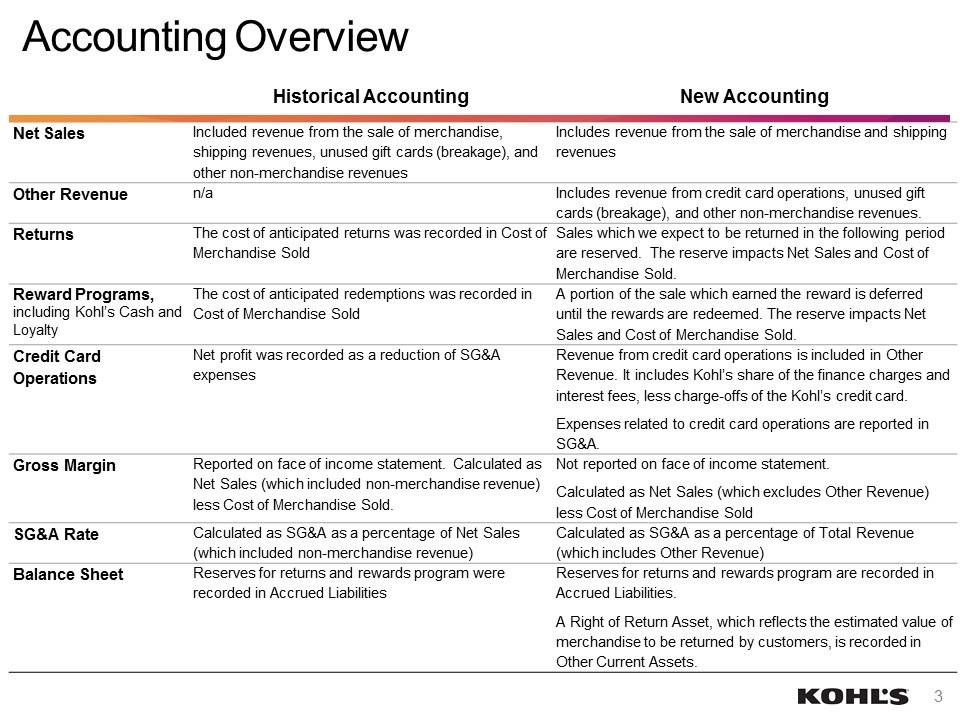

Accounting Overview Historical Accounting New Accounting Net Sales Included revenue from the sale of merchandise, shipping revenues, unused gift cards (breakage), and other non-merchandise revenues Includes revenue from the sale of merchandise and shipping revenues Other Revenue n/a Includes revenue from credit card operations, unused gift cards (breakage), and other non-merchandise revenues. Returns The cost of anticipated returns was recorded in Cost of Merchandise Sold Sales which we expect to be returned in the following period are reserved. The reserve impacts Net Sales and Cost of Merchandise Sold. Reward Programs, including Kohl’s Cash and Loyalty The cost of anticipated redemptions was recorded in Cost of Merchandise Sold A portion of the sale which earned the reward is deferred until the rewards are redeemed. The reserve impacts Net Sales and Cost of Merchandise Sold. Credit Card Operations Net profit was recorded as a reduction of SG&A expenses Revenue from credit card operations is included in Other Revenue. It includes Kohl’s share of the finance charges and interest fees, less charge-offs of the Kohl’s credit card. Expenses related to credit card operations are reported in SG&A. Gross Margin Reported on face of income statement. Calculated as Net Sales (which included non-merchandise revenue) less Cost of Merchandise Sold. Not reported on face of income statement. Calculated as Net Sales (which excludes Other Revenue) less Cost of Merchandise Sold SG&A Rate Calculated as SG&A as a percentage of Net Sales (which included non-merchandise revenue) Calculated as SG&A as a percentage of Total Revenue (which includes Other Revenue) Balance Sheet Reserves for returns and rewards program were recorded in Accrued Liabilities Reserves for returns and rewards program are recorded in Accrued Liabilities. A Right of Return Asset, which reflects the estimated value of merchandise to be returned by customers, is recorded in Other Current Assets.

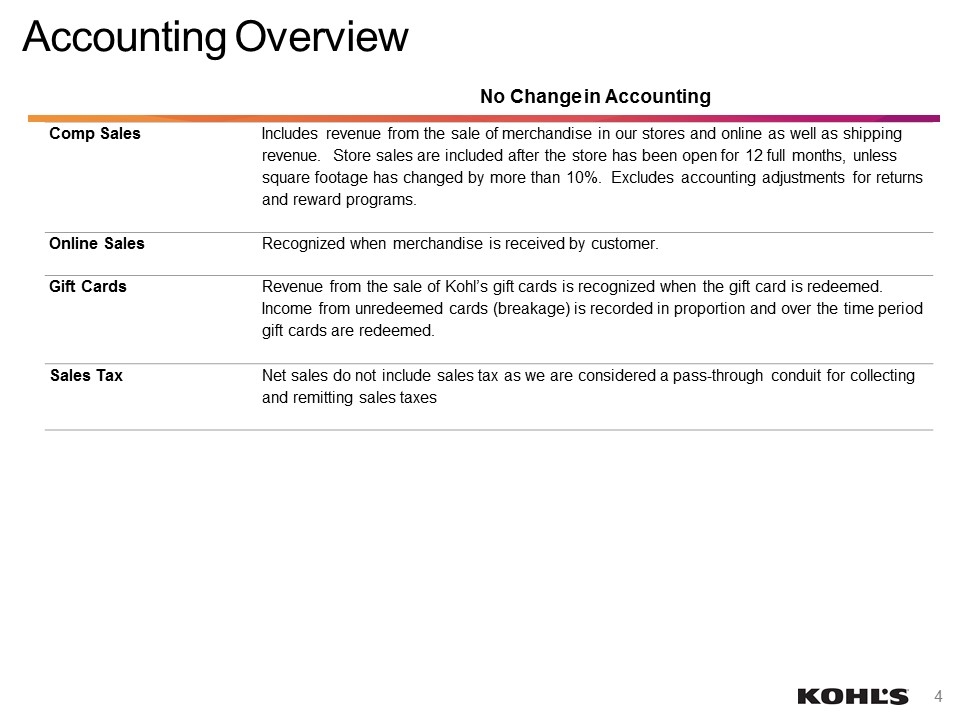

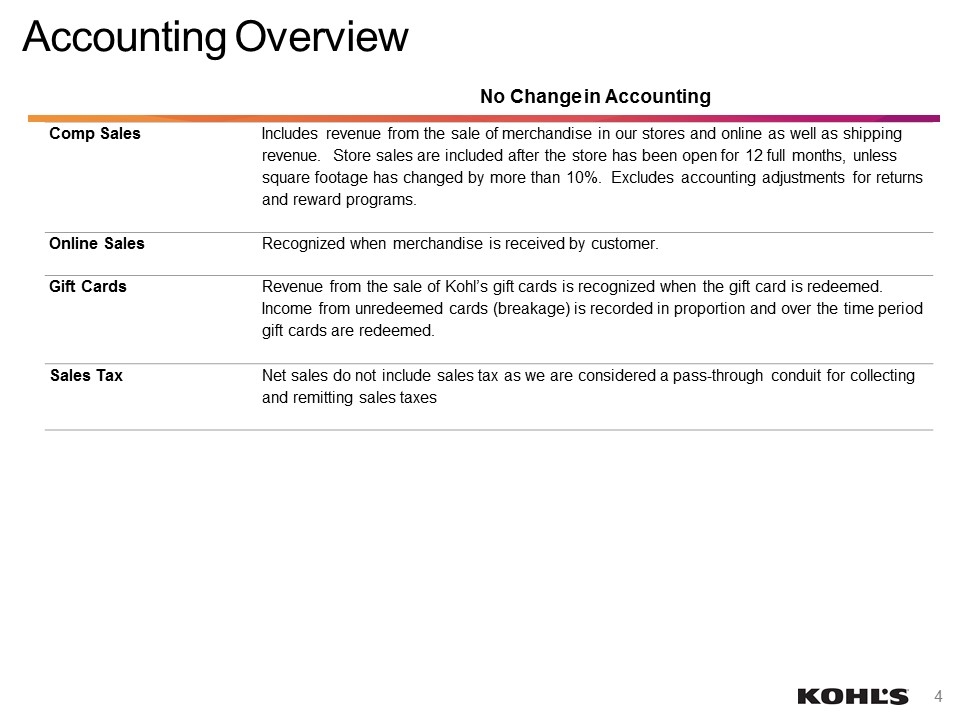

Accounting Overview No Change in Accounting Comp Sales Includes revenue from the sale of merchandise in our stores and online as well as shipping revenue. Store sales are included after the store has been open for 12 full months, unless square footage has changed by more than 10%. Excludes accounting adjustments for returns and reward programs. Online Sales Recognized when merchandise is received by customer. Gift Cards Revenue from the sale of Kohl’s gift cards is recognized when the gift card is redeemed. Income from unredeemed cards (breakage) is recorded in proportion and over the time period gift cards are redeemed. Sales Tax Net sales do not include sales tax as we are considered a pass-through conduit for collecting and remitting sales taxes

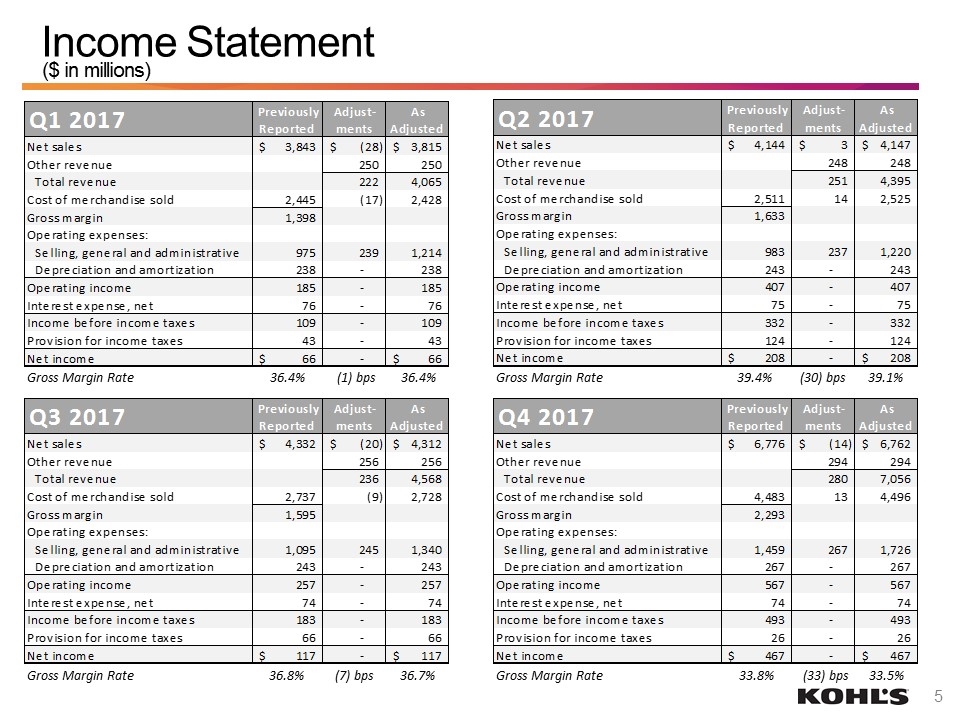

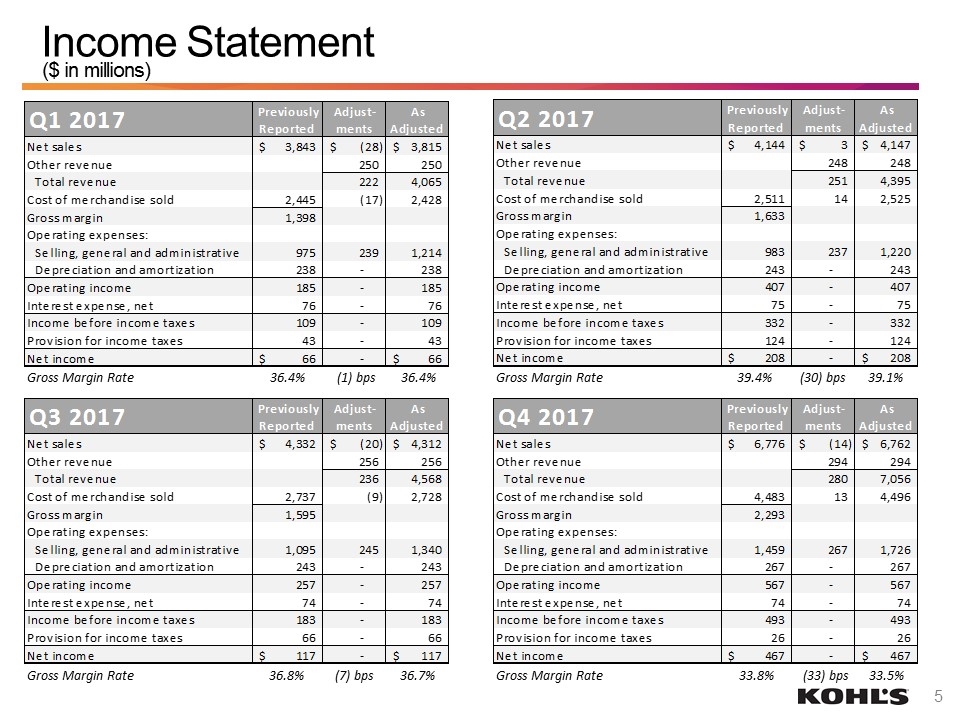

Income Statement ($ in millions) Gross Margin Rate Gross Margin Rate Gross Margin Rate 36.4% Gross Margin Rate 36.4% (1) bps 39.4% 39.1% (30) bps 33.8% 33.5% (33) bps 36.8% 36.7% (7) bps

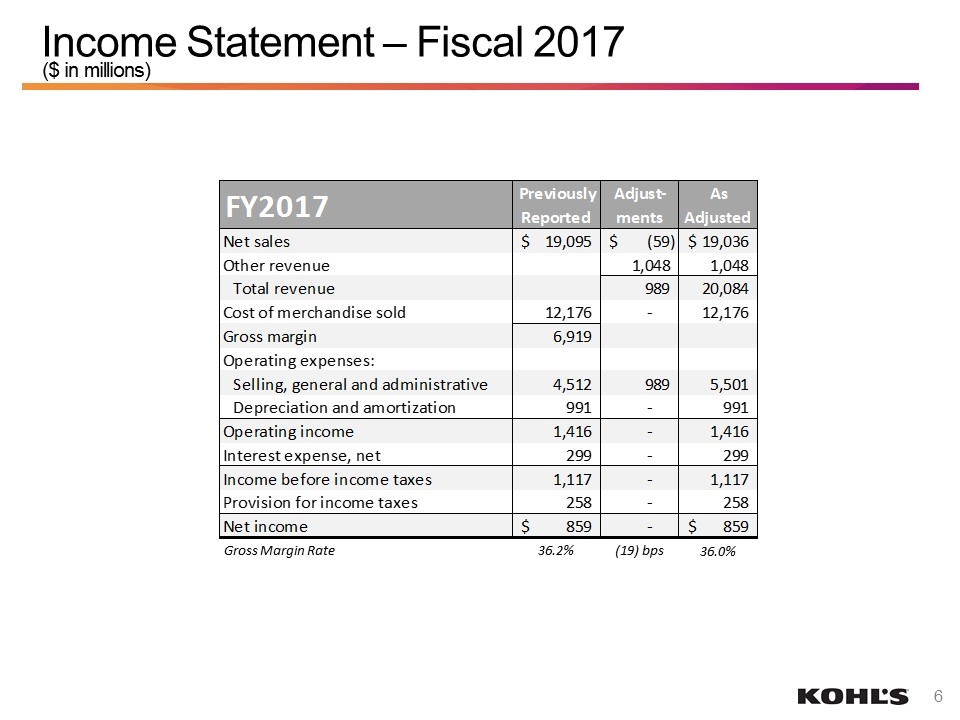

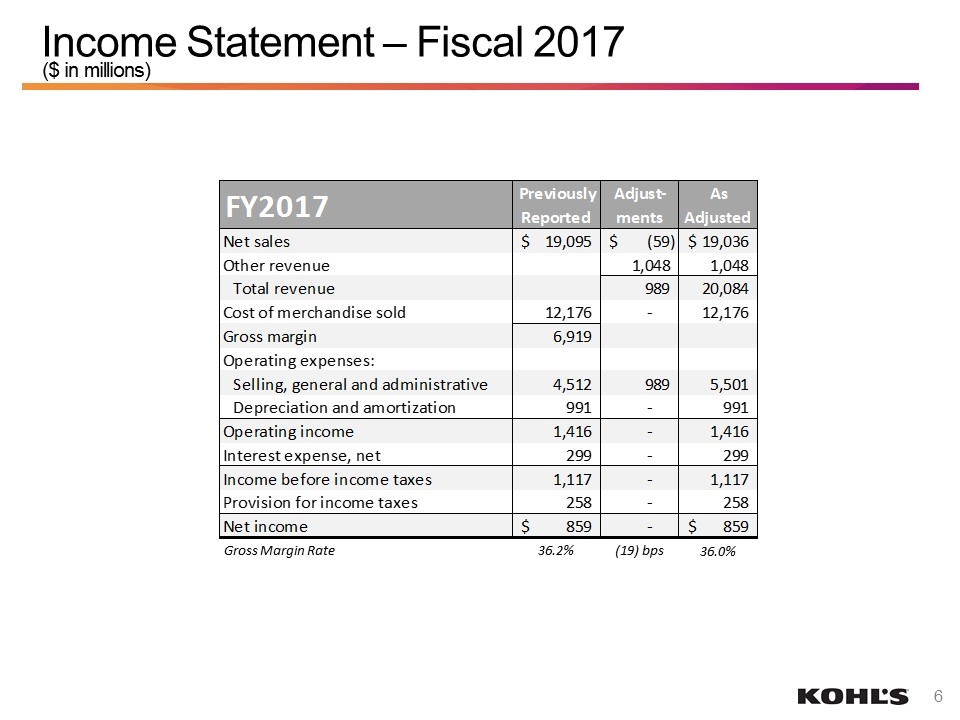

Income Statement – Fiscal 2017 ($ in millions) Gross Margin Rate 36.2% 36.0% (19) bps