UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06625

The Payden & Rygel Investment Group

(Exact name of registrant as specified in charter)

333 South Grand Avenue

Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Edward S. Garlock, Esq.

Secretary

333 South Grand Avenue

Los Angeles, CA 90071

(Name and address of agent for service)

Registrant’s telephone number, including area code: 213-625-1900

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Reports to Shareholders are attached herewith.

Annual Report

| | |

Management Discussion & Analysis | | |

Short Duration Bond Strategies

During the fiscal year ended October 31, 2020, the Federal Reserve Board deployed swift and unprecedented stimulus measures to ease financial conditions and support financial markets in the wake of the Covid-19 pandemic. Included in these measures was reducing the target range for the federal funds rate to between 0.00%-0.25%. They did so through two separate rate cuts totaling 1.50%. Short dated U.S. Treasury yields moved in sympathy, reaching all-time lows, with the 2-year and 3-year yields ending the fiscal year period at 0.15% and 0.20%, respectively. Although we have seen a rebound in economic activity following the dramatic March 2020 declines, uncertainty around the duration and impact of the Covid-19 pandemic should limit increases of overall interest rate levels. Credit premiums across all fixed income sectors spiked in March. But, they have since recovered as the Federal Reserve expanded its balance sheet and implemented numerous other purchase facilities to support markets.

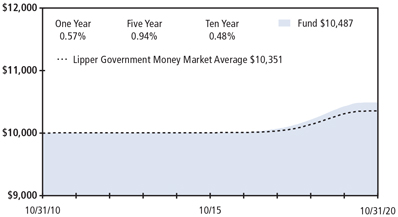

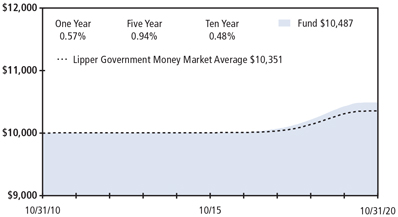

The Payden Cash Reserves Money Market Fund (PBHXX) continued to provide stable daily liquidity. For the fiscal year ended October 31, 2020, the Fund returned 0.57%, compared to a return of 0.42% for the Lipper Government Money Market Average. Money market rates decreased as the Federal Reserve Board decreased its target range, although LIBOR and front-end rates still offer attractive yields. Rates positioning contributed the most to outperformance over the year.

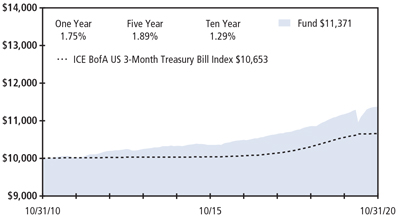

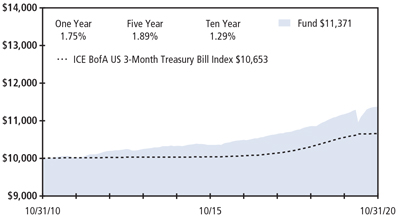

The Payden Limited Maturity Fund (PYLMX) returned 1.75% for the fiscal year ended October 31, 2020, compared to a return of 0.92% for its benchmark, the ICE BofA US 3-Month Treasury Bill Index. Rates positioning and income from allocations to corporate securities and securitized products were the largest contributors to outperformance. The Fund made use of futures and forward currency contracts for hedging purposes. The use of these derivatives impacted performance by 0.00%.

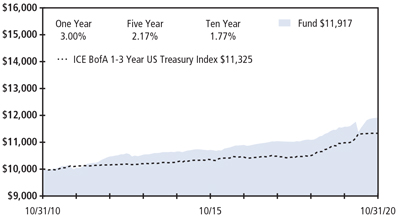

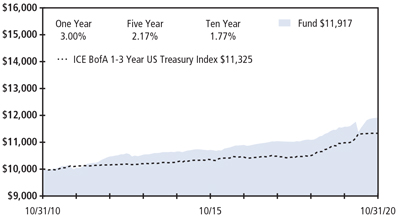

The Payden Low Duration Fund (PYSBX) returned 3.00% for the fiscal year ended October 31, 2020, compared to a return of 3.19% for its benchmark, the ICE BofA 1-3 Year US Treasury Index. The Fund’s allocation to asset-backed and single-A rated corporate securities contributed positively to relative performance, while the allocation to triple-B rated corporate securities and mortgage-backed securities detracted from relative performance versus the benchmark. The Fund invests in futures, swaps and forward currency contracts for hedging and investment purposes. The use of these derivatives impacted performance by 0.00%.

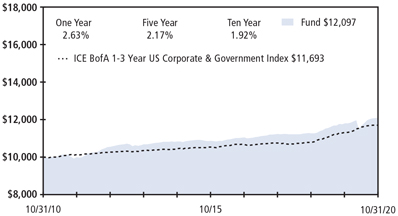

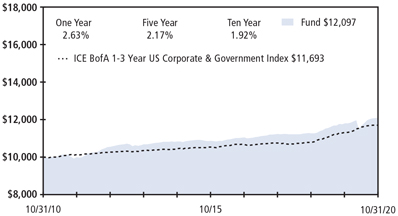

The Payden Global Low Duration Fund (PYGSX) returned 2.63% for the fiscal year ended October 31, 2020, compared to a return of 3.39% for its benchmark, the ICE BofA 1-3 Year US Corporate & Government Index. The Fund’s allocation to asset-backed and single-A rated corporate securities contributed positively to relative performance, while the allocation to triple-B rated corporates and mortgage-backed securities detracted relative performance versus the benchmark. The Fund invests in futures, swaps, options and forward currency contracts for hedging investment purposes. The use of these derivatives impacted performance by 0.00%.

Intermediate Duration Strategies

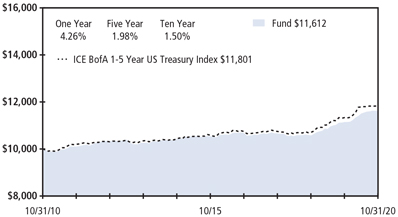

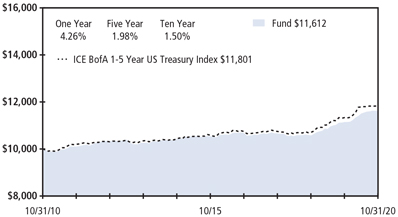

The Payden U.S. Government Fund (PYUSX) returned 4.26% for the fiscal year ended October 31, 2020, compared to its benchmark, the ICE BofA 1-5 Year US Treasury Index, which returned 4.14%. Over the past year, the Covid-19 global pandemic forced the U.S. to shut down the economy during the Fund’s second fiscal quarter to stem the spread of the virus. The third and fourth fiscal quarters witnessed sharp rebounds in activity, but economic activity is still significantly lower compared to pre-pandemic levels. The Federal Reserve Board responded resolutely, first moving interest rates to zero from 1.75% over a two-week period in March, then purchasing large volumes of US Treasury and agency mortgage backed securities and finally instituting a number of liquidity programs to support various sectors of the fixed income marketplace. The Fund, which invests predominantly in short average life agency mortgage backed securities (MBS), modestly outperformed its index over the year. The Fund was positioned in agency mortgage pools with low coupon mortgage loans and agency commercial mortgage backed securities, both of which have low prepayment risk and perform well in low interest rate periods. The Fund is positioned for the current low rate environment to remain in place for the foreseeable future and will remain invested in agency MBS due to their additional yield above US Treasury securities.

The Fund made limited use of interest rate derivative over the course of the fiscal year. Typically, the Fund will use US Treasury futures to manage interest rate volatility. The market impact of derivatives was negligible over the past fiscal year.

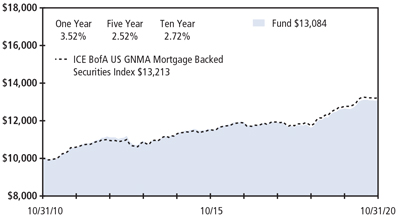

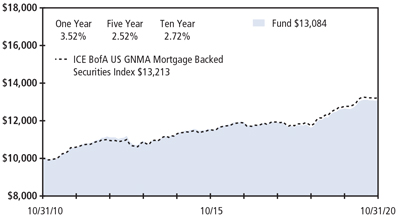

The Payden GNMA Fund (PYGNX) returned 3.52%, for the fiscal year ended October 31, 2020, while its benchmark, the ICE BofA US GNMA Mortgage Backed Securities Index, returned 3.54%. Over the past year, the Covid-19 global pandemic forced the U.S. to shut down the economy during the Fund’s second fiscal quarter to stem the spread of the virus. The third and fourth fiscal quarters witnessed sharp rebounds in activity, but economic activity is still significantly lower when compared to pre-pandemic levels. The Federal Reserve Board responded resolutely, first moving interest rates to zero from 1.75% over a two-week period in March, then

Annual Report 1

| | |

Management Discussion & Analysis continued | | |

purchasing large volumes of US Treasury and agency mortgage backed securities and finally instituting a number of liquidity programs to support various sectors of the fixed income marketplace. The Fund slightly underperformed its benchmark due to faster prepayment speeds on semi seasoned mortgage pools that responded with faster than expected prepayment due to the drop-in mortgage rates. The Fund is currently positioned for faster prepayments by overweighting lower coupon mortgage pools that have less sensitivity to prepayments and purchasing mortgage pools that will likely receive purchase demand from the Federal Reserve Board’s asset purchase program.

We expect the Federal Reserve Board to keep rates unchanged for the foreseeable future. However, we do expect a modest steepening of the yield curve as longer maturity rates respond to the potential for higher inflation. Support for GNMA securities remains robust, primarily from domestic banking institutions that have a surplus of deposits as consumers save more in response to the global pandemic.

The Fund anticipates using certain US Treasury securities and Euro dollar futures contracts to manage interest rate, yield curve and volatility exposure. The Fund’s usage of derivative contracts was negligible over the past year.

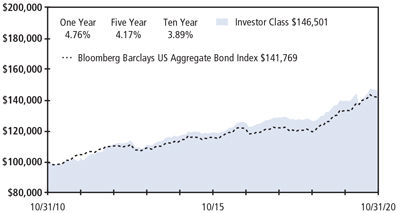

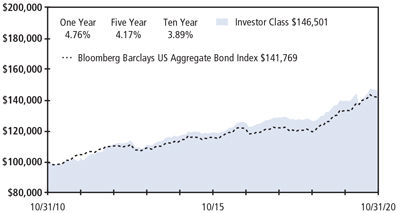

The Payden Core Bond Fund, Investor Class (PYCBX) returned 4.76% for the fiscal year ended October 31, 2020, compared to a 6.19% return for its benchmark, the Bloomberg Barclays US Aggregate Bond Index. The Fund’s Adviser Class (PYCWX) returned 4.52% and its SI Class (PYCSX) returned 4.88% for the same period.

This fiscal year was marked by the historic Covid-19 experience which led to significant market reactions and quickly changing dynamics. Government initiatives, like what was done in the global financial crisis of 2008, helped to calm markets over the ensuing months. Over the fiscal year, we have experienced some specific key themes. First, US government yields have fallen due to the Federal Reserve Board’s initiative to lower borrowing costs. The overnight Federal Funds rates fell to zero, and longer-term maturities declined in concert with little concern about future potential inflation. Credit markets reacted quite negatively at first, but even they have stabilized in part due to the Federal Reserve Board’s purchase programs of credit and mortgage related securities. The Fund lagged the return of the benchmark over the fiscal year due to our higher allocations in a couple of sectors. The hardest hit sector was the securitized sector, which includes a variety of asset backed bonds and other consumer related debt securities. These bonds were the hardest hit the first month of the crisis, and while they have largely rebounded, they are not all the way back to pre-crisis levels. Despite the underperformance, we were successful at limiting further downside by staying the course in our positions and not having any forced selling due to fund flows. The Fund ended the fiscal year comfortable in its sector positioning and ready to continue adding value in the periods ahead. The Fund uses derivatives for interest rate, currency management and credit sector management. It utilizes interest rate swaps and interest rate futures to manage overall duration and yield curve positioning. Foreign currency forwards are traded to hedge currency exposure and to take outright positions on specific currencies. The net performance impact of all derivative use was -0.16% for the fiscal year.

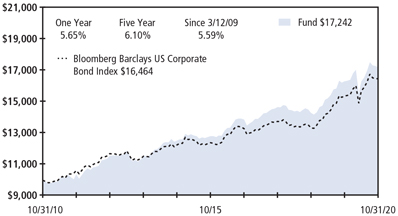

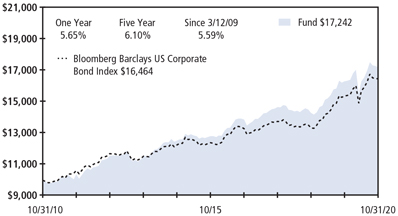

The Payden Corporate Bond Fund (PYACX) generated a net return of 5.65% for the fiscal year ended October 31, 2020, compared to a return of 7.05% for its benchmark, the Bloomberg Barclays U.S. Corporate Bond Index. The Fund’s biggest detractor from performance was its overweight to the Financials sector, specifically within the REIT and Insurance sub-sectors, which underperformed during the height of the pandemic. In addition, the Fund’s underweight to the Consumer Non-Cyclicals and Technology sectors that contain many higher quality credits that outperformed during the sell-off also detracted from performance. However, the Fund did hold onto its exposure to many of its higher beta positions, which then put in a strong recovery into year-end. The Fund increased its exposure throughout the year to the Automobile sector, which contributed positively to performance as these manufacturers recovered from the pandemic at a faster than expected clip, and they also benefited from implicit sovereign support. The Fund used U.S. Treasury futures as a means of hedging, as well as for active duration management. The Fund also used credit SWAP derivatives, specifically IG and HY CDX, which were used primarily to hedge underlying credit exposure or at times as a way to add credit exposure while investing inflows or while maintaining a cash buffer for liquidity purposes. While the use of CDX detracted from performance by -0.33% over the fiscal year, this was largely offset by gains in the underlying positions that it was hedging against.

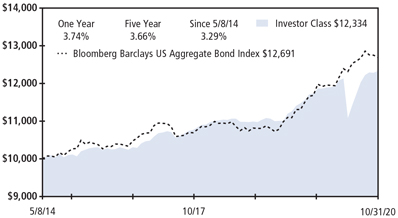

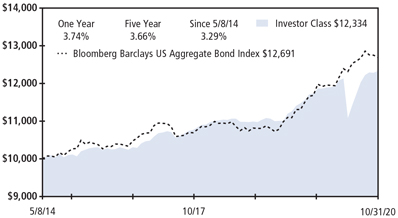

The Payden Strategic Income Fund, Investor Class (PYSGX) returned 3.74% for the fiscal year ended October 31, 2020, compared to a 6.19% return for its benchmark, the Bloomberg Barclays US Aggregate Bond Index. The Fund’s SI Class (PYSIX) returned 3.90% for the same period. The Fund’s primary objective is to maintain an income advantage relative to the broad bond market and to exploit relative value by sector rotation and bond selection. This is achieved by investing primarily in investment grade and high yield corporate bonds, securitized debt and emerging markets. In addition, the Fund has been managed with a duration profile that is shorter in nature than the benchmark as a way to protect principal in the event of rising interest rates.

2 Payden Mutual Funds

This fiscal year was marked by the historic Covid-19 experience, which led to significant market reactions and quickly changing dynamics. Government initiatives, like what was done in the global financial crisis of 2008, helped to calm markets over the ensuing months. Over the fiscal year, we have experienced some specific key themes. First, US government yields have fallen due to the Federal Reserve Board’s initiative to lower borrowing costs. The overnight Federal Funds rate fell to zero, and longer-term maturities declined in concert with little concern about future potential inflation. Credit markets reacted quite negatively at first, but even they have stabilized in part due to the Federal Reserve Board’s purchase programs of credit and mortgage related securities. The Fund lagged the return of the benchmark over the fiscal year due to the Fund’s higher allocations in a couple of sectors and also due to its much shorter duration position, which meant that the Fund did not have the same price rally in light of lower interest rates. The hardest hit was the securitized sector which includes a variety of asset backed bonds and other consumer related debt securities. These bonds were the hardest hit the first month of the crisis and they have largely rebounded, but not all the way back to pre-crisis levels. Despite the underperformance, we were successful at limiting further downside by staying the course in our positions and not having any forced selling due to fund flows. Thus, we end the fiscal year comfortable in the Fund’s sector positioning and ready to continue adding value in the periods ahead. The Fund uses derivatives for interest rate, currency management and credit sector management. It utilizes interest rate swaps and interest rate futures to manage overall duration and yield curve positioning. Foreign currency forwards are traded to hedge currency exposure and to take outright positions on specific currencies. The net performance impact of all derivative use was -0.11% for the fiscal year.

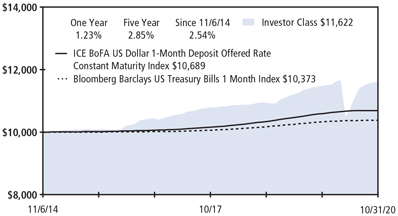

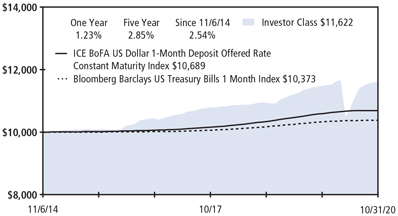

For the fiscal year ended October 31, 2020, the Payden Absolute Return Bond Fund, Investor Class (PYARX) returned 1.23%. This is compared to a return of 0.47% for the Bloomberg Barclays US Treasury Bills 1-Month Index and a return of 0.93% for the ICE BofA Dollar 1-Month Deposit offered Rate Constant Maturity Index, which are the Fund’s benchmarks. The Fund’s SI Class (PYAIX) returned 1.45%. A positive tone for markets to start the fiscal year quickly changed in March as Covid-19 reared its ugly head and slowed economic activity. Global markets saw the highest level of volatility since the 2008 Global Financial Crisis. What began as a sell-off in lower quality credit turned into a liquidity crunch, with higher quality assets being sold at depressed levels in order to raise capital. This created a unique buying opportunity for the Fund to purchase higher quality, stable assets at very opportunistic levels. Almost as quickly as it started, market sentiment rebounded strongly in subsequent months driven by an unprecedented and coordinated monetary and fiscal response from central banks and governments globally. Nearly all core income sectors have recovered from the pandemic-related drawdown. The strategy prefers securitized assets relative to corporate credit, particularly given the resilience in US housing, a low interest rate backdrop, and diversification of collateral. Primary market issuance offered attractive concessions and global rates simultaneously dropped as central banks eased, leading to positive tactical credit and rates performance. The Fund generated modest positive performance from tail risk hedges. The Fund remains structured with low interest rate sensitivity and invested in a diversified mix of fixed income sectors including corporate, mortgage-backed and asset-backed securities. The Fund employs futures, options, swaps and forward currency contracts to manage sensitivity to undesired risk exposures as well as for efficient investment purposes, which detracted 0.01% from performance for the fiscal year.

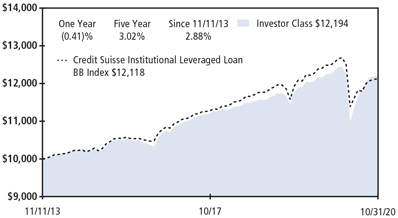

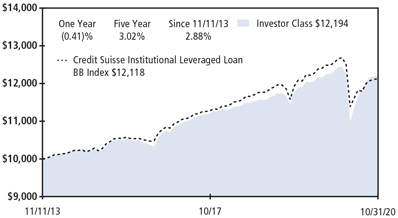

Loan Strategy

The leveraged loan market finished the fiscal year ended October 31, 2020 with a return of -2.92% per the Credit Suisse Institutional Leveraged Loan BB Index. The loss was primarily due to the March return of -9.98%, which was the index’s worst monthly return since 2008. For the year ended October 31, 2020, the Payden Floating Rate Fund, Investor Class (PYFRX) returned -0.41%, and the Fund’s SI Class (PYFIX) also returned -0.41%. The Fund’s benchmark, the Credit Suisse Leveraged Institutional Loan BB Index, returned -2.92% for the same period. A top performer for the review period was a loan issued by the auto parts distributor, Dealer Tire. The loan was purchased at a discount during the market dislocation in the spring and has recovered to par since. The primary detractor to performance were positions in credit risk transfer securities that are backed by mortgages underwritten and pooled by Fannie Mae and Freddie Mac. The bonds have recovered some of their losses since March, but they lagged the overall loan market during the fiscal year. We see value in these securities on a risk-adjusted basis and continue to hold them. The Fund occasionally uses credit default swaps to gain short term market exposure when cash inflows are heavy. These positions are nominally small exposures and track the market.

Annual Report 3

| | |

Management Discussion & Analysis continued | | |

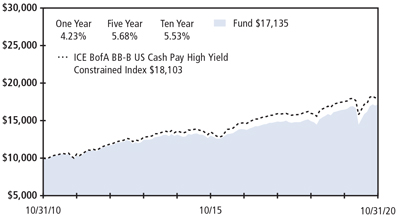

High Yield Strategy

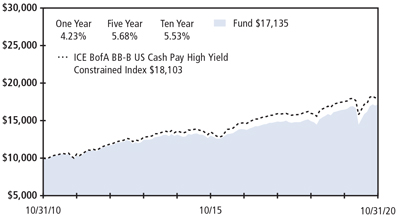

High-yield bonds returned 3.34% during the fiscal year ended October 31, 2020, as measured by the ICE BofA BB-B US Cash Pay High Yield Constrained Index. The fiscal year was marked by extraordinary volatility, as the Covid-19 pandemic initially induced an economic recession, but then largely rallied following intervention by central banks and strong fiscal stimulus that boosted economic growth. Sector performance ranged from -7.27% for Energy to 8.06% for Telecommunications. BB-rated bonds returned 4.69%, B-rated bonds returned 0.77%, and CCC-rated bonds returned -2.92%.

The Payden High Income (PYHRX) returned 4.23% for the fiscal year ended October 31, 2020. The Fund’s benchmark, the ICE BofA BB-B US Cash Pay High Yield Constrained Index, returned 3.34% for the same period. Security selection in the Energy sector was the biggest contributor to relative outperformance as the portfolio’s bonds outperformed the benchmark’s energy bonds by 9.68%. Positioning in the Insurance sector was also beneficial thanks in part to security selection in the life insurance subsector. Positions in credit risk transfer securities detracted as mortgage forbearance increased following the March shutdowns. Positioning in the Banking sector also detracted due to exposure to consumer finance company, CIT, that underperformed during the period. The Fund uses credit default swaps to gain short term market exposure when cash inflows are heavy. These positions are nominally small exposures and track the market. The Fund also holds forward currency contracts to hedge foreign exchange exposure. Losses associated with forward euro contracts of -0.05% were offset by currency-driven outperformance by euro-denominated bonds.

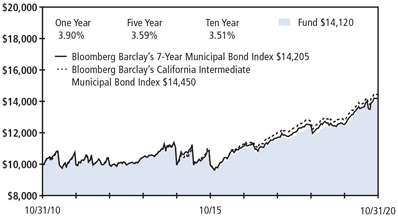

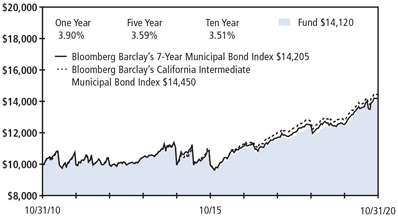

Municipal Strategy

For the fiscal year ended October 31, 2020, the Payden California Municipal Social Impact Fund (PYCRX) returned 3.90%. The Fund’s benchmarks, the Bloomberg Barclays California Intermediate Municipal Index and the Bloomberg Barclays 7-Year Municipal Bond Index, returned 4.11% and 4.17%, respectively, for the same period. The Fund’s underperformance relative to its benchmarks was due primarily to its allocations across the yield curve. While the Fund was positioned neutral to headline duration for most of the year, its under-allocation to intermediate maturities and over-allocation to long maturities was a detracting factor as short and intermediate-dated interest rates fell more than long-dated interest rates. The Fund invests in futures contracts for hedging and investment purposes. The use of interest rate futures impacted performance by -0.01%.

Municipal mutual funds continued to see significant inflows in late calendar-year 2019 until an abrupt reversal in March and April 2020 on Covid-19 concerns, when almost $50 billion was pulled from mutual funds. Since then, fund flows have recovered and are now positive year-to-date. This strong demand in late 2020 has created a tailwind for municipal performance.

Looking ahead, we expect to see continued strong demand for municipals. Municipal valuations, as measured by the ratio of municipal-to-U.S. Treasury yields, are at attractive levels relative to historical medians. As a result, the Fund has selectively reduced its allocation to California taxable municipal securities and increased its allocation to fully tax-exempt municipal securities. While the Fund maintains its higher quality bias and an overweight to revenue secured sectors, it has trimmed its underweight to general obligation bonds. This was done to increase relative credit stability amidst continued uncertainty around Covid-19 related revenue disruption.

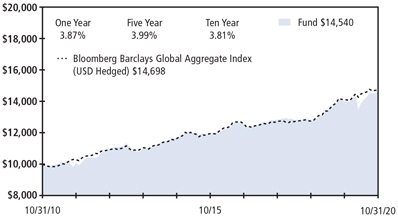

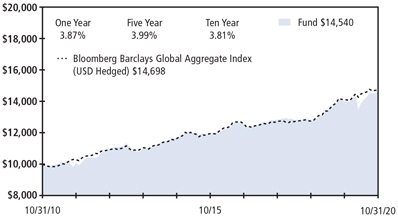

Global Bond Strategy

The Payden Global Fixed Income Fund (PYGFX) returned 3.87% for the fiscal year ended October 31, 2020 compared to a return of 4.32% for its benchmark, the Bloomberg Barclays Global Aggregate Index (USD Hedged). The Fund’s overweight positions in non-government bonds, including investment grade corporates, high yield corporates and securitized markets detracted from relative performance in the first quarter of 2020 given the economic impact of the coronavirus pandemic. As risk assets rallied in the second and third quarters of 2020, the portfolio continued to make up ground versus the benchmark. In terms of active duration management, relative country and curve trades were favoured, although overall, such trades detracted from portfolio performance. In the currency space, our weaker US dollar stance in the second and third quarter of 2020 aided performance. However, this positive contribution was offset by the negative contribution of an emerging market basket trade implemented before the pandemic. The Fund used derivatives for hedging and active investment purposes throughout the fiscal year. It utilizes interest rate swaps, bond and interest rate futures to manage overall duration and yield curve positioning. Currency forwards are traded to hedge foreign currency exposure and to take outright positions on specific currencies. The use of government bond futures and forward currency contracts for active management purposes detracted approximately 0.33% and 0.04% from the Fund’s return, respectively.

4 Payden Mutual Funds

Emerging Market Bond Strategies

For the fiscal year ended October 31, 2020, emerging markets (EM) fixed income performance was mixed, as the consequences of the novel coronavirus outbreak reverberated across all countries. Developing countries experienced sharp rates of economic contraction as a result of pandemic-associated mobility and business restrictions, predominantly in the first and second quarter of 2020, causing a sharp sell-off across EM securities. A rapid and historically large stimulus response by global central banks and fiscal authorities helped to bridge the shock, allowing EM assets to largely recover by the end of the fiscal year, posting modestly positive total returns in both sovereign and corporate debt. EM currencies broadly depreciated against the U.S. dollar, although country dispersion was pronounced. Currencies in Asia outperformed other regions, aided by China’s relative economic resilience. Similar to developed countries, EM central banks eased monetary policy extensively, bringing yields down and posting positive returns from interest rates. However, this positive performance was not enough to offset the negative performance of broad EM currency depreciation, resulting in negative total return for the period.

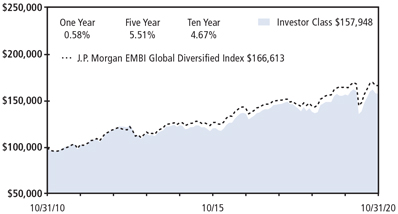

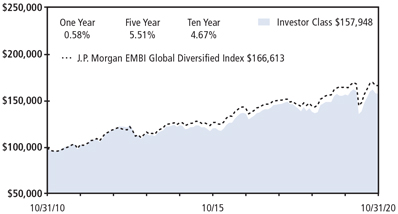

The Payden Emerging Markets Bond Fund, Investor Class (PYEMX) returned 0.58%, the Fund’s Adviser Class (PYEWX) returned 0.33%, and the Fund’s SI Class (PYEIX) returned 0.64% for the fiscal year ended October 31, 2020. The Fund’s benchmark, the J.P. Morgan EMBI Global Diversified Index, returned 0.98% for the same period. Within USD-pay sovereigns, underweight positioning in Lebanon and Ecuador added, as did overweight exposures in Guatemala, Nigeria, and the Dominican Republic. Against this, overweight exposures in Sri Lanka, Angola, and Ukraine detracted, as did underweight allocations to the Philippines, Peru and Saudi Arabia. Among quasi-sovereigns, overweight exposures in Malaysia and Indonesia contributed positively, while underweight positioning in China and Chile detracted. Off-benchmark allocations to corporates and local currency denominated debt benefitted relative performance. The Fund invests in swaps, futures, options and forward currency contracts for credit, currency and interest rate risk hedging and investment purposes. During the period, the use of derivative instruments contributed 0.81% to the Fund’s total return.

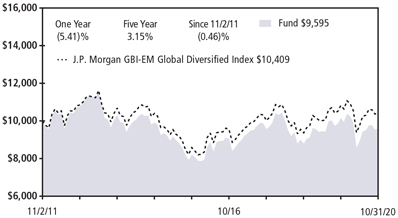

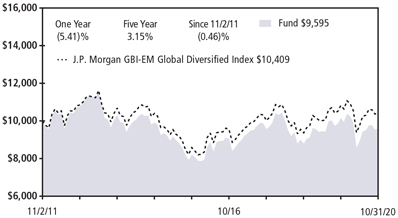

The Payden Emerging Markets Local Bond Investor Class (PYELX) returned -5.41% for the fiscal year ended October 31, 2020. The Fund’s benchmark, the J.P. Morgan GBI-EM Global Diversified Index returned -3.81% for the same period. Relative to the benchmark, the Fund benefitted from overweight rates positioning in Uruguay and security selection in both Romania and Brazil. Overweight rates positioning in Peru, underweight rates exposure in Thailand, and security selection in Mexico and South Africa detracted. Overall, currency positioning detracted during the period. Underweight positions in the Turkish lira, South African rand, and Thai baht added, as did overweight exposure in the Mexican peso. An overweight stance in the Brazilian real, Czech koruna, Colombian peso, Indonesian rupiah and Dominican Republic peso detracted. The Fund invests in swaps, futures, options and forward currency contracts for credit, currency and interest rate risk hedging, as well as investment purposes. During the period, the use of derivative instruments detracted -0.56% from the Fund’s total return.

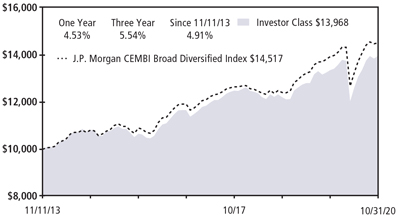

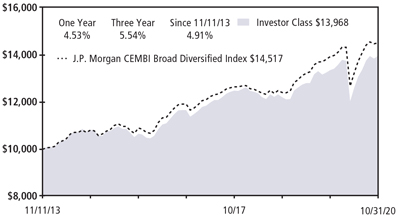

The Payden Emerging Market Corporate Bond Fund, Investor Class (PYCEX) returned 4.53%, and the Fund’s SI Class (PYCIX) returned 4.52% for the fiscal year ended October 31, 2020. The Fund’s benchmark, the J.P. Morgan CEMBI Broad Diversified Index, returned 4.24% for the period. The Fund’s selection of emerging market corporates was the primary contributor, while an off-index allocation to USD-pay sovereign bonds underperformed. Off-index positions in USD-pay quasi-sovereigns and developed market corporates also benefitted relative performance. Within emerging market corporates, overweight exposure to the consumer goods sector in Israel added, as did selection of financial credits in Mexico, utilities in India, telecommunications in South Africa and utilities in Saudi Arabia. Avoiding troubled oil and gas credits in Argentina, metals and mining in Ukraine and oil and gas in Ghana also benefitted relative performance. An overweight to industrials in Brazil, transports in Colombia, and transports in Chile detracted, as did underweight exposure to financials in South Korea. The Fund invests in swaps, futures, options and forward currency contracts for credit, currency and interest rate risk hedging and investment purposes. During the period, the use of derivative instruments contributed -0.12% to the Fund’s total return.

Equity Strategy

The broad U.S. equity market, as represented by the S&P 500 Index posted a positive return of 9.70% for the fiscal year ended October 31, 2020, despite extreme pandemic-driven volatility. The fiscal year started on a positive note driven by the low interest rate environment and progress in U.S.–China trade negotiations. The upward momentum continued into the first quarter of 2020, with equity markets reaching record highs, despite growing Covid-19 concerns. However, as the global pandemic became more of a reality in February, the market reacted by falling over 30% from peak to trough, reaching a bear market at the fastest rate in history and

Annual Report 5

| | |

Management Discussion & Analysis continued | | |

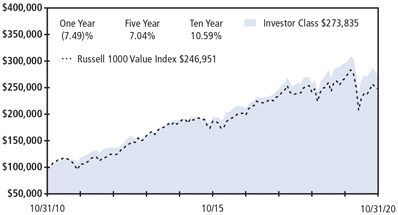

abruptly ending an 11-year equity bull market. The sell-off differed from past bear markets, with the more defensive value stocks, represented by the Russell 1000 Value index returning -7.58% and significantly underperforming the tech-dominated growth stocks, represented by the Russell 1000 Growth Index returning 29.22%, which benefited from the working-from-home environment. Following the selloff, the overall equity market rebounded sharply beginning in April due to an unprecedented amount of government stimulus and central bank intervention. The recovery continued in the following months as coronavirus cases slowed, the economy re-opened and the Federal Reserve Board’s pledge to keep interest rates near zero until 2023. Given the favorable backdrop, the S&P 500 index established new all-time-highs in mid-August and continued to reach new highs until a brief tech-led selloff in the first part of September. Volatility remained elevated throughout the final two months of the fiscal year over concerns of a second wave of Covid-19 and political uncertainty surrounding the U.S. presidential election.

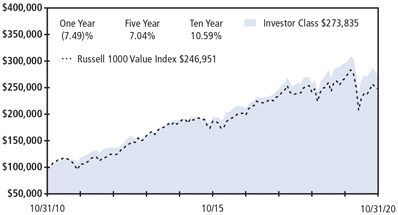

The Payden Equity Income Fund (PYVLX) which is comprised of large-cap value stocks, returned -7.49% for the fiscal year ended October 31, 2020, while the Fund’s Advisor Class (PYVAX) returned -7.66% and the Fund’s SI Class (PYVSX) returned -7.40%. The Fund’s benchmark, the Russell 1000 Value Index, returned -7.58% for the same time period. The Fund moderately outperformed its benchmark due to its strong security type and sector allocations. The Fund benefited from its overweight to real estate investment trusts and its underweight to the financial sector, which offset its overweight to master limited partnerships. Within individual stock selection, the strongest areas of stock selection were in the Technology and Consumer Staples sectors, while the weakest area was in the Health Care sector. Strong individual performers in the Fund were software giant Apple and food packaging company Conagra Brands.

6 Payden Mutual Funds

(THIS PAGE INTENTIONALLY LEFT BLANK)

7

| | |

Portfolio Highlights & Investments | | |

| | |

| Abbreviations | | |

| |

| AGM - Assured Guaranty Municipal Corporation | | G2 - Ginnie Mae II pool |

| AMT - Alternative Minimum Tax | | G2SF - Ginnie Mae |

| ARM - Adjustable Rate Mortgage | | GBP - British Pound |

| ARS - Argentine Peso | | GN - Ginnie Mae I pool |

| AUD - Australian Dollar | | GNR - Ginnie Mae REMICS |

| BAM - Build America Mutual | | HUF - Hungarian Forint |

| BRL - Brazilian Real | | IDR - Indonesian Rupiah |

| CAD - Canadian Dollar | | JPY - Japanese Yen |

| CDOR - Canadian Dollar offered rate | | KRW - South Korean Won |

| CHF - Swiss Franc | | KZT - Kazakhstani Tenge |

| CLO - Collateralized Loan Obligation | | LIBOR - London Interbank Offered Rate |

| CLP - Chilean Peso | | MXIBTILE - Mexican Interbank 28 day interest rate |

| CNH - Offshore China Renminbi | | MXN - Mexican Peso |

| CNY - China Renminbi | | MYR - Malaysian Ringgit |

| COP - Colombian Peso | | NCUA - National Credit Union Administration |

| CZK - Czech Koruna | | NOK - Norwegian Krone |

| DKK - Danish Krone | | PEN - Peruvian Sol |

| DOP - Dominican Peso | | PHP - Philippine Peso |

| EGP - Egyptian Pound | | PLN - Polish Zloty |

| EUR - Euro | | REMIC - Real Estate Mortgage Investment Conduit |

| EURIBOR - Euro Interbank Offered Rate | | RON - New Romanian Leu |

| FDIC - Federal Deposit Insurance Corporation | | RUB - Russian Ruble |

| FFCB - Federal Farm Credit Banks Funding Corporation | | SEK - Swedish Krona |

| FG - Freddie Mac Gold Pool | | SGD - Singapore Dollar |

| FH - Freddie Mac Non Gold Pool | | STACR - Structured Agency Credit Risk |

| FHLB - Federal Home Loan Banks | | TBA - To-Be-Announced |

| FHLMC - Federal Home Loan Mortgage Company (Freddie Mac) | | THB - Thai Baht |

| FHR - Freddie Mac REMICS | | TRY - Turkish Lira |

| FN - Fannie Mae Pool | | TWD - Taiwan Dollar |

| FNCL - Fannie Mae or Freddie Mac | | UAH - Ukrainian Hryvnia |

| FNMA - Federal National Mortgage Association (Fannie Mae) | | USD - US Dollar |

| FNR - Fannie Mae REMICS | | UYU - Uruguayan Peso |

| FR - Freddie Mac Pool | | ZAR - South African Rand |

8 Payden Mutual Funds

Payden Cash Reserves Money Market Fund

| | | | | | | | |

| | The Fund seeks stability, liquidity and current income by generally investing in the highest quality, short term securities with an average portfolio maturity not to exceed 90 days. | | |

Past performance does not predict future returns. The graph does not reflect the impact of taxes or transaction costs a shareholder would pay. |

| | Portfolio Composition - percent of investments | | | | |

| | U.S. Treasury | | | 42 | % |

| | Repurchase Agreement | | | 40 | % |

| | U.S. Government Agency | | | 13 | % |

| | U.S. Government Guaranteed | | | 3 | % |

| | Other | | | 2 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | This information is not part of the audited financial statements. | |

| | | | | | |

| Schedule of Investments - October 31, 2020 | |

Principal or Shares | | Security Description | | Value

(000) | |

U.S. Government Agency (13%) | | | | |

300,000 | | FFCB Funding Corp., (1 mo. LIBOR USD | | | | |

| | + 0.000%), 0.15%, 7/16/21 (a) | | $ | 300 | |

5,000,000 | | FFCB Funding Corp., (1 mo. LIBOR USD | | | | |

| | + 0.010%), 0.16%, 10/20/21 (a) | | | 5,000 | |

3,000,000 | | FFCB Funding Corp., (1 mo. LIBOR USD | | | | |

| | + 0.075%), 0.22%, 3/29/21 (a) | | | 3,001 | |

5,000,000 | | FHLB, (1 mo. LIBOR USD + 0.010%), | | | | |

| | 0.13%, 4/05/21 (a) | | | 5,001 | |

5,000,000 | | FHLB, (1 mo. LIBOR USD + 0.010%), | | | | |

| | 0.13%, 5/03/21 (a) | | | 5,002 | |

10,900,000 | | FHLB, (1 mo. LIBOR USD + 0.010%), | | | | |

| | 0.14%, 3/26/21 (a) | | | 10,900 | |

15,000,000 | | FHLB, (U.S. Secured Overnight Financing Rate | | | | |

| | + 0.100%), 0.20%, 12/23/20 (a) | | | 15,001 | |

| | | | | | |

Total U.S. Government Agency (Cost - $44,205) | | | 44,205 | |

| | | | | | |

NCUA Guaranteed (2%) | | | | |

2,969,393 | | NCUA Guaranteed Notes Trust 2010-R2, 2A, (1 | | | | |

| | mo. LIBOR USD + 0.470%), | | | | |

| | 0.61%, 11/05/20 (a) | | | 2,969 | |

4,233,774 | | NCUA Guaranteed Notes Trust 2011-C1, 2A, (1 | | | | |

| | mo. LIBOR USD + 0.530%), 0.67%, 3/09/21 (a) | | | 4,235 | |

| | | | | | |

Total NCUA Guaranteed (Cost - $7,204) | | | 7,204 | |

| | | | | | |

U.S. Treasury (41%) | | | | |

15,000,000 | | U.S. Cash Management Bill, 0.11%, 2/02/21 (b) | | | 14,996 | |

10,000,000 | | U.S. Cash Management Bill, 0.11%, 1/05/21 (b) | | | 9,998 | |

10,000,000 | | U.S. Treasury Bill, 0.09%, 11/05/20 (b) | | | 10,000 | |

16,000,000 | | U.S. Treasury Bill, 0.11%, 4/22/21 (b) | | | 15,992 | |

7,400,000 | | U.S. Treasury Bill, 0.11%, 4/08/21 (b) | | | 7,396 | |

5,000,000 | | U.S. Treasury Bill, 0.11%, 12/22/20 (b) | | | 4,999 | |

10,000,000 | | U.S. Treasury Bill, 0.12%, 2/04/21 (b) | | | 9,997 | |

20,000,000 | | U.S. Treasury Bill, 0.13%, 3/25/21 (b) | | | 19,991 | |

7,400,000 | | U.S. Treasury Bill, 0.13%, 10/07/21 (b) | | | 7,391 | |

6,500,000 | | U.S. Treasury Bill, 0.18%, 12/17/20 (b) | | | 6,498 | |

5,000,000 | | U.S. Treasury Note, (3 mo. U.S. Treasury Bill | | | | |

| | Yield + 0.055%), 0.15%, 7/31/22 (a)(b) | | | 5,001 | |

| | | | | | |

| | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

10,000,000 | | U.S. Treasury Note, (3 mo. U.S. Treasury Bill | | | | |

| | Yield + 0.115%), 0.21%, 1/31/21 (a)(b) | | $ | 10,000 | |

5,000,000 | | U.S. Treasury Note, (3 mo. U.S. Treasury Bill | | | | |

| | Yield + 0.139%), 0.23%, 4/30/21 (a)(b) | | | 5,001 | |

5,000,000 | | U.S. Treasury Note, (3 mo. U.S. Treasury Bill | | | | |

| | Yield + 0.154%), 0.25%, 1/31/22 (a)(b) | | | 5,008 | |

5,000,000 | | U.S. Treasury Note, 2.00%, 1/15/21 (b) | | | 5,005 | |

7,500,000 | | U.S. Treasury Note, 2.38%, 3/15/21 (b) | | | 7,548 | |

| | | | | | |

Total U.S. Treasury (Cost - $144,821) | | | 144,821 | |

| | | | | | |

Investment Company (2%) | | | | |

8,553,313 | | Dreyfus Treasury Obligations Cash Management Fund

(Cost - $8,553) | | | 8,553 | |

| | | | | | |

Repurchase Agreement (39%) | | | | |

47,000,000 | | Bank of Montreal Tri Party, 0.06% 11/02/20 (c) | | | 47,000 | |

30,000,000 | | CIBC World Markets Tri Party, | | | | |

| | 0.06% 11/04/20 (d) | | | 30,000 | |

30,000,000 | | Citigroup Tri Party, 0.06% 11/05/20 (e) | | | 30,000 | |

30,000,000 | | Goldman Sachs Tri Party, 0.06% 11/03/20 (f) | | | 30,000 | |

| | | | | | |

Total Repurchase Agreement (Cost - $137,000) | | | 137,000 | |

| | | | | | |

Total Investments (Cost - $341,783) (97%) | | | 341,783 | |

Other Assets, net of Liabilities (3%) | | | 9,814 | |

| | | | | | |

Net Assets (100%) | | $ | 351,597 | |

| (a) | Floating rate security. The rate shown reflects the rate in effect at October 31, 2020. |

| (b) | Yield to maturity at time of purchase. |

| (c) | The repurchase agreement dated 10/30/2020 is collateralized by the following securities: |

| | | | | | |

Bank of Montreal Tri Party | | | | |

44,438,247 | | FMAC, maturity dated Oct 50, yielding 3.50% | | $ | 47,940 | |

| | | | | | |

Annual Report 9

Payden Cash Reserves Money Market Fund continued

| (d) | The repurchase agreement dated 10/28/2020 is collateralized by the following securities: |

| | | | | | |

CIBC World Markets Tri Party | | | | |

29,186,200 | | U.S. Treasury Securities, maturity dated Sep 24, yielding 1.50% | | $ | 30,600 | |

| | | | | | |

| (e) | The repurchase agreement dated 10/29/2020 is collateralized by the following securities: |

| | | | | | |

Citigroup Tri Party | | | | |

27,478,600 | | U.S. Treasury Securities, maturity from Nov 29-Jul 30, yielding from 0.13%-1.75% | | $ | 30,600 | |

| | | | | | |

| (f) | The repurchase agreement dated 10/27/2020 is collateralized by the following securities: |

| | | | | | |

Goldman Sachs Tri Party | | | | |

29,618,557 | | FMAC, maturity dated Nov 50, yielding 2.00% | | $ | 30,600 | |

| | | | | | |

Offsetting Assets and Liabilities

The Fund’s investments in repurchase agreements were all subject to enforceable Master Repurchase Agreements. Repurchase Agreements on a gross basis were as follows:

| | | | |

| | | Value | |

Repurchase Agreements | | (000’s) | |

| |

| Total gross amount of repurchase agreements presented on the | | $ | 137,000 | |

Statements of Assets and Liabilities | | | | |

Non-cash Collateral | | | (77,000 | ) |

| | | | |

Net Amount | | $ | 60,000 | |

| | | | |

See notes to financial statements.

10 Payden Mutual Funds

Payden Limited Maturity Fund

| | | | |

The Fund seeks a total return greater than a money market fund along with the preservation of capital by generally investing in investment grade debt securities with a maximum average portfolio maturity not to exceed two years. | |

Past performance does not predict future returns. The graph does not reflect the impact of taxes or transaction costs a shareholder would pay. |

| Portfolio Composition - percent of investments |

|

Corporate | | 43% |

Asset Backed | | 33% |

U.S. Treasury | | 11% |

Mortgage Backed | | 10% |

Other | | 3% |

|

|

|

|

This information is not part of the audited financial statements. |

| | | | | | |

| Schedule of Investments - October 31, 2020 | |

Principal

or Shares | | Security Description | | Value

(000) | |

Asset Backed (33%) | | | | |

3,792,079 | | AEP Texas Restoration Funding LLC, | | | | |

| | 2.06%, 2/01/27 | | $ | 3,901 | |

3,637,017 | | Allegro CLO III Ltd. 144A, (3 mo. LIBOR USD | | | | |

| | + 0.840%), 1.05%, 7/25/27 (a)(b) | | | 3,610 | |

5,155,000 | | Ally Master Owner Trust, 2.70%, 1/17/23 | | | 5,180 | |

9,141,287 | | Americredit Automobile Receivables Trust | | | | |

| | 2018-3, 3.38%, 7/18/23 | | | 9,284 | |

5,614,434 | | AmeriCredit Automobile Receivables Trust | | | | |

| | 2020-1, 1.10%, 3/20/23 | | | 5,633 | |

2,420,000 | | AmeriCredit Automobile Receivables Trust | | | | |

| | 2020-2, 0.60%, 12/18/23 | | | 2,425 | |

6,960,000 | | AMSR 2020-SFR2 Trust 144A, | | | | |

| | 1.63%, 7/17/37 (b) | | | 7,046 | |

4,400,000 | | AMSR 2020-SFR5 Trust 144A, | | | | |

| | 1.38%, 11/17/37 (b) | | | 4,403 | |

1,000,000 | | Arbor Realty Commercial Real Estate Notes | | | | |

| | 2019-FL1 Ltd. 144A, (1 mo. LIBOR USD | | | | |

| | + 1.150%), 1.30%, 5/15/37 (a)(b) | | | 991 | |

1,910,441 | | Atrium XII 144A, (3 mo. LIBOR USD | | | | |

| | + 0.830%), 1.05%, 4/22/27 (a)(b) | | | 1,894 | |

2,240,000 | | Bank of The West Auto Trust 2019-1 144A, | | | | |

| | 2.43%, 4/15/24 (b) | | | 2,289 | |

1,800,000 | | Bank of The West Auto Trust 2019-1 144A, | | | | |

| | 2.51%, 10/15/24 (b) | | | 1,867 | |

5,132,886 | | Barings CLO Ltd. 2013-I 144A, (3 mo. LIBOR | | | | |

| | USD + 0.800%), 1.02%, 1/20/28 (a)(b) | | | 5,084 | |

1,610,000 | | BDS 2020-FL5 Ltd. 144A, (1 mo. LIBOR USD | | | | |

| | + 1.150%), 1.30%, 2/16/37 (a)(b) | | | 1,589 | |

1,316,442 | | BlueMountain CLO 2013-1 Ltd. 144A, (3 mo. | | | | |

| | LIBOR USD + 1.230%), 1.45%, 1/20/29 (a)(b) | | | 1,316 | |

1,856,132 | | BlueMountain CLO 2015-2 Ltd. 144A, (3 mo. | | | | |

| | LIBOR USD + 0.930%), 1.15%, 7/18/27 (a)(b) | | | 1,839 | |

2,850,182 | | BMW Canada Auto Trust 144A, 1.96%, 9/20/22 | | | | |

| | CAD (b)(c) | | | 2,157 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

731,039 | | BMW Canada Auto Trust 144A, | | | | |

| | 2.15%, 10/20/21 CAD (b)(c) | | $ | 550 | |

2,300,000 | | BMW Vehicle Owner Trust 2020-A, | | | | |

| | 0.39%, 2/27/23 | | | 2,302 | |

5,250,000 | | Bristol Park CLO Ltd. 144A, (3 mo. LIBOR USD | | | | |

| | + 0.990%), 1.23%, 4/15/29 (a)(b) | | | 5,191 | |

3,760,000 | | BSPRT 2018-FL4 Issuer Ltd. 144A, (1 mo. | | | | |

| | LIBOR USD + 1.300%), 1.45%, 9/15/35 (a)(b) | | | 3,682 | |

3,431,681 | | Canadian Pacer Auto Receivables Trust 2020-1 | | | | |

| | 144A, 1.77%, 11/21/22 (b) | | | 3,454 | |

2,820,000 | | CarMax Auto Owner Trust 2020-3, | | | | |

| | 0.49%, 6/15/23 | | | 2,824 | |

5,900,000 | | CarMax Auto Owner Trust 2020-4, | | | | |

| | 0.31%, 1/16/24 | | | 5,903 | |

5,700,000 | | CCG Receivables Trust 2020-1 144A, | | | | |

| | 0.54%, 12/14/27 (b) | | | 5,707 | |

2,340,737 | | Chesapeake Funding II LLC 144A, | | | | |

| | 0.87%, 8/16/32 (b) | | | 2,351 | |

3,000,000 | | CLNC 2019-FL1 Ltd. 144A, (1 mo. LIBOR USD | | | | |

| | + 1.250%), 1.40%, 8/20/35 (a)(b) | | | 2,951 | |

115,747 | | CNH Equipment Trust 2017-A, 2.07%, 5/16/22 | | | 116 | |

329,185 | | CNH Equipment Trust 2019-A, 2.96%, 5/16/22 | | | 330 | |

1,940,000 | | CNH Equipment Trust 2020-A, 1.08%, 7/17/23 | | | 1,949 | |

769,125 | | Commonbond Student Loan Trust 2017-A-GS | | | | |

| | 144A, (1 mo. LIBOR USD + 0.850%), | | | | |

| | 1.00%, 5/25/41 (a)(b) | | | 766 | |

666,420 | | Dell Equipment Finance Trust 2020-1 144A, | | | | |

| | 1.98%, 5/21/21 (b) | | | 668 | |

5,400,000 | | Dell Equipment Finance Trust 2020-2 144A, | | | | |

| | 0.47%, 10/24/22 (b) | | | 5,411 | |

1,287,471 | | Drive Auto Receivables Trust 2017-1, | | | | |

| | 3.84%, 3/15/23 | | | 1,306 | |

860,564 | | Drive Auto Receivables Trust 2020-1, | | | | |

| | 1.99%, 12/15/22 | | | 864 | |

Annual Report 11

Payden Limited Maturity Fund continued

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

4,101,024 | �� | Drive Auto Receivables Trust 2020-2, | | | | |

| | 0.85%, 7/17/23 | | $ | 4,108 | |

3,339,052 | | Enterprise Fleet Financing 2018-2 LLC 144A, | | | | |

| | 3.14%, 2/20/24 (b) | | | 3,370 | |

2,200,000 | | Enterprise Fleet Financing 2020-1 LLC 144A, | | | | |

| | 1.78%, 12/22/25 (b) | | | 2,234 | |

5,950,000 | | Enterprise Fleet Financing 2020-2 LLC 144A, | | | | |

| | 0.61%, 7/20/26 (b) | | | 5,953 | |

5,350,000 | | FirstKey Homes 2020-SFR2 Trust 144A, | | | | |

| | 1.27%, 10/19/37 (b) | | | 5,329 | |

270,290 | | Ford Auto Securitization Trust 144A, | | | | |

| | 2.10%, 9/15/21 CAD (b)(c) | | | 203 | |

7,250,000 | | Ford Auto Securitization Trust 2020-AA 144A, | | | | |

| | 0.52%, 8/15/22 CAD (b)(c) | | | 5,442 | |

3,550,000 | | Ford Auto Securitization Trust 2020-AA 144A, | | | | |

| | 0.89%, 8/15/24 CAD (b)(c) | | | 2,665 | |

1,679,269 | | Ford Credit Auto Lease Trust 2020-A, | | | | |

| | 1.80%, 7/15/22 | | | 1,690 | |

3,140,000 | | Ford Credit Auto Lease Trust 2020-B, | | | | |

| | 0.50%, 12/15/22 | | | 3,144 | |

1,015,640 | | Ford Credit Auto Owner Trust 2017-C, | | | | |

| | 2.01%, 3/15/22 | | | 1,018 | |

481,838 | | Ford Credit Auto Owner Trust 2019-A, | | | | |

| | 2.78%, 2/15/22 | | | 483 | |

6,480,000 | | Ford Credit Floorplan Master Owner Trust A | | | | |

| | 2020-1, 0.70%, 9/15/25 | | | 6,492 | |

1,462,668 | | Foursight Capital Automobile Receivables Trust | | | | |

| | 2020-1 144A, 1.97%, 9/15/23 (b) | | | 1,476 | |

2,930,735 | | Galaxy XXIX CLO Ltd. 144A, (3 mo. LIBOR | | | | |

| | USD + 0.790%), 1.07%, 11/15/26 (a)(b) | | | 2,909 | |

53,386 | | GM Financial Automobile Leasing Trust 2018-3, | | | | |

| | 3.18%, 6/21/21 | | | 53 | |

2,040,000 | | GM Financial Automobile Leasing Trust 2020-2, | | | | |

| | 0.80%, 7/20/23 | | | 2,054 | |

6,410,000 | | GM Financial Consumer Automobile Receivables | | | | |

| | Trust 2020-3, 0.35%, 7/17/23 | | | 6,414 | |

468,311 | | GreatAmerica Leasing Receivables Funding LLC | | | | |

| | Series 2019-1 144A, 2.97%, 6/15/21 (b) | | | 469 | |

359,532 | | GreatAmerica Leasing Receivables Funding LLC | | | | |

| | Series 2020-1 144A, 1.69%, 2/15/21 (b) | | | 360 | |

4,230,000 | | Greystone CRE Notes 2019-FL2 Ltd. 144A, (1 | | | | |

| | mo. LIBOR USD + 1.180%), | | | | |

| | 1.33%, 9/15/37 (a)(b) | | | 4,153 | |

9,000,000 | | Gulf Stream Meridian 2 Ltd. 144A, (3 mo. | | | | |

| | LIBOR USD + 1.400%), | | | | |

| | 0.00%, 10/15/29 (a)(b)(d) | | | 9,000 | |

3,090,000 | | Honda Auto Receivables 2020-2 Owner Trust, | | | | |

| | 0.74%, 11/15/22 | | | 3,099 | |

1,060,814 | | HPEFS Equipment Trust 2019-1 144A, | | | | |

| | 2.19%, 9/20/29 (b) | | | 1,068 | |

5,900,000 | | Hyundai Auto Lease Securitization Trust 2020-B | | | | |

| | 144A, 0.36%, 1/17/23 (b) | | | 5,906 | |

2,197,864 | | Invitation Homes 2018-SFR1 Trust 144A, (1 | | | | |

| | mo. LIBOR USD + 0.700%), | | | | |

| | 0.85%, 3/17/37 (a)(b) | | | 2,187 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

1,150,000 | | John Deere Owner Trust 2020-B, | | | | |

| | 0.41%, 3/15/23 | | $ | 1,151 | |

3,410,000 | | KREF 2018-FL1 Ltd. 144A, (1 mo. LIBOR USD | | | | |

| | + 1.100%), 1.25%, 6/15/36 (a)(b) | | | 3,399 | |

4,690,000 | | Kubota Credit Owner Trust 2020-2 144A, | | | | |

| | 0.41%, 6/15/23 (b) | | | 4,694 | |

5,575,000 | | LCM XX LP 144A, (3 mo. LIBOR USD | | | | |

| | + 1.040%), 1.26%, 10/20/27 (a)(b) | | | 5,536 | |

2,240,000 | | Madison Park Funding XIII Ltd. 144A, (3 mo. | | | | |

| | LIBOR USD + 0.950%), 1.17%, 4/19/30 (a)(b) | | | 2,220 | |

6,800,000 | | Magnetite VII Ltd. 144A, (3 mo. LIBOR USD | | | | |

| | + 0.800%), 1.04%, 1/15/28 (a)(b) | | | 6,717 | |

3,349,900 | | Marathon CRE 2018 FL1 Ltd. 144A, (1 mo. | | | | |

| | LIBOR USD + 1.150%), 1.30%, 6/15/28 (a)(b) | | | 3,323 | |

3,139,780 | | Mercedes-Benz Auto Lease Trust 2020-A, | | | | |

| | 1.82%, 3/15/22 | | | 3,153 | |

3,460,000 | | Mercedes-Benz Auto Lease Trust 2020-B, | | | | |

| | 0.31%, 2/15/23 | | | 3,461 | |

1,295,569 | | MMAF Equipment Finance LLC 2019-A 144A, | | | | |

| | 2.84%, 1/10/22 (b) | | | 1,302 | |

1,900,000 | | MMAF Equipment Finance LLC 2020-A 144A, | | | | |

| | 0.74%, 4/09/24 (b) | | | 1,907 | |

2,750,000 | | MMAF Equipment Finance LLC 2020-B 144A, | | | | |

| | 0.38%, 8/14/23 (b) | | | 2,751 | |

2,206,979 | | Navient Private Education Refi Loan Trust | | | | |

| | 2020-B 144A, 1.80%, 1/15/69 (b) | | | 2,217 | |

1,410,000 | | Navient Private Education Refi Loan Trust | | | | |

| | 2020-G 144A, 1.17%, 9/16/69 (b) | | | 1,413 | |

6,456,685 | | Navient Student Loan Trust 2019-7 144A, (1 | | | | |

| | mo. LIBOR USD + 0.500%), | | | | |

| | 0.65%, 1/25/68 (a)(b) | | | 6,431 | |

2,830,000 | | Navistar Financial Dealer Note Master Trust | | | | |

| | 144A, (1 mo. LIBOR USD + 0.950%), | | | | |

| | 1.10%, 7/25/25 (a)(b) | | | 2,851 | |

4,360,000 | | Nissan Auto Lease Trust 2019-B, | | | | |

| | 2.27%, 7/15/22 | | | 4,414 | |

7,729,024 | | Nissan Auto Lease Trust 2020-A, | | | | |

| | 1.80%, 5/16/22 | | | 7,780 | |

177,807 | | Nissan Auto Receivables 2019-A Owner Trust, | | | | |

| | 2.82%, 1/18/22 | | | 178 | |

5,420,000 | | Oaktree CLO 2020-1 Ltd. 144A, (3 mo. LIBOR | | | | |

| | USD + 2.000%), 2.34%, 7/15/29 (a)(b) | | | 5,445 | |

698,938 | | Octagon Investment Partners XXIII Ltd. 144A, | | | | |

| | (3 mo. LIBOR USD + 0.850%), | | | | |

| | 1.09%, 7/15/27 (a)(b) | | | 694 | |

4,765,806 | | Palmer Square Loan Funding 2020-1 Ltd. 144A, | | | | |

| | (3 mo. LIBOR USD + 0.800%), | | | | |

| | 1.05%, 2/20/28 (a)(b) | | | 4,721 | |

2,350,000 | | PFS Financing Corp. 144A, 0.97%, 2/15/26 (b) | | | 2,361 | |

571,841 | | Prestige Auto Receivables Trust 2019-1 144A, | | | | |

| | 2.44%, 7/15/22 (b) | | | 573 | |

3,050,000 | | Santander Consumer Auto Receivables Trust | | | | |

| | 2020-B 144A, 0.38%, 2/15/23 (b) | | | 3,051 | |

750,000 | | Santander Drive Auto Receivables Trust 2017-3, | | | | |

| | 3.20%, 11/15/23 | | | 766 | |

12 Payden Mutual Funds

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

4,702,768 | | Santander Drive Auto Receivables Trust 2019-2, | | | | |

| | 2.59%, 5/15/23 | | $ | 4,720 | |

3,920,000 | | Santander Drive Auto Receivables Trust 2020-2, | | | | |

| | 0.62%, 5/15/23 | | | 3,925 | |

6,260,000 | | Santander Drive Auto Receivables Trust 2020-3, | | | | |

| | 0.46%, 9/15/23 | | | 6,266 | |

2,831,361 | | Santander Retail Auto Lease Trust 2019-B 144A, | | | | |

| | 2.29%, 4/20/22 (b) | | | 2,855 | |

3,250,000 | | Santander Retail Auto Lease Trust 2020-B 144A, | | | | |

| | 0.42%, 11/20/23 (b) | | | 3,251 | |

2,621,777 | | SMB Private Education Loan Trust 2020-A | | | | |

| | 144A, (1 mo. LIBOR USD + 0.300%), | | | | |

| | 0.45%, 3/15/27 (a)(b) | | | 2,620 | |

802,352 | | SoFi Consumer Loan Program 2020-1 Trust | | | | |

| | 144A, 2.02%, 1/25/29 (b) | | | 811 | |

700,319 | | SoFi Professional Loan Program 2019-C LLC | | | | |

| | 144A, 2.13%, 11/16/48 (b) | | | 705 | |

1,348,561 | | SoFi Professional Loan Program 2020-A Trust | | | | |

| | 144A, 2.06%, 5/15/46 (b) | | | 1,362 | |

3,370,000 | | STWD 2019-FL1 Ltd. 144A, (1 mo. LIBOR | | | | |

| | USD + 1.080%), 1.23%, 7/15/38 (a)(b) | | | 3,333 | |

2,740,000 | | Synchrony Card Funding LLC, 2.34%, 6/15/25 | | | 2,829 | |

1,099,647 | | Towd Point Mortgage Trust 2017-5 144A, (1 | | | | |

| | mo. LIBOR USD + 0.600%), | | | | |

| | 0.75%, 2/25/57 (a)(b) | | | 1,098 | |

1,724,043 | | Toyota Auto Receivables 2019-B Owner Trust, | | | | |

| | 2.59%, 2/15/22 | | | 1,730 | |

2,680,000 | | Toyota Auto Receivables 2020-C Owner Trust, | | | | |

| | 0.36%, 2/15/23 | | | 2,683 | |

4,310,000 | | Trillium Credit Card Trust II 144A, (1 mo. | | | | |

| | LIBOR USD + 0.370%), 0.52%, 12/26/24 (a)(b) | | | 4,314 | |

4,040,000 | | TRTX 2019-FL3 Issuer Ltd. 144A, (1 mo. | | | | |

| | LIBOR USD + 1.450%), 1.60%, 10/15/34 (a)(b) | | | 3,976 | |

3,330,000 | | Tryon Park CLO Ltd. 144A, (3 mo. LIBOR USD | | | | |

| | + 0.890%), 1.13%, 4/15/29 (a)(b) | | | 3,305 | |

1,000,000 | | Venture XXIV CLO Ltd. 144A, (3 mo. LIBOR | | | | |

| | USD + 1.180%), 1.40%, 10/20/28 (a)(b) | | | 994 | |

10,770,000 | | Verizon Owner Trust 2020-B, 0.47%, 2/20/25 | | | 10,792 | |

11,850,000 | | Verizon Owner Trust 2020-C, 0.41%, 4/21/25 | | | 11,854 | |

528,344 | | Volvo Financial Equipment LLC Series 2019-1 | | | | |

| | 144A, 2.90%, 11/15/21 (b) | | | 529 | |

2,000,000 | | Volvo Financial Equipment LLC Series 2019-1 | | | | |

| | 144A, 3.00%, 3/15/23 (b) | | | 2,038 | |

3,422,607 | | Westlake Automobile Receivables Trust 2017-2 | | | | |

| | 144A, 3.28%, 12/15/22 (b) | | | 3,440 | |

754,739 | | Westlake Automobile Receivables Trust 2018-1 | | | | |

| | 144A, 3.41%, 5/15/23 (b) | | | 761 | |

692,672 | | Westlake Automobile Receivables Trust 2019-1 | | | | |

| | 144A, 3.06%, 5/16/22 (b) | | | 694 | |

6,090,000 | | Westlake Automobile Receivables Trust 2020-2 | | | | |

| | 144A, 0.93%, 2/15/24 (b) | | | 6,114 | |

12,000,000 | | Westlake Automobile Receivables Trust 2020-3 | | | | |

| | 144A, 0.56%, 5/15/24 (b) | | | 12,008 | |

2,180,000 | | Wheels SPV 2 LLC 144A, 0.51%, 8/20/29 (b) | | | 2,183 | |

4,379,514 | | Wheels SPV 2 LLC 144A, 2.30%, 5/22/28 (b) | | | 4,426 | |

38,878 | | World Omni Auto Receivables Trust 2019-A, | | | | |

| | 3.02%, 4/15/22 | | | 39 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

10,580,000 | | World Omni Auto Receivables Trust 2019-B, | | | | |

| | 2.59%, 7/15/24 | | $ | 10,796 | |

4,147,336 | | World Omni Auto Receivables Trust 2020-A, | | | | |

| | 1.02%, 6/15/23 | | | 4,164 | |

4,690,000 | | World Omni Auto Receivables Trust 2020-C, | | | | |

| | 0.35%, 12/15/23 | | | 4,694 | |

4,650,000 | | World Omni Automobile Lease Securitization | | | | |

| | Trust 2020-B, 0.32%, 9/15/23 | | | 4,651 | |

4,450,000 | | World Omni Select Auto Trust 2020-A, | | | | |

| | 0.47%, 6/17/24 | | | 4,455 | |

Total Asset Backed (Cost - $404,445) | | | 405,036 | |

Commercial Paper(d) (1%) | | | | |

10,000,000 | | BASF SE, 0.21%, 12/22/20 | | | 9,998 | |

1,750,000 | | Engie SA, 0.20%, 12/18/20 | | | 1,749 | |

Total Commercial Paper (Cost - $11,746) | | | 11,747 | |

Corporate Bond (44%) | | | | |

Financial (25%) | | | | |

3,660,000 | | AerCap Ireland Capital DAC/AerCap Global | | | | |

| | Aviation Trust, 3.95%, 2/01/22 | | | 3,723 | |

2,500,000 | | AIG Global Funding 144A, 1.90%, 10/06/21 (b) | | | 2,538 | |

870,000 | | AIG Global Funding 144A, 2.30%, 7/01/22 (b) | | | 899 | |

475,000 | | Air Lease Corp., 3.88%, 4/01/21 | | | 480 | |

2,400,000 | | Ally Financial Inc., 1.45%, 10/02/23 | | | 2,422 | |

3,000,000 | | Ameriprise Financial Inc., 3.00%, 3/22/22 | | | 3,110 | |

3,750,000 | | ANZ New Zealand Int’l Ltd. 144A, | | | | |

| | 2.88%, 1/25/22 (b) | | | 3,864 | |

383,000 | | Assurant Inc., (3 mo. LIBOR USD + 1.250%), | | | | |

| | 1.48%, 3/26/21 (a) | | | 383 | |

3,953,000 | | Athene Global Funding 144A, | | | | |

| | 4.00%, 1/25/22 (b) | | | 4,097 | |

3,330,000 | | Australia & New Zealand Banking Group Ltd. | | | | |

| | 144A, (3 mo. LIBOR USD + 0.320%), | | | | |

| | 0.56%, 11/09/20 (a)(b) | | | 3,330 | |

3,400,000 | | Banco Bilbao Vizcaya Argentaria SA, | | | | |

| | 0.88%, 9/18/23 | | | 3,399 | |

1,655,000 | | Banco Bradesco SA 144A, 2.85%, 1/27/23 (b) | | | 1,681 | |

1,665,000 | | Banco del Estado de Chile 144A, | | | | |

| | 2.67%, 1/08/21 (b) | | | 1,671 | |

6,265,000 | | Bank of America Corp., (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.740%), 0.81%, 10/24/24 (a) | | | 6,274 | |

2,127,000 | | Bank of America Corp., (3 mo. LIBOR USD | | | | |

| | + 0.790%), 1.04%, 3/05/24 (a) | | | 2,141 | |

1,530,000 | | Bank of Montreal, (3 mo. LIBOR USD | | | | |

| | + 0.790%), 1.04%, 8/27/21 (a) | | | 1,540 | |

5,340,000 | | Bank of Nova Scotia, (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.550%), 0.65%, 9/15/23 (a) | | | 5,355 | |

3,565,000 | | Barclays Bank PLC, (3 mo. LIBOR USD | | | | |

| | + 0.460%), 0.68%, 1/11/21 (a) | | | 3,567 | |

3,635,000 | | Barclays Bank PLC, 1.70%, 5/12/22 | | | 3,704 | |

4,000,000 | | BBVA USA, 3.50%, 6/11/21 | | | 4,065 | |

3,315,000 | | BNZ International Funding Ltd. 144A, | | | | |

| | 2.10%, 9/14/21 (b) | | | 3,368 | |

2,265,000 | | Canadian Imperial Bank of Commerce, (U.S. | | | | |

| | Secured Overnight Financing Rate + 0.800%), | | | | |

| | 0.89%, 3/17/23 (a) | | | 2,281 | |

2,065,000 | | Capital One Financial Corp., (3 mo. LIBOR USD | | | | |

| | + 0.950%), 1.19%, 3/09/22 (a) | | | 2,083 | |

Annual Report 13

Payden Limited Maturity Fund continued

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

5,000,000 | | Capital One Financial Corp., 3.05%, 3/09/22 | | $ | 5,165 | |

1,965,000 | | CIT Group Inc., 5.00%, 8/15/22 | | | 2,078 | |

12,070,000 | | Citigroup Inc., (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.686%), 0.78%, 10/30/24 (a) | | | 12,072 | |

2,240,000 | | Citigroup Inc., (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.867%), 2.31%, 11/04/22 (a) | | | 2,281 | |

4,300,000 | | Citigroup Inc., 2.90%, 12/08/21 | | | 4,410 | |

5,005,000 | | Credit Suisse AG, (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.450%), 0.55%, 2/04/22 (a) | | | 5,010 | |

3,010,000 | | Credit Suisse AG, 1.00%, 5/05/23 | | | 3,048 | |

2,765,000 | | Credit Suisse AG, 2.10%, 11/12/21 | | | 2,814 | |

1,135,000 | | Credit Suisse AG, 2.80%, 4/08/22 | | | 1,175 | |

750,000 | | Credit Suisse Group Funding Guernsey Ltd., | | | | |

| | 3.45%, 4/16/21 | | | 761 | |

3,080,000 | | Deutsche Bank AG, (3 mo. LIBOR USD | | | | |

| | + 0.815%), 1.03%, 1/22/21 (a) | | | 3,080 | |

4,310,000 | | Federation des Caisses Desjardins du Quebec | | | | |

| | 144A, 0.45%, 10/07/23 (b) | | | 4,306 | |

2,654,000 | | Goldman Sachs Group Inc., (3 mo. LIBOR USD | | | | |

| | + 0.750%), 1.01%, 2/23/23 (a) | | | 2,667 | |

1,325,000 | | Goldman Sachs Group Inc., (3 mo. LIBOR USD | | | | |

| | + 1.170%), 1.45%, 11/15/21 (a) | | | 1,326 | |

4,300,000 | | Goldman Sachs Group Inc., 5.75%, 1/24/22 | | | 4,578 | |

4,000,000 | | Huntington Bancshares Inc., 2.30%, 1/14/22 | | | 4,086 | |

770,000 | | Icahn Enterprises LP/Icahn Enterprises Finance | | | | |

| | Corp., 6.25%, 2/01/22 | | | 774 | |

1,895,000 | | Industrial & Commercial Bank of China Ltd., (3 | | | | |

| | mo. LIBOR USD + 0.750%), | | | | |

| | 0.99%, 11/08/20 (a) | | | 1,895 | |

5,000,000 | | ING Bank NV 144A, 2.63%, 12/05/22 (b) | | | 5,232 | |

965,000 | | Intercontinental Exchange Inc., 0.70%, 6/15/23 | | | 972 | |

2,050,000 | | Itau Unibanco Holding SA 144A, | | | | |

| | 2.90%, 1/24/23 (b) | | | 2,069 | |

3,710,000 | | Jackson National Life Global Funding 144A, | | | | |

| | (U.S. Secured Overnight Financing Rate | | | | |

| | + 0.600%), 0.70%, 1/06/23 (a)(b) | | | 3,719 | |

2,621,000 | | JPMorgan Chase & Co., (3 mo. LIBOR USD | | | | |

| | + 0.730%), 0.94%, 4/23/24 (a) | | | 2,636 | |

5,000,000 | | Lloyds Bank PLC, 2.13%, 7/24/22 (e) | | | 5,151 | |

3,700,000 | | Lloyds Banking Group PLC, (1 yr. US Treasury | | | | |

| | Yield Curve Rate T Note Constant Maturity | | | | |

| | + 1.100%), 1.33%, 6/15/23 (a) | | | 3,731 | |

3,290,000 | | Macquarie Group Ltd. 144A, (3 mo. LIBOR | | | | |

| | USD + 1.020%), 1.28%, 11/28/23 (a)(b) | | | 3,305 | |

5,120,000 | | Met Tower Global Funding 144A, | | | | |

| | 0.55%, 7/13/22 (b) | | | 5,144 | |

5,500,000 | | Metropolitan Life Global Funding I 144A, (U.S. | | | | |

| | Secured Overnight Financing Rate + 0.350%), | | | | |

| | 0.44%, 9/08/22 (a)(b) | | | 5,509 | |

2,320,000 | | Metropolitan Life Global Funding I 144A, | | | | |

| | 0.90%, 6/08/23 (b) | | | 2,346 | |

955,000 | | Mitsubishi UFJ Financial Group Inc., (3 mo. | | | | |

| | LIBOR USD + 0.700%), 0.95%, 3/07/22 (a) | | | 961 | |

4,000,000 | | Mitsubishi UFJ Financial Group Inc., | | | | |

| | 3.54%, 7/26/21 | | | 4,097 | |

5,500,000 | | Mitsubishi UFJ Financial Group Inc., | | | | |

| | 3.76%, 7/26/23 | | | 5,960 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

3,960,000 | | Mizuho Financial Group Inc., (3 mo. LIBOR | | | | |

| | USD + 0.610%), 0.86%, 9/08/24 (a) | | $ | 3,961 | |

6,700,000 | | Mizuho Financial Group Inc., (3 mo. LIBOR | | | | |

| | USD + 0.940%), 1.20%, 2/28/22 (a)(f) | | | 6,768 | |

3,910,000 | | Morgan Stanley, (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.700%), 0.80%, 1/20/23 (a) | | | 3,924 | |

1,785,000 | | Morgan Stanley, (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.745%), 0.86%, 10/21/25 (a) | | | 1,784 | |

2,000,000 | | Morgan Stanley, (3 mo. LIBOR USD + 1.400%), | | | | |

| | 1.61%, 10/24/23 (a) | | | 2,035 | |

4,000,000 | | Morgan Stanley, 2.63%, 11/17/21 | | | 4,096 | |

5,000,000 | | National Australia Bank Ltd. 144A, (3 mo. | | | | |

| | LIBOR USD + 0.410%), 0.66%, 12/13/22 (a)(b) | | | 5,021 | |

2,785,000 | | National Bank of Canada, (1 yr. US Treasury | | | | |

| | Yield Curve Rate T Note Constant Maturity | | | | |

| | + 0.770%), 0.90%, 8/15/23 (a) | | | 2,803 | |

3,145,000 | | Natwest Group PLC, (3 mo. LIBOR USD | | | | |

| | + 1.470%), 1.75%, 5/15/23 (a) | | | 3,166 | |

5,025,000 | | New York Life Global Funding 144A, (3 mo. | | | | |

| | LIBOR USD + 0.280%), 0.50%, 1/10/23 (a)(b) | | | 5,024 | |

985,000 | | Nordea Bank Abp 144A, 1.00%, 6/09/23 (b) | | | 999 | |

1,580,000 | | Owl Rock Capital Corp., 4.25%, 1/15/26 | | | 1,598 | |

1,700,000 | | PayPal Holdings Inc., 2.20%, 9/26/22 | | | 1,758 | |

3,780,000 | | PNC Bank NA, (3 mo. LIBOR USD + 0.325%), | | | | |

| | 0.58%, 2/24/23 (a) | | | 3,789 | |

4,080,000 | | PNC Bank NA, (3 mo. LIBOR USD + 0.430%), | | | | |

| | 0.67%, 12/09/22 (a) | | | 4,094 | |

2,805,000 | | PNC Bank NA, 1.74%, 2/24/23 (g) | | | 2,854 | |

1,105,000 | | Protective Life Global Funding 144A, | | | | |

| | 1.08%, 6/09/23 (b) | | | 1,120 | |

4,515,000 | | Reliance Standard Life Global Funding II 144A, | | | | |

| | 2.63%, 7/22/22 (b) | | | 4,644 | |

4,140,000 | | Royal Bank of Canada, 0.50%, 10/26/23 | | | 4,138 | |

2,000,000 | | Royal Bank of Canada 144A, | | | | |

| | 1.90%, 9/23/22 (b)(f) | | | 2,058 | |

2,300,000 | | Santander Holdings USA Inc., 3.70%, 3/28/22 | | | 2,384 | |

3,350,000 | | Santander UK PLC, (3 mo. LIBOR USD | | | | |

| | + 0.300%), 0.55%, 11/03/20 (a) | | | 3,350 | |

1,000,000 | | Santander UK PLC 144A, 1.63%, 2/12/23 (b) | | | 1,027 | |

2,325,000 | | Santander UK PLC, 2.10%, 1/13/23 | | | 2,401 | |

2,350,000 | | Simon Property Group LP, 2.75%, 6/01/23 | | | 2,459 | |

4,240,000 | | Skandinaviska Enskilda Banken AB 144A, | | | | |

| | 0.55%, 9/01/23 (b) | | | 4,241 | |

2,500,000 | | SL Green Operating Partnership LP, (3 mo. | | | | |

| | LIBOR USD + 0.980%), 1.26%, 8/16/21 (a) | | | 2,481 | |

241,000 | | SLM Corp., 5.13%, 4/05/22 | | | 248 | |

690,000 | | Starwood Property Trust Inc., 3.63%, 2/01/21 | | | 690 | |

690,000 | | State Street Corp. 144A, (U.S. Secured Overnight | | | | |

| | Financing Rate + 2.690%), | | | | |

| | 2.83%, 3/30/23 (a)(b) | | | 714 | |

2,330,000 | | Sumitomo Mitsui Trust Bank Ltd. 144A, | | | | |

| | 0.80%, 9/12/23 (b) | | | 2,340 | |

1,940,000 | | Synchrony Financial, 2.85%, 7/25/22 | | | 2,002 | |

2,064,000 | | Synchrony Financial, 3.75%, 8/15/21 | | | 2,102 | |

910,000 | | Synovus Bank, (U.S. Secured Overnight | | | | |

| | Financing Rate + 0.945%), 2.29%, 2/10/23 (a) | | | 922 | |

14 Payden Mutual Funds

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

2,015,000 | | Toronto-Dominion Bank, (U.S. Secured | | | | |

| | Overnight Financing Rate + 0.450%), | | | | |

| | 0.54%, 9/28/23 (a) | | $ | 2,019 | |

1,575,000 | | Truist Bank, (U.S. Secured Overnight Financing Rate + 0.730%), 0.82%, 3/09/23 (a) | | | 1,588 | |

2,000,000 | | Truist Financial Corp., 3.05%, 6/20/22 | | | 2,083 | |

2,110,000 | | UBS AG 144A, (3 mo. LIBOR USD + 0.480%), 0.73%, 12/01/20 (a)(b) | | | 2,110 | |

2,725,000 | | UBS AG 144A, 1.75%, 4/21/22 (b) | | | 2,774 | |

5,000,000 | | UniCredit Bank AG, 1.88%, 7/05/22 (e) | | | 5,120 | |

5,375,000 | | Wells Fargo & Co., (3 mo. LIBOR USD | | | | |

| | + 0.930%), 1.14%, 2/11/22 (a) | | | 5,386 | |

3,750,000 | | Wells Fargo Bank NA, (3 mo. LIBOR USD | | | | |

| | + 0.510%), 0.73%, 10/22/21 (a) | | | 3,765 | |

4,000,000 | | Wells Fargo Bank NA, 3.63%, 10/22/21 | | | 4,118 | |

3,370,000 | | Westpac Banking Corp., (3 mo. LIBOR USD | | | | |

| | + 0.390%), 0.61%, 1/13/23 (a)(f) | | | 3,388 | |

2,565,000 | | Westpac Banking Corp., 2.80%, 1/11/22 | | | 2,643 | |

| | | | | 306,322 | |

Industrial (14%) | | | | |

1,810,000 | | AbbVie Inc. 144A, (3 mo. LIBOR USD | | | | |

| | + 0.460%), 0.73%, 11/19/21 (a)(b) | | | 1,814 | |

3,735,000 | | AbbVie Inc. 144A, 2.15%, 11/19/21 (b) | | | 3,803 | |

1,000,000 | | AbbVie Inc., 2.30%, 5/14/21 | | | 1,009 | |

3,340,000 | | American Honda Finance Corp., | | | | |

| | 0.40%, 10/21/22 | | | 3,341 | |

5,340,000 | | American Honda Finance Corp., 0.88%, 7/07/23 | | | 5,386 | |

1,065,000 | | Aviation Capital Group LLC 144A, (3 mo. LIBOR USD + 0.670%), 0.88%, 7/30/21 (a)(b) | | | 1,042 | |

3,620,000 | | Aviation Capital Group LLC 144A, (3 mo. LIBOR USD + 0.950%), 1.20%, 6/01/21 (a)(b) | | | 3,568 | |

1,750,000 | | BMW U.S. Capital LLC 144A, (3 mo. LIBOR | | | | |

| | USD + 0.500%), 0.75%, 8/13/21 (a)(b) | | | 1,754 | |

1,430,000 | | Caterpillar Financial Services Corp., (3 mo. | | | | |

| | LIBOR USD + 0.220%), 0.45%, 1/06/22 (a) | | | 1,432 | |

4,635,000 | | Caterpillar Financial Services Corp., (3 mo. | | | | |

| | LIBOR USD + 0.735%), 0.99%, 5/13/22 (a) | | | 4,685 | |

2,435,000 | | Cigna Corp., (3 mo. LIBOR USD + 0.650%), | | | | |

| | 0.90%, 9/17/21 (a) | | | 2,435 | |

1,255,000 | | CNH Industrial Capital LLC, 1.95%, 7/02/23 | | | 1,277 | |

2,880,000 | | Daimler Finance North America LLC 144A, (3 mo. LIBOR USD + 0.880%), 1.14%, 2/22/22 (a)(b) | | | 2,897 | |

4,500,000 | | Daimler Finance North America LLC 144A, | | | | |

| | 2.20%, 10/30/21 (b) | | | 4,575 | |

5,501,000 | | Daimler Finance North America LLC 144A, | | | | |

| | 3.35%, 2/22/23 (b) | | | 5,806 | |

132,000 | | Dell International LLC/EMC Corp. 144A, | | | | |

| | 5.88%, 6/15/21 (b) | | | 132 | |

2,430,000 | | Delta Air Lines Inc., 2.60%, 12/04/20 | | | 2,429 | |

3,745,000 | | Evernorth Health Inc., (3 mo. LIBOR USD | | | | |

| | + 0.750%), 1.01%, 11/30/20 (a) | | | 3,746 | |

1,150,000 | | Fidelity National Information Services Inc., (3 mo. EURIBOR + 0.400%), 0.04%, 5/21/21 EUR (a)(c)(d) | | | 1,340 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value

(000) | |

| | |

890,000 | | Ford Motor Credit Co. LLC, (3 mo. LIBOR USD + 1.270%), 1.50%, 3/28/22 (a) | | $ | 859 | |

1,460,000 | | Ford Motor Credit Co. LLC, 3.09%, 1/09/23 | | | 1,448 | |

1,340,000 | | Ford Motor Credit Co. LLC, 5.13%, 6/16/25 | | | 1,398 | |

5,000,000 | | Fox Corp., 3.67%, 1/25/22 | | | 5,200 | |

1,700,000 | | General Motors Financial Co. Inc., (3 mo. LIBOR USD + 0.540%), 0.79%, 11/06/20 (a) | | | 1,700 | |

2,014,000 | | General Motors Financial Co. Inc., (3 mo. LIBOR USD + 1.310%), 1.53%, 6/30/22 (a) | | | 2,017 | |

1,275,000 | | General Motors Financial Co. Inc., (3 mo. LIBOR USD + 1.550%), 1.78%, 1/14/22 (a) | | | 1,281 | |

5,500,000 | | General Motors Financial Co. Inc., | | | | |

| | 4.20%, 11/06/21 | | | 5,668 | |

1,025,000 | | Gilead Sciences Inc., (3 mo. LIBOR USD | | | | |

| | + 0.520%), 0.74%, 9/29/23 (a) | | | 1,027 | |

3,020,000 | | Gilead Sciences Inc., 0.75%, 9/29/23 | | | 3,028 | |

3,180,000 | | GlaxoSmithKline Capital PLC, 0.53%, 10/01/23 | | | 3,179 | |

1,860,000 | | Hewlett Packard Enterprise Co., (3 mo. LIBOR USD + 0.720%), 0.95%, 10/05/21 (a) | | | 1,860 | |

5,605,000 | | Honeywell International Inc., 0.48%, 8/19/22 | | | 5,614 | |

1,155,000 | | Honeywell International Inc., (3 mo. LIBOR | | | | |

| | USD + 0.230%), 0.50%, 8/19/22 (a) | | | 1,157 | |

2,805,000 | | Hyundai Capital America 144A, | | | | |

| | 1.25%, 9/18/23 (b) | | | 2,814 | |

1,020,000 | | Infor Inc. 144A, 1.45%, 7/15/23 (b) | | | 1,035 | |

2,235,000 | | John Deere Capital Corp., 0.55%, 7/05/22 (f) | | | 2,246 | |

840,000 | | Lennar Corp., 4.13%, 1/15/22 | | | 862 | |

6,015,000 | | LYB International Finance III LLC, (3 mo. | | | | |

| | LIBOR USD + 1.000%), 1.23%, 10/01/23 (a) | | | 6,019 | |

1,010,000 | | Marriott International Inc., (3 mo. LIBOR USD + 0.650%), 0.90%, 3/08/21 (a) | | | 1,008 | |

3,000,000 | | McDonald’s Corp., (3 mo. LIBOR USD | | | | |

| | + 0.430%), 0.65%, 10/28/21 (a) | | | 3,011 | |

5,100,000 | | Mondelez International Inc., 0.63%, 7/01/22 | | | 5,120 | |

3,500,000 | | Nissan Motor Acceptance Corp. 144A, (3 mo. LIBOR USD + 0.520%), 0.77%, 3/15/21 (a)(b) | | | 3,488 | |

975,000 | | Nutrition & Biosciences Inc. 144A, | | | | |

| | 0.70%, 9/15/22 (b) | | | 978 | |

4,025,000 | | Otis Worldwide Corp., (3 mo. LIBOR USD | | | | |

| | + 0.450%), 0.68%, 4/05/23 (a) | | | 4,026 | |

1,505,000 | | PACCAR Financial Corp., 0.80%, 6/08/23 | | | 1,518 | |

3,400,000 | | Penske Truck Leasing Co. LP/PTL Finance Corp. 144A, 3.38%, 2/01/22 (b) | | | 3,505 | |

1,105,000 | | Roper Technologies Inc., 0.45%, 8/15/22 | | | 1,107 | |

2,910,000 | | Royalty Pharma PLC 144A, 0.75%, 9/02/23 (b) | | | 2,911 | |

1,270,000 | | Ryder System Inc., 2.80%, 3/01/22 | | | 1,306 | |

1,039,000 | | Ryder System Inc., 2.88%, 6/01/22 | | | 1,075 | |

960,000 | | Smithfield Foods Inc. 144A, 2.65%, 10/03/21 (b) | | | 965 | |

1,885,000 | | Southwest Airlines Co., 4.75%, 5/04/23 | | | 2,020 | |

3,500,000 | | Spirit AeroSystems Inc., (3 mo. LIBOR USD | | | | |

| | + 0.800%), 1.05%, 6/15/21 (a) | | | 3,362 | |

205,000 | | Sprint Spectrum Co. LLC/Sprint Spectrum Co. II LLC/Sprint Spectrum Co. III LLC 144A, 3.36%, 9/20/21 (b) | | | 207 | |

450,000 | | Starbucks Corp., 1.30%, 5/07/22 | | | 457 | |

Annual Report 15

Payden Limited Maturity Fund continued

| | | | | | |

Principal

or Shares | | Security Description | | Value (000) | |

| | |

1,700,000 | | Takeda Pharmaceutical Co. Ltd. 144A, (3 mo. | | | | |

| | EURIBOR + 0.550%), 0.06%, 11/21/20 | | | | |

| | EUR (a)(b)(c) | | $ | 1,980 | |

465,000 | | Toll Brothers Finance Corp., 4.38%, 4/15/23 | | | 488 | |

4,290,000 | | Toyota Motor Credit Corp., 0.50%, 8/14/23 | | | 4,318 | |

6,280,000 | | Upjohn Inc. 144A, 1.13%, 6/22/22 (b) | | | 6,339 | |

995,000 | | Volkswagen Group of America Finance LLC | | | | |

| | 144A, 2.50%, 9/24/21 (b) | | | 1,013 | |

4,425,000 | | Volkswagen Group of America Finance LLC | | | | |

| | 144A, 2.90%, 5/13/22 (b) | | | 4,570 | |

5,500,000 | | Volkswagen Group of America Finance LLC | | | | |

| | 144A, 3.13%, 5/12/23 (b) | | | 5,818 | |

2,065,000 | | Volkswagen Group of America Finance LLC | | | | |

| | 144A, 3.88%, 11/13/20 (b) | | | 2,067 | |

3,500,000 | | Vulcan Materials Co., (3 mo. LIBOR USD | | | | |

| | + 0.650%), 0.90%, 3/01/21 (a) | | | 3,498 | |

| | | | | 167,038 | |

Utility (5%) | | | | |

4,044,000 | | CenterPoint Energy Inc., 3.60%, 11/01/21 | | | 4,171 | |

2,675,000 | | Chevron Corp., (3 mo. LIBOR USD + 0.900%), 1.11%, 5/11/23 (a) | | | 2,726 | |

4,025,000 | | Chevron USA Inc., (3 mo. LIBOR USD | | | | |

| | + 0.110%), 0.32%, 8/12/22 (a) | | | 4,026 | |

4,115,000 | | Chevron USA Inc., (3 mo. LIBOR USD | | | | |

| | + 0.200%), 0.41%, 8/11/23 (a) | | | 4,122 | |

2,065,000 | | Dominion Energy Inc., (3 mo. LIBOR USD | | | | |

| | + 0.530%), 0.78%, 9/15/23 (a) | | | 2,071 | |

6,180,000 | | DTE Energy Co., 0.55%, 11/01/22 | | | 6,206 | |

2,670,000 | | Duke Energy Progress LLC, (3 mo. LIBOR USD + 0.180%), 0.43%, 2/18/22 (a) | | | 2,671 | |

3,000,000 | | Evergy Inc., 4.85%, 6/01/21 | | | 3,044 | |

5,355,000 | | Florida Power & Light Co., (3 mo. LIBOR USD + 0.380%), 0.60%, 7/28/23 (a) | | | 5,358 | |

1,390,000 | | Gray Oak Pipeline LLC 144A, | | | | |

| | 2.00%, 9/15/23 (b) | | | 1,395 | |

1,325,000 | | Kinder Morgan Inc., (3 mo. LIBOR USD | | | | |

| | + 1.280%), 1.52%, 1/15/23 (a) | | | 1,332 | |

408,000 | | Occidental Petroleum Corp., 2.60%, 8/13/21 | | | 400 | |

425,000 | | Occidental Petroleum Corp., 2.70%, 8/15/22 | | | 394 | |

3,580,000 | | Pacific Gas and Electric Co., 1.75%, 6/16/22 | | | 3,581 | |

1,035,000 | | Phillips 66, (3 mo. LIBOR USD + 0.600%), | | | | |

| | 0.83%, 2/26/21 (a) | | | 1,035 | |

3,990,000 | | Sempra Energy, (3 mo. LIBOR USD + 0.450%), 0.70%, 3/15/21 (a) | | | 3,995 | |

1,737,000 | | Sunoco Logistics Partners Operations LP, | | | | |

| | 4.40%, 4/01/21 | | | 1,758 | |

5,445,000 | | Valero Energy Corp., (3 mo. LIBOR USD | | | | |

| | + 1.150%), 1.40%, 9/15/23 (a) | | | 5,444 | |

4,597,000 | | Williams Cos. Inc., 4.00%, 11/15/21 | | | 4,713 | |

| | | | | 58,442 | |

Total Corporate Bond (Cost - $528,277) | | | 531,802 | |

Foreign Government (1%) | | | | |

8,100,000 | | Instituto de Credito Oficial 144A, (3 mo. LIBOR USD + 0.150%), 0.40%, 12/15/21 (a)(b) | | | 8,100 | |

| | | | | | |

Principal

or Shares | | Security Description | | Value (000) | |

| | |

3,070,000 | | Kommuninvest I Sverige AB 144A, | | | | |

| | 0.25%, 12/01/22 (b) | | $ | 3,069 | |

371,000 | | Senegal Government International Bond 144A, | | | | |

| | 8.75%, 5/13/21 (b) | | | 384 | |

Total Foreign Government (Cost - $11,546) | | | 11,553 | |

Mortgage Backed (10%) | | | | |

1,330,136 | | AREIT 2018-CRE2 Trust 144A, (1 mo. LIBOR | | | | |

| | USD + 0.980%), 1.13%, 11/14/35 (a)(b) | | | 1,328 | |

2,866,879 | | BX Commercial Mortgage Trust 2019-XL 144A, (1 mo. LIBOR USD + 0.920%), 1.07%, 10/15/36 (a)(b) | | | 2,872 | |

1,009,076 | | BX Commercial Mortgage Trust 2020-BXLP | | | | |

| | 144A, (1 mo. LIBOR USD + 1.600%), | | | | |

| | 1.75%, 12/15/36 (a)(b) | | | 977 | |

1,829,648 | | BXMT 2017-FL1 Ltd. 144A, (1 mo. LIBOR | | | | |

| | USD + 0.870%), 1.02%, 6/15/35 (a)(b) | | | 1,828 | |

5,850,000 | | BXMT 2020-FL2 Ltd. 144A, (1 mo. LIBOR | | | | |

| | USD + 0.900%), 1.05%, 2/16/37 (a)(b) | | | 5,779 | |