Exhibit 99.1

1 Joseph A. Mollica, Ph.D., Chairman of the Board, Interim President & CEO, Pharmacopeia John L. Higgins, President & CEO

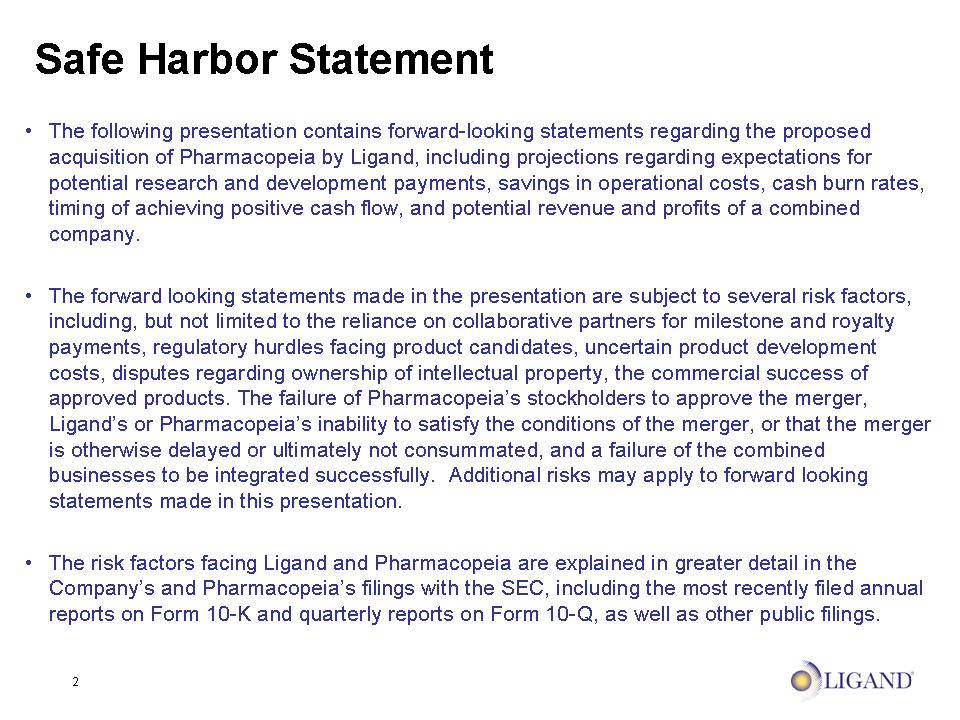

2 Safe Harbor Statement The following presentation contains forward-looking statements regarding the proposed acquisition of Pharmacopeia by Ligand, including projections regarding expectations for potential research and development payments, savings in operational costs, cash burn rates, timing of achieving positive cash flow, and potential revenue and profits of a combined company. The forward looking statements made in the presentation are subject to several risk factors, including, but not limited to the reliance on collaborative partners for milestone and royalty payments, regulatory hurdles facing product candidates, uncertain product development costs, disputes regarding ownership of intellectual property, the commercial success of approved products. The failure of Pharmacopeia’s stockholders to approve the merger, Ligand’s or Pharmacopeia’s inability to satisfy the conditions of the merger, or that the merger is otherwise delayed or ultimately not consummated, and a failure of the combined businesses to be integrated successfully. Additional risks may apply to forward looking statements made in this presentation. The risk factors facing Ligand and Pharmacopeia are explained in greater detail in the Company’s and Pharmacopeia’s filings with the SEC, including the most recently filed annual reports on Form 10-K and quarterly reports on Form 10-Q, as well as other public filings.

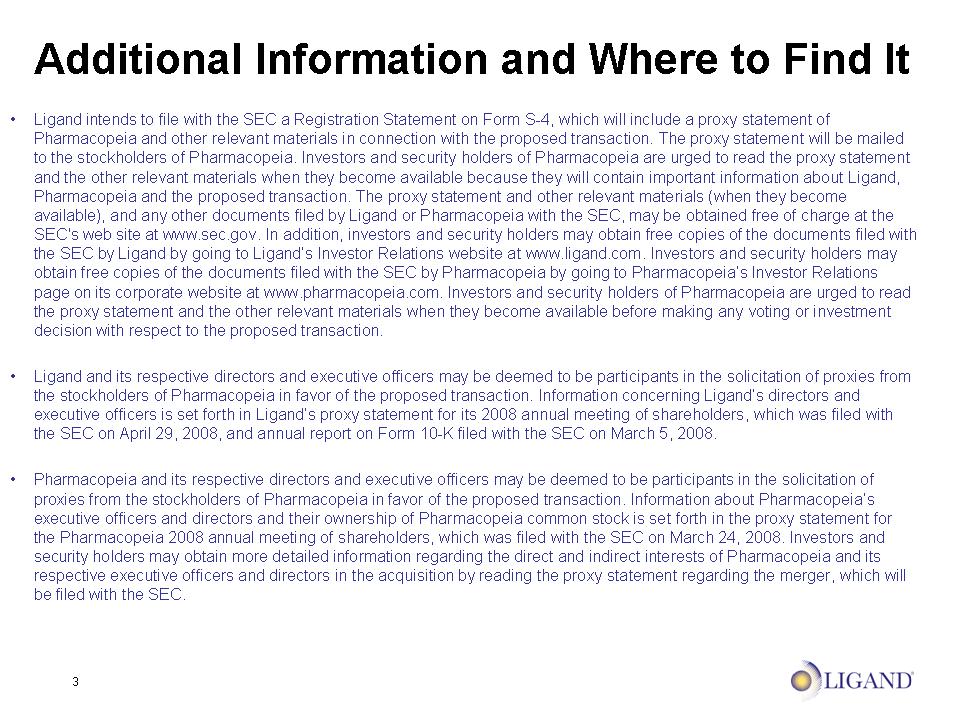

3 Additional Information and Where to Find It Ligand intends to file with the SEC a Registration Statement on Form S-4, which will include a proxy statement of Pharmacopeia and other relevant materials in connection with the proposed transaction. The proxy statement will be mailed to the stockholders of Pharmacopeia. Investors and security holders of Pharmacopeia are urged to read the proxy statement and the other relevant materials when they become available because they will contain important information about Ligand, Pharmacopeia and the proposed transaction. The proxy statement and other relevant materials (when they become available), and any other documents filed by Ligand or Pharmacopeia with the SEC, may be obtained free of charge at the SEC's web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Ligand by going to Ligand’s Investor Relations website at www.ligand.com. Investors and security holders may obtain free copies of the documents filed with the SEC by Pharmacopeia by going to Pharmacopeia’s Investor Relations page on its corporate website at www.pharmacopeia.com. Investors and security holders of Pharmacopeia are urged to read the proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction. Ligand and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Pharmacopeia in favor of the proposed transaction. Information concerning Ligand’s directors and executive officers is set forth in Ligand’s proxy statement for its 2008 annual meeting of shareholders, which was filed with the SEC on April 29, 2008, and annual report on Form 10-K filed with the SEC on March 5, 2008. Pharmacopeia and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Pharmacopeia in favor of the proposed transaction. Information about Pharmacopeia’s executive officers and directors and their ownership of Pharmacopeia common stock is set forth in the proxy statement for the Pharmacopeia 2008 annual meeting of shareholders, which was filed with the SEC on March 24, 2008. Investors and security holders may obtain more detailed information regarding the direct and indirect interests of Pharmacopeia and its respective executive officers and directors in the acquisition by reading the proxy statement regarding the merger, which will be filed with the SEC.

4 Agenda Proposed Transaction Vision for Combined Companies Opportunities and Benefits to Shareholders Milestone and Events Calendar Projected Process to Close Transaction

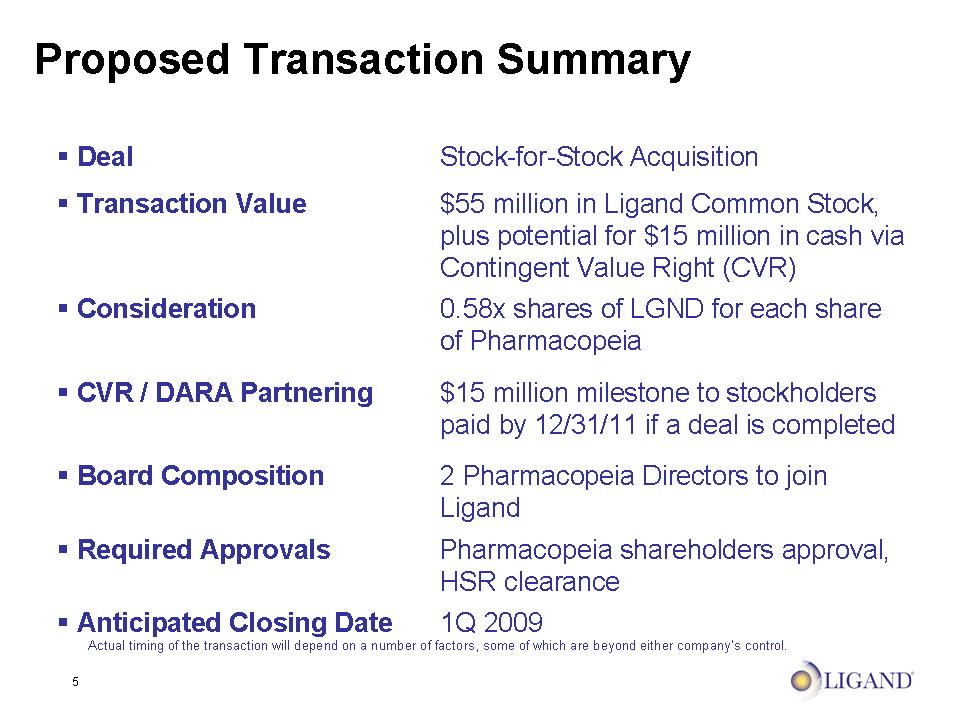

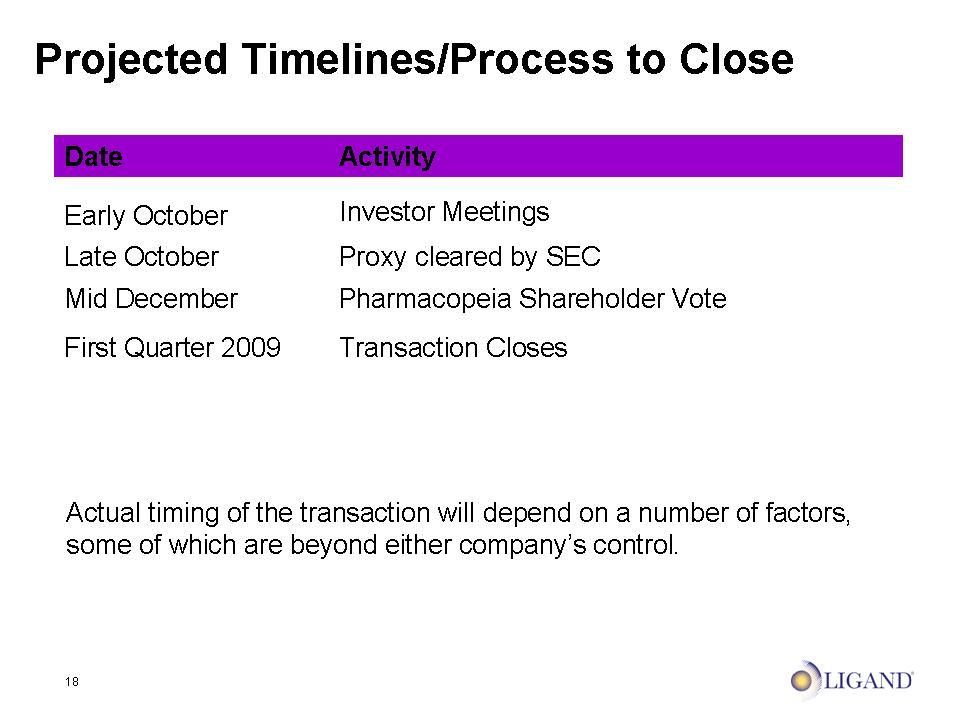

5 Proposed Transaction Summary Deal Stock-for-Stock Acquisition Transaction Value $55 million in Ligand Common Stock, plus potential for $15 million in cash via Contingent Value Right (CVR) Consideration 0.58x shares of LGND for each share of Pharmacopeia CVR / DARA Partnering $15 million milestone to stockholders paid by 12/31/11 if a deal is completed Board Composition 2 Pharmacopeia Directors to join Ligand Required Approvals Pharmacopeia shareholders approval, HSR clearance Anticipated Closing Date 1Q 2009 Actual timing of the transaction will depend on a number of factors, some of which are beyond either company’s control.

6 Fundamentals of a Strong Biotech Company Strong balance sheet Spending discipline Strong discovery capabilities and track record Robust pipeline of partnerable assets Revenue diversity Operating structure that has the potential to generate substantial cash flows and profitability

7 Vision for the Combined Companies Consolidated operations with strong fundamentals Strong balance sheet Cost-efficient R&D business with spending discipline Robust product pipeline Diverse royalty partnerships with promising potential revenue and profits Leverage highly successful drug discovery capabilities of both companies Focus on early stage drug discovery and development Partner pipeline assets at earliest value inflection point Leadership focused on shareholders, market credibility and solid foundation Strong Board of directors with two Pharmacopeia Directors added to Ligand Board Experienced management – scientific, restructuring and business development expertise

Commitment to driving shareholder value and to transparency on the business with goal to drive strong cash flow and earnings

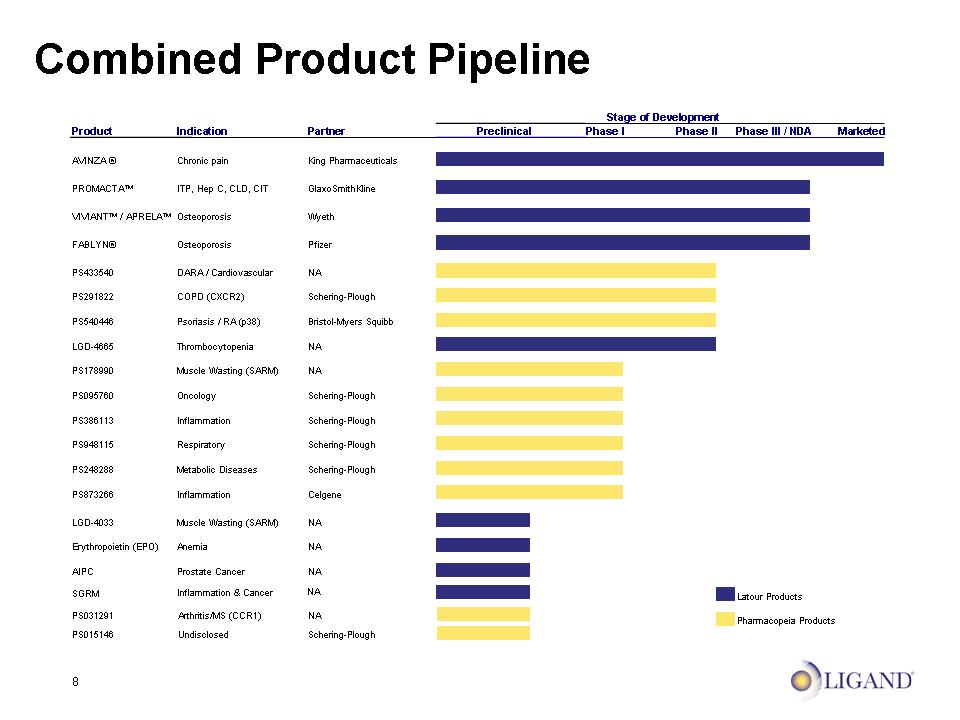

8 Combined Product Pipeline Stage of Development Product Indication Partner Preclinical Phase I Phase II Phase III / NDA Marketed AVINZA ® Chronic pain King Pharmaceuticals PROMACTA™ ITP, Hep C, CLD, CIT GlaxoSmithKline VIVIANT™ / APRELA™ Osteoporosis Wyeth FABLYN® Osteoporosis Pfizer PS433540 DARA / Cardiovascular NA PS291822 COPD (CXCR2) Schering-Plough PS540446 Psoriasis / RA (p38) Bristol-Myers Squibb LGD-4665 Thrombocytopenia NA PS178990 Muscle Wasting (SARM) NA PS095760 Oncology Schering-Plough PS386113 Inflammation Schering-Plough PS948115 Respiratory Schering-Plough PS248288 Metabolic Diseases Schering-Plough PS873266 Inflammation Celgene LGD-4033 Muscle Wasting (SARM) NA Erythropoietin (EPO) Anemia NA AIPC Prostate Cancer NA PS031291 Arthritis/MS (CCR1) NA Latour Products PS015146 Undisclosed Schering-Plough Pharmacopeia Products SGRM Inflammation & Cancer NA

9 Opportunities and Benefits to Shareholders Pro Forma company: ~113 million shares outstanding Ligand shareholders owning 84% of the combined company Pharmacopeia shareholders owning 16% of the company Ligand shareholders gain access to: Numerous royalty partnerships Pipeline assets Drug discovery assets Cash and NOLs Pharmacopeia shareholders will participate in: Lucrative potential near-term royalties Well capitalized company with no anticipated financing needs Expanded product pipeline Financial liquidity

10 Pro Forma Financial Forecast Projected to have more than $90 million in cash at time of closing including transaction/restructuring costs and Ligand indemnity fund Given our current outlook on the combined businesses, 2009 pro forma operating cash burn rate is expected to be $20 million Potential for additional revenue and cash infusion from new license agreements More than $350 million in potential Net Operating Loss carry-forwards before any limitations Robustly capitalized company that has sufficient cash to make it to profitability without additional financings

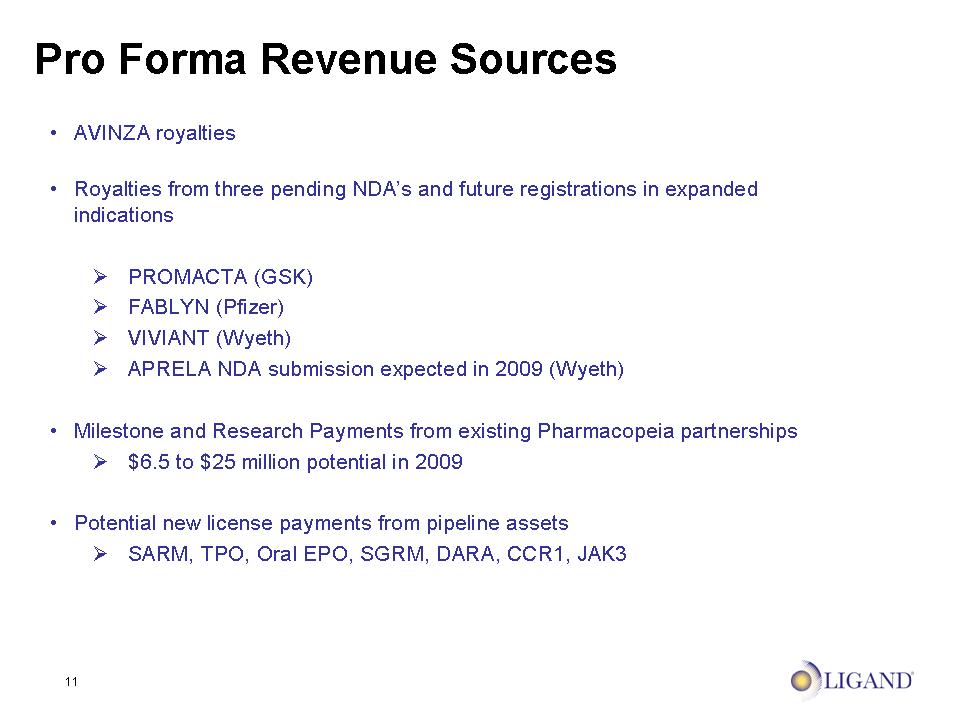

11 Pro Forma Revenue Sources AVINZA royalties Royalties from three pending NDA’s and future registrations in expanded indications PROMACTA (GSK) FABLYN (Pfizer) VIVIANT (Wyeth) APRELA NDA submission expected in 2009 (Wyeth) Milestone and Research Payments from existing Pharmacopeia partnerships $6.5 to $25 million potential in 2009 Potential new license payments from pipeline assets SARM, TPO, Oral EPO, SGRM, DARA, CCR1, JAK3

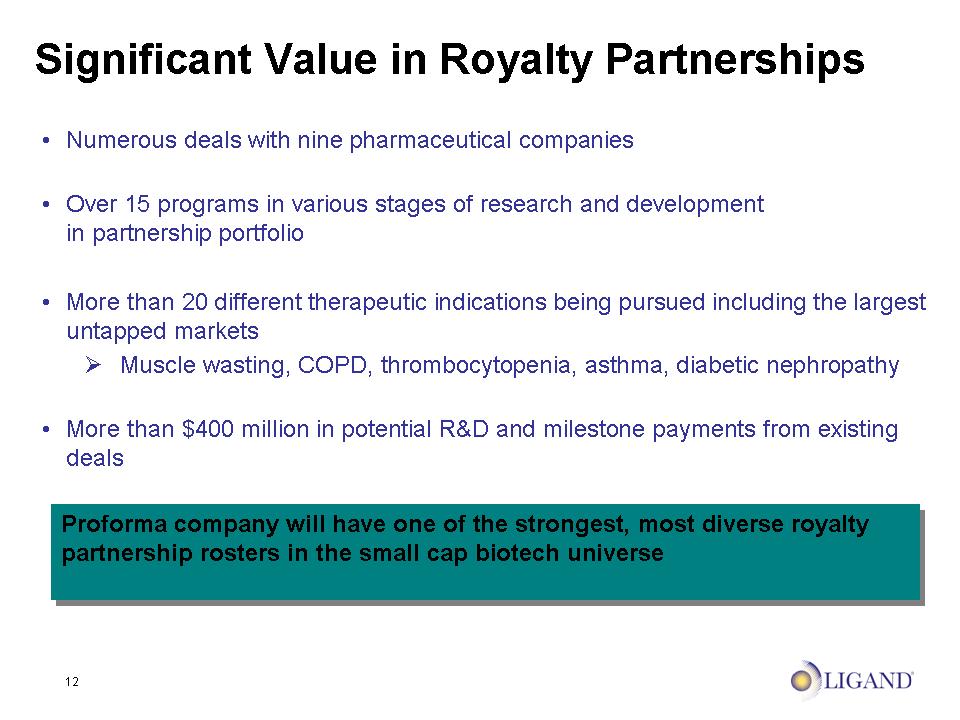

12 Significant Value in Royalty Partnerships Numerous deals with nine pharmaceutical companies Over 15 programs in various stages of research and development in partnership portfolio More than 20 different therapeutic indications being pursued including the largest untapped markets Muscle wasting, COPD, thrombocytopenia, asthma, diabetic nephropathy More than $400 million in potential R&D and milestone payments from existing deals Proforma company will have one of the strongest, most diverse royalty partnership rosters in the small cap biotech universe

13 Pharmaceutical Partnerships

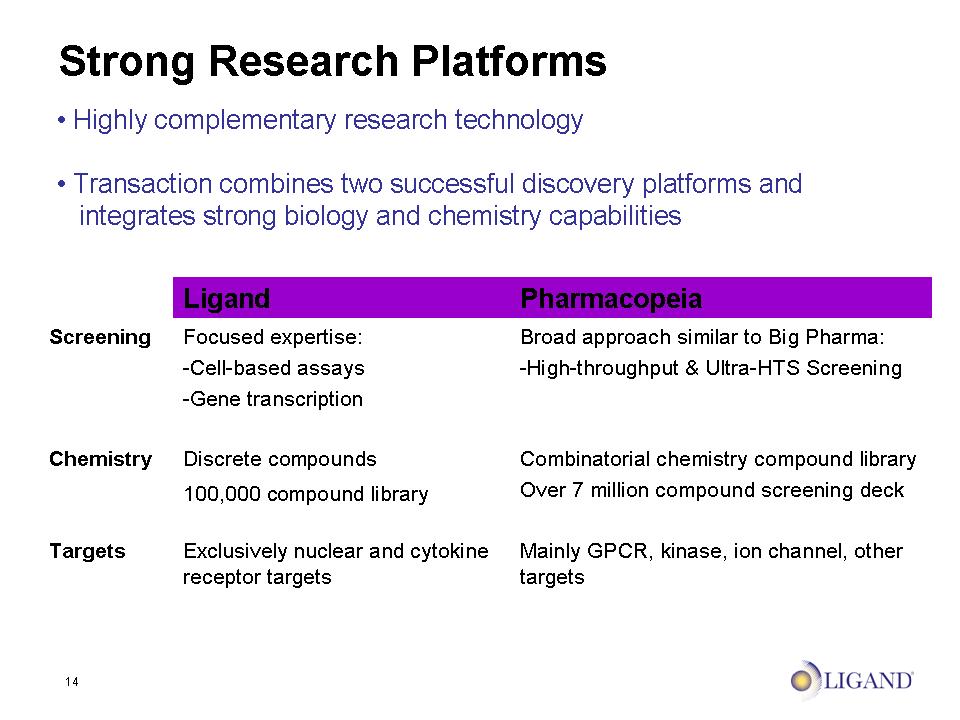

14 Strong Research Platforms Highly complementary research technology Transaction combines two successful discovery platforms and integrates strong biology and chemistry capabilities

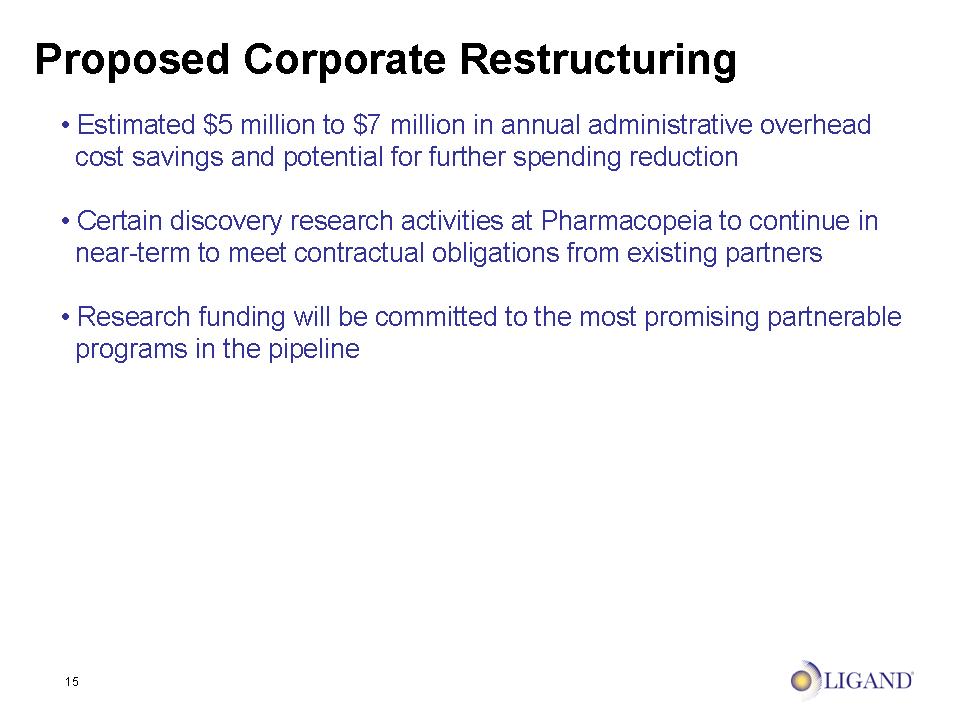

15 Proposed Corporate Restructuring Estimated $5 million to $7 million in annual administrative overhead cost savings and potential for further spending reduction Certain discovery research activities at Pharmacopeia to continue in near-term to meet contractual obligations from existing partners Research funding will be committed to the most promising partnerable programs in the pipeline

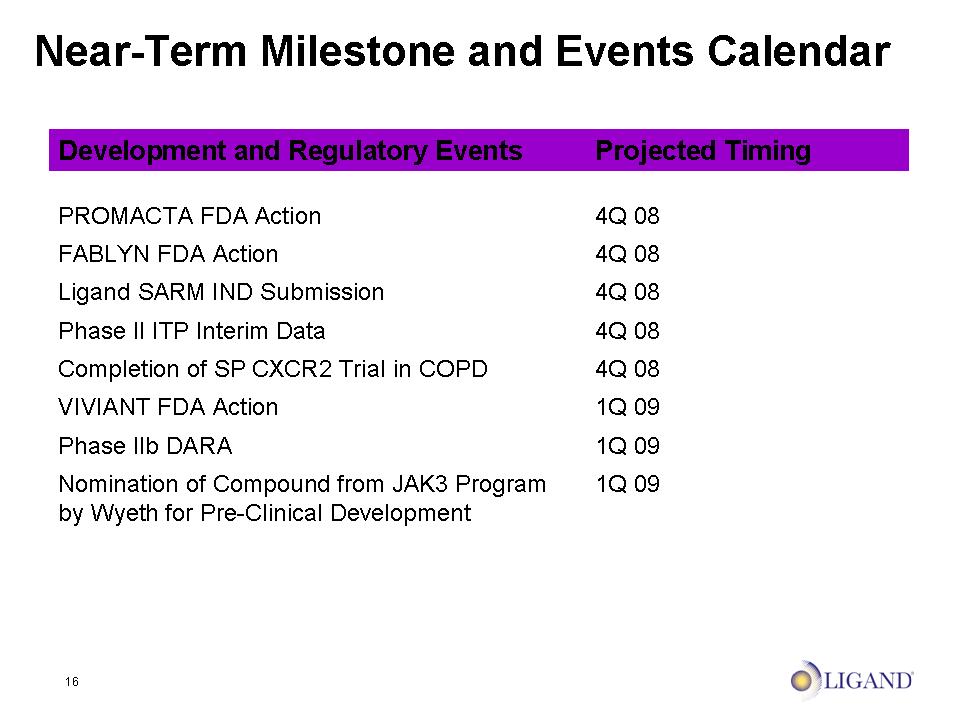

16 Near-Term Milestone and Events Calendar

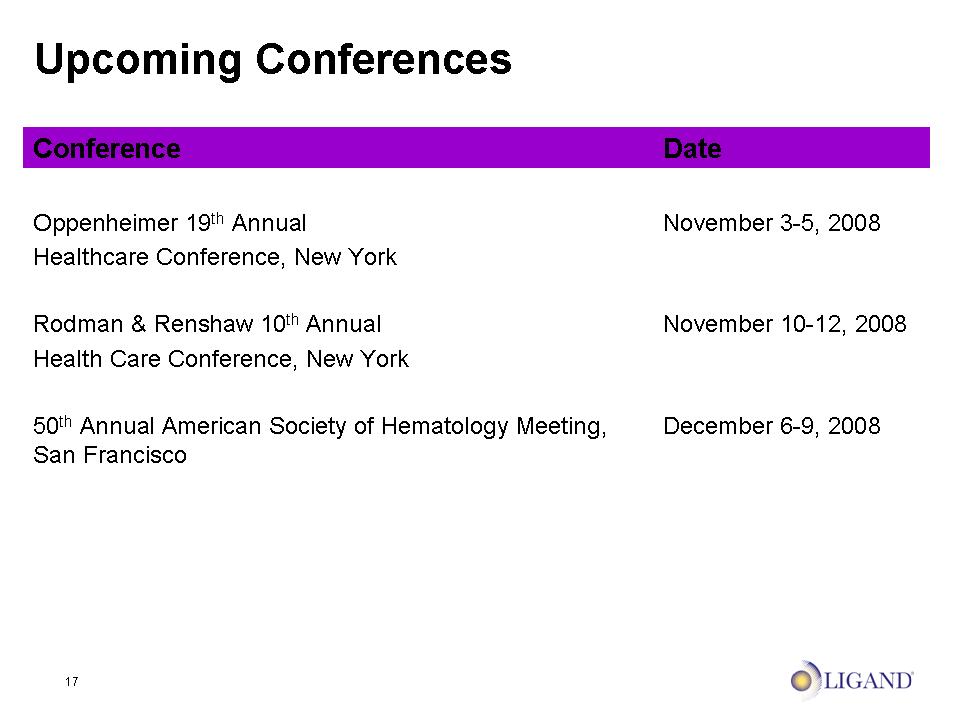

17 Upcoming Conferences

18 Projected Timelines/Process to Close Actual timing of the transaction will depend on a number of factors, some of which are beyond either company’s control.