Exhibit 99.2 ANCHORED SPIN-OFF INVESTOR PRESENTATION March 2022

2 LEGAL DISCLAIMERS About this Presentation This presentation is for informational purposes only to assist interested parties in making their own evaluation with respect to a proposed business combination (the Business Combination) between Avista Public Acquisition Corp. II (APAC) and OmniAb, Inc. (OmniAb), a wholly owned subsidiary of Ligand Pharmaceuticals Incorporated (Ligand), and related transactions, and for no other purpose. The information contained herein does not purport to be all inclusive and no representation or warranty, express or implied, is or will be given by APAC, OmniAb or Ligand or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy, completeness or reliability of the information contained in this presentation. Forward-Looking Statements This presentation contains forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. All statements other than statements of historical facts contained in this presentation, including statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, the tax consequences of the proposed transaction, the amount of gross proceeds expected to be available to OmniAb after the closing and giving effect to any redemptions by APAC shareholders, OmniAb’s future results of operations and financial position, business strategy and its expectations regarding the application of, and the rate and degree of market acceptance of, the OmniAb technology platform and other technologies, OmniAb’s expectations regarding the addressable markets for our technologies, including the growth rate of the markets in which it operates, the potential for and timing of receipt of milestones and royalties under OmniAb’s license agreements with partners, are forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Ligand, OmniAb and APAC, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include, but are not limited to: the risk that the transactions may not be completed in a timely manner or at all, which may adversely affect the price of Ligand’s or APAC’s securities; the risk that APAC shareholder approval of the proposed transactions is not obtained; the inability to recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, the amount of funds available in APAC’s trust account following any redemptions by APAC’s shareholders; the failure to receive certain governmental and regulatory approvals; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; changes in general economic conditions, including as a result of the COVID-19 pandemic or the conflict between Russia and Ukraine; the outcome of litigation related to or arising out of the proposed transactions, or any adverse developments therein or delays or costs resulting therefrom; the effect of the announcement or pendency of the transactions on Ligand’s, OmniAb’s or APAC’s business relationships, operating results, and businesses generally; the ability to continue to meet Nasdaq’s listing standards following the consummation of the proposed transactions; costs related to the proposed transactions; that the price of APAC’s or Ligand’s securities may be volatile due to a variety of factors, including Ligand’s, APAC’s or OmniAb’s inability to implement their business plans or meet or exceed their financial projections and changes in the combined capital structure; the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transactions, and identify and realize additional opportunities; and the ability of OmniAb to implement its strategic initiatives. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of APAC’s registration statement on Form S-1 (File No. 333-257177), the registration statement on Form S-4, the registration statement on Form 10, the proxy/information statement/prospectus and certain other documents filed or that may be filed by APAC, Ligand or OmniAb from time to time with the SEC following the date hereof. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Ligand, OmniAb and APAC assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Ligand, OmniAb, or APAC gives any assurance that Ligand, OmniAb or APAC will achieve their expectations. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Market and Industry Data This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about the antibody industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of OmniAb’s future performance and the future performance of the markets in which OmniAb operates are necessarily subject to a high degree of uncertainty and risk.

3 LEGAL DISCLAIMERS Important Information and Where to Find It In connection with the proposed transaction, OmniAb will file a registration statement on Form 10 registering shares of OmniAb common stock and APAC will file with the SEC a registration statement on Form S-4 registering shares of APAC common stock, warrants and certain equity awards. The Form S-4 to be filed by APAC will include a proxy statement/prospectus in connection with the APAC shareholder vote required in connection with the proposed transaction. The Form 10 to be filed by OmniAb will include the Form S-4 registration statement filed by APAC which will serve as an information statement/prospectus in connection with the spin-off of OmniAb. This communication does not contain all the information that should be considered concerning the Business Combination. This communication is not a substitute for the registration statements that OmniAb and APAC will file with the SEC or any other documents that APAC or OmniAb may file with the SEC or that APAC, Ligand or OmniAb may send to stockholders in connection with the Business Combination. It is not intended to form the basis of any investment decision or any other decision in respect to the Business Combination. APAC's shareholders and Ligand’s stockholders and other interested persons are advised to read, when available, the preliminary and definitive registration statements, and documents incorporated by reference therein, as these materials will contain important information about APAC, OmniAb and the Business Combination. The proxy statement/prospectus contained in APAC’s registration statement will be mailed to APAC's shareholders as of a record date to be established for voting on the Business Combination. The registration statements, proxy statement/prospectus and other documents (when they are available) will also be available free of charge, at the SEC's website at www.sec.gov, or by directing a request to: Avista Healthcare Public Acquisition Corp. II, 65 East 55th Street, 18th Floor, New York, NY 10022. Participants in the Solicitation APAC, Ligand and OmniAb and each of their respective directors, executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies from APAC’s shareholders in connection with the Business Combination. Shareholders are urged to carefully read the proxy statement/prospectus regarding the Business Combination when it becomes available, because it will contain important information. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of APAC’s shareholders in connection with the Business Combination will be set forth in the registration statement when it is filed with the SEC. Information about APAC's executive officers and directors and OmniAb's management and directors also will be set forth in the registration statement relating to the Business Combination when it becomes available. No Solicitation or Offer This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed Business Combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to any registration or qualification under the securities laws of any such jurisdictions. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. Trademarks This presentation contains trademarks, service marks, and trade names of Ligand, OmniAb, APAC and other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that APAC, Ligand or OmniAb will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights.

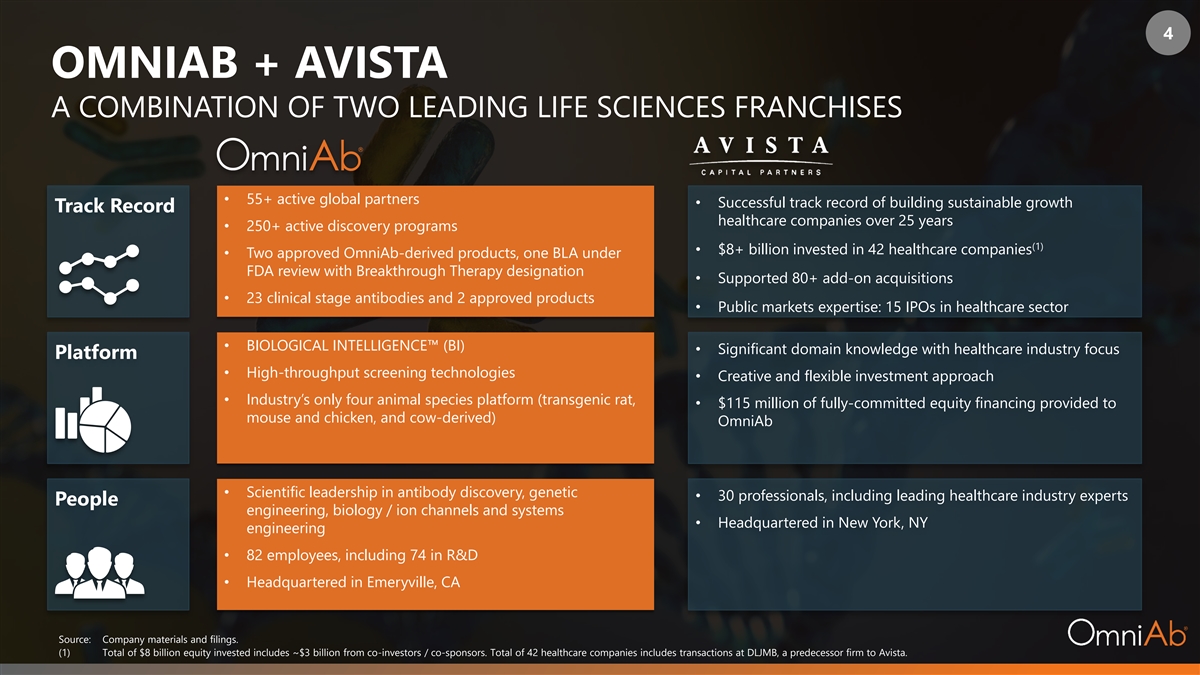

4 OMNIAB + AVISTA A COMBINATION OF TWO LEADING LIFE SCIENCES FRANCHISES • 55+ active global partners • Successful track record of building sustainable growth Track Record healthcare companies over 25 years • 250+ active discovery programs (1) • $8+ billion invested in 42 healthcare companies • Two approved OmniAb-derived products, one BLA under FDA review with Breakthrough Therapy designation • Supported 80+ add-on acquisitions • 23 clinical stage antibodies and 2 approved products • Public markets expertise: 15 IPOs in healthcare sector • BIOLOGICAL INTELLIGENCE™ (BI) • Significant domain knowledge with healthcare industry focus Platform • High-throughput screening technologies • Creative and flexible investment approach • Industry’s only four animal species platform (transgenic rat, • $115 million of fully-committed equity financing provided to mouse and chicken, and cow-derived) OmniAb • Scientific leadership in antibody discovery, genetic • 30 professionals, including leading healthcare industry experts People engineering, biology / ion channels and systems • Headquartered in New York, NY engineering • 82 employees, including 74 in R&D • Headquartered in Emeryville, CA Source: Company materials and filings. (1) Total of $8 billion equity invested includes ~$3 billion from co-investors / co-sponsors. Total of 42 healthcare companies includes transactions at DLJMB, a predecessor firm to Avista.

5 ADDING A LEADING DRUG DISCOVERY PLATFORM TO AVISTA’S PHARMA SERVICES PORTFOLIO Late-Stage Early-Stage Research Discovery Development & & Development Commercialization • Built capabilities and competitive strengths to • Avista investment professionals have deep domain expertise in the pharma services sector become partner of choice • Eight completed investments, including five successful exits via IPOs and sales to strategic acquirors ‒ BI designed to yield industry’s most diverse • Avista professionals’ investment experience spans the full spectrum of drug development including drug sets of high-quality antibodies discovery, preclinical / bio-analytical testing and late stage / post-approval ‒ Rapid deep sequencing of immune • Track record of creating value through: repertoires ‒ Investing to add new capabilities and accelerate revenue growth ‒ Differentiated ion channel capabilities ‒ Margin expansion ‒ Diversified business model ‒ Accretive M&A to enhance scale and capabilities ‒ Robust IP portfolio ‒ Creative financings

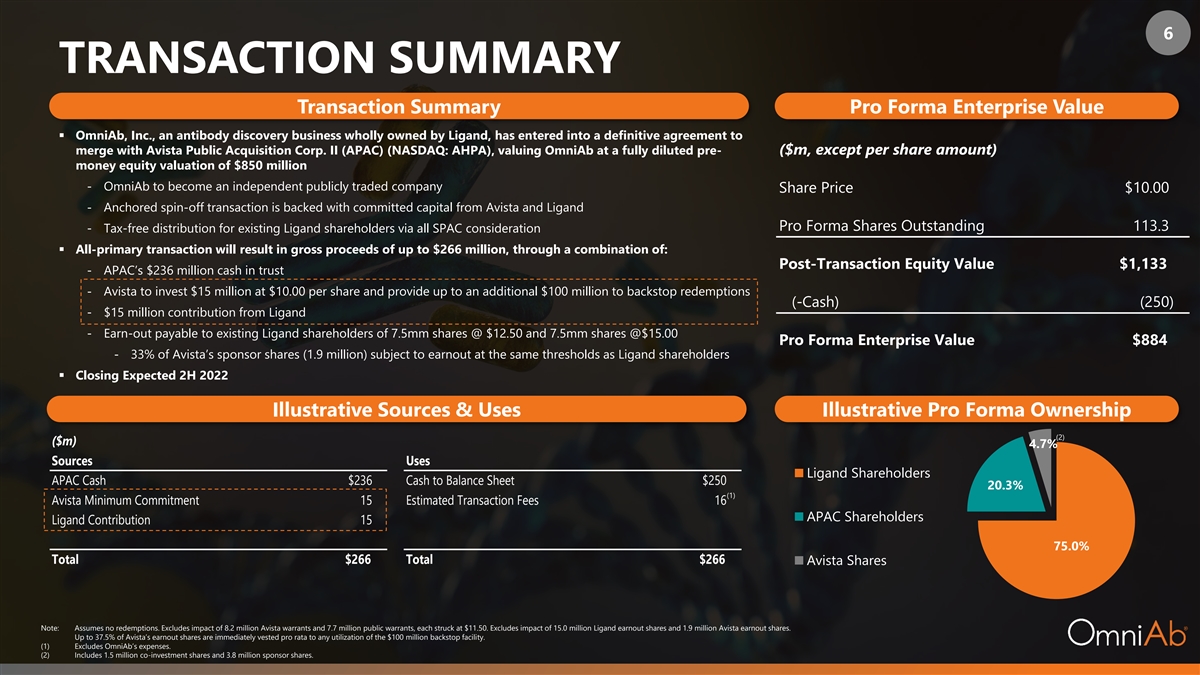

6 TRANSACTION SUMMARY Transaction Summary Pro Forma Enterprise Value ▪ OmniAb, Inc., an antibody discovery business wholly owned by Ligand, has entered into a definitive agreement to merge with Avista Public Acquisition Corp. II (APAC) (NASDAQ: AHPA), valuing OmniAb at a fully diluted pre- ($m, except per share amount) money equity valuation of $850 million - OmniAb to become an independent publicly traded company Share Price $10.00 - Anchored spin-off transaction is backed with committed capital from Avista and Ligand Pro Forma Shares Outstanding 113.3 - Tax-free distribution for existing Ligand shareholders via all SPAC consideration ▪ All-primary transaction will result in gross proceeds of up to $266 million, through a combination of: Post-Transaction Equity Value $1,133 - APAC’s $236 million cash in trust - Avista to invest $15 million at $10.00 per share and provide up to an additional $100 million to backstop redemptions (-Cash) (250) - $15 million contribution from Ligand - Earn-out payable to existing Ligand shareholders of 7.5mm shares @ $12.50 and 7.5mm shares @$15.00 Pro Forma Enterprise Value $884 - 33% of Avista’s sponsor shares (1.9 million) subject to earnout at the same thresholds as Ligand shareholders ▪ Closing Expected 2H 2022 Illustrative Sources & Uses Illustrative Pro Forma Ownership (2) ($m) 4.7% Sources Uses Ligand Shareholders APAC Cash $236 Cash to Balance Sheet $250 20.3% (1) Avista Minimum Commitment 15 Estimated Transaction Fees 16 APAC Shareholders Ligand Contribution 15 75.0% Total $266 Total $266 Avista Shares Note: Assumes no redemptions. Excludes impact of 8.2 million Avista warrants and 7.7 million public warrants, each struck at $11.50. Excludes impact of 15.0 million Ligand earnout shares and 1.9 million Avista earnout shares. Up to 37.5% of Avista’s earnout shares are immediately vested pro rata to any utilization of the $100 million backstop facility. (1) Excludes OmniAb’s expenses. (2) Includes 1.5 million co-investment shares and 3.8 million sponsor shares.

7 KEY MARKET COMPARABLES SUGGEST SUBSTANTIAL VALUE CREATION OPPORTUNITY Computationally-Enabled Next-Generation Discovery and Diversified Drug Discovery Drug Discovery Production Technologies Enterprise Value ($) in millions $4,844 $3,726 $2,616 $2,216 $2,095 $1,961 $1,878 $1,313 $1,301 $1,203 $835 $567 Private # of Active (1) (2) (3) (4) 252 425 111 78 12 Programs Source: Company materials, filings, and FactSet as of 03/18/22. (1) Includes 248 active programs with downstream economics. (2) Includes total program initiations, Adimab does not disclose current active program count. (3) Includes 54 active programs with downstream economics. (4) Includes 3 programs from recent Merck collaboration.

8 EXPERIENCED LEADERSHIP TEAM WITH PROVEN TRACK RECORD OF SUCCESS OmniAb Leadership Team Avista Leadership Team Matt Foehr Kurt Gustafson Thompson Dean David Burgstahler Board Member CFO, OmniAb Inc. Chairman and Co-Head of Investment Managing Partner and CEO, Avista CEO, OmniAb Inc. Board Member Xencor, Inc Comittee, Avista Capital Partners Capital Partners Board Member Viking Therapeutics Former Exec at Spectrum Pharmaceuticals, Board member Cooper Consumer Health, Board member Cosette Pharmaceuticals, Former Exec at Ligand, GlaxoSmithKline, Halozyme Theraputics, Amgen eMolecules, National Spine & Pain Centers, Inform Diagnostics, RVL Pharmaceuticals, Stiefel Labs, Connetics Probo Medical, Vision Healthcare United BioSource Corporation, XIFIN OmniAb Board Nominees John Higgins Carolyn Bertozzi, PhD Sarah Boyce Jennifer Cochran, PhD Sunil Patel Board Chair Board Member Board Member Board Member Board Member CEO and Board Member, Ligand Professor of Humanities & Sciences Chair of HC&C Committee Chair of Nominating Committee Chair of Audit Committee Former CFO, Connetics Corp Stanford University CEO, Avidity Professor of Bioengineering Public & Private Biotech Executive Board Member Bio-Techne Investigator HHMRI Board Member Berkeley Lights Stanford University Former Abgenix, Gilead, BiPar and Former Board Member Lilly, Advisor to Former Akcea Therapeutics, Ionis Founder of multiple companies OncoMed GlaxoSmithKline Pharmaceuticals, Forest Labs Founder of multiple companies

THE OMNIAB PLATFORM

10 SETTING THE STAGE - OMNIAB’S SPIN-OFF FROM LIGAND • Ligand’s proven business model is focused on developing Ligand at a Glance and acquiring technologies that enable the discovery and development of medicines Broad portfolio of 140+ different partners ‒ 140+ partners among pharmaceutical and biotechnology companies PROPRIETARY ‒ 400+ fully-funded programs in various stages COMPOUNDS ‒ 1,600+ issued patents worldwide • On November 9, 2021, Ligand announced its intention to split into two separate, publicly-traded companies ‒ SpinCo: OmniAb, Icagen and other antibody discovery technologies ‒ RemainCo: Core existing royalties and Captisol, Pelican technologies • Anchored tax-free spin-off to create two well-capitalized companies ‒ Operational focus ‒ Business-specific capital allocation ‒ Agility to meet partner needs • Opportunity to unlock value of OmniAb Note: Each dot in above graphic represents a program

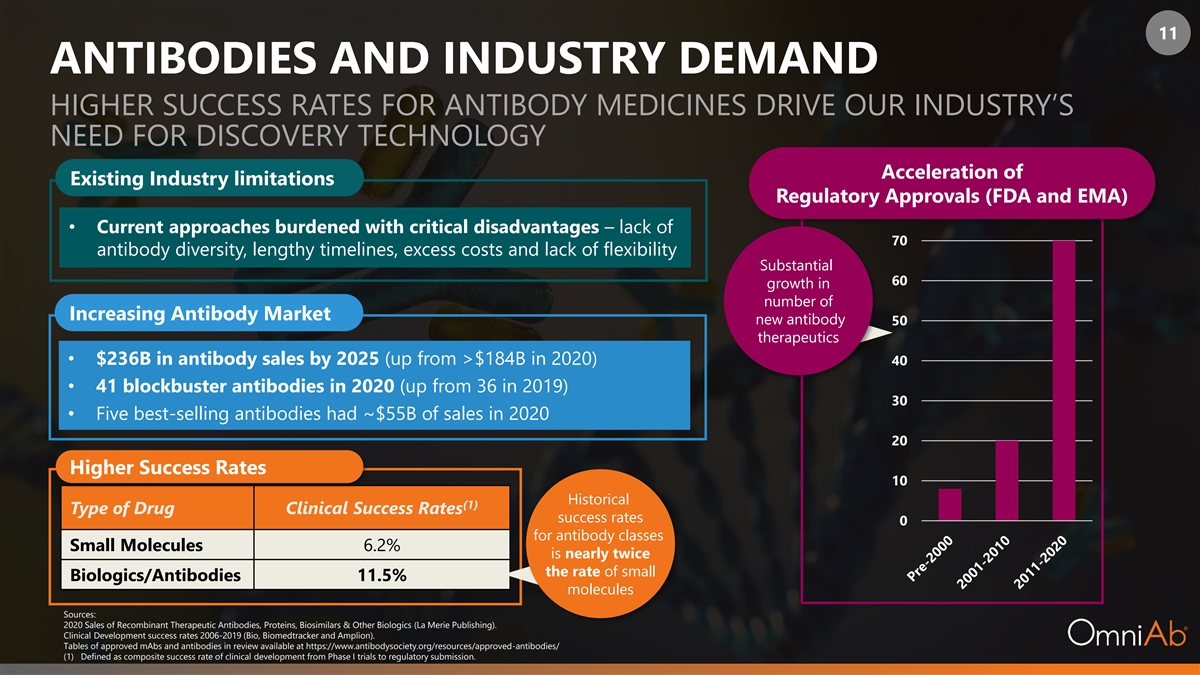

11 ANTIBODIES AND INDUSTRY DEMAND HIGHER SUCCESS RATES FOR ANTIBODY MEDICINES DRIVE OUR INDUSTRY’S NEED FOR DISCOVERY TECHNOLOGY Acceleration of Existing Industry limitations Regulatory Approvals (FDA and EMA) 80 • Current approaches burdened with critical disadvantages – lack of 70 antibody diversity, lengthy timelines, excess costs and lack of flexibility Substantial 60 growth in number of Increasing Antibody Market new antibody 50 therapeutics • $236B in antibody sales by 2025 (up from >$184B in 2020) 40 • 41 blockbuster antibodies in 2020 (up from 36 in 2019) 30 • Five best-selling antibodies had ~$55B of sales in 2020 20 Higher Success Rates 10 Historical (1) Type of Drug Clinical Success Rates success rates 0 for antibody classes Small Molecules 6.2% is nearly twice the rate of small Biologics/Antibodies 11.5% molecules Sources: 2020 Sales of Recombinant Therapeutic Antibodies, Proteins, Biosimilars & Other Biologics (La Merie Publishing). Clinical Development success rates 2006-2019 (Bio, Biomedtracker and Amplion). Tables of approved mAbs and antibodies in review available at https://www.antibodysociety.org/resources/approved-antibodies/ (1) Defined as composite success rate of clinical development from Phase I trials to regulatory submission.

12 OMNIAB HISTORY OVER 13 YEARS OF INVESTMENT BUILT OUR BEST-IN-CLASS PLATFORM 2008 2016 2017 2018 2019 2020 Ligand OMT Crystal Bio Icagen Taurus Acquired OMT Founded (OmniChicken) (Ion Channel (OmniTaur) (OmniAb) Technology) Ab Initio Development of (Computationally xCella OmniRat/OmniFlic/OmniMouse Powered Antigen Design) (Microcapillary Platform) & 16 partnerships signed Significant Internal Investment and R&D • Next generation animals (Bispecifics, HCO, etc.) • Expanded state-of-the art labs and added capacity • AI-powered single-cell microcapillary platform Strategically built tech platform to optimally harness the power of BIOLOGICAL INTELLIGENCE™

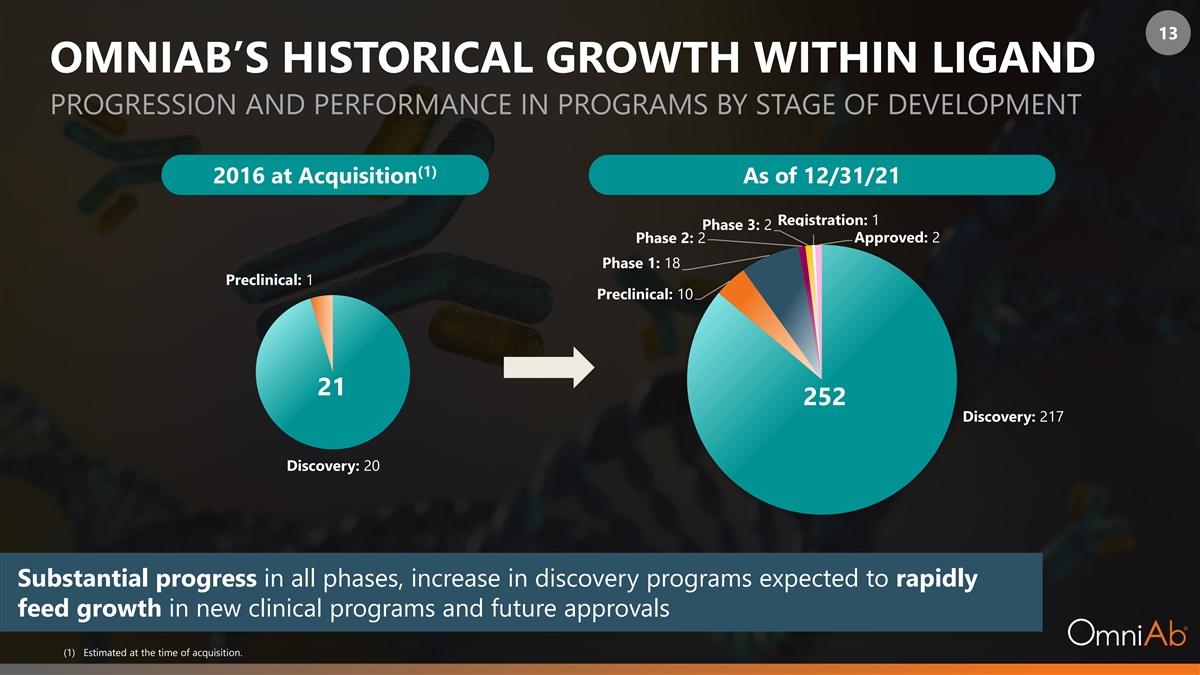

13 OMNIAB’S HISTORICAL GROWTH WITHIN LIGAND PROGRESSION AND PERFORMANCE IN PROGRAMS BY STAGE OF DEVELOPMENT (1) 2016 at Acquisition As of 12/31/21 Registration: 1 Phase 3: 2 Approved: 2 Phase 2: 2 Phase 1: 18 Preclinical: 1 Preclinical: 10 21 252 Discovery: 217 Discovery: 20 Substantial progress in all phases, increase in discovery programs expected to rapidly feed growth in new clinical programs and future approvals (1) Estimated at the time of acquisition.

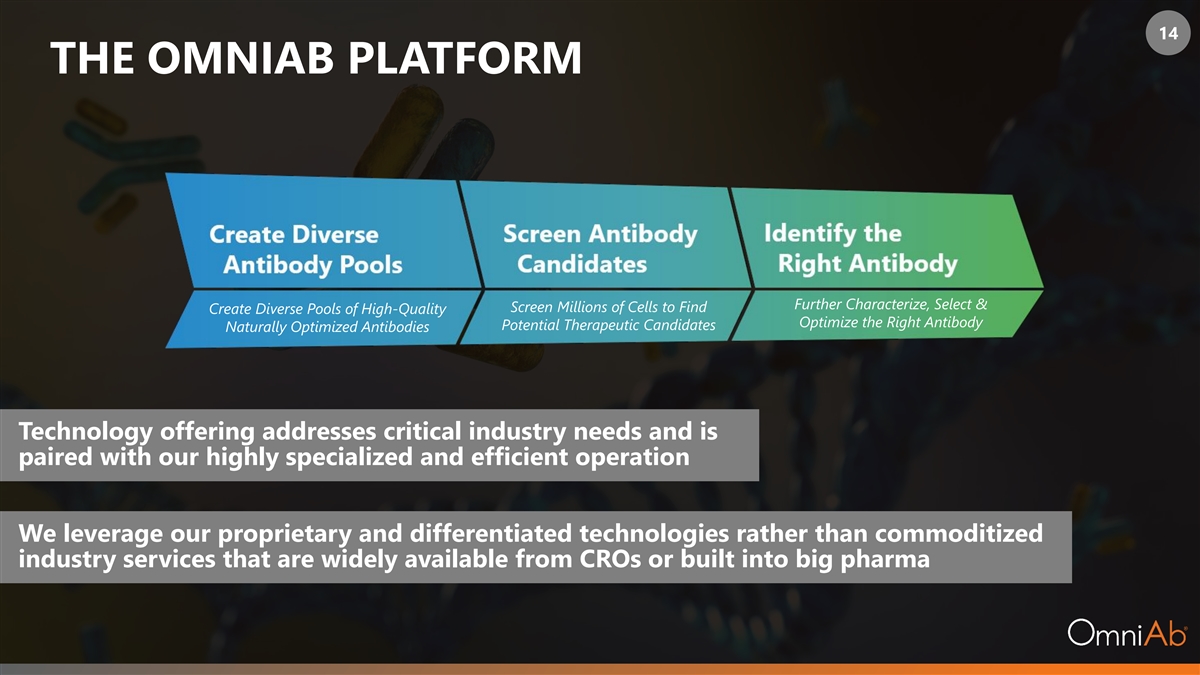

14 THE OMNIAB PLATFORM Further Characterize, Select & Screen Millions of Cells to Find Create Diverse Pools of High-Quality Optimize the Right Antibody Potential Therapeutic Candidates Naturally Optimized Antibodies Technology offering addresses critical industry needs and is paired with our highly specialized and efficient operation We leverage our proprietary and differentiated technologies rather than commoditized industry services that are widely available from CROs or built into big pharma

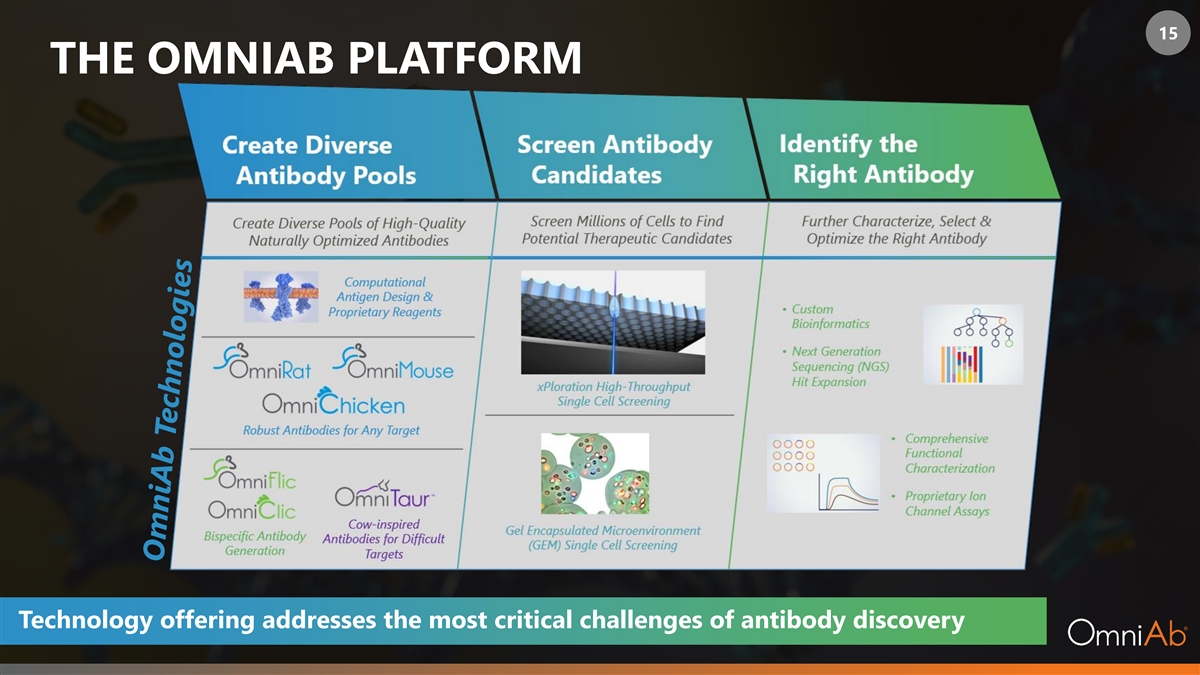

15 THE OMNIAB PLATFORM Technology offering addresses the most critical challenges of antibody discovery

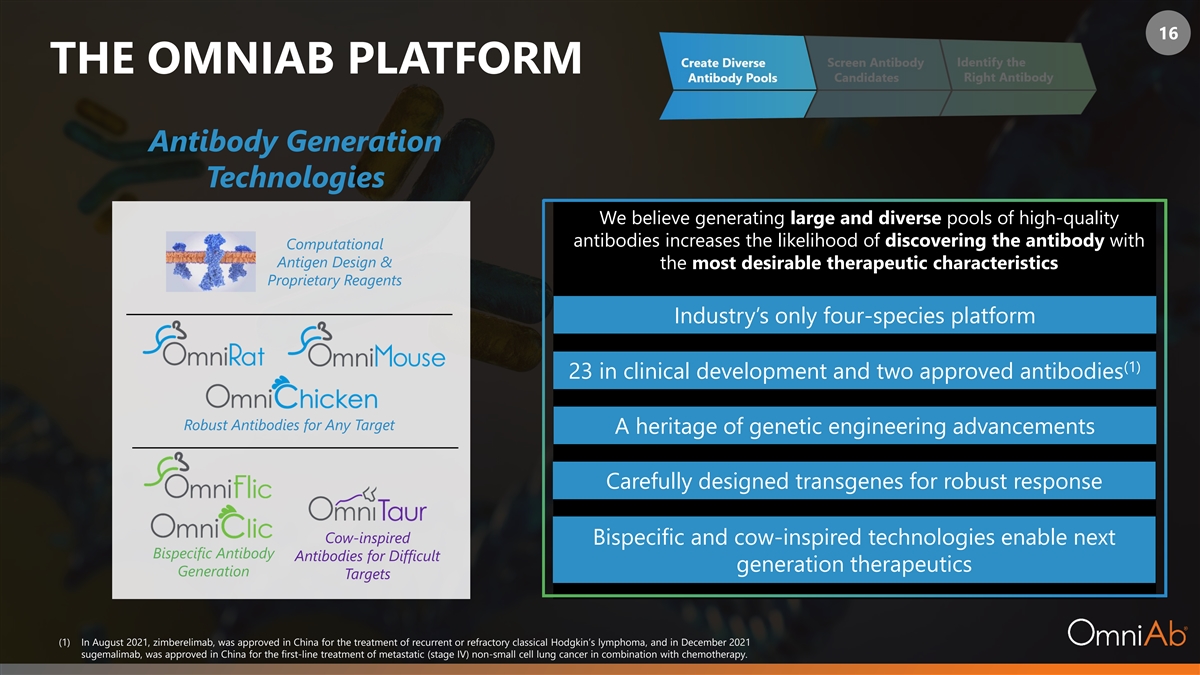

16 THE OMNIAB PLATFORM Antibody Generation Technologies We believe generating large and diverse pools of high-quality antibodies increases the likelihood of discovering the antibody with Computational Antigen Design & the most desirable therapeutic characteristics Proprietary Reagents Industry’s only four-species platform (1) 23 in clinical development and two approved antibodies Robust Antibodies for Any Target A heritage of genetic engineering advancements Carefully designed transgenes for robust response Cow-inspired Bispecific and cow-inspired technologies enable next Bispecific Antibody Antibodies for Difficult generation therapeutics Generation Targets (1) In August 2021, zimberelimab, was approved in China for the treatment of recurrent or refractory classical Hodgkin’s lymphoma, and in December 2021 sugemalimab, was approved in China for the first-line treatment of metastatic (stage IV) non-small cell lung cancer in combination with chemotherapy.

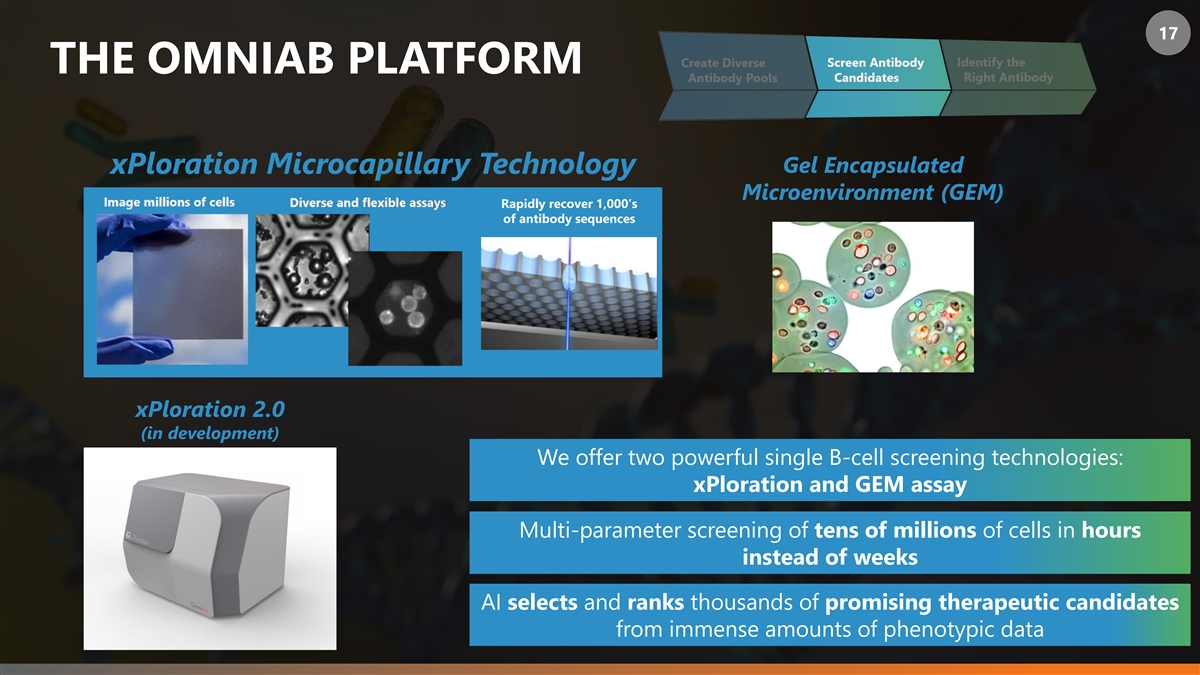

17 THE OMNIAB PLATFORM Gel Encapsulated xPloration Microcapillary Technology Microenvironment (GEM) Rapidly recover 1,000’s of antibody sequences xPloration 2.0 (in development) We offer two powerful single B-cell screening technologies: xPloration and GEM assay Multi-parameter screening of tens of millions of cells in hours instead of weeks AI selects and ranks thousands of promising therapeutic candidates from immense amounts of phenotypic data

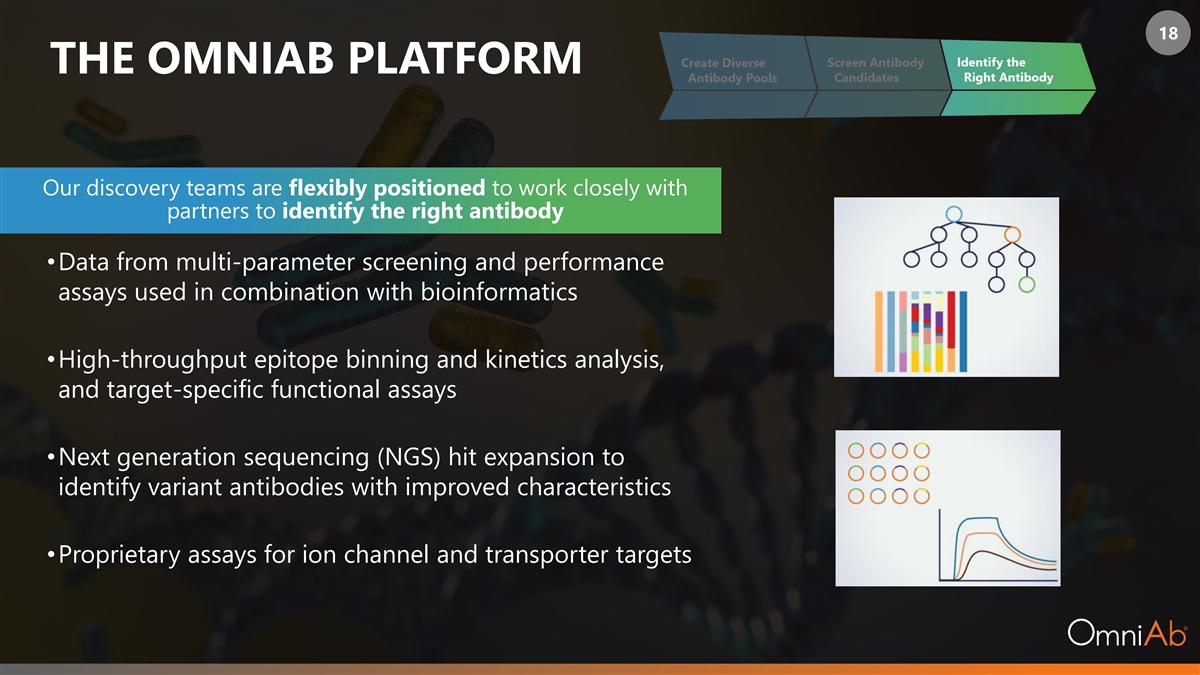

18 THE OMNIAB PLATFORM Our discovery teams are flexibly positioned to work closely with partners to identify the right antibody •Data from multi-parameter screening and performance assays used in combination with bioinformatics •High-throughput epitope binning and kinetics analysis, and target-specific functional assays •Next generation sequencing (NGS) hit expansion to identify variant antibodies with improved characteristics •Proprietary assays for ion channel and transporter targets

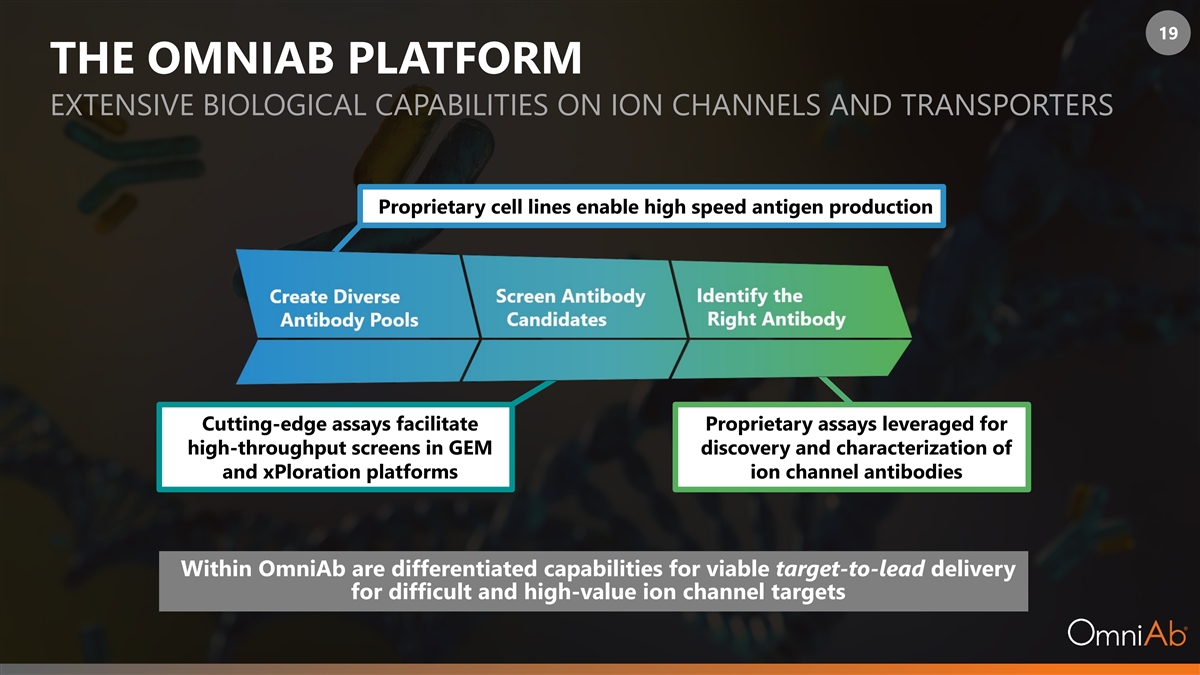

19 THE OMNIAB PLATFORM EXTENSIVE BIOLOGICAL CAPABILITIES ON ION CHANNELS AND TRANSPORTERS Proprietary cell lines enable high speed antigen production Cutting-edge assays facilitate Proprietary assays leveraged for high-throughput screens in GEM discovery and characterization of and xPloration platforms ion channel antibodies Within OmniAb are differentiated capabilities for viable target-to-lead delivery for difficult and high-value ion channel targets

20 OMNIAB BUSINESS MODEL OUR AGREEMENTS ARE STRUCTURED TO ALIGN ECONOMIC AND SCIENTIFIC INTERESTS WITH OUR PARTNERS License partnerships designed to include: • Technology access and collaboration/service fees • Milestones • Royalties on commercial sales We have nearly $1.5 billion in contracted milestones from active OmniAb programs today (excluding antibody discovery programs), with continued growth expected as partners expand use of the platform and as we add new partners

21 OMNIAB INTELLECTUAL PROPERTY ADVANTAGE PARTNERS FILING PATENTS ON OMNIAB-DERIVED ANTIBODIES CREATE DURABLE ROYALTY STREAMS AND A LENGTHY INTELLECTUAL PROPERTY TAIL Antibody Patent Applications • We maintain a broad intellectual property estate with filed by Partners multiple long duration patent families covering each 70 major element of our technology platform 60 • Licenses are structured so that royalties are linked to the 50 patents for the antibodies discovered with OmniAb, 40 thereby creating a lengthy coverage tail 30 >60 patent filings by our partners claiming an 20 OmniAb-derived antibody as primary invention, with expiries up to 2041 10 0 Over 300 patents issued worldwide

22 SELECT OMNIAB PARTNERS >55 COMPANIES CURRENTLY HAVE ACCESS TO OMNIAB ANTIBODIES

23 THE POWER OF OMNIAB PARTNER CASE STUDIES Partner A Partner B Partner C Partner D Emerging Biotech Big Pharma Established Biotech Global Pharma • Novel multi-transmembrane target• Growth factor target, highly • Asia-based global pharma player • Partner has history of success in for triple negative breast cancer conserved among mammals that is establishing a new and developing antibodies, with large discovery group and expanding substantial presence in antibody • All previously-known antibodies to • Human version of target non- novel biology space with large investment and immunogenic in other rodents; no target could only bind to denatured or expansion of global antibody team titer achieved despite numerous fixed form, therefore unsuitable for • Partner needed a flexible, scalable immunization attempts by partner therapeutic use • Partner needed OmniAb’s antibody antibody discovery solution to start discovery engine to power their dozens of new programs every year • Genetic knockout of target gene • Our antigen tech was applied to growth attempted in mice but was lethal deliver mg-scale quantities of purified • Deep collaboration to develop next receptor in native conformation for • Selected OmniAb as core • OmniChicken immunization led to generation rodents, which were immunization and screening technology to feed robust discovery robust titers and diverse antibody tested in parallel with active novel panels and development efforts programs • OmniChicken immunization led to discovery of a large and diverse • Developed three-way collaboration • >90% of sequences recovered had • OmniAb wholly owns rights to next- panel of fully-human antibodies with deep repertoire analysis to excellent developability profiles generation animals and can include capable of binding target on live rapidly identify best binders for them in the OmniAb technology based on multi-parameter in-silico tissues bispecific antibodies offering to other partners analysis

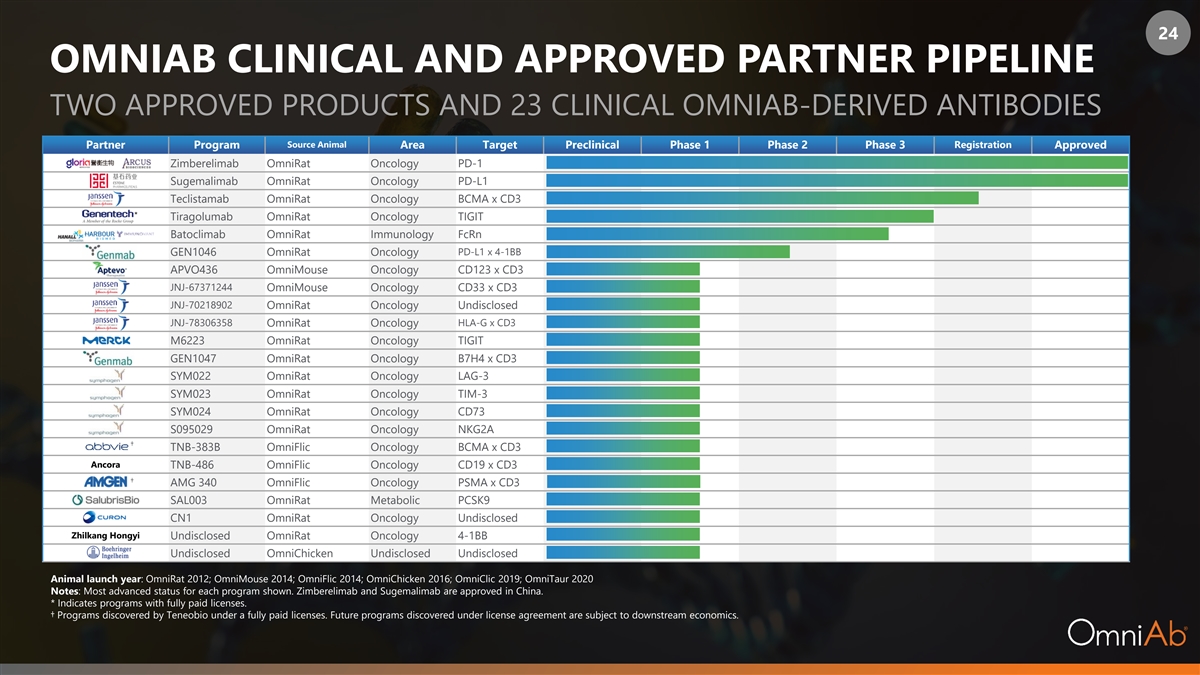

24 OMNIAB CLINICAL AND APPROVED PARTNER PIPELINE TWO APPROVED PRODUCTS AND 23 CLINICAL OMNIAB-DERIVED ANTIBODIES Source Animal Partner Program Area Target Preclinical Phase 1 Phase 2 Phase 3 Registration Approved Zimberelimab OmniRat Oncology PD-1 Sugemalimab OmniRat Oncology PD-L1 Teclistamab OmniRat Oncology BCMA x CD3 * Tiragolumab OmniRat Oncology TIGIT Batoclimab OmniRat Immunology FcRn PD-L1 x 4-1BB GEN1046 OmniRat Oncology APVO436 OmniMouse Oncology CD123 x CD3 JNJ-67371244 OmniMouse Oncology CD33 x CD3 JNJ-70218902 OmniRat Oncology Undisclosed JNJ-78306358 HLA-G x CD3 OmniRat Oncology M6223 OmniRat Oncology TIGIT GEN1047 OmniRat Oncology B7H4 x CD3 SYM022 OmniRat Oncology LAG-3 SYM023 OmniRat Oncology TIM-3 SYM024 OmniRat Oncology CD73 S095029 OmniRat Oncology NKG2A † TNB-383B OmniFlic Oncology BCMA x CD3 Ancora TNB-486 OmniFlic Oncology CD19 x CD3 † AMG 340 OmniFlic Oncology PSMA x CD3 † SAL003 OmniRat Metabolic PCSK9 CN1 OmniRat Oncology Undisclosed Zhilkang Hongyi Undisclosed OmniRat Oncology 4-1BB Undisclosed OmniChicken Undisclosed Undisclosed Animal launch year: OmniRat 2012; OmniMouse 2014; OmniFlic 2014; OmniChicken 2016; OmniClic 2019; OmniTaur 2020 Notes: Most advanced status for each program shown. Zimberelimab and Sugemalimab are approved in China. * Indicates programs with fully paid licenses. † Programs discovered by Teneobio under a fully paid licenses. Future programs discovered under license agreement are subject to downstream economics.

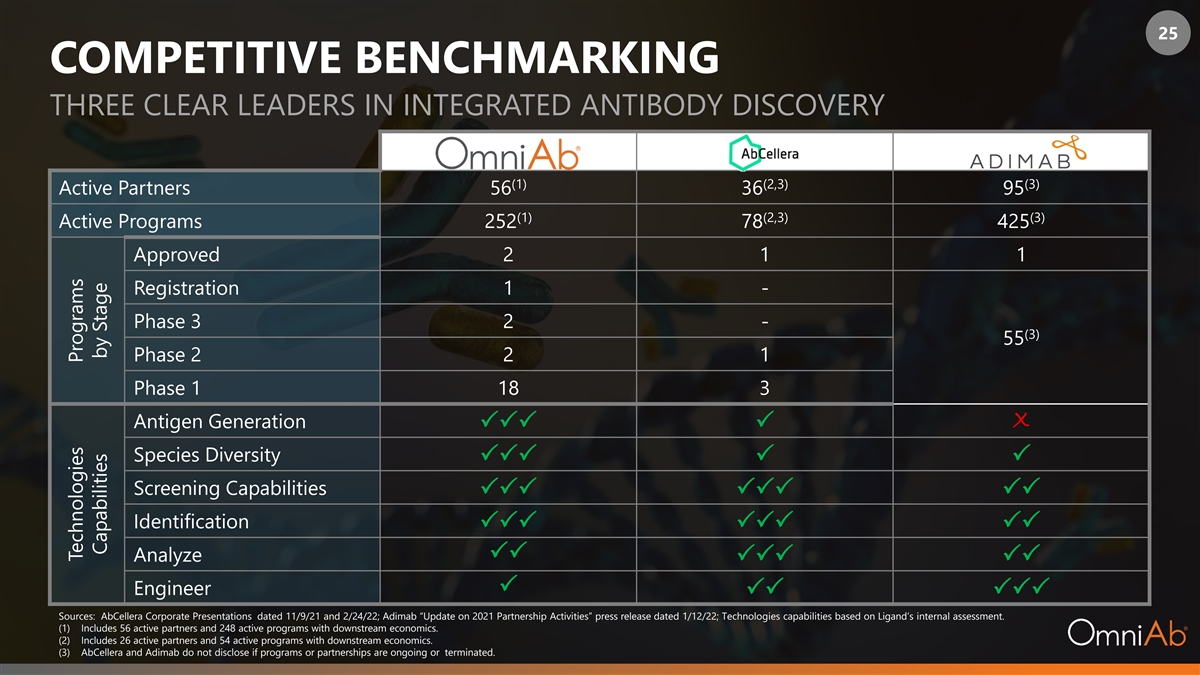

25 COMPETITIVE BENCHMARKING THREE CLEAR LEADERS IN INTEGRATED ANTIBODY DISCOVERY (1) (2,3) (3) Active Partners 56 36 95 (1) (2,3) (3) Active Programs 252 78 425 Approved 2 1 1 Registration 1 - Phase 3 2 - (3) 55 Phase 2 2 1 Phase 1 18 3 X Antigen Generation �������� Species Diversity ���������� Screening Capabilities ���������������� Identification ���������������� Analyze���� ���������� �� Engineer ���������� Sources: AbCellera Corporate Presentations dated 11/9/21 and 2/24/22; Adimab “Update on 2021 Partnership Activities” press release dated 1/12/22; Technologies capabilities based on Ligand’s internal assessment. (1) Includes 56 active partners and 248 active programs with downstream economics. (2) Includes 26 active partners and 54 active programs with downstream economics. (3) AbCellera and Adimab do not disclose if programs or partnerships are ongoing or terminated. Technologies Programs Capabilities by Stage

26 OMNIAB TEAM SCIENTIFIC LEADERSHIP Bill Harriman, PhD Marie-Cecile Van De Lavoir, PhD, DVM Christel Iffland, PhD Doug Krafte, PhD SVP, Antibody Discovery VP, Operations VP, Antibody Technology SVP, Ion Channels Co-Founder/CSO, Crystal Bioscience Co-Founder/COO, Crystal Bioscience Former Associate Director at Merck KGaA / Former Exec at Icagen, Pfizer Pain & Sensory Trellis, Roche, Abgenix Origen Therapeutics, Inventor Germ Cell Technology EMD Serono, Co-inventor of Avelumab Disorders, Boehringer Ingelheim, Aurora Biosciences UCSF-Immunology, Haas MBA Fulbright Scholar, UCSF, Utrecht, Guelph, Cornell Dana Farber, Albert Einstein College Univ. Rochester, Vanderbilt Shelley Izquierdo, PhD Phil Leighton, PhD Bob Chen, PhD Ellen Collarini, PhD Sr. Director, Antibody Discovery Sr. Director, Molecular Biology Sr. Director, Systems Engineering Sr. Director, Cell Biology Crystal Bioscience, Trellis Genetic Engineering Lead, Crystal Bioscience and Origen Former Exec at xCella Bio (Co-Founder/CTO) Crystal Bioscience, Trellis, Roche UC Berkeley Princeton, UCSF Stanford Bioengineering Univ. Michigan, Univ. College-London

FINANCIAL REVIEW

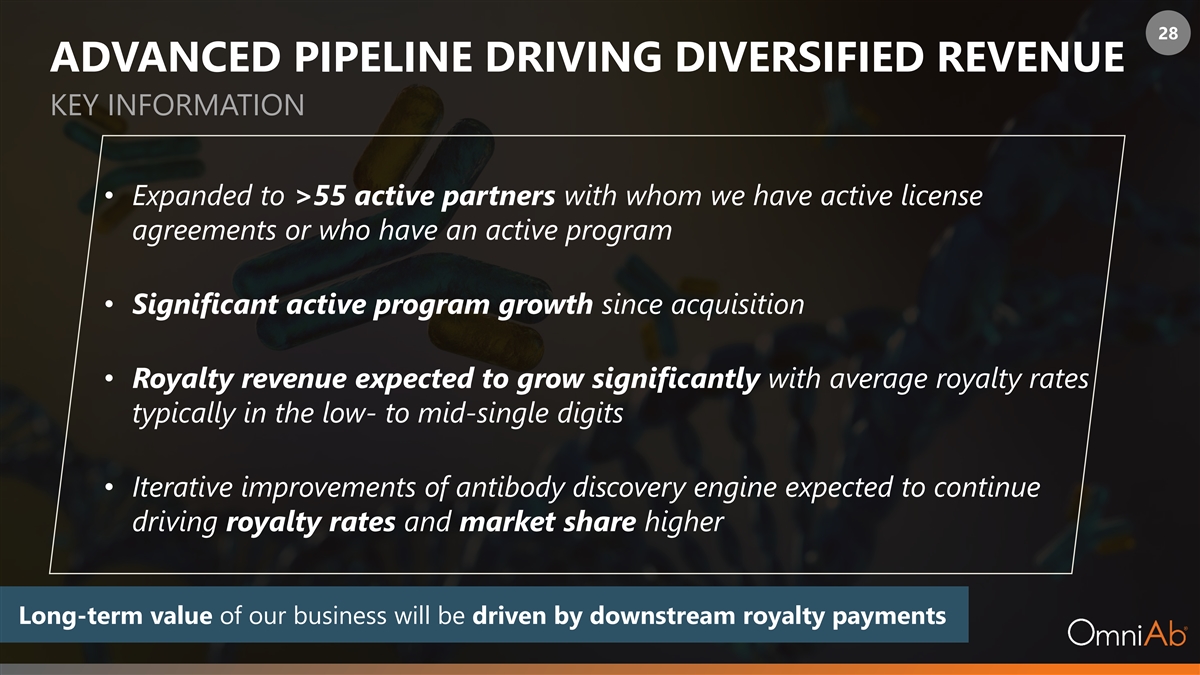

28 ADVANCED PIPELINE DRIVING DIVERSIFIED REVENUE KEY INFORMATION • Expanded to >55 active partners with whom we have active license agreements or who have an active program • Significant active program growth since acquisition • Royalty revenue expected to grow significantly with average royalty rates typically in the low- to mid-single digits • Iterative improvements of antibody discovery engine expected to continue driving royalty rates and market share higher Long-term value of our business will be driven by downstream royalty payments

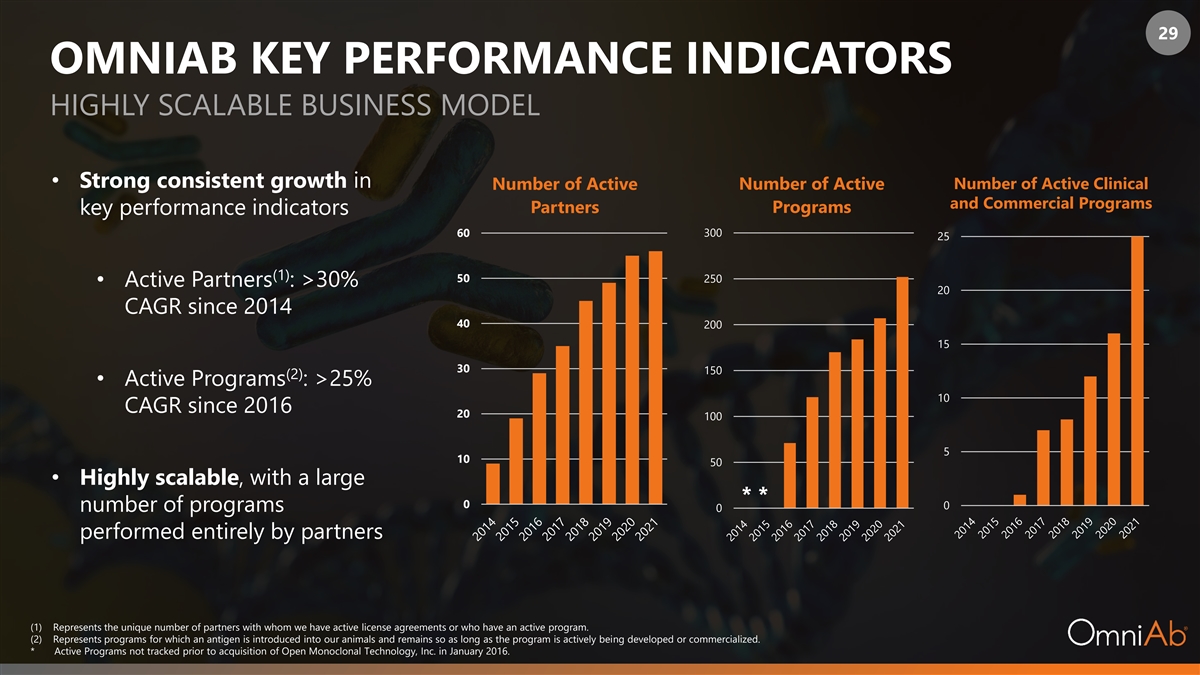

29 OMNIAB KEY PERFORMANCE INDICATORS HIGHLY SCALABLE BUSINESS MODEL • Strong consistent growth in Number of Active Clinical Number of Active Number of Active and Commercial Programs Partners Programs key performance indicators 60 300 25 (1) 50 250 • Active Partners : >30% 20 CAGR since 2014 40 200 15 30 150 (2) • Active Programs : >25% 10 CAGR since 2016 20 100 5 10 50 • Highly scalable, with a large * * 0 0 number of programs 0 performed entirely by partners (1) Represents the unique number of partners with whom we have active license agreements or who have an active program. (2) Represents programs for which an antigen is introduced into our animals and remains so as long as the program is actively being developed or commercialized. * Active Programs not tracked prior to acquisition of Open Monoclonal Technology, Inc. in January 2016.

30 UNIT ECONOMICS AND PIPELINE DEVELOPMENT TO DRIVE FUTURE VALUE Current Portfolio Pipeline Development Per program economics Expected market growth (1) ▪ $236B in antibody sales by 2025 ▪ Research fees (1) ▪ Up from $184B in 2020 ▪ Clinical and commercial milestones ▪ Royalties Portfolio expansion Key Value ▪ Investments in go-to-market NPV per program initiatives Drivers ▪ Peak sales ▪ Risk-sharing with partners ▪ Average royalty rates Ab market opportunity ▪ Probability of success ▪ Antigen generation ▪ Time to approval ▪ Screening technologies ▪ Time to peak sales ▪ Next-generation identification and optimization (1) 2020 Sales of Recombinant Therapeutic Antibodies, Proteins, Biosimilars & Other Biologics (La Merie Publishing).

31 ILLUSTRATIVE REVENUE PROFILES FOR SUCCESSFUL PARTNERED PROGRAMS OMNIAB PARTICIPATION IS WEIGHTED TOWARDS DOWNSTREAM SUCCESS Flexible transaction structures enable optionality for partners while maintaining value for OmniAb Program A Program B Research / Upfront Clinical Milestones Commercial Milestones / Royalties Target equivalent NPV for all structures Per product gross revenue potential, if approved and marketed, of up to $1 billion+ to OmniAb

APPENDIX

33 ZIMBERELIMAB APPROVED THE FIRST APPROVED OMNIRAT-DERIVED ANTIBODY • On August 30, 2021, zimberelimab (GLS-010), an OmniAb-derived fully human anti-PD-1 mAb, was approved in China for the treatment of recurrent or refractory classical Hodgkin’s lymphoma ‒ Marks the first approval of an OmniAb-derived mAb • In 2015, GloriaBio contracted with WuXi Biologics to discover and develop zimberelimab in China using OmniRat ‒ Zimberelimab entered clinic in March 2017, and NDA was submitted to China NMPA in February 2020 • GloriaBio is also investigating zimberelimab in advanced solid tumors, and was granted Breakthrough Therapy designation for the treatment of patients with recurrent/metastatic cervical cancer in March 2021 • Zimberelimab is being developed by Arcus Biosciences (in collaboration with Gilead) in North America, Europe, Japan and certain other territories through a 2017 agreement

34 SUGEMALIMAB APPROVED THE SECOND APPROVED OMNIRAT-DERIVED ANTIBODY ® • On December 21, 2021, CStone announced approval in China for Cejemly (sugemalimab) ‒ Fully-human, full length anti-PD-L1 monoclonal, said to mirror the natural G-type immunoglobulin 4 (IgG4), which reduces immunogenicity risks and potential toxicity, approved as part of first-line treatment for metastatic nonsquamous NSCLC ‒ Touted by CStone as “first and only anti-PD-L1 approved for first-line treatment in metastatic nonsquamous NSCLC anywhere in the world” ‒ CStone also has an NDA pending for Cejemly® for Stage III NSCLC • Pfizer responsible for commercializing in China via 2020 strategic collaboration • EQRx licensed exclusive rights to sugemalimab for development / commercialization outside of China, targeting filings by year-end

For more information, please visit www.omniab.com