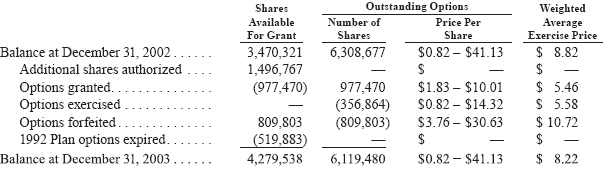

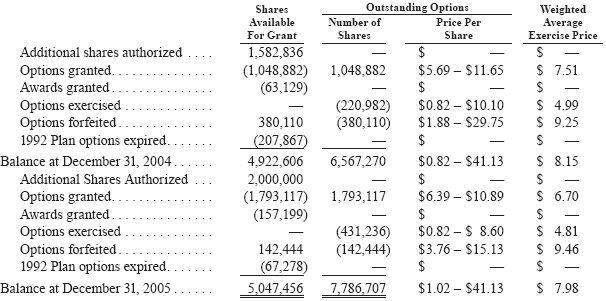

As of December 31, 2005 and 2004, there were 5,492,791 and 4,612,346 exercisable options outstanding at weighted average exercise prices per share of $8.56 and $8.91, respectively.

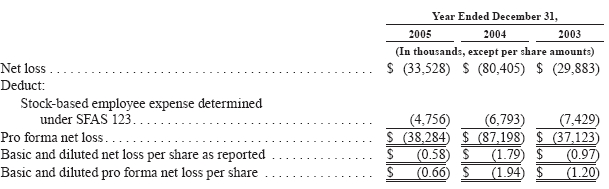

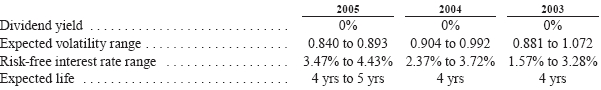

We have elected to apply APB Opinion 25 in accounting for our stock option awards granted to employees and directors, rather than the alternative fair value accounting method provided under SFAS 123. Under APB Opinion 25, no compensation expense is recognized for grants of options to employees and directors at an exercise price equal to or greater than the fair market value of the underlying common stock on the date of grant. Accordingly, based on our option grants in 2005, 2004 and 2003, no compensation expense has been recognized related to employee and director stock options.

Pro forma information regarding net income and earnings per share under the alternative fair value accounting required by SFAS 123, as amended by SFAS 148, is presented in Note 1. This information is required to be determined as if we had accounted for our employee stock options granted subsequent to September 30, 1995, under the fair value method of that Statement.

There were no options granted with an exercise price below fair market value of our common stock on the date of grant for 2005, 2004 and 2003. The weighted average grant date fair value of options granted during 2005, 2004 and 2003 with an exercise price equal to the fair market value of our common stock on the date of grant was $6.77, $7.51 and $5.46, respectively. There were 340,000 options granted to consultants with an exercise price greater than the fair market value of our common stock in 2005 with a weighted average exercise price of $6.39. There were no options granted with an exercise price greater than the fair market value in 2004 and 2003.

GERON CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

We grant options and warrants to consultants from time to time in exchange for services performed for us. In general, these options and warrants vest over the contractual period of the consulting arrangement. We granted options and warrants to consultants to purchase 817,682, 31,791 and 72,970 shares of our common stock in 2005, 2004 and 2003, respectively. The fair value of these options and warrants is being amortized to expense over the vesting term of the options and warrants. In addition, we will record any additional increase in the fair value of the option or warrant as the options and warrants vest. We recorded expense of $3,277,000, $269,000 and $163,000 for the fair value of these options and warrants in 2005, 2004 and 2003, respectively. As of December 31, 2005, unamortized fair value of options and warrants to consultants of $1,355,000 remained outstanding.

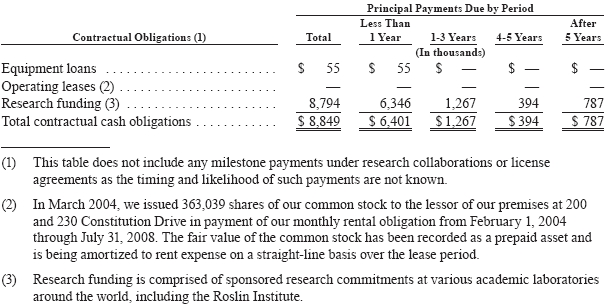

We also grant common stock to consultants, vendors, board members and research institutions in exchange for services performed for us. In 2005, 2004 and 2003, we issued 262,413, 959,558 and 281,793 shares of common stock, respectively, in exchange for goods or services. For these stock grants, we recognized an expense equal to the fair market value of the granted shares on the date of grant. In 2005, 2004 and 2003, we recognized approximately $3,002,000, $6,167,000 and $1,291,000, respectively, of expense in connection with stock grants to consultants, vendors, board members and research institutions. Also, we have prepaid our rental obligation for our facilities with common stock and as of December 31, 2005, have a prepaid balance of $1,752,000 which is being amortized to rent expense on a straight-line basis over the term of the lease to July 31, 2008.

Employee Stock Purchase Plan

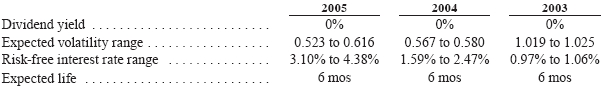

In July 1996, we adopted the 1996 Employee Stock Purchase Plan (Purchase Plan) and reserved an aggregate of 300,000 shares of common stock for issuance thereunder. In May 2003, the stockholders approved an amendment to increase the number of authorized shares to 600,000 shares of common stock. Under the terms of the Purchase Plan, employees can choose to have up to 10% of their annual salary withheld to purchase our common stock. The purchase price of the stock is 85% of the lower of the subscription date fair market value and the purchase date fair market value. Approximately 27% of the eligible employees have participated in the Purchase Plan in 2005. Approximately 287,000, 266,000 and 247,000 shares have been issued under the Purchase Plan as of December 31, 2005, 2004 and 2003, respectively. As of December 31, 2005, 312,498 shares were available for issuance under the Purchase Plan.

We do not recognize compensation cost related to employee purchase rights under the Purchase Plan. The pro forma compensation cost estimated for the fair value of the employees’ purchase rights of approximately $51,000 for 2005, $47,000 for 2004, $57,000 for 2003 has been included in the pro forma information included in Note 1.

Common Stock Reserved for Future Issuance

Common stock reserved for future issuance as of December 31, 2005 is as follows:

Share Purchase Rights Plan

On July 20, 2001, our Board of Directors adopted a share purchase rights plan and declared a dividend distribution of one right for each outstanding share of common stock to stockholders of record as of July 31, 2001. Each right entitles the holder to purchase one unit consisting of one one-thousandth of a share of Series A Junior Participating Preferred Stock for $100 per unit. Under certain circumstances, if a person or group acquires 15% or more of our outstanding common stock, holders of the rights (other than the person or group triggering their exercise) will be able to purchase, in exchange for the $100

60

GERON CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

exercise price, shares of our common stock, par value $0.001 per share, or of any company into which we are merged having a value of $200. The rights expire on July 31, 2011 unless extended by our Board of Directors. As of December 31, 2005, no rights were exercisable into any shares of common stock.

401(k) Plan

We sponsor a defined-contribution savings plan under Section 401(k) of the Internal Revenue Code covering all full-time U.S. employees (Geron 401K Plan). Participating employees may contribute up to the annual Internal Revenue Service contribution limit. The Geron 401K Plan also permits us to provide discretionary matching and profit sharing contributions. The Geron 401K Plan is intended to qualify under Section 401 of the Internal Revenue Code so that contributions by employees or by us, and income earned on the contributions, are not taxable to employees until withdrawn from the Geron 401K Plan. Our contributions, if any, will be deductible by us when made. At the direction of each participant, the assets of the Geron 401K Plan are invested in any of 14 different investment options.

In December 2005, 2004 and 2003, our Board of Directors approved a matching contribution equal to 100% of each employee’s 2005, 2004 and 2003 contributions, respectively. The matching contributions are invested in our common stock and vest ratably over four years for each year of service completed by the employee, commencing from the date of hire, until it is fully vested when the employee has completed four years of service. We provided the matching contribution in the month following Board approval.

Our accrual for matching the 2005 employee contributions under this plan was approximately $681,000, of which $454,000 was fully vested as of December 31, 2005 and $374,000 was recorded as research and development expense and $80,000 was recorded as general and administrative expense. Our accrual for matching the 2004 employee contributions under this plan was approximately $497,000, of which $371,000 was fully vested as of December 31, 2004 and $305,000 was recorded as research and development expense and $66,000 was recorded as general and administrative expense. As of December 31, 2005, $227,000 had been recorded as deferred compensation for the remaining unvested portion of the 2005 matching contribution and will be amortized as compensation expense over the remaining vesting periods. As of December 31, 2005, the remaining deferred compensation for the 2004 match was $63,000 and $10,000 for the 2003 match.

Private Financings

In April 2005, we sold 740,741 shares of our common stock to investors at a price of $5.40 per share for total gross proceeds of $4,000,000. The shares were offered through a prospectus supplement to an effective universal shelf registration statement. In connection with the sale, we also issued warrants to purchase 370,370 shares with an exercise price of $7.95 per share. The warrants are immediately exercisable for a period of five years from the date of issuance. The fair value of the warrants of $1,610,000 was determined using the Black Scholes option-pricing model and was recognized as an issuance cost of the financing and resulted in offsetting entries to additional paid-in capital. The purchased shares and the shares underlying the warrant are subject to a two year lock-up which prohibits the sale or other disposition of these shares during the two year lock-up period.

In November 2004, we sold 6,557,377 shares of our common stock to institutional investors at $6.10 per share resulting in net cash proceeds of approximately $39,919,000. The shares were offered through a prospectus supplement to an effective universal shelf registration statement. In connection with the sale, we also issued warrants to purchase 2,049,180 shares with an exercise price of $6.10 per share with an expiration date in January 2005. We also issued warrants to purchase 2,295,082 shares with an exercise price of $8.62 per share that are exercisable beginning in May 2005 and expire in November 2008. The fair value of the warrants of $12,694,000 was determined using the Black Scholes option-pricing model and was recognized as an issuance cost with an offset to additional paid-in capital. In January 2005, we received cash proceeds of $12,500,000 upon the exercise of warrants to purchase 2,049,180 shares of common stock. As of December 31, 2005, warrants to purchase 2,295,082 shares remained outstanding.

61

GERON CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Public Offering and Concurrent Warrant Exercise

In September 2005, we completed an underwritten public offering of 6,900,000 shares of common stock, including 900,000 shares issued pursuant to the exercise by the underwriters of their option to cover over-allotments, at a price of $9.00 per share, resulting in net cash proceeds of approximately $57,985,000. Concurrent with the underwritten public offering, we issued 2,000,000 shares of common stock directly to Merck & Co., Inc. at $9.00 per share, pursuant to the exercise of an outstanding warrant issued to Merck on July 15, 2005. As a result of the concurrent underwritten public offering and exercise of the Merck warrant, and the exercise by the underwriters’ of their option to cover over-allotments, we issued an aggregate of 8,900,000 shares of common stock for total net proceeds of approximately $75,985,000.

13. COLLABORATIVE AGREEMENTS

In July 2005, we entered into a Research, Development and Commercialization License Agreement with Merck & Co., Inc. We received an upfront non-refundable license payment of $2,500,000 for the grant of an exclusive worldwide license for the use of telomerase in non-dendritic cell cancer vaccines, which is being recognized as license fee revenue over two years on a straight-line basis. We also received $1,000,000 for an exclusive option, to be exercised within two years, to negotiate a separate agreement covering our dendritic cell-based vaccine. We are recognizing revenue from the option payment over the two-year option period on a straight-line basis.

We and Merck will conduct a joint research and development program to optimize and expedite the demonstration of efficacy and tolerability of a potential telomerase vaccine. The companies formed a Joint Research Committee and a Joint Development Committee to coordinate the research program and clinical development, respectively. Each company will bear all of its own costs related to the research program; Merck will bear all costs of clinical development.

We also issued to Merck a warrant to purchase $18,000,000 of our common stock at an exercise price equal to the per share price of our next underwritten public offering. Merck fully exercised this warrant concurrently with the closing of our underwritten public offering in September 2005. See Note 12 on the Public Offering and Concurrent Warrant Exercise.

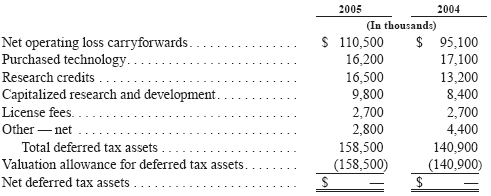

14. INCOME TAXES

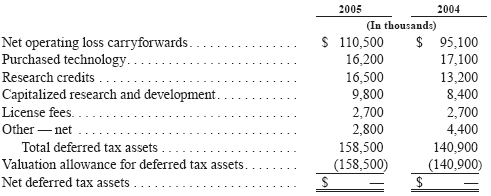

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of our deferred tax assets as of December 31 are as follows:

Because of our history of losses, the net deferred tax asset has been fully offset by a valuation allowance. The valuation allowance increased by $17,600,000, $42,700,000 and $17,300,000 during the years ended December 31, 2005, 2004 and 2003, respectively.

As of December 31, 2005, we had domestic federal net operating loss carryforwards of approximately $286,000,000 expiring at various dates beginning 2006 through 2025, and state net operating loss carryforwards of approximately $99,800,000 expiring at various dates beginning 2006 through 2015, if not utilized. Our foreign net operating loss carryforwards of approximately $25,200,000 carry forward indefinitely. We also had federal research and development tax credit carryforwards of

62

GERON CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

approximately $10,000,000 expiring at various dates beginning in 2007 through 2024, if not utilized. Our state research and development tax credit carryforwards of approximately $9,700,000 carry forward indefinitely.

Utilization of the net operating losses and credits may be subject to a substantial annual limitation due to the ownership change provisions of the Internal Revenue Code of 1986 and similar state provisions. The annual limitation may result in the expiration of net operating losses and credits before utilization.

Approximately $4,570,000 of the valuation allowance for deferred tax assets relates to benefits of stock option deductions which, when recognized, will be allocated directly to contributed capital.

15. SEGMENT INFORMATION

Statement of Financial Accounting Standards No. 131, “Disclosures about Segments of an Enterprise and Related Information” (SFAS 131) establishes standards for reporting information regarding operating segments in annual financial statements and requires selected information for those segments to be presented in interim financial reports issued to stockholders. SFAS 131 also establishes standards for related disclosures about products and services and geographic areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision making group, in making decisions how to allocate resources and assess performance. Our chief decision maker, as defined under SFAS 131, is the Chief Executive Officer. To date, we have viewed our operations as principally one segment, the discovery and development of therapeutic and diagnostic products for oncology and human embryonic stem cell therapies. As a result, the financial information disclosed herein materially represents all of the financial information related to our principal operating segment.

16. STATEMENT OF CASH FLOWS DATA

Interest expense for the year ended December 31, 2005, 2004 and 2003 was $257,000, $518,000 and $544,000, respectively.

63

GERON CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

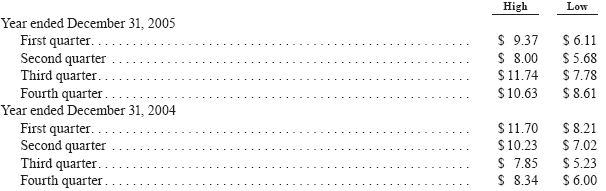

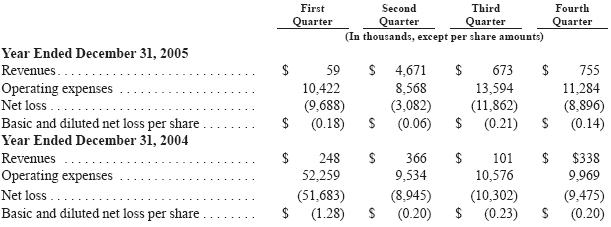

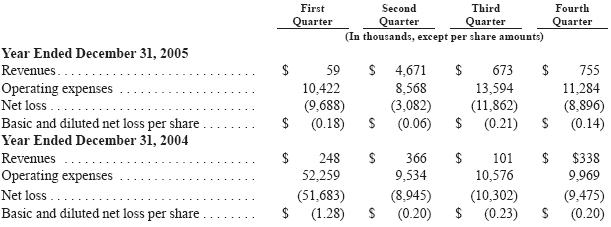

17. QUARTERLY RESULTS (UNAUDITED)

Basic and diluted net losses per share are computed independently for each of the quarters presented. Therefore, the sum of the quarters may not be equal to the full year net loss per share amounts.18. SUBSEQUENT EVENT

In January 2006, we awarded 175,514 shares of common stock to employees in lieu of cash for 2005 year-end performance bonuses. The shares were granted from the 2002 Equity Incentive Plan. Compensation expense related to this award was included in accrued compensation as of December 31, 2005.

64

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

Not Applicable.

ITEM 9A. CONTROLS AND PROCEDURES

Based on their evaluation as of a date within 90 days of the filing date of this annual report on Form 10-K, our principal executive officer and principal financial officer have concluded that our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the Exchange Act) are effective to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms.

There were no significant changes in Geron’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation and up to the filing date of this annual report on Form 10-K. We have not identified any significant deficiencies or material weaknesses, and therefore there were no corrective actions taken.

MANAGEMENT REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Internal control over financial reporting refers to the process designed by, or under the supervision of, our Chief Executive Officer and Chief Financial Officer, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, and includes those policies and procedures that:

| (1) | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| |

| (2) | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and |

| |

| (3) | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. |

Management is responsible for establishing and maintaining an adequate internal control over financial reporting. Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations. Internal control over financial reporting is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk. Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company.

Management has used the framework set forth in the report entitled “Internal Control — Integrated Framework” published by the Committee of Sponsoring Organizations (“COSO”) of the Treadway Commission to evaluate the effectiveness of the Company’s internal control over financial reporting. Management has concluded that the Company’s internal control over financial reporting was effective as of the end of the most recent fiscal year. The Company’s independent registered public accounting firm has issued an attestation report on management’s assessment of the Company’s internal control over financial reporting, which is included on page 40 of this Annual Report on Form 10-K.

| THOMASB. OKARMA | DAVIDL. GREENWOOD |

| President and Chief Executive Officer | Executive Vice President |

| | Chief Financial Officer |

65

PART III

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

IDENTIFICATION OF DIRECTORS

The information required by this Item concerning our directors is incorporated by reference from the section captioned “Proposal 1: Election of Directors” contained in our Definitive Proxy Statement related to the Annual Meeting of Stockholders to be held May 24, 2006, to be filed with the Securities and Exchange Commission (the Proxy Statement).

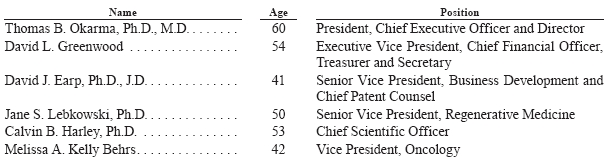

IDENTIFICATION OF EXECUTIVE OFFICERS

The information required by this Item concerning our executive officers is set forth in Part I of this Report.

CODE OF ETHICS

We have adopted a Code of Conduct with which every person who works for Geron is expected to comply. The Code of Conduct is publicly available on our website under the Investor Relations section atwww.geron.com. This website address is intended to be an inactive, textual reference only; none of the material on this website is part of this report. If any substantive amendments are made to the Code of Conduct or any waiver granted, including any implicit waiver, from a provision of the code to our Chief Executive Officer, Chief Financial Officer or Corporate Controller, we will disclose the nature of such amendment or waiver on that website or in a report on Form 8-K.

Copies of the Code of Conduct will be furnished without charge to any person who submits a written request directed to the attention of our Secretary, at our offices located at 230 Constitution Drive, Menlo Park, California, 94025.

ITEM 11. EXECUTIVE COMPENSATION

The information required by this Item is incorporated by reference from the section captioned “Executive Compensation” contained in the Proxy Statement.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The information required by this Item is incorporated by reference from the section captioned “Security Ownership of Certain Beneficial Owners and Management” contained in the Proxy Statement.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The information required by this Item is incorporated by reference from the sections captioned “Certain Transactions” and “Executive Compensation” contained in the Proxy Statement.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The information required by this Item is incorporated by reference from the section captioned “Principal Accountant Fees and Services” contained in the Proxy Statement.

66

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

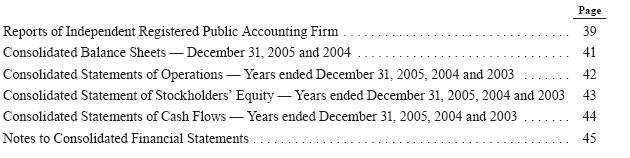

(a) (1) CONSOLIDATED FINANCIAL STATEMENTS

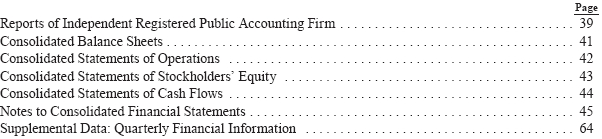

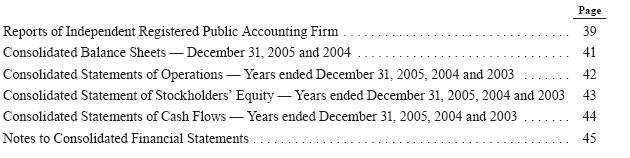

Included in Part II, Item 8 of this Report:

(2) FINANCIAL STATEMENT SCHEDULES

Financial statement schedules are omitted because they are not required or the information is disclosed in the financial statements listed in Item 15(a)(1) above.

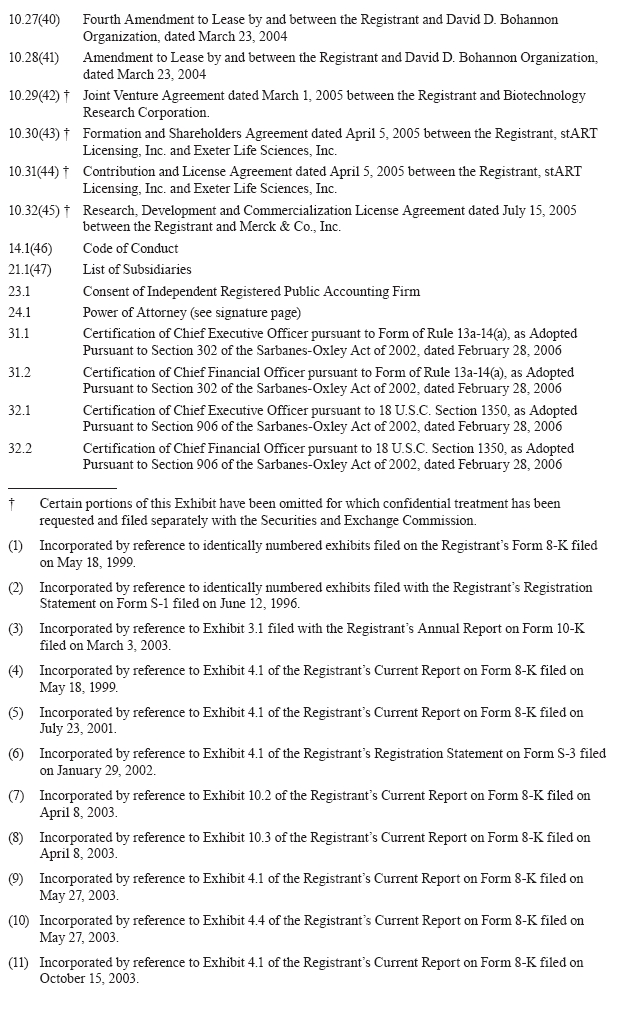

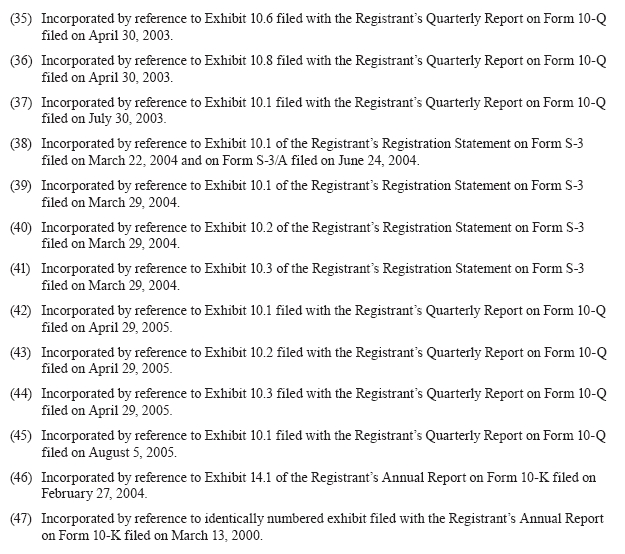

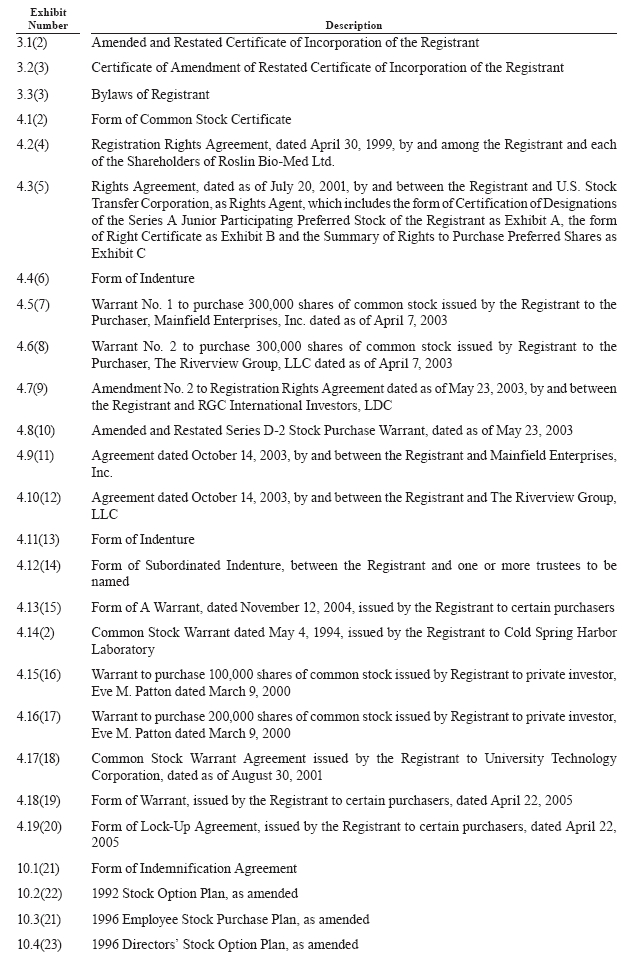

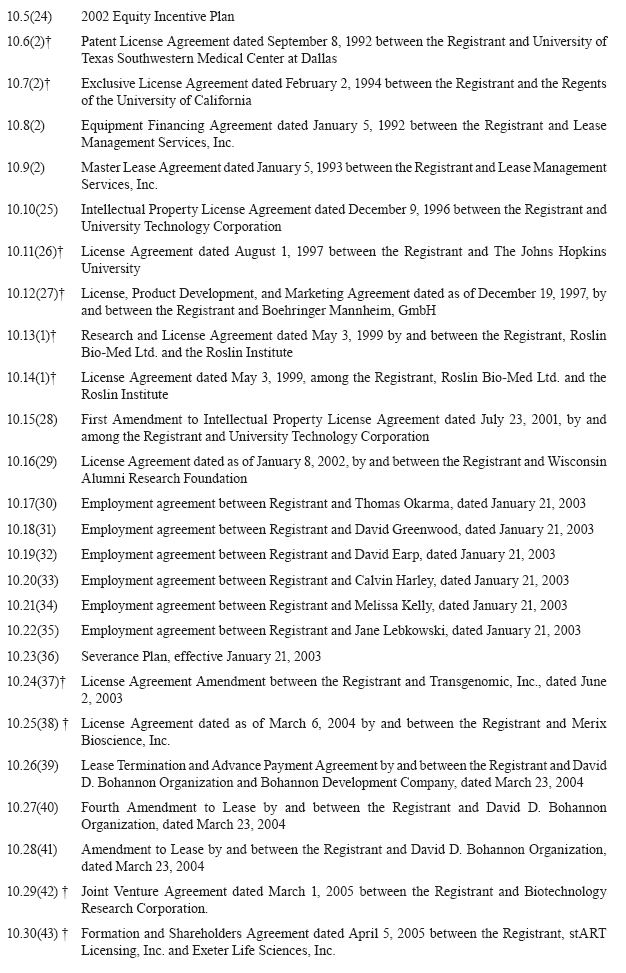

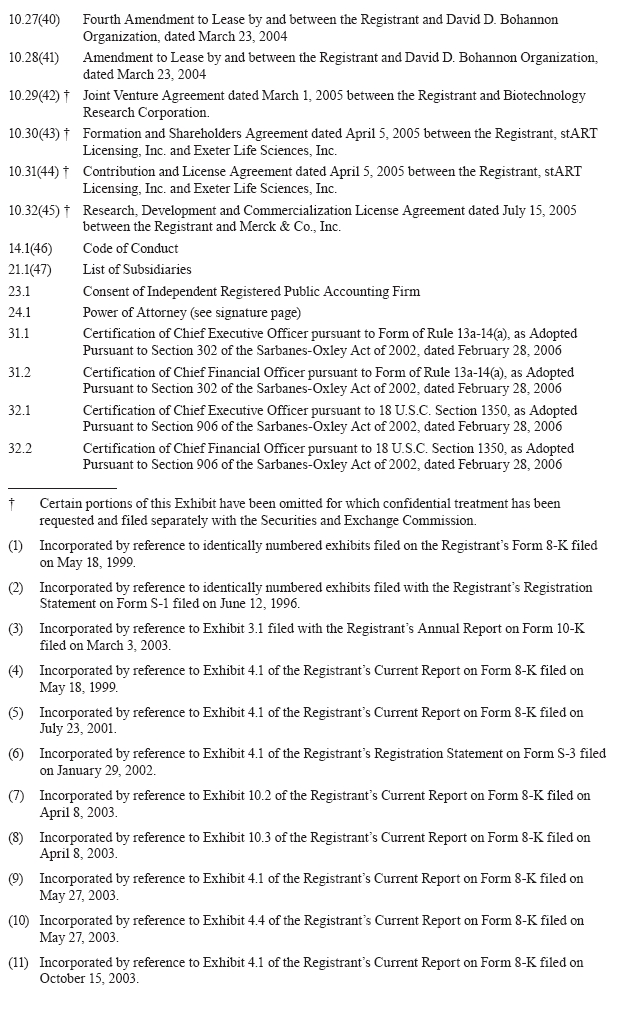

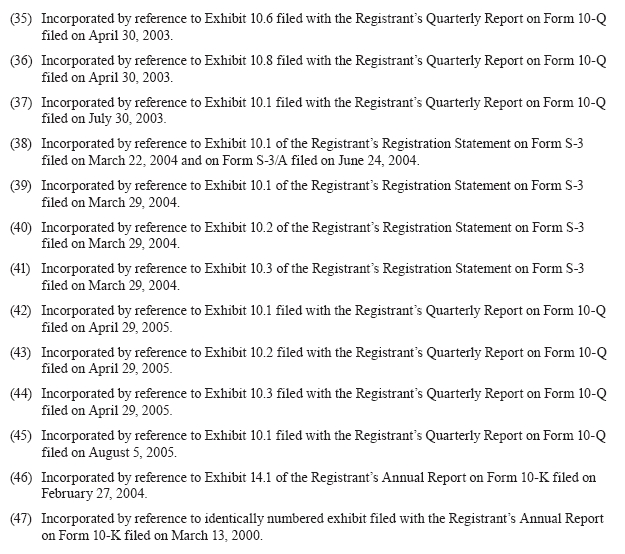

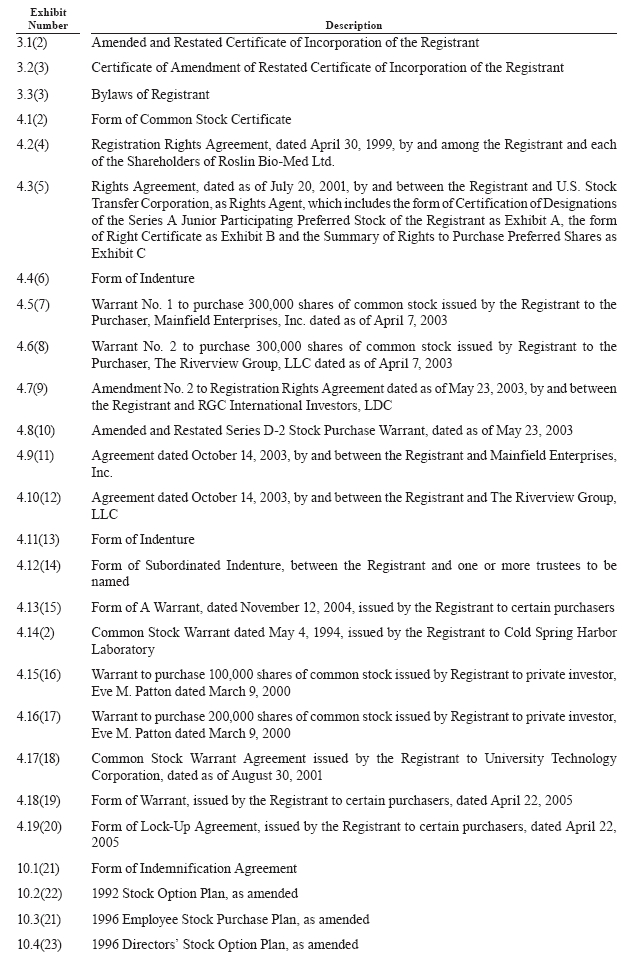

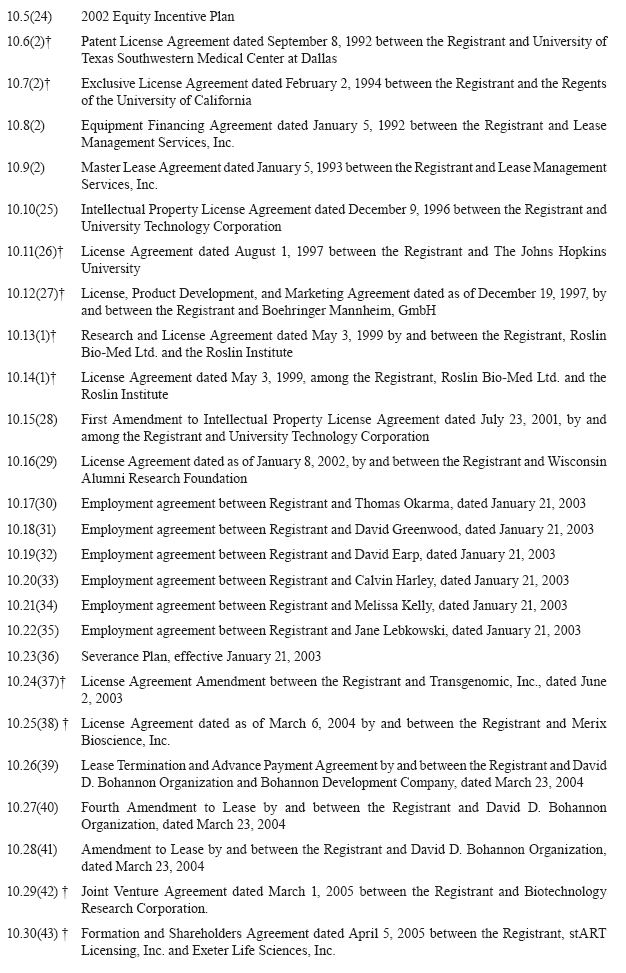

(3) EXHIBITS.

67

68

69

70

71

(b) REPORTS ON FORM 8-K

None

(c) INDEX TO EXHIBITS

See Exhibits listed under Item 15(a)(3) above.

(d) FINANCIAL STATEMENTS AND SCHEDULES

The financial statement schedules required by this Item are listed under Item 15(a)(1) and (2) above.

72

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Menlo Park, State of California, on the 28th day of February, 2006.

| Geron Corporation |

| |

| By:/s/ THOMAS B. OKARMA |

| THOMASB. OKARMA |

| President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW BY ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints, jointly and severally, Thomas B. Okarma and David L. Greenwood, and each one of them, attorneys-in-fact for the undersigned, each with the power of substitution, for the undersigned in any and all capacities, to sign any and all amendments to this annual report on Form 10-K, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that each of said attorneys-in-fact, or his substitutes, may do or cause to be done by virtue hereof.

IN WITNESS WHEREOF, each of the undersigned has executed this Power of Attorney as of the date indicated opposite his/her name.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

73

EXHIBIT INDEX

74

75

76

77

78