UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Portfolio, Inc.

(Exact name of registrant as specified in charter)

5300 Meadows Road, Suite 250

Lake Oswego, OR 97035

(Address of principal executive offices) (Zip code)

Robert McIver

5300 Meadows Road, Suite 250

Lake Oswego, OR 97035

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2011

Item 1. Report to Stockholders.

Letter from The Investment Adviser

DEAR FELLOW SHAREHOLDERS,

The Jensen Portfolio -- Class J Shares -- returned 23.31% for the year ended May 31, 2011, compared to a return of 25.95% for the Standard & Poor’s 500 Index over this period. Please see pages 4 through 6 of this report for complete standardized performance information for the Portfolio.

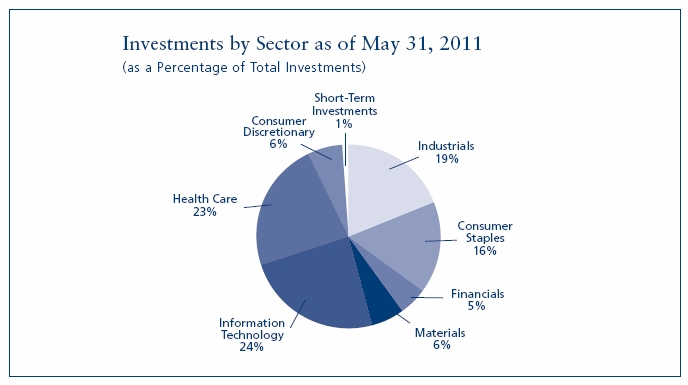

Specific stock selection added value in the Information Technology and Financial sectors, while detracting from returns in the Consumer Staples and Health Care sectors. From a sector perspective, our overweighting in the Industrials sector added value. In addition, substantially all of our underperformance versus the benchmark can be attributed to our lack of representation in the Energy and Telecom Services sectors as both saw much more positive returns than the benchmark as a whole. We avoid these sectors because they produce virtually no companies with the long-term record of consistent business performance that Jensen requires, measured by 10 consecutive years of 15% or greater Return on Equity, as determined by the Investment Adviser.

Market Perspective

The S&P 500 Index has shown a 98.7% return between the low of March 9, 2009 and May 31, 2011. Since that low over two fiscal years ago, the S&P 500 has risen from a level of 677 to 1345. Despite the strong rebound, the index is still well below its previous peak level.

Much of the rebound through March 2011 was led by lower quality companies, as investors appeared to show little concern for world events or the issues plaguing the U.S. domestic economy. Over the last couple of months, however, we have seen increasing volatility in the markets and a corresponding rotation to quality companies such as those in The Jensen Portfolio. This is likely due to renewed concerns about the continuing Eurozone sovereign debt crisis, particularly in Greece, the Middle East unrest, particularly in Libya and Syria, and the domestic economy as uncertainty clouds the Federal Reserve’s future policies and doubt persists as to their effectiveness.

The stimulus-fed environment and low interest rates that have propelled the shares of lower quality businesses may continue for the remainder of 2011, albeit in different forms. But there now appears to be additional concerns expressed by investors. Risks to the economy have really not abated. The U.S. unemployment rate still exceeds 9%, the housing market remains quite sluggish and consumers continue to express doubt about the economy, reflected in less than robust spending. Credit remains difficult to obtain, despite low interest rates, as lenders worry about default risk and the impact of proposed regulatory constraints. All of these factors are again weighing heavily on investors.

The Effect at Jensen

Despite ongoing volatility, or perhaps because of it, we continue to find what we believe are attractive opportunities across the portfolio. That is particularly true for companies that are positioned for growth from overseas operations, especially in emerging markets.

Our top contributors to performance for the fiscal year were Oracle, Cognizant Technology Solutions, Praxair, United Technologies and T. Rowe Price. While these companies are in different sectors, their combination of strong future business prospects, technological prowess, innovation-focused strategies and attractive market prices made these businesses compelling. Each of them operates in a sector that we believe is well positioned for future growth.

Significant detractors from the Portfolio’s performance for the fiscal year included Microsoft and Sysco. Other significant detractors were Nike, our newest addition to the Portfolio, as well as Johnson & Johnson and Clorox, both of which were sold. (Please see details below under “Portfolio Additions and Eliminations”). We believe that Nike’s short-term performance is not representative of the long-term opportunity that this company represents.

Shares of Microsoft were essentially flat for the fiscal year due to concerns about growth in the PC markets and the explosive growth of tablet devices. Exiting a recession, businesses generally spend on Information Technology because of the measurable improvements in productivity and the ability to maintain lean staffing levels. Adoption of Windows 7 has been slower than anticipated at the enterprise level as a result of the weak economy. Yet a silver lining remains. For many businesses still relying on the decade-old Windows XP, an upgrade is inevitable. Growth should also be driven by the strong product cycles of Microsoft’s server products and the launch of Office 2010. The robust free cash flow that these franchises provide enables Microsoft to continue developing areas such as online services, consumer products and its cloud computing venture, Azure, which we believe represents the next major growth area for the company.

Sysco, the global leader in food product distribution, continues to be impacted by concerns regarding consumer spending and more limited dining out. At the same time, the company continues to execute its strategy by maintaining a low cost structure, pursuing additional cost saving initiatives and assisting customers through a business transformation program designed to combat the sluggish economy. As the dominant company in its industry, Sysco has been gaining market share and utilizing its strong financial position to drive additional growth. Additional consumer confidence and clarity on the economy should benefit Sysco in the future.

Portfolio Additions and Eliminations

Becton Dickinson was added to the Portfolio in January 2011. Becton is a global medical device maker focused on the design and manufacture of needles and syringes for use in hospitals and other medical settings. The products are used for drug delivery, diabetes care and diagnostic fluid sampling. The company also provides tools that facilitate testing for diseases such as hospital-acquired infections and products that enable cellular analysis and pharmaceutical research. The company’s primary competitive advantage is its manufacturing scale in the needle and syringe business. The company produces over 29 billion syringes each year which translates into a nearly 70% global market share. The ubiquitous nature of its products, and the fact that each is discarded after a single use, create an attractive recurring revenue stream. The company has consistently generated returns well in excess of its capital cost, has strong and growing free cash flows and a strong balance sheet.

In April 2011 we added Nike, the world’s leading footwear, sportswear and equipment supplier, both in terms of revenue and market capitalization. The company operates in more than 170 countries and more than half of its revenues come from outside the U.S. Competitive advantages are numerous and include a premium, globally recognized brand name, powerful research and development abilities, large economies of scale across the business, diversified revenue sources and a strong marketing reputation. While the industry is competitive, we believe Nike is financially stronger than its competitors and is more profitable. Growth opportunities are present in nearly all markets and categories and huge global sports events such as the London Olympics in 2012 and the 2014 World Cup in Brazil should bode well for the company and its worldwide presence.

Johnson & Johnson and Clorox were both sold primarily due to concerns about growth prospects within their respective businesses.

Johnson & Johnson has been impacted by the likelihood of mandatory pricing concessions and the threat of pricing pressure as a result of the passage of healthcare reform in the U.S. last year. The company faces specific growth headwinds due to patent expirations and generic competition within its pharmaceutical franchise. While the company’s drug pipeline has historically been positive, the U.S. Food and Drug Administration has become increasingly more demanding in terms of the approval process for new pharmaceuticals brought to market. The company has also been forced to focus on quality issues within its consumer franchise. This has diverted resources from other growth initiatives.

Clorox has been struggling against private label competition in key categories more than other Consumer Staples companies that we follow. Pricing power appears to have eroded in the face of such competition. Moreover, the company lacks real exposure to what are considered high growth emerging markets such as the BRIC countries of Brazil, Russia, India and China. Most of our portfolio companies are deeply and strategically exposed to these countries which likely represent the next engine for growth. We also believe that management execution at Clorox has been underwhelming, whether related to the delay of planned divestitures or the missed expectations around a key acquisition that resulted in a substantial writedown of intangible assets within the last few months.

The Jensen Outlook

Equity markets have climbed considerably over the past two years. Corporate America is lean and productive, as demonstrated by many companies’ strong business performance exiting the recession. Consumer strength is improving, marked by lower delinquency rates on lending, rising auto sales and increased borrowing, offset somewhat by a lack of increased spending. Nonetheless, substantial risks remain in the global economy, many of which we have noted above.

We believe that the “easy money” has already been made. We do not anticipate trouble-free sailing for the equity markets, but we do see opportunities for longer term investors in high-quality U.S.-based growth companies. Business performance for these firms has been steadily improving. Their balance sheets are strong, allowing them to reinvest for future growth. Yet the share prices of these businesses have not risen to the same degree as the overall market in recent quarters. We do not expect the market to rise at rates similar to when credit was flowing more freely and the relationship between risk and reward was off balance. However, we anticipate that quality businesses will continue to perform at high levels and believe that the market will reflect such performance.

The Jensen Portfolio’s companies benefit from a balance of revenues from inside the U.S. as well as outside. Growth in the U.S. may be slow and the economic recovery thus far has been choppy. The challenges suppressing the recovery appear stubborn and will likely persist for at least the near term. But the strong free cash flows from the domestic operations of our companies are expected to be effectively deployed to faster growing economies around the world, as well as toward acquisitions, or returned to shareholders as dividends and share buybacks. We believe these quality businesses are well positioned for the next stage of the economic recovery, however it plays out.

We invite you to seek additional information about The Jensen Portfolio at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Investment Committee

This discussion and analysis of the Fund is as of May 2011 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security.

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index.

For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Portfolio is distributed by Quasar Distributors, LLC.

| the Jensen Portfolio (Unaudited) |

| |

| |

| | | |

| | Average Annual – FOR PERIODS ENDED MAY 31, 2011 | |

| | | |

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 1O YEARS | |

| | the Jensen Portfolio - Class J | | 23.31% | | 5.14% | | 5.64% | | 4.38% | |

| | S&P 500 Stock Index | | 25.95% | | 0.91% | | 3.32% | | 2.64% | |

| | | | | | | | | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2001 for Class J, the original share class of the fund. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| the Jensen Portfolio (Unaudited) |

| |

| |

| | | |

| | Average Annual – FOR PERIODS ENDED MAY 31, 2011 | |

| | | |

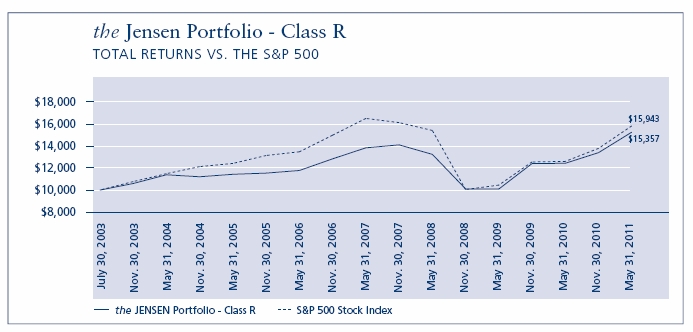

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | SINCE INCEPTION

JULY 30, 2003 | |

| | the Jensen Portfolio - Class R | | 23.08% | | 4.91% | | 5.39% | | 5.63% | |

| | S&P 500 Stock Index | | 25.95% | | 0.91% | | 3.32% | | 6.13% | |

| | | | | | | | | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on July 30, 2003, the inception date for Class R shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| the Jensen Portfolio (Unaudited) |

| |

| |

| | | |

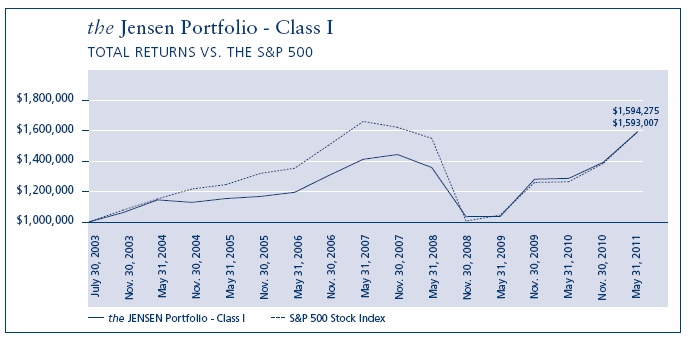

| | Average Annual – FOR PERIODS ENDED MAY 31, 2011 | |

| | | |

| | | | 1 YEAR | | 3 YEARS | | 5 YEARS | | SINCE INCEPTION

JULY 30, 2003 | |

| | the Jensen Portfolio - Class I | | 23.72% | | 5.45% | | 5.91% | | 6.12% | |

| | S&P 500 Stock Index | | 25.95% | | 0.91% | | 3.32% | | 6.13% | |

| | | | | | | | | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on July 30, 2003, the inception date for Class I shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| the Jensen Portfolio (Unaudited) |

| |

| |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Statement of Assets & Liabilities

May 31, 2011

| Assets: | | | |

| |

| Investments, at value (cost $3,196,161,615) | $ | 4,159,236,406 | |

| Income receivable | | 5,104,695 | |

| Receivable for capital stock issued | | 20,872,809 | |

| Other assets | | 98,245 | |

| Total Assets | | 4,185,312,155 | |

| |

| Liabilities: | | | |

| |

| Payable to Investment Adviser | | 1,818,472 | |

| Payable for investments purchased | | 4,987,035 | |

| Payable for capital stock redeemed | | 2,264,898 | |

| Accrued distribution fees | | 976,324 | |

| Other accrued expenses | | 984,969 | |

| Total Liabilities | | 11,031,698 | |

| NET ASSETS | $ | 4,174,280,457 | |

| |

| NET ASSETS CONSIST OF: | | | |

| Capital stock | | 3,283,369,982 | |

| Accumulated undistributed net investment income | | 5,908,831 | |

| Accumulated net realized loss | | (78,073,147 | ) |

| Unrealized appreciation on investments | | 963,074,791 | |

| Total Net Assets | $ | 4,174,280,457 | |

| |

| NET ASSETS CONSIST OF: | | | |

| Class J Shares: | | | |

| Net assets | $ | 2,593,127,869 | |

| Shares outstanding | | 89,082,721 | |

| Net Asset Value, Offering Price and Redemption Price Per Share | | | |

| (2,000,000,000 shares authorized, $.001 par value) | | | $29.11 | |

| |

| Class R Shares: | | | |

| Net assets | $ | 29,077,266 | |

| Shares outstanding | | 1,002,294 | |

| Net Asset Value, Offering Price and Redemption Price Per Share | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | | $29.01 | |

| |

| Class I Shares: | | | |

| Net assets | $ | 1,552,075,322 | |

| Shares outstanding | | 53,265,915 | |

| Net Asset Value, Offering Price and Redemption Price Per Share | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | | $29.14 | |

| 8 | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

Schedule of Investments

May 31, 2011

(showing percentage of total net assets)

| SHARES | | | VALUE |

| | | Common Stocks - 98.92% | |

| | | | |

| | | Aerospace & Defense - 4.95% | |

| 2,353,000 | | United Technologies | | |

| | | Corporation | $ | 206,522,810 |

| | | | |

| | | Air Freight & Logistics - 1.74% | |

| 903,000 | | CH Robinson Worldwide, Inc. | | 72,438,660 |

| | | | | |

| | | Beverages - 7.41% | | |

| 1,562,000 | | The Coca-Cola Company | | 104,357,220 |

| 2,879,000 | | PepsiCo, Inc. | | 204,754,480 |

| | | | | 309,111,700 |

| | | Capital Markets - 4.55% | | |

| 3,002,000 | | T. Rowe Price Group, Inc. | | 190,026,600 |

| | | | | |

| | | Chemicals - 5.49% | | |

| 1,219,000 | | Ecolab, Inc. | | 66,898,720 |

| 1,534,000 | | Praxair, Inc. | | 162,358,560 |

| | | | | 229,257,280 |

| | | Electrical Equipment - 4.26% | |

| 3,263,100 | | Emerson Electric Co. | | 178,002,105 |

| | | | | |

| | | Electronic Equipment, | | |

| | | Instruments & Components - 2.67% | | |

| 2,060,200 | | Amphenol Corporation | | 111,374,412 |

| | | | |

| | | Food & Staples Retailing - 1.66% | |

| 2,154,000 | | Sysco Corporation | | 69,380,340 |

| | | |

| | | Health Care Equipment & Supplies - 15.72% |

| 1,823,000 | | Becton Dickinson & Co. | | 159,603,650 |

| 1,116,000 | | CR Bard, Inc. | | 124,746,480 |

| 4,464,400 | | Medtronic, Inc. | | 181,701,080 |

| 3,050,000 | | Stryker Corporation | | 190,320,000 |

| | | | | 656,371,210 |

| | | Household Products - 7.31% | | |

| 1,360,000 | | Colgate-Palmolive | | |

| | | Company | | 119,040,800 |

| 2,777,000 | | The Procter & Gamble | | |

| | | Company | | 186,059,000 |

| | | | | 305,099,800 |

| | | Industrial Conglomerates - 4.82% | | |

| 2,133,500 | | 3M Co. | | 201,359,730 |

| | | | | |

| | | IT Services - 8.34% | | |

| 2,332,500 | | Automatic Data | | |

| | | Processing, Inc. | | 128,544,075 |

| 1,578,000 | | Cognizant Technology | | |

| | | Solutions Corporation (a) | | 119,991,120 |

| 3,086,000 | | Paychex, Inc. | | 99,677,800 |

| | | | | 348,212,995 |

| | | Life Sciences Tools & Services - 2.84% | | |

| 1,203,000 | | Waters Corporation (a) | | 118,567,680 |

| | | | | |

| | | Media - 4.70% | | |

| 4,193,000 | | Omnicom Group, Inc. | | 196,106,610 |

| | | | | |

| | | Pharmaceuticals - 4.43% | | |

| 3,539,000 | | Abbott Laboratories | | 184,912,750 |

| | | | | |

| | | Professional Services - 3.51% | | |

| 3,877,000 | | Equifax, Inc. | | 146,511,830 |

| | | | | |

| | | Software - 12.92% | | |

| 5,750,000 | | Adobe Systems, Inc. (a) | | 199,122,500 |

| 7,200,000 | | Microsoft Corporation | | 180,072,000 |

| 4,682,000 | | Oracle Corporation | | 160,218,040 |

| | | | | 539,412,540 |

| | | Textiles, Apparel & Luxury Goods - 1.60% |

| 790,000 | | Nike, Inc. | | 66,715,500 |

| | | | | |

| | | Total Common Stocks | | |

| | | (Cost $3,166,309,761) | | 4,129,384,552 |

| |

| | | Short-Term Investments - 0.72% | | |

| | | | | |

| | | Money Market Funds - 0.72% | | |

| 29,851,854 | | Fidelity Institutional | | |

| | | Government Portfolio - | | |

| | | Class I, 0.01% (b) | | 29,851,854 |

| | | Total Short-Term Investments | | |

| | | (Cost $29,851,854) | | 29,851,854 |

| |

| | | Total Investments (Cost | | |

| | | $3,196,161,615) - 99.64% | | 4,159,236,406 |

| | | | | |

| | | Other Assets in Excess of | | |

| | | Liabilities - 0.36% | | 15,044,051 |

| | | TOTAL NET ASSETS - | | |

| | | 100.00% | $ | 4,174,280,457 |

| (a) | Non-income producing security. |

| |

| (b) | Variable rate security. The rate listed is as of May 31, 2011. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | 9 |

Statement of Operations

Year Ended May 31, 2011

| Investment Income: | | |

| |

| Dividend income | $ | 66,217,870 |

| Interest income | | 15,715 |

| | | 66,233,585 |

| |

| Expenses: | | |

| |

| Investment advisory fees | | 16,634,201 |

| 12b-1 fees - Class J | | 5,304,067 |

| Sub-transfer agent expenses - Class J | | 1,617,956 |

| Administration fees | | 1,166,186 |

| Reports to shareholders - Class J | | 284,628 |

| Custody fees | | 269,724 |

| Federal and state registration fees | | 250,444 |

| Transfer agent fees - Class J | | 227,911 |

| Shareholder servicing fees - Class I | | 223,050 |

| Fund accounting fees | | 202,465 |

| Directors’ fees and expenses | | 156,423 |

| Transfer agent expenses | | 127,536 |

| 12b-1 fees - Class R | | 89,895 |

| Reports to shareholders - Class I | | 81,687 |

| Professional fees | | 75,535 |

| Other | | 58,058 |

| Transfer agent fees - Class I | | 3,938 |

| Reports to shareholders - Class R | | 3,285 |

| Transfer agent fees - Class R | | 1,597 |

| Total expenses | | 26,778,586 |

| |

| NET INVESTMENT INCOME | | 39,454,999 |

| |

| REALIZED AND UNREALIZED GAIN | | |

| ON INVESTMENTS: | | |

| |

| Net realized gain on investment | | |

| transactions | | 37,951,431 |

| Change in unrealized appreciation on | | |

| investments | | 627,037,013 |

| |

| Net gain on investments | | 664,988,444 |

| |

| NET INCREASE IN NET ASSETS | | |

| RESULTING FROM OPERATIONS | $ | 704,443,443 |

Statements of Changes in

Net Assets

| | YEAR ENDED | | YEAR ENDED |

| | MAY 31, ’11 | | MAY 31, ’10 |

| Operations: | | | | | | | |

| Net investment income | $ | 39,454,999 | | | $ | 23,493,187 | |

| Net realized gain on | | | | | | | |

| investment transactions | | 37,951,431 | | | | 25,737,399 | |

| Change in unrealized | | | | | | | |

| appreciation on | | | | | | | |

| investments | | 627,037,013 | | | | 323,785,262 | |

| Net increase in net | | | | | | | |

| assets resulting from | | | | | | | |

| operations | | 704,443,443 | | | | 373,015,848 | |

| |

| Capital Share Transactions: | | | | | | | |

| Shares sold - Class J | | 839,945,208 | | | | 580,796,998 | |

| Shares sold - Class R | | 19,763,215 | | | | 7,988,797 | |

| Shares sold - Class I | | 643,223,401 | | | | 589,099,767 | |

| Shares issued in reinvestment | | | | | | | |

| of dividends - Class J | | 21,223,874 | | | | 16,101,726 | |

| Shares issued in reinvestment | | | | | | | |

| of dividends - Class R | | 148,414 | | | | 89,865 | |

| Shares issued in reinvestment | | | | | | | |

| of dividends - Class I | | 13,429,551 | | | | 5,350,089 | |

| Shares redeemed - Class J | | (466,998,928 | ) | | | (453,881,722 | ) |

| Shares redeemed - Class R | | (6,896,607 | ) | | | (5,128,432 | ) |

| Shares redeemed - Class I | | (176,619,732 | ) | | | (122,660,025 | ) |

| Net increase | | 887,218,396 | | | | 617,757,063 | |

| | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS | | | | | | | |

| TO SHAREHOLDERS: | | | | | | | |

| Net investment income - Class J | | (21,860,971 | ) | | | (16,724,991 | ) |

| Net investment income - Class R | | (148,491 | ) | | | (89,865 | ) |

| Net investment income - Class I | | (15,500,369 | ) | | | (5,775,517 | ) |

| Total dividends and | | | | | | | |

| distributions | | (37,509,831 | ) | | | (22,590,373 | ) |

| | | | | | | | |

| INCREASE IN NET ASSETS | | 1,554,152,008 | | | | 968,182,538 | |

| | | | | | | | |

| NET ASSETS: | | | | | | | |

| Beginning of year | | 2,620,128,449 | | | | 1,651,945,911 | |

| End of year (including | | | | | | | |

| undistributed net | | | | | | | |

| investment income of | | | | | | | |

| $5,908,831 and $3,963,663, | | | | | | | |

| respectively) | $ | 4,174,280,457 | | | $ | 2,620,128,449 | |

| 10 | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

Financial Highlights

Class J

| | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED |

| | | MAY 31, ’11 | | MAY 31, ’10 | | MAY 31, ’09 | | MAY 31, ’08 | | MAY 31, ’07 |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | | $ | 23.86 | | | | | $ | 19.47 | | | | | $ | 26.91 | | | | | $ | 28.53 | | | | | $ | 24.37 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 0.27 | | | | | | 0.24 | | | | | | 0.30 | | | | | | 0.27 | | | | | | 0.22 | | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | | 5.25 | | | | | | 4.39 | | | | | | (6.78 | ) | | | | | (1.42 | ) | | | | | 4.16 | | |

| Total from investment operations | | | | 5.52 | | | | | | 4.63 | | | | | | (6.48 | ) | | | | | (1.15 | ) | | | | | 4.38 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.27 | ) | | | | | (0.24 | ) | | | | | (0.31 | ) | | | | | (0.26 | ) | | | | | (0.22 | ) | |

| Dividends from net realized capital gains | | | | — | | | | | | — | | | | | | (0.65 | ) | | | | | (0.21 | ) | | | | | — | | |

| Total distributions | | | $ | (0.27 | ) | | | | $ | (0.24 | ) | | | | $ | (0.96 | ) | | | | $ | (0.47 | ) | | | | $ | (0.22 | ) | |

| Net asset value, end of year | | | $ | 29.11 | | | | | $ | 23.86 | | | | | $ | 19.47 | | | | | $ | 26.91 | | | | | $ | 28.53 | | |

| Total return | | | | 23.31 | % | | | | | 23.85 | % | | | | | -23.90 | % | | | | | -4.08 | % | | | | | 18.05 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | | $ | 2,593,128 | | | | | $ | 1,776,091 | | | | | $ | 1,340,826 | | | | | $ | 1,706,765 | | | | | $ | 1,963,520 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | | 0.92 | % | | | | | 0.92 | % | | | | | 0.86 | % | | | | | 0.85 | % | | | | | 0.85 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | | 1.07 | % | | | | | 1.04 | % | | | | | 1.47 | % | | | | | 0.95 | % | | | | | 0.83 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | | 6.84 | % | | | | | 12.33 | % | | | | | 23.59 | % | | | | | 8.25 | % | | | | | 13.77 | % | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | 11 |

Financial Highlights

Class R

| | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED |

| | | MAY 31, ’11 | | MAY 31, ’10 | | MAY 31, ’09 | | MAY 31, ’08 | | MAY 31, ’07 |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | | $ | 23.78 | | | | | $ | 19.40 | | | | | $ | 26.81 | | | | | $ | 28.43 | | | | | $ | 24.29 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 0.23 | | | | | | 0.20 | | | | | | 0.23 | | | | | | 0.22 | | | | | | 0.15 | | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | | 5.23 | | | | | | 4.37 | | | | | | (6.75 | ) | | | | | (1.44 | ) | | | | | 4.14 | | |

| Total from investment operations | | | | 5.46 | | | | | | 4.57 | | | | | | (6.52 | ) | | | | | (1.22 | ) | | | | | 4.29 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.23 | ) | | | | | (0.19 | ) | | | | | (0.24 | ) | | | | | (0.19 | ) | | | | | (0.15 | ) | |

| Dividends from net realized capital gains | | | | — | | | | | | — | | | | | | (0.65 | ) | | | | | (0.21 | ) | | | | | — | | |

| Total distributions | | | | (0.23 | ) | | | | | (0.19 | ) | | | | | (0.89 | ) | | | | | (0.40 | ) | | | | | (0.15 | ) | |

| Net asset value, end of year | | | $ | 29.01 | | | | | $ | 23.78 | | | | | $ | 19.40 | | | | | $ | 26.81 | | | | | $ | 28.43 | | |

| Total return | | | | 23.08 | % | | | | | 23.59 | % | | | | | -24.10 | % | | | | | -4.34 | % | | | | | 17.73 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | | $ | 29,077 | | | | | $ | 12,533 | | | | | $ | 7,562 | | | | | $ | 18,662 | | | | | $ | 22,272 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | | 1.10 | % | | | | | 1.12 | % | | | | | 1.13 | % | | | | | 1.10 | % | | | | | 1.10 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | | 0.87 | % | | | | | 0.83 | % | | | | | 1.18 | % | | | | | 0.70 | % | | | | | 0.58 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | | 6.84 | % | | | | | 12.33 | % | | | | | 23.59 | % | | | | | 8.25 | % | | | | | 13.77 | % | |

| 12 | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

Financial Highlights

Class I

| | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED |

| | | MAY 31, ’11 | | MAY 31, ’10 | | MAY 31, ’09 | | MAY 31, ’08 | | MAY 31, ’07 |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | | $ | 23.88 | | | | | $ | 19.48 | | | | | $ | 26.91 | | | | | $ | 28.53 | | | | | $ | 24.38 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 0.37 | | | | | | 0.34 | | | | | | 0.37 | | | | | | 0.30 | | | | | | 0.25 | | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | | 5.24 | | | | | | 4.36 | | | | | | (6.80 | ) | | | | | (1.38 | ) | | | | | 4.16 | | |

| Total from investment operations | | | | 5.61 | | | | | | 4.70 | | | | | | (6.43 | ) | | | | | (1.08 | ) | | | | | 4.41 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (0.35 | ) | | | | | (0.30 | ) | | | | | (0.35 | ) | | | | | (0.33 | ) | | | | | (0.26 | ) | |

| Dividends from net realized capital gains | | | | — | | | | | | — | | | | | | (0.65 | ) | | | | | (0.21 | ) | | | | | — | | |

| Total distributions | | | | (0.35 | ) | | | | | (0.30 | ) | | | | | (1.00 | ) | | | | | (0.54 | ) | | | | | (0.26 | ) | |

| Net asset value, end of year | | | $ | 29.14 | | | | | $ | 23.88 | | | | | $ | 19.48 | | | | | $ | 26.91 | | | | | $ | 28.53 | | |

| Total return | | | | 23.72 | % | | | | | 24.21 | % | | | | | -23.71 | % | | | | | -3.86 | % | | | | | 18.23 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | | $ | 1,552,075 | | | | | $ | 831,505 | | | | | $ | 303,557 | | | | | $ | 343,250 | | | | | $ | 341,589 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | | 0.60 | % | | | | | 0.61 | % | | | | | 0.61 | % | | | | | 0.61 | % | | | | | 0.65 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | | 1.39 | % | | | | | 1.33 | % | | | | | 1.72 | % | | | | | 1.20 | % | | | | | 1.03 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | | 6.84 | % | | | | | 12.33 | % | | | | | 23.59 | % | | | | | 8.25 | % | | | | | 13.77 | % | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | 13 |

Notes to the Financial Statements

May 31, 2011

1. Organization and Significant Accounting Policies

The Jensen Portfolio, Inc. (the “Fund”) was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. The Fund is authorized to issue 5,000,000,000 shares of common stock. The Fund currently offers three different classes of shares. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I, and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee; Class R shares are subject to a 0.50% 12b-1 fee and Class I shares are subject to a shareholder servicing fee up to 0.10%, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees and shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges or the Nasdaq Stock Market are valued at the last sale price on the day the securities are valued or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. The three levels of the fair value hierarchy are as follows:

| Level 1 | | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| | | |

| Level 2 | | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| | | |

| Level 3 | | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, include active listed equities and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

The following is a summary of the inputs used, as of May 31, 2011, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments | | | | | | | | | | | | | | | |

| at Value | | | Total | | Level 1 | | Level 2 | | Level 3 |

| Total Common | | | | | | | | | | | | | | | |

| Stocks* | | | $ | 4,129,384,552 | | $ | 4,129,384,552 | | | $— | | | | $— | |

| Total Money | | | | | | | | | | | | | | | |

| Market | | | | | | | | | | | | | | | |

| Funds | | | | 29,851,854 | | | 29,851,854 | | | $— | | | | $— | |

| Total | | | | | | | | | | | | | | | |

| Investments | | | $ | 4,159,236,406 | | $ | 4,159,236,406 | | | $— | | | | $— | |

| * | | For further information regarding security characteristics, and industry classifications please see the Schedule of Investments. |

The Fund did not hold any investments during the year ended May 31, 2011 with significant unobservable inputs which would be classified as Level 3. There were no transfers of securities between levels during the reporting period. It is the Fund’s policy to record transfers between levels as of the end of the reporting period. The Fund did not hold any derivative instruments during the reporting period.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2011. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. As of May 31, 2011, open Federal tax years include the tax years ended May 31, 2008 through 2011. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. Additionally, GAAP requires that certain components of net assets relating to permanent differences be reclassified between the components of net assets. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2011, there were no reclassifications made.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each Director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed to the Class J shares based on the actual number of shareholder accounts held and serviced by certain financial intermediaries as described in the Class J shares’ prospectus. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% of the average daily net assets of Class I shares.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| | | YEAR ENDED | | YEAR ENDED |

| | | MAY 31, ’11 | | MAY 31, ’10 |

| Class J | | | | | | | | | | |

| Shares sold | | | 31,669,286 | | | | | 24,686,314 | | |

| Shares issued to holders in | | | | | | | | | | |

| reinvestment of dividends | | | 823,674 | | | | | 704,722 | | |

| Shares redeemed | | | (17,858,290 | ) | | | | (19,820,585 | ) | |

| Net increase | | | 14,634,670 | | | | | 5,570,451 | | |

| Shares outstanding: | | | | | | | | | | |

| Beginning of year | | | 74,448,051 | | | | | 68,877,600 | | |

| End of year | | | 89,082,721 | | | | | 74,448,051 | | |

| | | YEAR ENDED | | YEAR ENDED |

| | | MAY 31, ’11 | | MAY 31, ’10 |

| Class R | | | | | | | | | | |

| Shares sold | | | 724,521 | | | | | 353,425 | | |

| Shares issued to holders in | | | | | | | | | | |

| reinvestment of dividends | | | 5,743 | | | | | 3,932 | | |

| Shares redeemed | | | (255,106 | ) | | | | (220,096 | ) | |

| Net increase | | | 475,158 | | | | | 137,261 | | |

| Shares outstanding: | | | | | | | | | | |

| Beginning of year | | | 527,136 | | | | | 389,875 | | |

| End of year | | | 1,002,294 | | | | | 527,136 | | |

| | | | | | | | | | | |

| Class I | | | | | | | | | | |

| Shares sold | | | 24,717,114 | | | | | 24,246,129 | | |

| Shares issued to holders in | | | | | | | | | | |

| reinvestment of dividends | | | 520,046 | | | | | 230,635 | | |

| Shares redeemed | | | (6,794,093 | ) | | | | (5,239,430 | ) | |

| Net increase | | | 18,443,067 | | | | | 19,237,334 | | |

| Shares outstanding: | | | | | | | | | | |

| Beginning of year | | | 34,822,848 | | | | | 15,585,514 | | |

| End of year | | | 53,265,915 | | | | | 34,822,848 | | |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the year ended May 31, 2011, were $1,126,420,431 and $223,789,112 respectively.

4. Income Taxes

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

The distributions of $37,509,831 and $22,589,672 paid during the years ended May 31, 2011 and 2010 respectively were classified as ordinary for income tax purposes. Distributions of $0 and $701 paid during the years ended May 31, 2011 and 2010, respectively were classified as long term capital gain for income tax purposes.

At May 31, 2011, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | | $ | 3,196,472,769 | |

| Gross unrealized appreciation | | | 1,000,424,124 | |

| Gross unrealized depreciation | | | (37,660,487 | ) |

| Net unrealized appreciation | | | 962,763,637 | |

| Undistributed ordinary income | | | 5,908,831 | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | | 5,908,831 | |

| Other accumulated losses | | | (77,761,993 | ) |

| Total accumulated gains | | $ | 890,910,475 | |

At May 31, 2011, the Fund had tax basis capital losses of $77,761,993 which may be used to offset future capital gains. These carryforwards expire on May 31, 2018.

On June 20, 2011 and June 21, 2011, the Fund declared and paid, respectively, a distribution from ordinary income of $6,366,068, $66,700, and $5,097,804 for Class J, Class R, and Class I, respectively.

5. Line of Credit

The Fund has a $250 million revolving credit facility for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The unsecured line of credit has a one year term and is reviewed annually by the Board of Directors. The current agreement runs through December 20, 2011. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of May 31, 2011, the rate on the Fund’s line of credit was 2.25%. For the year ended May 31, 2011, the average borrowings and interest rate were $144,386 and 2.75% respectively. The August 30, 2010 balance of $12,211,000 was the maximum amount of borrowing during the year ended May 31, 2011. The Fund incurred interest expense of $4,026 during the reporting period, which is included in other expenses in the Fund’s Statement of Operations.

6. Investment Advisory Agreement

The Fund has an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Effective April 1, 2011, the Fund adopted breakpoints to its advisory fee schedule. Pursuant to the advisory agreement and breakpoint schedule, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion, up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion, up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion. Prior to April 1, 2011, the Investment Adviser was entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets.

Certain officers of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and

up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares.

Subsequent to its fiscal year end, effective July 1, 2011, the Fund adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares.

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. At May 31, 2011, Charles Schwab & Co., Inc., for the benefit of its customers, held 44.70% and 27.36% of the outstanding shares of the Class J and Class I share classes respectively. At May 31, 2011, Great-West Life & Annuity Insurance Company and State Street Bank Trust, for the benefit of their customers, owned 52.10% and 32.20%, respectively, of the outstanding shares of the Class R share class.

9. New Tax Law

On December 22, 2010, The Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”) was signed into law. The Modernization Act is the first major piece of legislation affecting regulated investment companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. Some highlights of the enacted provisions are as follows:

New capital losses may now be carried forward indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss.

The Modernization Act contains simplification provisions, which are aimed at preventing disqualification of a RIC for “inadvertent” failures of the asset diversification and/or qualifying income tests. Additionally, the Modernization Act exempts RICs from the preferential dividend rule, and repealed the 60-day designation requirement for certain types of pay-through income and gains.

Finally, the Modernization Act contains several provisions aimed at preserving the character of distributions made by a RIC during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions.

The provisions related to the RIC Modernization Act for qualification testing are effective for the May 31, 2011 taxable year. The effective date for changes in the treatment of capital losses is May 31, 2012 taxable year.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

The Jensen Portfolio, Inc.

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Jensen Portfolio, Inc. (the “Fund”) as of May 31, 2011, and the related statements of operations and changes in net assets, and the financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended May 31, 2010 and the financial highlights for the periods indicated prior to the year ended May 31, 2011, were audited by another independent registered public accounting firm, who expressed unqualified opinions on those statements and financial highlights.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2011 by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Jensen Portfolio, Inc. as of May 31, 2011, and the results of its operations, the changes in its net assets, and its financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

|

| |

COHEN FUND AUDIT SERVICES, LTD.

Westlake, Ohio

July 28, 2011 |

Expense Example – May 31, 2011 (Unaudited)

As a shareholder of The Jensen Portfolio (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period (December 1, 2010 – May 31, 2011).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Expense Example Tables

The Jensen Portfolio–Class J

| | | BEGINNING | | ENDING | | EXPENSES PAID |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | | DECEMBER 1, 2010 | | MAY 31, 2011 | | DECEMBER 1, 2010 – MAY 31, 2011 |

| Actual | | | $ | 1,000.00 | | | | $ | 1,141.60 | | | | $ | 4.86 | |

| Hypothetical (5% annual return before expenses) | | | | 1,000.00 | | | | | 1,020.39 | | | | | 4.58 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.91%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

The Jensen Portfolio–Class R

| | | BEGINNING | | ENDING | | EXPENSES PAID |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | | DECEMBER 1, 2010 | | MAY 31, 2011 | | DECEMBER 1, 2010 – MAY 31, 2011 |

| Actual | | | $ | 1,000.00 | | | | $ | 1,140.80 | | | | $ | 5.82 | |

| Hypothetical (5% annual return before expenses) | | | | 1,000.00 | | | | | 1,019.50 | | | | | 5.49 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 1.09%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

The Jensen Portfolio–Class I

| | | BEGINNING | | ENDING | | EXPENSES PAID |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | | DECEMBER 1, 2010 | | MAY 31, 2011 | | DECEMBER 1, 2010 – MAY 31, 2011 |

| Actual | | | $ | 1,000.00 | | | | $ | 1,143.60 | | | | $ | 3.15 | |

| Hypothetical (5% annual return before expenses) | | | | 1,000.00 | | | | | 1,022.00 | | | | | 2.97 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.59%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

Additional Information (Unaudited)

1. INVESTMENT ADVISORY AGREEMENT DISCLOSURE

Section 15(c) under the 1940 Act requires that a registered investment company’s board of directors, including a majority of independent directors voting separately, approve any new investment advisory contract for the fund and thereafter to review and approve the terms of the fund’s investment advisory agreement on an annual basis. In addition, Section 15(a) of the 1940 Act requires that any new investment advisory agreement be approved by the fund’s shareholders.

In their most recent deliberations concerning whether to renew the Fund’s Existing Agreement and whether to approve the New Agreement, the Board of Directors (the “Board”), including the Fund’s independent directors (“Independent Directors”), conducted the review and made the determinations that are described below. During its deliberations, the Board requested from the Adviser, and the Adviser furnished, all information reasonably necessary for it to evaluate both the renewal of the Fund’s existing investment advisory agreement with the Advisor (“Existing Agreement”) and the approval of the new investment advisory agreement with the Advisor (“New Agreement”). The New Agreement was approved by the Fund’s shareholders at a Special Meeting of the Fund’s shareholders on November 10, 2010. The term of the New Agreement commenced on February 28, 2011 and will continue until July 31, 2012 unless terminated earlier in accordance with its terms.

The entire Board first met on January 20, 2010 to consider the planned retirement of Robert Millen and the effects his retirement and the resulting change of control of the Adviser might have on the Fund’s and the Adviser’s operations. The entire Board met again on April 28, 2010 to consider the information provided by the Adviser in connection with the annual renewal of the Existing Agreement and the approval of the New Agreement. After the April 28 meeting, the Independent Directors met separately with their legal counsel to consider the information provided by the Adviser and identify additional information they needed to evaluate the Existing Agreement and the New Agreement. The entire Board then met again on July 21, 2010 to consider the annual continuation of the Existing Agreement and the approval of the New Agreement. During those meetings, the Board considered the factors and reached the conclusions described below, among others. The Board did not identify any single factor as controlling. Moreover, not every factor was given the same weight by each Director.

Nature, Extent and Quality of Services

The Board considered the nature, extent and quality of services provided to the Fund by the Adviser under the Existing Agreement and the services proposed to be provided under the New Agreement. The Board reviewed the terms of the Existing Agreement and the New Agreement, as well as the history of the Adviser and its investment discipline, its investment performance, and its day-to-day management of the Fund. The Board noted the Adviser’s focus on the business of the Fund, the compliance and other servicing aspects of the Fund, and the Adviser’s oversight of the Fund’s service providers.

The Board considered the proposed changes in the Adviser’s ownership and management and the potential impact on the Fund and the Adviser. The Board considered the Adviser’s business continuity plans, its organizational and ownership structure, and the composition of its investment committee, which makes all investment decisions for the Fund. The Board also considered the Adviser’s approach to risk management. Based on these and other factors, including the additional factors described below, the Board concluded that the services provided to the Fund under the Existing Agreement continued to be satisfactory and were not likely to change materially under the New Agreement.

Investment Performance

The Board examined the investment performance of the Fund compared to the S&P 500 Index and Russell 1000 Growth Index and to the Lipper Large Cap Core Funds and Morningstar Large Cap Growth Funds categories. Performance over one-, three-, five- and ten-year periods for the Fund was provided. The Board noted the favorable performance of the Fund for the three-, five- and ten-year periods compared to its relevant securities indices and comparable categories.

The Board observed that the Adviser appeared to have adhered to its strict investment discipline. They noted that the Adviser’s disciplined approach helped the Fund to be better positioned to weather the significant decline in the market in 2008 and early 2009. As a result of these and other factors, the Board concluded that the long-term investment performance of the Fund continued to be satisfactory.

Advisory Fee and Expense Ratio

The Board compared the Fund’s advisory fee with those of other comparable mutual funds in the Fund’s Lipper category. The Board noted that the Fund’s advisory fee of 0.50% continued to be below the median and the average for its category at similar asset levels, excluding passively managed funds and funds that have no share classes that are offered to retail investors. The

Board also noted that the Fund is a single fund (as opposed to one of a larger complex of funds) and that, while the Adviser employs a relatively straightforward investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders. The Board also noted that the advisory fee rate for which the Fund would be responsible under the New Agreement would be unchanged from the Existing Agreement.

The Board compared the fees charged to the Fund with the advisory fees charged to the non-Fund advisory clients of the Adviser. The Board observed that, with the exception of a small number of existing institutional clients where the Adviser believes the competitive market required a lower fee, the Adviser charges its separate accounts a minimum of 0.50%. In addition, the Board noted that the Adviser’s recently revised fee schedule for separate accounts provides for a minimum fee of 0.50% for individual investors and 0.45% for institutional investors.

The Board considered the Fund’s expense ratio and the expense ratios of other comparable mutual funds in the Fund’s Lipper and Morningstar categories. The Board noted that the Fund’s expense ratio was higher than the median and average of all funds with comparable net assets in its Lipper category but also noted that, when compared to retail class shares of actively managed funds, the Fund’s expense ratio was lower than the median and the average. Compared to retail class shares of actively managed funds in the Fund’s Morningstar category, the Board noted that the Fund’s expense ratio was below the average. The Board also noted that the Fund had a relatively low turnover rate, reducing the Fund’s transaction costs, which are not included in the Fund’s expense ratio but are deducted from the Fund’s net asset value. The Board acknowledged that, with the payment by the Fund of the sub transfer agency recordkeeping and shareholder servicing expenses and fees for certain of the Fund’s omnibus accounts (“Sub TA Fees”), the Fund’s expense ratio had increased during the past year, and was expected to increase further, but remain lower than the Lipper and Morningstar averages for retail-class shares of actively managed funds. In addition, the Board acknowledged that although under the New Agreement the Fund would be authorized to pay, subject to prior approval of the Board, certain costs of the Fund’s Compliance Personnel now paid by the Adviser, such costs were not expected to increase materially the Fund’s expense ratio. Otherwise, the Board noted, the expenses for which the Fund would be responsible under the New Agreement would be unchanged from the Existing Agreement. Based on these considerations and other factors, the Board concluded that the Fund’s advisory fee and expense ratio were reasonable relative to the Fund’s peer groups.

Profitability of the Adviser

The Board considered the profitability of the Existing Agreement to the Adviser, including an analysis of the Adviser’s profitability for 2009 and the methodology used to calculate that profitability, and compared the Adviser’s profitability to that of selected publicly traded mutual fund advisers. Even after adjustments for certain marketing revenues and expenses were made, it appeared that the Adviser’s pre-tax profit was higher than the average pre-tax profit margin of the group of publicly traded investment advisory firms. It was noted that the Adviser’s profitability may have been overstated due to the relatively low salaries and bonuses paid to its investment professionals, who may receive distributions of the Adviser’s profits on account of their equity ownership in the Adviser. The Board considered the fact that the Adviser had paid certain administrative expenses of the Fund and pays the cost of the Fund’s Chief Compliance Officer, though it noted that under the New Agreement the Fund would be authorized, subject to prior Board approval, to pay for certain costs of the Fund’s Compliance Personnel in the future. The Board also noted that the Fund had been subsidized by the Adviser during the early years of the Fund’s existence, and that only in the most recent eight years, as the Fund’s assets under management have grown, has the Fund contributed significantly to the Adviser’s profits. In addition, the Board acknowledged the entrepreneurial risk taken by the Adviser when it established the Fund.

The Board also examined the Adviser’s profitability from the Fund against the Adviser’s profitability from its separate account advisory business and found that the Fund provided a higher profit margin to the Adviser. The Board noted, however, that when adjustments for certain marketing revenues and expenses were made, the profit margins were similar. The Board understood that the administrative services the Adviser provides to the Fund are, on balance, more extensive than those it provides to its separate accounts and that economies of scale are realized with respect to managing one mutual fund compared to managing approximately 300 separate accounts. The Board also understood that in calculating its profitability from the Fund, the Adviser had been conservative in its method of allocating expenses to its Fund business relative to other acceptable allocation methodologies. The Board noted that the Adviser’s profitability from the Fund for 2010 was projected to increase as a result of the higher asset levels of the Fund and the payment by the Fund of the Sub TA Fees, which began in October 2009. The Board acknowledged the inherent limitations of profitability analyses, including the use of comparative data that is incomplete or dissimilar, such as financial information of publicly traded mutual fund advisers which have more diversified business lines and different cost structures than those of the Adviser, and the uncertainty of the various cost allocations and other assumptions used. Based on this and other information, the Board concluded that profits earned by the Adviser were not excessive.

Economies of Scale

The Board considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has benefited from any such economies, and whether the implementation of breakpoints in the Fund’s advisory fee was appropriate. The Board observed that, during a period of rapid Fund growth, the Fund’s expense ratio (for the Class J shares) had fallen from about 1% for the fiscal year ended May 31, 2002 to 0.92% for the fiscal year ended May 31, 2010, but was expected to increase with the payment by the Fund of the Sub TA Fees for the full year. Regarding the issue of breakpoints, although the Fund’s assets increased during the past year, the Board observed from the data presented that many comparable funds with breakpoints below the Fund’s 0.50% advisory fee had higher overall advisory fees at the same asset level as the current asset level of the Fund. Based on the data presented, the Board concluded that a breakpoint in the Fund’s advisory fee was not warranted at this time, but determined to reexamine the issue as Fund assets increase.

Other Benefits

The Board considered the potential fall-out benefits realized by the Adviser from services as investment manager of the Fund. The Board noted that the Adviser has no affiliated entities that provide services to the Fund and that the Adviser prohibits the receipt of third-party research for “soft dollars”. The Board understood that the Adviser maintained a separate account advisory business and had recently started a new fund. The Board noted that, while the Adviser’s non-Fund business might benefit from any favorable publicity received by the Fund, any such benefit was difficult to quantify.

Other Factors and Considerations