UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Portfolio, Inc.

(Exact name of registrant as specified in charter)

5300 Meadows Road, Suite 250

Lake Oswego, OR 97035-8234

(Address of principal executive offices) (Zip code)

Robert McIver

5300 Meadows Road, Suite 250

Lake Oswego, OR 97035-8234

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: November 30, 2015

Item 1. Reports to Stockholders.

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Growth Fund (the “Fund”) -- Class J Shares – returned 0.73% for the six months ended November 30, 2015, compared to a negative return of -0.21% over this period for the Standard & Poor’s 500 Index (the “Index”). The Fund and the Index had negative returns of -6.75% and -5.92%, respectively, for the period June 1, 2015 through August 31, 2015, while the Fund and the Index had returns of 8.02% and 6.07%, respectively, for the period September 1, 2015 through November 30, 2015. Please see pages 4 through 6 of this report for complete standardized performance information for the Fund.

Market Perspective

During the first half of the six months ended November 30, 2015, uncertainty surrounding U.S. monetary policy and emerging markets growth led U.S. stocks and the Fund into negative territory, with a negative mid-single digit return. The second half of the review period focused more on economic data such as a low rate of unemployment of 5%, an ongoing rise in home prices and an expectation of decent sales in the holiday season. Expectations that the Federal Reserve would begin normalizing interest rates in early December after a surprise back down in September played into investor sentiment. U.S. stocks and the Fund reacted with a mid to high single digit return, thus providing the overall returns for the entire 6 month period as noted earlier.

Against this backdrop of divergent return patterns we continue to be pleased by the underlying business performance of the companies in the Fund and believe it has provided the foundation for the Fund’s market performance. Our portfolio companies have produced average organic revenue growth of approximately 4.5% during this semi-annual time period. At the same time, earnings have grown an average of 2.6% and while not as robust as we would prefer to see, this average is substantially better than the companies that comprise the S&P 500 benchmark which produced an average decrease in earnings of nearly 12.5% for the same period.

As buyers of businesses for the long term, rather than short term stock traders, we see this level of performance as a testament to the strength of these companies’ business models which in turn allowed them to generate robust free cash flows that were reinvested to provide a foundation for consistent, future growth prospects. Further, we believe consistent growth can help to provide some protection against volatility such as we have experienced in recent months as a result of the many uncertainties in the global economy.

Within the S&P 500 Index, stocks in the highest EPS growth quintile and those in the highest Price/Earnings (“P/E”) quintile (including negative P/E stocks) continued the year long trend of outperforming the Index. This suggests that investors favored the fastest growing companies with little concern for valuation. Our analysis suggests this trend, along with outperformance by lower quality stocks, negatively impacted the Fund’s relative performance given our focus on stable growth, consistent profitability, and disciplined valuation. Nevertheless, that the Fund overcame these headwinds is, we believe, a testament to the inherent strengths of the companies in the Fund.

The Effect at Jensen

The Fund’s relative outperformance was due in part to 1) security selection in the Health Care and Materials sectors and 2) our lack of presence in the Energy, Telecom and Utilities sectors. Offsetting this to a degree was negative security selection in the Industrials sector.

Leading contributors to performance during the period were Microsoft and Nike, both of which released strong earnings reports and reassuring guidance. United Technologies (“UTX”) and Emerson were leading detractors to performance. UTX and Emerson are both global industrial conglomerates with leading market positions across their respective businesses. Technology leadership, the cost of replicating global manufacturing footprints, and entrenched market positions represent some of the most significant competitive advantages for both companies. Additionally, each are among the fund companies most exposed to infrastructure building in China and other emerging markets. Economic slowdowns in these markets resulted in disappointing business results and share price weakness during the year. While we are closely monitoring short-term headwinds, we remain confident in our long-term investment thesis for United Technologies and Emerson.

Portfolio Changes

Jensen executed five wholesale portfolio changes during the six month period ended November 30, 2015. We liquidated positions in Equifax, Varian Medical and Medtronic PLC and initiated positions in MasterCard and Stryker. This was in addition to normal trim/add trades during the period executed to take advantage of valuation opportunities. A brief synopsis of the changes follows:

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 1 |

Equifax (EFX) supplies credit related information to lenders and individuals. We sold the position solely due to valuation concerns as we retain a positive fundamental outlook on the business. Equifax has benefitted from significant entry barriers and we like the company’s strategy of acquiring unique data assets and combining those assets with sophisticated analytics to improve customer decision making capabilities. Equifax had been a long-time Fund holding, and the decision to exit the position was not taken lightly; however, we firmly believe in the importance of valuation discipline as part of our investment process.

Varian Medial (VAR) develops radiation-based medical and industrial equipment and dominates the global radiation oncology equipment market. We eliminated the position as a shift in payer mix pressured the company’s traditional end markets. Furthermore, we expect the company’s new growth efforts to result in more volatile and less consistent financial results than we prefer.

Medtronic PLC (MDT) manufactures and markets a broad range of medical devices. We sold the position as its fiscal 2015 financial performance resulted in Return on Equity of less than 15%, a breach of our requirement for Fund inclusion. Medtronic issued equity during the year to fund a portion of a large acquisition, resulting in the decline in Return on Equity. In our view, the acquisition was strategically sound, but our analysis indicates that the company may be burdened with low returns on capital for some time to come.

MasterCard (MA) is a global market leader in electronic payment processing, in which it partners with merchants and banks to complete electronic transactions. Our investment thesis is supported by the company’s powerful scale and network effect benefits. MasterCard earns a small percentage of the value of the billions of transactions it processes resulting in powerful operating leverage. Over time, we believe the continued global shift from cash-based to electronic-based transactions can drive solid revenue and free cash flow growth.

Stryker (SYK) sells a broad range of orthopedic implants, neurological devices, and surgical tools. The company’s competitive advantages include: leading global market positions, longstanding research collaborations with healthcare organizations, and intellectual property protection. We expect increasing global healthcare demand, new product advances in robotic surgery, and continued acquisition activity should result in steady growth in revenue and earnings.

The Jensen Outlook

Although the last three months of our semiannual period provided strong results overall, lackluster returns for much of 2015 from the U.S. stock market reflected an environment of an uneven domestic economy, overhangs from lower commodity prices, and weak economies abroad that weighed on market sentiment. Consequently, the outlook for 2016 is cloudier than in previous years. The big question entering 2016 is whether the U.S. stock market will shrug off current challenges, or if 2015’s muted returns signal the end of the recent bull market and slowing economic growth.

Major areas of focus for the markets in 2016, many of which are carrying over from 2015, will likely include energy and commodity prices, currency and interest rates, particularly with a Federal Reserve that is tightening while other countries are pursuing aggressive central bank stimulus that is not dampening volatility meaningfully. China and legislation and politics are likely to also impact markets in 2016.

These domestic and global factors will also influence the financial performance of our portfolio companies in 2016. At Jensen, we prefer to focus on those companies which we believe can produce strong underlying business results into 2016 and beyond and use short term volatility as an opportunity to take advantage of pricing disconnects in the stocks of these companies. We believe that companies with strong fundamentals, durable competitive advantages, and a history of growing free cash flow will have a greater ability to chart their own paths, and that these companies should outperform lower-quality businesses over time.

Whatever happens in 2016, we believe that paying attention to these important company fundamentals helps Fund shareholders manage risk, provide a measure of capital protection in volatile markets, and the opportunity for long-term capital appreciation for our clients.

Cordially,

The Jensen Investment Committee

| | |

| 2 | Jensen Quality Growth Fund | Semi-Annual Report |

This discussion and analysis of the Fund is as of November 30, 2015 and is subject to change, and any forecasts made cannot be guaranteed and should not be considered investment advice. Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk. The Fund is non-diversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year. Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures. Price to Earnings Ratio (P/E): Is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share. Earnings per Share (EPS) Growth: Illustrates the growth of earnings per share over time. Earnings growth is not a measure of a fund’s future performance. For use only when preceded or accompanied by a current prospectus for the Fund. The Jensen Quality Growth Fund is distributed by Quasar Distributions, LLC. |

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 3 |

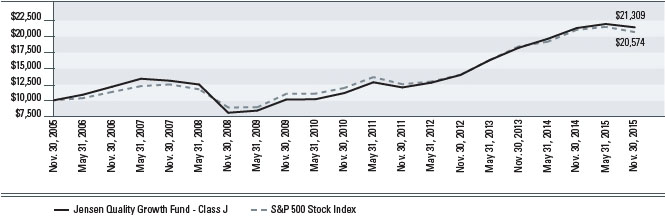

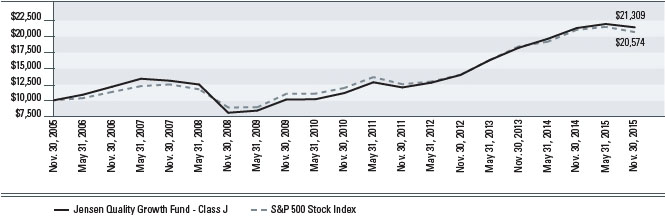

Jensen Quality Growth Fund - Class J (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended November 30, 2015 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class J | 2.92% | 15.56% | 12.59% | 7.86% |

| S&P 500 Stock Index | 2.75% | 16.09% | 14.40% | 7.48% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 2005 for Class J. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| 4 | Jensen Quality Growth Fund | Semi-Annual Report |

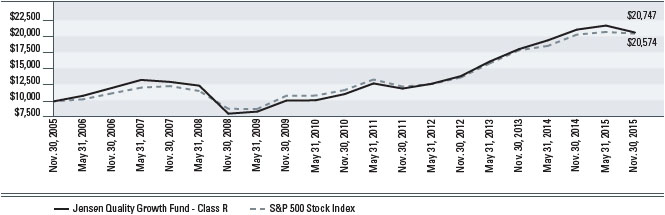

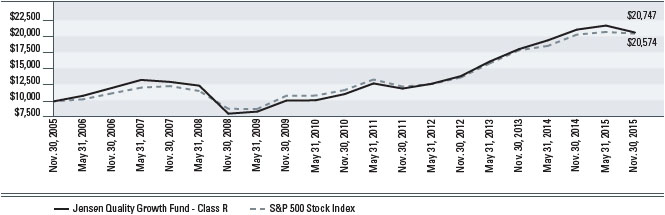

Jensen Quality Growth Fund - Class R (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended November 30, 2015 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class R | 2.54% | 15.15% | 12.26% | 7.57% |

| S&P 500 Stock Index | 2.75% | 16.09% | 14.40% | 7.48% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 2005 for Class R. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 5 |

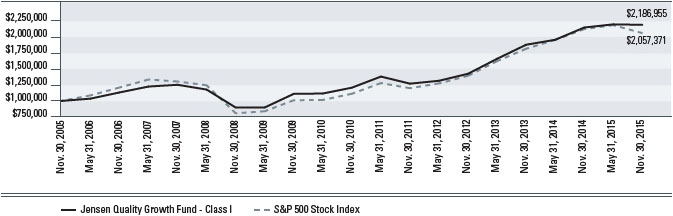

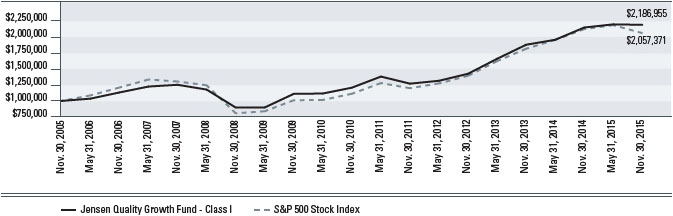

Jensen Quality Growth Fund - Class I (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended November 30, 2015 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class I | 3.17% | 15.84% | 12.89% | 8.14% |

| S&P 500 Stock Index | 2.75% | 16.09% | 14.40% | 7.48% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on November 30, 2005 for Class I. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| 6 | Jensen Quality Growth Fund | Semi-Annual Report |

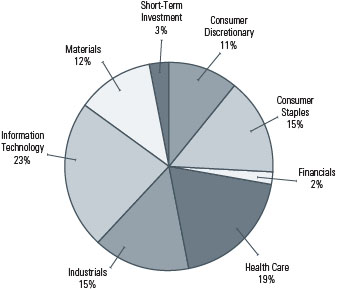

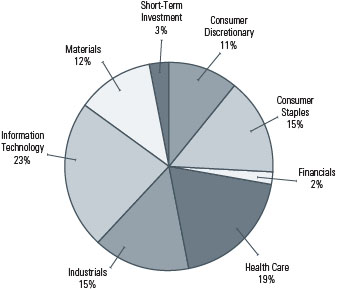

Investments by Sector as of November 30, 2015

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 7 |

Statement of Assets & Liabilities

November 30, 2015 (Unaudited)

| Assets: | |

| Investment, at value (cost $3,221,086,032) | $5,075,861,117 |

| Income receivable | 11,184,443 |

| Receivable for capital stock issued | 6,043,370 |

| Other assets | 107,160 |

| Total assets | 5,093,196,090 |

| |

| Liabilities: | |

| Payable to Investment Adviser | 2,219,517 |

| Payable for capital stock redeemed | 6,271,893 |

| Accrued distribution fees | 743,551 |

| Accrued director fees | 62,174 |

| Accrued expenses and other liabilities | 1,188,670 |

| Total liabilities | 10,485,805 |

| Total Net Assets | $5,082,710,285 |

| |

| Net Assets Consist of: | |

| Capital stock | 2,695,125,551 |

| Accumulated undistributed net investment income | 12,659,847 |

| Accumulated net realized gain | 520,149,802 |

| Unrealized appreciation on investments | 1,854,775,085 |

| Total Net Assets | $5,082,710,285 |

| |

| Net Assets Consist of: | |

| Class J Shares | |

| Net Assets | $2,070,121,203 |

| Shares outstanding | 50,574,507 |

| Net Asset Value - Offering Price and Redemption Price Per Share (2,000,000,000 shares authorized, $.001 par value) | $40.93 |

| |

| Class R Shares | |

| Net Assets | $33,286,133 |

| Shares outstanding | 816,992 |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized, $.001 par value) | $40.74 |

| |

| Class I Shares | |

| Net Assets | $2,979,302,949 |

| Shares outstanding | 72,748,359 |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized, $.001 par value) | $40.95 |

The accompanying notes are an integral part of these financial statements.

| | |

| 8 | Jensen Quality Growth Fund | Semi-Annual Report |

Schedule of Investments

November 30, 2015 (showing percentage of total net assets)

Common Stocks - 97.28% |

| | | |

| shares | Aerospace & Defense - 4.59% | value |

| 2,430,000 | United Technologies Corporation | $233,401,500 |

| |

| shares | Air Freight & Logistics - 2.99% | value |

| 1,474,000 | United Parcel Service, Inc. - Class B | $151,836,740 |

| |

| shares | Beverages - 7.64% | value |

| 2,420,000 | The Coca-Cola Company | $103,140,400 |

| 2,849,000 | PepsiCo, Inc. | $285,355,840 |

| | $388,496,240 |

| |

| shares | Capital Markets - 2.46% | value |

| 1,644,000 | T. Rowe Price Group, Inc. | $125,190,600 |

| |

| shares | Chemicals - 11.95% | value |

| 2,148,000 | Ecolab, Inc. | $255,955,680 |

| 1,638,000 | EI du Pont de Nemours & Company | $110,302,920 |

| 2,136,000 | Praxair, Inc. | $240,940,800 |

| | $607,199,400 |

| |

| shares | Electrical Equipment - 2.22% | value |

| 2,258,000 | Emerson Electric Company | $112,900,000 |

| |

| Electronic Equipment, Instruments & | |

| shares | Components - 2.79% | value |

| 2,578,000 | Amphenol Corporation - Class A | $141,918,900 |

| |

| Health Care Equipment & | |

| shares | Supplies - 8.33% | value |

| 1,972,000 | Becton Dickinson & Company | $296,293,000 |

| 1,317,000 | Stryker Corporation | $127,037,820 |

| | $423,330,820 |

| |

| Health Care Providers & | |

| shares | Services - 3.47% | value |

| 1,564,000 | UnitedHealth Group, Inc. | $176,278,440 |

| | |

| shares | Household Products - 6.91% | value |

| 2,484,000 | Colgate-Palmolive Company | $163,149,120 |

| 2,513,000 | The Procter & Gamble Company | $188,072,920 |

| | $351,222,040 |

| |

| shares | Industrial Conglomerates - 5.02% | value |

| 1,628,000 | 3M Company | $254,912,240 |

| |

| shares | IT Services - 10.09% | value |

| 2,431,000 | Accenture PLC - Class A (a) | $260,651,820 |

| 1,955,000 | Cognizant Technology Solutions Corporation - | |

| Class A (b) | $126,253,900 |

| 1,287,000 | MasterCard, Inc. - Class A | $126,023,040 |

| | | $512,928,760 |

| |

| shares | Life Sciences Tools & Services - 2.71% | value |

| 1,037,300 | Waters Corporation (b) | $137,774,186 |

| |

| shares | Media - 3.66% | value |

| 2,514,000 | Omnicom Group, Inc. | $185,834,880 |

| |

| shares | Pharmaceuticals - 4.82% | value |

| 2,421,000 | Johnson & Johnson | $245,102,040 |

| |

| shares | Software - 9.78% | value |

| 5,074,000 | Microsoft Corporation | $275,771,900 |

| 5,678,000 | Oracle Corporation | $221,271,660 |

| | $497,043,560 |

| |

| shares | Specialty Retail - 4.84% | value |

| 3,484,000 | The TJX Companies, Inc. | $245,970,400 |

| |

| Textiles, Apparel & Luxury | |

| shares | Goods - 3.01% | value |

| 1,158,000 | NIKE, Inc. - Class B | $153,180,240 |

| |

| Total Common Stocks | value |

| (Cost $3,089,745,901) | $4,944,520,986 |

The accompanying footnotes are an integral part of the financial statements.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 9 |

Schedule of Investments continued

November 30, 2015 (showing percentage of total net assets)

| Short-Term Investment - 2.59% | | |

| | | |

| shares | Money Market Fund - 2.59% | | value |

| 131,340,131 | Fidelity Institutional Money Market Funds - | | |

| Money Market Portfolio - Class I, 0.12% (c) | | $131,340,131 |

| |

| Total Short-Term Investment | | value |

| (Cost $131,340,131) | | $131,340,131 |

| |

| Total Investments | | value |

| (Cost $3,221,086,032) - 99.87% | $5,075,861,117 |

| Other Assets in Excess of Liabilities - 0.13% | | $6,849,168 |

| TOTAL NET ASSETS - 100.00% $5,082,710,285 |

| (a) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Ireland 5.1% as a percentage of net assets. |

| (b) | Non-income producing security. |

| (c) | Variable rate security. Rate listed is the 7-day effective yield as of November 30, 2015. |

The accompanying footnotes are an integral part of the financial statements.

| | |

| 10 | Jensen Quality Value Fund | Semi-Annual Report |

Statement of Operations

Six Months Ended November 30, 2015 (Unaudited)

| Investment Income: | | | |

| Dividend income | | $52,419,823 | |

| Interest income | | 73,436 | |

| | | 52,493,259 | |

| Expenses: | | | |

| Investment advisory fees | | 12,519,424 | |

| 12b-1 - Class J | | 2,607,097 | |

| Shareholder servicing fees - Class I | | 987,771 | |

| Administration fees | | 836,831 | |

| Sub-transfer agent expenses - Class J | | 509,977 | |

| Custody fees | | 176,520 | |

| Fund Accounting fees | | 146,218 | |

| Reports to shareholders - Class I | | 119,053 | |

| Transfer Agent fees -Class J | | 107,691 | |

| Federal and state registration fees | | 88,848 | |

| 12b-1 fees - Class R | | 88,206 | |

| Directors' fees and expenses | | 76,146 | |

| Professional fees | | 58,019 | |

| Reports to shareholders - Class J | | 56,082 | |

| Other | | 52,694 | |

| Transfer agent expenses | | 48,042 | |

| Transfer agent fees - Class I | | 31,149 | |

| Shareholder servicing fees - Class R | | 29,537 | |

| Reports to shareholders - Class R | | 2,449 | |

| Transfer agent fees - Class R | | 556 | |

| Total expenses | | 18,542,310 | |

| |

| Net Investment Income | | 33,950,949 | |

| |

| Realized and Unrealized Gain (Loss) on Investments: | |

| Net realized gain on investment transactions | | 190,195,350 | |

| Change in unrealized depreciation on investments | | (192,435,152 | ) |

| Net realized and unrealized loss on investments | | (2,239,802 | ) |

| Net Increase in Net Assets Resulting | | | |

| from Operations | | $31,711,147 | |

Statements of Changes in Net Assets

| Six Months Ended | |

| Nov. 30, 2015 | Year Ended |

| Operations: | (Unaudited) | May 31, 2015 |

| Net investment income | $33,950,949 | $64,730,980 |

| Net realized gain on investment | | |

| transactions | 190,195,350 | 453,465,173 |

| Change in unrealized appreciation | | |

| (depreciation) on investments | (192,435,152) | 98,277,828 |

| Net increase in net assets resulting | | |

| from operations | 31,711,147 | 616,473,981 |

| |

| Six Months Ended | |

| Nov. 30, 2015 | Year Ended |

| Capital Share Transactions: | (Unaudited) | May 31, 2015 |

| Shares sold - Class J | 93,755,265 | 228,047,996 |

| Shares sold - Class R | 2,636,329 | 7,577,608 |

| Shares sold - Class I | 266,640,278 | 694,433,936 |

| Shares issued in reinvestment of | | |

| dividends - Class J | 12,394,088 | 117,153,165 |

| Shares issued in reinvestment of | | |

| dividends - Class R | 152,348 | 2,129,386 |

| Shares issued in reinvestment of | | |

| dividends - Class I | 20,283,166 | 143,027,581 |

| Shares redeemed - Class J | (307,345,948) | (671,258,181) |

| Shares redeemed - Class R | (8,383,421) | (24,103,261) |

| Shares redeemed - Class I | (369,883,708) | (784,716,794) |

| Net decrease | (289,751,603) | (287,708,564) |

| |

| Six Months Ended | |

| Dividends and Distributions | Nov. 30, 2015 | Year Ended |

| to Shareholders: | (Unaudited) | May 31, 2015 |

| Net investment income - Class J | (12,772,443) | (24,079,570) |

| Net investment income - Class R | (152,348) | (300,698) |

| Net investment income - Class I | (21,460,645) | (35,585,394) |

| Net realized gains - Class J | – | (96,447,876) |

| Net realized gains - Class R | – | (1,828,737) |

| Net realized gains - Class I | – | (114,936,126) |

| Total dividends and distributions | (34,385,436) | (273,178,401) |

| |

| Six Months Ended | |

| Nov. 30, 2015 | Year Ended |

| Increase (Decrease) in Net Assets | (Unaudited) | May 31, 2015 |

| (292,425,892) | 55,587,016 |

| | | |

| Six Months Ended | |

| Nov. 30, 2015 | Year Ended |

| Net Assets: | (Unaudited) | May 31, 2015 |

| Beginning of Period | 5,375,136,177 | 5,319,549,161 |

| End of Period (including accumulated | | |

| undistributed net investment income | | |

| of $12,659,847 and $13,094,334, | | |

| respectively) | $5,082,710,285 | $5,375,136,177 |

The accompanying notes are an integral part of these financial statements.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 11 |

Financial Highlights

Class J

| six months ended | | | | | |

| Nov. 30, 2015 | year ended | year ended | year ended | year ended | year ended |

| Per Share Data: | (Unaudited) | May 31, 2015 | May 31, 2014 | May 31, 2013 | May 31, 2012 | May 31, 2011 |

| Net asset value, beginning of period | $40.88 | $38.33 | $33.98 | $27.33 | $29.11 | $23.86 |

| Income from investment operations: | | | | | | |

| Net investment income | 0.25 | 0.44 | 0.37 | 0.34 | 0.32 | 0.27 |

| Net realized and unrealized gains (losses) on investments | 0.04 | 4.14 | 5.52 | 6.65 | (1.80) | 5.25 |

| Total from investment operations | 0.29 | 4.58 | 5.89 | 6.99 | (1.48) | 5.52 |

| Less distributions: | | | | | | |

| Dividends from net investment income | (0.24) | (0.40) | (0.35) | (0.34) | (0.30) | (0.27) |

| Distributions from capital gains | — | (1.63) | (1.19) | — | — | — |

| Total distributions | $(0.24) | $(2.03) | $(1.54) | $(0.34) | $(0.30) | $(0.27) |

| Net asset value, end of period | $40.93 | $40.88 | $38.33 | $33.98 | $27.33 | $29.11 |

| Total return(1) | 0.73% | 12.07% | 17.57% | 25.74% | -5.04% | 23.31% |

| Supplemental data and ratios: | | | | | | |

| Net assets, end of period (000’s) | $2,070,121 | $2,273,979 | $2,447,876 | $2,531,859 | $2,307,634 | $2,593,128 |

| Ratio of expenses to average net assets(2) | 0.87% | 0.87% | 0.87% | 0.90% | 0.91% | 0.92% |

| Ratio of net investment income to average net assets(2) | 1.20% | 1.08% | 1.00% | 1.08% | 1.18% | 1.07% |

| Portfolio turnover rate(1) | 9.80% | 14.42% | 14.10% | 22.09% | 15.80% | 6.84% |

| (1) | Not annualized for the six months ended November 30, 2015 |

| (2) | Annualized for the six months ended November 30, 2015 |

The accompanying notes are an integral part of these financial statements.

| | |

| 12 | Jensen Quality Growth Fund | Semi-Annual Report |

Financial Highlights

Class R

| six months ended | | | | | |

| Nov. 30, 2015 | year ended | year ended | year ended | year ended | year ended |

| Per Share Data: | (Unaudited) | May 31, 2015 | May 31, 2014 | May 31, 2013 | May 31, 2012 | May 31, 2011 |

| Net asset value, beginning of period | $40.69 | $38.16 | $33.83 | $27.22 | $29.01 | $23.78 |

| Income from investment operations: | | | | | | |

| Net investment income | 0.16 | 0.28 | 0.23 | 0.25 | 0.26 | 0.23 |

| Net realized and unrealized gains (losses) on investments | 0.06 | 4.14 | 5.50 | 6.64 | (1.79) | 5.23 |

| Total from investment operations | 0.22 | 4.42 | 5.73 | 6.89 | (1.53) | 5.46 |

| Less distributions: | | | | | | |

| Dividends from net investment income | (0.17) | (0.26) | (0.21) | (0.28) | (0.26) | (0.23) |

| Distributions from capital gains | — | (1.63) | (1.19) | — | — | — |

| Total distributions | $(0.17) | $(1.89) | $(1.40) | $(0.28) | $(0.26) | $(0.23) |

| Net asset value, end of period | $40.74 | $40.69 | $38.16 | $33.83 | $27.22 | $29.01 |

| Total return(1) | 0.54% | 11.67% | 17.13% | 25.43% | -5.26% | 23.08% |

| Supplemental data and ratios: | | | | | | |

| Net assets, end of period (000’s) | $33,286 | $38,976 | $50,478 | $47,074 | $40,216 | $29,077 |

| Ratio of expenses to average net assets(2) | 1.24% | 1.22% | 1.25% | 1.16% | 1.12% | 1.10% |

| Ratio of net investment income to average net assets(2) | 0.83% | 0.71% | 0.63% | 0.82% | 0.96% | 0.87% |

| Portfolio turnover rate(1) | 9.80% | 14.42% | 14.10% | 22.09% | 15.80% | 6.84% |

| (1) | Not annualized for the six months ended November 30, 2015 |

| (2) | Annualized for the six months ended November 30, 2015 |

The accompanying notes are an integral part of these financial statements.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 13 |

Financial Highlights

Class I

| six months ended | | | | | |

| Nov. 30, 2015 | year ended | year ended | year ended | year ended | year ended |

| Per Share Data: | (Unaudited) | May 31, 2015 | May 31, 2014 | May 31, 2013 | May 31, 2012 | May 31, 2011 |

| Net asset value, beginning of period | $40.90 | $38.35 | $34.00 | $27.35 | $29.14 | $23.88 |

| Income from investment operations: | | | | | | |

| Net investment income | 0.29 | 0.53 | 0.46 | 0.42 | 0.40 | 0.37 |

| Net realized and unrealized gains (losses) on investments | 0.05 | 4.14 | 5.53 | 6.66 | (1.80) | 5.24 |

| Total from investment operations | 0.34 | 4.67 | 5.99 | 7.08 | (1.40) | 5.61 |

| Less distributions: | | | | | | |

| Dividends from net investment income | (0.29) | (0.49) | (0.45) | (0.43) | (0.39) | (0.35) |

| Distributions from capital gains | — | (1.63) | (1.19) | — | — | — |

| Total distributions | $(0.29) | $(2.12) | $(1.64) | $(0.43) | $(0.39) | $(0.35) |

| Net asset value, end of period | $40.95 | $40.90 | $38.35 | $34.00 | $27.35 | $29.14 |

| Total return(1) | 0.85% | 12.32% | 17.87% | 26.10% | -4.76% | 23.72% |

| Supplemental data and ratios: | | | | | | |

| Net assets, end of period (000’s) | $2,979,303 | $3,062,182 | $2,821,194 | $2,141,031 | $1,450,228 | $1,552,075 |

| Ratio of expenses to average net assets(2) | 0.63% | 0.62% | 0.63% | 0.62% | 0.60% | 0.60% |

| Ratio of net investment income to average net assets(2) | 1.45% | 1.33% | 1.25% | 1.36% | 1.49% | 1.39% |

| Portfolio turnover rate(1) | 9.80% | 14.42% | 14.10% | 22.09% | 15.80% | 6.84% |

| (1) | Not annualized for the six months ended November 30, 2015 |

| (2) | Annualized for the six months ended November 30, 2015 |

The accompanying notes are an integral part of these financial statements.

| | |

| 14 | Jensen Quality Growth Fund | Semi-Annual Report |

Notes to the Financial Statements

November 30, 2015 (Unaudited)

1. Organization and Significant Accounting Policies

The Jensen Portfolio, Inc., doing business as Jensen Quality Growth Fund (the “Fund”), was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. The Fund is authorized to issue 5,000,000,000 shares of common stock, 4,000,000 of such have been authorized for the existing share classes. The Fund currently offers three different classes of shares. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I, and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee, Class R shares are subject to a 0.50% 12b-1 fee and up to a 0.25% shareholder servicing fee, and Class I shares are subject to a shareholder servicing fee up to 0.10%, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees and shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges are valued at the last sale price at the close of the exchange. Equity securities listed on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at the current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. The three levels of the fair value hierarchy are as follows:

| Level 1 | | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| | |

| Level 2 | | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| | |

| Level 3 | | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 15 |

Investments whose values are based on quoted market prices in active markets, include common stocks and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

The following is a summary of the inputs used, as of November 30, 2015, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments at Value | Total | Level 1 | Level 2 | Level 3 |

| Total Common | | | | | | |

| Stocks* | $4,944,520,986 | $4,944,520,986 | $— | | $— | |

| Total Money | | | | | | |

| Market Fund | 131,340,131 | 131,340,131 | — | | — | |

| Total Investments | $5,075,861,117 | $5,075,861,117 | $— | | $— | |

| |

* For further information regarding security characteristics and industry classifications, please see the Schedule of Investments.

The Fund did not hold any investments during the period ended November 30, 2015 with significant unobservable inputs which would be classified as Level 3. There were no transfers of securities between levels during the reporting period. It is the Fund’s policy to record transfers between levels as of the end of the reporting period. The Fund did not hold any derivative instruments during the reporting period.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2015. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. As of May 31, 2015, open Federal tax years include the tax years ended May 31, 2012 through 2015. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. The Fund may utilize earnings and profits distibuted to shareholders on redemption of shares as part of the dividend paid deduction.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed to the Class J shares based on the actual number of shareholder accounts held and serviced by certain financial intermediaries as described in the Class J shares’ prospectus. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% and up to 0.25% of the average daily net assets of Class I shares and Class R shares, respectively.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

| | |

| 16 | Jensen Quality Growth Fund | Semi-Annual Report |

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| six months ended | | |

| Nov. 30, 2015 | year ended |

| Class J | (Unaudited) | May 31, 2015 |

| Shares sold | 2,363,302 | | 5,701,726 | |

| Shares issued in | | | | |

| reinvestment of dividends | 311,453 | | 2,909,757 | |

| Shares redeemed | (7,725,070 | ) | (16,847,098 | ) |

| Net decrease | (5,050,315 | ) | (8,235,615 | ) |

| Shares outstanding: | | | | |

| Beginning of period | 55,624,822 | | 63,860,437 | |

| End of period | 50,574,507 | | 55,624,822 | |

| |

| six months ended | | |

| Nov. 30, 2015 | year ended |

| Class R | (Unaudited) | May 31, 2015 |

| Shares sold | 66,477 | | 190,193 | |

| Shares issued in | | | | |

| reinvestment of dividends | 3,833 | | 53,060 | |

| Shares redeemed | (211,152 | ) | (608,079 | ) |

| Net decrease | (140,842 | ) | (364,826 | ) |

| Shares outstanding: | | | | |

| Beginning of period | 957,834 | | 1,322,660 | |

| End of period | 816,992 | | 957,834 | |

| |

| six months ended | | |

| Nov. 30, 2015 | year ended |

| Class I | (Unaudited) | May 31, 2015 |

| Shares sold | 6,684,719 | | 17,472,446 | |

| Shares issued in | | | | |

| reinvestment of dividends | 510,493 | | 3,554,047 | |

| Shares redeemed | (9,309,237 | ) | (19,730,984 | ) |

| Net decrease | (2,114,025 | ) | 1,295,509 | |

| Shares outstanding: | | | | |

| Beginning of period | 74,862,384 | | 73,566,875 | |

| End of period | 72,748,359 | | 74,862,384 | |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the year ended November 30, 2015, were $483,638,891 and $809,623,923, respectively.

4. Income Taxes

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

The distributions of $59,965,662 and $55,066,294 paid during the years ended May 31, 2015 and 2014, respectively, were classified as ordinary income for tax purposes. The distributions of $213,212,739 and $165,096,493 paid during the years ended May 31, 2015 and 2014, respectively, were classified as long-term capital gain for income tax purposes.

Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2015 accumulated net realized gain decreased by $89,516,656 and capital stock increased by $89,516,656. The permanent difference relates to the usage of tax equalization.

At May 31, 2015, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | | $3,318,930,641 | |

| Gross unrealized appreciation | | $2,056,132,801 | |

| Gross unrealized depreciation | | (8,977,466 | ) |

| Net unrealized appreciation | | 2,047,155,335 | |

| Undistributed ordinary income | | 15,941,175 | |

| Undistributed long-term capital gain | | 327,162,513 | |

| Total distributable earnings | | 343,103,688 | |

| Other accumulated gains | | — | |

| Total accumulated gains | | $2,390,259,023 | |

At May 31, 2015, the Fund had total tax basis capital losses of $0.

On December 17, 2015, the Fund declared and paid a distribution from ordinary income of $7,027,379, $79,140, and $12,153,581 for Class J, Class R, and Class I, respectively, to shareholders of record as of December 16, 2015.

On December 17, 2015, the Fund declared and paid a short-term capital gain of $1,157,930, $18,847, and $1,671,215 for Class J, Class R, and Class I, respectively, to shareholders of record as of December 16, 2015.

On December 17, 2015, the Fund declared and paid a long-term capital gain of $189,109,026, $3,078,072, and $272,936,870 for Class J, Class R, and Class I, respectively, to shareholders of record as of December 16, 2015.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 17 |

5. Line of Credit

The Fund has a $250 million revolving credit facility, subject to certain restrictions, for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The unsecured line of credit has a one-year term and is reviewed annually by the Board of Directors. The current agreement runs through December 19, 2015. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of November 30, 2015, the rate on the Fund’s line of credit was 2.25%. The Fund did not borrow on the line of credit during the six months ended November 30, 2015.

6. Investment Advisory Agreement

The Fund has an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Pursuant to the advisory agreement and breakpoint fee schedule, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion and up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion and up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion.

Certain officers of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares. The amount actually incurred for the six months ended November 30, 2015 was 0.07% on an annualized basis.

The Fund has also adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares. The amount actually incurred for the six months ended November 30, 2015 was 0.17% on an annualized basis.

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At November 30, 2015, Charles Schwab & Co., Inc., for the benefit of its customers, held 47.68% of the outstanding shares of the Class J share class. At November 30, 2015, Edward D. Jones and Co., for the benefit of its customers, held 27.75% of the outstanding shares of the Class I share class. At November 30, 2015, Great-West Life & Annuity and Great-West Trust Company LLC, for the benefit of their customers, held 31.00% and 28.09%, respectively, of the outstanding shares of the Class R share class.

9. Subsequent Events Evaluation

In preparing the financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure resulting from subsequent events through the date financial statements were available to be issued. This evaluation did not result in any subsequent events, other than those noted above, that necessitated disclosure and/or adjustments.

| | |

| 18 | Jensen Quality Growth Fund | Semi-Annual Report |

Expense Example - November 30, 2015 (Unaudited)

As a shareholder of Jensen Quality Growth Fund, you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (June 1, 2015–November 30, 2015).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 19 |

Expense Example Tables

| | | | | | | | | | | | Expenses Paid During |

| | Beginning Account Value | | | Ending Account Value | | | Period* June 1, 2015 – |

| Jensen Quality Growth Fund – Class J | | June 1, 2015 | | | November 30, 2015 | | | November 30, 2015 |

| Actual | | $1,000.00 | | | $1,007.30 | | | $4.38 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | | 1,020.71 | | | 4.41 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| | | | | | | | | | | | Expenses Paid During |

| | Beginning Account Value | | | Ending Account Value | | | Period* June 1, 2015 – |

| Jensen Quality Growth Fund – Class R | | June 1, 2015 | | | November 30, 2015 | | | November 30, 2015 |

| Actual | | $1,000.00 | | | $1,005.40 | | | $6.23 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | | 1,018.85 | | | 6.28 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.24%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| | | | | | | | | | | | Expenses Paid During |

| | Beginning Account Value | | | Ending Account Value | | | Period* June 1, 2015 – |

| Jensen Quality Growth Fund – Class I | | June 1, 2015 | | | November 30, 2015 | | | November 30, 2015 |

| Actual | | $1,000.00 | | | $1,008.50 | | | $3.17 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | | 1,021.91 | | | 3.19 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.63%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| | |

| 20 | Jensen Quality Growth Fund | Semi-Annual Report |

Additional Information (Unaudited)

1. Investment Advisory Agreement Disclosure

Section 15(c) under the 1940 Act requires that a registered investment company’s board of directors, including a majority of independent directors voting separately, approve any new investment advisory contract for the fund and thereafter to review and approve the terms of the fund’s investment advisory agreement on an annual basis. In addition, Section 15(a) of the 1940 Act requires that any new investment advisory agreement be approved by the fund’s shareholders.

In their most recent deliberations concerning whether to renew the Fund’s Investment Advisory and Service Contract with the Adviser (the “Agreement”), the Fund’s Board of Directors (the “Board”), including the Fund’s independent directors (“Independent Directors”), conducted the review and made the determinations that are described below. During its deliberations, the Board requested from the Adviser, and the Adviser furnished, all information reasonably necessary for it to evaluate the renewal of the Agreement.

The entire Board had first met on April 16, 2015 to consider the information provided by the Adviser in connection with the renewal of the Agreement. Prior to the April 16, 2015 meeting, the Independent Directors conferred separately with their legal counsel. After the April 16, 2015 meeting, the Independent Directors again met to consider the information provided by the Adviser. The Independent Directors requested certain additional information they needed to evaluate the Agreement.

The Board considered the various materials included in both the April 16, 2015 Board meeting materials and the materials presented at a meeting of the Board held on July 16, 2015. The Adviser confirmed that it had provided all information reasonably necessary for the Board to evaluate the Agreement. During the April 16, 2015 and July 16, 2015 Board meetings, the Board of Directors, including the Independent Directors, evaluated the meeting materials, acknowledging that not any single factor was controlling and not every factor was given the same weight by each member of the Board (each, a “Director”) and reached the conclusions described below, among others.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of services provided to the Fund by the Adviser under the Agreement. The Board reviewed the terms of the Agreement, as well as the history of the Adviser and its investment discipline, its investment performance, and its day-to-day management of the Fund. The Board noted the Adviser’s focus on the business of the Fund, the compliance and other servicing aspects of the Fund, and the Adviser’s oversight of the Fund’s service providers.

The Board considered the Adviser’s organizational and ownership structure, including the impact of changes in personnel and ownership during the last year, and the composition of its investment committee, which makes all investment decisions for the Fund. The Board also considered the Adviser’s approach to risk management and the acquisition of new analytical and compliance tools and services to manage the Fund’s operations. The Board also observed the findings from the 2015 Morningstar Mutual Fund Industry Stewardship Survey with respect to the funds managed by the Adviser. Based on these and other factors, including the additional factors described below, the Board concluded that the services provided to the Fund under the Agreement continued to be satisfactory.

Investment Performance. The Board examined the investment performance of the Fund compared to the S&P 500 Index and to the Lipper Large Cap Core Funds and Morningstar Large Cap Growth Funds categories for certain periods ending February 28, 2015. The Board also examined the Fund’s performance compared to a more-focused peer group provided in a Morningstar 15(c) independent report and presentation obtained by the Adviser. The Board noted the Class J shares’ underperformance compared to its index for the one-, three-, five-, and ten-year periods, and its outperformance compared to its index for the 15-year period. In addition, the Board noted the Class I shares’ underperformance compared to its index for the three- and five-year periods, and its outperformance compared to the index for the one-, ten- and 15-year periods. The Board noted that the Fund’s overall performance as rated by Morningstar was “Average” for returns and “Low” for risk. The Board observed that the Adviser appeared to have adhered to its strict investment discipline. Furthermore, the Board was informed by the Adviser that, since the peak of the last bull market (October 9, 2007) through February 28, 2015, the Fund’s average annual return was 7.51% compared to 6.39% for the S&P 500 Index, providing evidence that the full benefits of the Adviser’s investment discipline are realized over an entire economic and stock market cycle. As a result of these and other factors, the Board concluded that the overall long-term investment performance of the Fund continued to be satisfactory.

Advisory Fee and Expense Ratio. The Board compared the Fund’s advisory fee with those of the funds in the Fund’s Morningstar category and to the more-focused peer group provided in the Morningstar 15(c) independent report and presentation obtained by the Adviser. The Board noted that the Fund’s blended advisory fee of 0.494% continued to be below the median and the average for its Morningstar category for funds with between $2 billion and $8 billion in assets, even when passively managed funds and funds that have no share classes that

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 21 |

are offered to retail investors are included, and below the median and average of the more-focused peer group in the Morningstar 15(c) independent report and presentation. The Board also noted that, while the Adviser employs a relatively straightforward investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders.

The Board compared the fees charged to the Fund with the advisory fees charged to the non-Fund advisory clients of the Adviser. The Board observed that, with the exception of a small number of institutional separate account clients, the Adviser typically charges its separate accounts a minimum fee of 0.50% for individual investors and 0.45% for institutional investors, but also noted the limitations of such comparisons due to the different services required by separate account clients compared to the Fund. Separate accounts, the Board observed, may be smaller and require more personalized services, but they are subject to less regulation and generally do not require the same level of administrative support as the Fund. The Board also noted the Adviser’s consideration of entering into sub-advisory arrangements, where advisory fees are typically lower than those for a directly advised mutual fund because of the reduced services required of the sub-advisor.

The Board considered the Fund’s expense ratio and the expense ratios of other comparable mutual funds in the Fund’s Lipper and Morningstar categories. The Board observed that the Fund’s annual expense ratio (for Class J Shares) was higher than the average and median of actively managed retail class funds with comparable assets in its Morningstar category, and higher than the average of such funds in its Lipper category. For the Fund’s Class I Shares, the Board observed, the expense ratio was below the average and median when compared to the institutional funds in its Morningstar category. However, according to the Morningstar 15(c) independent report obtained by the Adviser and reviewed by the Board, the Fund’s expense ratio for both the Class J and Class I Shares ranked in the first quartile compared to a more-focused peer group of actively managed, retail funds that more closely resembled the specific characteristics of each Fund share class (e.g., including a 25 basis point 12b-1 fee, as applicable).

The Board noted that the expense ratio for the Class J Shares had declined from 92 basis points in 2010 to 87 basis points in May 2015, principally due to the effect of breakpoints in the Fund’s advisory fee, the percentage decrease in sub-transfer agency fees paid by the Fund, and a relative decline in the Fund’s fixed costs as a percentage of Fund assets. The Board also noted that the Fund had a relatively low turnover rate, reducing the Fund’s transaction costs, which are not included in the Fund’s expense ratio but are deducted from the Fund’s net asset value. Based on these considerations and other factors, the Board concluded that the Fund’s advisory fee and expense ratio were reasonable relative to the Fund’s peer groups.

Profitability of the Adviser. The Board considered the profitability of the Agreement to the Adviser, including an analysis of the Adviser’s profitability for 2014 and the methodology used to calculate that profitability, and compared the Adviser’s profitability to that of publicly traded investment advisers. Even after adjustments for certain compensation expenses, it appeared that the Adviser’s pre-tax profit margin was significantly higher than the median pre-tax profit margin of such other advisers. It was noted that the Adviser’s adjustment to its compensation expense was made because its profitability had been overstated due to the relatively low salaries and bonuses paid to its Managing Directors, who may receive distributions of the Adviser’s profits on account of their equity ownership in the Adviser. The Board considered the fact that the Adviser pays certain administrative expenses of the Fund, including the cost of the Fund’s Chief Compliance Officer, though it noted that under the Agreement the Fund is authorized, subject to prior Board approval, to pay for certain costs of the Fund’s compliance personnel in the future. Finally, the Board observed that the profit margin for the Adviser for 2014 was slightly lower than in 2013, but the Adviser’s profit margin from the Fund, excluding distribution and marketing revenues and expenses, was slightly higher in 2014 than in 2013. The Board also observed that the Fund’s net assets were slightly higher during 2014 than in 2013.

The Board also examined the Adviser’s profitability from the Fund against the Adviser’s profitability from its separate account advisory business and found that the Fund provided a higher profit margin to the Adviser. The Board understood that the administrative services the Adviser provides to the Fund are, on balance, more extensive than those it provides to its separate accounts but also noted that efficiencies are realized when managing a mutual fund compared to managing multiple separate accounts. The Board also understood that, in calculating its profitability from the Fund, the Adviser had been conservative in its method of allocating expenses to its Fund business relative to other acceptable allocation methodologies.

The Board acknowledged the inherent limitations of profitability analyses, including the use of comparative data that is incomplete or dissimilar, such as financial information of publicly traded advisers that have more diversified business lines and different cost structures than those of the Adviser, and the uncertainty of the various cost allocations and other assumptions used. Based on this and other information, the Board concluded that profits earned by the Adviser were not excessive.

Economies of Scale. The Board considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has benefited from any such economies, and whether the implementation of further breakpoints in the Fund’s advisory fee was appropriate. The Board observed that, during a period of rapid Fund growth, the Fund’s expense ratio (for the Class J shares)

| | |

| 22 | Jensen Quality Growth Fund | Semi-Annual Report |

had fallen from about 1.00% for the fiscal year ended May 31, 2002 to 0.87% for the fiscal year ended May 31, 2015, despite the addition of sub-transfer agency expenses beginning in 2010. Regarding the issue of breakpoints, the Board noted the Adviser’s implementation of a breakpoint fee schedule in October 2010. The Board also observed that, with net asset levels over $5 billion during the entire fiscal year ended May 31, 2015, Fund shareholders realized the benefit of the first fee breakpoint. The Board also noted that many comparable funds with breakpoints at lower levels had higher overall advisory fees at the same asset level as the current asset level of the Fund. Based on the data presented, the Board concluded that additional breakpoints in the Fund’s advisory fee were not warranted at this time.

Other Benefits. The Board considered the potential fall-out benefits realized by the Adviser from its services as investment manager of the Fund. The Board noted that the Adviser has no affiliated entities that provide services to the Fund and that the Adviser prohibits the receipt of third-party research for “soft dollars”. The Board understood that the Adviser maintained a separate account advisory business and managed another mutual fund. The Board noted that, while the Adviser’s non-Fund business might benefit from any favorable publicity received by the Fund, any such benefit was difficult to quantify.

Other Factors and Considerations. The Board periodically reviewed and considered other material information throughout the fiscal year relating to the quality of services provided to the Fund, such as the allocation of Fund brokerage, the marketing, administration and compliance program of the Fund, the Adviser’s management of its relationship with the Fund’s administrator, custodian, transfer agent and other service providers, and the expenses paid to those service providers. At its regular meetings, the Board also reviewed detailed information relating to the Fund’s portfolio and performance against various metrics, and participated in discussions with the Fund’s portfolio managers.

Based on its evaluation of all relevant factors and the information provided to it, the Board, including all of the Independent Directors, voted unanimously to renew the Agreement for a one-year period until July 31, 2016.

2. Shareholder Notification of Federal Tax Status

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2015 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2015 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

The Fund designates as a long-term capital gain dividend, pursuant to the Internal Revenue Code Section 852(b)(3), the amount necessary to reduce earnings and profits of the Fund related to net capital gain to zero for the fiscal year ended May 31, 2015.

Additional Information Applicable to Foreign Shareholders Only:

The Fund designates 0.01% of ordinary income distributions as interest-related dividends under Internal Revenue Code Section 871(k)(1)(c).

3. Availability of Proxy Voting Information

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

4. Portfolio Holdings

The Jensen Quality Growth Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 23 |

5. Additional Disclosure Regarding Fund Directors and Officers

Independent Directors

| Name, Address and Age | Position(s)

Held with

the Fund | Term of Office and

Length of Time

Served** | Principal Occupation During

Past Five Years | # of Portfolios

in Fund

Complex

Overseen

by Director | Other Directorships

Held by Director During the

Past Five Years |

Roger A. Cooke, J.D.

Jensen Quality Growth Fund

5300 Meadows Road

Suite 250

Lake Oswego, OR 97035

Year of Birth: 1948 | Independent

Director | Indefinite Term; since

June 1999. | Retired. Senior Vice President, General Counsel and Secretary of Precision Castparts Corp., a diversified manufacturer of complex metal products, (2000 – 2013); Executive Vice President – Regulatory and Legal Affairs of Fred Meyer, Inc., a retail grocery and general merchandise company, (1992 – 2000). | 1 | None |

| | | | | |

Robert E. Harold

Jensen Quality Growth Fund

5300 Meadows Road

Suite 250

Lake Oswego, OR 97035

Year of Birth: 1947 | Chairman

and

Independent

Director | Indefinite Term;

Chairman since July

2015 and Independent

Director since

September 2000. | Retired. Senior Director of Financial Planning of Nike, Inc., a footwear and apparel company (2001 – 2002); Global Brand Controller for Nike, Inc. (1996, 1997, 2000 – 2001); Interim Chief Financial Officer for Nike, Inc. (1998 – 1999); Interim Chief Executive Officer for Laika, Inc., an animation studio (March 2005 – October 2005). | 1 | Director of St. Mary’s Academy, a non-profit high school (2000 – 2013, and 2015 – present); Director of Laika, Inc., an animation studio (2002 – present). |

| | | | | |

Thomas L. Thomsen, Jr.

Jensen Quality Growth Fund

5300 Meadows Road

Suite 250

Lake Oswego, OR 97035

Year of Birth: 1944 | Independent

Director | Indefinite Term; since

December 2003. | Private rancher and real estate investor (2002 – present); Chief Executive Officer (2000 – 2002) and President (1998 – 2000) of Columbia Management Company (now called Columbia Management Investment Advisors, Inc.), investment adviser to the Columbia Funds family of mutual funds and to institutional and individual investors. | 1 | None |

| | | | | |

Kenneth Thrasher

Jensen Quality Growth Fund

5300 Meadows Road

Suite 250

Lake Oswego, OR 97035

Year of Birth: 1949 | Independent

Director | Indefinite Term;

since July 2007. | Chairman (2002 – present) and CEO (2002 – 2009) of Complí, a web-based compliance and risk management software solution company. | 1 | Northwest Natural Gas Company (a natural gas distribution and service provider). |

| | | | | | |

| | | | | | |

| | |

| 24 | Jensen Quality Growth Fund | Semi-Annual Report |

Interested Director

| Name, Address and Age | Position(s)

Held with

the Fund | Term of Office and

Length of Time

Served** | Principal Occupation During

Past Five Years | # of Portfolios

in Fund

Complex

Overseen

by Director | Other Directorships

Held by Director During the

Past Five Years |

Robert D. McIver*

Jensen Investment

Management, Inc.

5300 Meadows Road

Suite 250

Lake Oswego, OR 97035

Year of Birth: 1965 | Director and

President | Indefinite Term;

since July 17, 2015;

1 Year Term as

President of the Fund;

Served as President

since February 2007. | Director (since July 17, 2015) of the Fund; President and Director (February 2007 – present) and Director of Operations (2004 – February 2007) of Jensen Investment Management, Inc.; General Manager of Fairmont Villa Management and Vice President of Fairmont Riverside Golf Estates Ltd (2001 – 2004); Chief Investment Officer, Schroder & Co. Trust Bank (1999 – 2001); Portfolio Manager, Schroder Investment Management (1989 – 1999). | 1 | Jensen Investment Management, Inc. (since February 2007) |

| | | | | | |

| | | | | | |

| | |

| Semi-Annual Report | Jensen Quality Growth Fund | 25 |

Officers of the Fund