UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Quality Growth Fund Inc.

(Exact name of registrant as specified in charter)

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Address of principal executive offices) (Zip code)

Robert McIver

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2023

Date of reporting period: November 30, 2023

Item 1. Reports to Stockholders.

| (a) |

| SEMI-ANNUAL REPORT | Jensen Quality Growth Fund Inc. | |||||

| 11/30/2023 | ||||||

| Class I Shares JENIX | Class J Shares JENSX | Class R Shares JENRX | Class Y Shares JENYX | |||

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Growth Fund (“Fund”) — Class I Shares — returned 8.66% for the six-month period ended November 30, 2023, compared to an increase of 10.17% for the Standard & Poor’s 500 Index (“Index”) over the period. Please see pages 7 through 10 of this report for complete standardized performance information for the Fund.

Market Perspective

After a robust start to calendar 2023, when investors focused on the anticipation of declining inflation and looked through concerns of higher interest rates impacting economies around the world, the U.S. stock market pivoted somewhat in response to the impact of higher inflation and rising commodity and oil prices in the six-month period ending November 30, 2023.

Nonetheless, despite the challenges facing companies and their investors, including ongoing inflationary pressures, generationally high interest rates, continuing hawkish commentary from central banks in developed economies and rising geopolitical risk, stock market returns remained positive during the period and for the entire year.

Market sentiment was fueled by strong performance from energy companies as oil prices were elevated for much of the period. Additionally, information technology companies continued to rebound from the substantial declines in their share prices last year — a trend that also benefited the Jensen Quality Growth Fund. Offsetting this performance was the momentum-driven impact from a concentrated number of companies in which the Fund has no exposure, including Nvidia in the IT sector, Meta in the Communication Services sector, and Tesla and Amazon in the Consumer Discretionary sector. Neither Nvidia, Tesla nor Amazon qualify for inclusion in the Jensen investable universe due to a pattern of inconsistent returns on equity. In contrast, the Fund’s consumer-facing companies were less favored during the period as inflationary concerns, economic slowing and consumer sentiment weighed on global spending on goods.

The Fund’s performance was also held back by its focus on higher-quality stocks during the period, as investment performance from lower-quality stocks (B+ and lower, as measured by the S&P Quality & Dividend Rankings) was stronger than that of higher-quality stocks (A+, A and A-, as measured by the S&P Quality & Dividend Rankings).

The Effect at Jensen

During the review period, specific stock selection contributed positively to the Fund’s relative performance in the Health Care and Financials sectors, while detracting from returns primarily in the Consumer Discretionary and Communications Services sectors due, in large part, to the companies the Fund did not own as discussed above. From a sector perspective, the Fund’s lack of exposure to the Utilities sector contributed to performance as this was the weakest-performing sector for the period. The Fund’s overall exposure in the Information Technology sector also contributed to relative performance. Conversely, our relative overweight positions in the Health Care and Consumer Staples

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 1 |

sectors detracted from the Fund’s relative performance. Typically, very few, if any, companies in the Utilities and Financials sectors qualify for investment in the Fund due to our strict requirement for high and prolonged profitability, as measured by consistently strong return on equity (ROE).

Leading contributors to performance during the period were Intuit (INTU) and Microsoft (MSFT). Intuit is a software company specializing in financial tools and cloud services with products including TurboTax and QuickBooks. The company’s stock experienced a boost as investors responded positively to the announcement that it will integrate Artificial Intelligence (“AI”) into its products and services. Intuit’s well-received investor day at the close of the third calendar quarter further also reinforced its standing in the eyes of the investment community.

Microsoft benefited from strong performance in its core cloud services in Enterprise, namely Azure services and Office 365. Offsetting this was a slowdown in PC sales and gaming revenue due to challenging comparisons from the prior year that saw robust performance arising from the COVID pandemic. More recently, the market reacted positively to the company’s announcement of its $10 billion investment in OpenAI and the subsequent inclusion of OpenAI’s ChatGPT into its search results. ChatGPT represents a key advancement in generative AI, enabling Microsoft to jump ahead of the current AI leader, Google, which stumbled in its attempt to respond too quickly to Microsoft’s initiative. (Alphabet Inc., Google’s parent and a Fund holding, has since recovered.) From our perspective, enthusiasm for the influence of the AI industry has driven much of the momentum during the last six months.

Significant detractors from the Fund’s performance for the period included Pfizer (PFE) and PepsiCo (PEP). Pfizer, a multinational pharmaceutical and biotechnology corporation, underperformed the Index during the period due to a demand shortfall for its COVID-19 products that materially impacted guidance during the second calendar quarter. The company reduced 2023 revenue forecasts for these drugs in mid-October and noted uncertainty in 2024 and beyond. Longer term, we are encouraged to see Pfizer using previous cash flow generated from its COVID-19 product success to bolster its drug portfolio and pipeline through several promising acquisitions. While we are monitoring the implications of short-term financial performance, Pfizer shares have been a core holding due to the company’s diverse drug portfolio and improving drug pipeline.

Pepsi is a producer and marketer of a wide variety of branded beverages and snacks. Well-known brands include Frito-Lay, Pepsi, Mountain Dew, Sierra Mist and Gatorade. While the company has continued to report consistent sales and earnings growth due to relatively inelastic product demand and price increases that mitigated heightened cost inflation, the company’s stock has been negatively impacted by uncertainty regarding the development of GLP-1s (glucagon-like peptide-1 agonists), a class of Type 2 diabetes drugs that improve blood sugar control and promote increased satiation after eating. Presently, there are seven GLP-1 drugs approved for use in treating diabetes, three of which also have been approved by the FDA for weight loss, with many more in the pipeline. The impact of these drugs on revenue and earnings performance for Pepsi currently remains largely uncertain and the company believes that it is too early to provide any meaningful guidance regarding the impact of these new drugs. However, the market reacted strongly in the near term. Pepsi remains one of the Fund’s top holdings due to the strength of its competitive advantages and its track record of consistent financial results, and we will monitor developments closely as they occur.

| 2 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

We are constantly evaluating all the businesses owned by the Fund, as well as other investment candidates, to determine whether better opportunities exist in our investable universe, which comprises businesses that have delivered at least a 15% ROE for 10 consecutive years. Such determinations ultimately reflect a combination of fundamental considerations, valuation opportunities and overall risk profiles for the companies.

Fund Additions and Eliminations

During the period, the Jensen Investment Team enacted the purchase of a new holding and sold three holdings. We initiated a new position in KLA Corporation (KLAC) due to solid business fundamentals and attractive valuation. We sold our positions in United Parcel Service (UPS), Becton Dickinson (BDX) and TJX Companies (TJX) as part of ongoing efforts to upgrade the overall quality of the Fund. A brief synopsis of the changes follows.

KLA Corporation (“KLA”) is, in our assessment, one of the most essential semiconductor production equipment (“SPE”) manufacturers worldwide. The company makes highly differentiated machines needed in the process of manufacturing computer chips. More specifically, KLA is the leader in process control equipment, which ensures that crucial chip production steps are performed with the lowest possible error rate. KLA not only dominates the process control market with more than a 50% market share, but it has also gained market share over time; the process control segment now accounts for up to 90% of the company’s revenues.

The SPE industry benefits from strong secular demand drivers. Computer chips are found in many more devices beyond traditional personal computers, such as mobile phones, data centers, cars, gaming consoles and AI applications. The growing demand for more powerful computing also drives demand for more powerful and complex computer chips. Higher technological complexity opens the possibility for increased errors in chip production, necessitating more process control equipment, which benefited KLA.

As the global semiconductor process control leader, KLA is, in our opinion, protected by a wide economic moat. KLA’s long-tenured company leadership has consistently opted to return capital to investors through dividends and share buybacks. Also, the business of servicing its installed machines, which accounts for more than 20% of revenues, has been the role model for the industry and, we believe, will likely continue to drive KLA’s growth and profitability.

KLA Corporation possesses many of the qualitative business aspects that we prize at Jensen. These include high barriers to entry due to decades of accumulated knowledge, larger-than-peers’ R&D budgets in its chosen niche areas of focus, patents and an established ecosystem of partner companies. Its competitive position is further cemented by high switching costs due to the risk of interrupting well-running chip production processes, the highly customized nature of the tools provided and scale advantages.

Given KLA’s attractive fundamental business characteristics, its long-term history of shareholder value creation, and our valuation work that seeks to identify long-term attractive investment opportunities, we are pleased to have added the company to the Fund.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 3 |

First added to the Fund in 2012, United Parcel Service (“UPS”) is a global leader in package delivery and logistics. We made the decision to exit the position based on our valuation of the stock and our view that better opportunities exist in our investable universe. While we acknowledge the company’s strong brand, economies of scale, technological superiority, good management team and solid returns on capital, we had reduced the position over time due to our concerns about the company’s economic sensitivity, profit margin challenges and, as of late, increased debt levels.

We intend to closely monitor UPS and may consider reestablishing a position based on improvement in the company’s valuation, fundamentals and/or risk characteristics.

Becton Dickinson is a leading global supplier of medical devices and life sciences equipment. Key business segments include needles and syringes, catheters and infusion pumps. We chose to sell the long-time holding due to the company’s return on equity (ROE) falling below our 15% minimum threshold in its most recent fiscal year.

We retain a positive view on Becton Dickinson’s business, but a series of equity issuances over the past several years lowered the company’s ROE below our 15% standard. We began reducing the position in late 2022 and sold the remaining stake in mid-2023.

TJX Companies (“TJX”) is a leading global off-price retailer. Off-price retailers take advantage of inefficiencies in the retail supply chain to purchase and sell merchandise at a discount to traditional retailers. Key TJX store concepts include T.J. Maxx, HomeGoods and Marshalls.

Similar to Becton Dickinson, we also retain a positive view on TJX as a business. However, the stock price exceeded our estimate of full value and we began reducing the position in early 2023, completing the sale later in the year. We intend to closely monitor TJX and may consider reestablishing a position based on improvement in the company’s valuation, fundamentals and/or risk characteristics.

The Jensen Outlook

The last two years have provided a roller coaster of returns as the sharp negative returns in calendar 2022 have been largely offset over the course of 2023. Despite, or perhaps because of, the positive momentum in 2023, we maintain a cautious outlook for near-term market returns as we head into the coming year.

The economic challenges that have been building in recent years are still very much present today. While there are some signs of improvement, particularly with softening inflation from the generationally high levels of 2022, overall inflation remains higher than “normal” in much of the world. Likewise, earlier this year, the U.S. Federal Reserve paused its path of increasing interest rates — which was received positively by many investors. It appears current consensus is that the domestic economy is on relatively solid footing and the Fed may be successful in engineering a “soft landing.”

| 4 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Nonetheless, despite growing expectations that U.S. interest rates will be cut aggressively over the course of 2024, current indications from the Fed indicate that any cuts will likely be more measured. This will keep interest costs at higher levels relative to a few quarters ago and the impact on highly leveraged businesses will continue to be evidenced in stressed balance sheets and reduced cash flows that might otherwise be available for more productive uses. Elsewhere, other global central banks have not ruled out the potential for higher rates and any pause in their interest rate may not occur for some time. Thus, the effect of higher interest rates may not have fully impacted many global economies and could represent a substantial headwind to many companies’ financial performance.

Consequently, inflation is worth additional monitoring in 2024, particularly given that the domestic U.S. labor market remains strong. Overall unemployment is still very low and job openings continue to exceed the number of people looking for work. This could provide “stubborn” inflationary pressure, making expectations of any interest rate cuts in 2024 more challenging in pace or amount. This does not appear to be part of the stock market’s current view, although many companies management teams are providing cautious outlooks for the coming year, in part due to expected inflationary pressures.

We are also mindful of increased tensions that increasingly challenge the geopolitical status quo of the last 40 years. Lastly, 2024 brings a U.S. general and presidential campaign and election that may well produce volatility in the capital markets.

In contrast, we continue to have confidence in the high-quality businesses owned in the Fund, which favors characteristics such as strong and resilient business models, durable competitive advantages, pricing power, steady operating margins and strong free cash flow generation that is consistently reinvested into future growth opportunities, rewarding shareholders in the shorter term via growing dividends and stock buybacks. Likewise, our disciplined approach to valuation, which utilizes our deep research to construct discounted cash flow models that reflect the opportunities for (and threats to) the companies in which we invest, has provided us confidence to invest in these sound businesses.

The Jensen Investment Team remains confident in the strategy and process guiding our management of the Fund. Our goal remains the ownership of a portfolio of companies positioned to grow and accrue business value in a stable manner. We seek to participate in this value creation as investors via the long-term ownership of what we believe are appropriately priced, high-quality stocks. We believe the attributes noted above enable quality companies to generate business returns consistently above their cost of capital, ultimately resulting in shareholder value creation.

We also remain steadfast in our belief that paying attention to company fundamentals can help investors manage risk. This should offer a measure of capital protection in more volatile or generally lower-market-return environments and provide the opportunity for long-term capital appreciation.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our shareholders, partners and clients. Thank you.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 5 |

We invite you to seek additional information about The Jensen Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Investment Team

This discussion and analysis of the Fund is as of December 2023 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security.

The S&P 500 Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index.

For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk.

The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Quality Growth Fund is distributed by Quasar Distributors, LLC.

| 6 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Jensen Quality Growth Fund Inc. - Class J (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – | 1 year | 3 years | 5 years | 10 years |

| For periods ended November 30, 2023 | ||||

| Jensen Quality Growth Fund - Class J | 9.49% | 8.82% | 11.66% | 11.97% |

| S&P 500 Stock Index | 13.84% | 9.76% | 12.51% | 11.82% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 2013 for Class J. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 0.82%

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 7 |

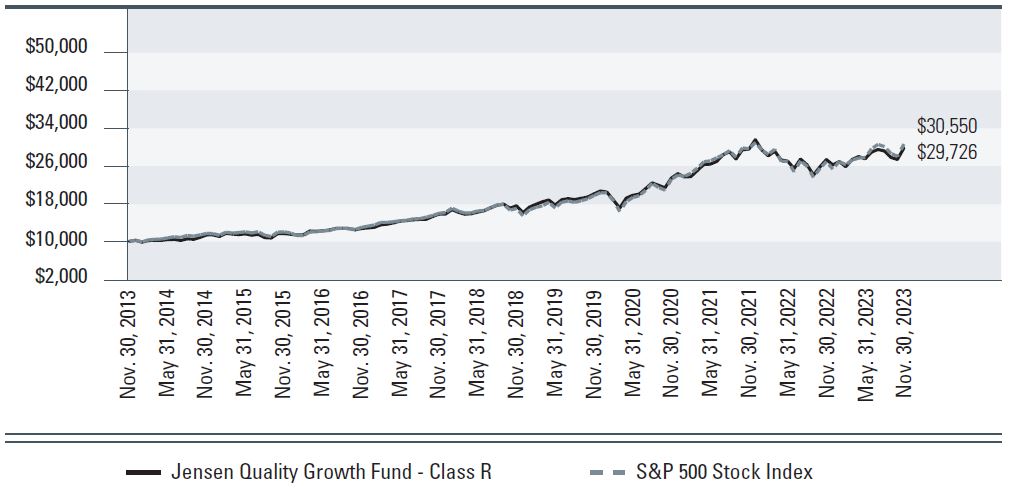

Jensen Quality Growth Fund Inc. - Class R (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – | 1 year | 3 years | 5 years | 10 years |

| For periods ended November 30, 2023 | ||||

| Jensen Quality Growth Fund - Class R | 8.92% | 8.30% | 11.15% | 11.51% |

| S&P 500 Stock Index | 13.84% | 9.76% | 12.51% | 11.82% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 2013 for Class R. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 1.29%

| 8 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

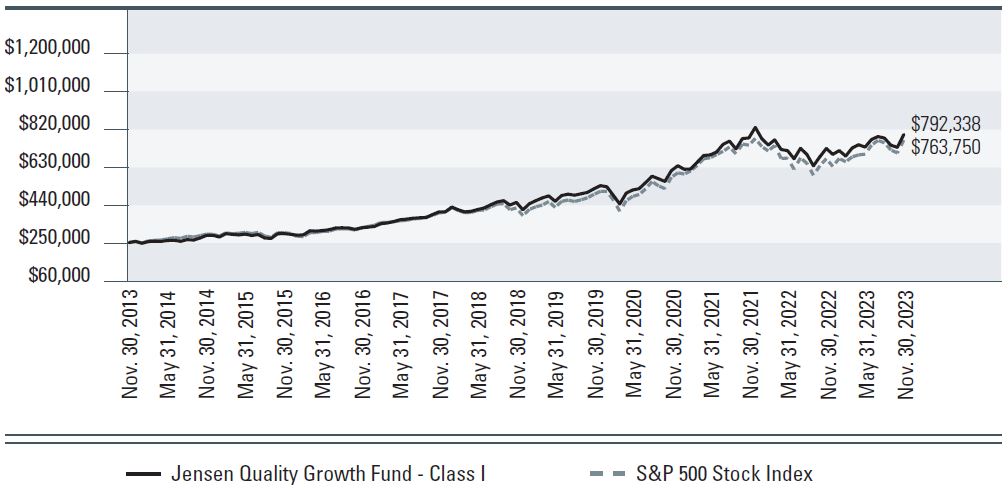

Jensen Quality Growth Fund Inc. - Class I (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – | 1 year | 3 years | 5 years | 10 years |

| For periods ended November 30, 2023 | ||||

| Jensen Quality Growth Fund - Class I | 9.72% | 9.04% | 11.90% | 12.23% |

| S&P 500 Stock Index | 13.84% | 9.76% | 12.51% | 11.82% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $250,000 made on November 30, 2013 for Class I. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 0.61%

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 9 |

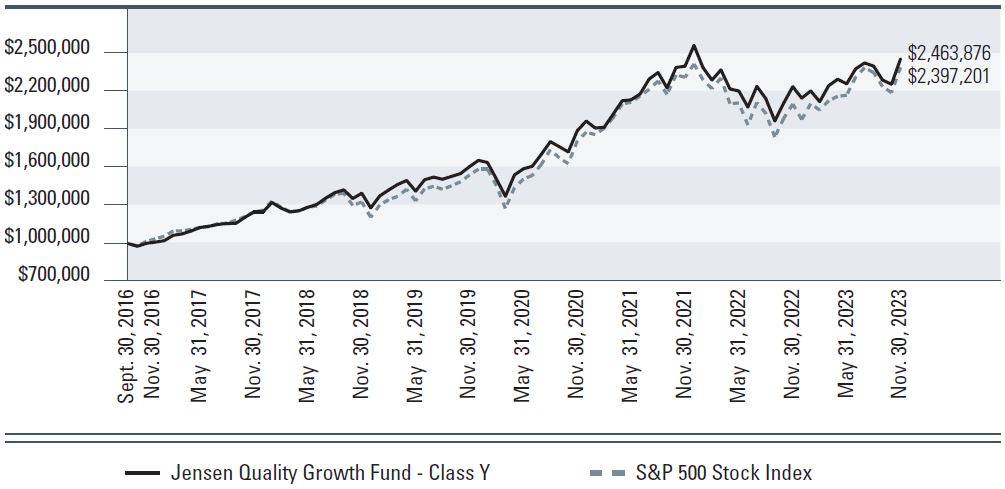

Jensen Quality Growth Fund Inc. - Class Y (Unaudited)

Total Returns vs. The S&P 500

| Total Returns – | 1 year | 3 years | 5 years | Since Inception |

| For periods ended November 30, 2023 | (September 30, 2016) | |||

| Jensen Quality Growth Fund - Class Y | 9.82% | 9.14% | 11.99% | 13.41% |

| S&P 500 Stock Index | 13.84% | 9.76% | 12.51% | 12.97% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on September 30, 2016 (commencement of operations for Class Y). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 0.53%

| 10 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

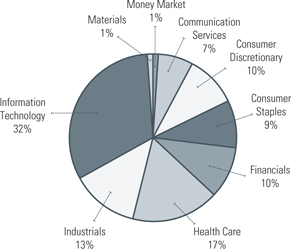

Investments by Sector as of November 30, 2023

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 11 |

Statement of Assets & Liabilities

As of November 30, 2023 (Unaudited)

| Assets: | |

| Investment, at value (Cost $5,820,640,757) | $10,335,342,568 |

| Dividend and interest income receivable | 17,771,406 |

| Receivable for capital stock issued | 8,188,474 |

| Other assets | 367,363 |

| Total assets | $10,361,669,811 |

| Liabilities: | |

| Payable to Investment Adviser | $4,013,824 |

| Payable for capital stock redeemed | 8,823,836 |

| Accrued distribution fees | 790,336 |

| Accrued director fees | 87,633 |

| Accrued expenses and other liabilities | 1,773,423 |

| Total liabilities | 15,489,052 |

| Total Net Assets | $10,346,180,759 |

| Net Assets Consist of: | |

| Capital stock | $5,032,526,757 |

| Total distributable earnings | 5,313,654,002 |

| Total Net Assets | $10,346,180,759 |

| Net Assets Consist of: | |

| Class J Shares | |

| Net Assets | $2,458,643,444 |

| Shares outstanding | 39,594,090 |

| Net Asset Value - Offering Price and Redemption Price Per Share (2,000,000,000 shares authorized) | $62.10 |

| Class R Shares | |

| Net Assets | $14,085,876 |

| Shares outstanding | 228,173 |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $61.73 |

| Class I Shares | |

| Net Assets | $5,215,318,605 |

| Shares outstanding | 84,073,357 |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $62.03 |

| Class Y Shares | |

| Net Assets | $2,658,132,834 |

| Shares outstanding | 42,855,089 |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $62.03 |

The accompanying notes are an integral part of these financial statements.

| 12 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Schedule of Investments

November 30, 2023 (Unaudited) (showing percentage of total net assets)

| Common Stocks - 98.43% | ||

| shares | Beverages - 6.24% | value |

| 3,836,000 | PepsiCo, Inc. | $645,560,440 |

| shares | Capital Markets - 1.46% | value |

| 413,000 | Moody’s Corporation | $150,728,480 |

| shares | Commercial Services & Supplies - 2.31% | value |

| 1,400,000 | Waste Management, Inc. | $239,386,000 |

| shares | Containers & Packaging - 1.33% | value |

| 2,482,000 | Ball Corporation | $137,229,780 |

| shares | Electronic Equipment, Instruments & Components - 2.30% | value |

| 2,617,000 | Amphenol Corporation - Class A | $238,120,830 |

| shares | Health Care Equipment & Supplies - 5.47% | value |

| 1,911,000 | Stryker Corporation | $566,286,630 |

| shares | Health Care Providers & Services - 5.96% | value |

| 1,115,000 | UnitedHealth Group, Inc. | $616,561,550 |

| shares | Hotels, Restaurants & Leisure - 3.78% | value |

| 3,933,000 | Starbucks Corporation | $390,546,900 |

| shares | Household Products - 2.75% | value |

| 1,855,000 | The Procter & Gamble Company | $284,779,600 |

| shares | Insurance - 4.63% | value |

| 2,402,000 | Marsh & McLennan Companies, Inc. | $479,006,840 |

| shares | Interactive Media & Services - 6.49% | value |

| 5,063,000 | Alphabet, Inc. - Class A (a) | $670,999,390 |

The accompanying footnotes are an integral part of the Financial Statements.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 13 |

Schedule of Investments continued

November 30, 2023 (Unaudited) (showing percentage of total assets)

| shares | IT Services - 15.95% | value |

| 2,015,000 | Accenture PLC - Class A (b) | $671,277,100 |

| 1,529,000 | Automatic Data Processing, Inc. | $351,547,680 |

| 1,422,000 | Broadridge Financial Solutions, Inc. | $275,612,040 |

| 849,000 | Mastercard, Inc. - Class A | $351,341,670 |

| $1,649,778,490 | ||

| shares | Pharmaceuticals - 5.58% | value |

| 1,815,000 | Johnson & Johnson | $280,707,900 |

| 9,732,000 | Pfizer, Inc. | $296,534,040 |

| $577,241,940 | ||

| shares | Professional Services - 4.40% | value |

| 1,286,000 | Equifax, Inc. | $279,975,060 |

| 725,000 | Verisk Analytics, Inc. | $175,036,750 |

| $455,011,810 | ||

| shares | Semiconductors & Semiconductor Equipment - 5.01% | value |

| 1,806,000 | Texas Instruments, Inc. | $275,794,260 |

| 445,000 | KLA Corporation | $242,355,900 |

| $518,150,160 | ||

| shares | Software - 12.39% | value |

| 889,000 | Intuit, Inc. | $508,027,940 |

| 2,041,000 | Microsoft Corporation | $773,355,310 |

| $1,281,383,250 | ||

| shares | Specialty Retail - 2.57% | value |

| 847,000 | The Home Depot, Inc. | $265,526,030 |

| shares | Technology Hardware, Storage & Peripherals - 5.71% | value |

| 3,109,000 | Apple, Inc. | $590,554,550 |

The accompanying footnotes are an integral part of the Financial Statements.

| 14 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Schedule of Investments continued

November 30, 2023 (Unaudited) (showing percentage of total assets)

| shares | Textiles, Apparel & Luxury Goods - 4.12% | value |

| 3,865,000 | NIKE, Inc. - Class B | $426,193,550 |

| Total Common Stock | value | |

| (Cost $5,668,344,409) | $10,183,046,220 | |

| Short-Term Investment - 1.47% | ||

| shares | Money Market Funds - 1.47% | value |

| 152,296,348 | First American Treasury Obligations Fund - Class X, 5.277% (c) | $152,296,348 |

| Total Short-Term Investment | value | |

| (Cost $152,296,348) | $152,296,348 | |

| Total Investments | value | |

| (Cost $5,820,640,757) - 99.90% | $10,335,342,568 | |

| Other Assets in Excess of Liabilities - 0.10% | $10,838,191 | |

| TOTAL NET ASSETS - 100.00% | $10,346,180,759 | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Ireland 6.49% as a percentage of net assets. |

| (c) | Variable rate security. Rate listed is the 7-day effective yield as of November 30, 2023. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying footnotes are an integral part of the Financial Statements.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 15 |

Statement of Operations

Six Months Ended November 30, 2023 (Unaudited)

| Investment Income: | |

| Dividend income | $85,662,451 |

| Interest income | 3,619,301 |

| Total investment income | 89,281,752 |

| Expenses: | |

| Investment advisory fees | 24,667,104 |

| 12b-1 - Class J | 3,022,546 |

| Shareholder servicing fees - Class I | 2,120,727 |

| Administration fees | 781,168 |

| Sub-transfer agent expenses - Class J | 530,504 |

| Fund Accounting fees | 264,575 |

| Directors’ fees and expenses | 199,548 |

| Federal and state registration fees | 160,725 |

| Custody fees | 129,171 |

| Reports to shareholders - Class I | 128,691 |

| Transfer agent expenses | 127,665 |

| Other | 75,267 |

| Reports to shareholders - Class Y | 71,661 |

| Professional fees | 64,779 |

| Chief Compliance Officer Fees | 49,110 |

| Reports to shareholders - Class J | 40,113 |

| 12b-1 fees - Class R | 34,685 |

| Transfer agent fees - Class J | 22,869 |

| Transfer agent fees - Class I | 18,699 |

| Transfer agent fees - Class Y | 11,859 |

| Transfer agent fees - Class R | 11,661 |

| Shareholder servicing fees - Class R | 11,574 |

| Interest Expense | 8,244 |

| Reports to shareholders - Class R | 366 |

| Total expenses | 32,553,311 |

| Net Investment Income | 56,728,441 |

| Realized and Unrealized Gain (Loss) on Investments: | |

| Net realized gain on investment transactions | 484,347,278 |

| Change in unrealized appreciation/depreciation on investments | 301,598,869 |

| Net realized and unrealized gain on investments | 785,946,147 |

| Net Increase in Net Assets Resulting from Operations | $842,674,588 |

The accompanying notes are an integral part of these financial statements.

| 16 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Statements of Changes in Net Assets

| Six Months Ended | ||

| November 30, 2023 | Year Ended | |

| Operations: | (Unaudited) | May 31, 2023 |

| Net investment income | $56,728,441 | $105,077,071 |

| Net realized gain on investment transactions | 484,347,278 | 338,979,430 |

| Change in unrealized appreciation/depreciation on investments | 301,598,869 | (200,761,543) |

| Net increase in net assets resulting from operations | 842,674,588 | 243,294,958 |

| Capital Share Transactions: | ||

| Shares Sold - Class J | 68,897,181 | 225,858,703 |

| Shares Sold - Class R | 1,044,059 | 2,231,395 |

| Shares Sold - Class I | 382,219,083 | 1,029,928,367 |

| Shares Sold - Class Y | 168,679,793 | 882,978,110 |

| Shares issued in reinvestment of dividends - Class J | 9,533,922 | 68,403,205 |

| Shares issued in reinvestment of dividends - Class R | 17,678 | 380,075 |

| Shares issued in reinvestment of dividends - Class I | 24,599,855 | 142,409,876 |

| Shares issued in reinvestment of dividends - Class Y | 12,386,805 | 74,379,953 |

| Shares redeemed - Class J | (170,686,354) | (366,840,232) |

| Shares redeemed - Class R | (1,591,954) | (6,604,069) |

| Shares redeemed - Class I | (493,981,700) | (989,100,871) |

| Shares redeemed - Class Y | (555,376,010) | (873,801,273) |

| Net Increase(Decrease) | (554,257,642) | 190,223,239 |

| Dividends and Distributions to Shareholders: | ||

| Net dividends and distributions to shareholders - Class J | (9,685,682) | (69,452,241) |

| Net dividends and distributions to shareholders - Class R | (17,678) | (380,078) |

| Net dividends and distributions to shareholders - Class I | (26,004,082) | (149,818,028) |

| Net dividends and distributions to shareholders - Class Y | (15,479,372) | (96,681,208) |

| Total dividends and distributions | (51,186,814) | (316,331,555) |

| Increase in Net Assets | 237,230,132 | 117,186,642 |

| Net Assets: | ||

| Beginning of Period | 10,108,950,627 | 9,991,763,985 |

| End of Period | $10,346,180,759 | $10,108,950,627 |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 17 |

Financial Highlights

Class J

| six months ended November 30, 2023 | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | |

| Per Share Data: | (unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value, beginning of period | $57.43 | $57.86 | $60.00 | $49.46 | $47.79 | $47.87 |

| Income from investment operations: | ||||||

| Net investment income(1) | 0.29 | 0.50 | 0.44 | 0.52 | 0.58 | 0.47 |

| Net realized and unrealized gains on investments | 4.62 | 0.75 | 1.83 | 15.63 | 5.30 | 3.88 |

| Total from investment operations | 4.91 | 1.25 | 2.27 | 16.15 | 5.88 | 4.35 |

| Less distributions: | ||||||

| Dividends from net investment income | (0.24) | (0.49) | (0.40) | (0.52) | (0.54) | (0.46) |

| Distributions from capital gains | — | (1.19) | (4.01) | (5.09) | (3.67) | (3.97) |

| Total distributions | $(0.24) | $(1.68) | $(4.41) | $(5.61) | $(4.21) | $(4.43) |

| Net asset value, end of period | $62.10 | $57.43 | $57.86 | $60.00 | $49.46 | $47.79 |

| Total return(2) | 8.56% | 2.29% | 2.92% | 33.95% | 12.15% | 9.58% |

| Supplemental data and ratios: | ||||||

| Net assets, end of period (000’s) | $2,458,643 | $2,363,726 | $2,455,146 | $2,549,594 | $2,422,553 | $2,700,303 |

| Ratio of expenses to average net assets(3) | 0.81% | 0.82% | 0.81% | 0.82% | 0.84% | 0.86% |

| Ratio of net investment income to average net assets(3) | 0.92% | 0.88% | 0.69% | 0.89% | 1.11% | 0.97% |

| Porfolio turnover rate(2) | 6.08% | 15.67% | 10.87% | 12.33% | 23.38% | 17.50% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (2) | Annualized. |

| (3) | Not Annualized. |

The accompanying notes are an integral part of these financial statements.

| 18 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Financial Highlights

Class R

| six months ended November 30, 2023 | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | |

| Per Share Data: | (unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value, beginning of period | $57.10 | $57.49 | $59.66 | $49.18 | $47.53 | $47.62 |

| Income from investment operations: | ||||||

| Net investment income(1) | 0.12 | 0.26 | 0.16 | 0.25 | 0.34 | 0.28 |

| Net realized and unrealized gains on investments | 4.59 | 0.74 | 1.81 | 15.57 | 5.30 | 3.86 |

| Total from investment operations | 4.71 | 1.00 | 1.97 | 15.82 | 5.64 | 4.14 |

| Less distributions: | ||||||

| Dividends from net investment income | (0.08) | (0.20) | (0.13) | (0.25) | (0.32) | (0.26) |

| Distributions from capital gains | — | (1.19) | (4.01) | (5.09) | (3.67) | (3.97) |

| Total distributions | $(0.08) | $(1.39) | $(4.14) | $(5.34) | $(3.99) | $(4.23) |

| Net asset value, end of period | $61.73 | $57.10 | $57.49 | $59.66 | $49.18 | $47.53 |

| Total return(2) | 8.25% | 1.83% | 2.44% | 33.36% | 11.66% | 9.17% |

| Supplemental data and ratios: | ||||||

| Net assets, end of period (000’s) | $14,086 | $13,531 | $17,801 | $26,380 | $23,995 | $28,197 |

| Ratio of expenses to average net assets(3) | 1.35% | 1.29% | 1.26% | 1.26% | 1.27% | 1.24% |

| Ratio of net investment income to average net assets(3) | 0.38% | 0.41% | 0.23% | 0.44% | 0.68% | 0.58% |

| Porfolio turnover rate(2) | 6.08% | 15.67% | 10.87% | 12.33% | 23.38% | 17.50% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (2) | Annualized. |

| (3) | Not Annualized. |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 19 |

Financial Highlights

Class I

| six months ended November 30, 2023 | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | |

| Per Share Data: | (unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value, beginning of period | $57.38 | $57.82 | $59.99 | $49.46 | $47.81 | $47.90 |

| Income from investment operations: | ||||||

| Net investment income(1) | 0.34 | 0.61 | 0.57 | 0.61 | 0.66 | 0.60 |

| Net realized and unrealized gains on investments | 4.61 | 0.76 | 1.84 | 15.65 | 5.34 | 3.87 |

| Total from investment operations | 4.95 | 1.37 | 2.41 | 16.26 | 6.00 | 4.47 |

| Less distributions: | ||||||

| Dividends from net investment income | (0.30) | (0.62) | (0.57) | (0.64) | (0.68) | (0.59) |

| Distributions from capital gains | — | (1.19) | (4.01) | (5.09) | (3.67) | (3.97) |

| Total distributions | $(0.30) | $(1.81) | $(4.58) | $(5.73) | $(4.35) | $(4.56) |

| Net asset value, end of period | $62.03 | $57.38 | $57.82 | $59.99 | $49.46 | $47.81 |

| Total return(2) | 8.66% | 2.51% | 3.14% | 34.24% | 12.41% | 9.85% |

| Supplemental data and ratios: | ||||||

| Net assets, end of period (000’s) | $5,215,319 | $4,909,180 | $4,762,505 | $5,003,474 | $4,002,485 | $3,454,461 |

| Ratio of expenses to average net assets(3) | 0.60% | 0.61% | 0.61% | 0.61% | 0.60% | 0.61% |

| Ratio of net investment income to average net assets(3) | 1.13% | 1.09% | 0.89% | 1.10% | 1.37% | 1.22% |

| Porfolio turnover rate(2) | 6.08% | 15.67% | 10.87% | 12.33% | 23.38% | 17.50% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (2) | Annualized. |

| (3) | Not Annualized. |

The accompanying notes are an integral part of these financial statements.

| 20 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Financial Highlights

Class Y

| six months ended November 30, 2023 | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | Year ended May 31, | |

| Per Share Data: | (unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value, beginning of period | $57.37 | $57.82 | $59.98 | $49.46 | $47.80 | $47.90 |

| Income from investment operations: | ||||||

| Net investment income(1) | 0.22 | 0.66 | 0.62 | 0.66 | 0.73 | 0.63 |

| Net realized and unrealized gains on investments | 4.77 | 0.75 | 1.84 | 15.64 | 5.31 | 3.87 |

| Total from investment operations | 4.99 | 1.41 | 2.46 | 16.30 | 6.04 | 4.50 |

| Less distributions: | ||||||

| Dividends from net investment income | (0.33) | (0.67) | (0.61) | (0.69) | (0.71) | (0.63) |

| Distributions from capital gains | — | (1.19) | (4.01) | (5.09) | (3.67) | (3.97) |

| Total distributions | $(0.33) | $(1.86) | $(4.62) | $(5.78) | $(4.38) | $(4.60) |

| Net asset value, end of period | $62.03 | $57.37 | $57.82 | $59.98 | $49.46 | $47.80 |

| Total return(2) | 8.72% | 2.59% | 3.23% | 34.34% | 12.51% | 9.90% |

| Supplemental data and ratios: | ||||||

| Net assets, end of period (000’s) | $2,658,133 | $2,822,513 | $2,756,312 | $2,755,356 | $2,306,038 | $916,705 |

| Ratio of expenses to average net assets(3) | 0.52% | 0.52% | 0.52% | 0.52% | 0.54% | 0.55% |

| Ratio of net investment income to average net assets(3) | 1.30% | 1.17% | 0.98% | 1.18% | 1.46% | 1.31% |

| Porfolio turnover rate(2) | 6.08% | 15.67% | 10.87% | 12.33% | 23.38% | 17.50% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (2) | Annualized. |

| (3) | Not Annualized. |

The accompanying footnotes are an integral part of the Financial Statements.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 21 |

Notes to the Financial Statements

November 30, 2023

1. Organization and Significant Accounting Policies

The Jensen Quality Growth Fund Inc. (the “Fund”), was incorporated as an Oregon corporation on April 17, 1992, and is registered as an open-end, non-diversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective March 1, 2018, the name of the Fund was changed from The Jensen Portfolio, Inc. doing business as Jensen Quality Growth Fund to The Jensen Quality Growth Fund Inc. The Fund is authorized to issue 5,000,000,000 shares of common stock, all of which have been authorized for the existing share classes. The Fund currently offers four different classes of shares; Class J, Class R, Class I, and Class Y. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee, Class R shares are subject to a 0.50% 12b-1 fee and up to a 0.25% shareholder servicing fee, Class I shares are subject to a shareholder servicing fee of up to 0.10%, and Class Y shares are not subject to any 12b-1, shareholder servicing or sub transfer agency fee as described in the separate prospectuses for each of the Fund’s share classes. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees, shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services Investment Companies”.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges are valued at the last sale price at the close of the exchange. Equity securities listed on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at the current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the

| 22 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the year. The three levels of the fair value hierarchy are as follows:

| Level 1 | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| Level 2 | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| Level 3 | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, include common stocks and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 23 |

The following is a summary of the inputs used, as of November 30, 2023, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments at Value | Total | Level 1 | Level 2 | Level 3 | ||||||||

| Total Common Stocks* | $10,183,046,220 | $10,183,046,220 | $— | $— | ||||||||

| Total Money Market Fund | $ 152,296,348 | $ 152,296,348 | — | — | ||||||||

| Total Investments | $10,335,342,568 | $10,335,342,568 | $— | $— | ||||||||

| * | For further information regarding security characteristics and industry classifications, please see the Schedule of Investments. |

The Fund did not hold any investments during the period ended November 30, 2023 with significant unobservable inputs which would be classified as Level 3. The Fund did not hold any derivative instruments during the reporting year.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2023. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| 24 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed and approved by the Fund’s Board of Directors to the Class J shares based on the yearly average of five published per-account rates from five known brokerages. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% and up to 0.25% of the average daily net assets of Class I shares and Class R shares, respectively.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| Period ended | ||||||

| November 30, | year ended | |||||

| Class J | 2023 | May 31, 2023 | ||||

| Shares sold | 1,152,983 | 4,031,942 | ||||

| Shares issued in reinvestment of dividends | 159,940 | 1,237,255 | ||||

| Shares redeemed | (2,874,031 | ) | (6,546,978 | ) | ||

| Net decrease | (1,561,108 | ) | (1,277,781 | ) | ||

| Shares outstanding: | ||||||

| Beginning of period | 41,155,198 | 42,432,979 | ||||

| End of period | 39,594,090 | 41,155,198 | ||||

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 25 |

| Period ended | ||||||

| November 30, | year ended | |||||

| Class R | 2023 | May 31, 2023 | ||||

| Shares sold | 17,628 | 40,376 | ||||

| Shares issued in reinvestment of dividends | 298 | 6,892 | ||||

| Shares redeemed | (26,739 | ) | (119,902 | ) | ||

| Net decrease | (8,813 | ) | (72,634 | ) | ||

| Shares outstanding: | ||||||

| Beginning of period | 236,986 | 309,620 | ||||

| End of period | 228,173 | 236,986 | ||||

| Period ended | ||||||

| November 30, | year ended | |||||

| Class I | 2023 | May 31, 2023 | ||||

| Shares sold | 6,405,612 | 18,407,562 | ||||

| Shares issued in reinvestment of dividends | 413,307 | 2,581,241 | ||||

| Shares redeemed | (8,302,323 | ) | (17,801,411 | ) | ||

| Net increase (decrease) | (1,483,404 | ) | 3,187,392 | |||

| Shares outstanding: | ||||||

| Beginning of period | 85,556,761 | 82,369,369 | ||||

| End of period | 84,073,357 | 85,556,761 | ||||

| Period ended | ||||||

| November 30, | year ended | |||||

| Class Y | 2023 | May 31, 2023 | ||||

| Shares sold | 2,829,356 | 15,935,174 | ||||

| Shares issued in reinvestment of dividends | 208,334 | 1,348,362 | ||||

| Shares redeemed | (9,378,777 | ) | (15,759,798 | ) | ||

| Net increase | (6,341,087 | ) | 1,523,738 | |||

| Shares outstanding: | ||||||

| Beginning of period | 49,196,176 | 47,672,438 | ||||

| End of period | 42,855,089 | 49,196,176 | ||||

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the period ended November 30, 2023, were $616,571,551 and $1,091,626,567, respectively.

| 26 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

4. Income Taxes

The distributions of $106,314,260 and $93,525,514 paid during the years ended May 31, 2023 and 2022, respectively, were classified as ordinary income for tax purposes. The distributions of $210,017,295 and $627,290,825 paid during the years ended May 31, 2023 and 2022, respectively, were classified as long-term capital gain for income tax purposes.

Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2023, distributable earnings decreased by $40,963,116 and capital stock increased by $40,963,116. The permanent difference relates to tax equalization.

At May 31, 2023, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | $5,896,034,957 | |

| Gross unrealized appreciation | $4,326,273,913 | |

| Gross unrealized depreciation | $(129,129,179 | ) |

| Net unrealized appreciation | $4,197,144,734 | |

| Undistributed ordinary income | $15,951,425 | |

| Undistributed long-term capital gain | $309,070,069 | |

| Distributable earnings | $325,021,494 | |

| Other accumulated gains | $— | |

| Total distributable earnings | $4,522,166,228 | |

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

5. Line of Credit

The Fund has the lesser of (i) $400 million, (ii) 20% of the gross market value of the Fund, or (iii) 33.33% of the net market value of the unencumbered assets of the Fund available under a revolving secured credit facility, subject to certain restrictions, for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities and is reviewed annually by the Board of Directors. The secured credit facility is with the Fund’s custodian, U.S. Bank. The existing credit facility runs through December 11, 2024. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of November 30, 2023 the interest rate on the Fund’s line of credit was 7.25%. During the period ended November 30, 2023, the Jensen Quality Growth Fund’s maximum borrowing was $39,572,000 and average daily borrowing was $311,591. The Fund’s max borrowing was on August 4, 2023.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 27 |

6. Investment Advisory Agreement

The Fund is a party to an Investment Advisory and Service Contract with the Investment Adviser. Pursuant to the terms of the Investment Advisory and Service Contract approved by Fund shareholders, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion and up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion and up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion.

Certain officers and a director of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares. 12b-1 fees incurred for the period ended November 30, 2023, are disclosed on the Statement of Operations and the amount payable at year end is disclosed on the Statement of Assets and Liabilities.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares. The amount actually incurred for the period ended November 30, 2023 was 0.08% on an annualized basis.

The Fund has also adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares. The amount actually incurred for the period ended November 30, 2023 was 0.17% on an annualized basis.

| 28 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At November 30, 2023, Charles Schwab & Co., Inc., for the benefit of its customers, held 47.95% of the outstanding shares of the Class J share class. At November 30, 2023, Wells Fargo Clearing Services LLC, for the benefit of its customers, held 38.02% of the outstanding shares of the Class I share class. At November 30, 2023, State Street Bank & Trust Co., for the benefit of its customers, hold 25.41% of the outstanding shares of the Class R share class, respectively. At November 30, 2023, Edward D Jones and Co., for the benefit of its customers, held 37.83% of the outstanding shares of the Class Y share class.

9. Subsequent Events

On December 14, 2023, The Fund declared and paid a distribution from ordinary income of $0.16234762, $0.12371883, $0.02345323, and $0.17643748 per Class J, Class I, Class R and Class Y share respectively, to shareholders of record as of December 13, 2023.

On December 14, 2023, the Fund declared and paid a long-term capital gain of $4.13720 per Class J, Class I, Class R and Class Y share to shareholders of record as of December 13, 2023.

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure resulting from subsequent events after the Statement of Assets and Liabilities date of November 30, 2023 through the date the financial statements were available for issue.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 29 |

Expense Example – November 30, 2023 (Unaudited)

As a shareholder of The Jensen Quality Growth Fund Inc. (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (June 1, 2023 - November 30, 2023).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| 30 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

Expense Example Tables (Unaudited)

| Ending | Expenses Paid | ||||||||

| Beginning | Account Value | During Period* | |||||||

| Account Value | November 30, | Jun 1, 2023 – | |||||||

| Jensen Quality Growth Fund – Class J | June 1, 2023 | 2023 | Nov 30, 2023 | ||||||

| Actual | $1,000.00 | $1,085.60 | $4.22 | ||||||

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,020.95 | 4.09 | ||||||

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.81%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Ending | Expenses Paid | ||||||||

| Beginning | Account Value | During Period* | |||||||

| Account Value | November 30, | Jun 1, 2023 – | |||||||

| Jensen Quality Growth Fund – Class R | June 1, 2023 | 2023 | Nov 30, 2023 | ||||||

| Actual | $1,000.00 | $1,082.50 | $7.13 | ||||||

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,018.15 | 6.91 | ||||||

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.37%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Ending | Expenses Paid | ||||||||

| Beginning | Account Value | During Period* | |||||||

| Account Value | November 30, | Jun 1, 2023 – | |||||||

| Jensen Quality Growth Fund – Class I | June 1, 2023 | 2023 | Nov 30, 2023 | ||||||

| Actual | $1,000.00 | $1,086.60 | $3.13 | ||||||

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,022.00 | 3.03 | ||||||

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.60%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Ending | Expenses Paid | ||||||||

| Beginning | Account Value | During Period* | |||||||

| Account Value | November 30, | Jun 1, 2023 – | |||||||

| Jensen Quality Growth Fund – Class Y | June 1, 2023 | 2023 | Nov 30, 2023 | ||||||

| Actual | $1,000.00 | $1,087.20 | $2.71 | ||||||

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,022.40 | 2.63 | ||||||

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 31 |

Additional Information (Unaudited)

1. Investment Advisory Agreement Disclosure

Section 15(c) under the 1940 Act requires that a registered investment company’s board of directors, including a majority of independent directors, approve any new investment advisory contract for the fund and thereafter to review and approve the terms of the fund’s investment advisory agreement on an annual basis. In addition, Section 15(a) of the 1940 Act requires that any new investment advisory agreement be approved by the fund’s shareholders.

In its most recent deliberations concerning whether to renew The Jensen Quality Growth Fund Inc.’s (the “Fund”) Investment Advisory and Service Contract (the “Agreement”) with Jensen Investment Management, Inc. (the “Adviser”), the Fund’s Board of Directors (the “Board”) including the Fund’s independent directors (“Independent Directors”) conducted the review and made the determinations that are described below. During its deliberations, the Board requested from the Adviser, and the Adviser furnished, all information reasonably necessary for it to evaluate the renewal of the Agreement.

The entire Board first met on April 18, 2023 to consider the information provided by the Adviser in connection with the renewal of the Agreement. Prior to and after the April 18, 2023 meeting, the Independent Directors conferred separately with their legal counsel and one of the Independent Directors separately conferred with the Adviser regarding the Adviser’s profitability analysis.

The Board considered the information included in both the April 18, 2023 Board meeting materials and the materials presented at a Board meeting held on July 18, 2023 (the “Meeting”). The Adviser confirmed that it had provided all information reasonably necessary for the Board to evaluate the Agreement. At the Meeting, a discussion ensued relating to the advisory fee payable under the Agreement and the factors described in the memorandum prepared by Fund counsel included in the April 18, 2023 Board meeting materials. During the Meeting and the April 18, 2023 Board meeting, the Board of Directors, including the Independent Directors, evaluated those and other factors, acknowledging that not any single factor was controlling and that not every factor was given the same weight by each Director, and they reached the conclusions described below, among others.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of services provided to the Fund by the Adviser under the Agreement. The Board reviewed the terms of the Agreement, as well as the history of the Adviser and its investment discipline, its investment performance, and its day-to-day management of the Fund. The Board noted the Adviser’s focus on the business of the Fund, the compliance and other servicing aspects of the Fund, and the Adviser’s oversight of the Fund’s service providers.

The Board considered the Adviser’s business continuity plan, its organizational and ownership structure and recent changes in ownership, and the composition of its investment committee, which makes all investment decisions for the Fund, and the potential impact of changes in Adviser

| 32 | The Jensen Quality Growth Fund Inc. | Semi-Annual Report |

personnel and ownership on both the Fund and the Adviser. The Board also considered the Adviser’s approach to risk management. Based on these and other factors, including the additional factors described below, the Board concluded that the services provided to the Fund under the Agreement continued to be satisfactory.

Investment Performance. The Board examined the investment performance of the Fund compared to the S&P 500 Index and the Fund’s rankings and ratings in the Morningstar Large Cap Blend categories, respectively, for certain periods ending May 31, 2023. The Board noted that, with the exception of the three-year period, the Fund (Class I Shares) outperformed its index for the one-year, five-year, ten-year and fifteen-year periods. The Board noted that the Fund received an Analyst Rating of Silver from Morningstar, and that the Fund’s overall Morningstar rating was five Stars (out of a possible five Stars) for the Class J, I and Y shares, and four Stars for the Class R shares.

The Board observed that the Adviser appeared to have adhered to its strict investment discipline. Furthermore, the Board was informed by the Adviser that, during the most recent stock market “peak-to peak” performance cycle (starting from February 19, 2020 to January 3, 2022), the Class I Shares’ annualized appreciation was 24.08% compared to an annualized return of 22.37% for the S&P 500 Index, providing evidence that the full benefits of the Adviser’s investment discipline are realized over an entire stock market performance cycle and appear to have been generated with less volatility than the overall market.

Advisory Fee and Expense Ratio. The Board compared the Fund’s advisory fee with those of the funds in the Fund’s Large Cap Blend Morningstar category and a more-focused peer group of retail class shares and institutional class shares of actively managed funds in the Fund’s Morningstar category. The Board noted that the Fund’s blended advisory fee of 0.481% was below the median but above the average, in the case of the Class I shares, and above the median and the average in the case of the Class J shares, for the Fund’s Morningstar category (large cap blend funds between $5 billion and $13 billion in assets), including actively managed retail class funds and actively managed institutional class funds. The Board also noted that, while the Adviser employs a relatively straightforward investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders.

The Board compared the fees charged to the Fund with the advisory fees charged to the non- Fund advisory clients of the Adviser. The Board observed that, with the exception of a small number of long-time institutional separate account clients and a collective investment fund, the Adviser typically charges its separate accounts a minimum annualized fee rate of (i) 1% of assets under management (“AUM”) for individual investors that includes breakpoints that decline to an annualized fee rate of 0.55%, and (ii) 0.55% of AUM for institutional investors that declines to an annualized fee rate of 0.45% of AUM on assets above $50 million. The Board also noted the limitations of such comparisons due to the different services required by separate account clients compared to the Fund. Separate accounts, the Board observed, may be smaller and require more personalized services, but they are subject to less regulation and generally do not require the same level of administrative support as the Fund.

Semi-Annual Report

| The Jensen Quality Growth Fund Inc. | 33 |