UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03833

MAINSTAY VP FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, NJ 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

FORM N-CSR

| Item 1. | Reports to Stockholders. |

MainStay VP Funds Trust

Message from the President and Annual Report

December 31, 2013

Message from the President

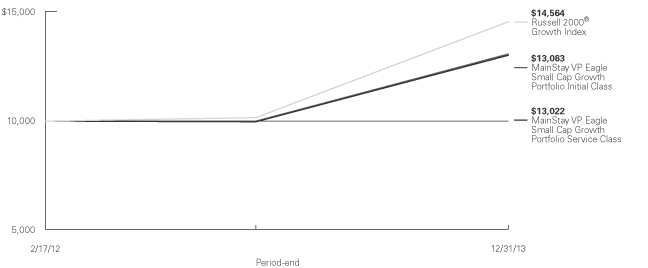

The 12 months ended December 31, 2013, was a positive period for many equity investors. Major U.S. stock market indexes provided high double-digit returns. According to Russell data, small- and mid-capitalization stocks tended to outperform large-cap stocks, with small-cap stocks gaining more than 40% for the year. Of course, past performance is no guarantee of future results.

Generally speaking, growth stocks tended to outperform value stocks across all capitalization levels. Results varied, however, when economically sensitive stocks were compared to stocks with defensive characteristics.

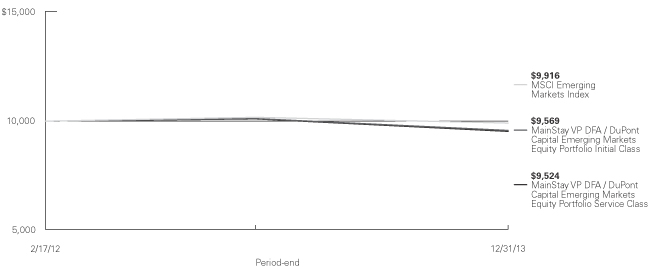

In general, international stocks of developed nations advanced during the reporting period, but emerging-market stocks declined. Slower growth in China took a toll on metals & mining companies and some commodities. In the third quarter, economic indicators improved in the United States, Europe and Japan, and emerging-market stocks tended to recover some of the ground they had lost earlier in the year.

Bond investors faced a challenging environment in 2013, and speculation about Federal Reserve policy took center stage. In May, Federal Reserve Chairman Ben Bernanke suggested that the Federal Open Market Committee (“FOMC”) might begin tapering its extensive bond-purchase program, widely known as quantitative easing. Anticipating the loss of a substantial source of demand, the bond market responded with lower prices and sharply higher yields.

In September, the FOMC signaled that economic conditions did not yet warrant the much-anticipated tapering. This news had a calming effect on the bond markets. In December, however, the FOMC stated that tapering would begin in January 2014, and that other accommodative policies—such as maintaining

the federal funds rate in a target range close to zero—would likely to remain in place “for a considerable time after the asset purchase program ends and the economic recovery strengthens.”

Bond yields rose during the reporting period, and U.S. Treasury securities generally recorded negative total returns. High-yield corporate bonds provided solid positive returns. On the whole, convertible securities were even stronger, largely because of the performance of their underlying stocks.

Despite the ups and downs of the markets, the portfolio managers of MainStay VP Portfolios focused on the investment strategies they could employ to pursue the investment objectives of their respective Portfolios. Using time-tested investment strategies and risk-management techniques, they sought to position their Portfolios for long-term results consistent with their mandate.

The reports that follow provide additional insight into the market forces, investment decisions and individual securities that influenced MainStay VP Portfolios in 2013. We invite you to carefully consider the information in the reports and use it as part of your overall financial planning and review.

At MainStay, we know that serving your financial needs is both a privilege and a responsibility. We thank you for choosing MainStay VP Funds Trust, and we look forward to helping you pursue your financial goals for many years to come.

Sincerely,

Stephen P. Fisher

President

Not part of the Annual Report

This page intentionally left blank

Table of Contents

Investors should refer to each Portfolio’s Summary Prospectus and/or the MainStay VP Funds Trust Prospectus and consider each Portfolio’s investment objectives, strategies and risks. The Summary Prospectus and/or the Prospectus contain this and other information about each Portfolio. You may obtain copies of each Portfolio’s Summary Prospectus and/or the Prospectus and the Statement of Additional Information free of charge, upon request, by calling toll-free 800-598-2019, by writing to New York Life Insurance and Annuity Corporation, 51 Madison Avenue, Room 251, New York, New York 10010 or by sending an email to MainStayShareholderServices@nylim.com. These documents are also available at mainstayinvestments.com/vpdocuments.

| | | | |

| mainstayinvestments.com | | | M-1 | |

Index Definitions

The information below is an explanation of the various indices and reference rates cited throughout the Portfolio Investment and Performance Comparisons and the Portfolio Management Discussion and Analysis sections that follow from page M-4 through page M-456. Please use this as a reference.

Please note that you cannot make an investment directly in an index. Past performance is no guarantee of future results. Results for securities indices assume reinvestment of all income and capital gains but do not reflect fees, expenses or taxes. Securities in each Portfolio may not precisely match those in a related index, and as a result, performance of the Portfolio may differ.

Balanced Composite Index consists of the Russell Midcap® Value Index (60% weighted) and the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index (40% weighted).

Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index is a market-capitalization-weighted index including U.S. government and fixed-coupon domestic investment-grade corporate bonds.

Bank of America Merrill Lynch All U.S. Convertibles Index is a market-capitalization-weighted index of domestic corporate convertible securities. To be included in the Index, bonds and preferred stocks must be convertible only to common stock.

Bank of America Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index represents the London InterBank Offered Rate (“LIBOR”) with a constant 3-month average maturity.

Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred-interest bonds and payment-in-kind securities. Issuers included in the Index have maturities of one year or more and have a credit rating lower than BBB–/Baa3, but are not in default. No single issuer may constitute greater than 2% of the Index.

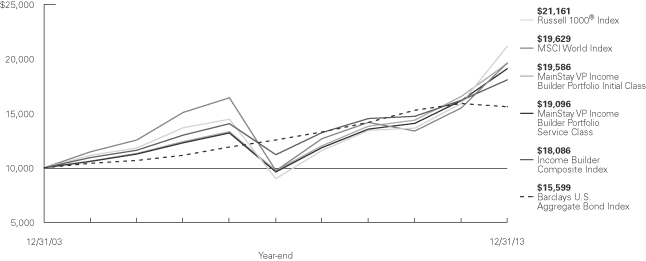

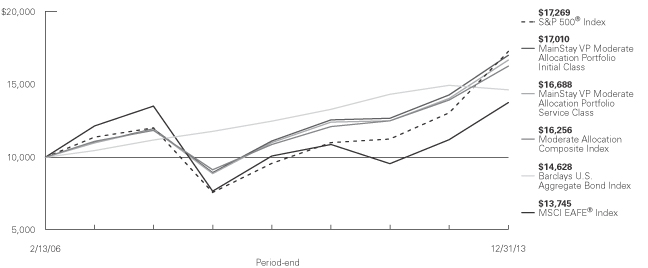

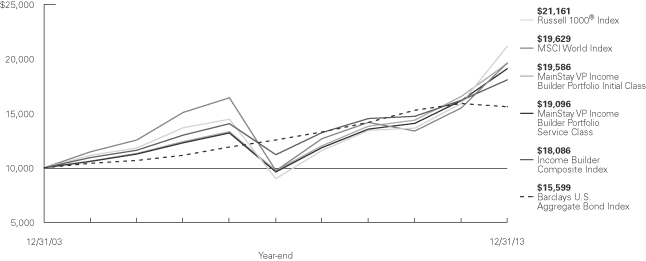

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities.

Barclays U.S. Government Bond Index consists of publicly issued debt of the U.S. Treasury and government agencies.

Barclays U.S. Government/Credit Bond Index includes investment-grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury, with maturities of at least one year.

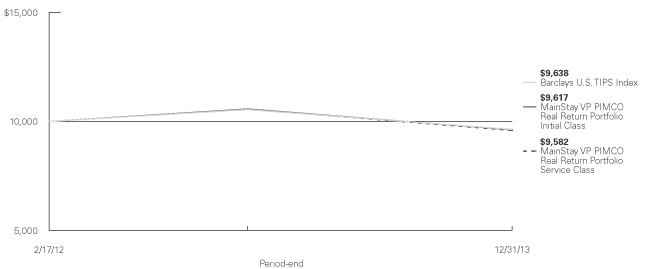

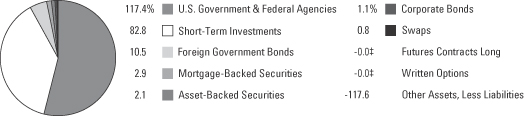

Barclays U.S. TIPS Index includes all publicly issued U.S. Treasury Inflation-Protected Securities (“TIPS”) that have at least one year remaining to maturity and are rated investment grade.

Conservative Allocation Composite Index consists of the S&P 500® Index, the MSCI EAFE® Index and the Barclays U.S.

Aggregate Bond Index weighted 35%, 5% and 60%, respectively.

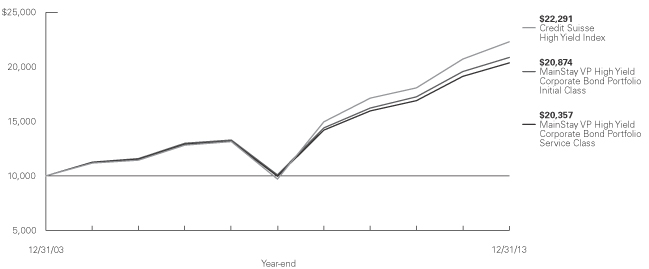

Credit Suisse High Yield Index is a market-weighted index that includes publicly traded bonds rated below BBB by Standard & Poor’s and below Baa by Moody’s.

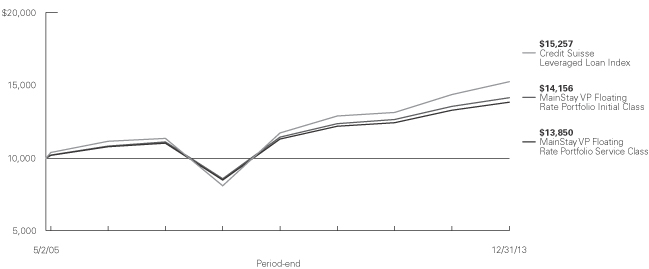

Credit Suisse Leveraged Loan Index represents tradable, senior-secured, U.S. dollar denominated non-investment-grade loans.

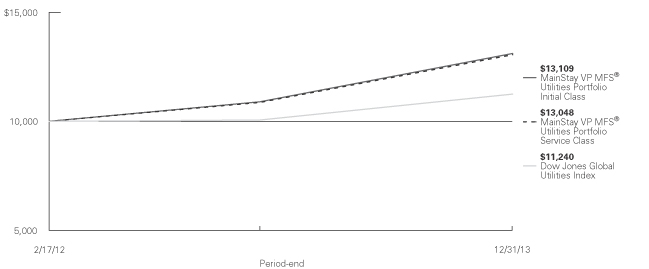

Dow Jones Global Utilities Index is a free-float market-capitalization-weighted index that measures the performance of utility companies in developed and emerging markets.

Growth Allocation Composite Index consists of the S&P 500® Index and the MSCI EAFE® Index weighted 80% and 20%, respectively.

Income Builder Composite Index consists of the MSCI World Index and the Barclays U.S. Aggregate Bond Index weighted 50%/50%, respectively.

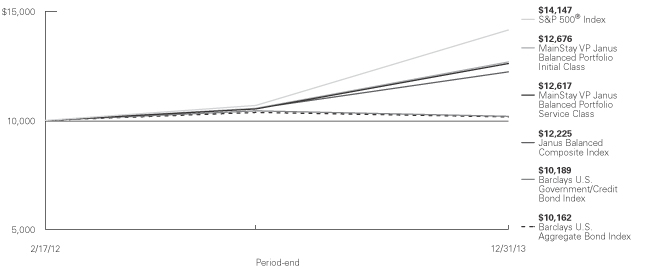

Janus Balanced Composite Index consists of the S&P 500® Index (55% weighted) and the Barclays U.S. Aggregate Bond Index (45% weighted).

LIBOR—London InterBank Offered Rate is a composite of interest rates at which banks borrow from one another in the London market, and it is a widely used benchmark for short-term interest rates.

Lipper Inc. is an independent monitor of fund performance. Results are based on total returns with all dividend and capital-gain distributions reinvested. More information about the Lipper peer group for an individual Portfolio can be found in the Portfolio’s Investment and Performance Comparison.

Moderate Allocation Composite Index consists of the S&P 500® Index, the MSCI EAFE® Index and the Barclays U.S. Aggregate Bond Index weighted 50%, 10% and 40%, respectively.

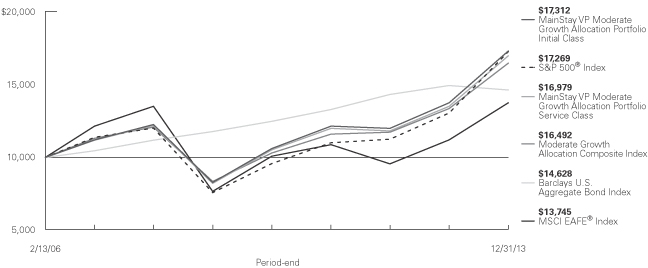

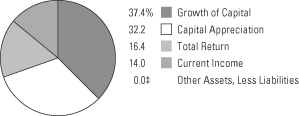

Moderate Growth Allocation Composite Index consists of the S&P 500® Index, the MSCI EAFE® Index and the Barclays U.S. Aggregate Bond Index weighted 65%, 15% and 20%, respectively.

Morningstar Intermediate Government Category Average is representative of funds that have at least 90% of their bond holdings in bonds backed by U.S. government or by U.S. government-linked agencies. These funds have durations between 3.5 and 6 years and/or average effective maturities between 4 and 10 years.

Morningstar Nontraditional Bond Category Average contains funds that pursue strategies divergent in one or more ways from conventional practice in the broader bond-fund universe. Morningstar category averages are equal-weighted returns based on constituents of the category at the end of the period.

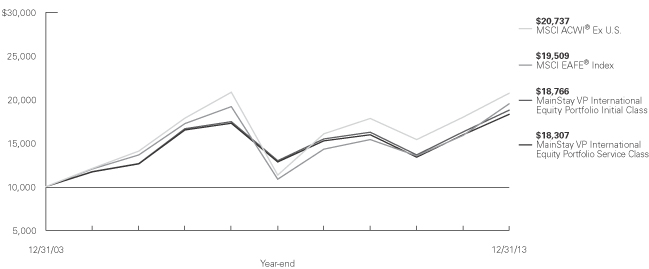

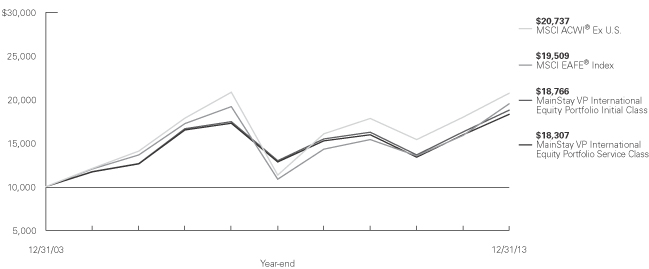

MSCI ACWI® (All Country World Index) Ex U.S. is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States.

MSCI EAFE® Index consists of international stocks representing the developed world outside of North America.

MSCI Emerging Markets Index is a free float-adjusted market-capitalization-weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index is a free float-adjusted market- capitalization-weighted index that is designed to measure the equity market performance of developed markets.

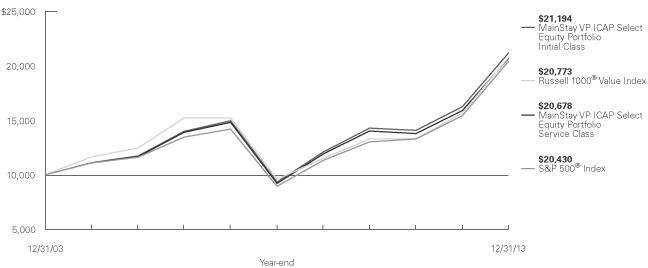

Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership.

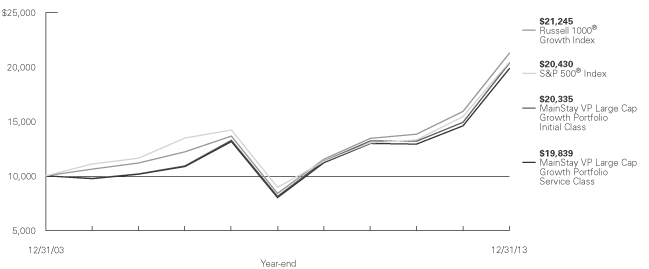

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2500™ Index measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500™ Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership.

Russell 3000® Index measures the performance of the largest 3,000 U.S. companies.

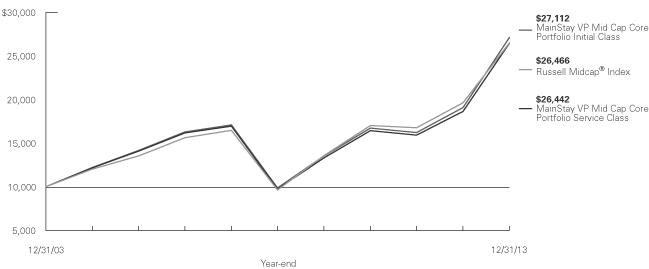

Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership.

Russell Midcap® Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values.

S&P 500® is a registered trademark of the McGraw-Hill Companies, Inc.

S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock-market performance.

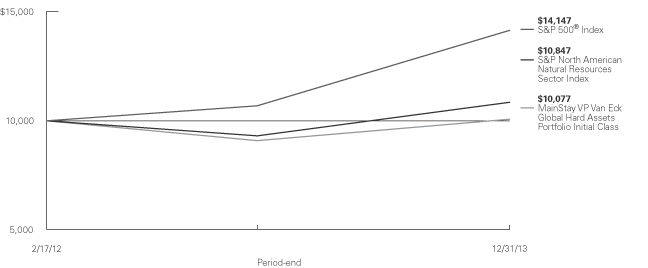

S&P North American Natural Resources Sector Index is a modified capitalization-weighted index designed as a benchmark for U.S. traded natural resource-related stocks. The natural resource sector includes mining, energy, paper and forest products, and plantation-owning companies.

| | | | |

| mainstayinvestments.com | | | M-3 | |

MainStay VP Balanced Portfolio

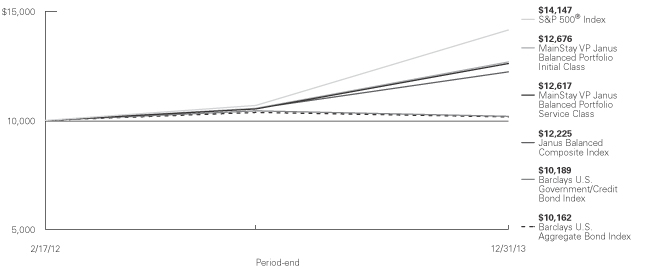

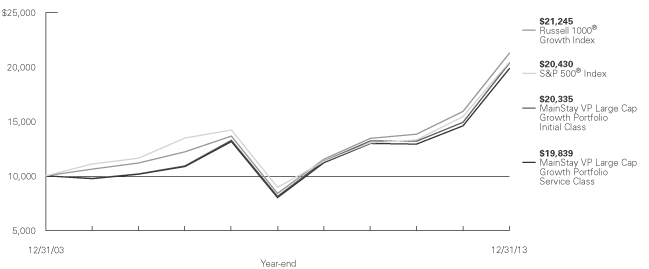

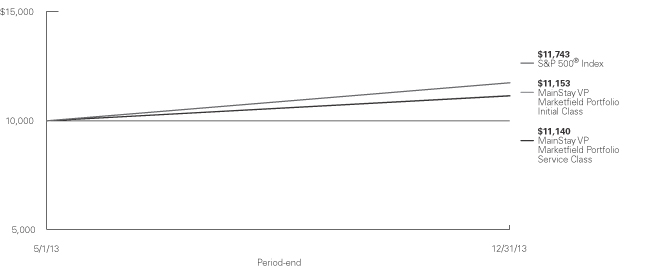

Investment and Performance Comparison1 (Unaudited)

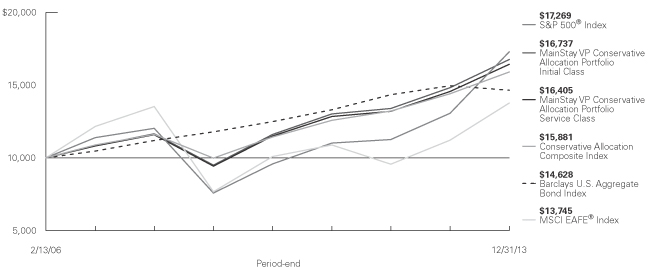

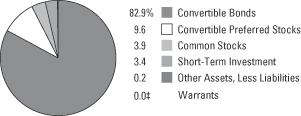

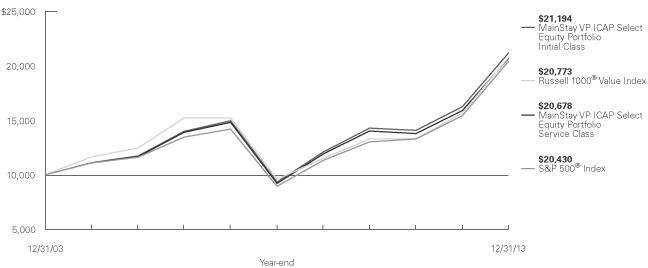

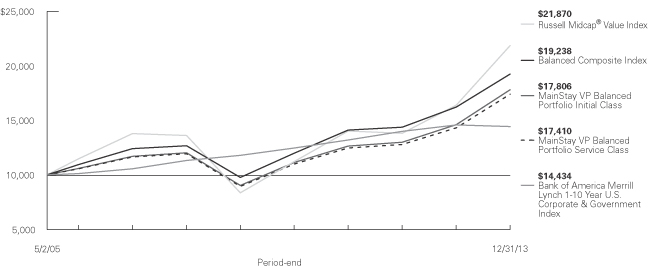

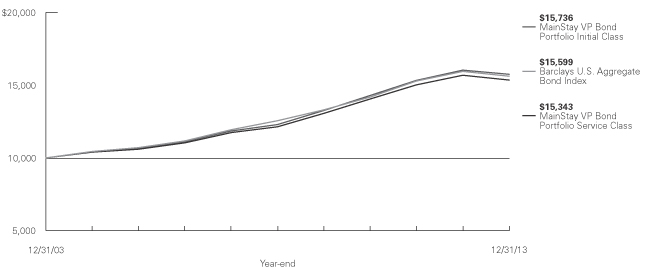

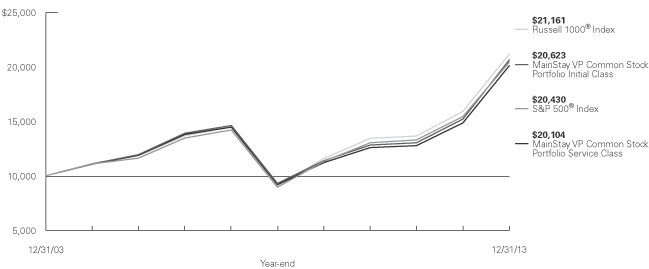

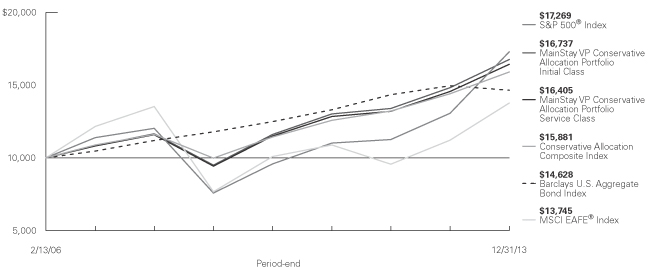

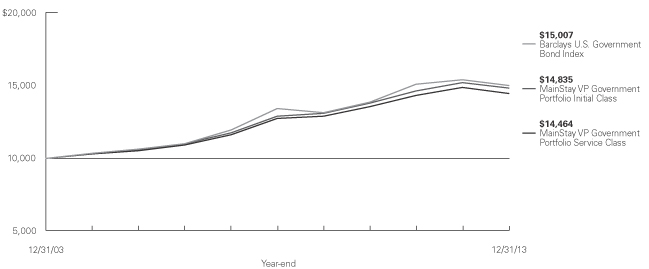

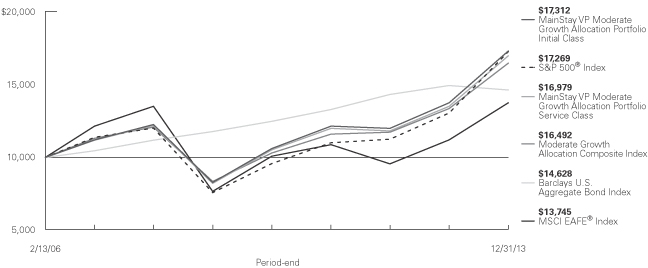

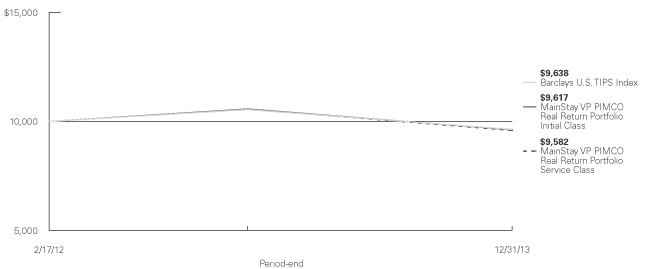

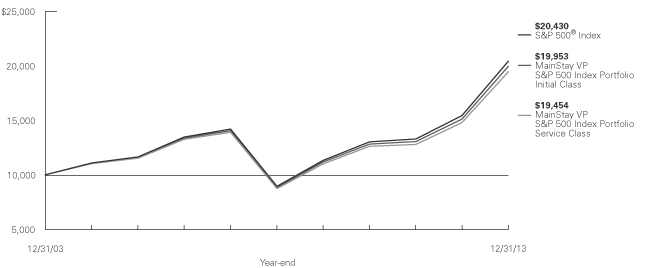

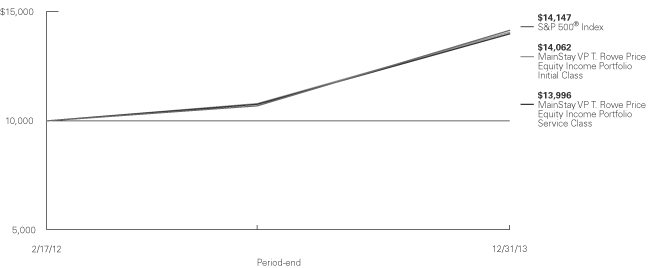

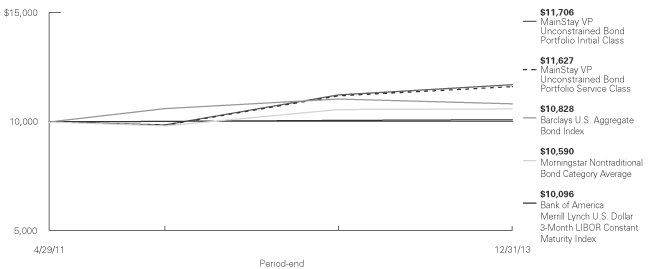

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The performance table and graph do not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. Please refer to the Performance Summary appropriate for your policy. For performance information current to the most recent month-end, please call 800-598-2019 or visit www.newyorklife.com.

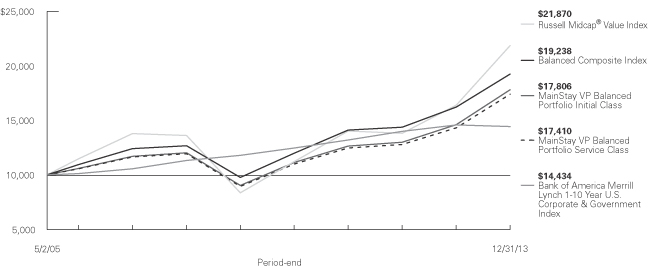

Average Annual Total Returns for the Period Ended December 31, 2013

| | | | | | | | | | | | | | | | |

| Class | | One Year | | | Five Years | | | Since Inception (5/2/05) | | | Gross Expense Ratio2 | |

| Initial Class Shares | | | 21.87 | % | | | 14.50 | % | | | 6.88 | % | | | 0.79 | % |

| Service Class Shares | | | 21.57 | | | | 14.21 | | | | 6.60 | | | | 1.04 | |

| | | | | | | | | | | | |

| Benchmark Performance | | One

Year | | | Five

Years | | | Since Inception

(5/2/05) | |

Russell Midcap® Value Index3 | | | 33.46 | % | | | 21.16 | % | | | 9.45 | % |

Balanced Composite Index3 | | | 18.63 | | | | 14.54 | | | | 7.83 | |

Bank of America Merrill Lynch 1-10 Year U.S. Corporate & Government Index3 | | | –1.04 | | | | 4.13 | | | | 4.33 | |

Average Lipper Variable Products Mixed-Asset Target Allocation Growth Portfolio4 | | | 19.36 | | | | 13.98 | | | | 6.87 | |

| 1. | Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been different. For information on current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Portfolio’s “Total Annual Portfolio Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Please refer to pages M-2 and M-3 for additional explanations and disclosure regarding the Portfolios, their benchmark indices and other indices mentioned in the reports. |

| 4. | The Average Lipper Variable Products Mixed-Asset Target Allocation Growth Portfolio is representative of portfolios that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash, and cash equivalents. Lipper Inc. is an independent monitor of fund performance. Results are based on total returns with all dividend and capital gain distributions reinvested. |

| | |

| M-4 | | MainStay VP Balanced Portfolio |

Cost in Dollars of a $1,000 Investment in MainStay VP Balanced Portfolio (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from July 1, 2013, to December 31, 2013, and the impact of those costs on your investment.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other Portfolios. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from July 1, 2013, to December 31, 2013. Shares are only sold in connection with variable life and annuity contracts and the example does not reflect any contract level or transactional fees or expenses. If these costs had been included, your costs would have been higher.

This example illustrates your Portfolio’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended

December 31, 2013. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Portfolio with the ongoing costs of investing in other Portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

7/1/13 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

12/31/13 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

12/31/13 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Initial Class Shares | | $ | 1,000.00 | | | $ | 1,107.90 | | | $ | 4.04 | | | $ | 1,021.40 | | | $ | 3.87 | |

| | | | | |

| Service Class Shares | | $ | 1,000.00 | | | $ | 1,106.50 | | | $ | 5.42 | | | $ | 1,020.10 | | | $ | 5.19 | |

| 1. | Expenses are equal to the Portfolio’s annualized expense ratio of each class (0.76% for Initial Class and 1.02% for Service Class) multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| | | | |

| mainstayinvestments.com | | | M-5 | |

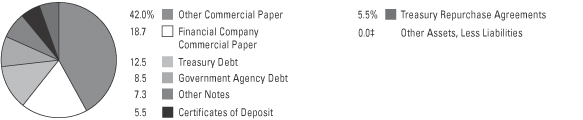

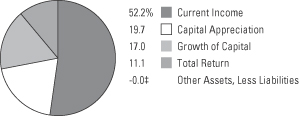

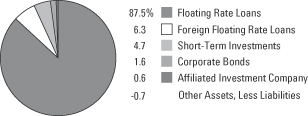

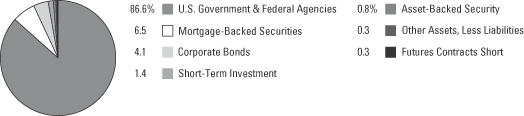

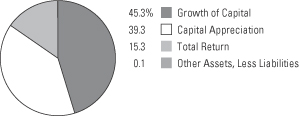

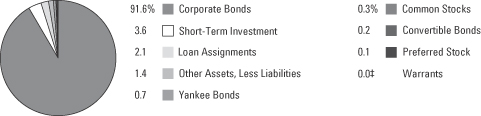

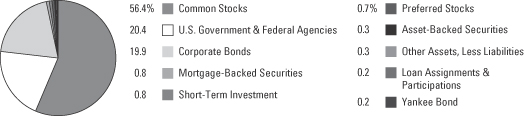

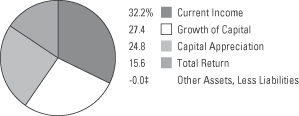

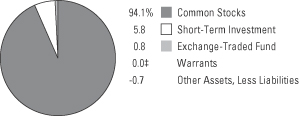

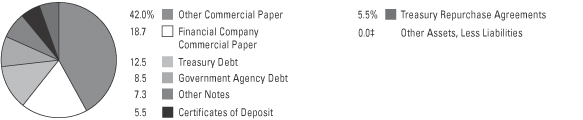

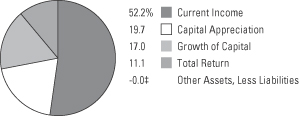

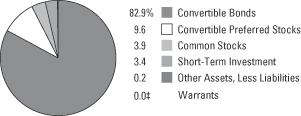

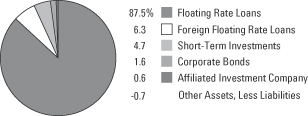

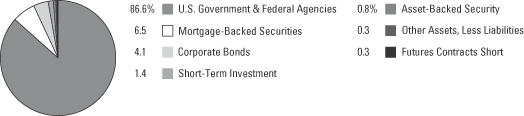

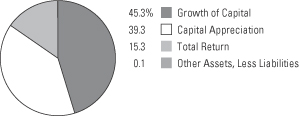

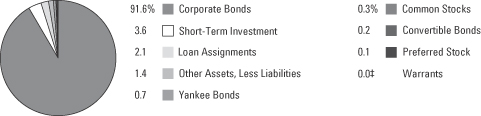

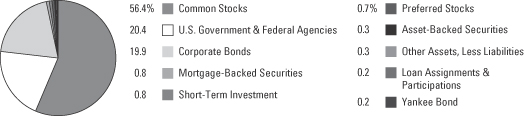

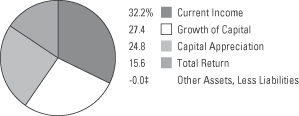

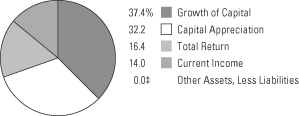

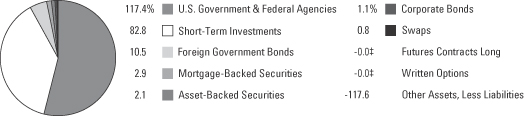

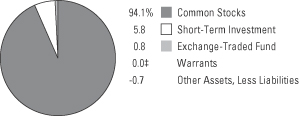

Portfolio Composition as of December 31, 2013 (Unaudited)

See Portfolio of Investments beginning on page M-11 for specific holdings within these categories.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings or Issuers Held as of December 31, 2013 (excluding short-term investments) (Unaudited)

| 1. | United States Treasury Notes, 0.25%–2.50%, due 2/28/15–8/15/23 |

| 2. | S&P Midcap 400 Index–Midcap SPDR Trust Series 1 |

| 3. | Federal National Mortgage Association,

0.375%–2.75%, due 3/13/14–5/21/18 |

| 4. | iShares Intermediate Credit Bond Fund |

| 5. | Federal Home Loan Mortgage Corporation,

0.875%–1.75%, due 9/10/15-10/2/19 |

| 8. | Ford Motor Credit Co. LLC, 3.00%–4.375%, due 6/12/17–8/6/23 |

| | |

| M-6 | | MainStay VP Balanced Portfolio |

Portfolio Management Discussion and Analysis (Unaudited)

Answers to the questions reflect the views of Jae S. Yoon, CFA, Thomas J. Girard, Donald F. Serek, CFA, and George S. Cherpelis of New York Life Investments,1 the Portfolio’s Manager, and Andrew Ver Planck, CFA, of Cornerstone Capital Management Holdings LLC (“Cornerstone Holdings”), the Portfolio’s Subadvisor.

How did MainStay VP Balanced Portfolio perform relative to its benchmark and peers for the 12 months ended December 31, 2013?

For the 12 months ended December 31, 2013, MainStay VP Balanced Portfolio returned 21.87% for Initial Class shares and 21.57% for Service Class shares. Over the same period, both share classes underperformed the 33.46% return of the Russell Midcap® Value Index,2 which is the Portfolio’s broad-based securities-market index. For the 12 months ended December 31, 2013, both share classes outperformed the 18.63% return of the Balanced Composite Index,2 which is a secondary benchmark of the Portfolio, and the –1.04% return of the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index,2 which is an additional benchmark of the Portfolio. Both share classes outperformed the 19.36% return of the average Lipper2 Variable Products Mixed-Asset Target Allocation Growth Portfolio for the 12 months ended December 31, 2013.

What factors affected the relative performance in the equity portion of the Portfolio during the reporting period?

The equity portion of the Portfolio outperformed the Russell Midcap® Value Index during the reporting period. The underlying quantitative model worked well, with valuation factors based on cash flow and revenue making strong contributions to the model’s performance. (Contributions take weightings and total returns into account.) The model was successful in identifying both winners and losers, but it was particularly effective in identifying stocks that would outperform the Russell Midcap® Value Index, which helped translate the model’s performance to the long-only performance of the equity portion of the Portfolio.

During the reporting period, which sectors were the strongest contributors to relative performance in the equity portion of the Portfolio and which sectors were particularly weak?

In the equity portion of the Portfolio, the financials, industrials and utilities sectors were the strongest positive contributors to performance relative to the Russell Midcap® Value Index. In financials, the Portfolio benefited by avoiding real estate investment trusts

(REITs) and favoring insurance stocks. In industrials, the Portfolio’s overweight position in the transportation industry, including airlines, helped relative performance. An underweight position in the utilities sector, which significantly trailed the Russell Midcap® Value Index, also contributed positively to the Portfolio’s relative performance.

In the equity portion of the Portfolio, the weakest contributions to relative performance came from the telecommunication services, consumer discretionary and energy sectors. Within telecommunication services, stock selection within wireless telecommunication services was weak. Stock selection in the consumer discretionary sector was especially poor among apparel retailers, although the negative effects were partially offset by an overweight position in the sector. Unfavorable stock selection in the energy sector, particularly among oil and gas exploration companies, also hurt performance relative to the Russell Midcap® Value Index.

During the reporting period, which individual stocks made the strongest contributions to the Portfolio’s absolute performance and which stocks detracted the most?

In the equity portion of the Portfolio, semiconductor devices company Micron Technology, cardiovascular device maker Boston Scientific and hard drive manufacturer Western Digital made the strongest positive contributions to the Portfolio’s absolute performance. The Portfolio held a substantial position in Micron Technology because the stock has a large weight in the benchmark and our model showed that the stock’s alpha potential (or ability to outperform the benchmark) was high. The stock returned an impressive 243% in 2013, making it the highest contributor to absolute performance. Boston Scientific, which was also a heavily weighted stock because of its substantial weight in the Russell Midcap® Value Index, returned 110% during the reporting period. Western Digital appreciated more than 100% in 2013.

The stocks that detracted the most from absolute performance in the equity portion of the Portfolio were metals & mining company Newmont Mining, electronic manufacturing service provider Jabil Circuits and specialty retailer Abercrombie & Fitch.

| 1. | “New York Life Investments” is a service mark used by New York Life Investment Management Holdings LLC and its subsidiary New York Life Investment Management LLC. |

| 2. | Please refer to pages M-2 and M-3 for additional explanations and disclosure regarding the Portfolios, their benchmark indices and service providers mentioned in the reports. |

| | | | |

| mainstayinvestments.com | | | M-7 | |

Newmont Mining declined as the price of gold collapsed in 2013. Jabil’s shares dropped after the company missed earnings estimates amid slowing demand for Apple products. Abercrombie struggled to meet earnings expectations in the crowded—and often fickle—retailers-to-teens space.

Did the equity portion of the Portfolio make any significant purchases or sales during the reporting period?

In February 2013, the equity portion of the Portfolio started purchasing shares of Xerox and, by the end of the reporting period, increased the position to as overweight as our model would allow. The stock’s return potential increased on the basis of attractive readings for valuation, sentiment and momentum. The equity portion of the Portfolio started building positions in Chesapeake Energy in July 2013, on the basis of improving valuation and price trend.

The equity portion of the Portfolio sold Symantec, a software and infrastructure company, during 2013, completely exiting the position in September. Despite attractive valuation, the stock’s momentum and sentiment scores were too weak for our model. We reduced the Portfolio’s equity position in oil refiner Marathon Petroleum during the reporting period as a risk control measure when the stock was removed from the benchmark during Russell’s annual index reconstitution.

How did sector weightings in the equity portion of the Portfolio change during the reporting period?

Information technology saw the largest increase in sector weighting relative to the Russell Midcap® Value Index, moving from an underweight position to one that was modestly overweight as the equity portion of the Portfolio purchased stocks in the computer storage and semiconductor industries. In the energy sector, purchases in oil refiners and oil and gas exploration companies caused the equity portion of the Portfolio to shift from a neutral position relative to the benchmark to an overweight position.

The health care sector saw the most substantial decrease in relative sector weightings, moving from a significant overweight to a modestly overweight position as we trimmed health care equipment and life sciences stocks. Consumer staples exposure also

went from an overweight to a modestly overweight position, as the equity portion of the Portfolio disposed of some packaged foods and tobacco stocks.

How was the equity portion of the Portfolio positioned at the end of the reporting period?

As of December 31, 2013, the equity portion of the Portfolio was most significantly overweight relative to the Russell Midcap® Value Index in consumer discretionary and energy. As of the same date, the equity portion of the Portfolio was most substantially underweight relative to the Index in the financials sector, followed by utilities.

What factors affected the relative performance of the fixed-income portion of the Portfolio during the reporting period?

Throughout the reporting period, the fixed-income portion of the Portfolio held overweight positions relative to the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index in corporate bonds, U.S. government agencies, asset-backed securities and commercial mortgage-backed securities. The corporate sector was the strongest-performing fixed-income sector during the reporting period. Our overweight position in U.S. government agencies also gradually added to performance. The fixed-income portion of the Portfolio started the reporting period with an overweight position in mortgage-backed securities. Rising interest rates and expectations that the Federal Reserve would taper its open-market bond purchases left the mortgage-backed securities sector vulnerable to spread3 widening. This prompted us to reduce the Portfolio’s mortgage-backed securities exposure to neutral during the end of the first half of 2013. Our overweight positioning in the mortgage-backed securities sector during this time frame detracted from performance. During the second half of the year, the positive excess return of the fixed-income portion of the Portfolio in relation to the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index was driven by the overweight position in U.S. corporate bonds, particularly by holdings in the financial and industrial subsectors.

| 3. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. The term “spread assets” refers to assets that typically trade at a spread to U.S. Treasury securities. |

| | |

| M-8 | | MainStay VP Balanced Portfolio |

What was the duration strategy of the fixed-income portion of the Portfolio during the reporting period?

The duration of the fixed-income portion of the Portfolio varied over the course of the reporting period. During the first half of the reporting period, we held duration close to that of the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index. In the latter portion of the first half, the duration was positioned to be slightly shorter than the Index. The fixed-income portion of the Portfolio maintained this position throughout the second half of the reporting period. This duration positioning was accretive to performance during the reporting period.

What specific factors, risks, or market forces prompted significant decisions for the fixed-income portion of the Portfolio during the reporting period?

There were four periods where specific factors, risks and market forces prompted asset allocation decisions for the fixed-income portion of the Portfolio. During the middle of the first half of 2013, our expectation that the Japanese quantitative easing program would be beneficial for mortgage-backed securities led us to add an overweight position to that sector. Toward the end of the second quarter, however, our expectation that the Federal Reserve might begin tapering its open-market bond purchases toward the end of 2013 led us to reduce our overweight position in mortgage-backed securities. As the end of the first half neared, lackluster economic growth—along with continuing suggestions that the Federal Reserve might begin tapering its asset purchases—caused spread assets to underperform. We used this opportunity to add to our overweight position in the corporate sector. This allocation decision helped the performance of the fixed-income portion of the Portfolio. The last instance occurred in the fourth quarter of 2013 when we modestly reduced our overweight position in the corporate sector in an effort to mitigate credit risk in the face of tightening valuations. The reduction occurred primarily in the financial and industrial subsectors.

During the reporting period, which market segments were the strongest positive contributors to the Portfolio’s performance and which market segments were particularly weak?

During the reporting period, an overweight position in the corporate bond sector made the strongest positive contribution to the performance of the fixed-income portion of the Portfolio. Within the corporate sector, overweight positions in the financial and industrial subsectors were the main drivers of outperformance relative to the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index. Positioning in the mortgage-backed securities and asset-backed securities sectors during the reporting period adversely affected the performance of the fixed-income portion of the Portfolio.

Did the fixed-income portion of the Portfolio make any significant purchases or sales during the reporting period?

We made purchases and sales throughout the reporting period, as previously described, when the asset allocation of the fixed-income portion of the Portfolio was modified. The purpose of these purchases and sales, in the aggregate, was to adjust positions in spread assets.

How did sector weightings change in the fixed-income portion of the Portfolio during the reporting period?

The fixed-income portion of the Portfolio held overweight positions relative to the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index in the financial, industrial and utility subsectors of the corporate bond sector. These overweight positions were maintained during the first half of the reporting period. During the second quarter, these subsector weightings were increased, as we sought to take advantage of attractive valuations. During the fourth quarter, the financial and industrial subsectors were modestly decreased in an effort to reduce the Portfolio’s spread-asset risk. During the first half of the reporting period we added to an already overweight position in the asset-backed securities sector.

| | | | |

| mainstayinvestments.com | | | M-9 | |

How was the fixed-income portion of the Portfolio positioned at the end of the reporting period?

As of December 31, 2013, the fixed-income portion of the Portfolio held overweight allocations to spread assets that were offset by an underweight position in U.S. Treasury securities. The largest overweight allocation within spread assets was in the corporate bond sector. As of December 31, 2013, the duration of the fixed-income portion of the Portfolio was slightly shorter than the duration of the Bank of America Merrill Lynch 1–10 Year U.S. Corporate & Government Index.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

| | |

| M-10 | | MainStay VP Balanced Portfolio |

Portfolio of Investments December 31, 2013

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 38.5%† Asset-Backed Securities 2.4% | |

Auto Floor Plan 0.3% | |

CNH Wholesale Master Note Trust

Series 2013-2A, Class A

0.767%, due 8/15/19 (a)(b) | | $ | 375,000 | | | $ | 375,494 | |

Ford Credit Floorplan Master Owner Trust A

Series 2013-5, Class A2

0.637%, due 9/15/18 (a) | | | 275,000 | | | | 275,674 | |

Series 2013-4, Class A2

0.717%, due 6/15/20 (a) | | | 150,000 | | | | 150,243 | |

Navistar Financial Dealer Note Master Trust

Series 2013-2, Class A

0.845%, due 9/25/18 (a)(b) | | | 175,000 | | | | 175,704 | |

| | | | | | | | |

| | | | | | | 977,115 | |

| | | | | | | | |

Automobile 0.2% | |

Chesapeake Funding LLC

Series 2013-1A, Class A

0.618%, due 1/7/25 (a)(b) | | | 200,000 | | | | 199,518 | |

Huntington Auto Trust

Series 2012-2, Class A3

0.51%, due 4/17/17 | | | 200,000 | | | | 199,584 | |

| | | | | | | | |

| | | | | | | 399,102 | |

| | | | | | | | |

Credit Cards 0.1% | |

American Express Issuance Trust II

Series 2013-2, Class A

0.597%, due 8/15/19 (a) | | | 125,000 | | | | 125,354 | |

Citibank Credit Card Issuance Trust

Series 2013-A7, Class A7

0.60%, due 9/10/20 (a) | | | 150,000 | | | | 150,265 | |

Discover Card Master Trust

Series 2012-A1, Class A1

0.81%, due 8/15/17 | | | 86,000 | | | | 86,301 | |

| | | | | | | | |

| | | | | | | 361,920 | |

| | | | | | | | |

Other ABS 1.8% | |

Apidos CDO

Series 2013-14A, Class A

1.394%, due 4/15/25 (a)(b)(c) | | | 475,000 | | | | 467,875 | |

Ares CLO, Ltd.

2013-2A, Class A1

1.501%, due 7/28/25 (a)(b)(c) | | | 450,000 | | | | 442,800 | |

Babson CLO, Ltd.

Series 2013-IA, Class A

1.342%, due 4/20/25 (a)(b)(c) | | | 450,000 | | | | 441,900 | |

Ballyrock CDO, Ltd.

Series 2013-1A, Class A

1.417%, due 5/20/25 (a)(b) | | | 350,000 | | | | 346,010 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Other ABS (continued) | |

Carlyle Global Market Strategies

Series 2013-3A, Class A1A

1.39%, due 7/15/25 (a)(b)(c) | | $ | 250,000 | | | $ | 245,968 | |

Series 2013-2A, Class A1

1.396%, due 4/18/25 (a)(b) | | | 250,000 | | | | 245,245 | |

Cent CLO, L.P.

Series 2013-18A, Class A

1.366%, due 7/23/25 (a)(b)(c) | | | 375,000 | | | | 368,906 | |

CNH Equipment Trust

Series 2012-C, Class A3

0.57%, due 12/15/17 | | | 200,000 | | | | 199,774 | |

Dryden Senior Loan Fund

Series 2013-26A, Class A

1.344%, due 7/15/25 (a)(b) | | | 280,000 | | | | 274,030 | |

Jamestown CLO, Ltd.

Series 2013-3A, Class A1A

1.693%, due 1/15/26 (a)(b)(c) | | | 450,000 | | | | 446,490 | |

Nomad CLO, Ltd.

Series 2013-1A, Class A1

1.444%, due 1/15/25 (a)(b) | | | 275,000 | | | | 270,707 | |

Octagon Investment Partners XVII, Ltd.

Series 2013-1A, Class A1

1.55%, due 10/25/25 (a)(b)(c) | | | 450,000 | | | | 446,625 | |

OHA Loan Funding, Ltd.

Series 2013-1A, Class A

1.528%, due 7/23/25 (a)(b) | | | 450,000 | | | | 445,131 | |

Race Point VIII CLO, Ltd.

Series 2013-8A, Class A

1.487%, due 2/20/25 (a)(b) | | | 270,000 | | | | 268,229 | |

Sheridan Square CLO, Ltd.

Series 2013-1A, Class A2

1.414%, due 4/15/25 (a)(b) | | | 275,000 | | | | 272,635 | |

| | | | | | | | |

| | | | | | | 5,182,325 | |

| | | | | | | | |

Total Asset-Backed Securities

(Cost $6,979,510) | | | | | | | 6,920,462 | |

| | | | | | | | |

|

| Corporate Bonds 15.4% | |

Aerospace & Defense 0.2% | |

BAE Systems PLC

3.50%, due 10/11/16 (b) | | | 100,000 | | | | 104,535 | |

General Dynamics Corp.

2.25%, due 7/15/16 | | | 50,000 | | | | 51,541 | |

Northrop Grumman Corp.

3.25%, due 8/1/23 | | | 175,000 | | | | 163,232 | |

United Technologies Corp.

1.80%, due 6/1/17 | | | 300,000 | | | | 304,624 | |

| | | | | | | | |

| | | | | | | 623,932 | |

| | | | | | | | |

| † | Percentages indicated are based on Portfolio net assets. |

| ¨ | | Among the Portfolio’s 10 largest holdings or issuers held, as of December 31, 2013, excluding short-term investments. May be subject to change daily. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | M-11 | |

Portfolio of Investments December 31, 2013 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Auto Manufacturers 0.2% | |

Daimler Finance North America LLC

2.375%, due 8/1/18 (b) | | $ | 150,000 | | | $ | 149,668 | |

3.875%, due 9/15/21 (b) | | | 200,000 | | | | 201,840 | |

Volkswagen International Finance N.V.

1.625%, due 3/22/15 (b) | | | 100,000 | | | | 101,129 | |

| | | | | | | | |

| | | | | | | 452,637 | |

| | | | | | | | |

Banks 5.3% | |

Abbey National Treasury Services PLC

3.05%, due 8/23/18 | | | 575,000 | | | | 590,830 | |

¨Bank of America Corp.

2.00%, due 1/11/18 | | | 250,000 | | | | 249,557 | |

2.60%, due 1/15/19 | | | 325,000 | | | | 326,435 | |

4.10%, due 7/24/23 | | | 650,000 | | | | 652,758 | |

5.65%, due 5/1/18 | | | 375,000 | | | | 426,851 | |

BB&T Corp.

1.103%, due 6/15/18 (a) | | | 275,000 | | | | 276,929 | |

1.45%, due 1/12/18 | | | 100,000 | | | | 97,367 | |

Capital One Financial Corp.

1.00%, due 11/6/15 | | | 250,000 | | | | 249,891 | |

2.15%, due 3/23/15 | | | 275,000 | | | | 279,560 | |

3.50%, due 6/15/23 | | | 150,000 | | | | 140,806 | |

¨Citigroup, Inc.

3.375%, due 3/1/23 | | | 75,000 | | | | 71,289 | |

3.50%, due 5/15/23 | | | 650,000 | | | | 605,664 | |

4.587%, due 12/15/15 | | | 160,000 | | | | 170,978 | |

5.375%, due 8/9/20 | | | 250,000 | | | | 284,410 | |

6.00%, due 8/15/17 | | | 100,000 | | | | 113,976 | |

6.01%, due 1/15/15 | | | 17,000 | | | | 17,902 | |

Commonwealth Bank of Australia

0.745%, due 9/20/16 (a)(b) | | | 300,000 | | | | 300,728 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank B.A.

3.375%, due 1/19/17 | | | 200,000 | | | | 210,578 | |

Credit Agricole S.A.

1.625%, due 4/15/16 (b) | | | 250,000 | | | | 251,541 | |

Goldman Sachs Group, Inc. (The)

2.375%, due 1/22/18 | | | 600,000 | | | | 602,281 | |

3.625%, due 2/7/16 | | | 75,000 | | | | 78,711 | |

5.375%, due 3/15/20 | | | 125,000 | | | | 139,016 | |

6.00%, due 6/15/20 | | | 300,000 | | | | 343,973 | |

HSBC Bank PLC

1.50%, due 5/15/18 (b) | | | 400,000 | | | | 390,588 | |

4.125%, due 8/12/20 (b) | | | 550,000 | | | | 581,949 | |

HSBC USA, Inc.

1.128%, due 9/24/18 (a) | | | 100,000 | | | | 100,139 | |

Huntington Bancshares, Inc.

2.60%, due 8/2/18 | | | 650,000 | | | | 650,380 | |

ING Bank N.V.

5.80%, due 9/25/23 (b) | | | 450,000 | | | | 470,517 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Banks (continued) | |

JPMorgan Chase & Co.

3.375%, due 5/1/23 | | $ | 450,000 | | | $ | 419,400 | |

4.50%, due 1/24/22 | | | 250,000 | | | | 264,433 | |

Korea Development Bank (The)

3.875%, due 5/4/17 | | | 200,000 | | | | 210,806 | |

Lloyds Bank PLC

2.30%, due 11/27/18 | | | 200,000 | | | | 199,481 | |

¨Morgan Stanley

4.10%, due 5/22/23 | | | 575,000 | | | | 556,457 | |

4.875%, due 11/1/22 | | | 300,000 | | | | 307,098 | |

5.50%, due 1/26/20 | | | 600,000 | | | | 673,543 | |

Royal Bank of Scotland Group PLC

2.55%, due 9/18/15 | | | 550,000 | | | | 562,516 | |

Santander UK PLC

5.00%, due 11/7/23 (b) | | | 850,000 | | | | 853,162 | |

Skandinaviska Enskilda Banken AB

1.75%, due 3/19/18 (b) | | | 400,000 | | | | 391,850 | |

Societe Generale S.A.

1.327%, due 10/1/18 (a) | | | 275,000 | | | | 276,579 | |

2.75%, due 10/12/17 | | | 250,000 | | | | 257,675 | |

Sumitomo Mitsui Trust Bank, Ltd.

1.024%, due 9/16/16 (a)(b) | | | 200,000 | | | | 200,963 | |

SunTrust Banks, Inc.

2.35%, due 11/1/18 | | | 200,000 | | | | 198,940 | |

Swedbank AB

1.75%, due 3/12/18 (b) | | | 600,000 | | | | 589,516 | |

Union Bank N.A.

0.996%, due 9/26/16 (a) | | | 250,000 | | | | 252,233 | |

Wells Fargo & Co.

2.15%, due 1/15/19 | | | 425,000 | | | | 423,669 | |

4.125%, due 8/15/23 | | | 225,000 | | | | 221,816 | |

Westpac Banking Corp.

1.125%, due 9/25/15 | | | 100,000 | | | | 101,084 | |

| | | | | | | | |

| | | | | | | 15,636,825 | |

| | | | | | | | |

Beverages 0.2% | | | | | |

Anheuser-Busch InBev Worldwide, Inc.

1.375%, due 7/15/17 | | | 250,000 | | | | 249,475 | |

4.375%, due 2/15/21 | | | 75,000 | | | | 80,193 | |

Diageo Capital PLC

1.50%, due 5/11/17 | | | 100,000 | | | | 99,784 | |

SABMiller Holdings, Inc.

2.45%, due 1/15/17 (b) | | | 250,000 | | | | 255,997 | |

| | | | | | | | |

| | | | | | | 685,449 | |

| | | | | | | | |

Building Materials 0.0%‡ | | | | | |

CRH America, Inc.

4.125%, due 1/15/16 | | | 100,000 | | | | 105,517 | |

| | | | | | | | |

| |

Chemicals 0.3% | | | | | |

Dow Chemical Co. (The)

5.70%, due 5/15/18 | | | 44,000 | | | | 50,306 | |

| | | | |

| M-12 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Chemicals (continued) | | | | | |

LYB International Finance B.V.

4.00%, due 7/15/23 | | $ | 400,000 | | | $ | 394,822 | |

NewMarket Corp.

4.10%, due 12/15/22 | | | 400,000 | | | | 381,052 | |

| | | | | | | | |

| | | | | | | 826,180 | |

| | | | | | | | |

Computers 0.2% | | | | | |

Hewlett-Packard Co.

2.35%, due 3/15/15 | | | 425,000 | | | | 431,651 | |

| | | | | | | | |

| |

Cosmetics & Personal Care 0.0%‡ | | | | | |

Procter & Gamble Co. (The)

1.45%, due 8/15/16 | | | 50,000 | | | | 50,730 | |

| | | | | | | | |

| |

Diversified Financial Services 0.3% | | | | | |

General Electric Capital Corp.

2.30%, due 4/27/17 | | | 350,000 | | | | 359,755 | |

5.50%, due 1/8/20 | | | 225,000 | | | | 257,662 | |

6.00%, due 8/7/19 | | | 225,000 | | | | 263,995 | |

| | | | | | | | |

| | | | | | | 881,412 | |

| | | | | | | | |

Electric 1.2% | | | | | |

Commonwealth Edison Co.

1.95%, due 9/1/16 | | | 100,000 | | | | 102,131 | |

Dayton Power & Light Co. (The)

1.875%, due 9/15/16 (b) | | | 150,000 | | | | 151,226 | |

Entergy Louisiana LLC

1.875%, due 12/15/14 | | | 25,000 | | | | 25,333 | |

3.30%, due 12/1/22 | | | 50,000 | | | | 47,017 | |

Entergy Mississippi, Inc.

3.10%, due 7/1/23 | | | 50,000 | | | | 46,452 | |

FirstEnergy Corp.

4.25%, due 3/15/23 | | | 275,000 | | | | 256,342 | |

GDF Suez

1.625%, due 10/10/17 (b) | | | 150,000 | | | | 148,484 | |

Great Plains Energy, Inc.

4.85%, due 6/1/21 | | | 280,000 | | | | 295,019 | |

5.292%, due 6/15/22 (d) | | | 45,000 | | | | 48,280 | |

Hydro-Quebec

2.00%, due 6/30/16 | | | 150,000 | | | | 154,020 | |

Kansas City Power & Light Co.

7.15%, due 4/1/19 | | | 250,000 | | | | 304,922 | |

NextEra Energy Capital Holdings, Inc.

1.20%, due 6/1/15 | | | 100,000 | | | | 100,512 | |

1.339%, due 9/1/15 | | | 550,000 | | | | 553,663 | |

Niagara Mohawk Power Corp.

2.721%, due 11/28/22 (b) | | | 100,000 | | | | 92,014 | |

NiSource Finance Corp.

4.45%, due 12/1/21 | | | 100,000 | | | | 101,325 | |

Pacific Gas & Electric Co.

3.85%, due 11/15/23 | | | 325,000 | | | | 323,251 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Electric (continued) | | | | | |

Pepco Holdings, Inc.

2.70%, due 10/1/15 | | $ | 100,000 | | | $ | 102,539 | |

PPL Capital Funding, Inc.

3.50%, due 12/1/22 | | | 100,000 | | | | 94,441 | |

4.20%, due 6/15/22 | | | 100,000 | | | | 99,817 | |

Progress Energy, Inc.

6.05%, due 3/15/14 | | | 250,000 | | | | 252,782 | |

Westar Energy, Inc.

6.00%, due 7/1/14 | | | 300,000 | | | | 308,252 | |

| | | | | | | | |

| | | | | | | 3,607,822 | |

| | | | | | | | |

Electronics 0.2% | | | | | |

Thermo Fisher Scientific, Inc.

2.40%, due 2/1/19 | | | 625,000 | | | | 619,182 | |

| | | | | | | | |

| |

Finance—Auto Loans 0.7% | | | | | |

American Honda Finance Corp.

0.744%, due 10/7/16 (a) | | | 100,000 | | | | 100,520 | |

2.125%, due 10/10/18 | | | 100,000 | | | | 99,589 | |

¨Ford Motor Credit Co. LLC

3.00%, due 6/12/17 | | | 900,000 | | | | 935,386 | |

4.375%, due 8/6/23 | | | 925,000 | | | | 929,957 | |

| | | | | | | | |

| | | | | | | 2,065,452 | |

| | | | | | | | |

Finance—Commercial 0.1% | | | | | |

Caterpillar Financial Services Corp.

2.05%, due 8/1/16 | | | 225,000 | | | | 230,971 | |

| | | | | | | | |

| |

Finance—Consumer Loans 0.1% | | | | | |

John Deere Capital Corp.

1.70%, due 1/15/20 | | | 250,000 | | | | 235,420 | |

2.80%, due 9/18/17 | | | 50,000 | | | | 52,343 | |

5.75%, due 9/10/18 | | | 75,000 | | | | 87,095 | |

| | | | | | | | |

| | | | | | | 374,858 | |

| | | | | | | | |

Finance—Credit Card 0.3% | | | | | |

American Express Co.

5.50%, due 9/12/16 | | | 250,000 | | | | 278,071 | |

Capital One Bank USA N.A.

2.15%, due 11/21/18 | | | 675,000 | | | | 671,389 | |

| | | | | | | | |

| | | | | | | 949,460 | |

| | | | | | | | |

Finance—Investment Banker/Broker 0.1% | | | | | |

BNP Paribas Home Loan Covered Bonds S.A.

2.20%, due 11/2/15 (b) | | | 175,000 | | | | 179,410 | |

| | | | | | | | |

| |

Finance—Other Services 0.1% | | | | | |

National Rural Utilities Cooperative Finance Corp.

1.90%, due 11/1/15 | | | 100,000 | | | | 102,389 | |

2.35%, due 6/15/20 | | | 175,000 | | | | 169,015 | |

| | | | | | | | |

| | | | | | | 271,404 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | M-13 | |

Portfolio of Investments December 31, 2013 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Food 0.4% | | | | | |

Ingredion, Inc.

1.80%, due 9/25/17 | | $ | 75,000 | | | $ | 73,099 | |

4.625%, due 11/1/20 | | | 250,000 | | | | 260,673 | |

Mondelez International, Inc.

4.125%, due 2/9/16 | | | 450,000 | | | | 477,071 | |

Safeway, Inc.

3.40%, due 12/1/16 | | | 250,000 | | | | 260,103 | |

| | | | | | | | |

| | | | | | | 1,070,946 | |

| | | | | | | | |

Gas 0.0%‡ | | | | | |

Sempra Energy

2.30%, due 4/1/17 | | | 75,000 | | | | 75,972 | |

| | | | | | | | |

| |

Hand & Machine Tools 0.0%‡ | | | | | |

Stanley Black & Decker, Inc.

3.40%, due 12/1/21 | | | 50,000 | | | | 49,127 | |

| | | | | | | | |

| |

Health Care—Products 0.0%‡ | | | | | |

Zimmer Holdings, Inc.

1.40%, due 11/30/14 | | | 100,000 | | | | 100,647 | |

| | | | | | | | |

| |

Insurance 1.0% | | | | | |

American International Group, Inc.

4.125%, due 2/15/24 | | | 400,000 | | | | 397,681 | |

Assurant, Inc.

2.50%, due 3/15/18 | | | 300,000 | | | | 293,116 | |

Five Corners Funding Trust

4.419%, due 11/15/23 (b) | | | 300,000 | | | | 295,717 | |

ING U.S., Inc.

2.90%, due 2/15/18 | | | 815,000 | | | | 833,570 | |

Markel Corp.

3.625%, due 3/30/23 | | | 275,000 | | | | 258,830 | |

MetLife, Inc.

1.756%, due 12/15/17 | | | 150,000 | | | | 148,409 | |

Metropolitan Life Global Funding I

5.125%, due 6/10/14 (b) | | | 225,000 | | | | 229,663 | |

Nationwide Financial Services, Inc.

5.375%, due 3/25/21 (b) | | | 100,000 | | | | 107,216 | |

Principal Financial Group, Inc.

8.875%, due 5/15/19 | | | 90,000 | | | | 115,068 | |

QBE Insurance Group, Ltd.

2.40%, due 5/1/18 (b) | | | 200,000 | | | | 192,140 | |

| | | | | | | | |

| | | | | | | 2,871,410 | |

| | | | | | | | |

Iron & Steel 0.1% | | | | | |

ArcelorMittal

4.25%, due 2/25/15 | | | 100,000 | | | | 102,750 | |

Carpenter Technology Corp.

4.45%, due 3/1/23 | | | 125,000 | | | | 119,937 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Iron & Steel (continued) | | | | | |

Reliance Steel & Aluminum Co.

4.50%, due 4/15/23 | | $ | 200,000 | | | $ | 196,184 | |

| | | | | | | | |

| | | | | | | 418,871 | |

| | | | | | | | |

Media 0.1% | | | | | |

COX Communications, Inc.

5.45%, due 12/15/14 | | | 64,000 | | | | 66,883 | |

DIRECTV Holdings LLC / DIRECTV Financing Co., Inc.

3.50%, due 3/1/16 | | | 75,000 | | | | 78,727 | |

Viacom, Inc.

1.25%, due 2/27/15 | | | 100,000 | | | | 100,498 | |

| | | | | | | | |

| | | | | | | 246,108 | |

| | | | | | | | |

Mining 0.6% | | | | | |

Barrick Gold Corp.

4.10%, due 5/1/23 | | | 725,000 | | | | 655,321 | |

BHP Billiton Finance USA, Ltd.

1.875%, due 11/21/16 | | | 150,000 | | | | 153,228 | |

Freeport-McMoRan Copper & Gold, Inc.

3.875%, due 3/15/23 | | | 350,000 | | | | 330,976 | |

Rio Tinto Finance USA PLC

1.084%, due 6/17/16 (a) | | | 250,000 | | | | 251,774 | |

Rio Tinto Finance USA, Ltd.

2.25%, due 9/20/16 | | | 275,000 | | | | 283,024 | |

3.50%, due 11/2/20 | | | 200,000 | | | | 204,194 | |

| | | | | | | | |

| | | | | | | 1,878,517 | |

| | | | | | | | |

Oil & Gas 0.5% | | | | | |

Anadarko Petroleum Corp.

5.95%, due 9/15/16 | | | 275,000 | | | | 306,368 | |

Apache Corp.

3.625%, due 2/1/21 | | | 150,000 | | | | 154,431 | |

BP Capital Markets PLC

1.846%, due 5/5/17 | | | 75,000 | | | | 75,753 | |

Petrobras International Finance Co.

2.875%, due 2/6/15 | | | 200,000 | | | | 203,000 | |

5.375%, due 1/27/21 | | | 500,000 | | | | 496,194 | |

Petroleos Mexicanos

3.50%, due 1/30/23 | | | 100,000 | | | | 91,625 | |

Plains Exploration & Production Co.

6.75%, due 2/1/22 | | | 100,000 | | | | 110,152 | |

Total Capital International S.A.

1.55%, due 6/28/17 | | | 100,000 | | | | 100,022 | |

| | | | | | | | |

| | | | | | | 1,537,545 | |

| | | | | | | | |

Oil & Gas Services 0.0%‡ | | | | | |

Cameron International Corp.

1.60%, due 4/30/15 | | | 50,000 | | | | 50,305 | |

| | | | | | | | |

| |

Packaging & Containers 0.3% | | | | | |

Bemis Co., Inc.

5.65%, due 8/1/14 | | | 215,000 | | | | 221,005 | |

| | | | |

| M-14 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Corporate Bonds (continued) | |

Packaging & Containers (continued) | | | | | |

Packaging Corp. of America

4.50%, due 11/1/23 | | $ | 650,000 | | | $ | 651,699 | |

| | | | | | | | |

| | | | | | | 872,704 | |

| | | | | | | | |

Pharmaceuticals 0.3% | | | | | |

Mylan, Inc.

2.60%, due 6/24/18 (b) | | | 125,000 | | | | 125,072 | |

Novartis Securities Investment, Ltd.

5.125%, due 2/10/19 | | | 125,000 | | | | 141,546 | |

Sanofi

1.25%, due 4/10/18 | | | 175,000 | | | | 170,383 | |

4.00%, due 3/29/21 | | | 125,000 | | | | 130,952 | |

Teva Pharmaceutical Finance Co. B.V.

2.40%, due 11/10/16 | | | 175,000 | | | | 180,052 | |

| | | | | | | | |

| | | | | | | 748,005 | |

| | | | | | | | |

Pipelines 0.4% | | | | | |

Energy Transfer Partners, L.P.

4.15%, due 10/1/20 | | | 375,000 | | | | 380,468 | |

Enterprise Products Operating LLC

1.25%, due 8/13/15 | | | 100,000 | | | | 100,664 | |

Plains All American Pipeline, L.P. / PAA Finance Corp.

8.75%, due 5/1/19 | | | 200,000 | | | | 255,811 | |

Spectra Energy Partners, L.P.

2.95%, due 9/25/18 | | | 200,000 | | | | 202,725 | |

Texas Eastern Transmission, L.P.

2.80%, due 10/15/22 (b) | | | 175,000 | | | | 156,486 | |

| | | | | | | | |

| | | | | | | 1,096,154 | |

| | | | | | | | |

Real Estate 0.0%‡ | | | | | |

WEA Finance LLC / WT Finance Australia Property, Ltd.

5.75%, due 9/2/15 (b) | | | 100,000 | | | | 107,863 | |

| | | | | | | | |

| |

Real Estate Investment Trusts 1.1% | | | | | |

Brandywine Operating Partnership, L.P.

5.70%, due 5/1/17 | | | 500,000 | | | | 550,158 | |

CBL & Associates, L.P.

5.25%, due 12/1/23 | | | 700,000 | | | | 699,070 | |

DDR Corp.

4.75%, due 4/15/18 | | | 200,000 | | | | 215,748 | |

Hospitality Properties Trust

6.30%, due 6/15/16 | | | 170,000 | | | | 183,520 | |

Host Hotels & Resorts, L.P.

6.00%, due 10/1/21 | | | 150,000 | | | | 163,323 | |

Liberty Property, L.P.

4.40%, due 2/15/24 | | | 125,000 | | | | 122,738 | |

National Retail Properties, Inc.

6.25%, due 6/15/14 | | | 200,000 | | | | 204,670 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Real Estate Investment Trusts (continued) | | | | | |

ProLogis, L.P.

4.25%, due 8/15/23 | | $ | 550,000 | | | $ | 543,320 | |

6.625%, due 5/15/18 | | | 509,000 | | | | 594,497 | |

| | | | | | | | |

| | | | | | | 3,277,044 | |

| | | | | | | | |

Retail 0.1% | | | | | |

Home Depot, Inc. (The)

4.40%, due 4/1/21 | | | 125,000 | | | | 134,997 | |

| | | | | | | | |

| |

Semiconductors 0.1% | | | | | |

Samsung Electronics America, Inc.

1.75%, due 4/10/17 (b) | | | 200,000 | | | | 198,719 | |

| | | | | | | | |

| |

Software 0.1% | | | | | |

Fiserv, Inc.

4.75%, due 6/15/21 | | | 200,000 | | | | 203,691 | |

| | | | | | | | |

| |

Telecommunications 0.7% | | | | | |

AT&T, Inc.

2.375%, due 11/27/18 | | | 125,000 | | | | 125,107 | |

Orange S.A.

2.75%, due 9/14/16 | | | 200,000 | | | | 207,690 | |

Telefonica Emisiones SAU

5.134%, due 4/27/20 | | | 675,000 | | | | 717,092 | |

Verizon Communications, Inc.

2.00%, due 11/1/16 | | | 100,000 | | | | 102,036 | |

5.15%, due 9/15/23 | | | 750,000 | | | | 805,269 | |

Vodafone Group PLC

1.25%, due 9/26/17 | | | 100,000 | | | | 97,718 | |

| | | | | | | | |

| | | | | | | 2,054,912 | |

| | | | | | | | |

Textiles 0.0%‡ | | | | | |

Mohawk Industries, Inc.

3.85%, due 2/1/23 | | | 100,000 | | | | 95,000 | |

| | | | | | | | |

| |

Transportation 0.1% | | | | | |

Burlington Northern Santa Fe LLC

4.70%, due 10/1/19 | | | 125,000 | | | | 137,126 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $44,969,893) | | | | | | | 45,218,555 | |

| | | | | | | | |

|

| Foreign Government Bonds 0.6% | |

Regional (State & Province) 0.2% | |

Province of Ontario

1.10%, due 10/25/17 | | | 425,000 | | | | 420,198 | |

Province of Quebec

3.50%, due 7/29/20 | | | 200,000 | | | | 207,620 | |

| | | | | | | | |

| | | | | | | 627,818 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | M-15 | |

Portfolio of Investments December 31, 2013 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Foreign Government Bonds (continued) | |

Sovereign 0.4% | |

Brazilian Government International Bond

2.625%, due 1/5/23 | | $ | 200,000 | | | $ | 172,000 | |

Italy Government International Bond

4.75%, due 1/25/16 | | | 175,000 | | | | 186,217 | |

Poland Government International Bond

5.00%, due 3/23/22 | | | 50,000 | | | | 53,438 | |

Romanian Government International Bond

4.375%, due 8/22/23 (b) | | | 250,000 | | | | 241,250 | |

Russian Federation

3.50%, due 1/16/19 (b) | | | 400,000 | | | | 406,200 | |

Turkey Government International Bond

6.75%, due 4/3/18 | | | 100,000 | | | | 108,600 | |

| | | | | | | | |

| | | | | | | 1,167,705 | |

| | | | | | | | |

Total Foreign Government Bonds

(Cost $1,829,407) | | | | | | | 1,795,523 | |

| | | | | | | | |

|

| Mortgage-Backed Securities 0.6% | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) 0.6% | |

Boca Hotel Portfolio Trust

Series 2013-BOCA, Class A

1.317%, due 8/15/26 (a)(b) | | | 310,992 | | | | 311,523 | |

Commercial Mortgage Pass Through Certificates

Series 2013-THL, Class A2

1.218%, due 6/8/30 (a)(b) | | | 300,000 | | | | 299,267 | |

JP Morgan Chase Commercial

Mortgage Securities Corp.

Series 2012-C6, Class A2

2.206%, due 5/15/45 | | | 100,000 | | | | 101,782 | |

Series 2006-CB15, Class A4

5.814%, due 6/12/43 (a) | | | 141,362 | | | | 152,510 | |

LB-UBS Commercial Mortgage Trust

Series 2006-C7, Class A3

5.347%, due 11/15/38 | | | 200,000 | | | | 219,592 | |

Morgan Stanley Bank of America

Merrill Lynch Trust

Series 2013-C13, Class A2

2.936%, due 11/15/46 (e) | | | 500,000 | | | | 507,767 | |

Morgan Stanley Capital I, Inc.

Series 2007-T25, Class A3

5.514%, due 11/12/49 (a) | | | 200,000 | | | | 221,028 | |

| | | | | | | | |

Total Mortgage-Backed Securities

(Cost $1,832,331) | | | | | | | 1,813,469 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| U.S. Government & Federal Agencies 19.2% | |

Federal Home Loan Bank 0.2% | |

1.30%, due 6/5/18 | | $ | 200,000 | | | $ | 194,956 | |

1.375%, due 5/28/14 | | | 300,000 | | | | 301,514 | |

| | | | | | | | |

| | | | | | | 496,470 | |

| | | | | | | | |

¨Federal Home Loan Mortgage Corporation 0.8% | |

0.875%, due 3/7/18 | | | 250,000 | | | | 242,847 | |

1.00%, due 9/27/17 | | | 75,000 | | | | 74,025 | |

1.00%, due 9/29/17 | | | 325,000 | | | | 321,193 | |

1.125%, due 5/25/18 | | | 225,000 | | | | 219,138 | |

1.20%, due 6/12/18 | | | 250,000 | | | | 245,498 | |

1.25%, due 10/2/19 | | | 300,000 | | | | 284,201 | |

1.75%, due 9/10/15 | | | 300,000 | | | | 306,995 | |

1.75%, due 5/30/19 | | | 725,000 | | | | 712,168 | |

| | | | | | | | |

| | | | | | | 2,406,065 | |

| | | | | | | | |

¨Federal National Mortgage Association 1.0% | |

0.375%, due 3/16/15 | | | 400,000 | | | | 400,643 | |

0.70%, due 9/6/16 | | | 175,000 | | | | 174,522 | |

0.875%, due 12/20/17 | | | 200,000 | | | | 195,818 | |

0.875%, due 5/21/18 | | | 250,000 | | | | 241,828 | |

1.00%, due 12/28/17 | | | 100,000 | | | | 97,711 | |

1.00%, due 2/15/18 | | | 275,000 | | | | 267,395 | |

1.125%, due 4/27/17 | | | 250,000 | | | | 250,973 | |

1.25%, due 1/30/17 | | | 710,000 | | | | 718,543 | |

1.375%, due 11/15/16 | | | 550,000 | | | | 559,229 | |

2.75%, due 3/13/14 | | | 100,000 | | | | 100,516 | |

| | | | | | | | |

| | | | | | | 3,007,178 | |

| | | | | | | | |

¨United States Treasury Notes 17.2% | |

0.25%, due 2/28/15 | | | 200,000 | | | | 200,125 | |

0.25%, due 10/31/15 | | | 3,200,000 | | | | 3,195,501 | |

0.25%, due 12/15/15 | | | 1,000,000 | | | | 997,773 | |

0.25%, due 12/31/15 | | | 6,000,000 | | | | 5,984,064 | |

0.25%, due 4/15/16 | | | 2,395,000 | | | | 2,382,278 | |

0.375%, due 1/15/16 | | | 325,000 | | | | 324,873 | |

0.375%, due 2/15/16 | | | 2,800,000 | | | | 2,797,374 | |

0.50%, due 6/15/16 | | | 1,825,000 | | | | 1,823,146 | |

0.50%, due 7/31/17 | | | 200,000 | | | | 195,797 | |

0.625%, due 7/15/16 | | | 725,000 | | | | 725,906 | |

0.625%, due 8/15/16 | | | 300,000 | | | | 300,070 | |

0.625%, due 10/15/16 | | | 3,000,000 | | | | 2,994,375 | |

0.625%, due 11/15/16 | | | 4,250,000 | | | | 4,237,050 | |

0.625%, due 12/15/16 | | | 3,000,000 | | | | 2,987,814 | |

0.75%, due 12/31/17 | | | 1,950,000 | | | | 1,906,733 | |

0.875%, due 9/15/16 | | | 2,765,000 | | | | 2,781,419 | |

1.25%, due 10/31/18 | | | 825,000 | | | | 808,823 | |

1.25%, due 11/30/18 | | | 315,000 | | | | 308,257 | |

1.375%, due 7/31/18 | | | 1,590,000 | | | | 1,575,715 | |

1.375%, due 9/30/18 | | | 2,300,000 | | | | 2,271,968 | |

1.50%, due 8/31/18 | | | 2,850,000 | | | | 2,835,528 | |

1.50%, due 12/31/18 | | | 1,200,000 | | | | 1,186,500 | |

| | | | |

| M-16 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| U.S. Government & Federal Agencies (continued) | |

United States Treasury Notes (continued) | |

1.75%, due 10/31/20 | | $ | 2,700,000 | | | $ | 2,590,312 | |

2.00%, due 7/31/20 | | | 1,500,000 | | | | 1,473,282 | |

2.00%, due 9/30/20 | | | 1,400,000 | | | | 1,368,500 | |

2.25%, due 7/31/18 | | | 1,575,000 | | | | 1,623,603 | |

2.50%, due 8/15/23 | | | 495,000 | | | | 475,354 | |

| | | | | | | | |

| | | | | | | 50,352,140 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $56,490,598) | | | | | | | 56,261,853 | |

| | | | | | | | |

|

| Yankee Bonds 0.3% (f) | |

Banks 0.2% | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank B.A.

4.625%, due 12/1/23 | | | 650,000 | | | | 654,562 | |

| | | | | | | | |

|

Transportation 0.1% | |

Canadian National Railway Co.

1.45%, due 12/15/16 | | | 125,000 | | | | 125,886 | |

| | | | | | | | |

Total Yankee Bonds

(Cost $772,358) | | | | | | | 780,448 | |

| | | | | | | | |

Total Long-Term Bonds

(Cost $112,874,097) | | | | | | | 112,790,310 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

Shares | | | | |

| Common Stocks 58.3% | |

Aerospace & Defense 1.1% | |

Exelis, Inc. | | | 9,097 | | | | 173,389 | |

General Dynamics Corp. | | | 4,280 | | | | 408,954 | |

L-3 Communications Holdings, Inc. | | | 6,284 | | | | 671,508 | |

Northrop Grumman Corp. | | | 4,043 | | | | 463,368 | |

Raytheon Co. | | | 4,481 | | | | 406,427 | |

Spirit AeroSystems Holdings, Inc. Class A (g) | | | 24,428 | | | | 832,506 | |

United Technologies Corp. | | | 3,621 | | | | 412,070 | |

| | | | | | | | |

| | | | | | | 3,368,222 | |

| | | | | | | | |

Agriculture 0.7% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 10,207 | | | | 442,984 | |

Bunge, Ltd. | | | 14,444 | | | | 1,185,997 | |

Reynolds American, Inc. | | | 7,092 | | | | 354,529 | |

| | | | | | | | |

| | | | | | | 1,983,510 | |

| | | | | | | | |

Airlines 1.0% | | | | | | | | |

Alaska Air Group, Inc. | | | 8,812 | | | | 646,536 | |

Delta Air Lines, Inc. | | | 43,057 | | | | 1,182,776 | |

Southwest Airlines Co. | | | 62,989 | | | | 1,186,713 | |

| | | | | | | | |

| | | | | | | 3,016,025 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Apparel 0.2% | | | | | | | | |

Deckers Outdoor Corp. (g) | | | 8,737 | | | $ | 737,927 | |

| | | | | | | | |

| | |

Auto Manufacturers 0.6% | | | | | | | | |

Ford Motor Co. | | | 25,922 | | | | 399,977 | |

General Motors Co. (g) | | | 11,091 | | | | 453,289 | |

Oshkosh Corp. | | | 17,106 | | | | 861,800 | |

PACCAR, Inc. | | | 2,196 | | | | 129,937 | |

| | | | | | | | |

| | | | | | | 1,845,003 | |

| | | | | | | | |

Auto Parts & Equipment 0.5% | | | | | | | | |

Johnson Controls, Inc. | | | 8,911 | | | | 457,134 | |

Lear Corp. | | | 11,056 | | | | 895,205 | |

TRW Automotive Holdings Corp. (g) | | | 998 | | | | 74,241 | |

| | | | | | | | |

| | | | | | | 1,426,580 | |

| | | | | | | | |

Banks 3.7% | | | | | | | | |

¨Bank of America Corp. | | | 21,983 | | | | 342,275 | |

Bank of New York Mellon Corp. | | | 13,196 | | | | 461,068 | |

BB&T Corp. | | | 10,839 | | | | 404,511 | |

Capital One Financial Corp. | | | 6,069 | | | | 464,946 | |

CIT Group, Inc. | | | 21,762 | | | | 1,134,453 | |

¨Citigroup, Inc. | | | 7,644 | | | | 398,329 | |

Comerica, Inc. | | | 22,327 | | | | 1,061,426 | |

Fifth Third Bancorp | | | 69,979 | | | | 1,471,658 | |

First Citizens BancShares, Inc. Class A | | | 108 | | | | 24,044 | |

First Republic Bank | | | 1,979 | | | | 103,601 | |

Goldman Sachs Group, Inc. (The) | | | 1,981 | | | | 351,152 | |

JPMorgan Chase & Co. | | | 7,810 | | | | 456,729 | |

KeyCorp | | | 90,085 | | | | 1,208,941 | |

M&T Bank Corp. | | | 65 | | | | 7,567 | |

¨Morgan Stanley | | | 11,219 | | | | 351,828 | |

PNC Financial Services Group, Inc. | | | 5,881 | | | | 456,248 | |

Regions Financial Corp. | | | 544 | | | | 5,380 | |

State Street Corp. | | | 6,292 | | | | 461,770 | |

SunTrust Banks, Inc. | | | 25,776 | | | | 948,815 | |

U.S. Bancorp | | | 8,647 | | | | 349,339 | |

Wells Fargo & Co. | | | 7,690 | | | | 349,126 | |

| | | | | | | | |

| | | | | | | 10,813,206 | |

| | | | | | | | |

Chemicals 0.8% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 3,121 | | | | 348,865 | |

CF Industries Holdings, Inc. | | | 2,999 | | | | 698,887 | |

Dow Chemical Co. (The) | | | 10,181 | | | | 452,037 | |

Mosaic Co. (The) | | | 7,749 | | | | 366,295 | |

PPG Industries, Inc. | | | 2,412 | | | | 457,460 | |

| | | | | | | | |

| | | | | | | 2,323,544 | |

| | | | | | | | |

Commercial Services 1.6% | | | | | | | | |

ADT Corp. (The) | | | 4,789 | | | | 193,811 | |

Apollo Education Group, Inc. (g) | | | 4,272 | | | | 116,711 | |

Booz Allen Hamilton Holding Corp. | | | 13,696 | | | | 262,278 | |

CoreLogic, Inc. (g) | | | 22,643 | | | | 804,506 | |

DeVry Education Group, Inc. | | | 12,269 | | | | 435,549 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | M-17 | |

Portfolio of Investments December 31, 2013 (continued)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks (continued) | |

Commercial Services (continued) | | | | | | | | |

ManpowerGroup, Inc. | | | 11,374 | | | $ | 976,572 | |

R.R. Donnelley & Sons Co. | | | 39,124 | | | | 793,435 | |

Towers Watson & Co. Class A | | | 8,379 | | | | 1,069,244 | |

| | | | | | | | |

| | | | | | | 4,652,106 | |

| | | | | | | | |

Computers 2.4% | | | | | | | | |

Apple, Inc. | | | 820 | | | | 460,110 | |

Brocade Communications Systems, Inc. (g) | | | 93,154 | | | | 826,276 | |

Computer Sciences Corp. | | | 18,621 | | | | 1,040,542 | |

DST Systems, Inc. | | | 7,011 | | | | 636,178 | |

EMC Corp. | | | 16,511 | | | | 415,252 | |

Hewlett-Packard Co. | | | 15,940 | | | | 446,001 | |

Lexmark International, Inc. Class A | | | 20,802 | | | | 738,887 | |

SanDisk Corp. | | | 14,858 | | | | 1,048,083 | |

Western Digital Corp. | | | 17,640 | | | | 1,479,996 | |

| | | | | | | | |

| | | | | | | 7,091,325 | |

| | | | | | | | |

Cosmetics & Personal Care 0.1% | | | | | | | | |

Procter & Gamble Co. (The) | | | 4,227 | | | | 344,120 | |

| | | | | | | | |

| |

Diversified Financial Services 0.2% | | | | | |

Artisan Partners Asset Management, Inc. | | | 10,230 | | | | 666,894 | |

| | | | | | | | |

| | |

Electric 3.6% | | | | | | | | |

AES Corp. (The) | | | 71,463 | | | | 1,036,928 | |

Alliant Energy Corp. | | | 2,996 | | | | 154,594 | |

Ameren Corp. | | | 20,444 | | | | 739,255 | |

American Electric Power Co., Inc. | | | 7,465 | | | | 348,914 | |

CMS Energy Corp. | | | 17,013 | | | | 455,438 | |

Consolidated Edison, Inc. | | | 7,783 | | | | 430,244 | |

Dominion Resources, Inc. | | | 5,367 | | | | 347,191 | |

DTE Energy Co. | | | 16,918 | | | | 1,123,186 | |

Duke Energy Corp. | | | 5,004 | | | | 345,326 | |

Edison International | | | 28,190 | | | | 1,305,197 | |

Entergy Corp. | | | 619 | | | | 39,164 | |

Exelon Corp. | | | 12,720 | | | | 348,401 | |

NextEra Energy, Inc. | | | 4,135 | | | | 354,039 | |

PG&E Corp. | | | 8,608 | | | | 346,730 | |

Pinnacle West Capital Corp. | | | 7,261 | | | | 384,252 | |

PPL Corp. | | | 8,769 | | | | 263,859 | |

Public Service Enterprise Group, Inc. | | | 31,806 | | | | 1,019,064 | |

Southern Co. (The) | | | 8,488 | | | | 348,942 | |

Wisconsin Energy Corp. | | | 6,858 | | | | 283,510 | |

Xcel Energy, Inc. | | | 28,084 | | | | 784,667 | |

| | | | | | | | |

| | | | | | | 10,458,901 | |

| | | | | | | | |

Electrical Components & Equipment 0.4% | | | | | |

Emerson Electric Co. | | | 6,509 | | | | 456,801 | |

Energizer Holdings, Inc. | | | 6,399 | | | | 692,628 | |

| | | | | | | | |

| | | | | | | 1,149,429 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Electronics 0.5% | | | | | | | | |

Agilent Technologies, Inc. | | | 1,718 | | | $ | 98,252 | |

Jabil Circuit, Inc. | | | 36,556 | | | | 637,537 | |

Thermo Fisher Scientific, Inc. | | | 3,201 | | | | 356,431 | |

Vishay Intertechnology, Inc. (g) | | | 21,648 | | | | 287,053 | |

| | | | | | | | |

| | | | | | | 1,379,273 | |

| | | | | | | | |

Engineering & Construction 0.3% | | | | | |

AECOM Technology Corp. (g) | | | 25,773 | | | | 758,499 | |

| | | | | | | | |

| | |

Entertainment 0.3% | | | | | | | | |

Gaming and Leisure Properties, Inc. (g) | | | 2,988 | | | | 151,820 | |

Regal Entertainment Group Class A | | | 35,784 | | | | 695,999 | |

| | | | | | | | |

| | | | | | | 847,819 | |

| | | | | | | | |

Environmental Controls 0.2% | | | | | | | | |

Waste Management, Inc. | | | 10,184 | | | | 456,956 | |

| | | | | | | | |

| | |

Finance—Credit Card 0.2% | | | | | | | | |

Discover Financial Services | | | 8,292 | | | | 463,937 | |

| | | | | | | | |

| |

Finance—Investment Banker/Broker 0.8% | | | | | |

Charles Schwab Corp. (The) | | | 13,535 | | | | 351,910 | |

Interactive Brokers Group, Inc. Class A | | | 28,667 | | | | 697,755 | |

LPL Financial Holdings, Inc. | | | 14,967 | | | | 703,898 | |

Raymond James Financial, Inc. | | | 9,512 | | | | 496,431 | |

| | | | | | | | |

| | | | | | | 2,249,994 | |

| | | | | | | | |

Finance—Other Services 0.4% | | | | | | | | |

CME Group, Inc. | | | 4,137 | | | | 324,589 | |

NASDAQ OMX Group, Inc. (The) | | | 21,437 | | | | 853,193 | |

| | | | | | | | |

| | | | | | | 1,177,782 | |

| | | | | | | | |

Food 0.8% | | | | | | | | |

Kellogg Co. | | | 5,713 | | | | 348,893 | |

Mondelez International, Inc. Class A | | | 10,056 | | | | 354,977 | |

Safeway, Inc. | | | 28,941 | | | | 942,608 | |

Sysco Corp. | | | 9,548 | | | | 344,683 | |

Tyson Foods, Inc. Class A | | | 13,938 | | | | 466,365 | |

| | | | | | | | |

| | | | | | | 2,457,526 | |

| | | | | | | | |

Forest Products & Paper 0.3% | | | | | | | | |

Domtar Corp. | | | 8,666 | | | | 817,550 | |

| | | | | | | | |

| | |

Gas 0.8% | | | | | | | | |

AGL Resources, Inc. | | | 9,551 | | | | 451,094 | |

CenterPoint Energy, Inc. | | | 29,794 | | | | 690,625 | |

Sempra Energy | | | 3,460 | | | | 310,570 | |

UGI Corp. | | | 20,860 | | | | 864,855 | |

| | | | | | | | |

| | | | | | | 2,317,144 | |

| | | | | | | | |

Health Care—Products 1.3% | | | | | | | | |

Alere, Inc. (g) | | | 11,730 | | | | 424,626 | |

Boston Scientific Corp. (g) | | | 114,004 | | | | 1,370,328 | |

| | | | |

| M-18 | | MainStay VP Balanced Portfolio | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | |