UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-03833

MAINSTAY VP FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

FORM N-CSR

Item 1. Reports to Stockholders.

MainStay VP Wellington U.S. Equity Portfolio

Message from the President and Annual Report

December 31, 2023

Special Notice:

Beginning in July 2024, new regulations issued by the Securities and Exchange Commission (SEC) will take effect requiring open-end mutual fund companies and ETFs to (1) overhaul the content of their shareholder reports and (2) mail paper copies of the new tailored shareholder reports to shareholders who have not opted to receive these documents electronically.

If you have not yet elected to receive your shareholder reports electronically, please contact your financial intermediary or visit our website.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Against a backdrop of easing inflationary pressures and continued economic growth, stocks and bonds generally gained ground during the 12-month period ended December 31, 2023, despite high levels of volatility and sharp disparities between the performance of the different market sectors.

Although the war in Ukraine, the outbreak of hostilities in the Middle East and several other notable events affected financial assets, inflation, interest rate, and economic growth trends stood at the forefront of market developments during most of the period. As the reporting period began, high levels of inflation already showed signs of easing in the face of aggressive rate hikes by U.S. Federal Reserve (the “Fed”). From a peak of 9.1% in June 2022, the annualized U.S. inflation rate dropped to 6.4% in January, and 3.4% in December 2023. At the same time, the Fed increased the benchmark federal funds rate from 4.25%–4.50% at the beginning of reporting period, to 5.25%–5.50% as of the end of 2023. Despite the increasing cost of capital and tighter lending environment that resulted from rising rates, economic growth remained surprisingly robust, bolstered by high levels of consumer spending, low levels of unemployment and better-than-expected corporate earnings. With the pace of rate increases slowing from the prior year, investors began hoping for an early shift to a looser monetary policy, with stock prices and bond yields reacting as economic data and statements from the Fed either reinforced or undercut those hopes. Following months of hawkish rhetoric, the Fed finally reversed its stance in December 2023, signaling a positive economic outlook with little chance of a recession and a likelihood of rate cuts in 2024.

The S&P 500® Index, a widely regarded benchmark of U.S. market performance, produced strong gains during the reporting period-– recovering all its losses from 2022 and approached new record territory. A preponderance of the Index’s gains were generated by a relatively small number of mega-cap stocks in the information technology, communication services and consumer discretionary sectors that stood to benefit from rapid developments in generative artificial intelligence (“AI”). Value-oriented, interest-rate sensitive and small-capitalization

shares lagged by significant margins, although market strength widened during the closing weeks of the reporting period. Most overseas equity markets trailed the U.S. market, as developed international economies experienced relatively low growth rates, and weak economic conditions in China undermined emerging markets.

Bonds produced generally positive returns, bolstered by attractive and relatively stable yields. The yield on the 10-year Treasury note hit a high of just under 5% in mid-October 2023, ranging between approximately 3.5% and 4.8% for most of the reporting period. The yield curve remained inverted throughout the year, with the 2-year Treasury yield modestly above the 10-year yield. Corporate bond prices trended moderately higher, generally outperforming government securities. After years of low yields and tight credit spreads, the corporate sector benefited from more attractive valuations and income opportunities. Among corporates, markets generally rewarded longer duration and lower credit quality, although an uptick in default rates posed added risks for high-yield corporate bonds. International bond markets produced mixed returns, with emerging-markets issues advancing over their developed-markets counterparts.

The market volatility of recent years reminds us of the constant need for experienced and steadfast portfolio management in the face of uncertainty. New York Life Investments remains dedicated to providing you, as a valued MainStay VP investor, with the guidance, resources and investment solutions you need to pursue your financial goals.

Thank you for trusting us to help meet your investment needs.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Investors should refer to the Portfolio’s Summary Prospectus and/or Prospectus and consider the Portfolio’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Portfolio. You may obtain copies of the Portfolio’s Summary Prospectus, Prospectus and Statement of Additional Information, which includes information about the MainStay VP Funds Trust's Trustees, free of charge, upon request, by calling toll-free 800-598-2019, by writing to New York Life Insurance and Annuity Corporation, 51 Madison Avenue, Room 251, New York, New York 10010 or by sending an email to MainStayShareholdersServices@nylim.com. These documents are also available at newyorklifeinvestments.com/investment-products/vp. Please read the Portfolio's Summary Prospectus and/or Prospectus carefully before investing. MainStay VP Funds Trust portfolios are separate account options which are purchased through a variable insurance or variable annuity contract.

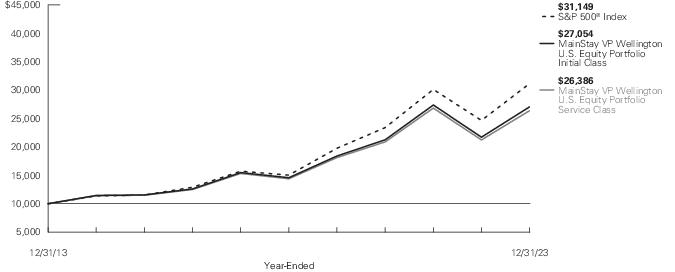

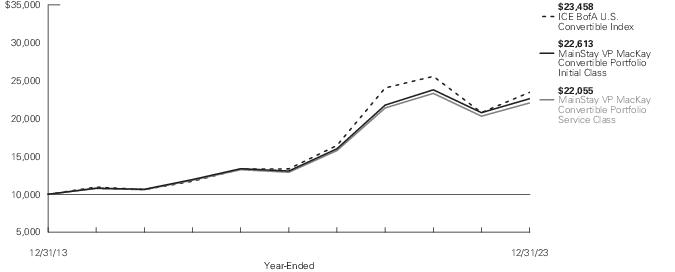

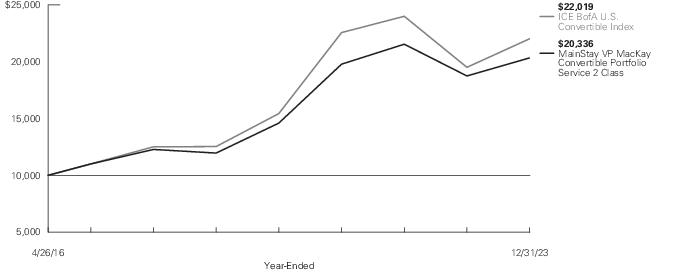

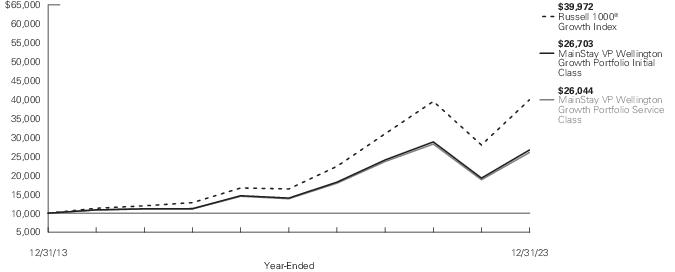

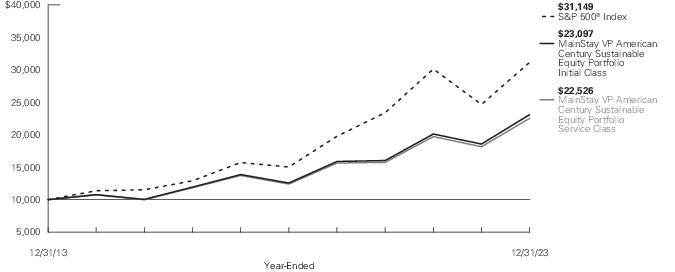

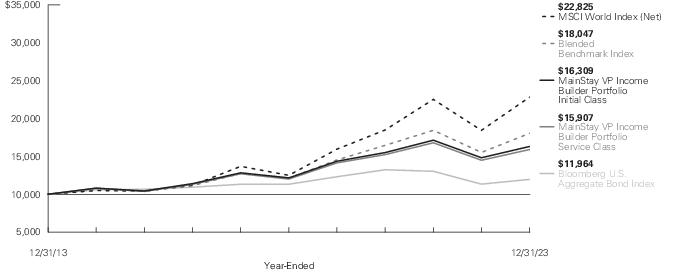

Investment and Performance Comparison (Unaudited)

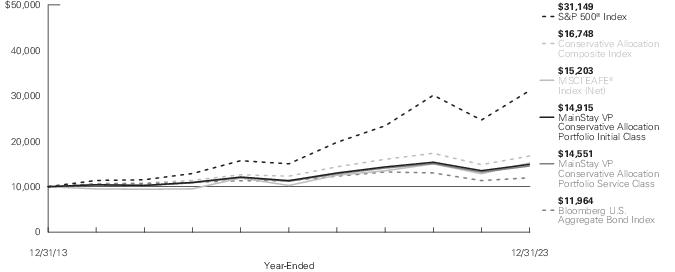

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The performance table and graph do not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. Please refer to the Performance Summary appropriate for your policy. For performance information current to the most recent month-end, please call 800-598-2019 or visit www.newyorklife.com.

Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been different. For information on current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements.

| Average Annual Total Returns for the Year-Ended December 31, 2023 |

| Class | Inception

Date1, 2 | One

Year | Five

Years | Ten

Years | Gross

Expense

Ratio3 |

| Initial Class Shares | 1/23/1984 | 24.58% | 13.16% | 10.46% | 0.57% |

| Service Class Shares | 6/5/2003 | 24.27 | 12.88 | 10.19 | 0.82 |

| 1. | Effective January 1, 2018, due to an organizational restructuring, all investment personnel of Cornerstone Capital Management Holdings LLC, the former subadvisor, transitioned to MacKay Shields LLC. |

| 2. | Effective May 1, 2021, the Portfolio replaced its subadvisor, MacKay Shields LLC, and modified its principal investment strategies. The past performance in the graph and table prior to that date reflects the Portfolio's prior subadvisors and principal investment strategies. |

| 3. | The gross expense ratios presented reflect the Portfolio’s “Total Annual Portfolio Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| Benchmark Performance* | One

Year | Five

Years | Ten

Years |

| S&P 500® Index1 | 26.29% | 15.69% | 12.03% |

| Morningstar Large Blend Category Average2 | 22.32 | 14.26 | 10.55 |

| * | Returns for indices reflect no deductions for fees, expenses or taxes, except for foreign withholding taxes where applicable. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 1. | The S&P 500® Index is the Portfolio's primary benchmark. S&P 500® is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. |

| 2. | The Morningstar Large Blend Category Average is representative of funds that represent the overall U.S. stock market in size, growth rates and price. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. The blend style is assigned to funds where neither growth nor value characteristics predominate. These funds tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, the funds' returns are often similar to those of the S&P 500® Index. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

Cost in Dollars of a $1,000 Investment in MainStay VP Wellington U.S. Equity Portfolio (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from July 1, 2023 to December 31, 2023, and the impact of those costs on your investment.

Example

As a shareholder of the Portfolio you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Portfolio expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from July 1, 2023 to December 31, 2023. Shares are only sold in connection with variable life and annuity contracts and the example does not reflect any contract level or transactional fees or expenses. If these costs had been included, your costs would have been higher.

This example illustrates your Portfolio’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended

December 31, 2023. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Portfolio with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Beginning

Account

Value

7/1/23 | Ending Account

Value (Based

on Actual

Returns and

Expenses)

12/31/23 | Expenses

Paid

During

Period1 | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

12/31/23 | Expenses

Paid

During

Period1 | Net Expense

Ratio

During

Period2 |

| Initial Class Shares | $1,000.00 | $1,083.70 | $2.94 | $1,022.38 | $2.85 | 0.56% |

| Service Class Shares | $1,000.00 | $1,082.30 | $4.25 | $1,021.12 | $4.13 | 0.81% |

| 1. | Expenses are equal to the Portfolio’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above-reported expense figures. |

| 2. | Expenses are equal to the Portfolio's annualized expense ratio to reflect the six-month period. |

| 6 | MainStay VP Wellington U.S. Equity Portfolio |

Industry Composition as of December 31, 2023 (Unaudited)

| Software | 11.8% |

| Semiconductors & Semiconductor Equipment | 9.2 |

| Interactive Media & Services | 8.6 |

| Technology Hardware, Storage & Peripherals | 5.9 |

| Broadline Retail | 4.8 |

| Banks | 3.9 |

| Machinery | 3.7 |

| Pharmaceuticals | 3.5 |

| Insurance | 3.2 |

| Health Care Equipment & Supplies | 3.1 |

| Oil, Gas & Consumable Fuels | 3.1 |

| Electric Utilities | 2.6 |

| Health Care Providers & Services | 2.5 |

| Capital Markets | 2.5 |

| Hotels, Restaurants & Leisure | 2.4 |

| Beverages | 2.3 |

| Life Sciences Tools & Services | 2.2 |

| Chemicals | 2.0 |

| Financial Services | 2.0 |

| Specialty Retail | 2.0 |

| Household Products | 1.9% |

| Biotechnology | 1.9 |

| Building Products | 1.8 |

| Entertainment | 1.4 |

| Electrical Equipment | 1.3 |

| Textiles, Apparel & Luxury Goods | 1.3 |

| Industrial REITs | 1.2 |

| IT Services | 1.2 |

| Consumer Finance | 1.1 |

| Personal Care Products | 1.1 |

| Aerospace & Defense | 1.1 |

| Electronic Equipment, Instruments & Components | 1.0 |

| Residential REITs | 0.7 |

| Energy Equipment & Services | 0.7 |

| Automobiles | 0.7 |

| Short–Term Investment | 0.3 |

| Other Assets, Less Liabilities | –0.0‡ |

| | 100.0% |

| ‡ | Less than one–tenth of a percent. |

See Portfolio of Investments beginning on page 10 for specific holdings within these categories. The Portfolio's holdings are subject to change.

Top Ten Holdings and/or Issuers Held as of December 31, 2023 (excluding short-term investments) (Unaudited)

| 1. | Microsoft Corp. |

| 2. | Apple, Inc. |

| 3. | Alphabet, Inc. |

| 4. | Amazon.com, Inc. |

| 5. | NVIDIA Corp. |

| 6. | Meta Platforms, Inc., Class A |

| 7. | UnitedHealth Group, Inc. |

| 8. | JPMorgan Chase & Co. |

| 9. | Broadcom, Inc. |

| 10. | Eli Lilly & Co. |

Portfolio Management Discussion and Analysis (Unaudited)

Answers to the questions reflect the views of portfolio managers Mammen Chally, Douglas W. McLane and David A. Siegle, of Wellington Management Company LLP (“Wellington”), the Portfolio’s Subadvisor.

How did MainStay VP Wellington U.S. Equity Portfolio perform relative to its benchmark and peers during the 12 months ended June 30, 2023?

For the 12 months ended December 31, 2023, MainStay VP Wellington U.S. Equity Portfolio returned 24.58% for Initial Class shares and 24.27% for Service Class shares. Over the same period, both share classes underperformed the 26.29% return of the S&P 500® Index (the “Index”), which is the Portfolio’s benchmark, and outperformed the 22.32% return of the Morningstar Large Blend Category Average.1

What factors affected the Portfolio’s relative performance during the reporting period?

The Portfolio underperformed the Index primarily due to sector attribution, a result of Wellington's bottom-up stock selection process. Security selection also weighed on relative results.

Which sectors were the strongest positive contributors to the Portfolio’s relative performance, and which sectors were particularly weak?

From a sector allocation perspective, overweight exposure to health care weighed on relative returns, with the negative impact partialy offset by the positive effect of an underweight allocation to the lagging energy sector. Security selection in industrials, information technology and consumer discretionary detracted from relative results, while selection in health care, materials and financials made positive contributions. (Contributions take weightings and total returns into account.)

During the reporting period, which individual stocks made the strongest positive contributions to the Portfolio’s absolute performance and which stocks detracted the most?

The strongest contributors to absolute performance included holdings in enterprise software company Microsoft, online retailer Amazon.com and consumer electronics maker Apple. Microsoft shares rose on better-than-expected earnings and revenue results driven by the performance of the company’s cloud unit, Azure. Shares also benefited from the anticipated rollout of Microsoft’s artificial intelligence (“AI”) product, Copilot. In addition, the company finalized its $69 billion purchase of video game maker Activision Blizzard. Amazon.com shares gained ground after semiconductor maker NVIDIA reported strong results, driven by rapidly increasing demand for AI, sparking a market rally. We believe that developments in AI should benefit Amazon Web Services and increase demand for its cloud computing platforms. Amazon also reported first-quarter earnings that beat consensus estimates earlier in the reporting period. Apple shares climbed after the company made several AI announcements at its I/O developer conference, including "AI Snapshot,” which integrates

generative AI results directly on top of Google's search results, and the incorporation of generative AI capabilities across its product suite. The stock benefited further from news that Samsung would not replace Google with Bing as the default search engine on its smartphones.

The most significant detractors from the Portfolio’s absolute performance included holdings in pharmaceutical company Pfizer, financial management firm The Charles Schwab Corporation and prestige beauty products maker The Estée Lauder Companies. Pfizer shares fell when the company reported mixed results in a Phase 2b study of danuglipron for obesity. Danuglipron was effective in weight reduction, but tolerability was poor with a high rate of gastrointestinal side effects and discontinuation rates. Management also issued muted 2024 guidance that was below expectations, and announced a multi-year cost-cutting effort that will include layoffs. Charles Schwab shares fell after the collapse of Silicon Valley Bank sparked a massive selloff of financial sector stocks, and investors feared that firms like Schwab, which have large bond holdings with long maturities, might be forced to sell such assets at a loss to cover a rush of deposit withdrawals. Earlier in the reporting period, Schwab reported fourth quarter 2022 results that missed estimates on lower deposit account fees. Estée Lauder shares fell as weak sales in China weighed on investor sentiment. In addition, in delivering fourth quarter 2023 financial results, the company lowered guidance below consensus estimates.

Did the Portfolio make any significant purchases or sales during the reporting period?

The Portfolio’s largest purchases included an increased position in semiconductor maker NVIDIA and a reinstated position in social media company Meta Platforms. We became more positive on NVIDIA given the company’s near monopoly in AI datacenter graphics processing units and the rapid growth of NVIDIA’s CUDA software business segment. We believe this segment will continue to benefit from the AI-related market momentum. We reinstated a position in Meta after engaging with the company. We saw signs that the company’s fundamentals were playing out positively, as prior headwinds (including Apple’s changes to its privacy management policies and TikTok’s incremental competition) became more benign. Meta’s ramp-up of its Reels product progressed (offering a more direct answer to TikTok), with the monetization of Reels providing better visibility into the stability of Meta’s overall advertising business. Given these trends and our outlook, we believed the stock’s valuation was attractive.

The Portfolio’s largest full sale was of shares in Pioneer Natural Resources following the announcement that Exxon Mobil would acquire the company. We trimmed the Portfolio’s position in Alphabet on strength.

| 1. | See "Investment and Performance Comparison" for more information on benchmark and peer group returns. |

| 8 | MainStay VP Wellington U.S. Equity Portfolio |

How did the Portfolio’s sector weightings change during the reporting period?

During the reporting period, we increased the Portfolio’s exposure to communication services and decreased its exposure to health care.

How was the Portfolio positioned at the end of the reporting period?

As of December 31, 2023, the Portfolio’s largest overweight positions relative to the Index were in the communication services and health care sectors. As of the same date, the Portfolio held its most significantly underweight positions in industrials and consumer staples.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not all MainStay VP Portfolios and/or share classes are available under all policies.

Portfolio of Investments December 31, 2023†^

| | Shares | Value |

| Common Stocks 99.7% |

| Aerospace & Defense 1.1% |

| RTX Corp. | 119,334 | $ 10,040,763 |

| Automobiles 0.7% |

| Tesla, Inc. (a) | 24,637 | 6,121,802 |

| Banks 3.9% |

| Bank of America Corp. | 390,808 | 13,158,505 |

| JPMorgan Chase & Co. | 132,710 | 22,573,971 |

| | | 35,732,476 |

| Beverages 2.3% |

| Constellation Brands, Inc., Class A | 43,433 | 10,499,928 |

| Monster Beverage Corp. (a) | 184,189 | 10,611,128 |

| | | 21,111,056 |

| Biotechnology 1.9% |

| Regeneron Pharmaceuticals, Inc. (a) | 8,335 | 7,320,547 |

| Vertex Pharmaceuticals, Inc. (a) | 24,876 | 10,121,796 |

| | | 17,442,343 |

| Broadline Retail 4.8% |

| Amazon.com, Inc. (a) | 290,659 | 44,162,728 |

| Building Products 1.8% |

| Builders FirstSource, Inc. (a) | 44,171 | 7,373,907 |

| Johnson Controls International plc | 161,967 | 9,335,778 |

| | | 16,709,685 |

| Capital Markets 2.5% |

| Charles Schwab Corp. (The) | 128,964 | 8,872,723 |

| Morgan Stanley | 146,683 | 13,678,190 |

| | | 22,550,913 |

| Chemicals 2.0% |

| PPG Industries, Inc. | 63,704 | 9,526,933 |

| Sherwin-Williams Co. (The) | 29,695 | 9,261,871 |

| | | 18,788,804 |

| Consumer Finance 1.1% |

| American Express Co. | 55,775 | 10,448,889 |

| Electric Utilities 2.6% |

| American Electric Power Co., Inc. | 78,760 | 6,396,887 |

| Duke Energy Corp. | 100,708 | 9,772,704 |

| Eversource Energy | 82,551 | 5,095,048 |

| PG&E Corp. | 157,232 | 2,834,893 |

| | | 24,099,532 |

| | Shares | Value |

| |

| Electrical Equipment 1.3% |

| AMETEK, Inc. | 70,392 | $ 11,606,937 |

| Electronic Equipment, Instruments & Components 1.0% |

| CDW Corp. | 38,846 | 8,830,473 |

| Energy Equipment & Services 0.7% |

| Schlumberger NV | 118,359 | 6,159,402 |

| Entertainment 1.4% |

| Netflix, Inc. (a) | 25,737 | 12,530,831 |

| Financial Services 2.0% |

| Mastercard, Inc., Class A | 43,489 | 18,548,493 |

| Health Care Equipment & Supplies 3.1% |

| Abbott Laboratories | 109,379 | 12,039,347 |

| Boston Scientific Corp. (a) | 221,013 | 12,776,761 |

| Hologic, Inc. (a) | 56,451 | 4,033,424 |

| | | 28,849,532 |

| Health Care Providers & Services 2.5% |

| UnitedHealth Group, Inc. | 44,166 | 23,252,074 |

| Hotels, Restaurants & Leisure 2.4% |

| Marriott International, Inc., Class A | 47,696 | 10,755,925 |

| McDonald's Corp. | 38,728 | 11,483,239 |

| | | 22,239,164 |

| Household Products 1.9% |

| Procter & Gamble Co. (The) | 121,045 | 17,737,934 |

| Industrial REITs 1.2% |

| Prologis, Inc. | 83,816 | 11,172,673 |

| Insurance 3.2% |

| Arch Capital Group Ltd. (a) | 85,606 | 6,357,957 |

| Chubb Ltd. | 49,816 | 11,258,416 |

| Progressive Corp. (The) | 72,249 | 11,507,821 |

| | | 29,124,194 |

| Interactive Media & Services 8.6% |

| Alphabet, Inc. (a) | | |

| Class A | 271,102 | 37,870,238 |

| Class C | 61,919 | 8,726,245 |

| |

| Meta Platforms, Inc., Class A (a) | 81,672 | 28,908,621 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 10 | MainStay VP Wellington U.S. Equity Portfolio |

| | Shares | Value |

| Common Stocks (continued) |

| Interactive Media & Services (continued) |

| |

| ZoomInfo Technologies, Inc. (a) | 175,178 | $ 3,239,041 |

| | | 78,744,145 |

| IT Services 1.2% |

| Accenture plc, Class A | 30,249 | 10,614,677 |

| Life Sciences Tools & Services 2.2% |

| Danaher Corp. | 42,526 | 9,837,965 |

| Thermo Fisher Scientific, Inc. | 19,867 | 10,545,205 |

| | | 20,383,170 |

| Machinery 3.7% |

| Deere & Co. | 32,568 | 13,022,966 |

| Illinois Tool Works, Inc. | 40,438 | 10,592,330 |

| Nordson Corp. | 39,961 | 10,556,098 |

| | | 34,171,394 |

| Oil, Gas & Consumable Fuels 3.1% |

| ConocoPhillips | 65,072 | 7,552,907 |

| Diamondback Energy, Inc. | 34,944 | 5,419,115 |

| EOG Resources, Inc. | 79,919 | 9,666,203 |

| Phillips 66 | 41,042 | 5,464,332 |

| | | 28,102,557 |

| Personal Care Products 1.1% |

| Estee Lauder Cos., Inc. (The), Class A | 70,817 | 10,356,986 |

| Pharmaceuticals 3.5% |

| Eli Lilly & Co. | 32,223 | 18,783,431 |

| Merck & Co., Inc. | 120,692 | 13,157,842 |

| | | 31,941,273 |

| Residential REITs 0.7% |

| AvalonBay Communities, Inc. | 36,313 | 6,798,520 |

| Semiconductors & Semiconductor Equipment 9.2% |

| Advanced Micro Devices, Inc. (a) | 63,596 | 9,374,686 |

| Broadcom, Inc. | 17,188 | 19,186,105 |

| KLA Corp. | 19,397 | 11,275,476 |

| NVIDIA Corp. | 69,293 | 34,315,280 |

| Texas Instruments, Inc. | 58,102 | 9,904,067 |

| | | 84,055,614 |

| | Shares | | Value |

| |

| Software 11.8% |

| Intuit, Inc. | 14,957 | | $ 9,348,574 |

| Microsoft Corp. | 184,511 | | 69,383,516 |

| Palo Alto Networks, Inc. (a) | 25,078 | | 7,395,001 |

| Salesforce, Inc. (a) | 46,257 | | 12,172,067 |

| Workday, Inc., Class A (a) | 34,132 | | 9,422,480 |

| | | | 107,721,638 |

| Specialty Retail 2.0% |

| AutoZone, Inc. (a) | 3,060 | | 7,911,966 |

| TJX Cos., Inc. (The) | 110,638 | | 10,378,951 |

| | | | 18,290,917 |

| Technology Hardware, Storage & Peripherals 5.9% |

| Apple, Inc. | 278,749 | | 53,667,545 |

| Textiles, Apparel & Luxury Goods 1.3% |

| NIKE, Inc., Class B | 106,120 | | 11,521,448 |

Total Common Stocks

(Cost $720,899,629) | | | 913,630,582 |

| Short-Term Investment 0.3% |

| Affiliated Investment Company 0.3% |

| MainStay U.S. Government Liquidity Fund, 5.235% (b) | 2,752,478 | | 2,752,478 |

Total Short-Term Investment

(Cost $2,752,478) | | | 2,752,478 |

Total Investments

(Cost $723,652,107) | 100.0% | | 916,383,060 |

| Other Assets, Less Liabilities | (0.0)‡ | | (435,738) |

| Net Assets | 100.0% | | $ 915,947,322 |

| † | Percentages indicated are based on Portfolio net assets. |

| ^ | Industry classifications may be different than those used for compliance monitoring purposes. |

| ‡ | Less than one-tenth of a percent. |

| (a) | Non-income producing security. |

| (b) | Current yield as of December 31, 2023. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

11

Portfolio of Investments December 31, 2023†^ (continued)

Investments in Affiliates (in 000's)

Investments in issuers considered to be affiliate(s) of the Portfolio during the year ended December 31, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| Affiliated Investment Companies | Value,

Beginning

of Year | Purchases

at Cost | Proceeds

from

Sales | Net

Realized

Gain/(Loss)

on Sales | Change in

Unrealized

Appreciation/

(Depreciation) | Value,

End of

Year | Dividend

Income | Other

Distributions | Shares

End of

Year |

| MainStay U.S. Government Liquidity Fund | $ 21,509 | $ 142,187 | $ (160,944) | $ — | $ — | $ 2,752 | $ 547 | $ — | 2,752 |

| Abbreviation(s): |

| REIT—Real Estate Investment Trust |

The following is a summary of the fair valuations according to the inputs used as of December 31, 2023, for valuing the Portfolio’s assets:

| Description | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Asset Valuation Inputs | | | | | | | |

| Investments in Securities (a) | | | | | | | |

| Common Stocks | $ 913,630,582 | | $ — | | $ — | | $ 913,630,582 |

| Short-Term Investment | | | | | | | |

| Affiliated Investment Company | 2,752,478 | | — | | — | | 2,752,478 |

| Total Investments in Securities | $ 916,383,060 | | $ — | | $ — | | $ 916,383,060 |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 12 | MainStay VP Wellington U.S. Equity Portfolio |

Statement of Assets and Liabilities as of December 31, 2023

| Assets |

Investment in unaffiliated securities, at value

(identified cost $720,899,629) | $913,630,582 |

Investment in affiliated investment companies, at value

(identified cost $2,752,478) | 2,752,478 |

| Receivables: | |

| Investment securities sold | 2,565,988 |

| Dividends | 495,896 |

| Portfolio shares sold | 27,375 |

| Securities lending | 939 |

| Other assets | 4,356 |

| Total assets | 919,477,614 |

| Liabilities |

| Payables: | |

| Investment securities purchased | 2,662,663 |

| Manager (See Note 3) | 413,720 |

| Portfolio shares redeemed | 334,645 |

| NYLIFE Distributors (See Note 3) | 51,426 |

| Professional fees | 29,865 |

| Shareholder communication | 26,975 |

| Custodian | 10,169 |

| Accrued expenses | 829 |

| Total liabilities | 3,530,292 |

| Net assets | $915,947,322 |

| Composition of Net Assets |

| Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | $ 35,007 |

| Additional paid-in-capital | 727,977,810 |

| | 728,012,817 |

| Total distributable earnings (loss) | 187,934,505 |

| Net assets | $915,947,322 |

| Initial Class | |

| Net assets applicable to outstanding shares | $670,328,474 |

| Shares of beneficial interest outstanding | 25,485,811 |

| Net asset value per share outstanding | $ 26.30 |

| Service Class | |

| Net assets applicable to outstanding shares | $245,618,848 |

| Shares of beneficial interest outstanding | 9,520,899 |

| Net asset value per share outstanding | $ 25.80 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

13

Statement of Operations for the year ended December 31, 2023

| Investment Income (Loss) |

| Income | |

| Dividends-unaffiliated | $ 12,274,395 |

| Dividends-affiliated | 547,361 |

| Securities lending, net | 1,095 |

| Total income | 12,822,851 |

| Expenses | |

| Manager (See Note 3) | 4,719,504 |

| Distribution/Service—Service Class (See Note 3) | 590,777 |

| Professional fees | 105,819 |

| Custodian | 23,772 |

| Trustees | 22,304 |

| Miscellaneous | 30,897 |

| Total expenses | 5,493,073 |

| Net investment income (loss) | 7,329,778 |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on unaffiliated investments | 12,794,409 |

| Net change in unrealized appreciation (depreciation) on unaffiliated investments | 172,050,018 |

| Net realized and unrealized gain (loss) | 184,844,427 |

| Net increase (decrease) in net assets resulting from operations | $192,174,205 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 14 | MainStay VP Wellington U.S. Equity Portfolio |

Statements of Changes in Net Assets

for the years ended December 31, 2023 and December 31, 2022

| | 2023 | 2022 |

| Increase (Decrease) in Net Assets |

| Operations: | | |

| Net investment income (loss) | $ 7,329,778 | $ 7,480,194 |

| Net realized gain (loss) | 12,794,409 | (24,077,250) |

| Net change in unrealized appreciation (depreciation) | 172,050,018 | (202,149,971) |

| Net increase (decrease) in net assets resulting from operations | 192,174,205 | (218,747,027) |

| Distributions to shareholders: | | |

| Initial Class | (6,075,145) | (127,232,665) |

| Service Class | (1,664,828) | (48,423,993) |

| Total distributions to shareholders | (7,739,973) | (175,656,658) |

| Capital share transactions: | | |

| Net proceeds from sales of shares | 42,700,997 | 139,698,289 |

| Net asset value of shares issued to shareholders in reinvestment of distributions | 7,739,973 | 175,656,658 |

| Cost of shares redeemed | (152,655,655) | (125,658,917) |

| Increase (decrease) in net assets derived from capital share transactions | (102,214,685) | 189,696,030 |

| Net increase (decrease) in net assets | 82,219,547 | (204,707,655) |

| Net Assets |

| Beginning of year | 833,727,775 | 1,038,435,430 |

| End of year | $ 915,947,322 | $ 833,727,775 |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

15

Financial Highlights selected per share data and ratios

| | Year Ended December 31, |

| Initial Class | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of year | $ 21.32 | | $ 34.39 | | $ 28.28 | | $ 26.83 | | $ 25.23 |

| Net investment income (loss) (a) | 0.21 | | 0.25 | | 0.21 | | 0.28 | | 0.38 |

| Net realized and unrealized gain (loss) | 5.00 | | (7.58) | | 7.77 | | 3.68 | | 5.74 |

| Total from investment operations | 5.21 | | (7.33) | | 7.98 | | 3.96 | | 6.12 |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.23) | | (0.19) | | (0.29) | | (0.43) | | (0.43) |

| From net realized gain on investments | — | | (5.55) | | (1.58) | | (2.08) | | (4.09) |

| Total distributions | (0.23) | | (5.74) | | (1.87) | | (2.51) | | (4.52) |

| Net asset value at end of year | $ 26.30 | | $ 21.32 | | $ 34.39 | | $ 28.28 | | $ 26.83 |

| Total investment return (b) | 24.58% | | (20.68)% | | 28.78% | | 15.55% | | 26.21% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 0.90% | | 0.90% | | 0.65% | | 1.09% | | 1.37% |

| Net expenses (c) | 0.56% | | 0.57% | | 0.58% | | 0.58% | | 0.58% |

| Portfolio turnover rate | 28% | | 21% | | 26% | | 143% | | 119% |

| Net assets at end of year (in 000's) | $ 670,328 | | $ 607,323 | | $ 732,245 | | $ 497,644 | | $ 543,355 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | Year Ended December 31, |

| Service Class | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value at beginning of year | $ 20.91 | | $ 33.85 | | $ 27.87 | | $ 26.47 | | $ 24.94 |

| Net investment income (loss) (a) | 0.15 | | 0.18 | | 0.13 | | 0.21 | | 0.31 |

| Net realized and unrealized gain (loss) | 4.91 | | (7.46) | | 7.65 | | 3.62 | | 5.67 |

| Total from investment operations | 5.06 | | (7.28) | | 7.78 | | 3.83 | | 5.98 |

| Less distributions: | | | | | | | | | |

| From net investment income | (0.17) | | (0.11) | | (0.22) | | (0.35) | | (0.36) |

| From net realized gain on investments | — | | (5.55) | | (1.58) | | (2.08) | | (4.09) |

| Total distributions | (0.17) | | (5.66) | | (1.80) | | (2.43) | | (4.45) |

| Net asset value at end of year | $ 25.80 | | $ 20.91 | | $ 33.85 | | $ 27.87 | | $ 26.47 |

| Total investment return (b) | 24.27% | | (20.87)% | | 28.46% | | 15.26% | | 25.89% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | |

| Net investment income (loss) | 0.66% | | 0.65% | | 0.40% | | 0.83% | | 1.12% |

| Net expenses (c) | 0.81% | | 0.82% | | 0.83% | | 0.83% | | 0.83% |

| Portfolio turnover rate | 28% | | 21% | | 26% | | 143% | | 119% |

| Net assets at end of year (in 000's) | $ 245,619 | | $ 226,405 | | $ 306,191 | | $ 270,170 | | $ 268,992 |

| (a) | Per share data based on average shares outstanding during the year. |

| (b) | Total return does not reflect any deduction of sales charges, mortality and expense charges, contract charges or administrative charges. For periods of less than one year, total return is not annualized. |

| (c) | In addition to the fees and expenses which the Portfolio bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements.

| 16 | MainStay VP Wellington U.S. Equity Portfolio |

Notes to Financial Statements

Note 1–Organization and Business

MainStay VP Funds Trust (the “Fund”) was organized as a Delaware statutory trust on February 1, 2011. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is comprised of thirty-one separate series (collectively referred to as the “Portfolios”). These financial statements and notes relate to the MainStay VP Wellington U.S. Equity Portfolio (the "Portfolio"), a "diversified” portfolio, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time.

Shares of the Portfolio are currently offered to certain separate accounts to fund variable annuity policies and variable universal life insurance policies issued by New York Life Insurance and Annuity Corporation (“NYLIAC”), a wholly-owned subsidiary of New York Life Insurance Company (“New York Life”) and may also be offered to fund variable annuity policies and variable universal life insurance policies issued by other insurance companies. NYLIAC allocates shares of the Portfolio to, among others, certain NYLIAC separate accounts. Shares of the Portfolio are also offered to the MainStay VP Conservative Allocation Portfolio, MainStay VP Moderate Allocation Portfolio, MainStay VP Growth Allocation Portfolio and MainStay VP Equity Allocation Portfolio, which operate as “funds-of-funds," and other variable insurance funds.

The following table lists the Portfolio's share classes that have been registered and commenced operations:

| Class | Commenced Operations |

| Initial Class | January 23, 1984 |

| Service Class | June 5, 2003 |

Shares of the Portfolio are offered and are redeemed at a price equal to their respective net asset value (“NAV”) per share. No sales or redemption charge is applicable to the purchase or redemption of the Portfolio's shares. Under the terms of the Fund’s multiple class plan, adopted pursuant to Rule 18f-3 under the 1940 Act, the classes differ in that, among other things, Service Class shares of the Portfolio pay a combined distribution and service fee of 0.25% of average daily net assets attributable to Service Class shares of the Portfolio to the Distributor (as defined in Note 3(B)) pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act. Contract owners of variable annuity contracts purchased after June 2, 2003, are permitted to invest only in the Service Class shares.

The Portfolio's investment objective is to seek long-term growth of capital.

Note 2–Significant Accounting Policies

The Portfolio is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services—Investment Companies. The Portfolio prepares its financial statements in accordance with generally accepted

accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the "Exchange") (usually 4:00 p.m. Eastern time) on each day the Portfolio is open for business ("valuation date").

Pursuant to Rule 2a-5 under the 1940 Act, the Board of Trustees of the Fund (the "Board") has designated New York Life Investment Management LLC (“New York Life Investments” or the "Manager") as its Valuation Designee (the "Valuation Designee"). The Valuation Designee is responsible for performing fair valuations relating to all investments in the Portfolio’s portfolio for which market quotations are not readily available; periodically assessing and managing material valuation risks; establishing and applying fair value methodologies; testing fair valuation methodologies; evaluating and overseeing pricing services; ensuring appropriate segregation of valuation and portfolio management functions; providing quarterly, annual and prompt reporting to the Board, as appropriate; identifying potential conflicts of interest; and maintaining appropriate records. The Valuation Designee has established a valuation committee ("Valuation Committee") to assist in carrying out the Valuation Designee’s responsibilities and establish prices of securities for which market quotations are not readily available. The Portfolio's and the Valuation Designee's policies and procedures ("Valuation Procedures") govern the Valuation Designee’s selection and application of methodologies for determining and calculating the fair value of Portfolio investments. The Valuation Designee may value the Portfolio's portfolio securities for which market quotations are not readily available and other Portfolio assets utilizing inputs from pricing services and other third-party sources. The Valuation Committee meets (in person, via electronic mail or via teleconference) on an ad-hoc basis to determine fair valuations and on a quarterly basis to review fair value events with respect to certain securities for which market quotations are not readily available, including valuation risks and back-testing results, and to preview reports to the Board.

The Valuation Committee establishes prices of securities for which market quotations are not readily available based on such methodologies and measurements on a regular basis after considering information that is reasonably available and deemed relevant by the Valuation Committee. The Board shall oversee the Valuation Designee and review fair valuation materials on a prompt, quarterly and annual basis and approve proposed revisions to the Valuation Procedures.

Investments for which market quotations are not readily available are valued at fair value as determined in good faith pursuant to the Valuation Procedures. A market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Portfolio can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. "Fair value" is defined as the price the Portfolio would reasonably expect to receive upon selling an asset or liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the

Notes to Financial Statements (continued)

asset or liability. Fair value measurements are determined within a framework that establishes a three-tier hierarchy that maximizes the use of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. "Inputs" refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Portfolio. Unobservable inputs reflect the Portfolio’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing assets or liabilities may not be an indication of the risks associated with investing in those assets or liabilities. The three-tier hierarchy of inputs is summarized below.

| • | Level 1—quoted prices (unadjusted) in active markets for an identical asset or liability |

| • | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Portfolio's own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The level of an asset or liability within the fair value hierarchy is based on the lowest level of an input, both individually and in the aggregate, that is significant to the fair value measurement. The aggregate value by input level of the Portfolio’s assets and liabilities as of December 31, 2023, is included at the end of the Portfolio of Investments.

The Portfolio may use third-party vendor evaluations, whose prices may be derived from one or more of the following standard inputs, among others:

| • Broker/dealer quotes | • Benchmark securities |

| • Two-sided markets | • Reference data (corporate actions or material event notices) |

| • Bids/offers | • Monthly payment information |

| • Industry and economic events | • Reported trades |

An asset or liability for which a market quotation is not readily available is valued by methods deemed reasonable in good faith by the Valuation Committee, following the Valuation Procedures to represent fair value. Under these procedures, the Valuation Designee generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information. The Valuation Designee may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to calculate fair value.

Discounts may also be applied due to the nature and/or duration of any restrictions on the disposition of the asset or liability. Fair value represents a good faith approximation of the value of a security. Fair value determinations involve the consideration of a number of subjective factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Valuation Procedures may differ from valuations for the same security determined for other funds using their own valuation procedures. Although the Valuation Procedures are designed to value a security at the price the Portfolio may reasonably expect to receive upon the security's sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Portfolio would actually realize upon the sale of the security or the price at which the security would trade if a reliable market price were readily available. During the year ended December 31, 2023, there were no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended or otherwise does not have a readily available market quotation on a given day; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been delisted from a national exchange; (v) a security subject to trading collars for which no or limited trading takes place; and (vi) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities valued in this manner are generally categorized as Level 2 or 3 in the hierarchy.

Equity securities, rights and warrants, if applicable, are valued at the last quoted sales prices as of the close of regular trading on the relevant exchange on each valuation date. Securities that are not traded on the valuation date are valued at the mean of the last quoted bid and ask prices. Prices are normally taken from the principal market in which each security trades. These securities are generally categorized as Level 1 in the hierarchy.

Investments in mutual funds, including money market funds, are valued at their respective NAVs at the close of business each day on the valuation date. These securities are generally categorized as Level 1 in the hierarchy.

Temporary cash investments acquired in excess of 60 days to maturity at the time of purchase are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities and ratings), both as furnished by independent pricing services. Temporary cash investments that mature in 60 days or less at the time of purchase ("Short-Term Investments") are valued using the amortized cost method of valuation, unless the use of such method would be inappropriate. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between such cost and the value on maturity date. Amortized cost approximates

| 18 | MainStay VP Wellington U.S. Equity Portfolio |

the current fair value of a security. Securities valued using the amortized cost method are not valued using quoted prices in an active market and are generally categorized as Level 2 in the hierarchy.

The information above is not intended to reflect an exhaustive list of the methodologies that may be used to value portfolio investments. The Valuation Procedures permit the use of a variety of valuation methodologies in connection with valuing portfolio investments. The methodology used for a specific type of investment may vary based on the market data available or other considerations. The methodologies summarized above may not represent the specific means by which portfolio investments are valued on any particular business day.

(B) Income Taxes. The Portfolio's policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute all of its taxable income to the shareholders of the Portfolio within the allowable time limits.

The Manager evaluates the Portfolio’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is permitted only to the extent the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Manager analyzed the Portfolio's tax positions taken on federal, state and local income tax returns for all open tax years (for up to three tax years) and has concluded that no provisions for federal, state and local income tax are required in the Portfolio's financial statements. The Portfolio's federal, state and local income tax and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state and local departments of revenue.

(C) Dividends and Distributions to Shareholders. Dividends and distributions are recorded on the ex-dividend date. The Portfolio intends to declare and pay dividends from net investment income and distributions from net realized capital and currency gains, if any, at least annually. All dividends and distributions are reinvested at NAV in the same class of shares of the Portfolio. Dividends and distributions to shareholders are determined in accordance with federal income tax regulations and may differ from determinations using GAAP.

(D) Security Transactions and Investment Income. The Portfolio records security transactions on the trade date. Realized gains and losses on security transactions are determined using the identified cost method. Dividend income is recognized on the ex-dividend date, net of any foreign tax withheld at the source, and interest income is accrued as earned using the effective interest rate method. Distributions received from real estate investment trusts may be classified as dividends, capital gains and/or return of capital.

Investment income and realized and unrealized gains and losses on investments of the Portfolio are allocated pro rata to the separate classes

of shares based upon their relative net assets on the date the income is earned or realized and unrealized gains and losses are incurred.

(E) Expenses. Expenses of the Fund are allocated to the individual Portfolios in proportion to the net assets of the respective Portfolios when the expenses are incurred, except where direct allocations of expenses can be made. Expenses (other than fees incurred under the distribution and service plans, further discussed in Note 3(B), which are charged directly to the Service Class shares) are allocated to separate classes of shares pro rata based upon their relative net assets on the date the expenses are incurred. The expenses borne by the Portfolio, including those of related parties to the Portfolio, are shown in the Statement of Operations.

Additionally, the Portfolio may invest in exchange-traded funds ("ETFs") and mutual funds, which are subject to management fees and other fees that may cause the costs of investing in ETFs and mutual funds to be greater than the costs of owning the underlying securities directly. These indirect expenses of ETFs and mutual funds are not included in the amounts shown as expenses in the Statement of Operations or in the expense ratios included in the Financial Highlights.

(F) Use of Estimates. In preparing financial statements in conformity with GAAP, the Manager makes estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and assumptions.

(G) Securities Lending. In order to realize additional income, the Portfolio may engage in securities lending, subject to the limitations set forth in the 1940 Act and relevant guidance by the staff of the Securities and Exchange Commission (“SEC”). If the Portfolio engages in securities lending, the Portfolio will lend through its custodian, JPMorgan Chase Bank, N.A., ("JPMorgan"), acting as securities lending agent on behalf of the Portfolio. Under the current arrangement, JPMorgan will manage the Portfolio's collateral in accordance with the securities lending agency agreement between the Portfolio and JPMorgan, and indemnify the Portfolio against counterparty risk. The loans will be collateralized by cash (which may be invested in a money market fund) and/or non-cash collateral (which may include U.S. Treasury securities and/or U.S. government agency securities issued or guaranteed by the United States government or its agencies or instrumentalities) at least equal at all times to the market value of the securities loaned. Non-cash collateral held at year end is segregated and cannot be transferred by the Portfolio. The Portfolio bears the risk of delay in recovery of, or loss of rights in, the securities loaned. The Portfolio may also record a realized gain or loss on securities deemed sold due to a borrower’s inability to return securities on loan. The Portfolio bears the risk of any loss on investment of cash collateral. The Portfolio will receive compensation for lending its securities in the form of fees or it will retain a portion of interest earned on the investment of any cash collateral. The Portfolio will also continue to receive interest and dividends on the securities loaned and any gain or loss in the market price of the securities loaned that may occur during the

Notes to Financial Statements (continued)

term of the loan will be for the account of the Portfolio. Income earned from securities lending activities, if any, is reflected in the Statement of Operations.

(H) Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Portfolio enters into contracts with third-party service providers that contain a variety of representations and warranties and that may provide general indemnifications. The Portfolio's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Portfolio that have not yet occurred. The Manager believes that the risk of loss in connection with these potential indemnification obligations is remote. However, there can be no assurance that material liabilities related to such obligations will not arise in the future, which could adversely impact the Portfolio.

Note 3–Fees and Related Party Transactions

(A) Manager and Subadvisor. New York Life Investments, a registered investment adviser and an indirect, wholly-owned subsidiary of New York Life, serves as the Portfolio's Manager, pursuant to an Amended and Restated Management Agreement ("Management Agreement"). The Manager provides offices, conducts clerical, recordkeeping and bookkeeping services and keeps most of the financial and accounting records required to be maintained by the Portfolio. Except for the portion of salaries and expenses that are the responsibility of the Portfolio, the Manager pays the salaries and expenses of all personnel affiliated with the Portfolio and certain operational expenses of the Portfolio. The Portfolio reimburses New York Life Investments in an amount equal to the portion of the compensation of the Chief Compliance Officer attributable to the Portfolio. Wellington Management Company LLP ("Wellington" or the "Subadvisor"), a registered investment adviser, serves as the Subadvisor to the Portfolio and is responsible for the day-to-day portfolio management of the Portfolio. Pursuant to the terms of a Subadvisory Agreement between New York Life Investments and Wellington, New York Life Investments pays for the services of the Subadvisor.

Effective May 1, 2023, pursuant to the Management Agreement, the Fund pays the Manager, on behalf of the Portfolio, a monthly fee for the services performed and the facilities furnished at an annual rate of the Portfolio's average daily net assets as follows: 0.55% up to $500 million; 0.525% from $500 million to $1 billion; 0.50% from $1 billion to $3 billion; and 0.49% in excess of $3 billion. During the year ended December 31, 2023, the effective management fee rate was 0.54% of the Portfolio's average daily net assets.

Prior to May 1, 2023, the Fund paid the Manager, on behalf of the Portfolio, a monthly fee for the services performed and the facilities furnished at an annual rate of the Portfolio's average daily net assets as follows: 0.55% up to $500 million; 0.525% from $500 million to $1 billion; and 0.50% in excess of $1 billion.

During the year ended December 31, 2023, New York Life Investments earned fees from the Portfolio in the amount of $4,719,504 and paid the Subadvisor fees in the amount of $2,053,452.

JPMorgan provides sub-administration and sub-accounting services to the Portfolio pursuant to an agreement with New York Life Investments. These services include calculating the daily NAVs of the Portfolio, maintaining the general ledger and sub-ledger accounts for the calculation of the Portfolio's NAVs, and assisting New York Life Investments in conducting various aspects of the Portfolio's administrative operations. For providing these services to the Portfolio, JPMorgan is compensated by New York Life Investments.

Pursuant to an agreement between the Fund and New York Life Investments, New York Life Investments is responsible for providing or procuring certain regulatory reporting services for the Portfolio. The Portfolio will reimburse New York Life Investments for the actual costs incurred by New York Life Investments in connection with providing or procuring these services for the Portfolio.

(B) Distribution and Service Fees. The Fund, on behalf of the Portfolio, has entered into a distribution agreement with NYLIFE Distributors LLC (the “Distributor”), an affiliate of New York Life Investments. The Portfolio has adopted a distribution plan (the “Plan”) in accordance with the provisions of Rule 12b-1 under the 1940 Act. Under the Plan, the Distributor has agreed to provide, through its affiliates or independent third parties, various distribution-related, shareholder and administrative support services to the Service Class shareholders. For its services, the Distributor is entitled to a combined distribution and service fee accrued daily and paid monthly at an annual rate of 0.25% of the average daily net assets attributable to the Service Class shares of the Portfolio.

Note 4-Federal Income Tax

As of December 31, 2023, the cost and unrealized appreciation (depreciation) of the Portfolio’s investment portfolio, including applicable derivative contracts and other financial instruments, as determined on a federal income tax basis, were as follows:

| | Federal Tax

Cost | Gross

Unrealized

Appreciation | Gross

Unrealized

(Depreciation) | Net

Unrealized

Appreciation/

(Depreciation) |

| Investments in Securities | $724,758,000 | $210,878,907 | $(19,253,847) | $191,625,060 |

As of December 31, 2023, the components of accumulated gain (loss) on a tax basis were as follows:

Ordinary

Income | Accumulated

Capital

and Other

Gain (Loss) | Other

Temporary

Differences | Unrealized

Appreciation

(Depreciation) | Total

Accumulated

Gain (Loss) |

| $7,318,375 | $(11,008,930) | $— | $191,625,060 | $187,934,505 |

| 20 | MainStay VP Wellington U.S. Equity Portfolio |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is primarily due to wash sale adjustments.

As of December 31, 2023, for federal income tax purposes, capital loss carryforwards of $11,008,930, as shown in the table below, were available to the extent provided by the regulations to offset future realized gains of the Portfolio. Accordingly, no capital gains distributions are expected to be paid to shareholders until net gains have been realized in excess of such amounts.

Capital Loss

Available Through | Short-Term

Capital Loss

Amounts (000’s) | Long-Term

Capital Loss

Amounts (000’s) |

| Unlimited | $11,009 | $— |

The Portfolio utilized $12,154,818 of capital loss carryforwards during the year ended December 31, 2023.

During the years ended December 31, 2023 and December 31, 2022, the tax character of distributions paid as reflected in the Statements of Changes in Net Assets was as follows:

| | 2023 | 2022 |

| Distributions paid from: | | |

| Ordinary Income | $7,739,973 | $100,243,996 |

| Long-Term Capital Gains | — | 75,412,662 |

| Total | $7,739,973 | $175,656,658 |

Note 5–Custodian

JPMorgan is the custodian of cash and securities held by the Portfolio. Custodial fees are charged to the Portfolio based on the Portfolio's net assets and/or the market value of securities held by the Portfolio and the number of certain transactions incurred by the Portfolio.

Note 6–Line of Credit

The Portfolio and certain other funds managed by New York Life Investments maintain a line of credit with a syndicate of banks in order to secure a source of funds for temporary purposes to meet unanticipated or excessive redemption requests.

Effective July 25, 2023, under the credit agreement (the “Credit Agreement”), the aggregate commitment amount is $600,000,000 with an additional uncommitted amount of $100,000,000. The commitment fee is an annual rate of 0.15% of the average commitment amount payable quarterly, regardless of usage, to JPMorgan, who serves as the agent to the syndicate. The commitment fee is allocated among the Portfolio and certain other funds managed by New York Life Investments based upon their respective net assets and other factors. Interest on any revolving credit loan is charged based upon the Federal Funds Rate, Daily Simple Secured Overnight Financing Rate ("SOFR") + 0.10%, or the Overnight Bank Funding Rate, whichever is higher. The Credit Agreement expires on July 23, 2024, although the Portfolio, certain other funds managed by New York Life Investments and the syndicate of banks may renew the Credit Agreement for an additional year on the same or

different terms or enter into a credit agreement with a different syndicate of banks. Prior to July 25, 2023, the aggregate commitment amount and the commitment fee were the same as those under the current Credit Agreement. During the year ended December 31, 2023, there were no borrowings made or outstanding with respect to the Portfolio under the Credit Agreement.

Note 7–Interfund Lending Program

Pursuant to an exemptive order issued by the SEC, the Portfolio, along with certain other funds managed by New York Life Investments, may participate in an interfund lending program. The interfund lending program provides an alternative credit facility that permits the Portfolio and certain other funds managed by New York Life Investments to lend or borrow money for temporary purposes directly to or from one another, subject to the conditions of the exemptive order. During the year ended December 31, 2023, there were no interfund loans made or outstanding with respect to the Portfolio.

Note 8–Purchases and Sales of Securities (in 000’s)

During the year ended December 31, 2023, purchases and sales of securities, other than short-term securities, were $238,497 and $330,933, respectively.

Note 9–Capital Share Transactions

Transactions in capital shares for the years ended December 31, 2023 and December 31, 2022, were as follows:

| Initial Class | Shares | Amount |

| Year ended December 31, 2023: | | |

| Shares sold | 1,098,980 | $ 25,462,776 |

| Shares issued to shareholders in reinvestment of distributions | 253,757 | 6,075,145 |

| Shares redeemed | (4,354,600) | (103,158,247) |

| Net increase (decrease) | (3,001,863) | $ (71,620,326) |

| Year ended December 31, 2022: | | |

| Shares sold | 4,126,421 | $ 120,131,397 |

| Shares issued to shareholders in reinvestment of distributions | 6,200,906 | 127,232,665 |

| Shares redeemed | (3,129,082) | (89,333,654) |

| Net increase (decrease) | 7,198,245 | $ 158,030,408 |

| |

Notes to Financial Statements (continued)

| Service Class | Shares | Amount |

| Year ended December 31, 2023: | | |

| Shares sold | 744,785 | $ 17,238,221 |

| Shares issued to shareholders in reinvestment of distributions | 70,860 | 1,664,828 |

| Shares redeemed | (2,122,516) | (49,497,408) |

| Net increase (decrease) | (1,306,871) | $ (30,594,359) |

| Year ended December 31, 2022: | | |

| Shares sold | 709,385 | $ 19,566,892 |

| Shares issued to shareholders in reinvestment of distributions | 2,404,906 | 48,423,993 |

| Shares redeemed | (1,332,405) | (36,325,263) |

| Net increase (decrease) | 1,781,886 | $ 31,665,622 |

Note 10–Other Matters

As of the date of this report, the Portfolio faces a heightened level of risk associated with current uncertainty, volatility and state of economies, financial markets, rising interest rates, and labor and health conditions around the world. Events such as war, acts of terrorism, recessions, rapid inflation, the imposition of international sanctions, earthquakes, hurricanes, epidemics and pandemics and other unforeseen natural or human disasters may have broad adverse social, political and economic effects on the global economy, which could negatively impact the value of the Portfolio's investments. Developments that disrupt global economies and financial markets may magnify factors that affect the Portfolio's performance.

Note 11–Subsequent Events

In connection with the preparation of the financial statements of the Portfolio as of and for the year ended December 31, 2023, events and transactions subsequent to December 31, 2023, through the date the financial statements were issued, have been evaluated by the Manager for possible adjustment and/or disclosure. No subsequent events requiring financial statement adjustment or disclosure have been identified.

| 22 | MainStay VP Wellington U.S. Equity Portfolio |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of MainStay VP Funds Trust and Shareholders of MainStay VP Wellington U.S. Equity Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of MainStay VP Wellington U.S. Equity Portfolio (one of the portfolios constituting MainStay VP Funds Trust, referred to hereafter as the “Portfolio”) as of December 31, 2023, the related statement of operations for the year ended December 31, 2023, the statements of changes in net assets for each of the two years in the period ended December 31, 2023, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Portfolio as of December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2023 and the financial highlights for each of the five years in the period ended December 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Portfolio’s management. Our responsibility is to express an opinion on the Portfolio’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Portfolio in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023 by correspondence with the custodian, transfer agent, and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

New York, New York

February 26, 2024

We have served as the auditor of one or more investment companies in the MainStay group of funds since 1984.

Board Consideration and Approval of Management Agreement and Subadvisory Agreement (Unaudited)

The continuation of the Management Agreement with respect to the MainStay VP Wellington U.S. Equity Portfolio (“Portfolio”) and New York Life Investment Management LLC (“New York Life Investments”) and the Subadvisory Agreement between New York Life Investments and Wellington Management Company LLP (“WMC”) with respect to the Portfolio (together, “Advisory Agreements”) is subject to annual review and approval by the Board of Trustees of MainStay VP Funds Trust (“Board” of the “Trust”) in accordance with Section 15 of the Investment Company Act of 1940, as amended (“1940 Act”). At its December 6–7, 2023 meeting, the Board, including the Trustees who are not an “interested person” (as such term is defined in the 1940 Act) of the Trust (“Independent Trustees”) voting separately, unanimously approved the continuation of each of the Advisory Agreements for a one-year period.