UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File No. 811-06670

CREDIT SUISSE INSTITUTIONAL FUND, INC.

(Exact Name of Registrant as Specified in Charter)

466 Lexington Avenue, New York, New York | | 10017-3140 |

(Address of Principal Executive Offices) | | (Zip Code) |

J. Kevin Gao, Esq.

Credit Suisse Institutional Fund, Inc.

466 Lexington Avenue

New York, New York 10017-3140

Registrant’s telephone number, including area code: (212) 875-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2005 to April 30, 2006

Item 1. Reports to Stockholders.

2

CREDIT SUISSE

INSTITUTIONAL FUND

Semiannual Report

April 30, 2006

(unaudited)

CREDIT SUISSE INSTITUTIONAL FUND, INC.

n LARGE CAP VALUE PORTFOLIO

n INTERNATIONAL FOCUS PORTFOLIO

n CAPITAL APPRECIATION PORTFOLIO

n INVESTMENT GRADE FIXED INCOME PORTFOLIO

The Portfolios' investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, is provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Institutional Fund, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at 466 Lexington Ave., New York, NY 10017-3140. Credit Suisse Institutional Fund is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolios' management are as of the date of the letters and Portfolios' holdings described in this document are as of April 30, 2006; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

For the six months ended April 30, 2006, Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio1 (the "Portfolio") had a gain of 10.76%, vs. an increase of 12.87% for the Russell 1000® Value Index.2

Market Overview: GDP rebounds, market moves upward

The period was an overall positive one for US equities, supported by economic expansion and optimism over corporate earnings. While fourth quarter 2005 GDP growth was modest compared with earlier quarters, as the economy absorbed a severe hurricane season, growth rebounded: First quarter 2006 GDP rose at its highest quarterly rate in more than two years. Notwithstanding the period immediately following this report, investors' appetite for risk taking remained, in general, healthy during the semiannual period ended April 30, 2006. This occurred during a period of high energy costs, steadily rising interest rates and ongoing political tensions in the Middle East.

Most sectors of the market advanced, led by economically sensitive areas such as energy, materials and producer durables companies. In the large-capitalization area, value stocks outperformed growth stocks. Small-capitalization stocks outpaced larger cap stocks in general, extending a long period of small cap outperformance.

Strategic Review: Focus on company fundamentals

The Portfolio participated in the market's rally but trailed its benchmark. This was due in part to certain technology holdings that struggled, such as Microsoft and International Business Machines (0.9% and 2.2% of the Portfolio's net assets, respectively, as of April 30, 2006), which lagged as investors favored more-speculative technology stocks. The Portfolio's health care and financial services stocks, while positive in absolute terms, underperformed. On the positive side, the Portfolio's performance was aided by good stock selection in the energy-services sector, as well as its overweighting in that sector. The Portfolio's producer durables and consumer discretionary holdings also had good performance.

In terms of noteworthy recent portfolio activity, our purchases included Abbott Laboratories (1.3% of the Portfolio's net assets as of April 30, 2006), a health care products company, using weakness in the stock price as a buying opportunity. We believe that the company has the potential to improve its growth rate and relative valuation. In the financial services area, we purchased Aflac (1.2% of the Portfolio's net assets as of April 30, 2006). We viewed the stock as undervalued

1

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

compared with its historical range, and we think the company's insurance sales in Japan could rebound going forward. Our sales included a number of stocks that had appreciated to reach our price target, such as McDonalds and JC Penney.

Going forward, we will continue to adhere to our strategy of investing in dividend-paying stocks of companies with large market capitalizations. Using proprietary bottom-up equity research and detailed quantitative analyses, we look for stocks that are deeply discounted relative to our view of their upside potential, in terms of valuation and/or income, with an emphasis on companies that stand to benefit from the positive impact of a likely significant event.

The Credit Suisse Large Cap Value Team

Stephen J. Kaszynski

Robert E. Rescoe

Adam Scheiner

The value of investments generally will fluctuate in response to market movements and the Portfolio's performance will largely depend on the performance of value stocks, which may be more volatile than the overall market.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investment portfolio. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

2

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| 1 Year | | 5 Years | | Since

Inception | | Inception

Date | |

| | 10.06 | % | | | 5.89 | % | | | 7.88 | % | | | 6/30/97 | | |

Average Annual Returns as of April 30, 20061

| 1 Year | | 5 Years | | Since

Inception | | Inception

Date | |

| | 17.34 | % | | | 5.70 | % | | | 8.23 | % | | | 6/30/97 | | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Russell 1000® Value Index measures the performance of those companies in the Russell 1000® Index with lower price-to-book ratios and lower forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

3

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

4

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,107.60 | | |

| Expenses Paid per $1,000* | | $ | 3.92 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,021.08 | | |

| Expenses Paid per $1,000* | | $ | 3.76 | | |

| Annualized Expense Ratios* | | | 0.75 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

5

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

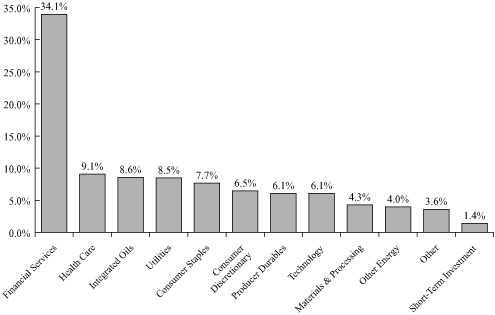

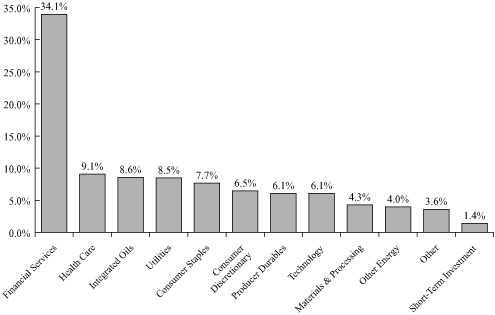

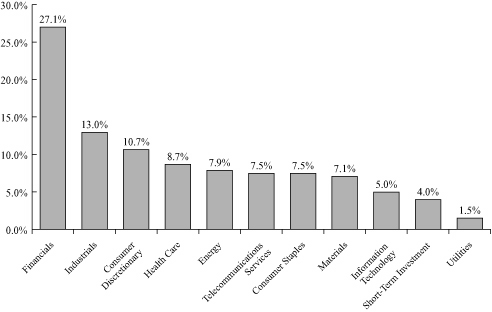

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments and may vary over time.

6

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

For the six months ended April 30, 2006, Credit Suisse Institutional Fund, Inc. — International Focus Portfolio1 (the "Portfolio") had a gain of 21.28%, vs. an increase of 22.89% for the MSCI EAFE Index.2 The Morgan Stanley Capital International ACWI (All Country World Index) Free Ex-USA Index2 had an increase of 25.04% in the period.

Market Overview: Across the board rally

The period was a solidly positive one for international equities. Most European stock markets outpaced the US market in local-currency returns, and had even better performance in US dollar terms due to a rise in the European currencies vs. the dollar in the period. Japan continued to rally on evidence that its economy is finally recovering, advancing about 23% in both yen and dollar terms. Emerging markets outpaced developed markets as a group, paced by the "BRIC" economies — Brazil, Russia, India and China — all with gains in excess of 40% in dollar terms.

From a sector standpoint, performance was positive across the board, led by materials, industrials, technology and consumer discretionary stocks. Telecommunications stocks had only a small gain on average.

Strategic Review: Strong Asia performance countered by Europe

The Portfolio participated in the rally in foreign stock markets, though it trailed its benchmark. Stocks that aided the Portfolio's return included its industrial and consumer discretionary holdings. Stocks that hindered the Portfolio's performance, relatively speaking, included its energy and materials holdings. The Portfolio's overweighting in the telecommunications sector also hampered its relative return. In regional terms, good stock selection in Japan and South Korea drove the Portfolio's outperformance in Asia, while its European holdings, including those from emerging Europe, collectively underperformed.

Outlook and strategy

Given recent strong performance in many international stock markets, some consolidation may be in store, and risks such as high energy prices, a weakening dollar or interest rates being hiked too far bear monitoring. However, on balance, we believe that the backdrop for international equities could remain favorable. Although interest rates have been steadily rising in the US, we think this trend may be near a peak. We also think the US economy can avoid a "hard landing," providing support for growth elsewhere in the world.

7

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

At the same time, the economic cycle appears to be picking up in Europe, Japan has been moving out of a deflationary environment, potentially continuing its broadest-based recovery in a decade, and many emerging markets have improving macro fundamentals. China continues to be the growth engine of Asia, as well as a key factor behind the direction of commodity prices.

From a sector perspective, valuations have converged over the past year or so. After many years of the markets favoring value over growth, the sound economic backdrop and comparable stock multiples could seem to favor growth stocks going forward.

We believe that growth opportunities exist in a number of areas. In developed markets, namely Europe and Japan, we have added names in computer software that stand to benefit from higher technology spending as legacy systems are upgraded. We have also increased our exposure to beverages and oil services (the latter being a structural growth story within a cyclical sector). We have added several Japanese "mega banks," in the belief they might be beneficiaries of rising interest rates and an improving lending environment in that country. We took advantage of a significant pullback in emerging markets earlier this year to add positions in stocks with potentially strong long-term growth prospects, such as Indian telecommunications and metals and mining companies. Stocks from emerging markets accounted for about 11% of the Portfolio's assets as of the end of the period.

The Credit Suisse International Equity Team

Nancy Nierman

Anne S. Budlong

Emily Alejos

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. The Portfolio's 15 largest holdings may account for 40% or more of the Portfolio's assets. As a result of this strategy, the Portfolio may be subject to greater volatility than a portfolio that invests in a larger number of issuers.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

8

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| | 25.75 | % | | | 8.95 | % | | | 5.41 | % | | | 8.39 | % | | | 9/01/92 | | |

Average Annual Returns as of April 30, 20061

| 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| | 34.47 | % | | | 9.05 | % | | | 5.31 | % | | | 8.73 | % | | | 9/01/92 | | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Morgan Stanley Capital International ACWI (All Country World Index) Free Ex-USA Index is a free float-adjusted market capitalization index that is designed to measure equity-market performance in the global developed and emerging markets, excluding the US. Effective February 28, 2006, the portfolio has elected to change its benchmark to the Morgan Stanley Capital International EAFE Index (Europe, Australasia and Far East) (net dividends), a free-float adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada. It is the exclusive property of Morgan Stanley Capital International Inc. Investors cannot invest directly in an index.

9

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

10

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,212.80 | | |

| Expenses Paid per $1,000* | | $ | 5.21 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,020.08 | | |

| Expenses Paid per $1,000* | | $ | 4.76 | | |

| Annualized Expense Ratios* | | | 0.95 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

11

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

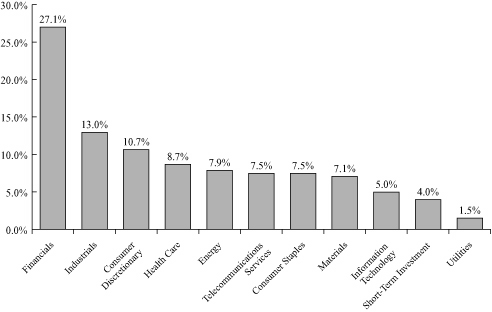

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

12

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

For the six months ended April 30, 2006, Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio1 (the "Portfolio") had a gain of 6.92%, vs. an increase of 7.06% for the Russell 1000® Growth Index.2

Market Overview: GDP rebounds, market moves upward

The period was an overall positive one for US equities, supported by economic expansion and optimism over corporate earnings. While fourth quarter 2005 GDP growth was modest compared with earlier quarters, as the economy absorbed a severe hurricane season, growth rebounded: First quarter 2006 GDP rose at its highest quarterly rate in more than two years. Notwithstanding the period immediately following this report, investors' appetite for risk taking remained, in general, healthy during the semiannual period ended April 30, 2006. This occurred during a period of high energy costs, steadily rising interest rates and ongoing political tensions in the Middle East.

Most sectors of the market advanced, led by economically sensitive areas such as energy, materials and producer durables companies. In the large-capitalization area, value stocks outperformed growth stocks. Small-capitalization stocks outpaced larger cap stocks in general, extending a long period of small cap outperformance.

Strategic Review: Focus on company fundamentals

Stocks that aided the Portfolio's performance in the period included its producer durables, materials and consumer staples holdings. However, this was offset by underperformance from the Portfolio's health care stocks, including UnitedHealth Group in the managed care area. We decided to eliminate this position in the period, based on concerns about profitability catalysts as well as management compensation issues.

Our noteworthy recent portfolio activity included establishing a position in Autodesk (0.7% of the Portfolio's net assets as of April 30, 2006), a provider of software and multimedia tools used in mechanical design and other applications. We believe that the company is entering an upgrade cycle, from two-dimensional to three-dimensional products, that could support sales and income growth for an extended period.

In addition to UnitedHealth, our other sales included American International Group, a globally oriented financial services company specializing in insurance.

13

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

We believe that the stock price had risen to fully reflect the company's emergence from previous difficulties.

Going forward, we will continue to adhere to our general strategy of seeking sectors and companies with the potential to outperform the overall market. We look for stocks available at a reasonable price relative to projected growth, while employing themes or patterns associated with growth companies, such as significant fundamental changes, generation of large free cash flows or company share-buyback programs.

Marian U. Pardo

Jeffrey T. Rose

The value of investments generally will fluctuate in response to market movements.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

14

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| 1 Year | | Since

Inception | | Inception

Date | |

| | 12.71 | % | | | 0.94 | % | | | 1/31/02 | | |

Average Annual Returns as of April 30, 20061

| 1 Year | | Since

Inception | | Inception

Date | |

| | 14.50 | % | | | 0.85 | % | | | 1/31/02 | | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Russell 1000® Growth Index measures the performance of those companies in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

15

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

16

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,069.20 | | |

| Expenses Paid per $1,000* | | $ | 3.85 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,021.08 | | |

| Expenses Paid per $1,000* | | $ | 3.76 | | |

| Annualized Expense Ratios* | | | 0.75 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

17

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

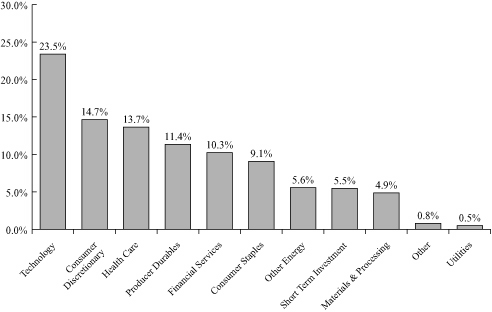

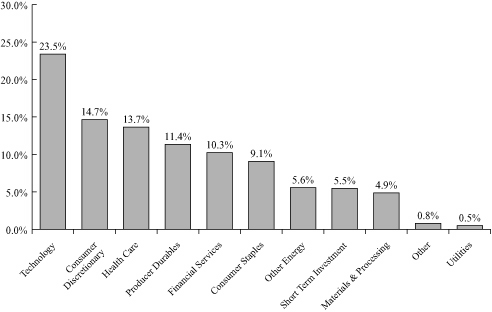

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding securities lending collateral) and may vary over time.

18

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

June 16, 2006

Dear Shareholder:

For the six months ended April 30, 2006, Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio1 (the "Portfolio") had a gain of 0.17%, vs. an increase of 0.56% for the Lehman Brothers Aggregate Bond Index.2

Market Overview: Rates continue to rise

The period was a slightly positive one for the US investment grade bond market in terms of total return, though bond prices were restrained by rising interest rates. The Federal Reserve continued its campaign to raise rates in small but steady increments, with the federal funds rate reaching 4.75% by the end of April 2006, up from 3.75% at the start of the period and 1.00% in June 2004.

The economy continued its growth trajectory despite the increase in interest rates (which can have a lagging effect on growth) along with higher energy costs. First quarter 2006 GDP rose at nearly a 5% annual rate, its highest quarterly rate in more than two years. Inflation remained within the Fed's comfort zone, but as of the end of the period was closer to its upper level of 2%, as measured by personal consumption expenditures. The best performing bonds in this environment tended to be lower-quality securities such as non-investment-grade corporate debt and emerging market bonds.

Strategic Review: Focus on issuer fundamentals

The Portfolio had a gain, but trailed its benchmark, despite our generally cautious approach to interest-rate risk (staying neutral to short with regard to the Portfolio's duration). We attribute this largely to the Portfolio's exposure to longer-dated corporate BBB rated bonds such as home builders. This was disappointing, as those holdings had mostly delivered on our optimistic industry and company-specific assumptions. For example, the underperformance of our home builder companies occurred despite a strong construction market, healthy earnings reports and upwardly revised earnings forecasts. In our view, these positives were countered by investor concerns over companies' shareholder-friendly uses of capital, with debt reduction less of a priority in many corporations.

In terms of noteworthy Portfolio adjustments, we opted to lower our weighting in BBB rated corporate bonds, ending the period with a slight underweighting in the category, vs. an overweighting we held in late 2005. While we continue to view corporate bonds as more compelling than Treasuries from a total return perspective, we have adopted a more neutral approach to lower-rated corporate securities based on financial trends within corporations. These include increased merger and acquisition activity, along with an ongoing corporate preference for

19

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

equity-shareholder friendly actions such as stock buybacks and higher dividends, as companies try to turn excess corporate cash into higher share prices. We continue to believe that attractive bonds exist among BBB rated corporates, but we also think that a highly selective approach is appropriate, and we remain focused on a bottom-up, fundamentals based strategy. We also continue to focus on asset-backed and commercial mortgage-backed securities for their diversification characteristics and total-return potential.

The Credit Suisse Fixed Income Management Team

Kevin D. Barry

Sheila Huang

Richard Avidon

Philip Wubbena

Fixed income investing entails credit risks and interest rate risks. Typically, when interest rates rise, the market value of fixed income securities generally decline and the share price of the fund can fall.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

20

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| 1 Year | | Since

Inception | | Inception

Date | |

| | 1.60 | % | | | 3.93 | % | | | 5/01/02 | | |

Average Annual Returns as of April 30, 20061

| 1 Year | | Since

Inception | | Inception

Date | |

| | 0.19 | % | | | 3.81 | % | | | 5/01/02 | | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Lehman Brothers US Aggregate Bond Index is composed of the Lehman Brothers Government/Corporate Bond Index and the Lehman Brothers Mortgage-Backed Securities Index. It includes US Treasury and agency issues, corporate bond issues and mortgage-backed securities rated investment-grade or higher by Moody's Investors Service; the Standard & Poor's division of The McGraw-Hill Companies, Inc.; or Fitch IBCA Inc. Investors cannot invest directly in an index.

21

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

22

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,001.70 | | |

| Expenses Paid per $1,000* | | $ | 1.99 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/05 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/06 | | $ | 1,022.81 | | |

| Expenses Paid per $1,000* | | $ | 2.01 | | |

| Annualized Expense Ratios* | | | 0.40 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

23

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Credit Quality Breakdown*

Ratings

S&P | |

| AAA | | | 64.0 | % | |

| AA | | | 3.0 | % | |

| A | | | 7.2 | % | |

| BBB | | | 8.0 | % | |

| BB | | | 1.0 | % | |

| Subtotal | | | 83.2 | % | |

| Short-Term Investments | | | 16.8 | % | |

| Total | | | 100.0 | % | |

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

24

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (97.0%) | |

| Aerospace & Defense (5.7%) | |

| L-3 Communications Holdings, Inc. | | | 5,800 | | | $ | 473,860 | | |

| Precision Castparts Corp. | | | 5,400 | | | | 340,092 | | |

| United Technologies Corp. | | | 13,200 | | | | 829,092 | | |

| | | | | | | | 1,643,044 | | |

| Banks (12.8%) | |

| Bank of America Corp. | | | 25,210 | | | | 1,258,483 | | |

| Bank of New York Company, Inc. | | | 3,600 | | | | 126,540 | | |

| Hudson City Bancorp, Inc. | | | 26,603 | | | | 356,746 | | |

| Mercantile Bankshares Corp. | | | 9,600 | | | | 360,768 | | |

| North Fork Bancorporation, Inc. | | | 6,750 | | | | 203,378 | | |

| U.S. Bancorp | | | 14,100 | | | | 443,304 | | |

| Wells Fargo & Co. | | | 14,000 | | | | 961,660 | | |

| | | | | | | | 3,710,879 | | |

| Beverages (1.0%) | |

| Coca-Cola Co. | | | 6,800 | | | | 285,328 | | |

| Building Products (1.6%) | |

| American Standard Companies, Inc. | | | 10,700 | | | | 465,771 | | |

| Chemicals (0.7%) | |

| Du Pont (E. I.) de Nemours & Co. | | | 4,900 | | | | 216,090 | | |

| Communications Equipment (0.9%) | |

| Motorola, Inc. | | | 11,600 | | | | 247,660 | | |

| Computers & Peripherals (2.6%) | |

| Dell, Inc.* | | | 4,600 | | | | 120,520 | | |

| International Business Machines Corp. | | | 7,700 | | | | 634,018 | | |

| | | | | | | | 754,538 | | |

| Diversified Financials (12.2%) | |

| American Express Co. | | | 3,700 | | | | 199,097 | | |

| Capital One Financial Corp. | | | 4,700 | | | | 407,208 | | |

| Citigroup, Inc. | | | 17,200 | | | | 859,140 | | |

| Freddie Mac | | | 4,300 | | | | 262,558 | | |

| JPMorgan Chase & Co. | | | 8,300 | | | | 376,654 | | |

| Lehman Brothers Holdings, Inc. | | | 3,000 | | | | 453,450 | | |

| Morgan Stanley | | | 9,100 | | | | 585,130 | | |

| SLM Corp. | | | 7,300 | | | | 386,024 | | |

| | | | | | | | 3,529,261 | | |

| Diversified Telecommunications Services (4.5%) | |

| ALLTEL Corp. | | | 6,900 | | | | 444,153 | | |

| AT&T, Inc. | | | 22,300 | | | | 584,483 | | |

| Sprint Nextel Corp. | | | 11,200 | | | | 277,760 | | |

| | | | | | | | 1,306,396 | | |

See Accompanying Notes to Financial Statements.

25

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Electric Utilities (3.8%) | |

| Dominion Resources, Inc. | | | 3,200 | | | $ | 239,584 | | |

| Exelon Corp. | | | 7,400 | | | | 399,600 | | |

| Mirant Corp.* | | | 11,400 | | | | 279,984 | | |

| TXU Corp. | | | 3,900 | | | | 193,557 | | |

| | | | | | | | 1,112,725 | | |

| Electrical Equipment (1.1%) | |

| Emerson Electric Co. | | | 3,600 | | | | 305,820 | | |

| Energy Equipment & Services (1.8%) | |

| Halliburton Co. | | | 4,300 | | | | 336,045 | | |

| Weatherford International, Ltd.* | | | 3,500 | | | | 185,255 | | |

| | | | | | | | 521,300 | | |

| Food & Drug Retailing (1.2%) | |

| CVS Corp. | | | 12,200 | | | | 362,584 | | |

| Food Products (1.7%) | |

| Kellogg Co. | | | 10,800 | | | | 500,148 | | |

| Healthcare Providers & Services (1.0%) | |

| Aetna, Inc. | | | 7,400 | | | | 284,900 | | |

| Household Products (1.2%) | |

| Procter & Gamble Co. | | | 6,100 | | | | 355,081 | | |

| Industrial Conglomerates (3.6%) | |

| 3M Co. | | | 3,600 | | | | 307,548 | | |

| General Electric Co. | | | 21,200 | | | | 733,308 | | |

| | | | | | | | 1,040,856 | | |

| Insurance (7.8%) | |

| Aflac, Inc. | | | 7,600 | | | | 361,304 | | |

| Allstate Corp. | | | 6,700 | | | | 378,483 | | |

| Hartford Financial Services Group, Inc. | | | 9,700 | | | | 891,721 | | |

| St. Paul Travelers Companies, Inc. | | | 14,600 | | | | 642,838 | | |

| | | | | | | | 2,274,346 | | |

| Machinery (1.5%) | |

| Deere & Co. | | | 4,900 | | | | 430,122 | | |

| Media (0.9%) | |

| Time Warner, Inc. | | | 15,700 | | | | 273,180 | | |

| Multiline Retail (1.5%) | |

| Federated Department Stores, Inc. | | | 1,900 | | | | 147,915 | | |

| Kohl's Corp.* | | | 5,300 | | | | 295,952 | | |

| | | | | | | | 443,867 | | |

See Accompanying Notes to Financial Statements.

26

Credit Suisse Institutional Fund, Inc. — Large Cap Value Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Oil & Gas (10.6%) | |

| Chevron Corp. | | | 15,400 | | | $ | 939,708 | | |

| ConocoPhillips | | | 5,500 | | | | 367,950 | | |

| Exxon Mobil Corp. | | | 18,000 | | | | 1,135,440 | | |

| Newfield Exploration Co.* | | | 7,400 | | | | 330,040 | | |

| Noble Energy, Inc. | | | 6,600 | | | | 296,868 | | |

| | | | | | | | 3,070,006 | | |

| Paper & Forest Products (0.8%) | |

| International Paper Co. | | | 6,000 | | | | 218,100 | | |

| Personal Products (0.9%) | |

| Alberto-Culver Co. | | | 6,100 | | | | 274,317 | | |

| Pharmaceuticals (7.9%) | |

| Abbott Laboratories | | | 8,500 | | | | 363,290 | | |

| Johnson & Johnson | | | 10,200 | | | | 597,822 | | |

| Pfizer, Inc. | | | 35,100 | | | | 889,083 | | |

| Wyeth | | | 9,200 | | | | 447,764 | | |

| | | | | | | | 2,297,959 | | |

| Real Estate (0.7%) | |

| Liberty Property Trust | | | 4,300 | | | | 192,210 | | |

| Semiconductor Equipment & Products (0.7%) | |

| Applied Materials, Inc. | | | 10,600 | | | | 190,270 | | |

| Software (0.9%) | |

| Microsoft Corp. | | | 11,000 | | | | 265,650 | | |

| Specialty Retail (3.0%) | |

| Abercrombie & Fitch Co. Class A | | | 2,400 | | | | 145,752 | | |

| Home Depot, Inc. | | | 11,800 | | | | 471,174 | | |

| Office Depot, Inc.* | | | 6,300 | | | | 255,654 | | |

| | | | | | | | 872,580 | | |

| Tobacco (2.4%) | |

| Altria Group, Inc. | | | 9,600 | | | | 702,336 | | |

| TOTAL COMMON STOCKS (Cost $24,108,625) | | | | | | | 28,147,324 | | |

| SHORT-TERM INVESTMENT (1.4%) | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 5/01/06 (Cost $403,000) | | $ | 403 | | | | 403,000 | | |

| TOTAL INVESTMENTS AT VALUE (98.4%) (Cost $24,511,625) | | | | | | | 28,550,324 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (1.6%) | | | | | | | 466,281 | | |

| NET ASSETS (100.0%) | | | | | | $ | 29,016,605 | | |

* Non-income producing security.

See Accompanying Notes to Financial Statements.

27

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (94.7%) | |

| Belgium (1.0%) | |

| Beverages (1.0%) | |

| InBev NV§ | | | 6,265 | | | $ | 315,491 | | |

| TOTAL BELGIUM | | | | | | | 315,491 | | |

| Brazil (0.5%) | |

| Metals & Mining (0.5%) | |

| Companhia Vale do Rio Doce ADR* | | | 3,123 | | | | 160,897 | | |

| TOTAL BRAZIL | | | | | | | 160,897 | | |

| Canada (1.1%) | |

| Diversified Telecommunications Services (1.1%) | |

| Rogers Communications, Inc. Class B§ | | | 7,700 | | | | 325,646 | | |

| TOTAL CANADA | | | | | | | 325,646 | | |

| Denmark (2.0%) | |

| Pharmaceuticals (2.0%) | |

| Novo Nordisk AS Series B | | | 9,550 | | | | 615,839 | | |

| TOTAL DENMARK | | | | | | | 615,839 | | |

| Egypt (1.4%) | |

| Telecommunications (1.4%) | |

| Orascom Telecom Holding SAE GDR | | | 8,143 | | | | 437,279 | | |

| TOTAL EGYPT | | | | | | | 437,279 | | |

| France (13.8%) | |

| Automobiles (1.2%) | |

| Renault SA§ | | | 3,044 | | | | 352,521 | | |

| Banks (2.4%) | |

| Societe Generale§ | | | 4,822 | | | | 734,849 | | |

| Beverages (0.7%) | |

| Pernod Ricard SA§ | | | 1,144 | | | | 221,535 | | |

| Insurance (2.2%) | |

| Axa | | | 18,650 | | | | 681,820 | | |

| Media (1.8%) | |

| Lagardere S.C.A.§ | | | 6,588 | | | | 543,267 | | |

| Oil & Gas (2.0%) | |

| Total SA§ | | | 2,223 | | | | 612,530 | | |

| Pharmaceuticals (1.0%) | |

| Sanofi-Aventis§ | | | 3,316 | | | | 312,205 | | |

| Textiles & Apparel (2.5%) | |

| LVMH Moet Hennessy Louis Vuitton SA§ | | | 7,281 | | | | 764,988 | | |

| TOTAL FRANCE | | | | | | | 4,223,715 | | |

See Accompanying Notes to Financial Statements.

28

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Germany (6.6%) | |

| Aerospace & Defense (1.5%) | |

| MTU Aero Engines Holding AG* | | | 12,743 | | | $ | 462,019 | | |

| Auto Components (1.7%) | |

| Continental AG§ | | | 4,417 | | | | 525,017 | | |

| Banks (1.1%) | |

| Bayerische Hypo-und Vereinsbank AG*§ | | | 9,801 | | | | 332,958 | | |

| Electric Utilities (1.5%) | |

| E.ON AG*§ | | | 3,836 | | | | 466,017 | | |

| Software (0.8%) | |

| SAP AG | | | 1,143 | | | | 249,335 | | |

| TOTAL GERMANY | | | | | | | 2,035,346 | | |

| Greece (1.5%) | |

| Diversified Telecommunications Services (1.5%) | |

| Hellenic Telecommunications Organization SA (OTE)* | | | 20,000 | | | | 447,206 | | |

| TOTAL GREECE | | | | | | | 447,206 | | |

| India (1.0%) | |

| Diversified Telecommunications Services (1.0%) | |

| Bharti Tele-Ventures, Ltd.* | | | 34,443 | | | | 308,577 | | |

| TOTAL INDIA | | | | | | | 308,577 | | |

| Israel (0.9%) | |

| Pharmaceuticals (0.9%) | |

| Teva Pharmaceutical Industries, Ltd. ADR | | | 7,000 | | | | 283,500 | | |

| TOTAL ISRAEL | | | | | | | 283,500 | | |

| Italy (3.9%) | |

| Banks (2.9%) | |

| SanPaolo IMI SpA§ | | | 35,031 | | | | 656,657 | | |

| UniCredito Italiano SpA§ | | | 30,426 | | | | 228,820 | | |

| | | | | | | | 885,477 | | |

| Oil & Gas (1.0%) | |

| Eni SpA | | | 10,280 | | | | 314,098 | | |

| TOTAL ITALY | | | | | | | 1,199,575 | | |

| Japan (21.4%) | |

| Auto Components (1.3%) | |

| Bridgestone Corp. | | | 16,000 | | | | 387,840 | | |

| Banks (3.7%) | |

| Mitsubishi UFJ Financial Group, Inc. | | | 29 | | | | 452,061 | | |

| Mizuho Financial Group, Inc. | | | 80 | | | | 678,930 | | |

| | | | | | | | 1,130,991 | | |

See Accompanying Notes to Financial Statements.

29

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Japan | |

| Chemicals (3.7%) | |

| Kuraray Company, Ltd.§ | | | 30,500 | | | $ | 374,783 | | |

| Shin-Etsu Chemical Company, Ltd. | | | 13,000 | | | | 747,709 | | |

| | | | | | | | 1,122,492 | | |

| Diversified Financials (2.0%) | |

| Daiwa Securities Group, Inc.§ | | | 45,000 | | | | 619,598 | | |

| Electronic Equipment & Instruments (1.5%) | |

| Omron Corp. | | | 16,800 | | | | 466,558 | | |

| Household Products (1.1%) | |

| Uni-Charm Corp.§ | | | 6,100 | | | | 348,400 | | |

| Machinery (2.6%) | |

| Komatsu, Ltd. | | | 37,000 | | | | 786,612 | | |

| Specialty Retail (2.3%) | |

| Yamada Denki Company, Ltd. | | | 6,400 | | | | 694,084 | | |

| Trading Companies & Distributors (3.2%) | |

| Sumitomo Corp. | | | 67,000 | | | | 998,673 | | |

| TOTAL JAPAN | | | | | | | 6,555,248 | | |

| Luxembourg (1.2%) | |

| Energy Equipment & Services (1.2%) | |

| Stolt Offshore SA*§ | | | 22,000 | | | | 357,923 | | |

| TOTAL LUXEMBOURG | | | | | | | 357,923 | | |

| Mexico (1.3%) | |

| Wireless Telecommunication Services (1.3%) | |

| America Movil SA de CV ADR Series L | | | 10,900 | | | | 402,319 | | |

| TOTAL MEXICO | | | | | | | 402,319 | | |

| Netherlands (3.9%) | |

| Banks (2.5%) | |

| ABN AMRO Holding NV§ | | | 26,055 | | | | 773,464 | | |

| Food Products (1.4%) | |

| Royal Numico NV* | | | 9,133 | | | | 413,320 | | |

| TOTAL NETHERLANDS | | | | | | | 1,186,784 | | |

| Norway (1.2%) | |

| Banks (1.2%) | |

| DNB NOR ASA§ | | | 25,800 | | | | 356,609 | | |

| TOTAL NORWAY | | | | | | | 356,609 | | |

| Singapore (1.4%) | |

| Banks (1.4%) | |

| United Overseas Bank, Ltd.§ | | | 42,685 | | | | 440,076 | | |

| TOTAL SINGAPORE | | | | | | | 440,076 | | |

See Accompanying Notes to Financial Statements.

30

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| South Korea (3.0%) | |

| Machinery (2.0%) | |

| Samsung Heavy Industries Company, Ltd. | | | 25,850 | | | $ | 611,291 | | |

| Oil & Gas (1.0%) | |

| S-Oil Corp. | | | 3,990 | | | | 309,042 | | |

| TOTAL SOUTH KOREA | | | | | | | 920,333 | | |

| Spain (0.7%) | |

| Tobacco (0.7%) | |

| Altadis SA | | | 4,765 | | | | 225,885 | | |

| TOTAL SPAIN | | | | | | | 225,885 | | |

| Sweden (2.1%) | |

| Communications Equipment (1.4%) | |

| Telefonaktiebolaget LM Ericsson§ | | | 116,180 | | | | 410,830 | | |

| Machinery (0.7%) | |

| Sandvik AB§ | | | 3,405 | | | | 220,856 | | |

| TOTAL SWEDEN | | | | | | | 631,686 | | |

| Switzerland (4.3%) | |

| Banks (2.5%) | |

| UBS AG§ | | | 6,474 | | | | 757,640 | | |

| Pharmaceuticals (1.8%) | |

| Novartis AG§ | | | 9,732 | | | | 556,194 | | |

| TOTAL SWITZERLAND | | | | | | | 1,313,834 | | |

| Taiwan (1.3%) | |

| Semiconductor Equipment & Products (1.3%) | |

| MediaTek, Inc. | | | 35,000 | | | | 409,016 | | |

| TOTAL TAIWAN | | | | | | | 409,016 | | |

| Thailand (1.0%) | |

| Banks (0.5%) | |

| Bangkok Bank Public Company, Ltd. | | | 48,800 | | | | 154,398 | | |

| Oil & Gas (0.5%) | |

| Thai Oil Public Company, Ltd. | | | 85,900 | | | | 154,332 | | |

| TOTAL THAILAND | | | | | | | 308,730 | | |

| United Kingdom (18.2%) | |

| Aerospace & Defense (1.0%) | |

| BAE Systems PLC | | | 39,800 | | | | 301,026 | | |

| Banks (4.4%) | |

| Barclays PLC | | | 27,023 | | | | 334,701 | | |

| HSBC Holdings PLC | | | 36,500 | | | | 627,796 | | |

| Royal Bank of Scotland Group PLC | | | 12,339 | | | | 400,028 | | |

| | | | | | | | 1,362,525 | | |

See Accompanying Notes to Financial Statements.

31

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| United Kingdom | |

| Beverages (1.4%) | |

| SABMiller PLC | | | 21,018 | | | $ | 438,843 | | |

| Commercial Services & Supplies (1.8%) | |

| Capita Group PLC | | | 18,057 | | | | 153,164 | | |

| Hays PLC | | | 131,001 | | | | 402,370 | | |

| | | | | | | | 555,534 | | |

| Metals & Mining (2.3%) | |

| BHP Billiton PLC | | | 25,226 | | | | 517,117 | | |

| Vedanta Resources PLC | | | 6,315 | | | | 180,243 | | |

| | | | | | | | 697,360 | | |

| Oil & Gas (2.1%) | |

| BP PLC | | | 53,539 | | | | 652,346 | | |

| Pharmaceuticals (2.9%) | |

| AstraZeneca PLC | | | 4,245 | | | | 232,660 | | |

| GlaxoSmithKline PLC | | | 23,048 | | | | 660,241 | | |

| | | | | | | | 892,901 | | |

| Tobacco (1.1%) | |

| Imperial Tobacco Group PLC | | | 10,379 | | | | 320,687 | | |

| Wireless Telecommunication Services (1.2%) | |

| Vodafone Group PLC | | | 155,658 | | | | 366,968 | | |

| TOTAL UNITED KINGDOM | | | | | | | 5,588,190 | | |

| TOTAL COMMON STOCKS (Cost $19,664,031) | | | | | | | 29,049,704 | | |

| PREFERRED STOCK (0.6%) | |

| Brazil (0.6%) | |

| Metals & Mining (0.6%) | |

| Companhia Vale do Rio Doce ADR (Cost $128,044) | | | 4,000 | | | | 177,920 | | |

| SHORT-TERM INVESTMENTS (30.1%) | |

| State Street Navigator Prime Portfolio§§ | | | 8,014,522 | | | | 8,014,522 | | |

| | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 5/01/06 | | $ | 1,233 | | | | 1,233,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $9,247,522) | | | | | | | 9,247,522 | | |

| TOTAL INVESTMENTS AT VALUE (125.4%) (Cost $29,039,597) | | | | | | | 38,475,146 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-25.4%) | | | | | | | (7,800,806 | ) | |

| NET ASSETS (100.0%) | | | | | | $ | 30,674,340 | | |

See Accompanying Notes to Financial Statements.

32

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

INVESTMENT ABBREVIATIONS

ADR = American Depositary Receipt

GDR = Global Depositary Receipt

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

33

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (89.8%) | |

| Aerospace & Defense (7.8%) | |

| Boeing Co. | | | 2,800 | | | $ | 233,660 | | |

| Lockheed Martin Corp. | | | 1,600 | | | | 121,440 | | |

| Precision Castparts Corp. | | | 3,100 | | | | 195,238 | | |

| United Technologies Corp. | | | 3,600 | | | | 226,116 | | |

| | | | | | | | 776,454 | | |

| Banks (3.5%) | |

| Hudson City Bancorp, Inc. | | | 7,400 | | | | 99,234 | | |

| Northern Trust Corp. | | | 2,100 | | | | 123,669 | | |

| Wells Fargo & Co. | | | 1,800 | | | | 123,642 | | |

| | | | | | | | 346,545 | | |

| Beverages (3.4%) | |

| Coca-Cola Co. | | | 3,500 | | | | 146,860 | | |

| PepsiCo, Inc. | | | 3,300 | | | | 192,192 | | |

| | | | | | | | 339,052 | | |

| Biotechnology (2.2%) | |

| Genentech, Inc.* | | | 1,500 | | | | 119,565 | | |

| Genzyme Corp.* | | | 1,700 | | | | 103,972 | | |

| | | | | | | | 223,537 | | |

| Chemicals (2.0%) | |

| Monsanto Co. | | | 2,400 | | | | 200,160 | | |

| Commercial Services & Supplies (0.7%) | |

| Avery Dennison Corp. | | | 1,100 | | | | 68,750 | | |

| Communications Equipment (8.2%) | |

| Cisco Systems, Inc.* | | | 11,300 | | | | 236,735 | | |

| Comverse Technology, Inc.* | | | 6,200 | | | | 140,430 | | |

| Corning, Inc.* | | | 10,800 | | | | 298,404 | | |

| Motorola, Inc. | | | 6,800 | | | | 145,180 | | |

| | | | | | | | 820,749 | | |

| Computers & Peripherals (3.4%) | |

| Apple Computer, Inc.* | | | 3,300 | | | | 232,287 | | |

| EMC Corp.* | | | 8,200 | | | | 110,782 | | |

| | | | | | | | 343,069 | | |

| Diversified Financials (4.9%) | |

| American Express Co. | | | 2,800 | | | | 150,668 | | |

| Morgan Stanley | | | 1,800 | | | | 115,740 | | |

| SLM Corp. | | | 2,200 | | | | 116,336 | | |

| TD Ameritrade Holding Corp. | | | 5,500 | | | | 102,080 | | |

| | | | | | | | 484,824 | | |

| Electrical Equipment (0.4%) | |

| Rockwell Automation, Inc. | | | 600 | | | | 43,476 | | |

See Accompanying Notes to Financial Statements.

34

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Electronic Equipment & Instruments (2.6%) | |

| Broadcom Corp. Class A* | | | 3,150 | | | $ | 129,496 | | |

| Roper Industries, Inc. | | | 2,800 | | | | 132,888 | | |

| | | | | | | | 262,384 | | |

| Energy Equipment & Services (2.9%) | |

| Grant Prideco, Inc.* | | | 2,200 | | | | 112,640 | | |

| Halliburton Co. | | | 1,400 | | | | 109,410 | | |

| Weatherford International, Ltd.* | | | 1,300 | | | | 68,809 | | |

| | | | | | | | 290,859 | | |

| Food & Drug Retailing (1.6%) | |

| CVS Corp. | | | 5,200 | | | | 154,544 | | |

| Food Products (0.9%) | |

| Wm. Wrigley Jr. Co. | | | 1,500 | | | | 70,605 | | |

| Wm. Wrigley Jr. Co. Class B | | | 375 | | | | 17,663 | | |

| | | | | | | | 88,268 | | |

| Healthcare Equipment & Supplies (3.9%) | |

| Dade Behring Holdings, Inc. | | | 2,800 | | | | 109,200 | | |

| Hologic, Inc.* | | | 1,300 | | | | 61,971 | | |

| IMS Health, Inc. | | | 2,600 | | | | 70,668 | | |

| St. Jude Medical, Inc.* | | | 3,800 | | | | 150,024 | | |

| | | | | | | | 391,863 | | |

| Healthcare Providers & Services (1.7%) | |

| Aetna, Inc. | | | 2,100 | | | | 80,850 | | |

| Omnicare, Inc. | | | 1,600 | | | | 90,736 | | |

| | | | | | | | 171,586 | | |

| Hotels, Restaurants & Leisure (4.4%) | |

| Cheesecake Factory, Inc.* | | | 1,300 | | | | 41,028 | | |

| Harrah's Entertainment, Inc. | | | 1,800 | | | | 146,952 | | |

| Penn National Gaming, Inc.* | | | 2,800 | | | | 114,016 | | |

| Starbucks Corp.* | | | 3,800 | | | | 141,626 | | |

| | | | | | | | 443,622 | | |

| Household Products (1.9%) | |

| Procter & Gamble Co. | | | 3,300 | | | | 192,093 | | |

| Industrial Conglomerates (0.8%) | |

| 3M Co. | | | 900 | | | | 76,887 | | |

| Insurance (1.5%) | |

| Genworth Financial, Inc. Class A | | | 4,500 | | | | 149,400 | | |

| Internet & Catalog Retail (1.2%) | |

| eBay, Inc.* | | | 3,400 | | | | 116,994 | | |

See Accompanying Notes to Financial Statements.

35

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Internet Software & Services (2.0%) | |

| Google, Inc. Class A* | | | 300 | | | $ | 125,382 | | |

| Yahoo!, Inc.* | | | 2,400 | | | | 78,672 | | |

| | | | | | | | 204,054 | | |

| IT Consulting & Services (2.2%) | |

| CACI International, Inc. Class A* | | | 1,800 | | | | 112,572 | | |

| NAVTEQ Corp.* | | | 2,600 | | | | 107,952 | | |

| | | | | | | | 220,524 | | |

| Machinery (1.4%) | |

| Deere & Co. | | | 1,600 | | | | 140,448 | | |

| Media (1.5%) | |

| Univision Communications, Inc. Class A* | | | 4,100 | | | | 146,329 | | |

| Multiline Retail (1.6%) | |

| Kohl's Corp.* | | | 2,900 | | | | 161,936 | | |

| Oil & Gas (2.4%) | |

| Hugoton Royalty Trust | | | 221 | | | | 6,097 | | |

| Newfield Exploration Co.* | | | 1,700 | | | | 75,820 | | |

| XTO Energy, Inc. | | | 3,700 | | | | 156,695 | | |

| | | | | | | | 238,612 | | |

| Pharmaceuticals (5.1%) | |

| Barr Pharmaceuticals, Inc.* | | | 2,000 | | | | 121,100 | | |

| Forest Laboratories, Inc.* | | | 3,500 | | | | 141,330 | | |

| Medco Health Solutions, Inc.* | | | 1,900 | | | | 101,137 | | |

| Wyeth | | | 3,000 | | | | 146,010 | | |

| | | | | | | | 509,577 | | |

| Semiconductor Equipment & Products (1.1%) | |

| Applied Materials, Inc. | | | 2,400 | | | | 43,080 | | |

| Maxim Integrated Products, Inc. | | | 2,000 | | | | 70,520 | | |

| | | | | | | | 113,600 | | |

| Software (7.1%) | |

| Adobe Systems, Inc.* | | | 5,130 | | | | 201,096 | | |

| Autodesk, Inc.* | | | 1,700 | | | | 71,468 | | |

| Electronic Arts, Inc.* | | | 1,900 | | | | 107,920 | | |

| Microsoft Corp. | | | 9,900 | | | | 239,085 | | |

| Red Hat, Inc.*§ | | | 3,100 | | | | 91,109 | | |

| | | | | | | | 710,678 | | |

| Specialty Retail (2.2%) | |

| Best Buy Company, Inc. | | | 1,150 | | | | 65,159 | | |

| Home Depot, Inc. | | | 3,800 | | | | 151,734 | | |

| | | | | | | | 216,893 | | |

See Accompanying Notes to Financial Statements.

36

Credit Suisse Institutional Fund, Inc. — Capital Appreciation Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Tobacco (0.9%) | |

| Altria Group, Inc. | | | 1,200 | | | $ | 87,792 | | |

| Wireless Telecommunication Services (2.4%) | |

| American Tower Corp. Class A* | | | 5,500 | | | | 187,770 | | |

| NII Holdings, Inc.* | | | 800 | | | | 47,920 | | |

| | | | | | | | 235,690 | | |

| TOTAL COMMON STOCKS (Cost $7,645,116) | | | | | | | 8,971,249 | | |

| SHORT-TERM INVESTMENTS (6.0%) | |

| State Street Navigator Prime Portfolio§§ | | | 75,000 | | | | 75,000 | | |

| | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 5/01/06 | | $ | 520 | | | | 520,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $595,000) | | | | | | | 595,000 | | |

| TOTAL INVESTMENTS AT VALUE (95.8%) (Cost $8,240,116) | | | | | | | 9,566,249 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (4.2%) | | | | | | | 421,727 | | |

| NET ASSETS (100.0%) | | | | | | $ | 9,987,976 | | |

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

37

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Schedule of Investments

April 30, 2006 (unaudited)

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (16.9%) | | | |

| Aerospace & Defense (0.7%) | | | |

| $ | 65 | | | Goodrich Corp., Notes | | (BBB- , Baa3) | | 04/15/08 | | | 7.500 | | | $ | 67,325 | | |

| Banks (1.3%) | | | |

| | 40 | | | Bank of America Corp., Global Notes | | (AA- , Aa2) | | 10/01/10 | | | 4.250 | | | | 38,145 | | |

| | 25 | | | Bank of America Corp., Rule 144A,

Company Guaranteed Notes

(Callable 12/31/06 @ $104.04)‡ | | (A , Aa3) | | 12/31/26 | | | 8.070 | | | | 26,364 | | |

| | 25 | | | Bank of New York Company, Inc.,

Senior Subordinated Notes

(Callable 03/15/08 @ $100.00)# | | (A , A1) | | 03/15/13 | | | 3.400 | | | | 24,059 | | |

| | 40 | | | USB Capital IX, Company Guaranteed Notes

(Callable 04/15/11 @ $100.00)# | | (A , A1) | | 04/15/42 | | | 6.189 | | | | 39,568 | | |

| | | | | | | | | | | | 128,136 | | |

| Commercial Services (1.5%) | | | |

| | 45 | | | Cendant Corp., Units | | (BBB+ , Baa1) | | 08/17/06 | | | 4.890 | | | | 44,819 | | |

| | 15 | | | Erac USA Finance Co., Rule 144A, Notes‡ | | (BBB+ , Baa1) | | 05/15/06 | | | 6.625 | | | | 15,005 | | |

| | 90 | | | Steelcase, Inc., Global Senior Notes | | (BBB- , Ba1) | | 11/15/06 | | | 6.375 | | | | 89,838 | | |

| | | | | | | | | | | | 149,662 | | |

| Diversified Financials (5.4%) | | | |

| | 45 | | | Ameriprise Financial, Inc., Senior Unsecured Notes | | (A- , A3) | | 11/15/10 | | | 5.350 | | | | 44,473 | | |

| | 50 | | | Citigroup, Inc., Global Subordinated Notes | | (A+ , Aa2) | | 09/15/14 | | | 5.000 | | | | 47,435 | | |

| | 70 | | | General Electric Capital Corp., Series MTNA,

Global Notes | | (AAA , Aaa) | | 06/15/12 | | | 6.000 | | | | 71,672 | | |

| | 20 | | | General Motors Acceptance Corp., Global Notes | | (BB , Ba1) | | 05/15/09 | | | 5.625 | | | | 18,747 | | |

| | 35 | | | Goldman Sachs Group, Inc., Global Notes | | (A+ , Aa3) | | 01/15/15 | | | 5.125 | | | | 33,157 | | |

| | 15 | | | JPMorgan Chase & Co., Global Notes§ | | (A+ , Aa3) | | 03/01/15 | | | 4.750 | | | | 13,957 | | |

| | 60 | | | Morgan Stanley, Global Subordinated Notes | | (A , A1) | | 04/01/14 | | | 4.750 | | | | 55,578 | | |

| | 65 | | | OMX Timber Finance Investment LLC,

Rule 144A, Company Guaranteed Notes

(Callable 10/31/19 @ $100.00)‡# | | (A+ , Aa3) | | 01/29/20 | | | 5.420 | | | | 60,997 | | |

| | 30 | | | Residential Capital Corp.,

Company Guaranteed Notes | | (BBB- , Baa3) | | 11/21/08 | | | 6.125 | | | | 29,888 | | |

| | 52 | | | Residential Capital Corp., Company

Guaranteed Notes | | (BBB- , Baa3) | | 02/22/11 | | | 6.000 | | | | 50,988 | | |

| | 60 | | | SLM Corp., Series MTNA, Global Notes | | (A , A2) | | 01/15/09 | | | 4.000 | | | | 57,721 | | |

| | 55 | | | Wachovia Capital Trust III, Bank Guaranteed

Notes (Callable 03/15/11 @ $100.00)# | | (A- , A2) | | 03/15/42 | | | 5.800 | | | | 53,977 | | |

| | | | | | | | | | | | 538,590 | | |

| Electric (1.3%) | | | |

| | 17 | | | American Electric Power Company, Inc.,

Series A, Global Notes | | (BBB , Baa2) | | 05/15/06 | | | 6.125 | | | | 17,005 | | |

| | 15 | | | Dominion Resources, Inc., Series A, Notes | | (BBB+ , Baa1) | | 11/15/06 | | | 3.660 | | | | 14,863 | | |

| | 25 | | | FPL Group Capital, Inc., Notes§ | | (A- , A2) | | 02/16/07 | | | 4.086 | | | | 24,757 | | |

| | 25 | | | PacifiCorp, First Mortgage Notes§ | | (A- , A3) | | 11/15/11 | | | 6.900 | | | | 26,580 | | |

| | 50 | | | TXU Corp., Global Senior Notes | | (BB+ , Ba1) | | 11/15/14 | | | 5.550 | | | | 46,714 | | |

| | | | | | | | | | | | 129,919 | | |

See Accompanying Notes to Financial Statements.

38

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS | | | |

| Healthcare-Services (0.2%) | | | |

| $ | 20 | | | WellPoint, Inc., Global Unsecured Notes§ | | (BBB+ , Baa1) | | 01/15/11 | | | 5.000 | | | $ | 19,504 | | |

| Insurance (1.4%) | | | |

| | 40 | | | American International Group, Inc.,

Global Notes§# | | (AA , Aa) | | 05/15/13 | | | 4.250 | | | | 36,675 | | |

| | 50 | | | Berkshire Hathaway Finance Corp.,

Global Company Guaranteed Notes | | (AAA , Aaa) | | 01/15/10 | | | 4.125 | | | | 47,763 | | |

| | 40 | | | Nationwide Mutual Insurance Co., Rule 144A,

Bonds (Callable 04/15/14 @ $100.00)‡ | | (A- , A2) | | 04/15/34 | | | 6.600 | | | | 37,605 | | |

| | 20 | | | Progressive Corp., Senior Notes | | (A+ , A1) | | 12/01/32 | | | 6.250 | | | | 19,883 | | |

| | | | | | | | | | | | 141,926 | | |

| Investment Company (0.3%) | | | |

| | 25 | | | Frank Russell Co., Rule 144A,

Company Guaranteed Notes‡ | | (AAA , Aa1) | | 01/15/09 | | | 5.625 | | | | 25,189 | | |

| Media (1.0%) | | | |

| | 16 | | | Comcast Cable Communications Holdings, Inc.,

Global Company Guaranteed Notes | | (BBB+ , Baa2) | | 03/15/13 | | | 8.375 | | | | 17,935 | | |

| | 30 | | | Comcast Corp., Company Guaranteed Notes | | (BBB+ , Baa2) | | 06/15/16 | | | 4.950 | | | | 27,202 | | |

| | 30 | | | Cox Communications, Inc., Global Notes | | (BBB- , Baa3) | | 12/15/14 | | | 5.450 | | | | 28,446 | | |

| | 10 | | | Time Warner, Inc., Global Company

Guaranteed Notes | | (BBB+ , Baa2) | | 05/01/32 | | | 7.700 | | | | 10,961 | | |

| | 15 | | | Viacom, Inc., Rule 144A, Senior Notes‡ | | (BBB , Baa3) | | 04/30/11 | | | 5.750 | | | | 14,912 | | |

| | | | | | | | | | | | 99,456 | | |

| Oil & Gas (1.4%) | | | |

| | 35 | | | Amerada Hess Corp., Notes | | (BBB- , Ba1) | | 08/15/31 | | | 7.300 | | | | 38,148 | | |

| | 50 | | | Enterprise Products Operating LP, Series B,

Global Senior Notes | | (BB+ , Baa3) | | 10/15/34 | | | 6.650 | | | | 48,722 | | |

| | 25 | | | Pemex Project Funding Master Trust,

Rule 144A, Company Guaranteed Notes‡# | | (BBB , Baa1) | | 06/15/10 | | | 6.210 | | | | 25,687 | | |

| | 25 | | | XTO Energy, Inc., Notes | | (BBB- , Baa3) | | 06/30/15 | | | 5.300 | | | | 23,855 | | |

| | | | | | | | | | | | 136,412 | | |

| Pharmaceuticals (0.2%) | | | |

| | 25 | | | Bristol-Myers Squibb Co., Notes§ | | (A+ , A1) | | 08/15/13 | | | 5.250 | | | | 24,322 | | |

| Real Estate (0.3%) | | | |

| | 30 | | | EOP Operating LP, Notes§ | | (BBB+ , Baa2) | | 10/01/10 | | | 4.650 | | | | 28,788 | | |

| Retail (0.1%) | | | |

| | 15 | | | Home Depot, Inc.,

Global Senior Unsecured Notes | | (AA , Aa3) | | 03/01/16 | | | 5.400 | | | | 14,637 | | |

| Telecommunications (1.8%) | | | |

| | 25 | | | AT&T, Inc., Global Notes | | (A , A2) | | 09/15/34 | | | 6.150 | | | | 23,624 | | |

| | 20 | | | Motorola, Inc., Notes | | (BBB+ , Baa2) | | 11/16/07 | | | 4.608 | | | | 19,784 | | |

| | 20 | | | Nextel Communications, Inc.,

Series E, Senior Notes | | (A- , Baa2) | | 10/31/13 | | | 6.875 | | | | 20,551 | | |

See Accompanying Notes to Financial Statements.

39

Credit Suisse Institutional Fund, Inc. — Investment Grade Fixed Income Portfolio

Schedule of Investments (continued)

April 30, 2006 (unaudited)

Par

(000) | |

| | Ratings†