UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06670 |

|

CREDIT SUISSE INSTITUTIONAL FUND, INC. |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq. Credit Suisse Institutional Fund, Inc. Eleven Madison Avenue New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2007 to April 30, 2008 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE

INSTITUTIONAL FUND

Semiannual Report

April 30, 2008

(unaudited)

CREDIT SUISSE INSTITUTIONAL FUND, INC.

n INTERNATIONAL FOCUS PORTFOLIO

The Portfolio's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, is provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Institutional Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Institutional Fund is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and Portfolio holdings described in this document are as of April 30, 2008; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report

April 30, 2008 (unaudited)

June 13, 2008

Dear Shareholder:

For the six-month period ended April 30, 2008, Credit Suisse Institutional Fund, Inc. — International Focus Portfolio1 had a loss of -7.82% versus a decrease of -9.21% for the Morgan Stanley Capital International EAFE Index (net dividends).2

Market Review: The credit crisis puts all markets under pressure

For the semiannual period ended April 30, 2008, international equity markets came under substantial pressure. The main drivers of negative equity market performance were the sub-prime mortgage crisis and the subsequent credit crisis it created. Banks and diversified financials underperformed, particularly investment banks as they are specifically exposed to the crisis as a group.

Prices in raw materials increased substantially over the period. The price of oil (West Texas Intermediate) rose from around $95 per barrel on November 1, 2007 to around $115 per barrel on April 30, 2008, after having reached nearly $120 per barrel. Soft commodities, like rice and wheat, also increased significantly. Overall, the general level of price increases contributed to increased inflation rates in most major economies around the world.

Additionally, the United States Federal Reserve cut interest rates aggressively during the period in an effort to alleviate the effects of the credit crunch and to stimulate slowing economic growth.

Portfolio Review and Outlook: Inflation is the major issue facing banks

Positive contributors to performance included our overweight position (against the index) in energy, as well as stock selection in telecommunications services and banks.

There are a number of themes in the portfolio currently. We are maintaining our overweight to the energy sector. Within energy, we prefer upstream exploration and development and oil services over integrated oil companies because we believe that the integrated oil companies are struggling in the current environment. Consider that they are having difficulty accessing resources as national oil companies become more powerful, and they are also facing substantially increased costs for developing resources.

Additionally, we believe that dealing with inflation is the major issue facing most central banks around the world at the moment as we expect the increases in the price of commodities (both "hard" and "soft") to continue feeding inflation.

1

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

In our opinion, on balance, equities will be a beneficiary of the increased inflation as they are one of the best hedges against inflation. Additionally, we believe that international equity markets are attractively valued, and feel there are many attractive investment opportunities available to us at the moment.

Conversely, we do believe that there is a risk of further economic slowdown for several reasons. First, we believe that the credit crunch has severely impacted banks' ability to lend, and a slowdown in bank lending (to both consumers and corporations) will be detrimental to the economy. Further, we believe that central banks around the world will have to raise interest rates to stave off inflation, and the impact of these increased interest rates will be slower economic growth.

The Credit Suisse International Equity Team

Neil Gregson

Tom Mann

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. The Portfolio's fifteen largest holdings may account for 40% or more of the Portfolio's assets. As a result of this strategy, the Portfolio may be subject to greater volatility than a portfolio that invests in a larger number of issuers.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

2

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Average Annual Returns as of March 31, 20081

| 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| | 4.25 | % | | | 20.17 | % | | | 5.36 | % | | | 8.45 | % | | | 09/01/92 | | |

Average Annual Returns as of April 30, 20081

| 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| | 3.61 | % | | | 18.84 | % | | | 5.58 | % | | | 8.71 | % | | | 09/01/92 | | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Morgan Stanley Capital International EAFE Index Net Dividends (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada. It is the exclusive property of Morgan Stanley Capital International, Inc. Investors cannot invest directly in an index.

3

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2008.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

4

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2008

| Actual Portfolio Return | |

| Beginning Account Value 11/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 04/30/08 | | $ | 921.80 | | |

| Expenses Paid per $1,000* | | $ | 4.54 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 04/30/08 | | $ | 1,020.14 | | |

| Expenses Paid per $1,000* | | $ | 4.77 | | |

| Annualized Expense Ratios* | | | 0.95 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 366.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

5

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

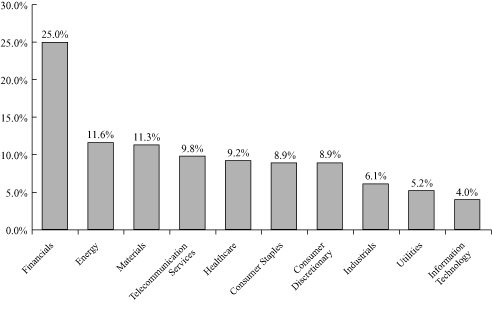

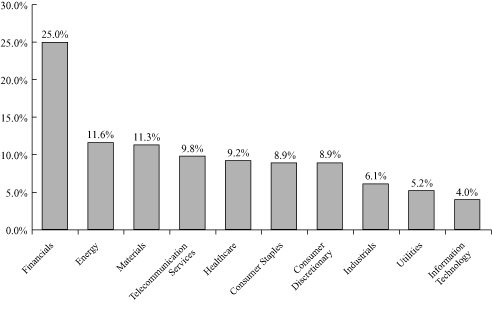

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

6

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments

April 30, 2008 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (97.5%) | |

| Belgium (1.5%) | |

| Metals & Mining (1.5%) | |

| Umicore* | | | 6,431 | | | $ | 340,863 | | |

| TOTAL BELGIUM | | | 340,863 | | |

| Bermuda (0.5%) | |

| Real Estate (0.5%) | |

| Hiscox Ltd. | | | 23,937 | | | | 120,425 | | |

| TOTAL BERMUDA | | | 120,425 | | |

| Brazil (1.7%) | |

| Oil & Gas (1.7%) | |

| Petroleo Brasileiro SA - Petrobras ADR | | | 3,670 | | | | 371,037 | | |

| TOTAL BRAZIL | | | 371,037 | | |

| Denmark (1.9%) | |

| Pharmaceuticals (1.9%) | |

| Novo Nordisk AS Series B | | | 6,062 | | | | 413,513 | | |

| TOTAL DENMARK | | | 413,513 | | |

| France (12.5%) | |

| Banks (3.0%) | |

| BNP Paribas§ | | | 3,259 | | | | 346,412 | | |

| Societe Generale§ | | | 2,838 | | | | 328,715 | | |

| | | | 675,127 | | |

| Beverages (1.5%) | |

| Pernod Ricard SA§ | | | 2,917 | | | | 332,601 | | |

| Insurance (1.1%) | |

| Axa§ | | | 6,480 | | | | 238,724 | | |

| Media (0.9%) | |

| Vivendi SA*§ | | | 5,165 | | | | 207,633 | | |

| Metals & Mining (1.6%) | |

| Vallourec SA§ | | | 1,330 | | | | 359,530 | | |

| Oil & Gas (1.0%) | |

| Total SA | | | 2,846 | | | | 237,703 | | |

| Pharmaceuticals (1.0%) | |

| Sanofi-Aventis | | | 2,846 | | | | 218,733 | | |

| Real Estate (1.1%) | |

| Unibail-Rodamco | | | 936 | | | | 239,687 | | |

| Textiles & Apparel (1.3%) | |

| LVMH Moet Hennessy Louis Vuitton SA | | | 2,524 | | | | 285,639 | | |

| TOTAL FRANCE | | | 2,795,377 | | |

See Accompanying Notes to Financial Statements.

7

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2008 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Germany (9.8%) | |

| Automotive (1.0%) | |

| Bayerische Motoren Werke AG§ | | | 4,090 | | | $ | 222,322 | | |

| Banks (1.4%) | |

| Deutsche Bank AG | | | 2,619 | | | | 311,385 | | |

| Chemicals (1.0%) | |

| K+S AG* | | | 508 | | | | 209,105 | | |

| Electric Utilities (2.9%) | |

| E.ON AG§ | | | 3,192 | | | | 645,596 | | |

| Electrical Equipment (1.3%) | |

| Norddeutsche Affinerie AG§ | | | 6,986 | | | | 292,528 | | |

| Multi-Utilities (2.2%) | |

| RWE AG§ | | | 4,321 | | | | 495,462 | | |

| TOTAL GERMANY | | | 2,176,398 | | |

| Greece (0.8%) | |

| Diversified Telecommunication Services (0.8%) | |

| Hellenic Telecommunications Organization SA | | | 6,021 | | | | 177,962 | | |

| TOTAL GREECE | | | 177,962 | | |

| India (2.2%) | |

| Diversified Telecommunication Services (2.2%) | |

| Bharti Airtel, Ltd.* | | | 21,824 | | | | 484,253 | | |

| TOTAL INDIA | | | 484,253 | | |

| Israel (2.0%) | |

| Pharmaceuticals (2.0%) | |

| Teva Pharmaceutical Industries, Ltd. ADR | | | 9,418 | | | | 440,574 | | |

| TOTAL ISRAEL | | | 440,574 | | |

| Italy (3.6%) | |

| Automotive (0.8%) | |

| Fiat SpA | | | 8,047 | | | | 178,360 | | |

| Banks (2.8%) | |

| Intesa Sanpaolo | | | 69,116 | | | | 512,303 | | |

| UniCredito Italiano SpA | | | 14,384 | | | | 108,090 | | |

| | | | 620,393 | | |

| TOTAL ITALY | | | 798,753 | | |

| Japan (14.2%) | |

| Automobiles (1.2%) | |

| Toyota Motor Corp. | | | 5,088 | | | | 257,991 | | |

| Banks (2.6%) | |

| Mitsubishi UFJ Financial Group, Inc. | | | 21,800 | | | | 239,007 | | |

| Mizuho Financial Group, Inc. | | | 66 | | | | 341,749 | | |

| | | | 580,756 | | |

See Accompanying Notes to Financial Statements.

8

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2008 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Japan | |

| Chemicals (1.9%) | |

| Shin-Etsu Chemical Company, Ltd. | | | 6,677 | | | $ | 411,364 | | |

| Diversified Financials (1.6%) | |

| Daiwa Securities Group, Inc. | | | 36,798 | | | | 363,259 | | |

| Electronic Equipment & Instruments (1.3%) | |

| Omron Corp. | | | 14,160 | | | | 294,861 | | |

| Household Products (2.0%) | |

| Uni-Charm Corp. | | | 6,410 | | | | 444,318 | | |

| Machinery (1.7%) | |

| Komatsu, Ltd. | | | 12,830 | | | | 388,505 | | |

| Specialty Retail (1.9%) | |

| Yamada Denki Company, Ltd.§ | | | 5,019 | | | | 428,737 | | |

| TOTAL JAPAN | | | 3,169,791 | | |

| Mexico (2.0%) | |

| Wireless Telecommunication Services (2.0%) | |

| America Movil SAB de CV ADR Series L | | | 7,862 | | | | 455,682 | | |

| TOTAL MEXICO | | | 455,682 | | |

| Netherlands (8.5%) | |

| Chemicals (1.3%) | |

| Koninklijke DSM NV§ | | | 5,293 | | | | 283,263 | | |

| Energy Equipment & Services (1.7%) | |

| Fugro NV | | | 4,278 | | | | 379,098 | | |

| Food Products (0.1%) | |

| Koninklijke Numico NV | | | 177 | | | | 15,129 | | |

| Household Durables (1.5%) | |

| Koninklijke (Royal) Philips Electronics NV§ | | | 9,153 | | | | 343,042 | | |

| IT Consulting & Services (2.6%) | |

| Exact Holding NV§ | | | 8,861 | | | | 300,150 | | |

| Ordina NV | | | 16,438 | | | | 270,293 | | |

| | | | 570,443 | | |

| Transportation Infrastructure (1.3%) | |

| Smit International NV | | | 2,599 | | | | 300,221 | | |

| TOTAL NETHERLANDS | | | 1,891,196 | | |

| Norway (6.4%) | |

| Banks (1.8%) | |

| DNB NOR ASA*§ | | | 27,162 | | | | 401,573 | | |

| Construction & Engineering (1.6%) | |

| Aker Kvaerner ASA§ | | | 14,031 | | | | 352,873 | | |

| Energy Equipment & Services (1.3%) | |

| Sevan Marine ASA*§ | | | 21,305 | | | | 297,253 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2008 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Norway | |

| Oil & Gas (1.7%) | |

| DNO ASA*§ | | | 197,238 | | | $ | 369,465 | | |

| TOTAL NORWAY | | | 1,421,164 | | |

| Singapore (2.2%) | |

| Banks (2.2%) | |

| United Overseas Bank, Ltd. | | | 32,340 | | | | 485,473 | | |

| TOTAL SINGAPORE | | | 485,473 | | |

| Spain (3.3%) | |

| Banks (1.9%) | |

| Banco Santander SA | | | 19,732 | | | | 425,483 | | |

| Diversified Telecommunication Services (1.4%) | |

| Telefonica SA | | | 11,074 | | | | 317,283 | | |

| TOTAL SPAIN | | | 742,766 | | |

| Switzerland (2.7%) | |

| Banks (1.1%) | |

| UBS AG* | | | 7,336 | | | | 241,505 | | |

| Pharmaceuticals (1.6%) | |

| Novartis AG | | | 7,242 | | | | 363,142 | | |

| TOTAL SWITZERLAND | | | 604,647 | | |

| Taiwan (1.6%) | |

| Diversified Telecommunication Services (1.6%) | |

| Chunghwa Telecom Company, Ltd. ADR | | | 13,875 | | | | 353,951 | | |

| TOTAL TAIWAN | | | 353,951 | | |

| United Kingdom (20.1%) | |

| Banks (2.6%) | |

| Barclays PLC | | | 11,791 | | | | 106,197 | | |

| HSBC Holdings PLC§ | | | 19,488 | | | | 337,428 | | |

| Royal Bank of Scotland Group PLC | | | 21,147 | | | | 142,572 | | |

| | | | 586,197 | | |

| Beverages (1.7%) | |

| SABMiller PLC | | | 16,498 | | | | 379,022 | | |

| Food & Drug Retailing (1.5%) | |

| Tesco PLC | | | 40,909 | | | | 345,129 | | |

| Insurance (0.6%) | |

| Chaucer Holdings PLC | | | 69,167 | | | | 122,299 | | |

| Metals & Mining (3.9%) | |

| Anglo American PLC | | | 4,587 | | | | 295,352 | | |

| Antofagasta PLC | | | 19,497 | | | | 306,560 | | |

| Johnson Matthey PLC | | | 6,595 | | | | 260,052 | | |

| | | | 861,964 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

April 30, 2008 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| United Kingdom | |

| Oil & Gas (3.9%) | |

| BG Group PLC | | | 15,114 | | | $ | 367,421 | | |

| BP PLC | | | 20,961 | | | | 253,008 | | |

| Royal Dutch Shell PLC Class A§ | | | 6,289 | | | | 251,770 | | |

| | | | 872,199 | | |

| Pharmaceuticals (2.5%) | |

| AstraZeneca PLC | | | 4,498 | | | | 187,962 | | |

| GlaxoSmithKline PLC | | | 16,751 | | | | 369,106 | | |

| | | | 557,068 | | |

| Tobacco (1.9%) | |

| Imperial Tobacco Group PLC | | | 8,842 | | | | 421,784 | | |

| Wireless Telecommunication Services (1.5%) | |

| Vodafone Group PLC | | | 107,913 | | | | 340,176 | | |

| TOTAL UNITED KINGDOM | | | 4,485,838 | | |

| TOTAL COMMON STOCKS (Cost $17,281,247) | | | 21,729,663 | | |

| RIGHTS (0.1%) | |

| Switzerland (0.1%) | |

| Banks (0.1%) | |

| UBS AG* (Cost $10,106) | | | 7,336 | | | | 12,326 | | |

| SHORT-TERM INVESTMENT (17.1%) | |

| State Street Navigator Prime Portfolio§§ (Cost $3,824,075) | | | 3,824,075 | | | | 3,824,075 | | |

| TOTAL INVESTMENTS AT VALUE (114.7%) (Cost $21,115,428) | | | 25,566,064 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-14.7%) | | | (3,280,095 | ) | |

| NET ASSETS (100.0%) | | $ | 22,285,969 | | |

INVESTMENT ABBREVIATION

ADR = American Depositary Receipt

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

11

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statement of Assets and Liabilities

April 30, 2008 (unaudited)

| Assets | |

Investments at value, including collateral for securities on loan of $3,824,075

(Cost $21,115,428) (Note 2) | | $ | 25,566,0641 | | |

| Foreign currency at value (cost $351,938) (Note 2) | | | 356,058 | | |

| Receivable for investments sold | | | 207,158 | | |

| Dividends receivable | | | 66,363 | | |

| Prepaid expenses and other assets | | | 5,103 | | |

| Total Assets | | | 26,200,746 | | |

| Liabilities | |

| Advisory fee payable (Note 3) | | | 11,028 | | |

| Administrative services fee payable (Note 3) | | | 3,180 | | |

| Payable upon return of securities loaned (Note 2) | | | 3,824,075 | | |

| Directors' fee payable | | | 11,873 | | |

| Due to custodian | | | 5,154 | | |

| Other accrued expenses payable | | | 59,467 | | |

| Total Liabilities | | | 3,914,777 | | |

| Net Assets | |

| Capital stock, $.001 par value (Note 6) | | | 1,457 | | |

| Paid-in capital (Note 6) | | | 154,487,398 | | |

| Undistributed net investment income | | | 171,810 | | |

| Accumulated net realized loss on investments and foreign currency transactions | | | (136,829,105 | ) | |

| Net unrealized appreciation from investments and foreign currency translations | | | 4,454,409 | | |

| Net Assets | | $ | 22,285,969 | | |

| Shares outstanding | | | 1,456,785 | | |

| Net asset value, offering price, and redemption price per share | | $ | 15.30 | | |

1 Including $3,632,497 of securities on loan.

See Accompanying Notes to Financial Statements.

12

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statement of Operations

For the Six Months Ended April 30, 2008 (unaudited)

| Investment Income (Note 2) | |

| Dividends | | $ | 277,960 | | |

| Interest | | | 7,493 | | |

| Securities lending | | | 15,727 | | |

| Foreign taxes withheld | | | (22,618 | ) | |

| Total investment income | | | 278,562 | | |

| Expenses | |

| Investment advisory fees (Note 3) | | | 87,725 | | |

| Administrative services fees (Note 3) | | | 3,180 | | |

| Printing fees (Note 3) | | | 31,242 | | |

| Registration fees | | | 20,049 | | |

| Audit and tax fees | | | 13,213 | | |

| Directors' fees | | | 12,203 | | |

| Custodian fees | | | 10,920 | | |

| Legal fees | | | 3,696 | | |

| Transfer agent fees | | | 816 | | |

| Insurance expense | | | 290 | | |

| Commitment fees (Note 4) | | | 64 | | |

| Miscellaneous expense | | | 8,308 | | |

| Total expenses | | | 191,706 | | |

| Less: fees waived (Note 3) | | | (87,533 | ) | |

| Net expenses | | | 104,173 | | |

| Net investment income | | | 174,389 | | |

| Net Realized and Unrealized Gain (Loss) from Investments and Foreign Currency Related Items | |

| Net realized gain from investments | | | 931,353 | | |

| Net realized gain from foreign currency transactions | | | 11,549 | | |

| Net change in unrealized appreciation (depreciation) from investments | | | (3,030,037 | ) | |

| Net change in unrealized appreciation (depreciation) from foreign currency translations | | | 23 | | |

| Net realized and unrealized loss from investments and foreign currency related items | | | (2,087,112 | ) | |

| Net decrease in net assets resulting from operations | | $ | (1,912,723 | ) | |

See Accompanying Notes to Financial Statements.

13

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statements of Changes in Net Assets

| | | For the Six Months

Ended

April 30, 2008

(unaudited) | | For the Year

Ended

October 31, 2007 | |

| From Operations | |

| Net investment income | | $ | 174,389 | | | $ | 489,423 | | |

| Net realized gain from investments and foreign currency transactions | | | 942,902 | | | | 7,086,494 | | |

Net change in unrealized appreciation (depreciation)

from investments and foreign currency translations | | | (3,030,014 | ) | | | (1,009,102 | ) | |

| Net increase (decrease) in net assets resulting from operations | | | (1,912,723 | ) | | | 6,566,815 | | |

| From Dividends | |

| Dividends from net investment income | | | (479,081 | ) | | | (435,704 | ) | |

| From Capital Share Transactions (Note 6) | |

| Proceeds from sale of shares | | | 24,852 | | | | 265,757 | | |

| Reinvestment of dividends | | | 473,899 | | | | 356,087 | | |

| Net asset value of shares redeemed | | | (157,545 | ) | | | (12,622,705 | ) | |

| Net increase (decrease) in net assets from capital share transactions | | | 341,206 | | | | (12,000,861 | ) | |

| Net decrease in net assets | | | (2,050,598 | ) | | | (5,869,750 | ) | |

| Net Assets | |

| Beginning of period | | | 24,336,567 | | | | 30,206,317 | | |

| End of period | | $ | 22,285,969 | | | $ | 24,336,567 | | |

| Undistributed net investment income | | $ | 171,810 | | | $ | 476,502 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Financial Highlights

(For a Share of the Portfolio Outstanding Throughout Each Period)

| | | For the Six

Months Ended

April 30, 2008 | | For the Year Ended October 31, | |

| | | (unaudited) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per share data | |

| Net asset value, beginning of period | | $ | 16.95 | | | $ | 13.58 | | | $ | 11.32 | | | $ | 9.73 | | | $ | 8.92 | | | $ | 7.19 | | |

| INVESTMENT OPERATIONS | |

| Net investment income1 | | | 0.12 | | | | 0.26 | | | | 0.19 | | | | 0.16 | | | | 0.13 | | | | 0.09 | | |

Net gain (loss) on investments and

foreign currency related items

(both realized and unrealized) | | | (1.44 | ) | | | 3.31 | | | | 2.33 | | | | 1.75 | | | | 0.97 | | | | 1.69 | | |

| Total from investment operations | | | (1.32 | ) | | | 3.57 | | | | 2.52 | | | | 1.91 | | | | 1.10 | | | | 1.78 | | |

| LESS DIVIDENDS AND DISTRIBUTIONS | |

| Dividends from net investment income | | | (0.33 | ) | | | (0.20 | ) | | | (0.26 | ) | | | (0.32 | ) | | | (0.05 | ) | | | (0.05 | ) | |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.24 | ) | | | — | | |

| Total dividends and distributions | | | (0.33 | ) | | | (0.20 | ) | | | (0.26 | ) | | | (0.32 | ) | | | (0.29 | ) | | | (0.05 | ) | |

| Net asset value, end of period | | $ | 15.30 | | | $ | 16.95 | | | $ | 13.58 | | | $ | 11.32 | | | $ | 9.73 | | | $ | 8.92 | | |

| Total return2 | | | (7.82 | )% | | | 26.56 | % | | | 22.55 | % | | | 19.95 | % | | | 12.50 | % | | | 24.90 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (000s omitted) | | $ | 22,286 | | | $ | 24,337 | | | $ | 30,206 | | | $ | 28,661 | | | $ | 55,190 | | | $ | 161,971 | | |

| Ratio of expenses to average net assets | | | 0.95 | %3 | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | |

Ratio of net investment income

to average net assets | | | 1.59 | %3 | | | 1.78 | % | | | 1.55 | % | | | 1.55 | % | | | 1.38 | % | | | 1.17 | % | |

Decrease reflected in above

operating expense ratios

due to waivers/reimbursements | | | 0.80 | %3 | | | 0.49 | % | | | 0.46 | % | | | 0.38 | % | | | 0.22 | % | | | 0.22 | % | |

| Portfolio turnover rate | | | 22 | % | | | 36 | % | | | 48 | % | | | 55 | % | | | 98 | % | | | 151 | % | |

1 Per share information is calculated using the average shares outstanding method.

2 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods less than one year are not annualized.

3 Annualized.

See Accompanying Notes to Financial Statements.

15

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements

April 30, 2008 (unaudited)

Note 1. Organization

The Credit Suisse Institutional Fund, Inc. (the "Fund"), is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers two managed investment funds, one of which, the International Focus Portfolio (the "Portfolio"), is contained in this report. The Portfolio is classified as diversified and has long-term capital appreciation as its investment objective. The Fund was incorporated under the laws of the State of Maryland on May 14, 1992.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Portfolio is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will matur e in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation. Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Portfolio's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. The Portfolio may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a portfolio to calculate its net asset value may differ from quoted or published prices for t he same securities.

B) FOREIGN CURRENCY TRANSACTIONS — The books and records of the Portfolio are maintained in U.S. dollars. Transactions denominated in foreign currencies are recorded at the current prevailing exchange rates. All assets and liabilities denominated in foreign currencies are translated into

16

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 2. Significant Accounting Policies

U.S. dollar amounts at the current exchange rate at the end of the period. Translation gains or losses resulting from changes in the exchange rate during the reporting period and realized gains and losses on the settlement of foreign currency transactions are reported in the results of operations for the current period. The Portfolio does not isolate that portion of realized gains and losses on investments in equity securities which is due to changes in the foreign exchange rate from that which is due to changes in market prices of equity securities. The Portfolio isolates that portion of realized gains and losses on investments in debt securiti es which is due to changes in the foreign exchange rate from that which is due to changes in market prices of debt securities.

C) SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes.

D) DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid at least annually. However, to the extent that a net realized capital gain can be reduced by a capital loss carryforward, such gain will not be distributed. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America ("GAAP").

E) FEDERAL INCOME TAXES — No provision is made for federal taxes as it is the Portfolio's intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies under the Internal Revenue Code of 1986, as amended, and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

F) USE OF ESTIMATES — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

G) SHORT-TERM INVESTMENTS — The Portfolio, together with other funds/portfolios, advised by Credit Suisse Asset Management, LLC ("Credit Suisse"), an indirect, wholly-owned subsidiary of Credit Suisse Group, pools

17

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 2. Significant Accounting Policies

available cash into either a short-term variable rate time deposit issued by State Street Bank and Trust Company ("SSB"), the Portfolio's custodian, or a money market fund advised by Credit Suisse. The short-term time deposit issued by SSB is a variable rate account classified as a short-term investment.

H) FORWARD FOREIGN CURRENCY CONTRACTS — The Portfolio may enter into forward foreign currency contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. Risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency. The Portfolio will enter into forward foreign currency contracts primarily for hedging purposes. Forward foreign currency contracts are adjusted by the daily forward exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the contract settlement date or an offsetting position is entered into. At April 30, 2008, the Portfolio had no open forward foreign currency contracts.

I) SECURITIES LENDING — Loans of securities are required at all times to be secured by collateral at least equal to 102% of the market value of domestic securities on loan (including any accrued interest thereon) and 105% of the market value of foreign securities on loan (including any accrued interest thereon). Cash collateral received by the Portfolio in connection with securities lending activity may be pooled together with cash collateral for other funds/portfolios advised by Credit Suisse and may be invested in a variety of investments, including certain Credit Suisse-advised funds, funds advised by SSB, the Fund's securities lending agent, or money market instruments. However, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

SSB has been engaged by the Portfolio to act as the Portfolio's securities lending agent. The Portfolio's securities lending arrangement provides that the Portfolio and SSB will share the net income earned from securities lending activities. During the six months ended April 30, 2008, total earnings from the Portfolio's investment in cash collateral received in connection with securities lending arrangements was $93,586 of which $73,177 was rebated to borrowers (brokers). The Portfolio retained $15,727 in income from the cash collateral investment and SSB, as lending agent, was paid $4,682. The Portfolio may also be entitled to certain minimum amounts of income from their securities lending activities. Securities lending income is accrued as earned.

18

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 2. Significant Accounting Policies

J) OTHER — The Portfolio may invest in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency risks (fluctuations in currency exchange rates), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks of investing in foreign securities include liquidity and valuation risks.

The Portfolio may be subject to taxes imposed by countries in which it invests with respect to its investments in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Portfolio accrues such taxes when the related income is earned or gains are realized.

Note 3. Transactions with Affiliates and Related Parties

Credit Suisse serves as investment adviser for the Portfolio. For its investment advisory services, Credit Suisse is entitled to receive a fee from the Portfolio at an annual rate of 0.80% of the Portfolio's average daily net assets. For the six months ended April 30, 2008, investment advisory fees earned and voluntarily waived were $87,725 and $87,533, respectively. Fee waivers and reimbursements are voluntary and may be discontinued by Credit Suisse at any time.

Credit Suisse Asset Management Limited ("Credit Suisse U.K.") and Credit Suisse Asset Management Limited ("Credit Suisse Australia"), each an affiliate of Credit Suisse, are sub-investment advisers to the Portfolio (the "Sub- Advisors"). Credit Suisse U.K.'s and Credit Suisse Australia's sub-investment advisory fees are paid by Credit Suisse out of Credit Suisse's net investment advisory fee and are not paid by the Portfolio.

Credit Suisse Asset Management Securities, Inc. ("CSAMSI"), an affiliate of Credit Suisse, and SSB serve as co-administrators to the Portfolio. No compensation is payable by the Fund to CSAMSI for co-administrative services.

For its co-administrative services, SSB receives a fee, exclusive of out-of-pocket expenses, calculated in total for all the Credit Suisse funds/portfolios co-administered by SSB and allocated based upon relative average net assets of each fund/portfolio, subject to an annual minimum fee. For the six months ended April 30, 2008, co-administrative services fees earned by SSB (including out-of-pocket expenses) were $3,180.

19

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 3. Transactions with Affiliates and Related Parties

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Portfolio to provide certain financial printing and fulfillment services. For the six months ended April 30, 2008, Merrill was paid $8,061 for its services to the Portfolio.

Note 4. Line of Credit

The Portfolio, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $50 million committed, unsecured line of credit facility ("Credit Facility") for temporary or emergency purposes with Deutsche Bank, A.G. as administrative agent and syndication agent and SSB as operations agent. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal funds rate plus 0.50%. Effective June 2008, Deutsche Bank, A.G. will no longer serve as administrative agent and syndication agent to the credit facility. At April 30, 2008, and during the six months ended April 30 , 2008, the Portfolio had no borrowings under the Credit Facility.

Note 5. Purchases and Sales of Securities

For the six months ended April 30, 2008, purchases and sales of investment securities (excluding short-term investments) were $5,440,441 and $4,751,325, respectively.

At April 30, 2008, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $21,115,428, $5,265,482 and $(814,846) and $4,450,636, respectively.

Note 6. Capital Share Transactions

The Fund is authorized to issue up to sixteen billion full and fractional shares of capital stock of separate series having a $.001 par value per share. Shares of

20

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 6. Capital Share Transactions

two series have been classified, one of which constitutes the interest in the Portfolio. Transactions in capital shares of the Portfolio were as follows:

| | | For the Six Months Ended

April 30, 2008 (unaudited) | | For the Year Ended

October 31, 2007 | |

| Shares sold | | | 1,554 | | | | 17,878 | | |

| Shares issued in reinvestment of dividends | | | 29,993 | | | | 25,399 | | |

| Shares redeemed | | | (10,386 | ) | | | (831,406 | ) | |

| Net increase (decrease) | | | 21,161 | | | | (788,129 | ) | |

The Portfolio imposes a 2% redemption fee on shares currently being offered that are purchased on or after March 1, 2007 and redeemed or exchanged within 30 days from the date of purchase. Reinvested dividends and distributions are not subject to the fee. The fee is charged based on the value of shares at redemption, is paid directly to the Portfolio and becomes part of the Portfolio's daily net asset value calculation. When shares are redeemed that are subject to the fee, reinvested dividends are redeemed first, followed by the shares held longest.

On April 30, 2008, the number of shareholders that held 5% or more of the outstanding shares of the Portfolio was as follows:

Number of

Shareholders | | Approximate Percentage

of Outstanding Shares | |

| | 2 | | | | 88 | % | |

Some of the shareholders are omnibus accounts, which hold shares on behalf of individual shareholders.

Note 7. Contingencies

In the normal course of business, the Portfolio may provide general indemnifications pursuant to certain contracts and organizational documents. The Portfolio's maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolio and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 8. Recent Accounting Pronouncements

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48" or the "Interpretation"), Accounting for Uncertainty in Income Taxes — an interpretation of FASB statement 109. FIN 48

21

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

April 30, 2008 (unaudited)

Note 8. Recent Accounting Pronouncements

supplements FASB Statement 109, Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the tax effects of a position be recognized only if it is "more likely than not" to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently support the position's sustainability with a likelihood of more than 50 percent. During the period e nded April 30, 2008, Management has adopted FIN 48. There was no material impact to the financial statements or disclosures thereto as a result of the adoption of this pronouncement.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 "Fair Value Measurements" ("FAS 157"). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years, beginning after November 15, 2007 and interim periods within those fiscal years. As of April 30, 2008, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required in subsequent reports.

In March 2008, FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities ("FAS 161"), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect a fund's financial position, financial performance, and cash flows. Management of the Funds does not believe the adoption of FAS 161 will materially impact the financial statement amounts, but will require additional disclosures. This will include qualitative and quantitative disclosures on derivative positions existing at period end and the effect of using de rivatives during the reporting period. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008.

22

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited)

In approving the renewal of the current Advisory and Sub-Advisory Agreements, the Board of Directors, including the Independent Directors, at a meeting held on November 13 and 14, 2007, considered the following factors with respect to the International Focus Portfolio (the "Portfolio"):

Investment Advisory Fee Rates

The Board reviewed and considered the contractual advisory fee rate of 0.80% for the Portfolio ("Contractual Advisory Fee"), in light of the extent and quality of the advisory services provided by Credit Suisse Asset Management, LLC ("Credit Suisse") or Credit Suisse Asset Management Limited ("Credit Suisse U.K.") and Credit Suisse Asset Management Limited ("Credit Suisse Australia"). The Board also reviewed and considered the fee waivers and/or expense reimbursement arrangements currently in place for the Portfolio and considered the actual fee rate of 0.49% paid by the Portfolio after taking waivers and reimbursements into account ("Net Advisory Fee"). The Board acknowledged that voluntary fee waivers and expense reimbursements could be discontinued at any time. The Board noted that the compensation paid to Credit Suisse U.K. and Credit Suisse Australia (collectively, the "Sub-Advisers") does not increase the fees or expenses otherwise inc urred by the Portfolio's shareholders.

Additionally, the Board received and considered information comparing the Portfolio's Contractual Advisory Fee, Net Advisory Fee and the Portfolio's overall expenses with those of funds in both the relevant expense group ("Expense Group") and universe of funds ("Expense Universe") provided by Lipper Inc., an independent provider of investment company data.

Nature, Extent and Quality of the Services under the Advisory and

Sub-Advisory Agreements

The Board received and considered information regarding the nature, extent and quality of services provided to the Portfolio by Credit Suisse under the Advisory Agreement and by the Sub-Advisers under the Sub-Advisory Agreements. The Board also noted information received at regular meetings throughout the year related to the services rendered by Credit Suisse and the Sub-Advisers. The Board reviewed background information about Credit Suisse and the Sub-Advisers, including their respective Forms ADV. The Board considered the background and experience of both Credit Suisse's and the Sub-Advisers' senior management and the expertise of, and the amount of attention given to the Portfolio by, senior personnel of Credit Suisse and the

23

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

Sub-Advisers. With respect to the Sub-Advisers, the Board also considered their expertise in managing the types of global investments that the Portfolio utilizes in its investment strategy. In addition, the Board reviewed the qualifications, backgrounds and responsibilities of the portfolio management team primarily responsible for the day-to-day portfolio management of the Portfolio and the extent of the resources devoted to research and analysis of actual and potential investments. The Board also received and considered information about the nature, extent and quality of services and fee rates offered to other Credit Suisse clients for comparable services.

In approving the Sub-Advisory Agreements, the Board also considered the benefits of retaining Credit Suisse's United Kingdom and Australian affiliates given the increased complexity of the domestic and international securities markets, specifically that retention of Credit Suisse U.K. and Credit Suisse Australia expands the universe of companies and countries from which investment opportunities could be sought and enhances the ability of the Portfolio to obtain the best price and execution on trades in international markets.

Portfolio Performance

The Board received and considered the performance results of the Portfolio over time, along with comparisons both to the relevant performance group ("Performance Group") and universe of funds ("Performance Universe") for the Portfolio. The Board was provided with a description of the methodology used to arrive at the funds included in the Performance Group and the Performance Universe.

Credit Suisse Profitability

The Board received and considered a profitability analysis of Credit Suisse based on the fees payable under the Advisory Agreement for the Portfolio, including any fee waivers or fee caps, as well as other relationships between the Portfolio on the one hand and Credit Suisse affiliates on the other. The Board received profitability information for the other funds in the Credit Suisse family of funds.

Economies of Scale

The Board considered whether economies of scale in the provision of services to the Portfolio were being passed along to the shareholders. Accordingly, the Board considered whether alternative fee structures (such as breakpoint fee

24

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

structures) would be more appropriate or reasonable taking into consideration economies of scale or other efficiencies that might accrue from increases in the Portfolio's asset levels.

Other Benefits to Credit Suisse

The Board considered other benefits received by Credit Suisse, the Sub-Advisers and their affiliates as a result of their relationships with the Portfolio. Such benefits include, among others, research arrangements with brokers who execute transactions on behalf of the Portfolio, administrative and brokerage relationships with affiliates of Credit Suisse and the Sub-Advisers and benefits potentially derived from an increase in Credit Suisse's and the Sub-Advisers' businesses as a result of their relationship with the Portfolio (such as the ability to market to shareholders other financial products offered by Credit Suisse, the Sub-Advisers and their affiliates).

The Board considered the standards applied in seeking best execution, whether and to what extent soft dollar credits are sought and how any such credits are utilized, any benefits that may be achieved by using an affiliated broker and the existence of quality controls applicable to brokerage allocation procedures. The Board also reviewed Credit Suisse's and the Sub-Advisers' method for allocating portfolio investment opportunities among their advisory clients.

Conclusions

In selecting Credit Suisse and the Sub-Advisers, and approving the Advisory Agreement and the investment advisory fee under such agreement and the Sub-Advisory Agreements, the Board concluded that:

• The Contractual Management Fee was among the lowest and the Net Advisory Fee was the lowest in the Expense Group. The Board considered the fee to be reasonable.

• Although the Portfolio's performance for the one-, two-, and three year periods was above the median of the Performance Universe, its performance was below most of its peers in the Performance Group for most periods reviewed. The Board had previously identified the need to address the Portfolio's performance and would continue to monitor steps undertaken by Credit Suisse to improve performance.

• Aside from performance (as described above), the Board was satisfied with the nature and extent of the investment advisory services provided to the

25

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

Portfolio by Credit Suisse and the Sub-Advisers and that, based on dialogue with management and counsel, the services provided by Credit Suisse under the Advisory Agreement and by the Sub-Advisers under the Sub-Advisory Agreements are typical of, and consistent with, those provided to similar mutual funds by other investment advisers.

• In light of the costs of providing investment management and other services to the Portfolio and Credit Suisse's ongoing commitment to the Portfolio and willingness to waive fees and expenses, the profits and other ancillary benefits that Credit Suisse and its affiliates received were considered reasonable.

• Credit Suisse's profitability based on fees payable under the Advisory Agreement was reasonable in light of the nature, extent and quality of the services provided to the Portfolio thereunder.

• In light of the relatively small size of the Portfolio and the amount of the Net Advisory Fee, the Portfolio's current fee structure (without breakpoints) was considered reasonable.

No single factor reviewed by the Board was identified by the Board as the principal factor in determining whether to approve the Advisory Agreement and Sub-Advisory Agreements. The Independent Directors were advised by separate independent legal counsel throughout the process.

26

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Privacy Policy Notice (unaudited)

Important Privacy Choices for Consumers

We are committed to maintaining the privacy of every current and prospective customer. We recognize that you entrust important personal information to us, and we wish to assure you that we take seriously our responsibilities in protecting and safeguarding this information.

In connection with making available investment products and services to current and potential customers, we may obtain nonpublic personal information about you. This information may include your name, address, e-mail address, social security number, account number, assets, income, financial situation, transaction history and other personal information.

We may collect nonpublic information about you from the following sources:

• Information we receive on applications, forms, questionnaires, web sites, agreements or in the course of establishing or maintaining a customer relationship; and

• Information about your transactions with us, our affiliates, or others.

We do not disclose any nonpublic personal information about our customers or former customers to anyone, except with your consent or as otherwise permitted by law.

In cases where we believe that additional products and services may be of interest to you, we may share the information described above with our affiliates.

We may also disclose this information to firms that perform services on our behalf. These agents and service providers are required to treat the information confidentially and use it only for the purpose for which it is provided.

We restrict access to nonpublic personal information about you to those employees, agents or other parties who need to know that information to provide products or services to you or in connection with your investments with or through us. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Note: This Notice is provided to clients and prospective clients of Credit Suisse Asset Management, LLC ("Credit Suisse"), and Credit Suisse Asset Management Securities, Inc., and shareholders and prospective shareholders in Credit Suisse sponsored and advised investment companies, including Credit Suisse Funds, and other consumers and customers, as applicable. This Notice is not intended to be incorporated in any offering materials but is merely a statement of our current Privacy Policy, and may be amended from time to time upon notice to you. This Notice is dated as of May 13, 2008.

27

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Portfolio voted proxies related to its portfolio securities during the 12 month period ended June 30 of each year, as well as the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities are available:

• By calling 1-800-222-8977

• On the Portfolio's website, www. Credit-suisse.com/us

• On the website of the Securities and Exchange Commission, www.sec.gov.

The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio's Forms N-Q are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-202-551-8090.

28

P.O. BOX 55030, BOSTON, MA 02205-5030

800-222-8977 n www.credit-suisse.com/us

CREDIT SUISSE ASSET MANAGEMENT SECURITIES, INC., DISTRIBUTOR. INSTFUND-SAR-0408

CREDIT SUISSE

INSTITUTIONAL FUND

Semiannual Report

April 30, 2008

(unaudited)

CREDIT SUISSE INSTITUTIONAL FUND, INC.

n ASIA BOND PORTFOLIO

The Portfolio's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Institutional Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Institutional Fund is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and the Portfolio holdings described in this document are as of April 30, 2008; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report

April 30, 2008 (unaudited)

June 17, 2008

Dear Shareholder:

Performance Summary

11/01/07 – 04/30/08

For the semiannual period ended April 30, 2008, Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio1 had a gain of 0.31% versus an increase of 2.59% for the HSBC Asian Local Bond Index.2

Market Review: Asian fundamentals remain strong

The period ended April 30, 2008, was a strong one for Asian markets. Local bond markets and Asian currencies performed resiliently during this global credit crisis.

In fact, the broad-based U.S. Dollar (USD) depreciation has added to the positive tone of Asian local bonds as investors diversify away from the United States. The Thai Baht (THB), Singapore Dollar (SGD), Taiwan Dollar (TWD), Chinese Yuan (CNY) and Malaysian Ringgit (MYR) each appreciated 4% to 7% against the USD over the period, as current account surpluses and capital flows remained strong. Conversely, the Indian Rupee (INR) and the Korean Won (KRW) were negatively impacted by the balance of payments deterioration, losing about 1.7% and 9.8%, respectively against the USD. Government bonds in the region, despite some pullback in March and April, rallied over the period, with Hong Kong and Singapore providing the best performance (yields lowered by 50 to 120bps), followed by Korea, Thailand and Malaysia. The surge in food and commodities prices in Q1 2008, however, has raised concerns of second round inflation risks and policy uncertainties. Indonesian bonds sold off more than 300bps, and Philippine bonds sold off about 130bps. Our position in these two markets was light compared to October 2007.

Asian credit spreads widened about 150bps to 200bps from October 2007 to March 2008 before recovering at least one-third of the loss in March/April 2008. Regardless, fundamentals of Asian issuers remain strong and credit downgrades were concentrated within the Chinese property sector, with the rest of the issuers enjoying stable credit profiles.

Portfolio Review and Outlook: Positive fundamentals point to outperformance of Asian credit

For the six-month period ended April 30, 2008, the Portfolio returned 0.31%, as compared to 2.59% for the benchmark. Contributing to performance were investments in the SGD (39.9% of the Portfolio at April 30, 2008), MYR (24.1% of

1

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

the Portfolio at April 30, 2008), and Korean Inflation Protected Securities (8% of the Portfolio at April 30, 2008). Detracting from performance was the Asian credit sector as Asian credit spreads followed the global trend of widening, despite having sound fundamentals.

Though the credit market has stabilized since March, there are still plenty of opportunities for the Portfolio to pick up bonds at cheap levels. The Portfolio will remain overweight in Asian currencies, but will concentrate more in countries with strong current account surpluses, such as SGD and MYR.

In the past few months, policy makers in Asia have shown a willingness to use stronger currencies to address imported price inflation, while adopting an easier monetary policy stance to promote domestic demand. We believe the appreciation trend of Asian currencies, especially CNY, SGD, MYR and TWD, will remain intact. However, with growth remaining strong in the region in Q1 2008 and inflation risks intensifying, Asian central banks may face difficulties in maintaining an easy interest rate policy stance.

Looking forward, we believe Asian credit markets will be susceptible to moves in offshore credit markets to some extent. Nevertheless, the positive fundamentals in the region argue for some outperformance of Asian credit relative to US credit. Additionally, there are signs that Fed actions in March have helped to alleviate systemic risk fears, and we believe this will prove positive for the investment grade financial sector in particular. Finally, we expect that the sell off in some local bond markets, such as Indonesia and Philippines, may provide opportunities later in the year.

The Credit Suisse Asia Bond Management Team

Robert Mann

Thomas Kwan

Victor Rodriguez

Andrew Bartlett

Adam McCabe

Fixed income investing entails credit risks and interest rate risks. Typically, when interest rates rise, the market value of fixed income securities generally declines and the share price of the Portfolio can fall. Additionally, the Portfolio may involve a greater degree of risk than other funds that invest in larger, more-developed markets. International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods; these risks are heightened for emerging-market investments.

2

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

High-yield bonds are lower-quality bonds that are also known as "junk bonds." Such bonds entail greater risk than those found in higher rated securities. The Portfolio is non-diversified, which means that it may invest a greater proportion of its assets in the securities of a smaller number of issuers and may, therefore, be subject to greater volatility.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

3

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Cumulative Returns as of March 31, 20081

| 1 Year | | Since

Inception | | Inception

Date | |

| __ | | 5.30 % | | 05/01/07 | |

Average Annual Return as of April 30, 20081

| 1 Year | | Since

Inception | | Inception

Date | |

| 4.37 % | | 4.37 % | | 05/01/07 | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The HSBC Asia Local Bond Index (ALBI), tracks the total return performance of a bond portfolio which consists of local currency denominated high quality and liquid bonds in Asia ex-Japan. The ALBI includes bonds from the following countries/region: Korea, Hong Kong SAR, India, Singapore, Taiwan, Malaysia, Thailand, Philippines, Indonesia and China. Investors cannot invest directly in an index.

4

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2008.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

5

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2008

| Actual Portfolio Return | |

| Beginning Account Value 11/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/08 | | $ | 1,003.10 | | |

| Expenses Paid per $1,000* | | $ | 2.99 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 11/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 4/30/08 | | $ | 1,021.88 | | |

| Expenses Paid per $1,000* | | $ | 3.02 | | |

| Annualized Expense Ratios* | | | 0.60 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 366.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

6

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Semiannual Investment Adviser's Report (continued)

April 30, 2008 (unaudited)

Credit Quality Breakdown*

Ratings

S&P | |

| AAA | | | 1.3 | % | |

| AA | | | 4.8 | % | |

| A | | | 42.9 | % | |

| BBB | | | 10.9 | % | |

| BB | | | 13.6 | % | |

| B | | | 2.6 | % | |

| NR | | | 15.8 | % | |

| Subtotal | | | 91.9 | % | |

| Short-Term investments | | | 8.1 | % | |

| Total | | | 100.0 | % | |

* Expressed as a percentage of total investments (excluding securities lending collateral) and may vary over time.

7

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Schedule of Investments

April 30, 2008 (unaudited)

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BONDS (87.5%) | | | |

| Australia (5.0%) | | | |

| Banks (3.8%) | | | |

| | 1,500 | | | USD | | Commonwealth Bank of Australia,

Series EMTN, Senior Subordinated Notes

(Callable 08/11/09 @ $100.00)# | | (AA-, Aa2) | | 08/11/14 | | | 3.396 | | | $ | 1,487,294 | | |

| | 24,000 | | | USD | | Commonwealth Bank of Australia,

Series EMTN, Subordinated Notes

(Callable 12/15/11 @ $100.00)#‡‡ | | (AA-, Aa2) | | 12/15/16 | | | 3.020 | | | | 24,042,240 | | |

| | 1,500 | | | USD | | National Australia Bank, Ltd., Series EMTN,

Subordinated Notes

(Callable 06/23/09 @ $100.00)#^^ | | (AA-, Aa2) | | 06/23/14 | | | 2.899 | | | | 1,470,537 | | |

| | | | 27,000,071 | | |

| Collateral CMO (1.2%) | | | |

| | 1,849 | | | USD | | Medallion Trust, Series 2007-1G, Class A 1#‡‡ | | (AAA, Aaa) | | 02/27/39 | | | 3.129 | | | | 1,750,345 | | |

| | 7,471 | | | USD | | Progress Trust, Series 2007-1G,

Class A 1, Rule 144A ‡# | | (AAA, Aaa) | | 08/19/38 | | | 3.140 | | | | 7,067,245 | | |

| | | | 8,817,590 | | |

| TOTAL AUSTRALIA | | | 35,817,661 | | |

| China (1.9%) | | | |

| Forest Products (0.8%) | | | |

| | 5,900 | | | USD | | Sino-Forest Corp., Senior Notes§ | | (BB, Ba2) | | 08/17/11 | | | 9.125 | | | | 6,047,500 | | |

| Retail (1.1%) | | | |

| | 8,000 | | | USD | | Parkson Retail Group, Ltd.,

Company Guaranteed Notes

(Callable 5/30/10 @103.56) | | (BB, Ba1) | | 05/30/12 | | | 7.125 | | | | 7,800,000 | | |

| TOTAL CHINA | | | 13,847,500 | | |

| Hong Kong (7.7%) | | | |

| Banks (0.5%) | | | |

| | 4,000 | | | USD | | Wing Hang Bank, Ltd., Series EMTN,

Subordinated Notes

(Callable 04/20/17 @ $100.00) | | (NR, A3) | | 04/20/17 | | | 6.000 | | | | 3,659,680 | | |

| Chemicals (0.3%) | | | |