Exhibit 1.2

Management’s Discussion and Analysis

The following is management’s discussion and analysis (“MD&A”) of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations for the year ended December 31, 2007, compared to those of the respective periods in the prior years. This MD&A has been prepared as of March 18, 2008 and is intended to supplement and complement the audited consolidated financial statements and notes thereto for the year ended December 31, 2007 (collectively, the “Financial Statements”). You are encouraged to review the Financial Statements in conjunction with your review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the US Securities and Exchange Commission and Canadian provincial securities regulatory authorities. All amounts are in Canadian dollars unless otherwise noted.

INDUSTRY OVERVIEW

Platinum Group Metals

Palladium is one of the six platinum group metals (“PGMs”), along with platinum, rhodium, ruthenium, iridium and osmium. Economically, the three most significant PGMs are palladium, platinum and rhodium. The primary use for palladium is in the manufacture of catalytic converters in the automotive industry. It is also used in the manufacture of jewellery and electronics, and in dental and chemical applications.

Supply

Palladium is typically produced as a by-product metal from platinum mines. According to the CPM Group, most of the world’s palladium is produced in Russia (35%), the Republic of South Africa (34%) and North America (12%). Global supply of palladium increased by approximately 3% in 2006 (the last year for which data is available) to 8,437,000 ounces. Of this total, mine production accounted for approximately 7,030,000 ounces (an increase of 3% from the prior year) and secondary recovery of palladium accounted for approximately 1,407,000 ounces.

Demand

Global fabrication demand for palladium (excluding investor demand) increased by 11.0% in 2006 to approximately 7,722,000 ounces, primarily as a result of the strong performance of the industries that use palladium and the relative attractiveness and affordability of palladium compared to substitutes (such as platinum, rhodium and gold). The year 2006 represented the third consecutive year of double-digit growth in palladium demand, and the fifth consecutive year of growth in palladium demand overall.

Approximately 50% of the global demand for palladium in 2006 stemmed from the automotive industry. The majority of the balance of palladium demand in 2006 stemmed from electronics (16%), jewellery (4%), Chinese demand for electronics and jewellery (10%), dental applications (13%) and other chemical applications (5%).

The primary use for palladium in the automotive industry is in the manufacture of catalytic converters, which reduce harmful vehicle exhaust emissions by converting them into less harmful carbon dioxide, nitrogen and water vapour. Palladium, platinum and rhodium are the primary components in catalytic converters. The demand for palladium in the automotive industry has more than doubled in the last ten years due to the larger number of vehicles being manufactured and the tightening of emissions standards that require the use of catalytic converters. Catalytic converters are now included in over 96 percent of new cars. With the palladium price currently substantially below that of platinum, automakers have a strong financial incentive to switch their catalyst formulations for gasoline vehicles from those based on platinum to palladium.

Palladium is also used in the manufacture of jewellery and may be used either on its own or as an alloy in “white gold”. In the electronics industry, palladium is used mainly in the production of multi-layer ceramic capacitors, which are used in electrical components for cellular telephones, personal and notebook computers, fax machines and home electronics. In the dental industry, palladium is widely used in alloys for dental restoration. Additionally, various chemical applications use palladium, including the

1

manufacture of paints, adhesives, fibers and coatings. Palladium is also used in the manufacture of polyester.

An important macroeconomic trend has been increased investor demand for palladium by virtue of its association with other precious metals (e.g., platinum and rhodium). Strong investor sentiment for these precious metals has provided support for a favorable palladium pricing environment.

COMPANY OVERVIEW

Overview of North American Palladium’s Business

North American Palladium is Canada’s only primary producer of PGMs, producing an estimated 4% of annual global palladium production. While the bulk of the Company’s revenue is derived from the sale of palladium, the Company also generates a considerable portion of its revenue from the sale of platinum, nickel, gold, and copper, all of which are by-products of the Company’s palladium mining operations. North American Palladium’s principal properties and projects are the Lac des Iles property (including the Lac des Iles mine and the Offset High Grade Zone (“OHGZ”)), the Shebandowan West Project and the Arctic Platinum Project (“APP”).

Lac des Iles Property

Lac des Iles mine

The Company owns and operates the Lac des Iles mine located 85 kilometers from Thunder Bay, Ontario, Canada. The Lac des Iles mine consists of an open pit mine, an underground mine and two processing plants (one of which is currently idle). The primary deposit on the property is the Roby Zone, a PGM deposit. The Company began mining the Roby Zone in 1993 using open pit mining methods. In April 2006, an underground mine went into commercial production to access a higher grade portion of the Roby Zone.

Offset High Grade Zone

The OHGZ is located on the Lac des Iles property and was discovered by the Company’s exploration team in 2001. The OHGZ is believed to be the fault-displaced continuation of the Roby Zone mineralization and is located below and approximately 250 meters to the west of the Roby Zone. A mineral resource estimate prepared by Scott Wilson Roscoe Postle Associates Inc. (“Scott Wilson RPA”) in October 2007 estimated that the OHGZ has more than three times the mineral resources of the current underground mine at the Roby Zone at similar grades, while still being open along strike to the north, south and at depth.

Shebandowan West Project

On December 10, 2007, the Company earned a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco. The Shebandowan West Project contains a series of nickel-copper-PGM mineralized bodies and is located approximately 100 kilometers southwest of the Company’s Lac des Iles mine. On October 25, 2007, the Company announced the completion of a NI 43-101 compliant mineral resource estimate for the Shebandowan West Project by an independent Qualified Person. Management is considering a mine development scenario that would entail excavation of the Shebandowan West Project by means of ramp-accessed underground mining methods at a rate of 500 to 1,000 tonnes per day, crushing the material on site and transporting it by truck to the Lac des Iles property for processing at the original mill on the Lac des Iles property. If plans proceed as expected, production at the Shebandowan West Project could commence in 2009.

Arctic Platinum Project

The APP is comprised of a series of advanced-stage nickel-copper-PGM exploration projects located approximately 60 kilometers south of the city of Rovaniemi, Finland. The Company is party to an agreement with subsidiaries of Gold Fields Limited of South Africa (“Gold Fields”) entitling it to earn up to a 60% interest in the APP. Management believes that the Company will satisfy the conditions of its earn-in right by August 31, 2008, which will include completion of a re-scoping study and exploration

2

program, completion of a feasibility study, and the preparation of the initial form of development proposal and associated budget.

To date, three areas of the APP have been explored by North American Palladium: (i) the Suhanko deposits, (ii) the Narkaus deposits, and (iii) the Penikat deposits. At Suhanko, the Company is studying a development scenario consisting of two open pit mines at two deposits located three kilometers from each other. Under this scenario, the nickel-copper-PGM bearing material would be processed through a centrally-located concentrator at a nominal throughput rate of five million tonnes per year. Additionally, management believes that the economics of the development scenario might be enhanced by the development of two higher grade deposits at Narkaus. A scoping study on the Suhanko deposits completed by Aker Kvaerner in October 2007 indicated that the mineral resources could potentially support a 20-year mine life at 7.5 million tones per annum. To this end, the Company has retained Aker Kvaerner to prepare a feasibility study for the Suhanko deposits.

Year Ended December 31, 2007 Highlights

• Revenue for the year ended December 31, 2007 of $195.9 million increased by $36.7 million (23%).

• Operating cash flow for the year (before changes in non-cash working capital)(1) improved by $36.9 million to $46.8 million compared to operating cash flow of $9.9 million in 2006.

• The net loss for the year ended December 31, 2007 was $28.7 million or $0.51 per share compared to a net loss of $34.1 million or $0.65 per share in 2006. The net loss for the year includes a net negative impact of $19.0 million (2006 – negative impact of $3.7 million) due to foreign exchange gains and losses.

• Palladium production of 286,334 ounces increased 21% compared to last year.

• Palladium sales for the year were recorded at an average price of US$356 per ounce compared to US$319 per ounce last year. The Company’s performance is highly correlated to prevailing palladium and by-product metal prices as it continues to sell all its metal production into the spot markets.

• Palladium accounted for 47% of the year’s total revenues while platinum and nickel continued to be important sources of revenue, at 16% and 22% of the year’s total revenue respectively.

• Cash cost per ounce of palladium produced,(1) net of by-product metal revenues and royalties, was US$164 for 2007 compared to US$201 the previous year, primarily due to the increased production volumes and stronger by-product prices, partially offset by the impact of the strengthening Canadian dollar on both costs and by-product revenue realized.

• On December 10, 2007, the Company earned a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco.

• The Company’s debt position at December 31, 2007 was $39.1 million and reflects a reduction of $35.8 million (48%) compared to the debt position at December 31, 2006 of $74.9 million.

• In December 2007 the Company completed an equity offering of 18.7 million units at a price of US$4.00 per unit. In connection with the offering the Company granted the underwriter’s an over-allotment option of 15% at the same price. This option was subsequently exercised in January 2008, increasing the gross proceeds of the offering to US$85.9 million.

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

3

Key Results

Operating Results

Year Ended December 31 | | 2007 | | 2006* | | 2005 | |

Palladium (oz) | | 286,334 | | 237,338 | | 177,167 | |

Payable Palladium (oz) | | 263,046 | | 217,022 | | 161,469 | |

Platinum (oz) | | 24,442 | | 22,308 | | 18,833 | |

Gold (oz) | | 20,092 | | 17,237 | | 14,308 | |

Copper (lbs) | | 5,536,044 | | 5,155,588 | | 5,514,670 | |

Nickel (lbs) | | 3,066,973 | | 2,721,042 | | 2,353,227 | |

Ore Tonnes Milled | | 5,006,383 | | 4,570,926 | | 4,780,599 | |

Ore Tonnes Mined – Underground | | 768,841 | | 721,179 | | — | |

Ore Tonnes Mined – Open Pit | | 4,374,225 | | 3,926,911 | | 3,705,555 | |

Waste Tonnes Mined – Open Pit | | 7,231,026 | | 8,888,037 | | 11,619,658 | |

Waste Strip Ratio | | 1.65:1 | | 2.26:1 | | 3.14:1 | |

* Metal production, tonnes milled and underground ore tonnes mined include pre-production activities from the underground mine that was not recorded as revenue but rather offset against the underground mine’s capital development costs. Metal production from the underground pre-production included 9,004 oz of palladium and other associated by-product metals.

Selected Annual Information

(thousands of dollars) | | 2007 | | 2006 | | 2005 | |

Revenue after pricing adjustments | | $ | 195,932 | | $ | 159,200 | | $ | 92,606 | |

Net loss | | (28,680 | ) | (34,109 | ) | (53,611 | ) |

Add back (deduct): | | | | | | | |

Exploration costs | | 12,138 | | 11,831 | | 7,927 | |

Non-Cash Items: | | | | | | | |

– Amortization | | 46,908 | | 30,103 | | 18,297 | |

– Accretion of convertible notes | | 12,947 | | 10,090 | | — | |

– Other non-cash items(1) | | 15,653 | | 3,828 | | (1,146 | ) |

Net income (loss) before exploration and non-cash items(1) | | $ | 58,966 | | $ | 21,743 | | $ | (28,533 | ) |

Net loss per share (dollars) | | | | | | | |

· Basic | | $ | (0.51 | ) | $ | (0.65 | ) | $ | (1.03 | ) |

· Fully diluted | | $ | (0.51 | ) | $ | (0.65 | ) | $ | (1.03 | ) |

Cash dividends declared | | Nil | | Nil | | Nil | |

Cash flow from operations prior to changes in non-cash working capital | | 46,828 | | 9,912 | | (36,460 | ) |

Total Assets | | 305,374 | | 265,157 | | 238,357 | |

Total Long-term debt, including current portion | | 39,081 | | 74,906 | | 46,272 | |

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

RESULTS OF OPERATIONS

Revenue

For the year ended December 31, 2007 the Company had revenue of $195.9 million compared to revenue of $159.2 million in 2006. The loss from mining operations for the year ended December 31, 2007 was $19.4 million, an increase of $1.3 million (7%), compared to the loss of $18.1 million last year.

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Sales of metals in concentrate are recognized in revenue when concentrate is delivered to a third party smelter for treatment, however, final pricing is not determined until the refined metal is sold, which can be up to six months later. Accordingly, revenue in the year is based on current US dollar denominated commodity

4

prices and foreign exchange rates for sales occurring in the year and ongoing pricing adjustments from prior sales that are still subject to final pricing. These final pricing adjustments result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the US dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues. Effective April 1, 2007, the amount of the final pricing adjustments recognized on any commodity price changes will also be reduced by any price participation deductions as provided for in the Company’s smelting and refining agreement. The Canadian dollar strengthened by 17% against the US dollar to $1.01 at December 31, 2007 compared to $0.86 at December 31, 2006.

Recorded Metal Prices and Average Exchange Rates

| | 2007 | | 2006 | | 2005 | |

Palladium – US$/oz | | $ | 356 | | $ | 319 | | $ | 230 | |

Platinum – US$/oz | | $ | 1,364 | | $ | 1,140 | | $ | 815 | |

Gold – US$/oz | | $ | 726 | | $ | 610 | | $ | 442 | |

Nickel – US$/lb | | $ | 15.58 | | $ | 11.68 | | $ | 6.60 | |

Copper – US$/lb | | $ | 3.30 | | $ | 3.02 | | $ | 1.50 | |

US/C$ exchange rate (Bank of Canada) | | US$ | 0.93 | | US$ | 0.88 | | US$ | 0.83 | |

| | | | | | | | | | | | | |

For the year ended December 31, 2007, revenue before pricing adjustments of $201.4 million increased $55.5 million (38%) from 2006, reflecting higher volumes and improved pricing of $68.7 million, partially offset by the impact of unfavourable foreign exchange rates of $13.2 million. Negative pricing adjustments from settlements and the mark-to-market of concentrate awaiting settlement for the year ended December 31, 2007 reduced revenue by $5.4 million ($14.2 million negative foreign exchange adjustment, partially offset by a $8.8 million favourable commodity price adjustment). This compares with favourable adjustments for the year ended December 31, 2006 of $13.4 million ($11.7 million favourable commodity price adjustment and a $1.7 million positive foreign exchange adjustment). For the year ended December 31, 2007, revenue after pricing adjustments was $195.9 million, an increase of $36.7 million (23%), compared to revenue of $159.2 million last year.

For the year ended December 31, 2007, palladium sales were recorded at US$356 per ounce, up 12% compared to US$319 in the 2006. Revenue in 2007 from the sale of palladium before pricing adjustments increased to $95.1 million from $70.6 million, and after pricing adjustments increased by 21% to $91.8 million (47% of total revenue) compared to $75.6 million (48% of total revenue) in 2006.

For the year ended December 31, 2007, total by-product revenues after pricing adjustments increased by 25% to $104.1 million, as compared to $83.6 million in 2006. In particular, platinum, gold and nickel sales saw strong growth of 27%, 32% and 28% respectively, reflecting increased sales volumes and higher commodity prices.

Operations

For the year ended December 31, 2007, palladium ounces produced increased by 21%. The mill processed 5,006,383 tonnes of ore or an average of 13,716 tonnes per day, producing 286,334 ounces of palladium compared to 4,570,926 tonnes of ore or an average of 12,523 tonnes per day, producing 237,338 ounces of palladium in 2006. In 2007, the average palladium head grade was 2.39 grams per tonne compared to 2.18 grams per tonne in 2006. The improved head grade can be attributed in part to a full year of production from the underground mine, which commenced commercial production in April 2006. For the year ended December 31, 2007, 768,841 tonnes of ore was extracted from the underground mine, with an average palladium grade of 5.79 grams per tonne. During the nine months ended December 31, 2006, 617,634 tonnes of ore was extracted from the underground mine, with an average palladium grade of 5.96 grams per tonne. For 2007 the palladium recoveries were 74.8%, compared to 74.0% in 2006.

5

In the Lac des Iles open pit, for the year ended December 31, 2007, 4,374,225 tonnes of ore were extracted with an average palladium grade of 1.79 grams per tonne compared to 3,926,911 tonnes at an average palladium grade of 1.63 grams per tonne the previous year. For the year ended December 31, 2007 the strip ratio improved to 1.65 compared to 2.26 in 2006.

The mill’s increased results reflect continued improvement to the throughput and availability due to Company personnel identifying and systematically resolving issues.

Operating Expenses

For the year ended December 31, 2007, total production costs of $125.1 million increased by $12.6 million (11%) compared to 2006, mainly due to the inclusion of the underground mine production costs for the three months ended March 31, 2007 of $8.1 million, which for the corresponding period in 2006, were capitalized as pre-production costs. Unit cash costs(1) to produce palladium (production costs including overhead and smelter treatment, refining and freight costs), net of by-product metal revenues and royalties, decreased to US$164 per ounce for the year ended December 31, 2007 compared to US$201 per ounce in 2006. The decrease in unit cash costs was primarily due to the impact of increased production and improved pricing for by-products, partially offset by the strengthening Canadian dollar on both costs and by-product revenue realized.

Smelter treatment, refining and freight charges for the year ended December 31, 2007 of $22.4 million increased by $7.0 million (45%) compared to 2006. The increase is attributable to higher sales volumes ($2.1 million) and higher costs associated with the Company’s new smelter agreement ($4.9 million) that came into effect April 1, 2007.

Non-cash amortization increased by $16.8 million (56%) to $46.9 million for the year ended December 31, 2007 compared to $30.1 million last year. The higher amortization is attributable to the 21% increase in palladium production ($3.8 million), the adjusted mine plan, effective from the fourth quarter of 2006, which resulted in an increase in the unit of production amortization rate ($9.1 million), and the inclusion of the amortization of the underground mine development costs for the first quarter of 2007 ($3.9 million), which commenced commercial production in April 2006.

The Company reviews and evaluates its long-lived assets for impairment annually. Impairment is considered to exist if total estimated future undiscounted cash flows are less than the carrying amount of the asset. During 2007, the Company engaged Scott Wilson RPA an independent geotechnical consulting company to complete a Mineral Resource and Mineral Reserve audit and to prepare an independent Technical NI 43-101 Report on the Lac des Iles mine as of June 2007. This was updated by a senior geologist with Lac des Iles Mines Ltd. (a qualified person) to December 31, 2007. As a result of these events the Company completed a detailed review of its life-of-mine operating plan for the Lac des Iles mine, the Company’s only operating mine, and compared the carrying value of the Company’s mining interests to the estimated recoverability.The Company’s management believes an impairment charge and a corresponding reduction in the carrying value of its mining interests is not required. Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company’s operating performance could have a material effect on the Company’s ability to recover the carrying amounts of its long-lived assets resulting in possible impairment charges.

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

6

Administrative expenses for the year ended December 31, 2007 of $7.8 million increased by $1.1 million (15%) compared to 2006. The increase is due primarily to increased director’s fees and expenses ($0.5 million), increased staff costs ($0.3 million) and higher capital taxes ($0.3 million).

Exploration expense for the year ended December 31, 2007 of $12.1 million was up $0.3 million (3%) compared to last year’s expenditure of $11.8 million. Included in the 2007 expenditure is $5.9 million ($6.8 - 2006) spent on the APP as the Company continues its evaluation activities in Finland. Costs associated with the APP project are being charged to exploration expense as incurred until it is determined whether the project can be economically developed, at which time the costs will be capitalized. In addition, the Company continued its exploration of the OHGZ at the Lac des Iles mine. Diamond drilling commenced in the second quarter of 2007 and the goal of this program is to provide detailed information as to the metals distribution for the upper portion of the��OHGZ.

Work continues on the Shebandowan West nickel-copper-PGM project and drill results from its Phase II drill campaign were announced in a press release on May 1, 2007. A technical report prepared in compliance with the requirements of National Instrument 43-101 disclosing the results of the mineral resource estimate was press released on October 26, 2007. On December 10, 2007, the Company announced that it has exercised its option to form an operating joint venture with Vale Inco Limited over the Shebandowan property.

Asset retirement costs for the year ended December 31, 2007 of $1.0 million compared to a charge of $0.6 million last year with the increase reflecting the increased palladium production.

For the year ended December 31, 2007, the result of the revenue and operating expense performance described above was a loss from mining operations of $19.4 million, an increase of $1.3 million (7%) compared to last year’s loss of $18.1 million.

Other Income (Expenses)

For the year ended December 31, 2007, other income and expenses was a net expense of $10.2 million, down by $7.2 million compared to a net expense of $17.4 million last year. The decrease in 2007 is due mainly to a $8.4 million foreign exchange gain (2006 – $1.8 million foreign exchange loss), which relates primarily to the translation of the Company’s US dollar denominated convertible notes and credit facilities, offset partially by a $3.0 million increase in interest and other financing charges. The increased interest and other financing charges are due primarily to a full year interest and accretion expense (increase of $3.1 million) relating to the convertible notes payable that were issued in March and June 2006.

Net Income (Loss)

For the year ended December 31, 2007, there was a tax recovery of $0.9 million (2006 recovery of $1.4 million). For the year ended December 31, 2007 the net loss was $28.7 million or $0.51 per share compared to a net loss of $34.1 million or $0.65 per share the previous year.

7

Summary of Quarterly Results

| | 2006* | | 2007 | |

(thousands of dollars

except per share

amounts) | | Q1 | | Q2 | | Q3 | | Q4 | | Q1* | | Q2 | | Q3 | | Q4 | |

Revenue – before pricing adjustments | | $ | 24,356 | | $ | 36,698 | | $ | 38,704 | | $ | 46,061 | | $ | 60,305 | | $ | 53,450 | | $ | 42,674 | | $ | 44,938 | |

Pricing adjustments: | | | | | | | | | | | | | | | | | |

Commodities | | 6,952 | | 566 | | 2,927 | | 1,229 | | 9,141 | | (2,421 | ) | 237 | | 1,799 | |

Foreign exchange | | 184 | | (1,745 | ) | (200 | ) | 3,468 | | (1,007 | ) | (6,534 | ) | (6,419 | ) | (231 | ) |

Revenue – after pricing adjustments | | $ | 31,492 | | $ | 35,519 | | $ | 41,431 | | $ | 50,758 | | $ | 68,439 | | $ | 44,495 | | $ | 36,492 | | $ | 46,506 | |

Cash flow from operations(1), prior to changes in non-cash working capital** | | (260 | ) | (965 | ) | 2,716 | | 8,421 | | 23,037 | | 12,865 | | 4,068 | | 6,858 | |

Exploration expense | | 2,024 | | 2,659 | | 2,576 | | 4,572 | | 3,228 | | 798 | | 2,933 | | 5,179 | |

Net income (loss) | | (4,141 | ) | (11,325 | ) | (11,247 | ) | (7,396 | ) | 5,507 | | (9,066 | ) | (14,033 | ) | (11,088 | ) |

Net income (loss) per share | | $ | (0.08 | ) | $ | (0.22 | ) | $ | (0.21 | ) | $ | (0.14 | ) | $ | 0.10 | | $ | (0.17 | ) | $ | (0.25 | ) | $ | (0.19 | ) |

Fully diluted net income (loss) per share | | $ | (0.08 | ) | $ | (0.22 | ) | $ | (0.21 | ) | $ | (0.14 | ) | $ | 0.10 | | $ | (0.17 | ) | $ | (0.25 | ) | $ | (0.19 | ) |

* Certain prior period amounts have been reclassified to conform to a classification adopted in the current period.

** Includes exploration expense

FOURTH QUARTER

Fourth Quarter Highlights

• Palladium production for the three months ended December 31, 2007 was 71,595 ounces, a decrease of 2% compared to the same period last year.

• Revenue after pricing adjustments for the fourth quarter of 2007 of $46.5 million decreased $4.3 million (8%) compared to the same period last year.

• Operating cash flow for the quarter (before changes in non-cash working capital)(1) declined by $1.5 million to $6.9 million compared to operating cash flow of $8.4 million in 2006.

• The net loss for the three months ended December 31, 2007 was $11.1 million or $0.19 per share compared to a net loss of $7.4 million or $0.14 per share in the same period last year.

• Palladium sales in the quarter were recorded at US$364 per ounce compared to US$322 per ounce in the comparable quarter last year, while by-product metal prices, with the exception of nickel, also realized considerable gains. Palladium accounted for 51% of the quarter’s total revenues while platinum and nickel continued to be important sources of revenue, at 17% and 15% of the quarter’s total revenue respectively.

• Cash cost per ounce of palladium produced,(1) net of by-product metal revenues and royalties, was US$223 for the fourth quarter 2007 compared to US$108 in the same period last year, primarily due to the lower production in 2007 and the impact of the strengthening Canadian dollar on both costs and by-product revenue realized.

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

8

Fourth Quarter Financial Results

Revenue

The Company earned revenue of $46.5 million for the three months ended December 31, 2007 compared to revenue of $50.8 million for the corresponding period in 2006. The loss from mining operations for the three months ended December 31, 2007 was $8.2 million, compared to income from mining operations of $0.5 million in the same period last year.

Revenue before pricing adjustments for the fourth quarter of 2007 decreased $1.1 million compared to the fourth quarter of 2006 and reflects a $7.0 million decrease due to a lower US$ exchange rate, offset partially by the net increase due to improved commodity prices and sales volumes of $5.9 million. Positive pricing adjustments from the mark-to-market of concentrate awaiting settlement in the fourth quarter of 2007 increased revenue in the quarter by $1.6 million ($1.8 million favourable commodity price adjustment offset partially by a $0.2 million negative foreign exchange adjustment). This compares to positive pricing adjustments in the fourth quarter of 2006 of $4.7 million ($3.5 million positive foreign exchange adjustment and a $1.2 million positive commodity price adjustment).

For the three months ended December 31, 2007, palladium sales were recorded at US$364 per ounce, up 13% compared to US$322 in the same period last year. Revenue from palladium sales before pricing adjustments in the fourth quarter of 2007 of $22.0 million increased by $0.5 million (2%) compared to the same period last year, but after pricing adjustments was lower by $0.4 million ($1.9 million negative foreign exchange adjustment offset partially by positive commodity price adjustments of $1.0 million).

Revenue from by-product metal sales after pricing adjustments in the three months ended December 31, 2007 decreased by $3.9 million (15%) to $22.7 million compared to $26.6 million in the same period last year.

Recorded Metal Prices and Average Exchange Rates

| | Q4 2007 | | Q4 2006 | |

Palladium – US$/oz | | $ | 364 | | $ | 322 | |

Platinum – US$/oz | | $ | 1,530 | | $ | 1,115 | |

Gold – US$/oz | | $ | 836 | | $ | 635 | |

Nickel – US$/lb | | $ | 11.70 | | $ | 15.11 | |

Copper – US$/lb | | $ | 3.03 | | $ | 2.85 | |

US/CDN.$exchange rate (Bank of Canada) | | US$ | 1.02 | | US$ | 0.88 | |

| | | | | | | | | |

Operations

During the three months ended December 31, 2007, the mill processed 1,165,769 tonnes of ore at an average of 12,671 tonnes per day, producing 71,595 ounces of palladium. During the same period in 2006, the mill processed 1,179,644 tonnes of ore at an average of 12,822 tonnes per day, producing 73,242 ounces of palladium. The average palladium head grade was 2.58 grams per tonne in the fourth quarter of 2007, compared to 2.52 grams per tonne in the corresponding period of 2006. In the fourth quarter of 2007, palladium recoveries were 75.2% as compared to 76.9% in fourth quarter of 2006, while mill availability in the period was 86.9% compared to 89.5% last year. The slight (2%) reduction in ounces produced in the fourth quarter of 2007 can be attributed to lower mill tonnage reflecting increased scheduled maintenance downtime in 2007 in order to reline the SAG and ball mills. The higher tonnage throughput for the year ended December 31, 2007 resulted in a rescheduling of planned maintenance activities.

During the three months ended December 31, 2007, 202,230 tonnes of ore were extracted from the Lac des Iles underground mine, with an average palladium grade of 5.98 grams per tonne, compared to 222,519 tonnes with an average palladium grade of 6.42 grams per tonne during the same period last year. In the Lac des Iles open pit operation for the three months ended December 31, 2007, 994,152 tonnes of ore were extracted with an average palladium grade of 1.92 grams per tonne compared

9

to 924,529 tonnes of ore extracted at an average palladium grade of 1.63 grams per tonne in the same period last year. Over this period, the strip ratio substantially improved to 1.74, compared to 2.13 in the same period for 2006.

Operating Expenses

Total production costs for the three months ended December 31, 2007 of $30.5 million reflected a $0.9 million (3%) increase over the $29.6 million in same period of 2006. Unit cash costs(1) to produce palladium (production costs including overhead and smelter treatment, refining and freight costs), net of by-product metal revenues and royalties, increased to US$223 per ounce in the fourth quarter of 2007 compared to US$108 per ounce in the corresponding period in 2006. The increase in unit cash costs was primarily due to the higher production costs, reduced nickel revenue (price per lb. US$11.70 in 2007 vs. US$15.11 in 2006) and the impact of the strengthening Canadian dollar on both costs and by-product revenue.

Smelter treatment, refining and freight charges for the three months ended December 31, 2007 of $5.9 million increased by $1.5 million (32%) compared to 2006. The increase is attributable to higher sales volumes ($0.4 million) and higher costs associated with the Company’s new smelter agreement that came into effect on April 1, 2007 ($1.1 million.)

Non-cash amortization increased to $10.9 million in the fourth quarter of 2007 compared to $10.0 million in the corresponding period in 2006. The higher amortization is attributable to the adjustment in the mine plan that was effective from the fourth quarter of 2006, which resulted in an increase in the unit of production amortization rate.

Administrative expenses for the three months ended December 31, 2007 of $2.1 million increased by $0.6 million (37%) compared to 2006, as a result of higher staff costs.

Exploration expense was $5.2 million in the fourth quarter of 2007 compared to $4.6 million in the corresponding period last year, an increase of $0.6 million (13%). The increase is due mainly to the ongoing exploration at Shebandowan and the APP.

For the three months ended December 31, 2007, the loss from mining operations was $8.2 million, a decline of $8.7 million compared to last year’s profit of $0.5 million, and reflects the revenue and operating expense issues described above.

Other Income (Expenses)

For the three months ended December 31, 2007, other income and expense was an expense of $2.9 million compared to an expense of $8.0 million in the corresponding period of 2006, a decrease of $5.1 million. The decrease in 2007 reflects a favourable foreign exchange impact compared to last year of $2.6 million, which relates primarily to the translation of the Company’s US dollar denominated convertible notes and credit facilities, and a reduction of interest and other financing charges of $2.5 million. The reduced interest and other financing charges are due primarily to lower interest and accretion expenses of $2.1 million relating to the convertible notes payable and reflects the scheduled repayment of the notes.

Net Income (Loss)

The Company reported a net loss of $11.1 million or $0.19 per share compared to net loss of $7.4 million or $0.14 per share for the three months ended December 31, 2006.

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

10

LIQUIDITY

Sources and Uses of Cash

Year ended December 31 | | 2007 | | 2006 | | 2005 | |

Cash generated (consumed) by operations before working capital changes | | $ | 46,828 | | $ | 9,912 | | $ | (36,460 | ) |

Changes in non-cash working capital | | (21,352 | ) | (43,701 | ) | 28,187 | |

Cash generated (consumed) by operations | | 25,476 | | (33,789 | ) | (8,273 | ) |

Cash provided (used) by financing | | 61,323 | | 41,295 | | (7,051 | ) |

Cash used in investing | | (15,346 | ) | (19,384 | ) | (35,400 | ) |

Increase (decrease) in cash and cash equivalents | | $ | 71,453 | | $ | (11,878 | ) | $ | (50,724 | ) |

Cash provided by operations(1) (prior to changes in non-cash working capital) for the year ended December 31, 2007 was $46.8 million, compared to cash provided by operations of $9.9 million in 2006. The $36.9 million improvement was mainly attributable to increased non-cash amortization expense ($16.8 million), the impact of an unrealized foreign exchange loss ($11.6 million), a decreased net loss ($5.4 million) and a higher non-cash add back for accretion expense relating to the convertible notes payable ($2.9 million). For the year ended December 31, 2007, non-cash working capital required $21.4 million compared to $43.7 million in 2006, a reduction of $22.3 million. The higher non-cash working capital requirement in 2006 reflected the build up of concentrate awaiting settlement from increased production, which included the grade improvement from the commercial start up of the underground mine in April 2006. In 2007, while production continued to increase, this was partially offset by the lower foreign exchange rate.

Palladium awaiting settlement decreased to 125,802 ounces at December 31, 2007 compared to 129,496 ounces at December 31, 2006. The decrease in the physical quantities of metal in the concentrate awaiting settlement, combined with the higher prices used to value the concentrate awaiting settlement, offset by the strengthening Canadian dollar resulted in a $3.0 million (4%) decrease in the value of concentrate awaiting settlement as at December 31, 2007, compared to December 31, 2006. After allowing for non-cash working capital changes, cash provided by operations was $25.5 million for the year ended December 31, 2007 compared to cash usage of $33.8 million in 2006.

Financing activities for the year ended December 31, 2007 provided cash of $61.3 million and reflects equity financings of $75.3 million less the scheduled repayment of debt. On February 27, 2007, the Company completed a private placement of 550,000 flow-through common shares at $11.00 per share for gross proceeds of $6.0 million. These proceeds are being used to expedite work on the Shebandowan Project. In December 2007 the Company completed an equity offering of 18.7 million units at a price of US$4.00 per unit. In connection with the offering the company granted the underwriter’s an over allotment option of 15% at the same price. This option was subsequently exercised in January 2008, increasing the gross proceeds of the offering to US$85.9 million.

The Company’s total debt position reduced to $39.1 million at December, 2007 compared to $74.9 million at December 31, 2006. During 2007, five principal payments related to Tranche I convertible notes totaling US$17.5 million and three principal payments related to the Tranche II convertible note totaling US$4.5 million were made. At the noteholder’s option, these payments were settled in a non-cash transaction by the issuance of 3,120,997 common shares which, in accordance with the terms of the convertible notes loan agreement, are valued at 90% of the five day volume weighted average price on the

(1) Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

11

AMEX exchange immediately prior to the payment date. As at December 31, 2007, US$26.5 million of principal amount of the convertible notes remained outstanding. The Company expects that the noteholders will continue to elect to receive interest and principal payments in common shares, however, should noteholders call for cash payments the Company has the right to defer payment of principal to the Series I and Series II note due dates of August 1, and December 1, 2008 respectively. The reduction in debt also includes scheduled long term debt repayments ($6.2 million), scheduled capital lease repayments ($2.0 million) and the repayment of the Kaiser-Francis Oil Company (“Kaiser-Francis”) credit facility ($5.8 million) from the first advance under the Auramet palladium and platinum advance purchase agreement (see Capital Resources below).

In addition, the strengthening of the Canadian dollar resulted in an unrealized foreign exchange translation gain on US dollar denominated debt at December 31, 2007 of $8.4 million.

On October 12, 2006 the Company closed a transaction with Kaiser-Francis for a US$5.0 million short term working capital loan maturing December 31, 2006. The interest rate under the loan was the 30-day LIBOR plus 2.5% per annum. The Company paid a commitment fee of US$37,000 and amounts not drawn under the loan were subject to a standby fee of 0.125% per annum. In connection with the loan, the Company granted to Kaiser-Francis a first priority security interest on the inventory and receivables of the Company. On December 13, 2006 the maturity date was extended to March 31, 2007, with no other change in terms. The Company paid a commitment fee of US$25,000 for the extension. In accordance with the terms of the Auramet palladium and platinum advance purchase agreement, the first advance received from Auramet on March 7, 2007 was used to repay this loan to Kaiser-Francis.

Investing activities required $15.3 million of cash in 2007, the majority of which was attributable to the ongoing lateral development and sustaining capital for the underground mine ($9.2 million) and the 2007 expansion of the tailings management facilities ($4.3 million). This compares with $19.4 million of net investing activities last year, which was mainly related to the underground mine development and sustaining capital ($12.1 million) and the 2006 expansion of the tailings management facilities ($4.7 million).

CAPITAL RESOURCES

As at December 31, 2007 the Company had cash and cash equivalents of $74.6 million compared to $3.2 million at the same time last year.

To meet working capital requirements and lateral development of the underground mine, the Company entered into a palladium and platinum advance purchase facility with Auramet Trading, LLC on January 19, 2007 pursuant to which the Company may, at its election, receive advance payments not exceeding an aggregate maximum amount of US$25.0 million. The Company is required to pay a monthly commitment fee of 0.5% per annum, on the unused portion of the Auramet facility. As at December 31, 2007, the Company had no advances outstanding under this facility and the maximum amount of US$25.0 million was available. Under the current agreement with Auramet no advances can be received after June 2008 and any amounts advanced must be repaid by December 2008.

The Company anticipates that current capital resources are sufficient to meet the needs of the existing operations at the Lac des Iles mine as well as the development of the Shebandowan West project, Phase I of the OHGZ project and further evaluation of APP. The Company is currently pursuing options for the renewal or replacement of the Auramet working capital facility together with financing options to provide funding for the development of the APP project in Finland.

12

Contractual Obligations

As at December, 2007 | | Payments Due by Period | |

(thousands of dollars) | | Total | | 1 Year | | 2-3 Years | | 4-5 Years(2) | |

Senior credit facility | | $ | 9,875 | | $ | 5,918 | | $ | 3,957 | | $ | — | |

Capital lease obligations | | 3,496 | | 1,672 | | 1,824 | | — | |

Convertible notes payable(1) | | 25,710 | | 25,710 | | — | | — | |

Interest obligations | | 1,421 | | 1,158 | | 263 | | — | |

Operating leases | | 3,257 | | 1,224 | | 2,008 | | 25 | |

Other purchase obligations | | 10,808 | | 10,808 | | — | | — | |

| | $ | 54,567 | | $ | 46,490 | | $ | 8,052 | | $ | 25 | |

(1) To date noteholders have elected to receive principal and interest payments in common stock.

(2) There are no payments due after five years.

RELATED PARTY TRANSACTIONS

On June 23, 2006, the Company repaid the balance of a US$20.0 million non-revolving credit facility that had been extended by Kaiser-Francis in December 2001 to finance the Company’s working capital requirements. This facility bore interest based on the 30-day LIBOR plus 2.50% and was subject to a standby fee of 0.125% per annum. The amount paid to Kaiser-Francis for interest and standby fee on this facility in 2006 was $0.6 million. Repayment of this facility was made pursuant to the terms of the Series II convertible note issued on June 23, 2006.

On October 12, 2006 the Company closed a transaction with Kaiser-Francis for a US$5.0 million short term working capital loan maturing December 31, 2006. On December 13, 2006, the maturity date was extended to March 31, 2007. Interest on this new facility was based on the 30-day LIBOR plus 2.5% and the standby fee was 0.125% per annum. This facility was repaid on March 7, 2007. As of February 22, 2008 Kaiser-Francis reported that it held approximately 41% of the issued and outstanding common shares of the Company.

On December 13, 2007 the Company completed a public offering of 18,666,667 units at a price of US$4.00 per unit ($4.04 per unit) for total gross proceeds of approximately US$74.7 million. Each unit consisted of one common share and one half of a common share purchase warrant of the Company. Each whole warrant will entitle the holder to purchase one common share at a price of US$5.05 per share at any time on or prior to December 13, 2009. Pursuant to the terms of the securities purchase agreement dated March 24, 2006 between the Company, Kaiser-Francis and IP Synergy Finance Inc. (“IP Synergy”) relating to the Company’s convertible notes due 2008, Kaiser-Francis and IP Synergy each had a right to subscribe at the public offering price for up to 12.5% of the total securities being offered by the Company in this offering. If either Kaiser-Francis or IP Synergy subscribed for less than its 12.5% share, the unused right was to be offered to the non-declining party, Kaiser-Francis or IP Synergy, as the case may be. IP Synergy elected not to participate in this offering pursuant to its pre-existing participation right, and, in accordance with the terms of the securities purchase agreement, Kaiser-Francis elected to subscribe for 25% of this offering.

On January 9, 2008, the Company issued an additional 2,800,000 units under a 30-day overallotment option granted to the underwriters at an exercise at a price of US$4.00 per unit, for total gross proceeds of US$11.2 million. Kaiser-Francis also exercised its pre-existing right under the securities purchase agreement to subscribe for 25% of the overallotment units.

REVIEW OF OPERATIONS AND PROJECTS

Lac des Iles Property

The Lac des Iles mine consists of an open pit mine, an underground mine, a processing plant with a nominal capacity of approximately 15,000 tonnes per day, and the original mill (which is currently idle)

13

with a capacity of approximately 2,400 tonnes per day. The primary deposit on the property is the Roby Zone, a disseminated magmatic nickel-copper-PGM deposit.

Mining Operations

The Company began mining the Roby Zone in 1993 using open pit mining methods. Ore and waste from the open pit is mined using conventional hydraulic 27 cubic meter and 23 cubic meter shovels, 190 tonne trucks, 187 millimeter blast hole drills and a fleet of conventional ancillary equipment. Mine waste is stockpiled outside of design pit limits.

Development of the underground mine commenced in the second quarter of 2004 in order to access the higher grade portion of the Roby Zone. The underground deposit lies below the ultimate pit bottom of the open pit and extends to a depth of approximately 660 meters below the surface where it is truncated by an offset fault. Commercial production from the underground mine commenced on April 1, 2006. For the year ended December 31, 2007, the underground mine had an average head grade of 5.79 grams per tonne palladium compared to 5.96 grams per tonne in 2006.

The chosen mining method for the underground mine is sublevel retreat longitudinal longhole stoping with no fill. The mining block interval is 70 meters floor to floor including a 15 meter to 25 meter sill pillar below each haulage level. Stopes are 45 meters to 55 meters high by the width of the ore body. Total intake ventilation for the mine is designed to be 205 cubic meters per minute. There is one intake ventilation raise/secondary egress situated outside the ultimate open pit limits and air exhausts up the main ramp.

The open pit has a remaining mine life of less than two years at the current rate of production. In light of favourable PGM market conditions, management is currently assessing the economic viability of a southern extension of the open pit, which could prolong the mine life of the open pit by an additional two to three years. The Company is contemplating commencing production from the upper portion of the OHGZ as the current underground mine ceases operations.

Milling Operations

In 2001, a new concentrator facility was commissioned which utilizes a conventional flotation technology to produce a palladium rich concentrate that also contains platinum, nickel, gold and copper.

Ore is first crushed in a gyratory crusher and conveyed to a coarse ore stockpile. With the commissioning of the secondary crusher in 2004, the coarse ore stream can be split so that a portion is crushed in the secondary crusher producing a fine material feed which is then combined with the coarse feed. This mixture of coarse and fine material feeds to the SAG mill to increase mill throughput. In 2005, modifications were made to the secondary crusher, including the installation of a slide gate and better control feed distribution. The ore is ground to a nominal P80 (the size of an opening through which 80% of the product will pass) of 74 microns in a conventional semi-autogenous mill/ball mill/pebble crusher (SABC) circuit. The ground ore then feeds a flotation circuit that is comprised of rougher/scavengers and four stages of cleaning. The flotation circuit in the old concentrator is currently connected to the new concentrator to provide additional cleaner flotation capacity. The final concentrate is thickened and dewatered using two pressure filters.

In 2007, the concentrator processed 5,006,383 tonnes of ore or 13,716 tonnes per calendar day at an average palladium head grade of 2.39 grams per tonne and an average palladium recovery of 74.8%. In 2006, the concentrator processed 4,570,926 tonnes of ore or 12,523 tonnes per calendar day at an average palladium head grade of 2.18 grams per tonne and an average palladium recovery of 74.0%. In 2007, the Company produced 286,334 ounces of palladium compared to 237,338 ounces in 2006.

Production costs per tonne of ore milled were $24.98 in 2007 compared to $24.60 in 2006. Cash costs, which include direct and indirect operating costs, smelting, refining, transportation and sales costs and royalties, net of credits for by-products, were US$164 per ounce of palladium in 2007 as compared to US$201 per ounce of palladium in 2006

14

Offset High Grade Zone

The OHGZ is located on the Lac des Iles property and was discovered by the Company’s exploration team in 2001. The OHGZ is believed to be the fault-displaced continuation of the Roby Zone mineralization and is located below and approximately 250 meters to the west of the Roby Zone. A mineral resource estimate prepared by Scott Wilson RPA in October 2007 estimated that the OHGZ has more than three times the mineral resources of the current underground mine at the Roby Zone at similar grades, while still being open along strike to the north, south and at depth.

From May to October 2007, the Company completed approximately 18,000 meters of infill drilling in the upper 300 meters of the OHGZ, with the objective of upgrading that portion of the mineral resources to the measured and indicated categories. The Company has begun to receive assay results and anticipates updating its mineral resources estimate for the OHGZ in the second quarter of 2008. The Company’s objective is to commence production from the OHGZ as the current underground mine reaches the end of its mine life in 2010.

In September 2007, the Company engaged two consulting firms, Micon International Limited and Nordmin Engineering Ltd., to prepare a scoping study. The scoping study will examine the economic viability of several exploitation scenarios for the OHGZ, including a continuation of the ramp from the current underground mine and shaft options. A report on the results of this preliminary economic assessment is nearing completion and the Company anticipates releasing the results during the second quarter of 2008.

An exploration drilling program is also currently in progress to search for the deep limits of the OHGZ. To date, the OHGZ has been traced to a depth of 1,300 meters below surface, and along a strike length of approximately 600 meters.

Shebandowan West Project

On December 10, 2007, the Company earned a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco. In order to earn its 50% interest, the Company incurred $3.0 million in exploration expenditures and made $0.2 million in cash payments. The properties contain a series of nickel-copper-PGM mineralized bodies and the land package totals approximately 7,842 hectares. These properties are located 90 kilometers west of Thunder Bay, Ontario, and approximately 100 kilometers southwest from the Company’s Lac des Iles mine. Vale Inco retains an option to increase its interest from 50% to 60%, exercisable in the event that a feasibility study on the properties results in a mineral reserve and mineral resource estimate of the equivalent of 200 million pounds of nickel and other metals. As currently envisaged, the Shebandowan West Project will not trigger Vale Inco’s back-in right.

The Shebandowan West Project encompasses three shallow mineralized zones known as the West, Road and “D” zones, all of which are located at shallow depths immediately to the west of the former Shebandowan mine in an area known as the Shebandowan West district. The Shebandowan West Project’s nickel-copper-PGM mineralization is believed by management to represent the western extension of the Shebandowan mine orebody. The former Shebandowan mine, which was in operation from 1972 to 1998, produced 8.7 million tonnes of ore at grades of 2.07% nickel, 1.00% copper and approximately 3.0 g/t PGM and gold.

Management is considering a mine development scenario that would entail excavation of the Shebandowan West Project by means of ramp-accessed underground mining methods at a rate of 500 to 1,000 tonnes per day, crushing the material on site and transporting it by truck to the Lac des Iles property for processing at the original mill on the Lac des Iles property. The original mill at Lac des Iles has been idle since 2001 and the Company believes that it could be refurbished quickly and at a relatively low cost. Preliminary metallurgical testing supports the possibility of producing a bulk sulphide concentrate from the Shebandowan West Project at the original mill.

15

A Technical Report in compliance with National instrument 43-101 disclosing the results of a mineral resource estimate by an independent Qualified Person was filed on October 26, 2007. In December 2007, the Company retained SRK Consulting to prepare a preliminary economic assessment of the ramp-accessed mine scenario. The results of this report are expected in the second quarter of 2008.

Community consultations and baseline environmental sampling are ongoing and completion of bulk sampling, process and design are expected to be completed during the first half of 2008. If plans proceed as expected, production at the Shebandowan West Project could commence in 2009.

Arctic Platinum Project

The Company is party to an agreement with Gold Fields entitling it to earn up to a 60% interest in a series of mining licenses and claims known as the APP. The agreement is subject to a back-in right in favor of Gold Fields which, if exercised, would decrease the Company’s interest to a 50% share. Upon satisfaction of the earn-in requirements, North American Palladium will have a casting vote at meetings of the joint venture partners, other than with respect to matters requiring a special majority vote.

In order to exercise the option, on or before August 31, 2008, the Company must: (i) complete a re-scoping and exploration program; (ii) complete a feasibility study; (iii) make a production decision and prepare the initial formal development proposal and associated budget based on the feasibility study; (iv) incur expenditures of US$12.5 million on the APP; and (v) issue 7,381,636 Common Shares to Gold Fields BV in order to earn a 50% interest or 9,227,033 Common Shares to earn a 60% interest. To date, the Company has completed the re-scoping study, incurred over US$11.6 million in expenditures and has commissioned a feasibility study. The Company believes that it will satisfy the conditions of the earn-in on or before August 31, 2008.

The APP is an advanced-stage PGM-nickel-copper exploration project located approximately 60 kilometers south of the city of Rovaniemi, Finland. To date, three areas of the APP have been explored by North American Palladium: the Suhanko deposits, the Narkaus deposits and the Penikat deposits.

The Suhanko Deposits

The Suhanko deposits are located approximately 60 kilometers south of the city of Rovaniemi, which has a population of approximately 4,400 and, as the capital of the Province of Lapland, is a major regional centre. The town is serviced by rail, road and air with multiple flights daily to and from Helsinki. The port of Kemi on the Gulf of Bothnia is kept open throughout the winter and is located 120 kilometers southwest of Rovaniemi.

Suhanko is comprised of several deposits over a total strike length of approximately 17 kilometers that have been demonstrated by Gold Fields to contain a number of nickel-copper-PGM deposits. Since the discovery of nickel-copper-PGM mineralization at the Yli-Portimo deposit in 1964, exploration in the Suhanko project area in the intervening years has resulted in the discovery of the following other deposits: Konttijarvi, Little Suhanko, Vaaralampi, Niittilampi, Ahmavaara, Suhanko North, and Tuumasuo. Exploration and delineation work in connection with the Company’s preparation of a feasibility study has focused on only the Konttijarvi and Ahmavaara deposits, with the total sizes of the remaining deposits being essentially undetermined.

The Narkaus Deposits

The Narkaus deposits are located approximately 30 kilometers northeast of the Suhanko deposits and contains a sequence of favorable rocks that have been demonstrated to be present along an aggregate strike length of approximately 20 kilometers. To date, significant nickel-copper-PGM mineralization has been discovered at a number of deposits, including the Siika-Kama, Kuohunki, Nutturalampi and Kilvenjärvi deposits. The Company continues to explore deposits in the Narkaus deposit area with a view to potentially improving the overall economics of the larger Suhanko deposit area.

16

The Penikat Deposits

The Penikat deposits are a separate intrusion located approximately 35 kilometers to the southwest of the Suhanko deposits. Traditional reef-style nickel-copper-PGM mineralization has been discovered in three distinct reefs over a strike length of approximately 27 kilometers. To date, exploration has concentrated on evaluating the shallow portions (essentially above a depth of 100 meters from surface) of one of these reefs where significant concentrations of nickel-copper-PGM mineralization located in the northern portion of the intrusion have been discovered. The exploration potential of the remaining two reefs, along with the depth extensions of the explored reef, remains essentially untested.

The Suhanko Deposits

Management has been examining a development scenario consisting of two nickel-copper-PGM open pit mines at two of the deposits that comprise the Suhanko area, the Ahmavaara and Konttijarvi deposits, which are located three kilometers from each other. The nickel-copper-PGM bearing material would be processed through a centrally-located concentrator at a nominal throughput rate of 5.0 million tonnes per year. PGM-nickel-copper bearing concentrate would be transported 125 kilometers by truck to a port facility located at Kemi, Finland and shipped to smelting and refining facilities for final extraction of the contained metals.

On October 30, 2007, the Company released the results of a scoping study by Aker Kvaerner on the two main mineral deposits in the Suhanko area, Ahmavaara and Konttijarvi, which indicated that the mineral resources could potentially support a 20-year mine life at approximately 7.5 million tonnes per annum. The Company has retained Aker Kvaerner to prepare a definitive feasibility study for the Suhanko project to build upon the recommendations in the scoping study. The Company has also contracted with a 30-year veteran of the mining industry to oversee the feasibility study and other work at the APP as the Company moves closer to satisfying its earn-in conditions.

An infill drilling campaign at the Ahmavaara deposit was completed earlier in 2007 and the assay results of the final 26 holes of the 83-hole drilling program were reported on October 22, 2007. Micon International Limited has now been engaged to conduct the update of the mineral resource estimates, which will include the results from the Ahmavaara infill drilling campaign. Micon will also conduct the open pit designs and optimization.

Bulk sampling of the Ahmavaara and Konttijarvi deposits was also completed in October 2007 in advance of pilot plant test work. A program of bench-scale metallurgical testing has been completed in support of a pilot plant test that commenced in December 2007 and was completed in February 2008. The pilot plant test provided samples that will be tested by smelters that have been identified for the concentrate marketing strategy and will allow the Company to pilot a flowsheet. In October 2007, the Company commenced discussions with various smelters, and follow-up meetings are planned now that samples are available. Initial smelting proposals in support of the feasibility study are anticipated by May 2008.

Grassroots Exploration Properties

In addition to its operating mine and three advanced exploration projects, the Company is constantly examining PGM and nickel opportunities, particularly in the areas surrounding the Company’s Lac des Iles mine.

Management believes that the Company is well positioned to partner with other PGM and nickel exploration companies in Canada, given the existing infrastructure at the Lac des Iles mine and the Company’s years of experience in mining PGM-nickel deposits. From time to time, the Company enters into confidentiality agreements with junior mining companies or individual prospectors to assess the prospective nature of their land holdings. In addition, management believes that the consolidation in the nickel industry may result in joint venture or acquisition opportunities for the Company as the major nickel companies seek to shed non-core assets.

17

The Company is also active in grassroots exploration and recently staked 39 claims containing 632 claim units at the Company’s Shawmere Project, located approximately 110 kilometers southwest of Timmins, Ontario, Canada. The Company intends to conduct a grassroots exploration program to assess the area’s potential for hosting PGM-nickel-copper mineralization similar to that found at its Lac des Iles mine.

Metal Sales

In 2007, the Company sold palladium both into the spot market and to Auramet Trading, LLC, a precious metals merchant (“Auramet”), under a palladium and platinum advance purchase facility that the Company entered into in January 2007. The facility provides for the sale, at the Company’s option, of an average of 10,000 ounces of palladium and 500 ounces of platinum per month. Under the terms of the facility, the Company may receive advance payments not exceeding, at any time, an aggregate maximum of US$25 million. The purchase price may be fixed or provisional. For fixed pricing, the Company may price at either: (i) Auramet’s current market bid price at the time of the transaction, or (ii) market limit orders, as defined under the terms of the agreement. In the case of provisional pricing, it is determined based on the afternoon fixing of the London Bullion Marketing Association immediately preceding the purchase. In each case, such pricing will reflect the forward value corresponding to the scheduled delivery date. Each advance payment is subject to a discount and, upon the delivery of the precious metals to Auramet, the Company is paid the difference between the advance payment and the purchase price. To secure the obligations of the Company under the agreement, the Company has granted to Auramet a security interest in the concentrates mined at the Lac des Iles mine, together with the proceeds arising from the sale of the concentrate, and, by way of security, an assignment of its smelting and refining agreement.

In 2006, all palladium production was sold into the spot market with one or more commodity dealers and manufacturers. From January 2000 to June 2005, the Company sold all of its palladium production to an automotive manufacturer under a contract with a US$325 per ounce floor price for 100% of its palladium production and a US$550 per ounce ceiling price on 50% of its palladium production.

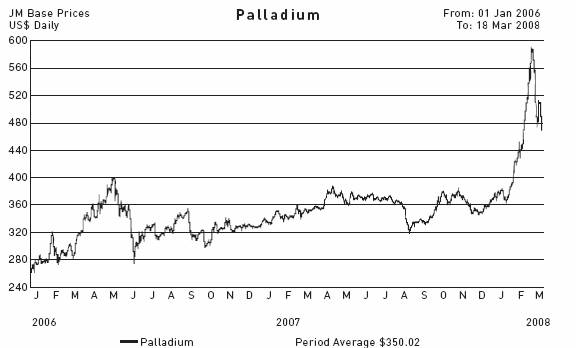

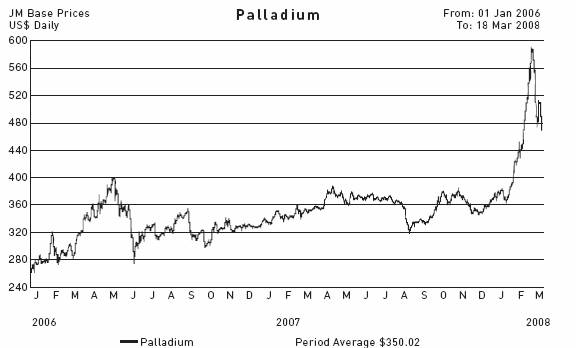

For the year ended December 31, 2007, the Company recorded a weighted average cash price of US$356 per ounce on its physical deliveries of palladium into the spot market. The Company expects that palladium prices will continue to trade higher in 2008 than in 2007. The average spot price was US$360 per ounce for the fourth quarter of 2007 (reaching a high of US$379), compared to an average price of US$321 per ounce for same period last year. Since January 1, 2005, the price of palladium has shown strong growth as a result of strong demand, most notably in the automotive industry, as indicated in the chart below from Johnson Matthey.

18

Source: Johnson Matthey

MANAGEMENT’S OUTLOOK

There is no significant pattern of variability or seasonality affecting the Company’s operations. The principal drivers of the Company’s performance are its monthly production of PGM and by-product metals from its Lac des Iles mine, the corresponding world spot prices of such metals and the prevailing US$ exchange rate.

Production for the year ended December 31, 2007 was 286,334 ounces of palladium with an average palladium head grade of 2.39 grams per tonne, and represents a 21% increase over the previous year’s production of 237,338 ounces, with a head grade of 2.18 grams per tonne. This continues the trend of improved volumes and head grade year over year reflecting the impact of the underground mine which has been in commercial production since the second quarter of last year. The Company’s 2008 year end production target is approximately 300,000 ounces of palladium. The proportion of by-product metals produced is, in aggregate, expected to increase in tandem with palladium production.

The Company’s intensive core exploration program will continue in 2008, with an important component being the continuation of activities on the APP in Finland. In addition, the Company continues to focus on the further definition of the OHGZ at Lac des Iles and the development of the Shebandowan West Project. A key strategy moving forward will be to continue the pursuit of opportunities to acquire good quality PGM-Ni-Cu projects.

Recorded Metal Prices

| | 2005 | | 2006 | | 2007 | | YTD 2008* | |

Palladium – US$/oz | | $ | 230 | | $ | 319 | | $ | 356 | | $ | 462 | |

Platinum – US$/oz | | $ | 815 | | $ | 1,140 | | $ | 1,364 | | $ | 1,903 | |

Gold – US$/oz | | $ | 442 | | $ | 610 | | $ | 726 | | $ | 941 | |

Nickel – US$/lb | | $ | 6.60 | | $ | 11.68 | | $ | 15.58 | | $ | 13.18 | |

Copper – US$/lb | | $ | 1.50 | | $ | 3.02 | | $ | 3.30 | | $ | 3.48 | |

* Based on the average month end London Metal Exchange (“LME”) afternoon price fix for the two months ended February 29, 2008.

19

The Company believes that the surplus pressures of the early 2000’s have abated and that there is evidence to support the view that the palladium market is moving towards more of a demand-driven pricing environment. This is being evidenced by increasing global catalytic demand, fueled by growing low tolerance emission legislation, and technological advances which could exploit pricing differentials between palladium and platinum. Electrical power supply problems in South Africa that produces approximately 35% of the world’s supply of palladium is another catalyst for higher palladium and platinum prices.

Critical Accounting Policies and Estimates

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company’s financial statements. The following accounting policies are considered critical:

(a) Impairment assessments of long-lived assets

Each year, the Company reviews the mining plan for the remaining life of mine. Significant changes in the mine plan can occur as a result of mining experience, mineral reserve estimates based on assessed geological and engineering analysis, new discoveries, changes in mining methods and production rates, process changes, investments in new equipment and technology, metal prices, estimates of future production costs and other factors. Based on year-end mineral reserves and the current mine plan, the Company reviews annually its accounting estimates and makes adjustments accordingly.

The Company assesses long-lived assets for recoverability on an annual basis. When the carrying value of a long-lived asset is less than its net recoverable value, as determined on an undiscounted basis, an impairment loss is recognized to the extent that its fair value, measured as the discounted cash flows over the life of the asset.

Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company’s operating performance could have a material effect on the Company’s ability to recover the carrying amounts of its long-lived assets resulting in possible additional impairment charges.

(b) Amortization of mining interests

The Company amortizes a large portion of its mining interests using the unit of production method based on proven and probable reserves to which they relate or on a straight-line basis over their estimated useful lives, ranging from three to seven years.

(c) Revenue Recognition

Revenue from the sale of palladium and by-product metals is recognized net of royalties upon the delivery of concentrate to the smelter, which is when title transfers and the rights and obligations of ownership pass. The Company’s metals are sold under contracts that provide for final prices that are determined by quoted market prices in a period subsequent to the date of sale. Variations from the provisionally priced sales are recognized as revenue adjustments as they occur until the price is finalized. Provisional pricing is based upon market prices in the month of recognition. Concentrate awaiting settlement at the smelter is net of estimated treatment and refining costs which are subject to final assay adjustments.

(d) Mine Restoration Obligation

Asset retirement obligations are recognized when incurred and recorded as liabilities at fair value. The amount of the liability is subject to re-measurement at each reporting period. The liability is accreted over time through periodic charges to earnings. In addition, the asset retirement obligation is capitalized as part of mining interests and amortized over the estimated life of the mine. The estimated asset retirement obligation may change materially based on future changes in operations, costs of reclamation and closure activities, and regulatory requirements.

20

RECENT ACCOUNTING PRONOUNCEMENTS ISSUED BUT NOT YET ADOPTED

(a) Financial Instruments – Recognition and Measurement

In December 2006, the CICA released new Handbook sections 3862, “Financial Instruments – Disclosures”, and 3863, “Financial Instruments – Presentation”, effective for fiscal years beginning on or after October 1, 2007. Section 3862, describes the required disclosures related to the significance of financial instruments on the Company’s financial position and performance and the nature and extent of risks arising for financial instruments to which the entity is exposed and how the entity manages those risks. This section complements handbook sections 3855, “Financial Instruments – Recognition and Measurements”; 3863, “Financial Instruments – Presentation; and 3865, “Hedges”. Section 3863, establishes standards for presentation of financial instruments and non financial derivatives. This section complements handbook section 3861, “Financial Instruments – Disclosure and Presentation”. The Company has not yet determined the effect these new standards will have on its financial position and results of operations.

(b) Capital Disclosures

In December 2006, the CICA released new Handbook section 1535, “Capital Disclosures”, which establishes standards for disclosing information about a Company’s capital and how it is managed, to enable users of financial statements to evaluate the Company’s objectives, policies and procedures for managing capital. This section will apply to interim and annual financial statements relating to fiscal years beginning on or after January 1, 2008. The Company has not yet determined the effect these new standards will have on its financial position and results of operations.

(c) Inventories

In June 2007, the CICA released new handbook section 3031, “Inventories,” effective for interim and annual financial statements beginning on or after January 1, 2008. Section 3031 supersedes the existing CICA section 3030, “Inventories,” and provides additional guidance on the determination of cost and its subsequent recognition as an expense, including any write-down to net realizable value, and disclosures made within the financial statements. The Company has not yet determined the effect these new standards will have on its financial position and results of operations.

OUTSTANDING SHARE DATA

As of March 18, 2008, there were 80,633,812 common shares of the Company outstanding and options outstanding pursuant to the 1995 Corporate Stock Option Plan entitling holders thereof to acquire 391,433 common shares of the Company at an average strike price of $9.82. As of the same date, there were also 12,724,202 warrants outstanding each warrant entitling the holder thereof to purchase one common share at an average strike price of US$5.81.

RISKS AND UNCERTAINTIES

The price of palladium is the most significant factor influencing the profitability of the Company. In the twelve months ended December 31, 2007, sales of palladium accounted for approximately 47% (December 31, 2006 – approximately 48%) of the Company’s revenue. Many factors influence the price of palladium, including global supply and demand, speculative activities, international political and economic conditions and production levels and costs in other PGM producing countries, particularly Russia and South Africa. The possible development of a substitute alloy or synthetic material, which has catalytic characteristics similar to platinum group metals, may result in a future decrease in demand for palladium and platinum.

Currency fluctuations will affect financial results since the prices of the Company’s products are denominated in United States dollars, whereas the Company’s administration, operating and exploration expenses are incurred mainly in Canadian dollars. As a result, any strengthening of the Canadian dollar relative to the United States dollar has a negative impact on the Company’s revenue and profitability.

The Company is dependent on one mine for its metal production. The business of mining is generally subject to risks and hazards, including environmental hazards, industrial accidents, metallurgical and

21

other processing problems, unusual and unexpected rock formations, pit slope failures, flooding and periodic interruptions due to inclement weather conditions or other acts of nature, mechanical equipment and facility performance problems and the availability of materials and equipment. These risks could result in damage to, or destruction of, the Company’s properties or production facilities, personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. Although the Company maintains insurance in respect of the mining operations that is within ranges of coverage consistent with industry practice, such insurance may not provide coverage of all the risks associated with mining. Currently the Company sells all of its concentrate to one smelting firm under a contract that was renegotiated during the second quarter of 2007 for a three year term that expires on March 31, 2010. This agreement may be extended on an annual basis for an additional two years by mutual agreement of both parties if such agreement is reached no later than six months prior to the anniversary date of March 31, 2010.

DISCLOSURE CONTROLS AND PROCEDURES