Exhibit 1.1

NORTH AMERICAN PALLADIUM LTD.

ANNUAL INFORMATION FORM

For the year ended December 31, 2012

Dated as of March 20, 2013

TABLE OF CONTENTS

| | | | |

FORWARD-LOOKING STATEMENTS | | | 2 | |

REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION | | | 3 | |

CORPORATE STRUCTURE | | | 4 | |

DESCRIPTION OF THE BUSINESS AND GENERAL DEVELOPMENTS | | | 6 | |

Three Year History | | | 6 | |

Business Overview | | | 11 | |

General Description of Palladium | | | 12 | |

Palladium Supply and Demand Fundamentals | | | 13 | |

The Lac des Iles Property | | | 15 | |

Other Mineral Properties in Ontario | | | 30 | |

Other Mineral Properties in Quebec | | | 34 | |

ENVIRONMENT | | | 38 | |

DIVIDENDS | | | 40 | |

CAPITAL STRUCTURE | | | 40 | |

MARKET FOR SECURITIES | | | 42 | |

DIRECTORS AND EXECUTIVE OFFICERS | | | 43 | |

LEGAL PROCEEDINGS | | | 47 | |

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 48 | |

TRANSFER AGENT AND REGISTRAR | | | 48 | |

MATERIAL CONTRACTS | | | 48 | |

INTERESTS OF EXPERTS | | | 48 | |

RISK FACTORS | | | 50 | |

AUDIT COMMITTEE INFORMATION | | | 60 | |

ADDITIONAL INFORMATION | | | 61 | |

AUDIT COMMITTEE MANDATE | | | 62 | |

IMPERIAL-METRIC CONVERSION TABLE | | | 67 | |

GLOSSARY OF TERMS | | | 67 | |

FORWARD-LOOKING STATEMENTS

This Annual Information Form (“AIF”) contains ‘forward-looking statements’ and/or ‘forward-looking information’, which include future-oriented financial information, within the meaning of the ‘safe harbor’ provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. All statements other than statements of historical fact are forward looking statements. The words ‘expect’, ‘believe’, ‘anticipate’, ‘target’, ‘plan’, ‘may’, ‘will’, ‘intend’, ‘estimate’, and similar expressions identify forward-looking statements, although these words may not be present in all forward-looking statements. Forward-looking statements included in this AIF include, without limitation: information as to strategy, plans or future financial or operating performance, such as the Company’s (as defined below) expansion plans, project timelines, production plans, projected cash flows or capital expenditures, cost estimates, mining or milling methods, projected exploration results, resource and reserve estimates and other statements that express management’s expectations or estimates of future performance.

Forward-looking statements, including future-oriented financial information, are necessarily based on a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and assumptions contained in this AIF, which may prove to be incorrect, include, but are not limited to the following:

| | • | | that the Lac des Iles property will be and remain viable operationally and economically; |

| | • | | that expectations for mill feed head grade, recovery rates and mill performance will be as expected at the Lac des Iles property; |

| | • | | the plans for mine production, mine development projects including the Lac des Iles mine (the “LDI Mine”) expansion, mill production and exploration will proceed as expected and on budget; |

| | • | | market fundamentals will result in reasonable demand and prices for palladium and by-product metals in the future; |

| | • | | the Company will not be subject to any environmental disasters, significant regulatory changes or material labour disruptions; |

| | • | | the information and advice the Company has received from its employees, consultants and advisors relating to matters such as mineral resource and mineral reserve estimates, engineering, mine planning, metallurgy, permitting and environmental matters is reliable and correct and, in particular, that the models used to calculate mineral resources and mineral reserves are appropriate and accurate; |

| | • | | the Company and its contractors will be able to attract and retain qualified employees; and |

| | • | | financing for the Company’s expansion and production plans will be available on reasonable terms. |

North American Palladium Ltd. and its subsidiaries (“NAP” or the “Company”) caution the reader that such forward-looking statements involve known and unknown risks that may cause the actual results to be materially different from those expressed or implied by the forward-looking statements. Such risks include, but are not limited to: the possibility that commodity prices and foreign exchange rates may fluctuate; the possibility that general economic

2

conditions may deteriorate; the inability to meet production level and cost estimates; inaccuracy of mineral resource and reserve estimates; decreases in the market price of palladium or other metals may render the mining of reserves uneconomic; the demand for, and cost of, exploration, development and construction services; the possibility of construction and commissioning delays; the risks related to future exploration programs, including the risk that future exploration will not replace mineral resources and mineral reserves that become depleted; inherent risks associated with mining and processing including environmental hazards; the uncertainty as to the Company’s ability to achieve or maintain projected production levels at the LDI Mine; the pursuit of any particular transaction or strategic alternative in connection with the strategic review process being undertaken in respect of the sale of the Company’s Quebec-based gold division; the potential uncertainty related to title to the Company’s mineral properties; the risk that the Company may not be able to obtain external financing necessary to continue its expansion and production plans; the Company’s reliance on third parties for smelting and refining the concentrate that is produced at the Lac des Iles mill; employment disruptions, including in connection with collective agreements between the Company and unions; environmental and other regulatory requirements; the costs of complying with environmental legislation and government regulations; the risk that permits and regulatory approvals necessary to conduct operations will not be available on a timely basis, on reasonable terms or at all; loss of key personnel; competition from other producers of platinum group metals (“PGMs”) and from potential new producers; risks involved in current or future litigation (including class actions) or regulatory proceedings; the development of new technology or new alloys that could reduce the demand for palladium; the ability of the Company to comply with the terms of its credit facility, senior secured notes, convertible debentures or future credit facilities; risks related to the Company’s hedging strategies; lack of infrastructure necessary to develop the Company’s projects; the ability of the Company to maintain adequate internal control over financial reporting and disclosure controls and procedures.

All of the forward looking statements made in this AIF are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the projected results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. The forward-looking statements are not guarantees of future performance. All forward looking statements in this Annual Information Form are made as at December 31, 2012, unless otherwise indicated, and the Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION

The information in this AIF is presented as at December 31, 2012 unless otherwise indicated.

Unless otherwise indicated, all dollar amounts referred to herein are in Canadian dollars.

Unless otherwise indicated, all financial information included herein has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

Unless otherwise indicated, all reserve and resource estimates included in this annual information form have been prepared in accordance with Canadian National Instrument 43-101 –Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

3

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this document uses the terms “measured resources,” “indicated resources” and “inferred resources”. Investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of a “measured resource” or “indicated resource” will ever be converted into a “reserve”. U.S. investors should also understand that “inferred resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of “inferred resources” exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. In addition, disclosure of “contained ounces” in a mineral resource is permitted disclosure under Canadian regulations. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth in this AIF may not be comparable with information made public by companies that report in accordance with U.S. standards.

CORPORATE STRUCTURE

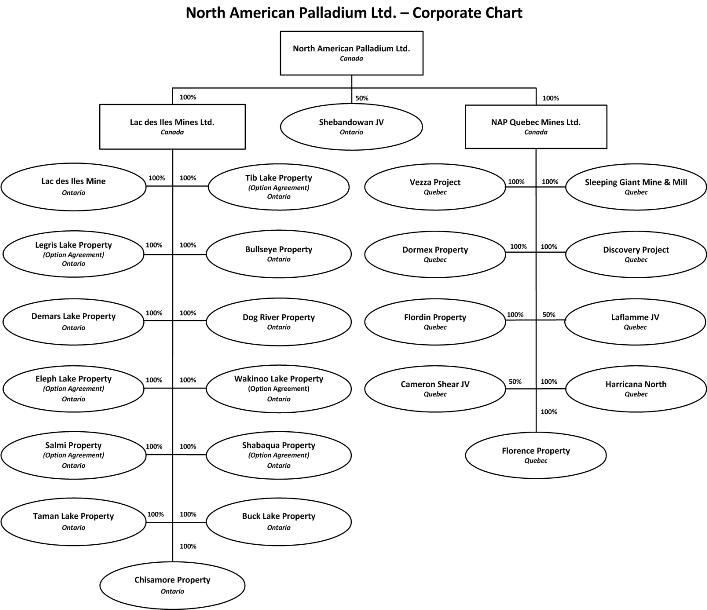

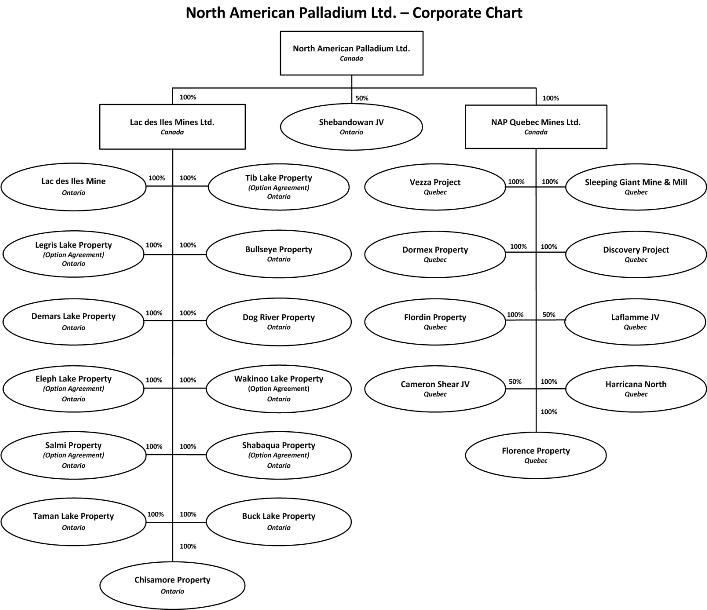

The Company is the successor to Madeleine Mines Ltd., a company incorporated under theMining Companies Act (Quebec) by letters patent in 1968. The Company completed its initial public offering in 1968 and has been listed with the Toronto Stock Exchange (the “TSX”) since December 19, 1968. In January 1992, Madeleine Mines Ltd. was amalgamated with 2945-2521 Quebec Inc. and the amalgamated company was wound up into the federally incorporated parent company, 2750538 Canada Inc. (“2750538”). 2750538 changed its name to Madeleine Mines Ltd. and, in June 1993, the name was changed to North American Palladium Ltd. The Company continues to exist under theCanada Business Corporations Act (“CBCA”). The Company has two wholly-owned subsidiaries: Lac des Iles Mines Ltd. (“LDI”) and NAP Quebec Mines Ltd. (“NAP Quebec”) (formerly Cadiscor Resources Inc. (“Cadiscor”)).

In 1991, LDI was incorporated under the CBCA as a subsidiary of Madeleine Mines Ltd. to hold a 50% interest in the Lac des Iles palladium property located approximately 85 kilometres northwest of the city of Thunder Bay. In 1994, LDI acquired the remaining 50% interest in the Lac des Iles property from Sheridan Platinum Group Ltd. to become the sole owner of the property.

Cadiscor was incorporated under the CBCA in 2006. On May 26, 2009, the Company acquired all of the issued and outstanding shares of Cadiscor pursuant to a plan of arrangement under the CBCA and Cadiscor became a wholly-owned subsidiary of NAP. In March of 2011, Cadiscor

4

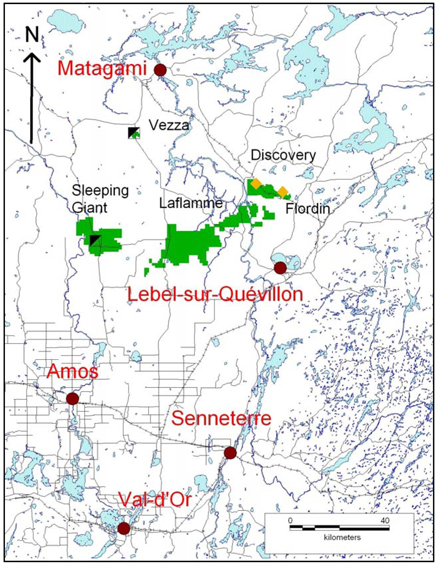

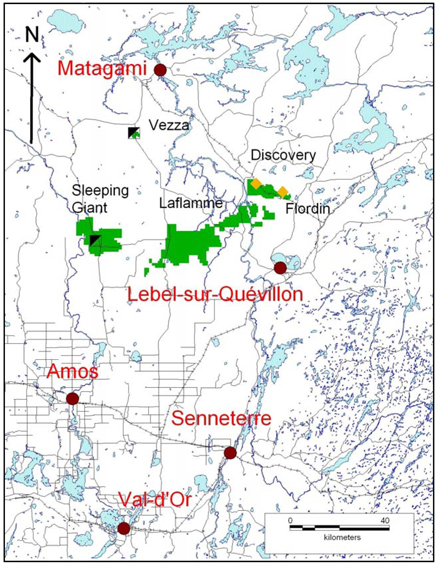

changed its name to NAP Quebec Mines Ltd. On May 10, 2010, the Company acquired the Vezza project in the Abitibi region of Quebec from Agnico-Eagle Mines Ltd. (“Agnico-Eagle”) and the project was subsequently transferred to NAP Quebec. NAP Quebec owns various other gold properties located in Quebec, including the Sleeping Giant mine and mill, the Flordin property, the Discovery project, and the Dormex property.

On May 20, 2010, the shareholders of the Company passed a special resolution authorizing an amendment to the articles of incorporation to cancel the class of shares of the Company known as the “special shares”. The Company had inherited these special shares by virtue of the amalgamation with 2750538 described above.

The Company’s head and registered office is located at 200 Bay Street, Suite 2350, Royal Bank Plaza, South Tower, Toronto, Ontario, M5J 2J2, Canada, Telephone: (416) 360-7590, Facsimile: (416) 360-7709.

The following chart describes the Company’s subsidiaries and properties as at March 20, 2013. The percentage ownership is indicated for each entity. Several of the option agreements referenced below have not been fully exercised.

5

DESCRIPTION OF THE BUSINESS AND GENERAL DEVELOPMENTS

Three Year History

2010

Due to the recovery in the price of palladium, in December of 2009, NAP announced the restart of mining operations at the Company’s LDI Mine, which was expected to be fully operational early in the second quarter of 2010. The LDI Mine had been put on care and maintenance in October 2008 due to the impact of the global financial crisis on metal prices.

In the first quarter of 2010, the Company achieved commercial production at the Sleeping Giant mine. Due to encouraging drill results, the Company commenced deepening the mine shaft by 200 metres to allow for the development of three new mining levels.

Following the decision to commence initial development of the Offset Zone at the LDI Mine, the Company began development in February 2010 of a 1,500 metre ramp from the bottom of the Roby Zone to the top of the Offset Zone at the LDI Mine to provide initial access for shaft construction required to mine the Offset Zone.

On March 31, 2010, the Company filed a NI 43-101 report for the Sleeping Giant gold mine entitled, “Updated Reserves and Resources on December 31, 2009 The Sleeping Giant Mine, Northwestern Quebec” prepared by Vincent Jourdain, P.Eng., a qualified person under NI 43-101.

On April 6, 2010, the Company released a mineral reserve and resource update for the Sleeping Giant mine, as well as a first-time mineral resource estimate for its Flordin property.

In the second quarter of 2010, the Company restarted underground production from the Roby Zone at the LDI Mine. The Company also signed a new collective agreement with the United Steelworkers and renewed its smelting and refining contract with Xstrata Nickel (“Xstrata”).

On April 28, 2010, the Company announced the completion of a bought deal prospectus offering of 20 million units for total gross proceeds of $100 million. Each unit consisted of one common share in the Company (a “Common Share”) and one half of a Common Share purchase warrant of the Company. The warrants expired on October 28, 2011.

On May 10, 2010, the Company acquired the Vezza gold project in the Abitibi region of Quebec from Agnico-Eagle. The Vezza property is situated 85 kilometres by paved road from NAP’s Sleeping Giant mine and mill.

On May 27, 2010, the Company announced the results of an updated resource estimate for the Offset Zone at the LDI Mine. The updated estimate was prepared by Roscoe Postle Associates Inc. (“RPA”).

In June 2010, the Company signed an option and purchase agreement to acquire a 100% interest in the Legris Lake property, which is located southeast of the LDI Mine.

6

In July 2010, the Company entered into a $30 million operating line of credit with a major Canadian bank. The credit facility was intended to be used for working capital liquidity and general corporate purposes.

On August 16, 2010, the Company announced the results of a technical report and preliminary economic assessment on the Offset Zone at the Lac des Iles property completed by P&E Mining Consultants Inc., with input from other consulting firms. The report aimed to highlight a preliminary approach to mining the Offset Zone, including details related to the development of the mine expansion.

In October 2010, the Company signed three option and purchase agreements to acquire a 100% interest in the Moose Calf and Kukkee gold properties, which are located near the Company’s Shebandowan property in Ontario. These properties have since been renamed the Shabaqua property.

In November 2010, NAP announced the discovery of a potential new PGM zone called the Sheriff Zone at the LDI Mine, located approximately 100 metres southeast of the Offset Zone, and announced additional PGE intersections from the Cowboy Zone and Outlaw Zone in the footwall to the Offset Zone.

On November 29, 2010, the Company filed a NI 43-101 report for the Lac des Iles property entitled, “Technical Report on the Lac des Iles Mine Property, Thunder Bay, Ontario, Canada” prepared by RPA.

On December 6, 2010, Greg Struble was appointed as Vice President and Chief Operating Officer of the Company.

On December 8, 2010, the Company announced that it elected to accelerate the expiry of the Series A warrants originally issued on September 30, 2009 and October 8, 2009. The Series A warrants expired on January 14, 2011.

2011

On February 18, 2011, the Company announced the completion of a bought deal prospectus offering of 2,667,000 flow-through Common Shares at a price of $8.25 per share for total gross proceeds of $22,002,750.

On March 22, 2011, the Company announced that its Board of Directors approved the adoption of a shareholder rights plan (the “Rights Plan”), which was subsequently approved by the Company’s shareholders at the annual and special meeting held on May 11, 2011. The Rights Plan is similar to plans adopted by other public companies in Canada, and was adopted to ensure shareholders are given fair treatment in the event of any take-over bid for the Company’s common shares and provide shareholders adequate time to properly evaluate an offer. The Rights Plan provides for the issuance of one right for each outstanding Common Share of the Company on the occurrence of certain events. The full text of the Rights Plan can be found under NAP’s SEDAR profile at www.sedar.com.

On March 30, 2011, the Board of Directors of the Company adopted a Majority Voting Policy for the election of directors in uncontested elections. Pursuant to that policy, if a nominee does not

7

receive the affirmative vote of at least the majority of votes cast at the meeting of shareholders, the director shall forthwith submit his or her resignation. The Board of Directors will then determine whether to accept the resignation as soon as possible and in any event within 90 days of the shareholders’ meeting.

On June 13, 2011, the Company released an updated mineral resource estimate for the Offset Zone at the LDI Mine.

On June 13, 2011, the Company filed a new NI 43-101 report for the Sleeping Giant mine entitled, “Technical Report, The Sleeping Giant Mine, Northwestern Quebec Reserves and Resources on December 31, 2010” prepared by Vincent Jourdain, Eng., Donald Trudel, Geo. and Marc-André Lavergne, Eng.

On June 28, 2011, the Company provided an update on the first tranche of drill results from its 2011 exploration program at the LDI Mine, including additional PGE intersections from the Cowboy Zone.

On September 14, 2011, additional results were released for the Lac des Iles property exploration program, including positive infill drill results in the Offset Zone and significant mineralization close to the deepest limit of the then current resource wireframe.

On July 12, 2011, the Company released results from its 2011 exploration program at the Company’s gold division in Quebec’s Abitibi region, including surface and underground drilling results at the Vezza project.

In July 2011, the Company increased its operating line of credit with a major Canadian bank from $30 million to $60 million to provide the Company with the financial flexibility to advance its development projects. The credit facility is secured by the Company’s accounts receivables and inventory.

In August 2011, the Company entered into an option and purchase agreement to purchase a 100% interest in the Salmi property, located near the LDI Mine.

On August 26, 2011, the Company released a mineral resource update for its Flordin property.

On October 4, 2011 the Company sold $70 million of senior secured notes (“Notes”) by way of a private placement, with Sprott Resource Lending Corp., who was the lead investor in the Notes. The Notes bear interest at a rate of 9.25% per year, payable semi-annually commencing on March 31, 2012, with a maturity date of October 4, 2014, and are subject to a Company option to extend for an additional year. The Company also issued a palladium warrant with each $1,000 note. Each palladium warrant entitles the holder to purchase 0.35 ounces of palladium at a purchase price of US$620 per ounce anytime up to October 4, 2014. The Company sold an additional $2 million of Notes and related palladium warrants on November 1, 2011.

On October 5, 2011, the Company provided an update on its mine expansion plan for the LDI Mine that factored in certain scope changes from its previous approach. The updated plan took into account the increased size of the Offset Zone resources, updated price assumptions for capital expenditures and newly available seismic information that impacted certain details of the mine design. The Company provided an update on its development progress, as well as clarifying certain details related to mining method and stope design, and capital expenditures.

8

2012

On January 17, 2012, the Company announced that the Vezza mine commenced processing a bulk sample at the Sleeping Giant mill, achieving results in line with expectations. The Company also announced its intention to cease mining operations at the Sleeping Giant mine due to an insufficient operating margin and that it would restructure the gold division, resulting in a non-cash impairment charge on the Company’s gold assets of approximately $50 million, which was reflected in fourth quarter 2011 financial results.

On January 30, 2012, the Company provided an update on the third and final tranche of drill results from its 2011 exploration program at the LDI Mine. Mineralization was discovered 300 metres to the west of the Offset, Cowboy and Outlaw zones and surface mineralization was encountered from trenches along the North VT Rim (500 metres northeast of the Lac des Iles open pit).

On February 24, 2012, the Company announced the appointment of Dr. David C. Peck as Head of Exploration of the Company, effective March 1, 2012.

On April 30, 2012, the Company announced the completion of a bought deal flow-through financing of 11,300,000 flow-through shares for total gross proceeds of $35,030,000.

On May 2, 2012, the Company entered into an agreement with Vale Canada Limited (“Vale”) for the smelting and refining of concentrate from the LDI Mine at the Vale Copper Cliff Nickel Smelter.

On May 3, 2012, the Company entered into an option and purchase agreement with Houston Lake Mining Inc. whereby the Company obtained an option to purchase a 100% interest the Tib Lake property located northwest of the LDI Mine, subject to a 2.5% NSR royalty in favour of a third party on a portion of the claims and a 2.5% NSR royalty in favour of Houston Lake Mining Inc. for the rest of the claims.

On July 9, 2012, after receiving necessary final production permits, the Company announced that it would delay commercial production at the Vezza project and begin exploring divestiture opportunities for its gold assets.

On July 10, 2012, the Company announced a bought deal financing of $43,000,000 principal amount of 6.15% convertible unsecured subordinated debentures with a maturity date of September 30, 2017. The offering was completed on July 31, 2012.

On July 16, 2012, the Company provided an update on its 2012 exploration program at the LDI Mine, including drill results from Offset Zone infill drilling, and confirmation that the Sheriff Zone extends to the surface.

On August 8, 2012, the Company released an updated mineral reserve and mineral resource estimate for the LDI Mine.

9

On September 13, 2012, the Company announced that its Chairman Andre Douchane was appointed Interim Chief Executive Officer, replacing William Biggar who retired effective September 30, 2012. The Company also announced that it commenced an executive search for a new permanent Chief Executive Officer.

On September 26, 2012, the Company entered into a purchase agreement with Platinex Inc. whereby the Company purchased a 100% interest in four unpatented mining claims near the Tib Lake property, subject to a 0.5% NSR royalty in favour of Platinex Inc.

On October 15, 2012, the Company provided a development update on its LDI Mine expansion, disclosing that the full operation of the shaft was delayed until the third quarter of 2013 and all other development was progressing on schedule.

On November 30, 2012 the Company announced the completion of a flow-through financing of 2,425,000 flow-through shares of the Company on a bought deal private placement basis for total proceeds of $4,001,250.

On December 11, 2012, the Company provided an update on its exploration activities at the LDI Mine including infill and extension drilling targeting the Offset Zone, and other greenfields properties in Ontario.

On December 13, 2012, the Company announced the resignation of Jeffrey Swinoga, Vice President, Finance and Chief Financial Officer of the Company, effective January 4, 2013.

On December 19, 2012, Tess Lofsky was appointed Vice President, General Counsel and Corporate Secretary.

2013 Year to Date

On January 14, 2013 the Company provided a development update on its LDI Mine expansion. The Company disclosed that it had made significant progress advancing the critical aspects of its mine expansion. On surface, the major construction components are completed while the shaft sinking was progressing well, in line with the Company’s scheduled rates of advancement.

On January 22, 2013, Dave Langille was appointed as Chief Financial Officer of the Company.

On January 31, 2013, the Company provided an update on its drill results from the second half of its 2012 underground and surface exploration programs at the Lac des Iles property. Definition drilling resulted in broad zones of lower grade palladium mineralization, containing local higher-grade intervals which enhanced the Sheriff Zone near-surface resource potential.

On February 13, 2013, the Company announced the filing of a final base shelf prospectus allowing the Company to make offerings of Common Shares (including flow through shares), debt securities, warrants and subscription receipts in an aggregate principal amount of up to US$300 million during the 25-month period that the shelf prospectus remains effective.

On February 19, 2013, the Company filed a new NI 43-101 report titled “Technical Report Lac des Iles Mine, Ontario, Incorporating Prefeasibility Study Offset Zone Phase 1” prepared by Tetra Tech WEI Inc. (“Tetra Tech”) for the LDI Mine (the “2013 LDI

10

Report”), which includes an initial mineral reserve estimate and prefeasibility study for Phase I of the Offset Zone. For the purposes of the 2013 LDI Report, the mineral reserves include the Phase I portion of the Offset Zone above the 990-metre mine level (4,490 metres elevation), which qualified due to density of drilling. The diluted mineable mineral reserves contained within the stope wireframe at a 2.5 g/t Pd cut-off grade were estimated to be 7,741,000 tonnes at a grade of 4.30 g/t Pd.

On February 21, 2013, the Company announced that at December 31, 2012, it had tested the gold division for impairment and concluded that the recoverable amount of the gold division was lower than the carrying value. As a result, the Company has recognized an impairment charge of $56.0 million on the assets for the year ended December 31, 2012.

On March 4, 2013, the Company announced the appointment of Mr. Robert Quinn to the position of Chairman and that Mr. Andre Douchane will continue to perform Chief Executive Officer responsibilities.

On March 15, 2013, the Company announced that its Board of Directors has adopted an advance notice by-law (the “By-Law”). The purpose of the By-Law is to provide shareholders, directors and management of the Company with a clear framework for nominating directors for election to the Board of Directors and timely information in connection with such nominations. Among other things, the By-Law requires that advance notice be given to the Company in circumstances where nominations of persons for election to the Board of Directors are made by shareholders other than pursuant to (i) a requisition of a meeting made pursuant to the provisions of theCanada Business Corporations Act; or (ii) a shareholder proposal made pursuant to the provisions of suchAct. No person will be eligible for election as a director of the Company unless nominated in accordance with the provisions of the By-Law. The By-Law is currently in effect. The Company will ask shareholders to confirm and ratify the By-Law at its next annual and special meeting of shareholders on May 9, 2013. The full text of the By-Law can be found under NAP’s SEDAR profile at www.sedar.com.

Business Overview

The following contains forward-looking statements and future-oriented financial information about the Company’s business. Reference should be made to “Forward-Looking Statements” on page 2. For a description of material factors that could cause the Company’s actual results to differ materially from the forward-looking statements in the following, please see “Risk Factors” beginning on page 49. Additionally, the following description of the Company’s business includes many geological terms that may not be familiar to the reader. For a description of the meaning of some of these terms, please see the “Glossary of Terms” beginning on page 66.

North American Palladium Ltd. is an established precious metals producer that has been operating its flagship LDI Mine in Ontario, Canada since 1993. The Company’s vision is to become a low cost mid-tier precious metals producer producing over 250,000 ounces of palladium annually.

The Lac des Iles property (including the LDI Mine and mill complex) is the Company’s only material property. LDI is one of two primary palladium producers in the world, offering investors exposure to the price of palladium. The LDI Mine is currently undergoing a major

11

expansion to transition operations from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method. The mine expansion is currently underway, with production from the shaft targeted for the end of the third quarter of 2013. It is expected that this expansion will result in increased palladium production at a reduced cash cost per ounce. Through an investment of $127.5 million in 2012, the Company achieved a number of critical development milestones and was able to significantly advance the project. In 2012, the mine expansion development was primarily focussed on: (i) completing the surface construction activities; (ii) advancing underground development (including mine level development and setting up mining stopes) and (iii) sinking the shaft.

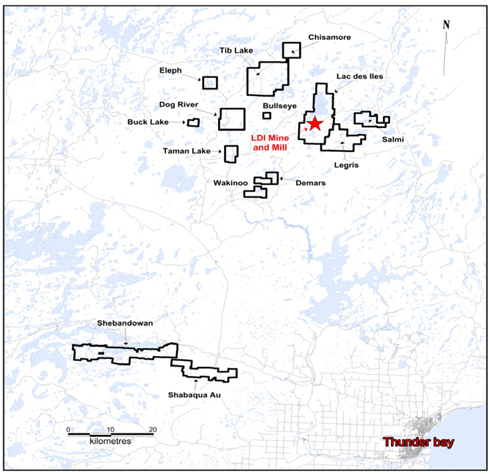

Beyond the LDI Mine expansion, there remains significant exploration upside near the mine, where a number of recent discoveries can potentially further increase production at the LDI Mine. The exploration upside is further complemented by the LDI Mine’s significant excess mill capacity and established infrastructure. Outside of the LDI Mine property, the Company’s regional PGE greenfields properties cover approximately 20,794 hectares (51,384 acres), including a majority of the most prospective mafic complexes in the area. The Company remains committed to maintaining a portfolio of development-stage and exploration-stage projects at and near the LDI Mine property and is actively engaged in significant exploration programs aimed at increasing its mineral reserves and mineral resources.

The Company also owns the Vezza gold project and the Sleeping Giant gold mine and mill located in the Abitibi region of Quebec, as well as other advanced projects including the Flordin project, the Discovery project, and the Shebandowan West project. The Company does not consider these properties to be material at this time. The Company is currently exploring opportunities for the divesture of its Quebec-based gold portfolio (held under its wholly-owned subsidiary NAP Quebec).

For the 2012 fiscal year, the Company’s revenue totalled $160.7 million. The Company’s revenue by commodity totalled $104.5 million for palladium, $17.8 million for platinum, $10.2 million for nickel, $18.6 million for gold, $9.2 million for copper and $0.4 million for other metals, representing approximately 65.0%, 11.1%, 6.3%, 11.6%, 5.7% and 0.2% respectively of its total consolidated revenue.

As of January 31, 2013, the Company had 422 employees. Of this number, 320 employees worked at the Lac des Iles property, 23 out of an exploration office in Thunder Bay, eight at the Company’s finance and administration office in Thunder Bay, 21 at the Vezza project, 25 at the Sleeping Giant mill complex, seven at the Company’s regional office in Val d’Or, four at the Company’s exploration office in Lebel-sur-Quévillon, and 14 at the Company’s corporate head office in Toronto.

General Description of Palladium

The Company produces concentrate at the Lac des Iles mill and may sell the concentrate directly to smelters for processing, into the spot market, or directly to end users after the palladium is refined. In each instance the price for palladium is expected to be determined with reference to prevailing spot market prices.

Platinum group metals are rare precious metals with unique physical characteristics that are used in diverse industrial applications and in jewellery. The unique characteristics of PGMs include: (1) strong catalytic properties; (2) excellent conductivity and ductility; (3) a high level of resistance to corrosion; (4) strength and durability; and (5) a high melting point. The six PGMs also include platinum, rhodium, ruthenium, iridium and osmium.

12

Demand for palladium is diversified by geography and end market. Palladium is primarily used in the manufacture of catalytic converters in the automotive industry, as well as in the manufacture of jewellery and electronics, and in dental and chemical applications. As a precious metal, there is also investment demand for palladium in the form of doré bars, generally held as physical inventory by exchange traded funds (“ETFs”) and institutional investors.

Palladium is typically produced as a by-product metal from either platinum mines in the Republic of South Africa (approximately 38% of world mine production) or Norilsk Nickel’s mines in Russia (approximately 41% of world mine production). North America contributes approximately 14% to the world’s supply of palladium. The Company’s LDI Mine is one of only two primary producers of palladium in the world.

Palladium Supply and Demand Fundamentals

Mine Supply

There are very few palladium producing regions worldwide and few known economically viable ore bodies. Russia and South Africa, which are known to be higher-risk jurisdictions, account for almost 80% of global mine palladium production, which was estimated to be approximately 6.3 million ounces in 2012. Growth in palladium mine supply is constrained, largely owing to political, infrastructure and cost issues in South Africa, declining palladium production in Russia, and a limited number of new projects on the horizon in the near term.

In particular, South African production is challenged by deeper mines, power and water limitations, higher operating costs, geopolitical risks, shortage of skilled labour, and the strengthening of currencies. There do not appear to be any near-term solutions in place, and the South African PGM mining industry has begun contracting with over 250,000 ounces of palladium lost in 2012 directly resulting from shutting down operations due to labour unrest and higher operating costs.

Secondary Supply

Secondary supply is derived from recycling (which is estimated to have contributed approximately 2.2 million ounces in 2012), and from a Russian government stockpile. The stockpile is believed to have contributed about 1 million ounces per year to the market in the past decade, and was consequently always considered to be a major overhang on the palladium price. It is estimated by industry experts that the Russian stockpile contribution has fallen to under 250,000 ounces in 2012 (record low), and accordingly this stockpile is now believed to be essentially depleted, or to no longer be a significant contributor to secondary supply.

Fabrication Demand

The primary source of fabrication demand is from the automotive sector, which consumes approximately 67% of world palladium production for the manufacture of catalytic converters. Palladium is used in a car’s exhaust system to help reduce harmful emissions into the environment by converting them into less harmful carbon dioxide, nitrogen and water vapour. Palladium, platinum and rhodium are the primary components in catalytic converters.

13

The demand for palladium in the automotive industry has more than doubled in the last ten years due to an increase in global automotive production and the tightening of emissions standards worldwide, resulting in steady growth in the use of catalytic converters.

The primary driver of growth in the automotive sector is from the emerging economies – Brazil, Russia, India and China (“BRIC”) – where there is emerging affluence, very low penetration of vehicles per capita, and the affordability factor is high due to low interest rates and leasing programs. Light global vehicle production is forecasted by IHS Automotive to increase at a compound annual growth rate of 4% to over 100 million units by 2017, with most of that growth driven by the BRIC economies.

Underpinning the demand for catalytic converters is the adoption of emission control standards in the BRIC economies, which mandate the use of catalytic converters. As the emission standards get more stringent, this translates into increased palladium usage in the catalytic converter. Catalytic converter manufacturers have also started to substitute palladium in place of platinum, where possible, for use in diesel powered engines. There is approximately 30% substitution of platinum with palladium in diesel engines.

Other sources of fabrication demand include: 12% from electronics, 5% from dental, and 5% from chemical, and 5% from jewellery. In the electronics industry, palladium’s demand has been rising in recent years. This increase is largely attributable to an increase in demand for palladium bearing semiconductors that are used in many electronic devices, including cellular telephones, personal and notebook computers, fax machines and home electronics. In the dental industry, palladium is widely used in alloys for dental restoration. Palladium is also used in the manufacture of jewellery and may be used either on its own or as an alloy in white gold. Additionally, palladium is used in crude oil refining catalysts, chemical process catalysts and various chemical applications, including the manufacture of paints, adhesives, fibres and coatings. Palladium is also used in the manufacture of polyester.

Investment Demand

An important macroeconomic trend has been the increase in demand for palladium for investment purposes. Strong investor sentiment for precious metals has provided support for a favourable palladium pricing environment. Increased participation by a greater variety of market participants, the resulting improvement in liquidity and the introduction of new investment vehicles are all improving investment demand for palladium.

Like gold, platinum and silver, palladium is increasingly viewed as an attractive precious metal that can help diversify investment portfolios. Together, the ETFs are believed to hold over 2 million ounces, and they are physically backed by palladium bars. In 2012, investment demand is estimated to have accounted for approximately 4% of total demand.

14

Price Outlook

The palladium market is forecasted by industry experts to be in a substantial supply deficit that started in 2012 due to the favourable outlook of strong fabrication and investment demand, constrained supply due to operational challenges in South Africa and a belief that the Russian palladium stockpile is nearing depletion. Other factors contributing to the projected deficit are the expected positive net investment in the ETF market, lower sales of palladium from Russia and South Africa, and increasing demand in autocatalyst applications.

In 2012, the average price of palladium was US$644 per ounce, ranging from a low of US$565 per ounce, to a high of US$722 per ounce. As of March 19, 2013, the price of palladium was US$733 per ounce.

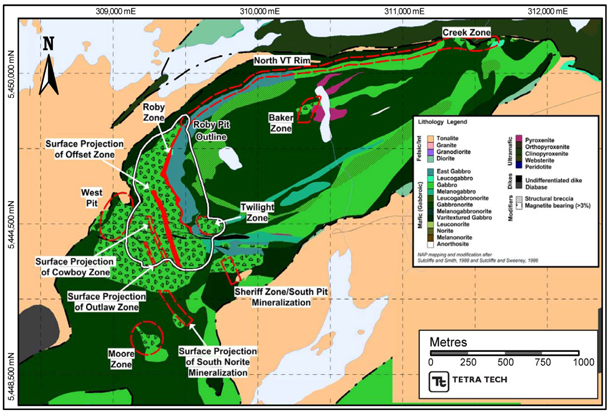

The Lac des Iles Property

The Company’s only material property is the Lac des Iles property. The property is located approximately 85 kilometres northwest of the city of Thunder Bay, Ontario, Canada. The property consists of an open pit, a ramp-accessed underground mine, a shaft accessed underground mine (under construction), and a mill with a nominal capacity of approximately 15,000 tonnes per day. The primary deposits on the property are the Roby Zone and the Offset Zone; both disseminated magmatic nickel-copper-PGM deposits. The Company has also identified other mineralized areas, including the Sheriff Zone, Cowboy Zone, the Outlaw Zone and the North VT Rim.

The Company began mining the Roby Zone open pit in 1993 and in April of 2006, the Company also began commercial production underground by mining the higher grade portion of the Roby Zone. On October 29, 2008 the LDI Mine was placed on temporary care and maintenance due to declining metal prices during the global financial crisis.

Following improvements in palladium prices, the Company announced on December 8, 2009 its intention to restart underground operations at the Roby Zone and on April 14, 2010, the Company announced that it had resumed production at the Roby Zone.

In late 2010, the Company commenced the expansion of its LDI Mine. The purpose of the expansion is to transition operations from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method. As part of the expansion plans, the Company is sinking a shaft to the depth of at least 825 metres below surface and setting up the underground infrastructure required to mine the Offset Zone using a high-volume bulk mining method. Production from the shaft is targeted for the end of the third quarter of 2013 and it is expected that this expansion will help transform the LDI Mine into a long life, low cost producer of palladium.

The following is a description of the Lac des Iles property that has largely been summarized from the 2013 LDI Report filed on February 19, 2013, which is available for review on SEDAR at www.sedar.com, and is subject to, and is qualified in its entirety by reference to the 2013 LDI Report. The authors of the 2013 LDI Report are “qualified persons” under NI 43-101. The mineral reserve and mineral resource estimates for the Lac des Iles property were prepared with an effective date of March 31, 2012.

15

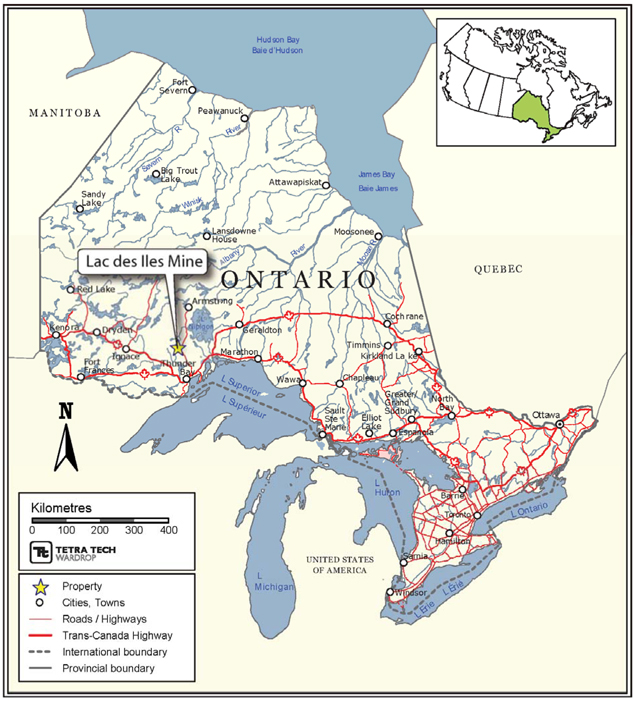

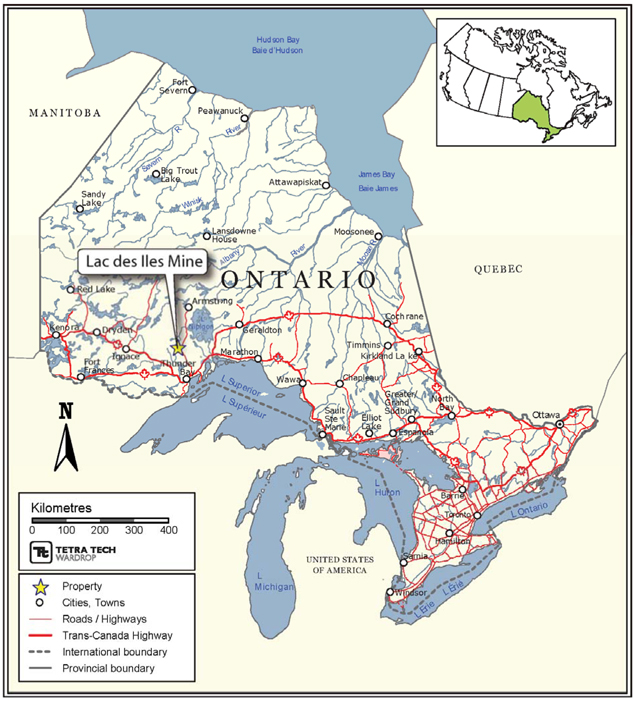

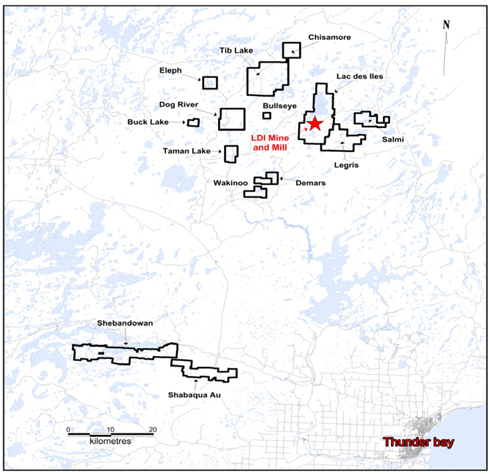

Project Description and Location

The Lac des Iles property is located at latitude 49°10’ north, longitude 89°37’ west, 85 kilometres northwest of the community of Thunder Bay in northwestern Ontario. The Lac des Iles property comprises approximately 8,649 hectares (21,371 acres) of mineral claims and leases. LDI, a wholly owned subsidiary of NAP, holds a 100% interest in six mining leases, comprising 3,513 hectares (8,680 acres). Contiguous with these leases are 54 mineral claims (consisting of 331 claim units) held 100% by LDI and covering 5,136 hectares (12,691 acres).

Figure 1: Lac des Iles property location map

16

On August 31, 1994, LDI, Sheridan Platinum Group Ltd. (“SPG”) and John Patrick Sheridan (“Sheridan”) entered into a royalty agreement pursuant to which SPG and Sheridan transferred certain Lac des Iles property claims and leases to LDI in exchange for a NSR royalty. Pursuant to the royalty agreement, NAP is required to pay SPG and Sheridan 5% of the NSR royalty at LDI Mine until the expiration of the Lac des Iles property leases. Four of the six mining leases expire on August 31, 2027, and the remaining two leases expire on September 30, 2027.

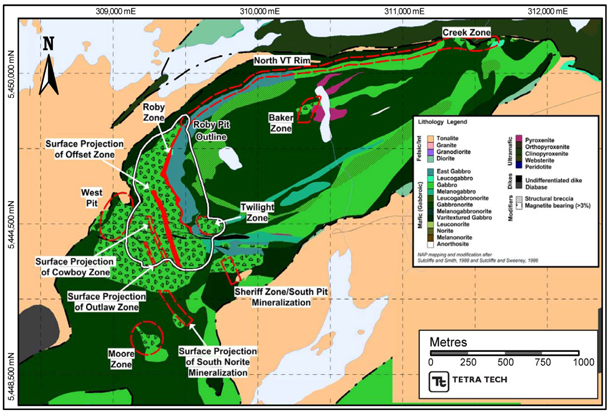

The following are the mineralized zones of the Lac des Iles property:

| | • | | Roby Open Pit Zone: A bulk-mineable, PGE-enriched disseminated sulphide deposit with a minimum north to south length of 950 metres, and a width of 815 metres, including the Twilight Zone in the southwestern portion of the deposit. Mining of this zone commenced in 1993 and continues to this day. |

| | • | | Roby Underground Zone (High Grade Zone): The Roby Underground Zone is primarily confined to a 400 metres long segment of the pyroxenite, although it does extend northward into the gabbronorite. The High Grade Zone, striking north-northwest to north-northeast, dips almost vertically near surface and flattens to nearly 45° at depth. The zone appears to be terminated down dip to the Offset Fault. Mining of this zone commenced in 2006 and continues to this day. |

| | • | | Offset Zone: Discovered in 2001, this zone is located below the Offset Fault structure, where it is displaced down and approximately 300 metres to the west. The Offset Zone can be split into three horizons and has been divided into three subzones: the High Grade Subzone, the Mid Subzone, and the Footwall Subzone. |

| | • | | Sheriff Zone: Discovered in 2010, this zone is a combination of the former Southeast Roby and South Pit zones connected through further drilling, previously believed to have been the Twilight Zone. It is located approximately 100 metres south east of the Offset Zone. |

| | • | | Baker Zone: Located approximately 1 kilometre northeast from the Roby and Twilight zones. |

| | • | | Moore Zone: A low-grade, presently uneconomic, mineralized zone, located approximately 500 metres south of the current Roby Pit with similar lithologies and textures to other Mine Block Intrusive (“MBI”) breccias. |

| | • | | Creek Zone: Located approximately 2 kilometres northeast of the Roby Pit in the northeastern nose of the MBI, near the contact with the north Archean Lac des Iles Intrusive Complex. |

| | • | | Cowboy Zone: Discovered in 2009, this zone is located 30 to 50 metres down section to the west of the Offset Zone and extends for up to 250 metres along strike and 350 metres down dip. |

| | • | | Outlaw Zone: Discovered in 2009, this zone lies approximately 30 to 60 metres west of the Cowboy Zone and further down section into the footwall of the Offset Zone. |

| | • | | Southern Norite Zone: Sits relatively along strike from the Offset Zone and 150 metres south of the shaft. |

17

The Company reports that its operations and facilities comply in all material respects with legislation in effect as of the date of the 2013 LDI Report and that it holds all necessary approvals and licenses for its operations at the mine and for all planned expansion projects. The Company believes that the LDI Mine is current with its permitting and licensing requirements.

The Company is responsible for all costs of closure and reclamation at the LDI Mine and the current mine closure plan currently provides for approximately $14.1 million of closure and reclamation costs. This obligation is secured by a letter of credit in the amount of approximately $14.1 million. A closure plan amendment was recently submitted to MNDM to include new developments within the footprint, including the shaft, and the Company’s plan to potentially expand mining operations by developing the north expansion of the existing pit and the Baker Zone.

Accessibility, Climate, Local Resources, Infrastructure and Physiology

The Lac des Iles property is located approximately 85 kilometres northwest of Thunder Bay. Access to the site is provided by a year-round gravel access road (which is open to the public and maintained by the Company) that connects to Provincial Highway 527 at a point 16 kilometres east of the mine. The nearest access to rail transport would be at Thunder Bay or Armstrong, Ontario, approximately 85 kilometres to the south and 133 kilometres to the north, respectively. Air access is available in Thunder Bay and Armstrong, Ontario. Thunder Bay has an international airport which is serviced by several major airlines. Thunder Bay provides most of the services and mine and mill consumables required by NAP’s Lac des Iles property and its Offset Zone Phase I project, as well as access to experienced staff and personnel with good mining and processing expertise.

The Lac des Iles property is located in northwestern Ontario which lies within the Superior Province of the Canadian Precambrian Shield. The topography of the site is favourable for the placement of facilities, being generally of low relief. Elevations on the Lac des Iles property range from 418 to 550 metres above sea level, exclusive of the open pit.

The Lac des Iles property experiences hot summers and cold winters, which is typical of the region. Maximum and minimum temperatures range from an extreme low of -30°C in the winter months to an extreme high of 38°C in the summer months. The average winter and summer temperatures are -13°C and 15°C, respectively. Mean annual precipitation for the Lac des Iles property is approximately 469 millimeters. Mill operations are enclosed and are not exposed to the weather other than feed inputs. Weather conditions are rarely severe enough to halt mining operations, although it does impact safe traction on the access roads and ramps within the open pit.

Water and sewer services are supplied independently for each facility and are considered by the Company to be adequate for current needs. Expansion of potable water and sewer services were completed in 2011 for the underground workforce additions. Electrical power is supplied by Hydro One via a 118 kilovolt line to a two-main substation on-site, pursuant to services agreement. The Company intends on retaining its current practice of using natural elevation differences where possible, such that water is diverted away from buildings and drains away in existing ditches to the lower lying areas, for storm water management.

18

The main facilities on the Lac des Iles property are: the operations camp; the old camp; main office and tire shop; the old mill; the new mill complex; the open pit shops; the warehouse and operational offices; the old concentrator building; the open pit and stockpile area; the underground portal and related ventilation accesses; and the tailings management facility (the “TMF”). There is also new infrastructure related specifically to the Offset Zone, which has been constructed in the past two years to accommodate the future mine expansion, including the shaft headframe, the hoist house, the compressor building, the mine dry, the substation and the surface load out facility.

In 2006, a 324-person operations camp and recreational complex was built in conjunction with the construction of the new mill. It is expected that this facility will be sufficient to accommodate the underground workforce once construction activities wind down. A construction camp was established in 2011, to accommodate added surface and underground construction workers during the peak construction period associated with readying the Offset Zone Phase I for production through the shaft facilities.

The LDI Mine has been operating a TMF since 1990. The TMF on the Lac des Iles property has two sections, the West TMF and the South TMF, which are located adjacent to one another, southwest of the open pit. Currently, all wastes created by the milling process are deposited in the South TMF. The West TMF has been closed upon reaching capacity and is undergoing progressive remediation. The tailings area is monitored according to industrial sewage works requirements set out by the Ministry of Environment (Ontario).

History

Geological investigations in the area began with reconnaissance mapping in the early 1930s, and again in the late 1960s, sparked by the discovery of aeromagnetic anomalies in the late 1950s. Various exploration programs were undertaken over the next 25 years by a number of companies, including F.H. Jowsey Limited, Gunnex, Anaconda American Brass Limited, Boston Bay, and Madeleine Mines.

In 1992, the Company acquired the Lac des Iles property, with open pit production commencing in 1993. Until 2008, the Company operated a combined open pit and underground mine from the Roby Zone and a 14,000 tonnes per day (“t/d”) processing plant, producing a bulk nickel-copper-PGE concentrate with gold credits. On October 21, 2008, NAP announced that, due to depressed metal prices, it was temporarily placing Lac des Iles property on care and maintenance effective October 29, 2008. The LDI Mine produced 212,046 oz of palladium in 2008 prior to going on care and maintenance.

When palladium prices began to recover in December 2009, NAP announced that it would restart operations as an underground only mine. On April 14, 2010, NAP announced that the Roby underground mine was back in production, with a potential two- to three-year mine life.

In 2010, the LDI Mine produced 95,057 oz of palladium, and in late 2010 the Company commenced its underground mine expansion to access the Offset Zone. The Offset Zone is believed to be the fault-offset, down-dip extension of the Roby Zone, a disseminated magmatic

19

nickel-copper-PGE deposit. Mine expansion was scoped out to consist of shaft sinking, extending the ramp from the Roby Zone to the Offset Zone, as well as surface and underground development to facilitate the mining of the Offset Zone using a high volume bulk mining method.

In 2011, while the Company balanced underground development with production, the LDI Mine produced 146,624 oz. of palladium from the blending of underground ore with lower-grade surface stockpile sources. In 2012, the Roby Zone open pit was restarted and blended with underground production from the Roby Zone and Offset Zone. As of year-end 2012, the LDI Mine produced 163,980 oz. of palladium from both underground and surface sources. Mining of the first Offset Zone stope commenced in the fourth quarter of 2012, and the shaft sinking was significantly advanced.

Geological Setting

The LDI Mine area is underlain by mafic to ultramafic rocks of the Archean Lac des Iles Intrusive Complex. These rocks have intruded granites and greenstones of the Wabigoon Subprovince of the Superior Province and lies immediately north of the Wabigoon-Quetico Subprovince boundary, which extends approximately 300 kilometres from Rainy Lake to Lake Nipigon. The Archean Lac des Iles Intrusive Complex is the largest of a series of mafic and ultramafic intrusions that occur along the boundary and which collectively define a 30 kilometres in diameter circular pattern. The LDI Mine lies in the southern portion of the Archean Lac des Iles Intrusive Complex, in a roughly elliptical intrusive package measuring 3 kilometres long by 1.5 kilometres wide, termed the MBI.

The MBI hosts a number of PGE deposits. The most important of these are the Roby Zone (including its three subzones: the North Roby Zone, the High Grade Zone, and the Breccia Zone) and the Offset Zone. The MBI comprises rocks with a very wide range of textures, and mafic and ultramafic compositions. The principal rock types in the Offset Zone area include: East Gabbro (“EGAB”); Heterolithic Gabbro Breccia (“HGABBX”); Varitextured Gabbro; Gabbro; Magnetic Gabbro; Pyroxenite; Gabbronorite; Gabbronorite Breccia; and Dikes.

The Offset Zone is a high-grade zone located below the Offset Fault structure where it is displaced down and approximately 300 metres to the west. The Offset Zone can be split into three horizons and has been divided into three subzones: the High Grade Subzone, the Mid Subzone, and the Footwall Subzone. The apparent width of the mineralization in: (a) the High Grade Subzone varies from 4 to 30 metres, with an average of 15 metres; (b) the Mid Subzone varies from 4 to 90 metres, with an average of 15 metres; and (c) the Footwall Subzone varies from 4 to 20 metres, with an average of 7 metres.

Exploration

The Company has conducted surface exploration on the mining lease using the overburden stripping and trenching technique. In 2010, 18 separate trenches were dug for a total length of 908 metres. In 2011, 14 separate trenches were opened for a total of approximately 1,000 metres. In 2012, eight trenches were completed for a total of 1,245 metres.

In January 2012, the Company provided an update on the third and final tranche of drill results from its 2011 exploration program at the LDI Mine. Mineralization was discovered 300 metres to the west of the Offset, Cowboy and Outlaw Zones and surface mineralization was encountered from trenches along the North VT Rim (500 metres northeast of the Lac des Iles open pit).

20

On July 16, 2012, the Company provided an update on its 2012 exploration program at the LDI Mine, including drill results from Offset Zone infill drilling, and confirmation that the Sheriff Zone extends to the surface.

On December 11, 2012, the Company provided an update on its exploration activities at the LDI Mine including infill and extension drilling targeting the Offset Zone and other greenfields properties in Ontario.

Mineralization

PGE and base metal mineralization at the Lac des Iles property appears to be dominantly stratabound along the contact between the EGAB and the mineralized HGABBX. Within the HGABBX, there is a high-grade core typically constrained to an easily recognized pyroxenite unit. Visible PGE mineralization is rare and its occurrence is difficult to predict. In general, economic PGE grades are anticipated within gabbroic to pyroxenitic rocks (in close proximity to the marker unit EGAB) that exhibit strong sausseritization of plagioclase feldspars, strong talcose alteration and association with either disseminated or blebby secondary sulphides. Higher PGE grades (mean – 7.89 grams per tonne (“g/t”) palladium, maximum – 55.95 g/t palladium) occur in those portions of the pyroxenite that are altered to an assemblage of amphibole (anthophyllite-actinolite-hornblende)-talc-chlorite. PGE grades show varying degrees of correlation with nickel and copper grades. The 2013 LDI Report notes that some parts of the deposit have very good PGE-copper-nickel (and sulphur) correlations, while others show no significant, positive correlation between PGE and copper or nickel. Sulphides typically occur as fine-grained disseminations of less than 1 to 3% and of varying proportions of pyrrhotite, pyrite, chalcopyrite, and pentlandite. The high-grade mineralization is located primarily within the western, highly altered portion of the pyroxenite, since much of the pyroxenite between the barren EGAB and the High Grade Zone is low-grade. The higher-grade “High Grade ore” is not restricted to the pyroxenite as it commonly straddles the pyroxenite/gabbro breccia contact to widths exceeding 250 metres.

21

Figure 2: Lac des Iles property mineralized zones

The majority of platinum-group minerals occur either interstitially to sulphides as cumulus grains or are associated with sulphides at sulphide-silicate boundaries, occurring as discrete mineral inclusions within secondary silicates of altered rocks. Palladium and platinum mineralization within the High Grade Zone consists primarily of fine-grained palladium-telluride minerals; kotulskite, michenerite, palladium-arsenide, PGE sulphide, and vysotskite.

Drilling

Prior owners of the LDI Mine drilled 135 holes totalling 21,425 metres on the LDI Mine, while the Company and its predecessor company drilled 1,747 holes totalling 594,858 metres on the LDI Mine.

Surface drilling on the LDI Mine in 2012 totalled approximately 19,405 metres in 81 diamond drill holes. Due to the influx of storm water into mine workings in late May 2012 underground drilling was suspended until October 2012. A total of 148 drillholes drilled from underground targeting both the Offset and Roby zones were completed for approximately 30,742 metres. All drilling on the LDI Mine in 2012 was contracted to Bradley Diamond Drilling of Thunder Bay, a division of Major Drilling of Moncton, New Brunswick, with NQ sized core (47.6 mm diameter). From 2000 to 2012, 543 surface and underground diamond drillholes totaling 210,242 metres have been drilled on the Offset Zone.

In 2012, the Company completed 36,771 metres of diamond drilling on the MBI at the Lac des Iles property. Of this total, (i) 17,695 metres were drilled from underground platforms targeting

22

extensions to the Offset Zone, (ii) 11,694 metres were completed on the Sheriff Zone targeting additional, near-surface mineralization south of the pit, and (iii) 3,000 metres were drilled on the North VT Rim target.

The authors of the 2013 LDI Report were of the opinion that the diamond drilling procedures at LDI meet industry standards and are acceptable to use for resource estimation.

Sampling and Analysis, and Security of Samples

The drill contractor delivered core boxes from the drill site to the core logging facility on the Lac des Iles property. Core samples at the core facility were stored in a secure warehouse only accessible to key NAP personnel. Additionally, the mine has a gate house and barriers that restrict public access. Drill core was also shipped to NAP’s Thunder Bay exploration office via Courtesy Courier, secured indoors in the building and processed at that facility.

Once delivered, the drillhole numbers were checked and reported to the logging geologists and the core was cleaned to remove any drill grease or additive. Geotechnical data for the core, including recovery length and rock quality designation (“RQD”) measurements, was then recorded on the core boxes with permanent marker. Specific gravity measurements are also routinely taken for all exploration drill core.

The core was logged in detail and all the data about lithology, alteration, mineralization, veining and structure was recorded manually on paper forms. Sample lengths of the cover vary from a 20 cm minimum sample length to a 2 metres maximum sample length. Since 2008, NAP’s Thunder Bay Exploration office has been using Century Systems Technology Inc.’s (acquired by CAE Mining in January 2011) Fusion Data Management suite of software to manage borehole data, including analytical results. Boreholes were created within the software and geologists and technicians entered the required information, including collar, survey, geological logs, RQD, specific gravity and lists for sample analysis. Activation Laboratories Ltd. (“ActLabs”) reported analytical results digitally and imported those results into the software. Copies of the result certificates are maintained on the exploration file server.

The core boxes were photographed in numerical order, five boxes at a time, and these photos were backed-up daily on the main server by the logging geologist.

From the core station, core was transferred to pallets located outside the core cutting facility. Sample intervals were transferred to a sample booklet with pre-printed sample numbers. One box of core was loaded to the core-splitting bench at the time, and the interval of core to be sampled was split in half using a pneumatic wedge splitter. One-half of the core was placed in a clean transparent bag, which had been previously labelled, and a pre-printed sample tag was placed inside of the bag. The bag was then sealed with a plastic tie strap and placed on the floor in an orderly manner for easy tracking. The core-splitting bench and splitter were thoroughly cleaned after each sample to avoid contamination. The remaining half of the core was put back in the core box, and transferred to covered storage racks where it will be kept for future reference. In general, one in five Offset Zone boreholes were split to maintain the Lac des Iles property core reference library with the remaining boreholes whole-core sampled. Individual samples were placed in plastic sample bags.

The authors of the 2013 LDI Report were of the opinion that the core logging and core sampling procedures meet industry standards and are acceptable to use for resource estimation.

23

For the 2011 through 2012 series drilling, NAP used ActLabs of Thunder Bay, Ontario for core sample preparation and analysis. Sample preparation at ActLabs was as follows:

| | • | | size reduction in a TM Engineering Ltd. Terminator jaw crusher to 80% passing -10 mesh (1.7 mm) |

| | • | | grind in a TM Engineering Ltd. Max 2 pulveriser with mild steel bowls to 95% passing - 150 mesh (105mm) |

| | • | | cleaner sand is used between each sample |

| | • | | pulps and rejects are retained at ActLabs for a variable period of time |

| | • | | once quality assurance (“QA”)/quality control (“QC”) checks have been completed the pulps and rejects are then shipped back to the mine where they are stored in sea-can shipping containers. |

The method for palladium-platinum-gold analysis was standard fire assay fusion on a 30 g aliquot with silver inquart. Furnace fusion is for 60 minutes at 850 to 1,060°C. The resulting lead button is cupelled at 950°C and the resulting silver-doré bead is digested in hot nitric acid and hydrochloric acid, cooled and the solution analyzed by inductively coupled plasma (“ICP”) optical emission spectrometry using a Varian 735 ICP. A blank and digested standard are run every 15 samples. Synthetically prepped standards monitor QC and instrument drift.

The method for nickel-copper-cobalt-silver analysis was a 0.25 g sample is digested with four acids (hydrogen fluoride, nitric acid, perchloric acid, and hydrochloric acid) and heated in several ramping and holding cycles taking the samples to incipient dryness after which samples are brought back into solution using aqua regia. Samples are analyzed using a Varian ICP. Each digestion batch has 14% QC including 5 method reagent blanks, 10 in-house controls, 10 sample duplicates, and 8 certified reference materials. Instrumental analysis undergoes and additional 13% QC to ensure control of instrument drift.

Due to the atypical character of the mineralization in the Offset Zone, NAP exploration staff decided in 2009 to custom-make their QA/QC duplicate program. In addition to the laboratories internal duplicates (known as lab dup and prep dup), NAP randomly and specifically selected samples for re-assays either through ActLabs or SGS Minerals Services (“SGS”). The pulps of those samples re-assayed by ActLabs are considered as the duplicate samples, whereas the samples sent to SGS as the check samples.

Around 10% of pulp splits, from 2009 to 2011 Offset Zone drilling were randomly selected and re-run by ActLabs, in order to control the reproducibility of the fire assay method results. The analytical technique used by ActLabs to re-run those pulps was identical to the one used for measuring the original assays. Samples with significant discrepancy are reported in the database data entry control sheet.

Approximately 10% of the pulp splits, from the expected high-grade zone, were forwarded to SGS, in order to check the reproducibility and consistency of the highgrade zone. For base

24

metals (copper, cobalt and nickel), SGS uses four acid digestion and ICP-atomic emission spectroscopy analysis (code ICP40B). The palladium, platinum, and gold metals are determined by fluxing and fire assay fusion with lead oxide collection, two acid digestion of the doré bead and ICP-atomic emission spectroscopy analysis (FAI323). Samples with significant discrepancy are reported in the database data entry control sheet.

Blanks and standard reference material samples were inserted into the drill core continuous sampling series at regular intervals during the 2010 to 2012 drill programs. All of the blank material and standard reference material was sourced from CDN Resource Laboratories (“CDN Resource”) of Langley, British Columbia. If one or more of the palladium, platinum or gold results from the blanks exceed the maximum allowable 10 ppb, the lab is instructed to re-assay from pulps all samples from the preceding blank that passed to the following blank that passed. If palladium exceeds two standard deviations, and if platinum and gold exceed three standard deviations from the recommended values and standard deviations reported on the CDN Resource certificates for each of those minerals, a failure has occurred and the lab is instructed to re-assay from pulps all samples from the preceding standard that passed to the following standard that passed. The re-assays from both blanks and standard reference material samples are then used in the drillhole database.

Tetra Tech carried out an internal validation of the diamond drillhole file against the original drillhole logs and assay certificates. The validation of the data files was completed on 18 of the 172 drillholes in the database or approximately 10% of the dataset. Data verification was completed on collar coordinates, end-of-hole depth, down-the-hole survey measurements, and “from” and “to” intervals. Tetra Tech imported the drillhole data into the Datamine™ program, which has a routine that checks for duplicate intervals, overlapping intervals, and intervals beyond the end of hole. The errors identified in the routine were checked against the original logs and corrected.

Eighteen independent samples of mineralized course rejects were collected for check assaying representing different mineralization grade ranges. The samples were sent to ALS Minerals in Thunder Bay, Ontario. The samples were prepared in Thunder Bay and the pulps were shipped by ALS Minerals to Vancouver, British Columbia for analysis. Each course reject was processed twice to generate two duplicate assay results for each original sample. ALS Minerals is accredited to international quality standards through International Organization for Standardization (“ISO”) / International Eletrotechnical Commission (“IEC”) 17025 (ISO/IEC 17025 includes ISO 9001 and ISO 9002 specifications) with CAN-P-1579 (Mineral Analysis).

The authors of the 2013 LDI Report were of the opinion that the data set from the Offset Zone is valid and acceptable for use in resource estimation.

25

Mineral Reserve and Mineral Resource Estimates

The table reproduced below summarizes the resources and reserves on the Lac des Iles property. The effective date of the mineral resources and reserves is March 31, 2012. The mineral resources set out below are exclusive of the mineral reserves.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Category | | Cut-off

(g/t) | | | Tonnes | | | Pd

(g/t) | | | Pt

(g/t) | | | Au

(g/t) | | | Ni

(%) | | | Cu

(%) | | | Pd

(oz) | |

Mineral Reserves | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proven | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offset Zone | | | 2.5 | | | | 5,632,000 | | | | 4.34 | | | | 0.30 | | | | 0.30 | | | | 0.11 | | | | 0.08 | | | | 786,563 | |

Roby Underground | | | 5.8 | | | | 420,000 | | | | 6.38 | | | | 0.42 | | | | 0.34 | | | | 0.08 | | | | 0.07 | | | | 86,149 | |

Open Pit | | | 1.8 | | | | 722,000 | | | | 1.99 | | | | 0.21 | | | | 0.22 | | | | 0.11 | | | | 0.10 | | | | 46,192 | |

Probable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offset Zone | | | 2.5 | | | | 2,109,000 | | | | 4.17 | | | | 0.30 | | | | 0.29 | | | | 0.10 | | | | 0.08 | | | | 282,609 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Reserve | | | — | | | | 8,883,000 | | | | 4.21 | | | | 0.30 | | | | 0.29 | | | | 0.11 | | | | 0.08 | | | | 1,201,513 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Measured | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offset Zone | | | 2.5 | | | | 4,942,550 | | | | 4.56 | | | | 0.33 | | | | 0.31 | | | | 0.12 | | | | 0.10 | | | | 724,094 | |

Open Pit | | | 1.8 | | | | 1,971,000 | | | | 2.00 | | | | 0.24 | | | | 0.15 | | | | 0.05 | | | | 0.07 | | | | 126,735 | |

Stockpile | | | | | | | 83,000 | | | | 1.63 | | | | 0.17 | | | | 0.14 | | | | 0.08 | | | | 0.06 | | | | 4,350 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Measured | | | — | | | | 6,996,550 | | | | 3.80 | | | | 0.31 | | | | 0.27 | | | | 0.12 | | | | 0.10 | | | | 855,179 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Indicated | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offset Zone | | | 2.5 | | | | 9,556,600 | | | | 4.11 | | | | 0.31 | | | | 0.29 | | | | 0.11 | | | | 0.09 | | | | 1,262,139 | |

Roby Underground | | | 5.8 | | | | 1,269,000 | | | | 7.16 | | | | 0.41 | | | | 0.33 | | | | 0.08 | | | | 0.06 | | | | 292,116 | |

Open Pit | | | 1.8 | | | | 2,565,000 | | | | 2.20 | | | | 0.24 | | | | 0.18 | | | | 0.07 | | | | 0.08 | | | | 181,422 | |

Low-grade Stockpile | | | 0.5 | | | | 13,188,000 | | | | 0.97 | | | | 0.12 | | | | 0.08 | | | | 0.06 | | | | 0.03 | | | | 411,274 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Indicated | | | — | | | | 26,578,600 | | | | 2.51 | | | | 0.21 | | | | 0.18 | | | | 0.08 | | | | 0.06 | | | | 2,146,952 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Measured + Indicated | | | — | | | | 33,575,150 | | | | 2.78 | | | | 0.23 | | | | 0.20 | | | | 0.08 | | | | 0.05 | | | | 3,002,132 | |

Inferred | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Offset Zone | | | 2.5 | | | | 13,669,000 | | | | 3.59 | | | | 0.30 | | | | 0.23 | | | | 0.09 | | | | 0.08 | | | | 1,575,840 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Inferred | | | — | | | | 13,669,000 | | | | 3.59 | | | | 0.30 | | | | 0.23 | | | | 0.09 | | | | 0.08 | | | | 1,575,840 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes: | Prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. |

Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The mineral resource for the Offset Zone was estimated as of June 30, 2012 by Todd McCracken, P.Geo, of Tetra Tech, an independent QP under NI 43-101. The effective date of the resource is March 31, 2012. The mineral resource calculation uses a minimum 2.5 g/t palladium resource block cut-off. The mineral resource estimate is based on the combination of geological modeling, geostatistics, and conventional block modelling (5 metres by 5 metres by 5 metres blocks). Assay grade capping was determined not to be necessary. The Offset Zone resource models used the ordinary kriging (OK) grade interpolation method within a 3Dl block model with mineralized zones defined by wireframed solids. The quality assurance (QA)/quality control (QC) protocols and corresponding sample preparation and shipment procedures for the Offset Zone have been reviewed by Tetra Tech. The following metal price assumptions were used: US$675/oz palladium, US$1,675/oz platinum, US$1,750/oz gold, US$8.00/lb nickel, and US$3.50/lb copper. A US$/CDN$ exchange rate of US$1.00 = CDN$1.00 was also applied.

Mineral reserves for the Offset Zone were estimated by Todd McCracken, P. Geo.; William Richard McBride, P.Eng.; Todd Kanhai, P.Eng.; and Philip Bridson, P.Eng. of Tetra Tech, independent QPs within the meaning of NI 43-101. The mineral reserves were estimated from drilling completed to March 31, 2012. Reserves were estimated to the 990 Mine Level (4,490 metres elevation), a maximum depth of 1,017.5 metres. The following metal price assumptions were used for reserves estimation: US$675/oz palladium, US$1,675/oz platinum, US$1,750/oz gold, US$8.00/lb nickel, and US$3.50/lb copper. A US$/CDN$ exchange rate of US$1.00 = CDN$1.00 was also applied. An average production rate of 3,500 t/d was used to determine the reserves. The following recoveries were used in the assumptions to determine the reserves: 80.45% palladium, 71.30% platinum, 83.97% gold, 43.13% nickel, and 88.55% copper.

The mineral resource estimate for the Roby Zone open pit and stockpiles were estimated as of June 30, 2010 by Scott Wilson RPA and updated by David N. Penna, P.Geo., an employee of LDI and a QP under NI 43-101 to reflect: (i) additions to mineral reserves in the Roby Zone as a result of a lower cut-off palladium grade; (ii) depletion from production up to March 31, 2012, and (iii) mineral reserves from the crown pillar (supported by

26