Exhibit 1.2

North American Palladium Ltd.

Management’s Discussion and Analysis

INTRODUCTION

Unless the context suggests otherwise, references to “NAP” or the “Company” or similar terms refer to North American Palladium Ltd. and its subsidiaries. “LDI” refers to Lac des Iles Mines Ltd. and “NAP Quebec” refers to NAP Quebec Mines Ltd.

The following is management’s discussion and analysis of the financial condition and results of operations (“MD&A”) to enable readers of the Company’s consolidated financial statements and related notes to assess material changes in financial condition and results of operations for the year ended December 31, 2012, compared to those of the respective periods in the prior year. This MD&A has been prepared as of February 21, 2013 and is intended to supplement and complement the consolidated financial statements and notes thereto for the year ended December 31, 2012 (collectively, the “Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB. Readers are encouraged to review the Financial Statements in conjunction with their review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities, available at www.sec.gov and www.sedar.com, respectively.

All amounts are in Canadian dollars unless otherwise noted and all references to production ounces refer to payable production.

FORWARD-LOOKING INFORMATION

Certain information contained in this MD&A constitutes ‘forward-looking statements’ within the meaning of the ‘safe harbor’ provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. The words ‘expect’, ‘believe’, ‘anticipate’, ‘contemplate’, ‘target’, ‘plan’, ‘may’, ‘will’, ‘intend’, ‘estimate’ and similar expressions identify forward-looking statements. Forward-looking statements included in this MD&A include, without limitation: information as to our strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans, projected cash flows or expenditures, operating cost estimates, mining including the LDI Mine expansion and other statements that express management’s expectations or estimates of future performance. The Company cautions the reader that such forward-looking statements involve known and unknown risk factors that may cause the actual results to be materially different from those expressed or implied by the forward-looking statements. Such risk factors include, but are not limited to: the possibility that metal prices and foreign exchange rates may fluctuate, inherent risks associated with development, exploration, mining and processing including risks to the LDI Mine expansion timeline, environmental hazards, uncertainty of mineral reserves and resources, the risk that the Company may not be able to obtain financing, the possibility that the Lac des Iles mine and may not perform as planned, changes in legislation, regulations or political and economic developments in Canada and abroad, employee relations, risks related to the availability of skilled labour, litigation and the risks associated with obtaining necessary licenses and permits. For more details on these and other risk factors see the Company’s most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and assumptions contained in this MD&A, which may prove to be incorrect, include, but are not limited to: that metal prices and exchange rates between the Canadian and United States dollar will be consistent with the Company’s expectations, that there will be no material delays affecting operations or the timing of ongoing development projects that there will be no material delays related to commissioning equipment, that prices for key mining and construction supplies, including labour costs, will remain consistent with the Company’s expectations, and that the Company’s current estimates of mineral reserves and resources are accurate. The forward-looking statements are not guarantees of future

1

2012 Annual Report

North American Palladium Ltd.

performance. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES

Mineral reserve and mineral resource information contained herein has been calculated in accordance with National Instrument 43-101 –Standards of Disclosure for Mineral Projects, as required by Canadian provincial securities regulatory authorities. Canadian standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained herein is not comparable to similar information disclosed in accordance with the requirements of the SEC. While the terms “measured”, “indicated” and “inferred” mineral resources are required pursuant to National Instrument 43-101, the SEC does not recognize such terms. U.S. investors should understand that “inferred” mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, U.S. investors are cautioned not to assume that any part or all of NAP’s mineral resources constitute or will be converted into reserves. For a more detailed description of the key assumptions, parameters and methods used in calculating NAP’s mineral reserves and mineral resources, see NAP’s most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the SEC.

OUR BUSINESS

NAP is an established precious metals producer that has been operating its flagship LDI Mine located in Ontario, Canada since 1993. LDI is one of only two primary producers of palladium in the world, and is currently undergoing a major expansion to increase production and reduce cash cost per ounce1. The Company is also developing the Vezza gold mine located in the Abitibi region of Quebec, which is held for sale.

The Company is expanding the underground LDI Mine to transition from mining via ramp access to mining via shaft while utilizing bulk mining methods. Through the utilization of the shaft and the bulk mining methods, operations are expected to benefit from increased mining rates and decreased operating costs, transforming LDI into a low cost producer with a rising production profile.

The Company has significant exploration potential near the LDI Mine, where a number of growth targets have been identified, and is engaged in a substantial exploration program aimed at increasing its palladium reserves and resources. As NAP pursues its organic growth strategy through the LDI Mine expansion, exploration will continue to be a key focus for the Company for many years to come. As an established palladium-platinum group metal (“PGM”) producer with excess mill capacity on a permitted property, NAP has potential to convert exploration success into production and cash flow on an accelerated timeline.

NAP trades on the TSX under the symbol PDL and on the NYSE MKT under the symbol PAL.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

2

2012 Annual Report

North American Palladium Ltd.

KEY HIGHLIGHTS

| | | | | | | | | | | | |

(expressed in thousands of dollars except cash cost per ounce,

metal units, metal prices and per share amounts) | | 2012 | | | 2011 | | | 2010 | |

FINANCIAL HIGHLIGHTS | | | | | | | | | | | | |

Revenue | | | $ 160,704 | | | | $ 143,659 | | | | $ 84,813 | |

Unit sales | | | | | | | | | | | | |

Palladium (oz) | | | 161,845 | | | | 146,457 | | | | 95,057 | |

Gold (oz) | | | 10,950 | | | | 7,256 | | | | 4,023 | |

Platinum (oz) | | | 11,056 | | | | 9,133 | | | | 4,894 | |

Nickel (lb) | | | 1,349,664 | | | | 814,551 | | | | 395,622 | |

Copper (lb) | | | 2,564,740 | | | | 1,593,479 | | | | 658,013 | |

Earnings | | | | | | | | | | | | |

(Loss) income from continuing operations | | | $ (11,403 | ) | | | $ 4,392 | | | | $ 2,914 | |

(Loss) Income from continuing operations per share | | | $ (0.07 | ) | | | $ 0.03 | | | | $ 0.02 | |

Net loss | | | $ (66,037 | ) | | | $ (65,154 | ) | | | $ (29,409 | ) |

Net loss per share | | | $ (0.39 | ) | | | $ (0.40 | ) | | | $ (0.21 | ) |

Adjusted net income1 | | | $ 7,709 | | | | $ 14,331 | | | | $ 6,720 | |

EBITDA1 | | | $ (45,248 | ) | | | $ (53,497 | ) | | | $ (17,073 | ) |

Adjusted EBITDA1 | | | $ 28,498 | | | | $ 25,988 | | | | $ 19,056 | |

Cash flow provided by (used in) operations | | | $ 55,249 | | | | $ 31,622 | | | | $ (73,750 | ) |

| Cash flow provided by (used in) continuing operations before changes in non-cash working capital1 | | | $ 15,594 | | | | $ 15,598 | | | | $ 10,007 | |

| Cash flow provided by (used in) continuing operations before changes in non-cash working capital per share1 | | | $ 0.09 | | | | $0.10 | | | | $ 0.07 | |

Capital spending, continuing operations | | | $ 145,180 | | | | $ 148,309 | | | | $ 35,732 | |

| | | |

OPERATING HIGHLIGHTS | | | | | | | | | | | | |

Production | | | | | | | | | | | | |

Palladium (oz) | | | 163,980 | | | | 146,624 | | | | 95,057 | |

Gold (oz) | | | 11,106 | | | | 7,267 | | | | 4,023 | |

Platinum (oz) | | | 11,187 | | | | 9,143 | | | | 4,894 | |

Nickel (lb) | | | 1,348,179 | | | | 816,037 | | | | 395,622 | |

Copper (lb) | | | 2,592,748 | | | | 1,596,185 | | | | 658,013 | |

Realized metal prices per ounce | | | | | | | | | | | | |

Palladium (US$) | | | $ 640 | | | | $ 733 | | | | $ 665 | |

Gold (US$) | | | $ 1,677 | | | | $ 1,534 | | | | $ 1,208 | |

Cash cost per ounce1 | | | | | | | | | | | | |

Palladium (US$) | | | $ 401 | | | | $ 448 | | | | $ 283 | |

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

3

2012 Annual Report

North American Palladium Ltd.

FINANCIAL CONDITION

| | | | | | | | | | | | |

| (expressed in thousands of dollars) | | As at December 31

2012 | | | As at December 31

2011 | | | As at December 31

2010 | |

Net working capital | | | $ 32,563 | | | | $ 108,432 | | | | $ 169,559 | |

Cash balance | | | $ ��20,168 | | | | $ 50,935 | | | | $ 75,159 | |

Shareholders’ equity | | | $ 246,900 | | | | $ 268,996 | | | | $ 290,450 | |

Total debt | | | $ 130,395 | | | | $ 70,230 | | | | $ 2, 391 | |

EXECUTIVE SUMMARY

Financial Highlights

Revenue for the year ended December 31, 2012 was $160.7 million, compared to $143.7 million in the prior year. In 2012, revenue increased from the palladium operations by $17.0 million. Net loss for the year was $66.0 million, including a $54.6 million loss from the discontinued gold operations, which included a non-cash gold asset impairment charge of $56.0 million, or $0.39 per share and Adjusted EBITDA1 was $28.5 million, compared to a net loss, including a non-cash gold asset impairment charge of $49.2 million, of $65.2 million or $0.40 per share and Adjusted EBITDA1 of $26.0 million in the prior year. For 2012, adjusted net income1 was $7.7 million, compared to adjusted net income1 of $14.3 million in the prior year. The Company’s operating activities provided cash of $15.6 million, before changes in non-cash working capital1.

Balance Sheet

As at December 31, 2012, the Company had approximately $32.6 million in working capital, including $20.2 million of cash on hand. As at December 31, 2012, the Company had US$27.5 million available on its US$60.0 million credit facility.

Investment in Growth

For the year ended December 31, 2012, the Company invested $14.5 million in exploration activities and $145.2 million in development expenditures at its palladium operations.

LDI Mine Palladium Production

The LDI Mine produced 163,980 ounces of payable palladium for the year ended December 31, 2012, exceeding management’s annual production guidance of 150,000 to 160,000 ounces. During the year, 2,063,260 tonnes of ore were processed by the LDI mill at an average palladium head grade of 3.44 grams per tonne, with a palladium recovery of 78%. For 2012, LDI’s palladium cash cost per ounce1 (net of byproduct credits) was US$401.

Production at the LDI Mine in 2012 included the blending of higher grade underground ore (853,600 milled tonnes with an average palladium grade of 5.19 grams per tonne) with lower grade surface ore (1,209,660 milled tonnes with an average palladium grade of 2.21 grams per tonne).

LDI Mine Expansion Update

In 2012, mine expansion expenditures totaled $127.5 million, excluding capitalized interest of $8.0 million. Development work in 2012 was focused on completing the surface construction activities, advancing underground development (including mine level development and setting up mining stopes) and sinking the shaft.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

4

2012 Annual Report

North American Palladium Ltd.

By year end, the Company made significant progress advancing the critical aspects of its mine expansion. On surface, the major construction components are now completed. The headframe, the main substation, the hoist house building, the service hoist (which is used for shaft sinking) and the auxiliary hoist are all fully operational and 100% completed. The installation of the production hoist has commenced and commissioning is scheduled for the first quarter of 2013. The remaining work on surface includes the installation of the main skip dump and the surface ore bins.

Underground, shaft sinking is progressing well, in line with the Company’s scheduled rates of advancement. The shaft sinking is currently at a depth of 550 metres below surface, representing almost 67% of the total 825 metres planned for the first phase of the shaft sinking. Installation of the 740-metre level loading pocket is scheduled for the first quarter of 2013, and the ramp and stope development is also progressing on schedule. The Company maintains its development timeline to begin hoisting mineralized material via shaft by the end of the third quarter of 2013.

Gold Division Update

The Company continues to evaluate opportunities for the divesture of its gold assets and undertakings located in Quebec, which are held by NAP Quebec Mines Ltd., including the Sleeping Giant gold mine and mill complex, the Vezza gold mine and the other exploration projects including the Flordin property and the Discovery project, and all associated rights, privileges, agreements, permits and associated infrastructure and equipment. As part of the Company’s ongoing consideration of opportunities for divestiture, which provided an indication of the value of these assets in late 2012, the Company believes that the current value of such assets is likely less than their book value. In anticipation of a potential sale, the Company recorded a non-cash impairment charge on its gold assets of $56.0 million, as reflected in the year end 2012 financial results.

In 2012, the Company continued to advance its Vezza gold project and commenced mining the initial test stope panels in late Q1 and Q2. Early results were not favorable with regards to dilution so the mining method was changed from Alimak stoping to long hole benching. As at year end, the stoping conversion is virtually complete with dilution results significantly improved. Due to these changes, as well as the desire to divest of the gold division, mining rates were slowed to achieve a balance between production rates and development requirements as the assets were prepared for sale. In 2012, capitalized expenditures at the Company’s Vezza gold project totaled $26.3 million.

Exploration

In 2012, the Company expensed $14.5 million in exploration costs and capitalized an additional $1.6 million associated with the LDI Mine expansion. In 2012, 229 holes were drilled totaling 50,148 metres. Exploration work in 2012 was predominately focused on underground exploration targeting the Offset Zone (infill drilling and testing Offset Zone extensions towards surface, at depth, and south) and surface exploration targeting the Sheriff Zone and the North VT Rim.

Palladium Market Outlook

Palladium spot prices averaged US$640 per ounce in 2012, ranging from a low of US$556 per ounce, to a high of US$719 per ounce. The price volatility seen in 2012 was largely driven by the uncertainty of the European debt crisis earlier in the year, however market sentiment recovered later in the year as the long term supply and demand fundamentals of palladium remained strong. The general consensus of the leading forecasters is that palladium prices will rise. Their outlook for palladium over the next ten years predicts a return to historically high prices, strong fabrication and investment demand, and constrained supply.

5

2012 Annual Report

North American Palladium Ltd.

Selected Annual Information

| | | | | | | | | | | | |

| (expressed in thousands of dollars, except per share amounts) | | 2012 | | | 2011 | | | 2010 | |

Revenue | | | $ 160,704 | | | | $ 143,659 | | | | $ 84,813 | |

Income from mining operations | | | 15,691 | | | | 28,404 | | | | 24,365 | |

Loss from discontinued operations | | | (54,634 | ) | | | (69,546 | ) | | | (32,323 | ) |

Net loss | | | (66,037 | ) | | | (65,154 | ) | | | (29,409 | ) |

Net loss per share – basic and diluted | | | (0.39 | ) | | | (0.40 | ) | | | (0.21 | ) |

(Loss) income from continuing operations per share – basic and diluted | | | (0.07 | ) | | | 0.03 | | | | 0.02 | |

Cash flow provided by (used in) operations prior to changes in non-cash working capital1 | | | 15,594 | | | | 15,598 | | | | 10,007 | |

Total assets | | | 471,232 | | | | 416,045 | | | | 348,437 | |

Total non-current liabilities | | | 129,155 | | | | 95,595 | | | | 15,932 | |

For the year ended December 31, 2011, revenue was $143.7 million compared to $84.8 million in the prior year. Income from mining operations for the year ended December 31, 2011 was $28.4 million compared to $24.4 million in the prior year. Production from LDI was successfully restarted in April 2010 after being temporarily placed on care and maintenance in October 2008 due to low metal prices.

Metal Prices and Foreign Exchange

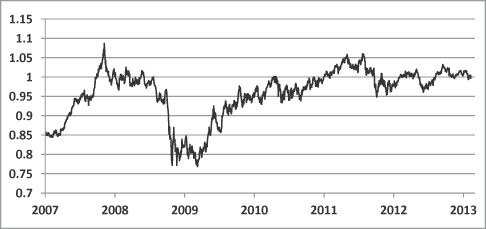

Palladium Price (US$/Troy oz)

During 2012, the palladium price averaged US$640 per ounce, ranging from a low of US$556 to a high of US$719 per ounce. As of February 21, 2013, the palladium price was US$722 per ounce.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

6

2012 Annual Report

North American Palladium Ltd.

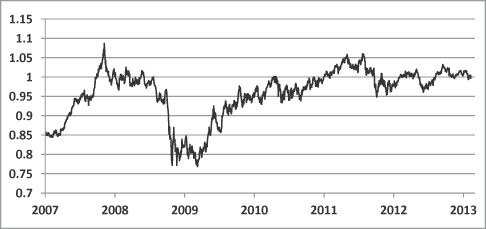

Canadian dollar exchange rate (CDN$1=US$)

During 2012, the average Canadian dollar exchange rate was $1.00, ranging from a low of $0.98 to a high of $1.03 to the U.S. dollar. The Canadian dollar closed 2012 at $1.01 to the U.S. dollar, compared to $0.98 at the end of 2011. As of February 21, 2013, the Canadian dollar exchange rate was $0.98.

NAP Realized Metal Prices and Exchange Rates

| | | | | | | | |

| | | 2012 | | | 2011 | |

Palladium – US$/oz | | | $ 640 | | | | $ 733 | |

Platinum – US$/oz | | | $ 1,557 | | | | $ 1,725 | |

Gold – US$/oz | | | $ 1,677 | | | | $ 1,534 | |

Nickel – US$/lb | | | $ 7.81 | | | | $ 10.52 | |

Copper – US$/lb | | | $ 3.58 | | | | $ 4.06 | |

Average exchange rate – CDN$1 = US$ | | | $ 1.00 | | | | $ 1.01 | |

Realized metal prices in the chart above represent the weighted average metal prices on amounts settled from smelters for final outturn of metals during the year.

Spot Metal Prices* and Exchange Rates

For comparison purposes, the following table sets out spot metal prices and exchange rates.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dec-31

2012 | | | Sep-30

2012 | | | Jun-30

2012 | | | Mar-31

2012 | | | Dec-31

2011 | | | Sep-30

2011 | | | Jun-30

2011 | | | Mar-31

2011 | |

Palladium – US$/oz | | | $ 699 | | | | $ 642 | | | | $ 578 | | | | $ 651 | | | | $ 636 | | | | $ 614 | | | | $ 761 | | | | $ 766 | |

Gold – US$/oz | | | $ 1,664 | | | | $ 1,776 | | | | $ 1,599 | | | | $ 1,663 | | | | $ 1,575 | | | | $ 1,620 | | | | $ 1,506 | | | | $ 1,439 | |

Platinum – US$/oz | | | $ 1,523 | | | | $ 1,668 | | | | $ 1,428 | | | | $ 1,640 | | | | $ 1,381 | | | | $ 1,511 | | | | $ 1,722 | | | | $ 1,773 | |

Nickel – US$/lb | | | $ 7.75 | | | | $ 8.40 | | | | $ 7.46 | | | | $ 7.91 | | | | $ 8.28 | | | | $ 8.30 | | | | $ 10.48 | | | | $ 11.83 | |

Copper – US$/lb | | | $ 3.59 | | | | $ 3.75 | | | | $ 3.44 | | | | $ 3.83 | | | | $ 3.43 | | | | $ 3.24 | | | | $ 4.22 | | | | $ 4.26 | |

Exchange rate (Bank of Canada) – CDN$1 = US$ | | | US$1.01 | | | | US$1.02 | | | | US$0.98 | | | | US$1.00 | | | | US$0.98 | | | | US$0.96 | | | | US$1.04 | | | | US$1.03 | |

* Based on the London Metal Exchange

7

2012 Annual Report

North American Palladium Ltd.

PALLADIUM OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS

The LDI Mine consists of an open pit, an underground mine, and a mill with a processing capacity of approximately 15,000 tonnes per day. The primary deposits on the property are the Roby Zone open pit, the underground Roby Zone and the underground Offset Zone, all disseminated magmatic palladium-platinum group metal deposits.

In 2012, underground ore production from the LDI Mine operated on average at approximately 2,200 tonnes per day, seven days a week, on two 12-hour shifts per day. At year end, the LDI Mine and mill had a workforce of approximately 320 employees, some of which are unionized and are subject to a three year agreement that expires in May, 2015.

Financial Results

Income from mining operations for the Palladium operations is summarized in the following table.

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Revenue | | | $ 160,704 | | | | $ 143,659 | |

Mining operating expenses | | | | | | | | |

Production costs | | | $ 100,802 | | | | $ 89,657 | |

Smelting, refining and freight costs | | | 13,679 | | | | 9,206 | |

Royalty expense | | | 6,720 | | | | 5,819 | |

Other | | | 3,813 | | | | 1,352 | |

Depreciation and amortization | | | 19,706 | | | | 10,144 | |

(Gain) loss on disposal of equipment | | | 293 | | | | (923 | ) |

Total mining operating expenses | | | $ 145,013 | | | | $ 115,255 | |

Income from mining operations | | | $ 15,691 | | | | $ 28,404 | |

The Company has included income from mining operations as an additional IFRS measure to provide the user with information on the actual results of operations for each reporting segment.

Revenue

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Metal sales for LDI are recognized in revenue at provisional prices when delivered to a smelter for treatment or designated shipping point. Final pricing is determined in accordance with LDI’s smelter agreements. In most cases, final pricing is determined two months after delivery to the smelter for gold, nickel and copper and four months after delivery for palladium and platinum. These final pricing adjustments can result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the U.S. dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues. The Company enters into financial contracts for past production delivered to the smelter to mitigate the smelter agreements’ provisional pricing exposure to rising or declining palladium and gold prices and an appreciating Canadian dollar. These financial contracts represent 55,000 ounces of palladium as at December 31, 2012 and mature from January 2013 through May 2013 at an average forward price of $640 per ounce of palladium. For substantially all of the palladium delivered to the customer under the smelter agreement, the quantities and timing of settlement specified in the financial contracts match final pricing settlement periods. The palladium financial contracts are being recognized on a mark-to-market basis as an adjustment to revenue. The fair value of these contracts at December 31, 2012 was a liability of $3.2 million included in accounts payable and accrued liabilities (December 31, 2011 – $2.0 million asset included in accounts receivable).

8

2012 Annual Report

North American Palladium Ltd.

Sales volumes of LDI’s major commodities are set out in the table below.

| | | | | | | | |

| | | 2012 | | | 2011 | |

Sales volumes | | | | | | | | |

Palladium (oz) | | | 161,845 | | | | 146,457 | |

Gold (oz) | | | 10,950 | | | | 7,256 | |

Platinum (oz) | | | 11,056 | | | | 9,133 | |

Nickel (lbs) | | | 1,349,664 | | | | 814,551 | |

Copper (lbs) | | | 2,564,740 | | | | 1,593,479 | |

Cobalt (lbs) | | | 12,368 | | | | 20,839 | |

Silver (oz) | | | 7,347 | | | | 3,752 | |

Revenue from metal sales from the palladium operations is set out in the table below.

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Revenue before pricing adjustments | | | $ 161,286 | | | | $ 148,480 | |

Pricing adjustments | | | (582 | ) | | | (4,821 | ) |

Revenue after pricing adjustments | | | $ 160,704 | | | | $ 143,659 | |

Revenue by metal | | | | | | | | |

Palladium | | | $ 104,501 | | | | $ 104,004 | |

Gold | | | 18,567 | | | | 11,971 | |

Platinum | | | 17,798 | | | | 13,867 | |

Nickel | | | 10,225 | | | | 7,585 | |

Copper | | | 9,216 | | | | 5,804 | |

Other metals | | | 397 | | | | 428 | |

| | | | $ 160,704 | | | | $ 143,659 | |

For the year ended December 31, 2012, revenue before pricing adjustments was $161.3 million, compared to $148.5 million in 2011. The increased revenue in 2012 was primarily due to increased revenue from non-palladium payable metals and an increase in the quantity of palladium ounces sold, partially offset by lower realized prices.

Operating Expenses from Continuing Operations

For the year ended December 31, 2012, operating expenses were $145.0 million, compared to $115.3 million in 2011. The increase in operating expenses in 2012 resulted primarily from mining and processing more physical tonnage (restart of the Roby open pit) and also from higher costs of contractor labour, power, parts and supplies, and fuel charges.

Cash cost per ounce1 of palladium sold, was US$401 for the year ended December 31, 2012 (2011 – US$448).

Due to the Company’s commitment to a comprehensive energy management plan, the Company qualified for the Ontario government’s Northern Industrial Electricity Rate (“NIER”) program to receive electricity price rebates of two cents per kilowatt hour. In the second quarter of 2011, the Company was accepted into the program. For the year ended December 31, 2012, a rebate of $3.4 million was received ($4.2 million, including a retroactive rebate of $1.9 million for LDI’s electricity costs for the period April 1, 2010 through March 31, 2011, was received for the year ended December 31, 2011). The rebate was treated as a reduction of operating expenses. The Company expects to continue to meet the eligibility criteria such that LDI will be entitled to receive additional quarterly rebates until March 2013 (and possibly longer, as the Ontario government intends to extend the NIER program).

Smelting, refining and freight costs for the year ended December 31, 2012 were $13.7 million compared to $9.2 million in 2011. The increase over the prior year is primarily due to more tonnes of concentrate sold and higher smelting and refining charges associated with the current smelter contracts compared to the previous contracts.

9

2012 Annual Report

North American Palladium Ltd.

For the year ended December 31, 2012, royalty expense was $6.7 million compared to $5.8 million in the prior year. Royalty expense was higher in the current year due to higher revenue, net of higher smelting and refining, and freight charges in the current year.

Depreciation and amortization at the LDI Mine for the year ended December 31, 2012 was $19.7 million, compared to $10.1 million for the year ended December 31, 2011. The increase over the prior year is due to a significant increase in depreciable assets associated with the LDI Mine expansion.

Other charges at the LDI Mine in 2012 were $3.8 million, compared to $1.4 million in the prior year. These additional costs are related to dewatering and repairing the damage caused by flooding due to two unprecedented rainfalls in the Thunder Bay region in the second and third quarters of 2012, and are reflected in the financial statements as Other expenses. These costs were excluded from the cash cost per ounce1 of US$401. Following these rainstorms, the Company made several improvements to LDI’s water management systems which are expected to limit the impact of flooding to underground operations in the future.

In 2012, the Company also capitalized $7.7 million related to necessary upgrades to its tailings management facility (“TMF”). Due to the two severe rainstorms, the extra water pumped to the TMF accelerated the timeline for the upgrades to the TMF that were previously planned for 2013.

Operating Results

The key operating results for the Palladium operations are set out in the following table.

| | | | | | | | |

| | | 2012 | | | 2011 | |

Tonnes of ore milled | | | 2,063,260 | | | | 1,689,781 | |

Production | | | | | | | | |

Palladium (oz) | | | 163,980 | | | | 146,624 | |

Gold (oz) | | | 11,106 | | | | 7,267 | |

Platinum (oz) | | | 11,187 | | | | 9,143 | |

Nickel (lbs) | | | 1,348,179 | | | | 816,037 | |

Copper (lbs) | | | 2,592,748 | | | | 1,596,185 | |

Palladium head grade (g/t) | | | 3.44 | | | | 3.70 | |

Palladium recoveries (%) | | | 78.4 | | | | 78.3 | |

Tonnes of ore mined | | | 2,051,563 | | | | 1,830,234 | |

Total cost per tonne milled | | | $ 49 | | | | $ 54 | |

Cash cost per ounce of palladium sold (US$)1 | | | $ 401 | | | | $ 448 | |

LDI Mine

Production during 2012 at the LDI Mine included the blending of higher grade underground ore with lower-grade surface ore. During the year ended December 31, 2012, 2,051,563 tonnes of ore was extracted (2011 – 1,830,234).

LDI Mill

For the year ended December 31, 2012, the mill processed 2,063,260 tonnes of ore, producing 163,980 ounces of payable palladium at an average palladium head grade of 3.44 grams per tonne, palladium recovery of 78.4% (2011 – 1,689,781 tonnes processed, at an average grade of 3.70 grams per tonne, with a palladium recovery of 78.3% producing 146,624 ounces). Production costs of $49 per tonne milled for the year ended December 31, 2012 were lower, compared to $54 per tonne in 2011, due primarily to more tonnage being produced and processed in the year. To improve efficiencies and minimize processing costs, the mill is operating on a batch basis, with a two-week operating and a two-week non-operating schedule.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

10

2012 Annual Report

North American Palladium Ltd.

LDI’s cash cost per ounce1 was US$401 for the year ended December 31, 2012, compared to US$448 per ounce in the prior year.

LDI Mine Expansion

The Company is currently expanding the LDI Mine to transition from mining via ramp access to mining via shaft while utilizing bulk mining methods. The objective of the mine expansion is to access the deeper and new ore zones that are less economical to mine via a ramp system. With a shaft access infrastructure, future production can be increased at a lower cash cost per ounce1.

Development work in 2012 was focused on completing the surface construction activities, advancing underground development, stoping panel setup and shaft sinking activities.

By 2012 year end, the Company had made significant progress advancing the critical aspects of its mine expansion, including:

| | • | | On surface, the major construction components are now completed. The headframe, the main substation, the hoist house building, the service hoist (which is used for shaft sinking) and the auxiliary hoist are all fully operational and 100% completed. The installation of the production hoist has commenced and commissioning is scheduled for the first quarter of 2013. |

| | • | | The remaining work on surface includes the installation of the main skip dumps and the surface ore bins and the installation of the back fill plant scheduled for 2014. |

| | • | | Underground, shaft sinking is progressing well, in line with the Company’s scheduled rates of advancement. The shaft sinking is at a depth of 550 metres below surface, representing almost 67% of the total 825 metres planned for the first phase of the shaft sinking. Installation of the 740-metre level loading pocket is scheduled for the first quarter of 2013, and the ramp and stope development is also progressing on schedule. |

| | • | | The Company maintains its development timeline to begin mining via shaft in the third quarter of 2013. |

In the year ended December 31, 2012, $127.5 million was invested in the mine expansion, excluding capitalized interest of $8.0 million.

GOLD OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS

NAP’s gold division consists of the developing Vezza gold mine, the Sleeping Giant mill, the closed Sleeping Giant mine and a number of nearby exploration projects, all located in the Abitibi region of Quebec. In 2012, the Company commenced a process to explore divestiture opportunities for its gold assets. In anticipation of a potential sale, the Company recorded a non-cash impairment charge on its gold assets, which are held for sale, of $56.0 million.

The mine production for the year ended December 31, 2012 is from the remaining ore from the Sleeping Giant mine during the first quarter, prior to the suspension of operations on January 17, 2012. Until the Vezza mine reaches commercial production, all costs (net of pre-production revenue from gold sales) will be capitalized.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

11

2012 Annual Report

North American Palladium Ltd.

Financial Results

The following table summarizes the mining operations for the Sleeping Giant mine and excludes the Vezza development project results, where all costs are being capitalized until commercial production has been achieved.

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Revenue | | | $ 3,004 | | | | $ 26,813 | |

Mining operating expenses | | | | | | | | |

Production costs | | | $ 2,153 | | | | $ 31,601 | |

Smelting, refining and freight costs | | | 16 | | | | 54 | |

Depreciation and amortization | | | 199 | | | | 7,460 | |

Gold assets impairment charge | | | 56,023 | | | | 49,210 | |

Gold mine closure, care and maintenance costs | | | 1,463 | | | | - | |

Gain on disposal of equipment | | | (435 | ) | | | (27 | ) |

Total mining operating expenses | | | $ 59,419 | | | | $ 88,298 | |

Loss from mining operations | | | $ (56,415 | ) | | | $ (61,485 | ) |

The Company has included loss from mining operations as an additional IFRS measure to provide the user with information of the actual results of operations for each reporting segment.

Revenue

Metal sales for the Sleeping Giant gold mine were recognized when metal was sold to a third party. Sales volumes are set out in the table below.

| | | | | | | | |

| | | 2012 | | | 2011 | |

Sales volumes | | | | | | | | |

Gold (oz) | | | 1,663 | | | | 17,019 | |

Silver (oz) | | | 2,578 | | | | 31,150 | |

As operations for the Sleeping Giant gold mine were suspended at the beginning of 2012 and pre-production revenue from the Vezza gold mine was capitalized, revenue was $3.0 million for the year ended December 31, 2012, compared to $26.8 million in the prior year, reflecting gold sales of 1,663 ounces with an average realized price of US$1,762 per ounce (2011 – 17,019 ounces with an average realized price of US$1,531).

Operating Expenses

For the year ended December 31, 2012, total production costs at the Sleeping Giant gold mine were $2.2 million as compared to $31.6 million in 2011 due to mine operations ceasing at the beginning of 2012.

Depreciation and amortization for the gold operations was $0.2 million for the year ended December 31, 2012 compared to $7.5 million in the prior year due to mine operations ceasing at the beginning of 2012.

As a result of the Company’s decision to cease mining operations at Sleeping Giant and restructure the gold division, closure costs and care and maintenance costs of $1.5 million (primarily severance) were recorded during the year ended December 31, 2012. As part of the Company’s active consideration of opportunities for divestiture of its gold assets, which has provided an indication of the value of these assets, the Company believes that the current value of these assets is likely significantly less than their book value. Accordingly, the Company has incurred a non-cash impairment charge of $56.0 million. As a result of the Company’s decision to cease mining operations at Sleeping Giant and restructure the gold divisions, a gold asset impairment charge of $49.2 million was recorded during the year ended December 31, 2011.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

12

2012 Annual Report

North American Palladium Ltd.

Operating Results

The key operating results for the Gold operations are set out in the following table.

| | | | | | | | |

| | | 2012 | | | 2011 | |

Tonnes of ore milled | | | 6,369 | | | | 74,154 | |

Production | | | | | | | | |

Gold (oz) | | | 1,199 | | | | 14,623 | |

Gold head grade (g/t) | | | 6.14 | | | | 6.36 | |

Gold recoveries (%) | | | 95.4 | | | | 96.4 | |

Tonnes of ore hoisted | | | 6,369 | | | | 73,701 | |

Total cost per tonne milled | | | $ 339 | | | | $ 426 | |

Sleeping Giant Mine

As operations for the Sleeping Giant gold mine were suspended at the beginning of 2012, 6,369 tonnes of ore were hoisted with an average gold grade of 6.14 grams per tonne for the year ended December 31, 2012, compared to 73,701 tonnes of ore hoisted from the underground mine in the prior year with an average gold grade of 6.36 grams per tonne.

Production costs per tonne of ore milled were $339 for the year ended December 31, 2012 (2011 – $426 per tonne).

Sleeping Giant Mill

For the year ended December 31, 2012, the mill processed 6,369 tonnes of ore, producing 1,199 ounces of gold at an average gold head grade of 6.14 grams per tonne, with a gold recovery of 95.4% and mill availability of 98.9% (2011 – 74,154 tonnes of ore, at an average gold head grade of 6.36 grams per tonne, with a gold recovery of 96.4% and mill availability of 98.9% producing 14,623 ounces of gold).

At December 31, 2012, the mill contained approximately 2,137 ounces (2011 – 2,742 ounces from Sleeping Giant) of gold being processed from Vezza that was included in inventory and valued at net realizable value. Despite the closure of the Sleeping Giant mine, the mill continued to operate to process ore from the nearby Vezza project.

Vezza Gold Project

In 2012, the Company continued to advance its Vezza gold project and commenced mining the initial test stoping panels in late Q1 and Q2. Early results were not favorable with regards to dilution so the mining method was changed from Alimak stoping to a modified long hole benching technique. As at year end, the stoping conversion is virtually complete with dilution results significantly improved. Due to this delay toward commercial production, mining rates were slowed to achieve a balance between production rates and development requirements. In 2012, capitalized expenditures at the Company’s Vezza gold project totaled $23.8 million.

The Company continues to evaluate opportunities for the divesture of its gold division assets and undertakings.

13

2012 Annual Report

North American Palladium Ltd.

CONSOLIDATED FINANCIAL RESULTS

General and administration

The Company’s general and administration expenses for the year ended December 31, 2012 were $12.0 million, compared to $12.2 million in the prior year. The decrease is primarily due to decreased staff at the Corporate head office.

Exploration

Exploration expense for the year ended December 31, 2012 was $14.5 million compared to $9.9 million in the prior year. The increase primarily reflects $4.6 million of increased exploration in Ontario compared with the prior year. Exploration expenditures are comprised as follows:

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Palladium operations | | | | | | | | |

Ontario exploration projects* | | | $ 14,408 | | | | $ 9,834 | |

Corporate and other** | | | 105 | | | | 105 | |

Total exploration expenditures | | | $ 14,513 | | | | $ 9,939 | |

| * | Ontario exploration projects include the LDI Mine Block intrusion, comprising the Roby, Offset, Cowboy, Sheriff, Baker, Creek and North VT Rim mineralized zones and the South LDI and South VT Rim target areas, the North Lac des Iles intrusive complex, several greenfields PGM properties in the LDI region, and two greenfields Au properties in the LDI-Thunder Bay region (Salmi Lake, Shabaqua). |

| ** | Corporate and other includes the Shebandowan Ni project (joint venture with Vale). |

Interest expense & other costs and other income

Interest expense & other costs and other income for the year ended December 31, 2012 was a net expense of $1.1 million compared to income of $0.3 million in the prior year. The current year net balance includes an accretion expense of $3.0 million, an interest on finance leases of $0.8 million and other interest expense of $ 0.6 million, partially offset by a gain on the renouncement of flow-through expenditures of $1.6 million, an unrealized gain on palladium warrants of $0.9 million, a gain or revaluation of debt of $0.8 million, and interest income of $0.2 million. The prior year balance includes a gain on renouncement of flow-through expenditures of $1.8 million and interest income of $0.9 million, partially offset by financing costs of $0.8 million, accretion expense of $0.7 million, unrealized loss in palladium warrants of $0.5 million and other items of $0.5 million.

Income and Mining Tax Expense (Recovery)

The income and mining tax expense (recovery) for the years ended December 31 are provided as follows:

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

LDI palladium mine | | | | | | | | |

Ontario transitional tax debit | | | $ - | | | | $ 2,388 | |

| | | | $ - | | | | $ 2,388 | |

Corporate and other | | | | | | | | |

Expiration of warrants | | | - | | | | $ (555 | ) |

| | | | - | | | | $ (555 | ) |

Income and mining tax expense | | | $ - | | | | $ 1,833 | |

For the year ended December 31, 2012, income and mining tax expense was $Nil compared to $1.8 million in the same period in 2011. The prior year balance includes Ontario transitional tax debits ($2.4 million) partially offset by the tax recovery on the expiration of Series B warrants ($0.6 million).

14

2012 Annual Report

North American Palladium Ltd.

Summary of Quarterly Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(expressed in thousands of Canadian dollars except

per share amounts) | | 2012 | | | 2011 | |

| | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

Revenue | | | $ 42,368 | | | | $ 36,193 | | | | $ 40,563 | | | | $ 41,580 | | | | $ 37,205 | | | | $ 32,689 | | | | $ 44,329 | | | | $ 29,436 | |

Production costs | | | 23,937 | | | | 24,257 | | | | 27,214 | | | | 25,394 | | | | 25,990 | | | | 22,497 | | | | 21,131 | | | | 20,039 | |

Exploration expense | | | 5,961 | | | | 2,604 | | | | 2,764 | | | | 3,184 | | | | 2,390 | | | | 1,742 | | | | 3,883 | | | | 1,924 | |

Capital expenditures | | | 41,810 | | | | 34,088 | | | | 32,072 | | | | 37,210 | | | | 44,446 | | | | 39,673 | | | | 31,450 | | | | 32,740 | |

Net income (loss) from continuing operations | | | (3,739 | ) | | | (5,908 | ) | | | (1,903 | ) | | | 147 | | | | (4,343 | ) | | | 356 | | | | 10,746 | | | | (2,367 | ) |

Cash provided by (used in) operations | | | 39,045 | | | | 5,174 | | | | 4,833 | | | | 6,197 | | | | (147 | ) | | | 16,232 | | | | 6,362 | | | | 9,175 | |

Cash provided by (used in) financing activities | | | 2,299 | | | | 35,280 | | | | 46,712 | | | | 6,201 | | | | 69,433 | | | | 71 | | | | 7,897 | | | | 61,256 | |

Cash provided by (used in) investing activities | | | (41,831 | ) | | | (33,864 | ) | | | (31,829 | ) | | | (37,131 | ) | | | (43,864 | ) | | | (38,822 | ) | | | (30,998 | ) | | | (32,740 | ) |

Net income (loss) per share from continuing operations – basic | | | $ (0.02 | ) | | | $ (0.03 | ) | | | $ (0.01 | ) | | | $ (0.00 | ) | | | $(0.03 | ) | | | $ (0.00 | ) | | | $ 0.07 | | | | $ (0.01 | ) |

Net income (loss) per share from continuing operations – diluted | | | (0.02 | ) | | | (0.03 | ) | | | (0.01 | ) | | | (0.00 | ) | | | (0.03 | ) | | | (0.00 | ) | | | 0.07 | | | | (0.01 | ) |

Cash provided by (used in) operations prior to changes in non-cash working capital per share1 | | | 0.03 | | | | 0.00 | | | | 0.03 | | | | 0.03 | | | | (0.01 | ) | | | 0.03 | | | | 0.08 | | | | (0.01 | ) |

Tonnes milled | | | 511,226 | | | | 504,022 | | | | 528,068 | | | | 519,944 | | | | 531,825 | | | | 442,253 | | | | 377,857 | | | | 337,846 | |

Palladium sold (ounces) | | | 44,394 | | | | 36,218 | | | | 42,285 | | | | 38,948 | | | | 35,116 | | | | 34,524 | | | | 46,362 | | | | 30,455 | |

Revenue for the three months ended December 31, 2012 was $42.4 million compared to $37.2 million for the three months ended December 31, 2011. Net loss for the quarter, was $3.7 million or $0.02 per share compared to a net loss of $4.3 million or $0.03 per share in the comparative period in 2011.

For the three months ended December 31, 2012, the Company expensed $6.0 million in exploration activities compared to $2.4 million in 2011 and $41.8 million in development expenditures at its palladium operations. For the three months ended December 31, 2012, the Company’s operations provided cash, before changes in non-cash working capital, of $5.2 million compared to cash used in operations, before changes in non-cash working capital, of $1.7 million for the same period in 2011. For the three months ended December 31, 2012, financing activities provided cash of $2.3 million, compared to cash provided by financing activities in 2011 of $69.4 million, primarily consisting of $69.7 million related to the issuance of senior secured notes. Investing activities required cash of $41.8 million for the three months ended December 31, 2012 compared to $43.9 million required for investing activities in the comparative period in 2011.

The LDI Mine produced 44,294 ounces of payable palladium for the three months ended December 31, 2012 compared to 34,121 ounces of payable palladium for the comparative period in 2011. During the fourth quarter of 2012, 511,226 tonnes of ore processed by the LDI mill (2011 – 531,825 tonnes).

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-29.

15

2012 Annual Report

North American Palladium Ltd.

FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Cash provided by operations prior to changes in non-cash working capital | | | $ 15,594 | | | | $ 15,598 | |

Changes in non-cash working capital | | | 39,655 | | | | 16,024 | |

Cash provided by operations | | | 55,249 | | | | 31,622 | |

Cash provided by financing | | | 90,492 | | | | 138,660 | |

Cash used in investing | | | (144,654 | ) | | | (146,425 | ) |

Increase in cash from continuing operations | | | 1,087 | | | | 23,857 | |

Net cash used in discontinued operations | | | (31,301 | ) | | | (48,081 | ) |

Reclassification of cash to assets held for sale | | | (553 | ) | | | (71 | ) |

Decrease in cash and cash equivalents | | | $ (30,767 | ) | | | $ (24,295 | ) |

Operating Activities

For the year ended December 31, 2012, cash provided by operations prior to changes in non-cash working capital was $15.6 million, unchanged from cash provided by operations of $15.6 million in the prior year.

For the year ended December 31, 2012, changes in non-cash working capital resulted in a source of cash of $39.7 million compared to a source of cash of $16.0 million in the prior year. The 2012 balance of $39.7 million is primarily due to a decrease in accounts receivable ($22.4 million), an increase in accounts payable and accrued liabilities ($22.4 million), partially offset by an increase in inventories ($2.4 million), an increase in other assets ($1.8 million) and a decrease in other financial liabilities ($0.9 million).

Financing Activities

For the year ended December 31, 2012, financing activities provided cash of $90.5 million consisting of $40.8 million related to the issuance of convertible debentures, $36.4 million related to the issuance of flow-through common shares, $15.3 million from drawdown on credit facility and $11.2 million drawdown on capital lease facility, partially offset by repayments of finance leases of $4.8 million and interest payments of $8.5 million. This compared to cash provided by financing activities of $138.7 million in the prior year consisting of $61.9 million related to the exercise of warrants, issuance of flow-through common shares and $69.7 million related to the issuance of senior secured notes and refund of reclamation deposit of $8.8 million, partially offset by net scheduled repayments and additions of $1.7 million of finance leases.

Anticipated operating cash flows and net proceeds on disposal of the gold division are not expected to provide sufficient cash to fund capital expenditures anticipated for 2013, therefore the Company plans to access the capital markets. The Company believes the debt and equity markets are currently available to finance this funding requirement. In the event access to the capital markets is unavailable, the Company will review its options to preserve cash resources.

Investing Activities

For the year ended December 31, 2012, investing activities required cash of $144.7 million primarily due to additions to mining interests of $145.2 million. For the year ended December 31, 2011, investing activities required cash of $146.4 million, primarily due to additions to mining interests of $148.3 million. The majority of the additions to mining interests were attributable to LDI’s mine expansion project.

16

2012 Annual Report

North American Palladium Ltd.

Additions to mining interests

Additions to mining interests are comprised as follows:

| | | | | | | | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

Palladium operations | | | | | | | | |

Offset Zone development | | | $ 130,408 | | | | $ 131,322 | |

Offset Zone exploration costs | | | 2,687 | | | | 9,216 | |

Tailings management facility | | | 7,750 | | | | 821 | |

Other equipment and betterments | | | 4,335 | | | | 6,950 | |

| | | | $ 145,180 | | | | $ 148,309 | |

In addition to the mining interests acquired by cash reflected in the table above, the Company also acquired equipment by means of finance leases. For the year ended December 31, 2012, $12.5 million of equipment was acquired by means of finance leases compared to $3.7 million in the prior year.

During the year, the Company issued 13,725,000 flow-through common shares at an average price of $2.84 per share for net proceeds of $36.4 million. The Company is required to spend the gross proceeds of $39.0 million on eligible exploration and mine development expenditures, which expenditures are expected to be renounced to investors for the 2012 tax year. As at December 31, 2012, $36.9 million was spent. The remaining $2.1 million commitment will be spent by March 31, 2013.

Capital Resources

As at December 31, 2012, the Company had cash and cash equivalents of $20.2 million compared to $50.9 million as at December 31, 2011. The decrease is due primarily to the investment in LDI’s mine expansion and the Vezza gold project held for sale net of financing and cash from operations. The funds are invested in short term interest bearing deposits at a major Canadian chartered bank.

The Company has a US$60.0 million credit facility that is secured by certain of the Company’s accounts receivables and inventory and may be used for working capital liquidity and general corporate purposes. Under the credit agreement, the Company utilized US$17.3 million for letters of credit primarily for reclamation deposits and has taken a drawdown of US$15.2 million, leaving US$27.5 million available at December 31, 2012.

During 2012, the Company established a $15.0 million capital lease facility to fund equipment for the LDI Mine expansion, of which $14.1 million ($9.8 million, net of repayments) had been utilized as at December 31, 2012.

In November 2012, the Company issued 2.4 million flow-through common shares at a price of $1.65 per share for net proceeds of $3.6 million. The Company is required to spend the gross proceeds of $4.0 million on eligible exploration and mine development expenditures, which expenditures are expected to be renounced to investors for the 2012 tax year. As at December 31, 2012, $1.9 million was spent. The remaining $2.1 million commitment was subsequently spent.

On April 30, 2012, the Company issued 11.3 million flow-through common shares at a price of $3.10 per share for net proceeds of $32.8 million. The Company is required to spend the gross proceeds of $35.0 million on eligible exploration and mine development expenditures, which expenditures are expected to be renounced to investors for the 2012 tax year. As at December 31, 2012, $35.0 million was spent.

On July 31, 2012, the Company completed an offering of 43,000 convertible unsecured subordinated debentures of the Company at a price of $1,000 per debenture, for total gross proceeds of $43.0 million ($40.8 million net proceeds). The debentures mature on September 30, 2017 and bear interest at a rate of 6.15% per year, payable semi-annually. At the option of the holder, the debentures may be converted into common shares of the Company at any time prior to maturity at a conversion price of $2.90 per common share. Of the net proceeds of $40.8 million, $33.9 million has been allocated to long-term debt with the remaining portion of $6.9 million allocated to the conversion feature and recorded in equity.

17

2012 Annual Report

North American Palladium Ltd.

During the second quarter of 2012, LDI signed a three-year smelting and refining contract for the majority of the mine’s concentrate. This new contract has higher smelting and refining charges from the previous contract, but has a shorter payment period, which has enabled the Company to reduce its investment in working capital.

Contractual Obligations

Contractual obligations are comprised as follows:

| | | | | | | | | | | | | | | | |

| As at December 31, 2012 | | Payments Due by Period | |

| (expressed in thousands of dollars) | | Total | | | 1-3 Years | | | 3-5 Years | | | 5+ Years | |

Finance lease obligations | | | $ 15,337 | | | | $ 4,374 | | | | $ 10,963 | | | | $ - | |

Operating leases | | | 6,721 | | | | 2,761 | | | | 3,960 | | | | - | |

Purchase obligations | | | 84,932 | | | | 84,932 | | | | - | | | | - | |

| | | | $ 106,990 | | | | $ 92,067 | | | | $ 14,923 | | | | $ - | |

In addition to the above, the Company also has asset retirement obligations at December 31, 2012 in the amount of $21.3 million for the LDI Mine, Sleeping Giant mill and Vezza gold mine. The Company obtained letters of credit of $15.9 million as financial surety for these future outlays. As a result, $5.4 million of funding is required prior to or upon closure of these properties.

Contingencies

From time to time, the Company is involved in litigation, investigations, or proceedings related to claims arising in the ordinary course of business. The Company does not believe such matters are material. In 2011, a Statement of Claim was filed with the Ontario Superior Court of Justice against the Company and two of its officers regarding a potential class action lawsuit. In 2012, a fresh Statement of Claim was filed increasing the amount of the claim to $100.0 million. In December of 2012, the plaintiffs filed a motion of record for certification and for leave. The Company intends to vigorously defend the potential claim. It is not possible at this time to estimate the outcome of the potential action and accordingly, the Company has not recorded any associated provisions within its consolidated financial statements at December 31, 2012. The company believes the net impact of this claim will not be material.

Related Party Transactions

There were no related party transactions for the period ended December 31, 2012.

OUTSTANDING SHARE DATA

As of February 21, 2013, there were 177,373,185 common shares of the Company outstanding. In addition, there were options outstanding pursuant to the Amended and Restated 2010 Corporate Stock Option Plan entitling holders thereof to acquire 3,542,249 common shares of the Company at a weighted average exercise price of$3.67 per share.

OVERVIEW OF NAP’S EXPLORATION PROPERTIES

NAP expects future growth will come from continued exploration and development of the Company’s grassroots and near-mine projects. With permits, mine infrastructure and available mill capacity at the LDI Mine, NAP can move from exploration success to production on an accelerated timeline. In addition to the significant exploration program at LDI, the Company’s 2013 exploration budget includes reconnaissance exploration on several, recently acquired greenfields platinum group equivalent (“PGE”) properties – all of which are located within 30 km of the LDI mill.

The Company’s continued to evaluate opportunities for divesture of its gold assets and undertakings. Consequently, there was minimal gold exploration expenditures in 2012.

18

2012 Annual Report

North American Palladium Ltd.

Ontario Properties

LDI Mine & Property

The LDI Mine Block includes approximately 21,000 acres of land and offers significant exploration upside that is complimented by the 15,000-tonne per day mill, which currently has excess capacity. Beyond the immediate mine site, most of the land has had minimal exploration. The exploration success achieved during the past few years gives management encouragement that there is strong potential to continue to grow the Company’s palladium reserve and resource base through exploration.

The LDI property includes the following surface and underground mineralized zones:

| | • | | Roby Zone: initially mined as an open pit since 1993, underground production from Roby commenced in 2006. |

| | • | | Offset Zone: discovered in 2001, located below and approximately 250 metres south west of the Roby Zone. The Offset Zone remains open in all directions and continues to expand through exploration. Mining from the Offset Zone commenced in the fourth quarter of 2012. The LDI Mine expansion is currently underway to access the northern and upper portion of the Offset Zone deposit. |

| | • | | Sheriff Zone*: discovered in 2010, located approximately 100 metres south east of the Offset Zone. This zone is currently being considered for its open pit potential. Planning has commenced to assess the zone’s economics, permitting requirements and production potential. |

| | • | | Cowboy Zone*: discovered in 2009 during infill drilling of the Offset Zone, located 30 to 60 metres to the west of the Offset Zone. This new discovery has the potential to extend LDI’s mine life and could positively impact the economics of the mine. |

| | • | | Outlaw Zone*: discovered in 2009, located to the west of the Offset Zone and the Cowboy Zone. Further drilling is required to define the extent of this mineralization. |

| | • | | North VT Rim*: historical drilling and more recent trenching on the northwestern margin of the LDI Mine Block intrusion have defined a narrow zone of PGE mineralization that is currently being investigated for its open pit potential. |

| * | The disclosure regarding these mineralized areas is conceptual in nature and there has been insufficient exploration to define a mineral resource of these areas. |

The main focus of the 2012 near-mine exploration program was underground exploration at LDI targeting the Offset Zone, including infill drilling and extension drilling towards surface, at depth, and to the south. In addition, the Company initiated a program of resource delineation drilling on the Sheriff Zone to determine if this zone could provide a future source of near-surface, pit grade resources. The Company also began the first program of systematic, closely spaced surface drilling on the North VT rim trend.

A total of 50,148 metres of diamond drilling were completed on the LDI property in 2012. This amount includes 19,405 metres of surface drilling and 30,743 metres of underground drilling. On January 31, 2013, the Company provided an update on the results of its 2012 exploration program for the following:

| | • | | Offset Zone underground extension drilling program, |

| | • | | the Sheriff Zone near-surface resource potential, |

| | • | | the Roby Zone north extension drilling program , |

| | • | | the North VT Rim surface exploration drilling, and |

| | • | | new mineralization intersected on the North LDI property. |

19

2012 Annual Report

North American Palladium Ltd.

PGE Greenfields Properties

The Company has interests in a number of greenfields properties including:

North Lac des Iles Intrusive Complex:

In 2012, the Company completed an airborne magnetic and electromagnetic survey over this property and conducted approximately 3,500 metres of diamond drilling on priority geology and geophysical targets.

Legris Lake Property:

The property is at a preliminary exploration stage, however its PGM potential and close proximity to the LDI mill presents an encouraging exploration target.

Tib Lake Property:

On May 3, 2012, LDI entered into an option and purchase agreement with Houston Lake Mining Inc. (“HLM”) whereby LDI obtained an exclusive right and option to purchase a 100% interest in 20 claims located northwest of the Lac des Iles mine, known as the Tib Lake property. The property is subject to a 2.5% net smelter royalty in favour of a third party on a portion of the claims and a 2.5% net smelter royalty in favour of HLM on the remaining claims. The property includes an additional 19 claims staked by LDI and 4 claims purchased from Platinex Inc. in September, 2012.

New Properties:

NAP has acquired a significant land position comprising intrusions in the immediate vicinity of the LDI Mine property. All of these intrusions are believed to be part of the same magmatic event that produced the Lac des Iles intrusive complex and its PGE-Cu-Ni resources. During the first three quarters of 2012, the Company acquired nine additional greenfields PGE properties through staking, option and purchase agreement. The location of these properties is shown in the Company’s July 16, 2012 news release.

In the third quarter of 2012, the Company commenced a reconnaissance exploration program on these recently acquired greenfields PGM properties. Initial drilling on the greenfields properties commenced in the fourth quarter of 2012.

Shebandowan Property:

The Company holds a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an Option and Joint Venture Agreement with Vale Canada Limited (“Vale”). The properties, known as the Shebandowan property, contain a series of nickel copper-PGE mineralized bodies.

In 2012, the Company focused on compiling all historical exploration data for the property. In 2013, the Company expects to complete a comprehensive technical review of this data, supporting a re-appraisal of the value of known mineralization and an assessment of the residual mineral potential on the property.

Moose Calf and Kukkee Properties:

In 2012, a limited amount of surface mapping and trenching was conducted on the property.

Salmi Property:

In 2012, a small program of surface mapping, trenching and shallow diamond drilling was conducted on the property.

Quebec Properties:

The primary focus in 2012 was the logging and sampling of core previously drilled from various properties. During 2012, minimal drilling was conducted in the gold division, primarily to meet work commitments.

20

2012 Annual Report

North American Palladium Ltd.

Vezza:

During 2012, the Company drilled 2,179 metres at the Vezza property.

Sleeping Giant Gold Mine & Property:

In 2012, the Company drilled 789 metres underground and completed the logging and sampling of core drilled in late 2011.

Flordin Property:

During 2012, logging of core drilled in late 2011 was completed. Sampling was completed late in the third quarter of 2012, with preliminary results received in the fourth quarter of 2012, but were still being validated at year end.

Discovery Property:

During 2012, drill core recovered in late 2011 was logged and sampled late in the third quarter. Assay results were received in the fourth quarter of 2012, but were still being validated at year end.

Dormex Property:

There was minimal work done on the property in 2012.

Laflamme Gold Property:

Laflamme is an early-stage gold exploration project in the Abitibi region of Quebec. The Company entered into a 50:50 joint venture agreement with Midland Exploration Inc. (“Midland”). The Company is the Operator of the joint venture and may acquire an additional 15% interest by completing a feasibility study.

In 2012, the Company drilled 2,072 metres. On July 25, 2012, Midland announced identification of a new area with strong gold potential and announced the start of ground geophysical surveys on the property.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company’s financial statements. The following accounting policies are considered critical:

The preparation of the consolidated financial statements in conformity with IFRS requires management to make judgments, estimates, and assumptions that affect the application of accounting policies and the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Significant estimates and assumptions relate to recoverability of mining operations and mineral exploration properties. While management believes that these estimates and assumptions are reasonable, actual results could vary significantly.

Certain assumptions are dependent upon reserves, which represent the estimated amount of ore that can be economically and legally extracted from the Company’s properties. In order to estimate reserves, assumptions are required about a range of geological, technical and economic factors, including quantities, grades, production techniques, recovery rates, production costs, transportation costs, commodity prices and exchange rates. Estimating the quantity and/or grade of reserves requires the size, shape and depth of ore bodies to be determined by analyzing geological data such as drilling samples. This process may require complex and difficult geological judgments to interpret the data. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

21

2012 Annual Report

North American Palladium Ltd.

Because the economic assumptions used to estimate reserves change from period to period, and because additional geological data is generated during the course of operations, estimates of reserves may change from period to period. Changes in reported reserves may affect the Company’s financial results and financial position in a number of ways, including the following:

| | • | | Asset carrying values including mining interests may be affected due to changes in estimated future cash flows; |

| | • | | Depreciation and amortization expensed in the statement of operations may change or be impacted where such expenses are determined by the units of production basis, or where the useful economic lives of assets change; |

| | • | | Decommissioning, site restoration and environmental provisions may change where changes in estimated reserves affect expectations about the timing or cost of these activities; and |

| | • | | The carrying value of deferred tax assets may change due to changes in estimates of the likely recovery of the tax benefits. |

| b. | Impairment assessments of long-lived assets |

The carrying amounts of the Company’s non-financial assets, excluding inventories and deferred tax assets, are reviewed at each reporting date to determine whether there is any indication of impairment. Impairment is assessed at the level of cash-generating units (“CGUs”). An impairment loss is recognized in the Consolidated Statements of Operations and Comprehensive Loss for any excess of carrying amount over the recoverable amount.

Impairment is determined for an individual asset unless the asset does not generate cash inflows that are independent of those generated from other assets or groups of assets, in which case, the individual assets are grouped together into CGUs for impairment purposes.

The recoverable amount of an asset or cash-generating unit is the greater of its “value in use”, defined as the discounted present value of the future cash flows expected to arise from its continuing use and its ultimate disposal, and its “fair value less costs to sell”, defined as the best estimate of the asset’s selling price less costs of disposal. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset.

An impairment loss is recognized in the Consolidated Statements of Operations and Comprehensive Loss if the carrying amount of an asset or its CGU exceeds its estimated recoverable amount. The recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use.

Impairment losses recognized in prior periods are assessed at each reporting date for any indications that the loss has decreased or no longer exists. An impairment loss on non-financial assets other than goodwill is reversed if there has been a change in the estimates used to determine the recoverable amount, only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of amortization, if no impairment loss had been recognized.

| c. | Depreciation and amortization of mining interests |

Mining interests relating to plant and equipment, mining leases and claims, royalty interests, and other development costs are recorded at cost with depreciation and amortization provided on the unit-of-production method over the estimated remaining ounces of palladium (LDI) and gold (NAP Quebec) to be produced based on the proven and probable reserves or, in the event that the Company is mining resources, an appropriate estimate of the resources mined or expected to be mined.

22

2012 Annual Report

North American Palladium Ltd.

Mining interests relating to small vehicles and certain machinery with a determinable expected life are recorded at cost with depreciation provided on a straight-line basis over their estimated useful lives, ranging from three to seven years, which most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset. Straight-line depreciation is calculated over the depreciable amount, which is the cost of an asset, less its residual value.

Significant components of individual assets are assessed and, if a component has a useful life that is different from the remainder of that asset, that component is depreciated separately using the unit-of-production or straight-line method as appropriate. Costs relating to land are not amortized.

Leased assets are depreciated over the shorter of the lease term and their useful lives unless it is reasonably certain that the Company will obtain ownership by the end of the lease term.

Depreciation methods, useful lives and residual values are reviewed at each financial year-end and adjusted if appropriate.

Revenue from the sale of metals in the course of ordinary activities is measured at the fair value of the consideration received or receivable, net of volume adjustments. Revenue is recognized when persuasive evidence exists, usually in the form of an executed sales agreement, that the significant risks and rewards of ownership have been transferred to the buyer, recovery of the consideration is probable, the associated costs and possible return of goods can be estimated reliably, there is no continuing management involvement with the goods, and the amount of revenue can be measured reliably. The timing of the transfers of risks and rewards varies depending on the individual terms of the contract of sale.

Revenue from the sale of palladium and by-product metals from the LDI Mine is provisionally recognized based on quoted market prices upon the delivery of concentrate to the smelter or designated shipping point, which is when title transfers and significant rights and obligations of ownership pass. The Company’s smelter contract provides for final prices to be determined by quoted market prices in a period subsequent to the date of concentrate delivery. Variations from the provisionally priced sales are recognized as revenue adjustments until final pricing is determined. Accounts receivable are recorded net of estimated treatment and refining costs, which are subject to final assay adjustments. Subsequent adjustments to provisional pricing amounts due to changes in metal prices and foreign exchange are disclosed separately from initial revenues in the notes to the financial statements.

Until its closure, revenue from the sale of gold-silver doré bars from Sleeping Giant was recognized when the significant risks and rewards of ownership have transferred to the buyer and selling prices are known or can be reasonably estimated.

| e. | Asset retirement obligations |

In accordance with Company policies, asset retirement obligations relating to legal and constructive obligations for future site reclamation and closure of the Company’s mine sites are recognized when incurred and a liability and corresponding asset are recorded at management’s best estimate. Estimated closure and restoration costs are provided for in the accounting period when the obligation arising from the related disturbance occurs.

The amount of any liability recognized is estimated based on the risk-adjusted costs required to settle present obligations, discounted using a pre-tax risk-free discount rate consistent with the time period of expected cash flows. When the liability is initially recorded, a corresponding asset retirement cost is recognized as an addition to mining interests and amortized using the unit of production method.

The liability for each mine site is accreted over time and the accretion charges are recognized as a finance cost in the Consolidated Statements of Operations and Comprehensive Loss. The liability is subject to re-measurement at each reporting date based on changes in discount rates and timing or amounts of the costs to be incurred. Changes in the liability, other than accretion charges, relating to mine rehabilitation and restoration obligations, which are not the result of current production of inventory, are added to or deducted from the carrying value of the related

23

2012 Annual Report

North American Palladium Ltd.

asset retirement cost in the reporting period recognized. If the change results in a reduction of the obligation in excess of the carrying value of the related asset retirement cost, the excess balance is recognized as a recovery through profit or loss in the period.

Adoption of New Accounting Standards

The following new accounting standards have been adopted by the Company.

IFRS 7 Financial Instruments: Disclosures