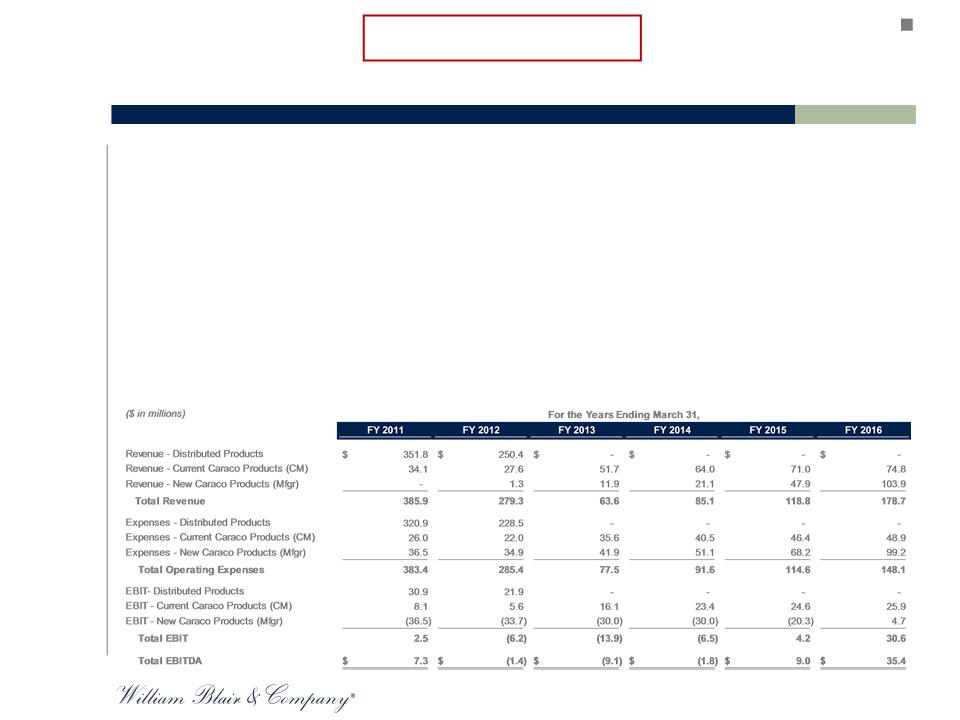

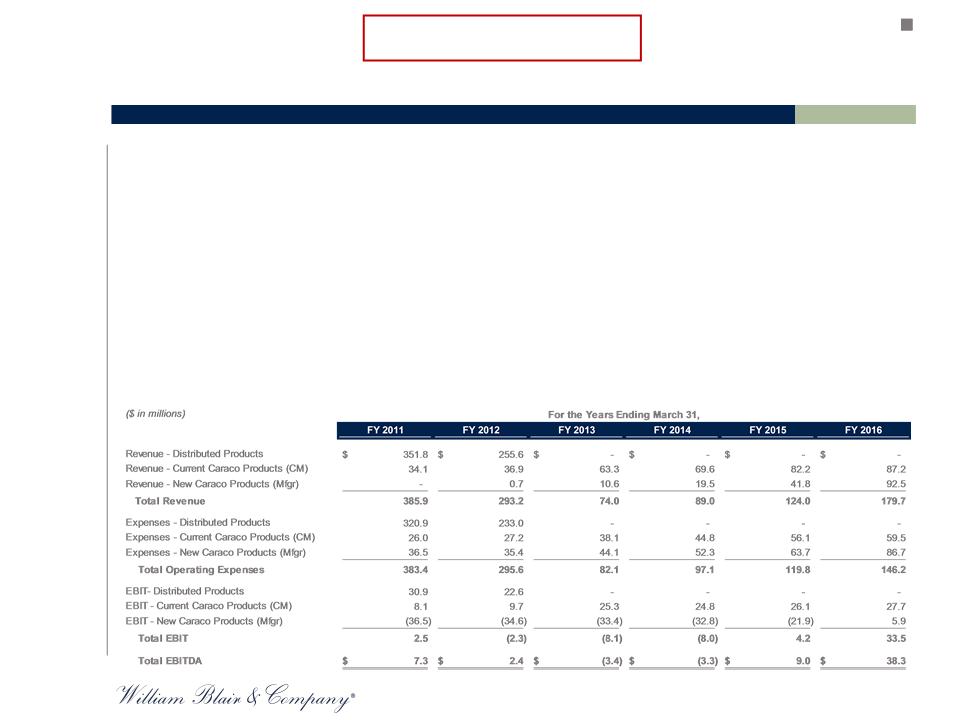

Key Assumptions Underlying our Analysis

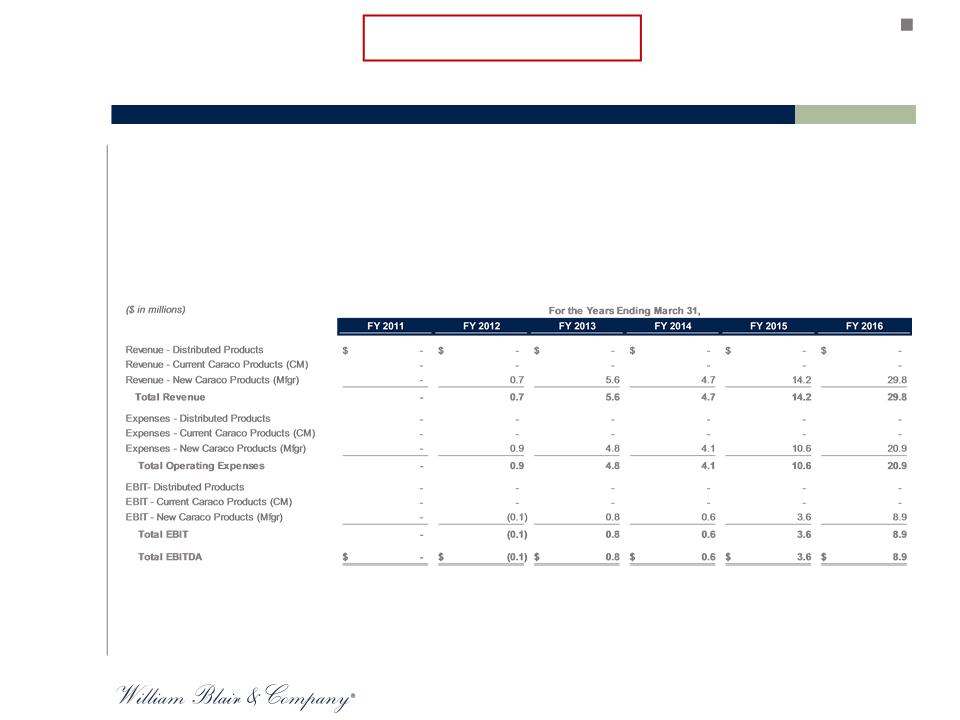

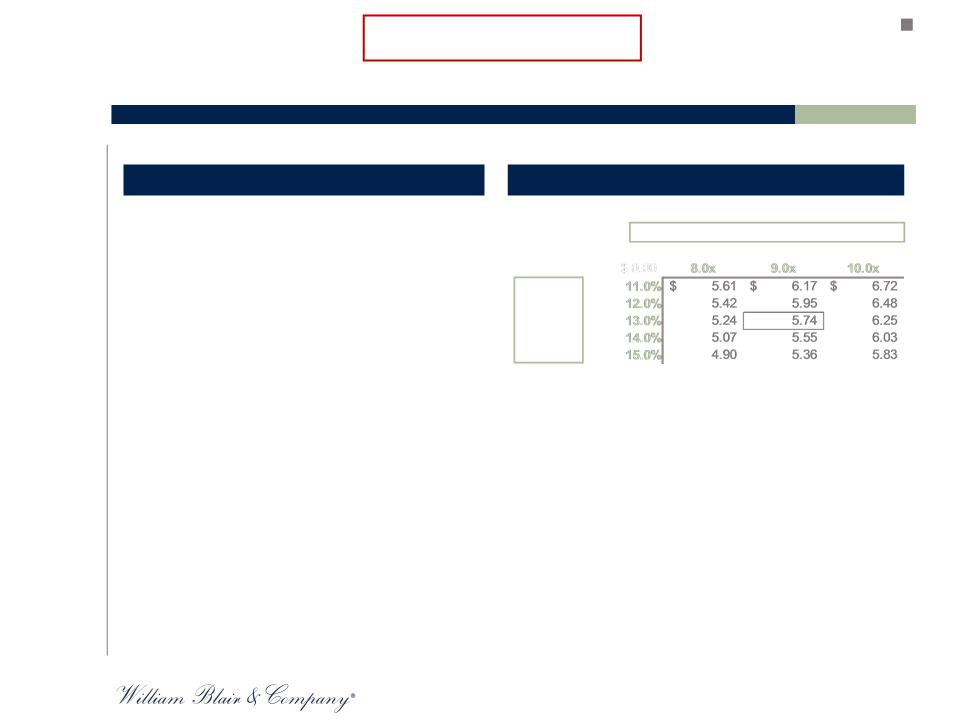

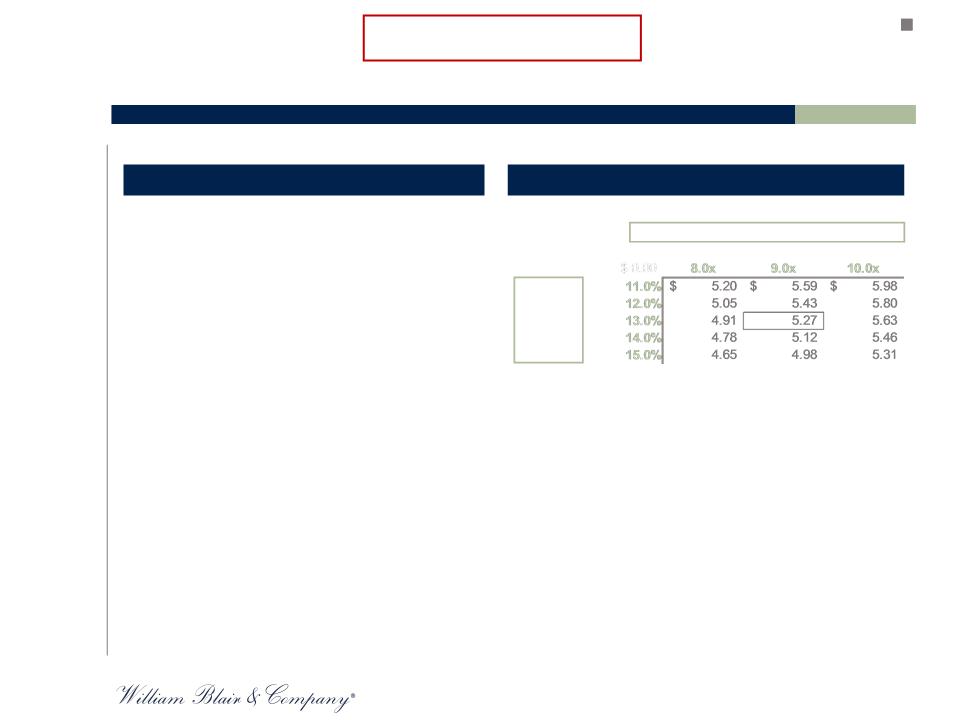

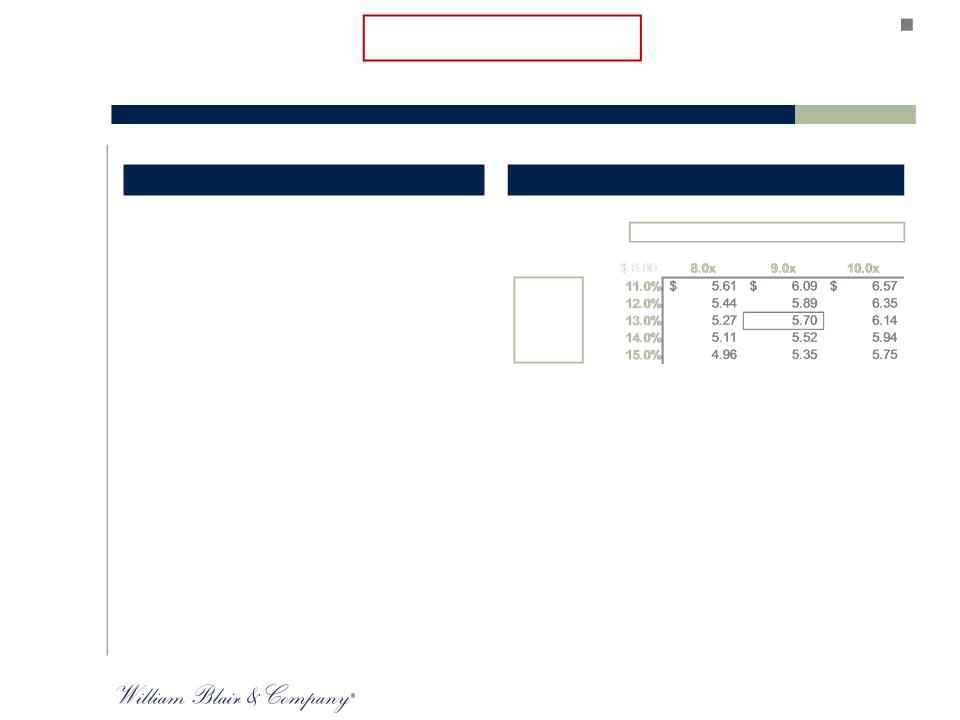

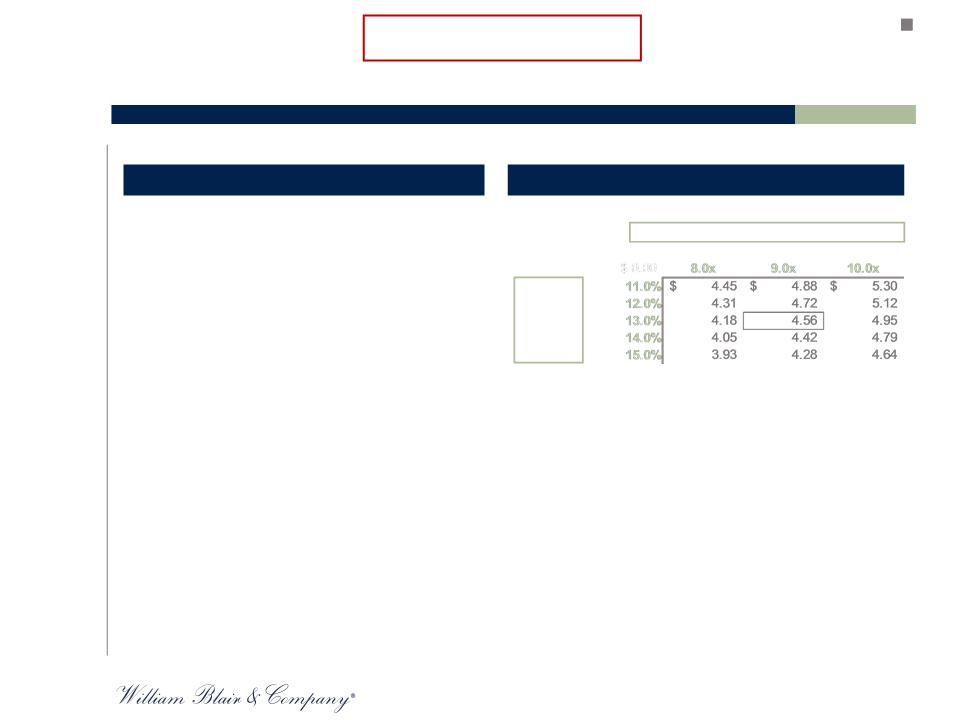

Discounted Cash Flow Analyses

§ At the instruction of the Independent Committee (the “Committee”), we have performed discounted cash

flow analyses on different potential operating scenarios:

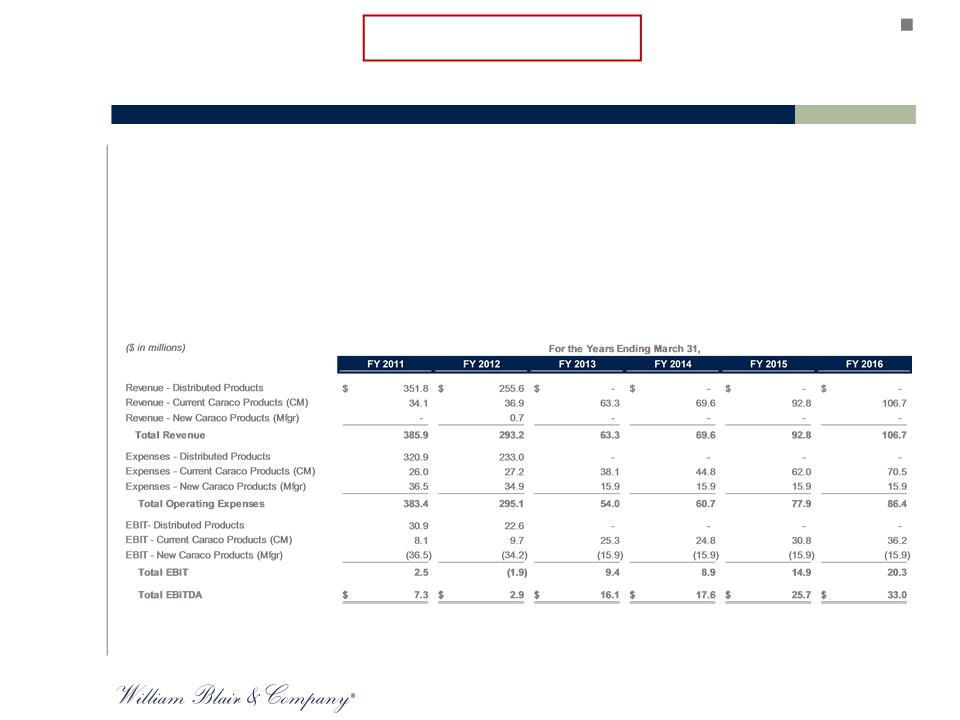

– Base Case: Management’s current forecast through fiscal year 2016, which reflects the resumption of

GIBSON’s manufacturing activities in fiscal year 2012 (the “Forecast”) in addition to ongoing contract

manufactured business

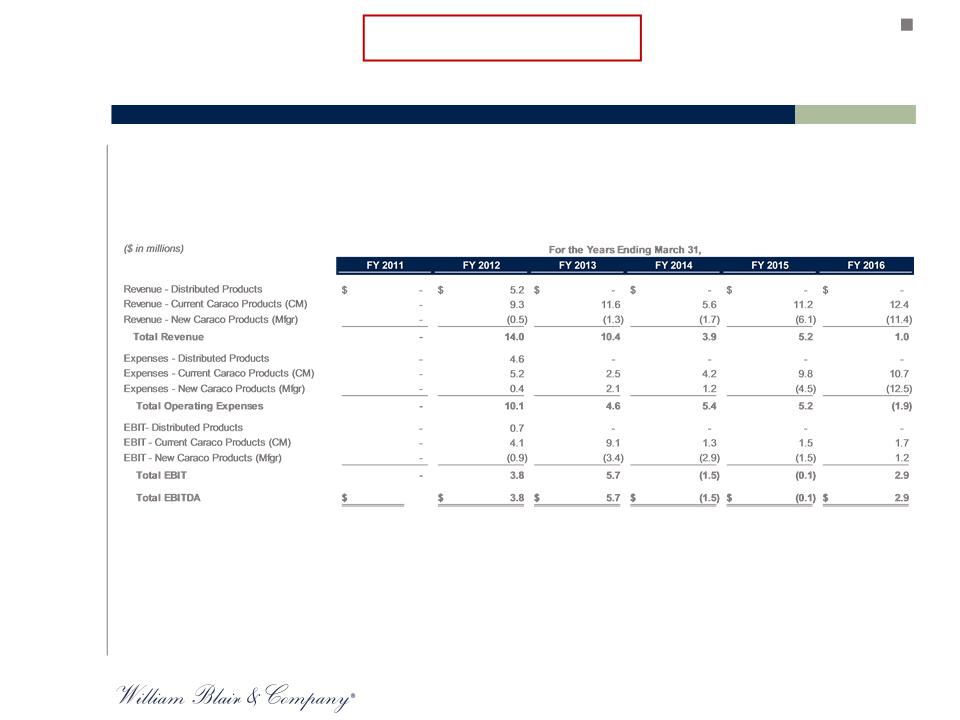

– Scenario 1: The Forecast, with manufacturing activities terminating on March 31, 2011

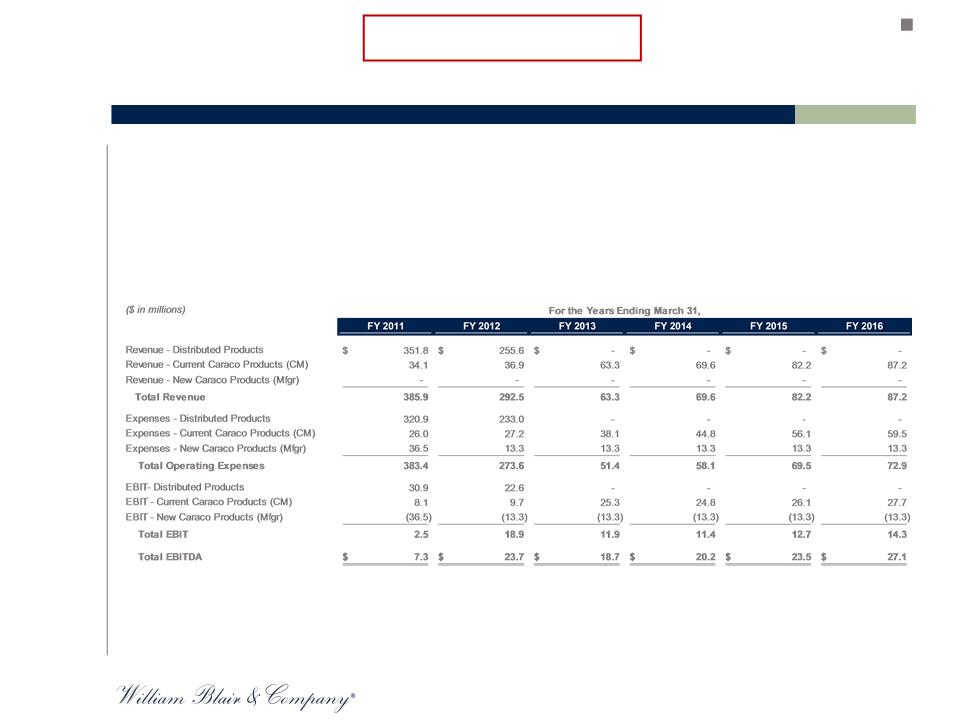

– Scenario 2: The Forecast, with manufacturing activities terminating on March 31, 2012

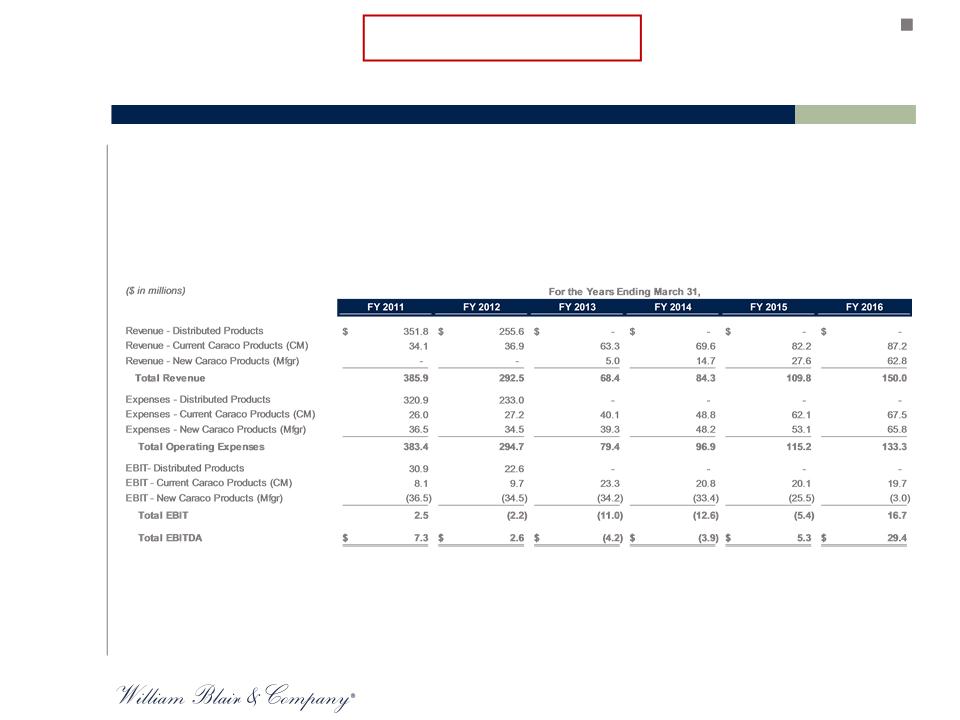

– Scenario 3: Management’s current forecast above; however, adjusted assuming the ability to manufacture

products is delayed a further two quarters

§ We have been advised by the Committee that the Forecast examined by us has been reasonably

prepared on a basis reflecting the best currently available estimates and judgments of the senior

management of GIBSON

§ For scenarios involving the termination of manufacturing activities, we have relied on the advice of the

Committee regarding certain assumptions (e.g., shutdown costs, liquidation proceeds, etc.) to enable this

analysis and express no opinion with respect to the estimates and judgments on which those

assumptions are based

§ Further, we acknowledge to the Committee that adjustments to these assumptions may have a material

effect on the outcome of the discounted cash flow analysis

§ Finally, we are not expressing any opinion as to the relative merits of any alternative operating scenario

that might exist for GIBSON or the effect of any other transaction in which GIBSON might engage

DRAFT

For discussion purposes only

9