Key Assumptions Underlying Our Review and Analysis

Executive Summary

§ We have assumed and relied upon, without any duty of independent verification, the accuracy and completeness of all of the

information that was examined by, or otherwise reviewed or discussed with, us for purposes of this presentation, including without

limitation the Forecasts, and we assume no responsibility or liability therefore.

§ We have not made or obtained an independent valuation or appraisal of the assets, liabilities or solvency of the Company.

§ We have been advised by senior management of the Company that the Forecasts examined by us have been reasonably

prepared on bases reflecting the best currently available estimates and judgments of the senior management of the Company, and

we have assumed, with the Company’s consent, that (i) the Forecasts will be achieved in the amounts and at the times

contemplated thereby and (ii) all material assets and liabilities (contingent or otherwise) of the Company are as set forth in their

respective financial statements or other information made available to us.

§ We express no opinion with respect to the Forecasts or the estimates and judgments on which they are based.

§ We have relied upon and assumed, without any duty of independent verification, that there has been no material change in the

business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company since the date of the

most recent financial statements and Forecasts provided to us (i.e., February 1, 2011), and that there is no information or any

facts that would make any of the information reviewed by us incomplete or misleading.

§ Our opinion does not address the relative merits of any aspect of the Transaction as compared to any alternative business

strategies that might exist for the Company.

§ Our opinion is based upon economic, market, financial and other conditions existing on, and other information disclosed to us as

of, the date of this opinion.

§ It should be understood that, although subsequent developments may affect this opinion, we do not have any obligation to update,

revise or reaffirm this opinion.

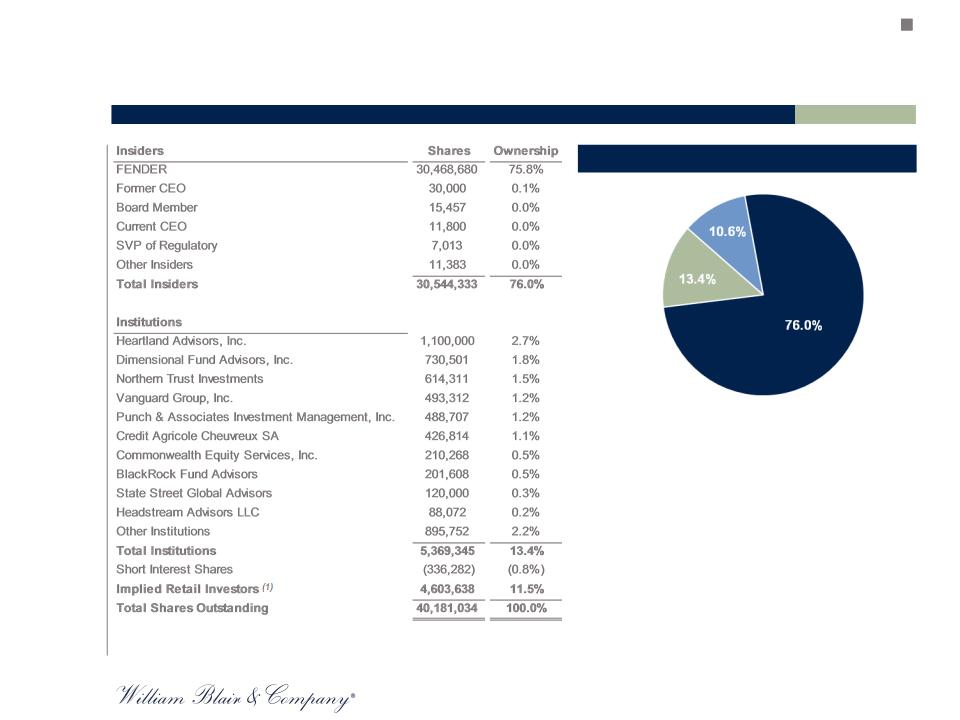

§ We have relied on the Committee’s determination that FENDER is not interested in selling its ownership stake in GIBSON. Based

upon FENDER’s position and other factors, the Committee determined not to proceed with a process to initiate contact with other

potential buyers at this time.

§ We have relied as to all legal, accounting and tax matters on advice of counsel to the Company as well as counsel to the

Committee.

§ We have assumed that the Transaction will be consummated on the terms described in the Agreement, without any waiver of any

material terms or conditions.

§ William Blair is serving as an investment banker in connection with the Transaction and will receive a fee for its services, a

significant portion of which is contingent upon consummation of the proposed Transaction.

§ In the ordinary course of our business, William Blair may from time to time trade the securities of the Company for William Blair’s

own account and for the accounts of customers, and accordingly may at any time hold a long or short position in such securities.

3