UNITED STATES SCHEDULE 14A INFORMATION REQUIRED IN PROXY STATEMENT PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES |

| Filed by the registrant x |

| Filed by a party other than the registrant o |

| Check the appropriate box: |

| o | Preliminary proxy statement | o | Confidential, for use of the Commission only (as permitted by Rule 14a-6 (e) (2)). | |

| x | Definitive proxy statement | |||

| o | Definitive additional materials | |||

| o | Soliciting material pursuant to Rule 14a-12 | |||

| CARACO PHARMACEUTICAL LABORATORIES, LTD |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

| Payment of filing fee (check the appropriate box): | |

| x | No fee required |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (a) | Title of each class of securities to which transaction applies: | |

| N/A | ||

| (b) | Aggregate number of securities to which transactions applies: | |

| N/A | ||

| (c) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| N/A | ||

| (d) | Proposed maximum aggregate value of transaction: | |

| N/A | ||

| (e) | Total fee paid: | |

| N/A | ||

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (a) | Amount Previously Paid: | |

| N/A | ||

| (b) | Form, Schedule or Registration Statement No.: | |

| N/A | ||

| (c) | Filing Party: | |

| N/A | ||

| (d) | Date Filed: | |

| N/A | ||

CARACO PHARMACEUTICAL LABORATORIES, LTD. NOTICE OF |

CARACO PHARMACEUTICAL LABORATORIES, LTD. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS May 20, 2005 Dear Shareholder, We invite you to attend our 2005 Annual Meeting of Shareholders at 10:00 a.m., Eastern Daylight Saving Time, on June 20, 2005 at the Ritz Carlton Hotel, 300 Town Center Drive, Dearborn, Michigan 48126. The annual report, which is enclosed, summarizes Caraco’s major developments during 2004 and includes the 2004 financials. Whether or not you plan to attend the Meeting, please complete and mail the enclosed proxy card promptly so that your shares will be voted as you desire.IF YOU WISH TO VOTE IN THE MANNER THE BOARD OF DIRECTORS RECOMMENDS, IT IS NOT NECESSARY TO SPECIFY YOUR CHOICES ON THE PROXY CARD. SIMPLY SIGN, DATE AND RETURN THE PROXY CARD. |

| Sincerely, | |

| Daniel H. Movens Chief Executive Officer |

CARACO PHARMACEUTICAL LABORATORIES, LTD. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

| Date: | June 20, 2005 |

| Time: | 10:00 a.m., Eastern Daylight Saving Time |

| Place: | Ritz Carlton Hotel 300 Town Center Drive Dearborn, Michigan 48126 |

We invite you to attend the Caraco Pharmaceutical Laboratories, Ltd. Annual Meeting of Shareholders to: |

| 1. | Elect three directors for three-year terms expiring in 2008 and upon the election and qualification of their successors. | |

| 2. | Transact any other business that is properly submitted before the Annual Meeting or any adjournment(s) of the Meeting. |

The record date for the Meeting is May 11, 2005 (the“ Record Date”). Only shareholders of record at the close of business on that date can vote at the Annual Meeting. Caraco is mailing this Notice of Annual Meeting to those shareholders. A proxy statement, proxy card and an annual report are enclosed with this Notice. Whether or not you plan to attend the Meeting and whether you own a few or many shares of stock, the Board of Directors urges you to vote promptly. You may vote by signing, dating and returning the enclosed proxy card. A list of shareholders who can vote at the Annual Meeting will be available for inspection by shareholders at the Meeting and for ten days prior to the Meeting during regular business hours at the offices of Caraco, 1150 Elijah McCoy Drive, Detroit, MI 48202. |

| By Order of the Board of Directors, | |

| Daniel H. Movens Chief Executive Officer | |

| May 20, 2005 |

TABLE OF CONTENTS |

CARACO PHARMACEUTICAL LABORATORIES, LTD. 1150 Elijah McCoy Drive 2005 PROXY STATEMENT

|

| 1. | Q: | What is a proxy? |

| A: | A proxy is a document, also referred to as a proxy card (which is enclosed), by which you authorize someone else to vote for you in the way that you want to vote. Caraco’s Board of Directors is soliciting this proxy. You may also abstain from voting. | |

| 2. | Q: | What is a proxy statement? |

| A: | A proxy statement is the document the United States Securities and Exchange Commission (the“ SEC”) requires to explain the matters on which you are asked to vote on the proxy card. Caraco’s proxy statement, together with its enclosed proxy card, was first mailed to shareholders on or about May 20, 2005. | |

| 3. | Q: | Who can vote? |

| A: | Only holders of Caraco’s common stock at the close of business on May 11, 2005, the Record Date, can vote at the Annual Meeting. Each shareholder of record has one vote for each share of common stock on each matter presented for a vote at the Meeting. | |

| 4. | Q: | How do I vote if my stock is held in “street name?” |

| A: | If your Caraco common stock is held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of stock held in “street name.” As a beneficial owner, you do not have the right to vote your stock. Only the “record holder” of the stock has such rights. If you wish to vote your stock, you should either (i) obtain a legal proxy from the record holder of the stock appointing you as its legal proxy or (ii) instruct the record holder how you would like the record holder to vote the stock you own. | |

| 5. | Q: | What will I vote on at the Meeting? |

| A: | At the Annual Meeting, shareholders will vote to: | |

| 1. | Elect three directors for three-year terms expiring in 2008 and upon the election and qualification of their successors. |

1 |

| 2. | Transact any other business that is properly submitted before the Annual Meeting or any adjournment(s) of the Meeting. |

| 6. | Q: | Who can attend the annual meeting? |

| A: | You are entitled to attend the annual meeting only if you were a Caraco shareholder as of the Record Date or you hold a valid proxy for the annual meeting. You should be prepared to present valid government-issued photo identification for admittance. In addition, if you are a shareholder of record, your name will be verified against the list of shareholders of record on the Record Date prior to your being admitted to the annual meeting. If you are not a shareholder of record but hold shares through a broker or nominee (i.e., in street name), you should provide proof of beneficial ownership on the Record Date, such as your most recent account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide valid government-issued photo identification or comply with the other procedures outlined above upon request, you may not be admitted to the annual meeting. | |

| The meeting will begin promptly at 10:00 a.m., local time. Check-in will begin at 9:30 a.m., and you should allow ample time for the check-in procedures. | ||

| 7. | Q: | How does the Board of Directors recommend I vote on the proposal? |

| A: | The Board of Directors recommends a vote“ FOR” all of the nominees listed in Proposal 1. | |

| 8. | Q: | How can I vote? |

| A: | You can vote in person or by proxy. To vote by proxy, sign, date and return the enclosed proxy card. If you return your signed proxy card to American Stock Transfer before the Annual Meeting, the persons named as proxies on the card will vote your shares as you directed. You may revoke a proxy at any time before the proxy is exercised by: | |

| 1. | giving written notice of revocation to the Chief Executive Officer of Caraco at 1150 Elijah McCoy Drive, Detroit, MI 48202; | |

| 2. | submitting another proxy that is properly signed and later dated; | |

| 3. | voting in person at the Meeting (but only if the shares are registered in Caraco’s records in the name of the shareholder and not in the name of a broker, dealer, bank or other third party); |

2 |

| 9. | Q: | What is a quorum? |

| A: | There were 26,360,694 shares of Caraco’s common stock outstanding on the Record Date. A majority of the outstanding shares, or 13,180,348 shares, present or represented by proxy, constitutes a quorum. For purposes of a quorum, abstentions and broker non-votes are included. A broker non-vote is a proxy a broker submits that does not indicate a vote for some or all the proposals because the broker does not have discretionary voting authority and the broker did not receive instructions as to how to vote on those proposals. A quorum must exist to conduct business at the Annual Meeting. | |

| 10. | Q: | How does voting work? |

| A: | If a quorum exists, each director must receive the favorable vote of a majority of the shares voted, excluding abstentions and broker non-votes, present in person or represented by proxy. | |

Caraco will vote properly executed Proxies it receives prior to the Meeting in the way you direct.If you sign the proxy card but do not specify instructions, the shares represented by Proxies will be voted“ FOR” the nominees for directors. No other matters are currently scheduled to be presented at the Meeting. If any matter or matters are properly brought before the Meeting or any adjournment thereof, it is the intention of the persons named in the accompanying proxy card to vote the shares represented by the proxy card as they determine. | ||

| 10. | Q: | Who pays for the costs of the Meeting? |

| A: | Caraco pays the cost of preparing and printing the proxy statement and soliciting proxies. Caraco will solicit proxies primarily by mail, but may also solicit proxies personally and by telephone. Caraco will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their out-of-pocket expenses for forwarding solicitation material to beneficial owners of Caraco’s common stock. | |

| 11. | Q: | When are shareholder proposals for the 2006 Annual Meeting due? |

| A: | As previously disclosed, Caraco has changed its fiscal year to March 31. Accordingly, it is anticipated that the next annual meeting will be held on or about September 4, 2006 and that the notice of the meeting will be mailed on or about August 4, 2006. Accordingly, all shareholder proposals to be considered for inclusion in next year’s proxy statement must be submitted in writing to the Chief Executive Officer, Caraco Pharmaceutical Laboratories, 1150 Elijah McCoy Drive, Detroit, Michigan 48202, before April 5, 2006. |

3 |

| 12. | Q: | How may a shareholder communicate with the Board of Directors? |

| A: | Shareholders may communicate with the Board of Directors or any member of the Board of Directors by sending a letter addressed to the Board of Directors, c/o Michael Perry, Human Resources Manager, at 1150 Elijah McCoy Drive, Detroit, Michigan 48202. The Board of Directors’ policy is to have all shareholder communications compiled by the Human Resources Manager and forwarded directly to the Board or the director as indicated in the letter. All letters will be forwarded to the appropriate party. The Board of Directors reserves the right to revise this policy in the event that this process is abused, becomes unworkable or otherwise does not efficiently serve the purpose of the policy. |

4 |

| Nominees | Age | Principal Occupation and Business Experience During Past 5 Years and other Directorships | Director Since | |||

| Sailesh T. Desai | 50 | Mr. Desai has served as a full time director of Sun Pharmaceutical Industries Limited (“Sun Pharma”), since 1999, responsible for domestic marketing of pharmaceutical formulations. From 1994 to 1998, Mr. Desai was the principal shareholder and Managing Director of Milmet Laboratories, Pvt. Ltd., a manufacturer and marketer of ophthalmic solutions which was organized under the laws of the Commonwealth of India and merged into Sun Pharma in 1998. | 2000 |

5 |

| Daniel H. Movens | 47 | Mr. Movens became the CEO of Caraco effective May 2, 2005. Prior to this, Mr. Movens was President of Anda, Inc., a wholly owned subsidiary of Andrx, Inc., a position he held since February 2004. Since 1995 Mr. Movens held a number of positions of increasing responsibility, including Executive Vice President of Operations. Mr. Movens was also an Operating Committee member for Andrx Corporation. For fifteen (15) years before joining Anda, Inc., Mr. Movens worked in the retail pharmacy industry, working for independent pharmacies and pharmacy chains. | 2005 | |||

| Georges Ugeux | 60 | In October 2003, Mr. Ugeux founded Galileo Global Advisors LLC (a company offering strategic advice on international business development). From September 1996 to October 2003, Mr. Ugeux was a Group Executive Vice President, International and Research and a member of the Office of the Chief Executive of NYSE. From 1995 until September 1996, Mr. Ugeux served as President of the European Investment Fund. From 1992 until 1995, Mr. Ugeux was President of Kidder, Peabody Europe as well as Managing Director while serving as a member of the Managing Committee of the Board of Directors of Kidder, Peabody Inc. From 1988 until 1992, Mr. Ugeux was Group Finance Director at Societe Generale de Belgique, a Belgian diversified industrial and financial conglomerate. | 2004 | |||

| DIRECTORS’ TERMS EXPIRING 2007 | ||||||

| Directors | Age | Principal Occupation and Business Experience During Past 5 Years and other Directorships | Director Since | |||

| Timothy S. Manney | 46 | Since May 2002, Mr. Manney has been President and Director of Synova, Inc. (a privately-held information technology staffing and creative – services consulting firm). From 1990 to May 2002, Mr. Manney served as the Chief Financial Officer of Covansys Corporation (a publicly-held information technology solutions company). | 2004 |

6 |

| Sudhir Valia | 48 | Mr. Valia has worked for Sun Pharma as a full time director responsible for finance, commercial, operations, projects and quality control since December 1993. Prior to then, Mr. Valia was a chartered accountant in private practice. Mr. Valia is a qualified chartered accountant in India. Mr. Shanghvi is Mr. Valia’s brother-in-law. | 1997 | |||

| DIRECTORS’ TERMS EXPIRING 2006 | ||||||

| Directors | Age | Principal Occupation and Business Experience During Past 5 Years and other Directorships | Director Since | |||

Dilip S. Shanghvi | 49 | Mr. Shanghvi has served as Chairman of the Board of Directors of Caraco since 1997. Mr. Shanghvi is the founder of Sun Pharma, its Managing Director since its inception in 1993, responsible for marketing, research and development and human resource development, and its Chairman since 1999. Mr. Valia is Mr. Shanghvi’s brother-in-law. | 1997 | |||

Jitendra N. Doshi | 54 | Mr. Doshi was the interim Chief Executive Officer of Caraco (from September 2003 to May 2005), and has been the Chief Financial Officer (since November 2002) and its Chief Operating Officer since (August 30, 2002). Mr. Doshi commenced employment with Caraco as its Senior Vice President – Commercial in April 2001. From September 1999 to April 2001, Mr. Doshi was employed by Sun Pharma as General Manager – Operations. From 1991 to 1999, Mr. Doshi was Managing Director of Aqua Bearing Ltd., an auto parts manufacturer organized under the laws of the Commonwealth of India. | 2001 | |||

Committees and Meetings ofDirectors During 2004, the Board of Directors met six times. All of our current directors attended at least 75% of the meetings of the Board and the committees on which they served, except for Mr. Desai. The Board of Directors encourages Board members to attend each Annual Meeting of Shareholders. At the 2004 Annual Meeting of Shareholders, four of the Caraco directors were in attendance. The Board of Directors is fixed at seven members. Two of such directors are independent under Amex listing standards currently in effect. Unless a company is a“ controlled company” under Amex regulations, a majority of its Board of Directors must be independent. As a result of Sun |

7 |

Pharma owning a majority of the outstanding voting shares, Caraco is a controlled company under Amex regulations and is therefore not required to have a majority of independent directors on its Board. The Board maintains three standing committees: audit, compensation and independent. These are described below. Audit Committee. The Audit Committee is responsible for selecting, evaluating, retaining and, where appropriate, replacing Caraco’s independent auditors. Generally, the Audit Committee monitors the integrity of Caraco’s financial statements and the independence and qualifications of the independent auditors. The Audit Committee is governed by a written charter, a copy of which is attached as Appendix A to this proxy statement. The Audit Committee’s responsibilities are described in more detail in such charter. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee held five meetings in 2004. The current members of the Audit Committee are Mr. Manney and Mr. Ugeux. Mr. Manney is the committee’s Chairman. Each of these members is independent under Section 121(A) of Amex listing standards currently in effect. The Board of Directors has determined that Mr. Manney is an audit committee financial expert. The Board of Directors is currently actively searching for a third independent director to serve on its Board of Directors to replace Mr. William C. Brooks (who resigned as a director on April 14, 2005), in order to bring it into compliance with the Amex requirements which require three independent directors on its Audit Committee. Compensation Committee. The Compensation Committee oversees Caraco’s policies and programs for the compensation of its officers. The Committee is to review and approve the compensation of the officers at least annually and report its actions to the Board of Directors. The Compensation Committee is also responsible for the review and approval of compensation programs for officers and employees, including fringe benefits and stock options and/or bonuses, as may be from time to time recommended by management. Grants of options or other awards under Caraco’s 1999 Equity Participation Plan are made by the two “non-employee directors” as defined by 16b-3 who are also “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. The Compensation Committee held two meetings during 2004. The Compensation Committee currently consists of Messrs. Manney, Shanghvi and Ugeux. Mr. Shanghvi serves as the Chairman. Under Amex regulations, controlled companies, such as Caraco, are not required to have compensation committees consisting solely of independent directors. Two of the three directors, Messrs. Manney and Ugeux, are independent. Independent Committee. The Independent Committee was established to negotiate a products agreement between Caraco and Sun Pharma Global, Inc. (“Sun Global”), a wholly-owned subsidiary of Sun Pharma. In 2005, the Board of Directors ratified and approved the authority of the Independent Committee (with respect to past, present and future actions) to review and approve all related party transactions. The Independent Committee currently consists of Messrs. Manney and Ugeux. Mr. Ugeux serves as the Chairman. |

8 |

Nomination of Directors The Board of Directors has not established a formal nominating committee as the entire Board serves in this capacity. Under Amex regulations, a controlled company is not required to establish a formal nominating committee. The Board of Directors has not maintained a formal nominating committee because the Board of Directors feels that it is not necessary since the size of the Board is relatively small. While the Board has not established a formal committee, in the past the Board has asked one or two of its directors to meet with a number of candidates and to make recommendations to the full Board. The Board may utilize a variety of methods for identifying potential nominees, including considering potential candidates who come to their attention through current officers, directors, Caraco’s professionals, professional search firms or other persons. Once a potential nominee has been identified, the Board evaluates whether the nominee has the appropriate skills and characteristics to become a director in light of the then make-up of the Board of Directors. This assessment includes an evaluation of the candidate’s judgment and skills, such as experience at a policy setting level, financial sophistication, leadership and objectivity. At a minimum, the Board of Directors believes that all members of the Board should have the highest professional and personal ethics and values. The Board of Directors considers stockholder nominations for candidates for membership on the Board when properly submitted in accordance with Company’s bylaws. The Company’s bylaws provide that nominations for the election of directors may be made by any stockholder entitled to vote in the election of directors if timely notice of such shareholder’s intent has been given in writing to the Secretary or an Assistant Secretary of the Company. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company not less than 120 calendar days before the date of the Company’s proxy statement is released to shareholders in connection with the previous year’s annual meeting. Each such notice shall set forth (a) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the shareholder is a shareholder of record of stock of the Company entitled to vote for the election of directors on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholders; (d) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and (e) the consent that each nominee to serve as a director of the Company is so elected. Report of the Audit Committee Management is primarily responsible for the financial statements and the reporting process. The independent registered public accounting firm is responsible for performing an audit of Caraco’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for expressing an opinion on those financial statements based on its audit. The Audit Committee reviews these processes on behalf of the Board of Directors. In this context, the Audit Committee has reviewed and discussed the audited |

9 |

financial statements contained in the 2004 Annual Report of Form 10-K with Caraco’s management and its independent registered public accounting firm. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended. The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as amended, and has discussed with the independent registered public accounting firm its independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Caraco’s Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission. |

| The Audit Committee | |

| Timothy S. Manney (Chairman) Georges Ugeux | |

10 |

Amount and Nature of Beneficial Ownership as of May 11, 2005 |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

| Sun Pharma | 16,868,680(1) | 63.1% | ||||||

| Corp Comm Dept, Acme Plaza | ||||||||

| Andheri Kurla Road, Andheri (East) | ||||||||

| Mumbai 400 059 India | ||||||||

| (1) | Sun Pharma directly owns 8,382,666 shares of common stock of Caraco and beneficially owns 8,486,014 shares registered in the name of Sun Global, whose address is Akara Building, 24 DeCastro Street, Wickhams Clay 1 Road, Town Tartola, British Virgin Islands. In addition, Sun Pharma and its affiliates own 5,984,000 shares of Series B preferred stock which are convertible into shares of common stock three years from the date of their respective issuance or upon a change in control. The earliest any shares of such series B preferred stock becomes convertible is December 2006. |

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Class | ||||||

| Jitendra N. Doshi(1) | 60,000 | (2) | * | |||||

| Dilip S. Shanghvi(3) | 0 | (4) | * | |||||

| Robert Kurkiewicz(1) | 10,013 | (5) | * | |||||

| Gurpartap Singh Sachdeva (1) | 9,800 | (6) | * | |||||

| Sailesh T. Desai (3) | 0 | (4) | * | |||||

| Timothy S. Manney (7) | 1,000 | (8) | * | |||||

| Georges Ugeux (9) | 1,000 | (10) | * | |||||

| Sudhir Valia (3) | 0 | (4) | * | |||||

| All current executive officers and directors as a group | ||||||||

| (8 persons) | 96,813 | (12)* | ||||||

| * | Less than 1.0% of the outstanding shares |

| (1) | The mailing address of each of these holders is 1150 Elijah McCoy Drive, Detroit, Michigan 48202. |

| (2) | Includes no stock options that are currently exercisable. |

11 |

| (3) | The mailing address of S. Desai, D. Shanghvi and S. Valia is Sun Pharmaceutical Industries Limited, Corp Comm Dept, Acme Plaza, Andheri Kurla Road, Andheri (East), Mumbai 400 059 India. |

| (4) | Excludes 16,868,680 shares of common stock and 5,984,000 shares of Series B preferred stock beneficially owned by Sun Pharma and its affiliates. (See footnote 1 under “Security Ownership of Certain Beneficial Owners” and “Transactions of Directors, Executive Officers and Certain Beneficial Holders of Caraco.”) Messrs. Desai, Shanghvi and Valia are directors of, and Mr. Shanghvi, together with his associate companies, is also the majority shareholder of, Sun Pharma, and, therefore, may be deemed to share investment control over the shares of common stock held by Sun Pharma and its affiliates. Each of Messrs. Desai, Shanghvi and Valia disclaims beneficial ownership of the shares of common stock beneficially owned by Sun Pharma and its affiliates. |

| (5) | Includes stock options that are currently exercisable to purchase 8,000 shares of common stock. |

| (6) | Includes stock options that are currently exercisable to purchase 2,000 shares of common stock and 1,800 shares held in the name of his wife.. |

| (7) | Mr. Manney’s mailing address is c/o Synova, Inc., 1000 Town Center, Suite 700, Southfield, MI 48075. |

| (8) | Includes stock options that are currently exercisable to purchase 1,000 shares of common stock. |

| (9) | Mr. Ugeux’s mailing address is c/o Galileo Global Advisors, One Rockefeller Center, Suite 1722, New York, New York, 10020. |

| (10) | Includes stock options that are currently exercisable to purchase 1,000 shares of common stock. |

12 |

Equity Compensation Plan Information |

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights. | Weighted-average exercise price of outstanding options, warrants and rights. | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

| (a) | (b) | (c) | |||||

| Equity compensation plans approved by security holders | 181,600 | $1.39 | 2,684,000 | ||||

| Equity compensation plans not approved by security holders | 200,000 | $3.50 | — | ||||

| Total | 381,600 | $2.03 | 2,684,000 |

13 |

During 2004 and 2003, Sun Global earned 3,808,000 shares and 544,000 shares of Series B stock for seven product transfers and one product transfer, respectively, as provided under the November 2002 products agreement. During 2002, we issued to Sun Pharma 1,632,000 shares of our common stock for three product transfers under the former 1997 products agreement with Sun Pharma. During 2003 and 2002, we borrowed approximately $0.6 million, $1.4 million, respectively, from Sun Pharma, and in 2003 we repaid the entire balance of all of our outstanding loans from Sun Pharma in the amount of approximately $10 million. Prior to April 1, 2001, the interest rate was 10%; thereafter it was 8%. During 2004, 2003 and 2002, we purchased approximately $16.7 million, $10.3 million and $2.4, respectively, of our materials from Sun Pharma. We intend to continue to purchase raw materials from Sun Pharma in 2005. During 2004, 2003 and 2002, Caraco purchased at Sun Pharma’s cost, approximately $0.61 million, $0.51 million, and $0.31 million, respectively, of equipment from Sun Pharma. We intend to continue to purchase equipment from Sun Pharma in 2005. We entered into two non-cancelable operating leases during 2000 with Sun Pharma to lease production machinery. The leases each require rental payments of $4,245 and expire during 2005. Caraco entered into a manufacturing and supply agreement and a distribution and sale agreement in December 2004 with an affiliate of Sun Pharma. No fees were earned by Caraco under these agreements in 2004. During 2004, 2003 and 2002, Caraco sold $5.4 million, $3.7 million and $2.6 million, respectively, to Anda, Inc. Prior to becoming our chief executive officer, Mr. Movens was an executive officer of Anda, Inc. The following table provides information about Caraco’s executive officers who are not directors as of May 11, 2005. |

| Name | Age | Five-Year Business Experience | Executive Officer Since | |||

| Robert Kurkiewicz | 54 | Commenced employment with Caraco as its Vice President -- Quality Assurance in November 1993 and was promoted to Sr. Vice President - Technical, October 1998. | 1993 |

14 |

| Gurpartap Singh Sachdeva | 36 | Vice President – Sales and Marketing since September 2003 and National Sales and Marketing Manager since September 2000. From May 1998 to September 2000, Mr. Singh was the Manager of Bulk Drugs for Sun Pharma. | 2005 |

| The Compensation Committee | ||

| Dilip S. Shanghvi (Chairman) Timothy S. Manney Georges Ugeux | ||

15 |

| Annual Compensation | Long Term Compensation | ||||||||||||||||

| Awards | Payouts | ||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation | Restricted Stock Awards | Securities Underlying Options | LTP Payments | All Other Compen- sation | |||||||||

| ($) | ($) | ($) | ($) | (#) | ($) | ($) | |||||||||||

| Jitendra N. Doshi | 2004 | 159,854 | 0 | 0 | 0 | 0 | 0 | 4,560(1) | |||||||||

| Chief Executive Officer | 2003 | 134,758 | 0 | 0 | 0 | 0 | 0 | 4,560(1) | |||||||||

| 2002 | 109,769 | 0 | 0 | 0 | 0 | 0 | 5,560(1) | ||||||||||

| Robert Kurkiewicz | 2004 | 142,604 | 0 | 0 | 0 | 0 | 0 | 4,560(1) | |||||||||

| Sr. Vice President | 2003 | 134,208 | 0 | 0 | 0 | 0 | 0 | 4,560(1) | |||||||||

| Technical | 2002 | 127,492 | 0 | 0 | 0 | 0 | 0 | $4,560(1) | |||||||||

(1) $380.00 per month was given to the named executive officers. Option Grants in Last Fiscal Year No stock options were granted in 2004 to the named executive officers. Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values The following table sets forth information for the named executive officers with regard to the aggregate stock options exercised during the year ended December 31, 2004. |

| Name | Shares Acquired on Exercise | Value Realized ($)(1) | Number of Securities Underlying Unexercised Options at FY-End (#) Exercisable/Unexercisable | Value of Unexercised In- the-Money Options at FY- End ($) (2) Exercisable/Unexercisable | |||||||

| Jitendra N. Doshi | 50,000 | $367,000 | 25,000 / 50,000 | $ 207,500 / 415,000 | |||||||

| Robert Kurkiewicz | 0 | $0 | 6,000 / 4,000 | $ 52,500 / 35,000 | |||||||

| (1) | The value is based on the difference between the exercise prices and the closing sales prices on the dates of exercise. |

| (2) | The value is based on the difference between the exercise prices and the closing sale price of Caraco’s common stock on December 31, 2004. |

16 |

Employment Agreements Jitendra N. Doshi, the Chief Executive Officer of Caraco, entered into an employment agreement with Caraco dated August 30, 2002 in his capacity as Chief Operating Officer. The employment agreement provides Mr. Doshi with a salary at the rate of $130,000 annually, which may be reviewed and adjusted, and a car allowance of $380.00 per month. The employment agreement is for a term of five (5) years, commencing on January 1, 2002 and ending on December 31, 2006. The Agreement automatically renews for successive one-year periods unless terminated by Caraco or Mr. Doshi upon ninety (90) days notice. In the event of the death or Disability (as such term is defined in the employment agreement) or if Caraco terminates Mr. Doshi for just cause (as such term is defined in the employment agreement), Mr. Doshi shall be entitled to his base salary and to benefits earned by him prior to the date of death, Disability or termination for just cause. In the event Caraco terminates Mr. Doshi without cause or if Mr. Doshi terminates for cause (as such term is defined in the employment agreement), he will receive base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In addition, any stock options that would become available for exercise at the end of the year during which such termination occurred shall immediately vest. In October 2003, Mr. Doshi became the Chief Executive Officer of Caraco. In October 2004, the Compensation Committee increased his salary to $165,000 annually. Robert Kurkiewicz, the Senior Vice President - Technical, entered into a five-year employment agreement on November 22, 1993 which was amended on January 1, 1999 to extend the term until January 1, 2003 and which was further amended on August 30, 2002 to extend the term until December 31, 2007. The agreement, as amended, provides Mr. Kurkiewicz with a salary of $129,800 per year and provides for a car allowance of $380.00 per month. The agreement provides that at the end of the term, it is renewable for successive one-year terms. In the event that Caraco terminates the agreement without cause, Mr. Kurkiewicz is entitled to receive monthly base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In addition, any stock options that would become available for exercise at the end of the year during which such termination occurred shall immediately vest. In October 2004, the Compensation Committee increased his salary to $145,000 annually. Gurpartap Singh Sachdeva, the Vice President of Sales and Marketing, entered into an employment agreement with Caraco dated February 1, 2005. The employment agreement provides Mr. Sachdeva with a salary at the rate of $135,000 annually, which may be reviewed and adjusted, and a car allowance of $380.00 per month. The employment agreement is for a term of five (5) years, commencing on February 1, 2005. The agreement automatically renews for successive one-year periods unless terminated by Caraco or Mr. Sachdeva upon ninety (90) days notice. In the event of the death or Disability (as such term is defined in the employment agreement) or if Caraco terminates Mr. Sachdeva for just cause (as such term is defined in the employment agreement), Mr. Sachdeva shall be entitled to his base salary and to benefits earned by him prior to the date of death, Disability or termination for just cause. In the event Caraco terminates Mr. Sachdeva without cause or if Mr. Sachdeva terminates for cause (as such term is defined in the employment agreement), he will receive base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In |

17 |

addition, any stock options that would become available for exercise at the end of the year during which such termination occurred shall immediately vest. As disclosed above, the Compensation Committee appointed Daniel H. Movens as CEO of Caraco effective May 2, 2005. Caraco and Mr. Movens have entered into an employment agreement effective as of May 2, 2005, the terms of which are summarized below. Under the employment agreement, Mr. Movens agrees to serve as Chief Executive Officer of the Company for period of thirty-six (36) calendar months which will automatically renew at the end of thirty-six (36) months. However, after the initial thirty-six (36) month period, each party may terminate the agreement upon ninety (90) days written notice to the other party. Mr. Movens shall receive a base salary of $390,000, may receive a bonus of up to fifty (50%) percent of the base compensation (with twenty-five (25%) percent of the base compensation guaranteed only for the first year), and shall receive stock options for 40,000 shares upon the effective date at the fair market value of the common stock on the day immediately preceding the effective date and stock options for 40,000 shares of the Company annually thereafter (all such options to vest over a period of three years from the date of their respective grants), a stock grant on the effective date of 45,000 shares of the Company’s common stock (which will vest over a period of three (3) years), and a stock grant of an additional 10,000 shares if the employment agreement is renewed. In addition, the Company will reimburse Mr. Movens for his reasonable relocation expenses; any such expense over and above $50,000 will require prior approval of the Company. If Mr. Movens is terminated without cause and for a reason other than for nonperformance, if Mr. Movens terminates for good reason, or if there is a change in control (as defined in the employment agreement) of the Company or Sun Pharmaceutical Industries Limited and Mr. Movens terminates within six months thereof because he reasonably determines that there has been a significant change in the nature and scope of his duties and powers, he is entitled to a lump sum severance payment in an amount equal to 1 ½ times the highest annual base and last earned bonus(es), together with certain benefits for a period of at least twelve (12) months, and all stock options and stock grants shall be deemed vested in full. With respect to any such amounts which are considered to be “parachute payments” under Internal Revenue Code §280G, the Company shall pay an additional amount representing a gross-up of any federal, state and local income tax liability arising from such payments. After one year of employment with the Company, the amount of this severance could be reviewed to be increased to two (2) times the highest annual base and last earned bonus(es). If Mr. Movens becomes disabled (as defined in the employment agreement), or dies, the Company shall be obligated to pay accrued unpaid salary and benefits for a one (1) year period following such date of disability or death. If Mr. Movens quits before the first anniversary of the employment agreement, he will receive no severance compensation. If Mr. Movens quits after one (1) year of service, the Company shall pay him his base salary for a maximum period of one (1) year following such termination, or until he finds another position, whichever comes first. In addition, if Mr. Movens is terminated for nonachievement of performance objectives, to be agreed upon, during his first year of employment, the Company will pay him his base salary for a maximum period of one (1) year, or until he finds another position, whichever comes first, and one-third (1/3) of the stock options and stock grants awarded to him will vest. If Mr. Movens is terminated for nonachievement of performance objectives, to be agreed upon, following his first |

18 |

year of employment, the Company will pay him 1 ½ times his base salary for a maximum period of one (1) year or until he finds another position, whichever comes first, and all of his stock options and stock grants awarded to him will vest. Mr. Movens is under no duty to seek other employment or to attempt in any way to reduce any amounts payable to him by means of mitigation or set off. The Company and Mr. Movens have also entered into a Confidentiality And Non-Competition agreement, pursuant to which Mr. Movens agrees not to solicit any customer of the Company for business in competition with the Company, or solicit for employment any other employee of the Company, for a period of two (2) years following his termination. In addition, for a period of twelve (12) months following the termination of his employment, Mr. Movens agrees not to engage in any activity within North America which is competitive in any material respect with the business of the Company, including generic pharmaceutical manufacturing and marketing, but excluding wholesale distribution. In addition, for a period of twelve (12) months following termination of his employment, Mr. Movens agrees that he will not perform services for any business or organization, whether as an employee, consultant, advisor, independent contractor, or otherwise, which engages in any activity within North America that is competitive in any material respect with the business conducted by the Company, including any business engaged in generic pharmaceutical manufacturing and marketing and any other business in which the Company generates more than ten (10%) percent of its gross revenues. Change in Control Arrangements Under our 1999 Equity Participation Plan, options granted under that plan will become fully exercisable following certain changes in control of our company, such as: |

| • | A person, other than Sun Pharma, becomes the owner of a majority of the outstanding shares of our company; | |

| • | A public announcement is made of a tender or exchange offer by any person, other than Sun Pharma, for 50% or more of the outstanding shares of our company; | |

| • | The shareholders of our company approve a merger or consolidation with any other corporation or entity, unless, following the merger, the shares outstanding immediately before the merger continue to represent a majority of the outstanding shares of the surviving entity immediately following the merger; |

Compensation Committee Interlocks and Insider Participation As noted, Mr. Dilip S. Shanghvi is the Chairman of our Compensation Committee and the Chairman of the Board of Caraco, a non-executive position. Mr. Shanghvi is also the Managing Director of Sun Pharma. As disclosed above, Sun Pharma engages in a number of transactions with Caraco. See “Transactions with Directors, Executive Officers, and certain Beneficial Holders of Caraco.” |

19 |

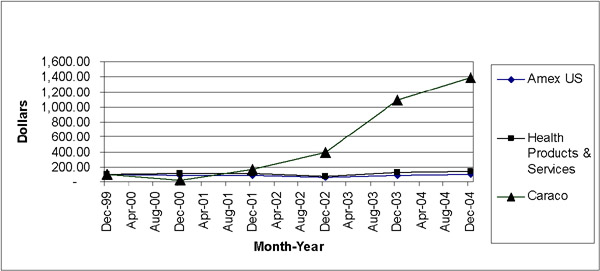

Set forth below is a line graph comparing the five-year cumulative total return among Caraco based on the market price of its common stock, the Amex Composite Index (U.S.) and the Amex Health Products and Services Index. The graph assumes $100 invested on December 31, 1999 in Caraco’s common stock, the Amex Composite Index (U.S.) and the Amex Health Products and Services Index. The total return assumes the reinvestment of dividends. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN AMONG CARACO |

|

| 12/99 | 12/00 | 12/01 | 12/02 | 12/03 | 12/04 | ||||||||

| Caraco Pharmaceutical Laboratories, Ltd. | 100 | 29 | 168 | 387 | 1,084 | 1,384 | |||||||

| Amex Composite Index ( U.S.) | 100 | 93 | 86 | 71 | 96 | 110 | |||||||

| Amex Health Products and Services Index | 100 | 119 | 113 | 78 | 137 | 144 |

20 |

Audit and Non-Audit Fees Aggregate fees for professional services rendered for Caraco by Rehmann Robson as of the years ended December 31, 2004 and 2003 are set forth below. The aggregate fees included in the Audit category are fees billedfor the fiscal years for the audit of Caraco’s annual financial statements and review of quarterly financial statements and statutory and regulatory filings or engagements. The aggregate fees included in each of the other categories are fees billedin the fiscal years. |

| 2004 | 2003 | |||||||

| Audit Fees | $ | 123,000 | $ | 95,500 | ||||

| Audit-Related Fees | $ | 7,280 | $ | 13,875 | ||||

| Tax Fees | $ | 10,245 | $ | 15,450 | ||||

| All Other Fees | $ | 0 | $ | 0 | ||||

| Total | $ | 40,525 | $ | 124,825 | ||||

Audit Fees for the years ended December 31, 2004 and 2003 were for professional services rendered for the audits of the financial statements of Caraco, quarterly review of the financial statements included in Caraco’s Quarterly Reports on Form 10-Q, or services that are normally provided by Rehmann Robson in connection with statutory and regulatory filings or engagements for such years, including Rehmann’s Robson’s audit of management’s assessment of internal control over financial reporting as of December 31, 2004. Audit-Related Fees for the years ended December 31, 2004 and 2003 were for assurance and related services by Rehmann Robson that are reasonably related to the performance of the audit or review of Caraco’s financial statements. Tax Fees for the years ended December 31, 2004 and 2003 were for professional services rendered by Rehmann Robson for services related to tax compliance, tax advice and tax planning. None of the services described above was approved by the Audit Committee under thede minimus exception provided by Rule 2-01(c)(7)(i)(C) under Regulation S-X. Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors Pursuant to its charter, the Audit Committee pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services. |

21 |

SHAREHOLDERS OF RECORD AS OF MAY 11, 2005 ARE ENTITLED TO RECEIVE A COPY WITHOUT CHARGE OF THE COMPANY’S 2004 ANNUAL REPORT TO THE SEC ON FORM 10-K. SHAREHOLDERS WHO WISH TO RECEIVE A COPY OF THIS REPORT SHOULD WRITE TO DANIEL H. MOVENS, CHIEF EXECUTIVE OFFICER, CARACO PHARMACEUTICAL LABORATORIES, LTD, 1150 ELIJAH MCCOY DRIVE, DETROIT, MICHIGAN 48202. |

| Daniel H. Movens Chief Executive Officer | |

| May 20, 2005 |

22 |

CARACO PHARMACEUTICAL LABORATORIES, LTD. Purpose The Committee is appointed by the Board of Directors to assist the Board in its oversight function by monitoring the following: |

| 1. | integrity of the Company’s financial statements, | |

| 2. | independent auditors’ qualifications and independence, | |

| 3. | performance of the Company’s internal audit function and independent auditors, | |

| 4. | compliance by the Company with legal and regulatory requirements. | |

| 5. | The Company’s systems of internal auditing and financial controls. | |

The Committee’s responsibilities are principally of an oversight nature. It is not the responsibility of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate or are in compliance with generally accepted accounting principles. The Committee recognizes that financial management, including any internal audit staff and/or persons performing similar functions, as well as the independent auditors, have more time, more knowledge and more detailed information regarding the Company than do Committee members. Furthermore, it is recognized that the members of the Committee are not full-time employees of the Company and are not, and do not represent themselves to be, accountants or auditors by profession or experts in the fields of accounting or auditing, including in respect of auditor independence. Consequently, in carrying out its oversight responsibilities, the Committee shall not be deemed to provide any expert or special assurance as to the Company’s financial statements or any professional certification as to the independent auditors’ work. Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements, including ensuring that the financial statements are accurate, complete, and stated in accordance with GAAP and, together with the other financial information included in the Company’s public disclosures, fairly present the financial condition, results of operations, and cash flows of the Company. Management is also responsible for the Company’s financial reporting process, accounting policies, internal audit function, internal control over financial reporting and disclosure controls and procedures. The independent auditors are responsible for planning and conducting an audit of the Company’s annual financial statements, expressing an opinion as to the conformity of such annual financial statements with GAAP, reviewing the Company’s quarterly financial statements and preparing an attestation report on management’s assessment of the Company’s internal control over financial reporting. The Audit Committee and the other Committees of the Board, as applicable, will coordinate their compliance and risk oversight efforts to the extent necessary or appropriate to ensure the complete and proper exchange of information. |

A-1 |

Membership The Committee shall be comprised of at least three Directors. Members shall be appointed and may be removed by the Board. The Committee shall meet the independence, financial literacy and expertise requirements of the American Stock Exchange, the requirements of Section 10A(m)(3) of the Securities Exchange Act of 1934 and the rules and regulations of the Securities and Exchange Commission (“SEC”). Committee members shall not simultaneously serve on the audit committees of more than three other public companies. Meetings and Operation The Committee shall meet at least quarterly, and more frequently as it may determine advisable in light of its responsibilities as set forth in this Charter. The Committee Chair sets the agenda for each meeting and determines the length and frequency of meetings. The Committee shall meet periodically, in separate executive sessions with management, the internal auditors and the independent auditor. The Committee may request any officer or employee of the Company, outside counsel or the independent auditors to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Committee shall determine how to best operate, including whether to delegate any responsibilities to subcommittees. The Committee shall operate in full compliance with the American Stock Exchange requirements for audit committees and other applicable laws and regulations. Independent Auditor The independent auditor shall report directly to the Committee. The Committee has the sole authority and responsibility to select, appoint, evaluate, retain, and, where appropriate, replace the independent auditor. The Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. Member Compensation No Committee member shall accept, directly or indirectly, any consulting, advisory or other compensatory fees from the Company, except for the member’s fees for services as a Director and member of the Committee and any other Committees of the Board. Responsibilities In carrying out its purposes, the Committee’s policies and procedures should remain flexible, so that it may be in a position to best react or respond to changing circumstances or conditions. In carrying out its purposes, the following should be considered within the responsibilities and authority of the Committee: |

A-2 |

| 1. | Select Independent Auditors. Select the independent auditors annually. | |

| 2. | Matters Concerning the Independence of Independent Auditors. Ensure that the Committee receives from the independent auditors the written disclosures and letter required by Independent Standards Board Standard No. 1 (See attached summary) delineating all relationships between the independent auditors and the Company; the Committee shall discuss with the independent auditors their independence, including any disclosed relationships or services that may impact the auditors’ objectivity and independence. If deemed appropriate by the Committee, the Committee may recommend that the Board of Directors take appropriate action in response to the independent auditors’ report to satisfy itself of their independence. | |

| Confirm with the independent auditors that the independent auditors are in compliance with the partner rotation requirements established by the SEC. | |

| Set policies for the Company’s hiring of employees or former employees of the independent auditor. | |

| Preapprove permitted non-audit services and all audit, review or attest engagements required under the securities laws to be rendered by the independent auditors (including the fees and terms thereof). Alternatively, the Company may enter into engagements to render such services pursuant to pre-approval policies and procedures established by the Audit Committee; provided, that such policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service and such policies and procedures do not include the delegation of Audit Committee responsibilities under the Exchange Act to management. Moreover, the pre-approval requirement for permissible non-audit services shall be waived under certain circumstances described in Section 10A of the Exchange Act. | |

| 3. | Review Quality Control Process of Independent Auditor. Obtain and review a report from the independent auditor at least annually regarding (a) the independent auditors’ internal quality-control procedures, (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the independent auditor and the Company. Present the conclusions of its review with respect to the independent auditors to the Board. | |

| 4. | Review Audit Plan. Review with the independent auditors their plans for, and the scope of, their annual audit. | |

| 5. | Conduct of Audit. Discuss with the independent auditors the matters required to be discussed by Statement on Auditing Standard No. 61 (see attached summary) relating to the conduct of the audit, including any difficulties encountered in the |

A-3 |

| course of the audit work and management’s response, any restrictions on the scope of activities or access to requested information, and any significant disagreements with management. | |

| 6. | Review Audit Results. Review with the independent auditors the report of their annual audit, or proposed report of their annual audit, the accompanying management letter, if any, and the reports of their reviews of the Company’s interim financial statements conducted in accordance with Statement on Auditing Standards No. 100. | |

| 7. | Review Annual Financial Statements. Review and discuss with management and the independent auditors the audited financial statements and the disclosures to be made in management’s discussion and analysis. Based on the foregoing, recommend to the Board whether the audited financial statements should be included in the Form 10-K. | |

| 8. | Review Quarterly Financial Results. Review and discuss with management the Company’s earnings releases (paying particular attention to any use of “pro-forma” or “adjusted” non-GAAP information), as well as financial information and earnings guidance provided to analysts and rating agencies (this may be done generally and need not occur in advance of each earnings release or each instance in which the Company may provide earnings guidance). | |

| 9. | Review Quarterly Financial Statements. Review and discuss with management and the independent auditor the quarterly financial statements and the disclosures to be made in the MD&A prior to filing the 10-Q. Discuss with the independent auditors their review of the quarterly financial statements. | |

| 10. | Financial Reporting Issues and Judgments: Related Matters. Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including any significant changes in the Company’s selection or application of accounting principles, any major issues as to the adequacy of the Company’s internal controls and any special steps adopted in light of material control deficiencies. | |

| Review and discuss reports from the independent auditors on: |

A-4 |

| (a) | All critical accounting policies and practices to be used. | |

| (b) | All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor. | |

| (c) | Other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences. | |

| (d) | Reports and disclosures of any insider or affiliated party transactions. | |

| Discuss with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Company’s financial statements. | ||

| 11. | Review Internal Audit Program. To the extent that the Company utilizes internal auditors and/or other persons performing such functions, such persons, shall report to the Committee and the Committee shall review and discuss with such persons, the internal audit function, the internal auditors’ budget, staffing, and reporting obligations, the proposed audit plan for the coming year, the coordination of that proposed audit plan with the Company’s independent auditors, the results of the internal audit and a specific review of any significant issues, including any significant difficulties, disagreements with management or scope restrictions encountered. | |

| 12. | Complaints Regarding Accounting and Auditing Matters. Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. | |

| 13. | Review Systems of Internal Accounting Controls. Review with management, the senior corporate auditing manager, the independent auditors and, as applicable, other persons performing the internal audit function, the adequacy of the Company’s internal accounting controls that could significantly affect the Company’s financial statements. | |

| Review disclosures made to Committee by the Company’s CEO and CFO during their certification process for the Form 10-K and Form 10-Q about any significant deficiencies in the design or operation of internal controls over financial reporting or material weaknesses therein and any fraud involving management or other employees who have a significant role in the Company’s internal controls over financial reporting. Review, discuss with the Chief Financial Officer, the senior corporate auditing manager, the independent auditors, and, as applicable, other persons performing the internal audit function, the Company’s report on internal controls over financial reporting and the auditors attestation relating thereto, prior to such documents being included in the Form 10-K. |

A-5 |

| 14. | Securities Exchange Act of 1934. Obtain assurance from the independent auditor that Section 10A(b) of the Securities Exchange Act of 1934 (see attached summary) has not been implicated. | |

| 15. | Legal Compliance and Risk Management Matters. | |

| • | At least annually, the Committee will meet with the management to review compliance with laws and regulations, including material reports or inquiries received from governmental agencies and material litigation. | |

| • | Review with the Company’s counsel legal matters that may have a material impact on the financial statements and legal and compliance matters that involve financial reporting or SEC compliance. | |

| • | Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. | |

| 16. | Prepare Proxy Statement Report. Prepare the report of the Committee required by the rules of the SEC to be included in the Company’s annual proxy statement. | |

| 17. | Code of Business Conduct and Ethics. Confirm with management on at least an annual basis that the Company’s Code of Business Conduct and Ethics has been communicated by the Company to all directors, officers and employees with a direction that all such persons certify that they have read and understood and will comply with the Code of Business Conduct and Ethics. | |

| 18. | Review Other Matters. Review such other matters in relation to the accounting, auditing, financial reporting and related compliance practices and procedures of the Company as the Committee may, in its own discretion, deem desirable in connection with the review functions described above. | |

| 19. | Board Reports. Regularly report its activities to the Board in such manner and at such times as it deems appropriate. The Committee shall review with the Board any issues that arise with respect to the quality or integrity of the Company’s financial statements, compliance with legal or regulatory requirements, the performance and independence of the independent auditors or the performance of the corporate auditors. |

| 20. | Review Committee Performance. Annually review its own performance. | |

| 21. | Review Charter. Review and reassess the adequacy of this Charter annually and submit it to the Board for approval. | |

| 22. | Related Party Transactions. Unless reviewed by a comparable body of the Board of Directors, review and provide oversight of all related party transactions. |

A-6 |

Advisors |

| The Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Committee may also utilize the services of the Company’s regular legal counsel and other advisors to the Company. |

Funding for Independent Auditors and Advisors The Company shall provide for appropriate funding, as determined by the Committee, for payment of: |

| • | compensation to the independent auditor for the purpose of rendering or issuing an audit report and for any other services approved by the Committee, | |

| • | compensation for any other advisors retained by the Committee, and | |

| • | ordinary administrative expenses that are necessary or appropriate in carrying out the Committee’s duties. |

Audit Committee Charter reference sheet: |

| 1. | Independence Standards Board Standard No. 1 | |

| Under ISB Standard No. 1, at least annually, an auditor must (1) disclose to the audit committee, in writing, all relationships between the auditor and its related entities that in the auditors’ professional judgment may reasonably be thought to bear on independence, (2) confirm in the letter that, in its professional judgment, it is independent of the company, and (3) discuss the auditors’ independence with the audit committee. | ||

| 2. | Statement on Accounting Standard No. 61 | |

| SAS No. 61 requires an independent auditor to communicate to the audit committee matters related to the conduct of the audit such as the selection of and changes in significant accounting policies, the methods used to account for significant unusual transactions, the effect of significant accounting policies in controversial or emerging areas, the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates, significant adjustments arising from the audit, and disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. | ||

| 3. | Statement on Accounting Standards No. 100 | |

| SAS No. 100 requires an independent auditor to be satisfied that any significant matters identified as a result of interim review procedures have been brought to |

A-7 |

| the attention of the audit committee, either by management or the auditor. If it is not possible for the auditor to make such communications prior to the filing, they should be made as soon as practicable thereafter. | ||

| 4. | Section 10A(b) of Securities Exchange Act of 1934 | |

| Section 10A(b) of the Securities Exchange Act of 1934, which is part of the Private Securities Litigation Reform Act of 1995, requires an independent auditor to inform management of, and assure that the audit committee is adequately informed with respect to, illegal acts that have come to the attention of the auditors in the course of their audits. |

A-8 |

CARACO PHARMACEUTICAL LABORATORIES, LTD. This Proxy is Solicited by the Board of Directors of Caraco Pharmaceutical Laboratories, Ltd. The undersigned hereby appoints Robert Kurkiewicz and Michael Perry, or either of them, each with power of substitution, to act as proxies for the undersigned, to represent the undersigned at the Annual Meeting of Shareholders (“Annual Meeting”) of Caraco Pharmaceutical Laboratories, Ltd. (“Caraco”) to be held at the Ritz Carlton Hotel, 300 Town Center Drive, Dearborn, Michigan 48126 on Monday, June 20, 2005 at 10:00 a.m., Eastern Daylight Saving Time, and at any adjournment(s) thereof, and to vote the number of shares the undersigned would be entitled to vote if personally present on all matters coming before the Annual Meeting, including the business identified on this Proxy and described in the Notice of Annual Meeting of Shareholders and Proxy Statement dated May 20, 2005 (“2005 Proxy Statement”). This revocable Proxy, when properly executed, will be voted in the manner directed by the undersigned shareholder.If no direction is made on an executed Proxy, this Proxy will be voted by the proxies “FOR” the election as directors of the persons named in Proposal 1. Discretionary authority is conferred by this Proxy with respect to certain matters as described in the 2005 Proxy Statement. The undersigned acknowledges receipt of the 2005 Proxy Statement. (Continued and to be signed on the reverse side) |

| PLEASE VOTE, DATE, AND SIGN ON REVERSE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE |

COMMENTS: |

ANNUAL MEETING OF SHAREHOLDERS OF CARACO PHARMACEUTICAL LABORATORIES, LTD. June 20, 2005 Please date, sign and mail |

| â Please detach along perforated line and mail in the envelope provided. â |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL NOMINEES. |

| 1. | The election of three directors. | 2. To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or continuation thereof. | |||

| NOMINEES: | |||||

| o | FOR ALL NOMINEES | ||||

| O | Sailesh T. Desai | Please be sure to sign and date this Proxy. | |||

| o | WITHHOLD AUTHORITY | ||||

| FOR ALL NOMINEES | O | Daniel H. Movens | TO INCLUDE ANY COMMENTS, USE THE COMMENTS | ||

| BOX ON THE REVERSE SIDE OF THIS CARD. | |||||

| o | FOR ALL EXCEPT | O | Georges Ugeux | ||

| (See instructions below) | |||||

INSTRUCTIONS To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT”and fill in the circle next to each nominee you wish to withhold, as shown here: l | |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | o |

| Signature of Shareholder | Date: | Signature of Shareholder | Date: | ||||

NOTE: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as an executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |