CARACO PHARMACEUTICAL LABORATORIES, LTD.

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

AND

PROXY STATEMENT

2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. ___)

Filed by the registrantx

Filed by a party other than the registranto

Check the appropriate box:

|

|

|

|

o | Preliminary proxy statement | o | Confidential, for use of the Commission |

| |||

x | Definitive proxy statement |

|

|

|

|

|

|

o | Definitive additional materials |

|

|

|

|

|

|

o | Soliciting material pursuant to Rule 14a-12 |

|

|

|

CARACO PHARMACEUTICAL LABORATORIES, LTD |

|

(Name of Registrant as Specified in Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

|

|

Payment of filing fee (check the appropriate box): | |

|

|

x | No fee required |

|

|

o | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

(a) Title of each class of securities to which transaction applies:

N/A

(b) Aggregate number of securities to which transactions applies:

N/A

(c) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

(d) Proposed maximum aggregate value of transaction:

N/A

(e) Total fee paid:

N/A

|

|

o | Fee paid previously with preliminary materials. |

|

|

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(a) Amount Previously Paid:

N/A

(b) Form, Schedule or Registration Statement No.:

N/A

(c) Filing Party:

N/A

(d) Date Filed:

N/A

CARACO PHARMACEUTICAL LABORATORIES, LTD.

1150 Elijah McCoy Drive

Detroit, Michigan 48202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND

PROXY STATEMENT

2006

July 31, 2006

Dear Shareholder,

We invite you to attend our 2006 Annual Meeting of Shareholders at 11:00 a.m., Eastern Daylight Saving Time, on September 11, 2006 at the Ritz Carlton Hotel, 300 Town Center Drive, Dearborn, Michigan 48126.

The annual report, which is enclosed, summarizes Caraco’s major developments during fiscal 2006 and includes the fiscal 2006 financials.

Whether or not you plan to attend the Meeting, please complete and mail the enclosed proxy card promptly so that your shares will be voted as you desire.IF YOU WISH TO VOTE IN THE MANNER THE BOARD OF DIRECTORS RECOMMENDS, IT IS NOT NECESSARY TO SPECIFY YOUR CHOICES ON THE PROXY CARD. SIMPLY SIGN, DATE AND RETURN THE PROXY CARD.

|

|

| Sincerely, Daniel H. Movens |

CARACO PHARMACEUTICAL LABORATORIES, LTD.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

|

Date: | September 11, 2006 |

Time: | 11:00 a.m., Eastern Daylight Saving Time |

Place: | Ritz Carlton Hotel |

We invite you to attend the Caraco Pharmaceutical Laboratories, Ltd. Annual Meeting of Shareholders to:

|

|

|

| 1. | Elect three directors for three-year terms expiring in 2009 and upon the election and qualification of their successors. |

|

|

|

| 2. | Transact any other business that is properly submitted before the Annual Meeting or any adjournment(s) of the Meeting. |

The record date for the Meeting is July 25, 2006 (the “Record Date”). Only shareholders of record at the close of business on that date can vote at the Annual Meeting. Caraco is mailing this Notice of Annual Meeting to those shareholders.

A proxy statement, proxy card and an annual report are enclosed with this Notice. Whether or not you plan to attend the Meeting and whether you own a few or many shares of stock, the Board of Directors urges you to vote promptly. You may vote by signing, dating and returning the enclosed proxy card.

A list of shareholders who can vote at the Annual Meeting will be available for inspection by shareholders at the Meeting and for ten days prior to the Meeting during regular business hours at the offices of Caraco, 1150 Elijah McCoy Drive, Detroit, MI 48202.

|

|

| By Order of the Board of Directors, Daniel H. Movens |

July 31, 2006

|

|

TABLE OF CONTENTS | |

| |

1 | |

|

|

5 | |

|

|

11 | |

|

|

11 | |

|

|

13 | |

|

|

TRANSACTIONS OF DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN | 13 |

|

|

15 | |

|

|

15 | |

|

|

17 | |

|

|

23 | |

|

|

24 | |

CARACO PHARMACEUTICAL LABORATORIES, LTD.

2006 PROXY STATEMENT

|

|

|

1. | Q: | What is a proxy? |

|

|

|

| A: | A proxy is a document, also referred to as a proxy card (which is enclosed), by which you authorize someone else to vote for you in the way that you want to vote. Caraco’s Board of Directors is soliciting this proxy. You may also abstain from voting. |

|

|

|

2. | Q: | What is a proxy statement? |

|

|

|

| A: | A proxy statement is the document the United States Securities and Exchange Commission (the “SEC”) requires to explain the matters on which you are asked to vote on the proxy card. Caraco’s proxy statement, together with its enclosed proxy card, was first mailed to shareholders on or about July 31, 2006. |

|

|

|

3. | Q: | Who can vote? |

|

|

|

| A: | Only holders of Caraco’s common stock at the close of business on July 25, 2006, the Record Date, can vote at the Annual Meeting. Each shareholder of record has one vote for each share of common stock on each matter presented for a vote at the Meeting. |

|

|

|

4. | Q: | How do I vote if my stock is held in “street name?” |

|

|

|

| A: | If your Caraco common stock is held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of stock held in “street name.” As a beneficial owner, you do not have the right to vote your stock. Only the “record holder” of the stock has such rights. If you wish to vote your stock, you should either (i) obtain a legal proxy from the record holder of the stock appointing you as its legal proxy or (ii) instruct the record holder how you would like the record holder to vote the stock you own. |

|

|

|

5. | Q: | What will I vote on at the Meeting? |

|

|

|

| A: | At the Annual Meeting, shareholders will vote to: |

|

|

|

|

| 1. Elect three directors for three-year terms expiring in 2009 and upon the election and qualification of their successors. |

1

|

|

|

|

| 2. Transact any other business that is properly submitted before the Annual Meeting or any adjournment(s) of the Meeting. |

|

|

|

6. | Q: | Who can attend the annual meeting? |

|

|

|

| A: | You are entitled to attend the annual meeting only if you were a Caraco shareholder as of the Record Date or you hold a valid proxy for the annual meeting. You should be prepared to present valid government-issued photo identification for admittance. In addition, if you are a shareholder of record, your name will be verified against the list of shareholders of record on the Record Date prior to your being admitted to the annual meeting. If you are not a shareholder of record but hold shares through a broker or nominee (i.e., in street name), you should provide proof of beneficial ownership on the Record Date, such as your most recent account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide valid government-issued photo identification or comply with the other procedures outlined above upon request, you may not be admitted to the annual meeting. |

|

|

|

|

| The meeting will begin promptly at 11:00 a.m., local time. Check-in will begin at 10:30 a.m., and you should allow ample time for the check-in procedures. |

|

|

|

7. | Q: | How does the Board of Directors recommend I vote on the proposal? |

|

|

|

| A: | The Board of Directors recommends a vote“FOR” all of the nominees listed in Proposal 1. |

|

|

|

8. | Q: | How can I vote? |

|

|

|

| A: | You can vote in person or by proxy. To vote by proxy, sign, date and return the enclosed proxy card. If you return your signed proxy card to American Stock Transfer before the Annual Meeting, the persons named as proxies on the card will vote your shares as you directed. You may revoke a proxy at any time before the proxy is exercised by: |

|

|

|

| 1. | giving written notice of revocation to Michael Perry, Human Resources Manager of Caraco, at 1150 Elijah McCoy Drive, Detroit, Michigan 48202; |

|

|

|

| 2. | submitting another proxy that is properly signed and later dated; |

|

|

|

| 3. | voting in person at the Meeting (but only if the shares are registered in Caraco’s records in the name of the shareholder and not in the name of a broker, dealer, bank or other third party); |

2

|

|

|

9. | Q: | What is a quorum? |

|

|

|

| A: | There were 26,427,594 shares of Caraco’s common stock outstanding on the Record Date. A majority of the outstanding shares, or 13,213,798 shares, present or represented by proxy, constitutes a quorum. For purposes of a quorum, abstentions and broker non-votes are included. A broker non-vote is a proxy a broker submits that does not indicate a vote for some or all the proposals because the broker does not have discretionary voting authority and the broker did not receive instructions as to how to vote on those proposals. A quorum must exist to conduct business at the Annual Meeting. |

|

|

|

10. | Q: | How does voting work? |

|

|

|

| A: | If a quorum exists, each director must receive the favorable vote of a majority of the shares voted, excluding abstentions and broker non-votes, present in person or represented by proxy. |

|

|

|

|

| Caraco will vote properly executed Proxies it receives prior to the Meeting in the way you direct.If you sign the proxy card but do not specify instructions, the shares represented by Proxies will be voted “FOR” the nominees for directors. No other matters are currently scheduled to be presented at the Meeting. If any matter or matters are properly brought before the Meeting or any adjournment thereof, it is the intention of the persons named in the accompanying proxy card to vote the shares represented by the proxy card as they determine. |

|

|

|

10. | Q: | Who pays for the costs of the Meeting? |

|

|

|

| A: | Caraco pays the cost of preparing and printing the proxy statement and soliciting proxies. Caraco will solicit proxies primarily by mail, but may also solicit proxies personally and by telephone. Caraco will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their out-of-pocket expenses for forwarding solicitation material to beneficial owners of Caraco’s common stock. |

|

|

|

11. | Q: | When are shareholder proposals for the 2007 Annual Meeting due? |

|

|

|

| A: | All shareholder proposals to be considered for inclusion in next year’s proxy statement must be submitted in writing to the Secretary or Assistant Secretary of Caraco Pharmaceutical Laboratories, Ltd., 1150 Elijah McCoy Drive, Detroit, Michigan 48202, before April 2, 2007. |

3

|

|

|

12. | Q: | How may a shareholder communicate with the Board of Directors? |

|

|

|

| A: | Shareholders may communicate with the Board of Directors or any member of the Board of Directors by sending a letter addressed to the Board of Directors, c/o Michael Perry, Human Resources Manager, at 1150 Elijah McCoy Drive, Detroit, Michigan 48202. The Board of Directors’ policy is to have all shareholder communications compiled by the Human Resources Manager and forwarded directly to the Board or the director as indicated in the letter. All letters will be forwarded to the appropriate party. The Board of Directors reserves the right to revise this policy in the event that this process is abused, becomes unworkable or otherwise does not efficiently serve the purpose of the policy. |

4

PROPOSAL 1 – ELECTION OF DIRECTORS

Election of Board of Directors

Caraco’s Board of Directors is divided into three classes with each class of directors elected to a three-year term of office. At each annual meeting, Caraco shareholders elect one class of directors for a three-year term to succeed the class of directors whose term of office expires at that meeting. This year you are voting on three candidate directors. Based on the recommendation of the Board of Directors, the following individuals, each of whom is a current director, are recommended for re-election: Dilip S. Shanghvi, Jitendra N. Doshi and Dr. John D. Crissman. Mr. Shanghvi has been a director since 1997, Mr. Doshi has been a director since 2001 and Mr. Crissman was appointed a director in July 2005. Each of the nominees has consented to his nomination and has agreed to serve as a director of Caraco if elected.

If any director is unable to stand for re-election, Caraco may vote the shares to elect any substitute nominee recommended by the Board of Directors. If the Board of Directors does not recommend any substitute nominees, the number of directors to be elected at the Annual Meeting may be reduced by the number of nominees who are unable to serve.

Caraco’s Board of Directors recommends a vote“FOR” these nominees.

NOMINEES FOR DIRECTORS’ TERMS EXPIRING 2009

|

|

|

|

|

|

|

Directors |

| Age |

| Principal Occupation and Business |

| Director |

|

|

| ||||

|

|

|

|

|

|

|

Dilip S. Shanghvi |

| 50 |

| Mr. Shanghvi has served as Chairman of the Board of Directors of Caraco since 1997. Mr. Shanghvi is the founder of Sun Pharmaceutical Industries Limited (“Sun Pharma”), its Managing Director since its inception in 1993, responsible for marketing, research and development and human resource development, and its Chairman since 1999. Mr. Valia is Mr. Shanghvi’s brother-in-law. |

| 1997 |

|

|

|

|

|

|

|

Jitendra N. Doshi |

| 55 |

| Mr. Doshi has been the Chief Financial Officer since November 2002 and the Chief Operating Officer of Caraco since August 2002. Mr. Doshi has taken on additional responsibilities as the Executive Director of Sun Pharmaceutical Industries, Inc., a generic pharmaceutical company and wholly-owned subsidiary of Sun Pharma. Mr. Doshi was the interim Chief Executive Officer of Caraco (from September 2003 to May 2005). Mr. Doshi commenced employment with Caraco as its Senior Vice President – Commercial in April 2001. From September 1999 to April 2001, Mr. Doshi was employed by Sun Pharma as General Manager – Operations. From |

| 2001 |

5

|

|

|

|

|

|

|

|

|

|

| 1991 to 1999, Mr. Doshi was Managing Director of Aqua Bearing Ltd., an auto parts manufacturer organized under the laws of the Commonwealth of India. |

|

|

|

|

|

|

|

|

|

Dr. John D. Crissman |

| 67 |

| Dr. Crissman is a tenured professor (since 1990) in the Department of Pathology of Wayne State University’s School of Medicine in Detroit, Michigan. Dr. Crissman was Dean of Wayne State University’s School of Medicine from June 1999 to October 2004. During this same period, he also held the positions of President, Academic Health Center Services, and Senior Vice President for Medical Affairs at the Detroit Medical Center. From 1990 through June 1999, Dr. Crissman was the Chair of Pathology of Wayne State University’s School of Medicine and Specialist-in-Chief, Pathology and Laboratory Service, at the Detroit Medical Center. |

| 2005 |

DIRECTORS’ TERMS EXPIRING 2008

|

|

|

|

|

|

|

Directors |

| Age |

| Principal Occupation and Business |

| Director |

|

|

| ||||

|

|

|

|

|

|

|

Daniel H. Movens |

| 48 |

| Mr. Movens became the CEO of Caraco in May 2005. Prior to this, Mr. Movens was President of Anda, Inc., a wholly-owned subsidiary of Andrx, Inc., a position he held since February 2004. Since 1995 Mr. Movens held a number of positions of increasing responsibility, including Executive Vice President of Operations of Anda, Inc. Mr. Movens was also an Operating Committee member for Andrx Corporation. For fifteen (15) years before joining Anda, Inc., Mr. Movens worked in the retail pharmacy industry, working for independent pharmacies and pharmacy chains. |

| 2005 |

|

|

|

|

|

|

|

Sailesh T. Desai |

| 52 |

| Mr. Desai has served as a full-time director of Sun Pharma since 1999, responsible for domestic marketing of some of the divisions dealing in specific therapy segments of pharmaceutical formulations. From 1994 to 1998, Mr. Desai was the principal shareholder and Managing Director of Milmet Laboratories, Pvt. Ltd., a manufacturer and marketer of ophthalmic solutions which was organized under the laws of the Commonwealth of India and merged |

| 2000 |

6

|

|

|

|

|

|

|

|

|

|

| into Sun Pharma in 1998. |

|

|

|

|

|

|

|

|

|

Georges Ugeux |

| 61 |

| In October 2003, Mr. Ugeux founded Galileo Global Advisors LLC (a company offering strategic advice on international business development). From September 1996 to October 2003, Mr. Ugeux was a Group Executive Vice President, International and Research and a member of the Office of the Chief Executive of NYSE. From 1995 until September 1996, Mr. Ugeux served as President of the European Investment Fund. From 1992 until 1995, Mr. Ugeux was President of Kidder, Peabody Europe as well as Managing Director while serving as a member of the Managing Committee of the Board of Directors of Kidder, Peabody, Inc. From 1988 until 1992, Mr. Ugeux was Group Finance Director at Societe Generale de Belgique, a Belgian diversified industrial and financial conglomerate. |

| 2004 |

DIRECTORS’ TERMS EXPIRING 2007

|

|

|

|

|

|

|

Directors |

| Age |

| Principal Occupation and Business |

| Director |

|

|

| ||||

|

|

|

|

|

|

|

Timothy S. Manney |

| 47 |

| Since May 2002, Mr. Manney has been President and Director of Synova, Inc. (a privately-held information technology staffing and creative–services consulting firm). From 1990 to 2001, Mr. Manney served as the Chief Financial Officer of Covansys Corporation (a publicly-held information technology solutions company). |

| 2004 |

|

|

|

|

|

|

|

Madhava Reddy |

| 48 |

| Mr. Reddy is President and Chief Executive Officer of HTC Global Services, Inc., a private Michigan corporation he organized in 1992. HTC Global Services is a global information and technology service and solution provider. HTC Global Services currently has offices in India, Singapore, Australia and Malaysia, and has its corporate offices in Troy, Michigan. Mr. Reddy, a CPA, is a member of the American Institute of Certified Public Accountants and the Michigan Association of Certified Public Accountants. |

| 2005 |

|

|

|

|

|

|

|

Sudhir Valia |

| 50 |

| Mr. Valia joined Sun Pharma as a director in January 1994 and has been a full-time director since his |

| 1997 |

7

|

|

|

|

|

|

|

|

|

|

| appointment in April 1994, currently responsible for finance, commercial, operations, projects and quality control.. Prior to then, Mr. Valia was a chartered accountant in private practice. Mr. Valia is a qualified chartered accountant in India. Mr. Shanghvi is Mr. Valia’s brother-in-law. |

|

|

Committees and Meetings ofDirectors

During fiscal 2006, the Board of Directors met four times. All of our current directors attended at least 75% of the meetings of the Board and the committees on which they served, except for Messrs. Shanghvi, Desai and Valia. The Board of Directors encourages Board members to attend each Annual Meeting of Shareholders. At the 2005 Annual Meeting of Shareholders, four of the Caraco directors were in attendance. In addition to meetings, the Board and the committees take corporate action through unanimous written consents.

The Board of Directors is fixed at nine members. Four of such directors are independent under Amex listing standards currently in effect. Unless a company is a“controlled company” under Amex regulations, a majority of its Board of Directors must be independent. As a result of Sun Pharma owning a majority of the outstanding voting shares, Caraco is a controlled company under Amex regulations and is therefore not required to have a majority of independent directors on its Board.

The Board maintains three standing committees: audit, compensation and independent. These are described below.

Audit Committee. The Audit Committee is responsible for selecting, evaluating, retaining and, where appropriate, replacing Caraco’s independent auditors. Generally, the Audit Committee monitors the integrity of Caraco’s financial statements and the independence and qualifications of the independent auditors. The Audit Committee is governed by a written charter. The Audit Committee’s responsibilities are described in more detail in such charter. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee held six meetings in fiscal 2006. The current members of the Audit Committee are Mr. Manney, Mr. Reddy and Mr. Ugeux. Mr. Manney is the committee’s Chairman. Each of these members is independent under Section 121(B) of the Amex listing standards currently in effect. As further required by such rules, each of the committee members is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. The Board of Directors has determined that Mr. Manney is an audit committee financial expert.

Compensation Committee. The Compensation Committee oversees Caraco’s policies and programs for the compensation of its officers. The Committee is to review and approve the compensation of the officers at least annually and report its actions to the Board of Directors. The Compensation Committee may delegate certain of its responsibilities to the chief executive officer, including the determination of base salaries and bonuses of all officers other than the chief executive officer, based on guidelines and restrictions set by the Compensation Committee. The Compensation Committee is also responsible for the review and approval of compensation programs for officers and employees, including fringe benefits and stock options and/or bonuses, as may be from time to time recommended by management. Grants of options or other awards under Caraco’s 1999 Equity Participation Plan are made by the two “non-employee directors” as defined by 16b-3 who are also “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. The Compensation

8

Committee held one meeting during fiscal 2006. The Compensation Committee currently consists of Messrs. Shanghvi, Manney, and Ugeux. Mr. Shanghvi serves as the Chairman. Under Amex regulations, controlled companies, such as Caraco, are not required to have compensation committees consisting solely of independent directors. Two of the three members, Messrs. Manney and Ugeux, are independent under Section 121(A) of the Amex listing standards currently in effect.

Independent Committee. The Independent Committee was established to negotiate a products agreement between Caraco and Sun Pharma Global, Inc. (“Sun Global”), a wholly-owned subsidiary of Sun Pharma. In 2005, the Board of Directors ratified and approved the authority of the Independent Committee (with respect to past, present and future actions) to review and approve all related party transactions. The Independent Committee held one meeting during fiscal 2006. The Independent Committee currently consists of Messrs. Crissman, Manney, Reddy and Ugeux. All of the members are independent under Section 121(A) of the Amex listing standards currently in effect. Mr. Ugeux serves as the Chairman.

Nomination of Directors

The Board of Directors has not established a formal nominating committee as the entire Board serves in this capacity. Under Amex regulations, a controlled company is not required to establish a formal nominating committee. The Board of Directors has not maintained a formal nominating committee because the Board of Directors feels that it is not necessary since the size of the Board is relatively small. While the Board has not established a formal committee, in the past the Board has asked one or two of its directors to meet with a number of candidates and to make recommendations to the full Board. The Board may utilize a variety of methods for identifying potential nominees, including considering potential candidates who come to their attention through current officers, directors, Caraco’s professionals, professional search firms or other persons. Once a potential nominee has been identified, the Board evaluates whether the nominee has the appropriate skills and characteristics to become a director in light of the then make-up of the Board of Directors. This assessment includes an evaluation of the candidate’s judgment and skills, such as experience at a policy setting level, financial sophistication, leadership and objectivity. At a minimum, the Board of Directors believes that all members of the Board should have the highest professional and personal ethics and values. Messrs. Crissman and Reddy, who were appointed to the Board in July 2005, were introduced for consideration by the Board by outside counsel and the Chairman of the Board, respectively.

The Board of Directors considers stockholder nominations for candidates for membership on the Board when properly submitted in accordance with Company’s bylaws. The Company’s bylaws provide that nominations for the election of directors may be made by any stockholder entitled to vote in the election of directors if timely notice of such shareholder’s intent has been given in writing to the Secretary or an Assistant Secretary of the Company. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of the Company not less than 120 calendar days before the date of the Company’s proxy statement is released to shareholders in connection with the previous year’s annual meeting. Each such notice shall set forth (a) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the shareholder is a shareholder of record of stock of the Company entitled to vote for the election of directors on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholders; (d) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange

9

Commission, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and (e) the consent of each nominee to serve as a director of the Company if so elected.

Report of the Audit Committee

Management is primarily responsible for the financial statements and the reporting process. The independent registered public accounting firm is responsible for performing an audit of Caraco’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for expressing an opinion on those financial statements based on its audit. The Audit Committee reviews these processes on behalf of the Board of Directors. In this context, the Audit Committee has reviewed and discussed the audited financial statements contained in the fiscal 2006 Annual Report on Form 10-K with Caraco’s management and its independent registered public accounting firm.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as amended, and has discussed with the independent registered public accounting firm its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Caraco’s Annual Report on Form 10-K for the year ended March 31, 2006 for filing with the Securities and Exchange Commission.

|

|

| The Audit Committee |

|

|

| Timothy S. Manney (Chairman) |

| Madhava Reddy |

| Georges Ugeux |

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics (the “Code”) applicable to its directors, officers and employees. A copy of the Code is available at no charge by contacting the Human Resources Manager, Michael Perry, at 1150 Elijah McCoy Drive, Detroit, MI 48202, or by telephone: (313) 871-8400 or by email: mperry@caraco.com.

Compensation of Directors

Directors who are employees of Caraco or who are directors and/or employees of Sun Pharma and its affiliates do not receive additional compensation for their service on the Board of Directors and its Committees. Each non-employee director receives an annual retainer of $12,000, a fee of $1,500 if in person ($500 if by telephone) for each attended Board and Committee meeting (with $500 extra for the chairman of the Committee), a one time grant of 3,000 stock options upon initial election and an annual grant of 1,500 stock options on each anniversary date of election. No additional Committee fees are paid if the Committee meets on

10

the same day as the Board meets. Non-employee directors are also reimbursed for out-of-pocket expenses incurred in connection with attending Board and Committee meetings.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The SEC requires that Caraco provide information about any shareholder who beneficially owns more than 5% of Caraco’s common stock. The following table provides the required information, as of the Record Date, about the shareholders (who are not officers or directors) known to Caraco to be the beneficial owner of more than 5% of Caraco’s common stock. Caraco relied solely on information furnished by its transfer agent and Schedule 13Ds.

Amount and Nature of Beneficial Ownership as of the Record Date

|

|

|

|

|

Name and Address of |

| Amount and Nature of |

| Percent |

|

| |||

|

|

|

|

|

Sun Pharma |

| 16,868,680(1) |

| 63.8% |

SPARC |

|

|

|

|

Tandalja, Vadodora 390 020 |

|

|

|

|

|

|

(1) | Sun Pharma directly owns 8,382,666 shares of common stock of Caraco and beneficially owns 8,486,014 shares registered in the name of Sun Global, whose address is International Trust Building, P.O. Box No. 659, Road Town, Tortola, British Virgin Islands. In addition, Sun Pharma and its affiliates own 11,968,000 shares of Series B preferred stock which are convertible into shares of common stock three years from the date of their respective issuance or upon a change in control. The earliest any shares of such Series B preferred stock becomes convertible is December 2006. |

SECURITY OWNERSHIP OF MANAGEMENT AND DIRECTORS

The following table contains information, as of the Record Date, about the number of shares of Caraco’s common stock beneficially owned by incumbent directors, the executive officers and by all current directors, nominees and executive officers as a group. The number of shares of common stock beneficially owned by each individual includes shares of common stock which the individual can acquire by September 25, 2006 through the exercise of any stock option or other right. Unless indicated otherwise, each individual has sole investment and voting power (or shares those powers with his or her spouse) with respect to the shares of common stock listed in the table.

|

|

|

|

|

Name of Beneficial Owner |

| Amount and Nature of |

| Percentage of Class |

|

| |||

|

|

|

|

|

Dilip S. Shanghvi (1) |

| 0 (2) | * | |

|

|

|

|

|

Daniel H. Movens (3) |

| 58,333 (4) |

| * |

|

|

|

|

|

Jitendra N. Doshi (5) |

| 65,000 |

| * |

|

|

|

|

|

Robert Kurkiewicz (3) |

| 12,013 (6) |

| * |

|

|

|

|

|

Gurpartap Singh Sachdeva (3) |

| 11,800 (7) |

| * |

|

|

|

|

|

Dr. John D. Crissman (8) |

| 1,000 (9) |

| * |

|

|

|

|

|

Sailesh T. Desai (10) |

| 0 (2) |

| * |

|

|

|

|

|

Timothy S. Manney (11) |

| 2,500(12) |

| * |

|

|

|

|

|

Madhava Reddy (13) |

| 1,000 (9) |

| * |

|

|

|

|

|

Georges Ugeux (14) |

| 2,500(12) |

| * |

|

|

|

|

|

Sudhir Valia (15) |

| 0 (2) |

| * |

|

|

|

|

|

All current executive officers and directors as a group (11 persons) |

| 152,146 |

| * |

|

|

|

|

|

11

|

|

* | Less than 1.0% of the outstanding shares |

|

|

(1) | The mailing address of Mr. Shanghvi c/o Sun Pharmaceutical Industries Limited, 17/B, Mahal Industrial Estate, Mahakali Caves Road, Andheri (East), Mumbai 400 093 India. |

|

|

(2) | Excludes 16,868,680 shares of common stock and 11,968,000 shares of Series B preferred stock beneficially owned by Sun Pharma and its affiliates. (See footnote 1 under“Security Ownership of Certain Beneficial Owners” and “Transactions of Directors, Executive Officers and Certain Beneficial Holders of Caraco.”) Mr. Shanghvi is the Chairman and Managing Director of, and Messrs. Desai, and Valia are directors of, and Mr. Shanghvi, together with his associate companies, is also the majority shareholder of, Sun Pharma, and, therefore, may be deemed to share investment control over the shares of common stock held by Sun Pharma and its affiliates. Each of Messrs. Desai and Valia disclaims beneficial ownership of the shares of common stock beneficially owned by Sun Pharma and its affiliates. |

|

|

(3) | The mailing address of each of these holders is 1150 Elijah McCoy Drive, Detroit, Michigan 48202. |

|

|

(4) | Includes 13,333 stock options that are currently exercisable. |

|

|

(5) | Mr. Doshi’s mailing address is c/o Sun Pharmaceutical Industries, Inc., 270 Prospect Plains Road, Cranbury, New Jersey 08512. |

|

|

(6) | Includes stock options that are currently exercisable to purchase 10,000 shares of common stock. |

|

|

(7) | Includes stock options that are currently exercisable to purchase 2,000 shares of common stock and 1,800 shares held in the name of his wife. |

|

|

(8) | Dr. Crissman’s mailing address is 540 E. Canfield, Detroit, Michigan 48201. |

|

|

(9) | Includes stock options that are currently exercisable to purchase 1,000 shares of common stock. |

|

|

(10) | Mr. Desai’s mailing address is c/o Sun Pharmaceutical Industries Limited, 4th Floor, R.K. Centre, Fatehgunj Main Road, Baroda 390 002 India. |

|

|

(11) | Mr. Manney’s mailing address is c/o Synova, Inc., 1000 Town Center, Suite 700, Southfield, Michigan 48075. |

|

|

(12) | Includes stock options that are currently exercisable to purchase 2,500 shares of common stock. |

|

|

(13) | Mr. Reddy’s mailing address is c/o HTC Global Services, Inc., 3270 West Big Beaver Road, Troy, Michigan 48084. |

|

|

(14) | Mr. Ugeux’s mailing address is c/o Galileo Global Advisors, One Rockefeller Center, Suite 1722, New York, New York 10020. |

|

|

(15) | Mr. Valia’s mailing address is c/o Sun Pharmaceutical Industries Limited, Acme Plaza, Andheri Kurla Road, Andheri (East), Mumbai 400 059 India. |

12

Equity Compensation Plan Information

3-31-06

|

|

|

|

|

|

|

| |||||

Plan category |

| Number of securities |

| Weighted-average |

| Number of securities |

| |||||

|

|

|

|

| ||||||||

|

|

| (a) |

|

| (b) |

|

| (c) |

| ||

|

|

|

|

| ||||||||

Equity compensation |

|

| 104,300 |

|

|

| $2.46 |

|

|

| 2,672,900 |

|

Equity compensation |

|

| 285,000 |

|

|

| $3.62 |

|

|

| 0 |

|

Total |

|

| 389,300 |

|

|

| $3.31 |

|

|

| 2,672,900 |

|

The equity compensation plans approved by security holders consists of the 1999 Equity Participation Plan. The above referenced options under the 1999 Plan were granted as incentive stock options to employees (72,500) and as non-qualified stock options to directors, former directors and consultants (31,800). One of the equity compensation plans not approved by shareholders consists of a grant of 45,000 shares of stock and a grant of a stock option for 40,000 shares to Mr. Movens made pursuant to his employment agreement with the Company. Under Mr. Movens’ employment agreement, he is to receive an annual stock option grant for not less than 40,000 shares and a stock grant of 10,000 shares if the employment agreement is renewed. See “Compensation of Executive Officers – Employment Agreements.” The other equity compensation plan consists of options granted to an unaffiliated generic drug company with respect to sign-up options for products. With respect to the formula for one product, the Company has determined it is different from the formula approved by the FDA and manufactured and introduced by the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires that Caraco’s directors, executive officers and persons who own more than ten percent of a registered class of Caraco’s equity securities file reports of stock ownership and any subsequent changes in stock ownership with the SEC not later than specified deadlines. To Caraco’s knowledge, based solely on a review of the copies of such reports furnished to Caraco, all directors, executive officers and persons who own more than ten percent of Caraco’s equity securities complied with applicable Section 16(a) filing requirements for fiscal 2006, except as follows: Mr. Doshi filed a late report with respect one transaction, Mr. Ugeux filed a late report with respect to one transaction and Sun Pharma and its affiliates filed two reports with respect to thirteen transactions not reported timely in which Series B preferred stock was acquired.

TRANSACTIONS OF DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN BENEFICIAL

HOLDERS OF CARACO

The following discloses transactions during fiscal 2006, the Transition Period (January 1, 2005 through March 31, 2005) (the “Transition Period”), and calendar years 2004 and 2003, and proposed transactions between

13

Caraco and several of the incumbent and nominee directors, executive officers and security holders who beneficially hold in excess of five percent of our outstanding shares:

On November 21, 2002, we entered into a products agreement with Sun Global. Under the agreement, which was approved by our independent directors, Sun Global has agreed to provide us with 25 new generic drugs over a 5-year period. In exchange for each new generic drug transferred to us by Sun Global which passes a bioequivalency test, we issue Sun Global 544,000 shares of Series B preferred stock.

During fiscal 2006, the Transition Period, 2004 and 2003, Sun Global earned 4,896,000, 1,632,000, 3,808,000 shares and 544,000 shares of Series B preferred stock for nine product transfers, three product transfers, seven product transfers and one product transfer, respectively, as provided under the November 2002 products agreement.

During 2003, we borrowed approximately $0.6 million from Sun Pharma, and in 2003 we repaid the entire balance of all of our outstanding loans from Sun Pharma in the amount of approximately $10 million. Prior to April 1, 2001, the interest rate was 10%; thereafter it was 8%.

During fiscal 2006, the Transition Period, 2004 and 2003, we purchased approximately $28.1 million, $5.3 million, $16.7 million and $10.3 million, respectively, of our raw materials and formulations from Sun Pharma. We intend to continue to purchase raw materials and formulations from Sun Pharma in fiscal 2007.

During fiscal 2006, the Transition Period, 2004 and 2003, Caraco purchased at Sun Pharma’s cost, approximately $0.2 million, $0.1 million, $0.6 million and $0.5 million, respectively, of machinery and equipment from Sun Pharma. We intend to continue to purchase machinery equipment from Sun Pharma in fiscal 2007.

We entered into two non-cancelable operating leases during 2000 with Sun Pharma to lease production machinery. The leases each require rental payments of $4,245, and expired during fiscal 2006.

Caraco entered into a manufacturing and supply agreement and a distribution and sale agreement in December 2004 with respect to one product with an affiliate of Sun Pharma, Sun Pharmaceutical Industries, Inc. (“SPII”). Caraco entered into another distribution and sales agreement with SPII in the Transition Period with respect to another product. There were no earnings by Caraco from these agreements in 2004. In the Transition Period, Caraco earned $45,000 from the sale and distribution of the first product and $33,000 from the sale and distribution of the second product. In fiscal 2006, Caraco earned $290,000 and $0 from the manufacture, sale and distribution of the first product and from the distribution and sale of the second product, respectively.

During the Transition Period, SPARC Bioresearch Private Limited (“SPARC”), an affiliate of Sun Pharma, performed certain analytical studies required as part of the bio-equivalency process for two products. The Company incurred approximately $172,000 of costs during the period for the studies performed by SPARC. No similar studies were performed by SPARC during fiscal 2006 or during the years ended December 31, 2004 and 2003.

As of July 31, 2006, Caraco and Sun are negotiating a proposed new technology transfer agreement for the transfer of products on a cash basis and a marketing/distribution agreement.

14

The following table provides information about Caraco’s executive officers who are not directors as of July 31, 2006.

|

|

|

|

|

|

|

Name | Age | Five-Year Business Experience | Executive | |||

|

|

| ||||

|

|

|

|

|

|

|

Robert Kurkiewicz |

| 55 |

| Commenced employment with Caraco as its Vice President-- Quality Assurance in November 1993 and was promoted to Sr. Vice President - Technical, October 1998. |

| 1993 |

|

|

|

|

|

|

|

Gurpartap Singh Sachdeva |

| 37 |

| Vice President – Sales and Marketing since September 2003 and National Sales and Marketing Manager since September 2000. From May 1998 to September 2000, Mr. Singh was the Manager of Bulk Drugs for Sun Pharma. |

| 2005 |

REPORT ON EXECUTIVE COMPENSATION

General

During fiscal 2006, the Company had four executive officers, Daniel H. Movens, its CEO, Jitendra N. Doshi, its Chief Operating Officer and Chief Financial Officer, Robert Kurkiewicz, its Senior Vice President – Technical and Gurpartap Singh Sachdeva, its Vice President – Sales and Marketing. Each has entered into employment agreements with the Company as disclosed in greater detail under “Compensation of Executive Officers – Employment Agreements” below.

The key elements of such executives’ compensation is a base salary, which may be adjusted annually, based on performance and other factors deemed reasonable by the Company, a performance bonus, stock options and/or grants of stock. For fiscal 2006, the Compensation Committee increased the base salaries of the executive officers (other than the chief executive officer) as set forth under “Compensation of Executive Officers-Employment Agreements” below based on performance and comparable salaries of other generic pharmaceutical companies. See “CEO Compensation” below for a separate discussion of the CEO’s compensation for fiscal 2006. Pursuant to guidelines and restrictions set by the Compensation Committee, the chief executive officer awarded discretionary bonuses to the other executive officers based on sales revenue performance for fiscal 2006.

Stock options and stock grants serve as a long-term incentive plans for such executive officers in that the grant of stock options and the grant of stock (which both vest over time) are intended to align the executive officers long-term interests with those of the shareholders. Stock options and grants of stock provide these executive

15

officers with the opportunity to purchase and maintain an equity interest in Caraco and to share in the appreciation of the value of the stock. The Company believes that stock options and stock grants directly motivate these executives to maximize long-term stockholder value. The vesting periods also encourage these key employees to continue in the employ of Caraco.

CEO Compensation

In fiscal 2006, our most highly compensated executive officer was Daniel H. Movens, the Chief Executive Officer. For fiscal 2006, Mr. Movens (who commenced employment in May 2005) received a salary of $352,900 and earned a bonus of $146,250 for fiscal 2006. Mr. Movens’ salary and bonus are determined based on his employment agreement. Among other things, Mr. Movens’ employment agreement provides that Mr. Movens shall receive a base salary of $390,000 (which is to be reviewed annually by the Compensation Committee and adjusted accordingly in its discretion), and may receive a bonus of up to 50% of the base compensation (with 25% of the base compensation guaranteed for the first year). In addition, pursuant to the employment agreement, Mr. Movens was granted stock options as of his commencement date for 40,000 shares (which vest over a period of three years) and was granted stock as of his commencement date for 45,000 shares (which vest over a period of three years). Under the employment agreement, the bonus is to be based on mutually set performance objectives/goals between the Board and Mr. Movens. Pursuant thereto, the Compensation Committee awarded Mr. Movens a discretionary bonus of $146,250 based on sales revenue performance for fiscal 2006.

|

|

| The Compensation Committee |

|

|

| Dilip S. Shanghvi (Chairman) |

| Timothy S. Manney |

| Georges Ugeux |

16

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows, as to the Chief Executive Officer, and as to the other executive officers who earned salary and bonus in excess of $100,000 during the last fiscal year, information concerning all compensation paid for services to Caraco during fiscal 2006, the Transition Period (“TP”), and calendar years 2004 and 2003.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annual Compensation |

| Long Term Compensation |

| ||||||||||||

|

|

|

|

|

|

|

|

|

| Awards |

| Payouts |

| ||||

Name and Principal |

| Year |

| Salary |

| Bonus |

| Other Annual |

| Restricted |

| Securities |

| LTIP |

| All Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel H. Movens |

| 2006 |

| 352,900 |

| 146,250 |

| 0 |

| 373,950(2) |

| 40,000 |

|

|

| 49,038 | (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jitendra N. Doshi |

| 2006 |

| 201,200 |

| 45,000 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

COO and CFO (4) |

| TP |

| 38,077 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 1,140 | (5) |

|

| 2004 |

| 159,854 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

|

| 2003 |

| 134,758 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Kurkiewicz |

| 2006 |

| 153,450 |

| 24,512 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

Sr. Vice President |

| TP |

| 33,460 |

|

|

|

|

|

|

|

|

|

|

| 1,140 | (5) |

Technical |

| 2004 |

| 142,604 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

|

| 2003 |

| 134,208 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gurpartap Singh |

| 2006 |

| 176,700 |

| 39,488 |

| 0 |

| 0 |

| 0 |

| 0 |

| 4,560 | (5) |

Sachdeva, VP Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Marketing (6) |

| TP |

| 30,774 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 1,140 | (5) |

|

|

(1) | Mr. Movens has been the Chief Executive Officer since May 2005. |

|

|

(2) | The dollar value of the 45,000 shares of restricted stock set forth in the table above is based on the closing market price of the common stock on the date of grant. No cash consideration was paid for such shares. As of March 31, 2006, the market value of such shares (based on a closing price of $13.00 per share) was $585,000. The grant of restricted stock lapses in one-third increments on May 2, 2006, 2007 and 2008. The restricted stock is entitled to participate in dividends in the same manner as all common stock. |

|

|

(3) | The Company reimbursed Mr. Movens for his relocation expenses in the amount of $47,538. In addition, the Company pays Mr. Movens $1,500 per annum to reimburse him for any life insurance premiums. |

|

|

(4) | Mr. Doshi was interim CEO of the Company until May 2005. |

|

|

(5) | Represents an auto allowance of $380.00 per month. |

|

|

(6) | Mr. Singh became an executive officer in January 2005. |

17

Option Grants in Last Fiscal Year

Option Grants in Last Fiscal Year

The following table sets forth certain information relating to option grants in fiscal 2006 to the individuals named in the Summary Compensation Table above.

Option/SAR Grants in Last Fiscal Year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of |

| % of Total |

| Exercise or |

| Expiration |

| Potential Realizable Value at |

| ||||||||||||||||

|

| Granted #(1)(2) |

| Fiscal Year |

| ($/Sh) |

| Date |

| 5 % |

| 10% |

| ||||||||||||||

|

|

|

|

|

|

|

| ||||||||||||||||||||

Daniel H. Movens |

|

|

| 40,000 |

|

|

|

| 100 | % |

|

| $ | 8.31 |

|

|

|

| 5-2-11 |

|

| $ | 113,200 |

| $ | 256,800 |

|

Jitendra N. Doshi |

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

| — |

|

| — |

|

Robert Kurkiewicz |

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

| — |

|

| — |

|

Gurpartap Singh Sachdeva |

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

| — |

|

| — |

|

|

|

(1) | None of the options granted were options with tandem SARs and no free-standing SARs were granted. |

|

|

(2) | Granted to the named executive officer on May 2, 2005 pursuant to his employment agreement. The options become exercisable in one third increments on May 2, 2006, 2007 and 2008, respectively. If a change of control (as defined in the employment agreement) occurs, these options would become immediately exercisable. |

|

|

(3) | Potential Realizable Value is calculated by determining the per share stock price for the option term based on the assumed growth rates, subtracting the exercise price per share and multiplying the difference by the number of shares underlying the grant. Five percent (5%) annual growth (compounded) results in a stock price per share of $11.14 and 10% annual growth (compounded) results in a stock price per share of $14.73. |

|

|

(4) | The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised, so that there is no assurance the value realized by an executive will be at or near the amounts reflected in this table. |

18

Aggregated Option SAR Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information for the named executive officers with regard to the aggregated stock options exercised during the year ended March 31, 2006.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

| Shares |

| Value |

| Number of Securities |

| Value of Unexercised In-the- |

| ||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||

Daniel H. Movens |

|

|

| — |

|

|

|

| — |

|

|

|

| 0/40,000 |

|

|

| $ | 0 /187,600 |

|

|

| |||||||||||||||||||||

Jitendra N. Doshi |

|

|

| 25,000 |

|

|

| $ | 222,000 |

|

|

|

| 0/25,000 |

|

|

| $ | 0 /293,750 |

|

|

| |||||||||||||||||||||

Robert Kurkiewicz |

|

|

| — |

|

|

|

| — |

|

|

|

| 10,000/0 |

|

|

| $ | 122,000 / 0 |

|

|

| |||||||||||||||||||||

Gurpartap Singh Sachdeva |

|

|

| — |

|

|

|

| — |

|

|

|

| 2,000/0 |

|

|

| $ | 24,400 /0 |

|

|

|

|

(1) | The Company has never granted options with tandem SARs or free-standing SARs. |

|

|

(2) | The value is based on the difference between the exercise price and the closing sale price on the date of exercise. |

|

|

(3) | The value is based on the difference between the exercise prices and the closing sale price of Caraco’s common stock on March 31, 2006. |

Employment Agreements

Daniel H. Movens, the Chief Executive Officer of Caraco, entered into an employment agreement with Caraco dated as of May 2, 2005. Under the employment agreement, Mr. Movens agrees to serve as Chief Executive Officer of the Company for period of thirty-six (36) calendar months which will automatically renew at the end of thirty-six (36) months. However, after the initial thirty-six (36) month period, each party may terminate the agreement upon ninety (90) days written notice to the other party. Mr. Movens shall receive a base salary of $390,000 (which is to be reviewed annually by the Compensation Committee and adjusted accordingly, in its discretion), may receive a bonus of up to fifty (50%) percent of the base compensation (with twenty-five (25%) percent of the base compensation guaranteed only for the first year), and shall receive stock options for 40,000 shares upon the effective date at the fair market value of the common stock on the day immediately preceding the effective date and stock options for not less than 40,000 shares of the Company annually thereafter (all such options to vest over a period of three years from the date of their respective grants), a stock grant on the effective date of 45,000 shares of the Company’s common stock (which will vest over a period of three (3) years), and a stock grant of an additional 10,000 shares if the employment agreement is renewed. In addition, the Company will reimburse Mr. Movens for his reasonable

19

relocation expenses; any such expense over and above $50,000 will require prior approval of the Company.

If Mr. Movens is terminated without cause and for a reason other than for nonperformance, if Mr. Movens terminates for good reason, or if there is a change in control (as defined in the employment agreement) of the Company or Sun Pharma and Mr. Movens terminates within six months thereof because he reasonably determines that there has been a significant change in the nature and scope of his duties and powers, he is entitled to a lump sum severance payment in an amount equal to 1 ½ times the highest annual base and last earned bonus(es), together with certain benefits for a period of at least twelve (12) months, and all stock options and stock grants shall be deemed vested in full. With respect to any such amounts which are considered to be “parachute payments” under Internal Revenue Code §280G, the Company shall pay an additional amount representing a gross-up of any federal, state and local income tax liability arising from such payments. After one year of employment with the Company, the amount of this severance could be reviewed to be increased to two (2) times the highest annual base and last earned bonus(es).

If Mr. Movens becomes disabled (as defined in the employment agreement), or dies, the Company shall be obligated to pay accrued unpaid salary and benefits for a one (1) year period following such date of disability or death. If Mr. Movens quits before the first anniversary of the employment agreement, he will receive no severance compensation. If Mr. Movens quits after one (1) year of service, the Company shall pay him his base salary for a maximum period of one (1) year following such termination, or until he finds another position, whichever comes first. In addition, if Mr. Movens is terminated for nonachievement of performance objectives, to be agreed upon, during his first year of employment, the Company will pay him his base salary for a maximum period of one (1) year, or until he finds another position, whichever comes first, and one-third (1/3) of the stock options and stock grants awarded to him will vest. If Mr. Movens is terminated for nonachievement of performance objectives, to be agreed upon, following his first year of employment, the Company will pay him 1 ½ times his base salary for a maximum period of one (1) year or until he finds another position, whichever comes first, and all of his stock options and stock grants awarded to him will vest. Mr. Movens is under no duty to seek other employment or to attempt in any way to reduce any amounts payable to him by means of mitigation or set off.

The Company and Mr. Movens have also entered into a Confidentiality And Non-Competition agreement, pursuant to which Mr. Movens agrees not to solicit any customer of the Company for business in competition with the Company, or solicit for employment any other employee of the Company, for a period of two (2) years following his termination. In addition, for a period of twelve (12) months following the termination of his employment, Mr. Movens agrees not to engage in any activity within North America which is competitive in any material respect with the business of the Company, including generic pharmaceutical manufacturing and marketing, but excluding wholesale distribution. In addition, for a period of twelve (12) months following termination of his employment, Mr. Movens agrees that he will not perform services for any business or organization, whether as an employee, consultant, advisor, independent contractor, or otherwise, which engages in any activity within North America that is competitive in any material respect with the business conducted by the Company, including any business engaged in generic pharmaceutical manufacturing and marketing and any other business in which the Company generates more than ten (10%) percent of its gross revenues.

20

Jitendra N. Doshi, the Chief Operating Officer and Chief Financial Officer of Caraco, entered into an employment agreement with Caraco dated August 30, 2002. The employment agreement provides Mr. Doshi with a salary at the rate of $130,000 annually, which may be reviewed and adjusted, and a car allowance of $380.00 per month. The employment agreement is for a term of five (5) years, commencing on January 1, 2002 and ending on December 31, 2006. The agreement automatically renews for successive one-year periods unless terminated by Caraco or Mr. Doshi upon ninety (90) days notice. In the event of the death or Disability (as such term is defined in the employment agreement) or if Caraco terminates Mr. Doshi for just cause (as such term is defined in the employment agreement), Mr. Doshi is entitled to his base salary and to benefits earned by him prior to the date of death, Disability or termination for just cause. In the event Caraco terminates Mr. Doshi without cause or if Mr. Doshi terminates for cause (as such term is defined in the employment agreement), he would receive base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In addition, any stock options that would have become available for exercise at the end of the year during which such termination occurred shall immediately vest. In August 2005, the Compensation Committee increased Mr. Doshi’s salary to $200,000 annually.

Robert Kurkiewicz, the Senior Vice President - Technical, entered into a five-year employment agreement on November 22, 1993 which was amended on January 1, 1999 to extend the term until January 1, 2003 and which was further amended on August 30, 2002 to extend the term until December 31, 2007. The agreement, as amended, provides Mr. Kurkiewicz with a salary of $129,800 per year and provides for a car allowance of $380.00 per month. The agreement provides that at the end of the term, it is renewable for successive one-year terms. In the event that Caraco terminates the agreement without cause, Mr. Kurkiewicz is entitled to receive monthly base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In addition, any stock options that would become available for exercise at the end of the year during which such termination occurred shall immediately vest. In August 2005, the Compensation Committee increased Mr. Kurkiewicz’s salary to $152,250 annually.

Gurpartap Singh Sachdeva, the Vice President of Sales and Marketing, entered into an employment agreement with Caraco dated February 1, 2005. The employment agreement provides Mr. Sachdeva with a salary at the rate of $135,000 annually, which may be reviewed and adjusted, and a car allowance of $380.00 per month. The employment agreement is for a term of five (5) years, commencing on February 1, 2005. The agreement automatically renews for successive one-year periods unless terminated by Caraco or Mr. Sachdeva upon ninety (90) days notice. In the event of the death or Disability (as such term is defined in the employment agreement) or if Caraco terminates Mr. Sachdeva for just cause (as such term is defined in the employment agreement), Mr. Sachdeva shall be entitled to his base salary and to benefits earned by him prior to the date of death, Disability or termination for just cause. In the event Caraco terminates Mr. Sachdeva without cause or if Mr. Sachdeva terminates for cause (as such term is defined in the employment agreement), he will receive base salary payments and his premium payments for health insurance benefits for six (6) months from the date of termination. In addition, any stock options that would become available for exercise at the end of the year during which such termination occurred shall immediately vest. In August 2005, the Compensation Committee increased Mr. Sachdeva’s salary to $175,500 annually.

21

Change in Control Arrangements

Under our 1999 Equity Participation Plan, options granted under that plan will become fully exercisable following certain changes in control of our company, such as:

|

|

|

| • | A person, other than Sun Pharma, becomes the owner of a majority of the outstanding shares of our company; |

|

|

|

| • | A public announcement is made of a tender or exchange offer by any person, other than Sun Pharma, for 50% or more of the outstanding shares of our company; |

|

|

|

| • | The shareholders of our company approve a merger or consolidation with any other corporation or entity, unless, following the merger, the shares outstanding immediately before the merger continue to represent a majority of the outstanding shares of the surviving entity immediately following the merger. |

See the disclosure above under “Employment Agreements” with respect to change in control arrangements under Mr. Movens’ employment agreement.

Compensation Committee Interlocks and Insider Participation

As noted, Mr. Dilip S. Shanghvi is the Chairman of our Compensation Committee and the Chairman of the Board of Caraco, a non-executive position. Mr. Shanghvi is also the Managing Director of Sun Pharma. As disclosed above, Sun Pharma engages in a number of transactions with Caraco. See “Transactions with Directors, Executive Officers, and certain Beneficial Holders of Caraco” above.

22

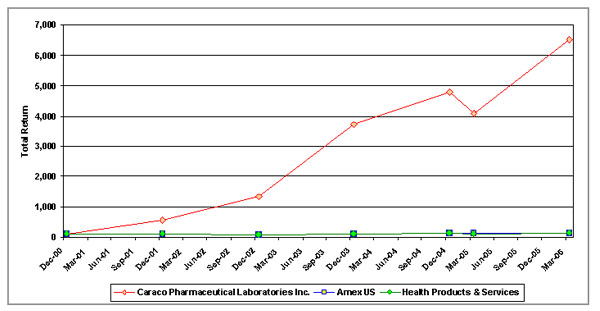

Set forth below is a line graph comparing the cumulative total return among Caraco based on the market price of its common stock, the Amex Composite Index (U.S.) and the Amex Health Products and Services Index. The graph assumes $100 invested on December 31, 2000 in Caraco’s common stock, the Amex Composite Index (U.S.) and the Amex Health Products and Services Index. The total return assumes the reinvestment of dividends. All periods through 2004 represented on the graph are as of December 31; thereafter, the periods are as of March 31.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN AMONG CARACO

PHARMACEUTICAL LABORATORIES, LTD. (MI), AMEX COMPOSITE INDEX (U.S.)

AND AMEX HEALTH PRODUCTS AND SERVICES (U.S.)

| 12/00 | 12/01 | 12/02 | 12/03 | 12/04 | 03/05 | 03/06 | |

|---|---|---|---|---|---|---|---|

| Caraco Pharmaceutical Laboratories, Ltd. | $100 | $575 | $1,335 | $3,740 | $4,775 | $4,090 | $6,500 |

| Amex Composite Index (U.S.) | $100 | $93.10 | $76.10 | $103 | $119 | $116.20 | $138 |

| Amex Health Products and Services Index | $100 | $94.40 | $65.20 | $114.30 | $117.60 | $96.60 | $124.70 |

23

RELATIONSHIP WITH INDEPENDENT AUDITORS

The Audit Committee has appointed Rehmann Robson as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending March 31, 2007. A representative of Rehmann Robson is expected to be present at the Annual Meeting with the opportunity to make a statement if such representative desires to do so and is expected to be available to respond to appropriate questions.

Audit and Non-Audit Fees

Aggregate fees for professional services rendered for Caraco by Rehmann Robson for the fiscal year ended March 31, 2006, the Transition Period and for the calendar year ended December 31, 2004 are set forth below. The aggregate fees included in the Audit category are fees billedfor the audit of Caraco’s fiscal, annual or Transition Period financial statements and review of quarterly financial statements and statutory and regulatory filings or engagements. The aggregate fees included in each of the other categories are fees billedin the fiscal years.

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal 2006 |

| Transition |

| 2004 |

| |||

|

|

|

|

| ||||||

Audit Fees |

| $ | 154,000 |

| $ | 128,000 |

| $ | 123,000 |

|

Audit-Related Fees |

|

| — |

|

| — |

| $ | 7,280 |

|

Tax Fees |

| $ | 20,615 |

| $ | 1,245 |

| $ | 10,245 |

|

All Other Fees |

| $ | 2,700 |

|

| — |

|

| — |

|

Total |

| $ | 177,315 |

| $ | 129,245 |

| $ | 140,525 |

|

Audit Fees for the fiscal year ended March 31, 2006, the Transition Period, and the calendar year ended December 31, 2004 were for professional services rendered for the audits of the financial statements of Caraco, quarterly review of the financial statements included in Caraco’s Quarterly Reports on Form 10-Q, or services that are normally provided by Rehmann Robson in connection with statutory and regulatory filings or engagements for such years, including Rehmann’s Robson’s audit of management’s assessment of internal control over financial reporting as of March 31, 2006, March 31, 2005 and December 31, 2004.

Audit-Related Fees for the calendar year ended December 31, 2004 were for assurance and related services by Rehmann Robson that are reasonably related to the performance of the audit or review of Caraco’s financial statements.

Tax Fees for the fiscal year ended March 31, 2006, the Transition Period and for the calendar year ended December 31, 2004 were for professional services rendered by Rehmann Robson for services related to tax compliance, tax advice and tax planning.

All Other Fees for the fiscal year ended March 31, 2006, were for assistance on SEC reporting requirements.

24

None of the services described above was approved by the Audit Committee under thede minimus exception provided by Rule 2-01(c)(7)(i)(C) under Regulation S-X.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Pursuant to its charter, the Audit Committee pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services.

SHAREHOLDERS OF RECORD AS OF JULY 25, 2006 ARE ENTITLED TO RECEIVE A COPY WITHOUT CHARGE OF THE COMPANY’S FISCAL 2006 ANNUAL REPORT TO THE SEC ON FORM 10-K. SHAREHOLDERS WHO WISH TO RECEIVE A COPY OF THIS REPORT SHOULD WRITE TO MICHAEL PERRY, HUMAN RESOURCES MANAGER, CARACO PHARMACEUTICAL LABORATORIES, LTD, 1150 ELIJAH MCCOY DRIVE, DETROIT, MICHIGAN 48202.

|

|

| Daniel H. Movens |

| Chief Executive Officer |

July 31, 2006

25

CARACO PHARMACEUTICAL LABORATORIES, LTD.

This Proxy is Solicited by the Board of Directors of Caraco Pharmaceutical Laboratories, Ltd.

The undersigned hereby appoints Robert Kurkiewicz and Michael Perry, or either of them, each with power of substitution, to act as proxies for the undersigned, to represent the undersigned at the Annual Meeting of Shareholders (“Annual Meeting”) of Caraco Pharmaceutical Laboratories, Ltd. (“Caraco”) to be held at the Ritz Carlton Hotel, 300 Town Center Drive, Dearborn, Michigan 48126 on Monday, September 11 at 11:00 a.m., Eastern Daylight Saving Time, and at any adjournment(s) thereof, and to vote the number of shares the undersigned would be entitled to vote if personally present on all matters coming before the Annual Meeting, including the business identified on this Proxy and described in the Notice of Annual Meeting of Shareholders and Proxy Statement dated July 31, 2006 (“2006 Proxy Statement”).

This revocable Proxy, when properly executed, will be voted in the manner directed by the undersigned shareholder.If no direction is made on an executed Proxy, this Proxy will be voted by the proxies “FOR” the election as directors of the persons named in Proposal 1. Discretionary authority is conferred by this Proxy with respect to certain matters as described in the 2006 Proxy Statement.

The undersigned acknowledges receipt of the 2006 Proxy Statement.

(Continued and to be signed on the reverse side)

PLEASE VOTE, DATE, AND SIGN ON REVERSE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE

|

COMMENTS: |

|

|

26

ANNUAL MEETING OF SHAREHOLDERS OF

CARACO PHARMACEUTICAL LABORATORIES, LTD.

September 11, 2006

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible

|

|

|

| Please detach along perforated line and mail in the envelope provided. | |

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL NOMINEES. |

PLEASE SIGN, DATE AND RETURN THE ENVELOPE. PLEASE MARK IN BLUE OR BLACK |

|

|

|

|

|

|

|

1. | The election of three directors. |

|

|

|

| 2. To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or continuation thereof. |

|

|

|

| NOMINEES: |

|

|

|

|

|

|

|

|

|

o | FOR ALL NOMINEES |

|

|

|

|

|

|

|

| ¡ | Dilip S. Shanghvi |

| Please be sure to sign and date this Proxy. |

|

|

|

|

|

|

|

o | WITHHOLD AUTHORITY |

| ¡ | Jitendra N. Doshi |

| TO INCLUDE ANY COMMENTS, USE THE COMMENTS BOX ON THE REVERSE SIDE OF THIS CARD. |

|

|

|

|

|

| |

o | FOR ALL EXCEPT |

| ¡ | Dr. John D. Crissman |

|

|

|

|

|

|

|

|

INSTRUCTIONS To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT”and fill in the circle next to each nominee you wish to withhold, as shown here:˜ |

|

| ||||

|

|

| ||||