MAKING THE WORLD A BETTER, SAFER, MORE CONNECTED PLACE TO LIVE. Earnings Conference Call May 16, 2019 Quarter Ended March 31, 2019

Cautionary Statement Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about the Company's financial condition and results of operations that are based on management's current expectations, estimates and projections about the markets in which the Company operates, as well as management's current beliefs and assumptions. Words such as "expects," "anticipates," "believes," "estimates" or other similar expressions and future or conditional verbs such as “will,” “should,” “would,” and “could” are intended to identify such forward- looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise. Factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not necessarily limited to, the following: (i) adverse economic conditions could impact our ability to realize operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue to operate and could cause a write down of long-lived assets or goodwill; (ii) an increase in the cost or a decrease in the availability of our principal or single-sourced purchased raw materials; (iii) changes in the competitive environment; (iv) uncertainty of the timing of customer product qualifications in heavily regulated industries; (v) economic, political, or regulatory changes in the countries in which we operate; (vi) difficulties, delays, or unexpected costs in completing the Company’s restructuring plans; (vii) acquisitions and other strategic transactions expose us to a variety of risks, including the ability to successfully integrate and maintain adequate internal controls over financial reporting in compliance with applicable regulations; (viii) our acquisition of TOKIN Corporation may not achieve all of the anticipated results; (ix) our business could be negatively impacted by increased regulatory scrutiny and litigation; (x) difficulties associated with retaining, attracting, and training effective employees and management; (xi) the need to develop innovative products to maintain customer relationships and offset potential price erosion in older products; (xii) exposure to claims alleging product defects; (xiii) the impact of laws and regulations that apply to our business, including those relating to environmental matters, data protection, cyber security and privacy; (xiv) the impact of international laws relating to trade, export controls and foreign corrupt practices; (xv) changes impacting international trade and corporate tax provisions related to the global manufacturing and sales of our products may have an adverse effect on our financial condition and results of operations; (xvi) volatility of financial and credit markets affecting our access to capital; (xvii) default or failure of one or more of our counterparty financial institutions could cause us to incur significant losses; (xviii) the need to reduce the total costs of our products to remain competitive; (xix) potential limitation on the use of net operating losses to offset possible future taxable income; (xx) restrictions in our debt agreements that could limit our flexibility in operating our business; (xxi) service interruption, misappropriation of data, or breaches of security as it relates to our information systems could cause a disruption in our operations, financial losses, and damage to our reputation; (xxii) economic and demographic experience for pension and other post-retirement benefit plans could be less favorable than our assumptions; (xxiii) fluctuation in distributor sales could adversely affect our results of operations; (xxiv) earthquakes and other natural disasters could disrupt our operations and have a material adverse effect on our financial condition and results of operations; and (xxv) volatility in our stock price. 2

ASC 606 Adoption GAAP (Unaudited) KEMET implemented Accounting Standards Codification 606, Revenue from Contracts with Customers (“ASC 606”) as of April 1, 2018 (Fiscal Year 2019). As a result of the implementation of the new standard, the Company changed some of its accounting policies surrounding revenue recognition to be compliant with the new standard. The Company adopted the requirements of ASC 606 using the full retrospective method, which required the Company to restate each prior reporting period presented in our 10-Q's and 10-K's. As such, financial data from fiscal years 2018 and earlier and the related fiscal quarters included in this presentation have been adjusted from what was presented in prior fiscal years to conform with the requirements of ASC 606. For further information on these ASC 606 adjustments, refer to footnote 1 in the Company's fiscal year 2019 10-Q's and the fiscal year 2019 10-K, once issued. 3

Key Drivers of KEMET Financial Success • Tantalum Vertical Integration • Focus on Polymer Technology • Operational Synergies from the TOKIN Acquisition • Ceramic product line focused on "specialty" value added that withstand high temperature, current, vibration, and voltage 4

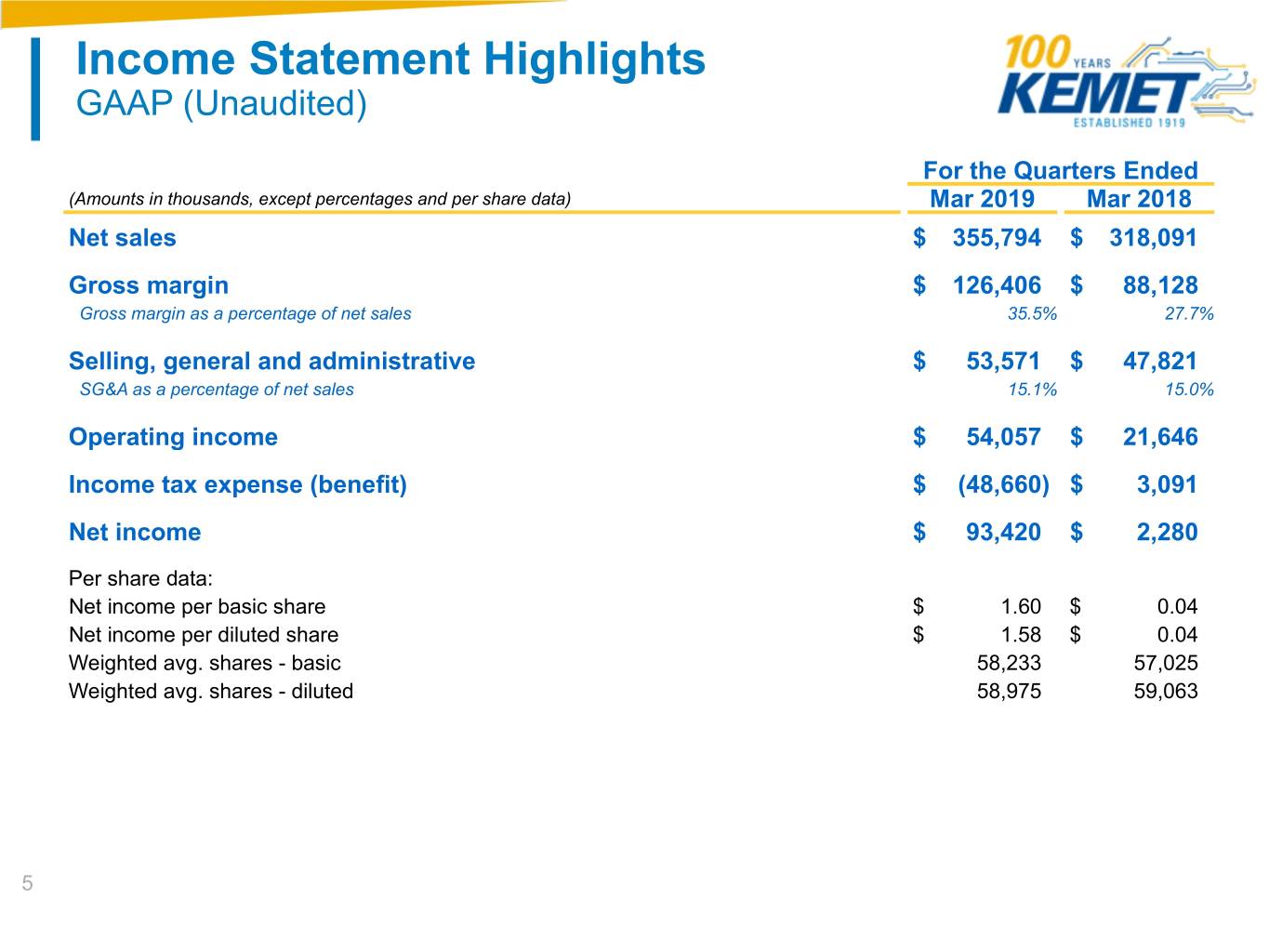

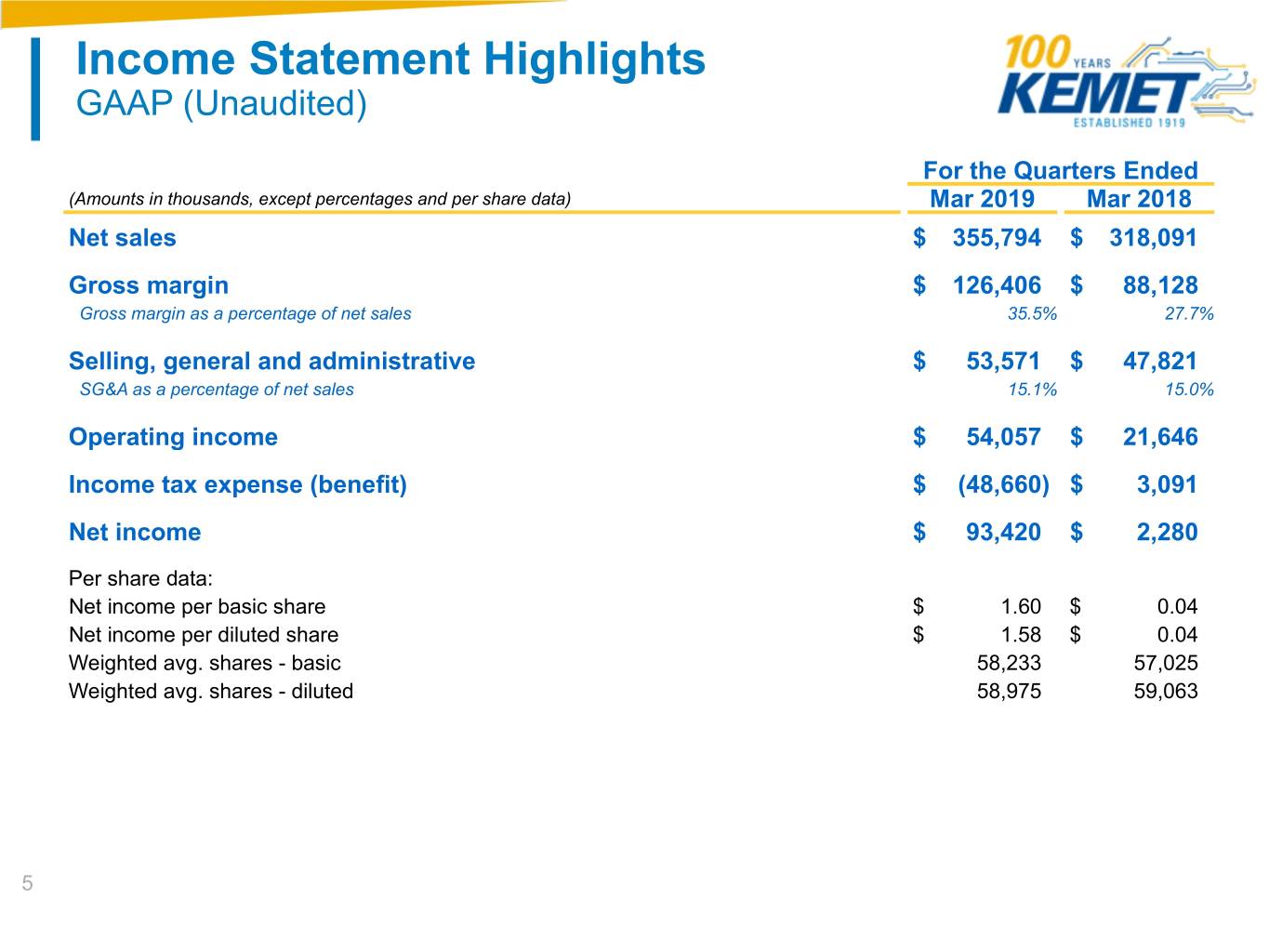

Income Statement Highlights GAAP (Unaudited) For the Quarters Ended (Amounts in thousands, except percentages and per share data) Mar 2019 Mar 2018 Net sales $ 355,794 $ 318,091 Gross margin $ 126,406 $ 88,128 Gross margin as a percentage of net sales 35.5% 27.7% Selling, general and administrative $ 53,571 $ 47,821 SG&A as a percentage of net sales 15.1% 15.0% Operating income $ 54,057 $ 21,646 Income tax expense (benefit) $ (48,660) $ 3,091 Net income $ 93,420 $ 2,280 Per share data: Net income per basic share $ 1.60 $ 0.04 Net income per diluted share $ 1.58 $ 0.04 Weighted avg. shares - basic 58,233 57,025 Weighted avg. shares - diluted 58,975 59,063 5

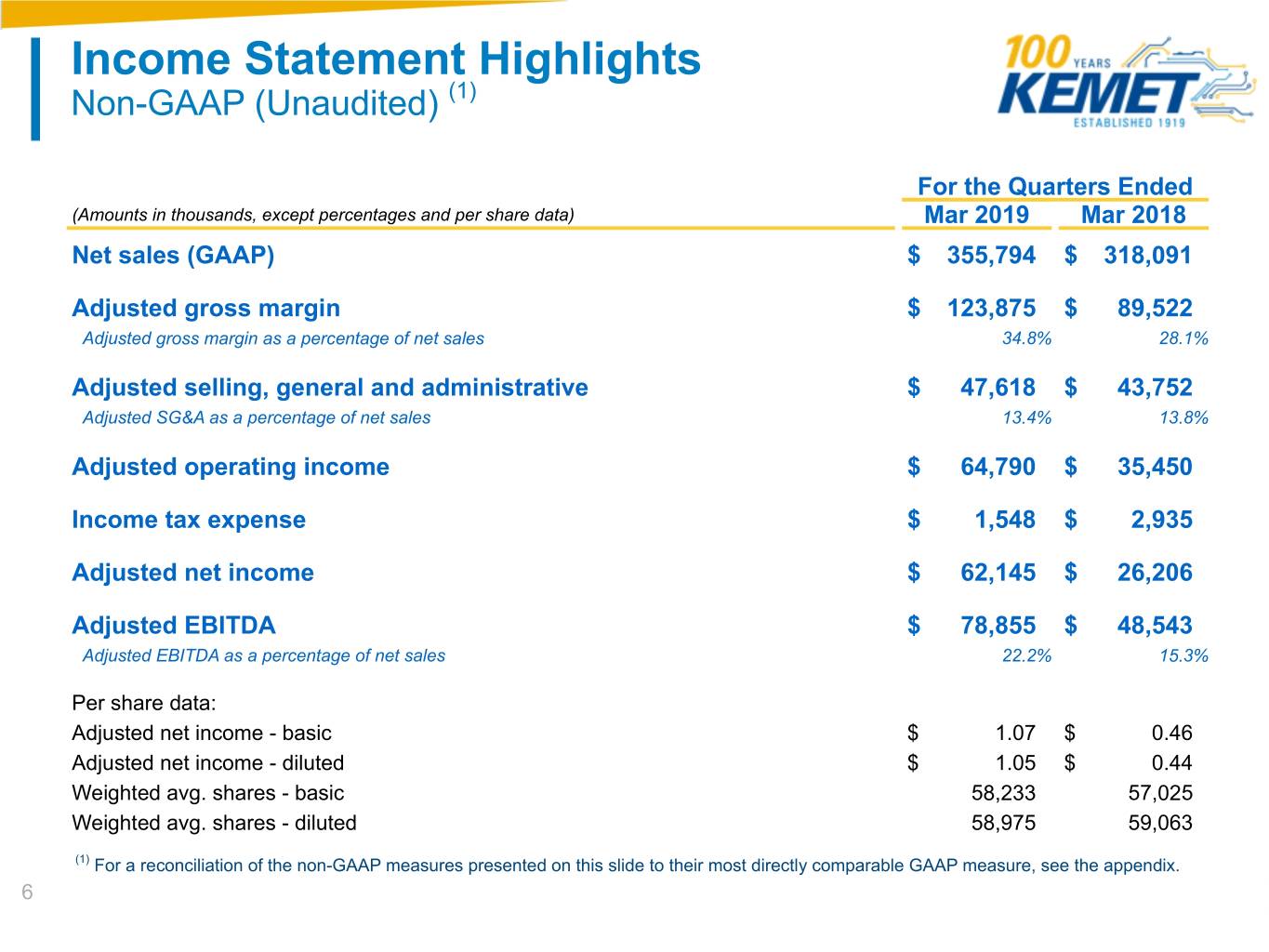

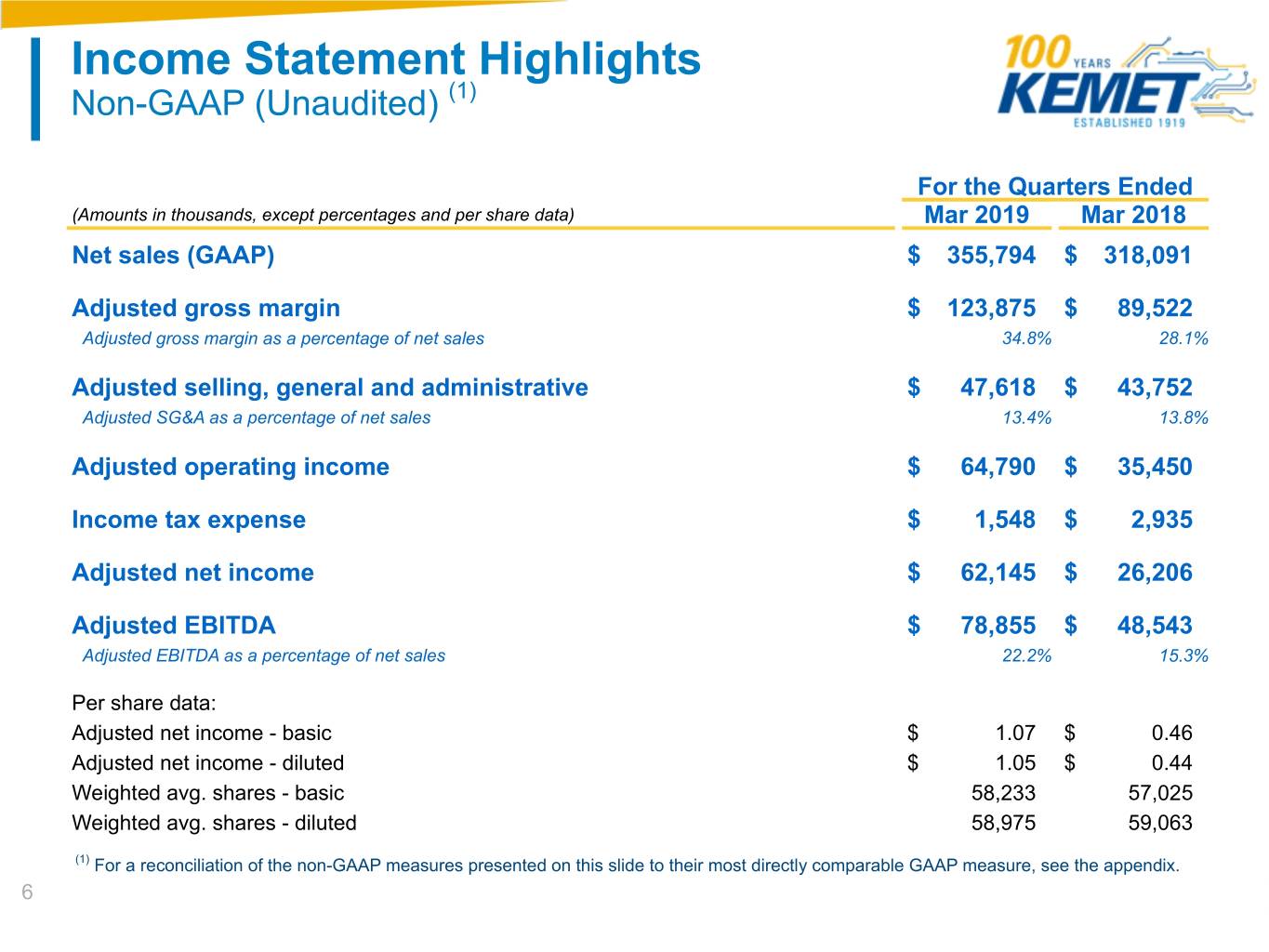

Income Statement Highlights Non-GAAP (Unaudited) (1) For the Quarters Ended (Amounts in thousands, except percentages and per share data) Mar 2019 Mar 2018 Net sales (GAAP) $ 355,794 $ 318,091 Adjusted gross margin $ 123,875 $ 89,522 Adjusted gross margin as a percentage of net sales 34.8% 28.1% Adjusted selling, general and administrative $ 47,618 $ 43,752 Adjusted SG&A as a percentage of net sales 13.4% 13.8% Adjusted operating income $ 64,790 $ 35,450 Income tax expense $ 1,548 $ 2,935 Adjusted net income $ 62,145 $ 26,206 Adjusted EBITDA $ 78,855 $ 48,543 Adjusted EBITDA as a percentage of net sales 22.2% 15.3% Per share data: Adjusted net income - basic $ 1.07 $ 0.46 Adjusted net income - diluted $ 1.05 $ 0.44 Weighted avg. shares - basic 58,233 57,025 Weighted avg. shares - diluted 58,975 59,063 (1) For a reconciliation of the non-GAAP measures presented on this slide to their most directly comparable GAAP measure, see the appendix. 6

Income Statement Highlights GAAP (Unaudited) (Amounts in thousands, except percentages and per share data) FY 2019 FY 2018 Net sales $ 1,382,818 $ 1,200,181 Gross margin $ 458,542 $ 339,437 Gross margin as a percentage of net sales 33.2% 28.3% Selling, general and administrative $ 202,642 $ 173,620 SG&A as a percentage of net sales 14.7% 14.5% Operating income $ 200,849 $ 112,852 Income tax expense (benefit) $ (39,460) $ 9,132 Net income (1) $ 206,587 $ 254,127 Per share data: Net income - basic $ 3.57 $ 4.81 Net income - diluted $ 3.50 $ 4.33 Weighted avg. shares - basic 57,840 52,798 Weighted avg. shares - diluted 59,082 58,640 (1) Fiscal year 2018 net income includes an acquisition gain of $130.1 million related to purchase of TOKIN and $75.2 million in equity income related to our 34% economic interest in TOKIN for the 19-day period ended April 19, 2017. 7

Income Statement Highlights Non-GAAP (Unaudited) (1) (Amounts in thousands, except percentages and per share data) FY 2019 FY 2018 Net sales (GAAP) $ 1,382,818 $ 1,200,181 Adjusted gross margin $ 460,371 $ 341,885 Adjusted gross margin as a percentage of net sales 33.3% 28.5% Adjusted selling, general and administrative $ 178,883 $ 160,914 Adjusted SG&A as a percentage of net sales 12.9% 13.4% Adjusted operating income $ 237,235 $ 142,105 Income tax expense $ 10,551 $ 9,162 Adjusted net income $ 208,995 $ 102,276 Adjusted EBITDA $ 289,507 $ 191,705 Per share data: Adjusted net income - basic $ 3.61 $ 1.94 Adjusted net income - diluted $ 3.54 $ 1.74 Weighted avg. shares - basic 57,840 52,798 Weighted avg. shares - diluted 59,082 58,640 (1) For a reconciliation of the non-GAAP measures presented on this slide to their most directly comparable GAAP measure, see the appendix. 8

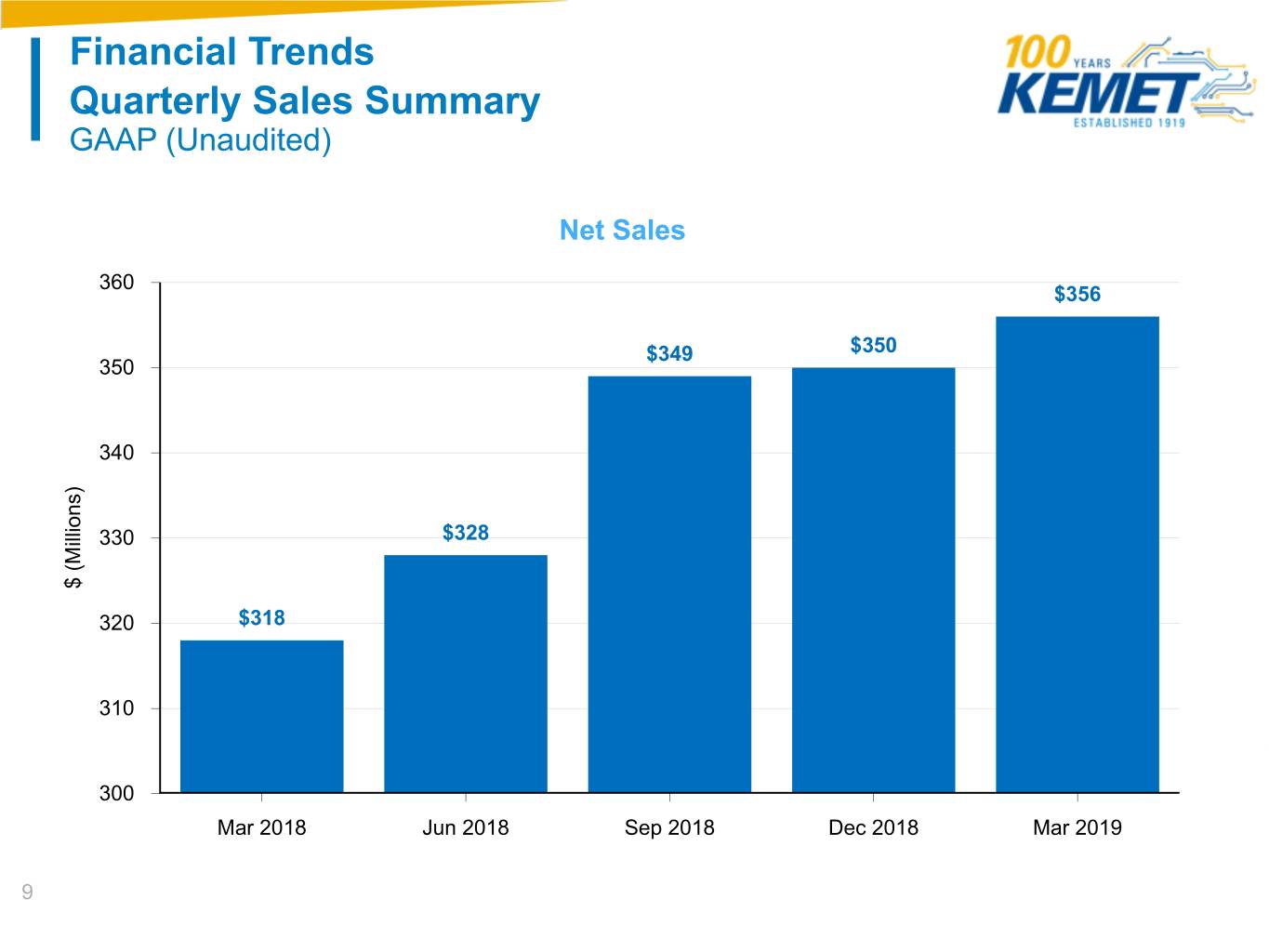

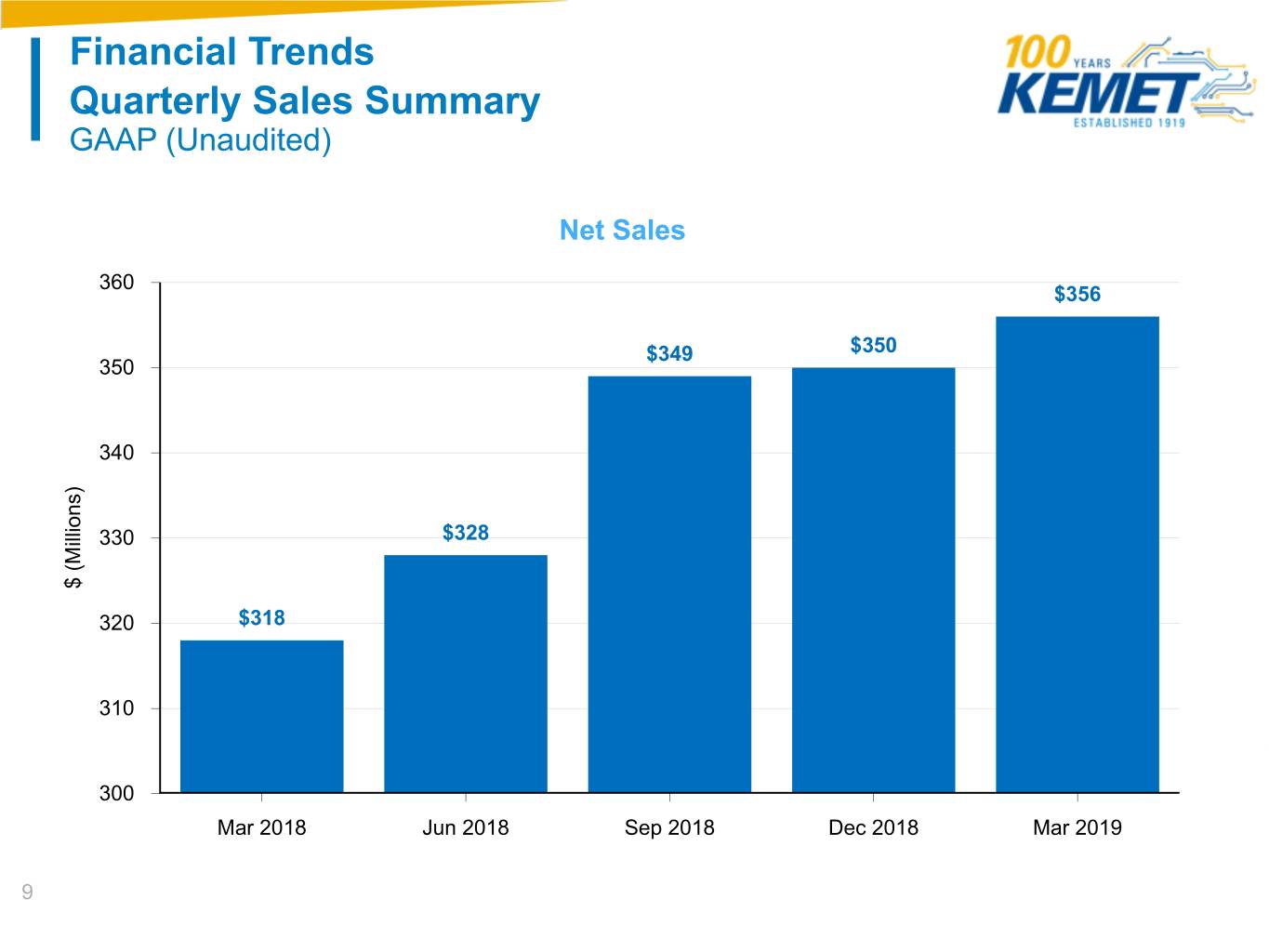

Financial Trends Quarterly Sales Summary GAAP (Unaudited) Net Sales 360 $356 $349 $350 350 340 ) s n o i l l $328 i 330 M ( $ 320 $318 310 300 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 9

LTM Operating Income Margins GAAP (Unaudited) 16.0% 15.0% 14.5% 14.0% 13.0% 12.5% 12.0% 11.0% 10.7% 10.0% 9.6% 9.4% 9.0% 8.0% Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 10

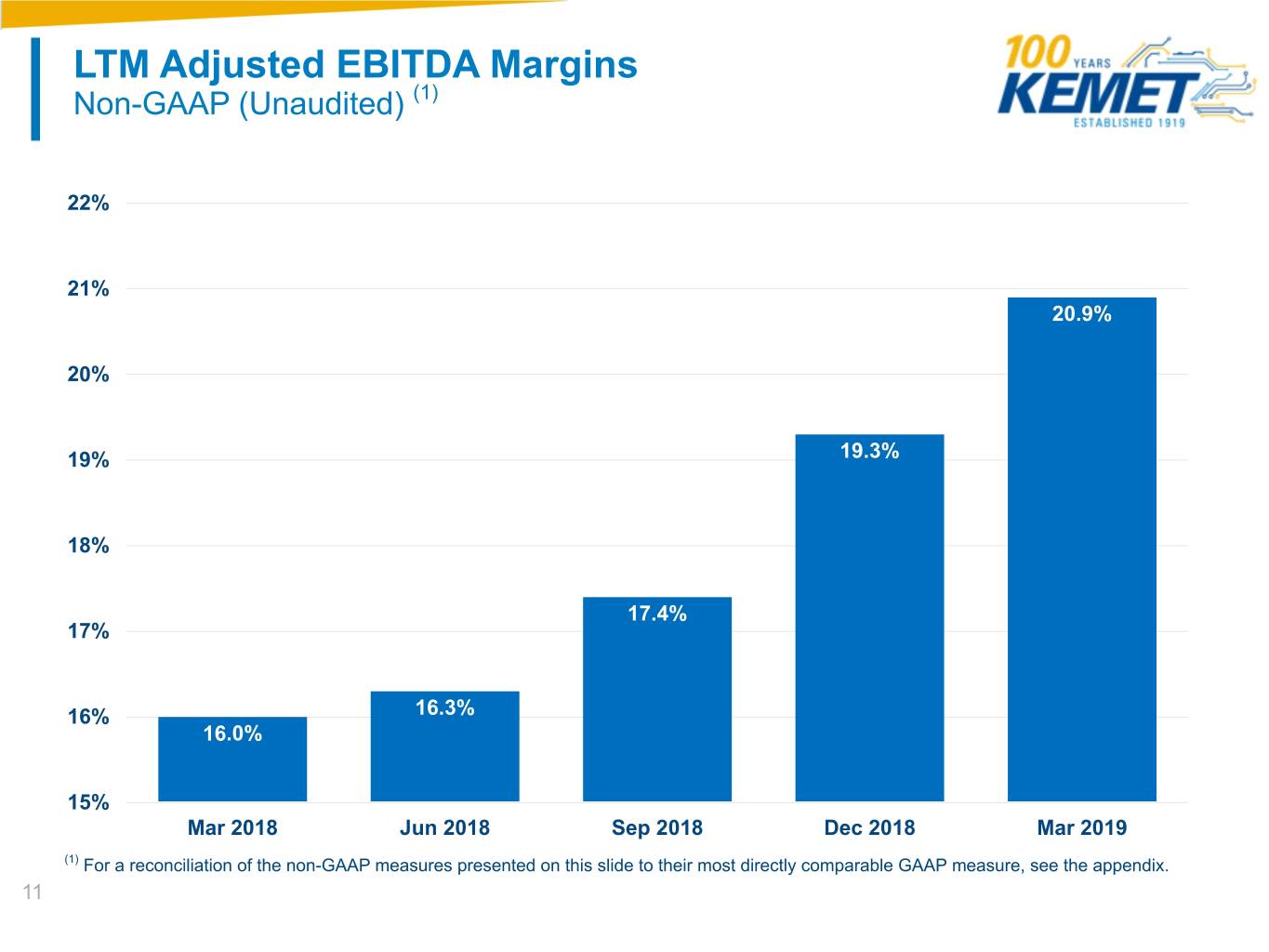

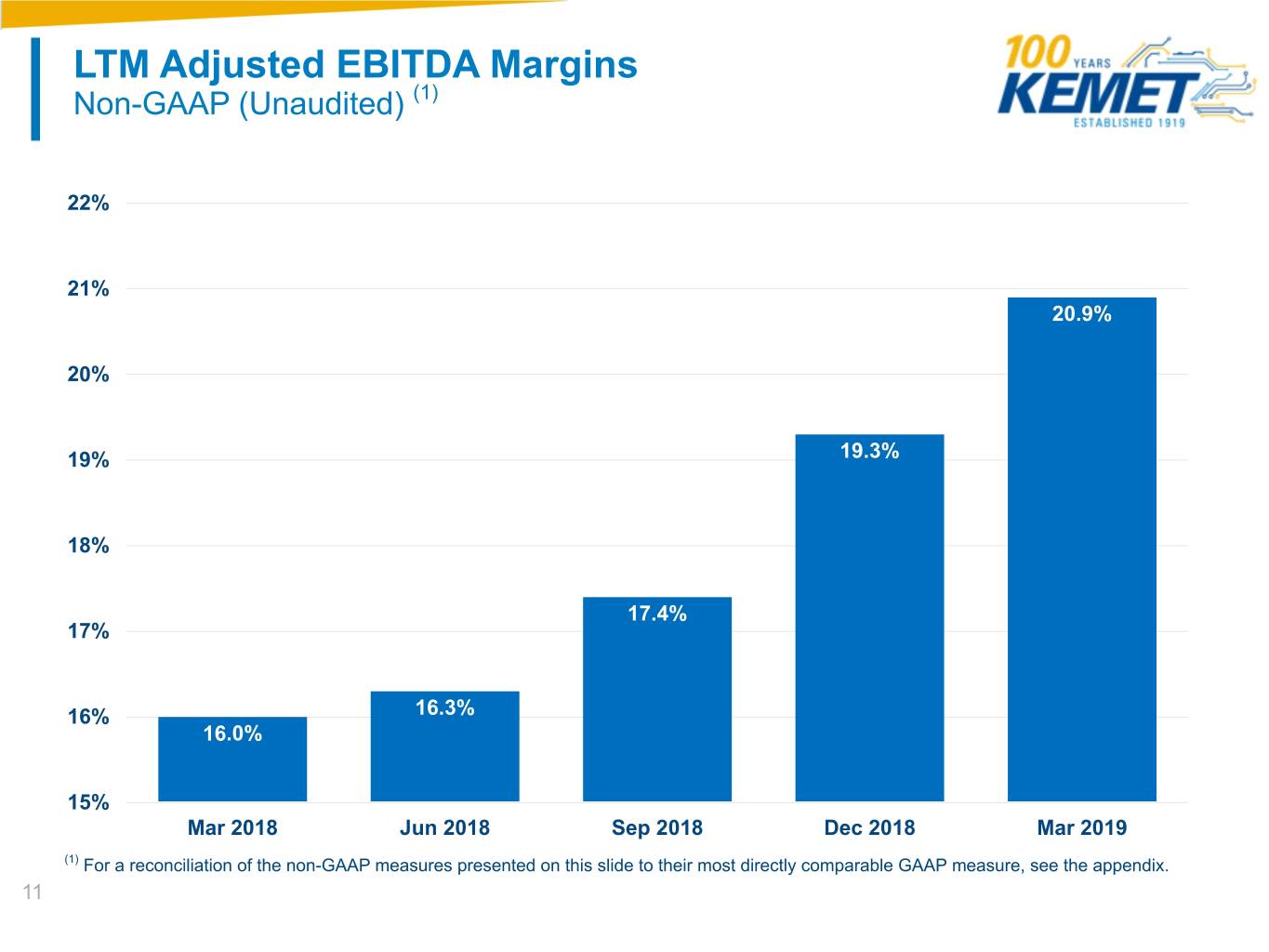

LTM Adjusted EBITDA Margins Non-GAAP (Unaudited) (1) 22% 21% 20.9% 20% 19% 19.3% 18% 17.4% 17% 16% 16.3% 16.0% 15% Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 (1) For a reconciliation of the non-GAAP measures presented on this slide to their most directly comparable GAAP measure, see the appendix. 11

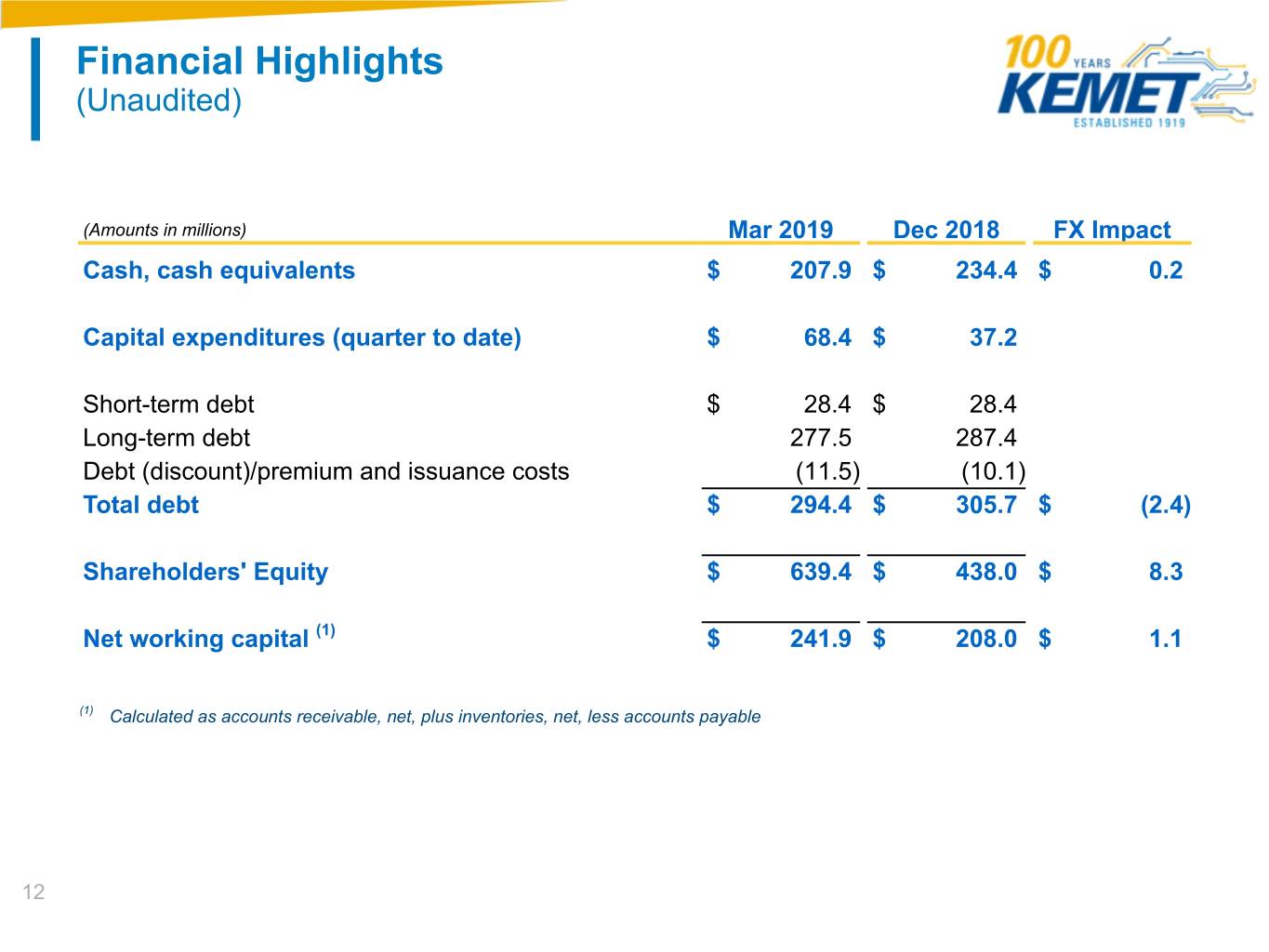

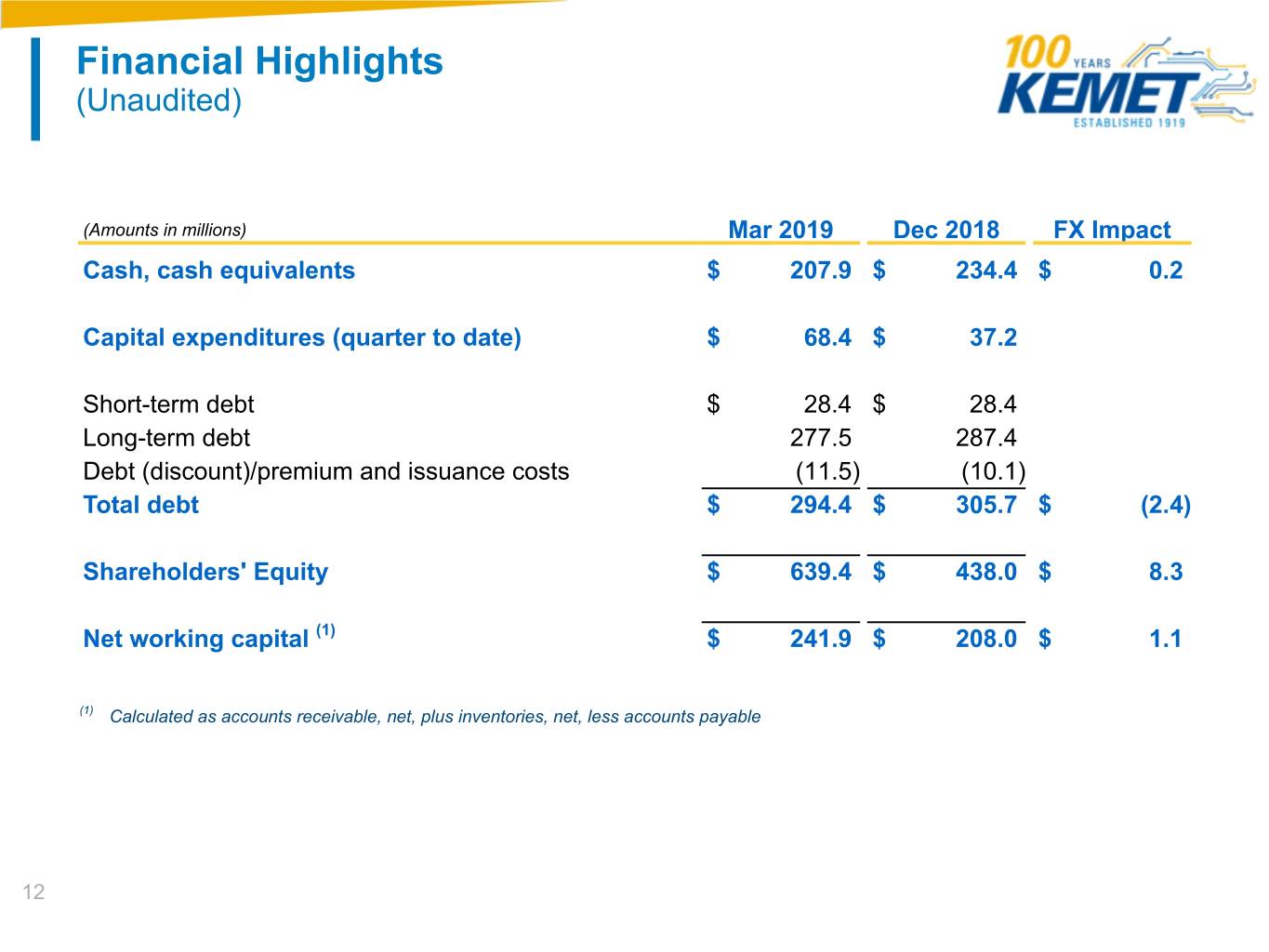

Financial Highlights (Unaudited) (Amounts in millions) Mar 2019 Dec 2018 FX Impact Cash, cash equivalents $ 207.9 $ 234.4 $ 0.2 Capital expenditures (quarter to date) $ 68.4 $ 37.2 Short-term debt $ 28.4 $ 28.4 Long-term debt 277.5 287.4 Debt (discount)/premium and issuance costs (11.5) (10.1) Total debt $ 294.4 $ 305.7 $ (2.4) Shareholders' Equity $ 639.4 $ 438.0 $ 8.3 Net working capital (1) $ 241.9 $ 208.0 $ 1.1 (1) Calculated as accounts receivable, net, plus inventories, net, less accounts payable 12

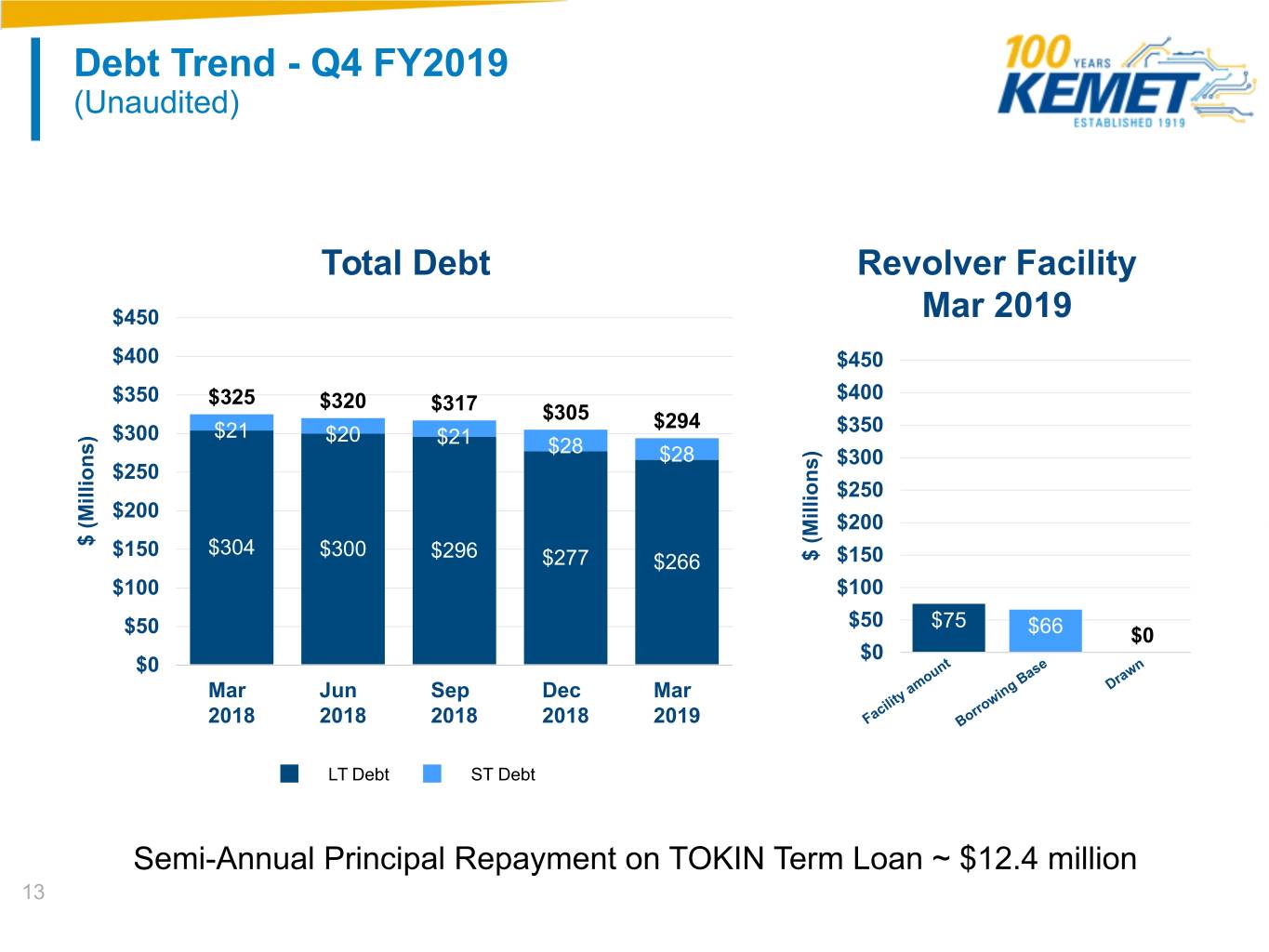

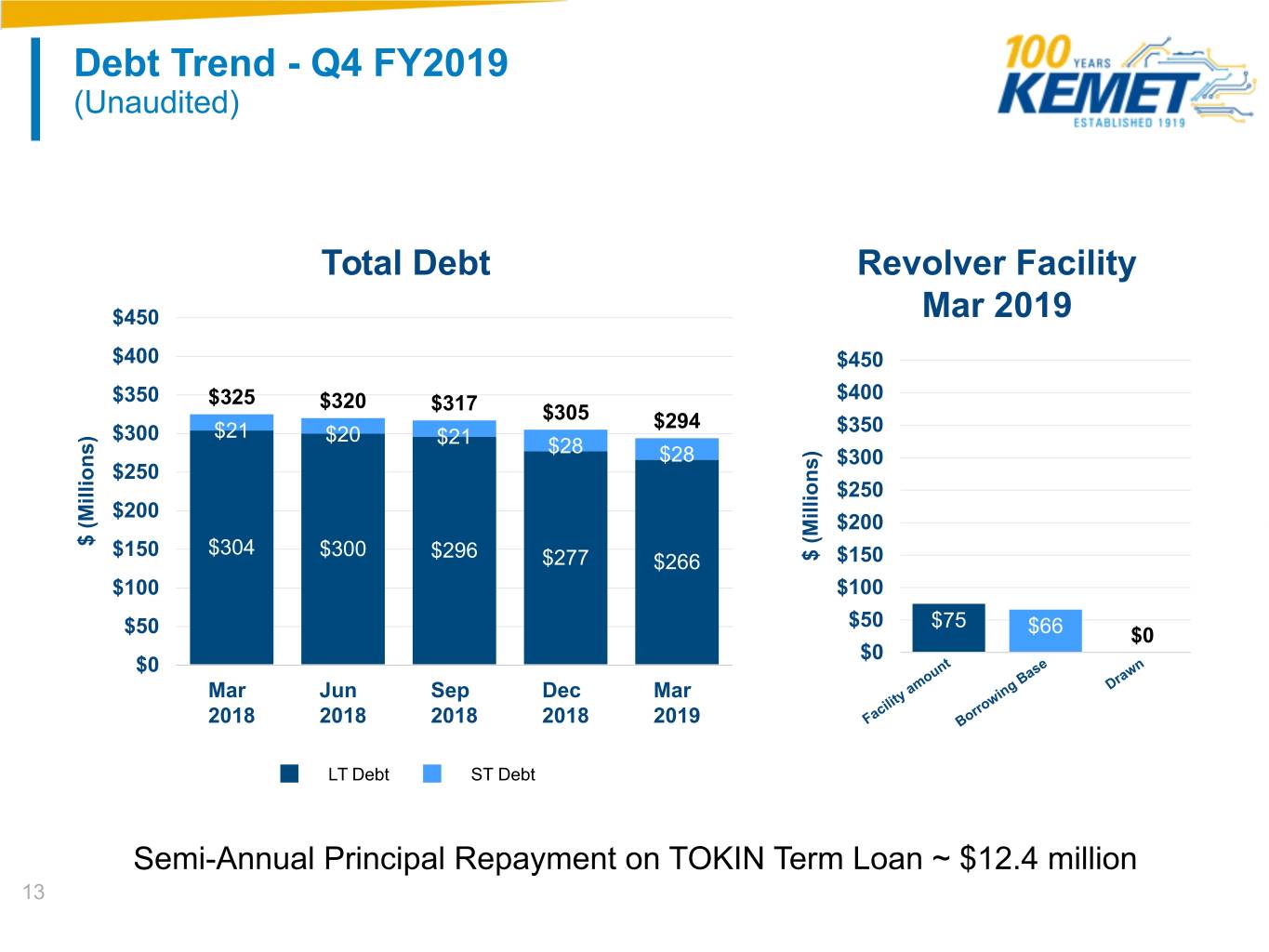

Debt Trend - Q4 FY2019 (Unaudited) Total Debt Revolver Facility $450 Mar 2019 $400 $450 $350 $325 $320 $400 $317 $305 $21 $294 $350 ) $300 $20 $21 s $28 $28 ) n $300 s o $250 n i l o l $250 i i l l i M $200 ( $200 M ( $ $150 $304 $300 $296 $ $277 $266 $150 $100 $100 $50 $75 $50 $66 $0 $0 nt e n $0 u as w o B ra am g D Mar Jun Sep Dec Mar y in lit w ci ro a or 2018 2018 2018 2018 2019 F B LT Debt ST Debt Semi-Annual Principal Repayment on TOKIN Term Loan ~ $12.4 million 13

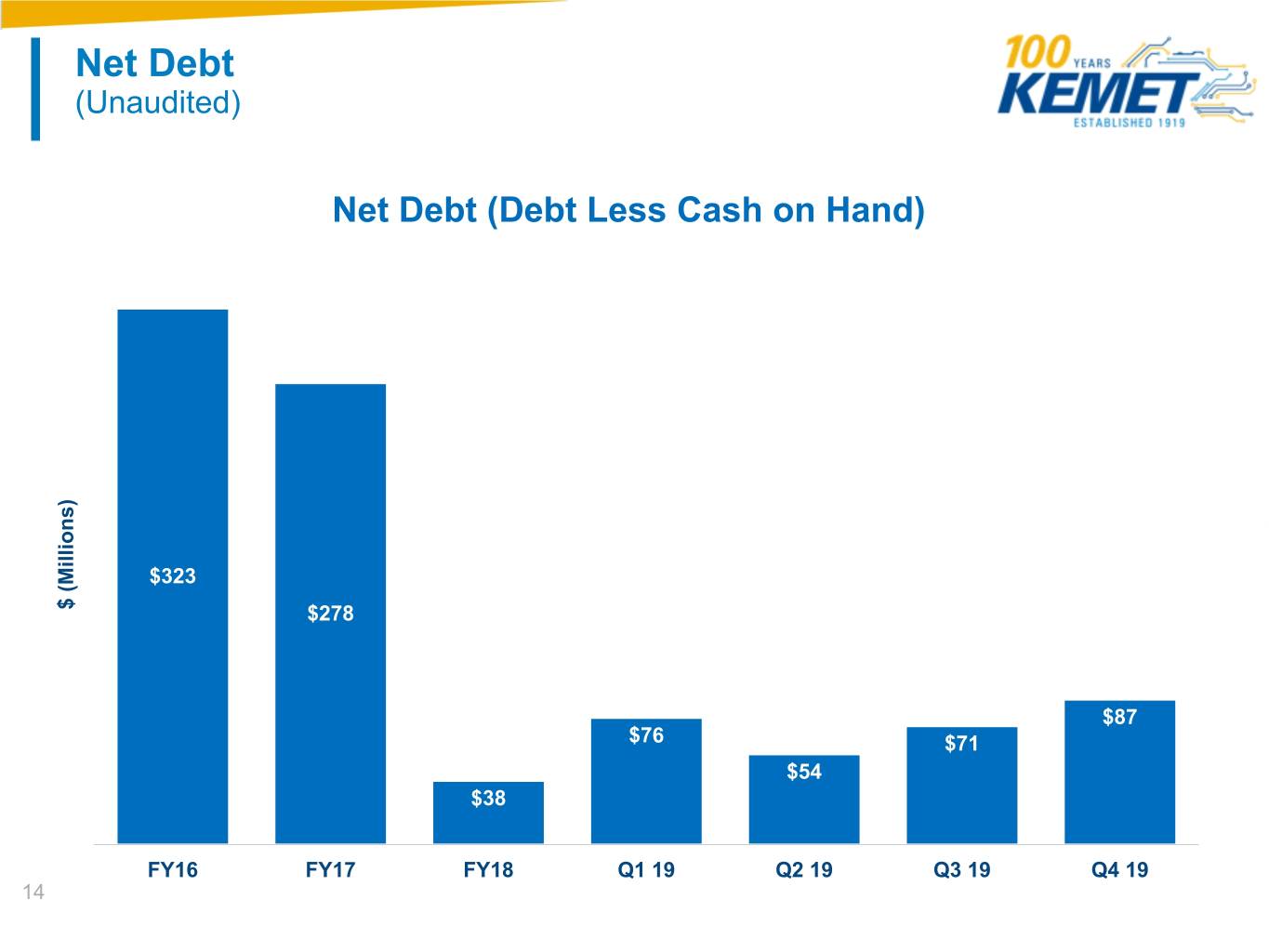

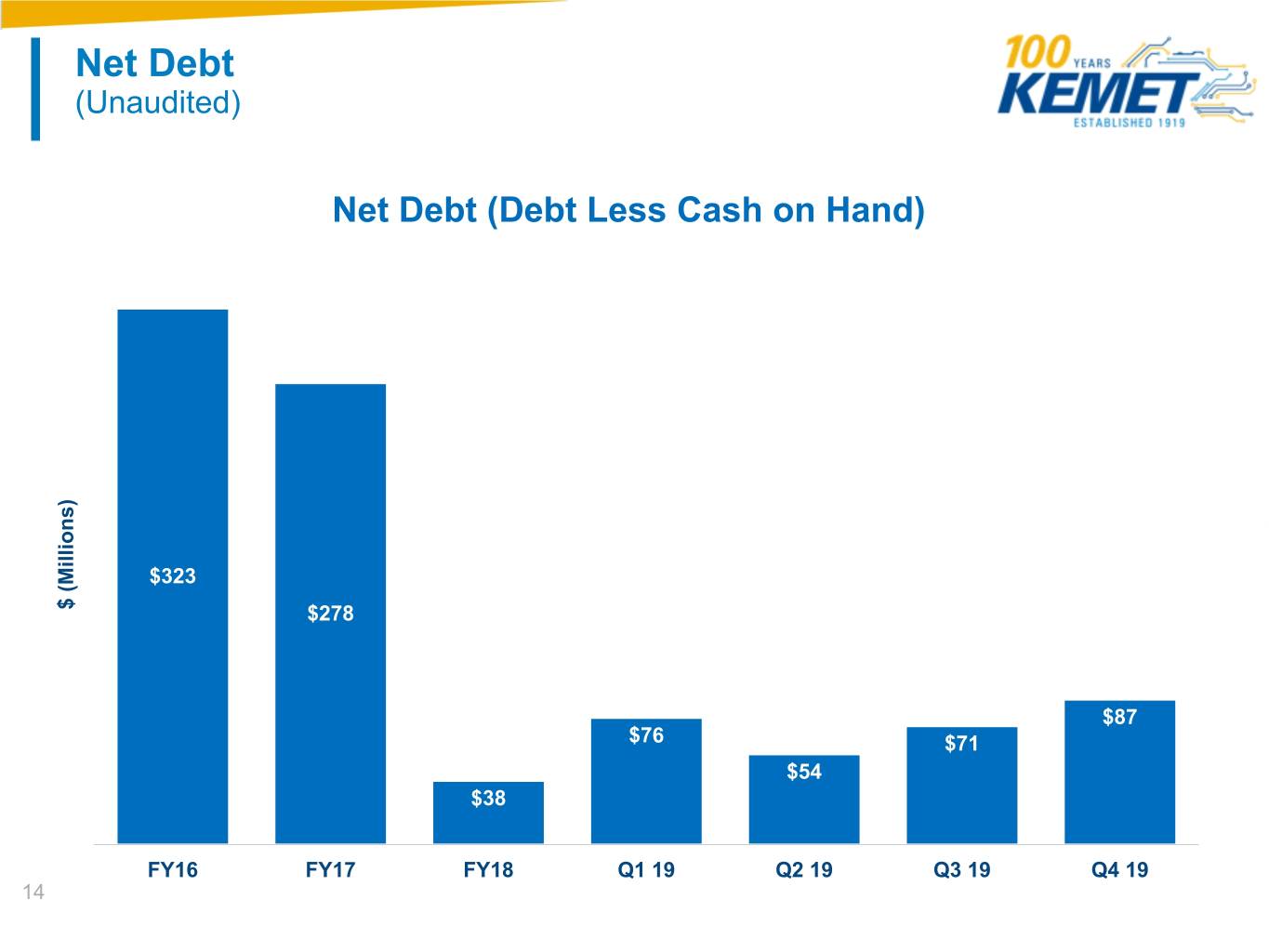

Net Debt (Unaudited) Net Debt (Debt Less Cash on Hand) ) s n o i l l i M $323 ( $ $278 $87 $76 $71 $54 $38 FY16 FY17 FY18 Q1 19 Q2 19 Q3 19 Q4 19 14

Leverage Non-GAAP (Unaudited) (1) Leverage (Debt/Adjusted EBITDA) 3.7 1.7 1.6 1.4 1.2 1.0 FY17 FY18 6/30/18 TTM 9/30/18 TTM 12/31/18 TTM FY19 (1) For a reconciliation of the non-GAAP measures presented on this slide to their most directly comparable GAAP measure, see the appendix. 15

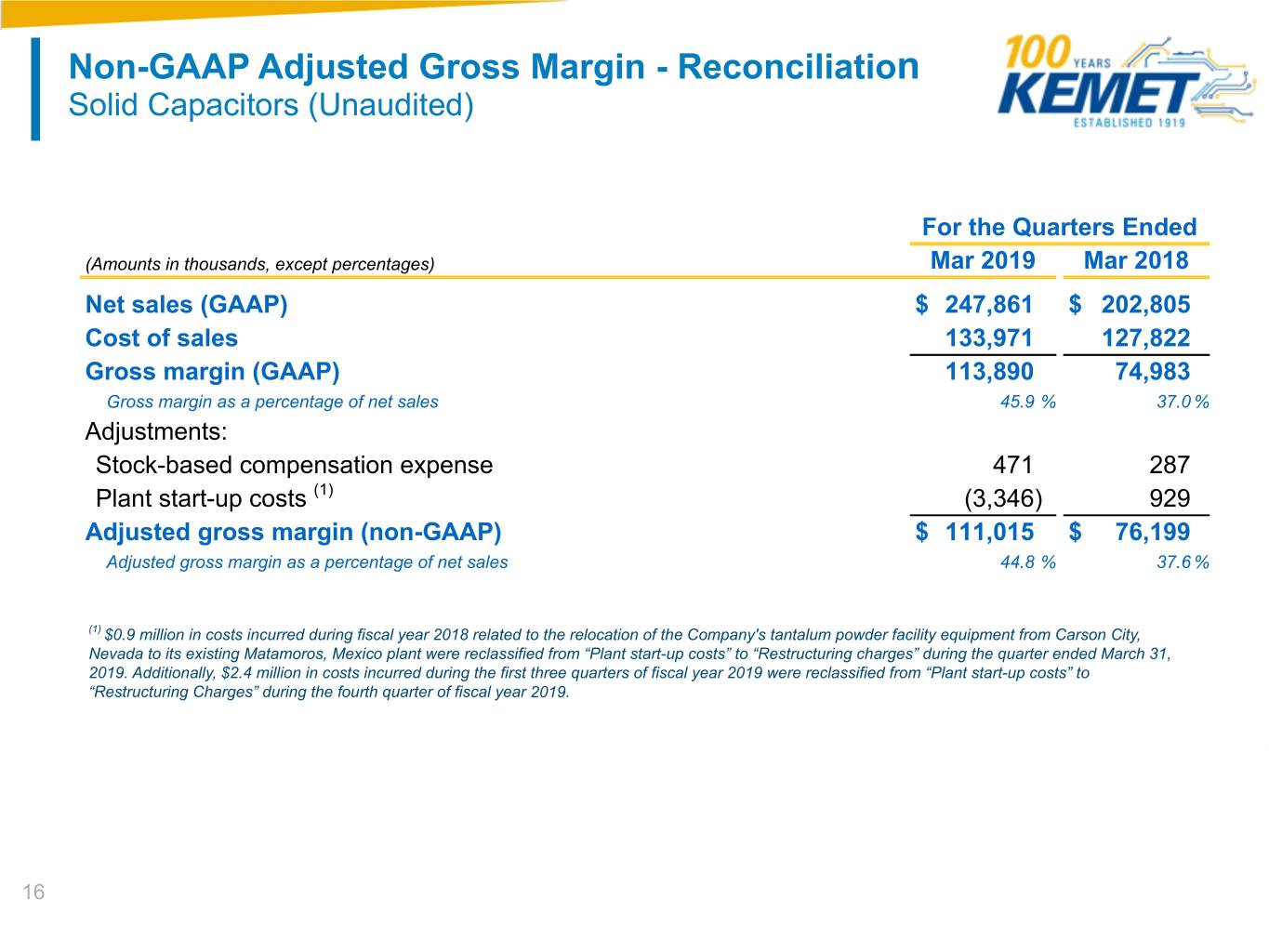

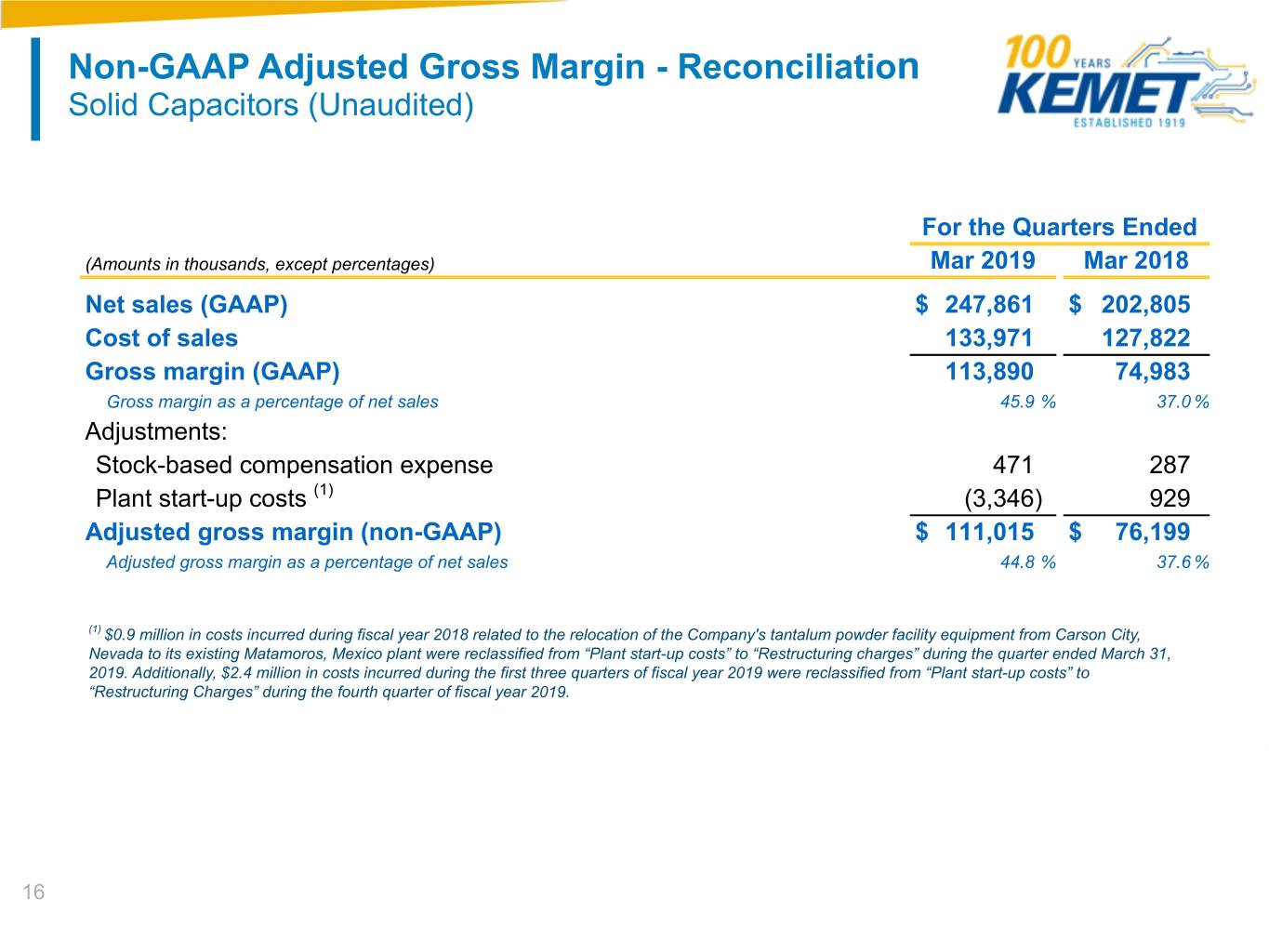

Non-GAAP Adjusted Gross Margin - Reconciliation Solid Capacitors (Unaudited) For the Quarters Ended (Amounts in thousands, except percentages) Mar 2019 Mar 2018 Net sales (GAAP) $ 247,861 $ 202,805 Cost of sales 133,971 127,822 Gross margin (GAAP) 113,890 74,983 Gross margin as a percentage of net sales 45.9 % 37.0 % Adjustments: Stock-based compensation expense 471 287 Plant start-up costs (1) (3,346) 929 Adjusted gross margin (non-GAAP) $ 111,015 $ 76,199 Adjusted gross margin as a percentage of net sales 44.8 % 37.6 % (1) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019. 16

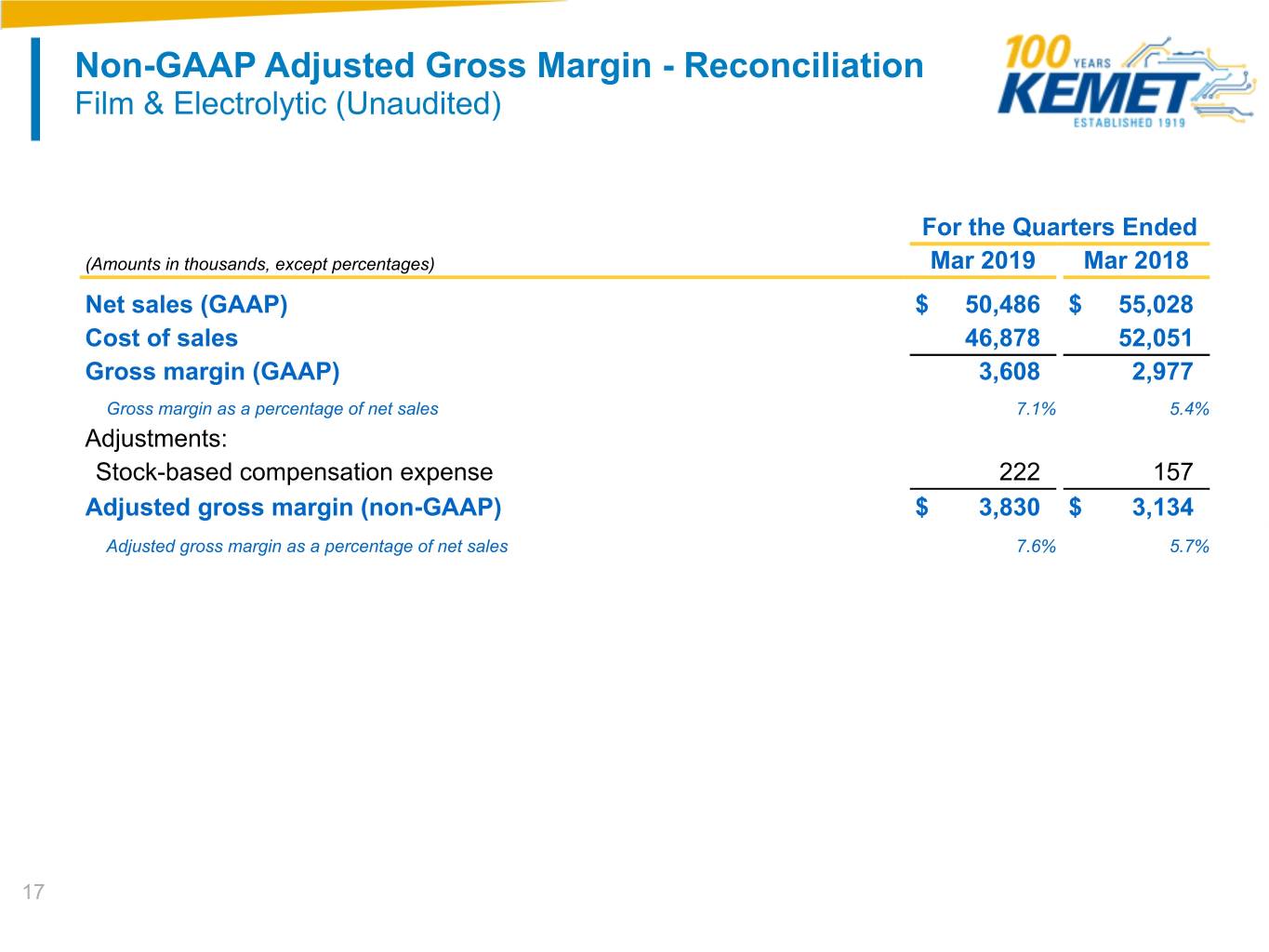

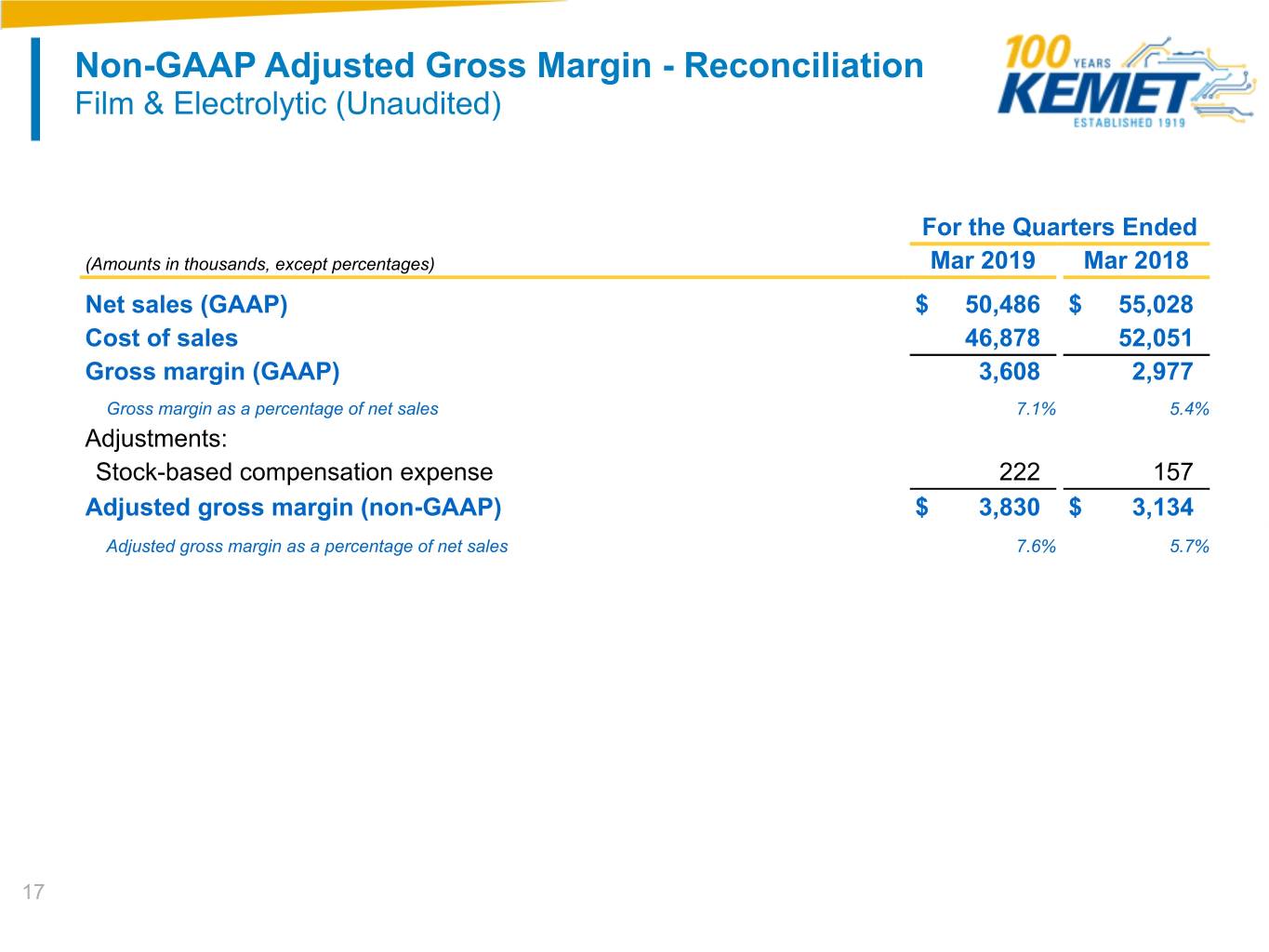

Non-GAAP Adjusted Gross Margin - Reconciliation Film & Electrolytic (Unaudited) For the Quarters Ended (Amounts in thousands, except percentages) Mar 2019 Mar 2018 Net sales (GAAP) $ 50,486 $ 55,028 Cost of sales 46,878 52,051 Gross margin (GAAP) 3,608 2,977 Gross margin as a percentage of net sales 7.1% 5.4% Adjustments: Stock-based compensation expense 222 157 Adjusted gross margin (non-GAAP) $ 3,830 $ 3,134 Adjusted gross margin as a percentage of net sales 7.6% 5.7% 17

Non-GAAP Adjusted Gross Margin - Reconciliation Electro-magnetic, Sensors & Actuators (Unaudited) For the Quarters Ended (Amounts in thousands, except percentages) Mar 2019 Mar 2018 Net sales (GAAP) $ 57,447 $ 60,258 Cost of sales 48,539 50,090 Gross margin (GAAP) 8,908 10,168 Gross margin as a percentage of net sales 15.5 % 16.9 % Adjustments: Stock-based compensation expense 122 21 Adjusted gross margin (non-GAAP) $ 9,030 $ 10,189 Adjusted gross margin as a percentage of net sales 15.7 % 16.9 % 18

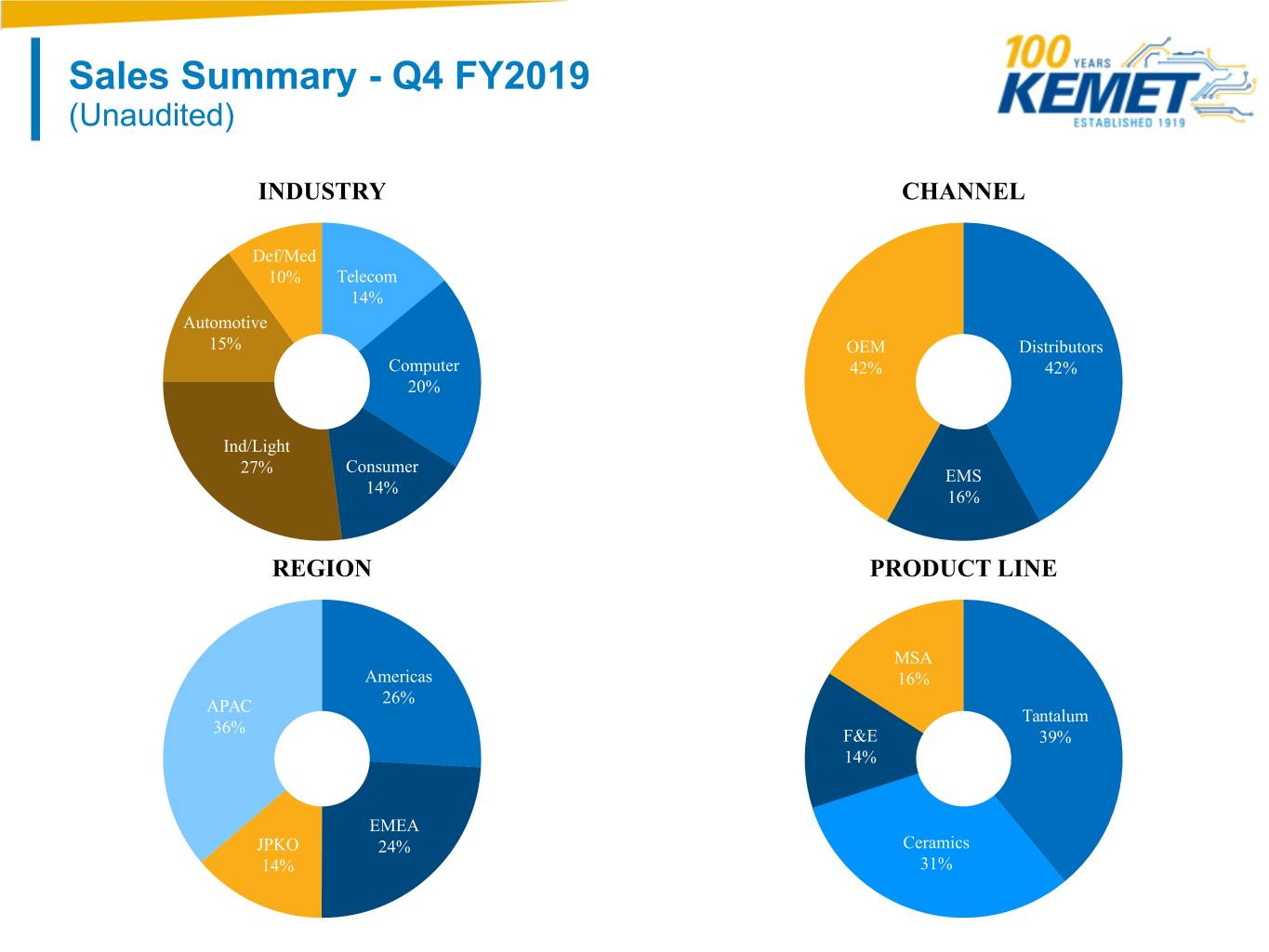

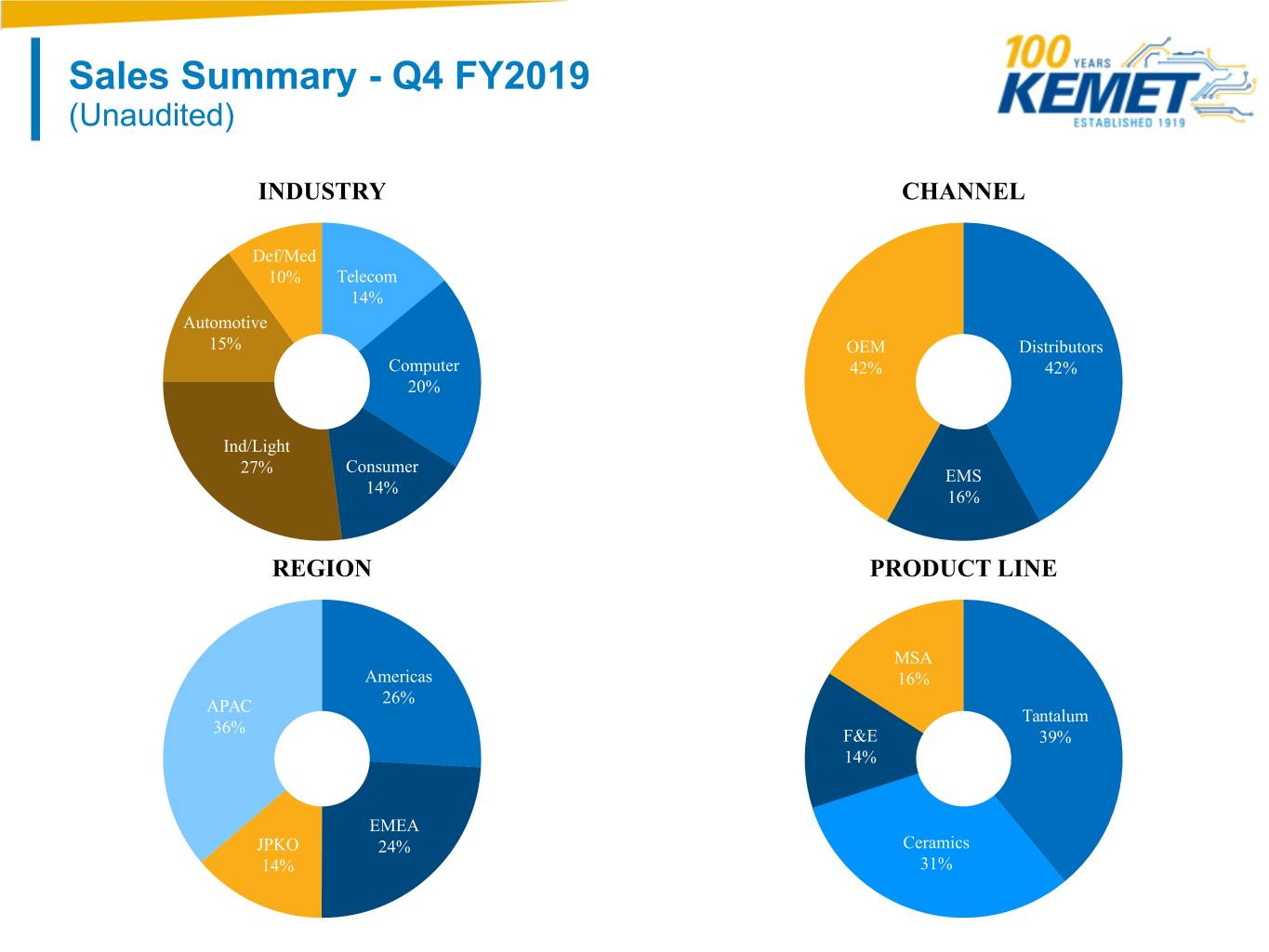

Sales Summary - Q4 FY2019 (Unaudited) INDUSTRY CHANNEL Def/Med 10% Telecom 14% Automotive 15% OEM Distributors Computer 42% 42% 20% Ind/Light Consumer 27% EMS 14% 16% REGION PRODUCT LINE MSA Americas 16% APAC 26% Tantalum 36% F&E 39% 14% EMEA JPKO 24% Ceramics 14% 31%

Sales Summary - FY 2019 (Unaudited) INDUSTRY CHANNEL Def/Med 10% Telecom 14% Automotive 15% OEM Distributors Computer 43% 42% 21% Ind/Light 26% Consumer EMS 14% 15% REGION PRODUCT LINE MSA Americas 17% 24% APAC Tantalum 39% F&E 41% 15% EMEA 23% JPKO Ceramics 14% 27%

Adjusted Gross Margin Reconciliation Non-GAAP (Unaudited) For the Quarters Ended Fiscal Year (Amounts in thousands, except percentages) Mar 2019 Mar 2018 2019 2018 Net sales (GAAP) $ 355,794 $ 318,091 $ 1,382,818 $ 1,200,181 Cost of sales 229,388 229,963 924,276 860,744 Gross margin (GAAP) $ 126,406 $ 88,128 $ 458,542 $ 339,437 Gross margin as a percentage of net sales 35.5 % 27.7 % 33.2 % 28.3 % Non-GAAP Adjustments: Stock-based compensation expense 815 465 2,756 1,519 Plant start-up costs (1) (3,346) 929 (927) 929 Adjusted gross margin (non-GAAP) $ 123,875 $ 89,522 $ 460,371 $ 341,885 Adjusted gross margin as a percentage of net sales 34.8% 28.1% 33.3% 28.5% (1) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019. 22

Adjusted Selling, General & Administrative Expenses Reconciliation Non-GAAP (Unaudited) For the Quarters Ended Fiscal Year (Amounts in thousands, except percentages) Mar 2019 Mar 2018 2019 2018 Net sales (GAAP) $ 355,794 $ 318,091 $ 1,382,818 $ 1,200,181 Selling, general and administrative expenses (GAAP) $ 53,571 $ 47,821 $ 202,642 $ 173,620 Selling, general, and administrative as a percentage of net sales 15.1% 15.0% 14.7% 14.5% Less non-GAAP adjustments: ERP integration costs/IT transition costs 3,117 80 8,813 80 Stock-based compensation expense 1,935 2,251 9,751 5,890 Legal expenses/fines related to antitrust class actions 901 1,738 5,195 6,736 Adjusted selling, general and administrative expenses (non-GAAP) $ 47,618 $ 43,752 $ 178,883 $ 160,914 Adjusted selling, general, and administrative as a percentage of net sales 13.4% 13.8% 12.9% 13.4% 23

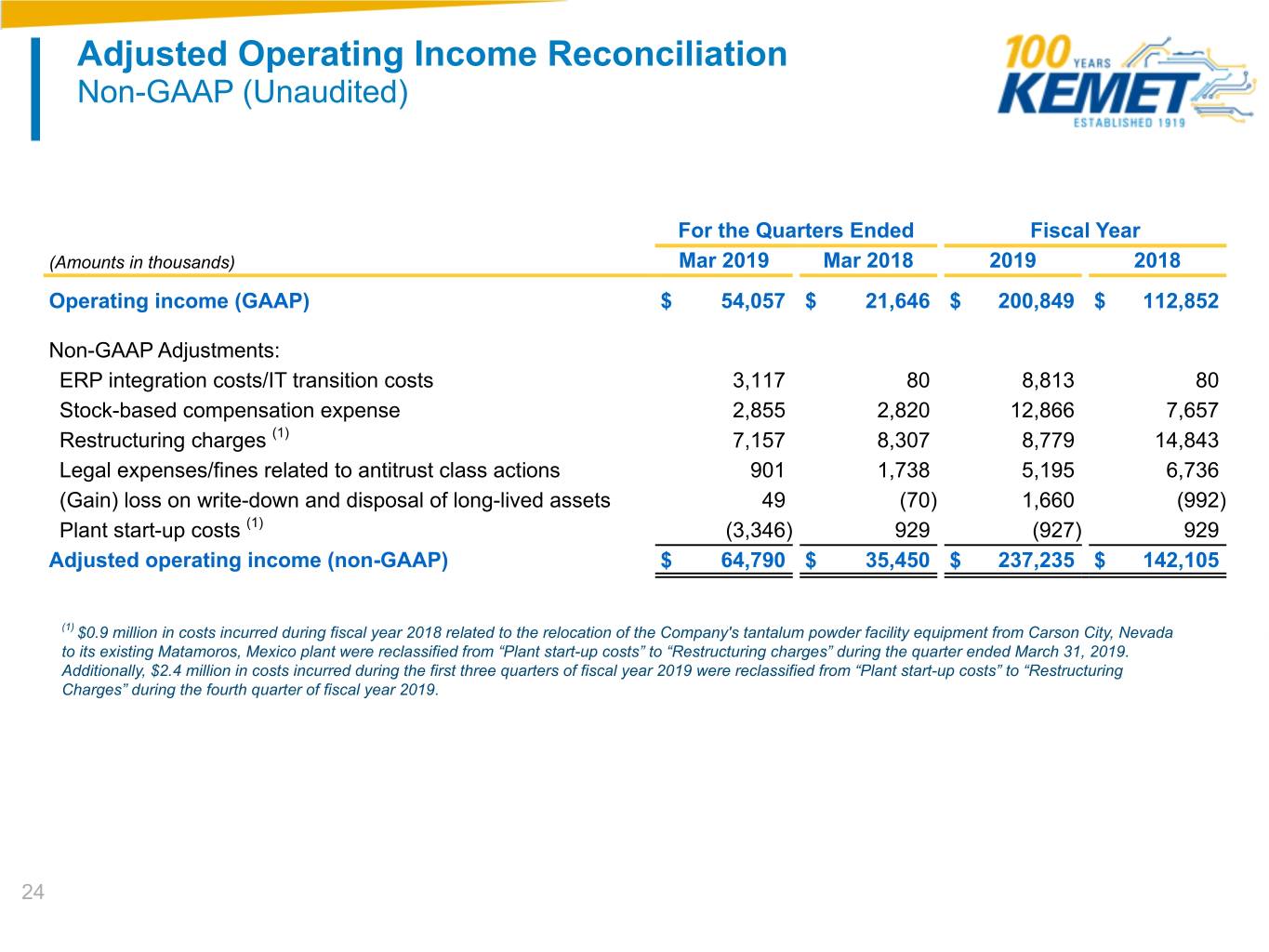

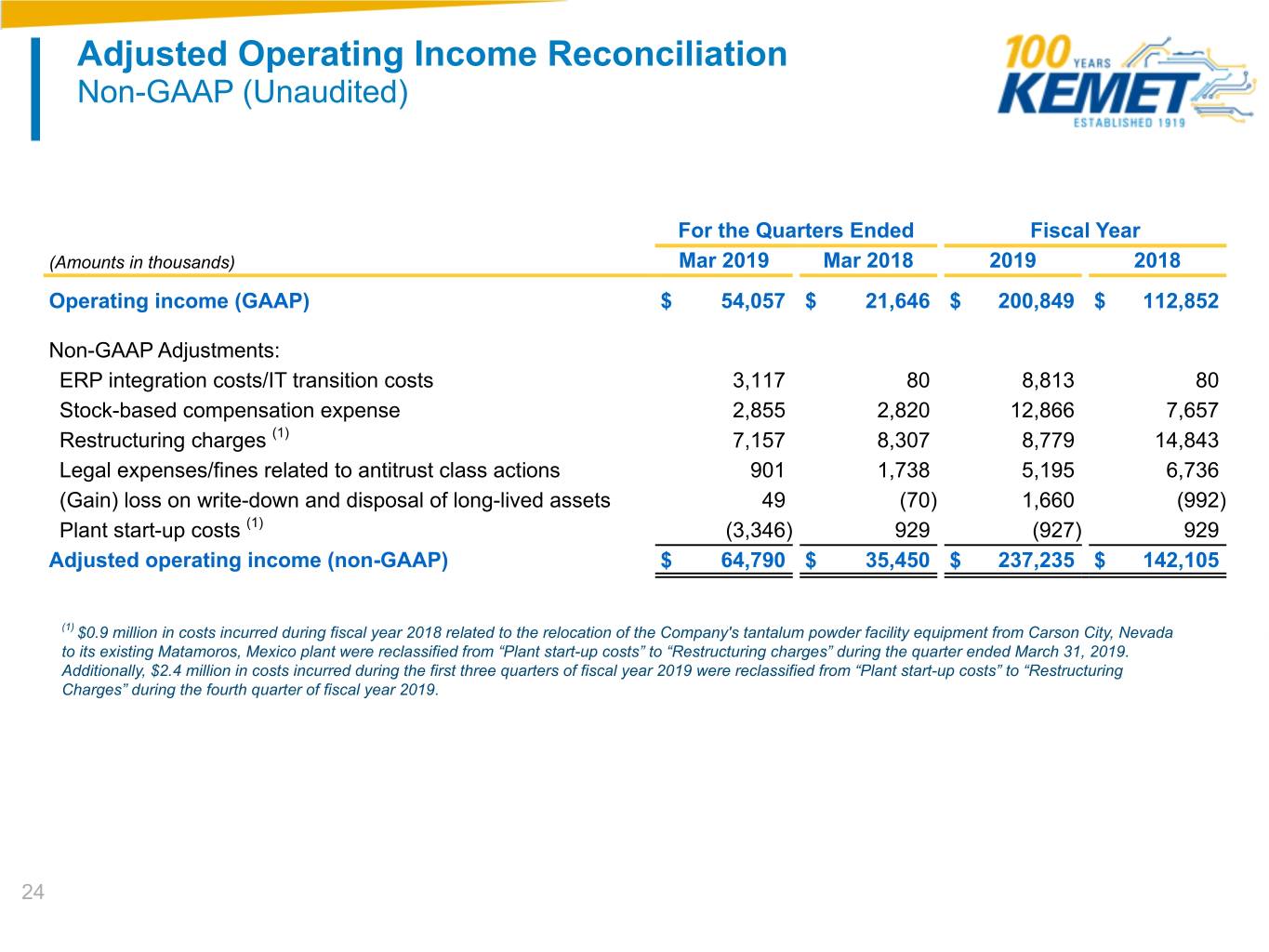

Adjusted Operating Income Reconciliation Non-GAAP (Unaudited) For the Quarters Ended Fiscal Year (Amounts in thousands) Mar 2019 Mar 2018 2019 2018 Operating income (GAAP) $ 54,057 $ 21,646 $ 200,849 $ 112,852 Non-GAAP Adjustments: ERP integration costs/IT transition costs 3,117 80 8,813 80 Stock-based compensation expense 2,855 2,820 12,866 7,657 Restructuring charges (1) 7,157 8,307 8,779 14,843 Legal expenses/fines related to antitrust class actions 901 1,738 5,195 6,736 (Gain) loss on write-down and disposal of long-lived assets 49 (70) 1,660 (992) Plant start-up costs (1) (3,346) 929 (927) 929 Adjusted operating income (non-GAAP) $ 64,790 $ 35,450 $ 237,235 $ 142,105 (1) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019. 24

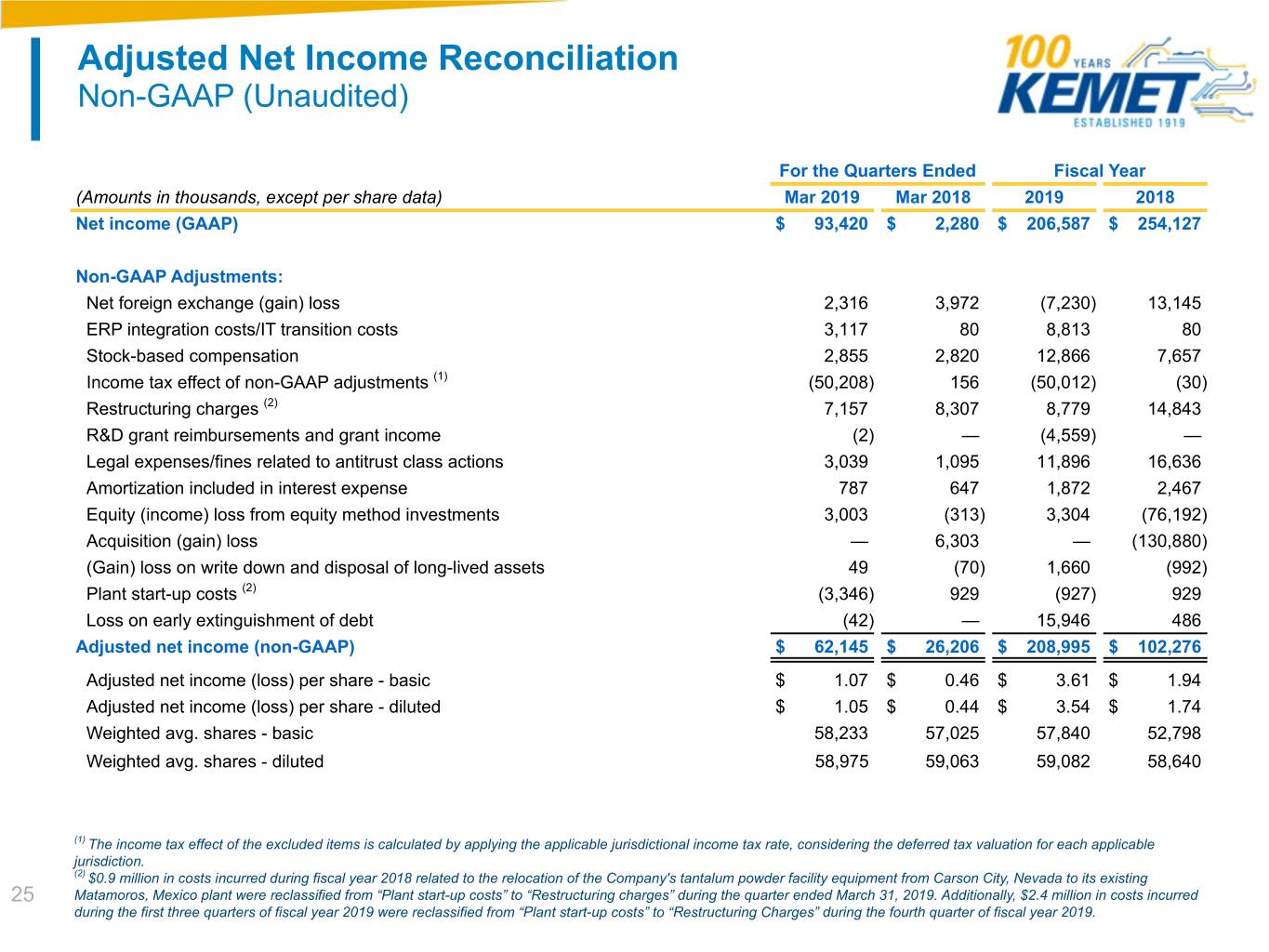

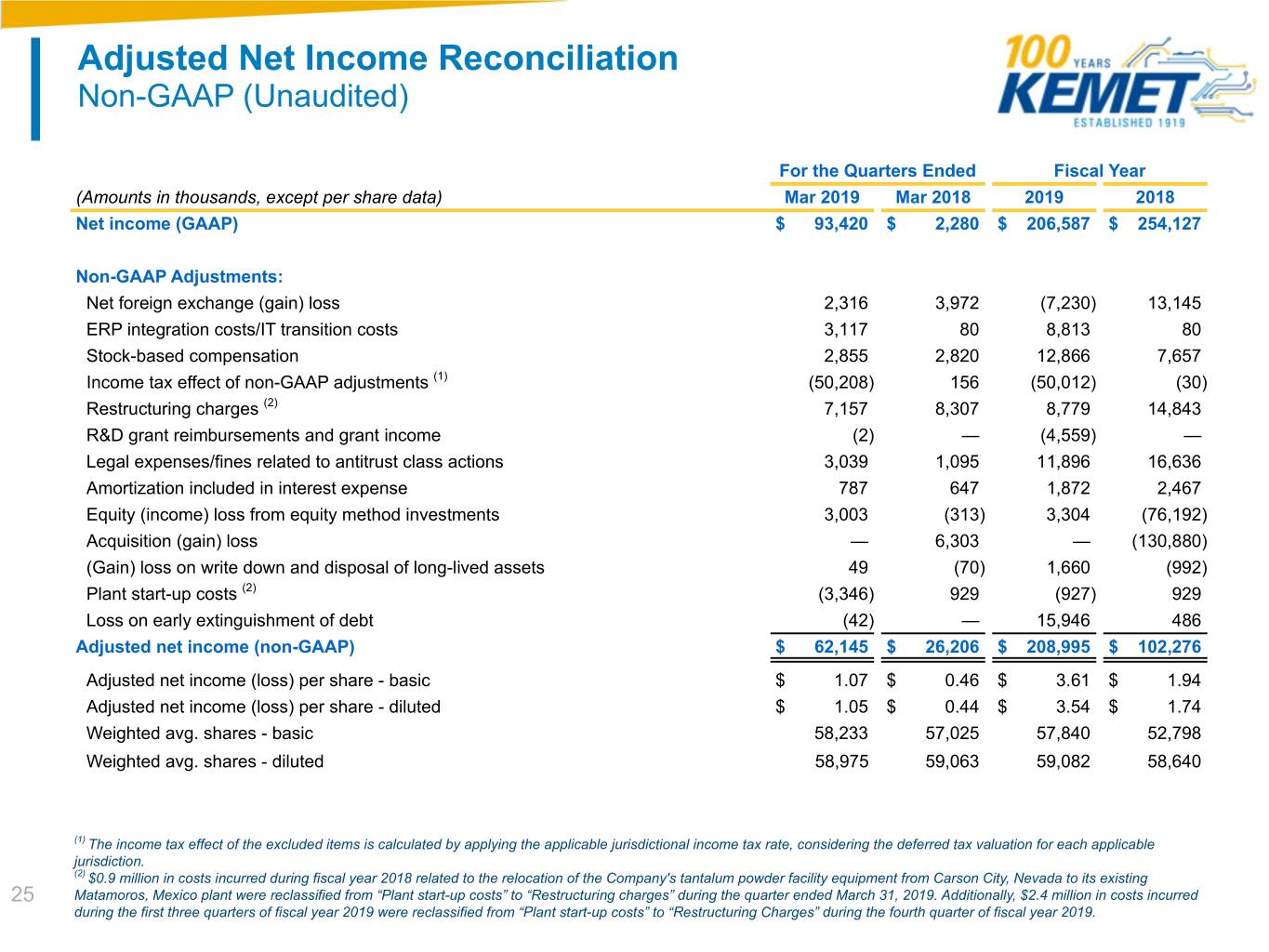

Adjusted Net Income Reconciliation Non-GAAP (Unaudited) For the Quarters Ended Fiscal Year (Amounts in thousands, except per share data) Mar 2019 Mar 2018 2019 2018 Net income (GAAP) $ 93,420 $ 2,280 $ 206,587 $ 254,127 Non-GAAP Adjustments: Net foreign exchange (gain) loss 2,316 3,972 (7,230) 13,145 ERP integration costs/IT transition costs 3,117 80 8,813 80 Stock-based compensation 2,855 2,820 12,866 7,657 Income tax effect of non-GAAP adjustments (1) (50,208) 156 (50,012) (30) Restructuring charges (2) 7,157 8,307 8,779 14,843 R&D grant reimbursements and grant income (2) — (4,559) — Legal expenses/fines related to antitrust class actions 3,039 1,095 11,896 16,636 Amortization included in interest expense 787 647 1,872 2,467 Equity (income) loss from equity method investments 3,003 (313) 3,304 (76,192) Acquisition (gain) loss — 6,303 — (130,880) (Gain) loss on write down and disposal of long-lived assets 49 (70) 1,660 (992) Plant start-up costs (2) (3,346) 929 (927) 929 Loss on early extinguishment of debt (42) — 15,946 486 Adjusted net income (non-GAAP) $ 62,145 $ 26,206 $ 208,995 $ 102,276 Adjusted net income (loss) per share - basic $ 1.07 $ 0.46 $ 3.61 $ 1.94 Adjusted net income (loss) per share - diluted $ 1.05 $ 0.44 $ 3.54 $ 1.74 Weighted avg. shares - basic 58,233 57,025 57,840 52,798 Weighted avg. shares - diluted 58,975 59,063 59,082 58,640 (1) The income tax effect of the excluded items is calculated by applying the applicable jurisdictional income tax rate, considering the deferred tax valuation for each applicable jurisdiction. (2) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing 25 Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019.

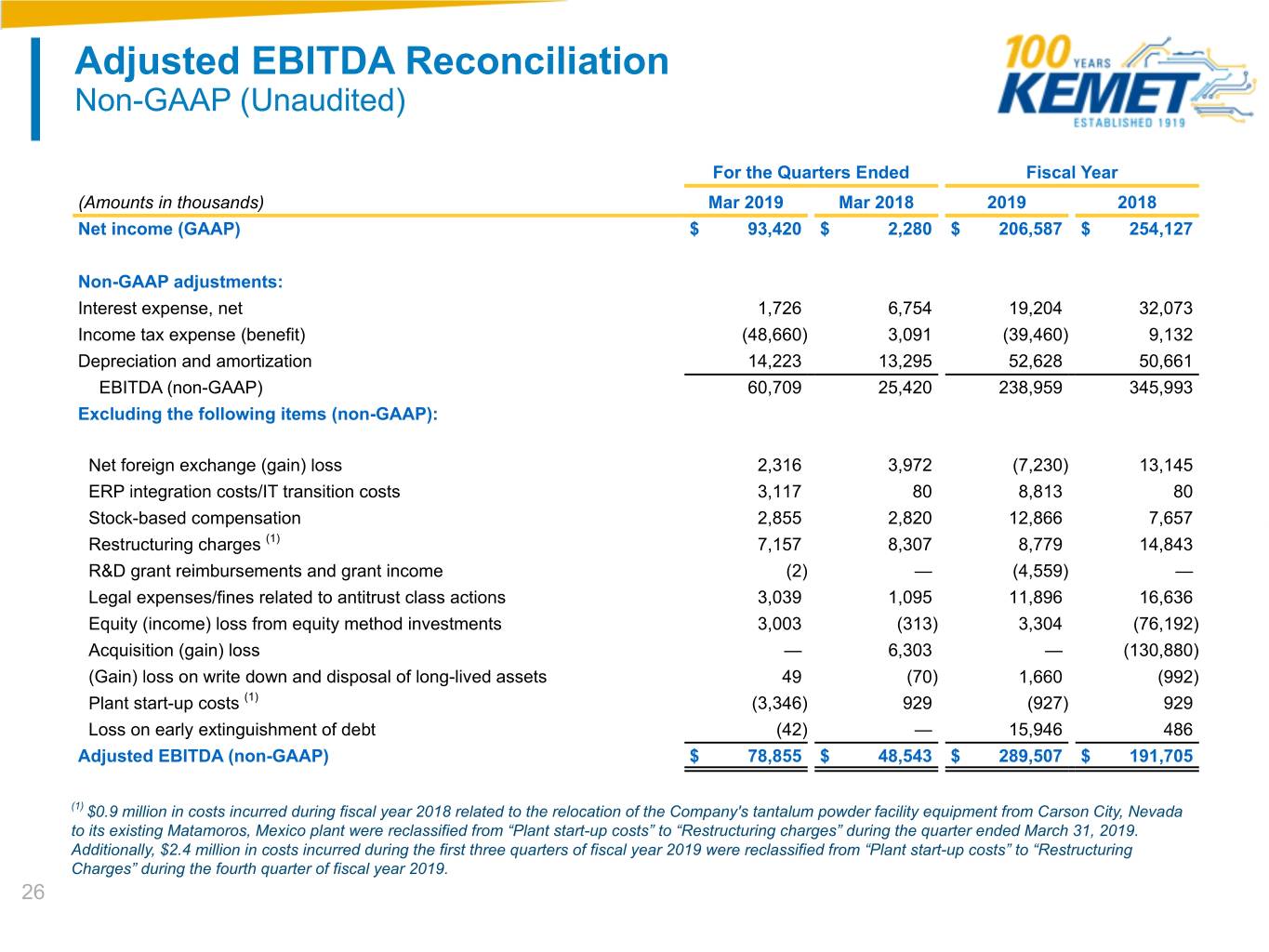

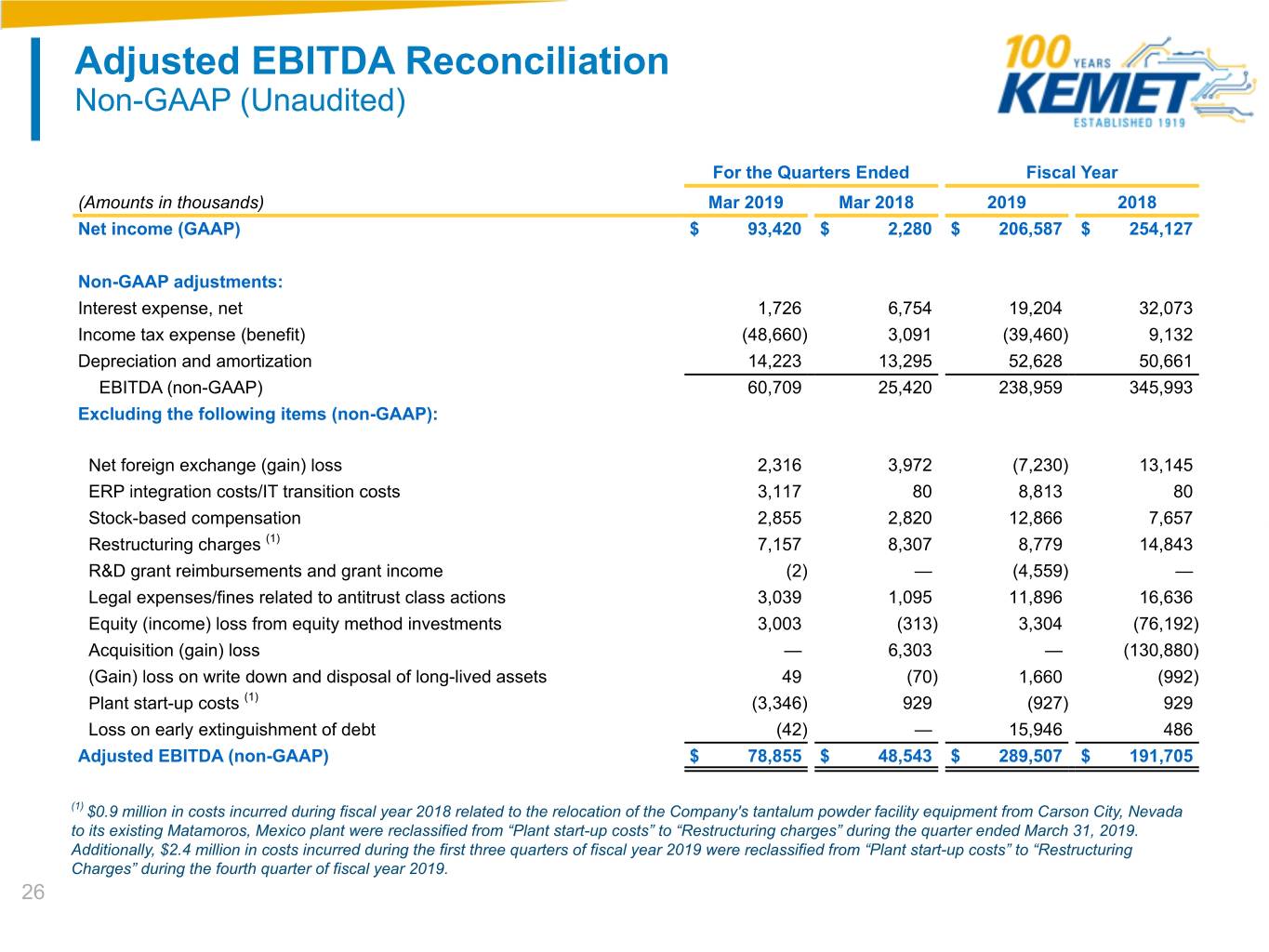

Adjusted EBITDA Reconciliation Non-GAAP (Unaudited) For the Quarters Ended Fiscal Year (Amounts in thousands) Mar 2019 Mar 2018 2019 2018 Net income (GAAP) $ 93,420 $ 2,280 $ 206,587 $ 254,127 Non-GAAP adjustments: Interest expense, net 1,726 6,754 19,204 32,073 Income tax expense (benefit) (48,660) 3,091 (39,460) 9,132 Depreciation and amortization 14,223 13,295 52,628 50,661 EBITDA (non-GAAP) 60,709 25,420 238,959 345,993 Excluding the following items (non-GAAP): Net foreign exchange (gain) loss 2,316 3,972 (7,230) 13,145 ERP integration costs/IT transition costs 3,117 80 8,813 80 Stock-based compensation 2,855 2,820 12,866 7,657 Restructuring charges (1) 7,157 8,307 8,779 14,843 R&D grant reimbursements and grant income (2) — (4,559) — Legal expenses/fines related to antitrust class actions 3,039 1,095 11,896 16,636 Equity (income) loss from equity method investments 3,003 (313) 3,304 (76,192) Acquisition (gain) loss — 6,303 — (130,880) (Gain) loss on write down and disposal of long-lived assets 49 (70) 1,660 (992) Plant start-up costs (1) (3,346) 929 (927) 929 Loss on early extinguishment of debt (42) — 15,946 486 Adjusted EBITDA (non-GAAP) $ 78,855 $ 48,543 $ 289,507 $ 191,705 (1) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019. 26

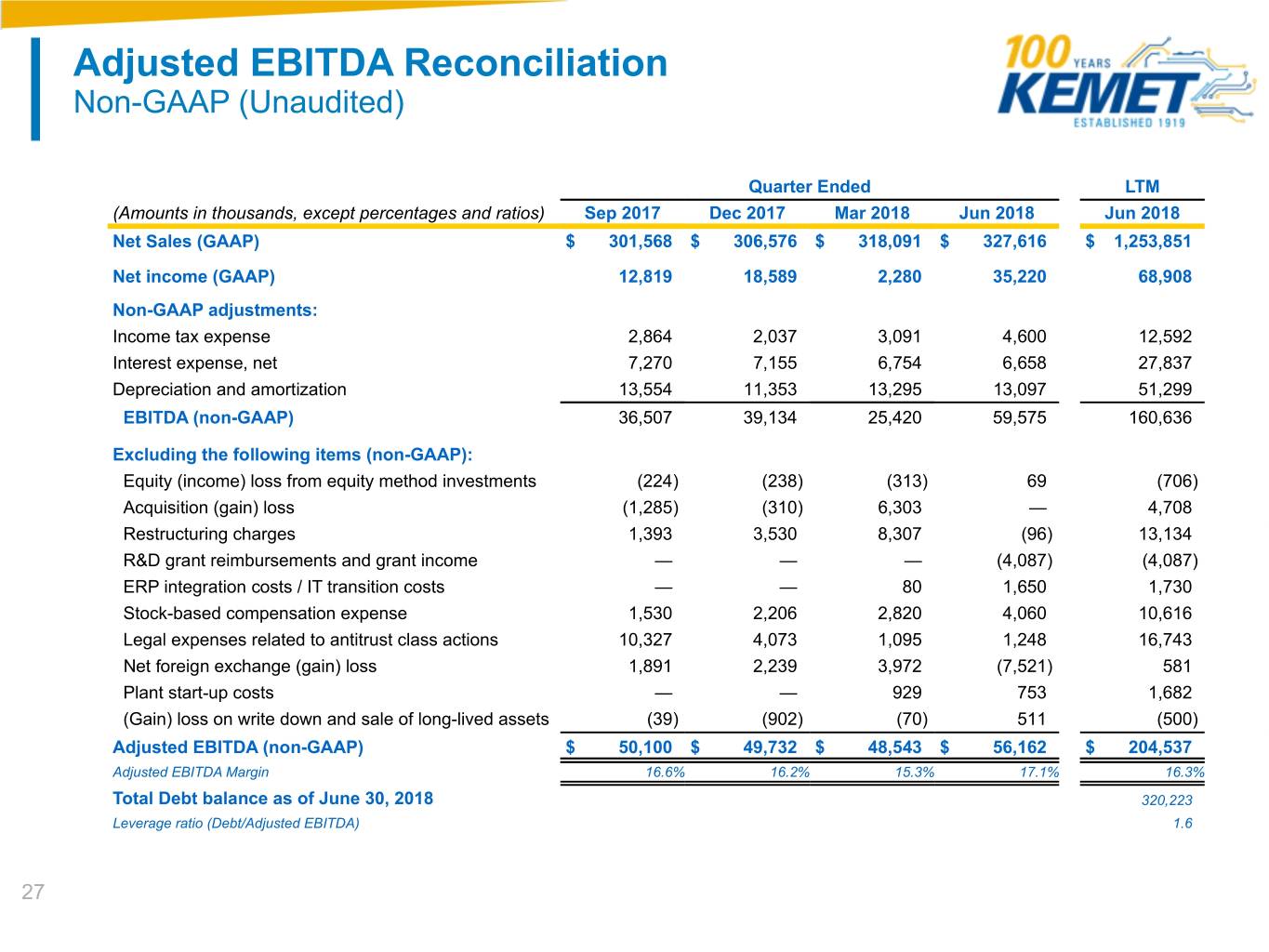

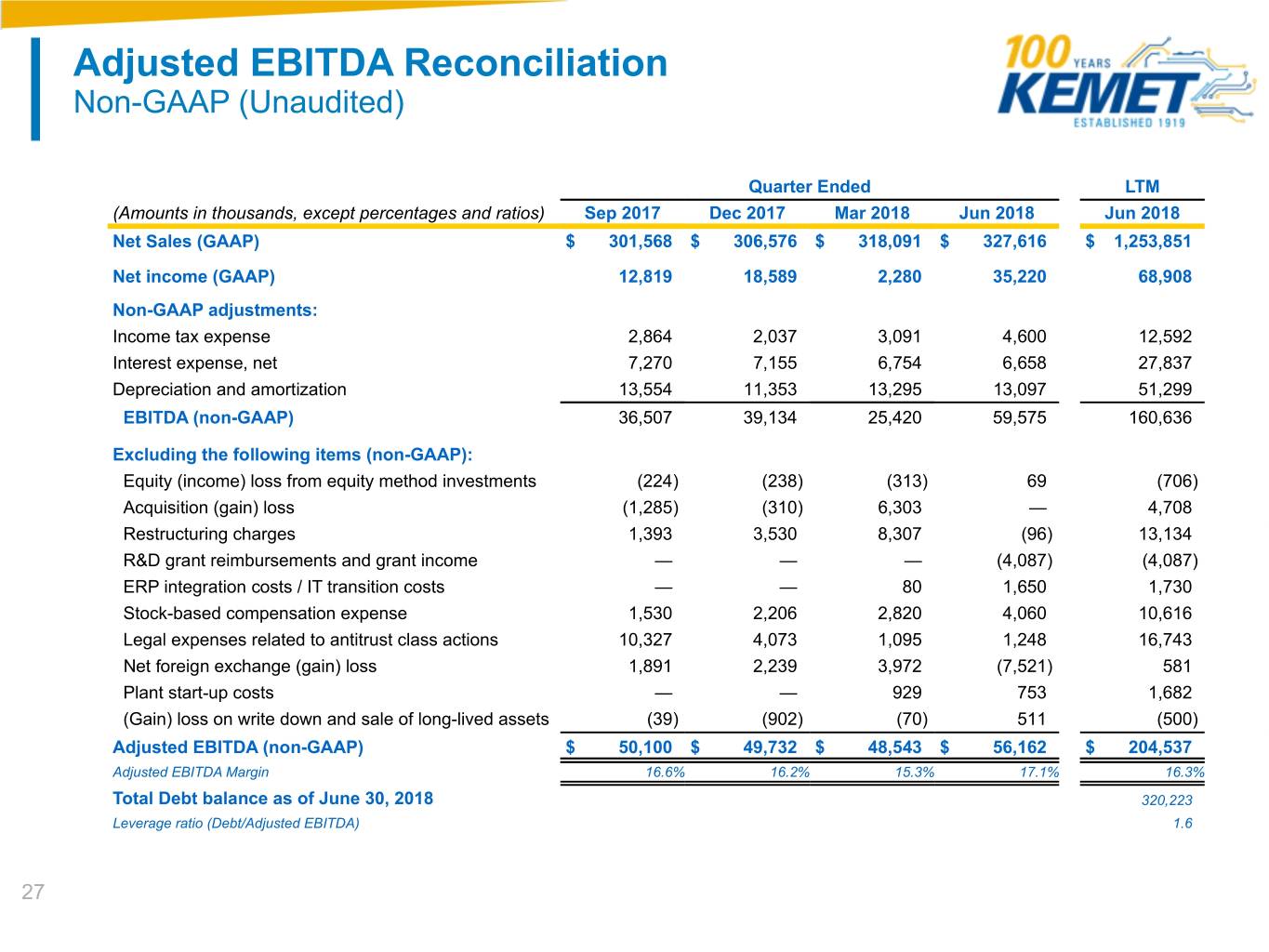

Adjusted EBITDA Reconciliation Non-GAAP (Unaudited) Quarter Ended LTM (Amounts in thousands, except percentages and ratios) Sep 2017 Dec 2017 Mar 2018 Jun 2018 Jun 2018 Net Sales (GAAP) $ 301,568 $ 306,576 $ 318,091 $ 327,616 $ 1,253,851 Net income (GAAP) 12,819 18,589 2,280 35,220 68,908 Non-GAAP adjustments: Income tax expense 2,864 2,037 3,091 4,600 12,592 Interest expense, net 7,270 7,155 6,754 6,658 27,837 Depreciation and amortization 13,554 11,353 13,295 13,097 51,299 EBITDA (non-GAAP) 36,507 39,134 25,420 59,575 160,636 Excluding the following items (non-GAAP): Equity (income) loss from equity method investments (224) (238) (313) 69 (706) Acquisition (gain) loss (1,285) (310) 6,303 — 4,708 Restructuring charges 1,393 3,530 8,307 (96) 13,134 R&D grant reimbursements and grant income — — — (4,087) (4,087) ERP integration costs / IT transition costs — — 80 1,650 1,730 Stock-based compensation expense 1,530 2,206 2,820 4,060 10,616 Legal expenses related to antitrust class actions 10,327 4,073 1,095 1,248 16,743 Net foreign exchange (gain) loss 1,891 2,239 3,972 (7,521) 581 Plant start-up costs — — 929 753 1,682 (Gain) loss on write down and sale of long-lived assets (39) (902) (70) 511 (500) Adjusted EBITDA (non-GAAP) $ 50,100 $ 49,732 $ 48,543 $ 56,162 $ 204,537 Adjusted EBITDA Margin 16.6% 16.2% 15.3% 17.1% 16.3% Total Debt balance as of June 30, 2018 320,223 Leverage ratio (Debt/Adjusted EBITDA) 1.6 27

Adjusted EBITDA Reconciliation Non-GAAP (Unaudited) Quarter Ended LTM (Amounts in thousands, except percentages and ratios) Dec 2017 Mar 2018 Jun 2018 Sep 2018 Sep 2018 Net Sales (GAAP) $ 306,576 $ 318,091 $ 327,616 $ 349,233 $ 1,301,516 Net income (GAAP) 18,589 2,280 35,220 37,141 93,230 Non-GAAP adjustments: Income tax expense 2,037 3,091 4,600 2,000 11,728 Interest expense, net 7,155 6,754 6,658 6,912 27,479 Depreciation and amortization 11,353 13,295 13,097 12,545 50,290 EBITDA (non-GAAP) 39,134 25,420 59,575 58,598 182,727 Excluding the following items (non-GAAP): Equity (income) loss from equity method investments (238) (313) 69 (64) (546) Acquisition (gain) loss (310) 6,303 — — 5,993 Restructuring charges 3,530 8,307 (96) — 11,741 R&D grant reimbursements and grant income — — (4,087) — (4,087) ERP integration costs / IT transition costs — 80 1,650 1,593 3,323 Stock-based compensation expense 2,206 2,820 4,060 4,417 13,503 Legal expenses related to antitrust class actions 4,073 1,095 1,248 6,060 12,476 Net foreign exchange (gain) loss 2,239 3,972 (7,521) 193 (1,117) Plant start-up costs — 929 753 1,361 3,043 (Gain) loss on write down and sale of long-lived assets (902) (70) 511 312 (149) Adjusted EBITDA (non-GAAP) $ 49,732 $ 48,543 $ 56,162 $ 72,470 $ 226,907 Adjusted EBITDA Margin 16.2% 15.3% 17.1% 20.8% 17.4% Total Debt balance as of September 30, 2018 316,636 Leverage ratio (Debt/Adjusted EBITDA) 1.4

Adjusted EBITDA Reconciliation Non-GAAP (Unaudited) Quarter Ended LTM (Amounts in thousands, except percentages and ratios) Mar 2018 Jun 2018 Sep 2018 Dec 2018 Dec 2018 Net Sales (GAAP) $ 318,091 $ 327,616 $ 349,233 $ 350,175 $ 1,345,115 Net income (GAAP) 2,280 35,220 37,141 40,806 115,447 Non-GAAP adjustments: Income tax expense 3,091 4,600 2,000 2,600 12,291 Interest expense, net 6,754 6,658 6,912 3,908 24,232 Depreciation and amortization 13,295 13,097 12,545 12,763 51,700 EBITDA (non-GAAP) 25,420 59,575 58,598 60,077 203,670 Excluding the following items (non-GAAP): Equity (income) loss from equity method investments (313) 69 (64) 296 (12) Acquisition (gain) loss 6,303 — — — 6,303 Restructuring charges 8,307 (96) — 1,718 9,929 R&D grant reimbursements and grant income — (4,087) — (470) (4,557) ERP integration costs / IT transition costs 80 1,650 1,593 2,453 5,776 Stock-based compensation expense 2,820 4,060 4,417 1,534 12,831 Legal expenses related to antitrust class actions 1,095 1,248 6,060 1,549 9,952 Net foreign exchange (gain) loss 3,972 (7,521) 193 (2,218) (5,574) Plant start-up costs 929 753 1,361 305 3,348 (Gain) loss on write down and sale of long-lived assets (70) 511 312 788 1,541 (Gain) loss on early extinguishment of debt — — — 15,988 15,988 Adjusted EBITDA (non-GAAP) $ 48,543 $ 56,162 $ 72,470 $ 82,020 $ 259,195 Adjusted EBITDA Margin 15.3% 17.1% 20.8% 23.4% 19.3% Total Debt balance as of December 31, 2018 305,676 Leverage ratio (Debt/Adjusted EBITDA) 1.2

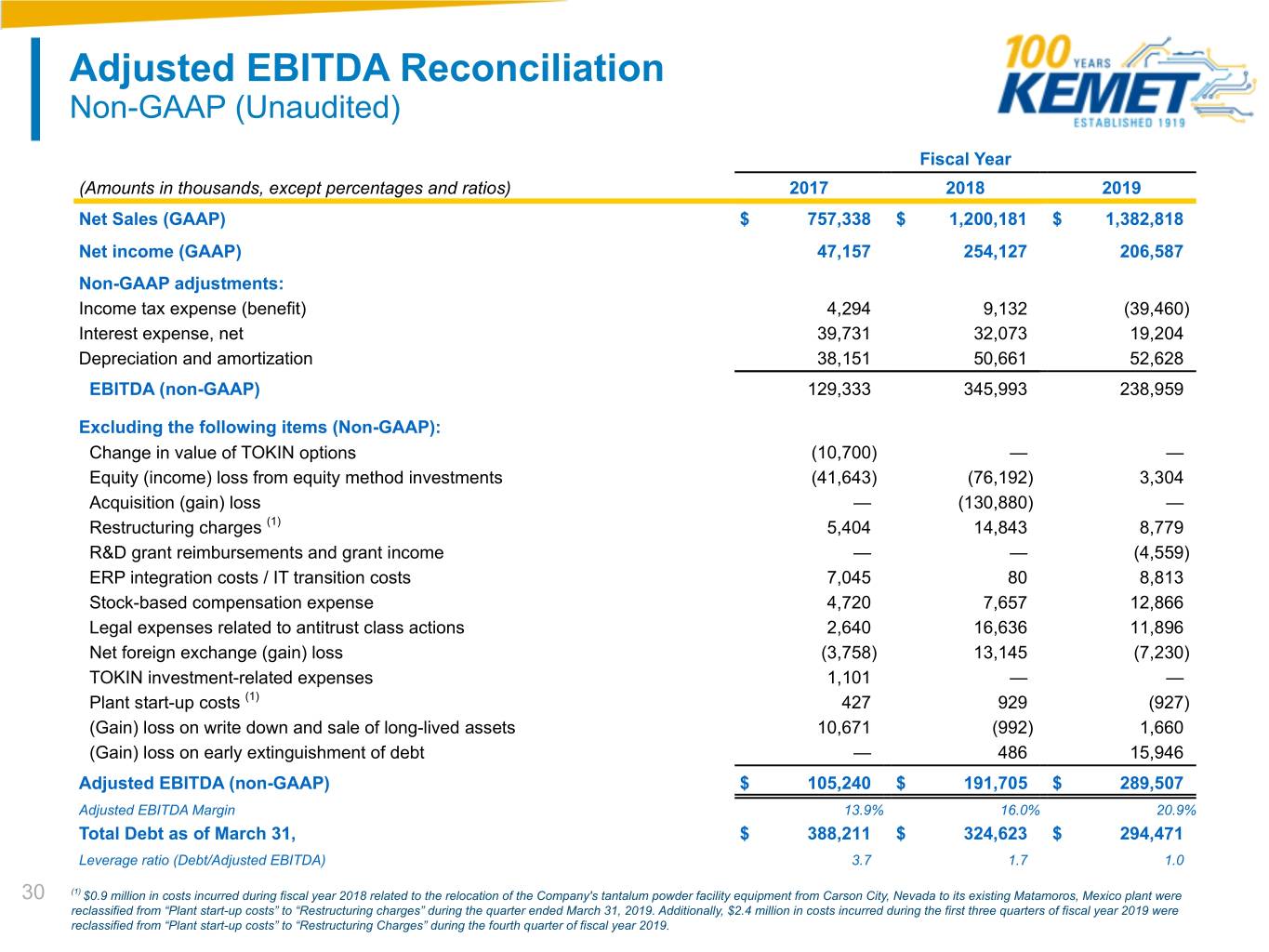

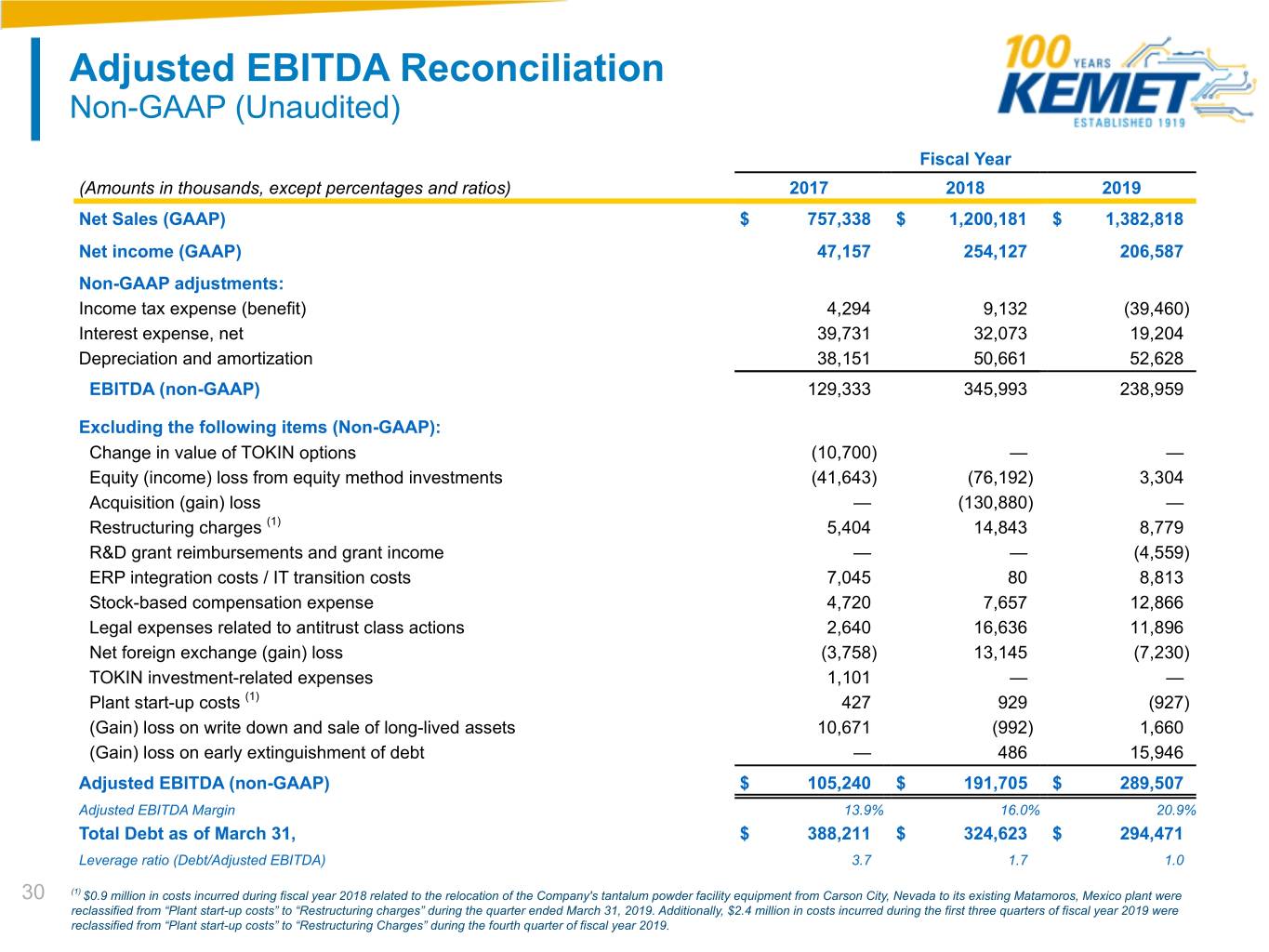

Adjusted EBITDA Reconciliation Non-GAAP (Unaudited) Fiscal Year (Amounts in thousands, except percentages and ratios) 2017 2018 2019 Net Sales (GAAP) $ 757,338 $ 1,200,181 $ 1,382,818 Net income (GAAP) 47,157 254,127 206,587 Non-GAAP adjustments: Income tax expense (benefit) 4,294 9,132 (39,460) Interest expense, net 39,731 32,073 19,204 Depreciation and amortization 38,151 50,661 52,628 EBITDA (non-GAAP) 129,333 345,993 238,959 Excluding the following items (Non-GAAP): Change in value of TOKIN options (10,700) — — Equity (income) loss from equity method investments (41,643) (76,192) 3,304 Acquisition (gain) loss — (130,880) — Restructuring charges (1) 5,404 14,843 8,779 R&D grant reimbursements and grant income — — (4,559) ERP integration costs / IT transition costs 7,045 80 8,813 Stock-based compensation expense 4,720 7,657 12,866 Legal expenses related to antitrust class actions 2,640 16,636 11,896 Net foreign exchange (gain) loss (3,758) 13,145 (7,230) TOKIN investment-related expenses 1,101 — — Plant start-up costs (1) 427 929 (927) (Gain) loss on write down and sale of long-lived assets 10,671 (992) 1,660 (Gain) loss on early extinguishment of debt — 486 15,946 Adjusted EBITDA (non-GAAP) $ 105,240 $ 191,705 $ 289,507 Adjusted EBITDA Margin 13.9% 16.0% 20.9% Total Debt as of March 31, $ 388,211 $ 324,623 $ 294,471 Leverage ratio (Debt/Adjusted EBITDA) 3.7 1.7 1.0 30 (1) $0.9 million in costs incurred during fiscal year 2018 related to the relocation of the Company's tantalum powder facility equipment from Carson City, Nevada to its existing Matamoros, Mexico plant were reclassified from “Plant start-up costs” to “Restructuring charges” during the quarter ended March 31, 2019. Additionally, $2.4 million in costs incurred during the first three quarters of fiscal year 2019 were reclassified from “Plant start-up costs” to “Restructuring Charges” during the fourth quarter of fiscal year 2019.

Non-GAAP Financial Measures Non-GAAP Financial Measures The Company has presented certain historical financial measures in this presentation that have not been prepared in accordance with GAAP, including adjusted net income, adjusted net income per share, adjusted EBITDA, adjusted gross margin, and adjusted selling, general and administrative expenses. The reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures have been included in this presentation. These non-GAAP financial measures are designed to complement the financial information presented in accordance with GAAP because management believes such measures are useful to investors for the reasons described below. Adjusted gross margin Adjusted gross margin represents net sales less cost of sales excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted gross margin to facilitate our analysis and understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted gross margin is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company. Adjusted gross margin should not be considered as an alternative to gross margin or any other performance measure derived in accordance with GAAP. Adjusted selling, general and administrative expenses Adjusted selling, general and administrative expenses represents selling, general and administrative expenses excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted selling, general and administrative expenses to facilitate our analysis and understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted selling, general and administrative expenses is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company. Adjusted selling, general and administrative expenses should not be considered as an alternative to selling, general and administrative expenses or any other performance measure derived in accordance with GAAP. Adjusted operating income Adjusted operating income represents operating income, excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted operating income to facilitate our analysis and understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted operating income is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company and allows investors to 31 monitor and understand changes in our ability to generate income from ongoing business operations. Adjusted operating income should not be considered as an alternative to operating income or any other performance measure derived in accordance with GAAP.

Non-GAAP Financial Measures Continued Adjusted net income and Adjusted net income per basic and diluted share Adjusted net income and Adjusted net income per basic and diluted share represent net income and net income per basic and diluted share, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted net income and Adjusted net income per basic and diluted share to evaluate the Company's operating performance by excluding the items outlined in the quantitative reconciliation provided above which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted net income and Adjusted net income per basic and diluted share are useful to investors because they provide a supplemental way to understand the underlying operating performance of the Company and allows investors to monitor and understand changes in our ability to generate income from ongoing business operations. Adjusted net income and Adjusted net income per basic and diluted share should not be considered as alternatives to net income, operating income, or any other performance measures derived in accordance with GAAP. Adjusted EBITDA Adjusted EBITDA represents net income before income tax expense (benefit), interest expense, net, and depreciation and amortization expense, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted EBITDA to monitor and evaluate our operating performance and to facilitate internal and external comparisons of the historical operating performance of our business. We present Adjusted EBITDA as a supplemental measure of our performance and ability to service debt. We also present Adjusted EBITDA because we believe such measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. We believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity, because cash expenditures on interest are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense goes down as deductible interest expense goes up; depreciation and amortization are non-cash charges. The other items excluded from Adjusted EBITDA are excluded in order to better reflect our continuing operations. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these types of adjustments. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income (loss), operating income (loss) or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. 32

Non-GAAP Financial Measures Continued Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • it does not reflect our cash expenditures, future requirements for capital expenditures or contractual commitments; • it does not reflect changes in, or cash requirements for, our working capital needs; • it does not reflect any income tax expense or benefit, including any changes to income taxes resulting from The Tax Cuts and Jobs Act enacted on December 22, 2017; • it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payment on our debt; • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and our Adjusted EBITDA measure does not reflect any cash requirements for such replacements; • it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; • it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; • it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and • other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations. You should compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA as supplementary information. 33