- REVRQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Revlon (REVRQ) 8-KRegulation FD Disclosure

Filed: 4 May 11, 12:00am

Exhibit 99.1

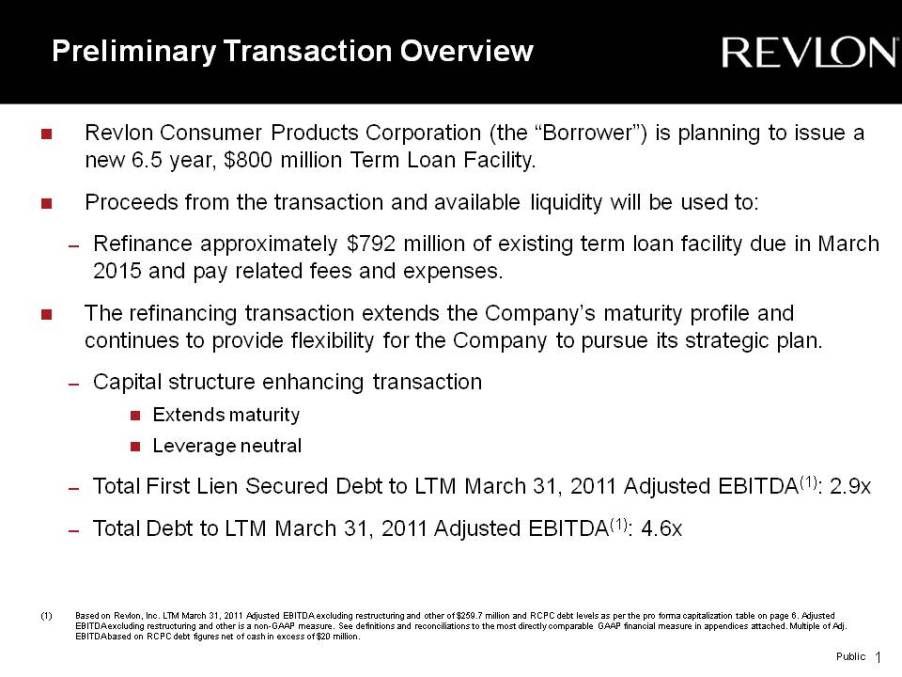

Revlon Consumer Products Corporation (the “Borrower”) is planning to issue a new 6.5 year, $800 million Term Loan Facility. $ Proceeds from the transaction and available liquidity will be used to: Refinance approximately $792 million of existing term loan facility due in March 2015 and pay related fees and expenses. The refinancing transaction extends the Company’s maturity profile and flexibility for the plan continues to provide Company to pursue its strategic plan. Capital structure enhancing transaction Extends maturity Leverage neutral Total First Lien Secured Debt to LTM March 31, 2011 Adjusted EBITDA(1): 2.9x Total Debt to LTM March 31, 2011 Adjusted EBITDA(1): 4.6x 1 (1) Based on Revlon, Inc. LTM March 31, 2011 Adjusted EBITDA excluding restructuring and other of $259.7 million and RCPC debt levels as per the pro forma capitalization table on page 6. Adjusted EBITDA excluding restructuring and other is a non-GAAP measure. See definitions and reconciliations to the most directly comparable GAAP financial measure in appendices attached. Multiple of Adj. EBITDA based on RCPC debt figures net of cash in excess of $20 million. Public

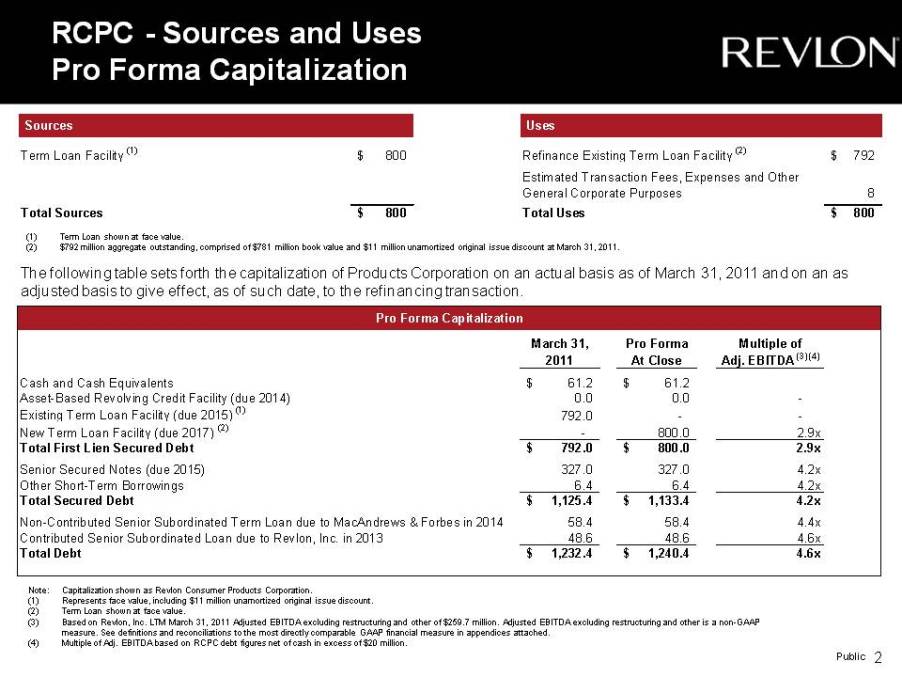

RCPC - Sources and Uses Pro Forma Capitalization Term Loan Facility (1) 800 $ Refinance Existing Term Loan Facility (2) 792 $ Sources Uses (1) Term Loan shown at face value. (2) $792 million aggregate outstanding, comprised of $781 million book value and $11 million unamortized original issue discount at March 31, 2011. 8 Total Sources 800 $ Total Uses 800 $ Estimated Transaction Fees, Expenses and Other General Corporate Purposes The following table sets forth the capitalization of Products Corporation on an actual basis as of March 31, 2011 and on an as adjusted basis to give effect, as of such date, to the refinancing transaction. Pro Forma Capitalization March 31, Pro Forma Multiple of 2011 At Close Adj. EBITDA(3) (4) Cash and Cash Equivalents 61.2 $ 61.2 $ Asset Based Revolving Credit Facility (due 2014) 0.0 0.0 - Existing Term Loan Facility (due 2015) (1) 792.0 - - New Term Loan Facility (due 2017) (2) - 800.0 2.9x Total First Lien Secured Debt 792.0 $ 800.0 $ 2.9x Senior Secured Notes (due 2015) 327.0 327.0 4.2x Other Short-Term Borrowings 6.4 6.4 4.2x Total Secured Debt 1,125.4 $ 1,133.4 $ 4.2x Note: Consumer Corporation Non-Contributed Senior Subordinated Term Loan due to MacAndrews & Forbes in 2014 58.4 58.4 4.4x Contributed Senior Subordinated Loan due to Revlon, Inc. in 2013 48.6 48.6 4.6x Total Debt 1,232.4 $ 1,240.4 $ 4.6x 2 Capitalization shown as Revlon Products Corporation. (1) Represents face value, including $11 million unamortized original issue discount. (2) Term Loan shown at face value. (3) Based on Revlon, Inc. LTM March 31, 2011 Adjusted EBITDA excluding restructuring and other of $259.7 million. Adjusted EBITDA excluding restructuring and other is a non-GAAP measure. See definitions and reconciliations to the most directly comparable GAAP financial measure in appendices attached. (4) Multiple of Adj. EBITDA based on RCPC debt figures net of cash in excess of $20 million. Public

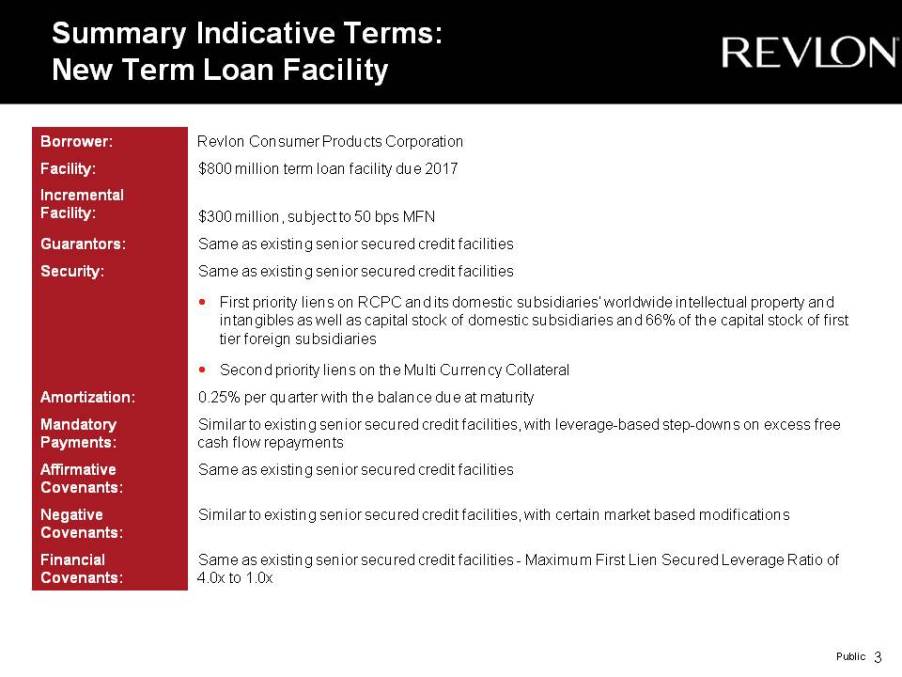

Summary Indicative Terms: New Term Loan Facility Borrower: Revlon Consumer Products Corporation Facility: $800 million term loan facility due 2017 Incremental Facility: $300 million, subject to 50 bps MFN Guarantors: Same as existing senior secured credit facilities Security: Same as existing senior secured credit facilities First priority liens on RCPC and its domestic subsidiaries’ worldwide intellectual property and intangibles as well as capital stock of domestic subsidiaries and 66% of the capital stock of first tier foreign subsidiaries Second priority liens on the Multi Currency Collateral Amortization: 0.25% per quarter with the balance due at maturity Mandatory facilities leverage based step downs Payments: Similar to existing senior secured credit facilities, with leverage step-on excess free cash flow repayments Affirmative Covenants: Same as existing senior secured credit facilities Negative Covenants: Similar to existing senior secured credit facilities, with certain market based modifications Financial Covenants: Same as existing senior secured credit facilities - Maximum First Lien Secured Leverage Ratio of 4.0x to 1.0x 3 Public