- REVRQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Revlon (REVRQ) 8-KRegulation FD Disclosure

Filed: 4 May 11, 12:00am

Exhibit 99.2

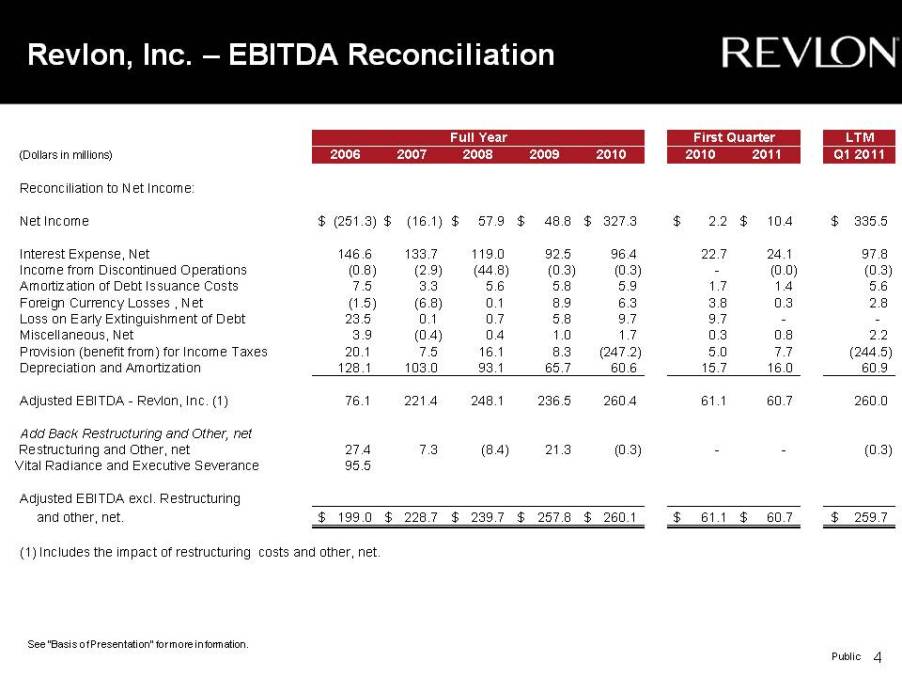

Revlon, Inc. – EBITDA Reconciliation Full Year (Dollars in millions) 2006 2007 2008 2009 2010 2010 2011 Q1 2011 First Quarter LTM Reconciliation to Net Income: Net Income (251.3) $ (16.1) $ 57.9 $ 48.8 $ 327.3 $ 2.2 $ 10.4 $ 335.5 $ Interest Expense 146 6 133 7 119 0 92 5 96 4 22 7 24 1 97 8 Expense, Net 146.6 133.7 119.0 92.5 96.4 22.7 24.1 97.8 Income from Discontinued Operations (0.8) (2.9) (44.8) (0.3) (0.3) - (0.0) (0.3) Amortization of Debt Issuance Costs 7.5 3.3 5.6 5.8 5.9 1.7 1.4 5.6 Foreign Currency Losses , Net (1.5) (6.8) 0.1 8.9 6.3 3.8 0.3 2.8 Loss on Early Extinguishment of Debt 23.5 0.1 0.7 5.8 9.7 9.7 - - Miscellaneous 3 9 (0 4) 0 4 1 0 1 7 0 3 0 8 2 2 Miscellaneous, Net 3.9 0.4) 0.4 1.0 1.7 0.3 0.8 2.2 Provision (benefit from) for Income Taxes 20.1 7.5 16.1 8.3 (247.2) 5.0 7.7 (244.5) Depreciation and Amortization 128.1 103.0 93.1 65.7 60.6 15.7 16.0 60.9 Adjusted EBITDA - Revlon, Inc. (1) 76.1 221.4 248.1 236.5 260.4 61.1 60.7 260.0 Add Back Restructuring and Other, net Restructuring and Other, net 27.4 7.3 (8.4) 21.3 (0.3) - - (0.3) Vital Radiance and Executive Severance 95.5 Adjusted EBITDA excl. Restructuring and other, net. 199.0 $ 228.7 $ 239.7 $ 257.8 $ 260.1 $ 61.1 $ 60.7 $ 259.7 $ (1) Includes the impact of restructuring costs and other, net. 4 See “Basis of Presentation” for more information. Public