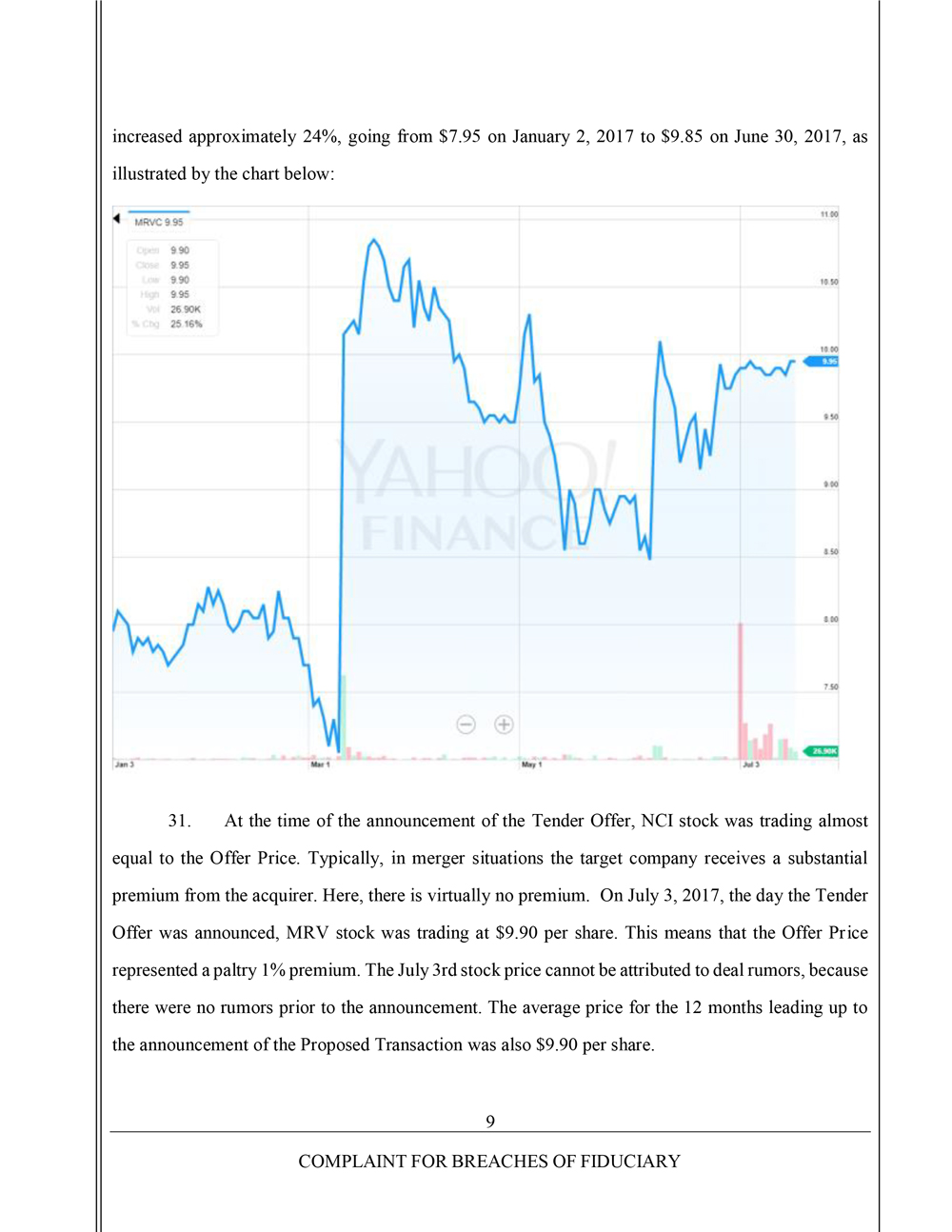

| Takeover Proposal, (iii) approve or recommend, or make any public statement approving or recommending, a Takeover Proposal, (iv) enter into any letter of intent, merger agreement or other agreement providing for a Takeover Proposal, (v) submit any Takeover Proposal to a vote of the stockholders of the Company, (vi) amend or grant any waiver or release under any standstill or similar agreement with respect to any class of equity securities of the Company or any of its Subsidiaries, (vii) approve any transaction under, or any third party becoming an “interested stockholder” under, Section 203 of the DGCL or (viii) resolve or agree to do any of the foregoing. 54. Furthermore, Section 6.3(c) grants ADVA recurring and unlimited matching rights, which gives MRV 48 hours to provide unfettered access to confidential, non-public information about competing proposals from third parties to ADVA. Additionally, Section 6.3 grants ADVA five (5) business days to negotiate with MRV, amend the terms of the Merger Agreement, and make a counter-offer that matches the superior offer. 55. The matching rights provision essentially ensures that no superior bidder will emerge. Any potential suitor will be unlikely to expend the time, cost, and effort to perform due diligence and make a superior proposal while knowing that MRV must inform ADVA of the terms and details of any superior proposal and allow ADVA five days to match. As a result, the matching rights provision unreasonably favors ADVA, to the detriment of MRV’s public stockholders. 56. Finally, Section 8.3 of the Merger Agreement requires the Company to pay ADVA a termination fee of $2,410,000 in the event the Company decides to pursue any alternative offer. The Merger Agreement also requires MRV to reimburse ADVA up to $ $1,000,000 in expenses under certain circumstances. Based on a transaction value of $68 million, this coercive termination fee of over 5% would require any competing bidder to agree to pay a naked premium simply for the right to provide MRV’s stockholders a superior offer. 57. Compounding matters, Raging Capital, Kenneth H. Traub, Robert M. Pons, Mark J. Bonney, Brian Bellinger, Jeannie H. Diefenderfer, Jeffrey Tuder, Stephen G. Krulik, and Adam L.A. Scheer (each, a “Supporting Stockholder”) entered into Tender and Support Agreements in connection with the Merger Agreement. The Support Agreements obligate the Supporting Stockholders to tender their shares of Company stock and otherwise support the transactions contemplated by the Merger 14 COMPLAINT FOR BREACHES OF FIDUCIARY |