UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-06677 |

| |

| Exact name of registrant as specified in charter: | | Dryden Index Series Fund |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | | 100 Mulberry Street, |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | | Gateway Center 3, |

| | | 100 Mulberry Street, |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 9/30/2005 |

| |

| Date of reporting period: | | 3/31/2005 |

| | | | |

| Item 1 | | – | | Reports to Stockholders – [ INSERT REPORT ] |

Dryden Stock Index Fund

| | |

| MARCH 31, 2005 | | SEMIANNUAL REPORT |

FUND TYPE

Large-capitalization stock

OBJECTIVE

Provide investment results that correspond to the price and yield performance of the S&P 500 Index

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden is a registered trademark of The Prudential Insurance Company of America.

Dear Shareholder,

May 16, 2005

We hope that you find the semiannual report for the Dryden Stock Index Fund informative and useful. As a JennisonDryden Mutual Fund shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope that history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

We believe it is wise to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds that cover all the basic asset classes and is reflective of your personal investor profile and tolerance for risk.

JennisonDryden Mutual Funds give you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of three leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC and/or Quantitative Management Associates LLC (QMA). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

Dryden Index Series Fund/Dryden Stock Index Fund

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Dryden Stock Index Fund (the Fund) is to provide investment results that correspond to the price and yield performance of the Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index). There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The maximum initial sales charge is 3.25% (Class A shares).

| | | | | | | | | | |

| Cumulative Total Returns1 as of 3/31/05 | | | | | | |

| | | Six Months | | One Year | | Five Years | | Ten Years | | Since Inception2 |

Class A | | 6.65% | | 6.14% | | –16.70% (–16.92) | | N/A | | –12.18% (–12.45) |

Class B | | 6.27 | | 5.34 | | –19.80 (–20.01) | | N/A | | –15.70 (–15.96) |

Class C | | 6.23 | | 5.30 | | –19.78 (–20.00) | | N/A | | –15.69 (–15.94) |

Class I | | 6.81 | | 6.43 | | –15.33 (–15.55) | | N/A | | 37.76 (37.18) |

Class Z | | 6.76 | | 6.38 | | –15.72 (–15.95) | | 168.82% (167.60) | | 239.89 (238.35) |

S&P 500 Index3 | | 6.88 | | 6.69 | | –14.83 | | 178.64 | | *** |

Lipper S&P 500 Index Objective Funds Avg.4 | | 6.58 | | 6.08 | | –17.09 | | 168.11 | | **** |

| | | | | | | | | | | |

| Average Annual Total Returns1 as of 3/31/05 | | | | |

| | | One Year | | Five Years | | Ten Years | | Since Inception2 |

Class A | | 2.69% | | –4.22% (–4.27) | | N/A | | –2.99% (–3.04) |

Class B | | 0.34 | | –4.51 (–4.56) | | N/A | | –3.31 (–3.36) |

Class C | | 4.30 | | –4.31 (–4.36) | | N/A | | –3.13 (–3.18) |

Class I | | 6.43 | | –3.27 (–3.32) | | N/A | | 4.27 (4.21) |

Class Z | | 6.38 | | –3.36 (–3.41) | | 10.39% (10.34) | | 10.37 (10.33) |

S&P 500 Index3 | | 6.69 | | –3.16 | | 10.79 | | *** |

Lipper S&P 500 Index Objective

Funds Avg.4 | | 6.08 | | –3.68 | | 10.36 | | **** |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 3.25%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1% respectively. Class I and Class Z shares are not subject to a sales charge.

| | |

| 2 | | Visit our website at www.jennisondryden.com |

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in effect. Without such fee waivers and expense reimbursements, the returns for the share classes would have been lower, as indicated in parentheses. Class A, Class B, and Class C shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, and 1.00% respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class I and Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

2Inception dates: Class A, B, and C, 11/18/99; Class I, 8/1/97; and Class Z, 11/5/92.

3The S&P 500 Index is an unmanaged index of 500 stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed.

4The Lipper S&P 500 Index Objective Funds Average (Lipper Average) represents returns based on the average return of all funds in the Lipper S&P 500 Index Objective Funds category for the periods noted. Funds in the Lipper Average are passively managed and limited expense (management fee no higher than 0.50%) funds are designed to replicate the performance of the S&P 500 Index on a reinvested basis.

Investors cannot invest directly in an index. The returns for the S&P 500 Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

***S&P 500 Index Closest Month-End to Inception cumulative total returns are –7.76% for Class A, B, and C; 38.89% for Class I; and 256.81% for Class Z. S&P 500 Index Closest Month-End to Inception average annual total returns are –1.50% for Class A, B, and C; 4.38% for Class I; and 10.79% for Class Z.

****Lipper Average Closest Month-End to Inception cumulative total returns are –10.35% for Class A, B, and C; 34.32% for Class I; and 243.36% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns are –2.03% for Class A, B, and C; 3.92% for Class I; and 10.44% for Class Z.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 3 |

Your Fund’s Performance (continued)

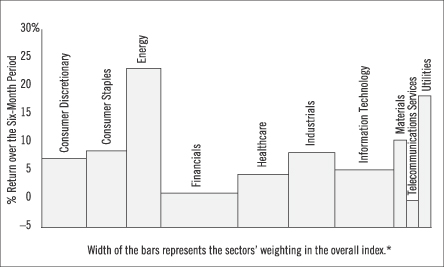

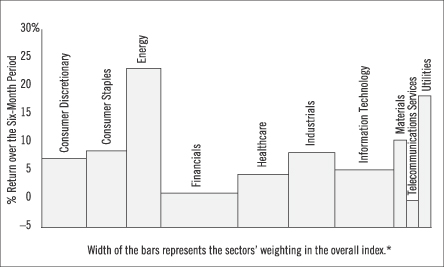

S&P 500 Index as of 3/31/05

Source: Factset.

“Standard & Poor’s®,” “S&P®,” “S&P 500®,” “Standard & Poor’s 500,” and “500” are trademarks of The McGraw-Hill Companies, Inc., and have been licensed for use by Prudential Investments LLC, its affiliates, and subsidiaries. The Dryden Stock Index Fund is not sponsored, endorsed, sold, or promoted by S&P, and S&P makes no representation regarding the advisability of investing in the Fund. The performance cited does not represent the performance of the Dryden Stock Index Fund. Past performance does not guarantee future results. Investors cannot invest directly in an index.

| * | Industry weightings are subject to change. |

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on October 1, 2004, at the beginning of the period, and held through the six-month period ended March 31, 2005.

The Fund may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs), Section 403(b) accounts, and Section 529 plan accounts. As of the close of the six-month period covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. Section 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 5 |

Fees and Expenses (continued)

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Dryden Stock

Index Fund | | Beginning Account

Value

October 1, 2004 | | Ending Account

Value March 31, 2005 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000 | | $ | 1,067 | | 0.62 | % | | $ | 3.20 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,022 | | 0.62 | % | | $ | 3.13 |

| | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000 | | $ | 1,063 | | 1.40 | % | | $ | 7.20 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,018 | | 1.40 | % | | $ | 7.04 |

| | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000 | | $ | 1,062 | | 1.40 | % | | $ | 7.20 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,018 | | 1.40 | % | | $ | 7.04 |

| | | | | | | | | | | | | | | |

| Class I | | Actual | | $ | 1,000 | | $ | 1,068 | | 0.30 | % | | $ | 1.55 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,023 | | 0.30 | % | | $ | 1.51 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000 | | $ | 1,068 | | 0.39 | % | | $ | 2.01 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,023 | | 0.39 | % | | $ | 1.97 |

| | | | | | | | | | | | | | | |

* Fund expenses for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2005, and divided by the 365 days in the Fund’s current fiscal year ending September 30, 2005 (to reflect the six-month period).

| | |

| 6 | | Visit our website at www.jennisondryden.com |

Portfolio of Investments

as of March 31, 2005 (Unaudited)

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

|

| LONG-TERM INVESTMENTS 97.7% |

| |

| COMMON STOCKS | | | |

| |

| Aerospace/Defense 2.1% | | | |

| 148,384 | (c) | | Boeing Co. | | $ | 8,674,529 |

| 37,106 | | | General Dynamics Corp. | | | 3,972,197 |

| 153,515 | | | Honeywell International, Inc. | | | 5,712,293 |

| 78,056 | | | Lockheed Martin Corp. | | | 4,766,100 |

| 66,148 | | | Northrop Grumman Corp. | | | 3,570,669 |

| 79,244 | | | Raytheon Co. | | | 3,066,743 |

| 32,563 | | | Rockwell Automation, Inc. | | | 1,844,368 |

| 30,263 | | | Rockwell Collins, Inc. | | | 1,440,216 |

| 91,420 | (c) | | United Technologies Corp. | | | 9,293,757 |

| | | | | |

|

|

| | | | | | | 42,340,872 |

| |

| Agricultural Products 0.2% | | | |

| 48,192 | | | Monsanto Co. | | | 3,108,384 |

| |

| Airlines 0.1% | | | |

| 22,984 | (c) | | Delta Airlines, Inc.(a) | | | 93,085 |

| 139,274 | | | Southwest Airlines Co. | | | 1,983,262 |

| | | | | |

|

|

| | | | | | | 2,076,347 |

| |

| Aluminum 0.2% | | | |

| 153,844 | (c) | | Alcoa, Inc. | | | 4,675,319 |

| |

| Automobiles & Trucks 0.6% | | | |

| 8,279 | (c) | | Cummins, Inc. | | | 582,428 |

| 27,240 | | | Dana Corp. | | | 348,400 |

| 106,684 | | | Delphi Automotive Systems Corp. | | | 477,944 |

| 327,463 | (c) | | Ford Motor Co. | | | 3,710,156 |

| 100,178 | (c) | | General Motors Corp. | | | 2,944,231 |

| 30,799 | | | Genuine Parts Co. | | | 1,339,448 |

| 33,752 | | | Johnson Controls, Inc. | | | 1,882,011 |

| 11,260 | (c) | | Navistar International Corp.(a) | | | 409,864 |

| 27,070 | (c) | | Visteon Corp. | | | 154,570 |

| | | | | |

|

|

| | | | | | | 11,849,052 |

| |

| Banking 7.6% | | | |

| 64,800 | | | AmSouth Bancorporation | | | 1,681,560 |

| 723,604 | | | Bank of America Corp. | | | 31,910,936 |

| 139,836 | | | Bank of New York Co., Inc. | | | 4,062,236 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 7 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 96,958 | | | BB&T Corp. | | $ | 3,789,119 |

| 43,067 | (c) | | Capital One Financial Corp. | | | 3,220,119 |

| 30,961 | (c) | | Comerica, Inc. | | | 1,705,332 |

| 22,500 | (c) | | Compass Bancshares, Inc. | | | 1,021,500 |

| 102,273 | | | Fifth Third Bancorp | | | 4,395,693 |

| 22,800 | | | First Horizon National Corp. | | | 930,012 |

| 53,484 | (c) | | Golden West Financial Corp. | | | 3,235,782 |

| 41,329 | | | Huntington Bancshares, Inc. | | | 987,763 |

| 632,366 | | | JP Morgan Chase & Co. | | | 21,879,864 |

| 73,035 | (c) | | KeyCorp | | | 2,369,986 |

| 19,300 | (c) | | M&T Bank Corp. | | | 1,969,758 |

| 75,246 | (c) | | Mellon Financial Corp. | | | 2,147,521 |

| 116,698 | | | National City Corp. | | | 3,909,383 |

| 84,350 | | | North Fork Bancorporation, Inc. | | | 2,339,869 |

| 39,662 | | | Northern Trust Corp. | | | 1,722,917 |

| 51,136 | | | PNC Financial Services Group | | | 2,632,481 |

| 47,402 | (c) | | Providian Financial Corp.(a) | | | 813,418 |

| 79,637 | | | Regions Financial Corp. | | | 2,580,239 |

| 63,300 | | | Sovereign Bancorp, Inc. | | | 1,402,728 |

| 59,762 | | | State Street Corp. | | | 2,612,795 |

| 65,783 | (c) | | SunTrust Banks, Inc. | | | 4,740,981 |

| 330,695 | | | US Bancorp | | | 9,530,630 |

| 285,448 | | | Wachovia Corp.(e) | | | 14,532,158 |

| 300,540 | | | Wells Fargo & Co. | | | 17,972,292 |

| 15,900 | | | Zions Bancorporation | | | 1,097,418 |

| | | | | |

|

|

| | | | | | | 151,194,490 |

| |

| Beverages 2.2% | | | |

| 141,554 | (c) | | Anheuser-Busch Co., Inc. | | | 6,708,244 |

| 17,976 | | | Brown-Forman Corp. | | | 984,186 |

| 412,732 | | | Coca-Cola Co. | | | 17,198,543 |

| 76,300 | (c) | | Coca-Cola Enterprises, Inc. | | | 1,565,676 |

| 11,747 | (c) | | Molson Coors Brewing Co. | | | 906,516 |

| 47,500 | | | Pepsi Bottling Group, Inc. | | | 1,322,875 |

| 297,305 | | | PepsiCo, Inc. | | | 15,766,084 |

| | | | | |

|

|

| | | | | | | 44,452,124 |

| |

| Chemicals 1.2% | | | |

| 39,432 | | | Air Products & Chemicals, Inc. | | | 2,495,651 |

| 170,936 | | | Dow Chemical Co. | | | 8,521,160 |

| 175,544 | | | E.I. du Pont de Nemours & Co. | | | 8,994,875 |

| 12,993 | | | Eastman Chemical Co. | | | 766,587 |

| 21,931 | | | Hercules, Inc.(a) | | | 317,780 |

See Notes to Financial Statements.

| | |

| 8 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 40,870 | (c) | | Rohm & Haas Co. | | $ | 1,961,760 |

| 11,116 | | | Sigma-Aldrich Corp. | | | 680,855 |

| | | | | |

|

|

| | | | | | | 23,738,668 |

| |

| Chemical—Specialty 0.2% | | | |

| 19,204 | | | Engelhard Corp. | | | 576,696 |

| 7,290 | | | Great Lakes Chemical Corp. | | | 234,155 |

| 57,658 | | | Praxair, Inc. | | | 2,759,512 |

| | | | | |

|

|

| | | | | | | 3,570,363 |

| |

| Commercial Services 0.1% | | | |

| 21,700 | | | Convergys Corp.(a) | | | 323,981 |

| 26,188 | | | Moodys Corp. | | | 2,117,562 |

| | | | | |

|

|

| | | | | | | 2,441,543 |

| |

| Computer Hardware 2.6% | | | |

| 142,824 | | | Apple Computer, Inc.(a) | | | 5,951,476 |

| 439,240 | | | Dell, Inc.(a) | | | 16,875,601 |

| 58,492 | | | Gateway, Inc.(a) | | | 235,723 |

| 297,034 | | | International Business Machines Corp. | | | 27,142,967 |

| 34,600 | | | NCR Corp.(a) | | | 1,167,404 |

| 49,665 | | | Seagate Technology(a)(f) | | | 0 |

| | | | | |

|

|

| | | | | | | 51,373,171 |

| |

| Computer Software & Services 6.4% | | | |

| 42,020 | | | Adobe Systems, Inc. | | | 2,822,484 |

| 21,700 | (c) | | Affiliated Computer Services, Inc. Class A(a) | | | 1,155,308 |

| 41,820 | | | Autodesk, Inc.(a) | | | 1,244,563 |

| 104,078 | (c) | | Automatic Data Processing, Inc., | | | 4,678,306 |

| 37,600 | | | BMC Software, Inc.(a) | | | 564,000 |

| 1,176,444 | | | Cisco Systems, Inc.(a) | | | 21,046,583 |

| 30,400 | (c) | | Citrix Systems, Inc.(a) | | | 724,128 |

| 104,258 | (c) | | Computer Associates International, Inc. | | | 2,825,392 |

| 34,151 | (c) | | Computer Sciences Corp.(a) | | | 1,565,823 |

| 72,700 | | | Compuware Corp.(a) | | | 523,440 |

| 216,100 | | | eBay, Inc.(a) | | | 8,051,886 |

| 50,400 | | | Electronic Arts, Inc.(a) | | | 2,609,712 |

| 433,304 | | | EMC Corp.(a) | | | 5,338,305 |

| 149,552 | | | First Data Corp. | | | 5,878,889 |

| 34,000 | (c) | | Intuit, Inc.(a) | | | 1,488,180 |

| 35,820 | (c) | | KLA-Tencor Corp. | | | 1,648,078 |

| 15,900 | | | Mercury Interactive Corp.(a) | | | 753,342 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 9 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 79,516 | | | Micron Technology, Inc.(a) | | $ | 822,196 |

| 1,829,412 | | | Microsoft Corp. | | | 44,216,888 |

| 55,702 | | | Novell, Inc.(a) | | | 331,984 |

| 25,300 | | | Novellus Systems, Inc.(a) | | | 676,269 |

| 27,400 | | | NVIDIA Corp.(a) | | | 651,024 |

| 829,440 | | | Oracle Corp.(a) | | | 10,351,411 |

| 54,279 | (c) | | Parametric Technology Corp.(a) | | | 303,420 |

| 97,000 | | | Siebel Systems, Inc.(a) | | | 885,610 |

| 593,296 | (c) | | Sun Microsystems, Inc.(a) | | | 2,396,916 |

| 49,600 | | | SunGuard Data Systems, Inc.(a) | | | 1,711,200 |

| 76,877 | | | VERITAS Software Corp.(a) | | | 1,785,084 |

| | | | | |

|

|

| | | | | | | 127,050,421 |

| |

| Construction 0.2% | | | |

| 15,737 | | | Fluor Corp. | | | 872,302 |

| 8,291 | | | KB Home | | | 973,861 |

| 22,886 | | | Pulte Homes, Inc. | | | 1,685,096 |

| 17,600 | (c) | | Vulcan Materials Co. | | | 1,000,208 |

| | | | | |

|

|

| | | | | | | 4,531,467 |

| |

| Containers 0.1% | | | |

| 21,132 | | | Ball Corp. | | | 876,556 |

| 16,110 | | | Bemis Co. | | | 501,343 |

| 24,758 | | | Pactiv Corp.(a) | | | 578,099 |

| | | | | |

|

|

| | | | | | | 1,955,998 |

| |

| Cosmetics & Soaps 2.2% | | | |

| 15,885 | | | Alberto-Culver Co. | | | 760,256 |

| 82,344 | (c) | | Avon Products, Inc. | | | 3,535,851 |

| 26,532 | (c) | | Clorox Co. | | | 1,671,251 |

| 94,330 | | | Colgate-Palmolive Co. | | | 4,921,196 |

| 177,439 | | | Gillette Co. | | | 8,957,121 |

| 13,675 | | | International Flavors & Fragrances, Inc. | | | 540,162 |

| 455,238 | (c) | | Procter & Gamble Co. | | | 24,127,614 |

| | | | | |

|

|

| | | | | | | 44,513,451 |

| |

| Diversified Gas | | | |

| 8,223 | | | NICOR, Inc. | | | 304,991 |

| |

| Drugs & Medical Supplies 10.4% | | | |

| 276,774 | | | Abbott Laboratories | | | 12,903,204 |

| 24,082 | (c) | | Allergan, Inc. | | | 1,672,977 |

| 20,000 | | | AmerisourceBergen Corp. | | | 1,145,800 |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 225,804 | | | Amgen, Inc.(a) | | $ | 13,144,051 |

| 9,238 | | | Bausch & Lomb, Inc. | | | 677,145 |

| 111,274 | | | Baxter International, Inc. | | | 3,781,091 |

| 45,312 | (c) | | Becton Dickinson & Co. | | | 2,647,127 |

| 60,120 | (c) | | Biogen Idec, Inc.(a) | | | 2,074,741 |

| 43,323 | | | Biomet, Inc. | | | 1,572,625 |

| 146,424 | | | Boston Scientific Corp.(a) | | | 4,288,759 |

| 347,014 | | | Bristol-Myers Squibb Co. | | | 8,834,977 |

| 18,712 | | | C.R. Bard, Inc. | | | 1,273,913 |

| 78,073 | | | Cardinal Health, Inc. | | | 4,356,473 |

| 83,200 | | | Caremark Rx, Inc.(a) | | | 3,309,696 |

| 64,600 | (c) | | Forest Laboratories, Inc.(a) | | | 2,386,970 |

| 45,000 | | | Genzyme Corp.(a) | | | 2,575,800 |

| 56,748 | | | Guidant Corp. | | | 4,193,677 |

| 28,207 | | | Hospira, Inc.(a) | | | 910,240 |

| 533,869 | (c) | | Johnson & Johnson | | | 35,854,642 |

| 38,433 | | | King Pharmaceuticals, Inc.(a) | | | 319,378 |

| 23,400 | | | Laboratory Corp. of America Holdings(a) | | | 1,127,880 |

| 200,597 | | | Lilly(Eli) & Co. | | | 10,451,104 |

| 42,200 | (c) | | MedImmune, Inc.(a) | | | 1,004,782 |

| 214,858 | | | Medtronic, Inc. | | | 10,947,015 |

| 391,744 | | | Merck & Co., Inc. | | | 12,680,753 |

| 31,100 | | | Mylan Laboratories, Inc. | | | 551,092 |

| 1,340,623 | | | Pfizer, Inc. | | | 35,218,166 |

| 17,600 | | | Quest Diagnostics, Inc. | | | 1,850,288 |

| 263,224 | | | Schering-Plough Corp. | | | 4,777,516 |

| 64,264 | | | St. Jude Medical, Inc.(a) | | | 2,313,504 |

| 70,400 | (c) | | Stryker Corp. | | | 3,140,544 |

| 20,600 | (c) | | Watson Pharmaceuticals, Inc.(a) | | | 633,038 |

| 240,791 | | | Wyeth | | | 10,156,564 |

| 44,011 | (c) | | Zimmer Holdings, Inc.(a) | | | 3,424,496 |

| | | | | |

|

|

| | | | | | | 206,200,028 |

| |

| Education 0.1% | | | |

| 33,600 | (c) | | Apollo Group, Inc.(a) | | | 2,488,416 |

| |

| Electronics 4.1% | | | |

| 53,024 | (c) | | Advanced Micro Devices, Inc.(a) | | | 854,747 |

| 84,596 | (c) | | Agilent Technologies, Inc.(a) | | | 1,878,031 |

| 68,600 | (c) | | Altera Corp.(a) | | | 1,356,908 |

| 68,900 | (c) | | Analog Devices, Inc. | | | 2,490,046 |

| 81,300 | | | Electronic Data Systems Corp. | | | 1,680,471 |

| 75,275 | | | Emerson Electric Co. | | | 4,887,606 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 11 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 67,607 | | | Freescale Semiconductor, Inc., Class B(a) | | $ | 1,166,221 |

| 529,702 | | | Hewlett-Packard Co. | | | 11,621,662 |

| 1,133,688 | | | Intel Corp. | | | 26,335,572 |

| 35,500 | (c) | | Jabil Circuit, Inc.(a) | | | 1,012,460 |

| 18,100 | | | L3 Communications Holdings, Inc. | | | 1,285,462 |

| 55,300 | (c) | | Linear Technology Corp. | | | 2,118,543 |

| 75,644 | | | LSI Logic Corp.(a) | | | 422,850 |

| 57,400 | | | Maxim Integrated Products, Inc. | | | 2,345,938 |

| 32,450 | | | Molex, Inc. | | | 855,382 |

| 443,513 | | | Motorola, Inc. | | | 6,639,389 |

| 64,352 | | | National Semiconductor Corp. | | | 1,326,295 |

| 23,370 | | | PerkinElmer, Inc. | | | 482,123 |

| 32,400 | | | PMC-Sierra, Inc.(a) | | | 285,120 |

| 16,100 | | | QLogic Corp.(a) | | | 652,050 |

| 103,300 | | | Sanmina Corp.(a) | | | 539,226 |

| 184,500 | | | Solectron Corp.(a) | | | 640,215 |

| 14,124 | | | Tektronix, Inc. | | | 346,462 |

| 31,300 | (c) | | Teradyne, Inc.(a) | | | 456,980 |

| 305,252 | | | Texas Instruments, Inc. | | | 7,780,873 |

| 53,300 | | | Xilinx, Inc. | | | 1,557,959 |

| | | | | |

|

|

| | | | | | | 81,018,591 |

| |

| Financial Services 7.6% | | | |

| 19,500 | | | Ambac Financial Group, Inc. | | | 1,457,625 |

| 215,859 | | | American Express Co. | | | 11,088,677 |

| 20,598 | (c) | | Bear, Stearns & Co., Inc. | | | 2,057,740 |

| 231,811 | | | Charles Schwab Corp. | | | 2,436,334 |

| 36,800 | | | CIT Group, Inc. | | | 1,398,400 |

| 933,855 | | | Citigroup, Inc. | | | 41,967,444 |

| 105,148 | (c) | | Countrywide Credit Industries, Inc. | | | 3,413,104 |

| 63,400 | (c) | | E*TRADE Financial Corp.(a) | | | 760,800 |

| 25,830 | (c) | | Equifax, Inc. | | | 792,723 |

| 172,934 | (c) | | Fannie Mae | | | 9,416,256 |

| 18,500 | | | Federated Investors, Inc., Class B | | | 523,735 |

| 31,100 | (c) | | Fiserv, Inc.(a) | | | 1,237,780 |

| 39,414 | | | Franklin Resources, Inc. | | | 2,705,771 |

| 123,332 | | | Freddie Mac | | | 7,794,582 |

| 83,500 | | | Goldman Sachs Group, Inc. | | | 9,184,165 |

| 29,560 | | | H&R Block, Inc. | | | 1,495,145 |

| 38,100 | | | Janus Capital Group, Inc. | | | 531,495 |

| 48,874 | | | Lehman Brothers Holdings, Inc. | | | 4,601,976 |

| 38,100 | | | Marshall & Ilsley Corp. | | | 1,590,675 |

| 229,964 | | | MBNA Corp. | | | 5,645,616 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 167,534 | | | Merrill Lynch & Co., Inc. | | $ | 9,482,424 |

| 198,036 | | | Morgan Stanley | | | 11,337,561 |

| 66,225 | | | Paychex, Inc. | | | 2,173,505 |

| 91,600 | | | Prudential Financial, Inc.(e) | | | 5,257,840 |

| 77,092 | | | SLM Corp. | | | 3,842,265 |

| 49,466 | | | Synovus Financial Corp. | | | 1,378,123 |

| 21,900 | | | T. Rowe Price Group, Inc. | | | 1,300,422 |

| 154,387 | (c) | | Washington Mutual, Inc. | | | 6,098,286 |

| | | | | |

|

|

| | | | | | | 150,970,469 |

| |

| Foods 1.4% | | | |

| 111,959 | | | Archer-Daniels-Midland Co. | | | 2,751,952 |

| 67,447 | | | Campbell Soup Co. | | | 1,957,312 |

| 91,743 | | | ConAgra, Inc. | | | 2,478,896 |

| 65,972 | (c) | | General Mills, Inc. | | | 3,242,524 |

| 61,014 | | | H.J. Heinz & Co. | | | 2,247,756 |

| 42,016 | | | Hershey Foods Corp. | | | 2,540,287 |

| 67,970 | | | Kellogg Co. | | | 2,941,062 |

| 23,800 | | | McCormick & Co., Inc. | | | 819,434 |

| 141,786 | | | Sara Lee Corp. | | | 3,141,978 |

| 110,280 | | | Sysco Corp. | | | 3,948,024 |

| 33,804 | | | Wm. Wrigley Jr. Co. | | | 2,216,528 |

| | | | | |

|

|

| | | | | | | 28,285,753 |

| |

| Forest Products 0.9% | | | |

| 46,730 | | | Georgia-Pacific Corp. | | | 1,658,448 |

| 87,384 | | | International Paper Co. | | | 3,214,857 |

| 87,216 | | | Kimberly-Clark Corp. | | | 5,732,707 |

| 18,556 | | | Louisiana-Pacific Corp. | | | 466,498 |

| 37,835 | | | MeadWestvaco Corp. | | | 1,203,910 |

| 33,300 | | | Plum Creek Timber Co., Inc. | | | 1,188,810 |

| 9,045 | | | Temple-Inland, Inc. | | | 656,215 |

| 43,500 | (c) | | Weyerhaeuser Co. | | | 2,979,750 |

| | | | | |

|

|

| | | | | | | 17,101,195 |

| |

| Gas Distribution 0.1% | | | |

| 30,100 | | | KeySpan Corp. | | | 1,172,997 |

| |

| Gas Pipelines 0.4% | | | |

| 32,397 | | | Cinergy Corp. | | | 1,312,727 |

| 120,804 | | | El Paso Corp. | | | 1,278,106 |

| 21,700 | | | Kinder Morgan, Inc. | | | 1,642,690 |

| 6,732 | | | Peoples Energy Corp. | | | 282,205 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 13 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 43,398 | | | Sempra Energy | | $ | 1,728,976 |

| 101,192 | | | Williams Companies, Inc. | | | 1,903,422 |

| | | | | |

|

|

| | | | | | | 8,148,126 |

| |

| Health Care 0.8% | | | |

| 13,200 | | | Express Scripts, Inc.(a) | | | 1,150,908 |

| 17,100 | (c) | | Fisher Scientific International, Inc.(a) | | | 973,332 |

| 76,700 | | | Gilead Sciences, Inc.(a) | | | 2,745,860 |

| 14,060 | | | Manor Care, Inc. | | | 511,222 |

| 53,576 | | | McKesson Corp. | | | 2,022,494 |

| 49,134 | (c) | | Medco Health Solutions, Inc.(a) | | | 2,435,572 |

| 52,500 | | | WellPoint, Inc.(a) | | | 6,580,875 |

| | | | | |

|

|

| | | | | | | 16,420,263 |

| |

| Hospital Management 0.9% | | | |

| 75,331 | | | HCA, Inc. | | | 4,035,482 |

| 43,500 | | | Health Management Associates, Inc. | | | 1,138,830 |

| 27,510 | | | Humana, Inc.(a) | | | 878,669 |

| 41,910 | | | IMS Health, Inc. | | | 1,022,185 |

| 82,172 | | | Tenet Healthcare Corp.(a) | | | 947,443 |

| 113,624 | | | United Health Group, Inc. | | | 10,837,457 |

| | | | | |

|

|

| | | | | | | 18,860,066 |

| |

| Housing Related 0.4% | | | |

| 20,694 | | | Centex Corp. | | | 1,185,145 |

| 32,200 | | | Leggett & Platt, Inc. | | | 929,936 |

| 81,926 | | | Masco Corp. | | | 2,840,374 |

| 13,318 | (c) | | Maytag Corp. | | | 186,053 |

| 48,627 | (c) | | Newell Rubbermaid, Inc. | | | 1,066,876 |

| 13,638 | | | Stanley Works | | | 617,392 |

| 11,639 | | | Whirlpool Corp. | | | 788,310 |

| | | | | |

|

|

| | | | | | | 7,614,086 |

| |

| Insurance 4.0% | | | |

| 49,300 | | | ACE Ltd. | | | 2,034,611 |

| 52,586 | | | Aetna, Inc. | | | 3,941,321 |

| 89,900 | (c) | | AFLAC, Inc. | | | 3,349,674 |

| 121,208 | | | Allstate Corp. | | | 6,552,504 |

| 462,738 | | | American International Group, Inc. | | | 25,640,313 |

| 58,389 | (c) | | Aon Corp. | | | 1,333,605 |

| 33,334 | | | Chubb Corp. | | | 2,642,386 |

| 23,197 | | | CIGNA Corp. | | | 2,071,492 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 28,769 | | | Cincinnati Financial Corp. | | $ | 1,254,616 |

| 51,653 | | | Hartford Financial Services Group, Inc. | | | 3,541,330 |

| 23,686 | | | Jefferson-Pilot Corp. | | | 1,161,798 |

| 31,830 | | | Lincoln National Corp. | | | 1,436,806 |

| 90,740 | | | Marsh & McLennan Companies, Inc. | | | 2,760,311 |

| 26,158 | | | MBIA, Inc. | | | 1,367,540 |

| 134,100 | | | Metlife, Inc. | | | 5,243,310 |

| 17,020 | | | MGIC Investment Corp. | | | 1,049,623 |

| 53,900 | | | Principal Financial Group, Inc. | | | 2,074,611 |

| 34,879 | | | Progressive Corp. | | | 3,200,497 |

| 21,929 | | | SAFECO Corp. | | | 1,068,162 |

| 119,811 | | | St. Paul Companies, Inc. | | | 4,400,658 |

| 19,915 | | | Torchmark Corp. | | | 1,039,563 |

| 56,426 | (c) | | UnumProvident Corp. | | | 960,371 |

| 25,300 | | | XL Capital Ltd. | | | 1,830,961 |

| | | | | |

|

|

| | | | | | | 79,956,063 |

| |

| Internet 0.5% | | | |

| 113,700 | (c) | | Symantec Corp.(a) | | | 2,425,221 |

| 244,000 | | | Yahoo!, Inc.(a) | | | 8,271,600 |

| | | | | |

|

|

| | | | | | | 10,696,821 |

| |

| Leisure 0.6% | | | |

| 16,499 | | | Brunswick Corp. | | | 772,978 |

| 101,600 | (c) | | Carnival Corp. | | | 5,263,896 |

| 20,324 | | | Harrah’s Entertainment, Inc. | | | 1,312,524 |

| 32,854 | (c) | | Hasbro, Inc. | | | 671,864 |

| 50,400 | | | International Game Technology | | | 1,343,664 |

| 76,313 | (c) | | Mattel, Inc. | | | 1,629,283 |

| | | | | |

|

|

| | | | | | | 10,994,209 |

| |

| Lodging 0.2% | | | |

| 53,621 | | | Hilton Hotels Corp. | | | 1,198,429 |

| 39,652 | | | Marriott International, Inc. | | | 2,651,133 |

| | | | | |

|

|

| | | | | | | 3,849,562 |

| |

| Machinery 1.0% | | | |

| 61,428 | | | Caterpillar, Inc. | | | 5,616,976 |

| 16,820 | | | Cooper Industries, Inc. | | | 1,202,966 |

| 43,240 | | | Deere & Co. | | | 2,902,701 |

| 35,762 | (c) | | Dover Corp. | | | 1,351,446 |

| 27,754 | | | Eaton Corp. | | | 1,815,112 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 15 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 30,395 | | | Ingersoll-Rand Co. | | $ | 2,420,962 |

| 31,184 | (c) | | PACCAR, Inc. | | | 2,257,410 |

| 21,592 | (c) | | Parker Hannifin Corp. | | | 1,315,385 |

| 10,342 | | | Snap-On, Inc. | | | 328,772 |

| 29,902 | | | Thermo Electron Corp.(a) | | | 756,221 |

| | | | | |

|

|

| | | | | | | 19,967,951 |

| |

| Media 3.8% | | | |

| 98,638 | | | Clear Channel Communications, Inc. | | | 3,400,052 |

| 394,690 | (c) | | Comcast Corp.(a) | | | 13,332,628 |

| 39,040 | | | Donnelley (R.R.) & Sons, Co. | | | 1,234,445 |

| 14,404 | | | Dow Jones & Co., Inc. | | | 538,277 |

| 45,889 | | | Gannett Co., Inc. | | | 3,628,902 |

| 76,712 | | | Interpublic Group of Companies, Inc.(a) | | | 942,023 |

| 13,583 | | | Knight-Ridder, Inc. | | | 913,457 |

| 34,300 | | | McGraw Hill Companies, Inc. | | | 2,992,675 |

| 9,096 | | | Meredith Corp. | | | 425,238 |

| 20,400 | (c) | | Monster Worldwide, Inc.(a) | | | 572,220 |

| 24,590 | (c) | | New York Times Co. | | | 899,502 |

| 499,500 | | | News Corp., Class A | | | 8,451,540 |

| 360,713 | (c) | | The Walt Disney Co. | | | 10,363,285 |

| 822,724 | | | Time Warner, Inc.(a) | | | 14,438,806 |

| 56,727 | (c) | | Tribune Co. | | | 2,261,706 |

| 54,900 | (c) | | Univision Communications, Inc.(a) | | | 1,520,181 |

| 304,152 | | | Viacom, Inc. | | | 10,593,614 |

| | | | | |

|

|

| | | | | | | 76,508,551 |

|

| Mineral Resources 0.3% |

| 33,128 | | | Freeport-McMoran Copper & Gold, Inc. | | | 1,312,200 |

| 78,797 | | | Newmont Mining Corp. | | | 3,329,173 |

| 17,730 | | | Phelps Dodge Corp. | | | 1,803,673 |

| | | | | |

|

|

| | | | | | | 6,445,046 |

|

| Miscellaneous Basic Industry 6.4% |

| 35,900 | | | American Power Conversion Corp. | | | 937,349 |

| 38,600 | | | American Standard Companies, Inc. | | | 1,794,128 |

| 36,464 | | | Applera Corp.-Applied Biosystems Group | | | 719,799 |

| 306,488 | | | Applied Materials, Inc. | | | 4,980,430 |

| 54,600 | (c) | | Applied Micro Circuits Corp.(a) | | | 179,634 |

| 83,900 | (c) | | Calpine Corp.(a) | | | 234,920 |

| 182,359 | | | Cendant Corp. | | | 3,745,654 |

| 26,400 | (c) | | Chiron Corp.(a) | | | 925,584 |

| 54,200 | | | Danaher Corp. | | | 2,894,822 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 69,500 | | | Dynegy, Inc.(a) | | $ | 271,745 |

| 47,682 | | | Ecolab, Inc. | | | 1,575,890 |

| 43,800 | | | EOG Resources, Inc. | | | 2,134,812 |

| 25,208 | | | Fortune Brands, Inc. | | | 2,032,521 |

| 1,892,872 | | | General Electric Co. | | | 68,256,964 |

| 16,474 | | | Grainger (W.W.), Inc. | | | 1,025,836 |

| 52,000 | (c) | | Harley-Davidson, Inc. | | | 3,003,520 |

| 52,468 | | | Illinois Tool Works, Inc. | | | 4,697,460 |

| 16,586 | | | ITT Industries, Inc. | | | 1,496,721 |

| 33,668 | | | Loews Corp. | | | 2,475,945 |

| 9,261 | | | Millipore Corp.(a) | | | 401,927 |

| 27,800 | | | Nabors Industries Ltd.(a) | | | 1,644,092 |

| 33,667 | | | Omnicom Group, Inc. | | | 2,980,203 |

| 23,404 | | | Pall Corp. | | | 634,716 |

| 29,974 | | | PPG Industries, Inc. | | | 2,143,740 |

| 33,200 | | | Robert Half International, Inc. | | | 895,072 |

| 14,018 | | | Sealed Air Corp.(a) | | | 728,095 |

| 38,350 | | | Symbol Technologies, Inc. | | | 555,692 |

| 25,167 | | | Textron, Inc. | | | 1,877,962 |

| 357,280 | | | Tyco International Ltd. | | | 12,076,064 |

| 21,500 | | | Waters Corp.(a) | | | 769,485 |

| | | | | |

|

|

| | | | | | | 128,090,782 |

|

| Miscellaneous Consumer Growth 0.9% |

| 138,398 | | | 3M Co. | | | 11,859,325 |

| 15,332 | | | Black & Decker Corp. | | | 1,211,075 |

| 252,797 | (c) | | Corning, Inc.(a) | | | 2,813,630 |

| 52,465 | (c) | | Eastman Kodak Co. | | | 1,707,736 |

| | | | | |

|

|

| | | | | | | 17,591,766 |

|

| Office Equipment & Supplies 0.8% |

| 18,868 | (c) | | Avery Dennison Corp. | | | 1,168,495 |

| 26,700 | (c) | | Cintas Corp. | | | 1,102,977 |

| 23,352 | (c) | | Lexmark International Group, Inc.(a) | | | 1,867,459 |

| 65,900 | (c) | | Network Appliance, Inc.(a) | | | 1,822,794 |

| 56,300 | | | Office Depot, Inc.(a) | | | 1,248,734 |

| 15,949 | | | OfficeMax, Inc. | | | 534,292 |

| 39,325 | | | Pitney Bowes, Inc. | | | 1,774,344 |

| 88,350 | | | Staples, Inc. | | | 2,776,841 |

| 62,390 | | | Unisys Corp.(a) | | | 440,473 |

| 172,198 | | | Xerox Corp.(a) | | | 2,608,800 |

| | | | | |

|

|

| | | | | | | 15,345,209 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 17 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

|

| Petroleum 7.1% |

| 16,878 | | | Amerada Hess Corp. | | $ | 1,623,832 |

| 43,618 | | | Anadarko Petroleum Corp. | | | 3,319,330 |

| 58,248 | | | Apache Corp. | | | 3,566,525 |

| 13,445 | | | Ashland Oil, Inc. | | | 907,134 |

| 27,300 | | | BJ Services Co. | | | 1,416,324 |

| 70,164 | | | Burlington Resources, Inc. | | | 3,513,112 |

| 380,380 | | | ChevronTexaco Corp. | | | 22,179,958 |

| 124,941 | | | ConocoPhillips | | | 13,473,637 |

| 85,400 | | | Devon Energy Corp. | | | 4,077,850 |

| 1,150,314 | | | Exxon Mobil Corp. | | | 68,558,714 |

| 27,259 | | | Kerr-McGee Corp. | | | 2,135,198 |

| 62,560 | | | Marathon Oil Corp. | | | 2,935,315 |

| 70,938 | | | Occidental Petroleum Corp. | | | 5,048,657 |

| 12,914 | | | Sunoco, Inc. | | | 1,336,857 |

| 56,263 | | | Transocean Sedco Forex, Inc.(a) | | | 2,895,294 |

| 45,939 | | | Unocal Corp. | | | 2,833,977 |

| 55,733 | | | XTO Energy, Inc. | | | 1,830,283 |

| | | | | |

|

|

| | | | | | | 141,651,997 |

| |

| Petroleum Services 1.1% | | | |

| 61,379 | (c) | | Baker Hughes, Inc. | | | 2,730,752 |

| 86,911 | | | Halliburton Co. | | | 3,758,901 |

| 23,100 | | | National-Oilwell Varco, Inc.(a) | | | 1,078,770 |

| 23,800 | (c) | | Nobel Corp. | | | 1,337,798 |

| 66,452 | | | PG&E Corp. | | | 2,266,013 |

| 20,510 | | | Rowan Companies, Inc. | | | 613,864 |

| 106,821 | | | Schlumberger Ltd. | | | 7,528,744 |

| 45,100 | (c) | | Valero Energy Corp. | | | 3,304,477 |

| | | | | |

|

|

| | | | | | | 22,619,319 |

| |

| Railroads 0.6% | | | |

| 66,223 | | | Burlington Northern Santa Fe Corp. | | | 3,571,406 |

| 38,203 | | | CSX Corp. | | | 1,591,155 |

| 72,111 | | | Norfolk Southern Corp. | | | 2,671,713 |

| 44,129 | | | Union Pacific Corp. | | | 3,075,791 |

| | | | | |

|

|

| | | | | | | 10,910,065 |

| |

| Real Estate Investment Trust 0.5% | | | |

| 17,500 | (c) | | Apartment Investment & Management Co., Class A | | | 651,000 |

| 28,900 | | | Archstone-Smith Trust | | | 985,779 |

| 69,300 | | | Equity Office Properties Trust | | | 2,088,009 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 49,700 | | | Equity Residential Properties Trust | | $ | 1,600,837 |

| 38,400 | | | Simon Property Group, Inc. | | | 2,326,272 |

| 32,000 | (c) | | Starwood Hotels & Resorts Worldwide, Inc. | | | 1,920,960 |

| | | | | |

|

|

| | | | | | | 9,572,857 |

| |

| Restaurants 0.8% | | | |

| 27,353 | | | Darden Restaurants, Inc. | | | 839,190 |

| 227,930 | | | McDonald’s Corp. | | | 7,097,740 |

| 72,000 | (c) | | Starbucks Corp.(a) | | | 3,719,520 |

| 19,879 | | | Wendy’s International, Inc. | | | 776,076 |

| 50,532 | | | Yum! Brands, Inc. | | | 2,618,063 |

| | | | | |

|

|

| | | | | | | 15,050,589 |

| Retail 6.2% | | | |

| 66,313 | (c) | | Albertson’s, Inc. | | | 1,369,363 |

| 47,900 | (c) | | AutoNation, Inc.(a) | | | 907,226 |

| 14,700 | (c) | | AutoZone, Inc.(a) | | | 1,259,790 |

| 55,100 | | | Bed Bath & Beyond, Inc.(a) | | | 2,013,354 |

| 55,700 | (c) | | Best Buy Co., Inc. | | | 3,008,357 |

| 21,524 | | | Big Lots, Inc.(a) | | | 258,718 |

| 31,878 | | | Circuit City Stores, Inc. | | | 511,642 |

| 33,800 | | | Coach, Inc.(a) | | | 1,914,094 |

| 83,608 | | | Costco Wholesale Corp. | | | 3,693,801 |

| 71,296 | | | CVS Corp. | | | 3,751,596 |

| 14,323 | | | Dillards, Inc. | | | 385,289 |

| 56,750 | | | Dollar General Corp. | | | 1,243,393 |

| 29,800 | | | Family Dollar Stores, Inc. | | | 904,728 |

| 29,575 | | | Federated Department Stores, Inc. | | | 1,882,153 |

| 149,713 | | | Gap, Inc. | | | 3,269,732 |

| 391,284 | | | Home Depot, Inc. | | | 14,962,700 |

| 52,084 | | | J.C. Penney Co., Inc. | | | 2,704,201 |

| 23,700 | | | Jones Apparel Group, Inc. | | | 793,713 |

| 55,600 | | | Kohl’s Corp.(a) | | | 2,870,628 |

| 131,334 | | | Kroger Co.(a) | | | 2,105,284 |

| 72,822 | | | Limited, Inc. | | | 1,769,575 |

| 20,492 | | | Liz Claiborne, Inc. | | | 822,344 |

| 136,948 | (c) | | Lowe’s Companies, Inc. | | | 7,818,361 |

| 53,071 | | | May Department Stores Co. | | | 1,964,688 |

| 45,938 | | | Nike, Inc. | | | 3,827,095 |

| 25,700 | | | Nordstrom, Inc. | | | 1,423,266 |

| 28,554 | | | Radioshack Corp. | | | 699,573 |

| 9,249 | | | Reebok International Ltd. | | | 409,731 |

| 80,000 | | | Safeway, Inc.(a) | | | 1,482,400 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 19 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| 11,707 | (c) | | Sears Holdings Corp.(a) | | $ | 1,559,068 |

| 24,216 | | | Sherwin-Williams Co. | | | 1,065,262 |

| 25,212 | | | Supervalu, Inc. | | | 840,820 |

| 159,082 | | | Target Corp. | | | 7,957,282 |

| 17,700 | (c) | | Tiffany & Co. | | | 611,004 |

| 82,532 | (c) | | TJX Companies, Inc. | | | 2,032,763 |

| 37,607 | (c) | | Toys ‘R’ Us, Inc.(a) | | | 968,756 |

| 615,226 | | | Wal-Mart Stores, Inc. | | | 30,828,975 |

| 179,478 | | | Walgreen Co. | | | 7,972,413 |

| | | | | |

|

|

| | | | | | | 123,863,138 |

| |

| Rubber 0.1% | | | |

| 11,588 | | | Cooper Tire & Rubber Co. | | | 212,755 |

| 23,199 | | | Goodrich Corp. | | | 888,290 |

| 34,071 | | | Goodyear Tire & Rubber Co.(a) | | | 454,848 |

| | | | | |

|

|

| | | | | | | 1,555,893 |

| |

| Steel - Producers 0.2% | | | |

| 13,718 | | | Allegheny Technologies, Inc. | | | 330,741 |

| 29,456 | | | Nucor Corp. | | | 1,695,487 |

| 20,209 | (c) | | United States Steel Corp. | | | 1,027,628 |

| | | | | |

|

|

| | | | | | | 3,053,856 |

| |

| Telecommunications 1.8% | | | |

| 147,400 | (c) | | ADC Telecommunications, Inc.(a) | | | 293,326 |

| 53,834 | (c) | | Alltel Corp. | | | 2,952,795 |

| 29,922 | (c) | | Andrew Corp.(a) | | | 350,387 |

| 83,855 | | | Avaya, Inc.(a) | | | 979,426 |

| 52,000 | (c) | | Broadcom Corp.(a) | | | 1,555,840 |

| 24,350 | (c) | | CenturyTel, Inc. | | | 799,654 |

| 92,500 | | | CIENA Corp.(a) | | | 159,100 |

| 57,000 | | | Citizens Communications Co. | | | 737,580 |

| 33,500 | (c) | | Comverse Technology, Inc.(a) | | | 844,870 |

| 280,900 | (c) | | JDS Uniphase Corp.(a) | | | 469,103 |

| 804,667 | | | Lucent Technologies, Inc.(a) | | | 2,212,834 |

| 201,940 | | | Nextel Communications, Inc.(a) | | | 5,739,135 |

| 290,500 | | | Qualcomm, Inc. | | | 10,646,825 |

| 320,336 | (c) | | Qwest Communications International, Inc.(a) | | | 1,185,243 |

| 27,876 | | | Scientific—Atlanta, Inc. | | | 786,661 |

| 261,430 | (c) | | Sprint Corp.(FON Group) | | | 5,947,533 |

| 71,194 | (c) | | Tellabs, Inc.(a) | | | 519,716 |

| | | | | |

|

|

| | | | | | | 36,180,028 |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | | Description | | Value (Note 1) |

| | | | | | | |

| |

| Textiles 0.1% | | | |

| 20,934 | | | V.F. Corp. | | $ | 1,238,037 |

| |

| Tobacco 1.4% | | | |

| 366,479 | | | Altria Group, Inc. | | | 23,964,062 |

| 25,600 | (c) | | Reynolds American, Inc. | | | 2,063,104 |

| 29,699 | | | UST, Inc. | | | 1,535,438 |

| | | | | |

|

|

| | | | | | | 27,562,604 |

| |

| Travel Services | | | |

| 25,941 | | | Sabre Holdings Corp. | | | 567,589 |

| |

| Trucking & Shipping 1.0% | | | |

| 54,816 | | | FedEx Corp. | | | 5,149,963 |

| 12,321 | | | Ryder System, Inc. | | | 513,786 |

| 199,200 | | | United Parcel Service, Inc., Class B | | | 14,489,808 |

| | | | | |

|

|

| | | | | | | 20,153,557 |

| |

| Utility Communications 2.2% | | | |

| 141,966 | | | AT&T Corp. | | | 2,661,863 |

| 326,356 | (c) | | BellSouth Corp. | | | 8,579,899 |

| 589,701 | | | SBC Communications, Inc. | | | 13,970,017 |

| 497,233 | | | Verizon Communications, Inc. | | | 17,651,771 |

| | | | | |

|

|

| | | | | | | 42,863,550 |

| |

| Utilities—Electric 2.7% | | | |

| 112,300 | | | AES Corp.(a) | | | 1,839,474 |

| 23,700 | (c) | | Allegheny Energy, Inc.(a) | | | 489,642 |

| 35,369 | (c) | | Ameren Corp. | | | 1,733,435 |

| 69,291 | (c) | | American Electric Power Co., Inc. | | | 2,360,051 |

| 56,879 | | | CenterPoint Energy, Inc. | | | 684,254 |

| 29,400 | (c) | | CMS Energy Corp.(a) | | | 383,376 |

| 44,251 | (c) | | Consolidated Edison, Inc. | | | 1,866,507 |

| 30,129 | | | Constellation Energy Group, Inc. | | | 1,557,669 |

| 59,652 | | | Dominion Resources, Inc. | | | 4,439,898 |

| 31,587 | | | DTE Energy Co. | | | 1,436,577 |

| 168,362 | (c) | | Duke Energy Corp. | | | 4,715,819 |

| 52,162 | | | Edison International | | | 1,811,065 |

| 40,215 | | | Entergy Corp. | | | 2,841,592 |

| 118,356 | | | Exelon Corp. | | | 5,431,357 |

| 57,706 | | | FirstEnergy Corp. | | | 2,420,767 |

| 65,272 | | | FPL Group, Inc. | | | 2,620,671 |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 21 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | | | | | | |

| Shares | | | Description | | Value (Note 1) | |

| | | | | | | | | |

| | 45,900 | | | NiSource, Inc. | | $ | 1,046,061 | |

| | 17,400 | (c) | | Pinnacle West Capital Corp. | | | 739,674 | |

| | 34,626 | | | PPL Corp. | | | 1,869,458 | |

| | 44,958 | (c) | | Progress Energy, Inc. | | | 1,885,988 | |

| | 39,197 | (c) | | Public Service Enterprise Group, Inc. | | | 2,131,925 | |

| | 130,815 | (c) | | Southern Co. | | | 4,163,841 | |

| | 35,300 | | | TECO Energy, Inc. | | | 553,504 | |

| | 42,614 | | | TXU Corp. | | | 3,393,353 | |

| | 72,283 | | | Xcel Energy, Inc. | | | 1,241,822 | |

| | | | | | |

|

|

|

| | | | | | | | 53,657,780 | |

| |

| | Waste Management 0.2% | | | | |

| | 56,100 | (c) | | Allied Waste Industries, Inc.(a) | | | 410,091 | |

| | 103,513 | | | Waste Management, Inc. | | | 2,986,350 | |

| | | | | | |

|

|

|

| | | | | | | | 3,396,441 | |

| |

| | Warehouse/Industrial 0.1% | | | | |

| | 33,600 | | | ProLogis | | | 1,246,560 | |

| | | | | | |

|

|

|

| | | | | Total long-term investments

(cost $1,492,091,531) | | | 1,942,046,471 | |

| | | | | | |

|

|

|

| |

| | SHORT-TERM INVESTMENTS 16.3% | | | | |

| |

| | Mutual Fund 16.1% | | | | |

| | 320,295,762 | (d) | | Dryden Core Investment Fund-Taxable Money Market Series

(cost $320,295,762; Note 3) | | | 320,295,762 | |

| | |

Principal

Amount (000)

| | | | | | |

| |

| | U.S. Government Securities 0.2% | | | | |

| $ | 4,000 | (b) | | United States Treasury Bills 2.75%, 6/16/05

(cost $3,976,947) | | | 3,976,815 | |

| | | | | | |

|

|

|

| | | | | Total short-term investments

(cost $324,272,709) | | | 324,272,577 | |

| | | | | | |

|

|

|

| | | | | Total Investments 114.0%

(cost $1,816,364,240) | | | 2,266,319,048 | |

| | | | | Liabilities in excess of other assets(g) (14.0%) | | | (278,447,663 | ) |

| | | | | | |

|

|

|

| | | | | Net Assets 100% | | $ | 1,987,871,385 | |

| | | | | | |

|

|

|

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| (a) | Non-income producing security. |

| (b) | Pledged as initial margin for financial futures contracts. |

| (c) | All or portion of security is on loan. The aggregate market value of such securities is $265,430,262; cash collateral of $276,820,426 (included in liabilities) was received with which the portfolio purchased highly liquid short-term investments. |

| (d) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (g) | Liabilities in excess of other assets include net unrealized appreciation (depreciation) on financial futures as follows: |

Open future contracts outstanding at March 31, 2005:

| | | | | | | | | | | | | | |

Number of

Contracts

| | Type

| | Expiration Date

| | Value at

March 31,

2005

| | Value at

Trade Date

| | Unrealized

Depreciation

| |

| | | Long Position: | | | | | | | | | | | | |

| 165 | | S&P 500 Index Futures | | June 2005 | | $ | 48,835,875 | | $ | 49,466,138 | | $ | (630,263 | ) |

The Industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of March 31, 2005 were as follows:

| | | |

Mutual Fund | | 16.1 | % |

Drugs & Medical Supplies | | 10.4 | |

Banking | | 7.6 | |

Financial Services | | 7.6 | |

Petroleum | | 7.1 | |

Computer Software & Services | | 6.4 | |

Miscellaneous Basic Industry | | 6.4 | |

Retail | | 6.2 | |

Electronics | | 4.1 | |

Insurance | | 4.0 | |

Media | | 3.8 | |

Utilities—Electric | | 2.7 | |

Computer Hardware | | 2.6 | |

Beverages | | 2.2 | |

Cosmetics & Soaps | | 2.2 | |

Utility Communications | | 2.2 | |

Aerospace/Defense | | 2.1 | |

Telecommunications | | 1.8 | |

Foods | | 1.4 | |

Tobacco | | 1.4 | |

Chemicals | | 1.2 | |

Petroleum Services | | 1.1 | |

Machinery | | 1.0 | |

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 23 |

Portfolio of Investments

as of March 31, 2005 (Unaudited) Cont’d.

| | | |

Trucking & Shipping | | 1.0 | % |

Forest Products | | 0.9 | |

Hospital Management | | 0.9 | |

Miscellaneous Consumer Growth | | 0.9 | |

Health Care | | 0.8 | |

Office Equipment & Supplies | | 0.8 | |

Restaurants | | 0.8 | |

Automobiles & Trucks | | 0.6 | |

Leisure | | 0.6 | |

Railroads | | 0.6 | |

Internet | | 0.5 | |

Real Estate Investment Trust | | 0.5 | |

Gas Pipelines | | 0.4 | |

Housing Related | | 0.4 | |

Mineral Resources | | 0.3 | |

Agricultural Products | | 0.2 | |

Aluminum | | 0.2 | |

Chemical—Specialty | | 0.2 | |

Construction | | 0.2 | |

Lodging | | 0.2 | |

Steel—Producers | | 0.2 | |

U.S. Government Securities | | 0.2 | |

Waste Management | | 0.2 | |

Airlines | | 0.1 | |

Commercial Services | | 0.1 | |

Containers | | 0.1 | |

Education | | 0.1 | |

Gas Distribution | | 0.1 | |

Rubber | | 0.1 | |

Textiles | | 0.1 | |

Warehouse/Industrial | | 0.1 | |

| | |

|

|

| | | 114.0 | |

Liabilities in excess of other assets | | (14.0 | ) |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

Financial Statements

| | |

| MARCH 31, 2005 | | SEMIANNUAL REPORT |

Dryden Stock Index Fund

Statement of Assets and Liabilities

as of March 31, 2005 (Unaudited)

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $265,430,262 (cost $1,816,364,240) | | $ | 2,266,319,048 | |

Receivable for investments sold | | | 3,452,728 | |

Dividends and interest receivable | | | 2,655,543 | |

Receivable for Fund shares sold | | | 1,391,249 | |

Other assets | | | 28,657 | |

| | |

|

|

|

Total assets | | | 2,273,847,225 | |

| | |

|

|

|

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan (Note 4) | | | 276,820,426 | |

Payable for Fund shares reacquired | | | 5,786,663 | |

Payable for investments purchased | | | 2,401,571 | |

Management fee payable | | | 472,647 | |

Accrued expenses | | | 276,580 | |

Distribution fee payable | | | 149,148 | |

Due to broker-variation margin | | | 63,183 | |

Deferred trustees’ fees | | | 5,622 | |

| | |

|

|

|

Total liabilities | | | 285,975,840 | |

| | |

|

|

|

| |

Net Assets | | $ | 1,987,871,385 | |

| | |

|

|

|

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 75,414 | |

Paid-in capital in excess of par | | | 1,886,876,488 | |

| | |

|

|

|

| | | | 1,886,951,902 | |

Undistributed net investment income | | | 9,976,008 | |

Accumulated net realized loss on investments | | | (358,381,070 | ) |

Net unrealized appreciation on investments | | | 449,324,545 | |

| | |

|

|

|

Net assets March 31, 2005 | | $ | 1,987,871,385 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share ($68,713,303 ÷ 2,608,060 shares of beneficial interest issued and outstanding) | | $ | 26.35 |

Maximum sales charge (3.25% of offering price) | | | 0.89 |

| | |

|

|

Maximum offering price to public | | $ | 27.24 |

| | |

|

|

| |

Class B | | | |

Net asset value, offering price and redemption price per share ($103,772,687 ÷ 3,964,542 shares of beneficial interest issued and outstanding) | | $ | 26.18 |

| | |

|

|

| |

Class C | | | |

Net asset value, offering price and redemption price per share

($50,627,903 ÷ 1,934,533 shares of beneficial interest issued and outstanding) | | $ | 26.17 |

| | |

|

|

| |

Class I | | | |

Net asset value, offering price and redemption price per share

($1,006,279,358 ÷ 38,141,601 shares of beneficial interest issued and outstanding) | | $ | 26.38 |

| | |

|

|

| |

Class Z | | | |

Net asset value, offering price and redemption price per share

($758,478,134 ÷ 28,765,211 shares of beneficial interest issued and outstanding) | | $ | 26.37 |

| | |

|

|

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 27 |

Statement of Operations

Six Months Ended March 31, 2005 (Unaudited)

| | | | |

Net Investment Income | | | | |

Dividends | | $ | 25,475,991 | |

Interest | | | 43,593 | |

Income from securities loaned, net | | | 152,557 | |

| | |

|

|

|

Total income | | | 25,672,141 | |

| | |

|

|

|

Expenses | | | | |

Management fee | | | 2,857,460 | |

Distribution fee—Class A | | | 94,775 | |

Distribution fee—Class B | | | 542,488 | |

Distribution fee—Class C | | | 261,973 | |

Transfer agent fee—Class A | | | 34,900 | |

Transfer agent fee—Class B | | | 102,600 | |

Transfer agent fee—Class C | | | 26,100 | |

Transfer agent fee—Class Z | | | 377,900 | |

Custodian’s fees and expenses | | | 132,000 | |

Registration fees | | | 36,000 | |

Insurance | | | 36,000 | |

Legal fees and expenses | | | 21,000 | |

Trustees’ fees | | | 20,000 | |

Audit fee | | | 8,000 | |

Miscellaneous | | | 14,594 | |

| | |

|

|

|

Total expenses | | | 4,565,790 | |

| | |

|

|

|

Less: Expense subsidy (Note 2) | | | (52,659 | ) |

| | |

|

|

|

Net expenses | | | 4,513,131 | |

| | |

|

|

|

Net investment income | | | 21,159,010 | |

| | |

|

|

|

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | (32,480,834 | ) |

Financial futures contracts | | | 3,406,299 | |

| | |

|

|

|

| | | | (29,074,535 | ) |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 148,640,142 | |

Financial futures contracts | | | (125,947 | ) |

| | |

|

|

|

| | | | 148,514,195 | |

| | |

|

|

|

Net gain on investments | | | 119,439,660 | |

| | |

|

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 140,598,670 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | |

| | | Six Months Ended March 31, 2005 | | | Year Ended September 30, 2004 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 21,159,010 | | | $ | 31,386,570 | |

Net realized loss on investment transactions | | | (29,074,535 | ) | | | (106,338,295 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 148,514,195 | | | | 368,645,604 | |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 140,598,670 | | | | 293,693,879 | |

| | |

|

|

| |

|

|

|

Dividends from net investment income (Note 1) | | | | | | | | |

Class A | | | (1,005,158 | ) | | | (706,145 | ) |

Class B | | | (696,856 | ) | | | (380,947 | ) |

Class C | | | (335,281 | ) | | | (185,574 | ) |

Class I | | | (18,956,096 | ) | | | (19,320,388 | ) |

Class Z | | | (13,150,739 | ) | | | (10,611,644 | ) |

| | |

|

|

| |

|

|

|

| | | | (34,144,130 | ) | | | (31,204,698 | ) |

| | |

|

|

| |

|

|

|

| | |

Fund share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 164,251,951 | | | | 567,196,166 | |

Net asset value of shares issued in reinvestment of dividends | | | 28,165,460 | | | | 25,160,223 | |

Cost of shares reacquired | | | (446,764,654 | ) | | | (890,551,839 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from Fund share transactions | | | (254,347,243 | ) | | | (298,195,450 | ) |

| | |

|

|

| |

|

|

|

Total decrease | | | (147,892,703 | ) | | | (35,706,269 | ) |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 2,135,764,088 | | | | 2,171,470,357 | |

| | |

|

|

| |

|

|

|

End of period(a) | | $ | 1,987,871,385 | | | $ | 2,135,764,088 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | 9,976,008 | | | $ | 22,961,128 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 29 |

Notes to Financial Statements

(Unaudited)

The Dryden Index Series Fund (the “Company”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The Company was established as a Delaware business trust on May 11, 1992 and currently consists of one fund, which is the Dryden Stock Index Fund (the “Fund”) formerly known as the Prudential Stock Index Fund. Investment operations of the Fund commenced on November 5, 1992. The Fund’s investment objective is to provide investment results that correspond to the price and yield performance of Standard & Poor’s 500 Composite Stock Price Index.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and ask prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the Nasdaq official closing price (NOCP) on the day of valuation, or if there was no NOCP, at the last sale price. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadviser(s); to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Options on securities and indices traded on an exchange are valued at the last sale price as of the close of trading on the applicable exchange or, if there was no sale, at the mean between the most recently quoted bid and asked prices on such exchange. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted bid and asked prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Funds’ normal pricing time, are valued at fair value in accordance with the Board of Trustees’ approved fair valuation procedures. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

| | |

| 30 | | Visit our website at www.jennisondryden.com |

Investments in mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities which mature in 60 days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than 60 days are valued at current market quotations.

Repurchase Agreements: In connection with transactions in repurchase agreements with United States financial institutions, it is the Fund’s policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or, if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Financial Futures Contracts: A financial futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities at a set price for delivery on a future date. Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount. This amount is known as the “initial margin.” Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying security. Such variation margin is recorded for financial statement purposes on a daily basis as unrealized gain or loss. When the contract expires or is closed, the gain or loss is realized and is presented in the Statement of Operations as net realized gain or loss on financial futures contracts.

The Fund invests in financial futures contracts in order to hedge its existing portfolio securities, or securities the Fund intends to purchase, against fluctuations in value caused by changes in prevailing interest rates or market conditions. Should interest rates move unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates and the underlying hedged assets.

| | |

| Dryden Index Series Fund/Dryden Stock Index Fund | | 31 |

Notes to Financial Statements

(Unaudited) Cont’d

Financial futures contracts involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

Securities Lending: The Fund may lend its portfolio securities to qualified institutions. The loans are secured by collateral in an amount equal to at least the market value at all times of the loaned securities. During the time the securities are on loan, the Fund will continue to receive the interest and dividends or amounts equivalent thereto on the loaned securities. The Fund receives compensation, net of any rebate and securities lending agent fee, for lending its securities in the form of interest or dividends on the collateral received for securities loaned. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. The Fund bears the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains or losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on the accrual basis.

Net investment income or loss (other than distribution and transfer agent fees) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day. Transfer agent fees are incurred based on shareholder activity and number of accounts for each class.

Dividends and Distributions: Dividends from net investment income and distributions of net capital and currency gains in excess of a capital loss carryforward, if any, are declared and paid annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

| | |

| 32 | | Visit our website at www.jennisondryden.com |

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and net capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with Prudential Investments LLC(“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management(“PIM”). The subadvisory agreement provides that PIM furnishes investment advisory services in connection with the management of the Fund. In connection therewith, PIM is obligated to keep certain books and records of the Fund. PI pays for the services of PIM, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly at an annual rate of .30 of 1% of the average daily net assets of the Fund up to $1 billion and .25 of 1% in excess of $1 billion.