UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06686

JPMorgan China Region Fund, Inc.

(Exact name of registrant as specified in charter)

One Beacon Street, 18th Floor

Boston, MA 02108

(Address of principal executive offices) (Zip code)

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 441-9800

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 through December 31, 2015

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

This report, including the financial statements herein, is sent to the stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

Annual Report

December 31, 2015

CONTENTS

OBJECTIVES (Unaudited)

JPMorgan China Region Fund, Inc. (the ‘Fund’) seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

The Fund provides investors with an opportunity to participate in the growing economies of the China Region where the economies of China, Hong Kong, Taiwan and Macau have become increasingly linked over recent years. Hong Kong enterprises have made substantial investments in China, particularly where labor and land prices are lower than in Hong Kong. Similarly, many Chinese companies have Hong Kong based subsidiaries with securities listed on the Hong Kong Stock Exchange (H-shares). Renminbi denominated China A-shares, which are listed in China, are available for acquisition by the Fund by direct investment up to $20m, as measured at the time of original investment. The current value of these holdings reflects any capital appreciation or depreciation since the initial investment and, therefore, there may be times when the Fund’s China A-share investments exceed $20m. In addition, the Fund can make indirect China A-share investments up to 10% of the Fund’s total assets through exposure to China A-share investment companies. Further details on China A-shares are provided in note 7(iii) of the Notes to Financial Statements on page 28.

The Fund invests to take advantage of the many opportunities that result from this linkage among the markets of the China Region.

MANAGEMENT (Unaudited)

JF International Management Inc. (‘JFIMI’) is the investment management company appointed to advise and manage the Fund’s portfolio (the ‘Investment Advisor’). JFIMI is part of JPMorgan Chase & Co. (‘JPMC’), one of the world’s premier financial services institutions. In asset management, JPMC operates globally under the name of J.P. Morgan Asset Management (‘JPMAM’). Funds under management for the global asset management business of JPMAM were US$1.7 trillion as of December 31, 2015.

The Fund’s lead portfolio manager is Emerson Yip, a Senior Portfolio Manager within JPMAM’s Greater China investment team in Hong Kong.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 1 | |

FORWARD-LOOKING STATEMENTS (Unaudited)

This report contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of the Fund and JFIMI and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as ‘anticipate,’ ‘estimate,’ ‘intend,’ ‘expect,’ ‘believe,’ ‘plan,’ ‘may,’ ‘should,’ ‘would,’ or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Fund to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could materially and negatively affect the results, performance or achievements of the Fund include changes in economic, political, legal and regulatory conditions in the China Region and elsewhere, changes in interest and exchange rates and related policies and other risks. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Fund, JFIMI or its respective representatives only as of the date hereof. The Fund, JFIMI and their respective representatives undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

|

| MARKET INFORMATION |

The Fund is listed on the New York Stock Exchange (symbol JFC). The share price is published in • The Wall Street Journal (daily online at www.WSJ.com/Free) |

The estimated net asset value is published in • The Wall Street Journal under “Closed-End Funds” (every Saturday) • www.jpmchinaregionfund.com |

| | | | | | |

| | | |

| 2 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

HIGHLIGHTS (unaudited, except as indicated)

| | | | | | | | |

| | | DECEMBER 31, 2015

US$ (Audited) | | | DECEMBER 31, 2014

US$ (Audited) | |

Net Assets | | | $113.2 million | | | | $125.0 million | |

Net Asset Value Per Share | | | $17.55 | | | | $19.39 | |

| | |

Market Data | | | | | | | | |

Share Price on the New York Stock Exchange | | | $15.32 | | | | $16.91 | |

Discount to Net Asset Value | | | 12.7% | | | | 12.8% | |

| | |

Total Return for the Year Ended December 31, 2015 | | | | | | | | |

Net Asset Value | | | | | | | (4.5)% | |

Share Price | | | | | | | (3.6)% | |

| | |

JFC Benchmark Index* | | | | | | | (5.3)% | |

MSCI Hong Kong Index | | | | | | | (0.5)% | |

MSCI China Index | | | | | | | (7.6)% | |

MSCI Taiwan Index | | | | | | | (11.0)% | |

CSI 300 Index | | | | | | | 2.3% | |

| | |

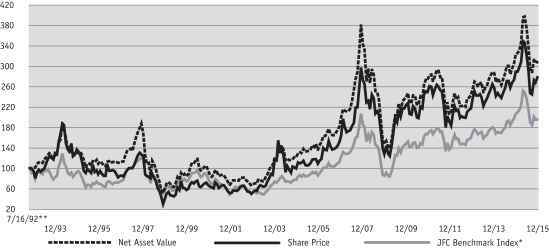

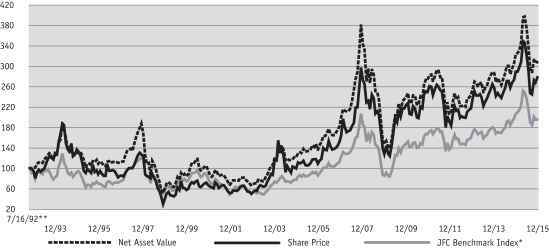

Net Asset Value and Share Price vs. Benchmark Index | | | | | | | | |

| * | | JFC Benchmark Index: 80% MSCI Golden Dragon Index (Net) 20% CSI 300 Index (Net). Prior to October 1, 2013, 80% MSCI Golden Dragon Index (GDR) +20% CSI 300 Index (Total). Prior to April 13, 2012, the MSCI Golden Dragon Index (Total). At December 31, 2011 the MSCI Golden Dragon Index (Total) comprised 24.1% of the MSCI Hong Kong Index (Total), 42.7% of the MSCI China Index (Total) and 33.2% of the MSCI Taiwan Index (Total). Prior to March 2001, 25% Taiwan Weighted Index, 20% BNP Paribas China Index, 50% MSCI Hong Kong, 5% HSBC; Prior to March 1999, 60% Hong Kong All Ordinaries, 30% Credit Lyonnais Securities Asia All China B Index, 10% Taiwan Weighted Index. Prior to January 1997, Peregrine Greater China Index. |

| ** | | Commencement of operations. |

Source: J.P. Morgan Asset Management.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 3 | |

CHAIRMAN’S STATEMENT

DECEMBER 31, 2015 (Unaudited)

Dear Fellow Stockholder

Performance

Against a background of what was a very volatile and uncertain year for Greater China markets, the Fund’s total return at net asset value (‘NAV’) fell by 4.5% during the year ended December 31, 2015, marginally outperforming our benchmark1, which fell by 5.3%. Over the same period, the Fund’s share price total return fell by 3.6%. The Fund’s relative out performance was primarily attributable to stock selection.

China A-shares

As previously reported, the Fund has $20m of China A-share quota which provides exposure to a market otherwise restricted to foreign investors. This serves as a differentiating factor for the Fund when compared to its peer group of other New York listed Greater China region closed ended funds. As at December 31, 2015, the Fund held 22.1% of its total assets in China A-share investments.

Leverage

The Fund’s credit facility with Scotiabank (Ireland) Ltd (’Scotiabank’) matures on February 24, 2017 at which point the Board will consider another gearing facility. This facility was increased from US$17.5m to US$22m on July 10, 2015 due to the growth in the Fund’s net assets. This financing arrangement with Scotiabank gives the Investment Advisor the flexibility to tactically manage leverage at its discretion under the scrutiny of your Board. During the year to December 31, 2015, the Fund’s leverage2 ranged from 1.2% to 12.1% and at the time of writing is 10.3%, reflecting the Investment Advisor’s current view on the market. The Investment Advisor does not receive a management fee on any cash held when borrowings are drawn under the leverage facility.

Share Repurchases and Discount Management

Your Board currently has authority to repurchase up to 644,764 shares (equal to 10% of the Fund’s issued share capital). Although there have been no share repurchases since January 2003, your Board continues to believe that the power to repurchase shares is of ongoing benefit to shareholders. Share repurchases are a useful tool for decreasing discount volatility and this approach will be used when considered to be appropriate by the Board.

During the year the Board established a Share Repurchase Committee with the objective to consider from time-to-time whether the Fund’s share repurchase policy should be amended, take action or make recommendations to the Board as it sees fit. Discussions of this Committee will be recorded and reported in the Fund’s Proxy Statement each year which will give shareholders greater transparency on the frequency of discussions on the Fund’s discount and demonstrate that the Board has been proactive in

monitoring the Fund’s discount outside of its regular quarterly meetings.

Board Succession

As mentioned in last year’s report, the Board through its Nomination Committee, considered succession planning and it was agreed that Mr Alexander Hamilton and Mr John Rettberg will retire from the Board at the conclusion of the Annual Stockholders’ Meeting in May 2016. On behalf of the Board, I would like to thank both Mr Hamilton and Mr Rettberg for their valuable insight and support to the Fund over the past 22 and 8 years respectively. The Board is currently in the process of recruiting two new Directors to maintain the right balance of skills. It is intended that they will be nominated for election by shareholders at the May 2016 Annual Meeting.

Outlook

The domestic Chinese markets got off to a volatile start to 2016, with the circuit breaker triggered twice in the first week. Investor sentiment was visibly fragile and the panic selling exacerbated the market sell-offs on both counts. Our Investment Advisor believes volatility could remain in the near term, and uncertainty and profit-taking pressures could also continue to weigh on the market before investors return their attention to state-owned enterprise (SOE) reforms and other market catalysts. It is the Investment Advisor’s view that we should expect to see ongoing macroeconomic challenges but accommodative monetary and fiscal policies, particularly as inflation is likely to remain at relatively low levels. They also expect more reforms will be implemented in 2016. Overall they believe that the liquidity situation should stay relatively loose and overall leverage in the stock market should not be as high as in 2015 given tighter regulatory control over grey market leverage.

As such, our Investment Advisor remains focused on the investment opportunities in “New China” that are fuelling the new growth engine in both onshore and offshore markets. There are plenty of companies that would be beneficiaries of long-term secular trends, in areas such as consumer-related businesses in autos and media, healthcare firms and environmental services. In Taiwan, headwinds may remain in the first half of 2016, though the Investment Advisor believes there is value to be found with select Apple supply chain names, which are well-positioned for market share gain. In contrast, the Investment Advisor remains cautious on the structural slowdown in the Hong Kong economy and sees fewer opportunities in the domestic businesses there.

Respectfully submitted

The Rt. Hon. The Earl of Cromer Chairman

February 29, 2016

| 1. | | 80% MSCI Golden Dragon Index (net) and 20% CSI 300 Index (net). |

| 2. | | Calculated as the sum of Total Investments less Net Assets divided by Net Assets. |

For more information please refer to the Fund’s website at www.jpmchinaregionfund.com

| | | | | | |

| | | |

| 4 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

INVESTMENT ADVISOR’S REPORT

For the twelve months ending December 2015, the Fund delivered a total return on net asset value of –4.5% (in USD terms), outperforming the benchmark return of –5.3%. Positive stock selection in all three of the Fund’s primary markets, particularly China, contributed to returns. Asset allocation added to returns as well, helped by our overweight exposure to China A-shares, which rallied the most, at the expense of Taiwan, which declined the most. The 8% average leverage in the Fund slightly detracted from performance on the back of significant market volatility and mixed equity returns.

Our quality Chinese financials overweights in insurance (Ping An), property developers (China Vanke) and mid-sized banks (Industrial Bank) contributed to returns. Ping An benefitted from growth in its life insurance business. China Vanke, the largest property developer, continued to gain share with margin stabilization and declining funding cost supporting ROE improvement. Industrial Bank has navigated the year’s volatility well and we believe in its growth opportunities as a well-run bank. Additionally, our underweights in large cap, index heavy banks, such as Bank of China and ICBC, also helped performance as they lagged the sector due to concerns over growth deceleration and the impact on the level of non-performing loans. Equally key, our secular growth holdings also added value, across areas such as internet (Tencent), healthcare (Sino Biopharmaceutical) and consumer discretionary (Regina Miracle and IMAX China). We expect Tencent to continue benefitting from mobile monetization of gaming, payment and advertising. Sino Biopharmaceutical enjoyed strong earnings and remains well-positioned to gain from favorable healthcare trends. Furthermore, continued consumption upgrades should provide tailwind to multi-year growth for Regina Miracle, the textile maker, and, IMAX China, the cinematic technology provider.

On the negative side, somewhat offsetting the positive impact of the financials that outperformed, a

few holdings in the sector put up poor returns and were the biggest detractors for the year. Sunac China traded down on disappointing earnings and concerns over potential acquisitions, raising concerns over management governance. China Minsheng Banking was hurt by the resignation of its President to cooperate in an anti-corruption investigation; and China Pacific Insurance fell short against competitors in growing its property and casualty book of business. We exited all three positions on deteriorated fundamentals when they no longer met our investment criteria. Additionally, the crackdown on margin financing presented headwinds for brokers, such as Huatai Securities and Haitong Securities where we were overweight. Our telecom underweight in China Mobile also struggled as the stock held up better in the volatile market environment given its defensive earnings stream. Moreover, the government’s tariff cut on wind and solar power and tempered support for renewable energy imposed downside risks for the largest wind power generator, China Longyuan Power, and our overweight there detracted. In Hong Kong, weakening retail trends continued to put downward pressure on the consumer discretionary sector, particularly the higher-end market, where we had positions in Chow Tai Fook Jewellery and Lifestyle International.

China

Market Performance

Chinese equities rallied in the first quarter of 2015, with offshore-listed equities up 8%, continuing the rally of the final quarter of 2014. The key catalysts were accommodative policy in terms of both cyclical stimulus (easing monetary/fiscal policies) and structural reforms (pertaining to Local Government Finance Vehicle (LGFV) debt swaps and deposit insurance, for example), despite the macroeconomic backdrop remaining weak. The gains were led by both cyclical names (beneficiaries of policy easing) as well as growth

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 5 | |

INVESTMENT ADVISOR’S REPORT (continued)

sectors. Meanwhile, macro indicators remained weak. January-February industrial production (up 6.8% year-on-year) and fixed-asset investment (up 13.9% year-on-year) both reached new post 2008-09 global financial crisis lows, due to still very high real interest rates as well as muted infrastructure spending (affected by anti-corruption campaigns). January’s consumer price inflation falling below 1% (posing a potential deflection risk) prompted more monetary easing. The People’s Bank of China (PBOC) implemented one more rate cut (since November 2014) as well as a first reduction in reserve ratio requirements, both in February. Money supply growth in February at 12.5% year-on-year marked an improvement from January’s 10.8% year-on-year levels. Earnings revisions continued to be negative, led by energy (due to the global oil price declines), materials, and staples, as a result of demand headwinds. Sectors seeing positive earnings revisions included non-bank financials (benefiting from underlying equity market strength) and transportation (also a beneficiary of oil price weakness).

Despite a rollercoaster second quarter, Chinese equities ended the year with offshore-listed equities up 4.2%. Stocks traded down sharply in June with A-shares falling in response to fears of a government crackdown on grey market margin financing, and offshore markets dragged down both by A-shares and renewed concerns over Greece. Macro indicators showed some signs of stabilisation from a very low base, thanks to monetary easing. Earnings revisions remained negative, in line with weak economic conditions, with industrials and materials representing the main detractors. Sectors where companies have seen positive revisions were led by brokers and insurance as underlying fundamentals continued to strengthen.

Chinese equities ended sharply down in the third quarter, with offshore-listed equities falling 23.2%. This was due to the higher risk premium created by the government crackdown on margin financing, the

sudden devaluation of the renminbi and weaker earnings potential due to further macro weakness. The government’s less coordinated crackdown of grey market financing resulted in a sharp share price fall after forced selling and dried-up market liquidity, despite support from buying by quasi-government funds. On the macro front, the unexpected 3% devaluation of the renminbi on 11 August surprised the market on the downside. Market worries about the currency move could potentially tie the government’s hands when it comes to further monetary easing. At 6.1%, August’s industrial production figure marked another fall from June’s 6.8% figure, and was close to the Global Financial Crisis low of 5.7%, despite supportive monetary policy. Money supply in August increased by 13.3% showed a continued rebound from April’s near-term low of 10.1% year-on-year growth. Meanwhile, the PBOC cut interest rates by 25 basis points (bps) and reduced the reserve requirement ratio by 50bps in late August/early September. Earnings revisions remained negative, as expected, led by economically sensitive sectors such as materials and technology. Even staples were hurt by weak demand. Positive revisions came from structural growth sectors like insurance, as well as beneficiaries of lower input costs such as utilities.

Chinese equities made modest gains in the fourth quarter, with offshore-listed equities (MSCI China Index) gaining 4%. Further loosening in monetary policy, including another 25 basis points (bps) reduction in interest rates and a 50 bps reduction in the reserve requirement ratio, supported domestic liquidity. However, the government has also taken some measures to offset some upward momentum in domestic equity market, including tightening the margin financing ratio, resuming IPOs and announcing the long-awaited registration system for IPOs. Macro numbers have shown some signs of stabilisation after more accommodative policies have been implemented. Industrial production value growth recovered from 5.6% year-on-year in October

| | | | | | |

| | | |

| 6 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

to 6.2% year-on-year in November, mainly driven by stronger growth from the automobile sector, after the government reduced the consumption tax for small engine passenger vehicles to stimulate sales. Nominal fixed asset investment growth accelerated to 10.2% year-on-year in November from 9.5% year-on-year in October, largely led by the faster growth of government-led investment and some recovery in manufacturing investment growth to 9.4% year-on-year from 8.3% year-on-year in October. The IMF announced its decision to include China’s RMB in the Special Drawing Rights currency basket in November. However, with the Federal Reserve starting to raise interest rates, RMB traded weaker to US dollar again since November, by around 2% during the quarter. Progress on the reform of state-owned enterprises has been made after the announcement of the merger and reorganisation of some shipping groups: COSCO Group with China Shipping Group and Sinotrans with China Merchants. Attention is then on insurance companies raising significant stakes in some bigger-cap value stocks in the A-share market and triggering a response from corporate management, such as at real estate developer Vanke. Regulators have started to look into the potential risk exposure of such leveraged and concentrated investment by insurance companies but with further reduction of interest rates and tightening of domestic bond yields, demand for high yielding equities should remain strong.

A-Shares

In the first quarter of 2015, the domestic A-share market (CSI 300 Index) rallied, up 15% over the period. Despite a correction in January after regulators suspended new margin account openings, A-shares rebounded in February and continued their strength in March. Expectations of further relaxation of monetary policies and additional fiscal stimulus including domestic infrastructure investment and increasing external demand from the new “One Belt One Road” initiative pushed the market higher.

Onshore A-shares finished up 10.4% in the second quarter of 2015. The market surged in April and May as the Chinese government continued its monetary easing and fiscal stimulus measures. The progress on mutual recognition to sell mutual funds cross-border between Hong Kong and China also encouraged liquidity provision that buoyed mainland stock markets. The gains were somewhat offset by sharp corrections that came in the second half of June after touching new highs in the middle of the month as regulators increased scrutiny on margin financing. The government stepped in to support the market but market sentiment took a hit. Valuations, however, for certain secular growth names became more attractive.

In the third quarter of 2015, however, the onshore A-share market fell nearly 30%. We saw panic selling following the correction in late June and unwinding of margin loans and subsequent various government actions to stabilize the market, including establishing government-controlled equity funds. However, the measures were inadequate to save sufficient investor confidence and worries over a potential exit by the government led to another round of broader base selling towards the end of July. Ensuing declines in August were driven by a surprise RMB devaluation of 2% mid-month in what authorities claimed was a technical adjustment, aligning the currency with its market-implied value, which the markets interpreted as both an acknowledgment of China’s economic weakness and a step towards a substantial competitive devaluation. Further OTC margin account cleanup drove additional weakness in September. As risk reduction by investors weighed on growth stocks amidst a scarcity of economic growth, valuation in those names became more reasonable.

Domestic A-shares (CSI 300) showed stronger recovery in the last quarter of the year by gaining 16% in RMB (or 14% in US dollar terms). Equities rose on further fiscal stimulus measures and monetary easing.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 7 | |

INVESTMENT ADVISOR’S REPORT (continued)

More importantly, 3Q results showed a broader and deeper deterioration in traditional corporate earnings while new industries marked little acceleration in earnings growth. This divergence in earnings results was reflected in respective performance of the “old economy” and “new economy” businesses. However, risk appetite dampened around mid November after regulators tightened regulatory measures around margin financing to prevent the market’s sharp rise. Despite weakness in other regional equities markets, the onshore market recovered in December and new growth stocks in areas such as entertainment and media continued to outperform.

Market Outlook

While the recently concluded Central Economic Working Conference did not set a concrete growth target, it has outlined five key tasks for 2016: reducing overcapacity, lowering costs for businesses, cutting housing inventory, expanding effective supply and preventing financial risks. The meeting also highlighted how fiscal policy will become more expansionary, with an emphasis on supply-side reforms. This should set broad policy direction in 2016, especially for the property sector, and we expect more industry reforms to be launched. Monetary policy should remain accommodative and flexible as inflationary pressure stays low. Onshore stock markets might see more volatility in first quarter as the new IPO registration system commences and major shareholders can also start selling down their stake from 8th January after a six-month ban since the market correction in mid-2015. This might have stronger pressure on the small and medium enterprises and ChiNext boards in the near term, given their outperformance and more demanding valuation. But we believe in the medium to long term, equities with structural growth potential should continue to outperform. Offshore equities should also offer opportunities, as current valuation should now reflect concern over economic growth outlook and RMB trend.

Hong Kong

Market Performance

Most of the gains in Hong Kong equities during the first quarter happened during January, driven by proposed corporate restructuring. The market witnessed explosive growth in turnover towards the end of the quarter, spurred by rule clarifications regarding easier participation from mainland-based mutual funds in the Stock Connect programme. However, the prime beneficiaries of the ensuing stock rally were China-related stocks rather than Hong Kong equities. The surprise announcement of the re-organisation of Cheung Kong and Hutchison Whampoa led to a re-rating due to the elimination of a holding company discount and the enhanced ability to undertake corporate actions following the restructure. Moreover, companies with similar restructuring potential also benefited from market speculation. As largely expected, the Hong Kong Monetary Authority announced further tightening measures at the end of February, primarily targeting mortgages on homes selling for under HKD 7 million. However, new property launches following the announcement of these measures were positively received as developers were able to take on additional financing while secondary property volumes were reduced. Retail sales in Hong Kong appear to be in structural decline, with weakness in overnight visitor growth and per capita spending. Hong Kong appears to be losing its share of mainland tourists to Japan, Korea, and Taiwan, owing in part to relative currency strength. Gaming revenues continued on their recent downward spiral, with declines worse than expected for each of the three months.

Hong Kong equities began the second quarter with a sharp rally sparked ostensibly by the clarification of the rules on domestic mainland China funds investing in Hong Kong equities under the Stock Connect programme. Market turnover set record highs on multiple fronts, including full utilisation of the southbound quota for the first time. However, at

| | | | | | |

| | | |

| 8 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

quarter end, the market sold off on concerns over Greece’s potential exit from the eurozone, coupled with a substantial market correction in the domestic China equity market. The de-listing of Hutchison Whampoa as part of the group reorganisation was positively received by the market. BOC Hong Kong also announced a sweeping re-focus — officially announcing its intention to sell its China operation in order to deploy more resources into growing its Southeast Asian business in conjunction with China’s “One Belt, One Road” initiative. The failure to pass the electoral reform package proposed by Beijing had little immediate impact on the market, with popular reaction rather muted. The retail sector in Hong Kong took another hit with the announcement of once-a-week restriction on visitors with Shenzhen resident visas. While this is targeted at parallel traders and should help to improve relations between local residents and mainland tourists, the change will nonetheless affect near-term tourist sales. Additionally, the Macau government surprised the market with a relaxation of transit visa restrictions, exactly a year after they were first tightened. While the near-term impact will be modest, this represents the first positive policy to be introduced over the past year or so.

In the third quarter, Hong Kong equities suffered a steep decline after a government crackdown on margin financing caused a sharp correction in the China A-share market. However, government measures — both on the supply and demand side — failed to stem the correction. Investor sentiment was further dented by a surprise 2% renminbi devaluation, sparking fears of a further competitive devaluation, which failed to materialise. Equities were also weighed down by global growth worries, culminating in the US Federal Reserve’s decision to delay an interest rate rise. The utilities sector bucked the trend based on its defensive nature and the delayed US rate hike. The proposed merger of Power Assets into Cheung Kong Infrastructure was also well received at the time, although it failed to

materialise due to an unattractive offer price. On the property front, primary sales projects continued to achieve decent volumes, although on a more selective basis, while secondary prices and rentals have started to pull back. There has been a more pronounced slide in retail rentals, given the continued decline in retail sales as tourist numbers have fallen, especially among overnight mainland tourists, and the strengthening of the Hong Kong dollar. Macau gaming shares started the quarter with a strong rally on the back of a relaxation of the transit visa rules — the first positive policy change in over a year. However, the sector suffered a sharp correction in line with that experienced by the Chinese stock market, which heightened concerns over potential new restrictions on capital outflows. Subsequently, new regulations were announced on casino junket operations and cash transfers from mainland China. The news of a junket manager absconding with client money also contributed to nervous sentiment, causing a further dip in gaming revenues during the middle of September.

Hong Kong equities staged a rally in October as the US rate hike was delayed, while China undertook further monetary easing. However, they retraced some of the gains approaching the rate hike in December, while the Chinese regulators continued to conduct broker investigations affecting sentiments on the domestic market. Despite the US rate increase, the Hong Kong banks did not raise their best lending or deposit rates due to ample system liquidity, partially owing to conversion out of renminbi deposits due to depreciation concerns. Residential property prices fell by 7.5% during the quarter, more than expected, owing to pressures from the falling equity market during the summer, coupled with concerns over the impending US rate hike. The speed of the downturn was exacerbated by the lack of liquidity in the secondary market, with the full-year activity level 10% below that of 2003 during SARS. New project launches also came under pressure, as sell-through rates continued to decline.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 9 | |

INVESTMENT ADVISOR’S REPORT (continued)

The retail sector, especially the high-end and tourist-driven segments, remained under pressure. For example, jewellers reported profit declines of over 40% while the total number of visitor arrivals fell 10% year-on-year in November (with mainland tourist arrivals down 15%). Macau gaming shares rallied on the back of strong National Day gaming volumes as well as better than expected third-quarter results. While gaming revenue growth remained negative year-on-year, the decline narrowed from 34% in the third quarter to 21% in the fourth quarter. However, the announcement of a renewed crackdown on UnionPay usage led to further worries over capital outflow restrictions.

Market Outlook

The impact of the US interest rate normalisation, including ramifications on the renminbi and capital flows, will be closely followed. Indeed, if the pace of interest rate increases turns out to be slower than expected, this could be a positive surprise for rate-sensitive sectors such as the Hong Kong property firms. Though delayed for longer due to market volatility, the eventual launch of the Shenzhen Hong Kong Stock Connect would also boost sentiments. We remain cautious on the structural slowdown in the Hong Kong economy. Valuations in the property sector have discounted significant price reductions, with potential positive surprises from less negative price performance or higher activity levels due to pent-up demand. In contrast, the office sector may witness less upward momentum if multinational and mainland Chinese financial firms are less active. The retail segment remains under pressure, although the mass end of the market should continue to generate modest growth. For Macau gaming, it appears that supportive measures are unlikely to be introduced soon, provided the market remains stable. The stimulus for outperformance will stem from sequential gaming revenue growth in excess of the property additions during last year and this year. The stocks appear to be fairly valued but a growth turnaround would lead to a re-rating cycle.

Taiwan

Market Performance

The Taiex Index gained 3% in the first quarter. The Taiwanese market saw profit taking in the technology sector at the start of the year, particularly in stocks that are part of the Apple supply chain, following a very strong iPhone 6 launch late in the third quarter of last year, as well as concerns that the consumer technology product cycle will be much more moderate in 2015. However, the selling reversed quickly, with qualified foreign institutional investors (QFIIs) becoming strong net buyers of Taiwanese stocks again. This trend reversal started in mid January as the Taiwanese market continued to deliver the best earnings revisions in the region (+5% vs. –2%), while still being seen as one of the most defensive of emerging markets, with a high dividend yield and a high current account surplus-to-GDP ratio of 12-13%. However, there was a shift in technology sentiment again in the final two weeks of the quarter after softer guidance from Taiwan Semiconductor Manufacturing Company as well as concerns about Mediatek’s margins. Foreign investors led the selling in upstream technology stocks in late March. Domestically, the government decided to postpone the implementation of the big player tax until 2018. The tax was seen as an impediment to trading volume as high net worth investors had been avoiding the market ahead of the implementation of the tax. The Government policy on capital markets has remained supportive, with more proposals to enhance retail participation and market turnover, which provided some support for the over the counter (OTC) market and domestic sectors. Most notably, Taiwan’s Financial Supervisory Commission (FSC) allowed more stocks for day trading and stock borrowing/lending (SBL) while removing the current cap on retail margin trading. At the same time, FSC announced a widening of the daily stock up/down limit from 7% to 10% on 3 February. The margin maintenance ratio was raised to 130%

| | | | | | |

| | | |

| 10 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

from 120%, along with higher price limits. The new daily limit is the first major revision to the stock limit in the past 25 years. The Central Bank of the Republic of China (CBC) kept the policy rate unchanged at 1.875%, marking the fourteenth consecutive quarter that the CBC has kept the rate unchanged — one of the longest periods of an unchanged policy rate in history. On the exchange rate, the CBC said that it would keep the currency dynamically stable. It would not intentionally support either the appreciation or the depreciation of the currency.

During the second quarter, the Taiex trended higher in April, but failed to sustain this momentum in latter sessions. The TWSE finished down 2.7% quarter on quarter. The strength in April was boosted by speculation over the establishment of a stock trading link between Taipei and Shanghai. Unsurprisingly, financials were one of the strongest performers for the quarter. Besides being the biggest beneficiaries of a stock connect, financials reported stronger-than-expected first-quarter 2015 results. The market turned weak in May and June, with investors locking in profits ahead of the summer. Technology wrapped up the quarter with 4.5% quarter-on-quarter decline, with weakness in most sub-sectors on concerns over slower-than-expected first-half momentum. Besides weak sales of PCs and notebooks, sluggish smartphone demand from China and the emerging markets meant inventory digestion was taking longer than expected. Non-technology fared better in comparison, with gains in energy, textile, financials and food. The textile sub-sector was helped by the fast-growing leisurewear market in the US, while the China Securities Finance Corporation’s new Renminbi Qualified Foreign Institutional Investor measure is expected to benefit Taiwan’s financial institutions. Exports and domestic demand started the year softly, with total export orders declining by 5.9% year-on-year in US dollar terms in May. Taiwan industrial production was weaker than expected,

down 3.2% year-on-year in May. The Central Bank of the Republic of China (Taiwan) kept the policy rate at 1.875%, shrugging off negative headline CPI inflation and demonstrating its confidence on the economic outlook.

The Taiwan Stock Exchange Index fell 13% in the third quarter — its biggest quarterly decline in the last four years. The index trended steadily down in July and August on strong selling following the worst slump in Chinese stocks since the global financial crisis. The market stabilised in September despite concerns of weak global growth after US Federal Reserve’s (the Fed’s) delay in interest rate rise. The market was supported by the launch of the National Stabilization Fund, which is to remain active until April 15, 2016. Defensive sectors like food outperformed. Owing to Taiwan new dollar weakness and an interest rate cut by Taiwan’s central bank, the financial sector came under heavy selling pressure. Weak technology demand and relatively high inventory levels not only led to a disappointing results season in the second quarter, but also to a weaker outlook for the technology sector in the third quarter. For example, most of the stocks in the Apple iPhone supply chain lost ground as investors worried about sales of the new phones this year. On the macro front, the Taiwanese government lowered its 2015 GDP growth forecast from 3.3% to 1.6%. The weakness in Taiwan’s second-quarter GDP was mainly a result of the poor performance of the export and manufacturing sectors. On the domestic front, GDP expenditure data showed decent growth in private consumption. Meanwhile, fixed investment growth rebounded in the second quarter, indicating the potential for moderate economic recovery going into the second half.

The Taiex traded well initially in the fourth quarter but the market fell heavily in November after the presidential summit between Taiwan and China failed to produce any substantial economic incentives and on increasing concerns over weaker

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 11 | |

INVESTMENT ADVISOR’S REPORT (continued)

than expected iPhone sales. This continued into December, when the index fell below the 8000 mark, before closing up 1.9% for the fourth quarter. The index shed 10.41% for the year, its steepest yearly drop since 2011. The foundry sector saw inflow from foreign institutional investors, driven by near-term rebound of Taiwan Semiconductor Manufacturing Company’s use of 28nm technology and a solid long-term outlook of widening technological advantage. Healthcare also gained traction thanks to better earnings results and new drug approvals, as well as the market expectation of favourable government policies — the Democratic Progressive Party (DPP) has made biotech one of its focus industries. Meanwhile, financials, materials and information technology (PCs) continued to be out of favour. The Taiwan government released third quarter real GDP falling 0.6% year-on-year. The breakdown of third quarter GDP by expenditure showed that while the economy is still contracting, exports posted a smaller drag. As external macro uncertainty lingered and consumer price index inflation remained muted, Taiwan’s central bank cut a key policy rate twice to 1.625%. With inflation pressure likely to remain muted in 2016 on weak growth, there could be room for further easing in the first quarter of 2016.

Market Outlook

The Taiwan market is likely to face a couple of headwinds going into the first half of 2016. Both

economic growth and corporate earnings would face a tough base comparison. Besides the first quarter being seasonally weak, the tech sector is likely to see slow iPhones shipment, on weaker than expected demand. Meanwhile there is a lack of new tech product cycle to offset the speed bump from Apple. Additionally, the Democratic Progress Party won presidential and legislative elections decisively, as anticipated. There could be a policy vacuum as the president-elect, Tsai Ing-Wen, is not likely to take over until late in the second quarter of 2016. However, Taiwan’s underperformance in 2015 could have already reflected any concerns over policy discontinuity and the DPP’s pro-independence stance. The first half of 2016 is likely to see anaemic tech growth, but the second half will likely accelerate on easy base comparisons, tech restocking and the launch of the iPhone 7. Negative earnings revisions have slowed, and recent merger and acquisitions activity in the technology sector is likely to continue. Valuation remains attractive on 12x 2016 earnings, with above regional-average dividend yield.

Emerson Yip

JF International Management, Inc

February 29, 2016

| | | | | | |

| | | |

| 12 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

TOP TEN HOLDINGS

AT DECEMBER 31, 2015 (Unaudited)

| | | | |

| | | % OF

NET ASSETS | |

Tencent Holdings Ltd. | | | 7.2 | |

| Provides internet, mobile, and telecommunication value-added services in China. The company has an instant messaging community in China. Tencent also provides online advertising services. | | | | |

| |

Taiwan Semiconductor Manufacturing Co., Ltd. (‘TSMC’) | | | 6.2 | |

| Manufactures and markets integrated circuits. The company provides the following services: wafer manufacturing, wafer probing, assembly and testing, mask production and design services. The company’s integrated circuits are used in computer, communication, consumer electronics, automotive and industrial equipment industries. | | | | |

| |

China Construction Bank Corp. ‘H’ | | | 5.6 | |

| Provides a complete range of banking services and other financial services to individual and corporate customers. The bank’s services include retail banking, international settlement, project finance and credit card services. | | | | |

| |

AIA Group Ltd. | | | 4.6 | |

| Offers insurance and financial services. The company writes life insurance for individuals and businesses, accident and health insurance, retirement planning, and wealth management services. | | | | |

| |

China Merchants Bank Co., Ltd. ‘H’ | | | 4.2 | |

| Provides a wide range of commercial banking services including deposits, loan, bill discount, government bonds underwriting and trading, interbank lending, letter of credit, bank guarantee, and other related services. | | | | |

| |

Ping An Insurance Group Co. Ltd. ‘A’ | | | 4.1 | |

| Provides a variety of insurance service in China. The Company writes property, casualty, and life insurance. Ping An Insurance also offers financial services. | | | | |

| |

Industrial Bank Co., Ltd. ‘A’ | | | 3.3 | |

| Provides personal, corporate, institutional and electronic banking services. The Bank’s businesses include residential mortgage, loan, savings and time deposit, RMB money management, foreign currency management advisory service and trading, and debit and credit cards. | | | | |

| |

China Vanke Co., Ltd. ‘H’ | | | 3.0 | |

| A property development company, which develops residential properties in Shenzhen, Shanghai, Beijing, Tianjin, Shenyang, Nanjing, and other big cities in China. | | | | |

| |

CK Hutchison Holdings Ltd. | | | 2.5 | |

| Holds all of the non-property businesses of the Cheung Kong Group and the Hutchison Group, including ports and related services, telecommunications, retail, infrastructure, energy and movable assets leasing operations. | | | | |

| |

Sino Biopharmaceutical Ltd. | | | 2.4 | |

| Through its subsidiaries, researches, develops, produces, and sells biopharmaceautical products for the medical treatment of ophthalmia, as well as modernized Chinese medicine and chemical medicine for the treatment of hepatitis. | | | | |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 13 | |

INVESTMENT PORTFOLIO

AT DECEMBER 31, 2015

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK | |

CHINA (63.1%) | |

Aerospace & Defense (0.5%) | |

Avic Aviation Engine Corp. plc, ‘A’ | | | 74,801 | | | | 518,709 | |

| | | | | | | | |

Airlines (1.1%) | |

Spring Airlines Co., Ltd., ‘A’ | | | 135,129 | | | | 1,269,384 | |

| | | | | | | | |

Automobiles (1.1%) | |

Chongqing Changan Automobile Co., Ltd., ‘A’ | | | 493,602 | | | | 1,289,951 | |

| | | | | | | | |

Banks (13.0%) | |

China Construction Bank Corp. | | | 9,206,000 | | | | 6,307,554 | |

China Merchants Bank Co., Ltd. | | | 2,000,000 | | | | 4,722,550 | |

Industrial Bank Co., Ltd., ‘A’ | | | 1,404,500 | | | | 3,692,069 | |

| | | | | | | | |

| | | | | | | 14,722,173 | |

| | | | | | | | |

Beverages (0.9%) | |

Kweichow Moutai Co., Ltd., ‘A’ | | | 29,580 | | | | 993,911 | |

| | | | | | | | |

Capital Markets (2.1%) | |

Huatai Securities Co., Ltd., ‘A’ | | | 781,250 | | | | 2,372,528 | |

| | | | | | | | |

Chemicals (1.1%) | |

Jiangsu Kangde Xin Composite Material Co., Ltd., ‘A’ | | | 221,597 | | | | 1,300,180 | |

| | | | | | | | |

Commercial Services & Supplies (0.6%) | |

Beijing Originwater Technology Co., Ltd., ‘A’ | | | 86,100 | | | | 686,429 | |

| | | | | | | | |

Construction & Engineering (1.5%) | |

China Communications Construction Co., Ltd. | | | 1,661,000 | | | | 1,697,424 | |

| | | | | | | | |

Diversified Consumer Services (0.7%) | |

China Maple Leaf Educational Systems Ltd. | | | 1,582,000 | | | | 777,727 | |

| | | | | | | | |

Diversified Telecommunication Services (2.3%) | |

China Telecom Corp., Ltd. | | | 5,456,000 | | | | 2,562,544 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (3.0%) | |

AAC Technologies Holdings, Inc. | | | 297,000 | | | | 1,937,194 | |

Hangzhou Hikvision Digital Technology Co., Ltd., ‘A’ | | | 285,580 | | | | 1,512,427 | |

| | | | | | | | |

| | | | | | | 3,449,621 | |

| | | | | | | | |

Health Care Providers & Services (0.8%) | |

Phoenix Healthcare Group Co., Ltd. | | | 787,000 | | | | 920,023 | |

| | | | | | | | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Hotels, Restaurants & Leisure (1.9%) | |

China CYTS Tours Holding Co., Ltd., ‘A’ | | | 286,200 | | | | 1,027,369 | |

Wynn Macau Ltd. | | | 937,600 | | | | 1,096,077 | |

| | | | | | | | |

| | | | | | | 2,123,446 | |

| | | | | | | | |

Independent Power & Renewable Electricity Producers (0.7%) | |

China Longyuan Power Group Corp., Ltd. | | | 1,083,000 | | | | 817,485 | |

| | | | | | | | |

Insurance (5.4%) | |

PICC Property & Casualty Co., Ltd. | | | 694,000 | | | | 1,380,827 | |

Ping An Insurance Group Co. of China Ltd., ‘A’ | | | 841,752 | | | | 4,666,606 | |

| | | | | | | | |

| | | | | | | 6,047,433 | |

| | | | | | | | |

Internet Software & Services (10.5%) | |

Alibaba Group Holding Ltd. (a) | | | 24,700 | | | | 2,007,369 | |

Tencent Holdings Ltd. | | | 414,800 | | | | 8,162,141 | |

Wangsu Science & Technology Co., Ltd., ‘A’ | | | 186,091 | | | | 1,719,169 | |

| | | | | | | | |

| | | | | | | 11,888,679 | |

| | | | | | | | |

Leisure Products (1.2%) | |

Guangdong Alpha Animation and Culture Co., Ltd., ‘A’ | | | 163,925 | | | | 1,305,372 | |

| | | | | | | | |

Machinery (2.0%) | |

China Conch Venture Holdings Ltd. | | | 467,000 | | | | 967,738 | |

Han’s Laser Technology Industry Group Co., Ltd., ‘A’ | | | 165,700 | | | | 660,646 | |

Shenzhen Inovance Technology Co., Ltd., ‘A’ | | | 92,702 | | | | 673,823 | |

| | | | | | | | |

| | | | | | | 2,302,207 | |

| | | | | | | | |

Media (1.1%) | |

Zhejiang Huace Film & TV Co., Ltd., ‘A’ | | | 263,950 | | | | 1,210,895 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels (3.0%) | |

China Petroleum & Chemical Corp. | | | 1,857,400 | | | | 1,121,623 | |

CNOOC Ltd. | | | 2,217,000 | | | | 2,308,526 | |

| | | | | | | | |

| | | | | | | 3,430,149 | |

| | | | | | | | |

Pharmaceuticals (0.9%) | |

Jiangsu Hengrui Medicine Co., Ltd., ‘A’ | | | 132,594 | | | | 1,002,990 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Real Estate Management & Development (5.0%) | |

China Vanke Co., Ltd. | | | 1,148,200 | | | | 3,392,724 | |

Poly Real Estate Group Co., Ltd., ‘A’ | | | 1,363,650 | | | | 2,234,390 | |

| | | | | | | | |

| | | | | | | 5,627,114 | |

| | | | | | | | |

Road & Rail (1.2%) | |

CAR, Inc. (a) | | | 785,000 | | | | 1,300,559 | |

| | | | | | | | |

Software (0.3%) | |

Aisino Co., Ltd., ‘A’ | | | 42,500 | | | | 382,353 | |

| | | | | | | | |

Specialty Retail (1.1%) | |

China Harmony New Energy Auto Holding Ltd. | | | 1,818,000 | | | | 1,283,148 | |

| | | | | | | | |

Trading Companies & Distributors (0.1%) | |

Xiamen C & D, Inc., ‘A’ | | | 73,208 | | | | 158,172 | |

| | | | | | | | |

TOTAL CHINA | | | | | | | 71,440,606 | |

| | | | | | | | |

HONG KONG (31.5%) | |

Auto Components (0.8%) | |

Nexteer Automotive Group Ltd. | | | 831,000 | | | | 924,281 | |

| | | | | | | | |

Banks (2.8%) | |

BOC Hong Kong Holdings Ltd. | | | 672,500 | | | | 2,056,535 | |

Dah Sing Banking Group Ltd. | | | 602,800 | | | | 1,067,144 | |

| | | | | | | | |

| | | | | | | 3,123,679 | |

| | | | | | | | |

Commercial Services & Supplies (1.2%) | |

China Everbright International Ltd. | | | 1,073,000 | | | | 1,378,969 | |

| | | | | | | | |

Communications Equipment (0.7%) | |

VTech Holdings Ltd. | | | 81,200 | | | | 841,855 | |

| | | | | | | | |

Diversified Financial Services (2.3%) | |

Hong Kong Exchanges and Clearing Ltd. | | | 101,354 | | | | 2,595,953 | |

| | | | | | | | |

Gas Utilities (1.6%) | |

China Resources Gas Group Ltd. | | | 594,000 | | | | 1,774,324 | |

| | | | | | | | |

Household Durables (0.8%) | |

Man Wah Holdings Ltd. | | | 773,600 | | | | 910,347 | |

| | | | | | | | |

Industrial Conglomerates (3.2%) | |

CK Hutchison Holdings Ltd. | | | 205,500 | | | | 2,773,569 | |

Shun Tak Holdings Ltd. | | | 2,256,000 | | | | 849,997 | |

| | | | | | | | |

| | | | | | | 3,623,566 | |

| | | | | | | | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Insurance (6.3%) | |

AIA Group Ltd. | | | 866,600 | | | | 5,210,748 | |

China Taiping Insurance Holdings Co., Ltd. (a) | | | 617,000 | | | | 1,910,698 | |

| | | | | | | | |

| | | | | | | 7,121,446 | |

| | | | | | | | |

Pharmaceuticals (2.3%) | |

Sino Biopharmaceutical Ltd. | | | 2,926,000 | | | | 2,665,474 | |

| | | | | | | | |

Real Estate Management & Development (4.5%) | |

Cheung Kong Property Holdings Ltd. | | | 357,500 | | | | 2,324,888 | |

New World Development Co., Ltd. | | | 1,444,053 | | | | 1,427,274 | |

Sun Hung Kai Properties Ltd. | | | 108,000 | | | | 1,304,353 | |

| | | | | | | | |

| | | | | | | 5,056,515 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods (2.6%) | |

Pacific Textiles Holdings Ltd. | | | 561,000 | | | | 865,744 | |

Regina Miracle International Holdings Ltd. (a) (e) | | | 703,000 | | | | 1,025,013 | |

Samsonite International S.A. | | | 361,800 | | | | 1,087,727 | |

| | | | | | | | |

| | | | | | | 2,978,484 | |

| | | | | | | | |

Water Utilities (0.6%) | |

Beijing Enterprises Water Group Ltd. (a) | | | 922,000 | | | | 645,991 | |

| | | | | | | | |

Wireless Telecommunication Services (1.8%) | |

China Mobile Ltd. | | | 178,000 | | | | 2,009,664 | |

| | | | | | | | |

TOTAL HONG KONG | | | | | | | 35,650,548 | |

| | | | | | | | |

TAIWAN (15.4%) | |

Banks (1.4%) | |

E.Sun Financial Holding Co., Ltd. | | | 2,768,833 | | | | 1,614,246 | |

| | | | | | | | |

Diversified Financial Services (1.4%) | |

Fubon Financial Holding Co., Ltd. | | | 1,142,989 | | | | 1,565,881 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (1.4%) | |

Delta Electronics, Inc. | | | 14,965 | | | | 70,846 | |

Largan Precision Co., Ltd. | | | 21,000 | | | | 1,451,274 | |

| | | | | | | | |

| | | | | | | 1,522,120 | |

| | | | | | | | |

Food & Staples Retailing (0.9%) | |

President Chain Store Corp. | | | 161,000 | | | | 1,007,261 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment (8.9%) | |

Advanced Semiconductor Engineering, Inc. | | | 1,647,802 | | | | 1,906,307 | |

Chipbond Technology Corp. | | | 322,000 | | | | 466,134 | |

Silicon Motion Technology Corp. | | | 23,205 | | | | 727,709 | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 15 | |

INVESTMENT PORTFOLIO

AT DECEMBER 31, 2015 (continued)

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Semiconductors & Semiconductor Equipment — continued | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,606,057 | | | | 6,991,998 | |

| | | | | | | | |

| | | | | | | 10,092,148 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals (1.4%) | |

Catcher Technology Co., Ltd. | | | 189,000 | | | | 1,588,090 | |

| | | | | | | | |

TOTAL TAIWAN | | | | | | | 17,389,746 | |

| | | | | | | | |

TOTAL INVESTMENTS

(110.0% of Net Assets)

(Cost $110,769,590) | | | | 124,480,900 | |

| | | | | | | | |

Liabilities in excess of other assets

(-10.0% of Net Assets) | | | | (11,293,531 | ) |

| | | | | | | | |

NET ASSETS (100.0%) | | | | | | | 113,187,369 | |

| | | | | | | | |

| | | | |

As of December 31, 2015, aggregate cost for Federal income tax purposes was $111,287,759. The aggregate unrealized gain for all securities is as follows: | |

Excess of market value over cost | | | 21,268,660 | |

Excess of cost over market value | | | (8,075,519 | ) |

| | | | |

Net unrealized gain | | | 13,193,141 | |

| | | | |

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS :

| (a) | Non-income producing security. |

| (e) | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. Unless otherwise indicated, this security has been determined to be liquid under procedures established by the Board of Directors and may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| A | China A - shares. (See Note 7.iii on page 28) |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

STATEMENT OF ASSETS AND LIABILITIES

AT DECEMBER 31, 2015

| | | | |

| | | (in US$) | |

ASSETS: | |

Investments in non-affiliates, at value (cost $110,769,590) | | | 124,480,900 | |

Cash | | | 3,088,950 | |

Foreign currency, at value (cost $6,541,954) | | | 6,520,020 | |

Deposits at broker (See Note 7.iii.) | | | 27,163 | |

Receivable for securities sold | | | 138,074 | |

Dividends receivable | | | 28,955 | |

Other assets | | | 10,000 | |

| | | | |

Total Assets | | | 134,294,062 | |

| | | | |

| |

LIABILITIES: | | | | |

Loan payable to bank (See Note 6) | | | 15,000,000 | |

Payables | | | | |

Distributions | | | 4,748,169 | |

Payable for securities purchased | | | 1,001,302 | |

Accrued Liabilities | | | | |

Deferred China capital gains tax | | | 117,697 | |

Custodian and accounting fees | | | 75,093 | |

Administration fees | | | 29,167 | |

Investment advisory fees | | | 25,300 | |

Interest on loan | | | 7,058 | |

Directors’ fees and expenses | | | 1,703 | |

Other | | | 101,204 | |

| | | | |

Total Liabilities | | | 21,106,693 | |

| | | | |

Net Assets | | | 113,187,369 | |

| | | | |

| |

| Net assets consist of: | | | | |

Common stock, $0.01 par value

(100,000,000 shares authorized; 6,447,637 shares issued and outstanding) | | | 64,476 | |

Paid-in capital | | | 98,994,144 | |

Accumulated undistributed (distributions in excess of) net investment income | | | (7,906 | ) |

Accumulated realized gain on investments and foreign currency transactions | | | 447,855 | |

Accumulated net unrealized appreciation on investments, foreign currency holdings, and other

assets and liabilities denominated in foreign currencies | | | 13,688,800 | |

| | | | |

Net Assets | | | 113,187,369 | |

| | | | |

Net Asset Value Per Share ($113,187,369 ÷ 6,447,637) | | | 17.55 | |

| | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 17 | |

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2015

| | | | |

| | | (in US$) | |

INVESTMENT INCOME: | |

Dividends from non-affiliates (net of foreign withholding tax of $318,859) | | | 3,265,120 | |

Interest income from non-affiliates | | | 3,059 | |

Interest income from affiliates | | | 2,583 | |

| | | | |

Total Investment Income | | | 3,270,762 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees | | | 1,469,088 | |

Directors’ fees and expenses | | | 310,177 | |

Custodian and accounting fees | | | 289,858 | |

Interest expense to non-affiliates (See Note 6) | | | 180,967 | |

Legal fees | | | 90,730 | |

Administration fees | | | 87,500 | |

Audit fees | | | 81,934 | |

Shareholder report fees | | | 46,022 | |

Insurance fees | | | 43,428 | |

NYSE listing fees | | | 24,570 | |

Shareholder service fees | | | 19,257 | |

Interest expense to affiliates | | | 3 | |

Other expenses | | | 26,984 | |

| | | | |

Total Expenses | | | 2,670,518 | |

| | | | |

Less amounts waived (See Note 4) | | | (62,646 | ) |

| | | | |

Net expenses | | | 2,607,872 | |

| | | | |

Net Investment Income | | | 662,890 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY

HOLDINGS AND OTHER ASSETS AND LIABILITIES DENOMINATED IN FOREIGN CURRENCIES: | | | | |

Net realized gain (loss) | | | | |

Investments in non-affiliates* | | | 8,148,602 | |

Foreign currency transactions | | | (193,073 | ) |

| | | | |

Net realized gain (loss) | | | 7,955,529 | |

| | | | |

Net change in unrealized appreciation/depreciation | | | | |

Investments in non-affiliates | | | (14,152,977 | ) |

Foreign currency translations | | | (24,121 | ) |

| | | | |

Change in net unrealized appreciation/depreciation | | | (14,177,098 | ) |

| | | | |

Net realized and unrealized gain (loss) on investments, foreign currency holdings and other

assets and liabilities denominated in foreign currencies | | | (6,221,569 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (5,558,679 | ) |

| | | | |

| * | Net of a reduction of China capital gain tax accrual of $378,724. (See Note 2) |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 18 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

STATEMENT OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | | | | | |

| | | Year Ended

December 31, 2015

(in US$) | | | Year Ended

December 31, 2014

(in US$) | |

INCREASE IN NET ASSETS: | |

Operations | | | | | | | | |

Net investment income | | | 662,890 | | | | 907,437 | |

Net realized gain (loss) on investment transactions | | | 7,955,529 | | | | 8,321,030 | |

Net change in unrealized appreciation (depreciation) on investments, foreign currency holdings and other assets and liabilities denominated in foreign currencies | | | (14,177,098 | ) | | | 5,177,093 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (5,558,679 | ) | | | 14,405,560 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO STOCKHOLDERS: | | | | | | | | |

Net investment income | | | (2,134,575 | ) | | | (818,850 | ) |

Net realized gain | | | (4,141,684 | ) | | | — | |

| | | | | | | | |

Total distributions to shareholders | | | (6,276,259 | ) | | | (818,850 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | (11,834,938 | ) | | | 13,586,710 | |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 125,022,307 | | | | 111,435,597 | |

| | | | | | | | |

End of period (including undistributed (distributions in excess of) net investment income of $(7,906) and $1,491,587, respectively) | | | 113,187,369 | | | | 125,022,307 | |

| | | | | | | | |

| | |

SHARE TRANSACTIONS | | | | | | | | |

Opening number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

Closing number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 19 | |

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2015

| | | | |

| | | (in US$) | |

INCREASE (DECREASE) IN CASH | | | | |

Cash flows provided (used) by operating activities: | | | | |

Decrease in net assets resulting from operations | | | (5,558,679 | ) |

Adjustments to reconcile net increase/decrease in net assets resulting

from operations to net cash provided (used) by operating activities: | | | | |

Purchase of investment securities | | | (148,297,709 | ) |

Proceeds from disposition of investment securities | | | 156,811,863 | |

Change in unrealized (appreciation)/depreciation on investments in non-affiliates | | | 14,152,977 | |

Net realized (gain)/loss on investments | | | (8,148,602 | ) |

Decrease in deposits at broker | | | 1,268 | |

Decrease in dividends receivable | | | 20,273 | |

Increase in other assets | | | (10,000 | ) |

Decrease in accrued expenses and other liabilities | | | (103,368 | ) |

| | | | |

Net cash provided (used) by operating activities | | | 8,868,023 | |

| | | | |

| |

Cash flows provided (used) by financing activities: | | | | |

Proceeds from borrowings | | | 2,500,000 | |

Repayment of borrowings | | | (2,500,000 | ) |

Cash distributions paid to shareholders | | | (1,528,090 | ) |

| | | | |

Net cash provided (used) by financing activities | | | (1,528,090 | ) |

| | | | |

Net increase in cash | | | 7,339,933 | |

| | | | |

| |

Cash: | | | | |

Beginning of year (including foreign currency of $1,162,989) | | | 2,269,037 | |

| | | | |

End of year (including foreign currency of $6,520,020) | | | 9,608,970 | |

| | | | |

Supplemental disclosure of cash flow information:

During 2015, the Fund paid $190,342 in interest expense, including $3 to affiliates.

For purposes of reporting the Statement of Cash Flows, the Fund considers all cash accounts that are not subject to withdrawal restrictions or penalties to be cash.

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 20 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

December 31,

2015

(in US$) | | | For the

Year Ended

December 31,

2014

(in US$) | | | For the

Year Ended

December 31,

2013

(in US$) | | | For the

Year Ended

December 31,

2012

(in US$) | | | For the

Year Ended

December 31,

2011

(in US$) | |

For a share outstanding

throughout each year: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | 19.39 | | | | 17.28 | | | | 15.47 | | | | 12.75 | | | | 17.41 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.10 | | | | 0.14 | | | | 0.10 | | | | 0.08 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | (0.97 | ) | | | 2.10 | | | | 1.84 | | | | 2.74 | | | | (4.70 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.87 | ) | | | 2.24 | | | | 1.94 | | | | 2.82 | | | | (4.56 | ) |

| | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.34 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.10 | ) | | | (0.10 | ) |

Distributions from net realized gains | | | (0.63 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.97 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.10 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | 17.55 | | | | 19.39 | | | | 17.28 | | | | 15.47 | | | | 12.75 | |

| | | | | | | | | | | | | | | | | | | | |

Market value, end of period | | | 15.32 | | | | 16.91 | | | | 15.16 | | | | 14.00 | | | | 11.02 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investment Return | | | | | | | | | | | | | | | | | | | | |

Per share market value* | | | (3.6 | )% | | | 12.5 | % | | | 9.2 | % | | | 28.2 | % | | | (29.6 | )% |

| | | | | |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | | 113,187,369 | | | | 125,022,307 | | | | 111,435,597 | | | | 99,728,043 | | | | 82,226,478 | |

Ratio of net expenses to average net assets** | | | 2.00 | % | | | 2.14 | % | | | 2.26 | % | | | 2.11 | % | | | 1.89 | % |

Ratio of net expenses to average net assets, excluding interest expense** | | | 1.86 | % | | | 1.94 | % | | | 2.05 | % | | | 2.04 | % | | | 1.89 | % |

Ratio of total expenses to average net assets, without waivers and reimbursements** | | | 2.05 | % | | | 2.16 | % | | | 2.28 | % | | | 2.12 | % | | | 1.89 | % |

Ratio of total expenses to average net assets, without waivers and reimbursements, excluding interest expense** | | | 1.91 | % | | | 1.96 | % | | | 2.07 | % | | | 2.04 | % | | | 1.89 | % |

Ratio of net investment income to average net assets | | | 0.51 | % | | | 0.82 | % | | | 0.61 | % | | | 0.54 | %�� | | | 0.87 | % |

Portfolio turnover rate | | | 106.0 | % | | | 86.7 | % | | | 66.6 | % | | | 85.8 | % | | | 66.8 | % |

Number of shares outstanding at end of period (in thousands) | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | |

| * | The total investment return excludes the effect of commissions. Dividends and distributions, if any, are assumed for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan or if specified in accordance with the terms of the distribution. |

| ** | The presentation of the expense ratios for the fiscal years ended December 31, 2012 through December 31, 2014 have been revised to correct for an immaterial error in the presentation of expense waivers in those prior periods’ Statements of Operations, which are not presented herein. Certain amounts in those prior years were treated as reductions of total investment advisory fees, whereas the correction treats them as voluntary waivers. The impact of the revision is the inclusion of the total expense ratio for each period presented to reflect contractual expenses prior to the voluntary waiver. Previously only the net expense ratio was presented. |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 21 | |

NOTES TO FINANCIAL STATEMENTS

AT DECEMBER 31, 2015

1. Organization and Capital

JPMorgan China Region Fund, Inc. (the ‘Fund’) was incorporated in the State of Maryland on May 22, 1992, and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940 (‘1940 Act’). The Fund commenced operations on July 16, 1992.

The Fund seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

2. Significant Accounting Policies

The following significant accounting policies, which are in conformity with U.S. generally accepted accounting principles (‘GAAP’), are consistently followed by the Fund in the preparation of its financial statements.

The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reported period. Actual results could differ from these estimates.

i) Security Valuation — The valuation of investments is in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board of Directors (the “Board”), which established the following approach to valuation, as described more fully below.

All securities for which market quotations are readily available are valued at the last sales price prior to the time of determination or, if no sales price is available at that time, at the mean between the last current bid and ask prices. Securities that are traded over-the-counter are valued, if bid and ask quotations are available, at the mean between the current bid and ask prices. Certain investments of the Fund may, depending upon market conditions, trade in relatively thin markets and/or in markets that experience significant volatility. As a result of these conditions, the prices used by the Fund to value securities may differ from the value that would be realized if these securities were sold and the differences could be material. All other securities and assets are valued at fair value as determined in good faith by the Board of Directors. It is possible that the estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and such differences could be material. In valuing the Fund’s assets, quotations of foreign securities in a foreign currency are translated to United States (‘U.S.’) dollar equivalents at the prevailing exchange rate in effect on the valuation date. Investments in open ended mutual funds are valued at current day’s closing net asset value per share (‘NAV’).

JF International Management Inc. (the Investment ‘Advisor’), an indirect wholly-owned subsidiary of JPMorgan Chase & Co. (‘JPMorgan’) has established the Asian Fair Valuation Committee (“AFVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Advisor implements the valuation policies for the valuation of investments, as directed by the Board. The AFVC oversees and carries out the policies for the valuation of investments held in the Fund. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of macro or security specific events, market events and pricing vendor and broker due diligence. The Advisor is responsible for discussing and assessing the potential impacts of the fair values on an ongoing basis, and at least on a quarterly basis with the AFVC and the Board.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| | | | | | |

| | | |

| 22 | | | | JPMORGAN CHINA REGION FUND, INC. | | DECEMBER 31, 2015 |

NOTES TO FINANCIAL STATEMENTS

AT DECEMBER 31, 2015 (continued)

The various inputs that are used in determining the fair value of the Fund’s investments are summarized into the three broad levels listed below.

| • | | Level 1 — quoted prices in active markets for identical securities |

| • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

See the table on “Quantitative Information about Level 3 Fair Value Measurements” for information on the valuation techniques and inputs used to value Level 3 securities held by the Fund at December 31, 2015.